Exhibit 10.1

PURCHASE AND SALE AGREEMENT

GSD FLOWERFIELD LLC,

Seller

- with -

B2K SMITHTOWN LLC,

Purchaser

|

Premises: |

Approximately 49.0 Acres of Real Property St. James, New York |

PURCHASE AND SALE AGREEMENT (this “Purchase Agreement”) dated as of July ___, 2025 (“Effective Date”) by and between GSD FLOWERFIELD LLC, a limited liability company validly organized and existing under the laws of the State of New York, having an office at 1 Flowerfield Road, Suite 24, St. James, New York 11780 (“Seller”), and B2K SMITHTOWN LLC, a limited liability company validly organized and existing under the laws of the State of Delaware, having its principal place of business in care of B2K Development LLC, 300 Jericho Turnpike, Suite 100, Jericho, New York 11753 (“Purchaser”).

WITNESSETH:

WHEREAS, Seller is the fee simple owner of certain land being in the Hamlet of St. James, Town of Smithtown, County of Suffolk, State of New York; which parcels are included within the 74.89 acres of land subject to the application known as Gyrodyne Subdivision #1178 submitted to the Town of Smithtown Planning Board (“Overall Property”); and

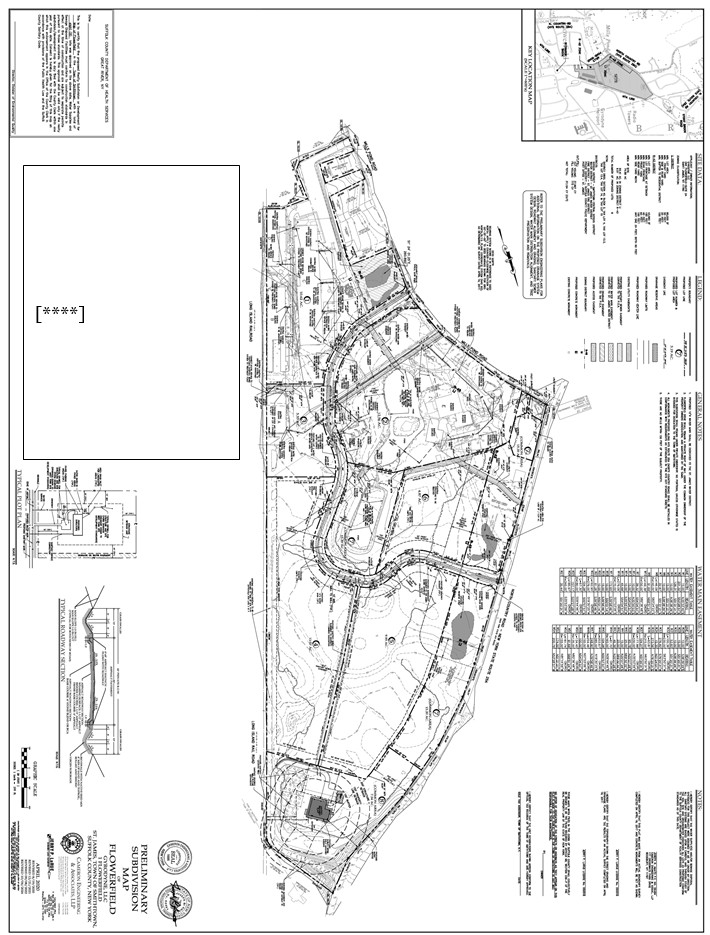

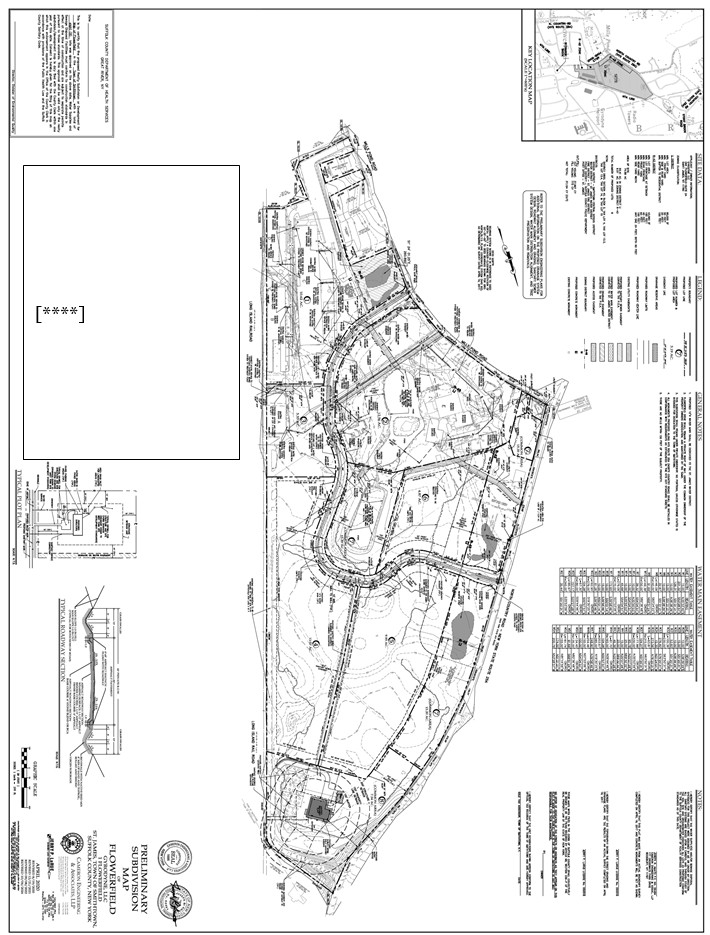

WHEREAS, Seller desires to subdivide the Overall Property into separate and distinct parcels, one parcel of which to be approximately forty-nine (49.0) acres of real property generally shown as proposed lots 4, 5, 6, 7, and 8 (“Property”) on that certain Preliminary Subdivision Map of Flowerfield, prepared by Cameron Engineering & Associates, LLP, dated April 2020, as revised August 19, 2020, as revised December 21, 2021, as revised September 8, 2022, and as further revised October 4, 2024, a copy of which is annexed hereto and made a part hereof as EXHIBIT “A” (the “Preliminary Subdivision Map”); and

WHEREAS, Seller desires to sell to Purchaser, and Purchaser desires to purchase from Seller, together with all right, title, and interest of Seller, if any, in and to: (a) the land lying in the bed of any street or highway in front of or adjoining such land to the center line thereof and to any unpaid award for any taking thereof by condemnation, or any damage to such land by reason of a change of grade of any street or highway, (b) the appurtenances, including streets, easements, rights-of-way, and vehicle parking rights used in connection the Property, (c) any air or development rights appurtenant to the Property or any portion thereof, and (d) all licenses, permits, certificates of occupancy and other approvals issued by any state, federal, or local authority relating to the use, maintenance, or operation of such land (the “Premises”) on the terms, covenants, and conditions set forth in this Purchase Agreement.

NOW, THEREFORE, in consideration of the Premises and the mutual covenants contained herein, Seller and Purchaser hereby covenant and agree as follows:

SECTION 1

SALE OF PREMISES AND ACCEPTABLE TITLE

1.1 Seller shall sell to Purchaser, and Purchaser shall purchase from Seller, the Premises at the price and upon the terms and conditions set forth herein. As used herein, the term (i) [******]

1.2 (A) Seller shall convey and Purchaser shall accept marketable fee simple title to the Premises in accordance with the terms of this Purchase Agreement, subject only to the matters (“Permitted Exceptions”) set forth in EXHIBIT “B” annexed hereto and made a part hereof and such other matters as Purchaser has agreed to take subject to or is deemed to have taken subject to in accordance with this Section 1.2.

