Management’s

Discussion and

Analysis

For the Three and Six Months Ended June 30, 2025 and 2024

This Management’s Discussion and Analysis (“MD&A”) has been prepared as of August 6, 2025 and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three and six months ended June 30, 2025 in comparison with the corresponding periods ended June 30, 2024. This discussion should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2025 and consolidated financial statements and notes thereto for the year ended December 31, 2024 prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) available at www.centerragold.com and on SEDAR+ (“SEDAR”) at www.sedarplus.ca and EDGAR at www.sec.gov/edgar. In addition, this discussion contains forward-looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. See “Cautionary Statement on Forward- Looking Information” below. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated. All references in this document denoted with NG indicate a “specified financial measure” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. None of these measures are standardized financial measures under IFRS and these measures may not be comparable to similar financial measures disclosed by other issuers. See section “Non-GAAP and Other Financial Measures” below for a discussion of the specified financial measures used in this document and a reconciliation to the most directly comparable IFRS measures.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact contained or incorporated by reference in this document, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking information or forward-looking statements within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this document. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “aimed”, “anticipate”, “believe”, “beyond”, “commenced”, “continue”, “expect”, “extend”, “evaluate”, “finalizing”, “focused”, “forecast”, “goal”, “intend”, “in line”, “ongoing”, “optimistic”, “on track”, “plan”, “potential”, “preliminary”, “project”, “pursuing”, “target”, or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms.

Such statements include, but may not be limited to: statements regarding 2025 guidance, outlook and expectations, including, but not limited to, production, costs, capital expenditures, grade profiles, cash flow, care and maintenance, PP&E and reclamation costs, recoveries, processing, inflation, depreciation, depletion and amortization, taxes and annual royalty payments; the ability of the Company to finance the majority of 2025 expenditures from the cash flows provided by the Mount Milligan Mine and Öksüt Mine; exploration potential, budgets, focuses, programs, targets and projected exploration results; gold, copper and molybdenum prices; market conditions; the declaration, payment and sustainability of the Company’s dividends; the continuation of the Company’s normal course issuer bid (“NCIB”) and automatic share purchase plan and the timing, methods and quantity of any purchases of Shares under the NCIB; compliance with applicable laws and regulations pertaining to the NCIB; the availability of cash for repurchases of Common Shares under the NCIB; achieving emission reductions economically and operationally; the development and construction of Goldfield and the ability of the Company to enhance its value proposition including delivering strong returns; Goldfield Project’s life of mine, average annual production and costs including its initial capital costs and the expectation to fund this from the Company’s existing liquidity; the timing of first production at Goldfield and the impact it would have on Centerra’s production profile, cash flow and value to shareholders; the results of a technical study on the Goldfield Project including the economics for the project and the ability of financial hedges to lock in strong margins, safeguard project economics and expedite the capital payback period; the capital investment required at the Goldfield Project and any benefits realized from its short timeline to first production and its flowsheet; the timing and content of a pre-feasibility

study (“PFS”) at the Mount Milligan Mine and any related evaluation of resources or reserves or a life of mine beyond 2036, options for additional tailings capacity, any increased mill throughput, additional downstream flowsheet improvements and their costs and any impact on metal recovery; the future success of the Kemess Project, the timing and content of a preliminary economic assessment (“PEA”) and accompanying update on its technical concept including mining methods; any potential synergies between the Kemess Project and Thesis Gold Inc’s properties; the timing and amount of future benefits and obligations in connection with the Additional Royal Gold Agreement; the ability of the existing infrastructure at the Kemess Project to lower execution risk for the project and the possibility that any additional infrastructure will complement it; the success of an infill and grade control drilling program at the Mount Milligan Mine and its ability to enhance geological confidence and provide an improved and more robust mine plan; the expectation that production and sales at the Mount Milligan and Öksüt Mines will be weighted towards the second half of 2025; the timing and capital required for the restart of Thompson Creek Mine; the integrated business plan of the Molybdenum Business Unit including the restart of the Thompson Creek Mine and commercial optimization of the Langeloth Facility; the commercial success of the Molybdenum Business Unit and the Langeloth Facili; the commissioning of equipment at the Thompson Creek Mine and the development of site infrastructure and housing; the Company’s strategic plan; the impact of any trade tariffs being consistent with the Company’s current expectations; royalty rates and taxes in Türkiye including withholding taxes related to repatriation of earnings; the site-wide optimization program at the Mount Milligan Mine; financial hedges; and other statements that express management’s expectations or estimates of future plans and performance, operational, geological or financial results, estimates or amounts not yet determinable and assumptions of management.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, geopolitical and competitive uncertainties and contingencies, which may prove to be incorrect. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, government royalties, tariffs, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of any sanctions or tariffs imposed by Canada, the United States or other jurisdictions; potential defects of title in the Company’s properties that are not known as of the date hereof; permitting and development of our projects, including tailings facilities, being consistent with the Company’s expectations; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anti-corruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper, molybdenum and other mineral prices; the use of provisionally-priced sales contracts for production at the Mount Milligan Mine; reliance on a few key customers for the gold-copper concentrate at the Mount Milligan Mine; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; persistent inflationary pressures on key input prices; the impact of restrictive covenants in the Company’s credit facilities and in the Royal Gold Streaming Agreement which may, among other things, restrict the Company from pursuing certain business activities. including paying dividends or repurchasing shares under its NCIB, or making distributions from its subsidiaries; the Company’s ability to obtain future financing; sensitivity to fuel price volatility; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; the ability to obtain adequate insurance

coverage; changes to taxation laws or royalty structures in the jurisdictions where the Company operates, and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including: unanticipated ground and water conditions; the stability of the pit walls at the Company’s operations leading to structural cave-ins, wall failures or rock-slides; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water, where applicable; there being no significant disruptions affecting the activities of the Company whether due to extreme weather events or other related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or other force majeure events; the risk of having sufficient water to continue operations at the Mount Milligan Mine and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks, whether caused by decisions of third-party providers or force majeure events (including, but not limited to: labour action, flooding, landslides, seismic activity, wildfires, earthquakes, pandemics, or other global events such as wars); lower than expected ore grades or recovery rates; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic or pandemic; seismic activity, including earthquakes; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; regulations regarding greenhouse gas emissions and climate change; significant volatility of molybdenum prices resulting in material working capital changes and unfavourable pressure on viability of the molybdenum business; the Company’s ability to accurately predict decommissioning and reclamation costs and the assumptions they rely upon; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; risk of cyber incidents such as cybercrime, malware or ransomware, data breaches, fines and penalties; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns, and project resources.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this document are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, those set out in the Company’s latest Annual Report on Form 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this document.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Qualified Person & QA/QC | 47 |

| |

Overview

Centerra’s Business

Centerra is a Canada-based mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra’s principal operations are the Mount Milligan gold-copper mine located in British Columbia, Canada (the “Mount Milligan Mine”), and the Öksüt gold mine located in Türkiye (the “Öksüt Mine”). The Company also owns the Kemess project (the “Kemess Project”) in British Columbia, Canada, the Goldfield Project in Nevada, United States, as well as exploration properties in Canada, the United States of America (“USA”) and Türkiye. The Company also owns and operates a Molybdenum Business Unit (“Molybdenum BU”), which includes the Langeloth metallurgical processing facility, operating in Pennsylvania, USA (the “Langeloth”), and two primary molybdenum properties: the Thompson Creek Mine in Idaho, USA, and the Endako Mine (75% ownership) in British Columbia, Canada.

As at June 30, 2025, Centerra’s significant subsidiaries were as follows:

| | | | | | | | | | | |

| Entity | Property - Location | Current Status | Ownership |

Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | Operation | 100% |

| Endako Mine - Canada | Care and maintenance | 75% |

Öksüt Madencilik A.S. | Öksüt Mine - Türkiye | Operation | 100% |

Thompson Creek Mining Co. | Thompson Creek Mine - USA | Development | 100% |

Langeloth Metallurgical Company LLC | Langeloth Facility - USA | Operation | 100% |

| Gemfield Resources LLC | Goldfield Project - USA | Development (1) | 100% |

| AuRico Metals Inc. | Kemess Project - Canada | Exploration and evaluation | 100% |

(1)On August 6, 2025, the Board of Directors approved the construction of the Goldfield Project.

The Company’s common shares are listed on the Toronto Stock Exchange and the New York Stock Exchange and trade under the symbols “CG” and “CGAU”, respectively.

As at August 6, 2025, there are 203,306,950 common shares issued and outstanding, options to acquire 2,706,082 common shares outstanding under the Company’s stock option plan, and 1,117,536 restricted share units redeemable for common shares outstanding under the Company’s restricted share unit plan (redeemable on a 1:1 basis for common shares).

