Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

BlackRock Funds

|

| Entity Central Index Key |

0000844779

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000160936 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Sustainable Advantage Large Cap Core Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

BIRIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Sustainable Advantage Large Cap Core Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$51 |

0.48% |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

0.48%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended May 31, 2025, the Fund’s Institutional Shares returned 11.85%. -

For the same period, the Russell 1000® Index returned 13.73%. What contributed to performance? Fundamental measures that evaluate research spending relative to assets together with text-based forecasts of sales growth proved additive across innovation-oriented companies, reflecting investors’ preference for firms reinvesting for future expansion during the market’s recovery. An environmental, social and governance (“ESG”) insight that scores companies on workforce well-being and broader stakeholder practices added to returns in communication services, aligning the portfolio with firms that demonstrated strong human-capital management while digital media demand remained resilient. Text-based sentiment measures drawn from broker reports and online search trends supported successful positioning in consumer discretionary, as the Fund’s holdings there benefited from steady consumer spending and renewed appetite for discretionary goods. What detracted from performance? Traditional valuation measures evaluating company sales relative to enterprise value struggled in materials, as weaker commodity prices pressured these stocks. Within energy, sentiment insights that track short-term retail trading flows detracted amid sharp moves in oil prices. Finally, an ESG measure that penalizes companies with high carbon emission intensity relative to profits weighed on returns in both energy and materials. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

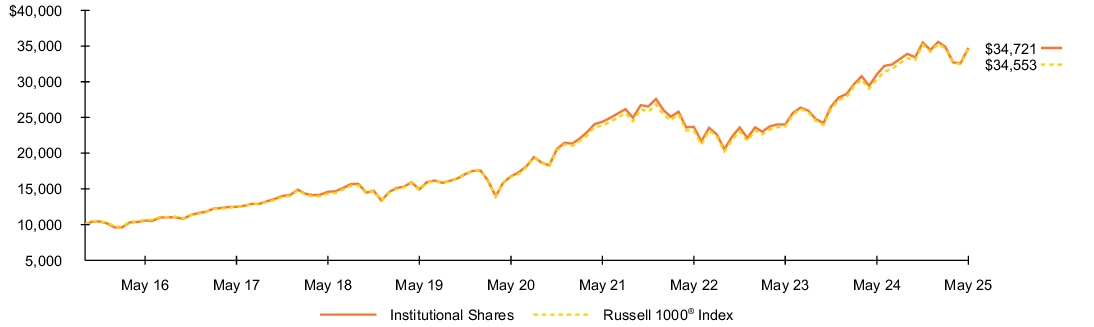

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: October 5, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

Since Fund

Inception |

|

| Institutional Shares |

11.85 |

% |

15.68 |

% |

13.76 |

% |

| Russell 1000® Index |

13.73 |

|

15.66 |

|

13.71 |

|

|

| Performance Inception Date |

Oct. 05, 2015

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 20, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 868,629,561

|

| Holdings Count | Holding |

226

|

| Advisory Fees Paid, Amount |

$ 3,077,947

|

| Investment Company Portfolio Turnover |

129.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$868,629,561 |

| Number of Portfolio Holdings |

226 |

| Net Investment Advisory Fees |

$3,077,947 |

| Portfolio Turnover Rate |

129% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

| Sector allocation |

| Sector(a) |

Percent of

Net Assets |

|

| Information Technology |

31.5 |

% |

| Financials |

14.3 |

% |

| Consumer Discretionary |

11.2 |

% |

| Health Care |

10.9 |

% |

| Industrials |

9.5 |

% |

| Communication Services |

9.4 |

% |

| Consumer Staples |

5.0 |

% |

| Energy |

2.9 |

% |

| Real Estate |

2.2 |

% |

| Utilities |

1.3 |

% |

| Materials |

1.3 |

% |

| Short-Term Securities |

0.4 |

% |

| Liabilities in Excess of Other Assets |

0.1 |

|

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% | (b)Excludes short-term securities.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund. The investment objective of the Fund is to seek to provide total return while seeking to maintain certain environmental, social and governance (“ESG”) characteristics and climate risk exposure relative to the Fund’s benchmark. In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Material Fund Change Name [Text Block] |

On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund.

|

| Material Fund Change Expenses [Text Block] |

In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000160934 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Sustainable Advantage Large Cap Core Fund

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

BIRAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Sustainable Advantage Large Cap Core Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$77 |

0.73% |

|

| Expenses Paid, Amount |

$ 77

|

| Expense Ratio, Percent |

0.73%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended May 31, 2025, the Fund’s Investor A Shares returned 11.62%. -

