Exhibit 99.1

Notice of Annual General Meeting of Shareholders and Management Information Circular July 14, 2025

Exhibit 99.1

Notice of Annual General Meeting of Shareholders and Management Information Circular July 14, 2025

Letter to Shareholders

Dear shareholders,

It is our pleasure to invite you to Alithya’s 2025 Annual General Meeting of Shareholders to be held virtually on September 10, 2025 (the “Meeting”).

This past fiscal year, completed on March 31, 2025 (“fiscal 2025”), presented a challenging geopolitical and macroeconomic environment that demanded operational discipline and capital efficiency. Despite these headwinds, management took prudent steps to strengthen our foundation, prioritize high-impact initiatives, and invest in areas driving sustainable growth.

The Company achieved notable results: Adjusted EBITDA1 reached 14.4% in the fourth quarter and 10.1% for the full year, reflecting disciplined execution and a focus on higher-value services. Gross margin set a record at 36.8% in the fourth quarter of fiscal 2025, driven by improved service mix, utilization, and our smart-shore model. Revenue growth was sustained across geographies, led by offerings that help clients modernize mission-critical systems with AI and IP accelerators and our expertise in our partners’ industry leading solutions.

We ended the year with a strong financial position ensuring flexibility for strategic growth. Recent acquisition, including eVerge and XRM Vision, have further strengthened our capabilities to deliver transformative solutions and access to global talent, expanded our smart-shoring footprint in Canada, the U.S., Morocco and India, and brought in proprietary solutions enhancing our portfolio. eVerge’s Salesforce enterprise application platform and practice and Oracle CX practice, as well as XRM Vision’s team of Microsoft specialists and accelerators streamlining financial reconciliation have proven especially complementary.

Management remains committed to operational efficiency, prudent capital allocation, and executing on our strategic priorities. We are confident with our business potential and the opportunities ahead, while mindful of the need for careful execution in the current environment.

On behalf of the Board, we extend heartfelt thanks to Robert Comeau, who is not standing for re-election. His exemplary leadership and dedication have shaped important decisions, strengthened our governance and advanced our mission to become a trusted advisor. It’s been a privilege to work with Robert. We wish him all the best in his next chapter.

We also take the opportunity to welcome Pierre Blanchette, who has joined as Chief Financial Officer on July 28. With nearly 30 years of experience in finance, Pierre brings valuable financial expertise and strategic insight as we scale and advance our strategic objectives.

Our Board of Directors remains deeply engaged, ensuring strong governance and oversight. We remain particularly vigilant in monitoring global geopolitical developments, addressing emerging challenges with care and diligence to safeguard our business.

At the upcoming Meeting, we will review the Company’s financial position, business operations and value delivered to shareholders, and address your comments and questions. As a shareholder, you have the right to vote your shares on all items that come before the Meeting. Whether or not you plan to attend, we invite you to review the accompanying management information circular dated July 14, 2025 and vote your shares.

Thank you for your continued trust and support of our long-term vision. The Board values your input and looks forward to ongoing dialogue.

Sincerely,

|

| |

|

| |

| Pierre Turcotte |

Paul Raymond | |

| Chair of the Board |

President and Chief Executive Officer | |

| 1 | This is a financial measure that is not in accordance with International Financial Reporting Standards (“IFRS”). The definition of Adjusted EBITDA can be found in section 5 entitled “Non-IFRS Measures and Other Financial Measures” of Alithya’s Management’s Discussion and Analysis for fiscal 2025 (“MD&A”). Please also refer to section 8.8 of the MD&A entitled “EBITDA and Adjusted EBITDA” for a quantitative reconciliation of the Adjusted EBITDA for the year and fourth quarter of fiscal 2025 to their most directly comparable IFRS measure. Sections 5 and 8.8 of the MD&A are hereby incorporated by reference. The MD&A has been filed and is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. |

ALITHYA | Notice of Meeting and of Availability of Materials III

Notice of Annual General Meeting of Shareholders and of Availability of Proxy Materials

Notice is hereby given that the annual general meeting of shareholders (the “Meeting”) of Alithya Group inc. (the “Company”) will be held as a virtual meeting on Wednesday, September 10, 2025 at 10:00 a.m. (Eastern Daylight Time) for the purposes of:

| ITEMS OF BUSINESS |

FOR MORE DETAILS, PLEASE REFER TO | |||

| 1 |

Receiving the audited consolidated financial statements of the Company for the fiscal year ended March 31, 2025 and the auditor’s report thereon (the “Annual Financial Statements”); |

Section entitled “Business of the Meeting – Financial Statements” of the management information circular dated July 14, 2025 (the “Information Circular”). | ||

|

2 |

Electing the directors of the Company; |

Sections entitled “Business of the Meeting – Election of Directors” and “Nominees for Election to the Board” of the Information Circular. | ||

| 3 |

Appointing the auditor for the year ending March 31, 2026 and authorizing the Board of Directors to fix the auditor’s compensation; and |

Section entitled “Business of the Meeting – Appointment of the Auditor” of the Information Circular. | ||

|

4 |

Considering such other business that may properly come before the Meeting or any adjournment or postponement thereof. |

Section entitled “Business of the Meeting – Other Business” of the Information Circular. | ||

The Information Circular provides additional information relating to the matters to be dealt with at the Meeting and forms an integral part of this notice. The Board of Directors has fixed July 14, 2025 as the record date for the determination of the shareholders entitled to receive notice of the Meeting and vote at the Meeting. To maximize the number of participants at the Meeting, the Company will be holding the Meeting virtually via a live audio webcast available online at meetings.lumiconnect.com/400-353-766-264, where all shareholders regardless of geographic location will have an equal opportunity to participate and vote.

Notice-and-Access

As permitted under Canadian securities rules, management is using “Notice-and-Access” to deliver the Information Circular prepared in connection with the Meeting and the Annual Financial Statements to both registered and non-registered shareholders. This means that instead of mailing paper copies of the Information Circular and the Annual Financial Statements, these are posted online for shareholders to access them, which reduces mailing and printing costs, and is more environmentally friendly as it reduces paper use. Shareholders will therefore receive by mail (i) this notice, which explains how to access the Information Circular and the Annual Financial Statements electronically and request paper copies, and how to vote and/or attend the Meeting, (ii) a form of proxy (for registered shareholders) or a voting instruction form (“VIF”) (for non-registered shareholders), with instructions on how to vote, and (iii) an additional document explaining how to attend and vote at the Meeting (the “Virtual Meeting User Guide”). Shareholders who previously signed up for electronic delivery of Meeting materials will receive them via email.

How to Access the Information Circular and Annual Financial Statements

The Information Circular and Annual Financial Statements and other Meeting materials are available on our website at www.alithya.com/en/alithya/investors, on the website of our transfer agent, TSX Trust Company (“TSX Trust”), at www.meetingdocuments.com/TSXT/ALYA, as well as on

SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Please review the Information Circular before voting.

How to Request Paper Copies

Shareholders may request paper copies of the Information Circular and Annual Financial Statements at no cost.

Before the Meeting, shareholders may request paper copies on the website of TSX Trust at www.meetingdocuments.com/TSXT/ALYA or by contacting TSX Trust at 1-888-433-6443 (toll free in Canada and the U.S.) or 1-416-682-3801. The Information Circular and/or Annual Financial Statements, as applicable, will be sent within three business days of receipt of the request. To receive a paper copy of the Information Circular prior to the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025, requests must be received by no later than 10:00 a.m. (Eastern Daylight Time) on August 29, 2025. Shareholders who request paper copies of these documents will not receive a new form of proxy or VIF and should therefore keep the form that was sent to them to vote their shares. After the Meeting, requests for paper copies may be made by email at secretariat@alithya.com, by mail at Corporate Secretariat, Alithya Group inc., 700, René-Lévesque West Blvd, Suite 400, Montréal, Québec, H3B 1X8, or by phone at 1-844-985-5552. Paper copies of the documents will be sent within ten business days of receipt of the request.

How to Vote

Shareholders may vote prior to the Meeting or at the Meeting. It is however recommended that shareholders vote prior to the Meeting using all forms of proxy or VIFs received even if they intend to attend the Meeting. Shareholders should read the Information Circular and other Meeting materials before voting and refer to the instructions on their form of proxy or VIF and in the Information Circular for details on how to vote. Voting instructions must be received by the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025 (or if the Meeting is adjourned or postponed, by 10:00 a.m. (Eastern Daylight Time) on the business day prior to the day fixed for the adjourned or postponed meeting).