(B) Prior to the expiration of the Investigation Period (as hereinafter defined), Purchaser shall deliver to Seller’s attorneys, a title commitment (“Title Commitment”) from BSD Land Services (“BSD”; BSD or any other reputable title insurance company licensed to do business in the State of New York selected by Purchaser is herein referred to as the “Title Company”). In the event the Title Commitment sets forth exceptions to title to which Purchaser objects which are not Permitted Exceptions set forth on EXHIBIT “B” (each, a “Title Defect”), Purchaser shall notify Seller within twenty (20) days thereafter of the Title Defect. Purchaser’s failure to so notify Seller within such twenty (20) day period shall be deemed a waiver of Purchaser’s right to raise such objections (the “Title Objection Notice”).

(C) Seller shall be deemed to have agreed to cure any such Title Defect(s) at or prior to the Closing, provided, however, that Seller shall have thirty (30) days from delivery of Purchaser’s Title Objection Notice by a response notice to Purchaser (“Seller’s Response Notice”) to decline to cure objections to title which are not a Must Clear Item (as hereinafter defined). Notwithstanding anything contained in this Section 1.2 to the contrary, Seller shall be obligated to (i) satisfy all mortgages and other voluntary monetary liens, (ii) all other monetary lien incurred by or taken subject to by Seller during Seller’s period of ownership, and (iii) all other Title Defects that would reasonably be expected not to exceed Two Hundred Fifty Thousand and 00/100 ($250,000.00) Dollars in the aggregate to cure (the items in clauses (i), (ii), and (iii) are hereinafter collectively referred to as “Must Clear Items”).

(D) In the event BSD or another Title Company acting as agent for a national underwriter is unwilling or unable to remove any exception(s) to title, Seller shall have the right to replace the Title Company with any other reputable title underwriter licensed to conduct business in the State of New York willing to omit such exception(s) without additional premium. In such event, Purchaser shall be bound to accept title from such title underwriter engaged by Seller, provided that they are willing to issue the Title Policy (as hereinafter defined).

(E) In the event there exists any Title Defect which Seller has declined to cure pursuant to a Seller’s Response Notice (except the Must Clear Items that Seller is obligated to cure as described in subsection 1.2(c) above, Purchaser shall have the option of (i) closing title, notwithstanding such Title Defect, without any abatement of the Purchase Price, or (ii) terminating this Purchase Agreement by written notice to Seller within ten (10) days after Purchaser receives Seller’s Response Notice. In the event Purchaser elects to terminate this Purchase Agreement by reason of the foregoing, the balance of the Deposit (as hereinafter defined) then remaining in escrow shall be returned promptly to Purchaser, Seller shall retain any portion of the Deposit previously released to Seller, and neither party shall have any further obligation to the other, except as otherwise expressly set forth in this Purchase Agreement.

(F) At Closing, the Title Company shall deliver or unconditionally commit to deliver to Purchaser an Owner’s Policy of Title Insurance with respect to the Property, issued by the Title Company on the current ALTA form in the amount of the Purchase Price, insuring Purchaser as owner of fee title to the Property, subject only to the Permitted Exceptions (the “Title Policy”). Delivery of the Title Policy or the Title Company’s commitment to deliver the Title Policy shall be an express condition to Purchaser’s obligation to proceed to Closing.

1.3 Responsibility for Violations. (A) Except as provided herein, all notes or notices of violations of law or governmental ordinances, orders, or requirements which were noted or issued prior to the Closing Date by any governmental department, agency or bureau having jurisdiction as to conditions affecting the Premises shall be removed by or complied with by Seller and Seller shall close all open permits, other than those which will be closed by virtue of Purchaser pulling a building permit for the Project (as hereinafter defined) affecting the Premises and Seller shall pay all fees, fines, and penalties due in connection therewith. If such removal or compliance has not been completed prior to the Closing, Seller shall pay to Purchaser at the Closing the reasonably estimated unpaid cost to effect or complete such removal or compliance, and Purchaser shall be required to accept title to the Premises subject thereto and all such notes or notices of violations noted or issued shall be the sole responsibility of Purchaser.

(B) Seller, upon written request by Purchaser, shall promptly furnish to Purchaser written authorizations to make any necessary searches for the purposes of determining whether notes or notices of violations have been noted or issued with respect to the Premises.

SECTION 2

PURCHASE PRICE AND DOWNPAYMENT

2.1 (A) The minimum purchase price (“Minimum Purchase Price”) to be paid by Purchaser to Seller for the Premises is TWENTY-FOUR MILLION AND NO/100 ($24,000,000.00) DOLLARS, subject to adjustment as set forth in this Agreement. The term “Purchase Price”, as used in this Agreement, shall be deemed to mean the Minimum Purchase Price adjusted as expressly set forth in this Agreement. In the event Purchaser obtains Approvals (as hereinafter defined) [******] then in such event, the Purchase Price shall be increased by SIXTY THOUSAND AND NO/100 ($60,000.00) DOLLARS for [******]

(B) Subject to the restrictions on allocations [******] Purchaser shall have the right to allocate the Purchase Price [******], the STP Parcel, and the Common Area Parcel in its discretion, provided that the closings of all four portions of the Premises occur on the same date. Notwithstanding the foregoing, Purchaser shall have the right to bifurcate the closings [******] and close title to either [******] within thirty (30) days following the closing of the other parcel provided that (i) Purchaser delivers written notice to Seller of its exercise of its right to bifurcate the closings at least ten (10) days prior to the first closing, (ii) any balance of the Initial Deposit and the Additional Deposit (as such terms are hereinafter defined) are released to Seller on the first closing date, (iii) Purchaser delivers a second additional deposit of Five Hundred Thousand and No/100 (the “Second Additional Deposit”) directly to Seller (which Second Additional Deposit shall be deemed non-refundable), and (iv) Purchaser closes title to the STP Parcel and the Common Area Parcel at the first closing.

(C) At Closing, the parties shall execute and deliver at Closing a Declaration of Covenants and Restrictions, in the form annexed hereto and made a part hereof as EXHIBIT “C” [******] for recording against the Premises at Closing. [******]

2.2 Within five (5) business days after Purchaser’s execution of this Purchase Agreement, Purchaser shall deliver the sum of TWO HUNDRED FIFTY THOUSAND AND NO/100 ($250,000.00) DOLLARS, by check, subject to collection, payable to the order of, or by electronic wire transfer to, CERTILMAN BALIN ADLER & HYMAN LLP, AS ESCROW AGENT (“Escrow Agent”), who shall hold and disburse the proceeds and interest earned thereon, if any, (“Initial Deposit”) in accordance with the terms, covenants and conditions of Section 22 herein.

2.3 Within five (5) business days after Purchaser’s receipt of the Site Plan Approval (as hereinafter defined), Purchaser shall deliver the additional sum of TWO HUNDRED FIFTY THOUSAND AND NO/100 ($250,000.00) DOLLARS, by check, subject to collection, payable directly to, or by electronic wire transfer directly to, Seller, (the “Additional Deposit”). The Initial Deposit, the Additional Deposit, and the Second Additional Deposit to the extent then due and payable or otherwise delivered by Purchaser, are hereinafter collectively referred to as the “Deposit”.

