Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

BlackRock Series, Inc.

|

| Entity Central Index Key |

0001062806

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000005984 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock International Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

MAILX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock International Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$68 |

0.67% |

|

| Expenses Paid, Amount |

$ 68

|

| Expense Ratio, Percent |

0.67%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Institutional Shares returned 3.41%. -

For the same period, the Fund’s benchmark, the MSCI ACWI ex USA Index, returned 13.75%. What contributed to performance? In sector terms, stock selection within energy and an overweight to materials contributed to absolute performance. At the individual stock level, Sony Inc. delivered a series of strong earnings reports driven by robust sales for its PlayStation 5 gaming console and growth in its network services business, leading analysts to upgrade estimates. The stock also reacted positively to management changes announced in early 2025. Deutsche Telekom’s strong performance was largely driven by its U.S. subsidiary T-Mobile, in which it holds a 50% stake. T-Mobile had seen significant profitability improvements as U.S. competitive dynamics eased, even as it had been gaining market share from AT&T. Deutsche Telekom also benefited from broadening its European footprint. Off-benchmark exposure to Mastercard proved additive as the company delivered strong earnings while exceeding revenue expectations. Mastercard remained a market leader and was well-positioned to benefit from the ongoing secular shift from cash to electronic payments. What detracted from performance? Stock selection within and overweights to both healthcare and information technology were the top sector detractors. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock, given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. LVMH Moet Hennessy Louis Vuitton SA suffered from a challenging backdrop for luxury goods amid weakening U.S. consumer demand and a slowdown in China. The Fund exited the position on the view that LVMH’s business mix had become less diversified, even as its pricing power waned. U.K. housebuilder Taylor Wimpey plc saw its results suffer from cost inflation along with a less favorable interest rate environment. Taylor Wimpey remained well positioned within a cyclical industry with high barriers to entry from economies of scale. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

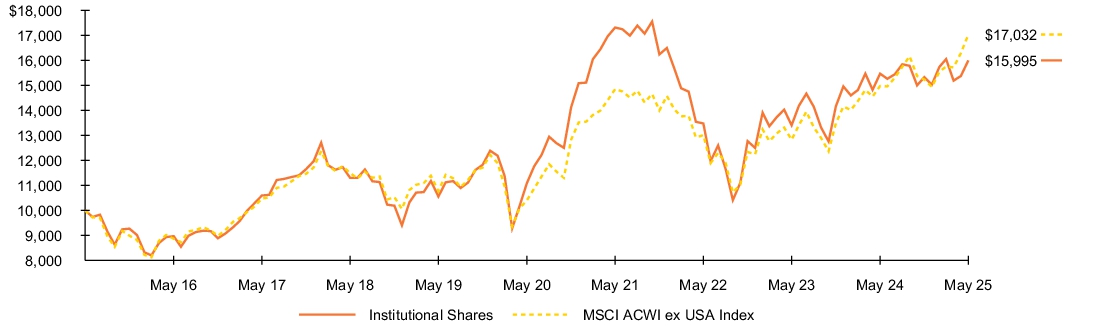

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Institutional Shares |

3.41 |

% |

7.60 |

% |

4.81 |

% |

| MSCI ACWI ex USA Index |

13.75 |

|

10.37 |

|

5.47 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,199,946,293

|

| Holdings Count | Holding |

40

|

| Advisory Fees Paid, Amount |

$ 8,167,899

|

| Investment Company Portfolio Turnover |

95.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,199,946,293 |

| Number of Portfolio Holdings |

40 |

| Net Investment Advisory Fees |

$8,167,899 |

| Portfolio Turnover Rate |

95% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United Kingdom |

15.7 |

% |

| Germany |

11.4 |

% |

| Japan |

8.5 |

% |

| Canada |

7.4 |

% |

| France |

7.1 |

% |

| Switzerland |

7.1 |

% |

| United States |

6.5 |

% |

| Taiwan |

6.5 |

% |

| Netherlands |

5.6 |

% |

| Spain |

5.2 |

% |

| Other# |

18.0 |

% |

| Short-Term Securities |

0.8 |

% |

| Other Assets Less Liabilities |

0.2 |

% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest countries are presented. Additional countries are found in Other. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% | (a)Excludes short-term securities.

|

| C000005981 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock International Fund

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

MDILX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock International Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$93 |