ALITHYA | Notice of Meeting and of Availability of Materials II

How to Attend the Meeting

The Meeting will be held virtually via a live audio webcast available online at meetings.lumiconnect.com/400-353-766-264 and will be open to all shareholders as well as to the general public, except that only registered shareholders and duly appointed and registered proxyholders will have the opportunity to vote and ask questions. The process to attend the Meeting is different for registered shareholders and non-registered shareholders.

Please refer to the information contained in this notice, the Information Circular and the Virtual Meeting User Guide. It is recommended to undertake all required steps at least one week before the Meeting and to join the Meeting at least 15 minutes before it begins to avoid missing the beginning due to technical difficulties.

REGISTERED SHAREHOLDERS

Shareholders who received a form entitled “Form of Proxy” or an email directed to registered shareholders from TSX Trust are registered shareholders. To attend the Meeting, registered shareholders may visit meetings.lumiconnect.com/400-353-766-264 on the day of the Meeting, select the option “I have a login” and enter the 13-digit control number that appears on their form of proxy or in the email they received, as their username, and “alithya2025” (case sensitive) as their password.

Registered shareholders who appointed someone else than the persons named by management as their proxyholder to represent them at the Meeting must, after having submitted their proxy, either contact or have their proxyholder contact TSX Trust by phone at 1-866-751-6315 (toll free in Canada and the U.S.) or 1-416-682-3860, or complete the online form at www.tsxtrust.com/control-number-request, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 to register such other person and provide an email address at which TSX Trust will send a 13-digit proxyholder control number 24 to 48 hours before the Meeting.

NON-REGISTERED SHAREHOLDERS

Shareholders who received a form entitled “Voting Instruction Form” from TSX Trust or their intermediary or an email requesting voting instructions from their intermediary, and shareholders who participate in the Company’s Employee Share Purchase Plan (“ESPP Participants”) are non-registered shareholders. Non-registered shareholders are shareholders whose shares are registered in the name of their intermediary (such as a securities broker or a financial institution) which holds them on their behalf. As the Company and TSX Trust do not typically have a record of such shareholders, and, as a result, of their entitlement to vote, non-registered shareholders who wish to vote and ask questions at the Meeting or appoint someone else than the persons named by management must follow the following two steps:

Step 1: Submit their voting instructions and appoint themselves or someone else as their proxyholder by mail, internet, fax or email, as applicable, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline their intermediary may fix. Voting by phone is not recommended as it is not possible to appoint someone else than the persons named by management by phone.

Important Note: U.S. non-registered shareholders who are not ESPP Participants and who wish to appoint themselves or a proxyholder must obtain a legal proxy form from their intermediary and submit it to TSX Trust by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025.

Step 2: Once their voting instructions or legal proxy form has been submitted, non-registered shareholders or their proxyholder must contact TSX Trust by phone at 1-866-751-6315 (toll free in Canada and the U.S.) or 1-416-682-3860, or complete the online form at www.tsxtrust.com/control-number-request, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 to register and provide an email address at which TSX Trust will send a 13-digit proxyholder control number 24 to 48 hours before the Meeting.

Once these steps are completed and a proxyholder control number has been received, non-registered shareholders or their proxyholder will be able to attend the Meeting at meetings.lumiconnect.com/400-353-766-264 by selecting the option “I have a login” and entering their 13-digit proxyholder control number as their username and “alithya2025” (case sensitive) as their password. Without a proxyholder control number, non-registered shareholders and their proxyholders will only be able to attend the Meeting by selecting the option “I am a guest”, which will not entitle them to vote or ask questions. Non-registered shareholders who do not complete the above two steps by 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 will not be able to obtain a proxyholder control number. The control number appearing on their VIF is NOT a proxyholder control number and may not be used to attend the Meeting.

Questions

For questions about “Notice-and-Access” or assistance with the process to vote or attend the Meeting, shareholders may contact TSX Trust by phone at 1-800-387-0825 or Broadridge Financial Solutions, Inc. at 1-844-916-0609 (toll free in North America) or 1-303-562-9305, as applicable. For live technical assistance in operating the Meeting platform and voting during the Meeting, please contact Lumi Canada Inc. at support-ca@lumiglobal.com.