2.4 On the Closing Date (as hereinafter defined), Purchaser shall pay to Seller or its designees the balance of the Purchase Price, after receiving credit for the Deposit (including any portion thereof released to Seller other than portions of the Deposit released pursuant to Section 22.4 herein, which released amounts shall not be credited against the Purchase Price at Closing) and subject to adjustment as expressly set forth in this Purchase Agreement.

2.5 All sums which are to be paid to Seller under this Purchase Agreement shall be paid by unendorsed official bank teller’s checks drawn on a bank which is a member of the New York Clearinghouse Association, or by electronic wire transfer of immediately available federal funds. Upon two (2) days’ written notice from Seller (which notice may be given via email to Purchaser’s attorney), Purchaser shall deliver separate checks at Closing or make separate wire transfers in the number and amounts requested by Seller as designated in such notice.

SECTION 3

INVESTIGATION PERIOD AND APPROVAL PERIOD

3.1 Investigation Period. (A) Purchaser shall have a period of ninety (90) days following the Effective Date (“Investigation Period”) within which it may conduct investigations and studies concerning the Premises. Such investigations and studies are hereinafter referred to as the “Investigation Period Permitted Activities”. Any report prepared by a party (other than Purchaser) in performing such investigations shall hereinafter be referred to as a “Report”. Purchaser’s Investigation Period Permitted Activities shall be performed pursuant to the provisions of Section 3.2 below.

(B) Within seven (7) days following the execution of this Agreement, Seller shall provide Purchaser with copies of the following documents to the extent they exist and are in the possession of Seller: (i) Environmental Claims; (ii) prior Phase I and Phase II environmental site assessment reports relating to the Property; (iii) permits, licenses, registrations, certificates, authorizations or approvals obtained pursuant to any Environmental Law; (iv) surveys; (v) topography reports, drawings and studies, (vi) title reports, (vii) Seller’s title policy; (viii) documentation with respect to the zoning of the Premises, and (ix) any documentation with respect to the availability of utilities at the Premises.

(C) During the Investigation Period, Purchaser shall have the opportunity to inspect the Premises which inspection may include, but shall not be limited to (i) an environmental survey and/or assessment to determine the existence of pollutants and/or contaminants and/or hazardous and/or toxic substances, materials and/or chemicals as defined in Environmental Laws (as defined in Section 16.1 herein) (hereinafter referred to collectively or individually as “Hazardous Substances”), (ii) inspection of underground storage tanks, if any, (iii) compliance with all applicable laws, statutes, rules and regulations imposed by any relevant governmental authority having jurisdiction over the Premises, and (iv) all other matters reasonably affecting or reasonably related to the transaction as may be appropriate. Notwithstanding the foregoing, Purchaser shall, prior to commencing any Investigation Period Permitted Activities, (i) notify Seller of the scope of all testing to be undertaken at the Premises, the methodologies to be used and the identities of the consultants and/or contractors retained by Purchaser to conduct such testing; and (ii) obtain Seller’s prior written consent to any invasive testing at the Premises, which consent shall not be unreasonably withheld. For the purpose of this subsection, invasive testing shall include, but is not limited to, (i) taking, sampling or testing groundwater or soils, (ii) air quality sampling or testing, and (iii) probing, cutting, penetrating, removing or otherwise disturbing the Property in order to sample, test, observe and/or monitor the Property.

(D) Purchaser shall have the right to terminate this Purchase Agreement, for any reason or no reason whatsoever, by written notice to Seller (which notice may be given via email to hstein@certilmanbalin.com and mstieglitz@certilmanbalin.com) delivered on or before 5:00pm New York time on the last day of the Investigation Period (such date hereinafter referred to as the “Investigation Period Notice Date”), time being of the essence. In such event, any Report prepared in connection therewith shall be delivered to Seller. Any notice purporting to terminate this Purchase Agreement pursuant to the provisions of this subsection 3.1(D) after 5:00pm New York time on the Investigation Period Notice Date shall be deemed null and void and of no force and effect. In the event Purchaser terminates this Purchase Agreement, as provided herein, the sole liability of Seller shall be to cause Escrow Agent to promptly refund the Initial Deposit to Purchaser after receipt of Purchaser’s cancellation notice and all Reports. Upon such reimbursement, this Purchase Agreement shall be null and void and the parties hereto shall be relieved of all further obligations and liabilities except as otherwise expressly set forth in this Purchase Agreement.

(E) In the event Purchaser does not cancel this Purchase Agreement as provided in subsection 3.1(D) above, then, in such event, Seller and Purchaser shall proceed with the transaction contemplated herein in accordance with the terms of this Purchase Agreement. In such event, Purchaser may continue to visit the Property to conduct inspections provided that it continues to comply with the requirements for Purchaser’s Investigation Period Permitted Activities in accordance with and subject to the terms of Section 3.2 herein.

(F) At Purchaser’s request, Seller shall provide access to the Premises to allow Purchaser to install and operate a marketing trailer and a construction trailer in a location(s) approved by Seller, provided (i) Purchaser obtains all necessary permits and approvals for the installation of such trailers from required Authorities (if required), (ii) Purchaser’s request includes a depiction of the location of the trailers; and (iii) Purchaser complies with the notice, insurance, and indemnity requirements set forth in Section 3.2 herein.

3.2 (A) Purchaser’s Investigation Period Permitted Activities shall be performed and conducted at Purchaser’s sole cost and expense and in all respects in a commercially reasonable manner by Purchaser, its employees, agents, and independent contractors. In connection with the foregoing, and for the purpose of conducting and performing any Investigation Period Permitted Activities, Purchaser and its employees, agents, and independent contractors shall have the right and license, during the Investigation Period, to enter onto the Premises as described in subsection 3.2(B) below.

(B) In order to obtain entry to the Premises where necessary to perform the Investigation Period Permitted Activities, Purchaser and its employees, agents and independent contractors and representatives shall notify by telephone of the identity of the company intending to enter the Premises and the approximate period of time during which they will be located on the Premises. Seller shall coordinate each and every entry by Purchaser and/or its agents upon the Premises and may, at Seller’s option, have a representative of Seller present during any and all testing and other investigations and inspections at the Premises.

(C) Prior to any entry upon the Premises to conduct any inspection, Purchaser shall furnish, or cause its contractors or agents to furnish, to Seller, evidence of insurance, naming Seller and any other party requested by Seller as an additional insured, insuring Seller from and against liability resulting from injury to or death of any person or persons and damage to or destruction of property, in an amount not less than ONE MILLION AND NO/100 ($1,000,000.00) DOLLARS per occurrence and TWO MILLION AND NO/100 ($2,000,000.00) DOLLARS in the aggregate.

(D) Purchaser hereby indemnifies and shall protect, save, defend, and hold forever harmless Seller from and against all liabilities, obligations, claims, damages, judgments, awards, penalties, costs, and expenses including, without limitation, reasonable attorneys’ fees and court costs at all levels of proceedings, which Seller may incur, suffer, or sustain, or for which Seller may become obligated or liable by reason of any act or omission on the part of Purchaser, its employees, agents, and/or independent contractors in the performance of conduct of the Investigation Period Permitted Activities or by reason of any injury to or death of persons or loss of or damage to property in connection with, or as a result of, any such entry or entries upon or use of the Premises by Purchaser, its employees, agents, and/or independent contractors in connection with the Investigation Period Permitted Activities or as a result of any liens for labor or services performed and/or materials furnished by or for the account of Purchaser in respect of the Premises. For the avoidance of doubt, Purchaser shall have no liability to Seller under this Section 3.2D for: (i) pre-existing conditions upon the Premises except to the extent that the actions of Purchaser exacerbate any existing conditions and then only to the extent that such pre-existing conditions are made worse by Purchaser; and (ii) the negligence or willful misconduct of Seller or its agents or employees. In the event this Purchase Agreement terminates for any reason, Purchaser shall also be obligated to restore the Premises to the condition in which it existed prior to the commencement of Purchaser’s activities thereon. The provisions of this subsection 3.2(D) shall survive any termination of this Purchase Agreement.

