Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

BlackRock Funds II

|

| Entity Central Index Key |

0001398078

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000058057 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Dividend Portfolio

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

BIBDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Dividend Portfolio (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$84 |

0.80% |

|

| Expenses Paid, Amount |

$ 84

|

| Expense Ratio, Percent |

0.80%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Institutional Shares returned 9.61%. -

For the same period, the Fund’s benchmark, the MSCI All Country World Index, returned 13.65%. What contributed to performance? In sector terms, leading contributors included stock selection in energy along with an overweight to, and stock selection within, materials. At the individual stock level, semiconductor company Broadcom Inc. had been a prime beneficiary of optimism around artificial intelligence (“AI”). Broadcom remains well-positioned as the market shifts toward application-specific chips, which are increasingly critical to improving AI model efficiency. Philip Morris International Inc. delivered strong results driven by the expansion of its smoke-free portfolio. The Fund exited the position due to rising competition in U.S. nicotine pouches and concerns that Philip Morris may need to cut prices to remain competitive. Shares of Spanish Bank BBVA rose notably since the start of 2025 as European financials have benefited from higher interest rates and plans for fiscal stimulus. In addition, BBVA posted earnings beats for both the fourth quarter of 2024 and first quarter of 2025, driven by its trading division. What detracted from performance? Stock selection in consumer discretionary weighed on return, along with overweights to, and stock selection within, healthcare and consumer staples. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. Shares of U.S. managed care company United Health Group Inc. declined late in the period, following downgraded guidance driven by higher-than-expected claims activity. The current valuation appeared compelling given structural tailwinds for Medicare Advantage broadly and potential levers available to the company to help improve profitability. U.S. semiconductor manufacturer Texas Instruments Inc. declined sharply following weak fourth quarter 2024 results driven by softness in the industrial and auto markets, which led to elevated inventories and lower revenue and net income. The Fund exited the position. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

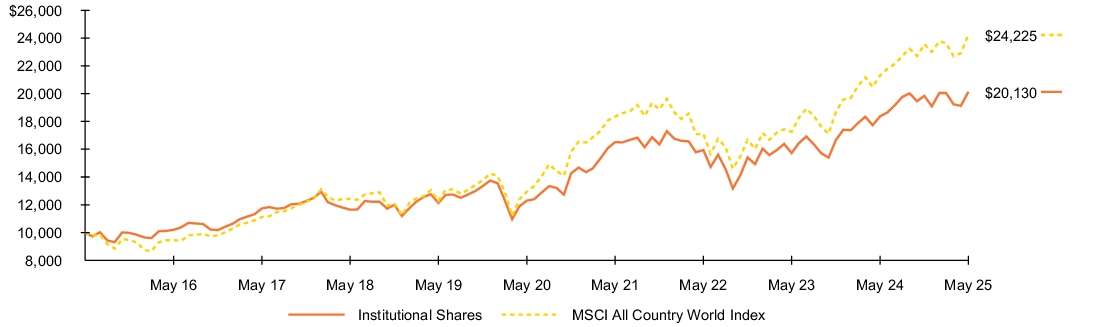

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Institutional Shares |

9.61 |

% |

10.35 |

% |

7.25 |

% |

| MSCI All Country World Index |

13.65 |

|

13.37 |

|

9.25 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,009,586,312

|

| Holdings Count | Holding |

48

|

| Advisory Fees Paid, Amount |

$ 6,627,287

|

| Investment Company Portfolio Turnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,009,586,312 |

| Number of Portfolio Holdings |

48 |

| Net Investment Advisory Fees |

$6,627,287 |

| Portfolio Turnover Rate |

44% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United States |

66.4 |

% |

| United Kingdom |

10.8 |

% |

| Taiwan |

5.3 |

% |

| France |

3.8 |

% |

| Denmark |

2.5 |

% |

| Spain |

2.2 |

% |

| Canada |

2.1 |

% |

| Netherlands |

2.0 |

% |

| Switzerland |

2.0 |

% |

| Japan |

1.5 |

% |

| Short-Term Securities |

1.6 |

% |

| Liabilities in Excess of Other Assets |

(0.2 |

)% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| C000172902 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Dividend Portfolio

|

| Class Name |

Class K Shares

|

| Trading Symbol |

BKBDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Dividend Portfolio (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$74 |

0.71% |

|

| Expenses Paid, Amount |

$ 74

|

| Expense Ratio, Percent |

0.71%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Class K Shares returned 9.68%. -

