2025 Base Case

Island Gold District

NI 43-101 Technical Report

Dubreuilville, Ontario, Canada

Prepared for

181 Bay Street, Suite 3910

Toronto, ON M5J 2T3, Canada

Prepared by

Christopher Bostwick - FAusIMM

Nathan Bourgeault - P.Eng.

Tyler Poulin - P.Geo.

Jeffrey Volk - M.Sc. CPG, FAusIMM

David Bucar - P.Eng.

Effective Date: June 23, 2025

Issue Date: August 6, 2025

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 1

|

Cautionary Note Regarding Forward-Looking Statements and Information

This report contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities laws. All statements and information, other than information and statements of historical fact, which address events, results, outcomes or developments that Alamos Gold Inc. (“Alamos” or the “Company”) expects to occur are, or may be deemed to be, forward-looking and are generally, but not always, identified by the use of forward-looking terminology such as “expect”, “assume”, “believe”, “anticipate”, “intend”, “potential”, “proposed”, “plan”, “objective”, “predict”, “estimate”, “scheduled”, “continue”, “ongoing”, “likely”, “future”, “forecast”, “budget”, “target” or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved or the negative connotation of such terms. Forward-looking statements and information contained in this report are based on information available to Alamos at the time of preparation of this report; expectations, estimates and projections as of the date of this report; assumptions, conditions and qualifications as set forth in the report; and data, reports and other information supplied to Alamos by third party sources.

Forward-looking statements and information in this report may include, without limitation, guidance and information as to strategy, plans, expectations or future financial or operating performance, pertaining to, or anticipated to result from, the Island Gold District, such as expectations, assumptions, estimations and guidance regarding: integration of the Island Gold and Magino operations; Mineral Resource and Mineral Reserve estimates; mine and reserve life; mine plans; the Island Gold Phase 3+ project and anticipated timing of progress and completion as well as results therefrom; Island Gold District project infrastructure; project-related risks; project economics; estimates of capital and operating expenditures; the financial model for the integrated Island Gold District; construction of the 115kV powerline; timing of installation and coming online of a 44kV grid power line; Island Gold and Magino sites power integration; water management plan; mined and processed gold grades and weights; market demand for gold and silver; gold and other metal prices; foreign exchange rates; gold metallurgical recovery rates; mining methodologies and results; equipment requirements; recovery methods; use of the Magino mill; mining, processing and milling rates; production rates; mine production schedules; life of mine production physicals; planned exploration activities; environmental studies, permitting and social and community impact; the Company’s approach to sustainability; mine closure; reclamation; and other statements that express management’s expectations or estimates of future performance, operational, geological or financial results.

Alamos cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect Alamos’ ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: assumptions and parameters underlying the life of mine not being realized; a decrease in the future gold price; discrepancies between actual and estimated production; discrepancies related to the impact of various capital projects and the anticipated benefits therein; required capital investments; estimates of net present value and internal rate of returns; changes to tax rates; the accuracy of or changes to current estimates of Mineral Reserve and Mineral Resources changes to capital and operating cost estimates and the assumptions on which such estimates are based; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates which may be impacted by unscheduled maintenance, weather issues, labour and contractor availability and other operating or technical difficulties); operations may be exposed to illnesses, diseases, epidemics and pandemics; the impact of any illness, disease, epidemic or pandemic on the broader market and the trading price of the Company's shares; provincial and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for the Company’s operations) in Canada, Mexico, the United States and

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 2

|

Türkiye; the duration of any regulatory responses to any illness, disease, epidemic or pandemic; government and the Company’s attempts to reduce the spread of any illness, disease, epidemic or pandemic which may affect many aspects of the Company's operations including the ability to transport personnel to and from site, contractor and supply availability and the ability to sell or deliver gold doré bars; fluctuations in the price of gold or certain other commodities such as, diesel fuel, natural gas, and electricity; changes in foreign exchange rates (particularly CAD, MXN, USD and Turkish lira); the impact of inflation and any tariffs, trade barriers and/or regulatory costs; changes in the Company's credit rating; any decision to declare a quarterly dividend; employee and community relations; litigation and administrative proceedings; disruptions affecting operations; availability of and increased costs associated with mining inputs and labour; delays with the Phase 3+ Expansion project at the Island Gold mine, construction of the Lynn Lake Project, construction of the PDA project, and/or the development or updating of mine plans; risks associated with the start-up of new mines; the risk that the Company’s mines may not perform as planned; uncertainty with the Company’s ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining necessary licenses and permits, including the necessary licenses, permits, authorizations and/or approvals from the appropriate regulatory authorities for the Company’s development stage and operating assets; labour and contractor availability (and being able to secure the same on favourable terms); contests over title to properties; expropriation or nationalization of property; political and economic developments; inherent risks and hazards associated with mining and mineral processing including environmental hazards, industrial hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; changes in national and local government legislation, controls or regulations in Canada, Mexico, Türkiye, the United States and other jurisdictions in which the Company does or may carry on business in the future; increased costs and risks related to the potential impact of climate change; failure to comply with environmental and health and safety laws and regulations; disruptions in the maintenance or provision of required infrastructure and information technology systems; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; and business opportunities that may be pursued by the Company.

Additional risk factors and details with respect to risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this Technical Report are set out in the Company's latest 40-F/Annual Information Form and Management’s Discussion and Analysis under the heading “Risk Factors”, which is available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this Technical Report.

The Company and the Qualified Persons who authored the Technical Report disclaim any intention and undertake no obligation to update publicly or otherwise revise any forward-looking statements or information contained herein whether as a result of new information or future events or otherwise, except as may be required by law.

Cautionary Note to U.S. Investors

Alamos prepares its disclosure in accordance with the requirements of securities laws in effect in Canada. Unless otherwise indicated, all Mineral Resource and Mineral Reserve estimates included in this document have been prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 3

|

reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under Regulation S-K 1300 and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Alamos may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Alamos prepared the mineral reserve or mineral resource estimates under the standards adopted under Regulation S-K 1300. U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under Regulation S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Alamos reports are or will be economically or legally mineable.

Cautionary non-GAAP Measures and Additional GAAP Measures

Note that for purposes of this section, GAAP refers to IFRS. The Company believes that investors use certain non-GAAP and additional GAAP measures as indicators to assess gold mining companies. They are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared with GAAP. “Cash flow from operating activities before changes in non-cash working capital” is a non-GAAP performance measure that could provide an indication of the Company’s ability to generate cash flows from operations and is calculated by adding back the change in non-cash working capital to “cash provided by (used in) operating activities” as presented on the Company’s consolidated statements of cash flows. “Cash flow per share” is calculated by dividing “cash flow from operations before changes in working capital” by the weighted average number of shares outstanding for the period. “Free cash flow” is a non-GAAP performance measure that is calculated as cash flows from operations net of cash flows invested in mineral property, plant and equipment and exploration and evaluation assets as presented on the Company’s consolidated statements of cash flows and that would provide an indication of the Company’s ability to generate cash flows from its mineral projects. “Mine site free cash flow” is a non-GAAP measure which includes cash flow from operating activities at, less capital expenditures at each mine site. “Return on equity” is defined as earnings from continuing operations divided by the average total equity for the current and previous year. “Mining cost per tonne of ore” and “cost per tonne of ore” are non-GAAP performance measures that could provide an indication of the mining and processing efficiency and effectiveness of the mine. These measures are calculated by dividing the relevant mining and processing costs and total costs by the tonnes of ore processed in the period. “Cost per tonne of ore” is usually affected by operating efficiencies and waste-to-ore ratios in the period. “Total capital expenditures per ounce produced” is a non-GAAP term used to assess the level of capital intensity of a project and is calculated by taking the total growth and sustaining capital of a project divided by ounces produced life of mine. “Growth capital” are expenditures primarily incurred at development projects and costs related to major projects at existing operations, where the projects will materially benefit the mine site. “Sustaining capital” are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects. “Total cash costs per ounce”, “all-in sustaining costs per ounce”, “mine-site all-in sustaining costs”, and “all-in costs per ounce” as used in this analysis are non-GAAP terms typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price realized during the period. These non-GAAP terms are also used to assess the ability of a mining company to generate cash flow from operations. There may be some variation in the method of computation of these metrics as determined by the Company compared with other mining

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 4

|

companies. In this context, “total cash costs” reflects mining and processing costs allocated from in-process and doré inventory and associated royalties with ounces of gold sold in the period. Total cash costs per ounce are exclusive of exploration costs. “All-in sustaining costs per ounce” include total cash costs, exploration, corporate and administrative, share based compensation and sustaining capital costs. “Mine-site all-in sustaining costs” include total cash costs, exploration, and sustaining capital costs for the mine-site, but exclude an allocation of corporate and administrative and share based compensation. “Capitalized exploration” are expenditures that meet the IFRS definition for capitalization and are incurred to further expand the known Mineral Reserve and Resource at existing operations or development projects. “Adjusted net earnings” and “adjusted earnings per share” are non-GAAP financial measures with no standard meaning under IFRS. “Adjusted net earnings” excludes the following from net earnings: foreign exchange gain (loss), items included in other loss, certain non-reoccurring items and foreign exchange gain (loss) recorded in deferred tax expense. “Adjusted earnings per share” is calculated by dividing “adjusted net earnings” by the weighted average number of shares outstanding for the period.

Additional GAAP measures that are presented on the face of the Company’s consolidated statements of comprehensive income and are not meant to be a substitute for other subtotals or totals presented in accordance with IFRS, but rather should be evaluated in conjunction with such IFRS measures. This includes “Earnings from operations”, which is intended to provide an indication of the Company’s operating performance and represents the amount of earnings before net finance income/expense, foreign exchange gain/loss, other income/loss, and income tax expense. Non-GAAP and additional GAAP measures do not have a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other companies. A reconciliation of historical non-GAAP and additional GAAP measures are detailed in the Company’s Management’s Discussion and Analysis available at www.alamosgold.com.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 5

|

TABLE OF CONTENTS

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 6

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 7

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 8

|

LIST OF TABLES

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 9

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 10

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 11

|

LIST OF FIGURES

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 12

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 13

|

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 14

|

1 SUMMARY

1.1 Introduction

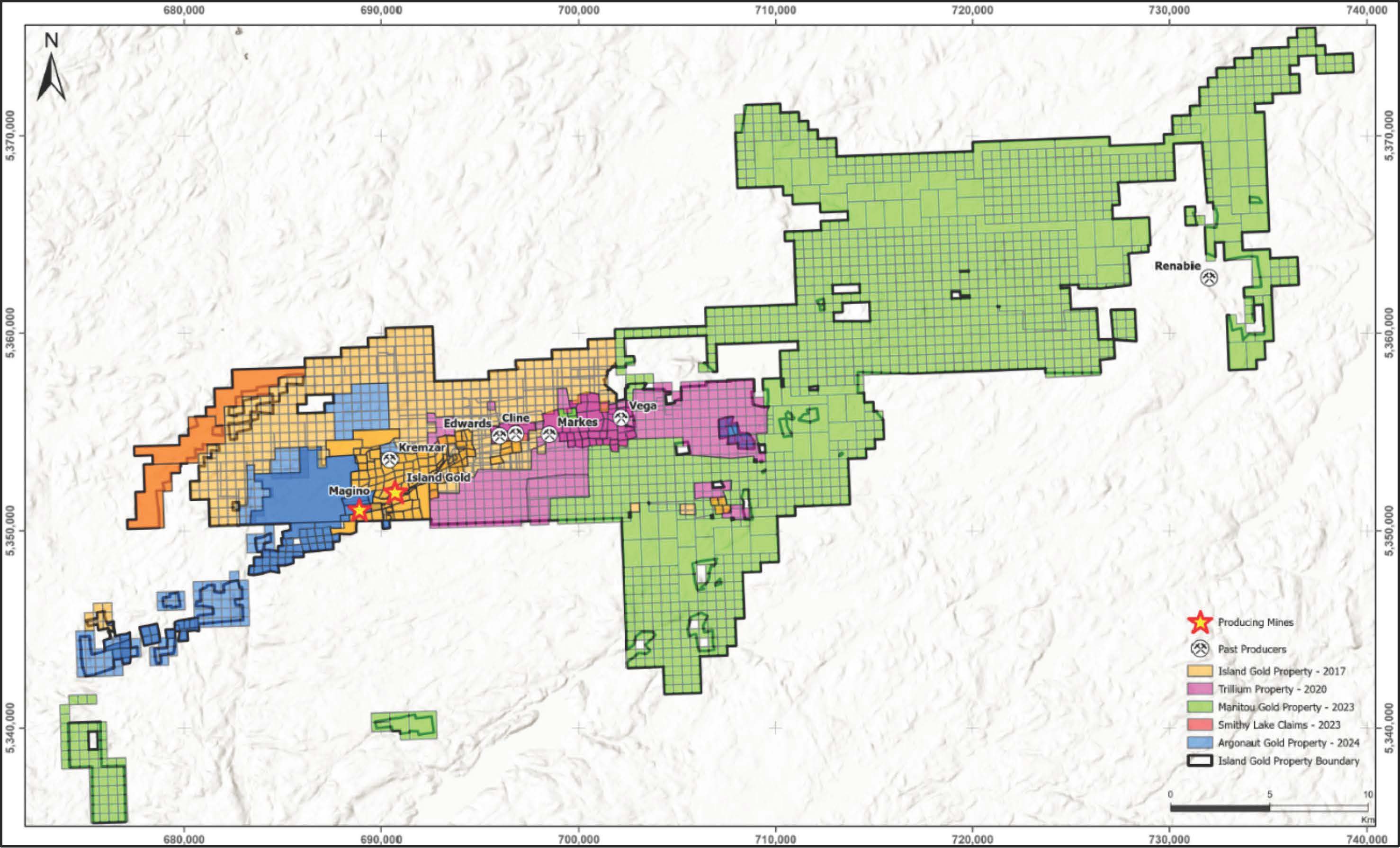

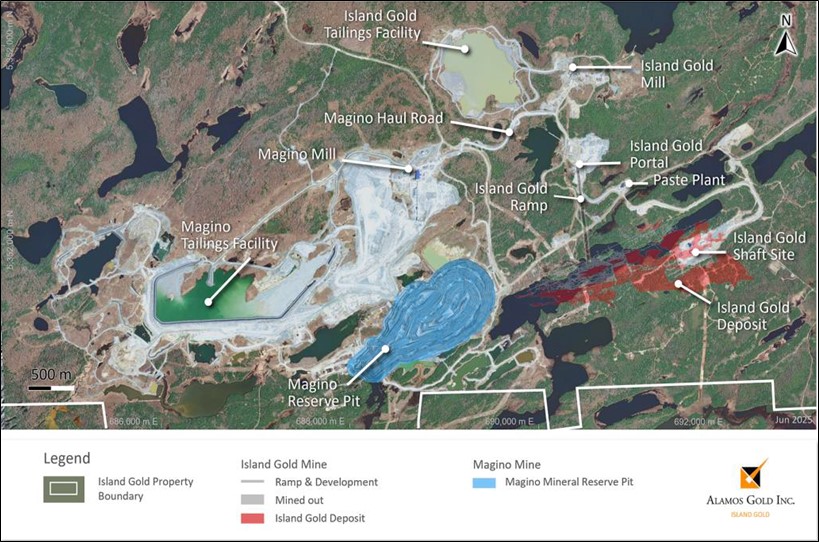

On 12 July 2024, Alamos Gold Inc. (Alamos or Alamos Gold or the Company) completed the acquisition of Argonaut Gold Inc. (Argonaut) and its Magino Mine (Magino) located next to Alamos’ Island Gold Mine (Island Gold), located in Northern Ontario, Canada. Having since successfully integrated the Island Gold and Magino operations into a combined operating entity, the Island Gold District (District), Alamos, in a press release dated June 23rd, 2025, announced the results of its Base Case Life of Mine Plan completed on the District. This report outlines the Base Case Life of Mine Plan and conforms to National Instrument 43-101 Standards of Disclosure of Mineral Projects (NI 43-101).

This Report will provide an update on several aspects of the District, including:

•Status of the integration of the Island Gold and Magino operations;

•The planned Magino mill expansion to 11,200 tpd and further on to 12,400 tpd;

•An updated Mineral Resource estimate;

•Updated mine plans, based on Proven and Probable Mineral Reserves, and resultant Mineral Reserve estimate;

•Status of Island Gold Phase 3+ Expansion development work consisting of shaft complex, shaft, paste plant, and underground expansion from 1,200 tpd to 2,400 tpd, completed to date;

•Updated estimates of capital and operating expenditures; and

•Updated financial model for the integrated District, based on Proven and Probable Mineral Reserves.

Island Gold utilized the services of internal resources and several qualified independent consulting firms to design, engineer and cost various elements of the Report. External resources included: Halyard Inc., Hatch Ltd., Redpath Mining Inc., WSP Global Inc., SLR Consulting Ltd., and Paterson and Cooke.

All costs are in Q1-2025 Canadian dollars (C$) unless otherwise stated.

All units of measurement are in metric, unless otherwise stated.

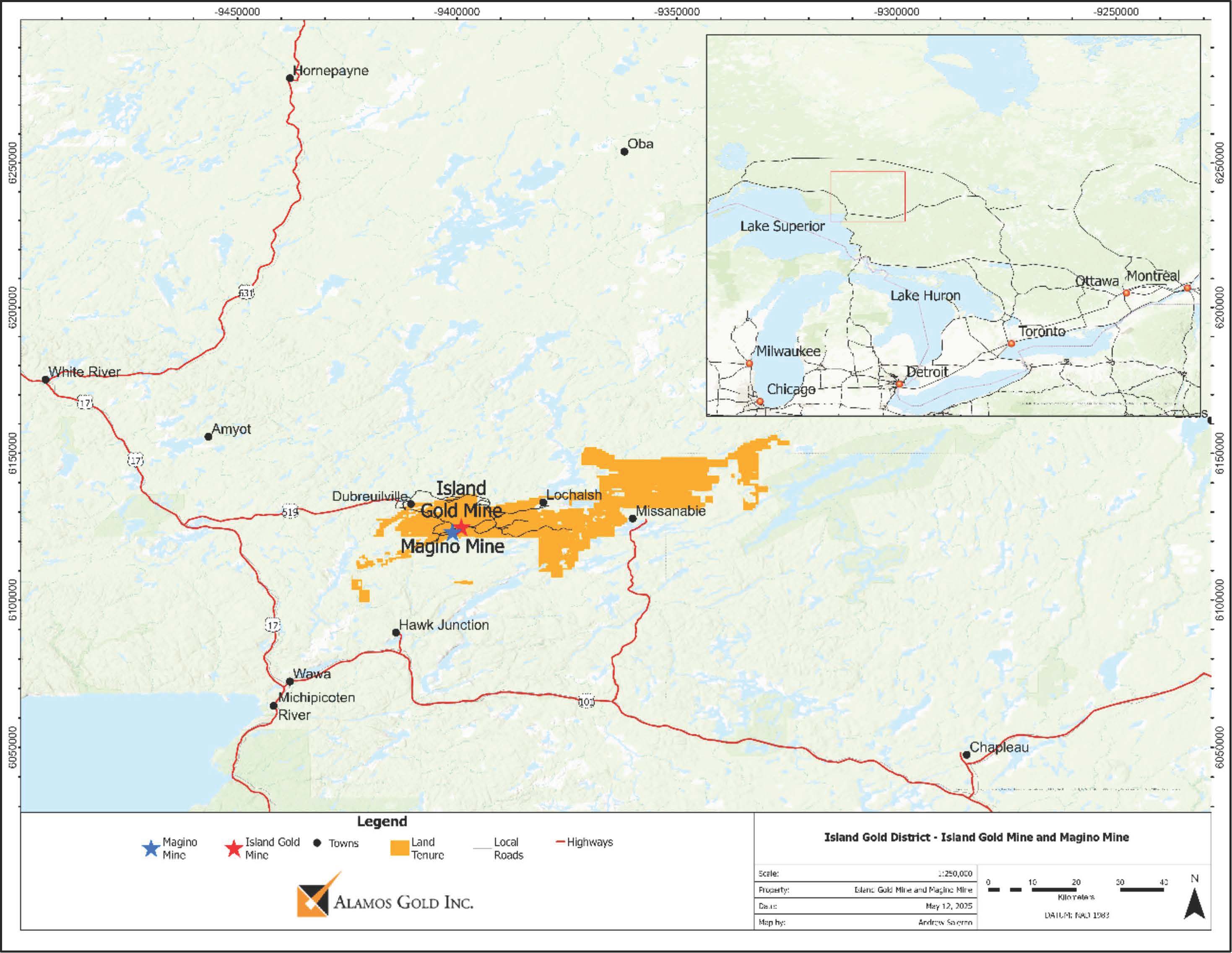

1.2 Property Description

The District, collectively comprised of the Island Gold Property and Magino Property is situated approximately 43 km northeast of Wawa, ON within the Ontario Ministry of Energy and Mines (MEM) Sault Ste. Marie Mining Division. The town of Dubreuilville, originally a forestry center, is located approximately 10 km to the northwest of the District. Access to the area is provided by the Trans-Canada Highway 17 which continues north from Wawa for 35 km, then following Highway 519 for 31 km to Dubreuilville. The Goudreau Road, an all-weather, year-round road, extends southeast from Dubreuilville for 12 km to the District.

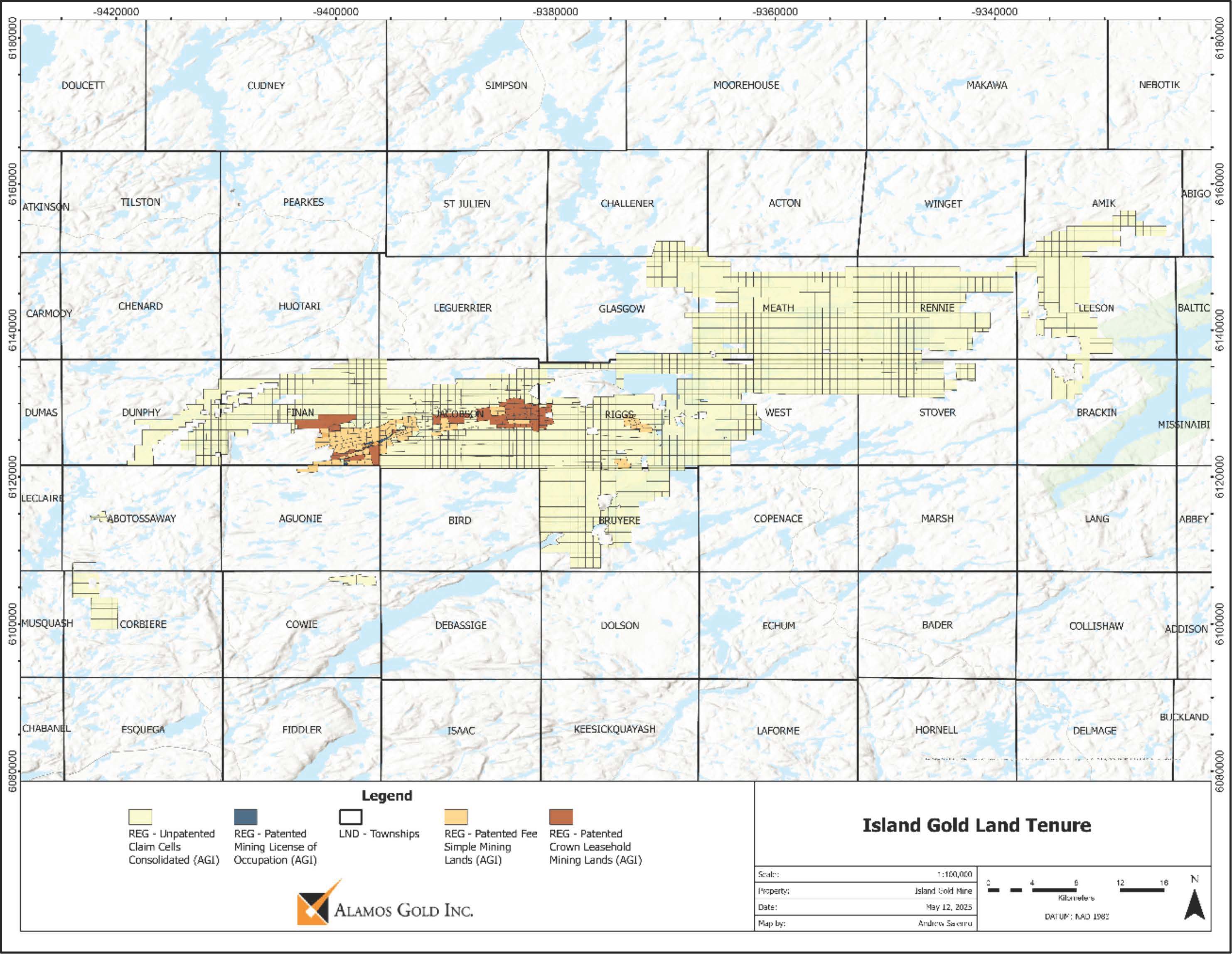

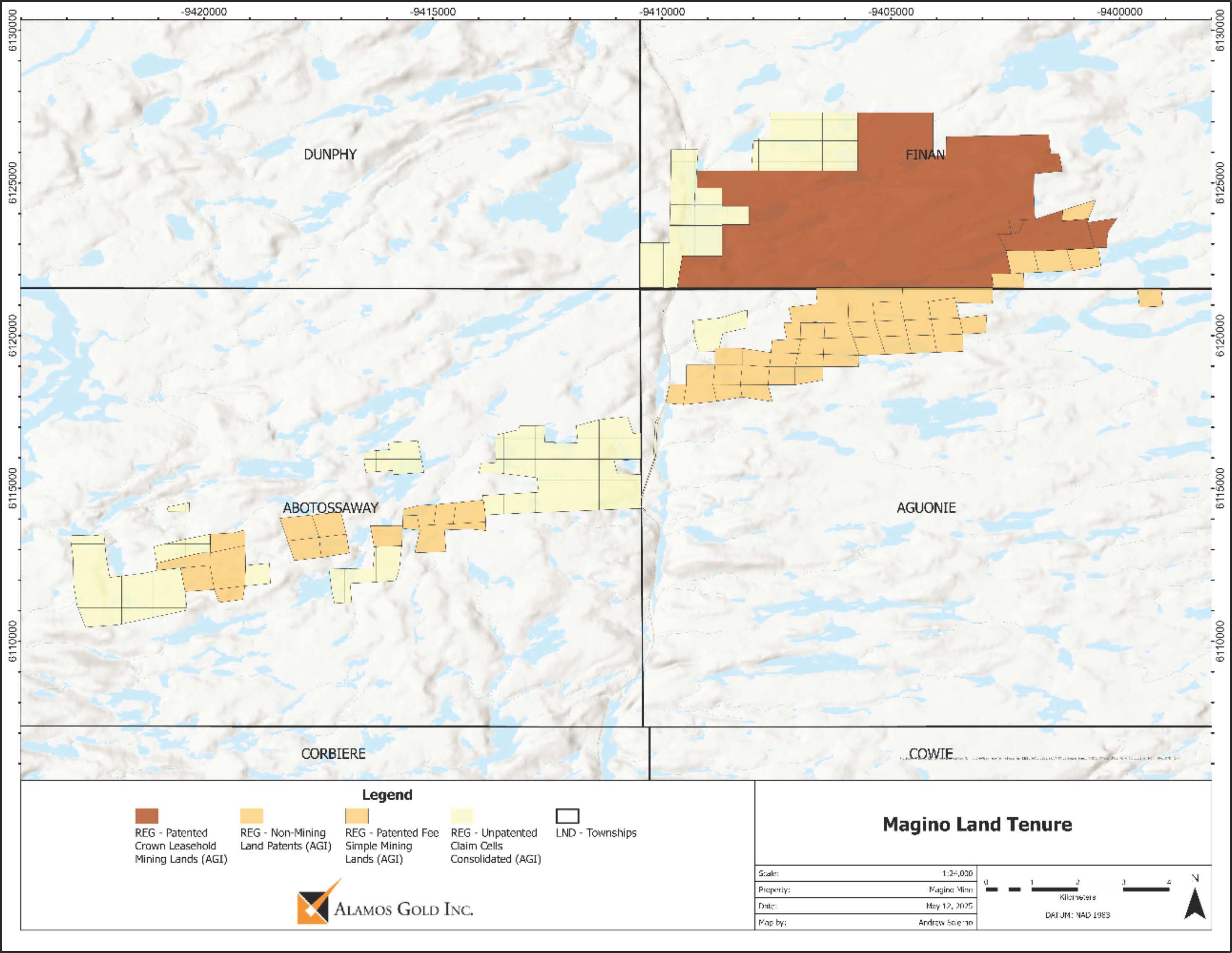

The District consists of patented fee simple and/or patented Crown leasehold mining rights and surface rights claims, mining licences of occupation, and unpatented cell claims, covering approximately 58,921 hectares (ha). Alamos controls, owns or holds 100% of the mineral rights to all the Mineral Resources and Mineral Reserves related claims at the District property.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 15

|

Collectively, the District is subject to different obligations and royalties. Based on the currently defined Mineral Resources and Mineral Reserves, the only royalties applicable are:

Island Gold Property

•The Lochalsh property area is subject to a 3% net smelter returns (NSR) royalty payable to Osisko Gold Royalties Ltd. (Osisko). The Island Main and Lochalsh zones, as well as a part of the Island Gold Mineral Resources below the 400 m Level, are located within this property area;

•The Goudreau Lake property area is subject to a 2% NSR royalty payable to Osisko as to a 69% interest and to Franco-Nevada Corporation as to a 31% interest; and

•The Goudreau property area is subject to a 2% NSR royalty payable to Osisko.

Magino Property

•A 3% NSR royalty in favour of Franco-Nevada Canada Holdings Corp.;

•A 0.84% NSR royalty in favour of certain Indigenous partners, as defined and identified under specific agreements entered with these partners;

•Two further royalties, a 2% NSR and a 3% NSR, both in favour of Osisko, that apply only to approximately 1% of the Magino Mineral Reserves; and

•A 10% Net Profits Interest royalty in favour of a third-party, which, based on current plans, is not expected to be payable.