0.92% |

|

| Expenses Paid, Amount |

$ 93

|

| Expense Ratio, Percent |

0.92%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Investor A Shares returned 3.14%. -

For the same period, the Fund’s benchmark, the MSCI ACWI ex USA Index, returned 13.75%. What contributed to performance? In sector terms, stock selection within energy and an overweight to materials contributed to absolute performance. At the individual stock level, Sony Inc. delivered a series of strong earnings reports driven by robust sales for its PlayStation 5 gaming console and growth in its network services business, leading analysts to upgrade estimates. The stock also reacted positively to management changes announced in early 2025. Deutsche Telekom’s strong performance was largely driven by its U.S. subsidiary T-Mobile, in which it holds a 50% stake. T-Mobile had seen significant profitability improvements as U.S. competitive dynamics eased, even as it had been gaining market share from AT&T. Deutsche Telekom also benefited from broadening its European footprint. Off-benchmark exposure to Mastercard proved additive as the company delivered strong earnings while exceeding revenue expectations. Mastercard remained a market leader and was well-positioned to benefit from the ongoing secular shift from cash to electronic payments. What detracted from performance? Stock selection within and overweights to both healthcare and information technology were the top sector detractors. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock, given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. LVMH Moet Hennessy Louis Vuitton SA suffered from a challenging backdrop for luxury goods amid weakening U.S. consumer demand and a slowdown in China. The Fund exited the position on the view that LVMH’s business mix had become less diversified, even as its pricing power waned. U.K. housebuilder Taylor Wimpey plc saw its results suffer from cost inflation along with a less favorable interest rate environment. Taylor Wimpey remained well positioned within a cyclical industry with high barriers to entry from economies of scale. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

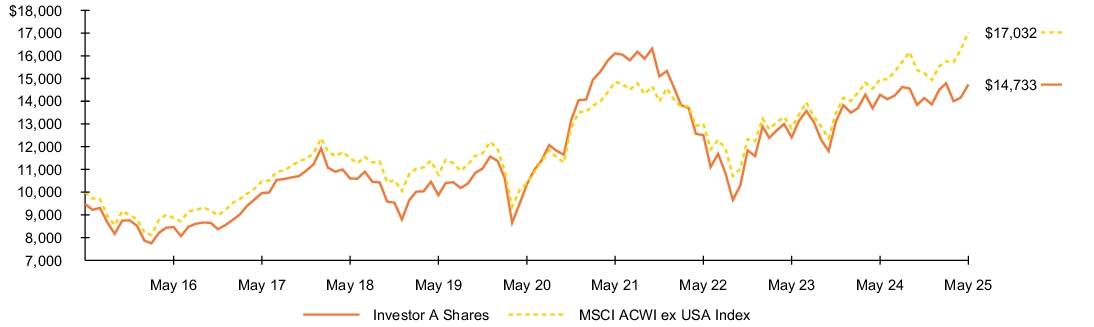

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor A Shares |

3.14 |

% |

7.33 |

% |

4.51 |

% |

| Investor A Shares (with sales charge) |

(2.28 |

) |

6.18 |

|

3.95 |

|

| MSCI ACWI ex USA Index |

13.75 |

|

10.37 |

|

5.47 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,199,946,293

|

| Holdings Count | Holding |

40

|

| Advisory Fees Paid, Amount |

$ 8,167,899

|

| Investment Company Portfolio Turnover |

95.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,199,946,293 |

| Number of Portfolio Holdings |

40 |

| Net Investment Advisory Fees |

$8,167,899 |

| Portfolio Turnover Rate |

95% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United Kingdom |

15.7 |

% |

| Germany |

11.4 |

% |

| Japan |

8.5 |

% |

| Canada |

7.4 |

% |

| France |

7.1 |

% |

| Switzerland |

7.1 |

% |

| United States |

6.5 |

% |

| Taiwan |

6.5 |

% |

| Netherlands |

5.6 |

% |

| Spain |

5.2 |

% |

| Other# |

18.0 |

% |

| Short-Term Securities |

0.8 |

% |

| Other Assets Less Liabilities |

0.2 |

% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest countries are presented. Additional countries are found in Other. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% | (a)Excludes short-term securities.

|

| C000005983 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock International Fund

|

| Class Name |

Investor C Shares

|

| Trading Symbol |

MCILX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock International Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$169 |

1.67% |

|

| Expenses Paid, Amount |

$ 169

|

| Expense Ratio, Percent |

1.67%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Investor C Shares returned 2.32%. -