Montréal, Québec

July 14, 2025

By Order of the Board of Directors,

Nathalie Forcier

Chief Legal Officer and Corporate Secretary

ALITHYA | Notice of Meeting and of Availability of Materials III

Table of Contents

| GENERAL INFORMATION |

2 | |||

|

Notice-and-Access |

2 | |||

| General Proxy Matters and Virtual Meeting Matters |

3 | |||

| Who Can Vote |

3 | |||

| How to Vote |

3 | |||

| How to Complete your Form and How Your Shares Will Be Voted |

5 | |||

| Voting at the Meeting |

5 | |||

| Changing your Vote |

5 | |||

| Conduct at the Meeting & Asking Questions |

6 | |||

| Additional Information |

7 | |||

| Proxy Solicitation |

7 | |||

| Transfer Agent |

7 | |||

| Authorized Share Capital |

7 | |||

| Normal Course Issuer Bid |

8 | |||

| Principal Shareholders |

8 | |||

| BUSINESS OF THE MEETING |

9 | |||

| Financial Statements |

9 | |||

| Election of Directors |

9 | |||

| Appointment of the Auditor |

9 | |||

| Other Business |

9 | |||

| NOMINEES FOR ELECTION TO THE BOARD |

10 | |||

| Description of the Nominee Directors |

10 | |||

| Cease trade orders, bankruptcies and Penalties |

13 | |||

| Board and Committee Attendance |

13 | |||

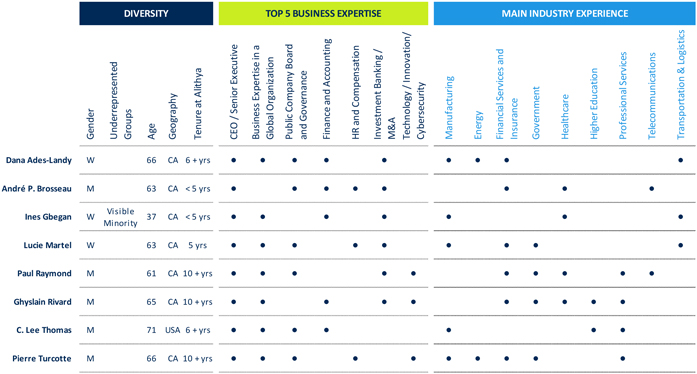

| Board Skills Matrix |

14 | |||

| DIRECTOR COMPENSATION |

15 | |||

| Structure of Compensation |

15 | |||

| Director Compensation Table |

16 | |||

| Incentive Plan Awards – Outstanding Awards |

16 | |||

| Incentive Plan Awards – Value Vested or Earned |

||||

| During the Year |

17 | |||

| Director Share Ownership Requirement |

17 | |||

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

18 | |||

| Board of Directors |

18 | |||

| Mandate of the Board |

18 | |||

| Composition of the Board |

18 | |||

| Committees’ Mandates and Membership |

20 | |||

| Board Renewal |

22 | |||

| Nomination to the Board |

22 | |||

| Director Orientation and Continuing Education |

24 | |||

| Talent Management and Succession Planning |

25 | |||

| Shareholder Engagement |

26 | |||

| Shareholder engagement by Management |

26 | |||

| Shareholder engagement by Directors |

26 | |||

| Strategic Oversight |

27 | |||

| Risk Oversight |

27 | |||

| Corporate Sustainability |

27 | |||

| Board and Management Oversight |

28 | |||

| Material Topics and Recent Developments |

28 | |||

| Ethical Business Conduct |

30 | |||

| Codes of Business Conduct |

30 | |||

| Related Party Transactions |

30 | |||

| Insider Trading Policy |

31 | |||

| Disclosure Policy |

31 | |||

| Clawback Policy |

31 | |||

| COMPENSATION DISCUSSION AND ANALYSIS |

33 | |||

| Letter from the Chair of the Human Capital and Compensation Committee |

33 | |||

| Executive Compensation Framework |

34 | |||

| Executive Compensation Approach |

34 | |||

| Compensation Review Process |

35 | |||

| Executive Compensation Description |

36 | |||

| Compensation of the NEOs |

40 | |||

| Incentive Plan Awards Held and Vested |

43 | |||

| Performance Graph |

44 | |||

| Trends in Compensation |

45 | |||

| Long Term Incentives |

45 | |||

| Employment Arrangements of the NEOs |

47 | |||

| OTHER INFORMATION |

49 | |||

| Indebtedness of Directors and Executive Officers |

49 | |||

| Interest of Informed Persons and Others in Material Transactions |

49 | |||

| Shareholder Proposals |

49 | |||

| Availability of Documents |

49 | |||

| Approval |

49 | |||

| SCHEDULE A | LONG TERM INCENTIVE PLAN AND SHARE PURCHASE PLAN DESCRIPTION | 50 | |||

| SCHEDULE B | MANDATE OF THE BOARD | 54 | |||

ALITHYA | Table of Contents i

General Information

This management information circular (the “Information Circular”) is provided in connection with the solicitation of proxies by the management of Alithya Group inc. for use at its annual general meeting of shareholders which will be held on Wednesday, September 10, 2025, at 10:00 a.m. (Eastern Daylight Time), for the purposes set forth in the foregoing Notice of Meeting, or at any adjournment or postponement thereof (the “Meeting”). To maximize the number of participants at the Meeting, the Company will be holding the Meeting virtually via a live audio webcast available online, where all shareholders regardless of geographic location will have an equal opportunity to participate and vote.

The record date for determination of shareholders entitled to receive notice of, and vote at, the Meeting is July 14, 2025 (the “Record Date”).

In this document “you” and “your” refer to the shareholders of Alithya Group inc. and “Alithya”, the “Company”, “we”, “us”, or “our” refer to Alithya Group inc. (and, where the context so requires, Alithya Group inc. and its subsidiaries).

The information provided in this Information Circular that relates to financial information is provided as at March 31, 2025. Except as otherwise stated, all other information is provided as at July 14, 2025 and all dollar amounts shown are in Canadian dollars.

NOTICE-AND-ACCESS

As permitted under Canadian securities rules, management is using “Notice-and-Access” to deliver this Information Circular and the annual financial statements to both registered and non-registered shareholders. This means that instead of mailing paper copies of this Information Circular to shareholders holding Class A subordinate voting shares (“subordinate voting shares”) or Class B multiple voting shares (“multiple voting shares” and, collectively with the subordinate voting shares, the “Shares”) as of the Record Date, this Information Circular is being posted online for shareholders to access it electronically, which reduces printing and mailing costs and is more environmentally friendly as it reduces paper use. Shareholders will therefore receive by mail (i) a notice explaining how to electronically access the Information Circular and the audited consolidated financial statements of the Company for the fiscal year ended March 31, 2025 (“fiscal 2025”) and the auditor’s report thereon (the “Annual Financial Statements”), how to request paper copies thereof, and how to vote and/or attend the Meeting, (ii) a form of proxy (for registered shareholders) or a voting instruction form (“VIF”) (for non-registered shareholders) with instructions on how to vote, and (iii) a document explaining how to attend the Meeting. Shareholders who previously signed up for electronic delivery of Meeting materials will receive them by email.

Non-registered shareholders are either objecting beneficial owners who object that intermediaries disclose information about their ownership in the Company, or non-objecting beneficial owners who do not object to such disclosure. Alithya is sending proxy-related materials directly to registered shareholders and non-registered shareholders who are non-objecting beneficial owners and is paying for intermediaries to deliver such materials to non-registered shareholders who are objecting beneficial owners.

HOW TO ACCESS THE INFORMATION CIRCULAR AND THE ANNUAL FINANCIAL STATEMENTS ELECTRONICALLY

This Information Circular and the Annual Financial Statements are available on our website at www.alithya.com/en/alithya/investors, on the website of our transfer agent, TSX Trust Company (“TSX Trust”) at www.meetingdocuments.com/TSXT/ALYA, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

HOW TO REQUEST A PAPER COPY OF THE INFORMATION CIRCULAR AND ANNUAL FINANCIAL STATEMENTS

You may request a paper copy of the Information Circular and the Annual Financial Statements at no cost up to one year from the date the Information Circular was filed on SEDAR+ and EDGAR.

Before the Meeting, shareholders may request paper copies of the Information Circular and the Annual Financial Statements prior to the Meeting on the website of TSX Trust at www.meetingdocuments.com/TSXT/ALYA or by contacting TSX Trust at 1-888-433-6443 (toll free in Canada and the U.S.) or 1-416-682-3801. The Information Circular and/or Annual Financial Statements, as applicable, will be sent within three business days of receipt of the request. Your request should be received no later than 10:00 a.m. (Eastern Daylight Time) on August 29, 2025 to receive the Information Circular prior to the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025. Shareholders who request paper copies of the Information Circular and Annual Financial Statements will not receive a new form of proxy or VIF and should therefore keep the original form sent to them to vote their Shares.

After the Meeting, requests for paper copies may be made by email at secretariat@alithya.com, by mail at Corporate Secretariat, Alithya Group inc., 700, René-Lévesque West Blvd, Suite 400, Montréal, Québec, H3B 1X8 or by phone at 1-844-985-5552. Paper copies will be sent within ten business days of receipt of the request.

QUESTIONS?

For questions about “Notice-and-Access” or for assistance with the process to vote or attend the Meeting, please contact TSX Trust by phone at 1-800-387-0825, or Broadridge Financial Solutions, Inc. at 1-844-916-0609 (toll free in North America) or 1-303-562-9305, as applicable. For live technical assistance in operating the Meeting platform and voting during the Meeting, please contact Lumi Canada Inc. (“Lumi”) at support-ca@lumiglobal.com. If you have questions about the information contained in this Information Circular, please contact our Corporate Secretariat team by email at secretariat@alithya.com or by mail at the address indicated in the section above.

ALITHYA | Management Information Circular 2

GENERAL PROXY MATTERS AND VIRTUAL MEETING MATTERS

Who Can Vote

Shareholders holding subordinate voting shares or multiple voting shares as at the close of business on the Record Date are entitled to vote at the Meeting and at any adjournment or postponement thereof. Your vote is important. Voting by proxy prior to the Meeting is the easiest way to vote your Shares. As a shareholder, it is important that you read this Information Circular carefully and vote your Shares either prior to the Meeting by proxy or at the Meeting by following the steps explained below.

Depending on how your Shares are registered, you may be a registered shareholder for a portion of your Shares and a non-registered shareholder for the balance thereof and may accordingly receive both a form of proxy and a VIF. It is recommended to vote using all forms received to ensure that all of your Shares are voted.

Employees who participate in the Company’s Employee Share Purchase Plan and have their shares managed by TSX Trust, in its capacity of plan administrator, (“ESPP Participants”) will receive the Meeting materials electronically from TSX Trust with instructions on how to vote using the internet.

How to Vote

REGISTERED SHAREHOLDERS

You are a registered shareholder if your Shares are registered in your name (i.e. your name appears on your share certificate or Direct Registration System (DRS) statement) and you received a form entitled “Form of Proxy” or an email directed to registered shareholders from TSX Trust.

Option 1 - Voting by Proxy Prior to the Meeting (Form of Proxy)

Voting by proxy means appointing a proxyholder (i.e. the persons named by management, yourself or someone else) to vote as per your voting specifications, if any, at the Meeting. You may vote by proxy using one of the methods described below:

|

Internet: Go to www.meeting-vote.com and follow the instructions. You will need your 13-digit control number that appears on your form of proxy or in the email TSX Trust sent you, if you signed up for electronic delivery. | |

|

Phone: Call 1-888-489-7352 (toll free in Canada and the U.S.). You will need your 13-digit control number that appears on your form of proxy or in the email you received from TSX Trust. If you vote by phone, you will not be able to appoint anyone other than the persons named by management as your proxyholder to represent you at the Meeting. Therefore, if you wish to appoint someone else as your proxyholder to attend the Meeting, this voting method is not recommended. | |

|

Fax or email: Complete your form of proxy and send it to TSX Trust by fax at 1-416-595-9593, or scan and email it to TSX Trust at proxyvote@tmx.com. | |

|

Mail: Complete and return your form of proxy in the prepaid envelope provided. | |

Your duly completed form of proxy must be received by TSX Trust, or you must have voted on the internet, by phone, by fax

or by email by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or, if the Meeting is adjourned or postponed, 10:00 a.m. (Eastern Daylight Time) on the business day prior to the day fixed for the adjourned or postponed meeting. If you elect to vote through the internet or by phone, you do not need to return your form of proxy.