The QP is not aware of any environmental liabilities on the Property not discussed in this Report and Alamos has obtained all required permits and / or has reasonable expectations to obtain all required permits to conduct the proposed work to achieve the work program outlined in this Report. The QP is not aware of any other significant factors and risks that may affect access, title, or the right or ability to perform the proposed work program on the Property.

1.3 Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access to the area is provided by the Trans Canada Highway 17, which continues north from Wawa for 35 km, and then following Highway 519 for 31 km to Dubreuilville which is 12 km to the northwest of the mine site via the all-weather Goudreau Road.

The District is contained within the Lake Superior Regional climatic zone and is described as "modified continental”. The mean annual temperature is about 10 ˚C, with extremes of –51 ˚C and 38 ˚C being recorded. Precipitation is in the range of 980 mm per year, with about 600 mm as rainfall and evaporation at 517 mm/year principally during the summer months.

Wawa has a population of 2,705 inhabitants and, Dubreuilville, originally a forestry community, has a population of 576 permanent residents and contains accommodations for mine personnel. The District is also within a few kilometres of a railway line operated by Canadian National. A hydro-electric power substation, water supply, gravel roads, and living accommodations are all available within the general mine area. Island Gold power is connected to the provincial power grid, meanwhile Magino energy supply is provided through a series of compressed natural gas-powered generators. A 115 kV powerline is currently being constructed between Hawk Junction and the mine site.

Island Gold infrastructure includes a primary tailings pond, a secondary settling pond, the Kremzar mill, the Lochalsh ramp and portal, a mine access road, power lines, and an electrical substation. Offices, core logging and storage facilities, a fire hall and separate mine drys for

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 16

|

men and women are also located at the mill site. The mill currently has a capacity of 1,200 tpd and the fully permitted tailings area is located at Miller Lake, west of the historic Kremzar Mine.

In addition, the Magino infrastructure includes a tailing management facility, various water control ponds, the 10,000 tpd Magino mill, offices, an assay laboratory (currently under construction), truck shop and wash (currently under construction) and a compressed natural gas-powered generating station.

The District lies in the Superior Province of the Canadian Shield, overlapped by the Boreal Shield ecological zone. Topography within the mine area varies from a high of approximately 490 masl in the vicinity of Miller and Maskinonge Lakes to a low of approximately 380 masl at Goudreau Creek. Periods of intense glacial activity have contributed to the hummocky, rock knelled and largely bedrock-controlled topography, characteristic of the region. Glacial advance from the north deposited a thin mantle of stony sand till over a scoured rock surface.

1.4 History

The Goudreau – Lochalsh Gold Camp area has been the subject of interest dating back to the early 1900’s and has attracted prospectors and mining companies in search of iron ore, gold, and base metal deposits. The Wawa – Michipicoten area has been recognized for its long history of iron exploration which has resulted in the development and production of several iron ore mining operations.

Gold exploration followed shortly thereafter, resulting in several gold discoveries which were subsequently developed and brought into commercial production in the area which would later become the District.

The initial discovery of gold was made by a group of prospectors at Emily Bay on Dog Lake in Riggs Township in 1900. Up to 1944, prospecting, geological mapping, trenching, shaft sinking, and 1,732 m of diamond drilling were completed to explore various gold prospects. Ultimately this period is marked principally by various exploration efforts by several companies carrying out surface trenching and diamond drilling on several gold prospects.

Island Gold Mine

After an extended period of relatively little interest and activity in the area presently known as the Island Gold Mine, exploration was resumed by Amax Inc. and its Canadian division, Canamax Resources Inc. (Canamax) in 1974. In 1985, drilling approximately 2 km south of the Kremzar Mine intersected a series of sub-parallel lenses containing gold mineralization within deformed rocks of the Goudreau Lake Deformation Zone. In December 1988, Canamax’s Kremzar Mine began commercial production. From 1988 to 1990, production from the Kremzar Mine was 306,603 t grading 4.77 g/t gold. Over 1989 and 1990, underground access was established into the Island Gold deposit with an adit and ramp developed from the north shore of Goudreau Lake. A 4,167 t bulk sample was extracted and processed at the Kremzar Mill. At the end of 1990, Canamax suspended all operations at both the Kremzar and Island Gold projects.

In 1996 the Island Gold property was acquired from Canada Tungsten Inc. by Patricia Mining Corp. (Patricia). From 1996 to 2002, various exploration activities on the property included prospecting, surface trenching, geological and geophysical surveys, and diamond drilling was carried out to explore for both Island Gold and Kremzar styles of gold bearing prospects and zones. In 2003, Patricia and Richmont Mines Inc. (Richmont), entered into a joint venture agreement. Work completed during the joint venture included 72,984 m of surface and

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 17

|

underground diamond drilling to test the various zones. On January 1, 2005, Richmont became the operator of the project.

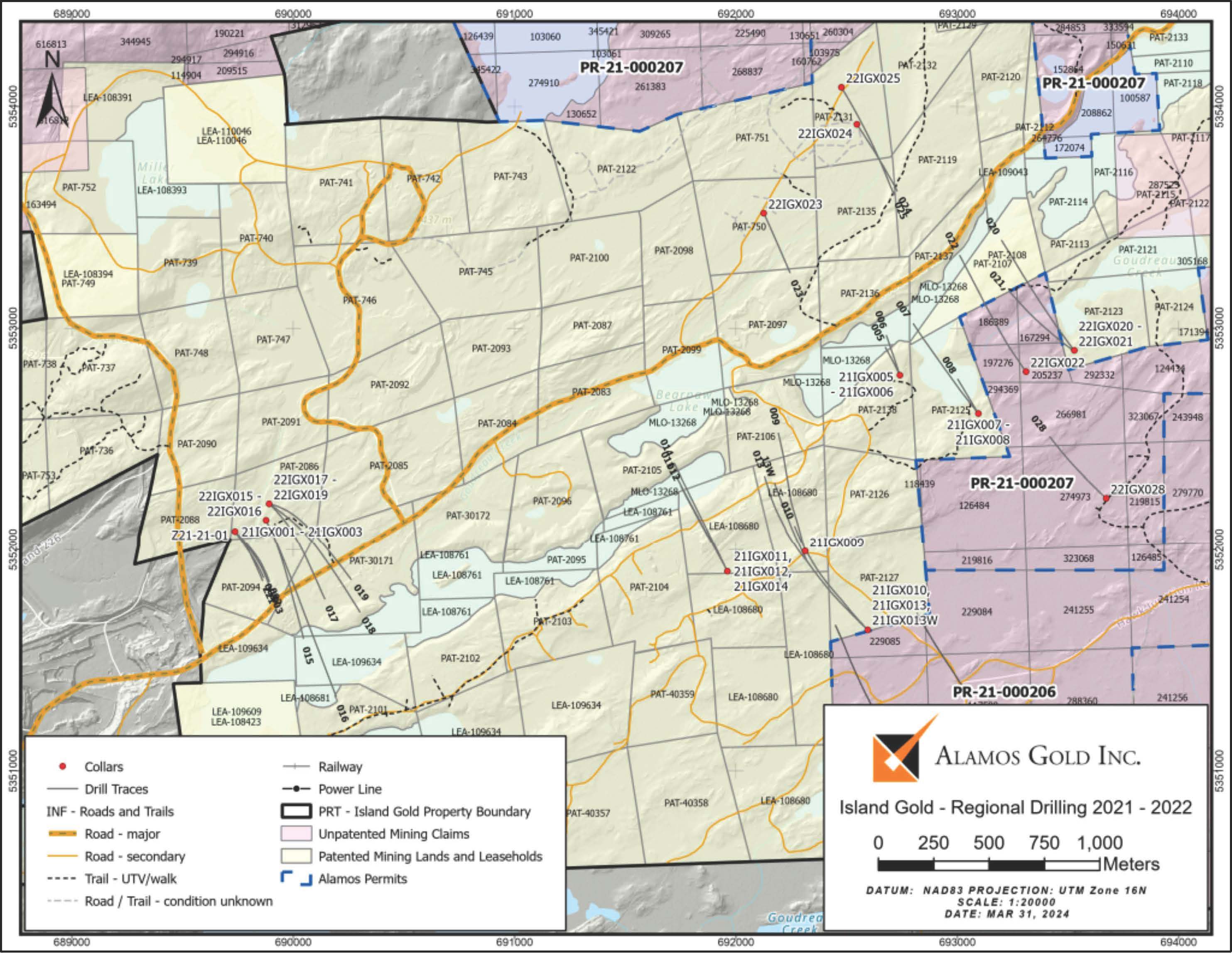

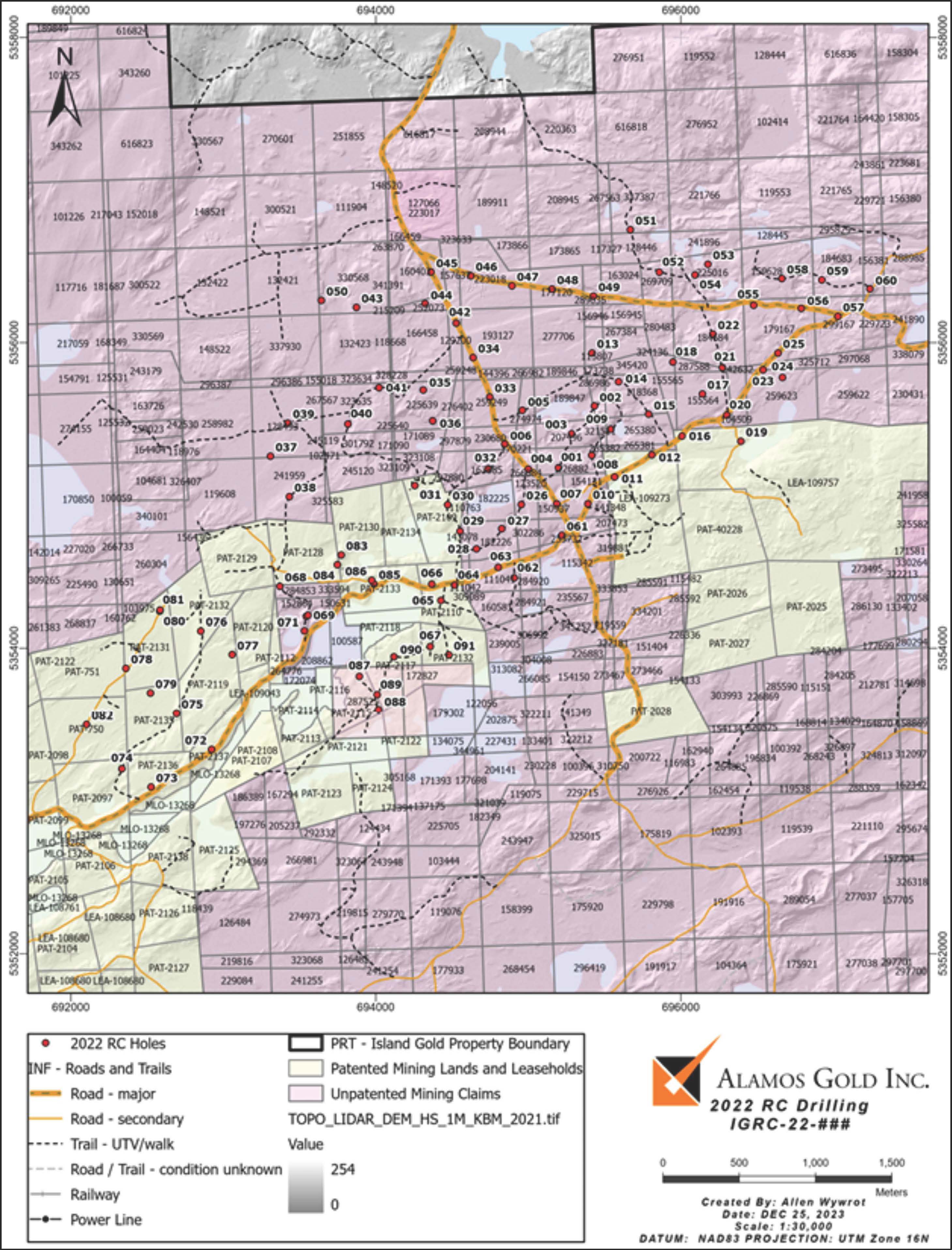

Commercial production at Island Gold began on October 1, 2007. Richmont acquired Patricia’s 45% interest in December 2008, becoming 100% owner of the property and operations. Exploration activities ramped up in 2009 with a minimum of 30,000 m of drilling completed in each of the next several years, increasing sharply to more than 80,000 m in 2012. This included drilling below the 400 m Level as part of the Island Gold deep exploration program, which was successful in extending the main C Zone at depth with an initial Inferred Mineral Resource being calculated on the high-grade deep C Zone in January 2013.

A large exploration program commenced at the end of 2015 to explore beneath Island Gold. Directional diamond drilling was used to reach targets at depth, allowing greater accuracy than conventional drilling techniques. As a result of this program, Mineral Resources were added in the C Zone at depth and to the East in the E1E Zone in the Extension 2 area. A total of 1,122,714 m of drilling was completed at the Island Gold Mine between 2015 and 2024.

Magino Mine

Various companies owned, operated, and explored the Magino Property between 1917 and present day, with a 30-year gap of inactivity from 1942 to 1972.

On September 25th, 1981, McNellen Resources Incorporated (McNellen), formerly Rico Copper Incorporated entered a joint venture with Cavendish Investing Limited (Cavendish); under the terms of the agreement, Cavendish could earn an undivided 50% interest in the property and project management control by expending C$900,000 on the property, which they did.

On November 1st, 1985, Muschocho Explorations Limited (Muscocho) acquired Cavendish’s interest in the property. At the time, Cavendish and McNellen each owned a 50% interest in the property.

Underground development began in 1986 under project ownership of McNellen and Muscocho, with production beginning in 1988. Mining continued from 1988 to 1992, during which 768,678 t were processed at a recovered grade of 0.137 oz/t gold (4.3 g/t), producing 105,543 oz of gold.

In 1996, three companies – Muscocho, McNellen, and Flanagan McAdam Resources Incorporated – combined to form Golden Goose Resources Inc. (Golden Goose), which emerged with a 100% interest in the property.

On August 31st, 2010, Kodiak Exploration Limited and Golden Goose announced a definitive merger agreement, whereby Kodiak Exploration Limited would acquire all the issued and outstanding shares of Golden Goose. The arrangement effectively combined the assets of both companies on a consolidated basis, with Golden Goose becoming a wholly owned subsidiary of Kodiak Exploration Limited. On January 4th, 2011, the merged assets were renamed Prodigy Gold Inc (Prodigy).

On December 11th, 2012, an agreement was completed that made Prodigy a wholly owned subsidiary of Argonaut. Argonaut accelerated the exploration program during 2011 and 2012 with the drilling of 725 holes for 186,665 m. This allowed Argonaut to continue to advance the project with Preliminary Feasibility Studies issued in 2014 and 2017 and a Feasibility Study completed during December 2017. Additional studies were conducted during 2018, 2019, and 2020, and Argonaut decided to develop the Magino Project in November 2020 and construction activity commenced in the first quarter of 2021. Commercial production of the Project was achieved in November 2023.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 18

|

Exploration after 2012, through 2019, continued at a relatively slower pace but accelerated from 2020 to present day with continued delineation drilling of the deposit.

In March 2024 Alamos announced the friendly acquisition of Argonaut whose combination would form the District. The acquisition closed in July 2024.

