Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Nuveen Multistate Trust III

|

|

| Entity Central Index Key |

0001020661

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000001556 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen North Carolina Municipal Bond Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

FLNCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$81 |

|

0.81% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 81

|

|

| Expense Ratio, Percent |

0.81%

|

[1] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

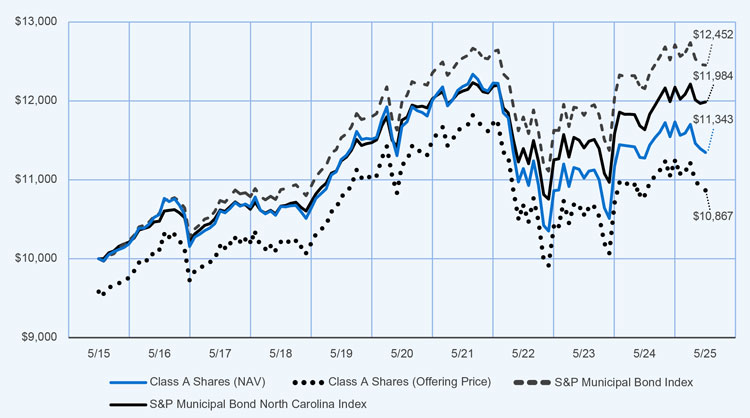

| Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned 0.59% for Class A Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond North Carolina Index, which returned 2.99%. • Top contributors to relative performance • An overweight to the airport and dedicated‑tax bond sectors. • Top detractors from relative performance • Duration positioning, especially an overweight to bonds with durations of 12 years and longer. • An underweight to the single-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

0.59% |

|

(0.57)% |

|

1.27% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

(3.59)% |

|

(1.42)% |

|

0.83% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond North Carolina Index |

|

2.99% |

|

0.38% |

|

1.83% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 499,899,320

|

|

| Holdings Count | Holding |

220

|

|

| Advisory Fees Paid, Amount |

$ 2,588,208

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$499,899,320 |

|

|

|

| Total number of portfolio holdings |

|

|

220 |

|

|

|

| Portfolio turnover (%) |

|

|

18% |

|

|

|

| Total management fees paid for the year |

|

|

$ 2,588,208 |

|

|

|

| Holdings [Text Block] |

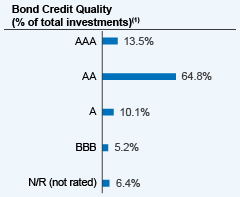

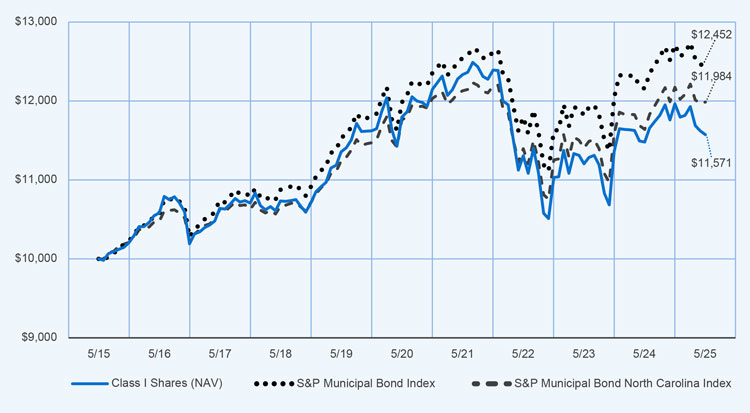

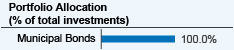

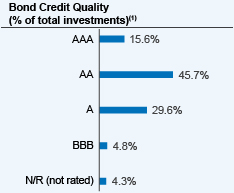

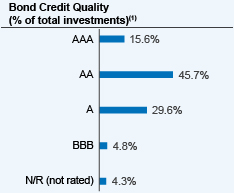

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000137685 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen North Carolina Municipal Bond Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

FDCCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$161 |

|

1.61% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 161

|

|

| Expense Ratio, Percent |

1.61%

|

[2] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

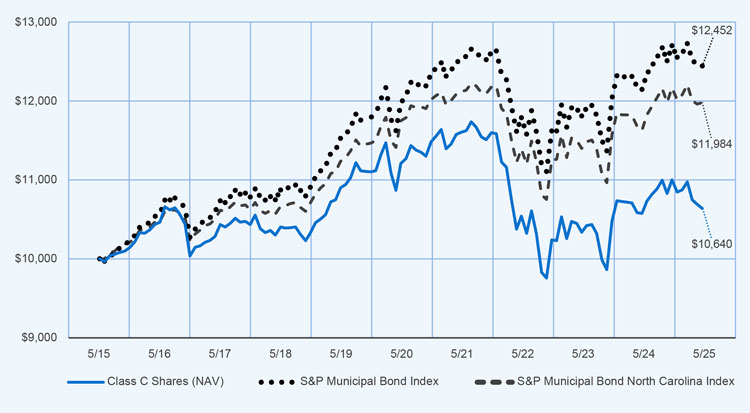

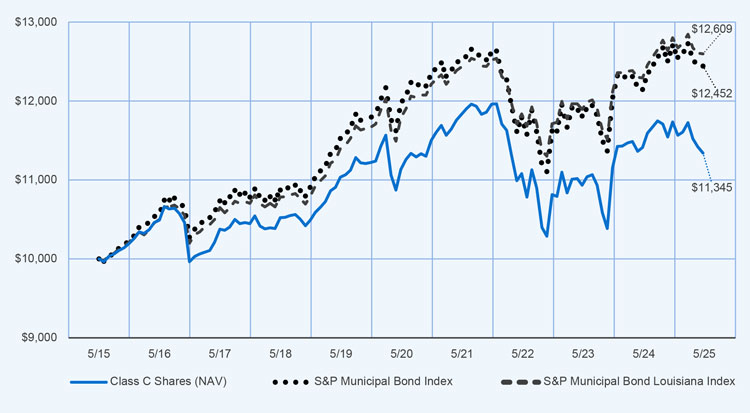

| Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned ‑0.19% for Class C Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond North Carolina Index, which returned 2.99%. • Top contributors to relative performance • An overweight to the airport and dedicated‑tax bond sectors. • Top detractors from relative performance • Duration positioning, especially an overweight to bonds with durations of 12 years and longer. • An underweight to the single-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

(0.19)% |

|

(1.37)% |

|

0.62% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond North Carolina Index |

|

2.99% |

|

0.38% |

|

1.83% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 499,899,320

|

|

| Holdings Count | Holding |

220

|

|

| Advisory Fees Paid, Amount |

$ 2,588,208

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$499,899,320 |

|

|

|

| Total number of portfolio holdings |

|

|

220 |

|

|

|

| Portfolio turnover (%) |

|

|

18% |

|

|

|

| Total management fees paid for the year |

|

|

$ 2,588,208 |

|

|

|

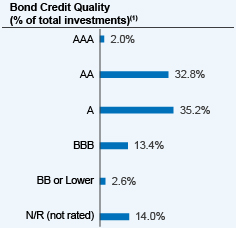

| Holdings [Text Block] |

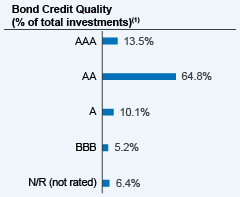

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001559 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen North Carolina Municipal Bond Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

FCNRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$61 |

|

0.61% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

0.61%

|

[3] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

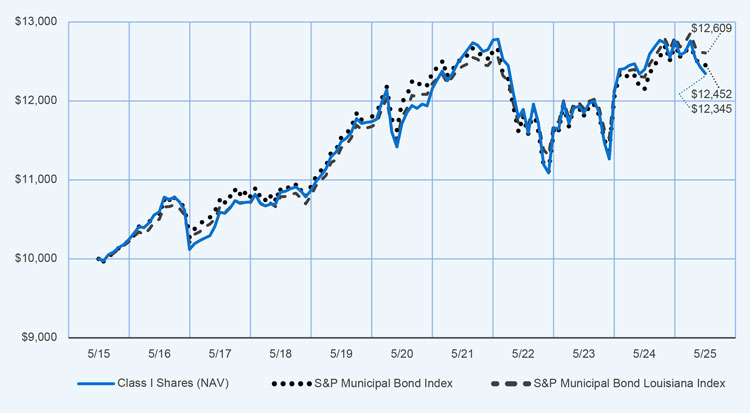

| Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned 0.83% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond North Carolina Index, which returned 2.99%. • Top contributors to relative performance • An overweight to the airport and dedicated‑tax bond sectors. • Top detractors from relative performance • Duration positioning, especially an overweight to bonds with durations of 12 years and longer. • An underweight to the single-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class I Shares at NAV |