When completing your form of proxy, make sure to indicate the name of the person you wish to appoint as your proxyholder to attend the Meeting on your behalf or leave the space for the appointment blank if you wish to appoint the persons named by management. In both cases, it is recommended to indicate how you wish to vote for each item to be voted on, otherwise your proxyholder will have the discretion to vote as he or she sees fit. If you appoint a proxyholder who is not the persons named by management, once your form is submitted, please contact, or ask your proxyholder to contact, TSX Trust by phone at 1-866-751-6315 (toll free in Canada and the U.S.) or 1-416-682-3860, or complete the online form available at www.tsxtrust.com/control-number-request, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 in order to register your proxyholder and provide an email address at which TSX Trust will send a 13-digit proxyholder control number for your proxyholder to be able to join the Meeting. Proxyholder control numbers will be distributed by TSX Trust 24 to 48 hours before the Meeting. Without a proxyholder control number, your proxyholder will be unable to join the Meeting and if your proxyholder does not join the Meeting, your voting rights will not be exercised, as your proxyholder is required to attend the Meeting for them to be exercised.

Option 2 – Attending and Voting at the Meeting

If you wish to attend and vote at the Meeting, you do not need to complete or submit your form of proxy. You may simply visit meetings.lumiconnect.com/400-353-766-264 on the day of the Meeting, select the option “I have a login” and enter the 13-digit control number that appears on your form of proxy or in the email TSX Trust sent you, if you signed up for electronic delivery, as your control number and “alithya2025” (case sensitive) as your password. Once logged in, simply follow the instructions on the screen during the Meeting. Joining the Meeting by selecting the option “I am a guest” will not allow you to vote or ask questions at the Meeting.

If you wish to appoint someone else to attend the Meeting on your behalf, please follow the instructions indicated in the preceding section entitled “Option 1 – Voting by Proxy Prior to the Meeting (Form of Proxy)”.

NON-REGISTERED SHAREHOLDERS

You are a non-registered shareholder if your Shares are not registered in the records of the Company directly in your name, but instead in the name of an intermediary (such as a securities broker or a financial institution) which holds them on your behalf. If you received a form entitled “Voting Instruction Form” from TSX Trust or your intermediary or an email requesting voting instructions from your intermediary, your Shares are not registered in your name.

ALITHYA | Management Information Circular 3

Employees who participate in the Company’s Employee Share Purchase Plan and have their shares managed by TSX Trust, in its capacity of plan administrator, are non-registered shareholders and will receive the Meeting materials electronically from TSX Trust with instructions on how to vote using the internet, which instructions are similar to those described below.

Option 1 - Voting by Proxy Prior to the Meeting (Voting Instruction Form)

Voting by proxy means appointing a proxyholder (i.e. the persons named by management, yourself or someone else) to vote as per your voting instructions, if any, at the Meeting. Instructions for voting by proxy prior to the Meeting vary depending on whether you received a VIF from TSX Trust or your intermediary.

If you received a VIF from TSX Trust, you may vote by proxy by giving your voting instructions using one of the methods described below:

|

Internet: Go to www.meeting-vote.com and follow the instructions. You will need your 13-digit control number that appears on your VIF. | |

|

Phone: Call 1-888-489-7352 (toll free in Canada and the U.S.). You will need your 13-digit control number that appears on your VIF. If you vote by phone, you will not be able to appoint anyone other than the persons named by management on your VIF as your proxyholder. Therefore, if you wish to appoint someone else as your proxyholder to attend the Meeting, this voting method is not recommended. | |

|

Fax or email: Complete the VIF and send it to TSX Trust by fax at 1-416-595-9593, or scan and email it to TSX Trust at proxyvote@tmx.com. | |

|

Mail: Complete and return your VIF in the prepaid envelope provided. | |

If you received a VIF or an email from your intermediary, you may vote by proxy by giving your voting instructions using one of the methods described below:

|

Internet: Go to www.proxyvote.com and follow the instructions. You will need your 16-digit control number that appears on your VIF or in the email you received.

| |

|

Phone: Call 1-800-474-7493 (English) (toll free in Canada), 1-800-474-7501 (French) (toll free in Canada) or 1-800-454-8683 (toll free in the U.S.). You will need your 16-digit control number that appears on your VIF or in the email you received. If you vote by phone, you will not be able to appoint anyone other than the persons named by management on your VIF as your proxyholder. Therefore, if you wish to appoint someone else as your proxyholder to attend the Meeting, this voting method is not recommended.

| |

|

Mail: Complete and return your VIF in the prepaid envelope provided.

| |

Your duly completed VIF must be received by TSX Trust or your intermediary, as applicable, or you must have voted on the internet, by phone, by fax or by email, as applicable, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline your intermediary may fix or, if the Meeting is adjourned or postponed, 10:00 a.m. (Eastern

Daylight Time) on the business day prior to the day fixed for the adjourned or postponed meeting. Please contact your intermediary to ensure you do not miss your applicable voting deadline. If you elect to vote on the internet or by phone, you do not need to return your VIF.

When completing your VIF, make sure to indicate the name of the person you wish to appoint as your proxyholder to attend the Meeting on your behalf or leave the space for the appointment blank if you wish to appoint the persons named by management. In both cases, it is recommended to indicate how you wish to vote for each item to be voted on, otherwise your proxyholder will have the discretion to vote as he or she sees fit. If you appoint a proxyholder who is not the persons named by management, once your form is submitted, please contact, or ask your proxyholder to contact, TSX Trust by phone at 1-866-751-6315 (toll free in Canada and the U.S.) or 1-416-682-3860, or complete the online form available at www.tsxtrust.com/control-number-request, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 in order to register your proxyholder and provide an email address at which TSX Trust will send a 13-digit proxyholder control number for your proxyholder to be able to join the Meeting. Proxyholder control numbers will be distributed by TSX Trust 24 to 48 hours before the Meeting. Without a proxyholder control number, your proxyholder will be unable to join the Meeting and if your proxyholder does not join the Meeting, your voting rights will not be exercised, as your proxyholder is required to attend the Meeting for them to be exercised.

Option 2 – Attending and Voting at the Meeting

As we do not have access to the names or holdings of our non-registered shareholders, if you wish to attend and vote at the Meeting or to appoint someone else to do so on your behalf, you must follow the following two steps:

Step 1: Submit to TSX Trust or your intermediary, as applicable, your voting instructions and appoint yourself or another person (who need not be a shareholder) as your proxyholder before the Meeting by inserting your name or such other person’s name in the space provided for such purpose. Although optional for shareholders who intend to attend the Meeting or have someone else attend it on their behalf, it is recommended to also specify how you wish to vote for each item to be voted on, otherwise your proxyholder will have the discretion to vote as he or she sees fit. Please refer to the section entitled “Option 1 – Voting by Proxy Prior to the Meeting (Voting Instruction Form)” earlier for further details on how to submit your voting instructions. Voting by phone is not recommended as it is not possible to appoint someone else than the persons named by management as proxyholder by phone. TSX Trust or your intermediary, as applicable, must receive your instructions by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline your intermediary may fix for your proxyholder’s appointment to be effective. Please contact your intermediary to ensure you do not miss your applicable voting deadline.

Important Note: U.S. non-registered shareholders who are not ESPP Participants and who wish to appoint themselves or a proxyholder must obtain a legal proxy form from their intermediary and submit it to TSX Trust by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025.

ALITHYA | Management Information Circular 4

Step 2: Once your voting instructions or legal proxy form has been submitted, contact, or ask your proxyholder to contact, TSX Trust by phone at 1-866-751-6315 (toll free in Canada and the U.S.) or 1-416-682-3860, or complete the online form available at www.tsxtrust.com/control-number-request, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 in order to register yourself or your proxyholder and provide an email address at which TSX Trust will send a 13-digit proxyholder control number to be able to join the Meeting. Proxyholder control numbers will be distributed by TSX Trust 24 to 48 hours before the Meeting. Intermediaries do not provide proxyholder control numbers. Therefore, shareholders who appointed themselves or someone else as their proxyholder through their intermediary must still contact TSX Trust thereafter.

Once these two steps are completed and a proxyholder control number is received from TSX Trust, you or your proxyholder will be able to attend the Meeting online at meetings.lumiconnect.com/400-353-766-264 by selecting the option “I have a login” and entering the proxyholder control number in the space provided for the control number and “alithya2025” (case sensitive) as password.