For the same period, the Russell 1000® Index returned 13.73%. What contributed to performance? Fundamental measures that evaluate research spending relative to assets together with text-based forecasts of sales growth proved additive across innovation-oriented companies, reflecting investors’ preference for firms reinvesting for future expansion during the market’s recovery. An environmental, social and governance (“ESG”) insight that scores companies on workforce well-being and broader stakeholder practices added to returns in communication services, aligning the portfolio with firms that demonstrated strong human-capital management while digital media demand remained resilient. Text-based sentiment measures drawn from broker reports and online search trends supported successful positioning in consumer discretionary, as the Fund’s holdings there benefited from steady consumer spending and renewed appetite for discretionary goods. What detracted from performance? Traditional valuation measures evaluating company sales relative to enterprise value struggled in materials, as weaker commodity prices pressured these stocks. Within energy, sentiment insights that track short-term retail trading flows detracted amid sharp moves in oil prices. Finally, an ESG measure that penalizes companies with high carbon emission intensity relative to profits weighed on returns in both energy and materials. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

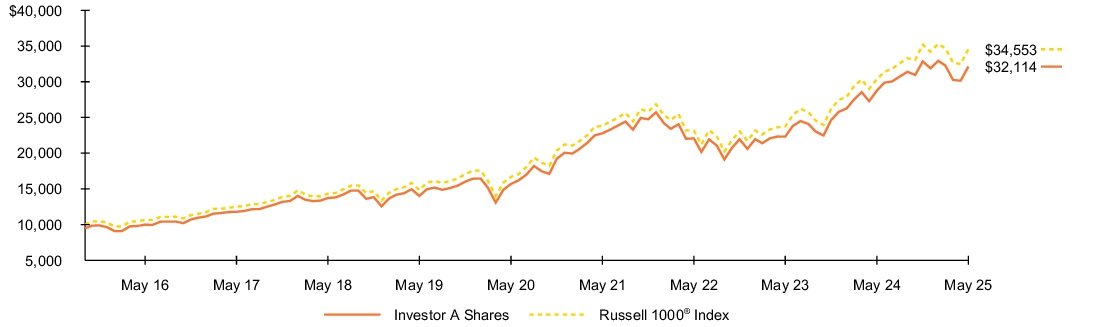

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: October 5, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

Since Fund

Inception |

|

| Investor A Shares |

11.62 |

% |

15.40 |

% |

13.48 |

% |

| Investor A Shares (with sales charge) |

5.75 |

|

14.16 |

|

12.84 |

|

| Russell 1000® Index |

13.73 |

|

15.66 |

|

13.71 |

|

|

| Performance Inception Date |

Oct. 05, 2015

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 20, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 868,629,561

|

| Holdings Count | Holding |

226

|

| Advisory Fees Paid, Amount |

$ 3,077,947

|

| Investment Company Portfolio Turnover |

129.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$868,629,561 |

| Number of Portfolio Holdings |

226 |

| Net Investment Advisory Fees |

$3,077,947 |

| Portfolio Turnover Rate |

129% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

| Sector allocation |

| Sector(a) |

Percent of

Net Assets |

|

| Information Technology |

31.5 |

% |

| Financials |

14.3 |

% |

| Consumer Discretionary |

11.2 |

% |

| Health Care |

10.9 |

% |

| Industrials |

9.5 |

% |

| Communication Services |

9.4 |

% |

| Consumer Staples |

5.0 |

% |

| Energy |

2.9 |

% |

| Real Estate |

2.2 |

% |

| Utilities |

1.3 |

% |

| Materials |

1.3 |

% |

| Short-Term Securities |

0.4 |

% |

| Liabilities in Excess of Other Assets |

0.1 |

|

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% | (b)Excludes short-term securities.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund. The investment objective of the Fund is to seek to provide total return while seeking to maintain certain environmental, social and governance (“ESG”) characteristics and climate risk exposure relative to the Fund’s benchmark. In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Material Fund Change Name [Text Block] |

On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund.

|

| Material Fund Change Expenses [Text Block] |

In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000160935 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Sustainable Advantage Large Cap Core Fund

|

| Class Name |

Investor C Shares

|

| Trading Symbol |

BIRCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Sustainable Advantage Large Cap Core Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$156 |

1.48% |

|

| Expenses Paid, Amount |

$ 156

|

| Expense Ratio, Percent |

1.48%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended May 31, 2025, the Fund’s Investor C Shares returned 10.73%. -

