Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

TIAA-CREF Funds

|

|

| Entity Central Index Key |

0001084380

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

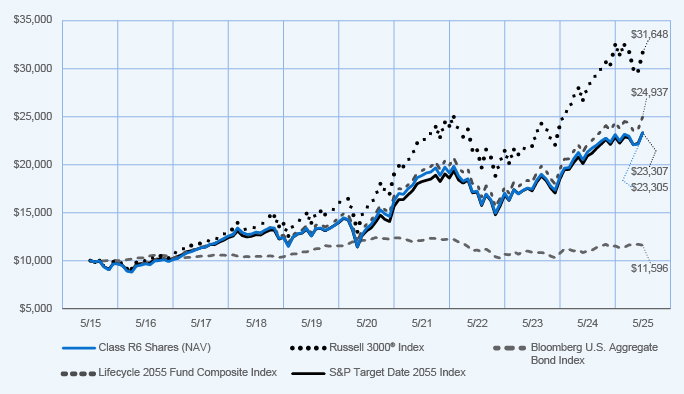

| C000079533 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2025 Fund

|

|

| Class Name |

Class R6 Shares

|

|

| Trading Symbol |

TLQIX

|

|

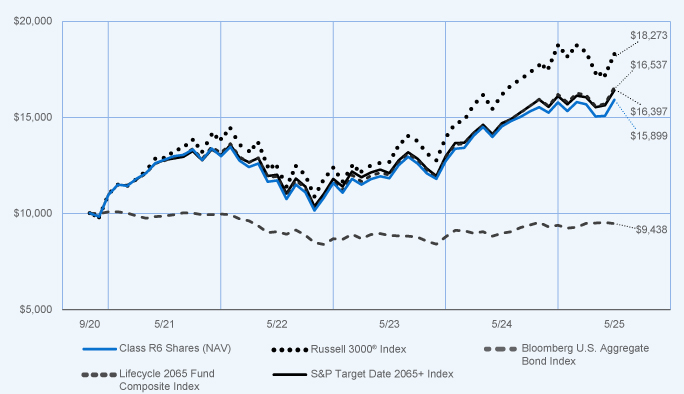

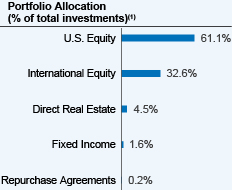

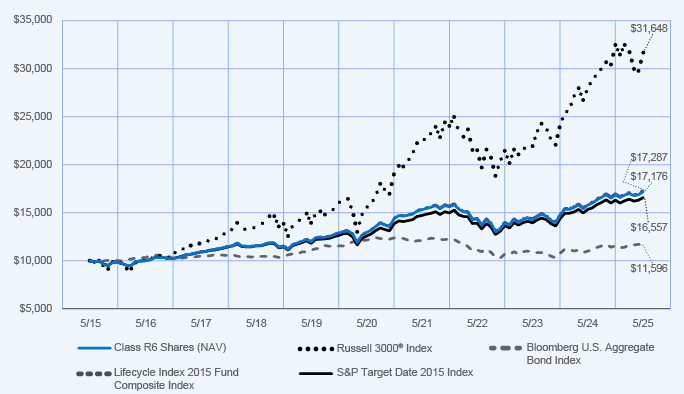

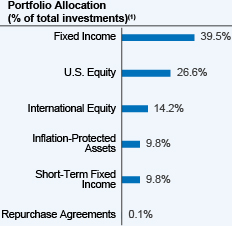

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle Index 2025 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$10 |

|

0.10% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 10

|

|

| Expense Ratio, Percent |

0.10%

|

[1] |

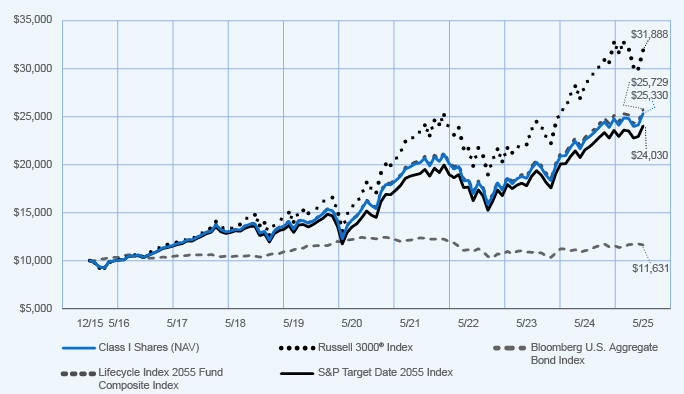

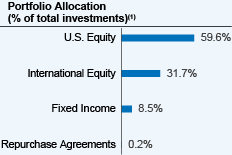

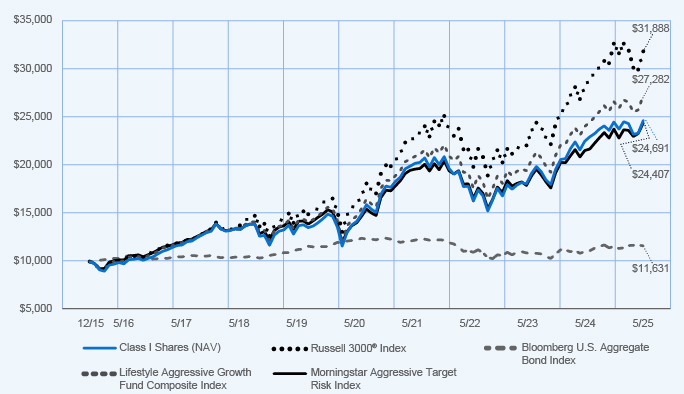

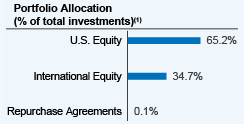

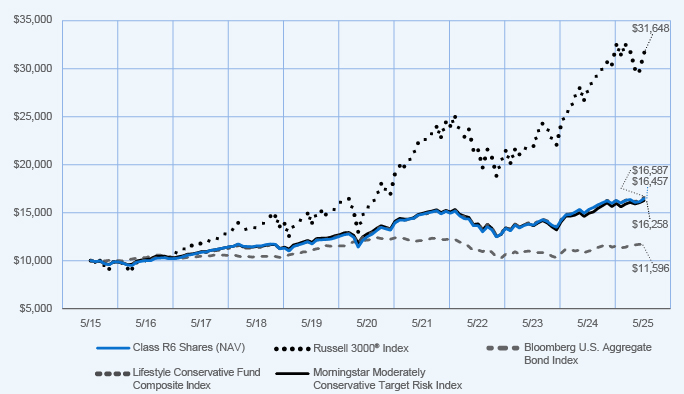

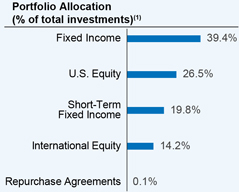

| Factors Affecting Performance [Text Block] |

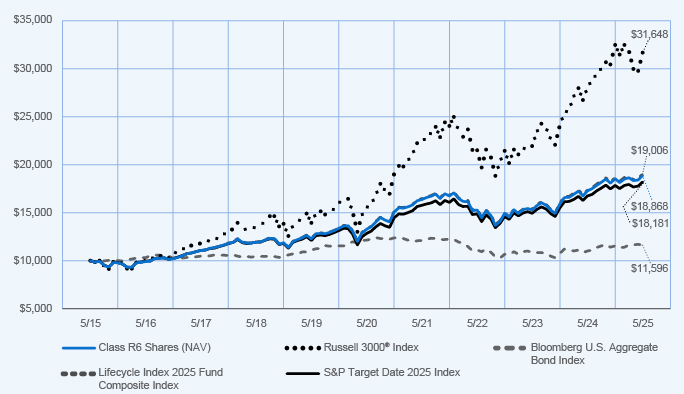

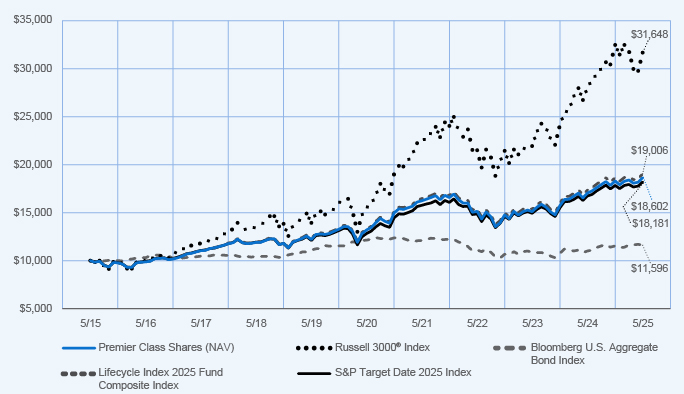

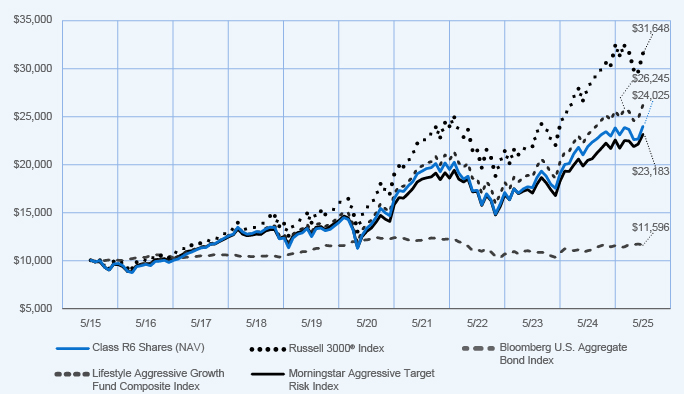

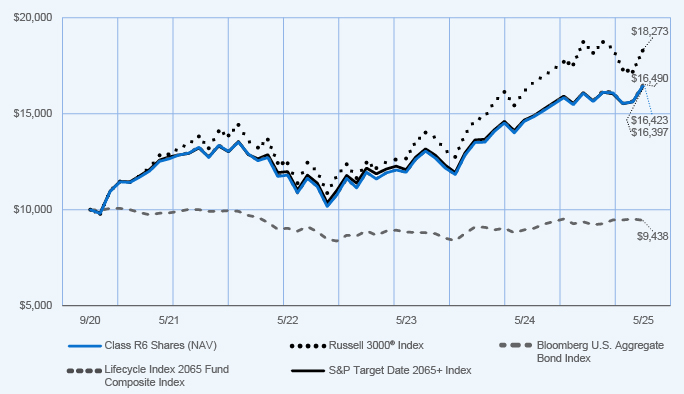

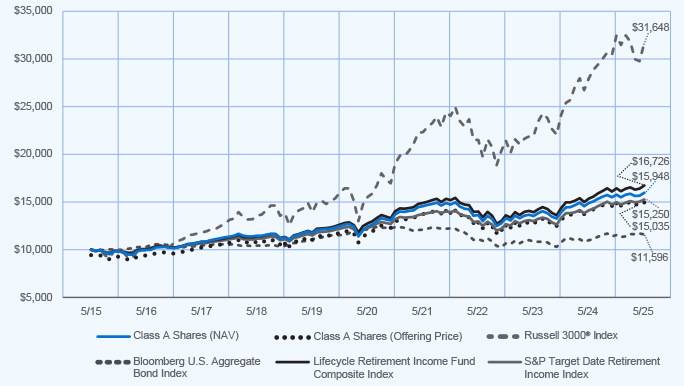

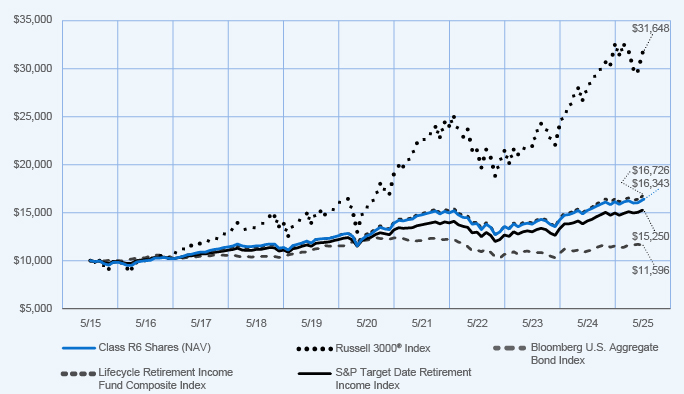

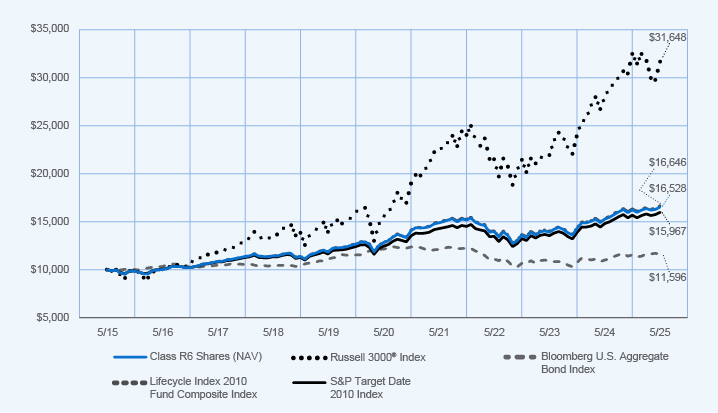

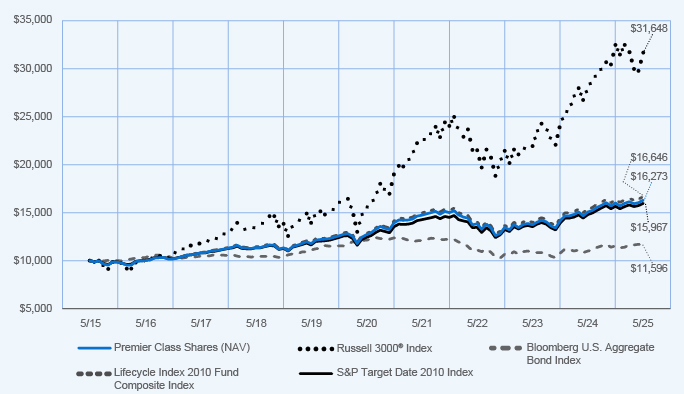

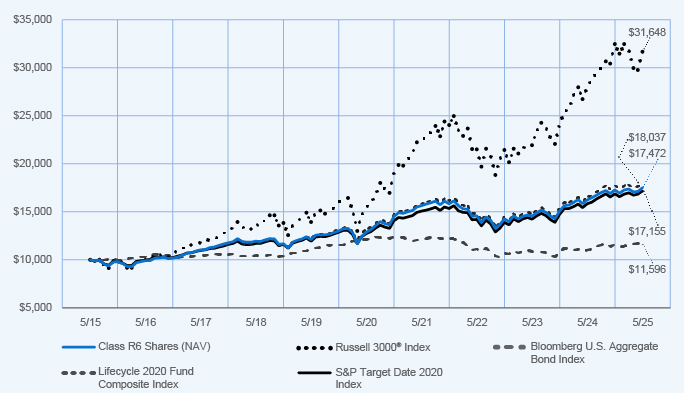

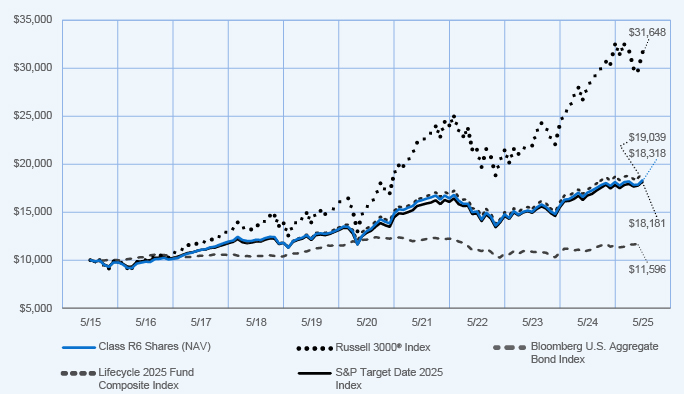

How did the Fund perform last year? What affected the Fund’s performance?

|

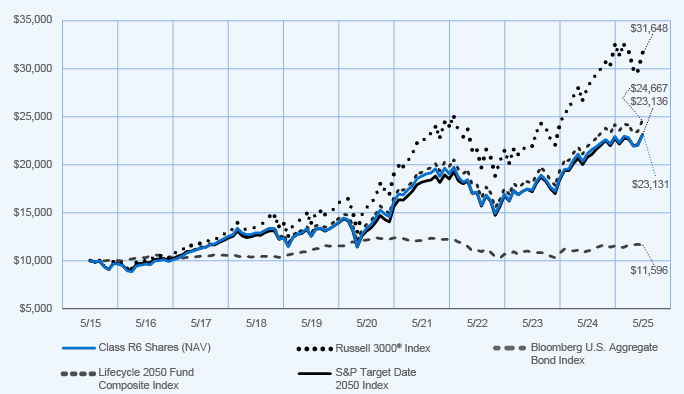

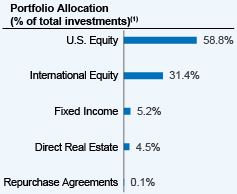

| Performance Highlights • The Nuveen Lifecycle Index 2025 Fund returned 9.42% for Class R6 Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund performed in line with the Lifecycle Index 2025 Fund Composite Index, which returned 9.64%. • The Fund’s Composite Index consisted of: 37.9% Bloomberg U.S. Aggregate Bond Index; 32.6% Russell 3000® Index; 17.5% MSCI EAFE + Emerging Markets Index; 6.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 6.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