For the same period, the Fund’s benchmark, the MSCI All Country World Index, returned 13.65%. What contributed to performance? In sector terms, leading contributors included stock selection in energy along with an overweight to, and stock selection within, materials. At the individual stock level, semiconductor company Broadcom Inc. had been a prime beneficiary of optimism around artificial intelligence (“AI”). Broadcom remains well-positioned as the market shifts toward application-specific chips, which are increasingly critical to improving AI model efficiency. Philip Morris International Inc. delivered strong results driven by the expansion of its smoke-free portfolio. The Fund exited the position due to rising competition in U.S. nicotine pouches and concerns that Philip Morris may need to cut prices to remain competitive. Shares of Spanish Bank BBVA rose notably since the start of 2025 as European financials have benefited from higher interest rates and plans for fiscal stimulus. In addition, BBVA posted earnings beats for both the fourth quarter of 2024 and first quarter of 2025, driven by its trading division. What detracted from performance? Stock selection in consumer discretionary weighed on return, along with overweights to, and stock selection within, healthcare and consumer staples. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. Shares of U.S. managed care company United Health Group Inc. declined late in the period, following downgraded guidance driven by higher-than-expected claims activity. The current valuation appeared compelling given structural tailwinds for Medicare Advantage broadly and potential levers available to the company to help improve profitability. U.S. semiconductor manufacturer Texas Instruments Inc. declined sharply following weak fourth quarter 2024 results driven by softness in the industrial and auto markets, which led to elevated inventories and lower revenue and net income. The Fund exited the position. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

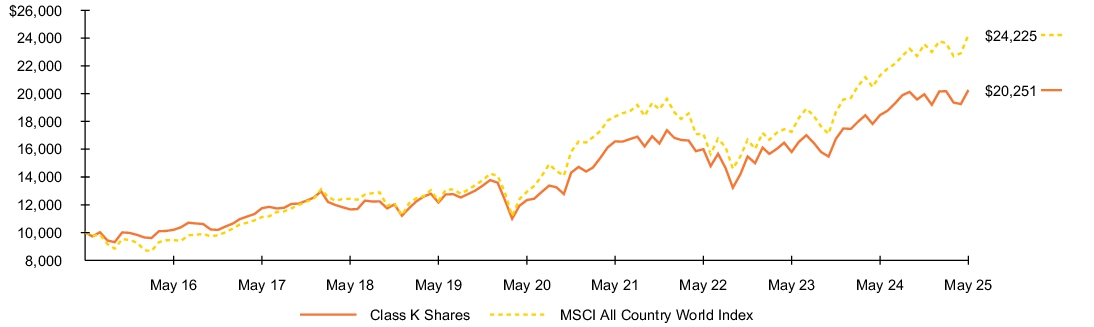

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Class K Shares |

9.68 |

% |

10.42 |

% |

7.31 |

% |

| MSCI All Country World Index |

13.65 |

|

13.37 |

|

9.25 |

|

|

| Performance Inception Date |

Jun. 08, 2016

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,009,586,312

|

| Holdings Count | Holding |

48

|

| Advisory Fees Paid, Amount |

$ 6,627,287

|

| Investment Company Portfolio Turnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,009,586,312 |

| Number of Portfolio Holdings |

48 |

| Net Investment Advisory Fees |

$6,627,287 |

| Portfolio Turnover Rate |

44% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United States |

66.4 |

% |

| United Kingdom |

10.8 |

% |

| Taiwan |

5.3 |

% |

| France |

3.8 |

% |

| Denmark |

2.5 |

% |

| Spain |

2.2 |

% |

| Canada |

2.1 |

% |

| Netherlands |

2.0 |

% |

| Switzerland |

2.0 |

% |

| Japan |

1.5 |

% |

| Short-Term Securities |

1.6 |

% |

| Liabilities in Excess of Other Assets |

(0.2 |

)% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| C000058059 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Dividend Portfolio

|

| Class Name |

Investor C Shares

|

| Trading Symbol |

BCBDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Dividend Portfolio (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$191 |

1.83% |

|

| Expenses Paid, Amount |

$ 191

|

| Expense Ratio, Percent |

1.83%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Investor C Shares returned 8.46%. -