Overview of Consolidated Financial and Operating Highlights

| | | | | | | | | | | | | | | | | | | | |

| ($millions, except as noted) | Three months ended June 30, | Six months ended June 30, |

| 2025 | 2024 | % Change | 2025 | 2024 | % Change |

| Financial Highlights | | | | | |

| Revenue | 288.3 | | 282.3 | | 2 | % | 587.8 | | 588.2 | | — | % |

| Production costs | 174.9 | | 162.5 | | 8 | % | 373.7 | | 336.3 | | 11 | % |

| Depreciation, depletion, and amortization ("DDA") | 26.0 | | 27.5 | | (5) | % | 50.1 | | 60.8 | | (18) | % |

| Earnings from mine operations | 87.4 | | 92.3 | | (5) | % | 164.0 | | 191.0 | | (14) | % |

Net earnings | 68.6 | | 37.7 | | 82 | % | 99.0 | | 104.1 | | 5 | % |

Adjusted net earnings(1) | 52.7 | | 46.4 | 14 | % | 79.0 | | 77.7 | | 2 | % |

Adjusted EBITDA(1) | 86.8 | | 87.2 | | 0 | % | 162.5 | | 185.1 | | (12) | % |

| Cash provided by operating activities | 25.3 | | 2.6 | | 873 | % | 83.9 | | 102.0 | | (18) | % |

Free cash flow (deficit)(1) | (25.6) | | (27.0) | | 5 | % | (15.5) | | 54.1 | | (129) | % |

| | | | | | |

| Additions to property, plant and equipment (“PP&E”) | 55.6 | | 37.9 | | 47 | % | 123.7 | | 53.2 | | 133 | % |

Capital expenditures - total(1) | 53.9 | | 36.3 | | 48 | % | 100.8 | | 53.1 | | 90 | % |

Sustaining capital expenditures(1) | 25.8 | | 30.6 | | (16) | % | 43.8 | | 46.8 | | (6) | % |

Non-sustaining capital expenditures(1) | 28.1 | | 5.7 | | 393 | % | 57.0 | | 6.3 | | 805 | % |

| | | | | | |

Net earnings per common share - $/share basic(2) | 0.33 | | 0.18 | | 83 | % | 0.48 | | 0.49 | | 1 | % |

| | | | | | |

Adjusted net earnings per common share - $/share basic(1)(2) | 0.26 | | 0.23 | | 13 | % | 0.38 | | 0.36 | | 6 | % |

| Operating highlights | | | | | | |

| Gold produced (oz) | 63,311 | | 89,828 | | (30) | % | 122,690 | | 201,169 | | (39) | % |

| | | | | | |

| Gold sold (oz) | 61,335 | | 83,258 | | (26) | % | 122,466 | | 187,571 | | (35) | % |

| Average market gold price ($/oz) | 3,280 | | 2,238 | | 47 | % | 3,070 | | 2,203 | | 39 | % |

Average realized gold price ($/oz )(3) | 2,793 | | 2,097 | | 33 | % | 2,674 | | 1,955 | | 37 | % |

| Copper produced (000s lbs) | 12,437 | | 13,549 | | (8) | % | 24,084 | | 27,880 | | (14) | % |

| Copper sold (000s lbs) | 12,103 | | 11,705 | | 3 | % | 24,244 | | 27,327 | | (11) | % |

| Average market copper price ($/lb) | 4.32 | | 4.42 | | (2) | % | 4.28 | | 4.12 | | 4 | % |

Average realized copper price ($/lb)(3) | 3.62 | | 3.79 | | (4) | % | 3.71 | | 3.41 | | 9 | % |

Molybdenum roasted (000 lbs)(5) | 3,165 | | 1,948 | | 62 | % | 6,199 | | 4,839 | | 28 | % |

| Molybdenum sold (000s lbs) | 3,076 | | 2,675 | | 15 | % | 7,320 | | 5,623 | | 30 | % |

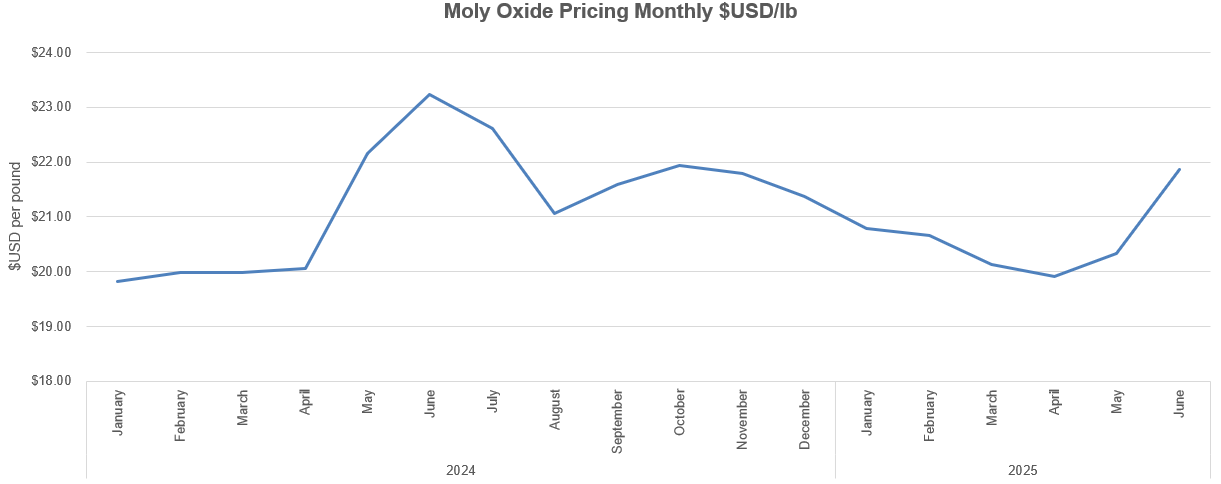

| Average market molybdenum price ($/lb) | 20.72 | 21.79 | | (5) | % | 20.62 | 19.93 | | 3 | % |

Average realized molybdenum price ($/lb)(3) | 21.43 | 22.10 | (3) | % | 21.52 | 21.25 | 1 | % |

| Unit costs | | | | | | |

Gold production costs ($/oz)(4) | 1,308 | | 870 | | 50 | % | 1,290 | | 802 | | 61 | % |

All-in sustaining costs on a by-product basis ($/oz)(1)(4) | 1,652 | | 1,179 | | 40 | % | 1,572 | | 1,001 | | 57 | % |

| | | | | | |

Gold - All-in sustaining costs on a co-product basis ($/oz)(1)(4) | 1,866 | | 1,260 | | 48 | % | 1,804 | | 1,125 | | 60 | % |

Copper production costs ($/lb)(4) | 2.06 | | 2.46 | | (16) | % | 2.15 | | 2.14 | | — | % |

Copper - All-in sustaining costs on a co-product basis ($/lb)(1)(4) | 2.53 | | 3.21 | | (21) | % | 2.54 | | 2.55 | | — | % |

(1)Non-GAAP financial measure. See discussion under “Non-GAAP and Other Financial Measures”.

(2)As at June 30, 2025, the Company had 204,325,992 common shares issued and outstanding.

(3)This supplementary financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure (“NI 51-112”) is calculated as a ratio of revenue from the consolidated financial statements and units of metal sold and includes the impact from the Mount Milligan Streaming Agreement (defined below), copper hedges and mark-to-market adjustments on metal sold not yet finally settled.

(4)All per unit costs metrics are expressed on a metal sold basis.

(5)Amount does not include 0.2 million pounds of molybdenum roasted of toll material for the three and six months ended June 30, 2025 (nil in 2024).

Overview of Consolidated Results

Second Quarter 2025 compared to Second Quarter 2024

Net earnings of $68.6 million were recognized in the second quarter of 2025, compared to net earnings of $37.7 million in the second quarter of 2024. The increase in net earnings was primarily due to:

•an unrealized gain of $15.0 million that was recognized in the second quarter of 2025 on the re-measurement of the amount due from Equinox Gold Corp. (“Equinox Gold”) in relation to the sale of Centerra’s 50% interest in the Greenstone Partnership in 2021, reflecting updated gold price assumptions related to the final portion of contingent consideration owing to the Company from Equinox Gold;

•lower expensed exploration and evaluation expenditures of $9.7 million recognized in the second quarter of 2025 compared to $20.7 million in the second quarter of 2024. The decrease in expensed exploration and evaluation expenditures was primarily due to a $6.8 million decrease in project evaluation costs at the Thompson Creek Mine and a $4.3 million decrease in drilling and related costs at the Goldfield Project; and

•income tax recovery of $2.2 million recognized in the second quarter of 2025 compared to an income tax expense of $17.8 million in the second quarter of 2024. The decrease in income tax expense was primarily related to a $7.6 million lower income tax expense at the Öksüt Mine, resulting from lower income generated at the Öksüt Mine due to a decrease in gold ounces sold and the impact of foreign currency translation on deferred income taxes at the Mount Milligan Mine, amounting to $19.8 million, partially offset by a $10.7 million drawdown on the deferred tax asset related to the Mount Milligan Mine and withholding tax expense on the repatriation of Öksüt Mine’s earnings.

The increase in net earnings was partially offset by other non-operating expense of $1.0 million recognized in the second quarter of 2025 compared to other non-operating income of $11.6 million in the second quarter of 2024 primarily attributable to an $8.3 million higher foreign exchange loss due to movement in foreign currency exchange rates and lower interest income earned on the Company’s cash balance.

Adjusted net earningsNG of $52.7 million were recognized in the second quarter of 2025, compared to adjusted net earningsNG of $46.4 million in the second quarter of 2024. The increase in adjusted net earningsNG was primarily due to lower expensed exploration and evaluation expenditures and lower income tax expense partially offset by higher other non-operating expense as outlined above.

The main adjusting items to net earnings in the second quarter of 2025 were:

•$15.0 million of unrealized gain on the re-measurement of the amount due related to the sale of the Company’s interest in the Greenstone Partnership;

•$12.1 million of unrealized loss on the financial asset related to the additional agreement with Royal Gold dated February 13, 2024 to increase cash payments for the Mount Milligan Mine’s gold and copper delivered to Royal Gold based on the achievement of certain threshold amounts of gold and copper delivered to Royal Gold from shipments occurring after January 1, 2024 (“Additional Royal Gold Agreement”);

•$11.0 million of deferred income tax adjustments reflecting primarily the impact of foreign exchange rate movement on deferred income taxes at the Mount Milligan Mine;

•$7.7 million of reclamation provision revaluation recovery primarily attributable to changes in the risk-free interest rates applied to discount the estimated provision for future reclamation cash outflows at the Endako Mine and the Kemess Project; and

•$6.2 million of unrealized loss on foreign exchange mainly from the effect of movement in foreign currency exchange rates on the reclamation provision at the Endako Mine and Kemess Project.