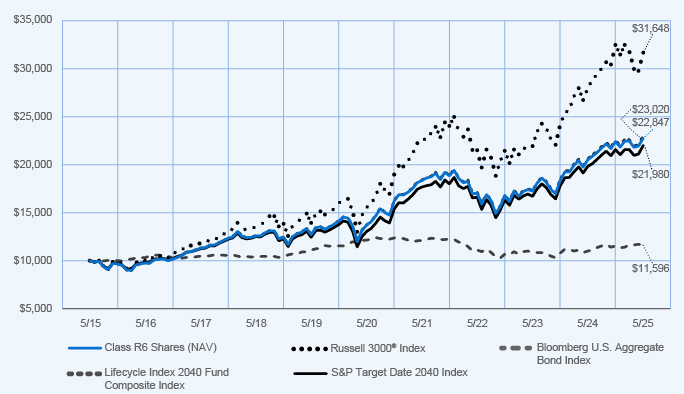

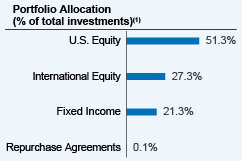

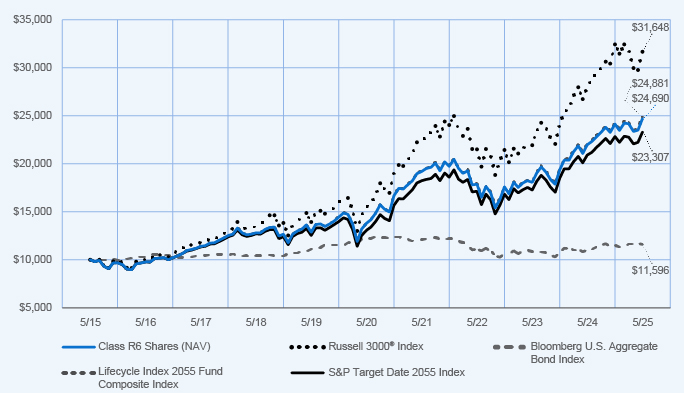

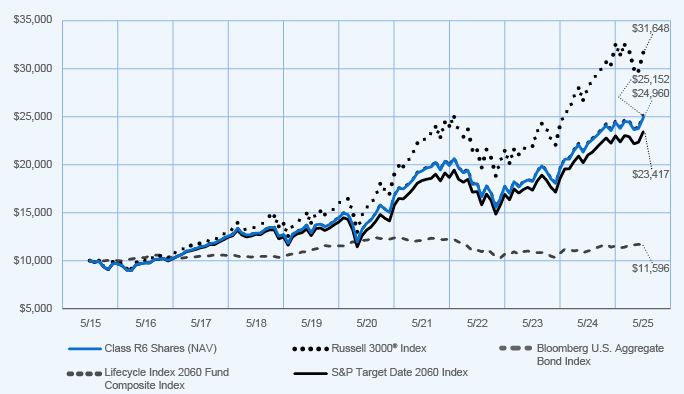

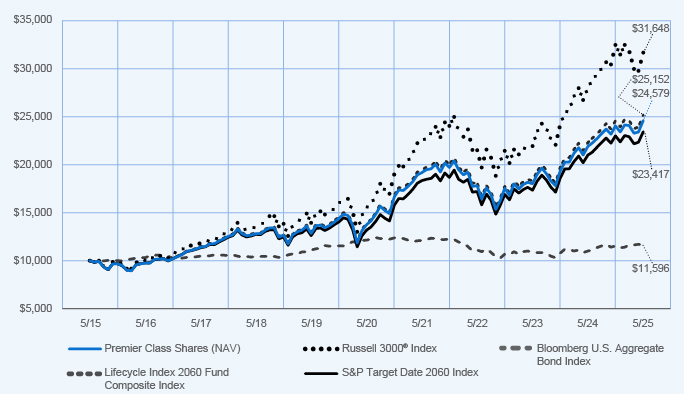

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class R6 Shares at NAV |

|

|

9.42 |

% |

|

|

7.30 |

% |

|

|

6.55 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2025 Fund Composite Index |

|

|

9.64 |

% |

|

|

7.41 |

% |

|

|

6.63 |

% |

| |

|

|

|

| S&P Target Date 2025 Index |

|

|

8.82 |

% |

|

|

7.23 |

% |

|

|

6.16 |

% |

|

|

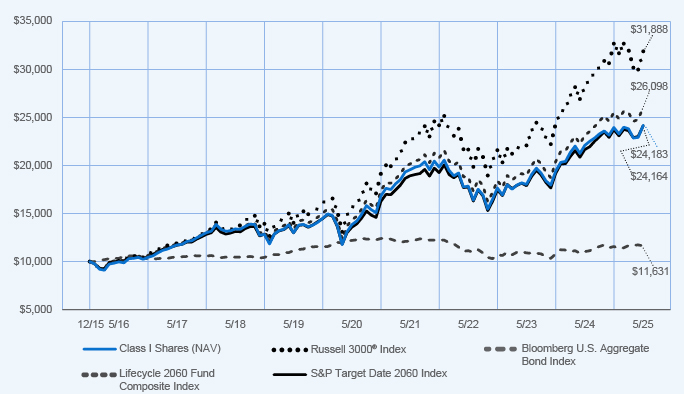

| No Deduction of Taxes [Text Block] |

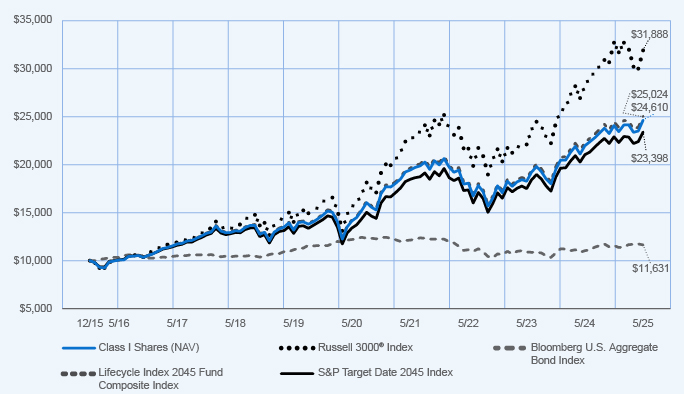

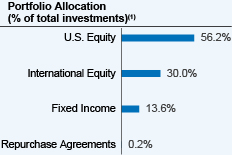

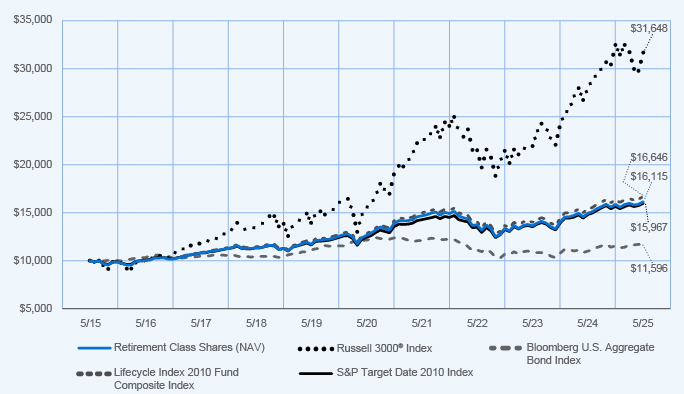

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 6,030,274,815

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 9,875,884

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

6,030,274,815 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

14% |

|

|

|

| Total management fees paid for the year |

|

$ |

9,875,884 |

|

|

|

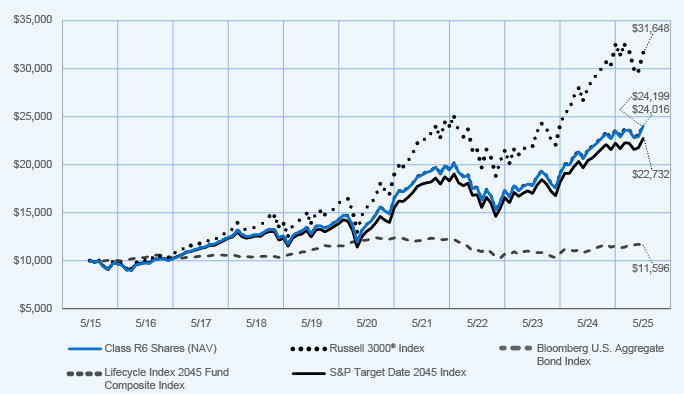

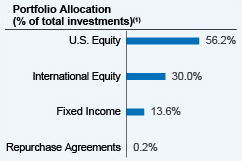

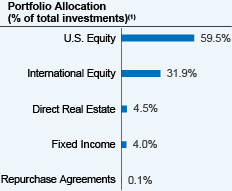

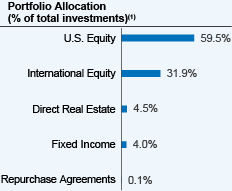

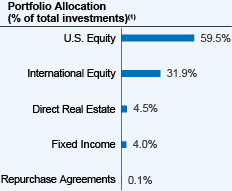

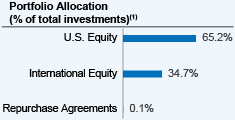

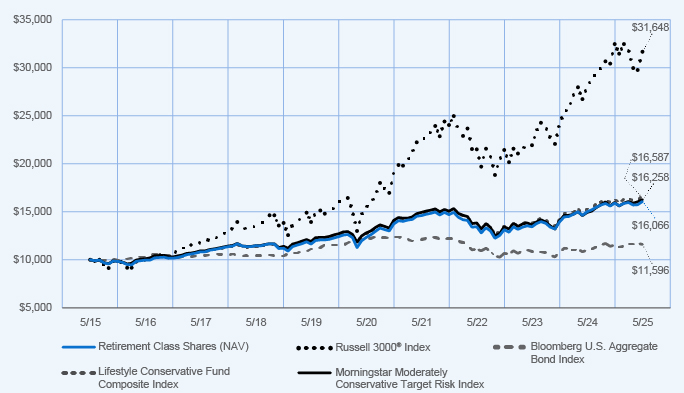

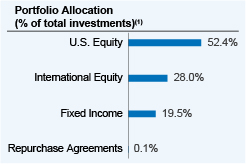

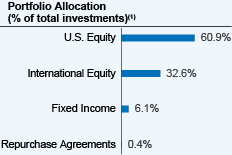

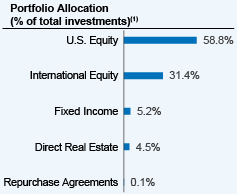

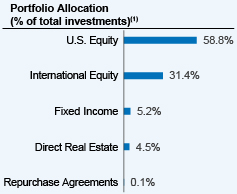

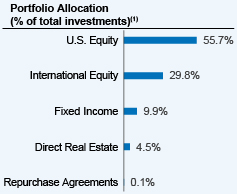

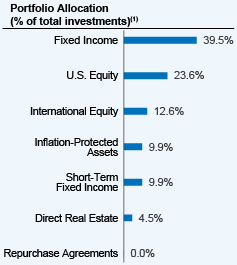

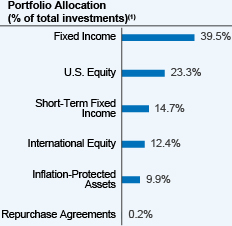

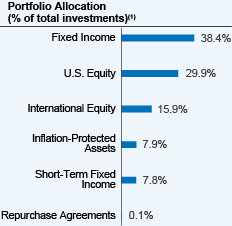

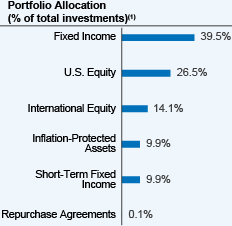

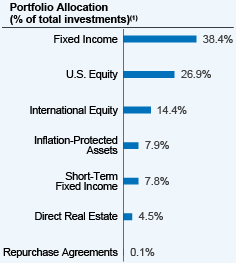

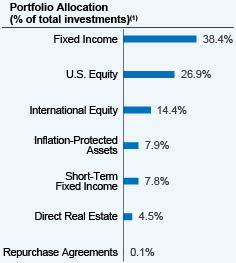

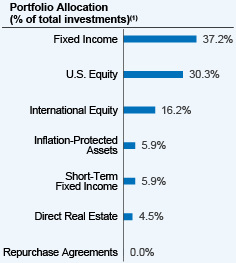

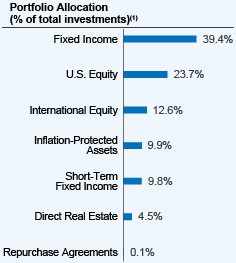

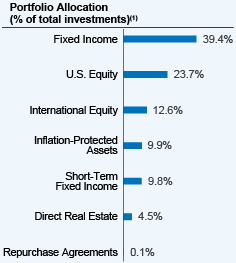

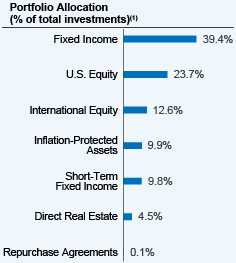

| Holdings [Text Block] |

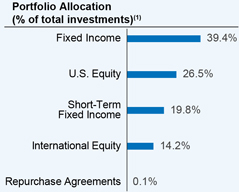

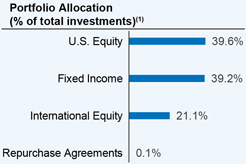

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079534 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2025 Fund

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TLVPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle Index 2025 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en-us/mutual-funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en-us/mutual-funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$26 |