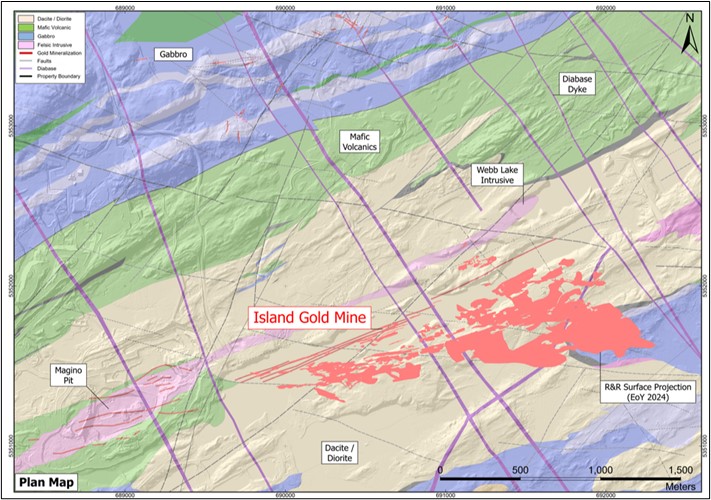

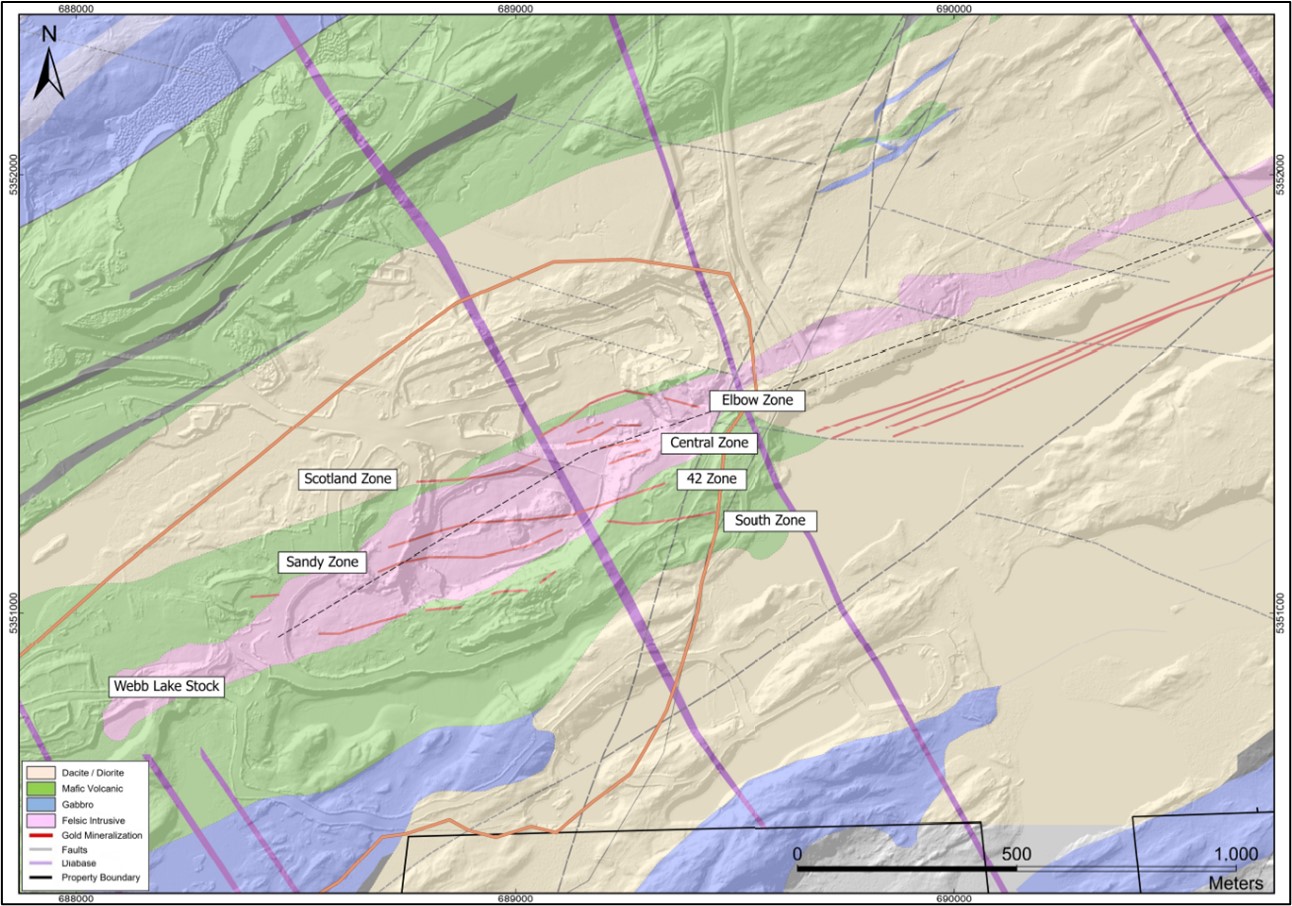

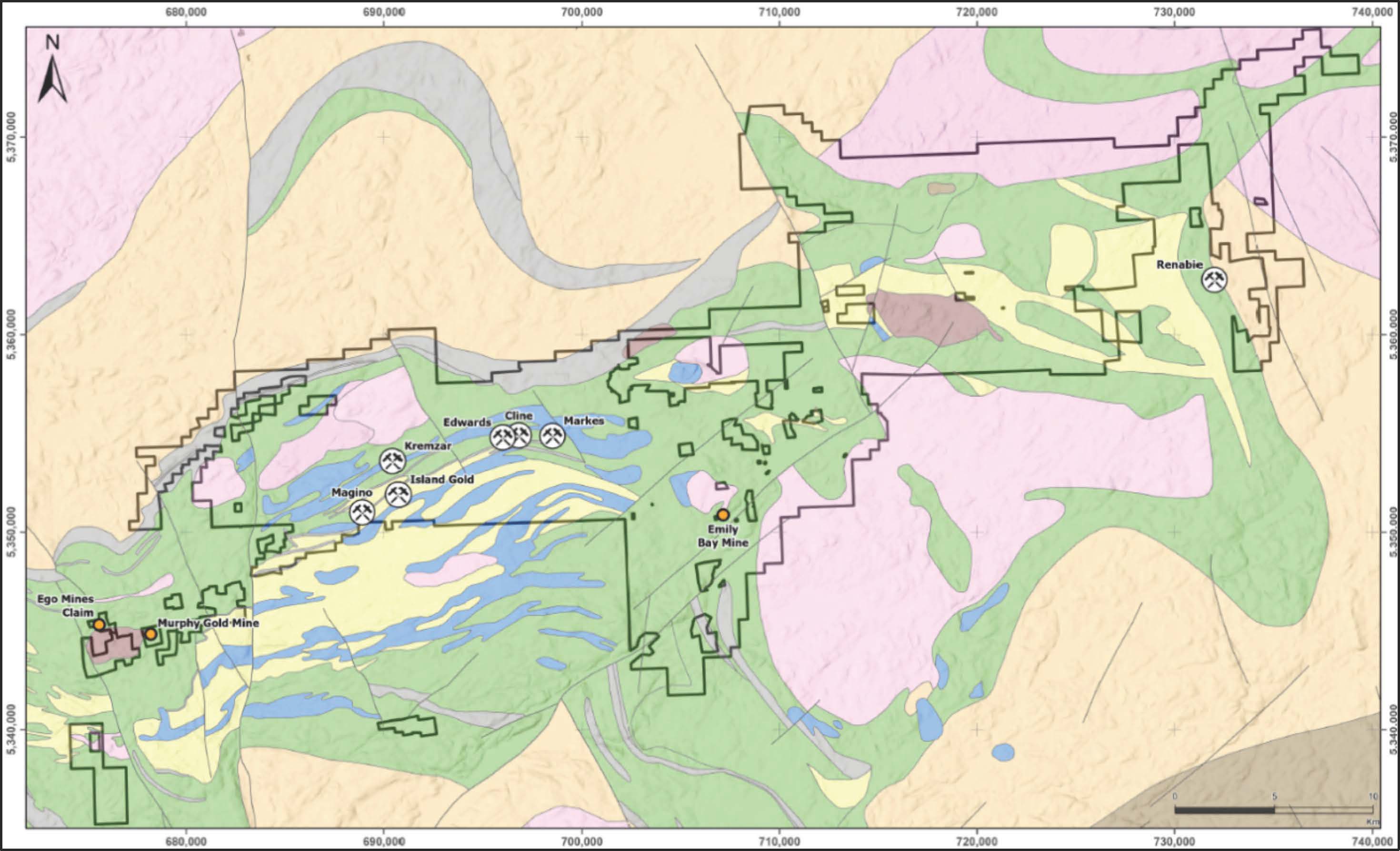

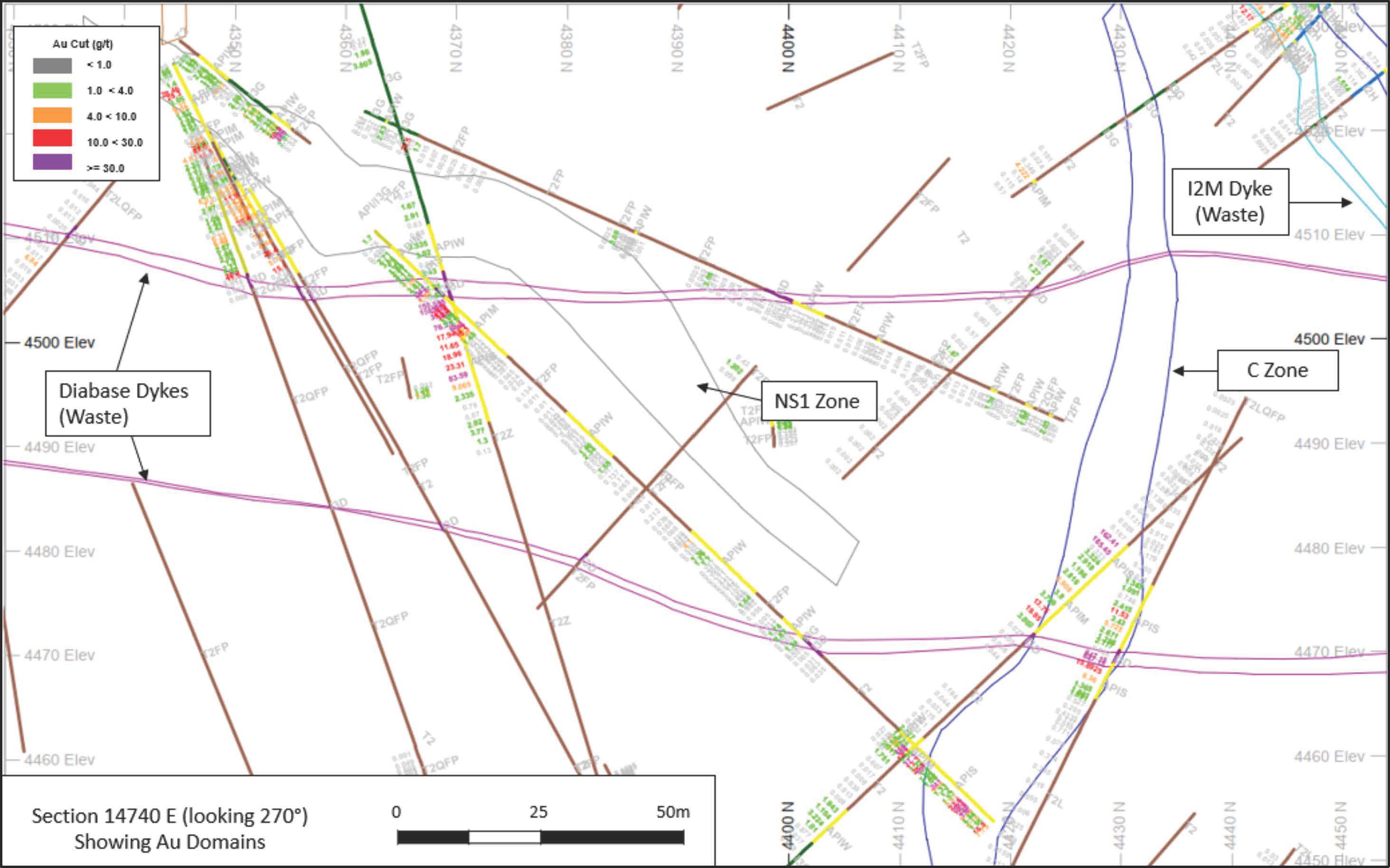

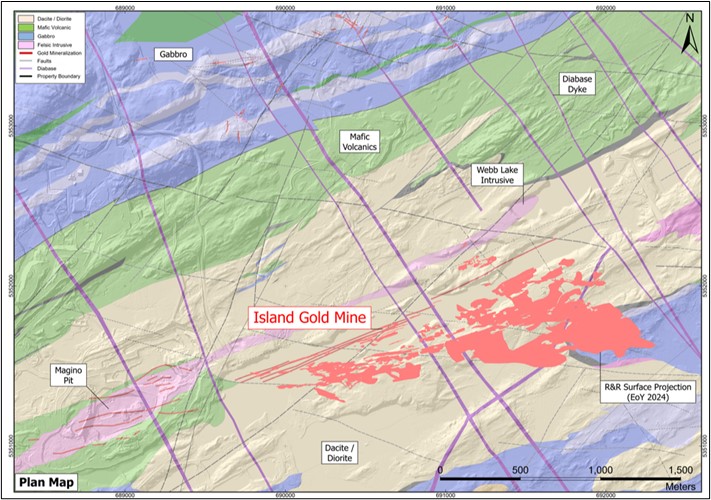

1.5 Geological Setting, Mineralization and Deposit Types

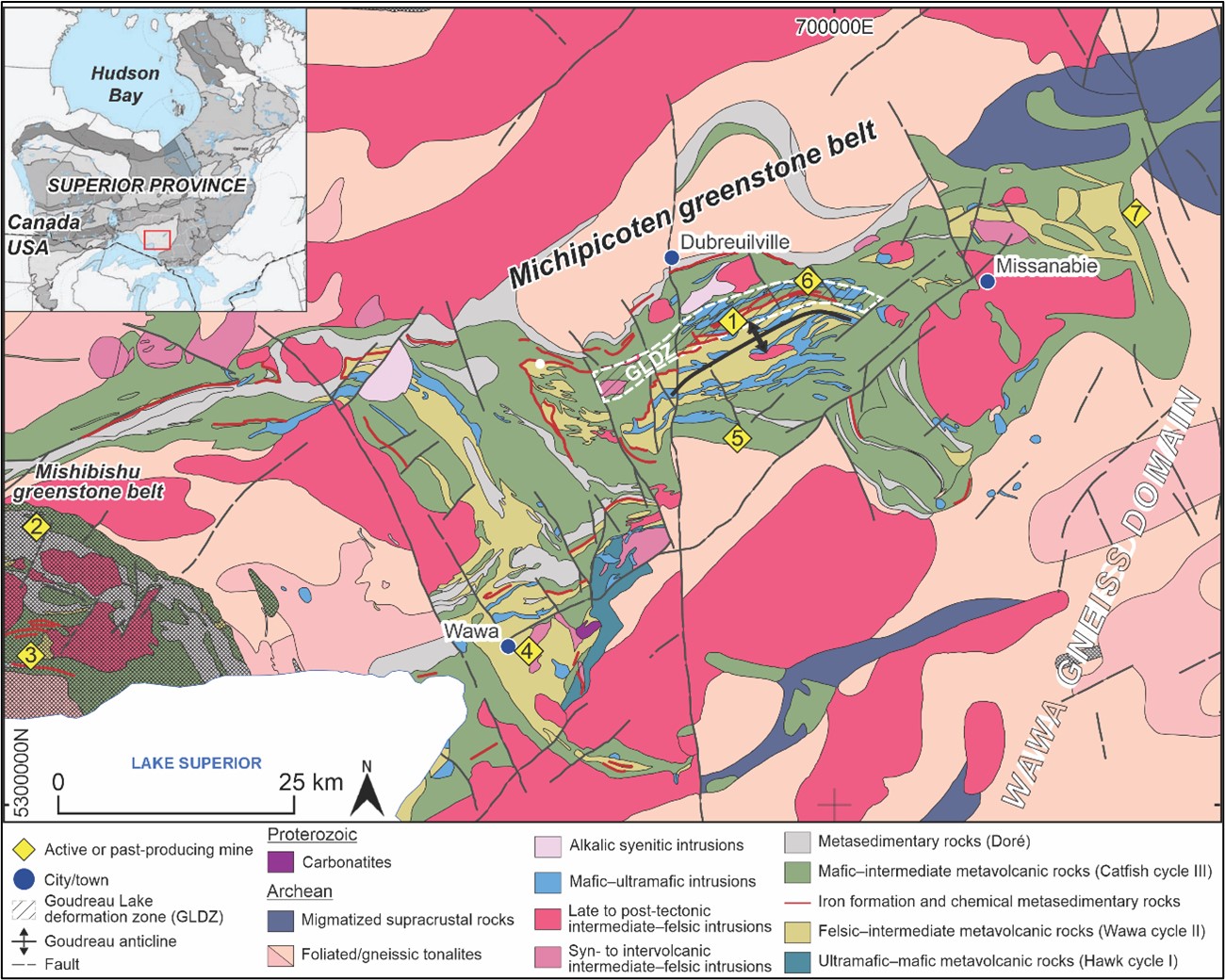

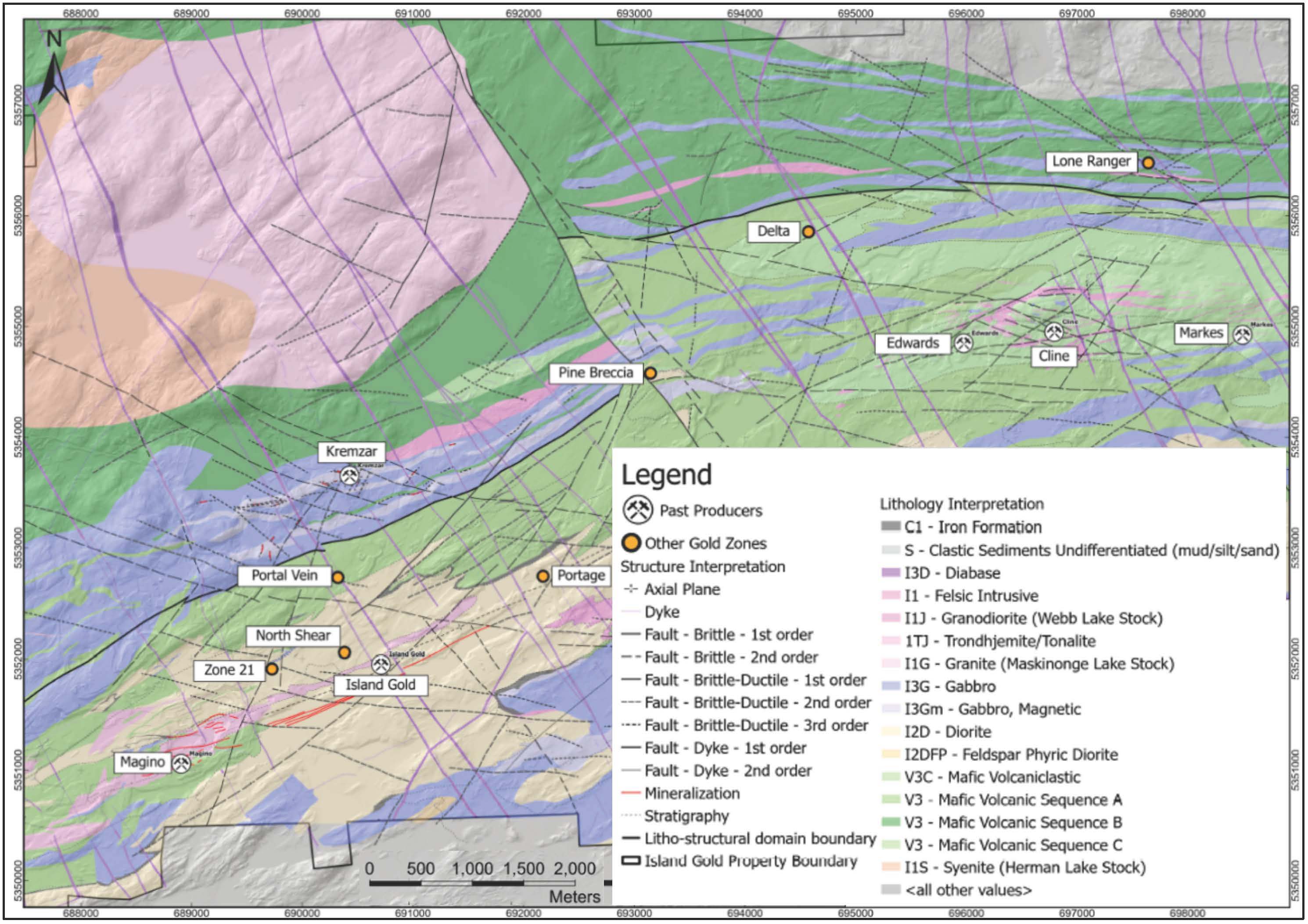

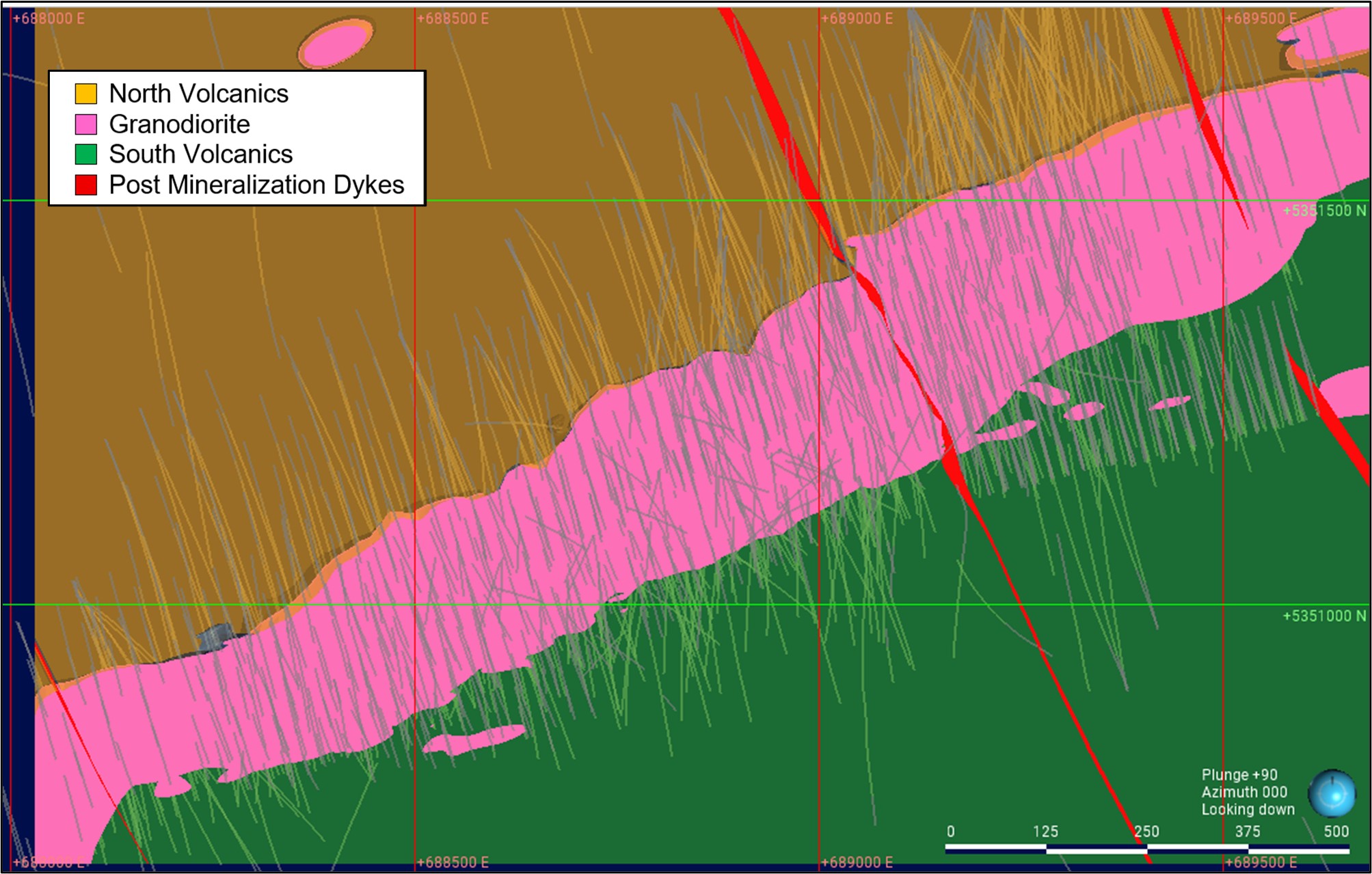

The Island Gold and Magino deposits are located in the Michipicoten Greenstone Belt (MGB) which is part of the Wawa Subprovince within the Archean Superior Province. The belt is east-west striking with an approximate length of 140 km and a maximum width of 40 km.

The MGB volcanic stratigraphy comprises three bimodal volcanic cycles with lower mafic and upper felsic sequences that are cut by syn-volcanic intrusions. The three volcanic cycles are separated by chemical sedimentary rocks, including Algoma-type iron formations. Rocks vary in age from 2,889 million years (Ma) for the Hawk Assemblage (Cycle I) to 2,750 Ma for the Wawa Assemblage (Cycle II), and to 2,700 Ma for the Catfish Assemblage (Cycle III). However, recent mapping and geochronological work suggests that volcanism may be more continuous than previously interpreted. The volcanic cycles are unconformably overlain by the Doré sedimentary rocks, a turbiditic sequence interpreted as the youngest supracrustal rocks in the MGB. Matachewan diabase dykes, lamprophyre dykes, as well as late- to post-tectonic alkalic to calc-alkalic intrusions and Proterozoic carbonatites intrude the folded and metamorphosed MGB supracrustal rocks.

The supracrustal rocks of the MGB have been repeatedly deformed and affected by regional greenschist to amphibolite-facies metamorphism. Early structures include major F1 recumbent folds, thrusts and associated cleavages. These early structures are refolded and crenulated by tight to isoclinal upright F2 folds with a steep penetrative regional S2 cleavage. The latest structures include northeast-trending shear zones that host auriferous vein systems and northerly-trending sinistral faults.

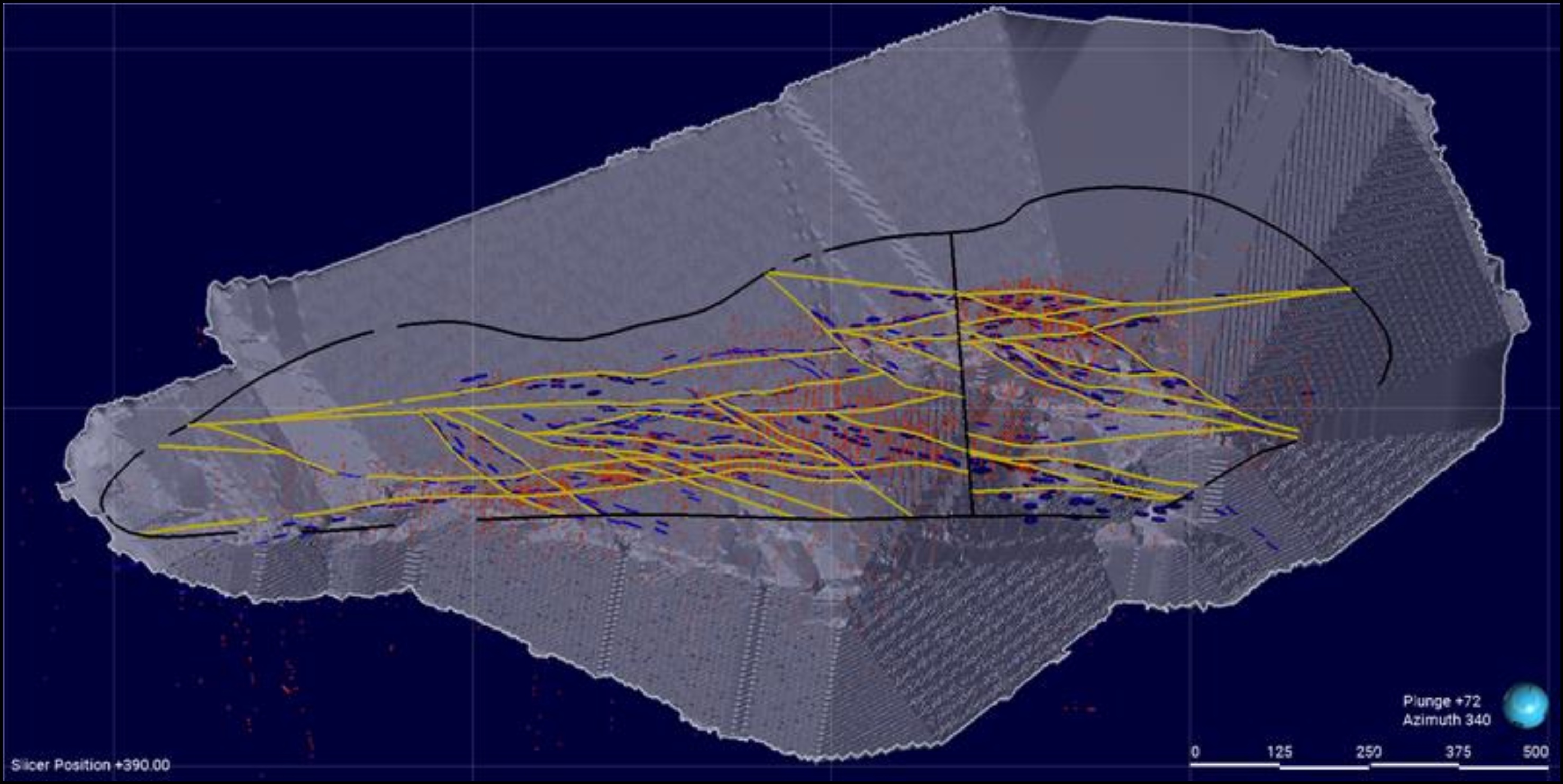

A regional northeast-trending deformation zone called the Goudreau Lake Deformation Zone (GLDZ) is situated in the Island Gold and Magino deposit areas, at the interface of the Wawa and Catfish Assemblage cycles. The GLDZ has been traced along strike for 30 km with a width of 4.5 km and is believed to be the main control of gold mineralization for the Island Gold and Magino deposits. It is a high angle, oblique-slip, fault zone with an overall dextral movement cutting stratigraphy at a shallow angle. The Island Gold and Magino gold deposits occur as a sequence of stacked east-northeast striking, steeply dipping, and subparallel zones of gold mineralization within the GLDZ.

The Island Gold and Magino deposits are both considered Archean orogenic lode gold deposits. Both deposits occur within the GLDZ and are part of the same system; however, they are hosted within different lithologies. Island Gold is a high-grade structurally hosted quartz-carbonate vein system hosted within felsic to intermediate volcanics, whereas gold mineralization at Magino occurs primarily within the tonalitic Webb Lake Stock with the first gold mineralizing event coincident with the emplacement of the stock, and the second later event associated with gold overprinting and remobilization during deformation within the GLDZ, a major regional brittle-ductile structure. The host terrane is a sequence of felsic to intermediate volcanic and intrusive rocks of the Wawa Assemblage which are in the greenschist to amphibolite metamorphic range as is common for this type of deposit.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 19

|

1.6 Sample Preparation, Analyses and Security

Island Gold and Magino have had historically different sample preparation, analysis and security policies and procedures. As part of the integration of the two operations, these policies and procedures are under review with the objective of standardization of the policies and procedures within the District.

Intervals selected for sampling are determined by a geologist during core logging. Sampling is conducted over mineralized zones at regular intervals. Where present, lithological boundaries - such as geological contacts or alteration zones - are used to constrain sample intervals. Sample locations are identified and marked on the core by the geologist during the logging process. Corresponding sample tags are inserted beneath the core within the core boxes at the end of each designated interval. Sample interval data, including sample numbers and associated quality control materials (standards and blanks), are manually recorded in the project database by District personnel.

The acQuire databases, which store all drill core and channel sample logs, assays, and surveys, are securely maintained on Island Gold’s private network. Access is restricted to employees directly involved in the process, with security groups limiting everyone to only the necessary sections of the database. Access is granted exclusively by a supervisor in the Geology Department.

Sample intervals, sample numbers, and the insertion of quality control samples - including CRMs and blanks - are manually recorded in the database by geologists at Island Gold. Upon completion of analytical work, assay results are delivered by the laboratories via email in CSV and PDF formats to designated Island Gold personnel. These results are electronically uploaded into the project database using a custom in-house application, which automatically matches assay data to the corresponding sample numbers, thereby eliminating the need for manual data entry at this stage.

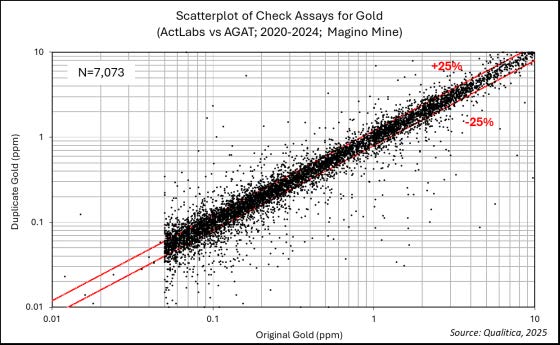

Island Gold

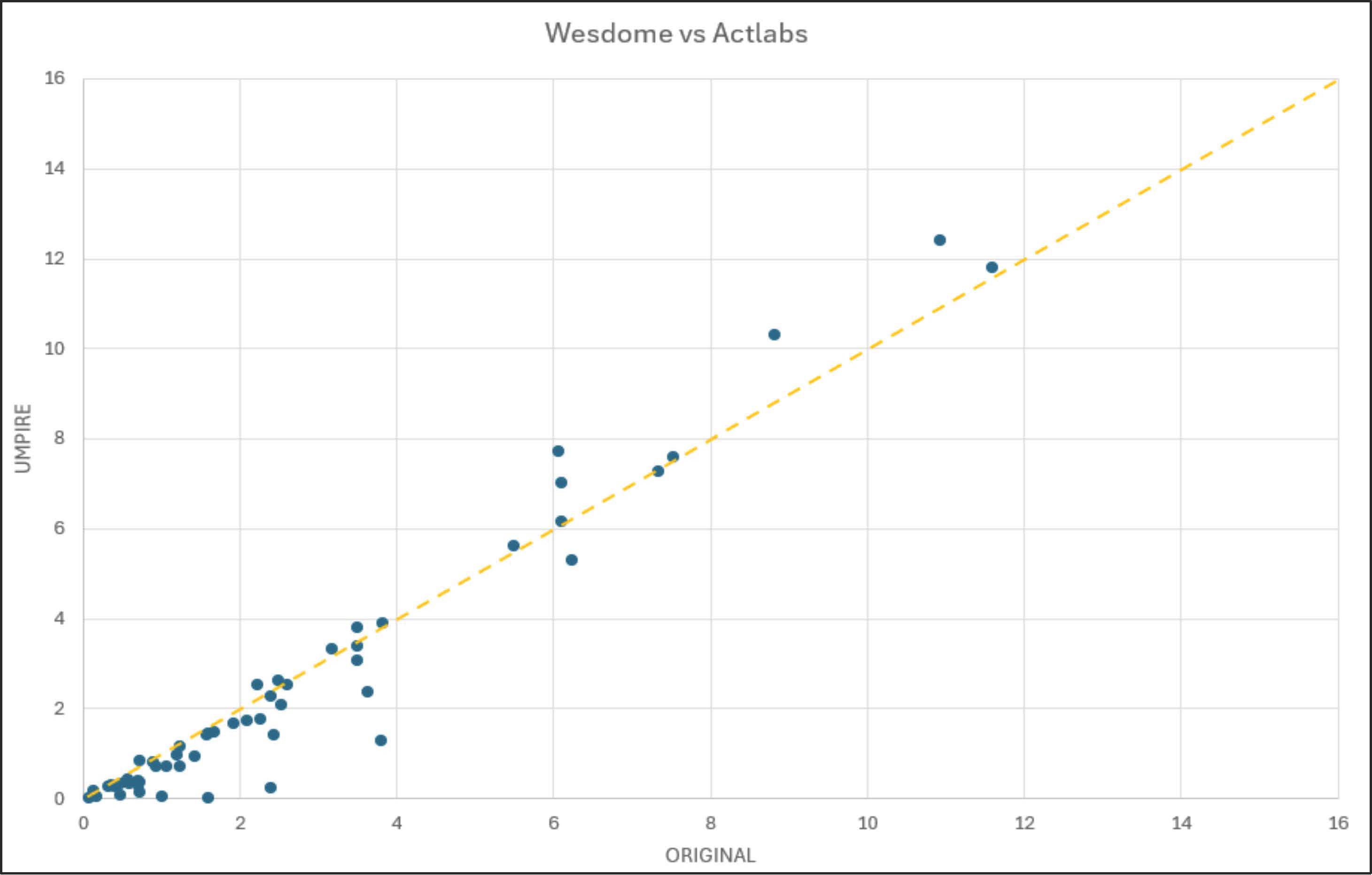

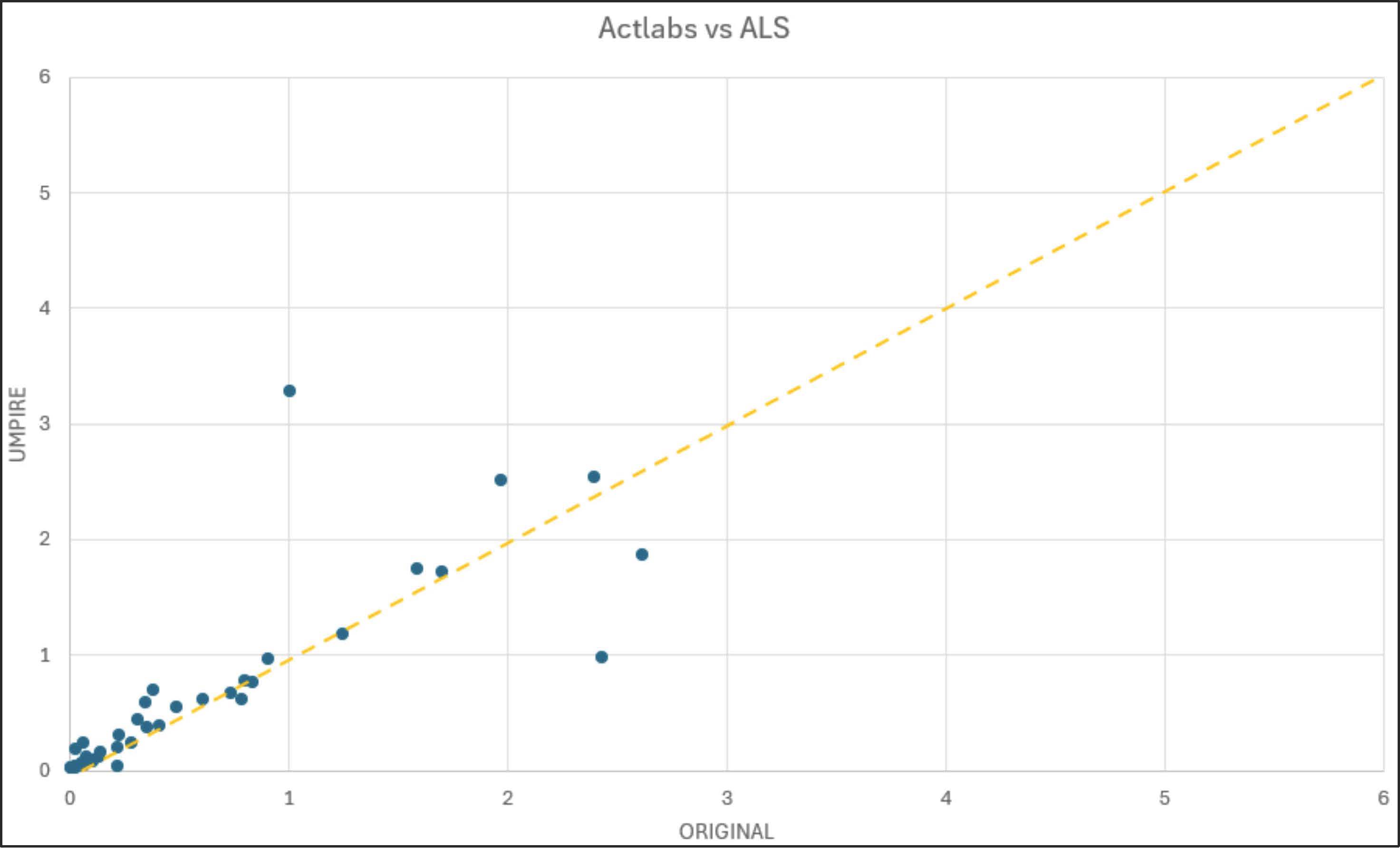

The primary analytical laboratory for drill core samples from Island Gold is AGAT. During the 2024 drilling program, core samples were also submitted to Actlabs, while the surface exploration drill core samples were analysed by ALS. AGAT, Actlabs, and ALS are all independent, accredited analytical laboratories conforming to the requirements of ISO/IEC 17025, as recognized by the Standards Council of Canada.

Until April 2021, most drill core samples were prepared and analyzed by LabExpert. In previous years, a limited number of definition drill core samples, along with all underground production samples, were analyzed at Wesdome. This laboratory also provides assay services for Wesdome’s Eagle River Mine. Between 2022 and 2023, approximately 19,900 samples were analyzed at Alamos’ Young Davidson Lab. The Wesdome and Young Davidson laboratories are not accredited facilities.

All laboratories referenced maintain internal quality control programs that include the routine insertion of reagent blanks, certified reference materials (CRMs), and pulp duplicates. AGAT, Actlabs, and ALS routinely participate in international proficiency testing (round robin programs), monitor the preparation of duplicate samples, and operate under quality management systems consistent with ISO/IEC 17025 accreditation.