The main adjusting items to net earnings in the second quarter of 2024 were:

•$7.4 million of unrealized loss on the financial asset related to the Additional Royal Gold Agreement;

•$5.5 million of unrealized gain on foreign exchange from the movement in foreign currency exchange rates on the reclamation provision at the Endako Mine and Kemess Project and on the income tax payable and royalty payable at the Öksüt Mine;

•$5.1 million of reclamation provision revaluation recovery resulting from the increase in the risk-free interest rates applied to discount the estimated provision for future reclamation cash outflows at the Thompson Creek Mine, Endako Mine and Kemess Project; and

•$1.9 million of deferred income tax adjustments mainly resulting from the foreign exchange rate movement on the deferred income tax expense at the Öksüt Mine and the Mount Milligan Mine.

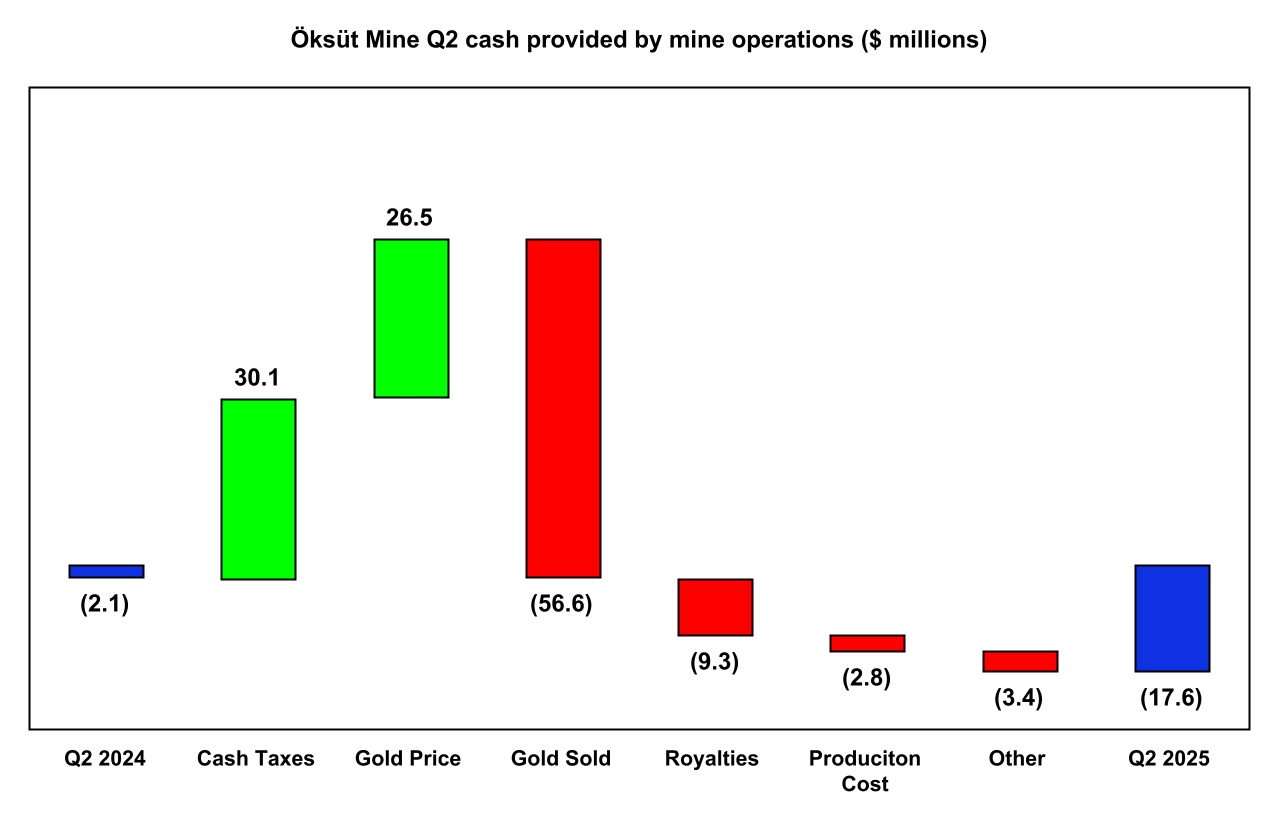

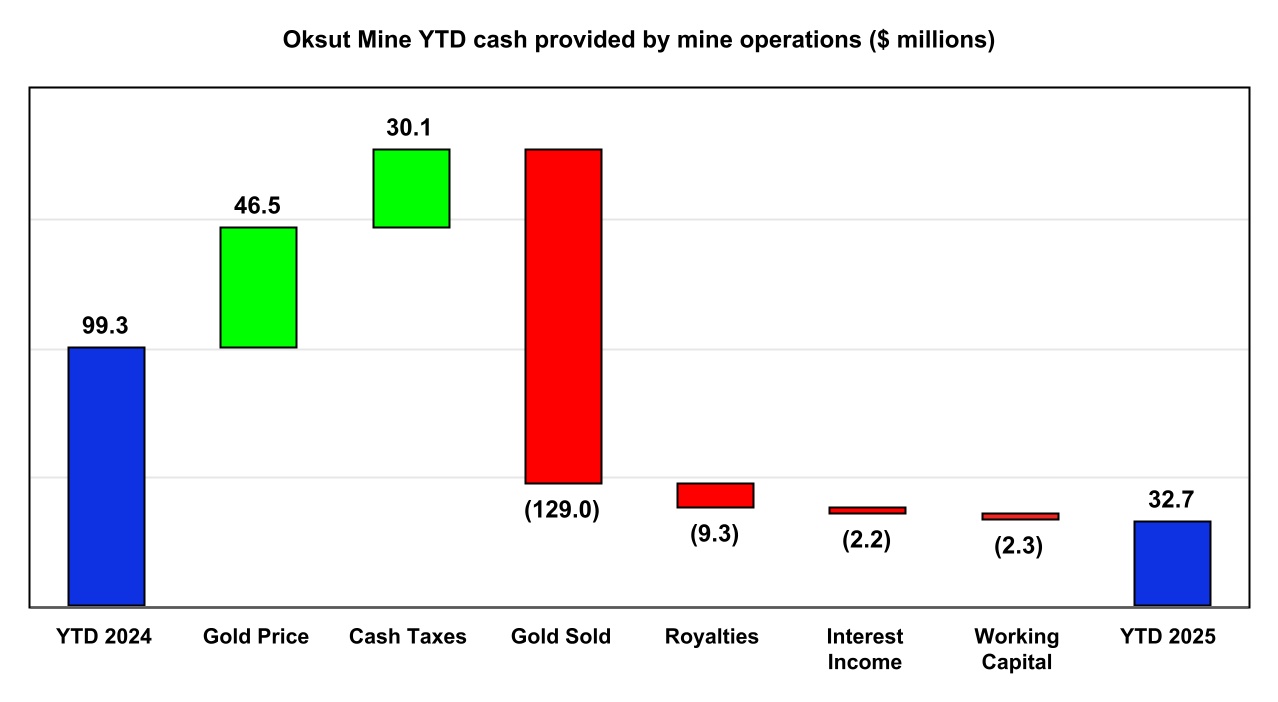

Cash provided by operating activities was $25.3 million in the second quarter of 2025, compared to $2.6 million in the second quarter of 2024. The increase was primarily attributable to $30.1 million lower tax payments at the Öksüt Mine and a $7.0 million decrease in cash used in operating activities at the Thompson Creek Mine due to the commencement of capitalization of certain costs after the restart decision, partially offset by $9.3 million higher royalty payments at the Öksüt Mine.

Free cash flow deficitNG of $25.6 million was recognized in the second quarter of 2025, compared to free cash flow deficitNG of $27.0 million in the second quarter of 2024. The slight decrease in free cash flow deficitNG was primarily due to higher cash provided by operating activities as outlined above partially offset by $23.7 million higher capital spending at the Thompson Creek Mine.

Six months ended June 30, 2025 compared to June 30, 2024

Net earnings of $99.0 million were recognized in 2025, compared to net earnings of $104.1 million in 2024. The slight decrease in net earnings was primarily due to:

•lower earnings from mine operations of $164.0 million in 2025 compared to $191.0 million in 2024. The decrease in earnings from mine operations was primarily due to lower ounces of gold produced and sold at the Öksüt Mine mainly attributable to higher production levels in 2024 from processing the built-up heap leach inventory following the resumption of operations in June 2023 and lower gold ounces and copper pounds sold at the Mount Milligan Mine. The decrease was partially offset by higher average realized gold and copper prices and lower production costs and DDA at the Öksüt Mine;

•a lower reclamation recovery of $2.8 million recognized in 2025 compared to a reclamation recovery of $30.1 million in 2024 primarily attributable to changes in the risk-free interest rates applied to discount the estimated provision for future reclamation cash outflows at the Endako Mine and Kemess Project and an increase in the estimate of future reclamation cash outflows at the Endako Mine in 2025. In addition, there was a reclamation recovery of $15.1 million recognized in 2024 at the Thompson Creek Mine from the increase in the risk-free interest rates applied to discount the estimated provision for future reclamation cash outflows. No reclamation expense or recovery was recognized at the Thompson Creek Mine in 2025 due to the commencement of development; and

•lower other non-operating income of $8.7 million recognized in 2025 compared to $27.6 million in 2024 primarily due to a $14.8 million higher unrealized foreign exchange loss attributable to a movement in foreign currency exchange rates and a $4.9 million decrease in interest income earned on the Company’s cash balance.