|

0.25% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.25%

|

[2] |

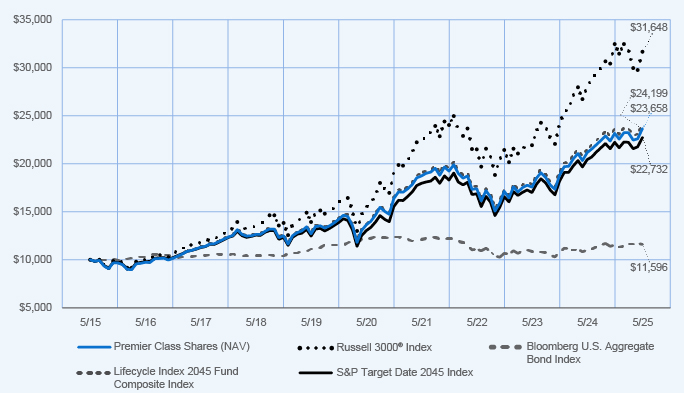

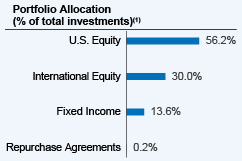

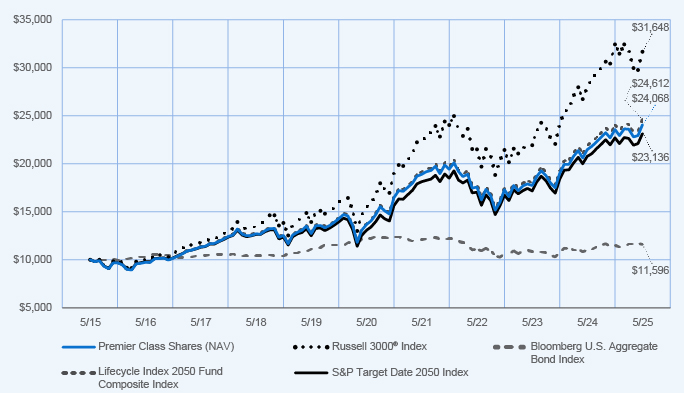

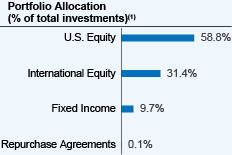

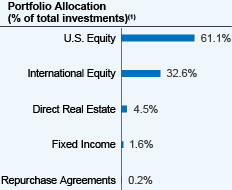

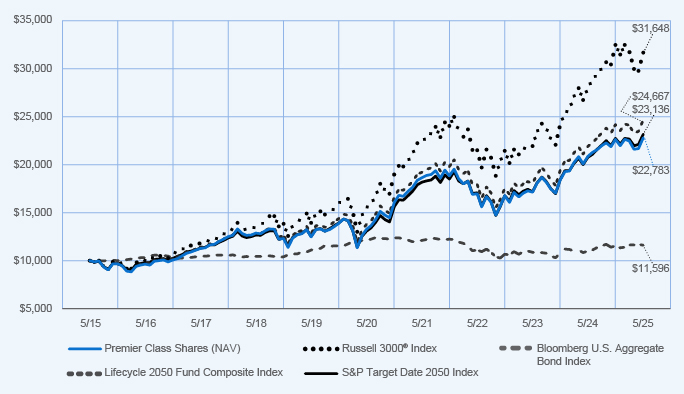

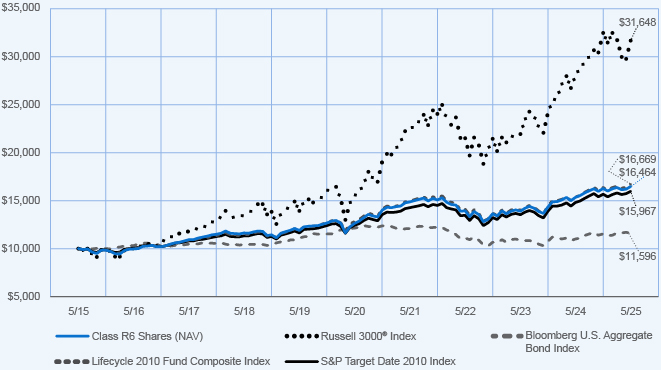

| Factors Affecting Performance [Text Block] |

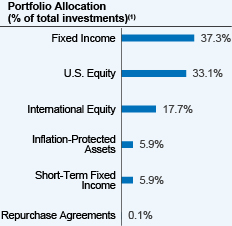

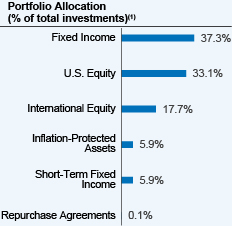

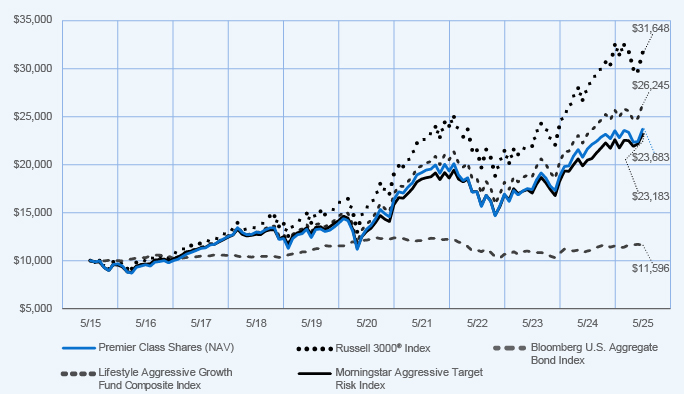

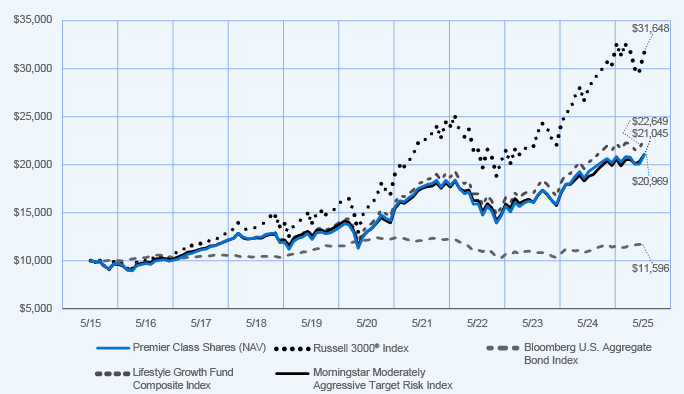

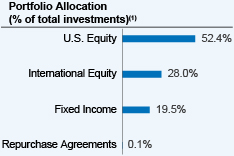

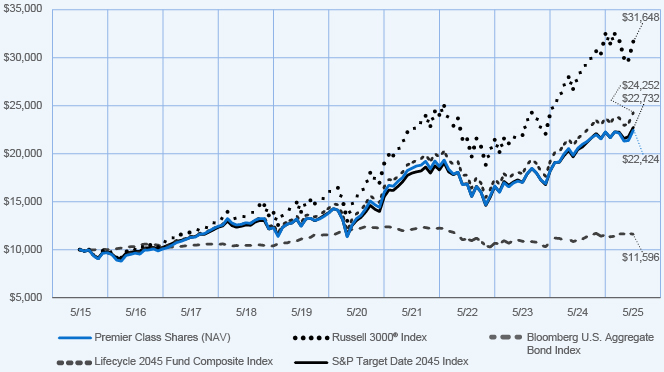

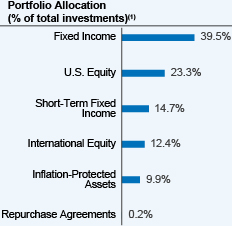

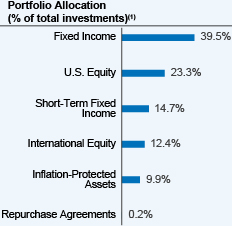

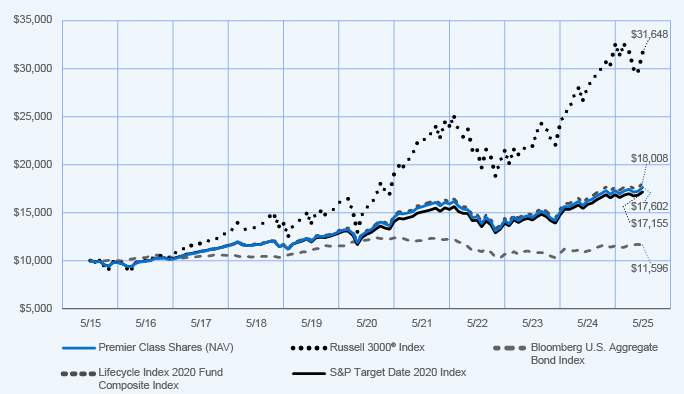

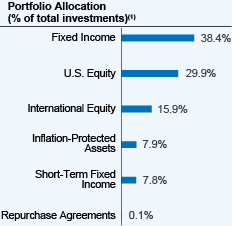

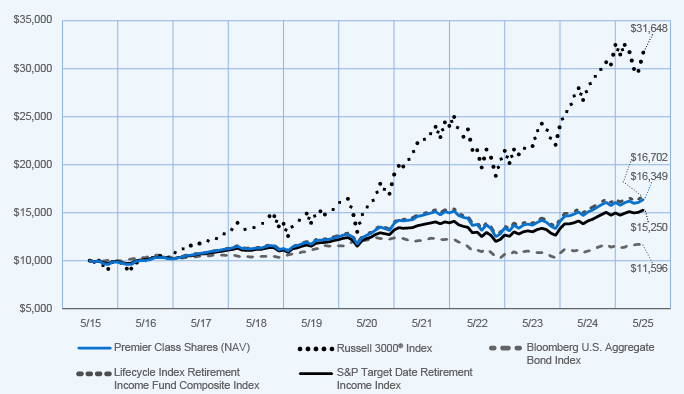

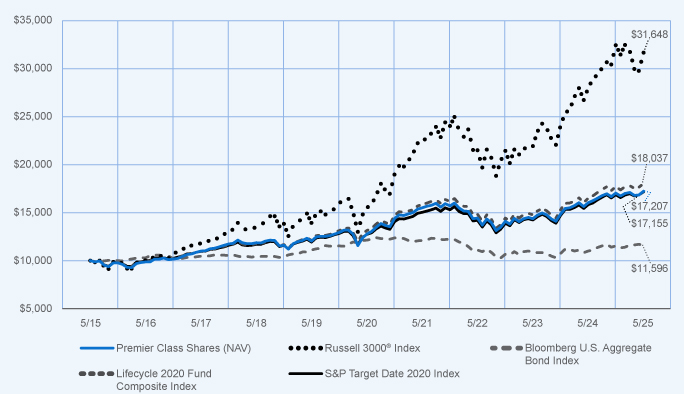

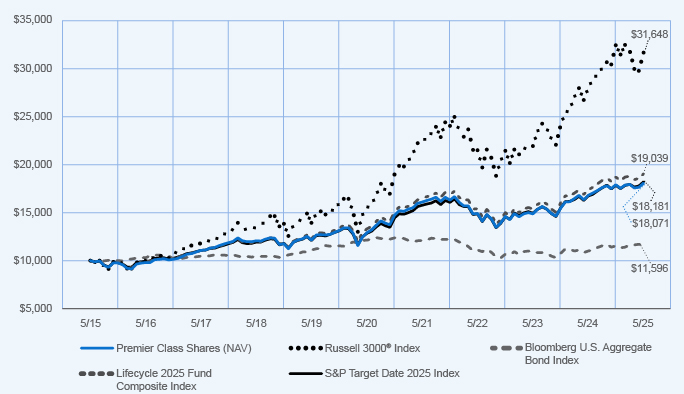

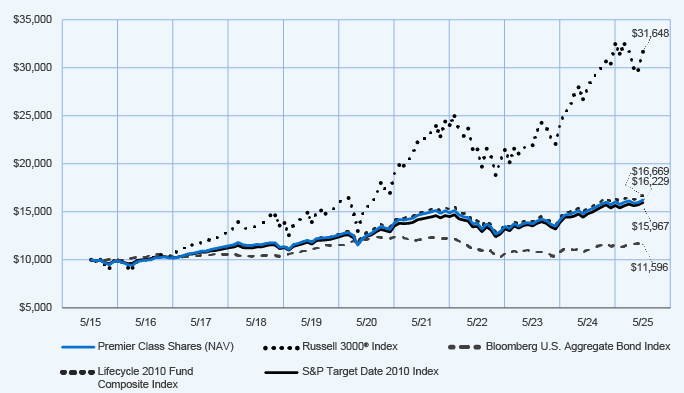

How did the Fund perform last year? What affected the Fund’s performance?

|

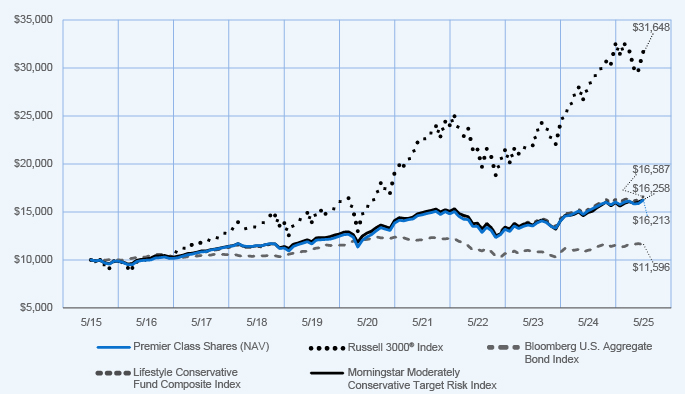

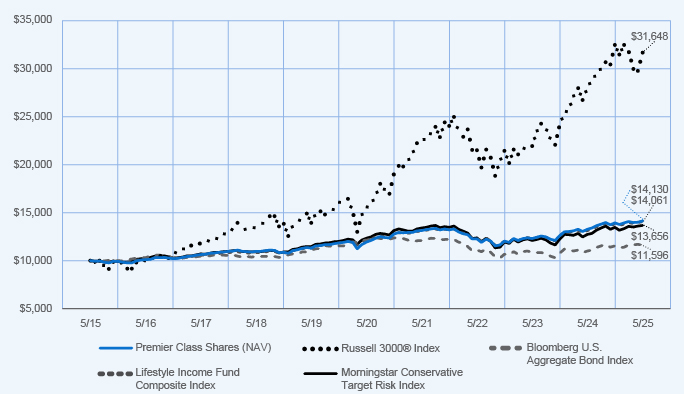

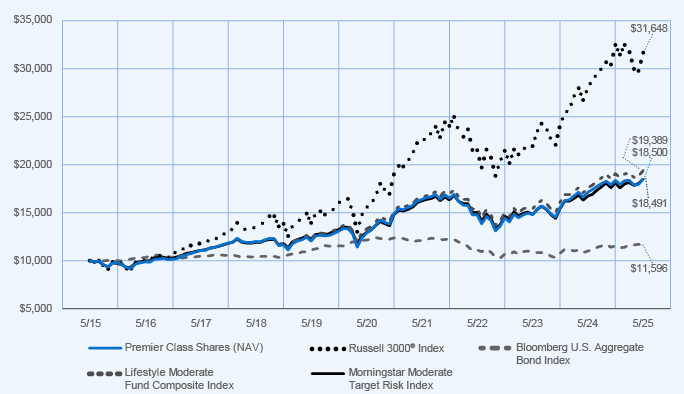

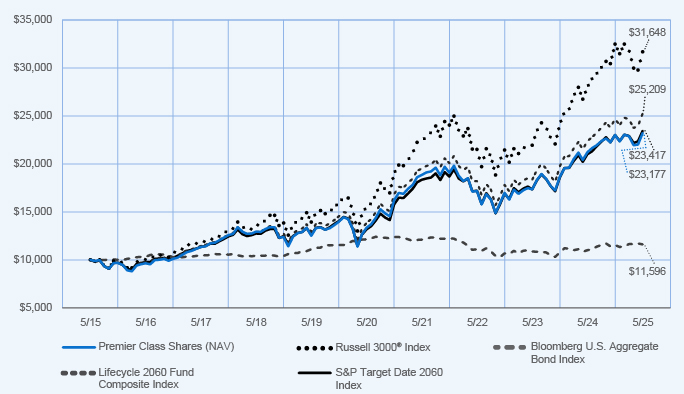

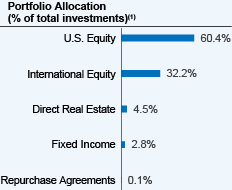

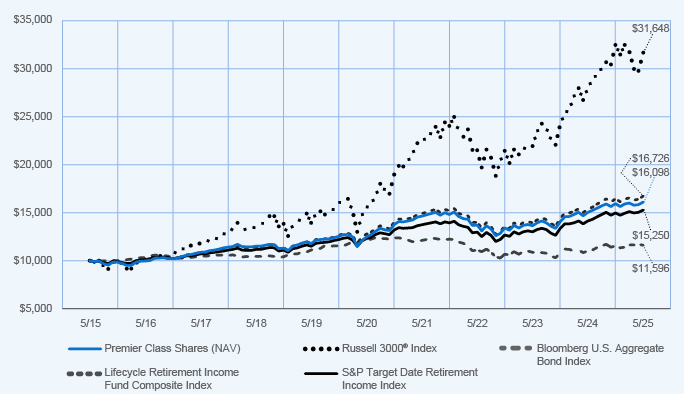

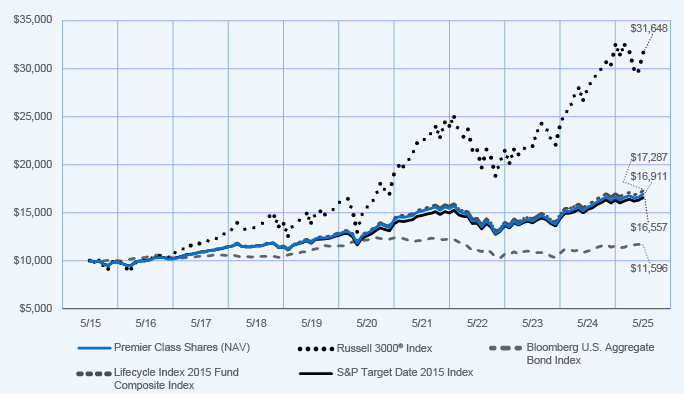

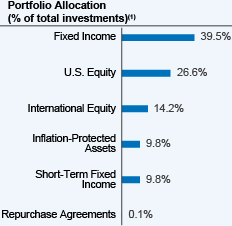

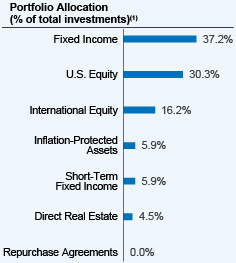

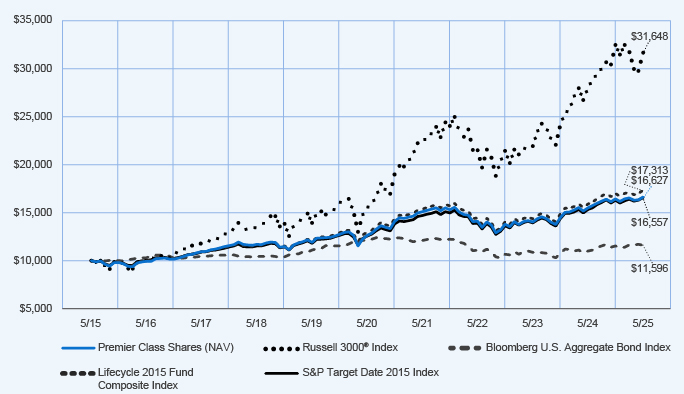

| Performance Highlights • The Nuveen Lifecycle Index 2025 Fund returned 9.26% for Premier Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2025 Fund Composite Index, which returned 9.64%. • The Fund’s Composite Index consisted of: 37.9% Bloomberg U.S. Aggregate Bond Index; 32.6% Russell 3000® Index; 17.5% MSCI EAFE + Emerging Markets Index; 6.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 6.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

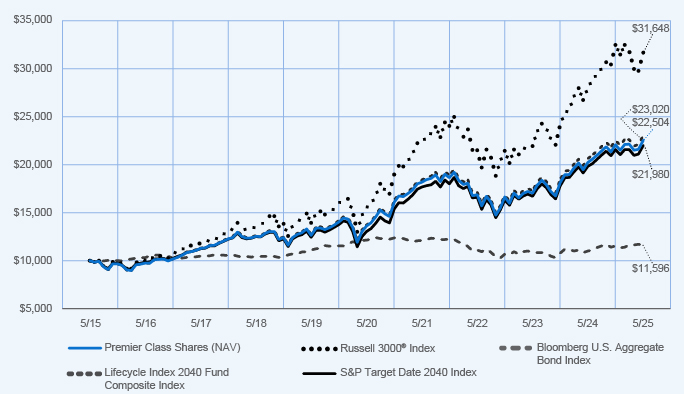

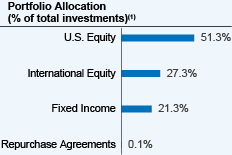

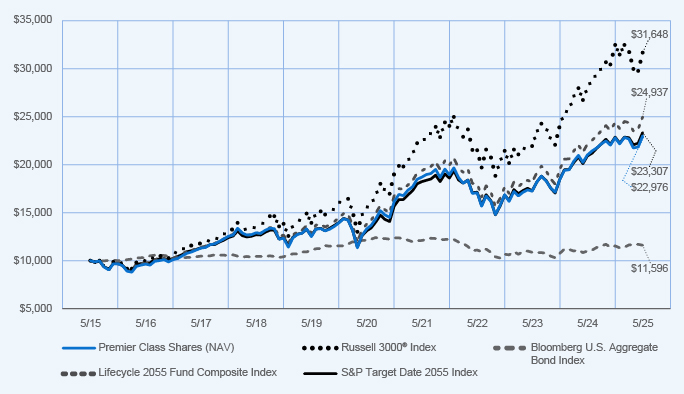

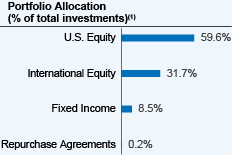

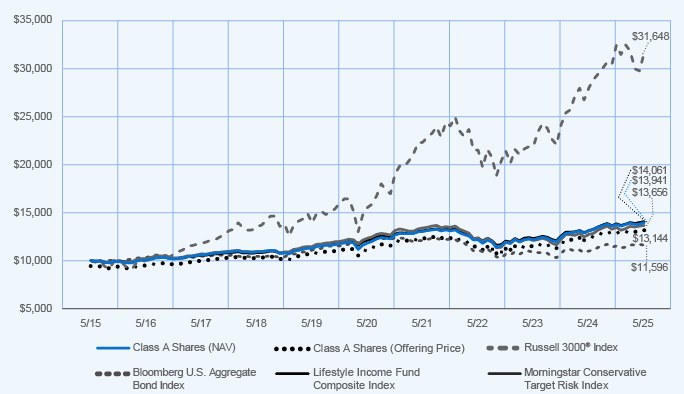

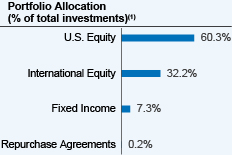

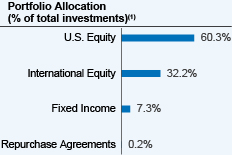

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Premier Class Shares at NAV |

|

|

9.26 |

% |

|

|

7.15 |

% |

|

|

6.40 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2025 Fund Composite Index |

|

|

9.64 |

% |

|

|

7.41 |

% |

|

|

6.63 |

% |

| |

|

|

|

| S&P Target Date 2025 Index |

|

|

8.82 |

% |

|

|

7.23 |

% |

|

|

6.16 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 6,030,274,815

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 9,875,884

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

6,030,274,815 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

14% |

|

|

|

| Total management fees paid for the year |

|

$ |

9,875,884 |

|

|

|

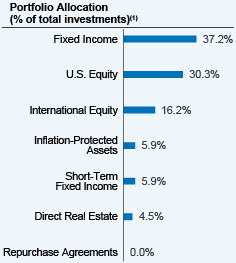

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079535 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2025 Fund

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TLQRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle Index 2025 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$37 |