Without a proxyholder control number, you or your proxyholder will not be able to attend the Meeting as a shareholder and will only be able to view the Meeting as a guest, which will not entitle you or your proxyholder to vote or ask any questions. If you do not complete the above two steps by 10:00 a.m. (Eastern Daylight Time) on September 8, 2025, you will not be able to obtain a proxyholder control number. The control number appearing on your VIF is NOT a proxyholder control number and may therefore not be used to attend the Meeting.

How to Complete your Form and How Your Shares Will Be Voted

You can choose to vote FOR or WITHHOLD on the items to be voted on.

When you vote by proxy prior to the Meeting, you may appoint either the persons named by management as your proxyholder (namely, the Chair of the Board of Directors (the “Board”) or the President and Chief Executive Officer of the Company) or you may appoint someone else to represent you at the Meeting and vote on your behalf. You have the right to appoint any other person (who need not be a shareholder) to attend and act on your behalf at the Meeting. That right may be exercised by writing the name of such person in the space provided for such purpose in your form of proxy or VIF.

If you do not intend to attend the Meeting or be represented at the Meeting, you may appoint the persons named by management to represent you at the Meeting and complete your form completely by indicating how you wish to vote for each item to be voted on. If you leave the section for the appointment of your proxyholder blank, you will be deemed having appointed the persons named by management as your proxyholder.

If you intend to attend the Meeting or have someone else than the persons named by management represent you as your proxyholder at the Meeting and vote on your behalf, although you could only indicate your name or the name of such other person in the space provided on your VIF and submit it without

indicating how you wish to vote for each item to be voted on, it is still recommended to complete your form and indicate how you wish to vote for each item.

If you have NOT specified how you wish your proxyholder to vote on a particular matter at the Meeting, your proxyholder will be entitled to vote your Shares as he or she sees fit or, in the case of the Chair of the Board or the President and Chief Executive Officer of the Company, your vote will be exercised as follows:

| • | FOR the election of management’s nominees as directors; and |

| • | FOR the appointment of KPMG LLP as auditor and authorizing the Board to fix their compensation. |

The proxy confers discretionary authority in respect of amendments to any of the foregoing matters and such other matters as may properly come before the Meeting. Management is not aware of any such amendments or of other matters to be submitted at the Meeting.

If you appointed a proxyholder other than the persons named by management to represent you at the Meeting and vote on your behalf, please make sure your proxyholder obtains his or her proxyholder control number and joins the Meeting, otherwise your voting rights will not be exercised, as your proxyholder is required to attend the Meeting for them to be exercised.

Voting at the Meeting

Registered shareholders who voted prior to the Meeting and who decide to attend the Meeting using their control number do not need to vote again using the voting buttons appearing on their screen during the Meeting. If they vote again at the Meeting, their vote will, however, be taken into account and replace their vote transmitted before the Meeting.

Proxyholders (including non-registered shareholders who appointed themselves as proxyholder and third parties who were appointed as proxyholders by registered shareholders or non-registered shareholders) do not have to vote again at the Meeting if the shareholder they represent already indicated on his, her or its VIF how they wish to vote. They may, however, if they wish, vote at the Meeting by voting in accordance with the voting instructions of the shareholder they represent or as they see fit, if the shareholder they represent has not indicated how to vote. If the shareholder who is represented by a proxyholder indicated how to vote for each item through voting instructions submitted prior to the Meeting and the proxyholder votes differently at the Meeting, the proxyholder’s vote will automatically be changed to follow the shareholder’s voting instructions submitted prior to the Meeting once the Meeting will have ended and the votes are compiled by the scrutineers.

Changing your Vote

If you change your mind about how you want to vote your Shares, you can revoke your proxy by any of the methods outlined below, or by any other means permitted by law.

Registered shareholders may change their vote by:

| • | voting again on the internet, by phone, by fax or by email, as applicable, by the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025; |

ALITHYA | Management Information Circular 5

| • | completing a new form of proxy with a later date than the form previously submitted and mailing it as soon as possible so that it is received by TSX Trust by the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025; |

| • | sending a written notice signed by them or their authorized attorney to the Corporate Secretary of the Company at the registered office of the Company (700, René-Lévesque West Blvd, Suite 400, Montréal, Québec, H3B 1X8) so that it is received by 10:00 a.m. (Eastern Daylight Time) on September 8, 2025; or |

| • | attending the Meeting at meetings.lumiconnect.com/400-353-766-264 on the day of the Meeting by selecting the option “I have a login” and entering the 13-digit control number that appears on their form of proxy as their username and “alithya2025” (case sensitive) as their password and voting at the Meeting. |

Non-registered shareholder may change their vote by:

| • | voting again on the internet, by phone, by fax or by email, as applicable, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline their intermediary may fix; |

| • | completing a new VIF with a later date than the one previously submitted and mailing it as soon as possible at the address directed by TSX Trust or their intermediary, as applicable, by no later than 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline their intermediary may fix; or |

| • | sending a written notice signed by them or their authorized attorney to the Corporate Secretary of the Company at the registered office of the Company (700, René-Lévesque West Blvd, Suite 400, Montréal, Québec, H3B 1X8) so that it is received by 10:00 a.m. (Eastern Daylight Time) on September 8, 2025. |

Although proxyholders (including non-registered shareholders who appointed themselves as proxyholder and third parties who were appointed as proxyholder by registered shareholders and non-registered shareholders) could vote differently at the Meeting using the online voting buttons, please note that if such votes differ from the last voting instructions processed by TSX Trust or their intermediary before the proxy voting deadline of 10:00 a.m. (Eastern Daylight Time) on September 8, 2025 or such other deadline their intermediary may fix, the vote of the proxyholder will automatically be modified once the Meeting will have ended and the votes are compiled to reflect the last voting instructions received from the shareholder before such deadline.

Conduct at the Meeting & Asking Questions

The Company’s by-laws describe the requirements for the Meeting and the Chair of the Meeting will conduct the meeting consistent with those requirements. As such, we will strictly follow the items to be covered at the Meeting and which are set forth in the section entitled “Business of the Meeting” of this Information Circular.

Shareholders and guests will be able to join the Meeting on the day of the Meeting at meetings.lumiconnect.com/400-353-766-264. For a better experience, it is recommended to use a high-speed internet connection and the latest version of Chrome, Safari, Edge or Firefox. Internet Explorer is not supported. It is

also recommended to ensure your browser is compatible by trying to log in at least 15 minutes before the Meeting.

Only registered shareholders and duly appointed and registered proxyholders will be eligible to vote while participating at the Meeting. Registered shareholders should use their 13-digit control number appearing on their form of proxy and non-registered shareholders should use their 13-digit proxyholder control number received by email from TSX Trust.

The voting polls will be open during the formal part of the Meeting. The Chair of the Meeting will indicate the time of opening and closure of the polls for the items to be voted on. Voting options will be visible on your screen and you will simply have to select your voting option. Your choice will be highlighted.

During the Meeting, only registered shareholders and duly appointed and registered proxyholders who have joined the Meeting using their 13-digit control number or proxyholder control number will have the opportunity to ask questions by typing and submitting questions through the field available for such purpose, and it will only be possible to submit questions in writing.

Guests and non-registered shareholders who did not appoint themselves as proxyholder by the 10:00 a.m. (Eastern Daylight Time) voting deadline on September 8, 2025 will not be able to log in to the Meeting and submit questions or vote at the Meeting. They will only be able to join the audio webcast as guests.

It is recommended that shareholders send their question as soon as possible during the Meeting so that these can be addressed at the appropriate time. Questions relating to matters to be voted on will be addressed by the Chair of the Meeting and other members of management present at the Meeting before those items are voted on while general questions will be addressed at the end of the Meeting, after the adjournment of the formal business of the Meeting and management’s presentation about the Company’s business.

To respect both time constraints and other shareholders, when submitting questions, shareholders are asked to be brief and as much to the point as possible. To allow us to answer questions from as many shareholders as possible, shareholders and proxyholders are kindly asked to cover only one topic per question. Questions from multiple shareholders on the same topic or that are otherwise related may be grouped, summarized and answered together.

