Forward Looking Statements Certain statements contained in this presentation, other

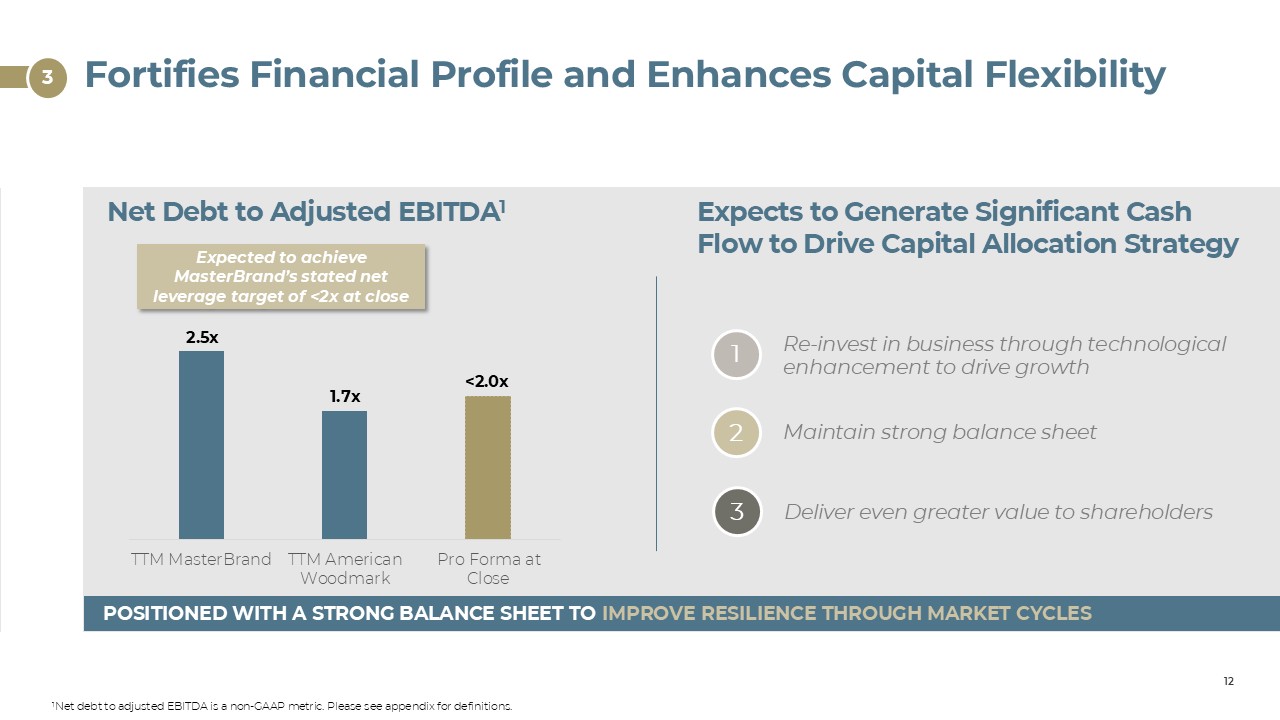

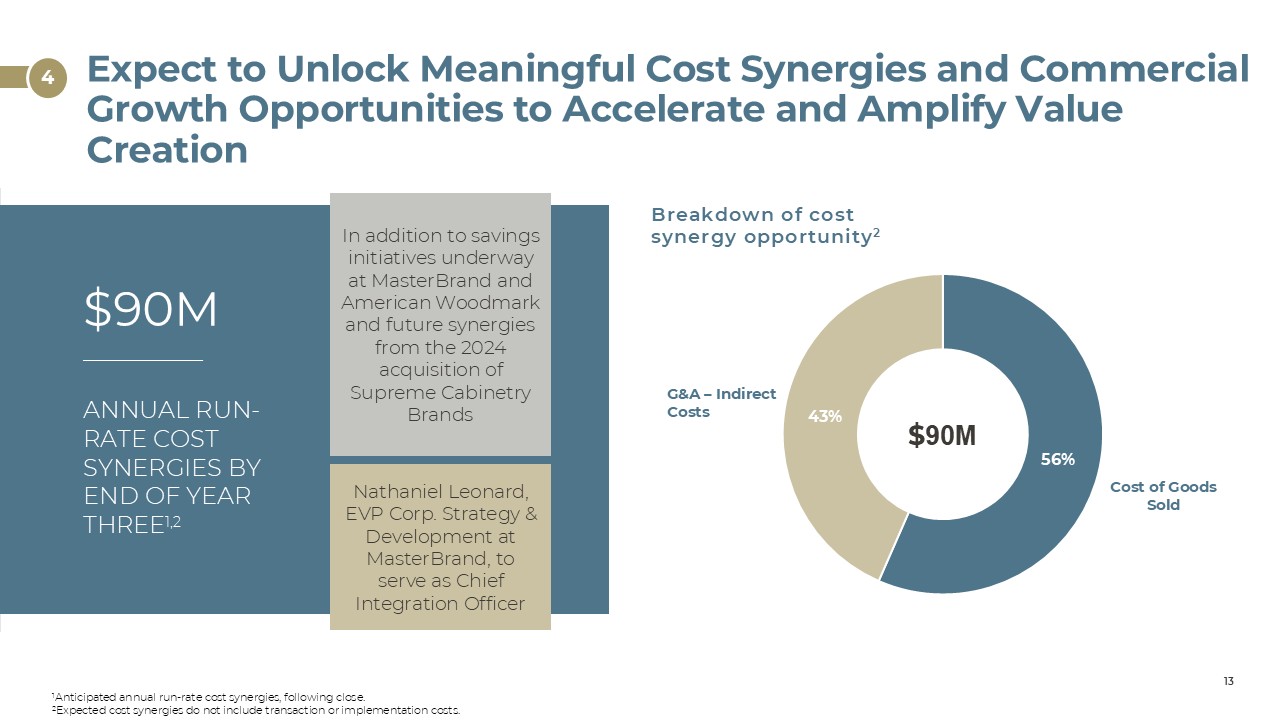

than purely historical information, including, but not limited to, statements as to the likelihood and anticipated timing of the closing of the proposed transaction, expected cost synergies and other expected benefits, effects or outcomes

relating to the proposed transaction, including financial estimates and projections, MasterBrand’s business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements preceded by, followed by or that otherwise include the word “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may

increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could,” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement,

an expectation or belief is expressed as to future results or events, such expectation or belief is based on the current plans and expectations of the management of MasterBrand or American Woodmark, as applicable. Although MasterBrand and

American Woodmark, as applicable, believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those

indicated or implied in such statements. These factors include a failure by either party or both parties to satisfy one or more of the closing conditions set forth in the merger agreement, including a failure to obtain any required regulatory or

governmental approvals or a failure to obtain the required approvals of either American Woodmark’s shareholders or MasterBrand’s stockholders; the occurrence of events or changes in circumstances that give rise to the termination of the merger

agreement by either party or a delay in the closing of the transaction; potential litigation relating to the transaction; the effect of the proposed transaction on the ability of either party to retain customers, maintain relationships with