|

0.35% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

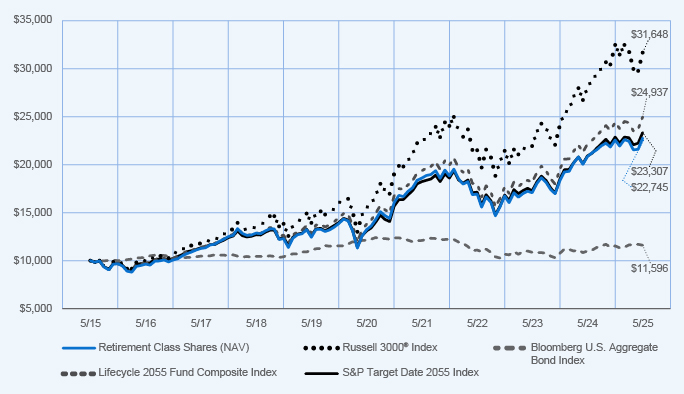

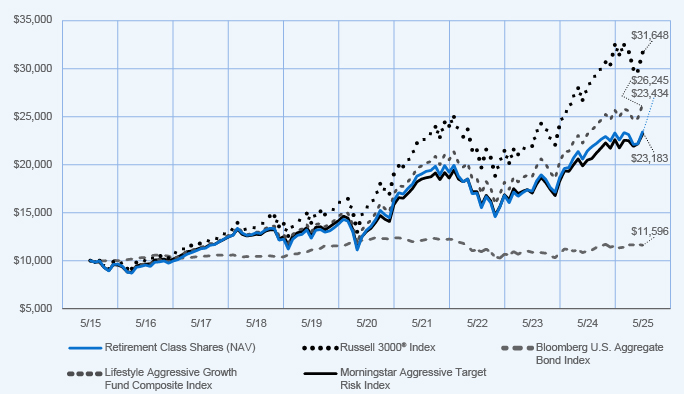

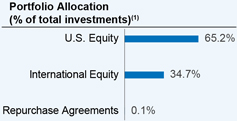

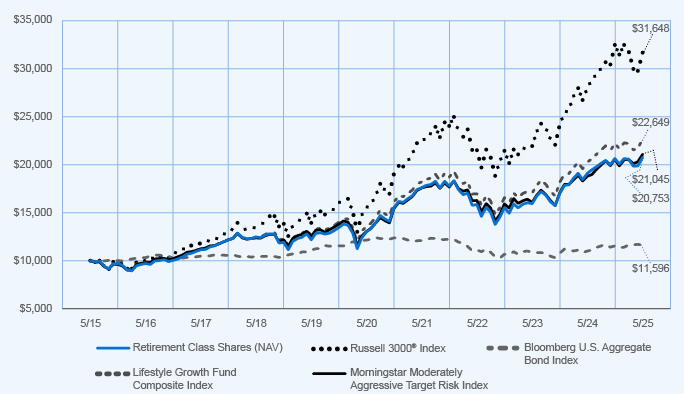

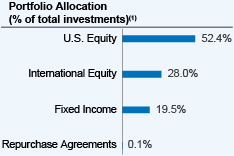

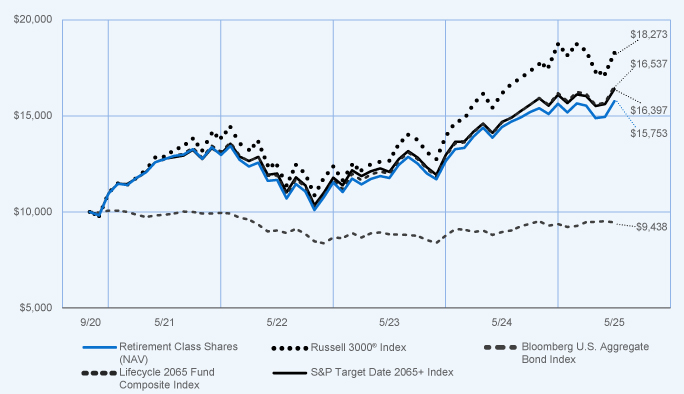

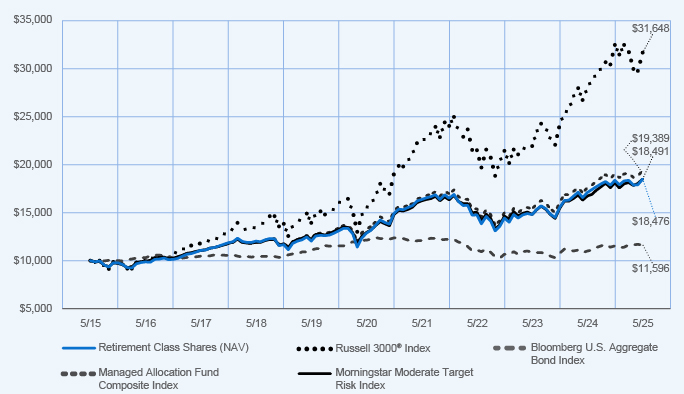

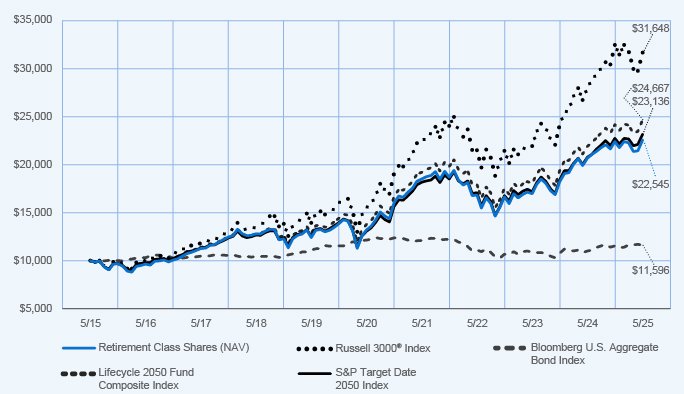

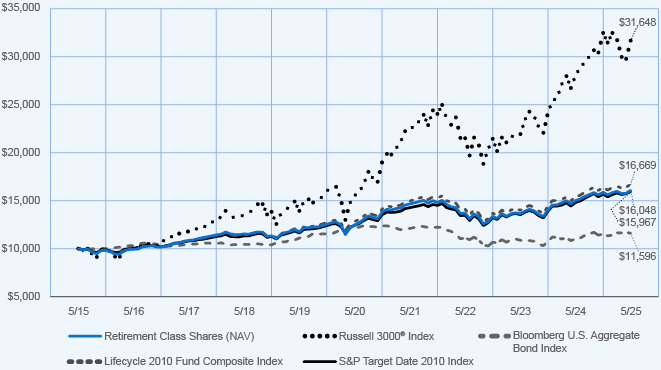

[3] |

| Factors Affecting Performance [Text Block] |

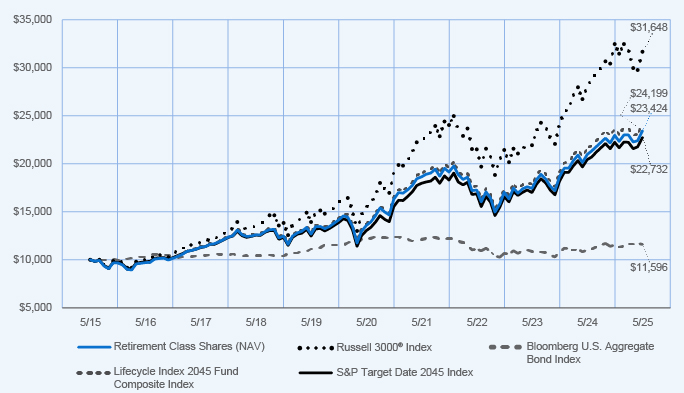

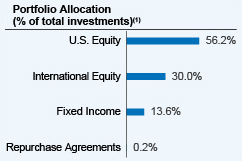

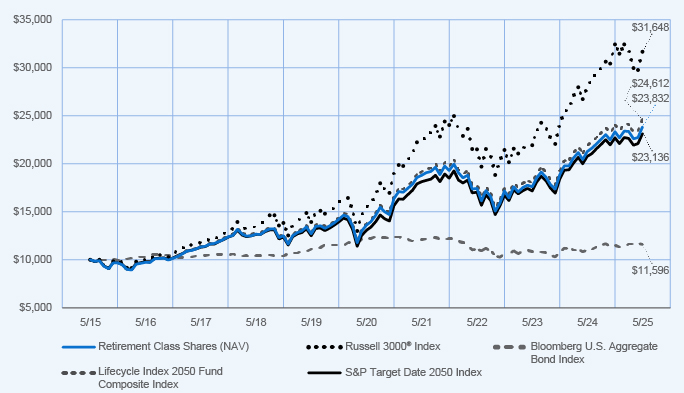

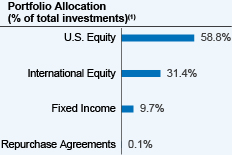

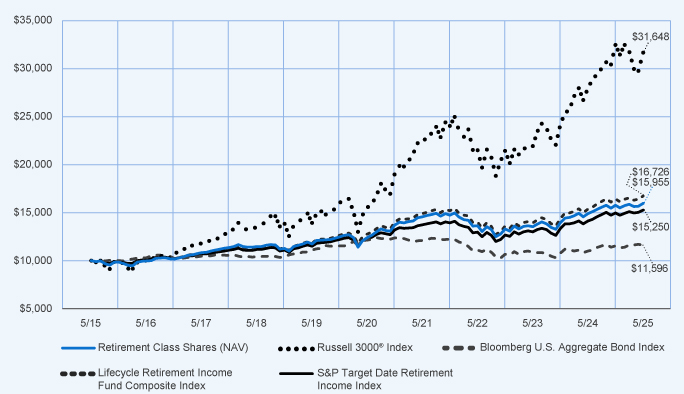

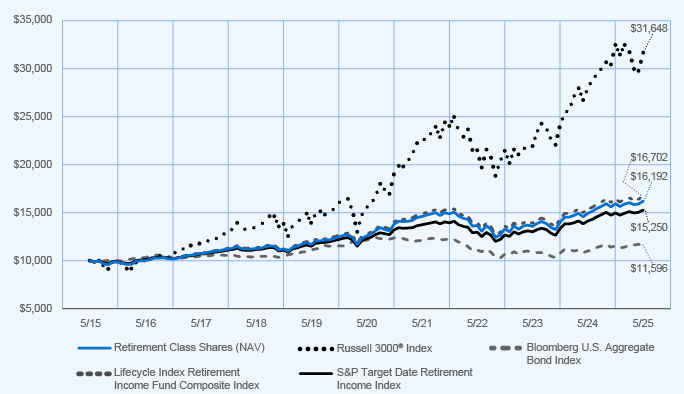

How did the Fund perform last year? What affected the Fund’s performance?

|

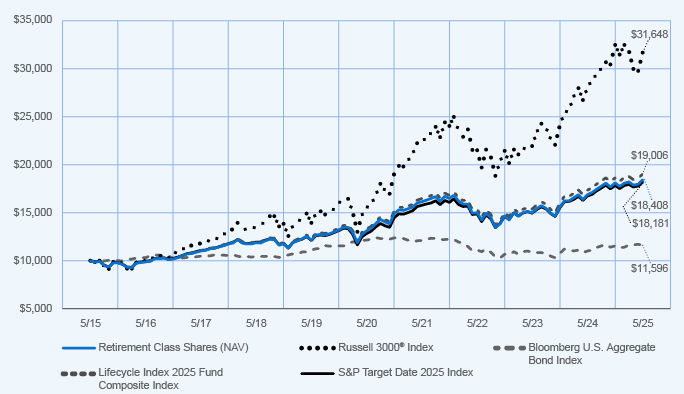

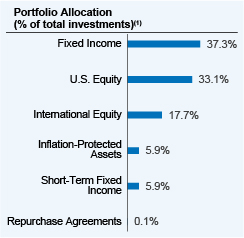

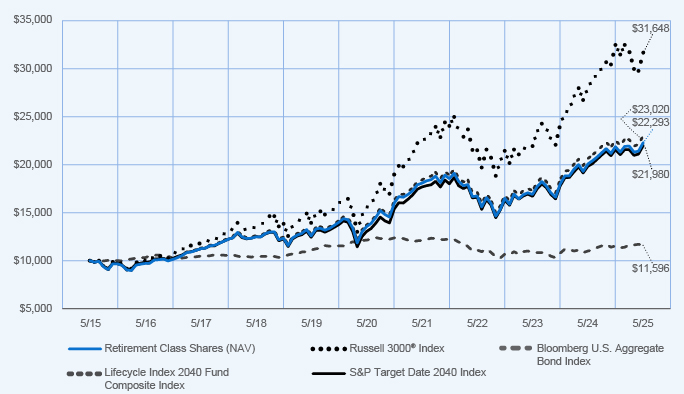

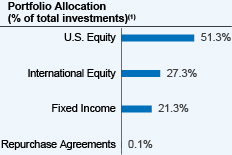

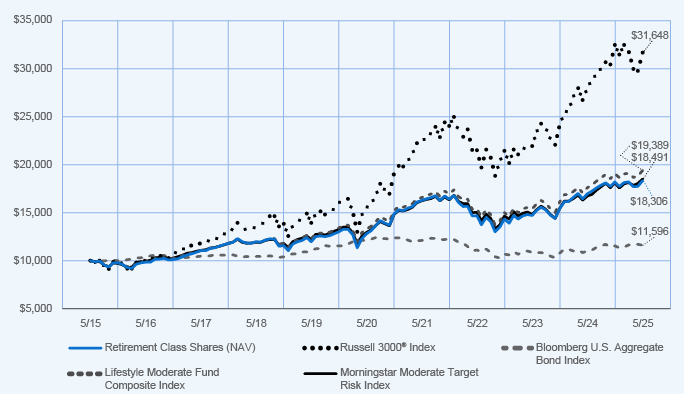

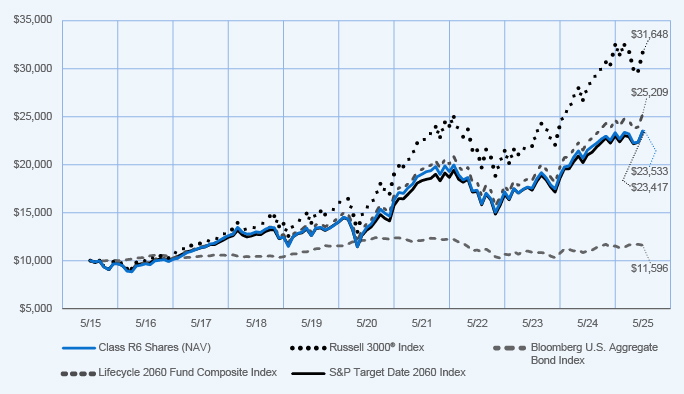

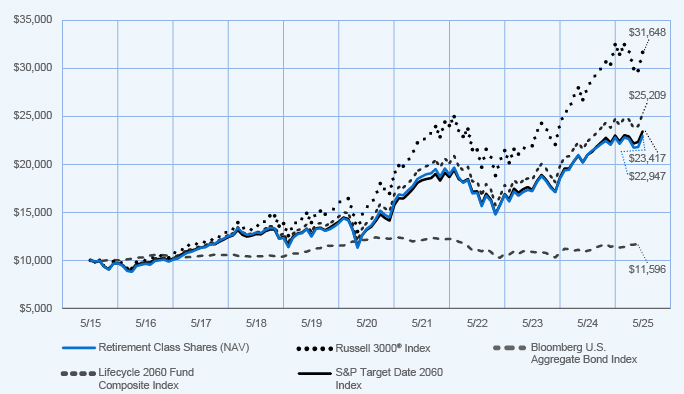

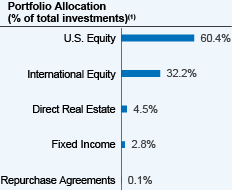

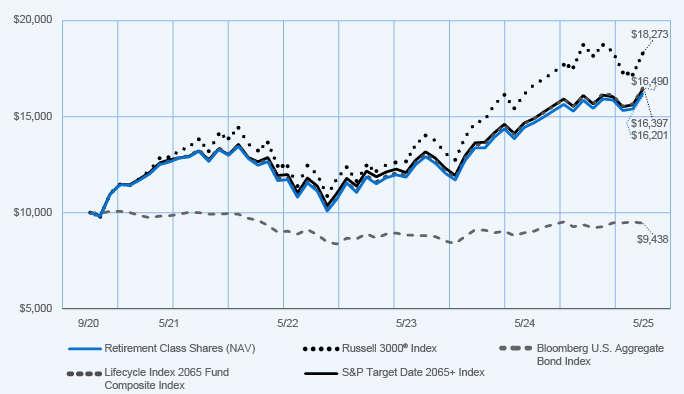

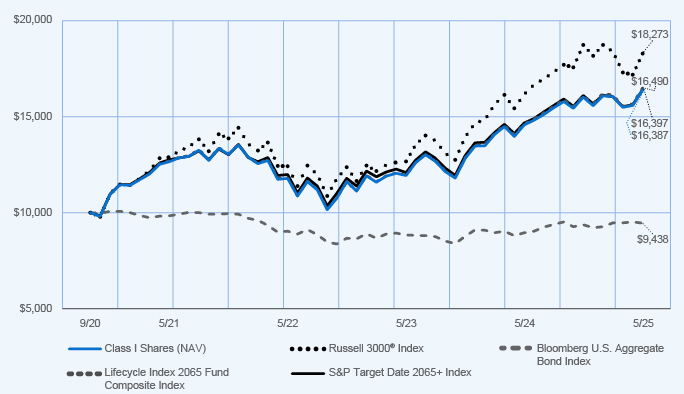

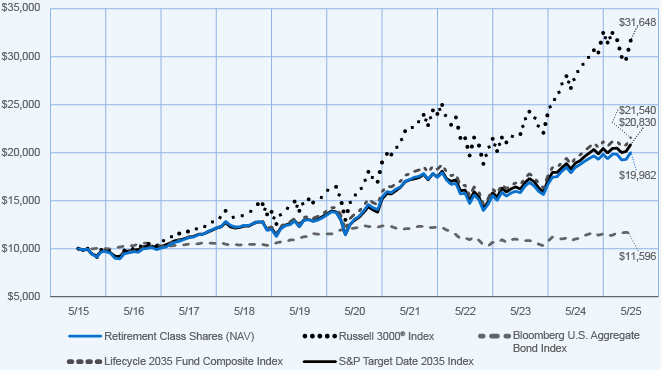

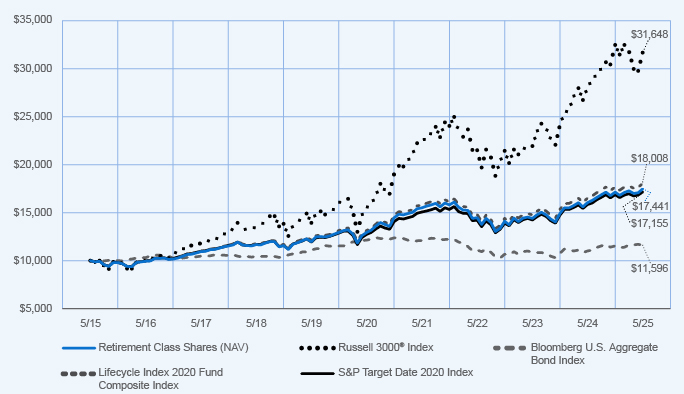

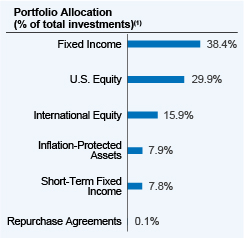

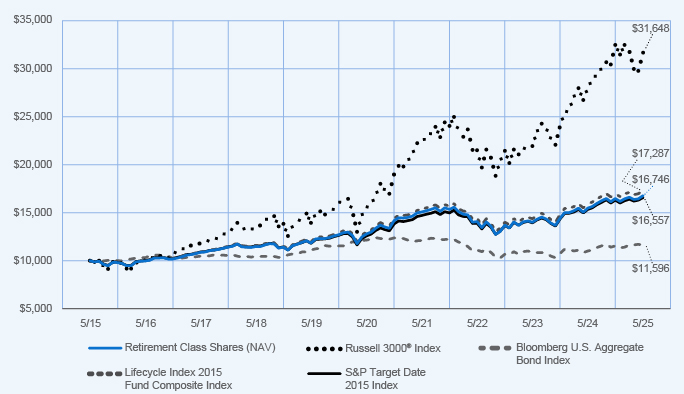

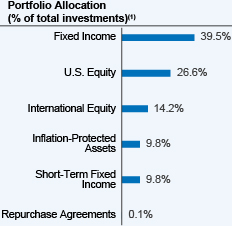

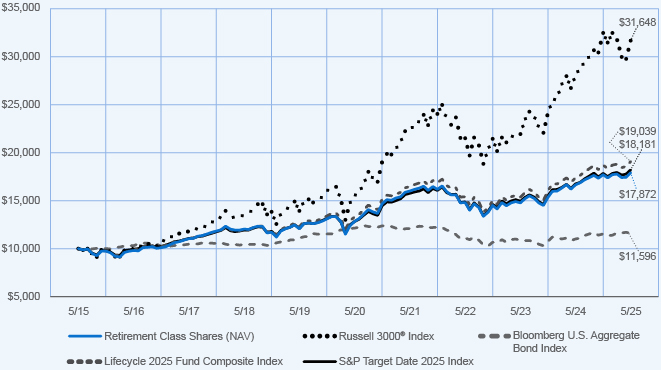

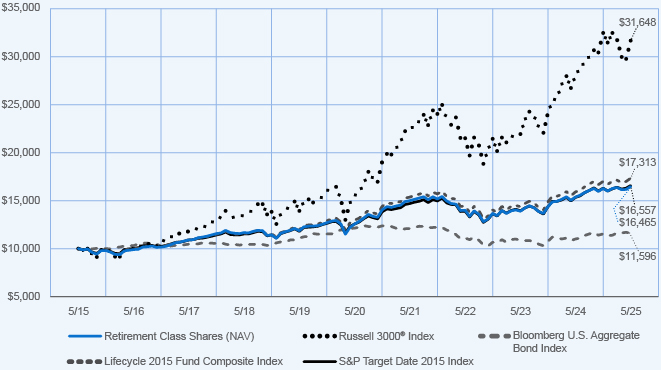

| Performance Highlights • The Nuveen Lifecycle Index 2025 Fund returned 9.13% for Retirement Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2025 Fund Composite Index, which returned 9.64%. • The Fund’s Composite Index consisted of: 37.9% Bloomberg U.S. Aggregate Bond Index; 32.6% Russell 3000® Index; 17.5% MSCI EAFE + Emerging Markets Index; 6.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 6.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

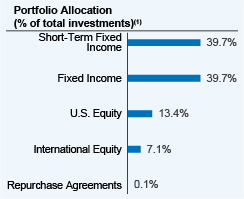

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Retirement Class Shares at NAV |

|

|

9.13 |

% |

|

|

7.04 |

% |

|

|

6.29 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2025 Fund Composite Index |

|

|

9.64 |

% |

|

|

7.41 |

% |

|

|

6.63 |

% |

| |

|

|

|

| S&P Target Date 2025 Index |

|

|

8.82 |

% |

|

|

7.23 |

% |

|

|

6.16 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 6,030,274,815

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 9,875,884

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

6,030,274,815 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

14% |

|

|

|

| Total management fees paid for the year |

|

$ |

9,875,884 |

|

|

|

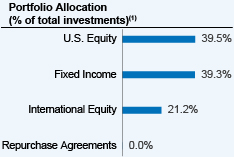

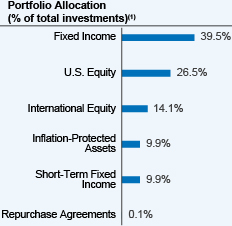

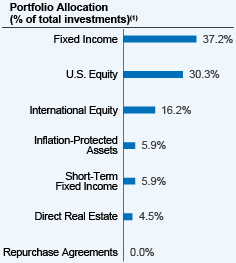

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000162582 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2025 Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

TLQHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle Index 2025 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$12 |

|

0.11% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.11%

|

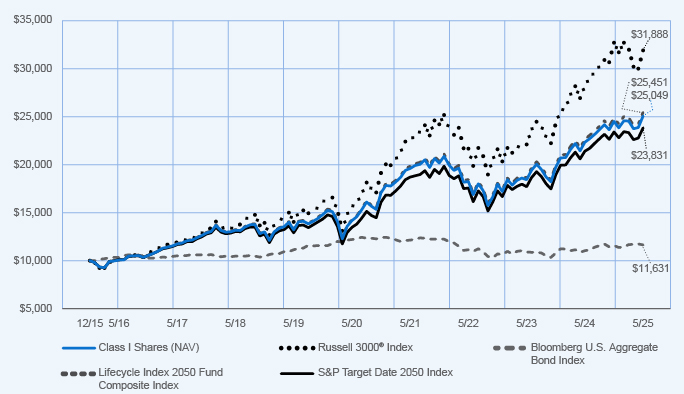

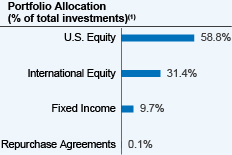

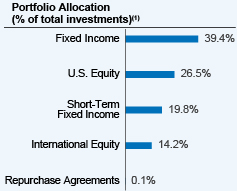

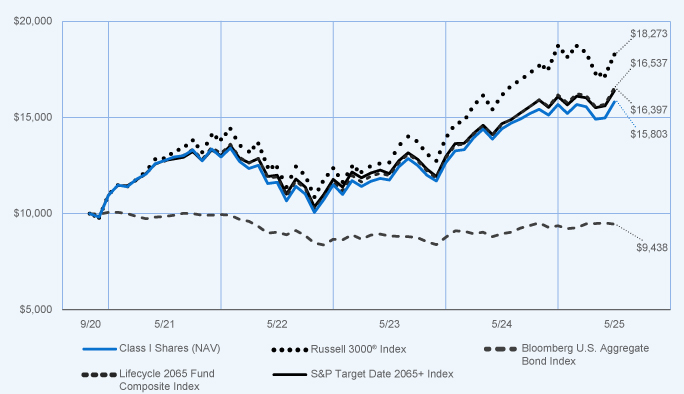

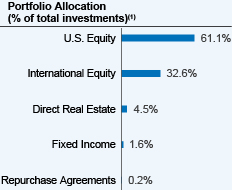

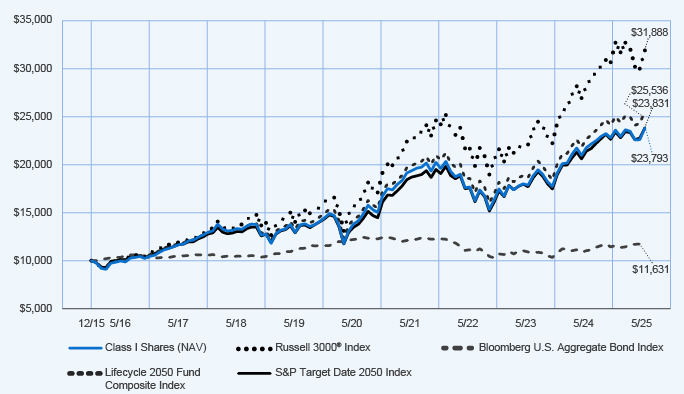

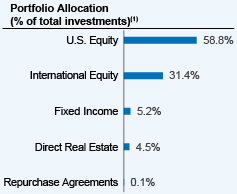

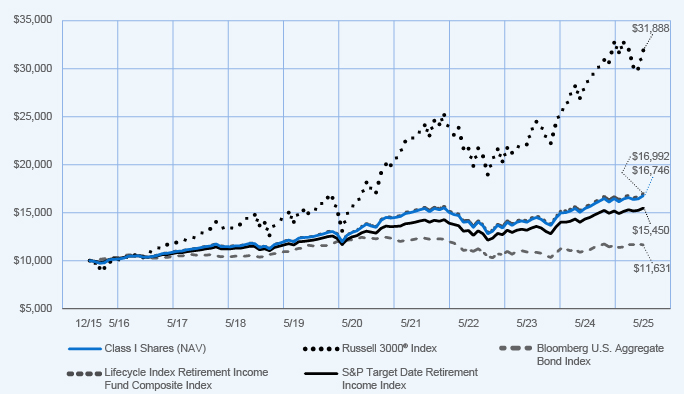

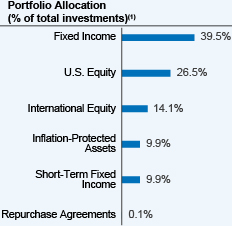

[4] |

| Factors Affecting Performance [Text Block] |

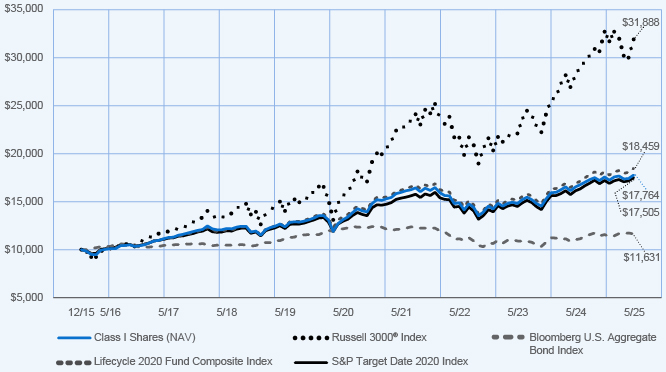

How did the Fund perform last year? What affected the Fund’s performance?

|

|

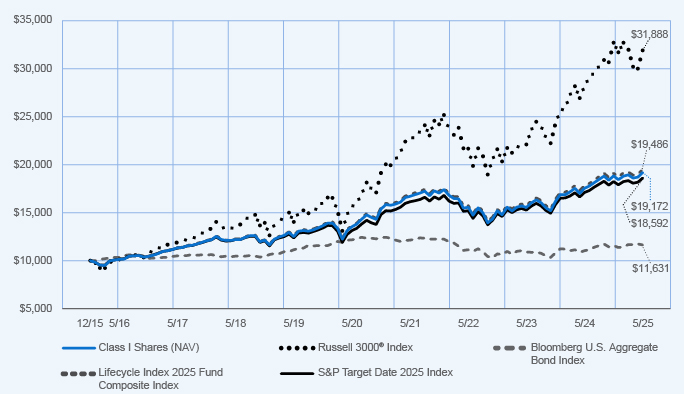

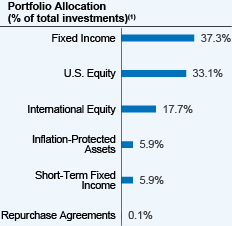

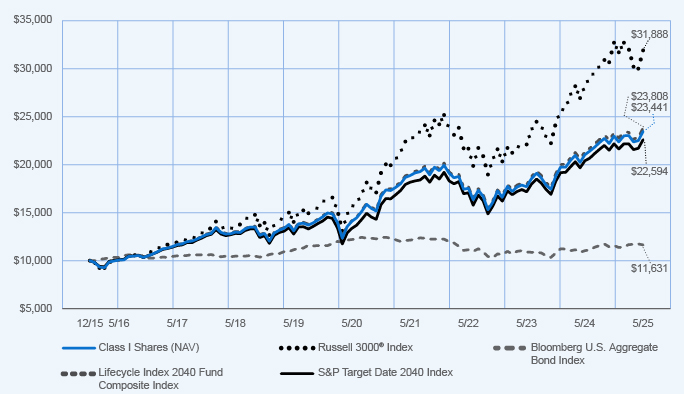

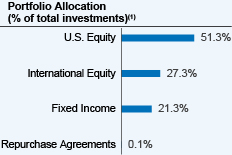

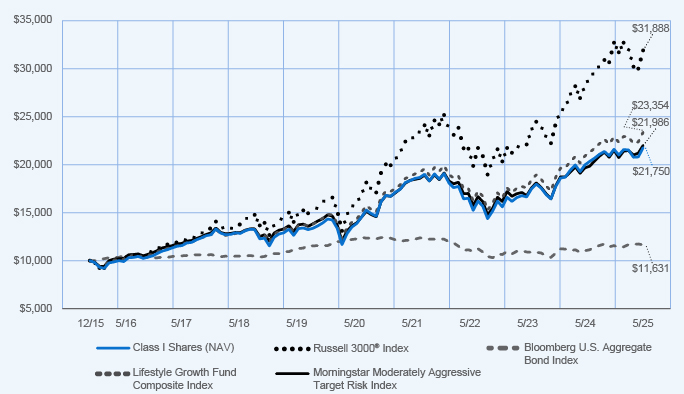

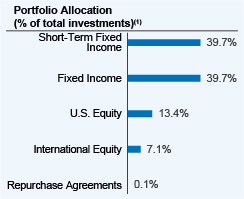

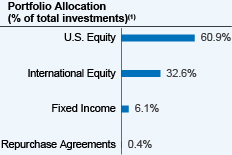

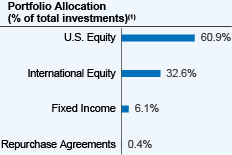

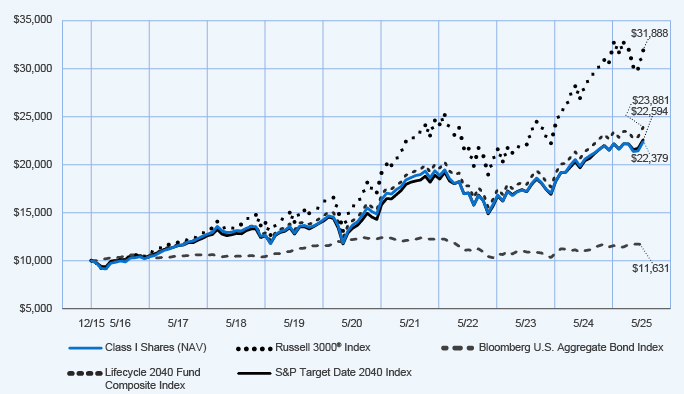

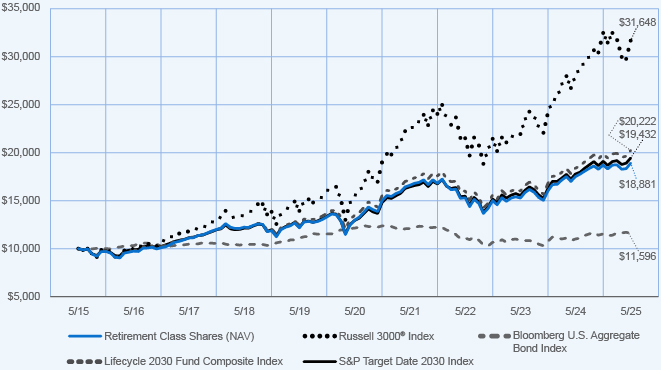

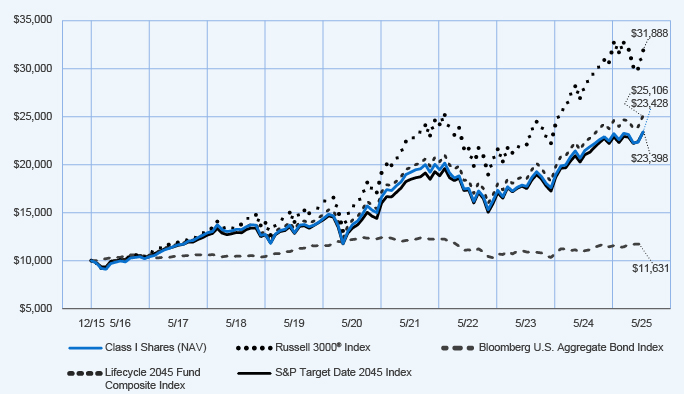

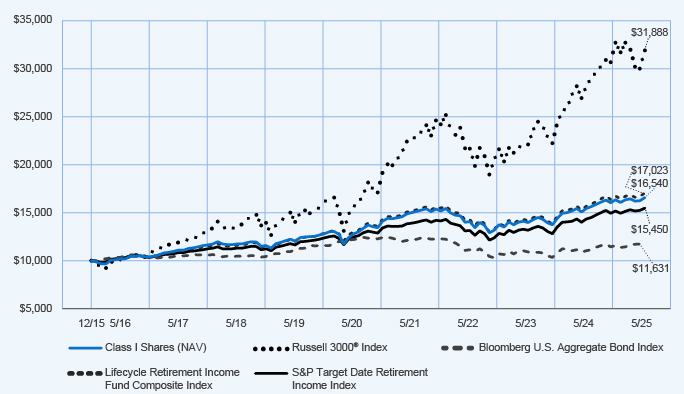

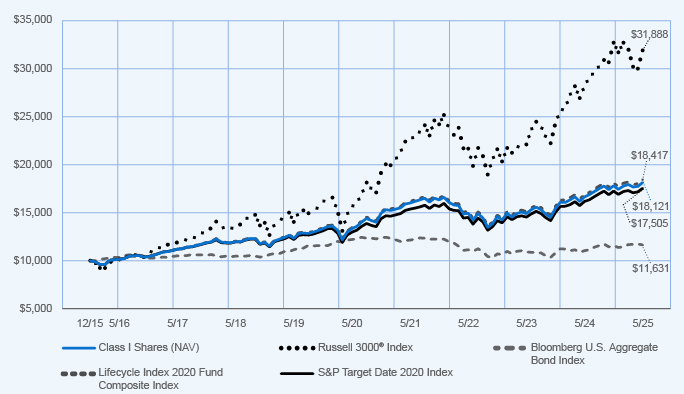

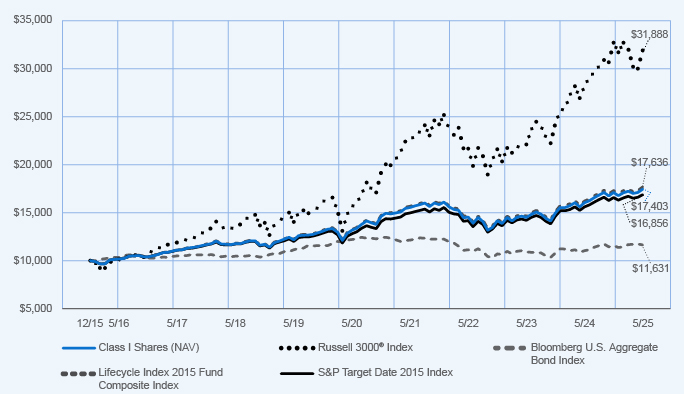

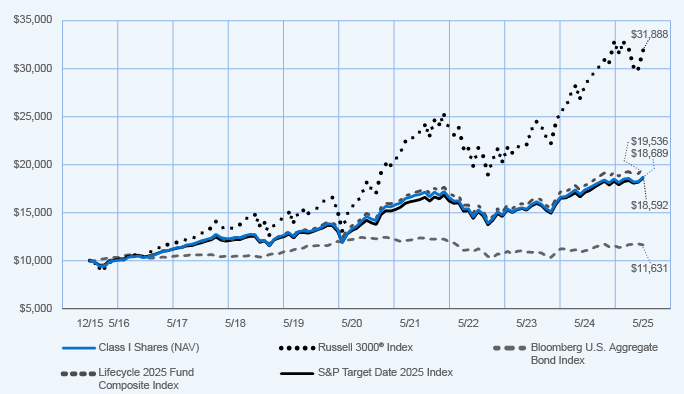

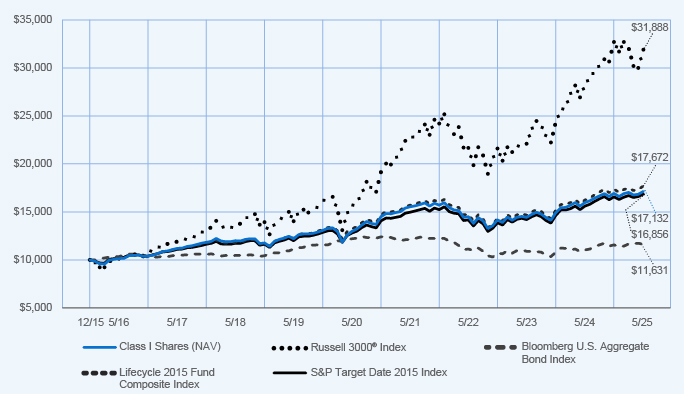

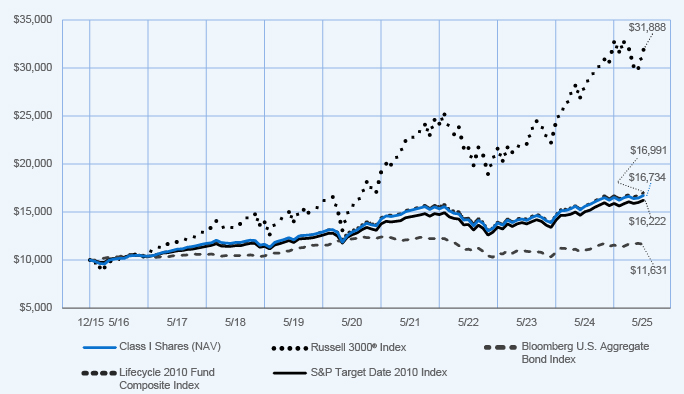

| Performance Highlights • The Nuveen Lifecycle Index 2025 Fund returned 9.37% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2025 Fund Composite Index, which returned 9.64%. • The Fund’s Composite Index consisted of: 37.9% Bloomberg U.S. Aggregate Bond Index; 32.6% Russell 3000® Index; 17.5% MSCI EAFE + Emerging Markets Index; 6.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 6.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