3.3 Subdivision Approval. (A) This Purchase Agreement shall be subject to and contingent upon Seller obtaining a subdivision of the Overall Property into separate and distinct parcels to create the Premises (“Subdivision Approval”) within [******] following the Investigation Period Notice Date (“Subdivision Approval Period”). Subdivision Approval includes, without limitation, the following: (i) review and approval by the Planning Board of the Town of Smithtown (the “Planning Board”) and expiration of any appeals period, (ii) review and approval by the Suffolk County Department of Health Services (“SCDHS”) under Article 6 of the Suffolk County Sanitary Code and expiration of any appeals period, and (iii) delivery of a stamped copy of the subdivision map filed in the Office of the Clerk of the County of Suffolk. Seller shall use commercially reasonable efforts to pursue the Subdivision Approval. Purchaser shall reasonably cooperate with Seller’s pursuit of the Subdivision Approval and, at Seller’s request, attend any and all meetings and public hearings with respect to the Subdivision Approval. Any reasonable, customary covenants required by SCDHS or the Planning Board shall not be considered a title objection, provided they do not contain any provisions which would materially adversely affect Purchaser’s ability to develop, construct and operate the Project.

(B) [******] Seller shall reasonably cooperate with Purchaser in its pursuit of the Subdivision Approval, and in such event the term Approvals, as hereinafter defined, shall thereafter be modified to include the Subdivision Approval.

(C) If this Purchase Agreement is [******] Escrow Agent shall promptly return the balance of the Deposit then remaining in escrow to Purchaser, Seller shall reimburse to Purchaser any portions of the Deposit previously released to Seller (other than pursuant to Section 22.4, which amounts shall not be reimbursed to Purchaser), and the parties hereto shall have no further rights or obligations to each other hereunder, except as otherwise expressly set forth in this Purchase Agreement.

(D) As used herein, the term “Subdivision Approval Date” shall be deemed to mean the date on which the Subdivision Approval is final and non-appealable.

3.4 Approvals. (A) This Purchase Agreement shall be further subject to and contingent upon Purchaser obtaining, at Purchaser’s sole cost and expense, final approval, beyond all appeal periods for the Project, but expressly excluding building permits, (the “Approvals”) required by any municipal, county, or state boards, authorities, bureaus, districts, or agencies (including, without limitation, boards, authorities, bureaus, districts, or agencies of the Town of Smithtown and the County of Suffolk) having jurisdiction, including, but not limited to, final approval from the Suffolk County Industrial Development Agency, if applicable, the Subdivision Approval (if Purchaser exercises its rights pursuant to Section 3.3(B) above), [******] final site plan approval beyond all appeal periods (“Site Plan Approval”), any necessary merger of Lot 4 and Lot 5 shown on the Preliminary Subdivision Map [******], any variances for the development of the Project (as determined by Purchaser in its reasonable discretion), but expressly excluding building permits, from the appropriate agencies and authorities within the Town of Smithtown and the County of Suffolk, including without limitation, the Suffolk County Department of Health Services, Suffolk County Department of Public Works, and Suffolk County Department of Health Office of Wastewater Management, necessary for the construction [******] together with accessory common facilities and amenities as determined by Purchaser, in its reasonable discretion, and any necessary utilities and related connections as determined by Purchaser, in its reasonable discretion, on the Property (the “Project”) within eighteen (18) months following the later of: (i) sixty (60) days following the Investigation Period Notice Date or (ii) sixty (60) days following the earlier of: (y) issuance of Subdivision Approval; or ([******] (the “Approval Period”). [******] Purchaser shall diligently and timely pursue all components of the Approvals and provide any and all additional information reasonably requested by the applicable governmental authorities. Purchaser’s application for Site Plan Approval shall not pierce (i) the cap of available sanitary flow to the Premises as set forth in the Flow Chart (as hereinafter defined), and (ii) the thresholds provided in the SEQRA analysis and/or finding statement annexed hereto and made a part hereof as Exhibit “I”, including, without limitation, sanitary density for the Premises consistent with the Flow Chart. Seller shall reasonably cooperate with Purchaser’s efforts to obtain the Approvals and shall execute all appropriate applications required in connection therewith. Purchaser shall, at Seller’s election, participate in monthly status calls with Seller regarding the status of all Approvals throughout the Approval Period. In the event an Article 78 is filed in connection with Purchaser’s application for the Approvals, Purchaser shall, at Purchaser’s sole cost and expense, diligently defend such Article 78 proceeding(s). [******]

(B) In the event Purchaser fails to obtain the Approvals on or before the expiration of the Approval Period, after having utilized diligent efforts to do so, then Purchaser may: (i) terminate this Purchase Agreement upon written notice to Seller delivered prior to 5:00 p.m. New York time on the last day of the Approval Period, whereupon Escrow Agent shall promptly return the balance of the Deposit then remaining in escrow to Purchaser, Seller shall retain any portion of the Deposit previously released to Seller, and the parties hereto shall have no further rights or obligations to each other hereunder except as otherwise expressly set forth in this Purchase Agreement; (ii) waive the foregoing Approval contingency and close title within sixty (60) days thereafter; or (iii) extend the Approval Period for a period of one hundred twenty (120) days (“First Extension Option”), upon the delivery of written notice to Seller prior to the expiration of the Approval Period, together with the payment of an extension fee paid directly to Seller in the amount of Seventy-Five Thousand and No/100 ($75,000.00) Dollars (“First Extension Fee”). The First Extension Fee shall be non-refundable and shall not be applied against Purchase Price. In the event Purchaser fails to obtain the Approvals on or before the expiration of the Approval Period, as extended by the First Extension Option, and fails to exercise the First Extension Option, Purchaser shall be deemed to have waived the Approvals contingency and shall close title to the Premises within sixty (60) days following the expiration of the Approval Period.

(C) In the event Purchaser exercised the First Extension Option and fails to obtain the Approvals on or before the expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option, after having utilized diligent efforts to do so, then Purchaser may: (i) terminate this Purchase Agreement upon written notice to Seller (which notice may be given via email to hstein@certilmanbalin.com and mstieglitz@certilmanbalin.com) delivered prior to 5:00pm New York time on the last day of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option, whereupon Escrow Agent shall promptly return the balance of the Deposit then remaining in escrow to Purchaser, Seller shall retain any portion of the Deposit previously released to Seller, and the parties hereto shall have no further rights or obligations to each other hereunder except as otherwise expressly set forth in this Purchase Agreement; (ii) waive the foregoing Approvals contingency and close title within sixty (60) days thereafter; or (iii) extend the Approval Period for a period of one hundred twenty (120) days (“Second Extension Option”), upon the delivery of written notice to Seller prior to the expiration of the Approval Period, as extended by the First Extension Option, together with the payment of an extension fee paid directly to Seller in the amount of Seventy-Five Thousand and No/100 ($75,000.00) Dollars (“Second Extension Fee”, hereinafter together with the First Extension Fee, to the extent then paid by Purchaser, collectively referred to as the “Extension Fees”). The Second Extension Fee shall be non-refundable and shall not be applied against the Purchase Price. In the event Purchaser fails to obtain the Approvals on or before the expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option, and fails to exercise the Second Extension Option, Purchaser shall be deemed to have waived the Approvals contingency and shall close title to the Premises within sixty (60) days following the expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option and the Second Extension Option.