For the same period, the Russell 1000® Index returned 13.73%. What contributed to performance? Fundamental measures that evaluate research spending relative to assets together with text-based forecasts of sales growth proved additive across innovation-oriented companies, reflecting investors’ preference for firms reinvesting for future expansion during the market’s recovery. An environmental, social and governance (“ESG”) insight that scores companies on workforce well-being and broader stakeholder practices added to returns in communication services, aligning the portfolio with firms that demonstrated strong human-capital management while digital media demand remained resilient. Text-based sentiment measures drawn from broker reports and online search trends supported successful positioning in consumer discretionary, as the Fund’s holdings there benefited from steady consumer spending and renewed appetite for discretionary goods. What detracted from performance? Traditional valuation measures evaluating company sales relative to enterprise value struggled in materials, as weaker commodity prices pressured these stocks. Within energy, sentiment insights that track short-term retail trading flows detracted amid sharp moves in oil prices. Finally, an ESG measure that penalizes companies with high carbon emission intensity relative to profits weighed on returns in both energy and materials. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

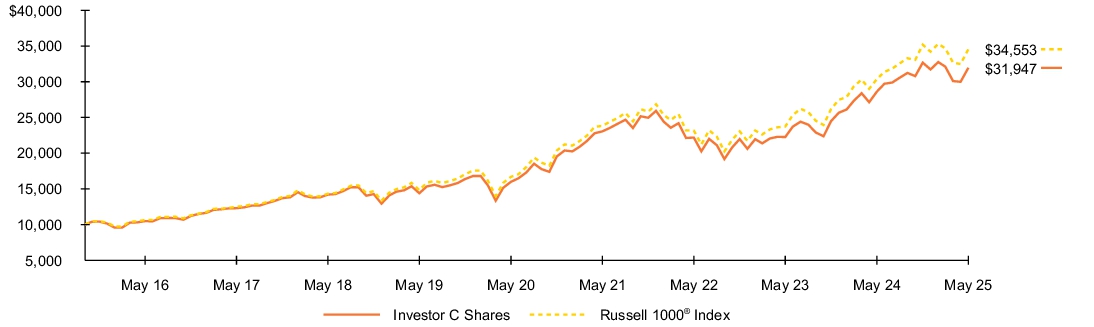

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: October 5, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

Since Fund

Inception |

|

| Investor C Shares |

10.73 |

% |

14.55 |

% |

12.78 |

% |

| Investor C Shares (with sales charge) |

9.78 |

|

14.55 |

|

12.78 |

|

| Russell 1000® Index |

13.73 |

|

15.66 |

|

13.71 |

|

|

| Performance Inception Date |

Oct. 05, 2015

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 20, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 868,629,561

|

| Holdings Count | Holding |

226

|

| Advisory Fees Paid, Amount |

$ 3,077,947

|

| Investment Company Portfolio Turnover |

129.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$868,629,561 |

| Number of Portfolio Holdings |

226 |

| Net Investment Advisory Fees |

$3,077,947 |

| Portfolio Turnover Rate |

129% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

| Sector allocation |

| Sector(a) |

Percent of

Net Assets |

|

| Information Technology |

31.5 |

% |

| Financials |

14.3 |

% |

| Consumer Discretionary |

11.2 |

% |

| Health Care |

10.9 |

% |

| Industrials |

9.5 |

% |

| Communication Services |

9.4 |

% |

| Consumer Staples |

5.0 |

% |

| Energy |

2.9 |

% |

| Real Estate |

2.2 |

% |

| Utilities |

1.3 |

% |

| Materials |

1.3 |

% |

| Short-Term Securities |

0.4 |

% |

| Liabilities in Excess of Other Assets |

0.1 |

|

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% | (b)Excludes short-term securities.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund. The investment objective of the Fund is to seek to provide total return while seeking to maintain certain environmental, social and governance (“ESG”) characteristics and climate risk exposure relative to the Fund’s benchmark. In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Material Fund Change Name [Text Block] |

On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund.

|

| Material Fund Change Expenses [Text Block] |

In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000166019 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Sustainable Advantage Large Cap Core Fund

|

| Class Name |

Class K Shares

|

| Trading Symbol |

BIRKX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Sustainable Advantage Large Cap Core Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$46 |

0.43% |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.43%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended May 31, 2025, the Fund’s Class K Shares returned 11.90%. -