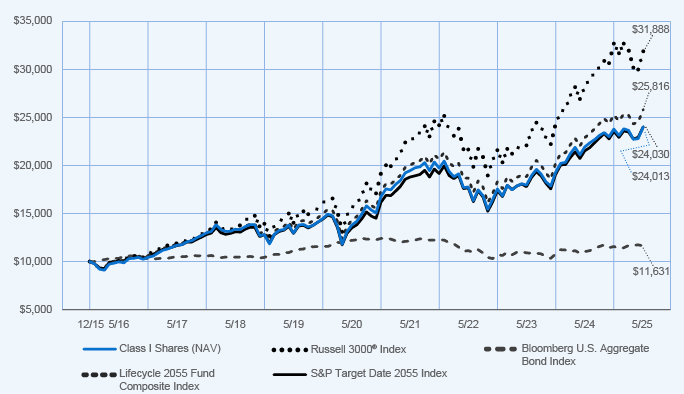

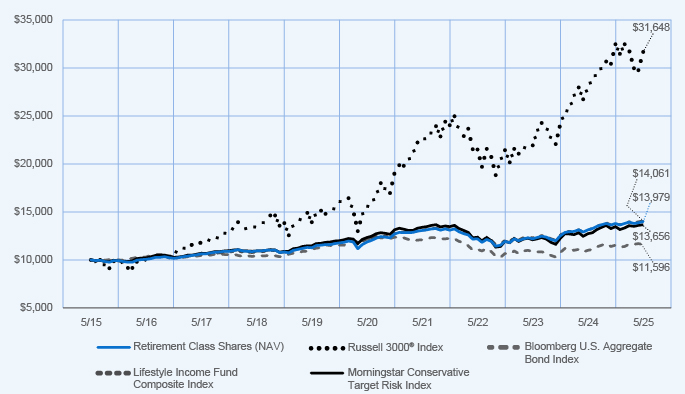

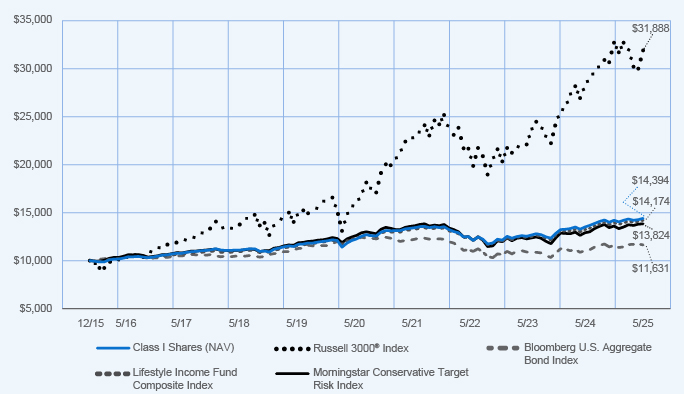

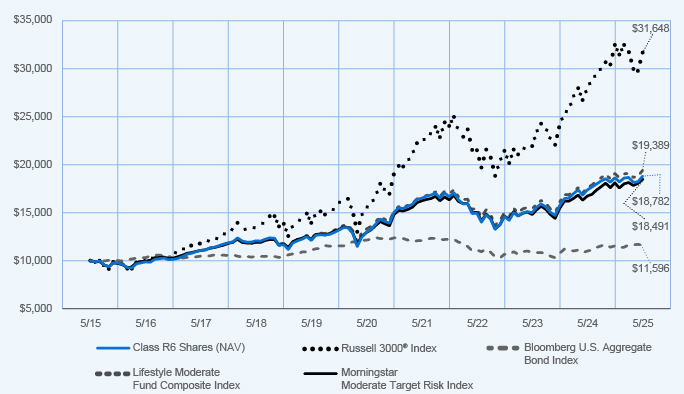

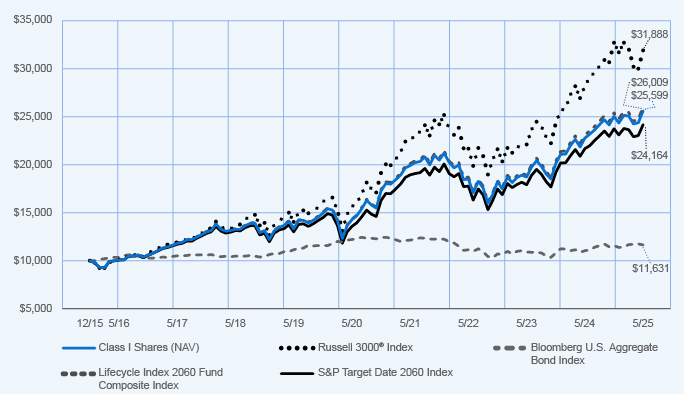

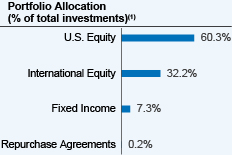

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

Since Inception |

| |

|

|

|

| Class I Shares at NAV |

|

|

9.37 |

% |

|

|

7.21 |

% |

|

7.10% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

13.00% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

1.60% |

| |

|

|

|

| Lifecycle Index 2025 Fund Composite Index |

|

|

9.64 |

% |

|

|

7.41 |

% |

|

7.28% |

| |

|

|

|

| S&P Target Date 2025 Index |

|

|

8.82 |

% |

|

|

7.23 |

% |

|

6.75% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 6,030,274,815

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 9,875,884

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$6,030,274,815 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

14% |

|

|

|

| Total management fees paid for the year |

|

|

$ 9,875,884 |

|

|

|

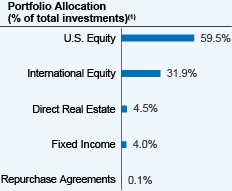

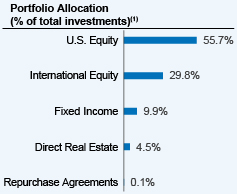

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079536 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2030 Fund

|

|

| Class Name |

Class R6 Shares

|

|

| Trading Symbol |

TLHIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle Index 2030 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of $10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$11 |

|

0.10% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 11

|

|

| Expense Ratio, Percent |

0.10%

|

[5] |

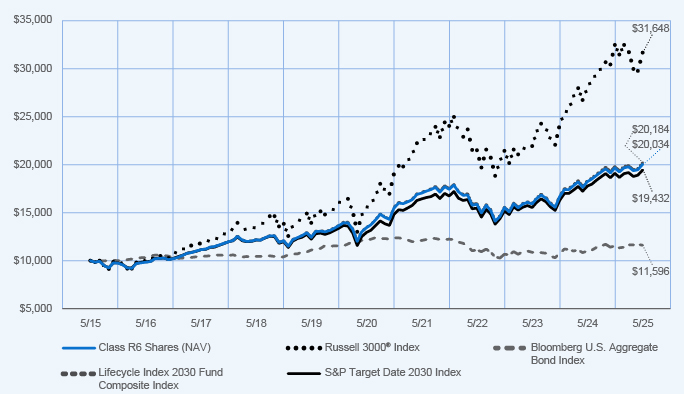

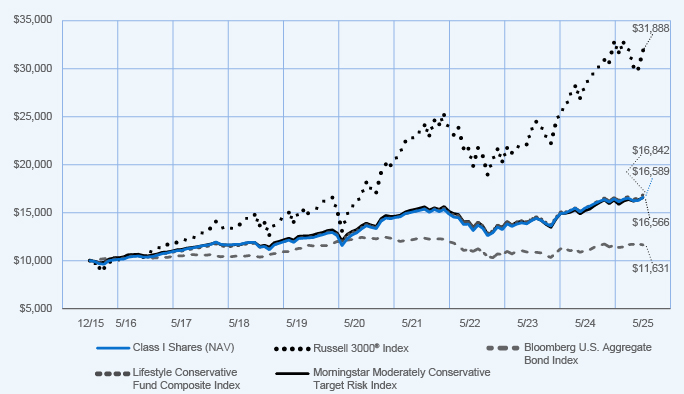

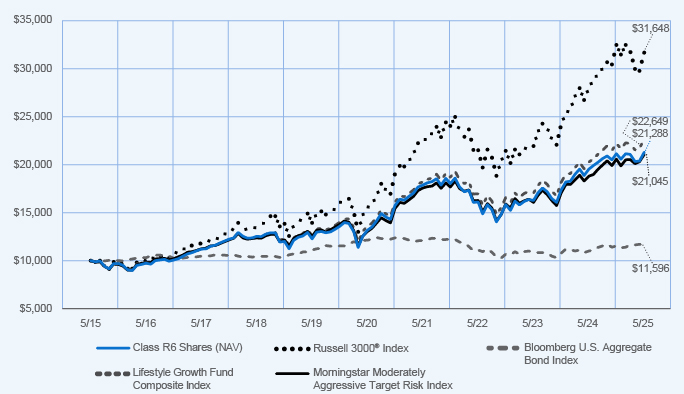

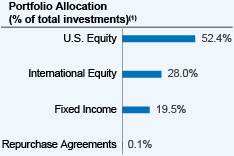

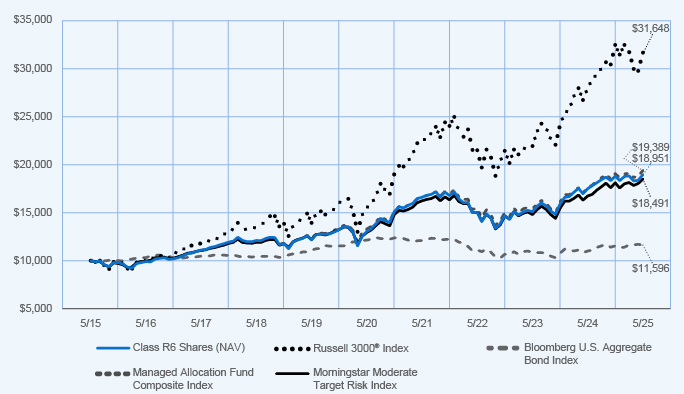

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

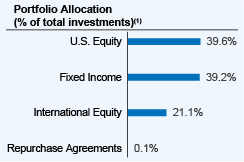

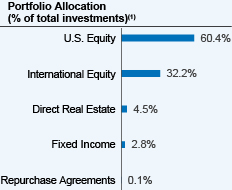

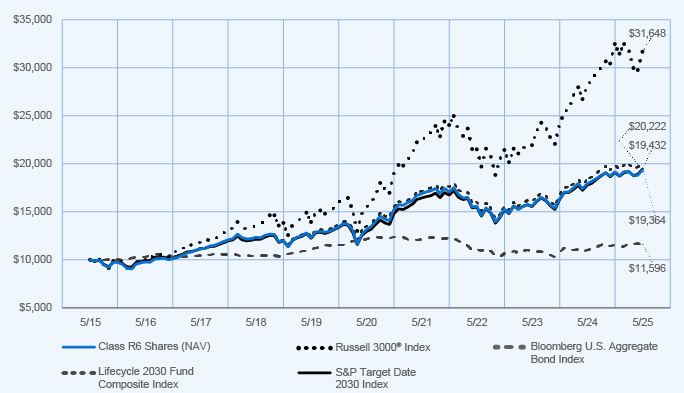

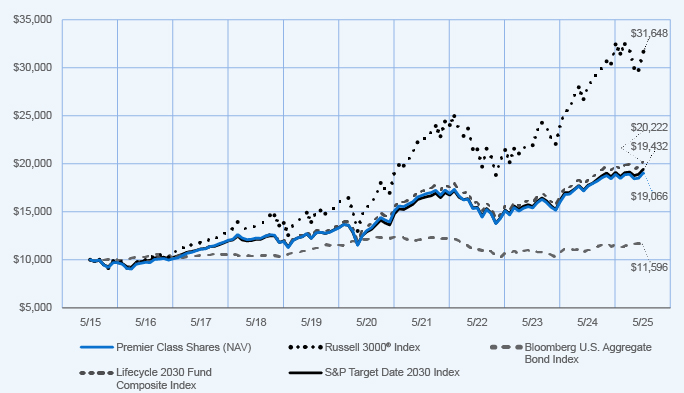

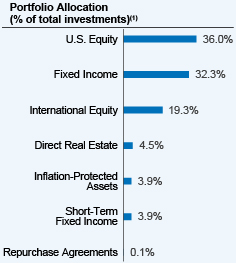

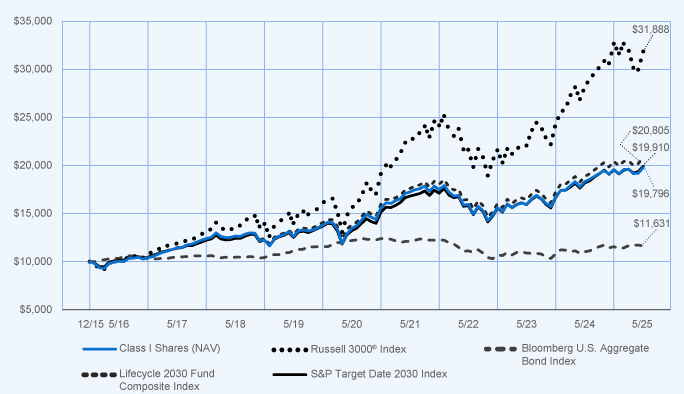

| Performance Highlights • The Nuveen Lifecycle Index 2030 Fund returned 10.01% for Class R6 Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund performed in line with the Lifecycle Index 2030 Fund Composite Index, which returned 10.23%. • The Fund’s Composite Index consisted of: 37.8% Russell 3000® Index; 33.9% Bloomberg U.S. Aggregate Bond Index; 20.3% MSCI EAFE + Emerging Markets Index; 4.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 4.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class R6 Shares at NAV |

|

|

10.01 |

% |

|

|

8.33 |

% |

|

|

7.20 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2030 Fund Composite Index |

|

|

10.23 |

% |

|

|

8.44 |

% |

|

|

7.28 |

% |

| |

|

|

|

| S&P Target Date 2030 Index |

|

|

9.51 |

% |

|

|

8.53 |

% |

|

|

6.87 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 8,826,858,954

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 13,474,913

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

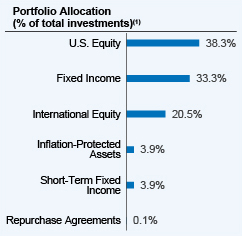

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

8,826,858,954 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

$ |

13,474,913 |

|

|

|

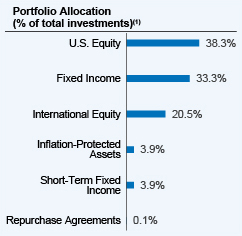

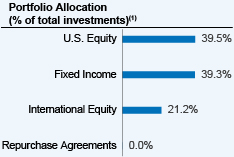

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079537 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2030 Fund

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TLHPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle Index 2030 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of $10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$26 |

|

0.25% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.25%

|

[6] |

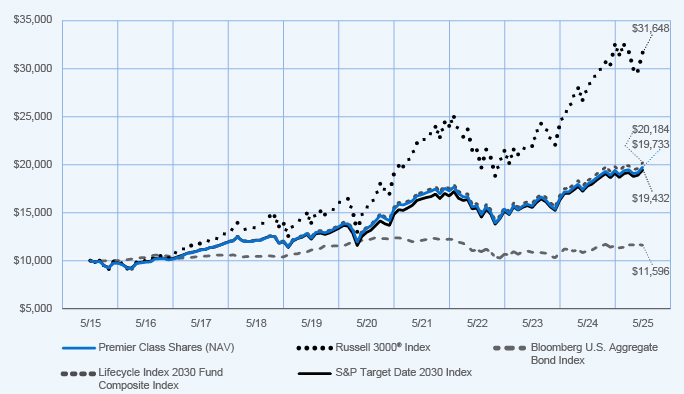

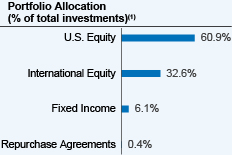

| Factors Affecting Performance [Text Block] |

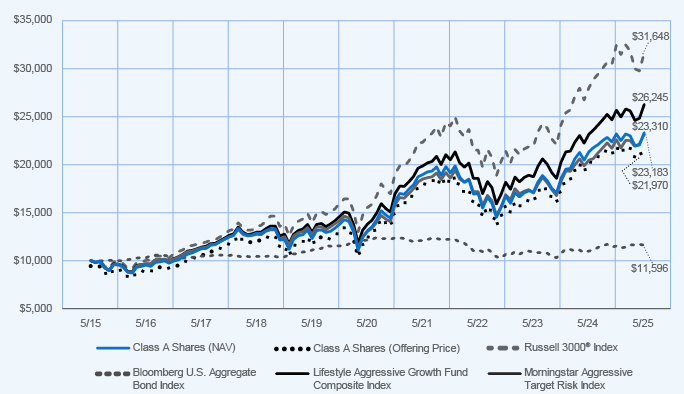

How did the Fund perform last year? What affected the Fund’s performance?

|

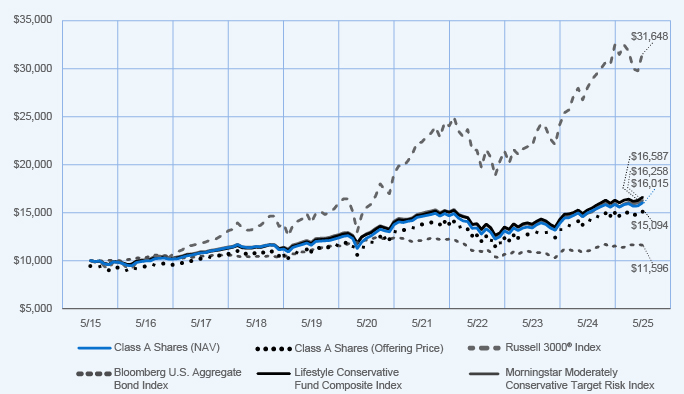

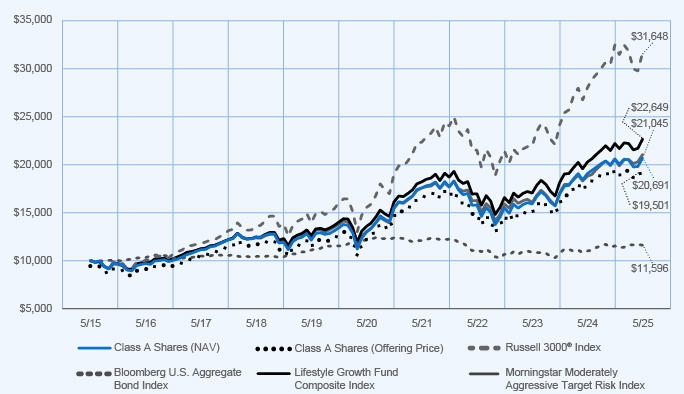

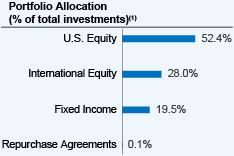

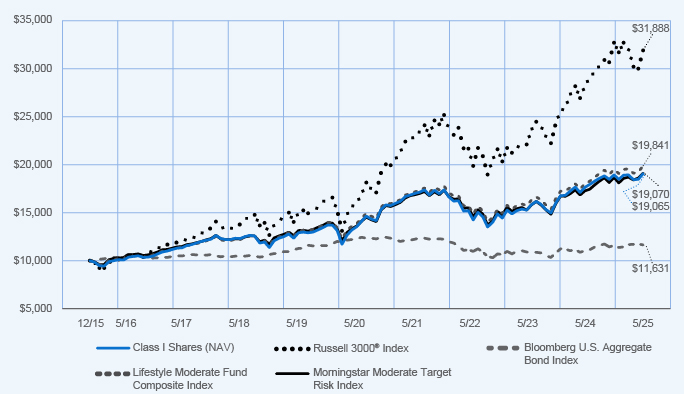

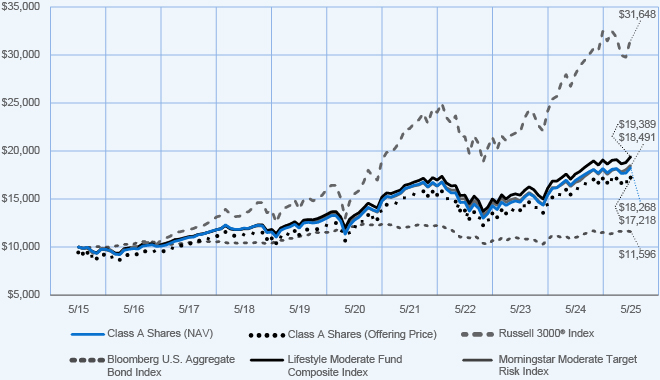

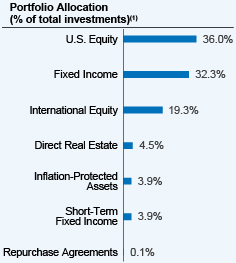

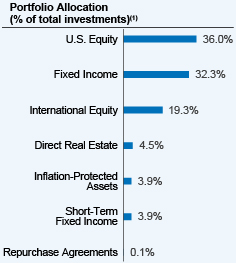

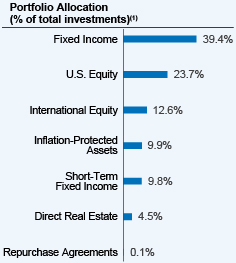

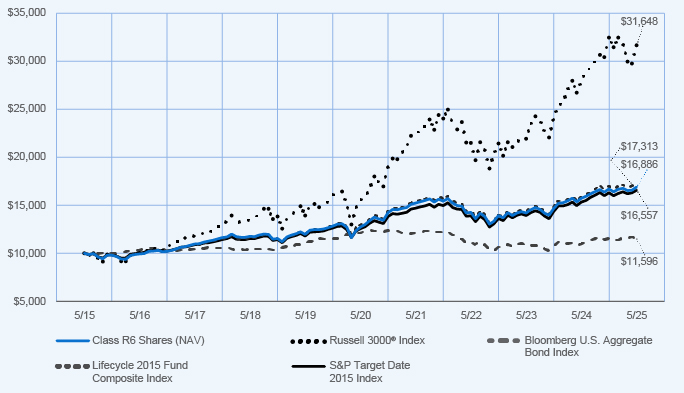

| Performance Highlights • The Nuveen Lifecycle Index 2030 Fund returned 9.83% for Premier Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2030 Fund Composite Index, which returned 10.23%. • The Fund’s Composite Index consisted of: 37.8% Russell 3000® Index; 33.9% Bloomberg U.S. Aggregate Bond Index; 20.3% MSCI EAFE + Emerging Markets Index; 4.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 4.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Premier Class Shares at NAV |

|

|

9.83 |

% |

|

|

8.17 |

% |

|

|

7.03 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2030 Fund Composite Index |

|

|

10.23 |

% |

|

|

8.44 |

% |

|

|

7.28 |

% |

| |

|

|

|

| S&P Target Date 2030 Index |

|

|

9.51 |

% |

|

|

8.53 |

% |

|

|

6.87 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 8,826,858,954

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 13,474,913

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

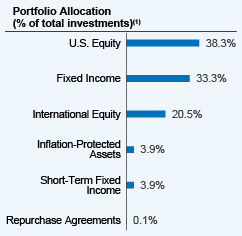

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

8,826,858,954 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

$ |

13,474,913 |

|

|

|

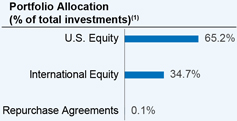

| Holdings [Text Block] |

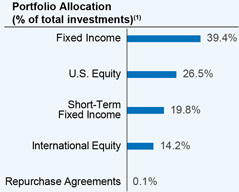

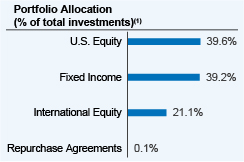

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079538 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2030 Fund

