Shareholder Report

|

6 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

AB EQUITY INCOME FUND INC

|

|

| Entity Central Index Key |

0000910036

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000028102 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Equity Income Fund

|

|

| Class Name |

Advisor Class

|

|

| Trading Symbol |

AUIYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Equity Income Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUIYX-S. You can also request this information by contacting us at (800) 227 4618.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 227 4618

|

|

| Additional Information Website |

https://www.abfunds.com/link/AB/AUIYX-S

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Advisor Class |

$31 |

0.63%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized | |

|

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.63%

|

[1] |

| Material Change Date |

Dec. 01, 2024

|

|

| AssetsNet |

$ 581,121,903

|

|

| Holdings Count | Holding |

69

|

|

| Advisory Fees Paid, Amount |

$ 1,375,120

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Net Assets |

$581,121,903 |

# of Portfolio Holdings |

69 |

Portfolio Turnover Rate |

21% |

Total Advisory Fees Paid (Net) |

$1,375,120 | |

|

| Holdings [Text Block] |

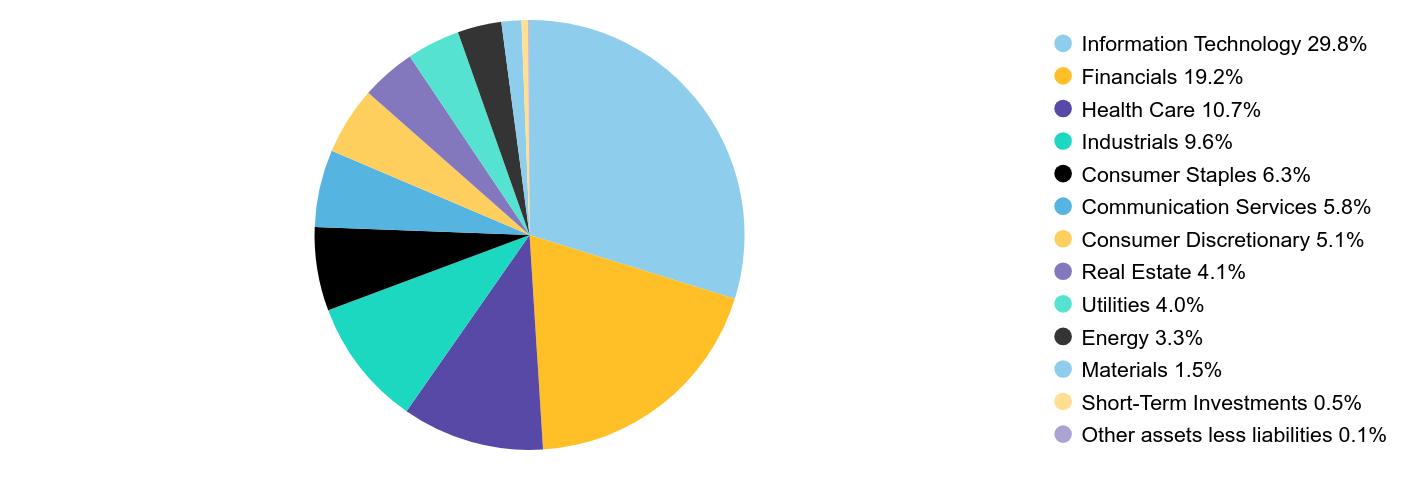

Sector Breakdown (% of Net Assets)

Value |

Value |

Information Technology |

29.8% |

Financials |

19.2% |

Health Care |

10.7% |

Industrials |

9.6% |

Consumer Staples |

6.3% |

Communication Services |

5.8% |

Consumer Discretionary |

5.1% |

Real Estate |

4.1% |

Utilities |

4.0% |

Energy |

3.3% |

Materials |

1.5% |

Short-Term Investments |

0.5% |

Other assets less liabilities |

0.1% | |

|

| Largest Holdings [Text Block] |

Company |

U.S. $ Value |

% of Net Assets |

Microsoft Corp. |

$52,748,970 |

9.1% |

Apple, Inc. |

$26,966,724 |

4.6% |

McDonald's Corp. |

$16,964,534 |

2.9% |

American Electric Power Co., Inc. |

$16,904,574 |

2.9% |

Broadcom, Inc. |

$16,436,553 |

2.8% |

Walt Disney Co. (The) |

$15,531,131 |

2.7% |

Wells Fargo & Co. |

$14,412,947 |

2.5% |

Merck & Co., Inc. |

$13,808,302 |

2.4% |

Intuit, Inc. |

$13,665,685 |

2.3% |

Visa, Inc. - Class A |

$13,266,988 |

2.3% |

Total |

$200,706,408 |

34.5% | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994. During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Material Fund Change Risks Change [Text Block] |

During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994.

|

|

| C000028099 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Equity Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

AUIAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Equity Income Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUIAX-S. You can also request this information by contacting us at (800) 227 4618.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 227 4618

|

|

| Additional Information Website |

https://www.abfunds.com/link/AB/AUIAX-S

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$43 |

0.88%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized | |

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.88%

|

[2] |

| Material Change Date |

Dec. 01, 2024

|

|

| AssetsNet |

$ 581,121,903

|

|

| Holdings Count | Holding |

69

|

|

| Advisory Fees Paid, Amount |

$ 1,375,120

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Net Assets |

$581,121,903 |

# of Portfolio Holdings |

69 |

Portfolio Turnover Rate |

21% |

Total Advisory Fees Paid (Net) |

$1,375,120 | |

|

| Holdings [Text Block] |

Sector Breakdown (% of Net Assets)

Value |

Value |

Information Technology |

29.8% |

Financials |

19.2% |

Health Care |

10.7% |

Industrials |

9.6% |

Consumer Staples |

6.3% |

Communication Services |

5.8% |

Consumer Discretionary |

5.1% |

Real Estate |

4.1% |

Utilities |

4.0% |

Energy |

3.3% |

Materials |

1.5% |

Short-Term Investments |

0.5% |

Other assets less liabilities |

0.1% | |

|

| Largest Holdings [Text Block] |

Company |

U.S. $ Value |

% of Net Assets |

Microsoft Corp. |

$52,748,970 |

9.1% |

Apple, Inc. |

$26,966,724 |

4.6% |

McDonald's Corp. |

$16,964,534 |

2.9% |

American Electric Power Co., Inc. |

$16,904,574 |

2.9% |

Broadcom, Inc. |

$16,436,553 |

2.8% |

Walt Disney Co. (The) |

$15,531,131 |

2.7% |

Wells Fargo & Co. |

$14,412,947 |

2.5% |

Merck & Co., Inc. |

$13,808,302 |

2.4% |

Intuit, Inc. |

$13,665,685 |

2.3% |

Visa, Inc. - Class A |

$13,266,988 |

2.3% |

Total |

$200,706,408 |

34.5% | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994. During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Material Fund Change Risks Change [Text Block] |

During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994.

|

|

| C000028101 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Equity Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

AUICX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Equity Income Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUICX-S. You can also request this information by contacting us at (800) 227 4618.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 227 4618

|

|

| Additional Information Website |

https://www.abfunds.com/link/AB/AUICX-S

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$80 |

1.63%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized | |

|

| Expenses Paid, Amount |

$ 80

|

|

| Expense Ratio, Percent |

1.63%

|

[3] |

| Material Change Date |

Dec. 01, 2024

|

|

| AssetsNet |

$ 581,121,903

|

|

| Holdings Count | Holding |

69

|

|

| Advisory Fees Paid, Amount |

$ 1,375,120

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Net Assets |

$581,121,903 |

# of Portfolio Holdings |

69 |

Portfolio Turnover Rate |

21% |

Total Advisory Fees Paid (Net) |

$1,375,120 | |

|

| Holdings [Text Block] |

Sector Breakdown (% of Net Assets)

Value |

Value |

Information Technology |

29.8% |

Financials |

19.2% |

Health Care |

10.7% |

Industrials |

9.6% |

Consumer Staples |

6.3% |

Communication Services |

5.8% |

Consumer Discretionary |

5.1% |

Real Estate |

4.1% |

Utilities |

4.0% |

Energy |

3.3% |

Materials |

1.5% |

Short-Term Investments |

0.5% |

Other assets less liabilities |

0.1% | |

|

| Largest Holdings [Text Block] |

Company |

U.S. $ Value |

% of Net Assets |

Microsoft Corp. |

$52,748,970 |

9.1% |

Apple, Inc. |

$26,966,724 |

4.6% |

McDonald's Corp. |

$16,964,534 |

2.9% |

American Electric Power Co., Inc. |

$16,904,574 |

2.9% |

Broadcom, Inc. |

$16,436,553 |

2.8% |

Walt Disney Co. (The) |

$15,531,131 |

2.7% |

Wells Fargo & Co. |

$14,412,947 |

2.5% |

Merck & Co., Inc. |

$13,808,302 |

2.4% |

Intuit, Inc. |

$13,665,685 |

2.3% |

Visa, Inc. - Class A |

$13,266,988 |

2.3% |

Total |

$200,706,408 |

34.5% | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994. During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Material Fund Change Risks Change [Text Block] |

During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994.

|

|

| C000028105 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Equity Income Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

AUIIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Equity Income Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUIIX-S. You can also request this information by contacting us at (800) 227 4618.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 227 4618

|

|

| Additional Information Website |

https://www.abfunds.com/link/AB/AUIIX-S

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class I |

$32 |

0.65%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized | |

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.65%

|

[4] |

| Material Change Date |

Dec. 01, 2024

|

|

| AssetsNet |

$ 581,121,903

|

|

| Holdings Count | Holding |

69

|

|

| Advisory Fees Paid, Amount |

$ 1,375,120

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Net Assets |

$581,121,903 |

# of Portfolio Holdings |

69 |

Portfolio Turnover Rate |

21% |

Total Advisory Fees Paid (Net) |

$1,375,120 | |

|

| Holdings [Text Block] |

Sector Breakdown (% of Net Assets)