For the same period, the Fund’s benchmark, the MSCI ACWI ex USA Index, returned 13.75%. What contributed to performance? In sector terms, stock selection within energy and an overweight to materials contributed to absolute performance. At the individual stock level, Sony Inc. delivered a series of strong earnings reports driven by robust sales for its PlayStation 5 gaming console and growth in its network services business, leading analysts to upgrade estimates. The stock also reacted positively to management changes announced in early 2025. Deutsche Telekom’s strong performance was largely driven by its U.S. subsidiary T-Mobile, in which it holds a 50% stake. T-Mobile had seen significant profitability improvements as U.S. competitive dynamics eased, even as it had been gaining market share from AT&T. Deutsche Telekom also benefited from broadening its European footprint. Off-benchmark exposure to Mastercard proved additive as the company delivered strong earnings while exceeding revenue expectations. Mastercard remained a market leader and was well-positioned to benefit from the ongoing secular shift from cash to electronic payments. What detracted from performance? Stock selection within and overweights to both healthcare and information technology were the top sector detractors. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock, given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. LVMH Moet Hennessy Louis Vuitton SA suffered from a challenging backdrop for luxury goods amid weakening U.S. consumer demand and a slowdown in China. The Fund exited the position on the view that LVMH’s business mix had become less diversified, even as its pricing power waned. U.K. housebuilder Taylor Wimpey plc saw its results suffer from cost inflation along with a less favorable interest rate environment. Taylor Wimpey remained well positioned within a cyclical industry with high barriers to entry from economies of scale. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

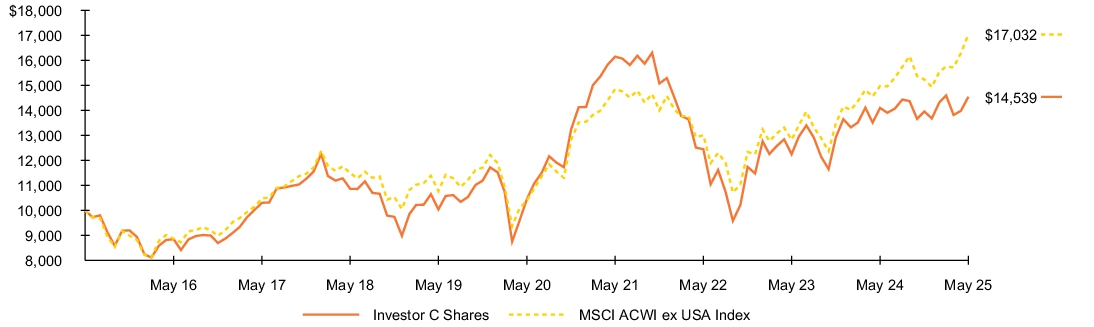

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor C Shares |

2.32 |

% |

6.52 |

% |

3.81 |

% |

| Investor C Shares (with sales charge) |

1.32 |

|

6.52 |

|

3.81 |

|

| MSCI ACWI ex USA Index |

13.75 |

|

10.37 |

|

5.47 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,199,946,293

|

| Holdings Count | Holding |

40

|

| Advisory Fees Paid, Amount |

$ 8,167,899

|

| Investment Company Portfolio Turnover |

95.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,199,946,293 |

| Number of Portfolio Holdings |

40 |

| Net Investment Advisory Fees |

$8,167,899 |

| Portfolio Turnover Rate |

95% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United Kingdom |

15.7 |

% |

| Germany |

11.4 |

% |

| Japan |

8.5 |

% |

| Canada |

7.4 |

% |

| France |

7.1 |

% |

| Switzerland |

7.1 |

% |

| United States |

6.5 |

% |

| Taiwan |

6.5 |

% |

| Netherlands |

5.6 |

% |

| Spain |

5.2 |

% |

| Other# |

18.0 |

% |

| Short-Term Securities |

0.8 |

% |

| Other Assets Less Liabilities |

0.2 |

% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest countries are presented. Additional countries are found in Other. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% | (a)Excludes short-term securities.

|

| C000198221 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock International Fund

|

| Class Name |

Class K Shares

|

| Trading Symbol |

MKILX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock International Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$63 |

0.62% |

|

| Expenses Paid, Amount |

$ 63

|

| Expense Ratio, Percent |

0.62%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Class K Shares returned 3.42%. -