The decrease in net earnings was partially offset by:

•lower income tax expense of $22.7 million recognized in 2025 compared to income tax expense of $47.6 million in 2024. The decrease in income tax expense was mainly due to a $20.1 million lower income tax expense at the Öksüt Mine, resulting from lower income generated at the Öksüt Mine due to lower gold ounces sold;

•an unrealized gain of $21.6 million was recognized in 2025 on the re-measurement of the amount due from Equinox Gold in relation to the sale of Centerra’s 50% interest in the Greenstone Partnership in

2021, reflecting updated gold price assumptions related to the final portion of contingent consideration owing to the Company from Equinox Gold; and

•lower expensed exploration and evaluation costs of $16.8 million recognized in 2025, compared to $35.6 million in 2024. The decrease was primarily attributable to a $13.7 million decrease in project evaluation costs at the Thompson Creek Mine and a $5.3 million decrease in drilling and related costs at the Goldfield Project.

Adjusted net earningsNG of $79.0 million were recognized in 2025, compared to adjusted net earningsNG of $77.7 million in 2024. The increase in adjusted net earningsNG was due to lower tax expense and lower expensed exploration and evaluation costs as outlined above, partially offset by lower earnings from mine operations and lower non-operating income.

The main adjusting items to net earnings in 2025 were:

•$21.6 million of an unrealized gain on the re-measurement of the amount due related to the sale of the Company’s interest in the Greenstone Partnership;

•$13.5 million of unrealized loss on the financial asset related to the Additional Royal Gold Agreement;

•$12.2 million of deferred income tax adjustments mainly resulting from the foreign exchange rate movement on deferred income taxes at the Mount Milligan Mine;

•$2.9 million of unrealized loss on foreign exchange mainly from the effect of movement in foreign currency exchange rates on the reclamation provision at the Endako Mine and Kemess Project; and

•$2.9 million of reclamation provision revaluation recovery, as noted above.

The main adjusting items to net earnings in 2024 were:

•$30.1 million reclamation provision revaluation recovery, as noted above;

•$8.9 million of unrealized loss on the financial asset related to the Additional Royal Gold Agreement;

•$4.9 million of deferred income tax adjustments mainly resulting from the foreign exchange rate movement on the deferred income tax expense at the Öksüt Mine and the Mount Milligan Mine;

•$3.4 million of unrealized gain on foreign exchange from the effect of movement in foreign currency exchange rates on the reclamation provision at the Endako Mine and Kemess Project and on the income tax payable and royalty payable at the Öksüt Mine; and

•$2.5 million of transaction costs related to the Additional Royal Gold Agreement.

Cash provided by operating activities was $83.9 million in 2025 compared to $102.0 million in 2024. The decrease in cash provided by operating activities was primarily due to $27.0 million lower earnings from mine operations as discussed above, $9.3 million in higher royalty payments at the Öksüt Mine, a $31.9 million unfavourable change in working capital at the Langeloth Facility. The decrease was partially offset by $30.1 million in lower tax payments at the Öksüt Mine and a $14.2 million decrease in cash used in operating activities at the Thompson Creek Mine due to the commencement of capitalization of certain costs after the restart decision.

Free cash flow deficitNG of $15.5 million was recognized in 2025 compared to free cash flowNG of $54.1 million in 2024. The decrease in free cash flowNG was primarily due to lower cash provided by operating activities as outlined above and $51.2 million higher capital spending at the Thompson Creek Mine.

Recent Events and Developments

Goldfield Project’s Construction Decision

The Company has completed a technical study of the Goldfield Project, which outlined attractive economics of an after-tax net present value (5%) (“NPV5%”) of $245 million and an after-tax internal rate of return (“IRR”) of 30%, using a long-term gold price of $2,500 per ounce and includes the impact of gold hedges on a portion of production in 2029 and 2030. The technical study forecasts a mine life of approximately seven years, average annual gold production of 100,000 ounces between 2029 and 2032, and a life of mine AISC of $1,392 per ounce. First production is expected by the end of 2028 and the production profile indicates a total of 533,000

ounces of gold production at head grade of 0.66 g/t and production costs of $1,077 per ounce over the life of mine.

Since the initial resource estimate published for the Goldfield Project in February 2025, the gold price has significantly risen, supporting an updated long-term price assumption of $2,500 per ounce for the Goldfield Project’s economics. The Company has implemented a gold hedging strategy covering 50% of gold production in 2029 and 2030, with a gold price floor of $3,200 per ounce and an average gold price cap of $4,435 per ounce in 2029 and $4,705 per ounce in 2030 set to protect margins while preserving upside potential. This approach is designed to ensure predictable cash flow during the ramp-up phase, with almost 80% of life-of-mine production remaining unhedged and fully exposed to market prices.

Over the last several months, Centerra has undertaken additional technical work and project optimizations that have significantly enhanced Goldfield Project’s value proposition. Favorable gold prices combined with these recent developments have improved the Goldfield Project’s economics, enabling Centerra to move forward with the execution. The Goldfield Project is expected to enhance Centerra’s near-term gold production and play a strategic role in supporting the company’s optimization and growth of its longer-life gold-copper projects in British Columbia.

Following the completion of the technical study in July 2025, the Centerra’s board of directors (the “Board”) approved the construction of the Goldfield Project in August 2025. The initial capital investment is estimated to be $252 million, to be funded by the Company’s existing liquidity, and the project is expected to benefit from a short timeline to first production by the end of 2028 and low execution risk given its relatively simple process flow sheet. Nevada, as a historic mining district, offers a stable regulatory environment, skilled workforce, and strong support for resource development.

The Company will perform an impairment reversal test in the third quarter of 2025 as prescribed in the requirements of IFRS 6.

Change to the Turkish Government State Royalty

The Öksüt Mine is subject to the Turkish Government State Royalty (“Turkish royalty”) which is a sliding scale royalty, applicable to gold and other metals. The Turkish royalty rates for gold were last increased in 2020 and tend to be reviewed by the government of Türkiye every few years. On July 24, 2025, the Turkish parliament passed certain amendments to the mining law, which included an updated Turkish royalty table reflecting elevated gold price environment. Under this new amendment, the maximum gold price threshold which might apply to the Turkish royalty was updated from $2,100 per ounce to $5,100 per ounce, among other things. The Turkish Mining Law continues to provide a reduction of 40% of the royalty amount payable for gold processed at refining facilities within Türkiye, which is the case for the Öksüt Mine.

The Company’s updated guidance for the Öksüt Mine’s full-year costs per unit reflects the updated Turkish royalty rates. See Outlook section in this MD&A.

Mount Milligan Mine Pre-Feasibility Study

Early in 2024, the Company initiated a preliminary economic assessment (“PEA”) as part of a strategic process to evaluate the total potential of the Mount Milligan Mine with a goal to unlock additional value beyond its current stated mine life. As a result of significant technical study progress to date and positive drill results, the Company made the decision in late 2024 to advance directly to a Pre-feasibility Study Technical Report (“PFS”). The results of the PFS are expected to be announced in the third quarter of 2025.

Work on the PFS is ongoing with the goal that the mine life can be further extended beyond the current mine life of approximately 2036. Centerra is progressing with the engineering solution for additional tailings capacity. The PFS will seek to incorporate an increased annual mill throughput in the range of 10% through ball mill motor upgrades and additional downstream flowsheet improvements at a modest overall capital expenditure, which may also provide the benefit of improved overall metal recovery. During the first half of 2025, a majority of the in-fill drilling program to support the forthcoming PFS was completed and assay results were incorporated into the resource model as they were received and validated. In addition, the development of an updated resource model, pit design and optimized mine plan have been completed. The final tailings storage facility (“TSF”) design for the technical report, engineering and execution planning of ball mill motor upgrades and preparation of the technical report have been progressing as planned.

Kemess Project Resource Update and PEA

The Kemess property has substantial gold and copper resources in a highly prospective Toodoggone district with significant infrastructure already in place, including a 300 kilometer 230 kilovolt power line to site, a 50,000 tonnes per day nameplate processing plant in need of some refurbishment; site infrastructure including a camp, administration facilities, truck shop and warehouse which will require some refurbishment; and tailings storage using the previously mined pit as well as an existing facility which is capable of expansion. Complementing this existing infrastructure, it is anticipated that new crushing, conveying, and mine infrastructure will be required for the open pit and underground operations.

During 2024, Centerra commenced evaluation of technical concepts and engineering trade-off studies for potential restart options at the Kemess Project. In the first half of 2025, the Company published an updated resource estimate. Gold mineral resources at the Kemess Project are estimated to contain 2.7 million ounces of measured and indicated resources and 2.2 million ounces of inferred resources. Copper mineral resources are estimated to contain 971 million pounds of measured and indicated resources and 821 million pounds of inferred resources. The updated resource is generally consistent with the Company’s previous understanding of the resource estimate. The Company is currently advancing a PEA which is expected to be completed by the end of 2025. The current operating concept is a combined open pit which is expected to be a traditional truck and shovel operation and long-hole stoping underground mining operation, which is expected to utilize paste backfill of the stopes for stability and be less capital intensive and have a better cash flow profile than the previously permitted underground block cave concept. In addition, the Company is continuing to advance technical studies that include metallurgical testing for flowsheet optimization, mine plan optimization, materials handling infrastructure engineering, tailings design optimization, as well as initiation of environmental baseline studies. Early indications show potential for a long-life operation that takes advantage of the significant existing infrastructure and has lower execution risk compared with a typical greenfield project of this scale. Complementing this existing infrastructure, it is anticipated that new crushing, conveying, and mine infrastructure will be required for the operations. The PEA is targeting a future operation with a potential annual production of approximately 250,000 gold equivalent ounces which combined with the Mount Milligan Mine would provide the Company with two long life gold-copper assets in British Columbia.

Restart of the Thompson Creek Mine and Strategic Plan for the Molybdenum BU

On September 12, 2024, Centerra announced the results of the Thompson Creek Mine feasibility study, including a strategic, integrated business plan for its Molybdenum BU consisting of a restart of the Thompson Creek Mine and a commercially optimized plan for the Langeloth Facility.