|

0.83% |

|

(0.38)% |

|

1.47% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond North Carolina Index |

|

2.99% |

|

0.38% |

|

1.83% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 499,899,320

|

|

| Holdings Count | Holding |

220

|

|

| Advisory Fees Paid, Amount |

$ 2,588,208

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$499,899,320 |

|

|

|

| Total number of portfolio holdings |

|

|

220 |

|

|

|

| Portfolio turnover (%) |

|

|

18% |

|

|

|

| Total management fees paid for the year |

|

|

$ 2,588,208 |

|

|

|

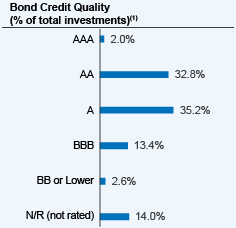

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001551 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Georgia Municipal Bond Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

FGARX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$66 |

|

0.66% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

0.66%

|

[4] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

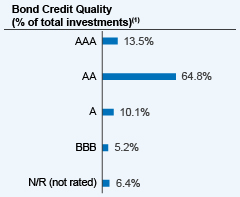

| Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned 0.91% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Georgia Index, which returned 3.16%. • Top contributors to relative performance • Pre‑refunded, short-duration bonds. • Top detractors from relative performance • Duration positioning, especially an underweight to bonds with durations of 10 years and longer. • Credit quality positioning, especially an underweight to AAA‑rated bonds, an overweight to AA‑rated bonds and an underweight to non‑rated bonds. • Sector positioning. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class I Shares at NAV |

|

0.91% |

|

(0.25)% |

|

1.37% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Georgia Index |

|

3.16% |

|

0.78% |

|

2.03% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 149,750,874

|

|

| Holdings Count | Holding |

84

|

|

| Advisory Fees Paid, Amount |

$ 847,092

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$149,750,874 |

|

|

|

| Total number of portfolio holdings |

|

|

84 |

|

|

|

| Portfolio turnover (%) |

|

|

15% |

|

|

|

| Total management fees paid for the year |

|

|

$ 847,092 |

|

|

|

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001548 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Georgia Municipal Bond Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

FGATX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$86 |

|

0.86% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 86

|

|

| Expense Ratio, Percent |

0.86%

|

[5] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

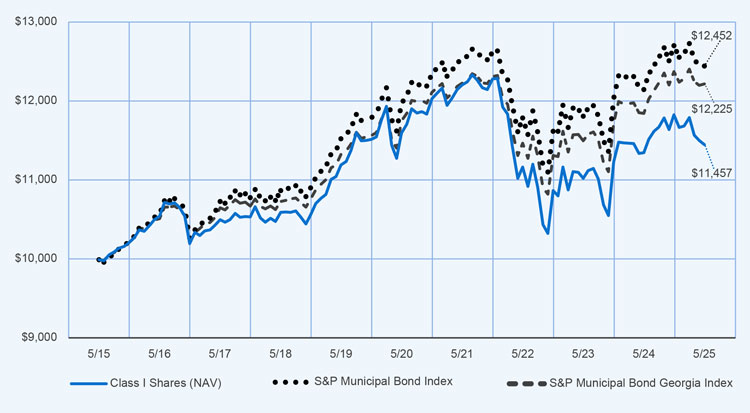

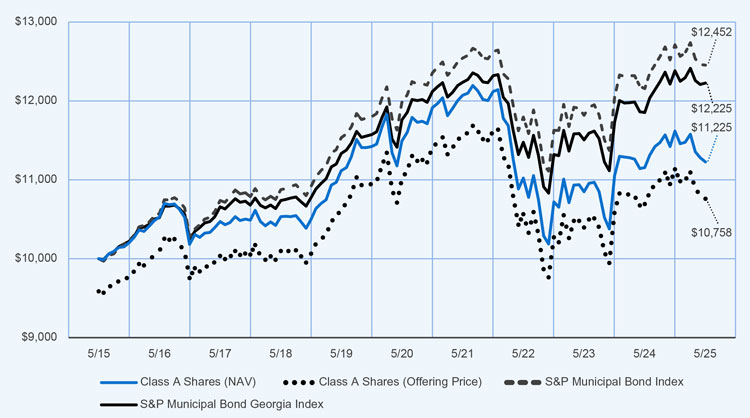

| Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned 0.62% for Class A Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Georgia Index, which returned 3.16%. • Top contributors to relative performance • Pre‑refunded, short-duration bonds. • Top detractors from relative performance • Duration positioning, especially an underweight to bonds with durations of 10 years and longer. • Credit quality positioning, especially an underweight to AAA‑rated bonds, an overweight to AA‑rated bonds and an underweight to non‑rated bonds. • Sector positioning. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