(D) In the event Purchaser fails to obtain the Approvals on or before the expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option and the Second Extension Option, after having utilized diligent efforts to do so, then Purchaser may: (i) terminate this Purchase Agreement upon written notice to Seller (which notice may be given via email to hstein@certilmanbalin.com and mstieglitz@certilmanbalin.com) delivered prior to 5:00pm New York time on the last day of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option and the Second Extension Option, whereupon Escrow Agent shall promptly return the balance of the Deposit then remaining in escrow to Purchaser, Seller shall retain any portion of the Deposit previously released to Seller, and the parties hereto shall have no further rights or obligations to each other hereunder except as otherwise expressly set forth in this Purchase Agreement; or (ii) waive the Approvals contingency and close title to the Premises within sixty (60) days following the expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option and the Second Extension Option. In the event Purchaser fails to obtain the Approvals and fails to terminate this Purchase Agreement on or before the expiration of the Approval Period, as extended by the First Extension Option and Second Extension Option, Purchaser shall be deemed to have waived the Approvals contingency and shall close title to the Premises within sixty (60) days following expiration of the Approval Period, as extended by Purchaser’s exercise of the First Extension Option and Second Extension Option.

(E) If at any time Purchaser, in its reasonable discretion, believes that any of the Approvals will not be obtainable within the time periods set forth in this Purchase Agreement, Purchaser shall have the right to terminate this Purchase Agreement upon written notice to Seller, which notice shall include a letter from Purchaser’s zoning counsel that the Approvals will not be obtainable within the time periods set forth in this Purchase Agreement. In the event Purchaser exercises the termination right set forth in the previous sentence, then, in such event, Escrow Agent shall promptly return the balance of the Deposit then remaining in escrow to Purchaser, Seller shall retain any portion of the Deposit previously released to Seller, and the parties hereto shall have no further rights or obligations to each other hereunder except as otherwise expressly set forth in this Purchase Agreement.

3.6 IDA Approval. This Purchase Agreement shall be further subject to and contingent upon Purchaser obtaining, at Purchaser’s sole cost and expense, a final inducement resolution from the Suffolk County Industrial Development Agency (“IDA”) providing economic benefits for the construction of the Project (“IDA Approval”) on or before the expiration of the Approval Period (as may be extended in accordance with the terms of Section 3.4 above) which IDA Approval shall include a payment in lieu of taxes (PILOT) program, mortgage recording tax and sales tax exemptions and which otherwise shall in all respects be satisfactory to Purchaser. Purchaser shall keep Seller reasonably appraised as to the status of the IDA Approval throughout the Approval Period.

3.7 In the event Purchaser terminates this Agreement for any reason other than an uncured default of Seller, Purchaser shall assign, and Seller shall assume, all of Purchaser’s right, title, and interest in any and all applications, architectural drawings, plans, reports, and other documents, drawings, and the like used in Purchaser’s pursuit of the Approvals to Seller without representation or warranty.

SECTION 4

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller warrants and represents to Purchaser as follows:

4.1 Seller is a limited liability company, duly organized, validly existing and in good standing under the laws of the State of New York, authorized to conduct business in the State of New York, and is the sole owner of the Premises. Neither the execution of this Purchase Agreement nor the consummation by Seller of the transactions contemplated by this Purchase Agreement will (a) conflict with, or result in a breach of, the terms, conditions or provisions of, or constitute a default, or result in a termination of, any agreement or instrument to which Seller is a party, (b) violate any restriction to which Seller is subject, or (c) result in the creation of any lien, charge or encumbrance upon the Premises or any part thereof.

4.2 Seller has all requisite power and authority, has taken all actions required by its organizational documents and applicable law, and has obtained all consents which are necessary to authorize or enable it to execute and deliver this Purchase Agreement and to consummate the transactions contemplated in this Purchase Agreement. The individual executing this Purchase Agreement on Seller’s behalf has been duly authorized and is empowered to bind Seller to this Purchase Agreement.

4.3 Seller is not listed nor is it owned or controlled by, or acting on behalf of, any person or entity on the list of Specially Designated Nationals and Blocked Persons maintained by the Office of Foreign Assets Control of the United States Department of the Treasury, or any other list of persons or entities with whom a citizen of the United States is restricted from doing business.

4.4 No bankruptcy, insolvency, rearrangement or similar action or proceedings, whether voluntary or involuntary, is pending or, to the best of Seller’s knowledge, threatened against Seller.

4.5 To the best of Seller’s knowledge, there are no outstanding violations of any laws, statutes, ordinances, rules or regulations with respect to the Premises, nor have any notices of any uncorrected violations of any laws, statutes, ordinances, rules or regulations been received.

4.6 There are no existing or pending contracts of sale, options to purchase or rights of first refusal affecting the Premises. There are no leases that would bind the Premises after the Closing Date. The Premises shall be delivered vacant, free and clear of all tenancies and rights of possession at Closing. On the Closing Date, there shall be no service, maintenance, supply, or union or other employment contracts affecting the Premises. There are no unrecorded use restrictions, easements, or rights of access affecting the Premises.

4.7 Seller is not a “foreign person” as such term is defined in Section 1445 of the Internal Revenue Code as amended by the Foreign Investment in Real Property Tax Act of 1980.

4.8 To the best of Seller’s knowledge, there are no pending or previously decided or contemplated eminent domain or condemnation proceedings affecting or which may affect any portion of the Premises.

The representations and warranties made by Seller in this Purchase Agreement shall be deemed restated and shall be true and accurate on the Closing Date and shall survive the Closing for a period of three (3) months.

SECTION 5

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Purchaser warrants and represents to Seller as follows:

5.1 Neither the execution of this Purchase Agreement nor the consummation by Purchaser of the transaction contemplated by this Purchase Agreement will (i) conflict with, or result in a breach of, the terms, conditions or provisions of, or constitute a default, or result in a termination of, any agreement or instrument to which Purchaser is a party, (ii) violate any restriction to which Purchaser is subject or (iii) constitute a violation of any applicable code, resolution, law, statute, regulation, ordinance, judgment, rule, decree or order.

5.2 Purchaser is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware, and has been authorized to conduct business in the State of New York.

5.3 Purchaser has all requisite authority, has taken all actions required by its organizational documents and applicable law, and has obtained all consents which are necessary to authorize or enable it to execute and deliver this Purchase Agreement, to apply for and diligently pursue the Approvals and to consummate the transactions contemplated in this Purchase Agreement. The individual executing this Purchase Agreement on Purchaser’s behalf has been duly authorized and is empowered to bind Purchaser to this Purchase Agreement.

5.4 Purchaser represents and warrants that it is not listed nor is it owned or controlled by, or acting for or on behalf of, any person or entity, on the list of Specially Designated Nationals and Blocked Persons maintained by the Office of Foreign Assets Control of the United States Department of the Treasury, or any other list of persons or entities with whom Seller is restricted from doing business.

SECTION 6

CLOSING

6.1 Except as otherwise provided in this Purchase Agreement, the closing of title (“Closing”) shall take place at the office of Seller’s counsel on the earlier of: (i) that certain date which is eight (8) months following the Town of Smithtown’s granting of the Site Plan Approval; or (ii) sixty (60) days following Purchaser’s waiver of the Approvals. If such earlier date falls on a Saturday, Sunday, or legal holiday for which banks in the State of New York are authorized to close, the Closing shall occur on the next business day. The actual date of the Closing is referred to in this Purchase Agreement as the “Closing Date”.