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TLHRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle Index 2030 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of $10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$37 |

|

0.35% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

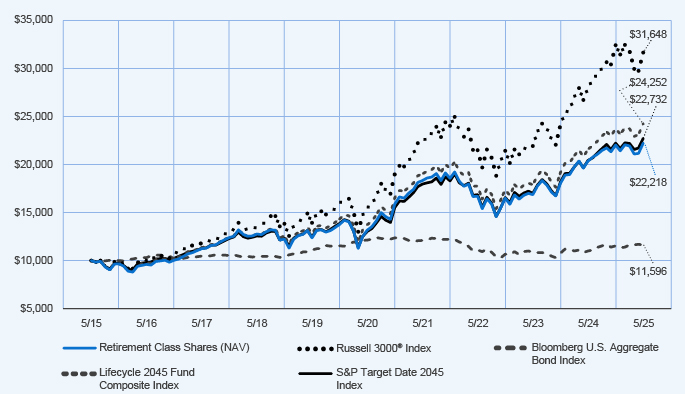

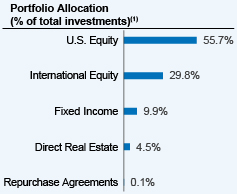

[7] |

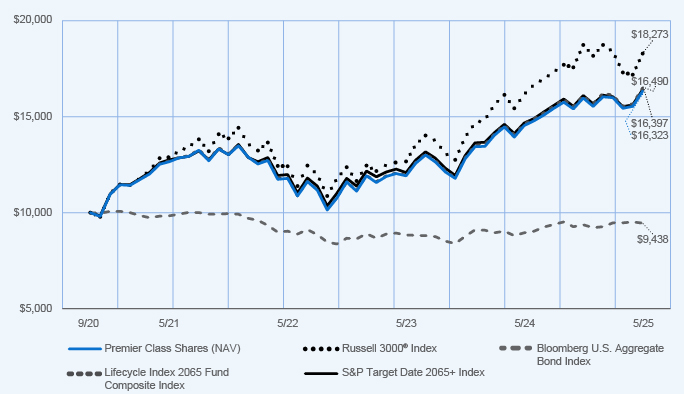

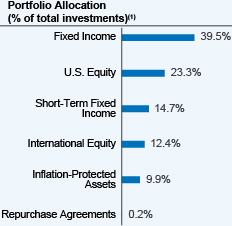

| Factors Affecting Performance [Text Block] |

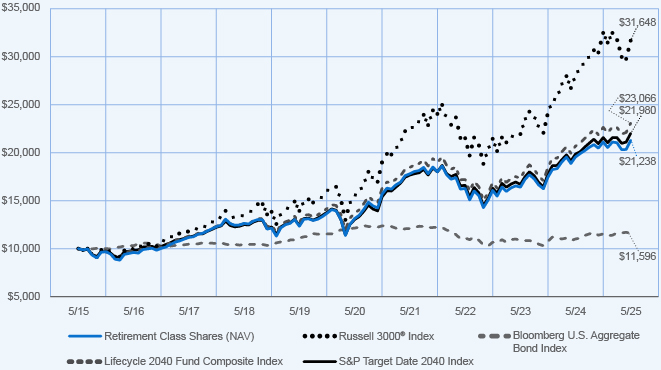

How did the Fund perform last year? What affected the Fund’s performance?

|

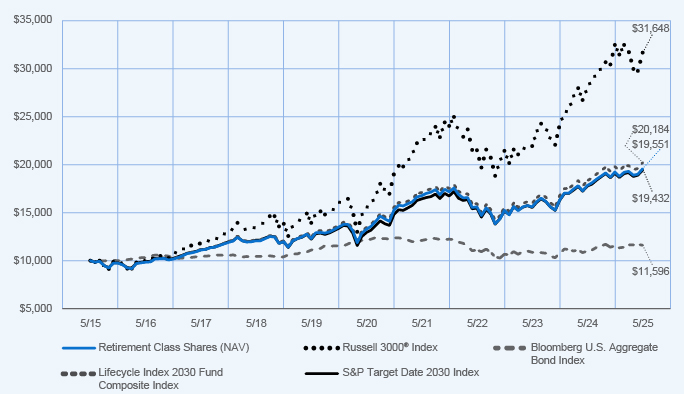

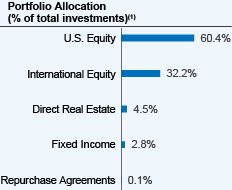

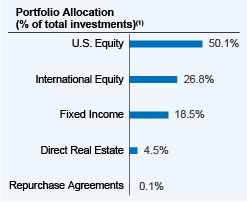

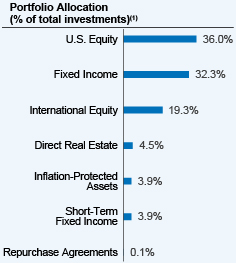

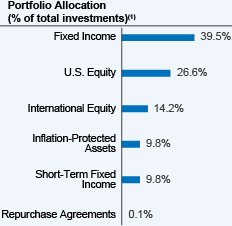

| Performance Highlights • The Nuveen Lifecycle Index 2030 Fund returned 9.71% for Retirement Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2030 Fund Composite Index, which returned 10.23%. • The Fund’s Composite Index consisted of: 37.8% Russell 3000® Index; 33.9% Bloomberg U.S. Aggregate Bond Index; 20.3% MSCI EAFE + Emerging Markets Index; 4.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 4.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

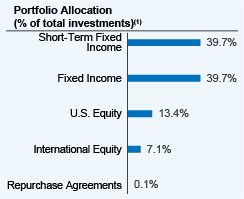

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Retirement Class Shares at NAV |

|

|

9.71 |

% |

|

|

8.07 |

% |

|

|

6.93 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2030 Fund Composite Index |

|

|

10.23 |

% |

|

|

8.44 |

% |

|

|

7.28 |

% |

| |

|

|

|

| S&P Target Date 2030 Index |

|

|

9.51 |

% |

|

|

8.53 |

% |

|

|

6.87 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 8,826,858,954

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 13,474,913

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

8,826,858,954 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

$ |

13,474,913 |

|

|

|

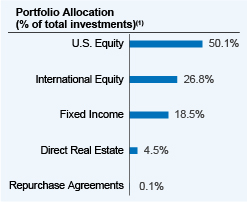

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000162583 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2030 Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

TLHHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle Index 2030 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$12 |

|

0.11% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.11%

|

[8] |

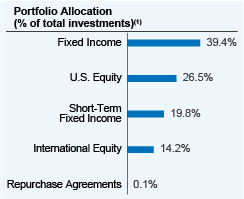

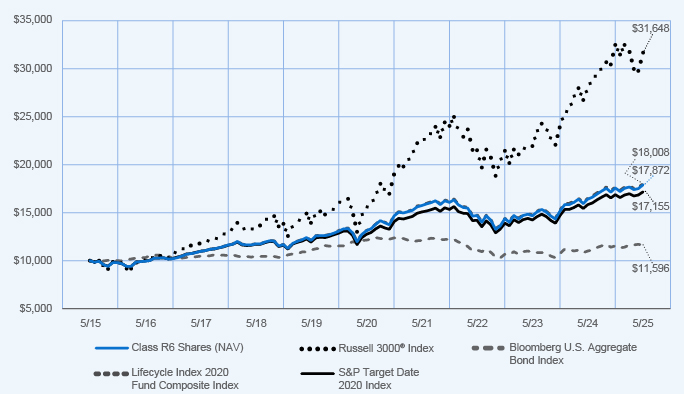

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

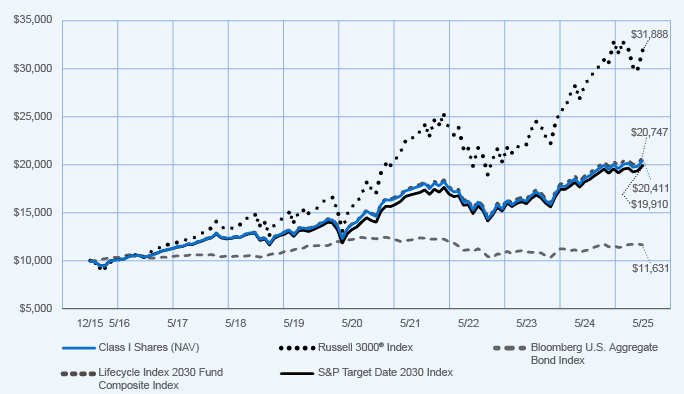

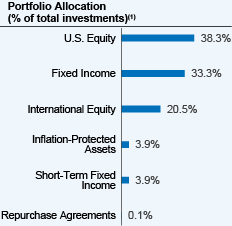

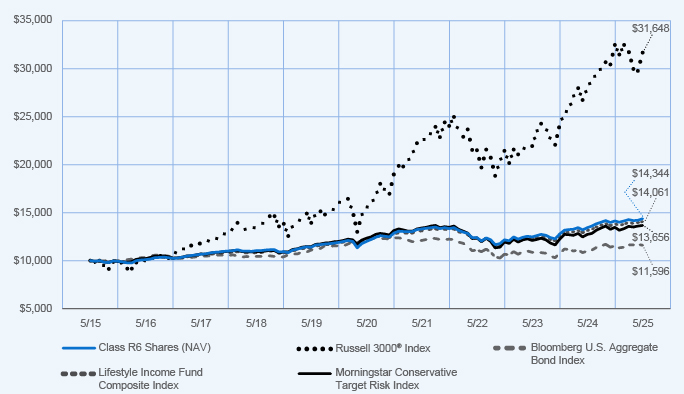

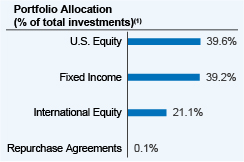

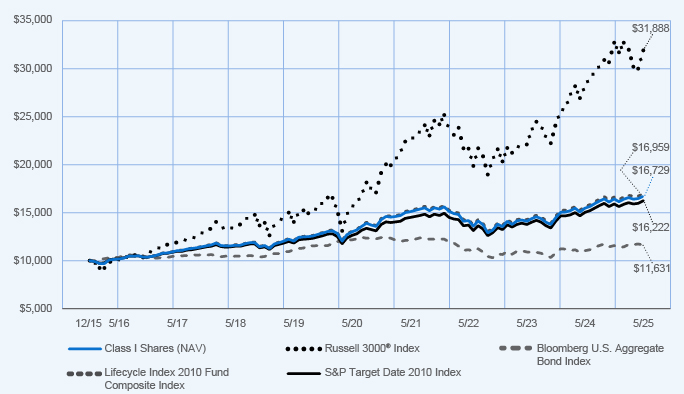

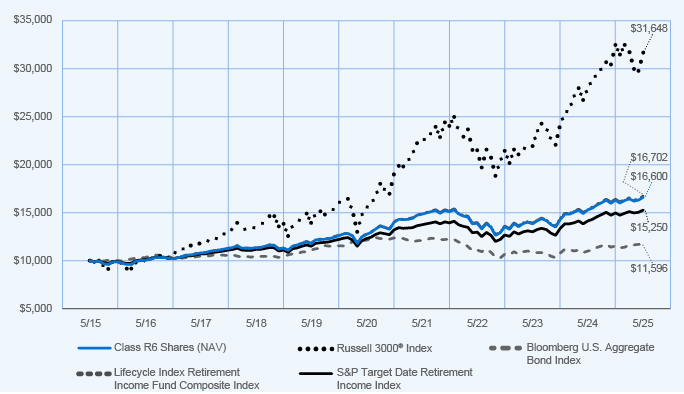

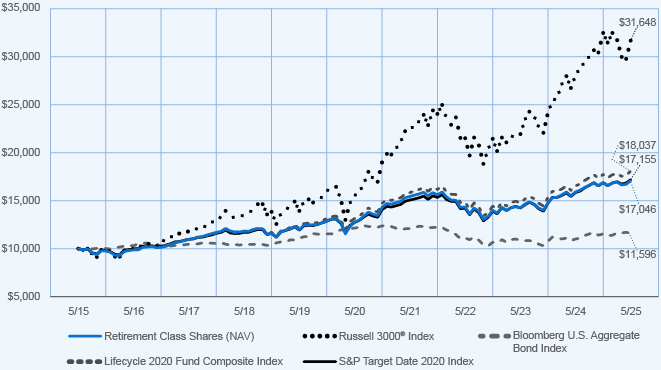

| Performance Highlights • The Nuveen Lifecycle Index 2030 Fund returned 9.96% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2030 Fund Composite Index, which returned 10.23%. • The Fund’s Composite Index consisted of: 37.8% Russell 3000® Index; 33.9% Bloomberg U.S. Aggregate Bond Index; 20.3% MSCI EAFE + Emerging Markets Index; 4.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 4.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

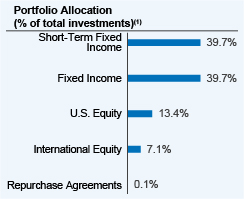

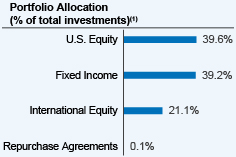

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

Since Inception |

| |

|

|

|

| Class I Shares at NAV |

|

|

9.96 |

% |

|

|

8.24 |

% |

|

7.81% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

13.00% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

1.60% |

| |

|

|

|

| Lifecycle Index 2030 Fund Composite Index |

|

|

10.23 |

% |

|

|

8.44 |

% |

|

7.99% |

| |

|

|

|

| S&P Target Date 2030 Index |

|

|

9.51 |

% |

|

|

8.53 |

% |

|

7.53% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 8,826,858,954

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 13,474,913

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$8,826,858,954 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

|

$ 13,474,913 |

|

|

|

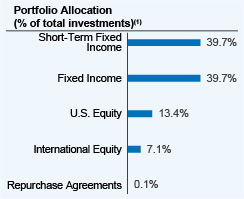

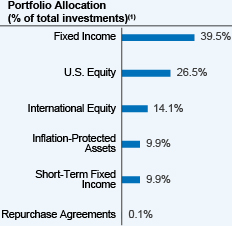

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000162584 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2035 Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

TLYHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle Index 2035 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$12 |

|

0.11% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.11%

|

[9] |

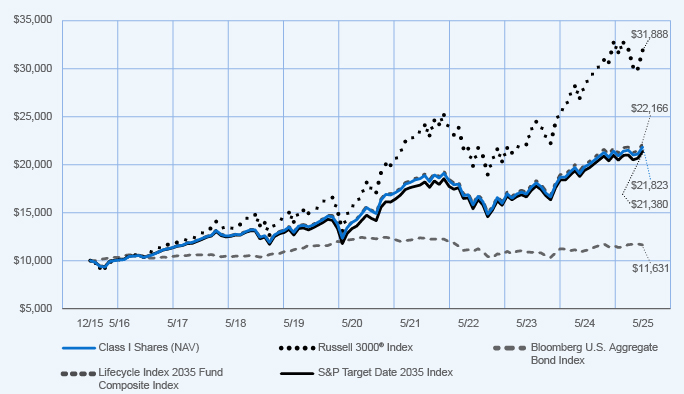

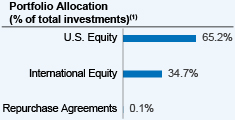

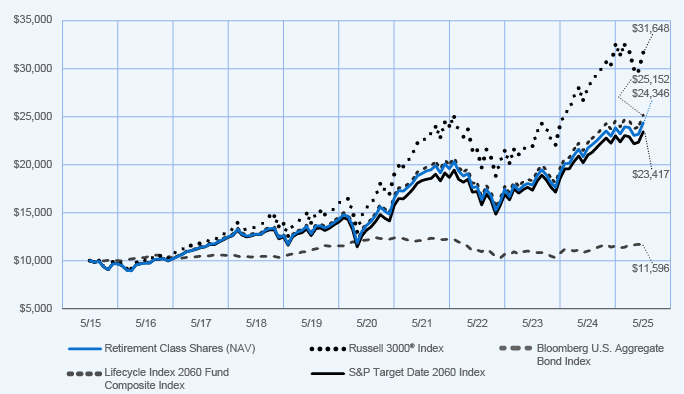

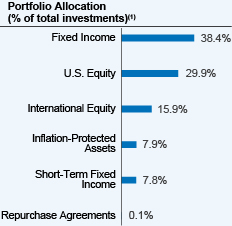

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

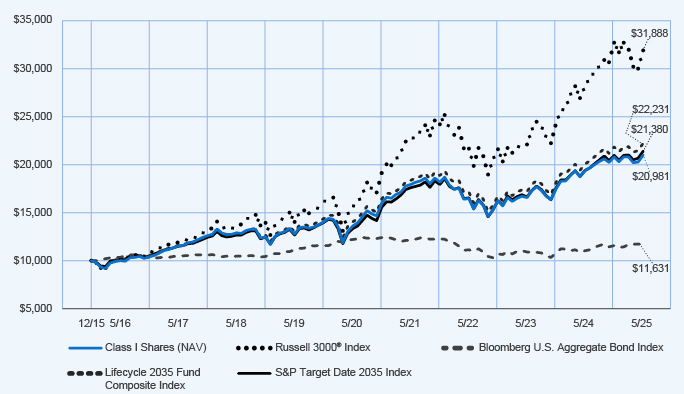

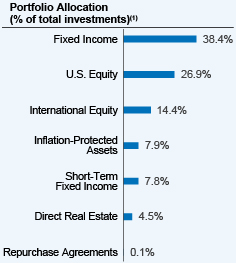

| Performance Highlights • The Nuveen Lifecycle Index 2035 Fund returned 10.56% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2035 Fund Composite Index, which returned 10.86%. • The Fund’s Composite Index consisted of: 43.0% Russell 3000® Index; 29.8% Bloomberg U.S. Aggregate Bond Index; 23.2% MSCI EAFE + Emerging Markets Index; 2.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 2.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