All shareholder questions are welcome, but conducting the business set out in the Meeting’s agenda for the benefit of all shareholders will be paramount. The Company does not intend to address any questions that are, among other things:

| • | irrelevant to the business of the Company or to the business of the Meeting; |

| • | related to material non-public information of the Company; |

| • | related to personal grievances; |

| • | derogatory references to individuals or that are otherwise in bad taste; |

| • | repetitious statements already made by another shareholder; |

| • | in furtherance of the shareholder’s personal or business interests; or |

ALITHYA | Management Information Circular 6

| • | out of order or not otherwise suitable for the conduct of the Meeting as determined by the Chair or the Secretary of the Meeting in their reasonable judgment. |

If there are any matters of individual concern to a shareholder and not of general concern to all shareholders or if a question asked was not otherwise answered, such matters may be raised separately after the Meeting by contacting the Company’s Corporate Secretary at secretariat@alithya.com.

The Company is committed to offering a forum where, to the fullest extent possible using available electronic solutions, shareholders may communicate adequately through the course of the Meeting.

For assistance with your control number to join the Meeting, please contact TSX Trust at 1-800-387-0825. For live technical assistance in operating the Meeting platform and voting, please contact Lumi at support-ca@lumiglobal.com.

In the event of technical malfunction or other significant problem that disrupts the Meeting, the Chair of the Meeting may adjourn, recess, or expedite the Meeting, or take such other action that the Chair determines is appropriate considering the circumstances.

An audio webcast playback will be available on the Company’s website in the Investors section after the Meeting.

ADDITIONAL INFORMATION

Proxy Solicitation

The solicitation of proxies by management is being made primarily by mail, but directors, officers or employees of the Company may also solicit proxies at a nominal cost. The Company does not intend to retain the services of a proxy advisory firm for the solicitation of proxies.

Transfer Agent

You can contact TSX Trust, the Company’s transfer agent, either by mail at 1700 – 1190 des Canadiens-de-Montreal Avenue, Montreal, Quebec, H3B 0G7, by telephone at 1-800-387-0825, by fax at 1-888-249-6189, or by email at shareholderinquiries@tmx.com.

Authorized Share Capital

The authorized share capital of the Company consists of (i) an unlimited number of subordinate voting shares, without par value, which are listed under the symbol ALYA on the Toronto Stock Exchange (“TSX”), (ii) an unlimited number of multiple voting shares, without par value, which are held by a limited number of holders, except that no further multiple voting shares can be issued, except pursuant to the exercise of options to purchase multiple voting shares that were issued and outstanding as at November 1, 2018, and (iii) an unlimited number of preferred shares, without par value, issuable in series. On January 1, 2025, in connection with an internal reorganization, the Company amended its articles to create two series of preferred shares, each consisting of an unlimited number of shares: the Series A preferred shares and the Series B preferred shares. As at July 14, 2025, 92,653,272 subordinate voting shares, 7,326,880 multiple voting shares and no preferred shares were issued and outstanding.

The following summary of the material features of the Company’s authorized share capital is given subject to the detailed provisions of its articles.

VOTING RIGHTS

Each subordinate voting share entitles its holder to one vote per share, and each multiple voting share entitles its holder to ten votes per share at any meeting of shareholders, other than meetings at which only the holders of a particular class or series of shares are entitled to vote due to statutory provisions or the specific attributes of this class or series. If and when issued, preferred shares will have such voting rights as may be determined by the Board at the time of issuance thereof. Subject to the provisions of the Business Corporations Act (Québec) or

as otherwise provided in the Company’s articles, the Series A preferred shares and Series B preferred shares are not entitled to receive notice of, nor to attend or vote at, meetings of the shareholders of the Company.

The subordinate voting shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws in that they do not carry equal voting rights with the multiple voting shares. In the aggregate, all voting rights associated with the subordinate voting shares represented, as at July 14, 2025, 55.84% of the voting rights attached to all issued and outstanding Shares.

RIGHTS TO DIVIDENDS AND RIGHTS UPON WINDING-UP AND DISSOLUTION

Subject to the prior rights of holders of preferred shares which rank prior to subordinate voting shares and multiple voting shares, if and when issued, holders of subordinate voting shares and multiple voting shares are entitled to receive pari passu any dividends and the remainder of the Company’s property in the event of a voluntary or involuntary winding-up or dissolution, or any other distribution of assets among shareholders for the purposes of winding up the Company’s affairs.

The holders of Series A preferred shares and Series B preferred shares are entitled to receive, as and when declared by the Board, in preference and priority to any payment of distributions on the subordinate voting shares and the multiple voting shares and over any other shares of any other class ranking junior to the Series A preferred shares and Series B preferred shares, pari passu with the holders of each series of preferred shares, non-cumulative preferential dividends.

In the event of a voluntary or involuntary liquidation, dissolution or winding up of the Corporation or any other distribution of assets among shareholders for the purposes of winding up the Company’s affairs, the holders of Series A preferred shares and Series B preferred shares are entitled to receive for each Series A or Series B preferred share, as applicable, in preference and priority to any distribution of the property of the Company to the holders of subordinate voting shares and multiple voting shares or to any other shares of any other class ranking junior to the Series A or Series B preferred shares, as applicable, but pari passu with the holders of each series of preferred shares, an amount equal to the Series A or Series B Preferred Redemption Price (as defined in Section C paragraph 6.1 of the Company’s articles) plus all declared and unpaid dividends

ALITHYA | Management Information Circular 7

thereon, but shall not be entitled to share any further in the distribution of the property of the Company.

CONVERSION RIGHTS

Multiple voting shares are, at the holder’s entire discretion, convertible into subordinate voting shares on a share for share basis and shall be automatically converted upon their transfer to a person who is not a Permitted Holder (as defined below) or upon the death of a Permitted Holder, unless acquired by any of the remaining Permitted Holders in accordance with the terms of the voting agreement dated November 1, 2018 entered into between the Permitted Holders (the “Voting Agreement”), a copy of which is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. For further information on the Voting Agreement, please refer to the section entitled “Principal Shareholders” below. The multiple voting shares are not convertible into any other class of shares. Under applicable Canadian laws, an offer to purchase multiple voting shares would not necessarily require that an offer be made to purchase subordinate voting shares. However, as indicated above, multiple voting shares shall be automatically converted into subordinate voting shares on a share for share basis upon their transfer to a person who is not a Permitted Holder. A “Permitted Holder” means each of Paul Raymond,

Ghyslain Rivard and Pierre Turcotte, and the entities over which they have control.

If and when issued, preferred shares will have such conversion rights as may be determined by the Board at the time of issuance thereof. The Series A and Series B preferred shares are not convertible into, or exchangeable for, any other class of shares of the Company.

RESTRICTIONS ON TRANSFER

Subject to the terms of the Voting Agreement, Permitted Holders cannot sell or otherwise transfer multiple voting shares to a person who is not a Permitted Holder, unless they first convert those shares into subordinate voting shares on a share for share basis, and then transfer such subordinate voting shares.

Normal Course Issuer Bid

On September 13, 2023, the Company announced the renewal of its normal course issuer bid (the “NCIB”) in order to purchase for cancellation up to 2,411,570 subordinate voting shares, representing 5% of the Company’s public float as of the close of markets on September 7, 2023. Purchases for cancellation under the NCIB commenced on September 20, 2023 and ended on September 19, 2024. Purchases were made on the open market through the facilities of the TSX. The Company did not renew its NCIB following September 19, 2024.