SECTION 7

CONDITIONS PRECEDENT AND COVENANTS

7.1 Purchaser’s obligation to close title pursuant to the terms of this Purchase Agreement is subject to and conditioned upon the following:

(A) Each of the representations and warranties made by Seller in Section 4 hereof being true and complete in all material respects on the Closing Date as if made on and as of such date. At the Closing, Seller shall deliver to Purchaser a certification to this effect;

(B) Seller shall have performed all obligations which it is required to perform pursuant to the provisions of this Purchase Agreement; and

(C) The condition of title is as required under Section 1.2 hereof.

7.2 Seller’s obligation to consummate the sale of the Premises pursuant to the terms of this Purchase Agreement is subject to and conditioned upon the following:

(A) Each of the representations and warranties made by Purchaser in Section 5 hereof being true and complete on the Closing Date as if made on and as of such date. At the Closing, Purchaser shall deliver to Seller a certification to this effect; and

(B) Purchaser shall have performed all obligations which it is required to perform pursuant to the provisions of this Purchase Agreement.

7.3 Seller covenants that between the Effective Date and the Closing Date, Seller shall:

(A) Maintain, operate and secure the Premises in a manner consistent with the manner in which Seller has maintained, operated and secured the Premises prior to the Effective Date;

(B) Not make any changes to the facilities operated at the Premises that would have a material adverse effect on the value of the Premises;

(C) Keep in effect all governmental permits relating to the Premises that are presently in effect;

(D) Other than leases expiring on or prior to the Closing Date, not sell, grant or transfer any interest in the Premises, including, without limitation, any air and development rights or any oil, gas, mineral, or executive rights in connection therewith or any water rights in connection therewith or enter into a contract to take any of the foregoing actions;

(E) Not bring or allow a release of Hazardous Substances onto the Premises;

(F) Not create (or agree to create) and execute any covenant, restriction, easement or other lien on or affecting the Premises, or amend, modify or terminate or violate any existing covenant, restrictive easement or other lien affecting the Premises without the prior written consent of Purchaser;

(G) Will not construct any buildings or structures on the Premises which will remain after Closing; and

(H) Maintain in full force and effect the insurance policies currently in effect with respect to the Premises, or policies of similar coverage, subject to customary exclusions at the time of renewal or issuance.

SECTION 8

SELLER’S CLOSING OBLIGATIONS

At the Closing, Seller shall:

8.1 Deliver a statutory form of Bargain and Sale Deed Without Covenants Against Grantor’s Acts (“Deed”), containing the covenant required by Section 13 of the Lien Law of the State of New York, and executed in proper statutory form for recording so as to convey to Purchaser marketable title to the Premises subject only to the Permitted Exceptions.

8.2 Deliver a form TP-584 duly executed by Seller, a New York State Equalization Form (RP-5217) executed by Seller, and any other instruments, affidavits and/or tax returns as are customarily executed by the seller of an interest in real property in connection with the recording of a deed.

8.3 Deliver a non-foreign affidavit with respect to Seller as required by IRC Section 1445(b)(2) of the Internal Revenue Code of 1986, as amended, (“Code”) and the regulations issued thereunder, and Purchaser shall not deduct or withhold any portion of the Purchase Price pursuant to Section 1445 of the Code.

8.4 Deliver such affidavits and indemnifications as the Title Company may reasonably require in order to omit from its title insurance policy all exceptions for parties in possession or persons entitled to a mechanic’s lien, judgments, bankruptcies or other returns against persons or entities whose names are the same or similar to Seller’s name; and other documents as the Title Company may reasonably require.

8.5 Deliver checks to the appropriate officers in payment of all applicable real property transfer taxes imposed upon the seller of an interest in real estate by statute and copies of any required tax returns therefor executed by Seller, unless Seller elects to have Purchaser pay any of such taxes and credit Purchaser with the amount thereof.

8.6 Deliver a resolution of Seller authorizing the sale and delivery of the Deed and setting forth facts showing that the transfer complies with all applicable law.

8.7 In the event the entire Deposit is not released to Seller prior to the Closing Date pursuant to the terms of this Purchase Agreement, deliver a letter authorizing Escrow Agent to disburse the balance of the Deposit then remaining in escrow to Seller.

8.8 Deliver vacant possession of the Premises to Purchaser.

8.9 Deliver to Purchaser the certification required in subsection 7.1(A).

8.10 [******]

SECTION 9

PURCHASER’S CLOSING OBLIGATIONS

At the Closing, Purchaser shall:

9.1 Deliver the balance of the Purchase Price, subject to adjustment as provided in this Purchase Agreement, by immediately available federal funds transferred by wire to such account(s) in such bank(s) as Seller shall designate; or by unendorsed official bank teller’s check(s) to Seller and/or its designees, at Seller’s option.

9.2 In the event the entire Deposit is not released to Seller prior to the Closing Date pursuant to the terms of this Purchase Agreement, deliver a letter authorizing Escrow Agent to disburse the balance of the Deposit then remaining in escrow to Seller.

9.3 Deliver to Seller the certification referred to in subsection 7.2(A).

9.4 Deliver to Seller an assumption of the FRE Agreement.

9.5 Cause the Deed to be recorded, duly complete all required real property transfer tax returns, and cause all such returns and checks in payment of such taxes to be delivered to the appropriate officers or to the Title Company promptly after the Closing.

9.6 Deliver to Seller such other documents as are required by this Purchase Agreement to be delivered by Purchaser or as reasonably requested by Seller in order to effectuate the provisions of this Purchase Agreement.

SECTION 10

APPORTIONMENTS AND OTHER PAYMENTS

10.1 The following apportionments shall be made between the parties at the Closing as of the close of business on the day immediately prior to the Closing Date: real estate taxes, water charges and sewer rents, if any, on the basis of the lien period for which assessed, except if there is a water meter on the Premises, apportionment at Closing shall be based on the last available reading, subject to adjustment after Closing when the next reading is available. If the Closing shall occur before a new tax rate is fixed, the apportionment of taxes at the Closing shall be based upon the tax rate for the immediately preceding period applied to the latest assessed valuation. Installments for assessments noted against the Premises prior to Closing shall be the responsibility of the Seller. If the Closing shall occur before the real estate taxes for the Premises are apportioned out of the Overall Property, then in such event the adjustment for real estate taxes shall be based upon fifty (50%) percent of the real estate taxes for the Overall Property, on a “land-only” basis and not including any real estate taxes for any buildings or other improvements located on the Overall Property.

10.2 In the event the net apportionment or payment is required to be made by Purchaser, the amount due shall be added to the payment due at the Closing and paid either by electronic wire transfer of immediately available funds or by unendorsed official bank teller’s check(s); or, in the event the net apportionment or payment is required to be made by Seller, the amount due shall be applied as a credit against the amount due at the Closing.

10.3 The parties hereto agree that any errors or omissions in computing apportionments at the Closing shall be corrected promptly after discovery, but in no event later than six (6) months after the Closing.

10.4 Seller shall pay the New York State transfer tax on the Deed. Purchaser shall pay the following costs: any transfer taxes imposed upon a purchaser by statute, the title insurance premium and the services charges by the Title Company (if any), and the cost of all recording charges in connection with the Closing other than charges incurred to record documents in connection with the clearing of title by Seller pursuant to this Purchase Agreement (which recording charges shall be paid by Seller), except as otherwise provided herein.