For the same period, the Fund’s benchmark, the MSCI ACWI ex USA Index, returned 13.75%. What contributed to performance? In sector terms, stock selection within energy and an overweight to materials contributed to absolute performance. At the individual stock level, Sony Inc. delivered a series of strong earnings reports driven by robust sales for its PlayStation 5 gaming console and growth in its network services business, leading analysts to upgrade estimates. The stock also reacted positively to management changes announced in early 2025. Deutsche Telekom’s strong performance was largely driven by its U.S. subsidiary T-Mobile, in which it holds a 50% stake. T-Mobile had seen significant profitability improvements as U.S. competitive dynamics eased, even as it had been gaining market share from AT&T. Deutsche Telekom also benefited from broadening its European footprint. Off-benchmark exposure to Mastercard proved additive as the company delivered strong earnings while exceeding revenue expectations. Mastercard remained a market leader and was well-positioned to benefit from the ongoing secular shift from cash to electronic payments. What detracted from performance? Stock selection within and overweights to both healthcare and information technology were the top sector detractors. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock, given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. LVMH Moet Hennessy Louis Vuitton SA suffered from a challenging backdrop for luxury goods amid weakening U.S. consumer demand and a slowdown in China. The Fund exited the position on the view that LVMH’s business mix had become less diversified, even as its pricing power waned. U.K. housebuilder Taylor Wimpey plc saw its results suffer from cost inflation along with a less favorable interest rate environment. Taylor Wimpey remained well positioned within a cyclical industry with high barriers to entry from economies of scale. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

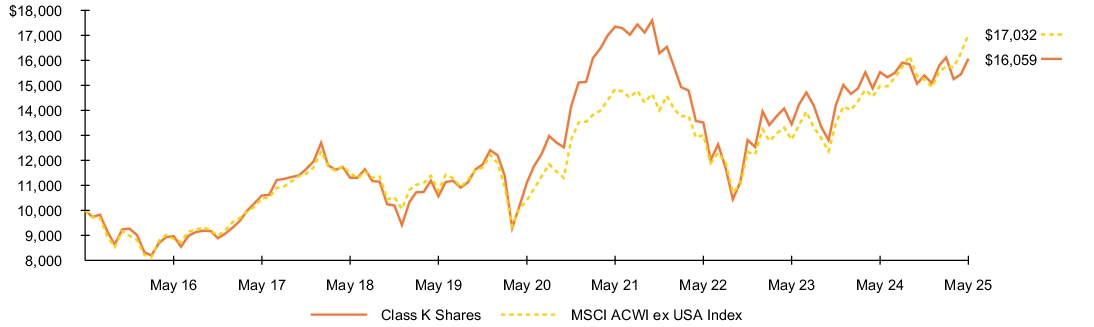

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Class K Shares |

3.42 |

% |

7.66 |

% |

4.85 |

% |

| MSCI ACWI ex USA Index |

13.75 |

|

10.37 |

|

5.47 |

|

|

| Performance Inception Date |

Jan. 25, 2018

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,199,946,293

|

| Holdings Count | Holding |

40

|

| Advisory Fees Paid, Amount |

$ 8,167,899

|

| Investment Company Portfolio Turnover |

95.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,199,946,293 |

| Number of Portfolio Holdings |

40 |

| Net Investment Advisory Fees |

$8,167,899 |

| Portfolio Turnover Rate |

95% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United Kingdom |

15.7 |

% |

| Germany |

11.4 |

% |

| Japan |

8.5 |

% |

| Canada |

7.4 |

% |

| France |

7.1 |

% |

| Switzerland |

7.1 |

% |

| United States |

6.5 |

% |

| Taiwan |

6.5 |

% |

| Netherlands |

5.6 |

% |

| Spain |

5.2 |

% |

| Other# |

18.0 |

% |

| Short-Term Securities |

0.8 |

% |

| Other Assets Less Liabilities |

0.2 |

% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest countries are presented. Additional countries are found in Other. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% | (a)Excludes short-term securities.

|

| C000101856 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock International Fund

|

| Class Name |

Class R Shares

|

| Trading Symbol |

BIFRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock International Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class R Shares |

$119 |

1.17% |

|

| Expenses Paid, Amount |

$ 119

|

| Expense Ratio, Percent |

1.17%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Class R Shares returned 2.88%. -