Since Inception |

| |

|

|

|

| Class I Shares at NAV |

|

|

10.56 |

% |

|

|

9.38 |

% |

|

8.57% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

13.00% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

1.60% |

| |

|

|

|

| Lifecycle Index 2035 Fund Composite Index |

|

|

10.86 |

% |

|

|

9.60 |

% |

|

8.75% |

| |

|

|

|

| S&P Target Date 2035 Index |

|

|

10.24 |

% |

|

|

9.95 |

% |

|

8.34% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 9,649,276,577

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 14,023,410

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$9,649,276,577 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

|

$ 14,023,410 |

|

|

|

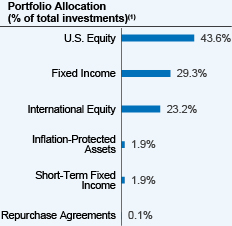

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079539 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2035 Fund

|

|

| Class Name |

Class R6 Shares

|

|

| Trading Symbol |

TLYIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle Index 2035 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$11 |

|

0.10% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 11

|

|

| Expense Ratio, Percent |

0.10%

|

[10] |

| Factors Affecting Performance [Text Block] |

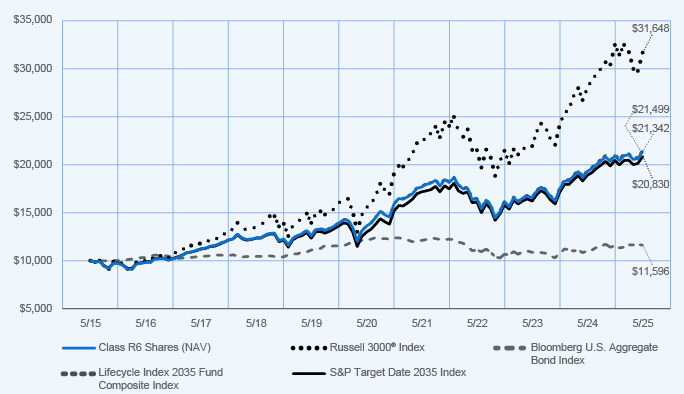

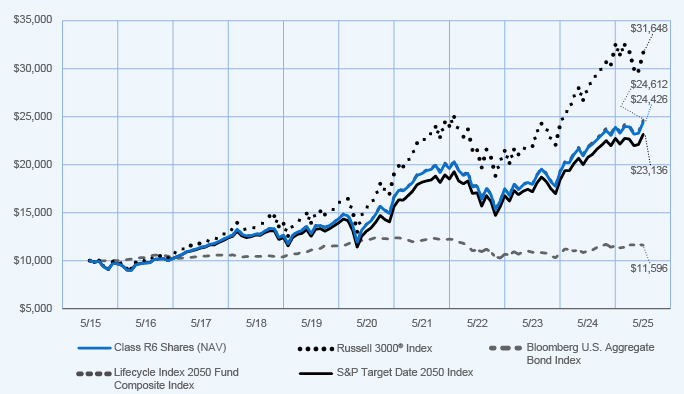

How did the Fund perform last year? What affected the Fund’s performance?

|

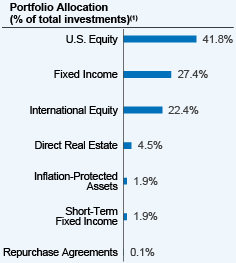

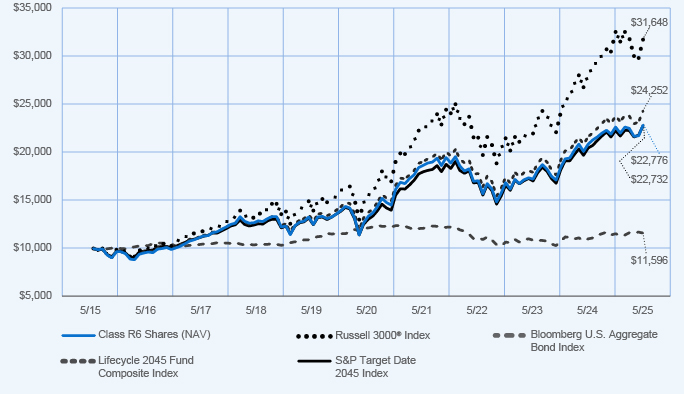

| Performance Highlights • The Nuveen Lifecycle Index 2035 Fund returned 10.57% for Class R6 Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2035 Fund Composite Index, which returned 10.86%. • The Fund’s Composite Index consisted of: 43.0% Russell 3000® Index; 29.8% Bloomberg U.S. Aggregate Bond Index; 23.2% MSCI EAFE + Emerging Markets Index; 2.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 2.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class R6 Shares at NAV |

|

|

10.57 |

% |

|

|

9.47 |

% |

|

|

7.88 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2035 Fund Composite Index |

|

|

10.86 |

% |

|

|

9.60 |

% |

|

|

7.95 |

% |

| |

|

|

|

| S&P Target Date 2035 Index |

|

|

10.24 |

% |

|

|

9.95 |

% |

|

|

7.61 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 9,649,276,577

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 14,023,410

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

9,649,276,577 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

$ |

14,023,410 |

|

|

|

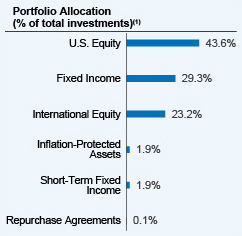

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079540 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2035 Fund

|

|

| Class Name |

Premier Class Shares

|

|

| Trading Symbol |

TLYPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle Index 2035 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Premier Class Shares |

|

$26 |

|

0.25% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.25%

|

[11] |

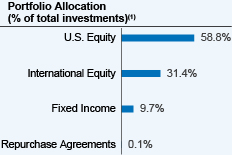

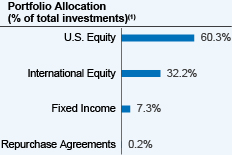

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

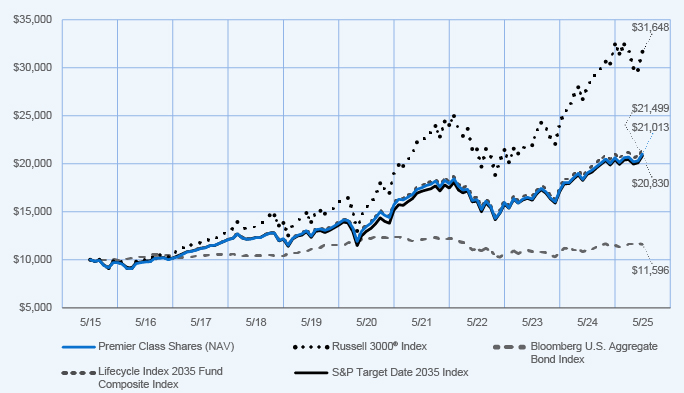

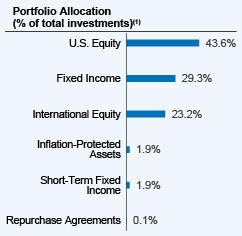

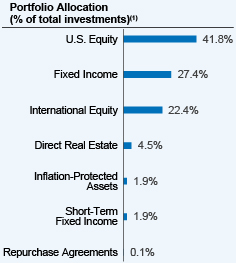

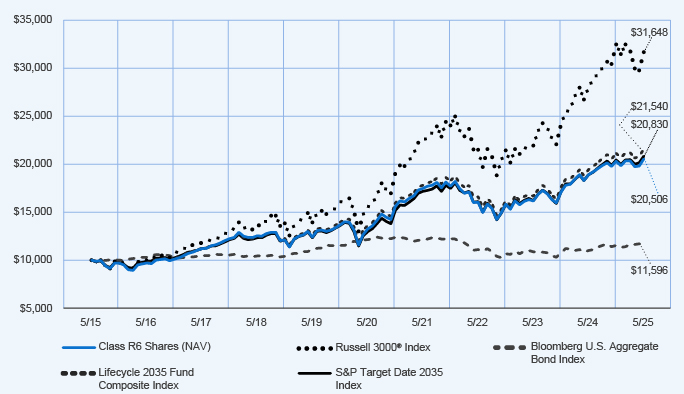

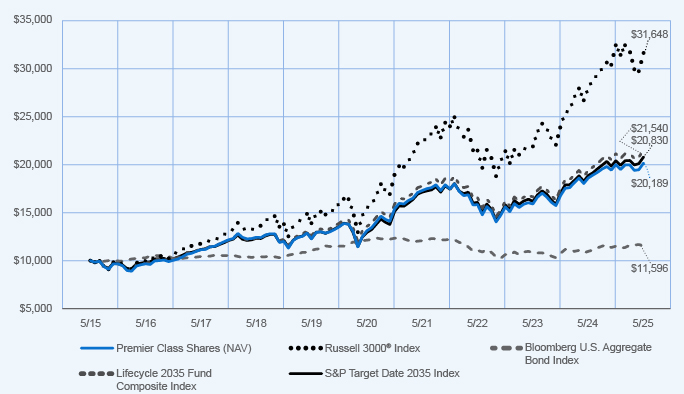

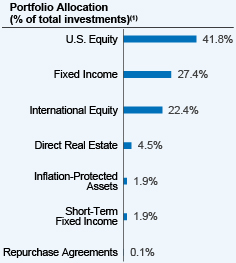

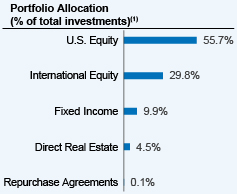

| Performance Highlights • The Nuveen Lifecycle Index 2035 Fund returned 10.45% for Premier Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2035 Fund Composite Index, which returned 10.86%. • The Fund’s Composite Index consisted of: 43.0% Russell 3000® Index; 29.8% Bloomberg U.S. Aggregate Bond Index; 23.2% MSCI EAFE + Emerging Markets Index; 2.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 2.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Premier Class Shares at NAV |

|

|

10.45 |

% |

|

|

9.30 |

% |

|

|

7.71 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2035 Fund Composite Index |

|

|

10.86 |

% |

|

|

9.60 |

% |

|

|

7.95 |

% |

| |

|

|

|

| S&P Target Date 2035 Index |

|

|

10.24 |

% |

|

|

9.95 |

% |

|

|

7.61 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 9,649,276,577

|

|

| Holdings Count | Holding |

7

|

|

| Advisory Fees Paid, Amount |

$ 14,023,410

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

9,649,276,577 |

|

|

|

| Total number of portfolio holdings |

|

|

7 |

|

|

|

| Portfolio turnover (%) |

|

|

13% |

|

|

|

| Total management fees paid for the year |

|

$ |

14,023,410 |

|

|

|

| Holdings [Text Block] |

(1) Affiliated investment companies (Underlying Funds), except for repurchase agreements.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000079541 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Lifecycle Index 2035 Fund

|

|

| Class Name |

Retirement Class Shares

|

|

| Trading Symbol |

TLYRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle Index 2035 Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Retirement Class Shares |

|

$37 |

|

0.35% | * The Fund’s ratios include the expenses and exclude the income of the Underlying Funds. Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

[12] |

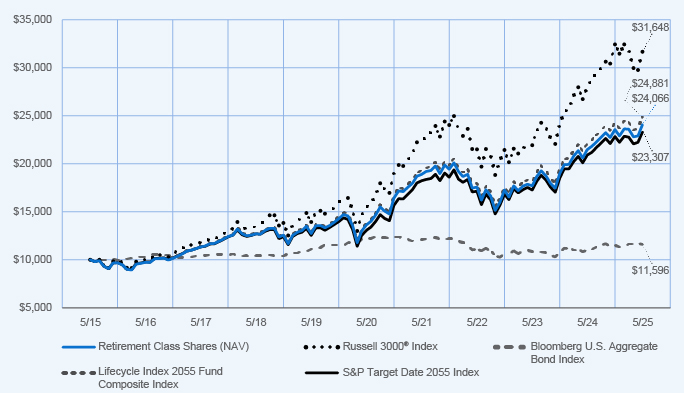

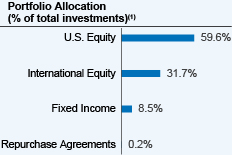

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

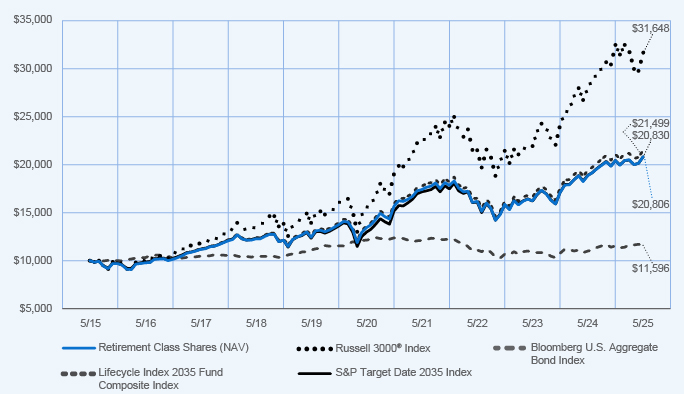

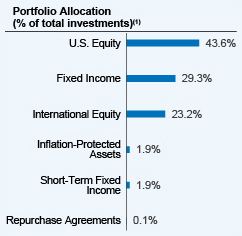

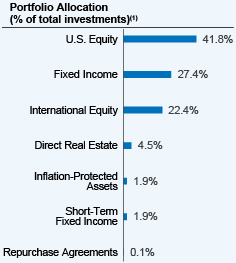

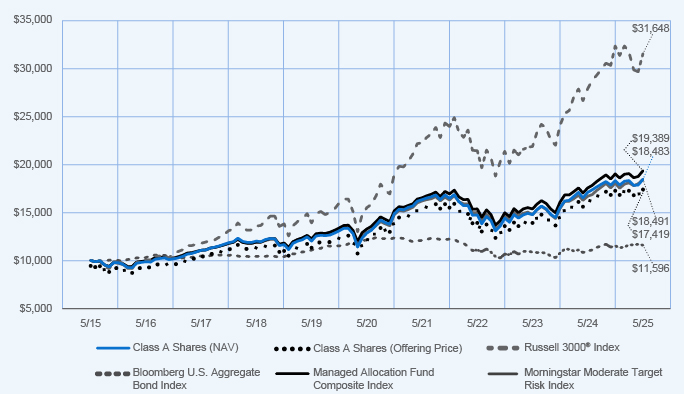

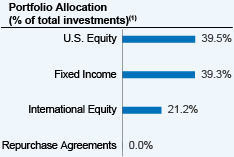

| Performance Highlights • The Nuveen Lifecycle Index 2035 Fund returned 10.34% for Retirement Class Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the Lifecycle Index 2035 Fund Composite Index, which returned 10.86%. • The Fund’s Composite Index consisted of: 43.0% Russell 3000® Index; 29.8% Bloomberg U.S. Aggregate Bond Index; 23.2% MSCI EAFE + Emerging Markets Index; 2.0% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 2.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to absolute performance » Underlying equity and fixed income funds advanced for the period. U.S. and international equity funds recorded double-digit gains and contributed most. • Top detractors from absolute performance » Management fees and other expenses incurred by the Fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

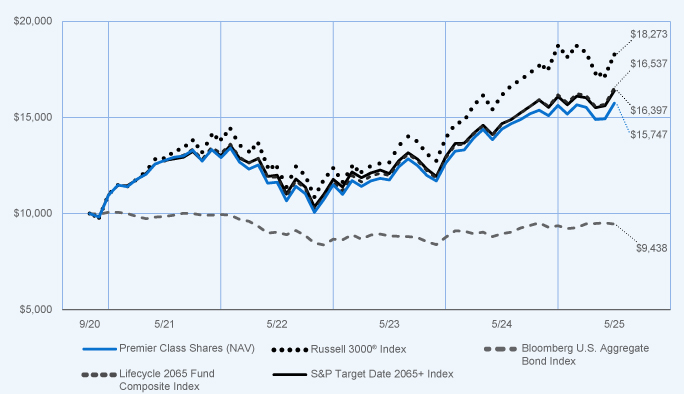

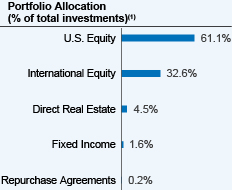

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Retirement Class Shares at NAV |

|

|

10.34 |

% |

|

|

9.19 |

% |

|

|

7.60 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

13.12 |

% |

|

|

15.34 |

% |

|

|

12.21 |

% |

| |

|

|

|

| Bloomberg U.S. Aggregate Bond Index |

|

|

5.46 |

% |

|

|

(0.90 |

)% |

|

|

1.49 |

% |

| |

|

|

|

| Lifecycle Index 2035 Fund Composite Index |

|

|

10.86 |

% |

|

|

9.60 |

% |

|

|

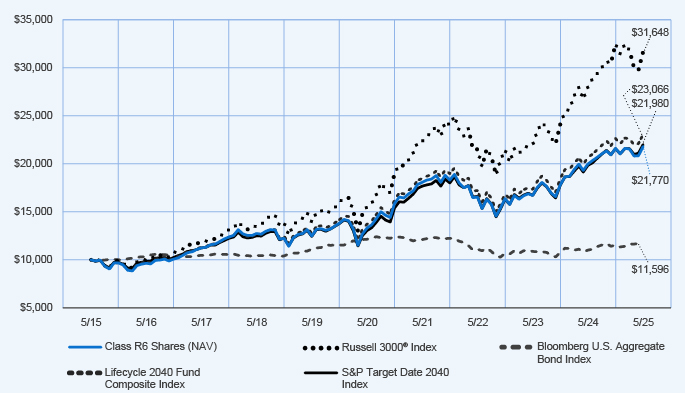

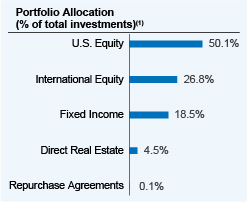

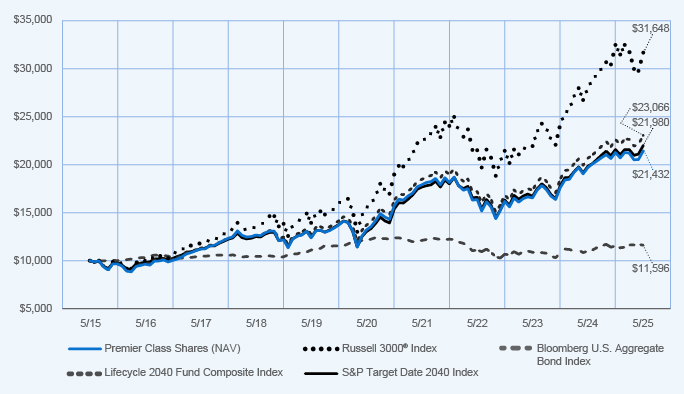

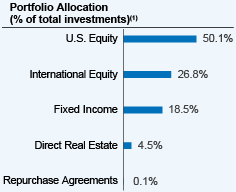

7.95 |