Principal Shareholders

As at July 14, 2025, to the knowledge of the Company, based on the most recent publicly available information, the only persons who beneficially owned, directly or indirectly, or exercised control or direction over 10% or more of the subordinate voting shares or multiple voting shares of the Company were Paul Raymond, Ghyslain Rivard, and Pierre Turcotte, Beneva Inc. (“Beneva”) and 9429-1143 Québec Inc. (a subsidiary of Quebecor Media inc.) (“Quebecor”) and Financière Outremont Inc., two companies controlled by Pierre Karl Péladeau. Their respective holdings are set out in the table that follows.

| |

SUBORDINATE VOTING SHARES |

|

MULTIPLE VOTING SHARES | |

SUBORDINATE VOTING SHARES AND MULTIPLE VOTING SHARES |

VOTING RIGHTS | ||||||||||||||||||||||||||

| (#) | (%) | (#) | (%) | (#) | (%) | (#) | (%) | |||||||||||||||||||||||||

| Paul Raymond |

400,990 | 0.43 | 1,080,138 | 14.74 | 1,481,128 | 1.48 | 11,202,370 | 6.75 | ||||||||||||||||||||||||

| Ghyslain Rivard |

- | - | 4,412,000 | 60.22 | 4,412,000 | 4.41 | 44,120,000 | 26.59 | ||||||||||||||||||||||||

| Pierre Turcotte |

320,700 | 0.35 | 1,834,742 | 25.04 | 2,155,442 | 2.16 | 18,668,120 | 11.25 | ||||||||||||||||||||||||

| Beneva Inc. |

9,983,276 | 10.77 | - | - | 9,983,276 | 9.99 | 9,983,276 | 6.02 | ||||||||||||||||||||||||

| 9429-1143 Québec Inc.(1) |

9,983,276 | 10.77 | - | - | 9,983,276 | 9.99 | 9,983,276 | 6.02 | ||||||||||||||||||||||||

| Financière Outremont Inc.(1) |

6,514,658 | 7.03 | - | - | 6,514,658 | 6.52 | 6,514,658 | 3.93 | ||||||||||||||||||||||||

| (1) | 9429-1143 Québec Inc. and Financière Outremont Inc. are both controlled by Pierre Karl Péladeau. As at July 14, 2025, they collectively beneficially owned, directly or indirectly, or exercised control or direction over Shares representing approximately 17.80% of the subordinate voting shares and 9.95% of the total voting rights of Alithya Group inc. |

Each of Paul Raymond, Ghyslain Rivard and Pierre Turcotte (collectively, the “Group of 3”) are party to the Voting Agreement pursuant to which each of them has agreed to vote, or cause to be voted, all of the Shares of the Company over which they have direct or indirect voting control from time to time and at all times (the “Controlled Shares”) at any shareholders meeting of the Company in a manner as will be decided upon by the decision of at least two of the three members of the Group of 3 (the “Majority Decision”). The Voting Agreement does not, however, apply to votes for the election of any of Messrs. Raymond, Rivard or Turcotte to the Board. It also does not apply in respect of a particular matter if, for that matter, (i) there is no Majority Decision notified to them by the deadline specified in the Voting Agreement, or (ii) a member of the Group of 3 holding Controlled Shares is not permitted by applicable law to vote on the matter.

As at July 14, 2025, the Group of 3 beneficially owned, directly or indirectly, or exercised control or direction over approximately 44.59% of the voting rights attached to the Shares of the Company. As at July 14, 2025, the directors and executive officers of the Company, as a group, beneficially owned , directly or indirectly, or exercised control or direction over 5,019,669 subordinate voting shares and 7,326,880 multiple voting shares, representing approximately 5.42% of the issued and outstanding subordinate voting shares and 100% of the issued and outstanding multiple voting shares respectively, and which shareholding interest carried approximately 47.18% of the total voting rights attached to the Shares of the Company.

ALITHYA | Management Information Circular 8

Business of the Meeting

Four items will be covered at the Meeting:

| • | presentation of the audited consolidated financial statements of the Company for the fiscal year ended March 31, 2025 (“fiscal 2025”) (the “Annual Financial Statements”) and the auditor’s report thereon; |

| • | election of the directors of the Company; |

| • | appointment of the auditor of the Company for the fiscal year ending March 31, 2026 and authorization to the Board of Directors to fix their compensation; and |

| • | consideration of such other business, if any, that may properly come before the meeting or any adjournment or postponement thereof. |

Financial Statements

The Annual Financial Statements and the auditor’s report thereon are available on our website at www.alithya.com, on SEDAR+ at www.sedarplus.ca, in the Company’s annual report on Form 40-F available on EDGAR at www.sec.gov, and in print, free of charge, to any shareholder who requests a copy to the Company by email at secretariat@alithya.com, or by mail at Corporate Secretariat, Alithya Group inc., 700, René-Lévesque West Blvd, Suite 400, Montréal, Québec, H3B 1X8, or by phone at 1-844-985-5552.

Election of Directors

The Board may consist of not less than three and not more than 15 directors. The Board has fixed at eight the number of directors to be elected at the Meeting. The persons named in the section entitled “Nominees for Election to the Board” of this Information Circular (“Nominee Directors”) are currently directors of the Company and were elected at the last meeting of shareholders. The Nominee Directors are, in the opinion of the Board and management, well qualified to act as directors of the Company for the ensuing year and have confirmed their willingness to serve as directors.

Unless otherwise indicated, the persons designated by management will vote FOR the election of the persons in the section entitled “Nominees for Election to the Board” of this Information Circular.

Appointment of the Auditor

The Board, on the recommendation of the Audit and Risk Management Committee (the “Audit Committee”), recommends that KPMG LLP (“KPMG”) be reappointed to serve as the Company’s auditor until the next annual meeting of shareholders. KPMG was first appointed as the Company’s auditor on September 15, 2021.

PRE-APPROVAL POLICY FOR EXTERNAL AUDITOR SERVICES

The Audit Committee has adopted procedures for the pre-approval of engagement for services of its external auditor,

which require pre-approval of all audit and non-audit services provided by the external auditor. The Audit Committee also recommends to the Board, and the Board approves, on an annual basis, the fees to be charged to the Company by the external auditor. For more details on the Company’s pre-approval policy and procedures, please refer to the section entitled “Audit and Risk Management Committee – Pre-approval Policy and Procedures” of the Company’s annual information form dated June 12, 2025, which is hereby incorporated by reference.

EXTERNAL AUDITOR SERVICE FEE

KPMG is the external auditor who prepared the report relating to the audit of the Company’s annual consolidated financial statements for fiscal 2025 and notes thereto, presented under the International Financial Reporting Standards.

For fiscal 2025 and 2024, the following fees were billed by KPMG:

| FISCAL 2025 | FISCAL 2024 | |||||||

| Audit fees(1) |

$ | 1,557,118 | $ 1,887,250 | |||||

| Audit-related fees(2) |

$ 133,750 | – | ||||||

| Tax fees(3) |

– | – | ||||||

| All other fees(4) |

– | $ 45,000 | ||||||

| Total |

$ | 1,690,868 | $ 1,932,250 | |||||

| (1) | “Audit fees” means the aggregate fees billed for professional services rendered by the auditor for the audit of the Company’s annual consolidated financial statements and internal control over financial reporting, the review of the Company’s interim condensed consolidated financial statements, and the audit of the Company’s internal controls over financial reporting. |

| (2) | “Audit-related fees” includes assurance and related services reasonably related to the audit of the Company’s annual consolidated financial statements and that are not included in audit services which are included in the “Audit fees” category. For fiscal 2025, audit-related fees consisted of fees billed in connection with financial due diligence assistance. |

| (3) | “Tax fees” means the aggregate fees billed for professional services rendered by the auditor for tax compliance and tax advice. |

| (4) | “All other fees” includes the aggregate of all other fees. For fiscal 2024, other fees consisted of fees billed in connection with information technology advisory services. |

Unless otherwise indicated, the persons designated by management will vote FOR the appointment of KPMG as the auditor of the Company and authorizing the Board to fix their compensation.

Other Business

Following the conclusion of the business to be conducted at the Meeting, shareholders will be invited to ask questions. Management is not aware of any changes to the foregoing items or of other matters to be submitted at the Meeting. If, however, there are changes or new items that properly come before the Meeting, your proxyholder will have the authority to vote your Shares on these items as he or she sees fit.

ALITHYA | Business of the Meeting 9

Nominees for Election to the Board

DESCRIPTION OF THE NOMINEE DIRECTORS

The following pages include a profile of each Nominee Director which provides an overview of his or her experience, qualifications, record of attendance at Board and committee meetings, ownership of Alithya securities, as well as their compliance with the minimum share ownership requirement applicable to directors. Each nominee is currently a director and, if elected, will hold office until the next annual meeting of shareholders. Information relating to Shares and deferred share units (“DSUs”) and, in the case of the executive director, options, performance share units (“PSUs”) and restricted share units (“RSUs”), beneficially owned by the nominees, or over which they exercise control or direction, is provided as at July 14, 2025.