For the same period, the Fund’s benchmark, the MSCI ACWI ex USA Index, returned 13.75%. What contributed to performance? In sector terms, stock selection within energy and an overweight to materials contributed to absolute performance. At the individual stock level, Sony Inc. delivered a series of strong earnings reports driven by robust sales for its PlayStation 5 gaming console and growth in its network services business, leading analysts to upgrade estimates. The stock also reacted positively to management changes announced in early 2025. Deutsche Telekom’s strong performance was largely driven by its U.S. subsidiary T-Mobile, in which it holds a 50% stake. T-Mobile had seen significant profitability improvements as U.S. competitive dynamics eased, even as it had been gaining market share from AT&T. Deutsche Telekom also benefited from broadening its European footprint. Off-benchmark exposure to Mastercard proved additive as the company delivered strong earnings while exceeding revenue expectations. Mastercard remained a market leader and was well-positioned to benefit from the ongoing secular shift from cash to electronic payments. What detracted from performance? Stock selection within and overweights to both healthcare and information technology were the top sector detractors. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock, given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. LVMH Moet Hennessy Louis Vuitton SA suffered from a challenging backdrop for luxury goods amid weakening U.S. consumer demand and a slowdown in China. The Fund exited the position on the view that LVMH’s business mix had become less diversified, even as its pricing power waned. U.K. housebuilder Taylor Wimpey plc saw its results suffer from cost inflation along with a less favorable interest rate environment. Taylor Wimpey remained well positioned within a cyclical industry with high barriers to entry from economies of scale. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

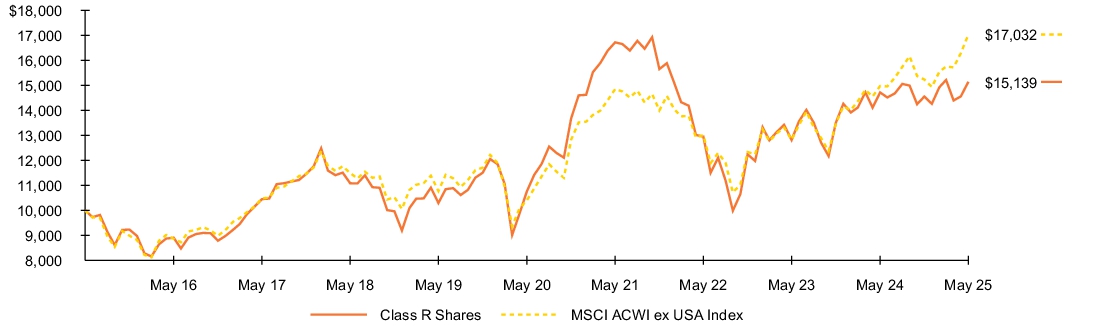

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Class R Shares |

2.88 |

% |

7.07 |

% |

4.23 |

% |

| MSCI ACWI ex USA Index |

13.75 |

|

10.37 |

|

5.47 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,199,946,293

|

| Holdings Count | Holding |

40

|

| Advisory Fees Paid, Amount |

$ 8,167,899

|

| Investment Company Portfolio Turnover |

95.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,199,946,293 |

| Number of Portfolio Holdings |

40 |

| Net Investment Advisory Fees |

$8,167,899 |

| Portfolio Turnover Rate |

95% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United Kingdom |

15.7 |

% |

| Germany |

11.4 |

% |

| Japan |

8.5 |

% |

| Canada |

7.4 |

% |

| France |

7.1 |

% |

| Switzerland |

7.1 |

% |

| United States |

6.5 |

% |

| Taiwan |

6.5 |

% |

| Netherlands |

5.6 |

% |

| Spain |

5.2 |

% |

| Other# |

18.0 |

% |

| Short-Term Securities |

0.8 |

% |

| Other Assets Less Liabilities |

0.2 |

% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest countries are presented. Additional countries are found in Other. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

5.1 |

% |

| Shell PLC |

4.0 |

% |

| Air Liquide SA |

3.4 |

% |

| RELX PLC |

3.2 |

% |

| AstraZeneca PLC |

3.2 |

% |

| Koninklijke KPN NV |

3.1 |

% |

| Sony Group Corp. |

3.1 |

% |

| Deutsche Telekom AG, Registered Shares |

3.1 |

% |

| Nestlé SA, Registered Shares |

3.1 |

% |

| SAP SE |

3.1 |

% | (a)Excludes short-term securities.

|