At significantly increased production capacity, integrated with Thompson Creek Mine, the Langeloth Facility has the potential to generate higher returns and higher cash flows from operations. Following the completion of a feasibility study and commercial optimization plan, the Board approved the full restart of operations at the Thompson Creek Mine and a progressive ramp-up of production at the Langeloth Facility.

The initial capital investment to restart the Thompson Creek Mine is approximately $397 million. The capital required is significantly de-risked due to an existing pit, advanced equipment rebuilds and purchases, and an existing process plant that requires modest upgrades and refurbishments. A majority of the anticipated capital

expenditures is expected to be focused on capitalized stripping, plant refurbishments and mine mobile fleet upgrades. At current metal prices, the capital investment to restart the Thompson Creek Mine is expected to be internally funded largely from the cash flows provided by the Mount Milligan Mine and the Öksüt Mine.

Second Quarter 2025 Highlights of Restart Activities

Since the restart decision in September 2024, the site achieved approximately 20% cost completion status with advancements in pre-stripping activities and mine equipment refurbishments and purchases, engineering studies, early mill works and other site infrastructure. In the first half of 2025, the Thompson Creek Mine continued pre-stripping operations, detailed engineering work for the plant refurbishment with an engineering consulting firm, early mill refurbishment activities with the Thompson Creek Mine maintenance workforce and advanced basic engineering work for the TSF.

The key milestones completed in the second quarter of 2025 include:

•Pre-stripping operations continued with 6.8 million tons moved;

•Detailed engineering work for the plant refurbishment continued with an engineering consulting firm, with a focus on full hazard and operability analysis of the plant process, review of the engineering design for the tailing distribution system and the advancement of long lead procurement packages and contracts;

•Mill refurbishment activities continued, with demolition of the combined ball mill sump and copper cementation plant, the painting work at the thickener and flotation area completed and draw hole liners and apron feeders re-installed;

•Mobile fleet refurbishment and purchases are on track, with the majority of the work on trucks, shovels, dozers and road graders completed;

•Basic engineering work for the TSF has been completed and detailed engineering work for the TSF commenced and continued as planned, with work on the three-dimensional model and civil pipe take-off currently in progress;

•Advanced construction of housing units in the neighboring communities to increase housing capacity; and

•The project schedule continues to target first production in the second half of 2027, consistent with the feasibility study.

In the second quarter of 2025, the Company incurred non-sustaining capital expendituresNG of $26.5 million at the Thompson Creek Mine. Since the restart decision, non-sustaining capital expendituresNG incurred have totaled $81.9 million. The project remains in line with the total initial capital expendituresNG estimate of $397 million as outlined in the feasibility study.

| | | | | |

| ($millions, except as noted) | As of June 30, 2025 |

Initial capital expendituresNG estimate | $ | 397.0 | |

Non-sustaining capital expendituresNG since the restart decision | 81.9 |

Remaining spend | 315.1 |

Centerra maintains a strong cash position of $522.3 million, ensuring sufficient liquidity to finance ongoing project activities and internal growth projects. The Company continues to expect to finance the majority of 2025 expenditures from the cash flows generated by the Mount Milligan Mine and the Öksüt Mine.

Normal Course Issuer Bid

On November 5, 2024, Centerra announced that the Toronto Stock Exchange had accepted the renewal of a NCIB to purchase for cancellation up to an aggregate of 18,800,929 common shares in the capital of the Company during the twelve-month period commencing on November 7, 2024 and ending on November 6, 2025. Any tendered common shares taken up and paid for by Centerra under the NCIB will be cancelled.

During the first half of 2025, the Company repurchased 6,355,433 common shares for total consideration of $42.0 million (C$58.7 million) under its NCIB program, which included $27.0 million (C$37.2 million) during the second quarter of 2025. The Board has authorized the Company to repurchase up to $75 million of Centerra’s common shares in 2025.

Exploration and Project Evaluation Update

Exploration activities during the quarter included drilling, surface rock and soil sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Türkiye, and the USA. The activities were primarily focused on drilling programs at the Mount Milligan Mine and the Kemess Project in British Columbia, and greenfield projects in Canada, USA and Türkiye. Project evaluation expenditures were primarily focused on the Goldfield Project in Nevada and the Kemess Project in British Columbia.

Mount Milligan Mine

For the six months ended June 30, 2025, 166 drill holes with a total of 46,664 metres of diamond drilling were completed at the Mount Milligan Mine, representing approximately 87% of the 2025 planned program. The drilling campaign is part of an in-fill drilling program to upgrade resource classification to support the forthcoming PFS at the Mount Milligan Mine. In-fill drilling occurred within the current open pit including the MBX and Great Eastern zones, as well as to the west of the ultimate pit boundary in the South Boundary and Southern Star West zones. In-fill drilling also occurred to test the western extension of the current resource pit including Saddle, Goldmark and North Slope. Assay results from the in-fill drilling program were incorporated into the resource model as they were received and validated to support and update resource model as part of the PFS.

2025 Outlook

The Company’s initial 2025 outlook was disclosed in the MD&A for the year ended December 31, 2024 filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar followed by a revised outlook disclosed in the MD&A for the three months ended March 31, 2025 as a result of additional planned drilling at the Kemess Project and increased cash tax payments for the Öksüt Mine due to higher gold prices resulting in higher income tax payments.

The Company has updated its 2025 outlook for the Mount Milligan Mine based on lower estimate for metal production which had a corresponding increase in unit costs. Estimates for the sustaining capital expendituresNG and non-Sustaining capital expendituresNG have also been updated at the Mount Milligan Mine as spending has been reallocated between categories, with no change in total capital expendituresNG..

The Company has also updated its 2025 outlook for the Öksüt Mine based on updated estimates upwards for the unit costs and cash taxes due to the impact of higher gold prices and royalties.

Except for the changes highlighted above, the rest of the Company’s outlook remains unchanged. The Company notes that the ongoing shifts and uncertainty around tariff policies may have an impact on the results of the Company’s operations in 2025, but at present the impact from the current tariffs are not expected to be material at the consolidated level.

The Company’s updated full year 2025 outlook and comparative actual results for the six months ended June 30, 2025 are set out in the following table:

Gold and copper producing assets

| | | | | | | | | | | | | | | |

| Units | 2025

Guidance -

updated | Six Months Ended June 30, 2025 | 2025

Guidance -

previous | |

| Production | | | | | |

Total gold production(1) | (koz) | 250 - 290 | 123 | 270 - 310 | |

Mount Milligan Mine(2)(3)(4) | (koz) | 145 - 165 | 71 | 165 - 185 | |

| Öksüt Mine | (koz) | 105 - 125 | 52 | 105 - 125 | |

Total copper production(2)(3)(4) | (Mlb) | 50 - 60 | 24 | 50 - 60 | |

Unit Costs(5) | | | | | |

Gold production costs(1) | ($/oz) | 1,300 - 1,400 | 1,290 | 1,100 - 1,200 | |

Mount Milligan Mine(2) | ($/oz) | 1,350 - 1,450 | 1,371 | 1,075 - 1,175 | |

| Öksüt Mine | ($/oz) | 1,200 - 1,300 | 1,181 | 1,100 - 1,200 | |

All-in sustaining costs on a by-product basisNG(1)(4) | ($/oz) | 1,650 - 1,750 | 1,572 | 1,400 - 1,500 | |