For the same period, the Fund’s benchmark, the MSCI All Country World Index, returned 13.65%. What contributed to performance? In sector terms, leading contributors included stock selection in energy along with an overweight to, and stock selection within, materials. At the individual stock level, semiconductor company Broadcom Inc. had been a prime beneficiary of optimism around artificial intelligence (“AI”). Broadcom remains well-positioned as the market shifts toward application-specific chips, which are increasingly critical to improving AI model efficiency. Philip Morris International Inc. delivered strong results driven by the expansion of its smoke-free portfolio. The Fund exited the position due to rising competition in U.S. nicotine pouches and concerns that Philip Morris may need to cut prices to remain competitive. Shares of Spanish Bank BBVA rose notably since the start of 2025 as European financials have benefited from higher interest rates and plans for fiscal stimulus. In addition, BBVA posted earnings beats for both the fourth quarter of 2024 and first quarter of 2025, driven by its trading division. What detracted from performance? Stock selection in consumer discretionary weighed on return, along with overweights to, and stock selection within, healthcare and consumer staples. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. Shares of U.S. managed care company United Health Group Inc. declined late in the period, following downgraded guidance driven by higher-than-expected claims activity. The current valuation appeared compelling given structural tailwinds for Medicare Advantage broadly and potential levers available to the company to help improve profitability. U.S. semiconductor manufacturer Texas Instruments Inc. declined sharply following weak fourth quarter 2024 results driven by softness in the industrial and auto markets, which led to elevated inventories and lower revenue and net income. The Fund exited the position. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

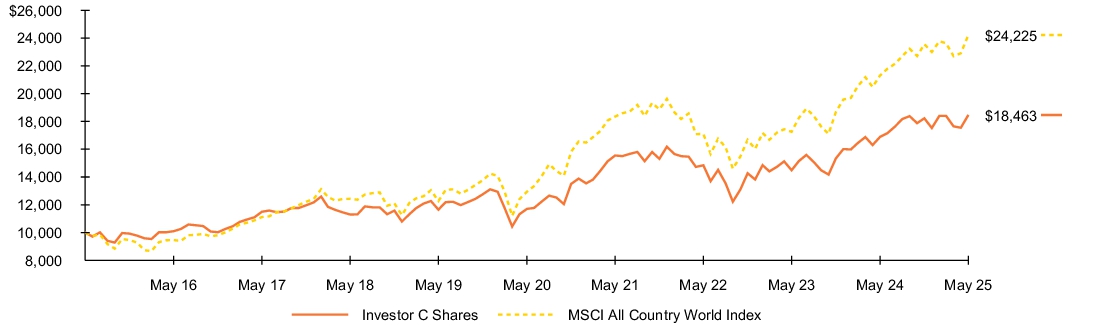

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor C Shares |

8.46 |

% |

9.20 |

% |

6.32 |

% |

| Investor C Shares (with sales charge) |

7.46 |

|

9.20 |

|

6.32 |

|

| MSCI All Country World Index |

13.65 |

|

13.37 |

|

9.25 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,009,586,312

|

| Holdings Count | Holding |

48

|

| Advisory Fees Paid, Amount |

$ 6,627,287

|

| Investment Company Portfolio Turnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,009,586,312 |

| Number of Portfolio Holdings |

48 |

| Net Investment Advisory Fees |

$6,627,287 |

| Portfolio Turnover Rate |

44% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United States |

66.4 |

% |

| United Kingdom |

10.8 |

% |

| Taiwan |

5.3 |

% |

| France |

3.8 |

% |

| Denmark |

2.5 |

% |

| Spain |

2.2 |

% |

| Canada |

2.1 |

% |

| Netherlands |

2.0 |

% |

| Switzerland |

2.0 |

% |

| Japan |

1.5 |

% |

| Short-Term Securities |

1.6 |

% |

| Liabilities in Excess of Other Assets |

(0.2 |

)% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| C000058058 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Dividend Portfolio

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

BABDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Dividend Portfolio (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$108 |

1.03% |

|

| Expenses Paid, Amount |

$ 108

|

| Expense Ratio, Percent |

1.03%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended May 31, 2025, the Fund's Investor A Shares returned 9.31%. -