10.5 Purchaser acknowledges that, as a result of the necessary subdivision of the Overall Property, the real estate taxes may not be apportioned amongst the lots forming a part of the Subdivision Approval as of the Closing Date. In the event the real estate taxes are not apportioned on the Closing Date, Purchaser shall be responsible for fifty (50%) percent of the real estate taxes attributable to the land-only value, and not for any real estate taxes attributable to the value of buildings or other improvements located on the Overall Property. Upon Seller’s request, Purchaser shall make such land-only tax payments to Seller until such time as the property taxes for the Premises have been apportioned. At Closing, the parties shall enter into an agreement to memorialize Purchaser’s obligation set forth in this Section 10.5. Seller covenants that it will promptly file and diligently pursue to completion, applications with the relevant taxing authorities for the apportionment of taxes among the individual lots promptly upon its receipt of Subdivision Approval and provide Purchaser with proof of filing.

10.6 The provisions of this Section 10 shall survive the Closing in accordance with the terms hereof.

SECTION 11

TERMINATION AND REMEDIES

11.1 In the event that on the Closing Date or after any permitted adjournment of the Closing Date, any of Seller’s representations or warranties contained herein are untrue in any material respect or if any of the conditions precedent to Purchaser’s obligation to consummate the transactions contemplated hereby shall have failed to occur and Seller fails to cure such untruth or condition precedent within thirty (30) days following written notice from Purchaser, Purchaser may, at its option (i) terminate this Purchase Agreement by giving written notice of termination to Seller, in which event Purchaser shall receive a refund of the Deposit and the Extension Fees (if previously paid by Purchaser), but specifically excluding any statutory interest, and neither party under this Purchase Agreement shall have any further obligation to the other, or (ii) close title to the Premises without any abatement of the Purchase Price, in which event Purchaser shall be deemed to have waived any rights it may have had on account of such untruth, failure to perform or failure to occur. If Seller defaults in any of its obligations under this Purchase Agreement and fails to cure such default within thirty (30) days following written notice from Purchaser of such default, then Purchaser may, at Purchaser’s election: (a) terminate this Purchase Agreement by giving written notice thereof to Seller, in which event the Deposit and the Extension Fees (if previously paid by Purchaser), but specifically excluding any statutory interest, will promptly be returned to Purchaser, and the parties shall have no further obligation to each other; (b) waive such default and consummate the transaction contemplated hereby in accordance with the terms of this Purchase Agreement; or (c) seek specific performance.

11.2 If Purchaser defaults under the terms of this Purchase Agreement and fails to cure such default (i) within five (5) business days following written notice for Purchaser’s failure to delivery the Additional Deposit and/or Second Additional Deposit, (ii) within thirty (30) days following written notice of Purchaser’s failure to close title to the Premises on the date set forth in Section 6, and (iii) within ten (10) business days following written notice for all other defaults, the entire damages which Seller will thereby sustain cannot be exactly determined; therefore, it is agreed that in the event of any default by Purchaser, the Deposit and the Extension Fees (if previously paid by Purchaser) shall be considered as liquidated damages for such failure or refusal of Purchaser to consummate this transaction or for any non-compliance, non-performance, breach or default by Purchaser, and shall become the exclusive property of, and be permanently retained by Seller, as Seller’s sole remedy and Purchaser’s sole obligation in any and all events. Seller shall retain such amounts as liquidated damages and no further rights or causes of action shall remain against Purchaser, nor shall Purchaser have any further rights under this Purchase Agreement or otherwise, with respect to Seller, except as otherwise expressly set forth in this Purchase Agreement.

SECTION 12

BROKER

12.1 Seller and Purchaser each represent and warrant to the other that no broker, finder or similar persons other than David Levitan, Ryan Robertson, and Jose Cruz, each of Jones Lang LaSalle (collectively, “Broker”) was involved in or connected with the transaction contemplated by this Purchase Agreement. Purchaser further represents that no broker, finder or similar person other than Broker brought the Premises to the attention of Purchaser. Purchaser and Seller each hereby indemnify and shall defend, save, and hold the other harmless of and from all loss, cost, liability, and expense, including, without limitation, reasonable attorneys’ fees, which may be incurred by the other in connection with any claim for commission or other compensation, whether based on a claim of brokerage, or based on a contract, quasi-contract or tort, which may be made by any person, firm or corporation other than Broker who claims to have dealt with Seller or Purchaser, as the case may be, in connection with the transaction contemplated by this Purchase Agreement. Seller shall pay Broker a fee pursuant to a separate agreement between Seller and Broker.

12.2 The representations and obligations under this Section 12 shall survive the Closing or, if the Closing does not occur for any reason, shall survive the termination of this Purchase Agreement.

SECTION 13

NOTICES

13.1 Any notice required to be given hereunder shall be given in writing by depositing such notice in a post-paid wrapper, in an official depository under the exclusive care and custody of the United States Postal Service within New York State, or by Express Mail, Federal Express or messenger service (with proper receipt therefor), addressed to the party at the address set forth below with a copy of any such notice by a similar method of delivery or by fax transmission (with proper receipt therefor and a copy sent by mail) to the attorney for such party as follows:

IF TO SELLER: GSD Flowerfield LLC

1 Flowerfield Road

Suite 24

St. James, New York 11780

Attention: Peter Pitsiokos, COO

Tel. (631) 374-8132

E-Mail: ppitsiokos@gyrodyne.com

and

GSD Flowerfield LLC

1 Flowerfield Road

Suite 24

St. James, New York 11780

Attention: Gary Fitlin, CFO

Tel. (631) 848-0894

E-Mail: gfitlin@gyrodyne.com

and

GSD Flowerfield LLC

1 Flowerfield Road

Suite 24

St. James, New York 11780

Attention: Paul Lamb

E-Mail: PLL@lambzankel.com

WITH A COPY: Certilman Balin Adler & Hyman, LLP

90 Merrick Avenue

9th Floor

East Meadow, New York 11554

Attention: Howard M. Stein, Esq.

and Michelle L. Stieglitz, Esq.

Tel. (516) 296-7093 (HMS) and (516) 296-7004 (MLS)

Fax (516) 296-7111

E-Mail: hstein@certilmanbalin.com

and mstieglitz@certilmanbalin.com

IF TO PURCHASER: B2K Smithtown LLC

c/o B2K Development LLC

300 Jericho Turnpike – Suite 100

Jericho, New York 11753

Attention: Steven Krieger and David Burman

E-Mail: skrieger@b2kdev.com and dburman@b2kdev.com

WITH A COPY: B2K Development LLC

300 Jericho Turnpike – Suite 100

Jericho, New York 11753

Attention: Craig Masheb, Esq.

and Nicholas J. Cappadora, Esq.

E-Mail: cmasheb@b2kdev.com

and ncappadora@b2kdev.com

IF TO ESCROW AGENT: Certilman Balin Adler & Hyman, LLP

90 Merrick Avenue

9th Floor

East Meadow, New York 11554

Attention: Howard M. Stein, Esq.

and Michelle L. Stieglitz, Esq.

Tel. (516) 296-7093 (HMS) and (516) 296-7004 (MLS)

Fax (516) 296-7111

E-Mail: hstein@certilmanbalin.com

and mstieglitz@certilmanbalin.com

Any notice hereunder may be given by the attorney for a party and shall have the same force and effect as if given by the party. Either party may by notice change the address at which notices are to be given hereunder. Notices shall be deemed given upon receipt or first refusal thereof.