For the same period, the Russell 1000® Index returned 13.73%. What contributed to performance? Fundamental measures that evaluate research spending relative to assets together with text-based forecasts of sales growth proved additive across innovation-oriented companies, reflecting investors’ preference for firms reinvesting for future expansion during the market’s recovery. An environmental, social and governance (“ESG”) insight that scores companies on workforce well-being and broader stakeholder practices added to returns in communication services, aligning the portfolio with firms that demonstrated strong human-capital management while digital media demand remained resilient. Text-based sentiment measures drawn from broker reports and online search trends supported successful positioning in consumer discretionary, as the Fund’s holdings there benefited from steady consumer spending and renewed appetite for discretionary goods. What detracted from performance? Traditional valuation measures evaluating company sales relative to enterprise value struggled in materials, as weaker commodity prices pressured these stocks. Within energy, sentiment insights that track short-term retail trading flows detracted amid sharp moves in oil prices. Finally, an ESG measure that penalizes companies with high carbon emission intensity relative to profits weighed on returns in both energy and materials. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

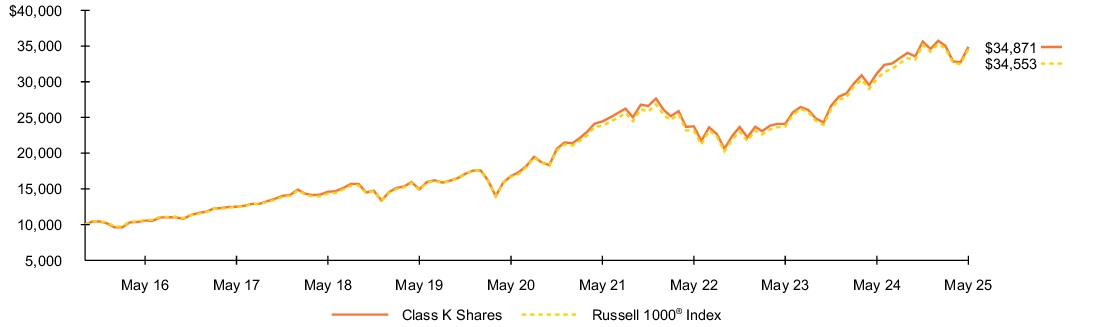

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: October 5, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

Since Fund

Inception |

|

| Class K Shares |

11.90 |

% |

15.74 |

% |

13.81 |

% |

| Russell 1000® Index |

13.73 |

|

15.66 |

|

13.71 |

|

|

| Performance Inception Date |

Oct. 05, 2015

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 20, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 868,629,561

|

| Holdings Count | Holding |

226

|

| Advisory Fees Paid, Amount |

$ 3,077,947

|

| Investment Company Portfolio Turnover |

129.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$868,629,561 |

| Number of Portfolio Holdings |

226 |

| Net Investment Advisory Fees |

$3,077,947 |

| Portfolio Turnover Rate |

129% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

| Sector allocation |

| Sector(a) |

Percent of

Net Assets |

|

| Information Technology |

31.5 |

% |

| Financials |

14.3 |

% |

| Consumer Discretionary |

11.2 |

% |

| Health Care |

10.9 |

% |

| Industrials |

9.5 |

% |

| Communication Services |

9.4 |

% |

| Consumer Staples |

5.0 |

% |

| Energy |

2.9 |

% |

| Real Estate |

2.2 |

% |

| Utilities |

1.3 |

% |

| Materials |

1.3 |

% |

| Short-Term Securities |

0.4 |

% |

| Liabilities in Excess of Other Assets |

0.1 |

|

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

| Ten largest holdings |

| Security(b) |

Percent of

Net Assets |

|

| Microsoft Corp. |

6.7 |

% |

| Apple, Inc. |

6.0 |

% |

| NVIDIA Corp. |

6.0 |

% |

| Amazon.com, Inc. |

3.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Alphabet, Inc., Class A |

2.4 |

% |

| Broadcom, Inc. |

1.9 |

% |

| Home Depot, Inc. |

1.7 |

% |

| Walmart, Inc. |

1.7 |

% |

| Bank of America Corp. |

1.6 |

% | (b)Excludes short-term securities.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund. The investment objective of the Fund is to seek to provide total return while seeking to maintain certain environmental, social and governance (“ESG”) characteristics and climate risk exposure relative to the Fund’s benchmark. In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Material Fund Change Name [Text Block] |

On February 20, 2025, the Fund’s Board approved a change in the name of the Fund to BlackRock Sustainable Aware Advantage Large Cap Core Fund.

|

| Material Fund Change Expenses [Text Block] |

In connection with the Fund’s name change, the Fund’s 80% investment policy will change to seek to invest, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that provide investment exposure to such securities or to one or more market risk factors associated with such securities. These changes are expected to become effective on or about September 26, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of planned changes to the Fund since May 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after May 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|