In 2024, Island Gold mine received over 61,000 gold assay results. The QP has reviewed the sample preparation, analytical, and security procedures, along with the insertion rates and performance of blanks, CRMs, and check assays for the mine’s drillhole samples. The observed failure rates are within expected industry ranges, and appropriate follow-up actions

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 20

|

were taken where failures occurred. No significant assay biases were identified. In the QP’s opinion, the Island Gold sampling protocols and resulting assay data meet industry standards, and the database is suitable for use in the Mineral Resource estimation

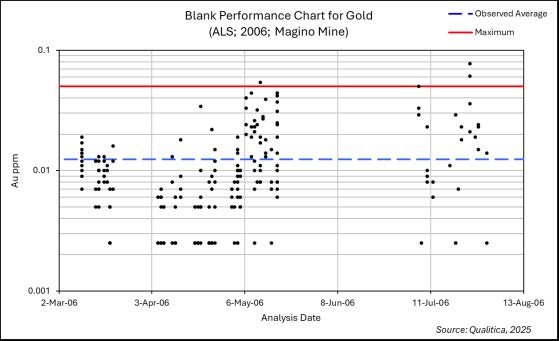

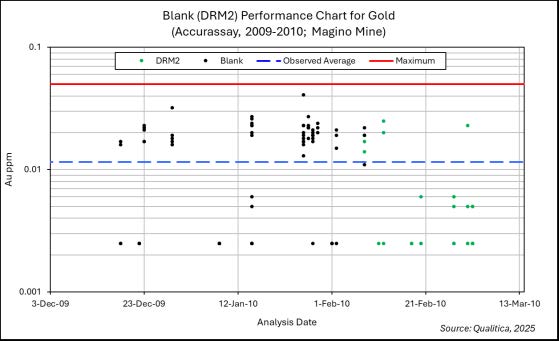

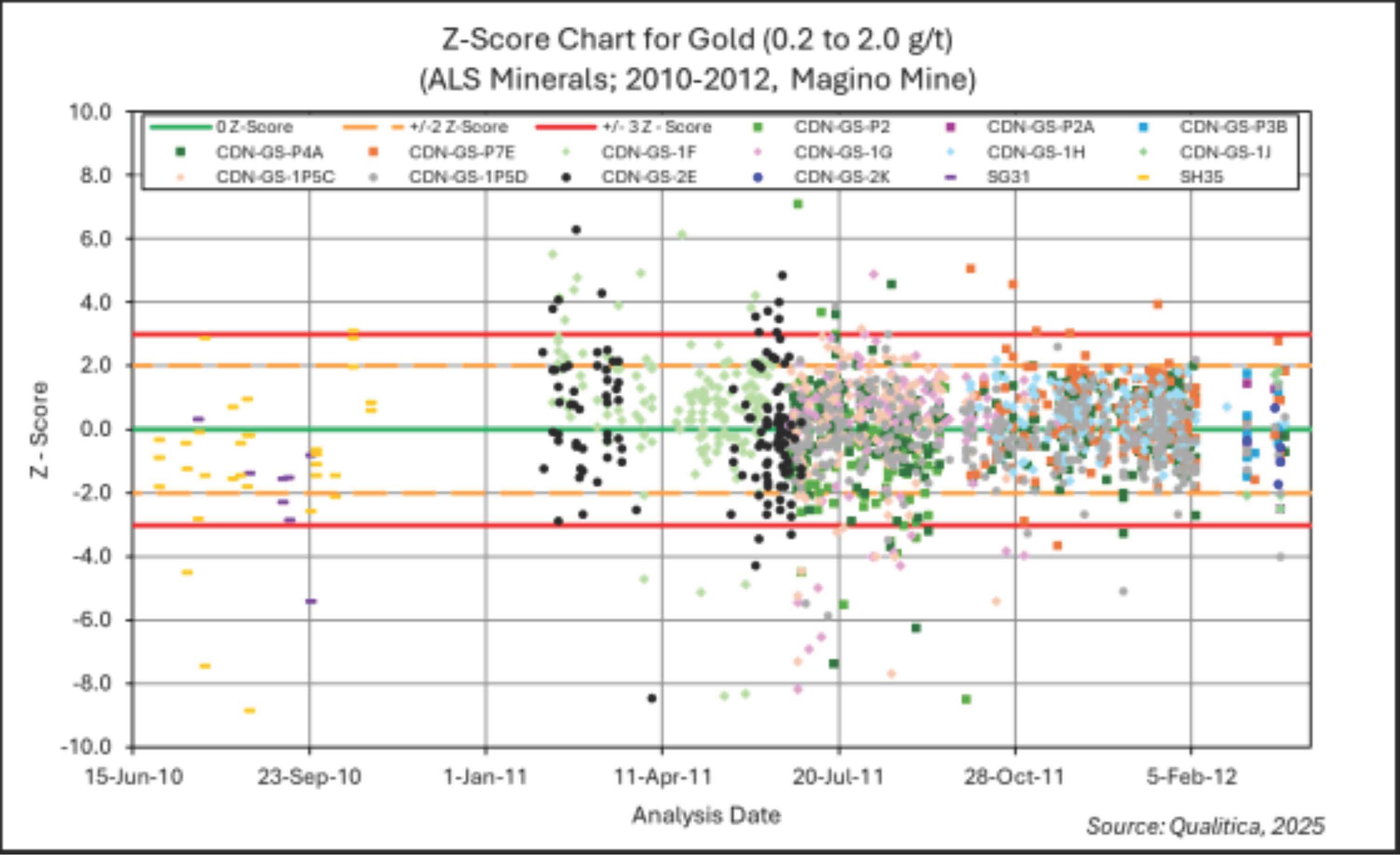

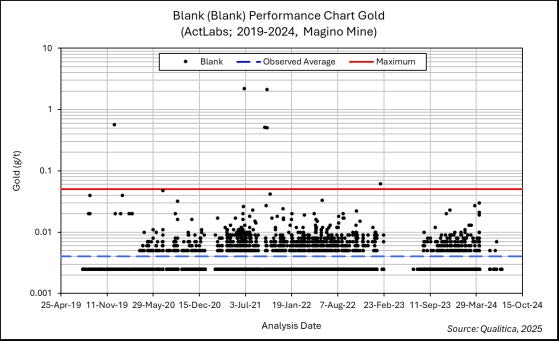

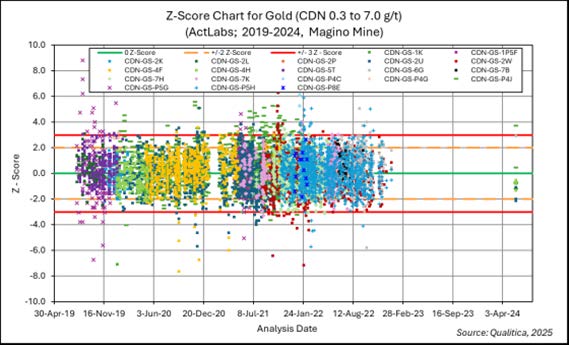

Magino

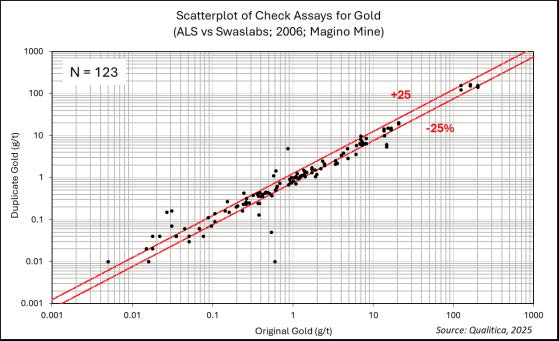

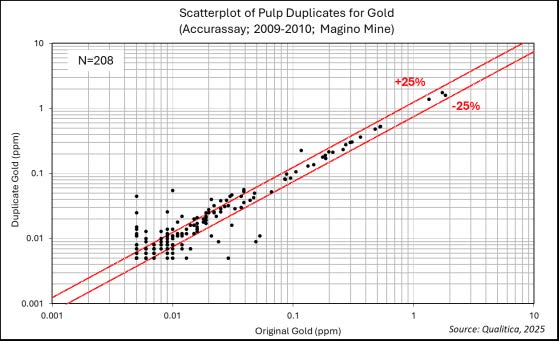

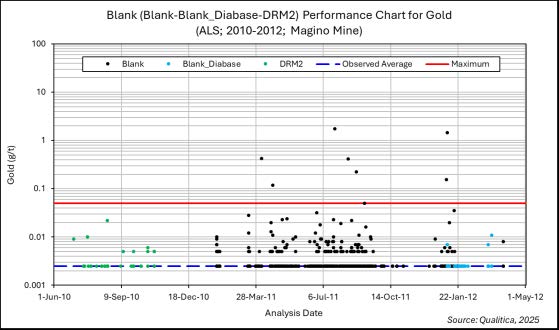

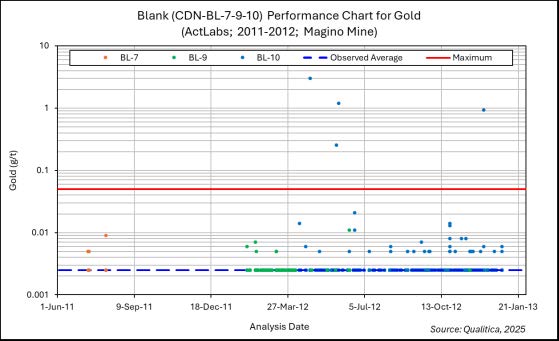

Golden Goose submitted samples to ALS Chemex (2006) and Accurassay Laboratories (2007–2010). Prodigy submitted samples to Accurassay (2010), ALS Chemex (2010-2012), and ActLabs (2011-2012). Argonaut submitted samples to ActLabs (2013-2024), Bureau Veritas (2016-2017), and MSA Labs (2024). Alamos has continued to submit samples to ActLabs and MSA Labs. All utilized labs are ISO 17025-accredited facilities.

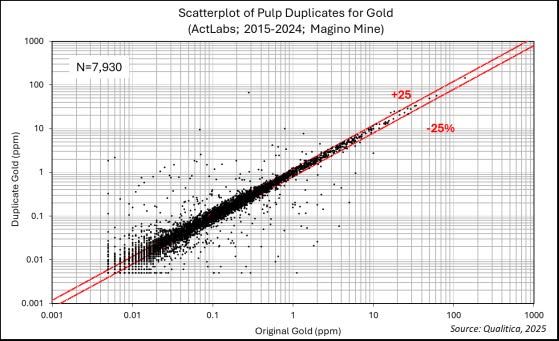

The Company maintains a rigorous assay quality control program. Blanks and CRMs are inserted with drill core samples on a routine basis. In addition, sample pulps are routinely submitted for check assays to an accredited commercial laboratory.

There is no evidence of significant assay bias or systematic contamination identified based on the quality control program.

The responsible QP is of the opinion that Magino maintains a quality program that meets or exceeds industry standards. Sample preparation, security, and analytical procedures are all industry-standard and produce analytical results for gold with accuracy and precision that is suitable for Mineral Resource estimation.

1.7 Data Verification

The Qualified Persons consider that the Island Gold and Magino databases are suitable for use in the Mineral Resource and Mineral Reserve estimation. These databases contain all the information related to drillholes, drift sampling, assay results and the laboratory certificates. Some verification of the original data was performed, and modifications were completed if needed prior to the calculation of any estimates. The verification of, and corrections to, the Island Gold and Magino databases were done prior to the Mineral Resource and Mineral Reserve estimates as of December 31st, 2024, presented in this Report.

1.8 Metallurgical Test Work

The Magino expansion project from 10,000 tpd to 12,400 tpd will see ore from two different ore bodies being processed through the common operating complex. The existing Magino feed is sourced from a low-grade high tonnage open pit operation, while the neighbouring Island Gold ore feed is sourced from the high-grade and lower tonnage underground operation. Previous metallurgical testing campaigns have been completed for each deposit to develop their respective original mineral processing flowsheets. Now that both ores will be combined in a common feed, a dedicated blended test work campaign has been completed to explicitly review the metallurgical performance of both ores being processed at the same time utilizing a new flowsheet design. The blended test work program was focused on developing the process design criteria for comminution, gravity concentration, leaching, and dewatering.

Both the historical Magino and Island Gold test work programs were developed with master composite samples intended on providing a representation of their respective deposits. Variability tests were also completed to help support development.

A blended test work program focused on the currently planned expansion utilizing feed material from each of the respective mines. Each contributing sample in the blend was assayed to ensure they were representative of the mine plan and fell within the bounds of what was

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 21

|

presented in the previous test work campaigns.

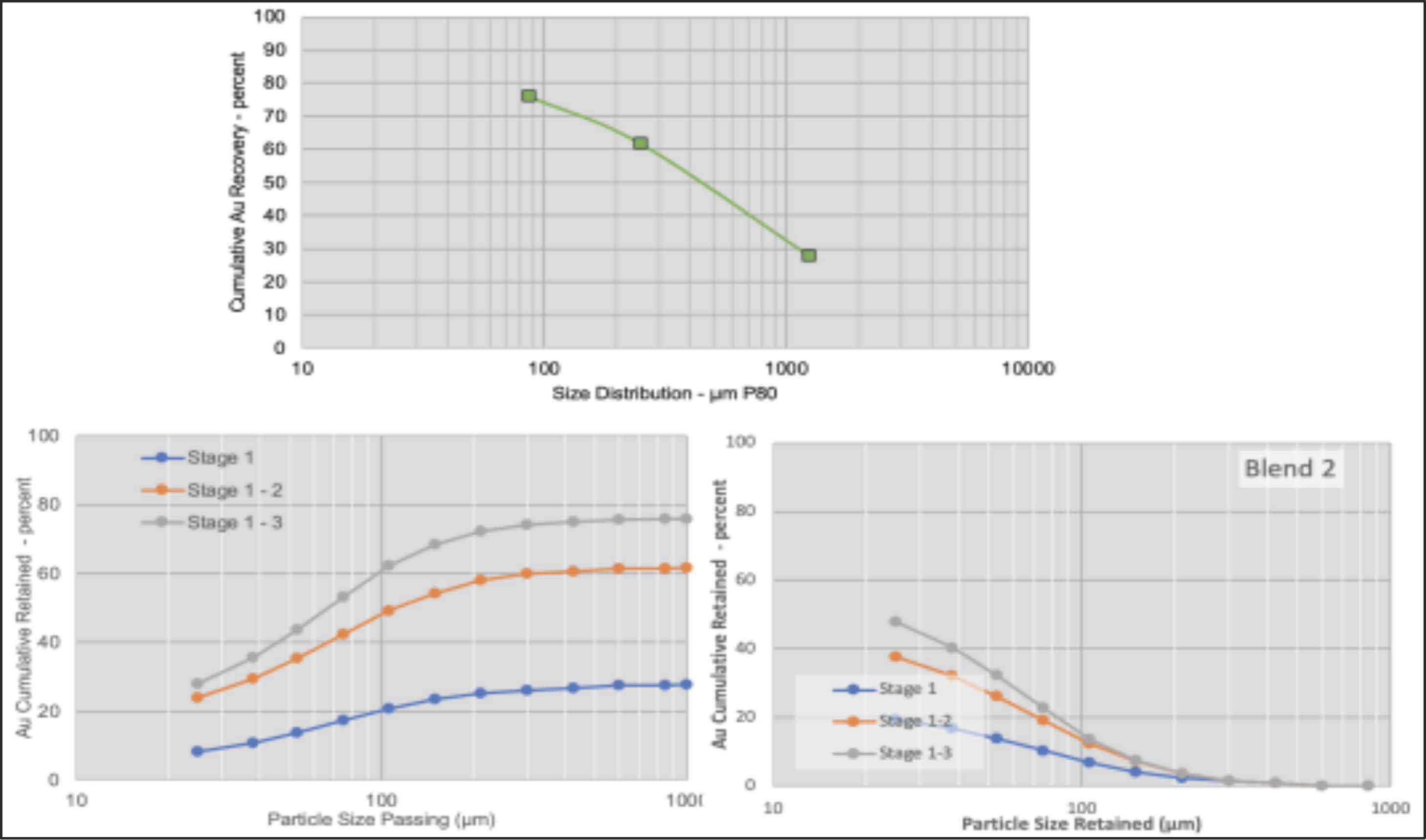

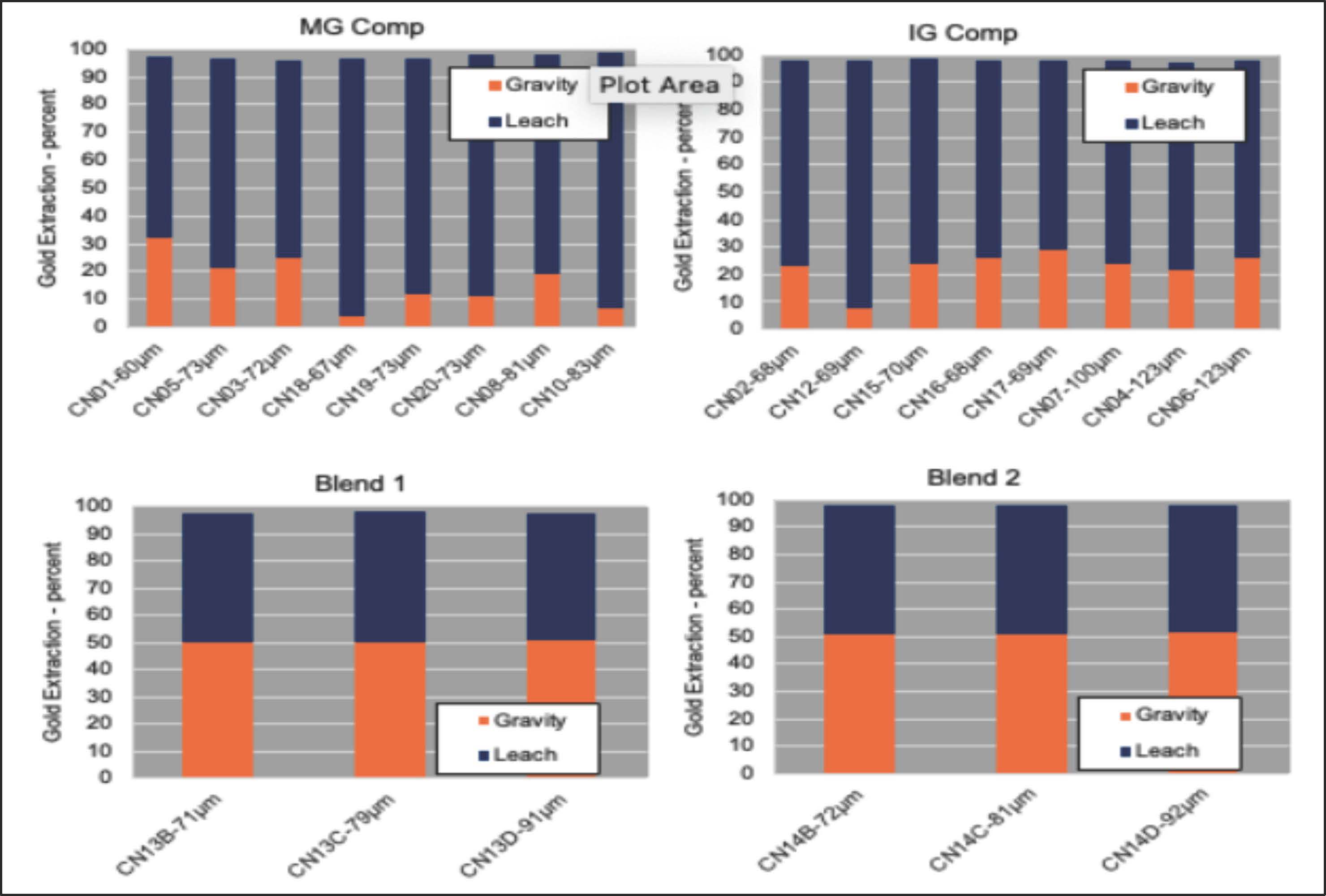

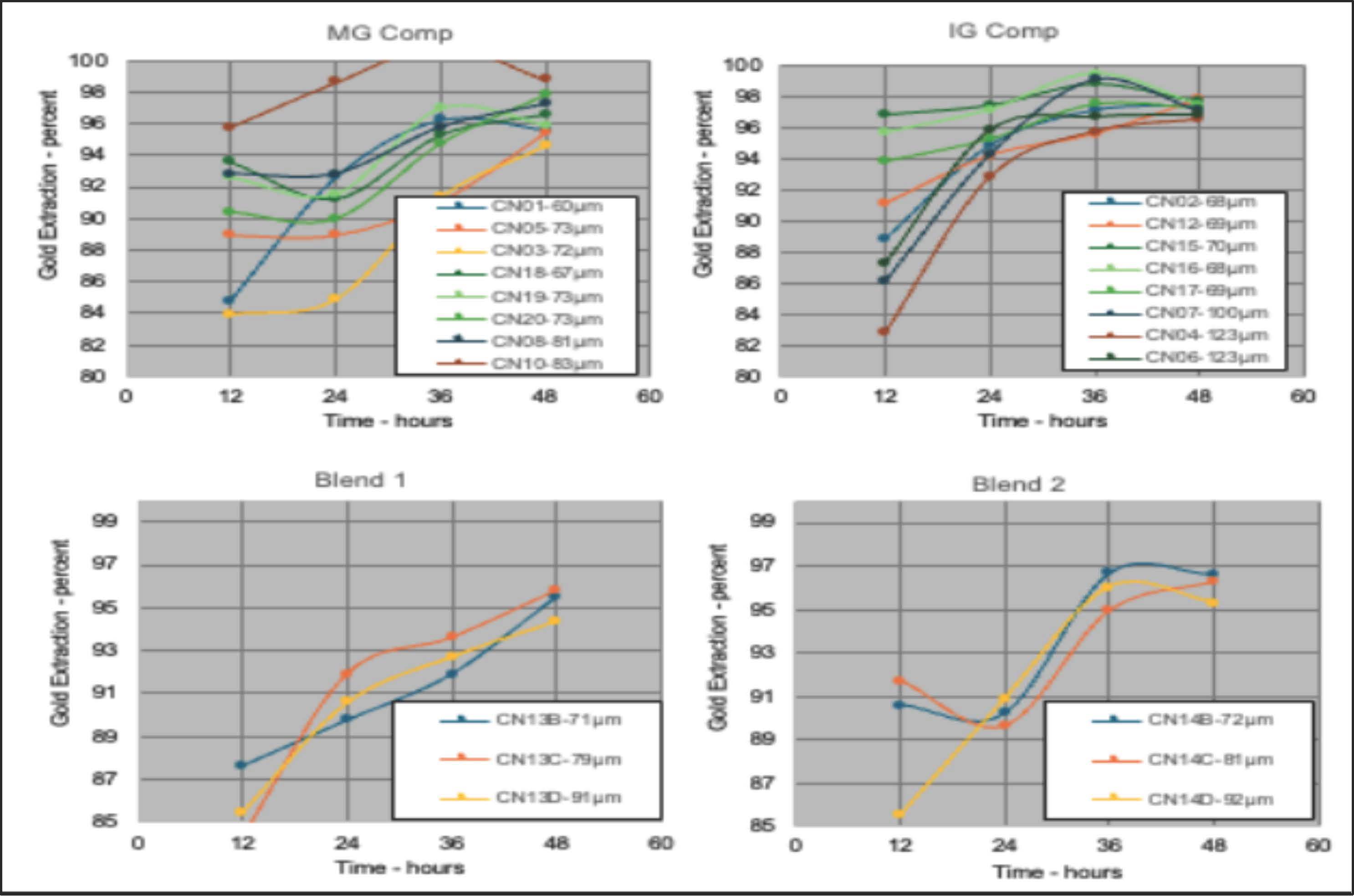

A metallurgical test program was carried out to evaluate the impact on gold recovery of blending material from the Magino and Island Gold deposits using a gravity and tailings leach flowsheet, followed by thickening. Two blend ratios were tested at selected grind sizes to assess their effect on recovery performance.

Island Gold material has limited SMC test data available. For this program, a single sample was provided and tested, yielding an Axb value of 30.2. This result is consistent with previous tests reported, which averaged an Axb of 30.0, classifying the sample as medium-hard with respect to SAG milling.

The Magino sample achieved combined gravity and leach gold recoveries ranging from 95.6 - 98.8%. Finer regrinding of the gravity tailings had no significant impact on gold extraction for this material.

The Island Gold sample showed slightly higher combined recoveries, between 97.3 - 98.2% gold. Gold content in the gravity concentrate was notably higher for this composite. However, recoveries decreased at coarser grind sizes, particularly above K₈₀ 100 µm.

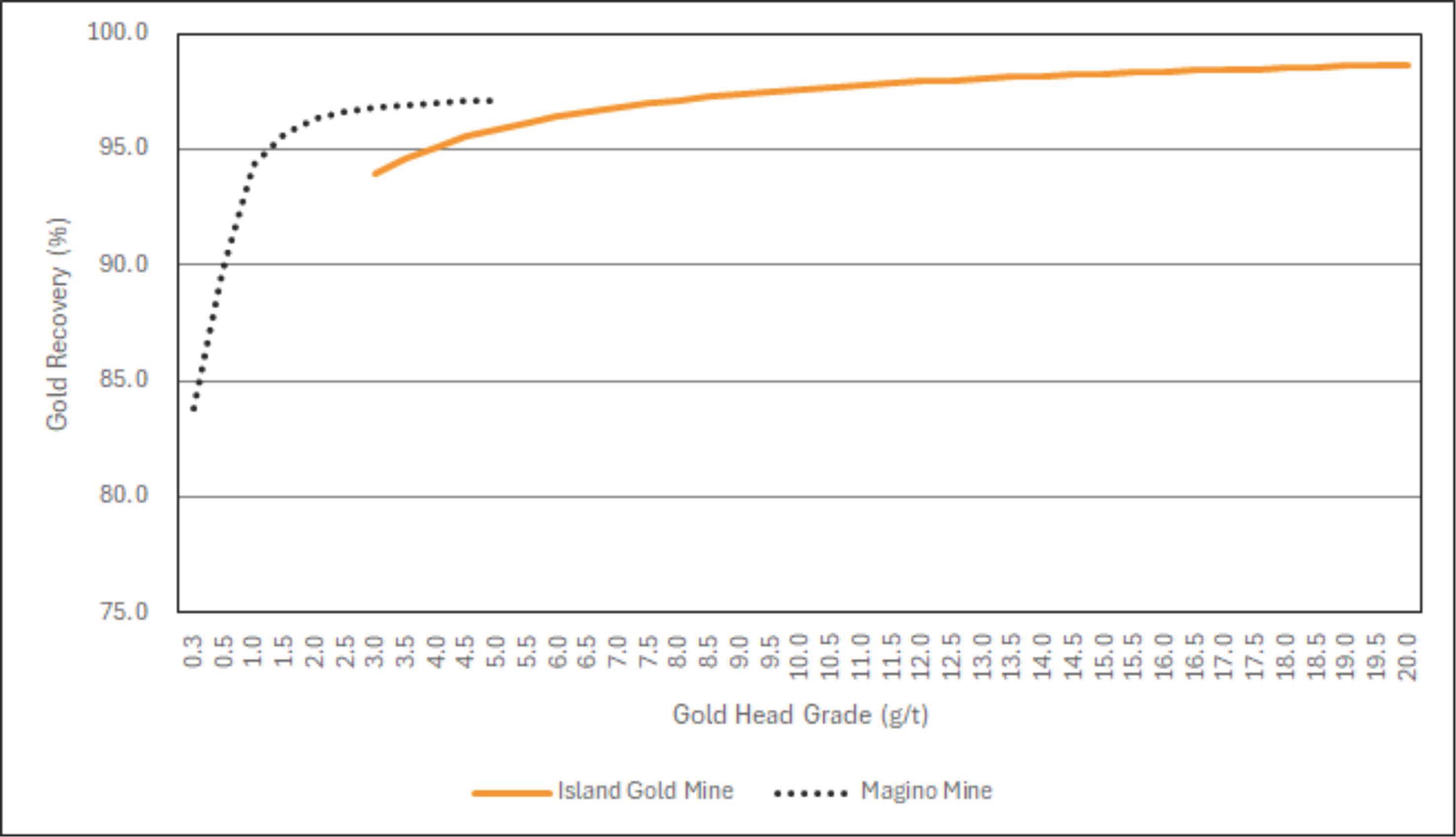

Recovery curves have been modeled based on actual mill performance for both ores. The Island Gold recovery curve is based on 2023 through Q1-2025 daily grade / recovery data in the Island Gold Mill and the Magino recovery curve is based on daily grade / recovery data since Magino mill start-up in 2023. The corresponding gold recovery algorithms are as follows:

Island Gold

AuRec = exp(4.580933 – 0.135214/Au + 0.005823*ln(Au))

Magino

AuRec = 57.088538 + (40.341080 * Au^1.514130) / (0.192565^1.514130 + Au^1.514130)

Where, AuRec = recoverable gold (%)

Au = gold head grade (g/t)

Both blend composites performed well overall. Blend 2, which contained a higher proportion of Island Gold material, delivered the highest overall gold recoveries, though a slight decline was observed as grind size increased. Based on the range of recoveries achieved in the test work and sensitivity to grind with the Island Gold ore, a calculated recovery has been developed to provide an overall recovery of approximately 96%. This is based on using a 1:9 blend ratio of Island Gold to Magino ore with average mine feed grades of 10.85 g/t gold for Island Gold and 0.91 g/t gold for Magino. Modeled recoveries of 97.7% for Island Gold and 93.9% for Magino are used.