Value |

Value |

Information Technology |

29.8% |

Financials |

19.2% |

Health Care |

10.7% |

Industrials |

9.6% |

Consumer Staples |

6.3% |

Communication Services |

5.8% |

Consumer Discretionary |

5.1% |

Real Estate |

4.1% |

Utilities |

4.0% |

Energy |

3.3% |

Materials |

1.5% |

Short-Term Investments |

0.5% |

Other assets less liabilities |

0.1% | |

|

| Largest Holdings [Text Block] |

Company |

U.S. $ Value |

% of Net Assets |

Microsoft Corp. |

$52,748,970 |

9.1% |

Apple, Inc. |

$26,966,724 |

4.6% |

McDonald's Corp. |

$16,964,534 |

2.9% |

American Electric Power Co., Inc. |

$16,904,574 |

2.9% |

Broadcom, Inc. |

$16,436,553 |

2.8% |

Walt Disney Co. (The) |

$15,531,131 |

2.7% |

Wells Fargo & Co. |

$14,412,947 |

2.5% |

Merck & Co., Inc. |

$13,808,302 |

2.4% |

Intuit, Inc. |

$13,665,685 |

2.3% |

Visa, Inc. - Class A |

$13,266,988 |

2.3% |

Total |

$200,706,408 |

34.5% | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994. During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Material Fund Change Risks Change [Text Block] |

During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994.

|

|

| C000135457 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Equity Income Fund

|

|

| Class Name |

Class Z

|

|

| Trading Symbol |

AUIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Equity Income Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUIZX-S. You can also request this information by contacting us at (800) 227 4618.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 227 4618

|

|

| Additional Information Website |

https://www.abfunds.com/link/AB/AUIZX-S

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class Z |

$29 |

0.59%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized | |

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.59%

|

[5] |

| Material Change Date |

Dec. 01, 2024

|

|

| AssetsNet |

$ 581,121,903

|

|

| Holdings Count | Holding |

69

|

|

| Advisory Fees Paid, Amount |

$ 1,375,120

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Net Assets |

$581,121,903 |

# of Portfolio Holdings |

69 |

Portfolio Turnover Rate |

21% |

Total Advisory Fees Paid (Net) |

$1,375,120 | |

|

| Holdings [Text Block] |

Sector Breakdown (% of Net Assets)

Value |

Value |

Information Technology |

29.8% |

Financials |

19.2% |

Health Care |

10.7% |

Industrials |

9.6% |

Consumer Staples |

6.3% |

Communication Services |

5.8% |

Consumer Discretionary |

5.1% |

Real Estate |

4.1% |

Utilities |

4.0% |

Energy |

3.3% |

Materials |

1.5% |

Short-Term Investments |

0.5% |

Other assets less liabilities |

0.1% | |

|

| Largest Holdings [Text Block] |

Company |

U.S. $ Value |

% of Net Assets |

Microsoft Corp. |

$52,748,970 |

9.1% |

Apple, Inc. |

$26,966,724 |

4.6% |

McDonald's Corp. |

$16,964,534 |

2.9% |

American Electric Power Co., Inc. |

$16,904,574 |

2.9% |

Broadcom, Inc. |

$16,436,553 |

2.8% |

Walt Disney Co. (The) |

$15,531,131 |

2.7% |

Wells Fargo & Co. |

$14,412,947 |

2.5% |

Merck & Co., Inc. |

$13,808,302 |

2.4% |

Intuit, Inc. |

$13,665,685 |

2.3% |

Visa, Inc. - Class A |

$13,266,988 |

2.3% |

Total |

$200,706,408 |

34.5% | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994. During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Material Fund Change Risks Change [Text Block] |

During the reporting period, the Fund added the following risk to its Principal Risks as set forth in its prospectus. Capital Gain Risk: As of the date of the Fund's Prospectus, a substantial portion of the Fund's net asset value is attributable to realized and/or net unrealized capital gains on portfolio securities. If the Fund realizes capital gains in excess of realized capital losses in any fiscal year, it generally expects to make capital gain distributions to shareholders. You may receive distributions that are attributable to appreciation of portfolio securities that happened before you made your investment. Unless you purchase shares through a tax-advantaged account (such as an IRA or 401(k) plan), these distributions will be taxable to you even though they economically represent a return of a portion of your investment. You should consult your tax professional about your investment in the Fund.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since December 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available on or about March 31, 2026 at www.abfunds.com/go/prospectus, or upon request at (800) 243-5994.

|

|

|

|