0.62% |

|

(0.47)% |

|

1.16% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

(3.58)% |

|

(1.32)% |

|

0.73% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Georgia Index |

|

3.16% |

|

0.78% |

|

2.03% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 149,750,874

|

|

| Holdings Count | Holding |

84

|

|

| Advisory Fees Paid, Amount |

$ 847,092

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$149,750,874 |

|

|

|

| Total number of portfolio holdings |

|

|

84 |

|

|

|

| Portfolio turnover (%) |

|

|

15% |

|

|

|

| Total management fees paid for the year |

|

|

$ 847,092 |

|

|

|

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000137683 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Georgia Municipal Bond Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

FGCCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$166 |

|

1.66% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 166

|

|

| Expense Ratio, Percent |

1.66%

|

[6] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

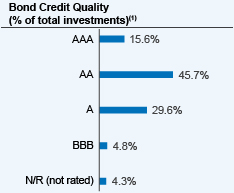

| Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned ‑0.12% for Class C Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Georgia Index, which returned 3.16%. • Top contributors to relative performance • Pre‑refunded, short-duration bonds. • Top detractors from relative performance • Duration positioning, especially an underweight to bonds with durations of 10 years and longer. • Credit quality positioning, especially an underweight to AAA‑rated bonds, an overweight to AA‑rated bonds and an underweight to non‑rated bonds. • Sector positioning. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

(0.12)% |

|

(1.25)% |

|

0.52% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Georgia Index |

|

3.16% |

|

0.78% |

|

2.03% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 149,750,874

|

|

| Holdings Count | Holding |

84

|

|

| Advisory Fees Paid, Amount |

$ 847,092

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$149,750,874 |

|

|

|

| Total number of portfolio holdings |

|

|

84 |

|

|

|

| Portfolio turnover (%) |

|

|

15% |

|

|

|

| Total management fees paid for the year |

|

|

$ 847,092 |

|

|

|

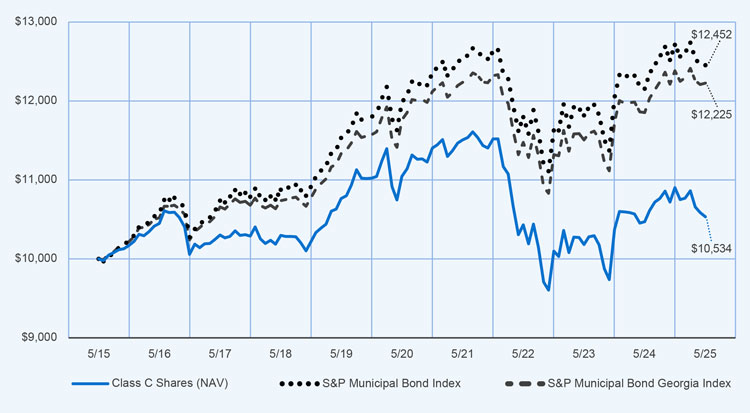

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001552 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Louisiana Municipal Bond Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

FTLAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$83 |

|

0.83% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 83

|

|

| Expense Ratio, Percent |

0.83%

|

[7] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

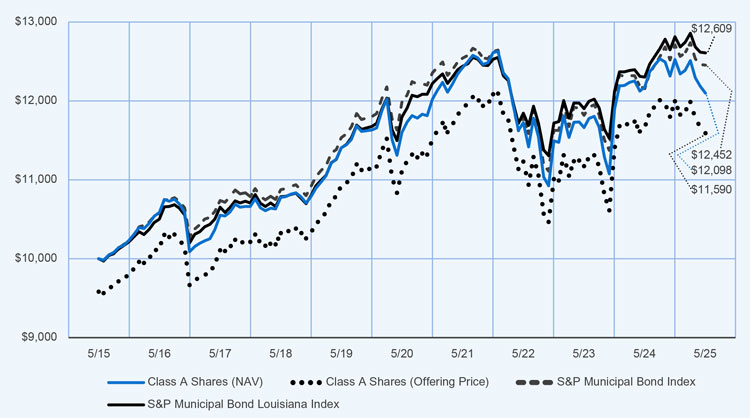

| Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned ‑0.64% for Class A Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Louisiana Index, which returned 2.50%. • Top contributors to relative performance • An overweight to non‑rated bonds. • An underweight to the dedicated‑tax bond sector and an overweight to the incremental‑tax bond sector. • Top detractors from relative performance • The Fund’s energy exposure hedge (Vistra Vision) position through the use of a total return swap. • Duration positioning, especially an underweight to bonds with durations of less than four years. • Sector positioning, especially an underweight to the multi-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