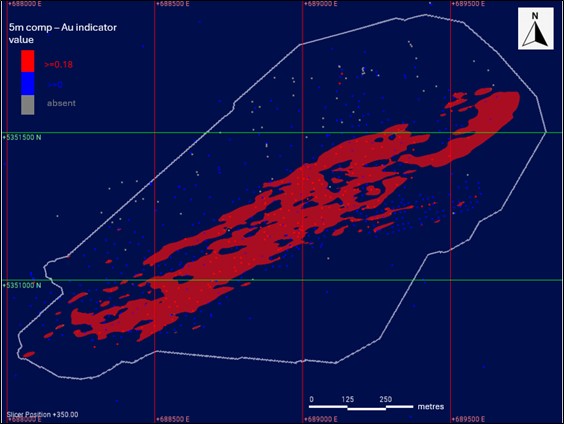

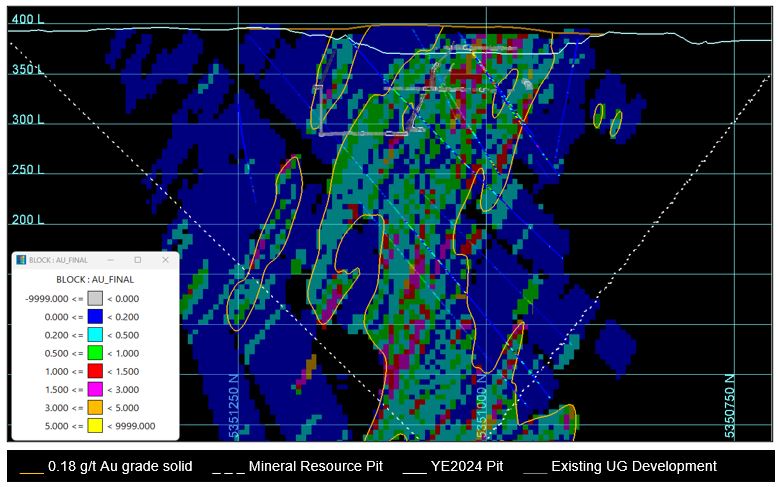

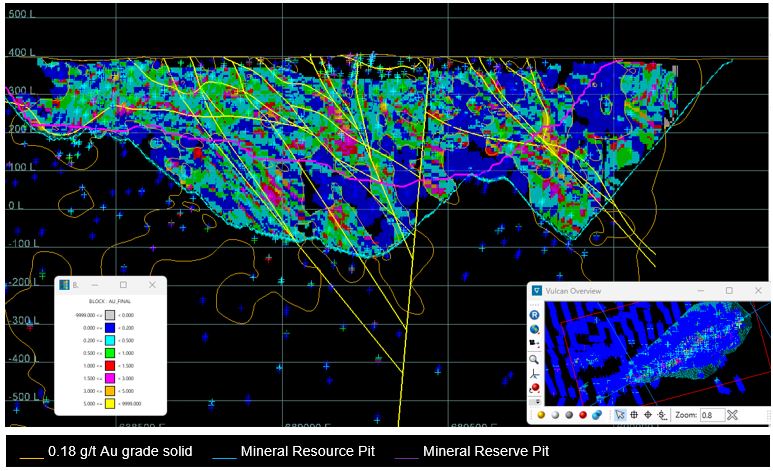

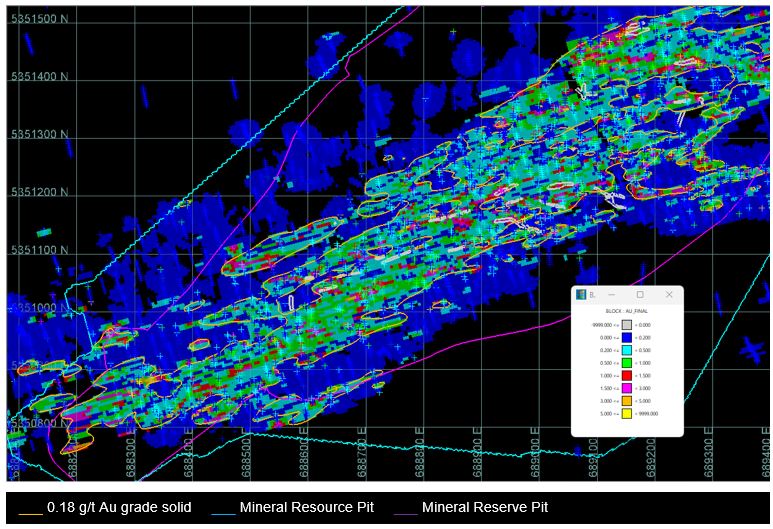

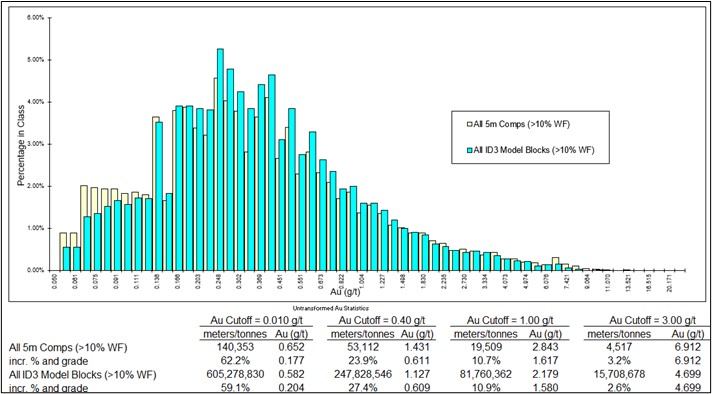

1.9 Mineral Resource Estimates

Updated Mineral Resource estimates were conducted for both the Island Gold underground and Magino open pit deposits, with an effective date of December 31st, 2024. The Island Gold and Magino Mineral Resource models are both separate and independent, and utilize different grade estimation and resource classification methodologies, as deemed appropriate by the respective QP’s and dictated by mining methods.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 22

|

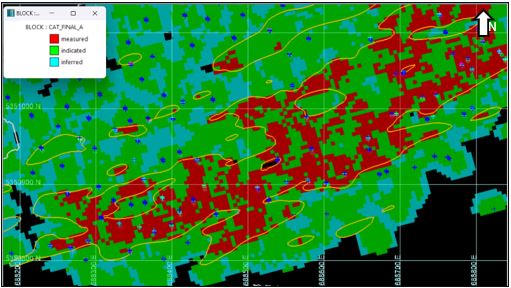

The Mineral Resource Estimates conform to CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and include Measured, Indicated and Inferred Resources

The underground Mineral Resources have been prepared by Alamos under the supervision of Mr. Tyler Poulin, P.Geo., Island Gold District Geology Superintendent. Mr. Poulin is not independent of the issuer and takes QP responsibility as defined in NI 43-101 for the underground Mineral Resource estimate.

The open pit Mineral Resources have been prepared under the supervision of Mr. Jeffrey Volk, CPG, FAusIMM, Director of Reserves and Resources for Alamos Gold Inc. Mr. Volk is not independent of the issuer and takes QP responsibility as defined in NI 43-101 for the open pit Mineral Resource estimate.

A summary of the Mineral Resource estimates within the Island Gold District is presented in Table 1-1.

Table 1-1 Summary of Mineral Resources – as of December 31st, 2024

| | | | | | | | | | | |

| Category | Tonnes and Grade | Contained Gold |

| Tonnes (kt) | Gold Grade (g/t) | (koz) |

Island Gold - Underground Measured Indicated Sub-Total Measured + Indicated Inferred |

470 2,640 3,110 2,449 |

14.66 9.75 10.49 16.88 |

222 827 1,049 1,329 |

Magino – Open Pit Measured Indicated Sub-Total Measured + Indicated Inferred |

5,061 55,209 60,270 40,291 |

0.87 0.91 0.91 0.92 |

141 1,615 1,756 1,191 |

Total Island Gold District Measured Indicated Total Measured + Indicated Inferred |

5,531 57,849 63,380 42,740 |

2.04 1.31 1.38 1.83 |

363 2,442 2,805 2,520 |

Notes:

•CIM definition standards for Mineral Resources and Mineral Reserves (2014) were used for reporting of Mineral Resources.

•Mineral Resources are estimated using a long-term gold price of US$1,800 per troy ounce. The exchange rate used was 1.00 C$ = 0.75 US$.

•Island Gold underground assumptions include:

Underground Mineral Resources are estimated at an undiluted cut-off grade of 3.36 g/t gold and are constrained by potentially mineable zones of contiguous blocks.

Gold metallurgical recovery estimated as 97%.

A minimum mining width of 2.00 m was used for all zones.

A specific gravity value of 2.78 t/m3 was used for all zones.

•Magino open pit assumptions include:

Open pit Mineral Resources are estimated at a cut-off grade of 0.28 g/t gold and contained within a potentially economic open pit shell optimized on Measured, Indicated and Inferred material. Includes external dilution at 0.00 g/t gold for material external to the 0.18 g/t gold solid.

Gold metallurgical recovery estimated as 91.7%.

Contained gold ounces are in-situ and do not include mining losses or metallurgical recovery losses.

•Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability.

•Mineral Resources are exclusive of Mineral Reserves.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 23

|

•Date of Mineral Resources is as of December 31st, 2024.

•The QP for the Island Gold underground Mineral Resource estimate is Mr. T. Poulin, P.Geo., Alamos Gold.

•The QP for the Magino open pit Mineral Resource estimate is Mr. Jeffrey Volk, CPG, FAusIMM, Director of Reserves and Resources for Alamos Gold Inc.

•Totals may not match due to rounding.

The Mineral Resources reported herein supersede the Mineral Resources reported previously at year-end 2024 by Alamos for the District on February 18th, 2025.

1.10 Mineral Reserve Estimates

The District is currently in operation, with production being provided by an underground mine (Island Gold) in combination with an adjacent open pit mine (Magino).

The Mineral Reserve Estimates conform to CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and only include Measured and Indicated Resources that have been converted to Proven and Probable Reserves.

The underground Mineral Reserves have been prepared by Island Gold under the supervision of Mr. Nathan Bourgeault, P.Eng., Technical Services Manager at the Island Gold District. Mr. Bourgeault is not independent of the issuer and takes QP responsibility as defined in NI 43-101 for the underground Mineral Reserve estimate.

The open pit Mineral Reserves have been prepared by Magino under the guidance of Mr. Christopher Bostwick, FAusIMM, Senior Vice President – Technical Services at Alamos. Mr. Bostwick is not independent of the issuer and takes QP responsibility as defined in NI 43-101 for the open pit Mineral Reserve estimate.

The modifying factors utilized to determine the underground reserves at Island Gold are found in Table 1-2.

Table 1-2 Island Gold Underground Cut-Off Grade Parameters

| | | | | | | | |

| Parameter | Units | Value |

| Gold Price | US$ | $1,600 |

| Exchange Rate | US$:C$ | 0.75 |

| Stope Cut-off Grade | g/t | 3.78 |

| Development/Marginal Cut-off Grade | g/t | 2.95 |

Stope Dilution1 | % | 10 - 25% |

Development1 Dilution | % | 15 - 30% |

| Dilution Grade | g/t | 0.50 |

Mining Recovery1 | % | 50 - 95% |

| Process Recovery | % | 96.5% |

| Ore Specific Gravity | t/m3 | 2.78 |

| Minimum Mining Width | m | 2.8 |

| Mining, Processing and G&A Cost (incl. royalties) | C$/t | $251 |

Notes:

1.Dependant on sector and mining method

The modifying factors utilized to determine the open pit reserves at Magino are found in Table 1-3.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 24

|

Table 1-3 Open Pit COG Calculation Parameters

| | | | | | | | |

Parameter Field | Unit | Value |

Metal Prices & FX Gold FX |

US $/oz (US$ : C$) |

1,600 0.75 |

Mining Cost Ore Base Cost Waste Base Cost Overburden Base Cost Inc. Cost per 5m Bench Below 390 Re-handle Long Term Stockpiles Sustaining Capital |

$/t ore $/t waste $/t overburden $/t mined $/t re-handle $/t mined |

3.65 3.59 1.68 0.01 1.96 1.29 |

Process Cost Process Fixed Cost Process Variable Cost Sustaining Capital Tailings Management Facility |

$/t milled $/t milled $/t milled $/t milled |

- 11.29 0.55 2.41 |

Treatment and Refining Gold Deductable (@99.9 % Payable) Freight, refining and representation |

$/oz recoverable $/oz recoverable |

2.13 5.09 |

Royalties IBAs Franco-Nevada Osisko South Osisko East |

% NSR % NSR % NSR % NSR |

0.84 3.00 2.00 3.00 |

| Gold Recovery at Cut-off Grade (COG) | % | 82.6 |

COG | g/t | 0.30 |

A summary of the Mineral Reserves estimated for the District is presented in Table 1-4.

Table 1-4 Summary of Mineral Reserves – as of December 31st, 2024

| | | | | | | | | | | |

| Category | Tonnes and Grade | Contained Gold |

| Tonnes (kt) | Gold Grade (g/t) | (koz) |

Island Gold Proven Probable Sub-Total Underground |

821 10,947 11,769 |

11.82 10.78 10.85 |

312 3,795 4,107 |

Magino Proven Probable Sub-Total Open Pit |

22,163 54,710 76,873 |

0.88 0.92 0.91 |

626 1,613 2,240 |

Total Island Gold District Proven Probable Total Mineral Reserves |

22,984 65,657 88,642 |

1.27 2.56 2.23 |

938 5,408 6,347 |

Notes:

•CIM definition standards for Mineral Resources and Mineral Reserves (2014) were used for reporting of Mineral Reserves.

•Mineral Reserves are estimated using a long-term gold price of US$1,600 per troy ounce. The exchange rate used was 1.00 C$ = 0.75 US$.

•Underground Mineral Reserves are estimated at cut-off grade of 2.95 g/t gold for developed areas and 3.78 g/t gold for undeveloped areas.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 25

|

•Underground assumptions include:

A minimum mining width of 2.80 m.

A specific gravity value of 2.78 t/m3 was used for all zones

Planned dilution ranged between 15% and 35% depending on mining objective, method and zone at an average grade of 0.5 g/t gold.

Mining recovery ranged between 50% and 95% depending on mining objective, method and zone.

Average gold recovery estimated as 96.5%.

Cut-off value of C$ 251/t, inclusive of costs for mining, processing, G&A, refining & transport, and royalties.

•Open pit Mineral Reserves are estimated at a cut-off grade of 0.30 g/t gold.

•Open pit assumptions include:

A 1.0-metre dilution skin applied to above COG block sides adjacent to below COG blocks. Dilution grade is applied per the grade present in below COG blocks.

Gold recovery is variable per a recovery algorithm. At COG, metal recovery is estimated as 82.6%.

•Effective date of Mineral Reserves is December 31st, 2024.

•The QP for the Island Gold underground estimate is Mr. N. Bourgeault, P.Eng., Alamos Gold.

•The QP for the Magino open pit estimate is Mr. C. Bostwick, FAusIMM, Alamos Gold.

•Totals may not match due to rounding.

The Mineral Reserves reported herein supersede the Mineral Reserves reported previously at year-end 2024 by Alamos for the District on February 18th, 2025.

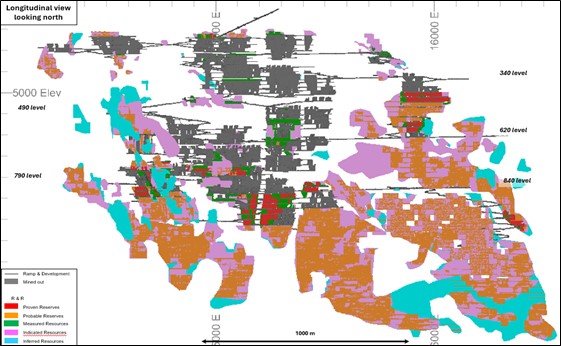

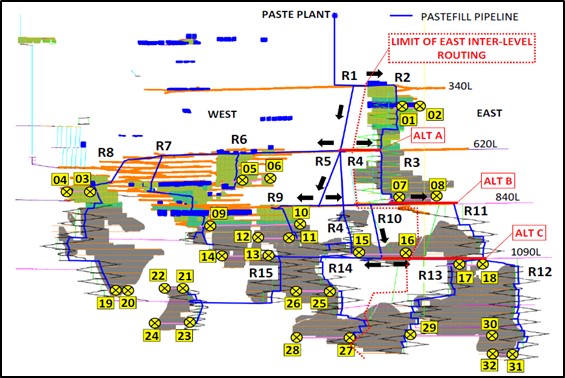

1.11 Mining Production Plans

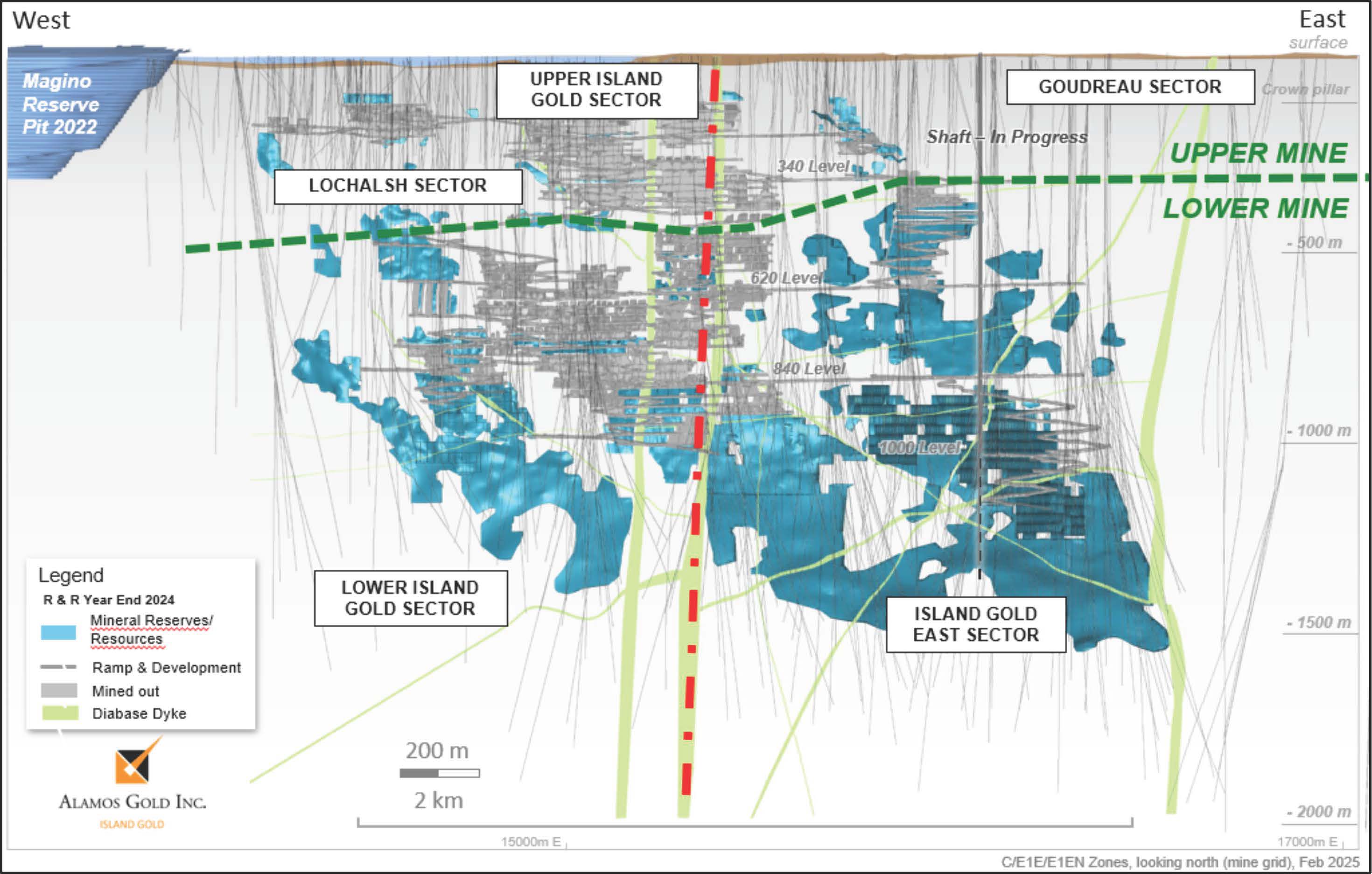

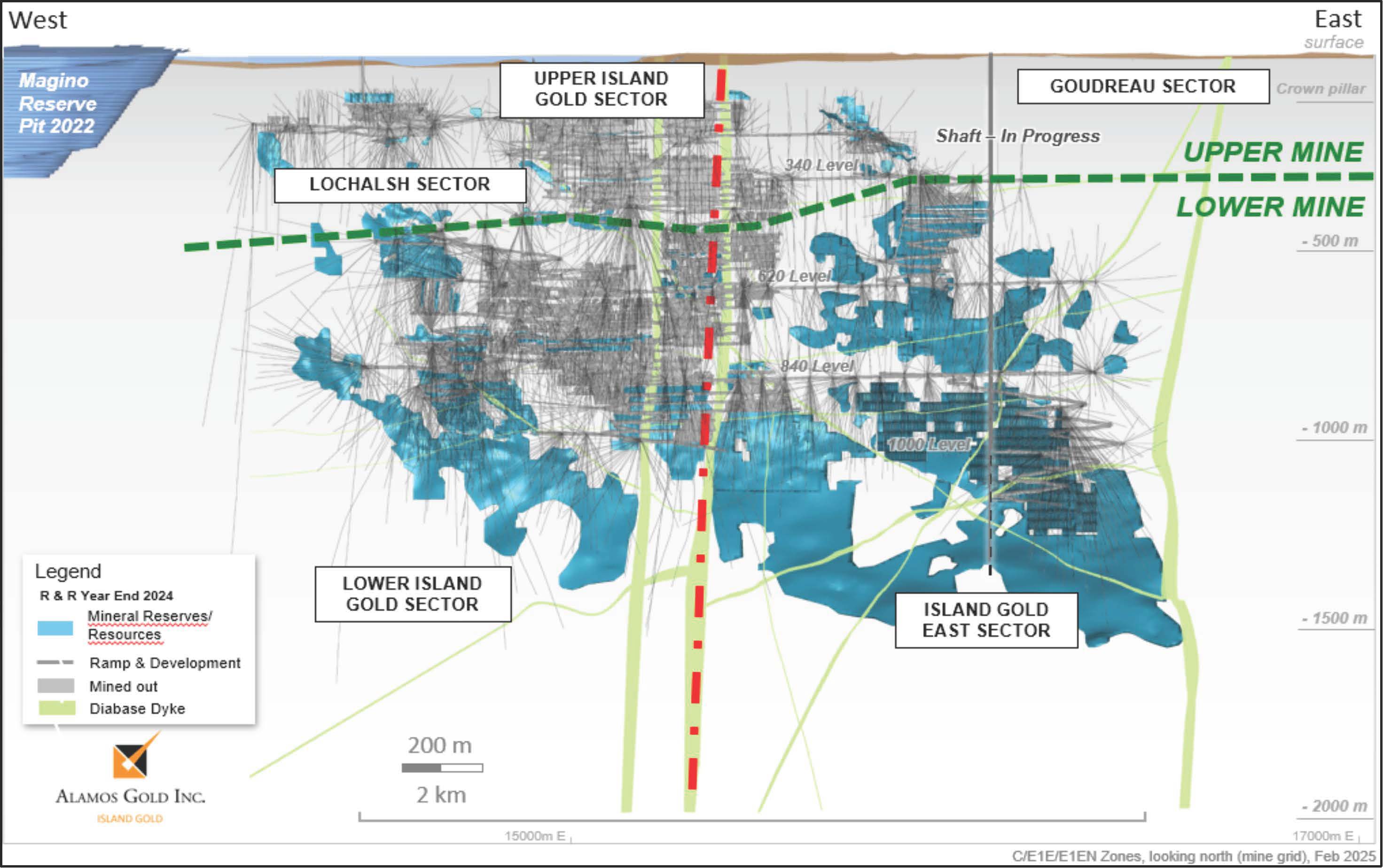

Mining at the District is conducted using both underground and open pit mining methods. As the combined operations integrate and commence processing through only the Magino mill, the processing rate is expected to increase from a combined 11,200 tpd in 2025 to 12,400 tpd by late 2026.

Over the life-of-mine (LOM), the underground and open pit operations (including stockpiles) are scheduled to provide 13.3% and 86.7% of the ore tonnage processed with 64.7% and 35.3% of the contained ounces processed, respectively.