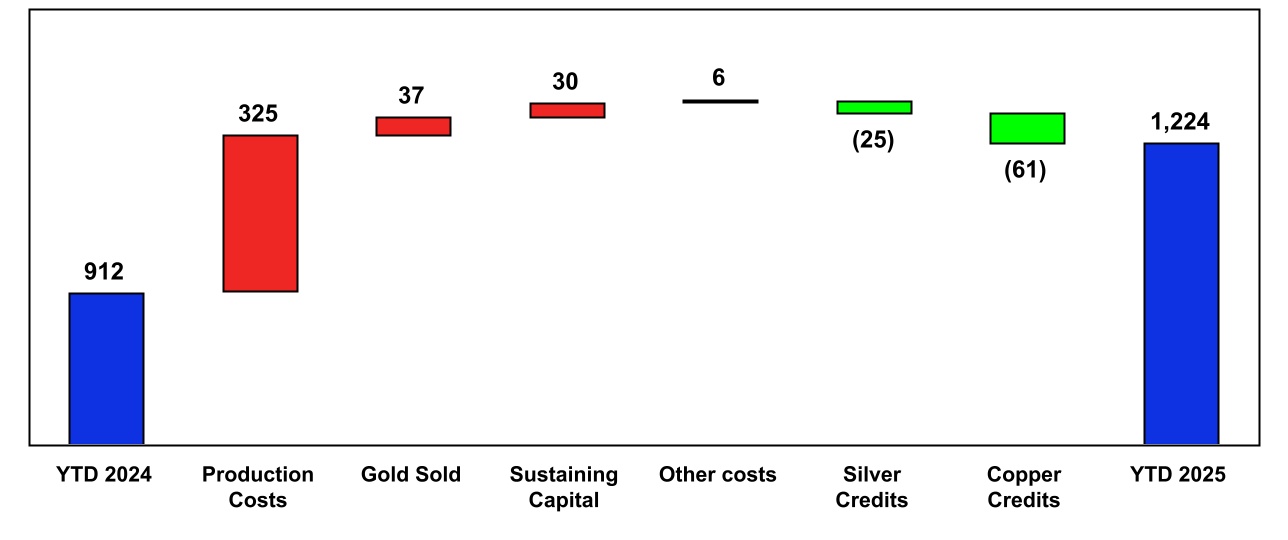

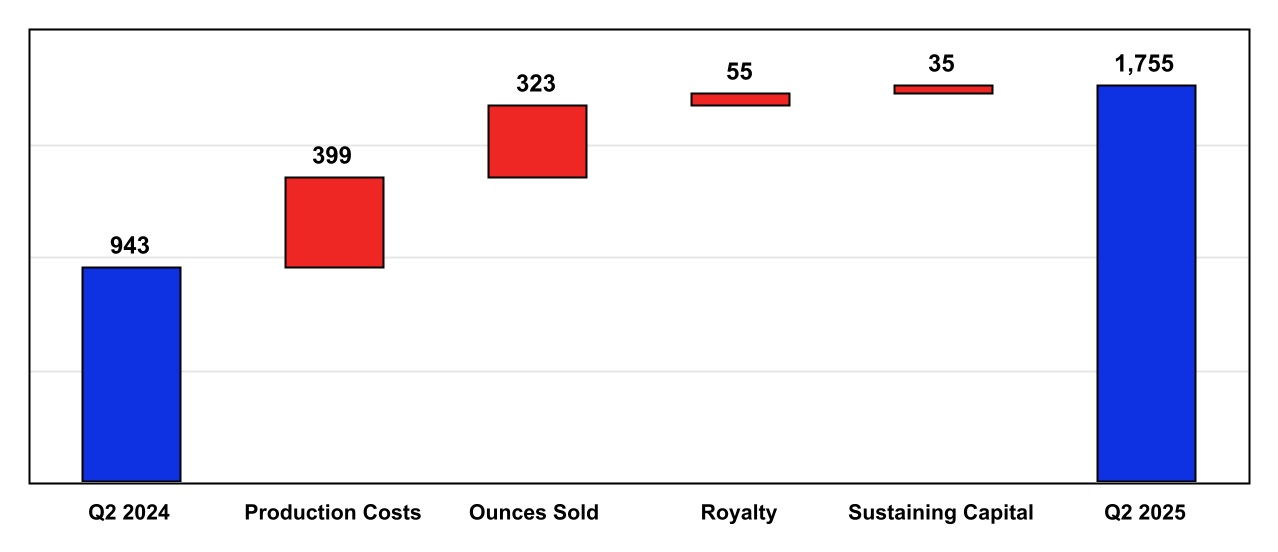

Mount Milligan Mine(4) | ($/oz) | 1,350 - 1,450 | 1,224 | 1,100 - 1,200 | |

| Öksüt Mine | ($/oz) | 1,675 - 1,775 | 1,665 | 1,475 - 1,575 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Capital Expenditures | | | | | |

Additions to PP&E(1) | ($M) | 105 - 130 | 64.2 | 105 - 130 | |

| Mount Milligan Mine | ($M) | 75 - 90 | 40.3 | 75 - 90 | |

| Öksüt Mine | ($M) | 30 - 40 | 23.9 | 30 - 40 | |

Total Capital ExpendituresNG(1) | ($M) | 105 - 130 | 47.9 | 105 - 130 | |

Sustaining Capital ExpendituresNG(1) | ($M) | 90 - 110 | 43.2 | 95 - 115 | |

| Mount Milligan Mine | ($M) | 60 - 70 | 23.9 | 65 - 75 | |

| Öksüt Mine | ($M) | 30 - 40 | 19.3 | 30 - 40 | |

Non-sustaining Capital ExpendituresNG(1) | ($M) | 15 - 20 | 4.7 | 10 - 15 | |

| Mount Milligan Mine | ($M) | 15 - 20 | 4.7 | 10 - 15 | |

Other Items | | | | | |

Depreciation, depletion and amortization(1) | ($M) | 95 - 115 | 47.8 | 95 - 115 | |

| Mount Milligan Mine | ($M) | 60 - 70 | 30.8 | 60 - 70 | |

| Öksüt Mine | ($M) | 35 - 45 | 17.0 | 35 - 45 | |

Current income tax and BC mineral tax expense(1) | ($M) | 48 - 55 | 34.4 | 35 - 42 | |

| Mount Milligan Mine | ($M) | 3 - 5 | 2.2 | 3 - 5 | |

| Öksüt Mine | ($M) | 40 - 50 | 32.2 | 32 - 37 | |

1.Consolidated Centerra figures.

2.The Mount Milligan Mine is subject to an arrangement with RGLD Gold AG and Royal Gold Inc. (together, “Royal Gold”) which entitles Royal Gold to purchase 35% and 18.75% of gold and copper produced, respectively, and requires Royal Gold to pay $435 per ounce of gold and 15% of the spot price per metric tonne of copper delivered (“Mount Milligan Mine Streaming Agreement”). Using assumed market prices of $3,300 per ounce of gold and $4.00 per pound of copper for the remaining two quarters of 2025, the Mount Milligan Mine’s average realized gold and copper price for that period would be $2,297 per ounce and $3.36 per pound, respectively, compared to average realized prices of $2,371 per ounce and $3.71 per pound in the six months ended June 30, 2025, when factoring in the Mount Milligan Streaming Agreement and concentrate refining and treatment costs.

3.Gold and copper production for 2025 at the Mount Milligan Mine assumes estimated recoveries of 63% to 65% for gold and 77% to 79% for copper, consistent with the previous guidance, and compared to the actual recoveries for gold of 62.0% and for copper of 77.3% achieved in the six months ended June 30, 2025.

4.Unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costsNG. Production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and metal deductions levied by smelters.

5.Units noted as ($/oz) relate to gold ounces.

Production Profile

In the six months ended June 30, 2025, the Company reported consolidated gold and copper production of 122,690 ounces of gold and 24.1 million pounds of copper, respectively. Centerra’s estimate for the full year 2025 consolidated gold production has been updated and is now projected to be between 250,000 and 290,000 ounces including an updated estimate of 145,000 to 165,000 ounces from the Mount Milligan Mine and 105,000 to 125,000 ounces from the Öksüt Mine, which is unchanged from the previous guidance. Copper production is expected to be 50 to 60 million pounds for the full year of 2025 and is unchanged from the previous guidance.

Mount Milligan Mine

In the six months ended June 30, 2025, the Mount Milligan Mine produced 70,938 ounces of gold and 24.1 million pounds of copper. Gold and copper production in the six months ended June 30, 2025, was lower than expected due to lower mill throughput and lower than anticipated gold grades. The mill throughput was lower due to processing harder than expected ore and unscheduled mill downtime due to operational issues experienced in the six months ended June 30, 2025. The plant completed a major scheduled shutdown in the first quarter of 2025, which included shell relining for both ball mills and the SAG mill. The plant is scheduled for another shutdown in the third quarter of 2025. In the first half of 2025, mining operations have encountered zones with more challenging mineralization, resulting in lower than anticipated gold grades from these areas of the pit. While gold grades remain above the average grade of the reserve, the Company believes that the variability is primarily attributed to certain zones being drilled with wider spacing, which has impacted the reconciliation. Centerra has commenced an infill and grade control drilling program in the second quarter of 2025. This initiative is expected to improve geological and mine plan confidence and will be integrated into the upcoming Mount Milligan PFS, contributing to a mine plan with greater visibility on grades moving forward. The Company expects gold and copper production for the Mount Milligan Mine to be weighted to the second half of the year. As a result of items noted above, the Company is revising downwards its 2025 gold production guidance to the range of 145,000 to 165,000 ounces, from the previous range of 165,000 to 185,000 ounces. Sales and monetization of gold ounces and copper pounds are dependent on the timing of ocean vessels and may result in timing differences between produced and sold ounces.

Öksüt Mine

In the six months ended June 30, 2025, the Öksüt Mine produced 51,752 ounces of gold. For the full year of 2025, the Öksüt Mine is expected to produce between 105,000 and 125,000 ounces of gold, which is unchanged from the previous guidance. In the six months ended June 30, 2025, gold production was in line with expectations due to a higher than expected gold grade that was slightly offset by lower recoveries in the period. In the second half of the year, gold production is expected to increase as the mine plan anticipates a transition to a higher-grade phase of the Keltepe pit. Gold sales are expected to closely follow the gold production and are expected to be weighted towards the second half of 2025.

Cost Profile

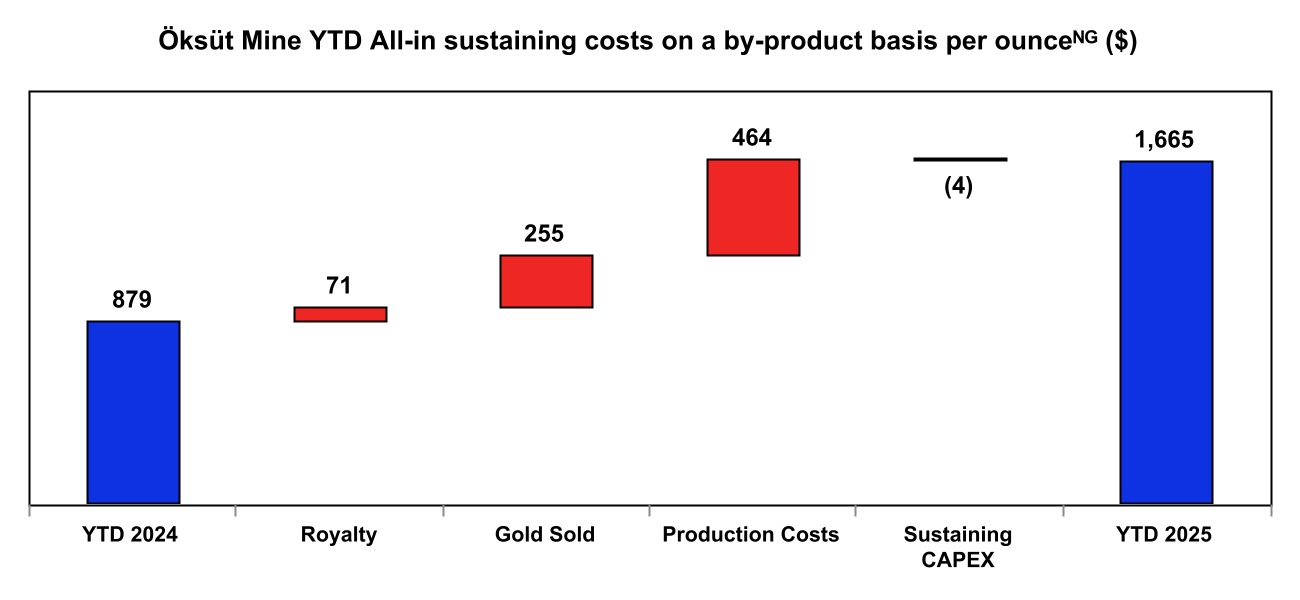

In the six months ended June 30, 2025, the Company’s consolidated gold production costs amounted to $1,290 per ounce. For the full year of 2025, the Company has updated its consolidated gold production costs guidance to the range of $1,300 to $1,400 per ounce, up from the previous guidance range of $1,100 to $1,200 per ounce. The increase in the guidance range for gold production costs per ounce is due to lower gold production at the Mount Milligan Mine, increased royalty costs at the Öksüt Mine, and relative changes in metal prices for gold and copper.

