Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

VALUED ADVISERS TRUST

|

| Entity Central Index Key |

0001437249

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000245604 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BFS Equity Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

BFSIX

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information Phone Number |

(855) 575-2430

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $104 | 0.99% |

|---|

|

| Expenses Paid, Amount |

$ 104

|

| Expense Ratio, Percent |

0.99%

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

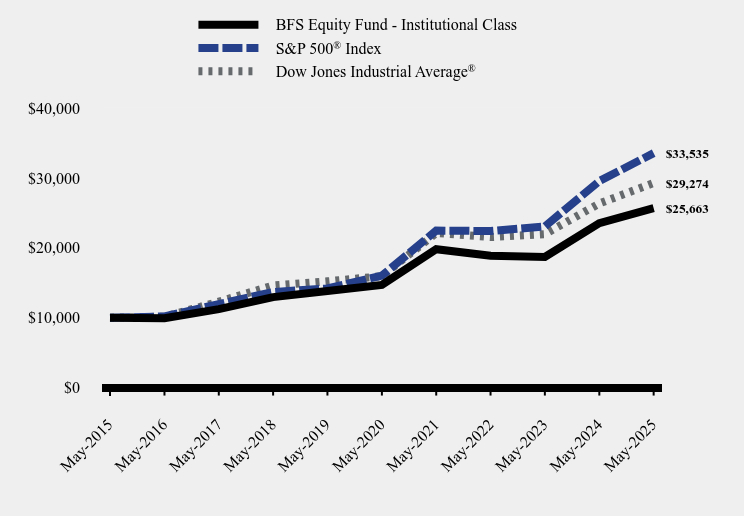

| Line Graph [Table Text Block] |

| BFS Equity Fund - Institutional Class | S&P 500® Index | Dow Jones Industrial Average® |

|---|

May-2015 | $10,000 | $10,000 | $10,000 |

|---|

May-2016 | $9,909 | $10,172 | $10,139 |

|---|

May-2017 | $11,212 | $11,948 | $12,284 |

|---|

May-2018 | $12,935 | $13,667 | $14,607 |

|---|

May-2019 | $13,819 | $14,184 | $15,198 |

|---|

May-2020 | $14,693 | $16,005 | $15,932 |

|---|

May-2021 | $19,789 | $22,458 | $22,113 |

|---|

May-2022 | $18,857 | $22,391 | $21,527 |

|---|

May-2023 | $18,680 | $23,045 | $21,950 |

|---|

May-2024 | $23,513 | $29,540 | $26,334 |

|---|

May-2025 | $25,663 | $33,535 | $29,274 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Years | 10 Years |

|---|

BFS Equity Fund - Institutional Class | 9.14% | 11.80% | 9.88% |

|---|

S&P 500® Index | 13.52% | 15.94% | 12.86% |

|---|

Dow Jones Industrial Average® | 11.16% | 12.94% | 11.34% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| AssetsNet |

$ 58,343,984

|

| Holdings Count | Holding |

41

|

| Advisory Fees Paid, Amount |

$ 333,067

|

| InvestmentCompanyPortfolioTurnover |

16.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$58,343,984

- Number of Portfolio Holdings41

- Advisory Fee (net of waivers)$333,067

- Portfolio Turnover16%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 89.7% | Money Market Funds | 6.0% | U.S. Government & Agencies | 4.3% |

Sector Weighting (% of net assets)Value | Value |

|---|

Energy | 2.2% | Consumer Staples | 3.7% | U.S. Treasury Obligations | 4.3% | Money Market Funds | 6.0% | Health Care | 6.3% | Industrials | 7.3% | Materials | 8.6% | Communications | 9.7% | Consumer Discretionary | 10.6% | Financials | 12.3% | Technology | 29.0% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Microsoft Corp. | 6.7% |

|---|

Fidelity Investments Money Market Government Portfolio, Institutional Class | 6.0% |

|---|

NVIDIA Corp. | 5.8% |

|---|

Meta Platforms, Inc., Class A | 5.0% |

|---|

Alphabet, Inc., Class A | 4.7% |

|---|

JPMorgan Chase & Co. | 4.5% |

|---|

Amazon.com, Inc. | 4.2% |

|---|

Apple, Inc. | 3.8% |

|---|

Broadcom, Inc. | 3.1% |

|---|

MasterCard, Inc., Class A | 3.0% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the year ended May 31, 2025. |

| C000089323 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

LS Opportunity Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

LSOFX

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information Phone Number |

(877) 336-6763

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional | $272 | 2.67% |

|---|

|

| Expenses Paid, Amount |

$ 272

|

| Expense Ratio, Percent |

2.67%

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 1 Year | 5 years | 10 Years |

|---|

LS Opportunity Fund - I | 3.49% | 8.12% | 6.60% |

|---|

S&P 500® Index | 13.52% | 15.94% | 12.86% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| AssetsNet |

$ 191,460,045

|

| Holdings Count | Holding |

96

|

| Advisory Fees Paid, Amount |

$ 3,417,428

|

| InvestmentCompanyPortfolioTurnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$191,460,045

- Number of Portfolio Holdings96

- Advisory Fee (net of waivers)$3,417,428

- Portfolio Turnover66%

|

| Holdings [Text Block] |

Long Sector Weighting (% of net assets)Value | Value |

|---|

Other Assets in Excess of Liabilities | 0.2% | Put Options Purchased | 0.1% | Exchange-Traded Funds | 0.8% | Communication Services | 1.1% | Real Estate | 1.6% | Materials | 2.6% | Energy | 3.6% | Consumer Discretionary | 5.5% | Information Technology | 7.3% | Health Care | 7.5% | Money Market | 7.6% | Consumer Staples | 9.5% | Industrials | 15.6% | Financials | 37.0% |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Invesco Treasury Portfolio, Institutional Class | 7.6% |

|---|

Brown & Brown, Inc. | 3.7% |

|---|

PNC Financial Services Group, Inc. (The) | 3.3% |

|---|

Fairfax Financial Holdings Ltd. | 3.3% |

|---|

Eaton Corp. PLC | 3.3% |

|---|

Progressive Corp. (The) | 3.1% |

|---|

Arthur J. Gallagher & Co. | 2.9% |

|---|

Globe Life, Inc. | 2.8% |

|---|

Abbott Laboratories | 2.6% |

|---|

Everest Re Group, Ltd. | 2.5% |

|---|

|