For the same period, the Fund’s benchmark, the MSCI All Country World Index, returned 13.65%. What contributed to performance? In sector terms, leading contributors included stock selection in energy along with an overweight to, and stock selection within, materials. At the individual stock level, semiconductor company Broadcom Inc. had been a prime beneficiary of optimism around artificial intelligence (“AI”). Broadcom remains well-positioned as the market shifts toward application-specific chips, which are increasingly critical to improving AI model efficiency. Philip Morris International Inc. delivered strong results driven by the expansion of its smoke-free portfolio. The Fund exited the position due to rising competition in U.S. nicotine pouches and concerns that Philip Morris may need to cut prices to remain competitive. Shares of Spanish Bank BBVA rose notably since the start of 2025 as European financials have benefited from higher interest rates and plans for fiscal stimulus. In addition, BBVA posted earnings beats for both the fourth quarter of 2024 and first quarter of 2025, driven by its trading division. What detracted from performance? Stock selection in consumer discretionary weighed on return, along with overweights to, and stock selection within, healthcare and consumer staples. At the individual stock level, Novo Nordisk A/S declined on disappointing trial data for CagriSema, its next generation weight loss drug, along with market share gains by competitor Eli Lilly. The Fund continued to hold the stock given CagriSema’s comparable efficacy to Eli Lilly’s incumbent drug and the expanding weight loss market. Shares of U.S. managed care company United Health Group Inc. declined late in the period, following downgraded guidance driven by higher-than-expected claims activity. The current valuation appeared compelling given structural tailwinds for Medicare Advantage broadly and potential levers available to the company to help improve profitability. U.S. semiconductor manufacturer Texas Instruments Inc. declined sharply following weak fourth quarter 2024 results driven by softness in the industrial and auto markets, which led to elevated inventories and lower revenue and net income. The Fund exited the position. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

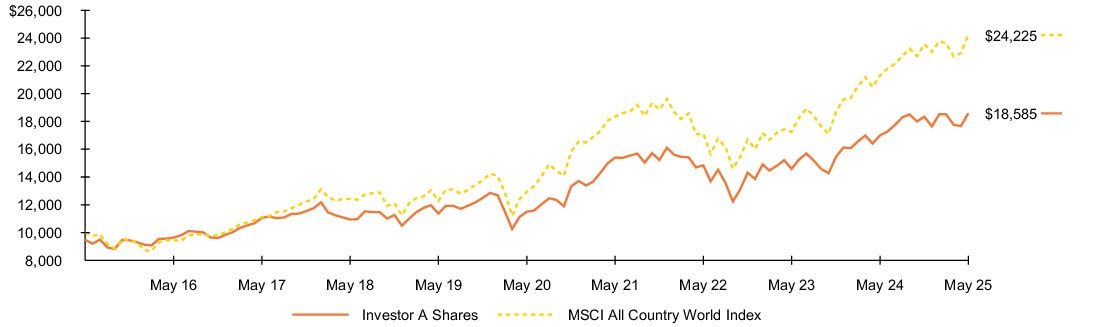

Fund performance Cumulative performance: June 1, 2015 through May 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor A Shares |

9.31 |

% |

10.07 |

% |

6.97 |

% |

| Investor A Shares (with sales charge) |

3.57 |

|

8.89 |

|

6.39 |

|

| MSCI All Country World Index |

13.65 |

|

13.37 |

|

9.25 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 1,009,586,312

|

| Holdings Count | Holding |

48

|

| Advisory Fees Paid, Amount |

$ 6,627,287

|

| Investment Company Portfolio Turnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,009,586,312 |

| Number of Portfolio Holdings |

48 |

| Net Investment Advisory Fees |

$6,627,287 |

| Portfolio Turnover Rate |

44% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025) Geographic allocation

| Country |

Percent of

Net Assets |

|

| United States |

66.4 |

% |

| United Kingdom |

10.8 |

% |

| Taiwan |

5.3 |

% |

| France |

3.8 |

% |

| Denmark |

2.5 |

% |

| Spain |

2.2 |

% |

| Canada |

2.1 |

% |

| Netherlands |

2.0 |

% |

| Switzerland |

2.0 |

% |

| Japan |

1.5 |

% |

| Short-Term Securities |

1.6 |

% |

| Liabilities in Excess of Other Assets |

(0.2 |

)% | Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security(a) |

Percent of

Net Assets |

|

| Microsoft Corp. |

5.9 |

% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.9 |

% |

| Broadcom, Inc. |

3.8 |

% |

| AstraZeneca PLC |

3.4 |

% |

| Coca-Cola Co. (The) |

2.8 |

% |

| Meta Platforms, Inc., Class A |

2.7 |

% |

| Accenture PLC, Class A |

2.7 |

% |

| Walmart, Inc. |

2.7 |

% |

| CMS Energy Corp. |

2.6 |

% |

| RELX PLC |

2.6 |

% |

| (a) |

Excludes short-term securities. |

|