Consolidated all-in sustaining costs on a by-product basisNG were $1,572 per ounce in the six months ended June 30, 2025. In 2025, the Company expects its consolidated all-in sustaining costs on a by-product basisNG to be in the range of $1,650 to $1,750 per ounce, which is increased from the previous guidance range of $1,400 to $1,500 per ounce due to increased production costs per ounce.

Mount Milligan Mine

In the six months ended June 30, 2025, the Mount Milligan Mine reported gold production costs of $1,371 per ounce, driven by lower gold production and a higher allocation of production costs to gold due to changes in the relative market prices of gold and copper. For the full year 2025, the Company anticipates the Mount Milligan Mine’s gold production costs to be in the range of $1,350 to $1,450 per ounce, which is higher from the previous guidance range of $1,075 to $1,175 per ounce mainly due to lower than expected 2025 gold production. Production costs per ounce for the remainder of the year are expected to be similar to the six months ended June 30, 2025. As part of the ongoing full asset optimization program, the Mount Milligan Mine has reduced operational costs and is actively pursuing opportunities to further reduce costs. These efforts are focused on several key areas including downtime minimization through equipment availability improvements, optimizing costs relating to grinding media, tires, major consumables, and spare parts through improvement of procurement strategies and consumption optimization. Approximately 90% of the Mount Milligan Mine’s costs are sourced from Canadian vendors and the Company is continuously evaluating implications from the current tariff environment but does not expect significant impact from tariffs levied on imported goods.

Copper production costs at the Mount Milligan Mine were $2.15 per pound in the six months ended June 30, 2025. For the full year of 2025, copper production costs are projected to be in the range of $2.00 to $2.50 per pound, which is unchanged from the previous guidance. Copper production costs in 2025 are expected to reflect a lower allocation of costs to copper production due to relative changes in the market price of gold and copper as noted above.

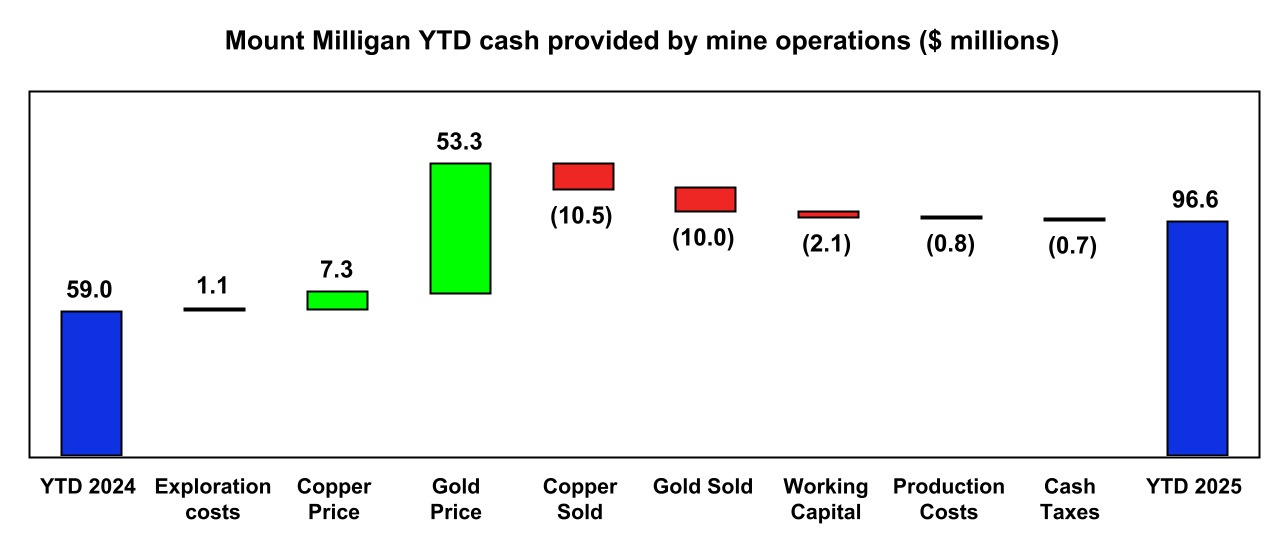

At the Mount Milligan Mine, all-in sustaining costs on a by-product basisNG were $1,224 per ounce in the six months ended June 30, 2025. For the full year of 2025, all-in sustaining costs on a by-product basisNG are expected to range from $1,350 to $1,450 per ounce, which increased from the previous guidance range of $1,100 to $1,200 per ounce due to anticipated increase in gold production costs per ounce for the full year as outlined above. The Company expects all-in sustaining costs on a by-product basisNG to be highest in the third quarter of 2025, primarily due to planned capital expendituresNG targeting further optimizations including a purchase of larger truck boxes to optimize payload and reduce future truck purchases. All-in sustaining costs on a by-product basisNG per ounce are expected to decline in the fourth quarter driven by higher gold and copper production and lower capital expendituresNG.

Öksüt Mine

In the six months ended June 30, 2025, the Öksüt Mine reported gold production costs of $1,181 per ounce due to higher royalty costs driven by elevated gold prices. Considering the impact of the increasing gold prices and the recent changes to the royalty rates as outlined in the Recent Events section in this MD&A, the Company has increased the Öksüt Mine’s full year 2025 gold production costs guidance to the range of $1,200 to $1,300 per ounce from the previous guidance range of $1,100 to $1,200 per ounce. Gold production costs per ounce are expected to trend higher in the second half of the year driven by higher royalty costs but are expected to be partially offset by higher production.

The Öksüt Mine’s all-in sustaining costs on a by-product basisNG were $1,665 per ounce in the six months ended June 30, 2025. The Company expects the Öksüt Mine’s full year all-in sustaining costs on a by-product basisNG to be in the range of $1,675 to $1,775 per ounce, which is increased from the previous guidance range of $1,475 to $1,575 due to anticipated increase in gold production costs per ounce for the full year as outlined above. The Company expects all-in sustaining costs on a by product basisNG per ounce to be highest in the third quarter of 2025, primarily due to planned capital expendituresNG associated with the expansion of the heap leach facility and capitalized stripping. All-in sustaining costs on a by-product basisNG per ounce are expected to decline in the fourth quarter helped by higher gold production and lower capital expendituresNG.

Capital Expenditures

Additions to Property, Plant and Equipment (“PP&E”) for IFRS accounting purposes include certain non-cash additions to PP&E such as changes in future reclamation costs and capitalization of leases. Capital expendituresNG, which comprise of sustaining capital expendituresNG and non-sustaining capital

expendituresNG, exclude such non-cash additions to PP&E. The reconciliation of additions to PP&E and capital expendituresNG is included in the Non-GAAP and Other Financial Measures section of this MD&A.

In the six months ended June 30, 2025, consolidated additions to PP&E for gold and copper producing assets were $64.2 million and total capital expendituresNG for these assets were $47.9 million. For the full year of 2025, both consolidated additions to PP&E and total capital expendituresNG are planned to be in the range of $105 to $130 million, which is unchanged from previous guidance. Total capital expendituresNG are expected to be elevated in the third quarter of 2025, primarily due to the timing of planned capital expendituresNG at both the Mount Milligan Mine and the Öksüt Mine.

The Mount Milligan Mine’s additions to PP&E in the six months ended June 30, 2025 were $40.3 million and total capital expendituresNG were $28.6 million. The difference between additions to PP&E and capital expendituresNG was mainly due to a change to future reclamation costs of $10.3 million. For the full year of 2025, the Mount Milligan Mine is expecting additions to PP&E and total capital expendituresNG to be in the range from $75 to $90 million, which is unchanged from the previous guidance. Total capital expendituresNG include sustaining capital expendituresNG in the range from $60 to $ 70 million, which is down from the range of $65 to $75 million in the previous guidance and non-sustaining capital expendituresNG in the range from $15 to $ 20 million, which is up from the range of $10 to $15 million in the previous guidance. The changes in the guidance ranges for sustaining capital expendituresNG and non-sustaining capital expendituresNG reflect revised capital allocations between these two categories of total capital expendituresNG. A significant portion of the sustaining capital expendituresNG for the full year of 2025 relates to capitalized TSF construction costs amounting to the range of $25 to $30 million with the remaining sustaining capital expendituresNG largely related to equipment rebuilds and a purchase of large truck boxes to optimize payload and reduce future truck purchases. Non-sustaining capital expendituresNG planned for the full year of 2025 include purchases of additional mining equipment to meet the increased tonnage movement requirements in the future years of the Mount Milligan Mine’s life of mine, and additional exploration costs for in-fill drilling in areas outside of the existing reserves that underpin the planned PFS and could form the basis of the extension to the current life of mine plan.