Here are a few highlights regarding the eight Nominee Directors:

|

87.5%

INDEPENDENT DIRECTORS |

|

37.5%

WOMEN ON BOARD |

|

62

YEARS OLD AVERAGE AGE |

|

97%

AVERAGE BOARD ATTENDANCE(1) |

|

97%

AVERAGE 2024 VOTING RESULTS | ||||||||

| Dana Ades-Landy, Québec, Canada | ||

|

|

Dana Ades-Landy returned to the National Bank of Canada, a Canadian chartered bank, in August 2020 to work in the Special Loans Group which she had previously run over seven years. Prior to this, she was the Chief Executive Officer of the Heart & Stroke Foundation of Canada (Québec). Ms. Ades-Landy has more than 25 years of experience as an executive in the banking industry, including executive leadership positions at Scotiabank, Laurentian Bank and National Bank of Canada. Ms. Ades-Landy currently serves as director and member of the Audit Committee of Sagen MI Canada Inc., as member of the Advisory Board of Innovaderm Research Inc., a private clinical research company and as member of the Departmental Audit Committee of the National Research Council of Canada. She previously served as director and Chair of the Audit Committee of First Lion Holdings Inc., the parent company of BFL Canada Risk and Insurance Inc., as well as Chair of the Audit Committee of the Canada Mortgage and Housing Corporation. Ms. Ades-Landy holds a Bachelor’s degree in Microbiology and Immunology from McGill University and a Master of Business Administration in Finance and accounting from Concordia University and is a member of the Institute of Corporate Directors. | |

| Age: 66 | Director since: November 2016 |

|

Last year’s voting results: 99.75% |

| ||||||||||

|

BOARD/COMMITTEE MEMBERSHIP |

|

ATTENDANCE(1) |

| |||||||||||

|

Board |

|

6 of 6 |

|

|

100% |

| ||||||||

|

Audit and Risk Management Committee

|

|

4 of 4 |

|

|

100% |

| ||||||||

|

SECURITIES HELD OR CONTROLLED |

| |||||||||||||

|

Subordinate Voting Shares

|

|

|

12,725

|

| ||||||||||

|

DSUs(2)

|

|

150,285 | ||||||||||||

|

Value at Risk(3)

|

|

$376,553 | ||||||||||||

|

Minimum Share Ownership Requirement(4) |

|

|

Met (2.1x) |

| ||||||||||

|

Independent |

|

Yes |

| |||||||||||

André P. Brosseau(5), Québec, Canada

|

|

André P. Brosseau is Chair of the Board and President and Chief Executive Officer of Du Musée Investments Inc., a family office with private investments in Canada, the U.S. and Brazil. Mr. Brosseau is also Vice Chair and owner of Qintess, an IT company specializing in digital transformation and telecommunication infrastructure management. Previously, he served as Chair of Québec Capital Markets from 2009 to 2010 and President of Blackmont Capital Markets in Toronto from 2007 to 2009 and was an executive at CIBC World Markets Inc. from 1994 to 2007. Mr. Brosseau currently serves as Vice-Chair of Quebecor Inc. and Quebecor Media Inc., as well as Chair of the Executive Committee of Quebecor Media Inc. He is also a director of Videotron Ltd. Mr. Brosseau previously served as member of the Audit and Risk Management Committee and of the Human Resources and Corporate Governance Committee of Quebecor Inc. and Quebecor Media Inc., as well as member of the Audit and Risk Management Committee of Videotron Ltd. Mr. Brosseau holds a Bachelor’s degree in Politics and a Master’s degree in Political Science from Université de Montréal, and is a member of the Institute of Corporate Directors. |

| Age: 63 | Director since: September 2022 |

|

Last year’s voting results: 99.82% |

| ||||||||||

|

BOARD/COMMITTEE MEMBERSHIP |

|

ATTENDANCE(1) |

| |||||||||||

|

Board |

|

5 of 6 |

|

|

83% |

| ||||||||

|

SECURITIES HELD OR CONTROLLED |

| |||||||||||||

|

Subordinate Voting Shares

|

|

|

350,000

|

| ||||||||||

|

DSUs(2)

|

|

|

138,791

|

| ||||||||||

|

Value at Risk(3)

|

|

|

$1,129,107

|

| ||||||||||

|

Minimum Share Ownership Requirement(4) |

|

|

Met (7.5x)

|

| ||||||||||

| Independent |

Yes | |||||||||||||

ALITHYA | Nominees for Election to the Board 10

| Ines Gbegan(6), Québec, Canada |

Age: 37 | |

Director since: March 2024 |

|

|

Last year’s voting results: 99.78 |

| |||||||||||||||||

|

|

Ines Gbegan is the Vice President, Finance of Biron Health Group Inc., a company offering medical laboratory expertise in Québec, a position she accepted in October 2023 after having served as interim Vice President, Finance since May 2023 and senior director, Finance between November 2022 and May 2023. Ms. Gbegan has more than 15 years of chartered accountant experience in audits, corporate accounting, and financial reporting. She previously held senior accounting roles at Transdev Canada Inc., a company in the transportation and logistics sector, from 2021 to 2022, at Enerkem Inc., a company in the renewable energy sector, from 2018 to 2021, and at PwC, a global accounting firm, prior to 2018. She also previously taught accounting at HEC Montréal for more than five years. In 2022, Ms. Gbegan became an “Aces of Finance” recipient, a distinction awarded by Financial Executives International Canada in recognition of distinguished financial management officials. She holds a Bachelor’s degree in Accounting and Finance, a specialized graduate diploma in public accounting and a Master’s degree in Professional Accounting. Ms. Gbegan is a Chartered Professional Accountant (CPA) and is a member of the Institute of Corporate Directors. |

|

BOARD/COMMITTEE

|

|

|

ATTENDANCE(1) |

| |||||||||||||||||

| Board | 6 of 6 | 100% | ||||||||||||||||||||||

|

|

SECURITIES HELD OR CONTROLLED |

| ||||||||||||||||||||||

|

|

Subordinate Voting Shares

|

|

|

-

|

| |||||||||||||||||||

|

|

DSUs(2)

|

|

57,045 | |||||||||||||||||||||

|

|

Value at Risk(3)

|

|

|

$131,774

|

| |||||||||||||||||||

|

|

Minimum Share Ownership Requirement(4)

|

|

|

On track (0.9x)

|

| |||||||||||||||||||

| Independent |

Yes | |||||||||||||||||||||||

| Lucie Martel, Québec, Canada | Age: 63 | |

Director since: September 2019 |

|

|

Last year’s voting results: 87.21% |

| |||||||||||||||||

|

|

Lucie Martel is a corporate director. Before becoming a corporate director in 2022, she acted as Senior Vice President and Chief Human Resources Officer of Intact Financial Corporation between September 2011 and December 2021 and previously as Senior Vice President at AXA Canada, which was acquired by Intact Financial Corporation in September 2011. She has more than 30 years of experience in strategic management of human resources and labour relations, with corporations including Laurentian Bank (where she was Vice President, Human Resources Management and Development), Direct Film and Uniroyal. Ms. Martel currently serves as director and Chair of the Human Resources Committee of the Board of Directors of Fiera Capital Corporation. She also previously served as director and Chair of the Human Resources Committee of the Société des alcools du Québec and the Montreal Heart Institute Foundation. Ms. Martel holds a Bachelor’s degree in Industrial Relations from Université de Montréal and is a member of the Institute of Corporate Directors. |

|

BOARD/COMMITTEE

|

|

|

ATTENDANCE(1)

|

| |||||||||||||||||

|

|

Board

|

|

|

6 of 6

|

|

|

100%

|

| ||||||||||||||||

| |

Human Capital and Compensation Committee (Chair) |

|

|

4 of 5 |

|

|

80% |

| ||||||||||||||||

|

|

Corporate Governance and

|

|

|

|

|

|

5 of 5 |

|

|

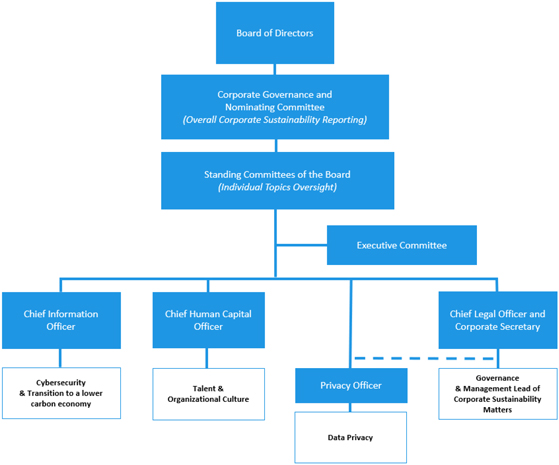

100% |