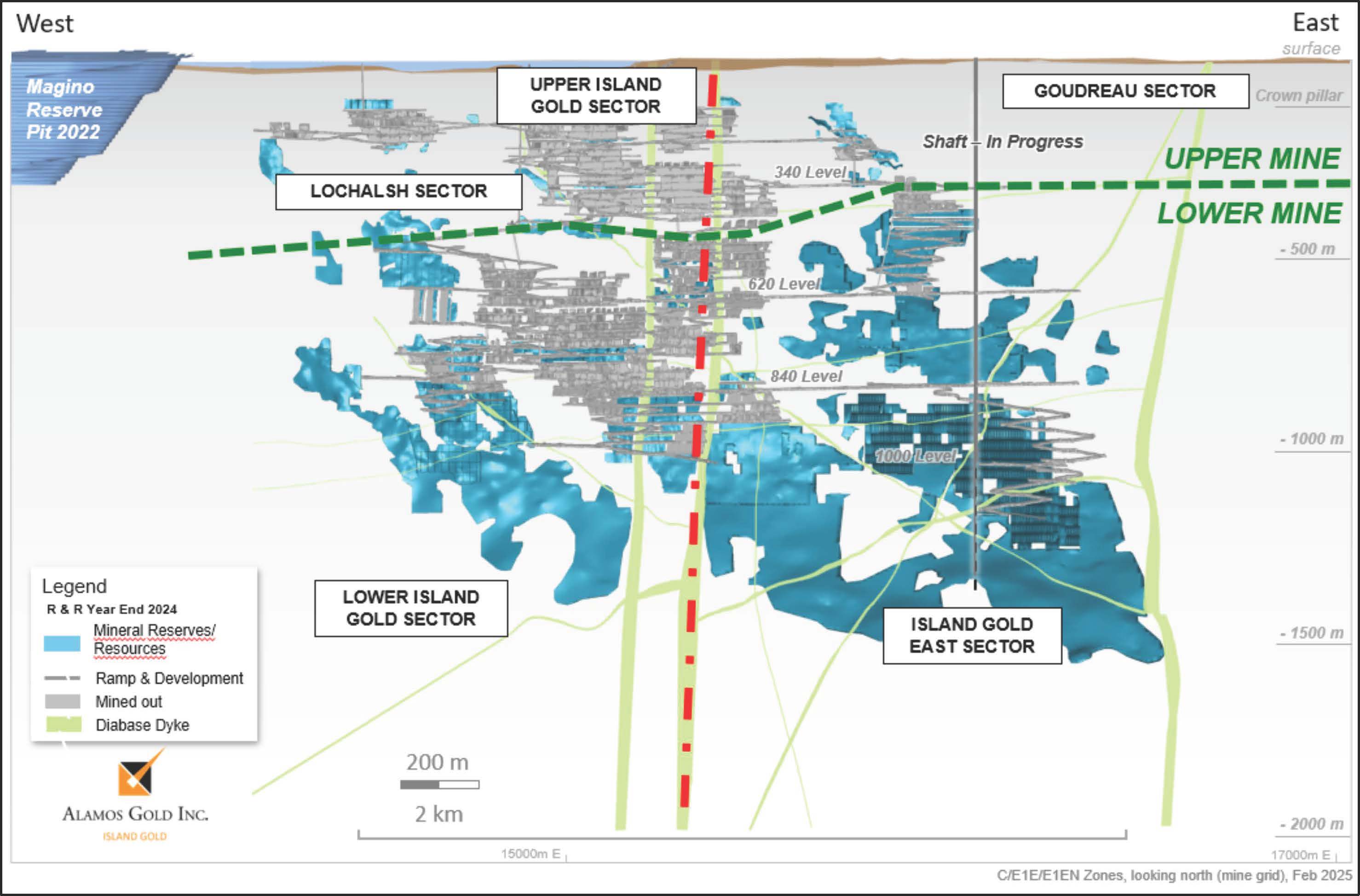

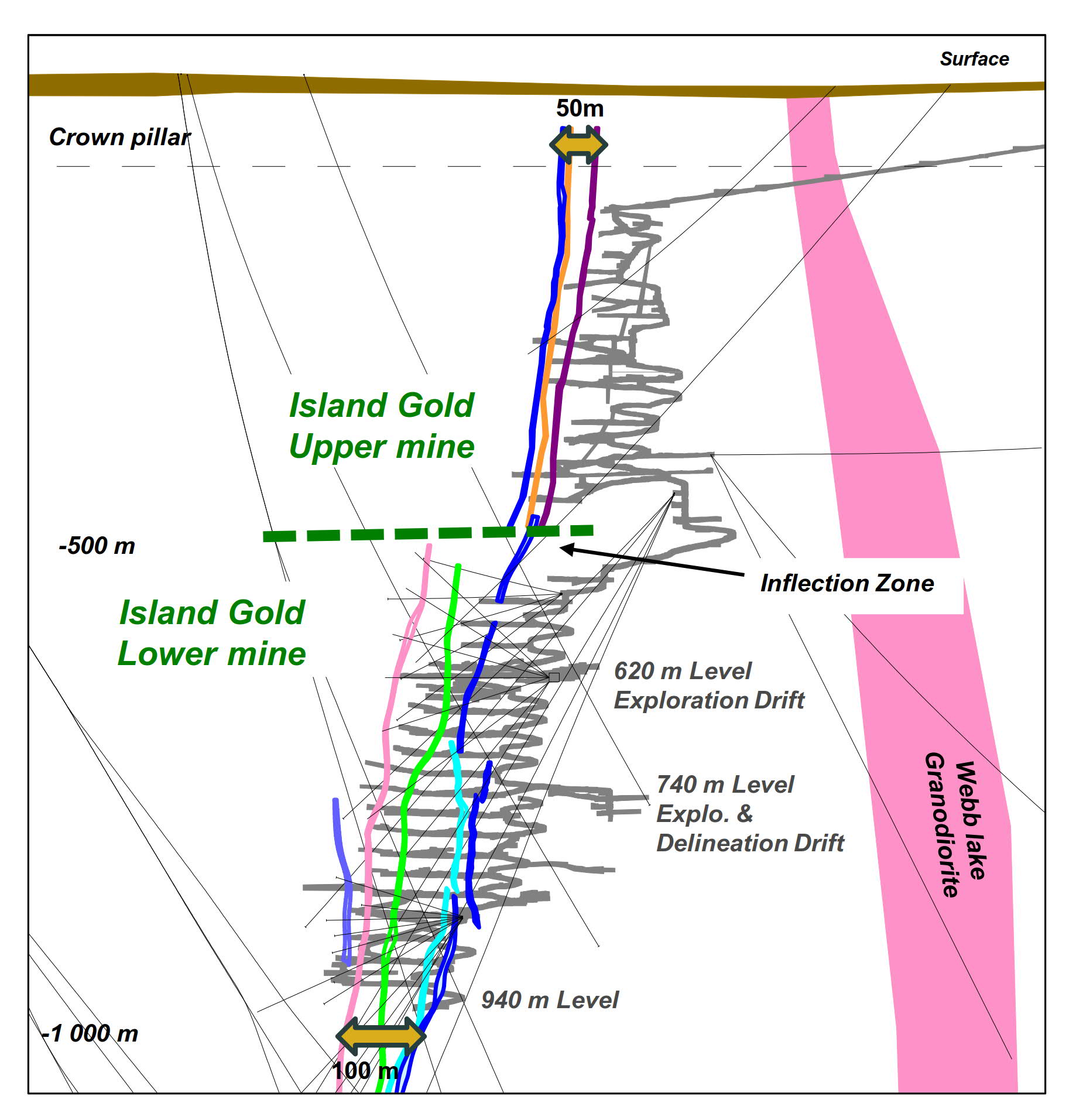

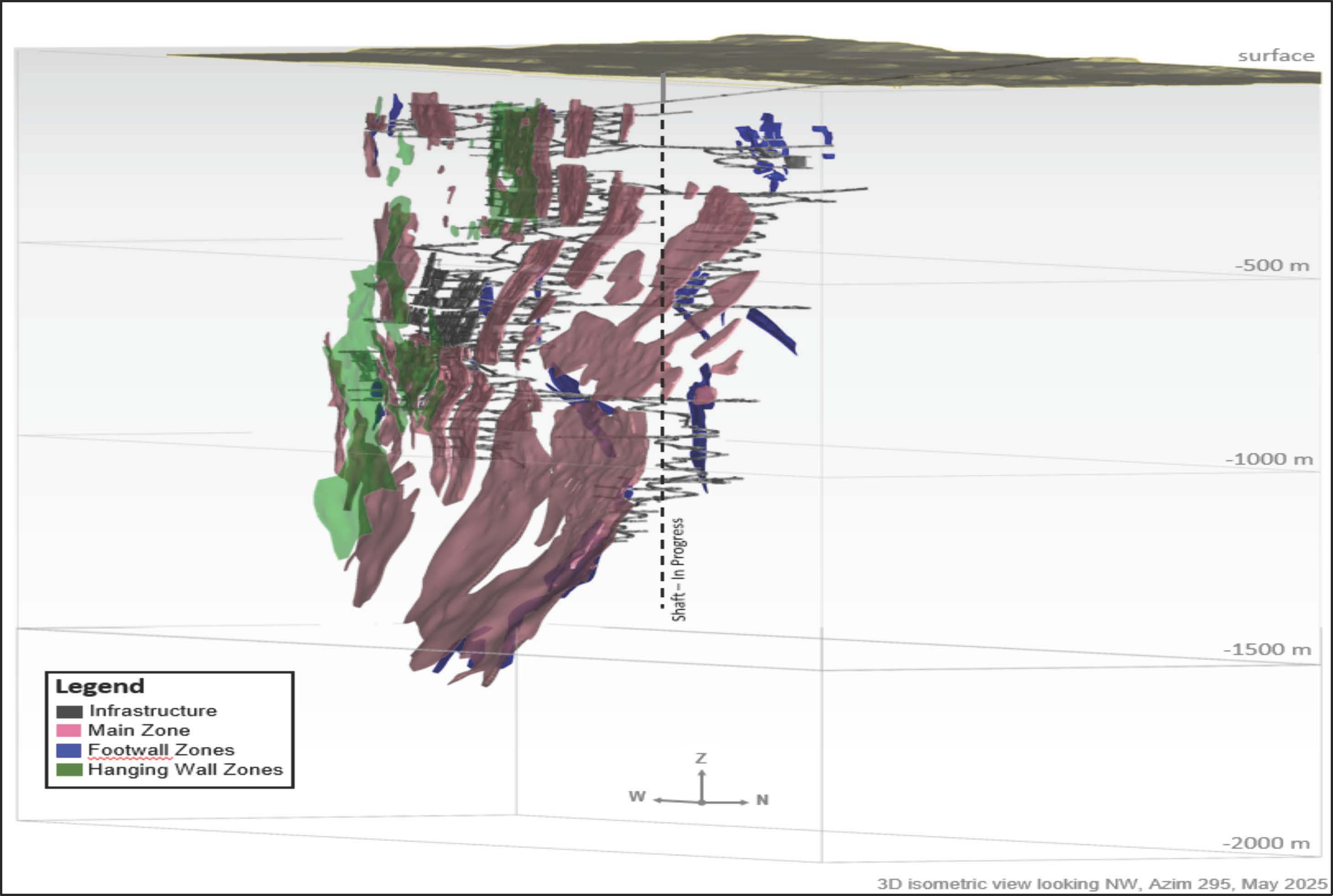

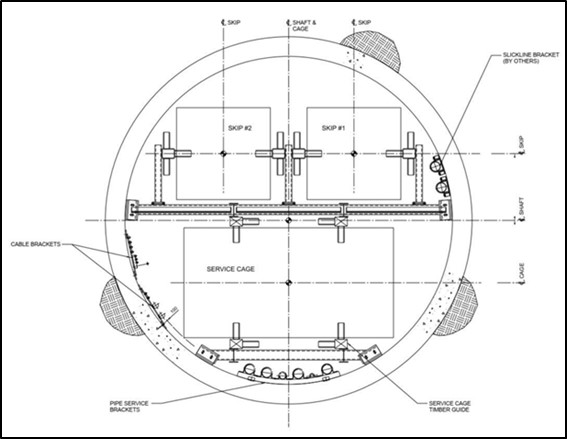

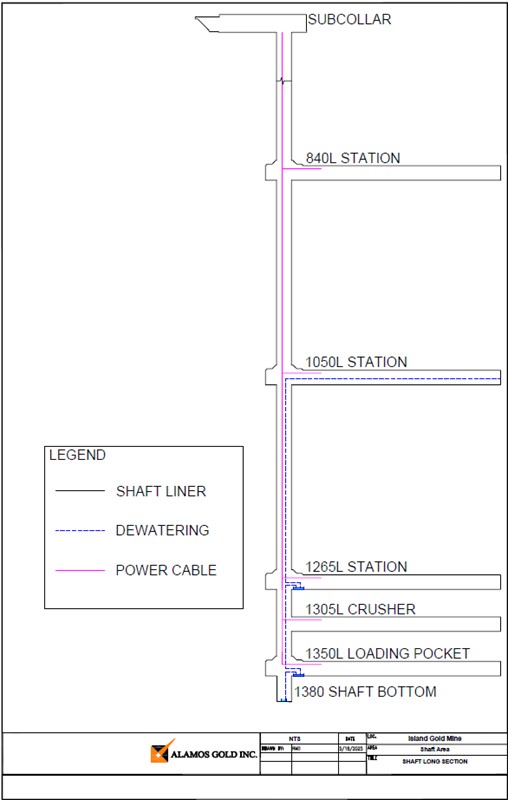

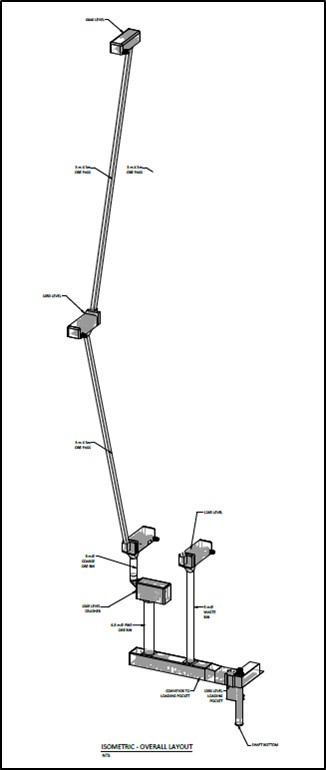

The underground mine is currently accessed via a single decline from surface down to the 425L, at which point multiple ramps are developed to internally access different zones of the mine at generally 26 m level intervals. A shaft is currently in development with completion scheduled in 2026 which will permit hoisting of ore and waste from the 1350L and provide services for the transport of personnel and services to any of three shaft stations.

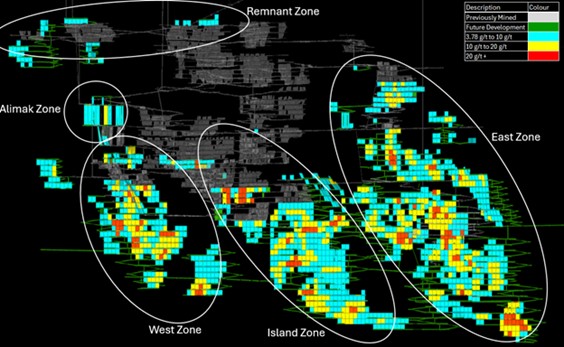

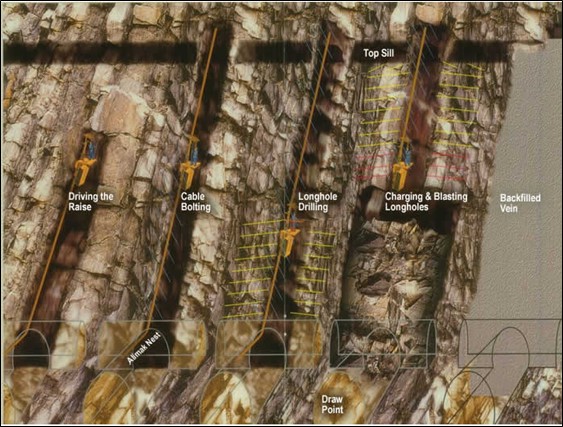

Multiple underground mining methods are employed, including: longitudinal longhole open stoping (principal method), transverse longhole open stoping, and alimak stoping. The selection of mining method is based on a variety of considerations including mineralization geometry, width of the ore zone, local stresses, etc.

A total of 140 km of lateral and vertical development are planned as part of the life of mine plan. Of this total approximately 21% is operating development, 75% is capital development and 4% is planned to support exploration activities.

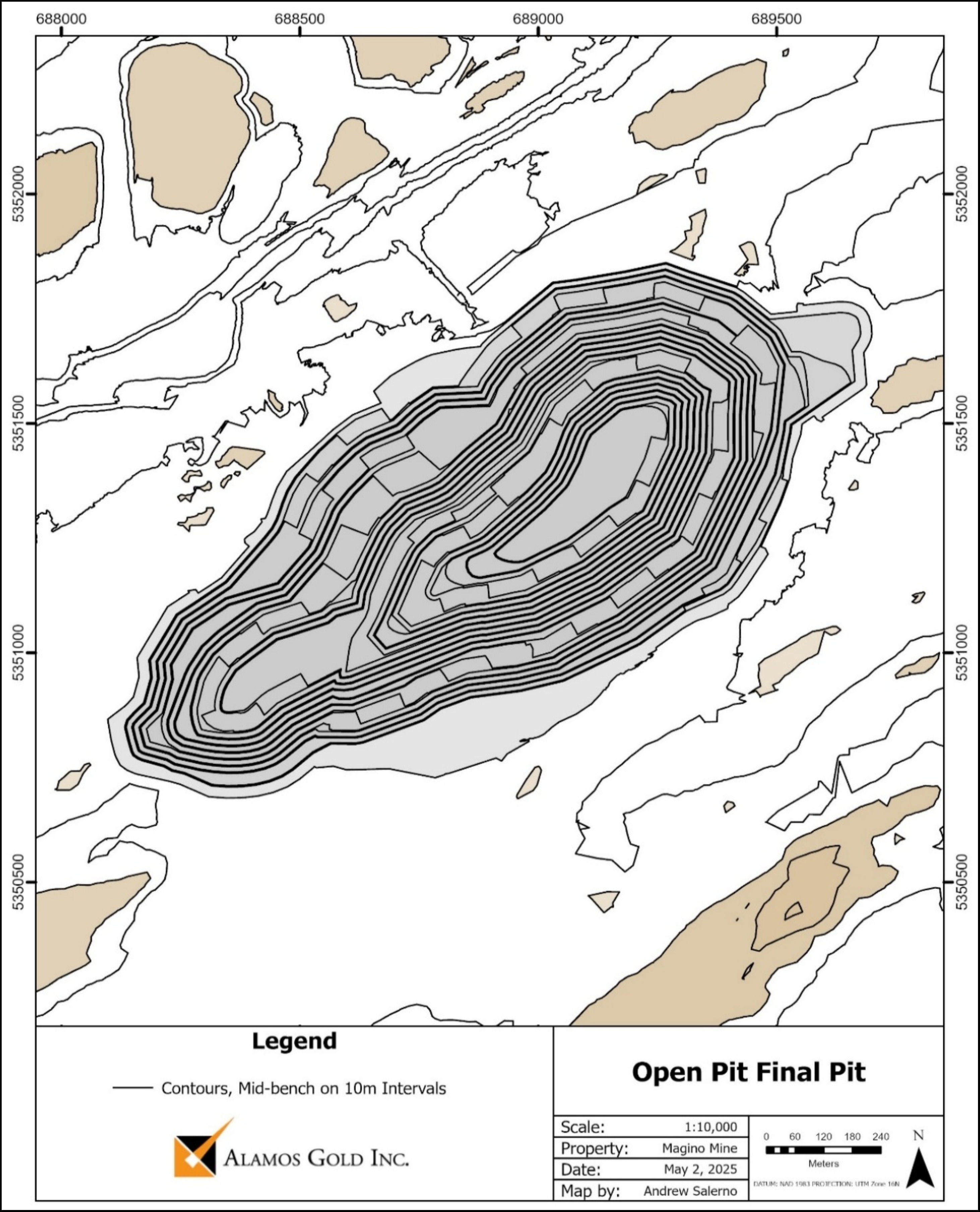

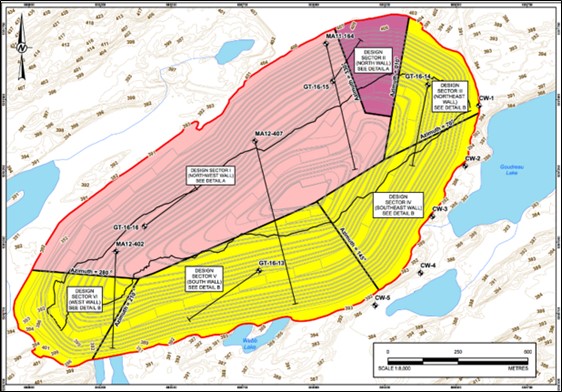

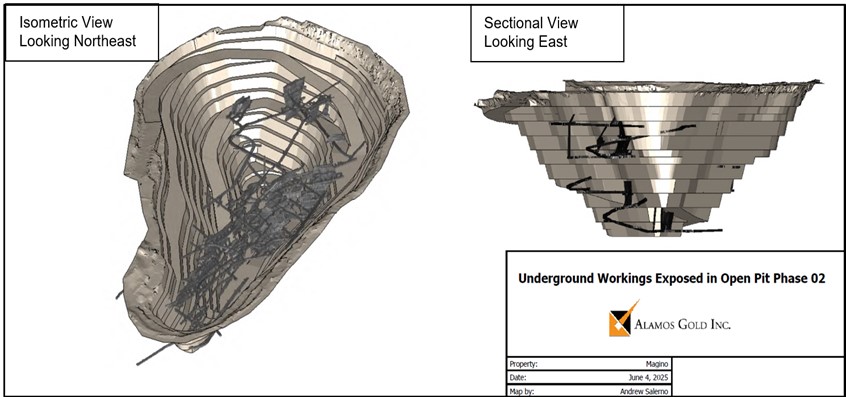

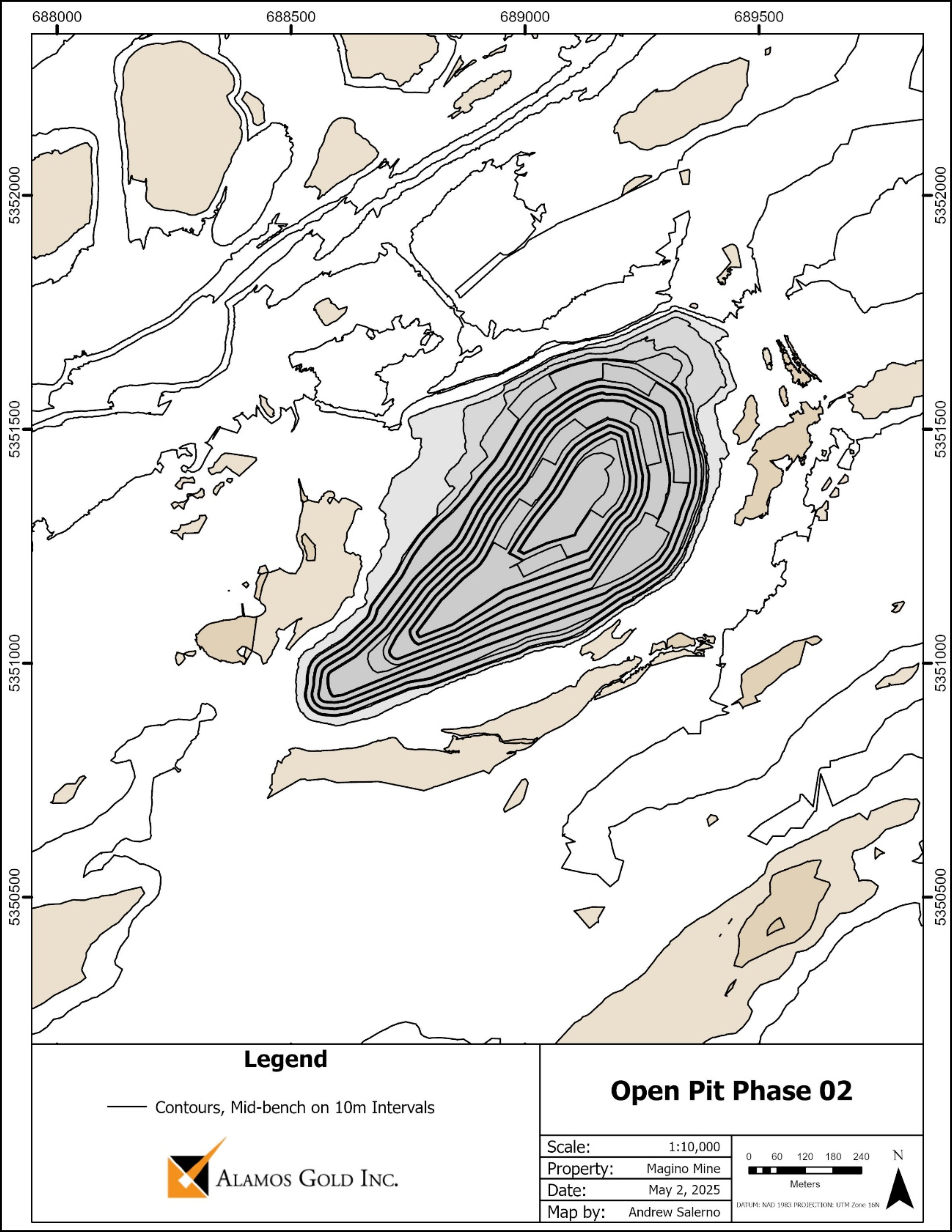

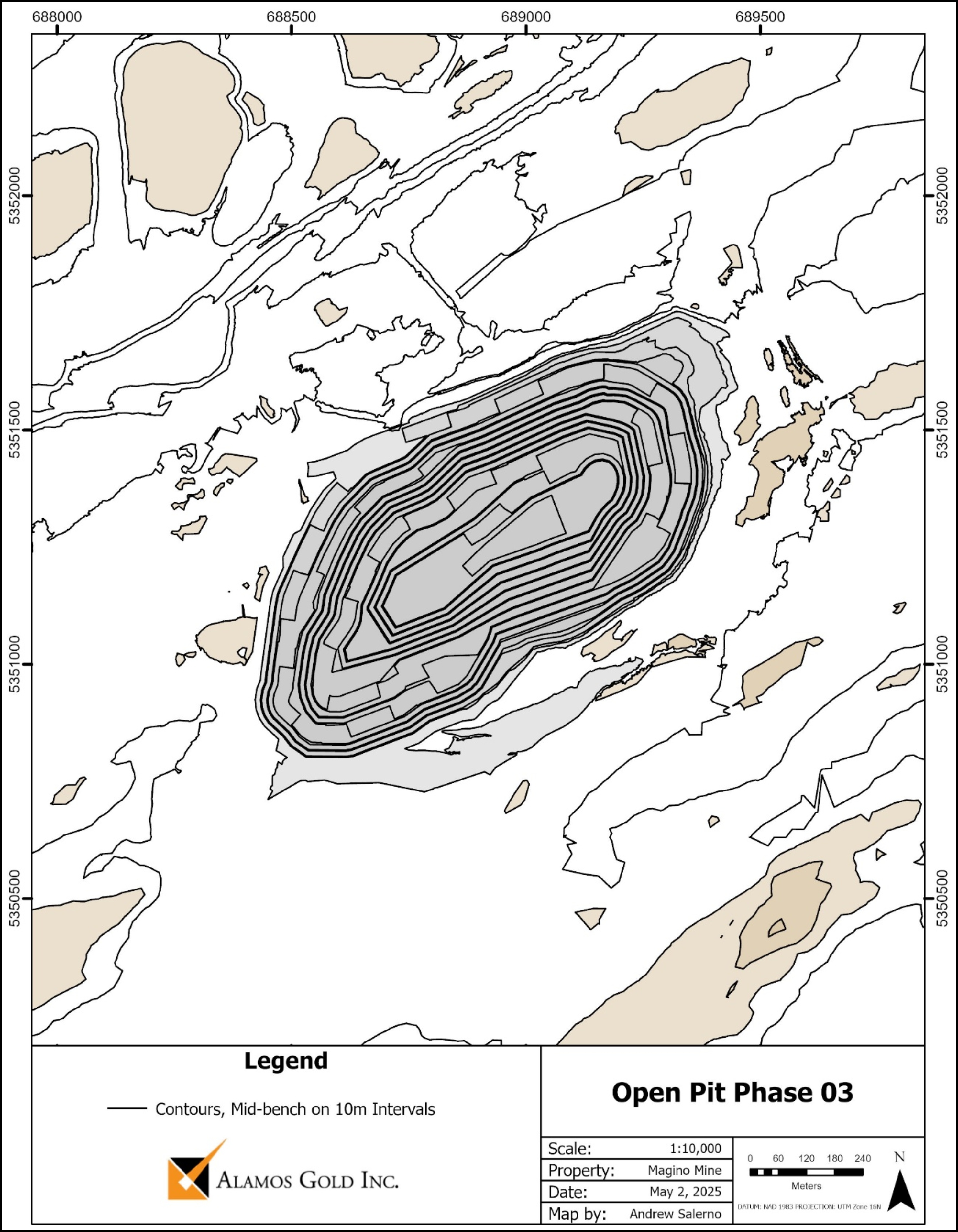

The open pit mine is a conventional truck and shovel mining operation, with a fleet of 139 t payload class haul trucks combined with diesel powered hydraulic shovels and excavators, supported by front-end loaders. The open pit operates at a peak mining rate of 74 ktpd ore and waste and has an overall strip ratio of 3.7:1 (waste:ore).

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 26

|

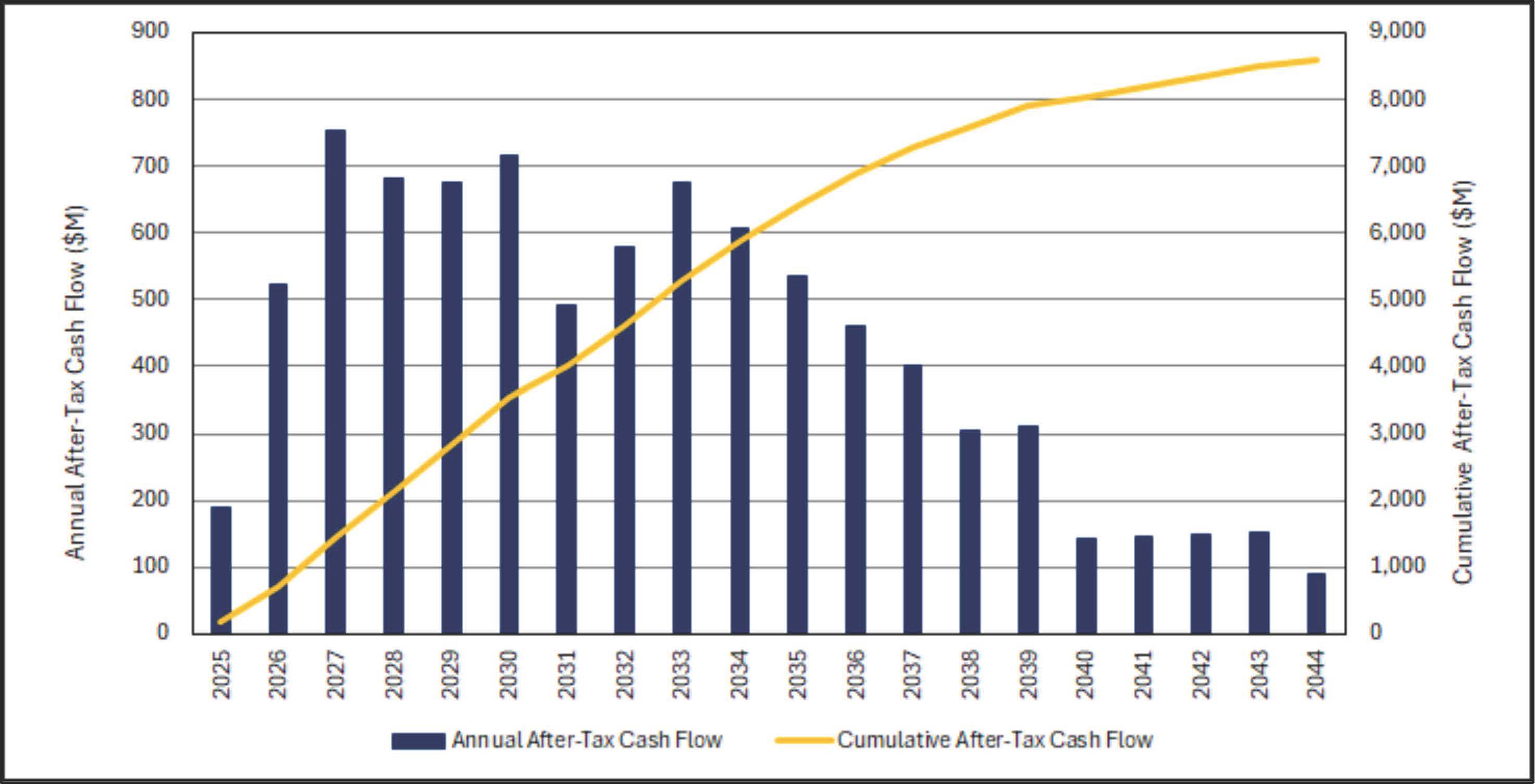

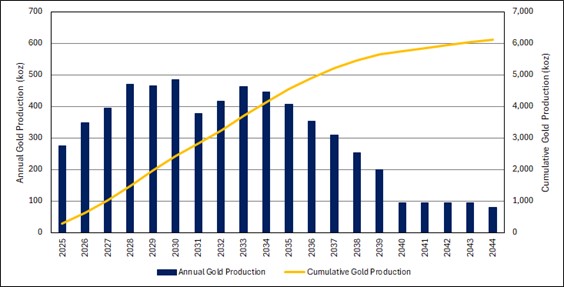

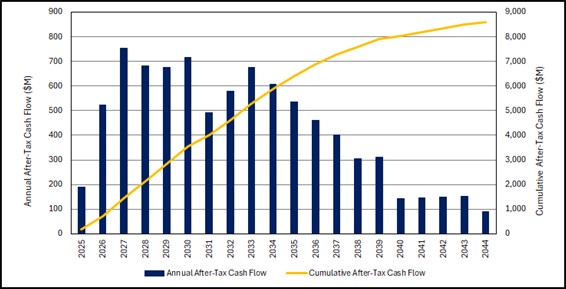

The combined open pit and underground operations have a remaining mine life through 2039. Processing of Magino stockpiles continues afterwards through 2044.