The Öksüt Mine’s additions to PP&E in the six months ended June 30, 2025 were $23.9 million and total capital expendituresNG were $19.3 million. The difference between additions to PP&E and capital expendituresNG was mainly due to a change to future reclamation costs of $3.3 million and the costs capitalized into right of use assets of $1.2 million. For the full year of 2025, the Öksüt Mine is expecting sustaining capital expendituresNG in the range of $30 to $ 40 million, which is unchanged from previous guidance. Most of 2025 sustaining capital expendituresNG relate to capitalized stripping costs amounting to $20 to $25 million, phase 3 of the heap leach pad expansion, and a barren solution distribution system to improve the heap leach irrigation system.

Depreciation, Depletion and Amortization

In the six months ended June 30, 2025, the Company’s DDA expense included in the cost of sales for gold and copper producing assets was $47.8 million. The Mount Milligan Mine’s DDA expense in the six months ended June 30, 2025 was $30.8 million and the Öksüt Mine’s DDA expense was $17.0 million. For the full year of 2025, the Company estimates DDA expense to be in the range of $95 to $115 million, including $60 to $70 million at the Mount Milligan Mine and $35 to $45 million at the Öksüt Mine, which are all unchanged from the previous guidance.

Current Taxes and Tax Payments

The Mount Milligan Mine’s current British Columbia mineral tax expense in the six months ended June 30, 2025 was $2.2 million and the cash taxes paid were $2.7 million. The difference between current tax expense and cash taxes paid is due to timing of tax payments. For the full year of 2025, Mount Milligan Mine’s current British Columbia mineral tax expense and tax payments are each expected to be in the range of $3 to $5 million, which is unchanged from the prior guidance.

The Öksüt Mine’s current income tax expense in the six months ended June 30, 2025 was $32.2 million, including a withholding tax of $19.0 million on the repatriation of Öksüt Mine’s earnings. Total cash taxes paid by the Öksüt Mine in the six months ended June 30, 2025 were $46.2 million, including a withholding tax of $15.8 million on the repatriation of Öksüt Mine’s earnings. The difference between current tax expense and cash taxes paid is due to timing of tax payments. For the full year of 2025, the Öksüt Mine income tax expense is expected to be in the range of $40 to $50 million, which is an increase from the previous guidance of $32 to $37 million, and is primarily driven by elevated gold prices. The income tax reflects a 25% income tax rate on taxable income. The Öksüt Mine is expected to pay approximately $60 to $70 million in cash taxes in 2025. This is an increase from the previous guidance of $45 to $50 million, reflecting a higher income tax expense for the fourth quarter of 2024, based on finalized 2024 tax filings and higher income tax expense in 2025, primarily driven by elevated gold prices. A large portion of the 2025 cash taxes were paid during the second quarter of 2025 as the second quarter payments included income tax for the fourth quarter of 2024, income tax for the first quarter of 2025, and a withholding tax of $15.8 million related to the repatriation of the Öksüt Mine’s earnings.

Molybdenum Business Unit

| | | | | | | | | | | |

| Units | 2025 Guidance | Six Months Ended June 30, 2025 |

Production - Langeloth Facility | | | |

Total molybdenum roasted(1) | Mlbs | 13 - 15 | 6.2 |

Total molybdenum sold | Mlbs | 13 - 15 | 7.3 |

Costs and Profitability - Langeloth Facility | | | |

Earnings (loss) from operations | ($M) | (3) - 5 | (2.0) |

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)NG | ($M) | 2 - 8 | 0.3 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Capital Expenditures | ($M) | | |

| Additions to PP&E | ($M) | 132 - 150 | 59.2 |

| Thompson Creek Mine | ($M) | 130 - 145 | 58.6 |

Langeloth Facility | ($M) | 2 - 4 | 0.6 |

Total capital expendituresNG | ($M) | 132 - 150 | 52.9 |

| | | |

Sustaining capital expendituresNG - Langeloth Facility | ($M) | 2 - 4 | 0.6 |

| | | |

Non-sustaining capital expendituresNG - Thompson Creek Mine | ($M) | 130 - 145 | 52.3 |

Other Items | ($M) | | |

Depreciation, depletion and amortization | ($M) | 3 - 5 | 2.2 |

Langeloth Facility | ($M) | 3 - 5 | 2.2 |

| | | |

Care and Maintenance Cash Expenditures - Endako Mine | ($M) | 6 - 8 | 2.9 |

Reclamation Costs - Endako Mine | ($M) | 4 - 7 | 3.8 |

| | | |

| | | |

| | | |

| | | |

1.2025 guidance and actual figures do not include any toll material roasted.

Thompson Creek Mine

Since the restart decision in September 2024, significant progress has been made in advancing the project. The Thompson Creek Mine’s additions to PP&E and total capital expendituresNG in the six months ended June 30, 2025 were $58.6 million and $52.3 million, respectively. The difference between additions to PP&E and capital expendituresNG was mainly due to a change to future reclamation costs of $0.4 million and capitalized portion of DDA of $4.5 million. Since the restart decision in September 2024, non-sustaining capital expendituresNG have been $81.9 million including capitalized stripping costs of $40.8 million, equipment refurbishments and capital equipment purchases of $23.9 million, engineering studies of $5.4 million and other capitalized costs of $17.2 million. For the full year of 2025, the Thompson Creek Mine’s

additions to PP&E and total capital expendituresNG are expected to be in the range of $130 to $145 million, which is unchanged from the previous guidance. Major activities contributing to the planned total capital expendituresNG for 2025 include:

•Progressive ramp-up of tons moved per month through the balance of 2025;

•Completion of remaining mine fleet refurbishments by the end of 2025;

•Completion of detailed engineering and procurement of long-lead mill equipment by the end of the third quarter of 2025;

•Procurement and construction of housing units in the neighboring communities to facilitate increased mining workforce levels;

•Site infrastructure development and other costs; and

•Completion of basic engineering and detailed engineering for the TSF by the end of the year.

The Company expects the total project spending to be within the total initial capital expenditure estimate of $397 million as outlined in the feasibility study. The Company estimates that the majority of costs at the Thompson Creek Mine will relate to goods and services sourced domestically within the United States and, as such, does not anticipate a material impact from U.S. import tariffs.

Langeloth Facility

In the six months ended June 30, 2025, the Langeloth Facility roasted and sold 6.2 and 7.3 million pounds of molybdenum, respectively. The Langeloth Facility has continued the previously disclosed ramp-up of operations and is planning to increase roasting volumes to the range of 13 to 15 million pounds for the full year of 2025. A significant portion of the concentrate processed at the Langeloth Facility is sourced from countries other than the United States, which may be subject to U.S. import tariffs. The majority of the molybdenum products made at the Langeloth Facility are sold to large steel mills within the United States. The Company is continuing to assess the impact of incremental tariff policies on the Langeloth Facility and has put plans in place to address adverse impacts from the currently implemented tariffs. Based on the existing state of U.S. tariffs, the Company does not anticipate any material impact on current year financial results.

In the six months ended June 30, 2025, Langeloth Facility’s loss from operations was $2.0 million, including DDA of $2.2 million, and adjusted EBITDANG was $0.3 million. For the full year of 2025, the Company expects the Langeloth Facility’s results to range from $3 million loss from operations to $5 million earnings from operations, which is unchanged from previous guidance. The Company expects the current production cost structure to remain relatively stable for the full year of 2025, allowing for further improvements in profitability as operations ramp up. Based on these estimates, the Company targets to achieve a positive adjusted EBITDANG in the range of $2 to $8 million for the full year of 2025, which is unchanged from the previous guidance. The Company is continuing to assess the impact of evolving U.S. import tariffs, which may adversely affect the Langeloth Facility’s profitability.

The Company expects that the cash provided by operations at the Langeloth Facility for the full year of 2025 will primarily be driven by adjusted EBITDANG and changes in working capital. The working capital requirements at the Langeloth Facility are highly dependent on market molybdenum prices. In the six months ended June 30, 2025, average molybdenum market price was $20.62 per pound and the Langeloth Facility reported $2.1 million in incremental working capital investment. A $5 per pound increase in molybdenum price has an approximate $20 million impact on working capital invested.

In the six months ended June 30, 2025, the Langeloth Facility’s additions to PP&E and total capital expendituresNG were $0.6 million. For the full year of 2025, the Langeloth Facility is projecting sustaining capital expendituresNG to be in the range of $2 to $4 million, which is unchanged from the previous guidance.

Endako Mine

In the six months ended June 30, 2025, the Company's share of cash expenditures at the Endako Mine totaled $5.4 million, including $2.9 million for care and maintenance. $3.8 million for reclamation, partially offset by cash inflow released from working capital movement of $1.3 million. For the full year of 2025, the

Company’s share of care and maintenance expenditures at the Endako Mine are expected to be between $6 and $8 million and reclamation expenditures are expected to be $4 to $7 million, which is unchanged from the previous guidance. Reclamation costs planned for the full year of 2025 have been included in the reclamation provision as at June 30, 2025 and relate primarily to the closure works on the spillway for the Tailings Pond 2 that started in 2024.

Global Exploration and Evaluation Projects

| | | | | | | | | | | |

| (Expressed in millions of United States dollars) | | 2025 Guidance | Six months ended June 30, 2025 | | |

Project Exploration and Evaluation Costs | | | | | |

Exploration Costs(1) | | 40 - 50 | 19.9 | | |

Brownfield Exploration(1) | | 25 - 30 | 12.7 | | |

| Greenfield and Generative Exploration | | 15 - 20 | 7.2 | | |

Evaluation Costs | | 8 - 12 | 2.9 | | |

| | | | | |

| | | | | |

Other Kemess Costs | | | | | |

Care & Maintenance | | 13 - 15 | 6.4 | | |

| | | | | |

| | | | | |

| | | | | |

1.Total and brownfield exploration costs include capitalized exploration costs at the Mount Milligan Mine of $6.9 million spent in the six months ended June 30, 2025, and $7 to $9 million projected for the full year of 2025.

Exploration Expenditures (excluding Project Evaluation costs)