(0.64)% |

|

0.85% |

|

1.92% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

(4.78)% |

|

(0.02)% |

|

1.49% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Louisiana Index |

|

2.50% |

|

1.35% |

|

2.35% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 218,246,283

|

|

| Holdings Count | Holding |

173

|

|

| Advisory Fees Paid, Amount |

$ 1,138,923

|

|

| Investment Company Portfolio Turnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$218,246,283 |

|

|

|

| Total number of portfolio holdings |

|

|

173 |

|

|

|

| Portfolio turnover (%) |

|

|

20% |

|

|

|

| Total management fees paid for the year |

|

|

$ 1,138,923 |

|

|

|

| Holdings [Text Block] |

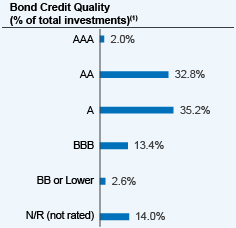

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000137684 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Louisiana Municipal Bond Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

FAFLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$162 |

|

1.63% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 162

|

|

| Expense Ratio, Percent |

1.63%

|

[8] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned ‑1.43% for Class C Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Louisiana Index, which returned 2.50%. • Top contributors to relative performance • An overweight to non‑rated bonds. • An underweight to the dedicated‑tax bond sector and an overweight to the incremental‑tax bond sector. • Top detractors from relative performance • The Fund’s energy exposure hedge (Vistra Vision) position through the use of a total return swap. • Duration positioning, especially an underweight to bonds with durations of less than four years. • Sector positioning, especially an underweight to the multi-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

(1.43)% |

|

0.06% |

|

1.27% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Louisiana Index |

|

2.50% |

|

1.35% |

|

2.35% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 218,246,283

|

|

| Holdings Count | Holding |

173

|

|

| Advisory Fees Paid, Amount |

$ 1,138,923

|

|

| Investment Company Portfolio Turnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$218,246,283 |

|

|

|

| Total number of portfolio holdings |

|

|

173 |

|

|

|

| Portfolio turnover (%) |

|

|

20% |

|

|

|

| Total management fees paid for the year |

|

|

$ 1,138,923 |

|

|

|

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001555 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Louisiana Municipal Bond Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

FTLRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$63 |

|

0.63% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

0.63%

|

[9] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned ‑0.41% for Class I Shares at net asset value (NAV) for the 12 months ended May 31, 2025. The Fund underperformed the S&P Municipal Bond Louisiana Index, which returned 2.50%. • Top contributors to relative performance • An overweight to non‑rated bonds. • An underweight to the dedicated‑tax bond sector and an overweight to the incremental‑tax bond sector. • Top detractors from relative performance • The Fund’s energy exposure hedge (Vistra Vision) position through the use of a total return swap. • Duration positioning, especially an underweight to bonds with durations of less than four years. • Sector positioning, especially an underweight to the multi-family housing bond sector. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class I Shares at NAV |

|

(0.41)% |

|

1.07% |

|

2.13% |

| |

|

|

|

| S&P Municipal Bond Index |

|

2.44% |

|

0.78% |

|

2.22% |

| |

|

|

|

| S&P Municipal Bond Louisiana Index |

|

2.50% |

|

1.35% |

|

2.35% |

| |

|

|

|

| Lipper Other States Municipal Debt Funds Classification Average |

|

0.90% |

|

(0.12)% |

|

1.32% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 218,246,283

|

|

| Holdings Count | Holding |

173

|

|

| Advisory Fees Paid, Amount |

$ 1,138,923

|

|

| Investment Company Portfolio Turnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of May 31, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$218,246,283 |

|

|

|

| Total number of portfolio holdings |

|

|

173 |

|

|

|

| Portfolio turnover (%) |

|

|

20% |

|

|

|

| Total management fees paid for the year |

|

|

$ 1,138,923 |

|

|

|

| Holdings [Text Block] |

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Credit Ratings Selection [Text Block] |

The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by September 30, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

|

|