Key physicals associated with the underground life of mine plan are presented in Table 1-5. The open pit life of mine plan is presented in Table 1-6.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 27

|

Table 1-5 Life of Mine Underground Production Physicals

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Units | Total LOM | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 |

| Stope Tonnes | kt | 9,871 | 323 | 509 | 640 | 663 | 716 | 712 | 744 | 772 | 770 | 770 | 770 | 755 | 737 | 619 | 371 |

| Stope Grade | g/t | 11.38 | 13.06 | 11.25 | 11.99 | 13.81 | 13.68 | 13.33 | 10.93 | 12.92 | 13.54 | 11.62 | 10.28 | 8.25 | 8.82 | 7.44 | 9.67 |

| Development Tonnes | kt | 1,882 | 159 | 182 | 236 | 214 | 159 | 164 | 132 | 106 | 106 | 106 | 106 | 105 | 104 | 3 | - |

| Development Grade | g/t | 8.10 | 9.38 | 9.83 | 7.20 | 8.06 | 9.29 | 9.12 | 11.19 | 7.34 | 6.56 | 7.22 | 5.97 | 7.33 | 4.29 | 2.29 | - |

| Total Ore Tonnes | kt | 11,769 | 482 | 699 | 878 | 878 | 876 | 876 | 876 | 878 | 876 | 876 | 876 | 861 | 841 | 625 | 371 |

| Total Ore Grade | g/t | 10.85 | 11.83 | 10.85 | 10.69 | 12.42 | 12.88 | 12.54 | 10.97 | 12.24 | 12.70 | 11.09 | 9.76 | 8.14 | 8.25 | 7.41 | 9.67 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Waste Tonnes | kt | 7,287 | 520 | 656 | 724 | 728 | 726 | 700 | 704 | 606 | 579 | 597 | 392 | 279 | 71 | 5 | - |

| | | | | | | | | | | | | | | | | |

| Ore Development | m | 29,927 | 2,894 | 2,890 | 3,671 | 3,331 | 2,486 | 2,596 | 2,035 | 1,671 | 1,659 | 1,669 | 1,697 | 1,658 | 1,618 | 53 | - |

| Waste Development | m | 99,382 | 5,987 | 8,477 | 9,651 | 10,356 | 10,145 | 10,003 | 9,886 | 7,517 | 7,949 | 8,637 | 5,615 | 4,023 | 1,070 | 64 | - |

| Exploration Development | m | 5,509 | 888 | 960 | 991 | 186 | 372 | 197 | 267 | 1,215 | 432 | - | - | - | - | - | - |

| Total Lateral Development | m | 134,818 | 9,769 | 12,327 | 14,313 | 13,873 | 13,003 | 12,797 | 12,188 | 10,402 | 10,041 | 10,306 | 7,313 | 5,682 | 2,688 | 117 | - |

| | | | | | | | | | | | | | | | | |

| Raise Development | m | 5,305 | 364 | 1,039 | 367 | 459 | 454 | 278 | 430 | 453 | 374 | 312 | 344 | 263 | - | 168 | - |

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 28

|

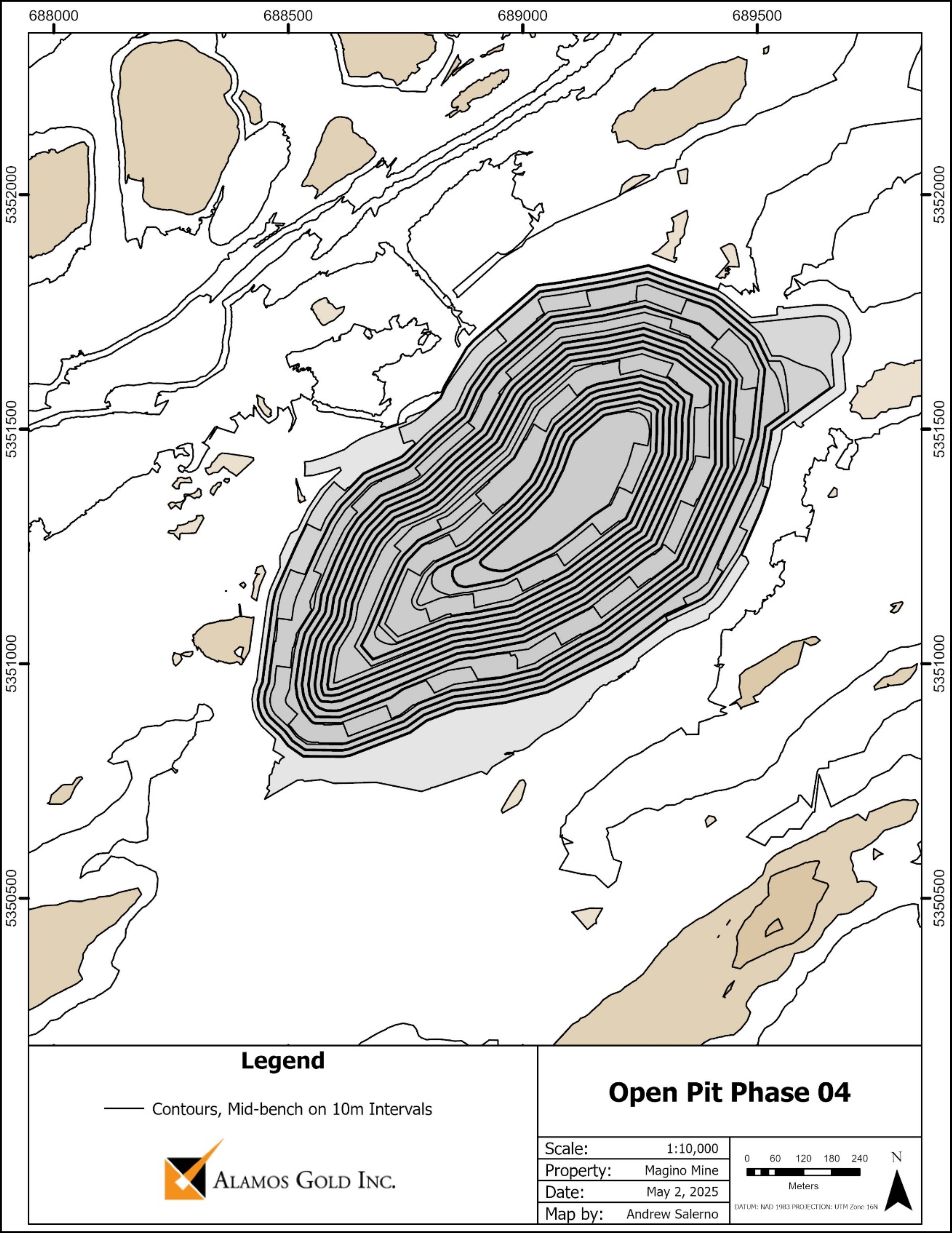

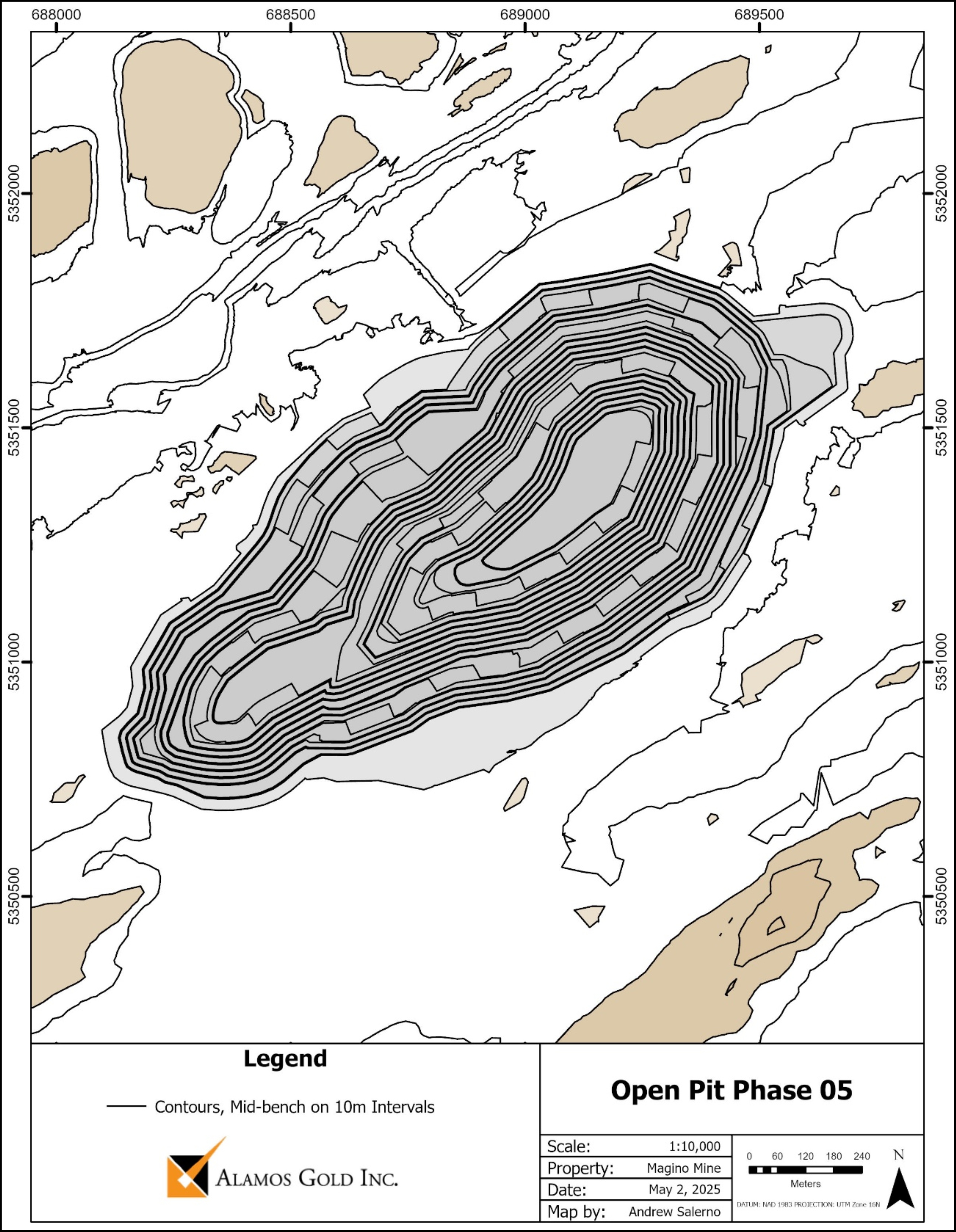

Table 1-6 Life of Mine Open Pit Production Physicals

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Units | Total | Period |

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

| Ore Tonnes | kt | 72,511 | 5,309 | 8,555 | 7,676 | 5,659 | 6,288 | 5,364 | 941 | 1,549 | 3,735 | 5,436 | 7,392 |

| Gold Grade | g/t | 0.92 | 0.85 | 0.82 | 0.94 | 1.00 | 0.80 | 1.08 | 0.66 | 0.73 | 1.00 | 0.99 | 1.03 |

| Gold Contained | koz | 2,142 | 146 | 224 | 233 | 183 | 162 | 186 | 20 | 36 | 120 | 173 | 244 |

| Waste Tonnes | kt | 267,977 | 15,456 | 15,037 | 18,727 | 21,266 | 20,637 | 21,561 | 23,275 | 23,275 | 19,600 | 17,899 | 15,943 |

| Total Tonnes Mined | kt | 340,488 | 20,765 | 23,592 | 26,403 | 26,925 | 26,925 | 26,925 | 24,216 | 24,824 | 23,335 | 23,335 | 23,335 |

| Strip Ratio | t:t | 3.70 | 3.91 | 2.76 | 3.44 | 4.76 | 4.28 | 5.02 | 25.74 | 16.02 | 6.25 | 4.29 | 3.16 |

| Re-handle Tonnes | kt | 35,925 | - | 337 | 1,648 | 740 | 730 | 730 | 2,709 | 2,111 | 0 | 0 | 0 |

| Total Tonnes Moved | kt | 376,413 | 20,765 | 23,929 | 28,051 | 27,665 | 27,655 | 27,655 | 26,925 | 26,935 | 23,335 | 23,335 | 23,335 |

| | | | | | | | | | | | | |

| Units | Total | Period |

| 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 |

| Ore Tonnes | kt | | 5,932 | 2,667 | 5,602 | 406 | - | - | - | - | - | - | - |

| Gold Grade | g/t | | 1.02 | 0.87 | 0.76 | 0.74 | - | - | - | - | - | - | - |

| Gold Contained | koz | | 194 | 74 | 136 | 10 | - | - | - | - | - | - | - |

| Waste Tonnes | kt | | 17,403 | 19,685 | 17,733 | 480 | - | - | - | - | - | - | - |

| Total Tonnes Mined | kt | | 23,335 | 22,352 | 23,335 | 886 | - | - | - | - | - | - | - |

| Strip Ratio | t:t | | 3.93 | 8.38 | 4.17 | 2.18 | - | - | - | - | - | - | - |

| Re-handle Tonnes | kt | | 27 | 1,018 | 251 | 3,747 | 4,538 | 4,526 | 4,526 | 4,526 | 3,759 | - | - |

| Total Tonnes Moved | kt | | 23,362 | 23,370 | 23,586 | 4,634 | 4,538 | 4,526 | 4,526 | 4,526 | 3,759 | - | - |

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 29

|

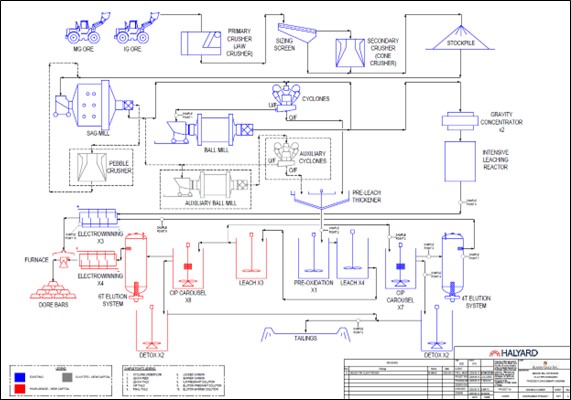

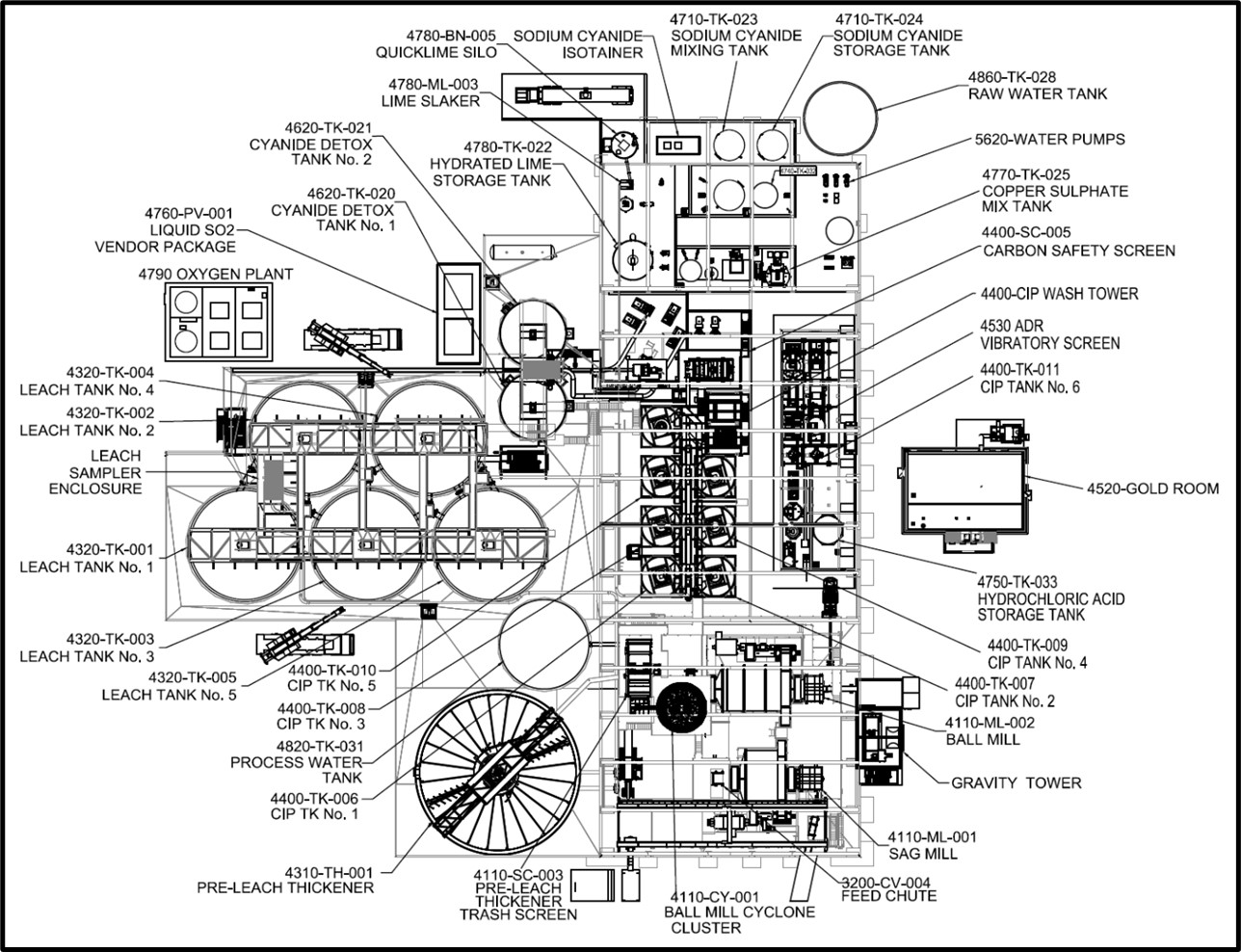

1.12 Processing

During H1-2025, both the Island Gold and Magino mills are used to process ore corresponding to each operation. In July 2025, the Island Gold mill will be put into a care-and-maintenance mode and eventually closed and dismantled.

Due to the limited use of the Island Gold mill in relation to the LOM presented within this Report, only the Magino mill process is presented.

The existing Magino processing facility will begin blending and processing Island Gold ore and Magino ore together in July of 2025. This will be described as Step 1 “Existing Magino Processing Facility”. In 2025 and 2026 Island Gold ore will be pre-crushed at the existing Island Gold crushing plant and hauled to Magino via a 2.7 km dedicated haul road at an initial rate of 1,200 tpd, increasing to 1,400 tpd by the end of 2025. Magino ore will fluctuate between 9,800 tpd and 10,000 tpd resulting in a combined Step 1 mill throughput of 11,200 tpd through the Magino processing facility. Starting in 2027 Island Gold ore will be crushed underground as opposed to at the existing Island Gold crushing plant and will be transported 6.6 km from the shaft complex to the Magino mill for processing.

The mill feed head grade is based on a 9:1 blend ratio of Magino lower grade ore at a nominal 1.0 g/t gold and Island Gold higher grade ore at a nominal 10 g/t gold, on average. This produces an average feed grade of approximately 1.9 g/t gold. The overall gold recovery from the blend is expected to be approximately 96.0%.

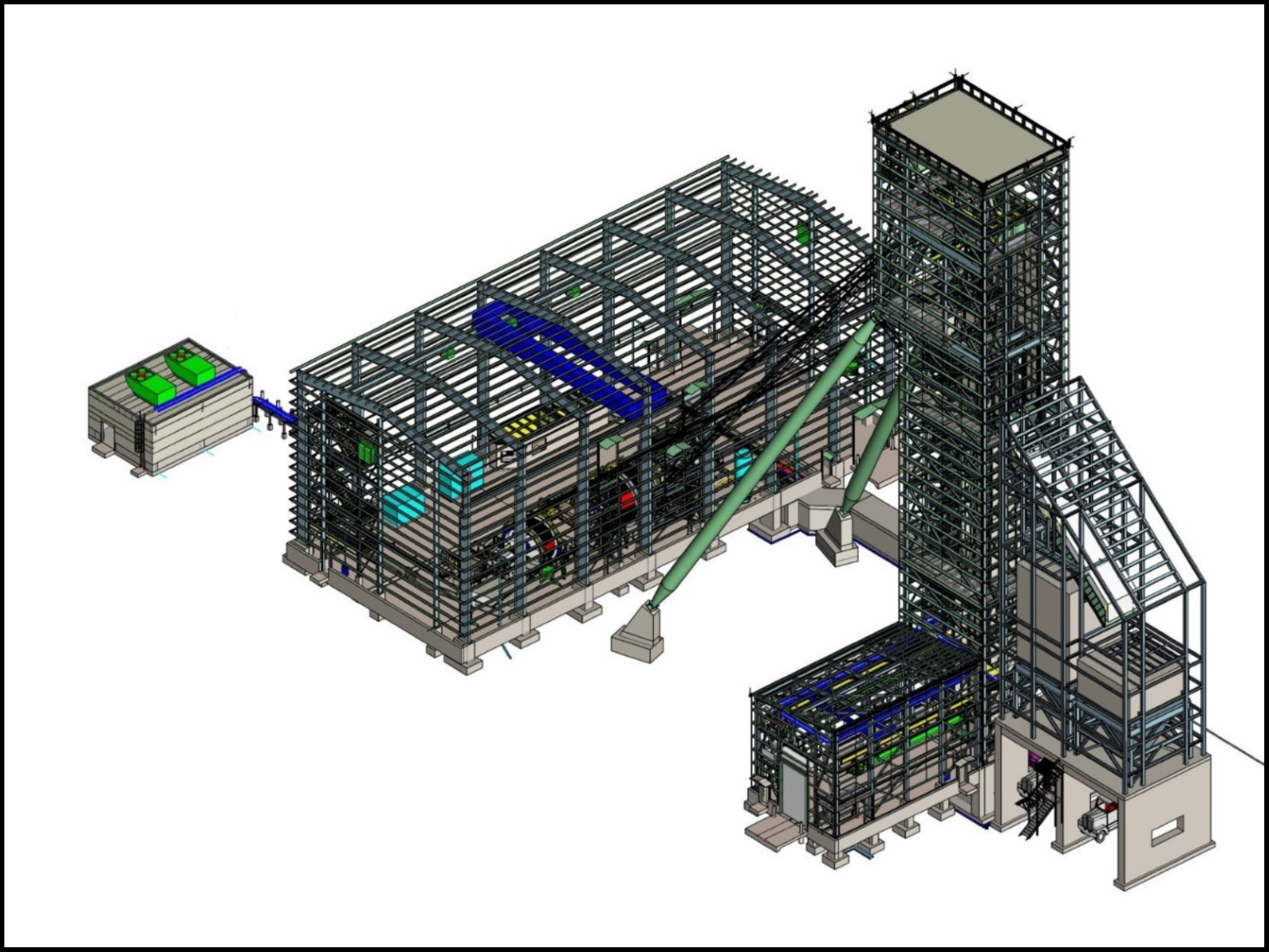

The existing Step 1 Magino process plant utilizes a crushing and grinding configuration consisting of a primary jaw and secondary cone crushing followed by a semi-autogenous (SAG) mill and ball mill grinding configuration. Ball mill discharge is in closed circuit with cyclones for classification and a gravity circuit to remove coarse gold. Cyclone overflow product is thickened and pumped to the existing carbon-in-leach (CIL) circuit where oxygen, lime and cyanide are added for cyanidation. The carbon-in-pulp (CIP) circuit recovers the dissolved gold and silver from the leached slurry. Loaded carbon from the CIP circuit is acid washed, followed by carbon stripping using an Anglo American Research Laboratories (AARL) elution process and electrowinning to recover the gold. Gravity concentrate is processed via an intensive leaching reactor (ILR). Pregnant solution from the AARL has two electrowinning cells and the ILR has its own electrowinning cell. This is followed by smelting of the filtered electrowinning sludge to produce gold doré.

CIP slurry tailings are pumped to the cyanide destruction circuit which uses a sulphur dioxide process to reduce the cyanide weak acid dissociable concentration to acceptable environmental levels prior to pumping of the plant tailings to the tailings management facility.

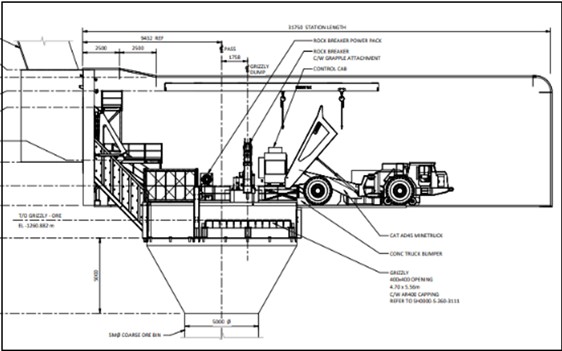

The Magino process plant Step 2 expansion phase will utilize underground crushing of Island Gold ore along with existing Magino ore being processed through the existing Magino crushing plant. Grinding will include the addition of a pebble crusher and auxiliary mill to re-crush the oversize product. The ball mill will be retrofitted with a new gear reducer to speed up the ball mill to 78% of critical speed. These additions will help improve mill throughput to 12,400 tpd. The Step 2 expansion will also include an expanded gold recovery plant to support additional gold production. The gold recovery plant consists of pre-oxidation, leaching, CIP elution, electrowinning and smelting. This expansion is expected to be completed in Q3-2026 and is linked to the completion of the Island Gold underground shaft and ore handling system, which is scheduled for completion in phases between Q3-2026 and H1-2027.

The Step 2 blending and crushing process at Magino will remain similar to Step 1. This will consist of blending 2,400 tpd Island Gold ore and 10,000 tpd Magino ore through the crushing and grinding system, resulting in a combined throughput of 12,400 tpd. The mill feed head

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 30

|

grade is based on Magino lower grade ore at a nominal 1.0 g/t gold and Island Gold high grade ore at a nominal 10 g/t gold, producing an average feed grade of approximately 2.7 g/t gold. The overall gold recovery from the blend is expected to be approximately 96.0%.

An underground crushing system to be implemented as part of the Phase 3+ Expansion will be introduced at this time and is expected to produce a 125 mm crushed product. The ore will be skipped to surface, loaded into 40 t haul trucks and transported to the Magino crusher utilizing a designated 6.6 km haul road. When completed, this underground crushing system will replace the existing surface crusher at Island Gold.

The existing Step 1 Magino process plant consists of the following unit operations:

•Primary and secondary crushing circuit and associated material handling equipment;

•Crushed ore storage reclaim tent and associated reclaim systems;

•SAG mill and ball mill circuits that produce a primary grind size P80 of 75 µm, gravity concentrators, cyclone classification and associated pumping and material handling systems;

•Pre-leach thickening;

•Cyanidation (5 leach tanks) circuit providing approximately 27 hours residence time;

•CIP carousel (7 tanks) circuit;

•Acid wash, elution, and carbon reactivation (4.0 t AARL plant);

•Gold electrowinning and smelting (gold room);

•SO2 cyanide destruction (2 DETOX tanks); and

•Tailings pumping to the primary tailings management facility.

The Step 2 Magino process plant expansion includes the following additions to the unit operations:

•Installation of a pebble crusher and auxiliary mill to the existing grinding circuit to increase throughput to 12,400 tpd;

•Conversion of one existing leach tank into a pre-oxidation tank;

•Installation of a leach feed transfer pump to split the feed between the existing leach circuit and Step 2 leach circuit;

•Installation of four additional leach tanks, providing approximately 48 hours additional residence time;

•Installation of an additional CIL carousel circuit (eight pump cell tanks);

•Installation of an additional 6.0 t adsorption-desorption-recovery (ADR) plant consisting of acid wash, elution (6.0 t ZADRA), and carbon reactivation;

•Replacement of the existing gold room with a new gold room for the increased doré production;

•Installation of an additional cyanide destruction circuit; and

•Installation of a new tailings pumping system for the increased throughput.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 31

|

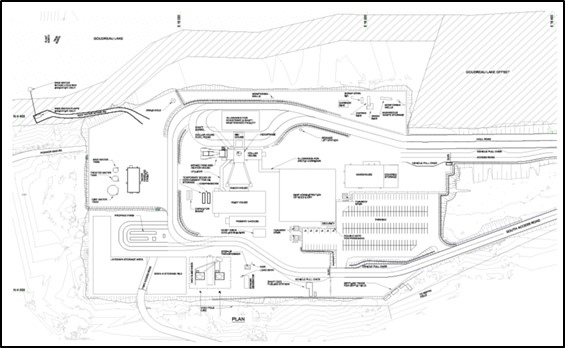

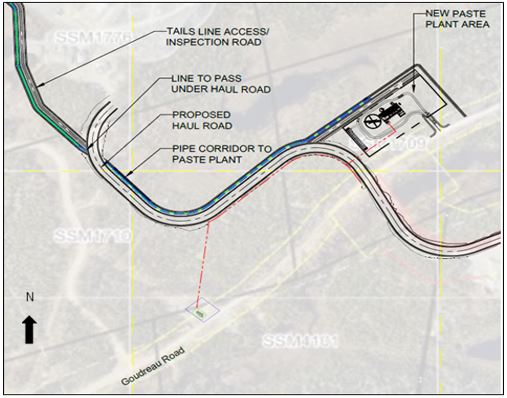

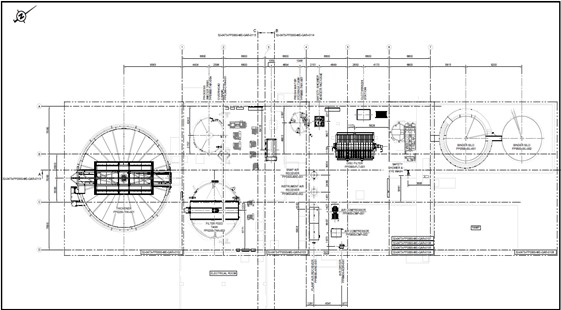

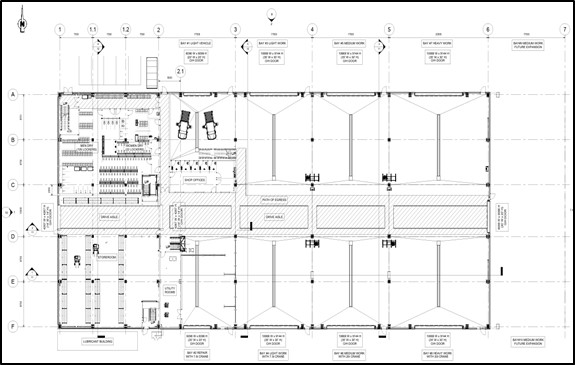

1.13 Project Infrastructure

Principal site infrastructure at the District has generally been constructed, with only a few outstanding buildings scheduled for completion for 2025 through 2026. Major infrastructure currently installed (or in the process of being installed) includes:

Current Infrastructure

•Dubreuilville infrastructure, including a main administrative building and camp facilities.

•Primary access and mine haul roads.

•A 10,000 tpd gold process plant.

•Underground and surface mining and maintenance facilities including an underground portal, fuel bays, and maintenance facilities.

•Warehousing facilities at both Island Gold (permanent) and Magino (temporary).

•A temporary explosive magazine managed by a specialized contractor at Magino and underground explosive magazines at Island Gold.

•A powerline connection to Island Gold and a compressed natural gas power generation station powering Magino.

•A mine rock management facility for the storage of non-acid generating waste rock excavated principally from Magino but also from development activities at Island Gold. Overburden (organics, soils, etc.) is collected from mining and infrastructure expansion areas and deposited in the southwest management area for temporary storage until required for progressive or final closure remediation purposes.

•A mid- to long-term stockpile storage area which is an integral part of the MRMF, forming the eastern side of the MRMF.

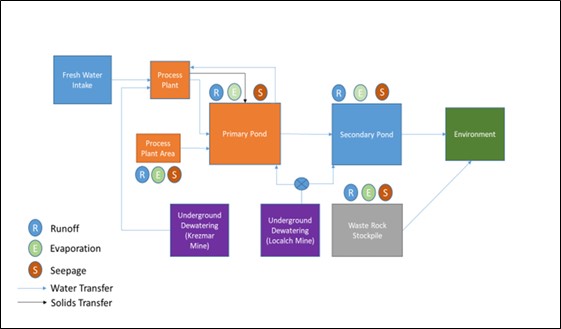

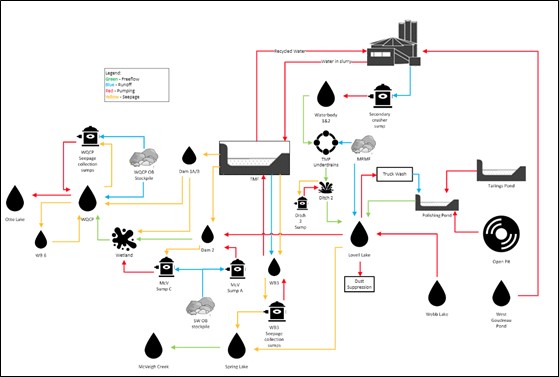

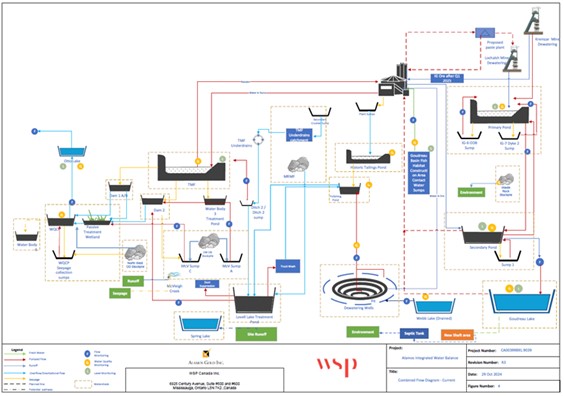

•A water treatment system designed to manage water for both Island Gold and Magino. An integral water balance of the integrated District has been developed.