suppliers and hire and retain key personnel; the effect of the proposed transaction and the announcement of the proposed transaction on the parties’ stock prices; disruptions in the ordinary course business of either party resulting from the

transaction; the continued availability of capital and financing and any rating agency actions related to the transaction or otherwise; the risk that certain limitations in the merger agreement may impact either party’s ability to pursue certain

business opportunities or strategic transactions; the diversion of the attention and time of management of either party from ordinary course business operations to the transaction and transaction-related issues; the impact of transaction and/or

integration costs and any increases in such costs; the existence of unknown liabilities; the ability of MasterBrand to successfully integrate American Woodmark into its business and operations; and the risk that any anticipated economic benefits,

cost savings or other synergies are not fully realized or take longer to realize than expected. Other factors include those listed under “Risk Factors” in Part I, Item 1A of MasterBrand Annual Report on Form 10-K for the fiscal year ended

December 29, 2024, Part II, Item 1A of MasterBrand’s Quarterly Report on Form 10-Q for the quarterly period ended March 30, 2025, American Woodmark’s Annual Report on Form 10-K for the fiscal year ended April 30, 2025, and other MasterBrand and

American Woodmark filings with the SEC. The forward-looking statements included in this presentation are made as of the date of this presentation and, unless legally required, neither MasterBrand nor American Woodmark undertakes any

obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this presentation. 2