•A tailings management facility for the storage of process tailings, including sufficient volume for the storage of historical Magino tailings and the sub-aqueous deposition of a limited quantity of potentially acid generating waste from Magino.

•Misc. security, administration, and general offices and buildings located throughout the property.

Under Construction

•An expansion of the current Magino mill to 11,200 tpd in 2025, including an assay laboratory. The mill will be further expanded to 12,400 tpd for 2027.

•Mining and maintenance facilities including a shaft complex (including new offices and maintenance facilities) and a paste backfill plant at Island Gold and a truck shop and truck wash at Magino. The truck shop will also contain new mine and maintenance offices and a warehouse facility.

•An underground ore / waste handling and crushing system for completion in 2026, as well as the development of an underground distribution system for paste backfill.

•Identification and construction of a new explosive magazine for the District for implementation in 2026.

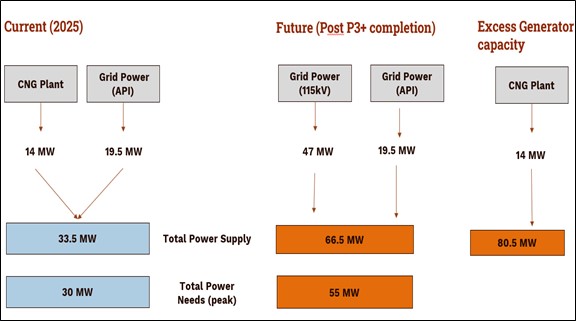

•A 115 kV connection of the provincial power grid to Magino to lower requirements from the compressed natural gas plant is programed for completion in 2026.

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 32

|

1.14 Environmental Studies, Permitting and Social or Community Impact

From exploration to operations to closure, one of the goals at the District is to safeguard the environment, educate its employees and the communities about the company’s environmental programs and commitments, and apply best management practices to prevent or mitigate any potential environmental impacts.

Numerous baseline studies have been completed across the District in the past 10 years as part of the various Island Gold expansion studies as well as the Magino Mine development which included a Federal Environmental Assessment process that was concluded in January 2019. Monitoring programs at both mine sites have been developed over time in collaboration with the numerous Indigenous Communities with whom Alamos has formal agreements.

The Island Gold Mine is located within the Maskinonge Lake and Goudreau Lake sub-watersheds (total area of 48.2 km2), approximately 40 km south of the Arctic drainage divide. Both sub-watersheds are part of the Michipicoten-Magpie watershed and Lake Superior Drainage Basin. Surface water drainage at the site is bedrock-controlled, generally flowing from northeast to southwest within the valleys between the elongated hills and ridges.

Magino is located within the Magpie – Michipicoten River Basin. The line dividing the river basins bisects the property, with surface flows in the northwestern portion of Magino draining to the Magpie River, and surface flows in the southeastern portion of site draining to the Michipicoten River. Both catchments eventually drain to Lake Superior.

Both mines are required to have an on-going water balance model which tracks all inputs and outputs out of the system. Since the integration of the Island Gold and Magino mines, an integrated water balance is being developed. This is still a work in progress and will allow for optimization of water management between the combined mine sites.

At Island Gold a groundwater monitoring program has been in place since 2013 with regular monitoring of groundwater levels and quality. Additional wells were installed from 2022 to 2024. Samples from the groundwater wells have been tested for various parameters including metals, cyanide, hydrocarbons, and anions, with no exceedances of the Ontario drinking water quality guidelines.

At the Magino, overall groundwater quality sampling results indicate that the groundwater in the project area is of good quality.

The District is largely composed of trembling aspen, white birch, balsam poplar, black spruce, white spruce, balsam fir, and jack pine. Wildlife populations in the area are regionally typical with the noted presence of moose, wolves, foxes, black bears, beavers, otters, muskrats, mink, snowshoe hares and red squirrels.

Several species at risk have been identified within the District and are discussed in detail in Section 20.1.7.

District strategy is to reduce consumption, reuse any waste generated, and dispose final waste in a safe and responsible manner. A waste management procedure has been developed and implemented for the District; it provides guidance to District and non-District personnel on the handling, processing, and disposal of waste, including hazardous waste and domestic materials generated during the normal operations of the facility.

Relevant regulatory agencies for the anticipated District permitting needs include the provincial Ministry of the Environment, Conservation and Parks, Ministry of Natural Resources, Ministry of Ministry of Energy and Mines. There may also be permitting requirements from the Federal

| | | | | |

Island Gold District – NI 43-101 Technical Report August 6, 2025 | 33

|

Department of Fisheries and Oceans and the Impact Assessment Agency of Canada if Alamos triggers any substantial changes to the current federal environmental assessment.

All permitting activities will cover modifications and/or additions to the site including but not limited to:

•Increased production rates;

•Updated water management and effluent discharge strategies;

•New air and noise discharges;

•Infrastructure additions/modifications related to the paste fill plant and new shaft area;

•New access roads;

•Aggregate sources; and

•Potential impacts to terrestrial habitats and natural water bodies including related fisheries resources.

The District’s environmental programs are designed with the goal of preventing all environmental incidents. However, in the event of unplanned incidents, the mine maintains a high degree of emergency preparedness with appropriate plans, resources, and training to minimize the impact on workers, operations, the environment, and the community should an unplanned incident occur. A spill prevention and control plan is mandated under the regulatory requirements of Ontario Reg. 224/07 Spill Prevention and Contingency Plan, the primary purpose of which is to prevent and reduce the risk of spills of pollutants, and to prevent, eliminate or ameliorate any adverse effects that result from spills of pollutants, is updated annually.

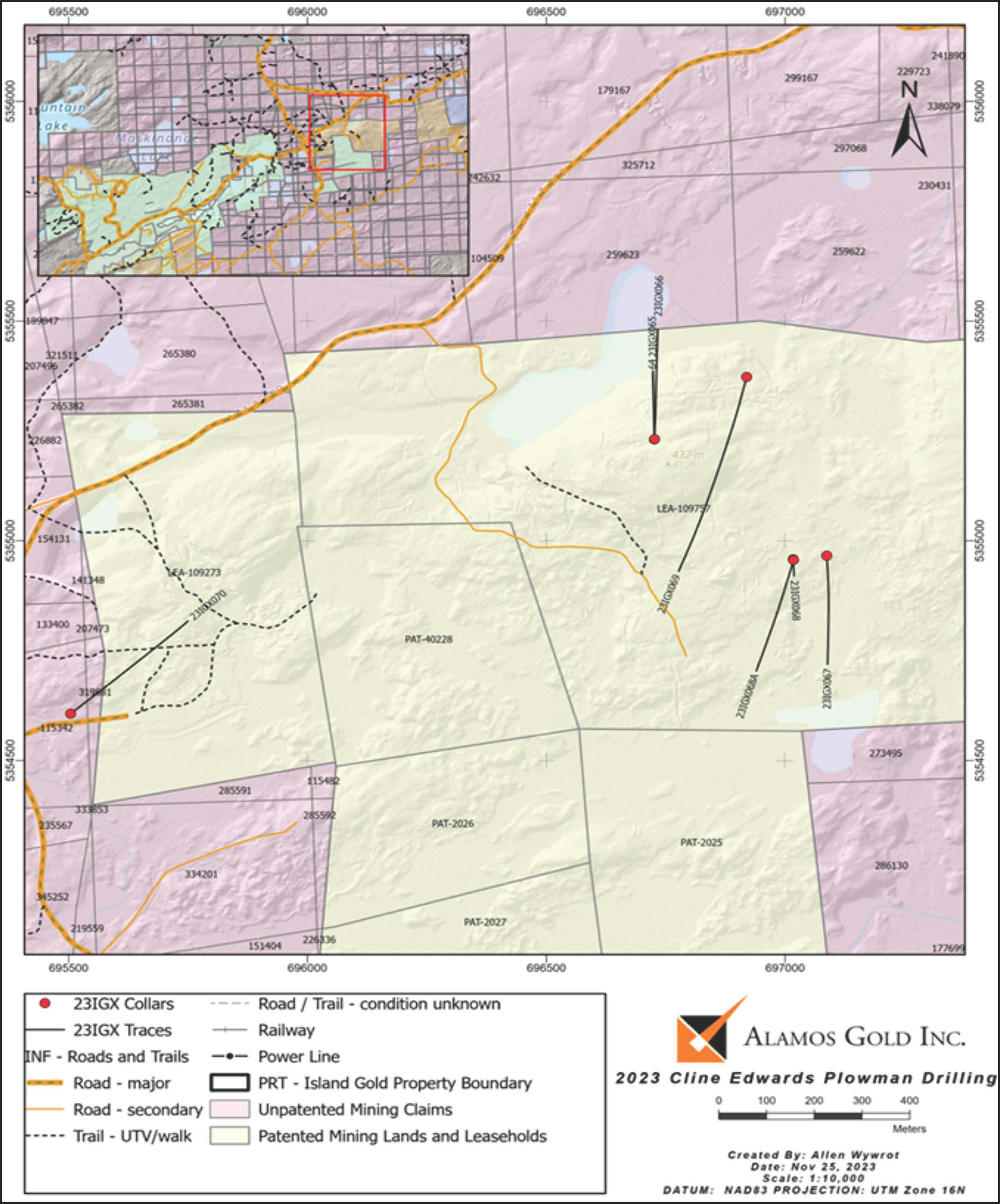

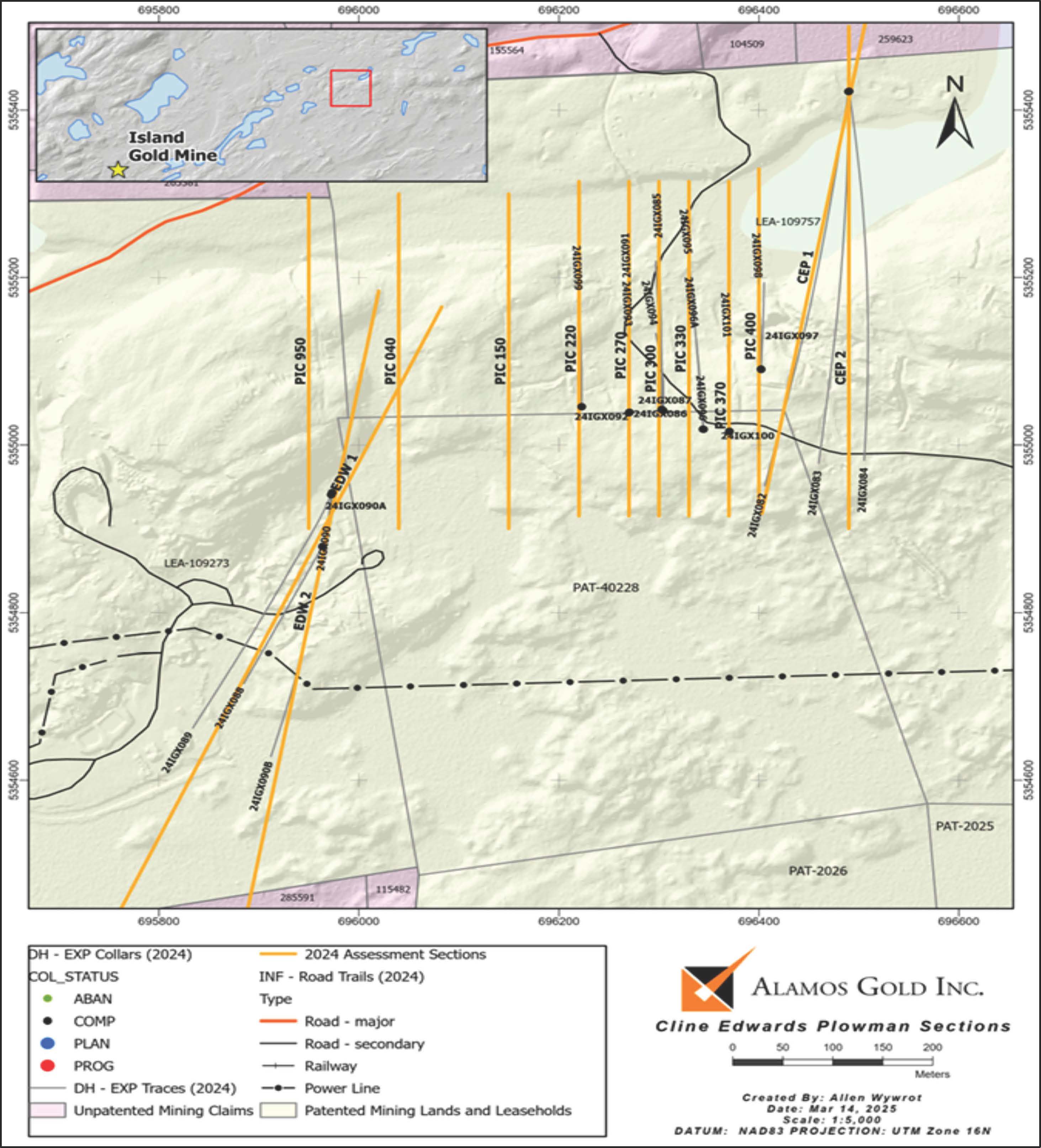

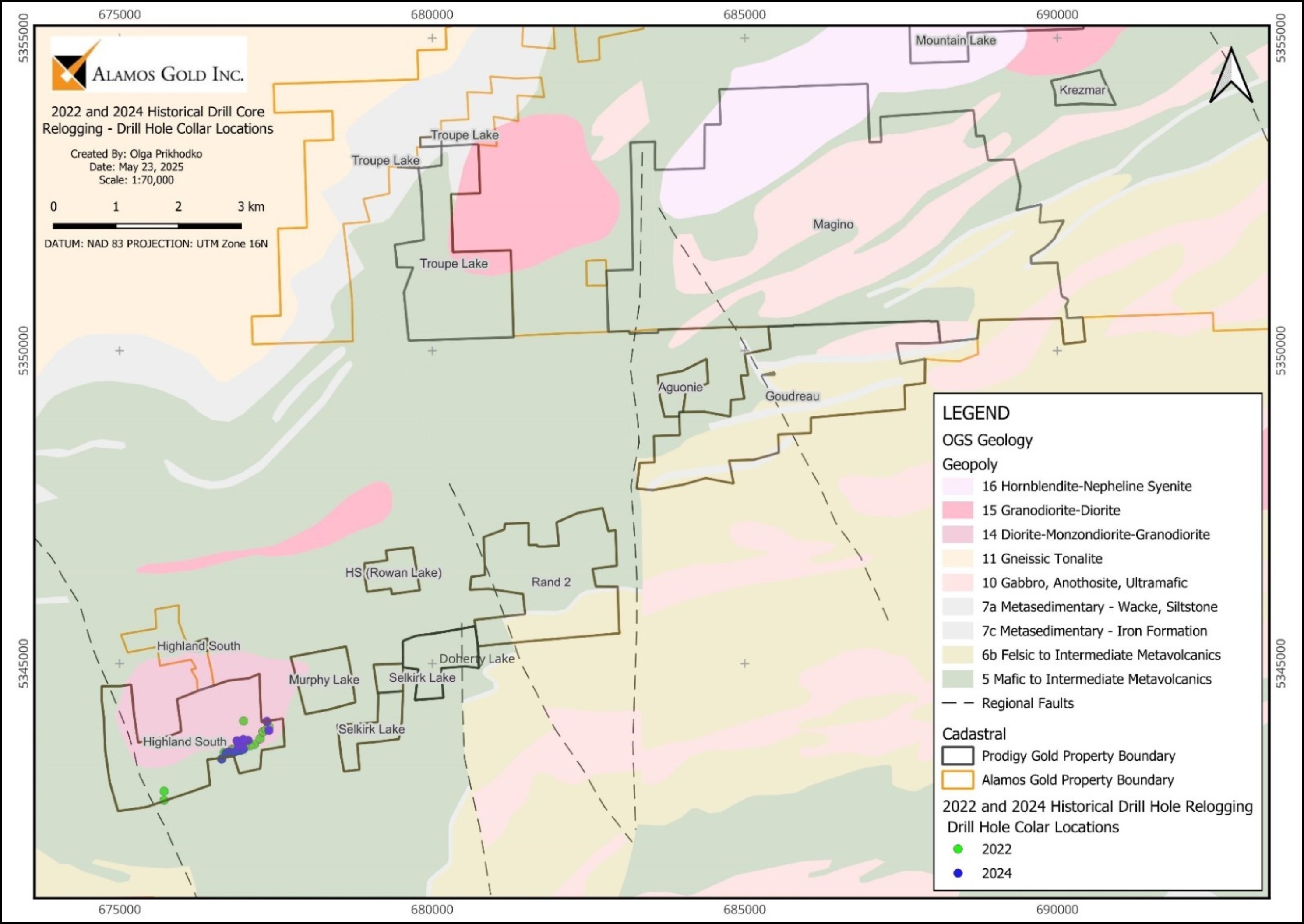

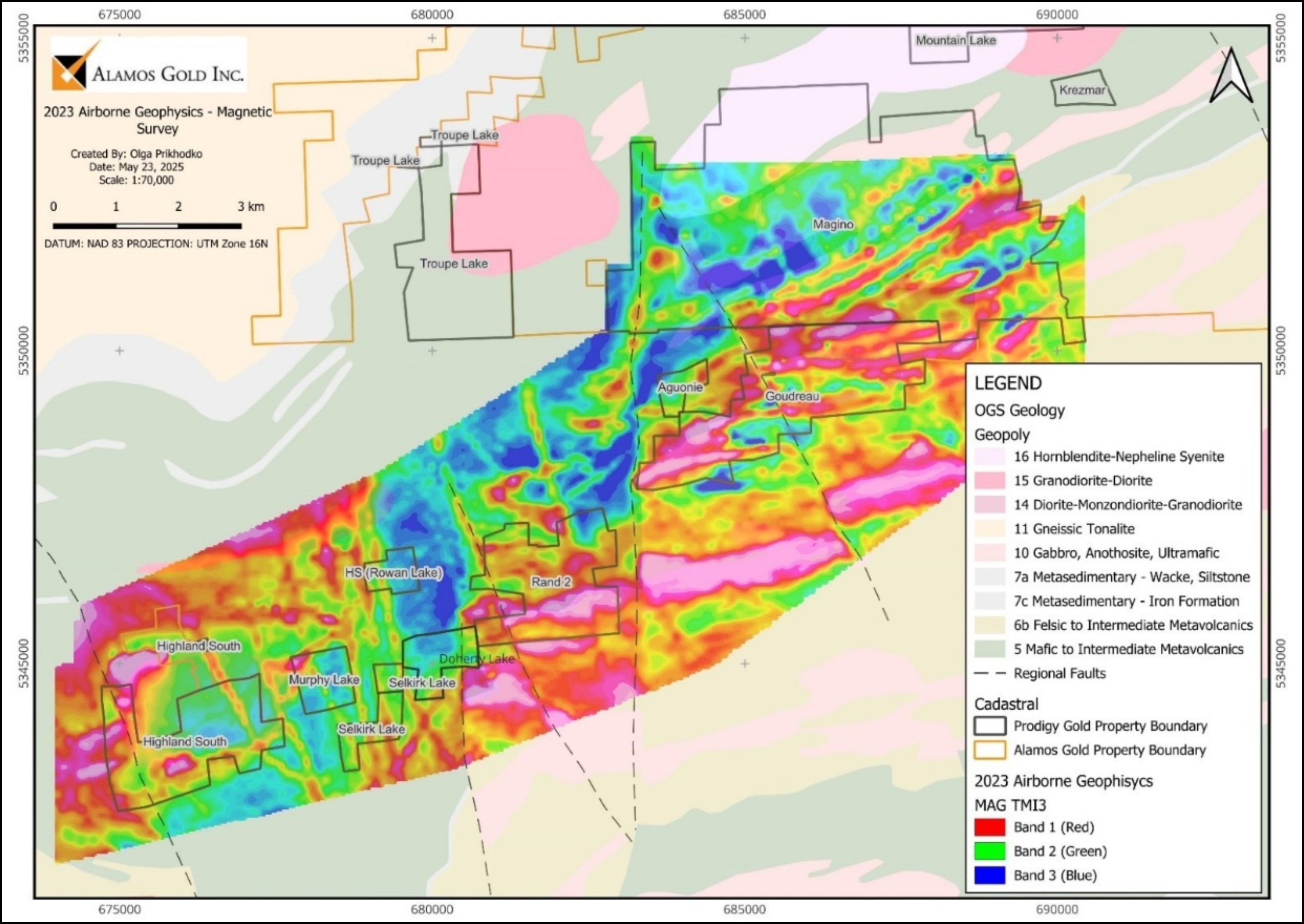

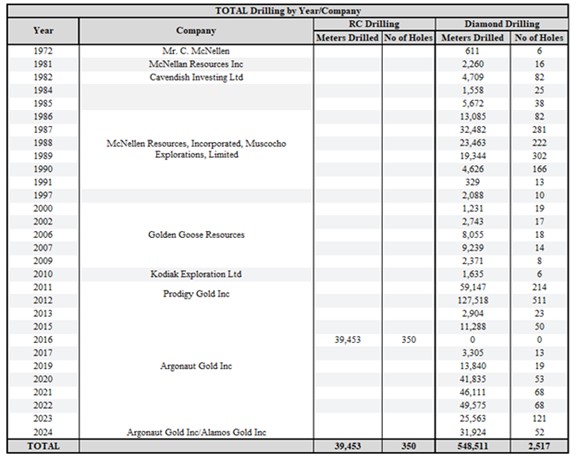

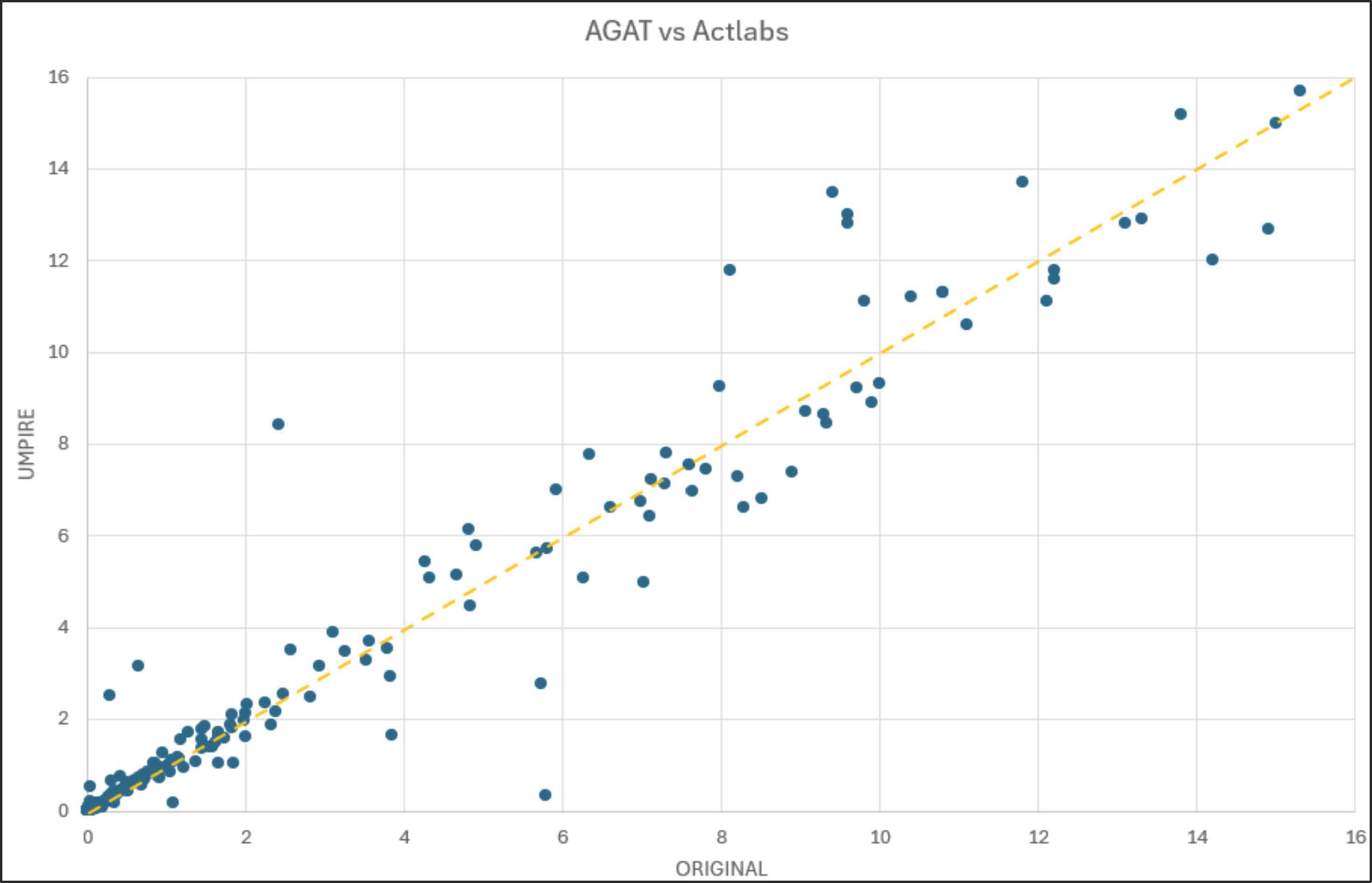

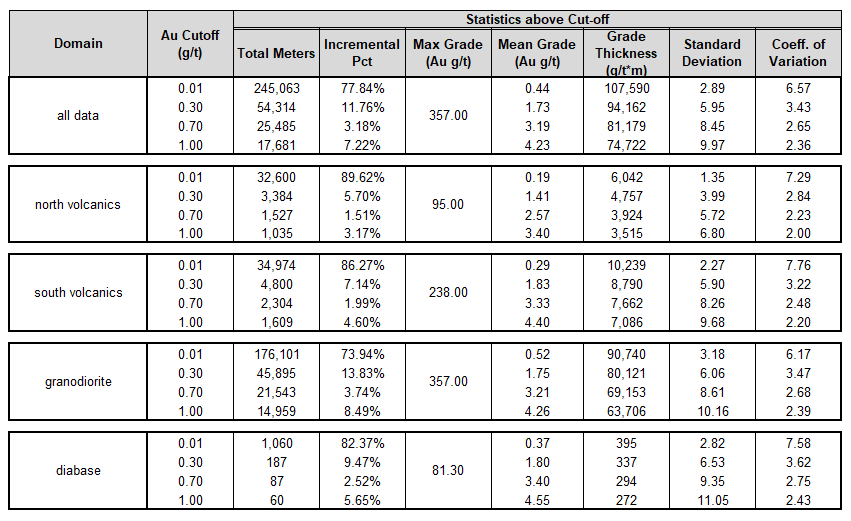

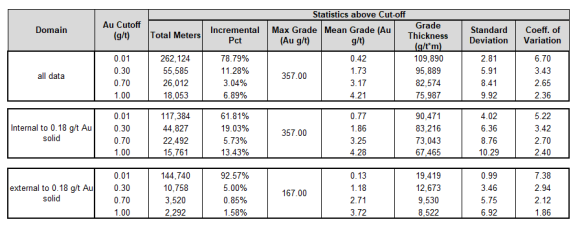

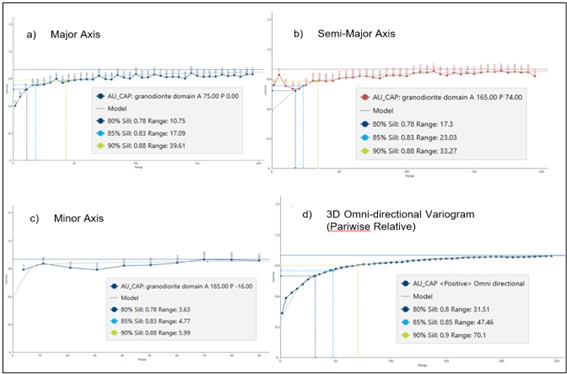

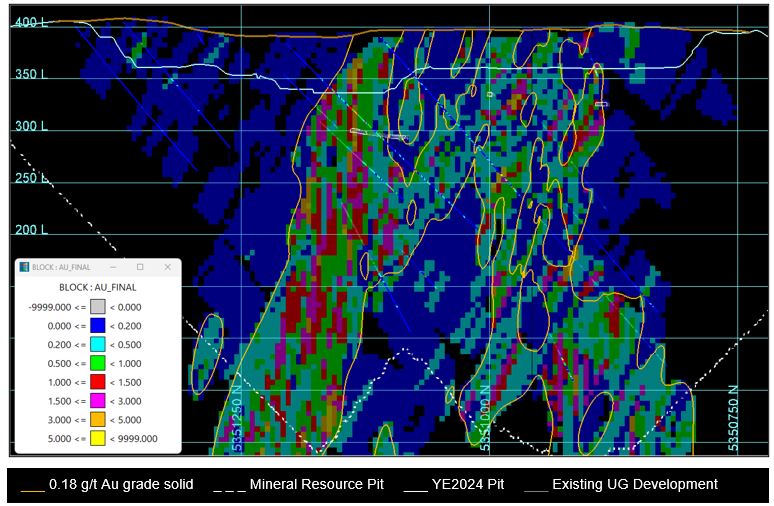

Alamos philosophy is to maximize local hiring of employees from the labour pool in the surrounding communities. This has increased the economic stability of the local communities of Dubreuilville, Wawa and White River who have been hit hard by the downturn of the forestry industry.