SECTION 14

CONDEMNATION AND CASUALTY

14.1 In the event of condemnation of the Premises or any portion thereof between the Effective Date and the Closing Date which would materially interfere with or adversely affect the Premises, Purchaser shall have the option to terminate this Purchase Agreement by written notice to Seller, in which event Seller shall retain that portion of the Deposit previously released to Seller and Seller shall cause Escrow Agent to refund the balance of the Deposit then remaining in escrow to Purchaser. Upon such reimbursement, this Purchase Agreement shall be null and void and the parties hereto shall be relieved of all further obligations and liabilities except as expressly set forth in this Purchase Agreement. In the event there is a condemnation and Purchaser does not elect to terminate this Purchase Agreement, Seller shall assign to Purchaser any condemnation award which is applicable only to the Premises Seller is entitled to receive and Seller and Purchaser shall proceed with the transaction contemplated herein in accordance with the terms hereof.

14.2 With respect to a casualty at the Premises, the provisions of Section 5-1311 of the General Obligations Law of the State of New York shall not apply. Purchaser shall have no right to cancel this Purchase Agreement as a result of any casualty at the Premises.

SECTION 15

CONFIDENTIALITY

15.1 Purchaser and Seller shall each keep the terms, covenants and conditions of this Purchase Agreement (“Confidential Information”) strictly confidential and not disclose all or any portion of the Confidential Information to any third party, except that each party may disclose Confidential Information to its affiliates and its directors, officers, employees, agents, potential equity partners or lenders, advisors (including, without limitation, financial advisors, counsel and accountants) (collectively, “Representatives”) and Escrow Agent; provided, however, each party agrees to notify in writing each of its Representatives (other than legal counsel who are bound by professional and ethical guidelines regarding confidentiality of client information) that receives Confidential Information of the confidentiality provisions of this Purchase Agreement and to direct its Representatives to keep the Confidential Information strictly confidential. Notwithstanding the foregoing, nothing in this Section 15 shall prevent Purchaser or Seller from disclosing or accessing any Confidential Information (a) in connection with the enforcement of its rights hereunder; (b) pursuant to a subpoena or order issued by a court of competent jurisdiction or by a judicial, administrative, legislative or regulatory body or committee, (c) pursuant to any legal requirement (including, without limitation, any legal requirement by virtue of Seller’s status as a public company), any statutory reporting requirement or any accounting or auditing disclosure requirement; (d) in connection with performance by either party of its obligations under this Purchase Agreement (including, without limitation, the pursuit of the Subdivision Approval and the Approvals and the delivery and recordation of instruments, notices or other documents required hereunder); or (e) to potential investors, participants or assignees in or of the transaction contemplated by this Purchase Agreement provided that the same have been advised of the confidentiality provisions of this Section 15.

15.2 The provisions of this Section 15 shall survive the Closing and/or earlier termination of this Purchase Agreement.

SECTION 16

DISCLAIMER: RELEASE OF CLAIMS

16.1 Except as expressly set forth in this Purchase Agreement, Purchaser, for itself, its heirs, grantees, successors and assigns, if any, does hereby release, acquit and forever discharge Seller, all of Seller’s affiliates, parent corporations and predecessors, its present and former members, officers, employees, agents, brokers, contractors and attorneys from any and all claims (whether known or unknown, contingent or liquidated, in contract or in tort or pursuant to any other theory) arising from or related to any conditions affecting the Premises effective as of the Closing Date. This release includes but is not limited to all claims, fines, penalties, demands and causes of action for personal injuries, breach of contract, failure of representations and warranties, loss of consortium and services, damage to real property, damage to personal property, damage to improvements or fixtures, illness, death, medical expenses, expenses of monitoring and testing, prejudgment interest, punitive damages, violations of Environmental Laws, attorneys’ fees and any and all other losses and damages of every kind or character that have accrued or may in the future accrue to Purchaser, its heirs, grantees, successors and assigns. The release set forth in this Section 16.1 specifically includes any claims under any Environmental Laws. “Environmental Laws” includes the Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act (42 U.S.C. §§ 6901, et seq.), the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (42 U.S.C. §§7401 et seq.), the Emergency Planning and Community Right to Know Act (42 U.S.C. §§ 1101 et seq.), the Clean Air Act (42 U.S.C. §§ 7401 et seq.), the Clean Water Act (33 U.S.C. §§ 1251 et seq.), the Toxic Substances Control Act (15 U.S.C. §§ 2601 et seq.), the Hazardous Materials Transportation Act (49 U.S.C. §§ 1801 et seq.), the Occupational Safety and Health Act (29 U.S.C. §§ 651 et seq.), the Federal Insecticide, Fungicide and Rodenticide Act (7 U.S.C. §§ l36 et seq.), and the Safe Drinking Water Act (42 U.S.C. §§ 3001 et seq.), as any of the same maybe amended from time to time, and any other federal, state or local law, and any regulations, orders, rules, procedures, guidelines and the like promulgated in connection therewith, regardless of whether such laws and/or regulations are in existence at the time this Purchase Agreement is executed.

16.2 The provisions of this Section 16 shall survive the Closing or, if the Closing does not occur for any reason, shall survive the termination of this Purchase Agreement.

SECTION 17

CONDITION OF PREMISES

17.1 Except as expressly set forth in this Purchase Agreement, Purchaser acknowledges that it has fully examined the Premises or will have fully examined the Premises during the Investigation Period and is purchasing the Premises in an “as is” condition “with all faults” and specifically and expressly without any warranties, representations or guarantees, from or on behalf of Seller and its agents. Except as expressly set forth in this Purchase Agreement, Purchaser has not relied, and is not relying, upon any information, document, sales brochures or other literature, maps or sketches, projection, proforma, statement, representation, guarantee or warranty (whether express or implied, or oral or written, or material or immaterial) that may have been given by or made by or on behalf of Seller.

17.2 Except as expressly set forth in this Purchase Agreement, Purchaser hereby acknowledges that it shall not be entitled to, and should not, rely on Seller or its agents as to: (i) the quality, nature, adequacy or physical condition of the Premises; (ii) the quality, existence, nature, adequacy or physical condition of soils, sub-surface support or ground water at the Premises; (iii) the existence, quality, nature, adequacy or physical condition of any utilities serving the Premises; (iv) the existence, quality, nature or adequacy of any ability to access utilities, including, but not limited to, electricity, natural gas, water and sewer; (v) the existence, quality, nature, adequacy, physical condition, or ability to access any rights of way or roads of any kind; (vi) the development potential of the Premises, its habitability, or the merchantability, or fitness, suitability or adequacy of the Premises for any particular purpose; (vii) the zoning classification, use or other legal status of the Premises; (viii) the existence, applicability, quality or nature of any setback requirements; (ix) the Premises’ or its operations’ compliance with any applicable codes, laws, regulations, statutes, ordinances, covenants, conditions or restrictions or any governmental or quasi-governmental entity or of any other person or entity; (x) the quality of any labor or materials relating in any way to the Premises; or (xi) compliance with any environmental or occupational protection, pollution, subdivision or land use laws, rules, regulations, orders or requirements including, but not limited to, those pertaining to the handling, generating, treating, storing or disposing of any hazardous waste, material or substance. The provisions of this Section 17.2 shall survive the Closing.

SECTION 18

ASSIGNMENT OF CONTRACT

18.1 Purchaser shall not assign this Purchase Agreement or the rights and obligations hereunder without the prior written consent of Seller. Notwithstanding the foregoing, Purchaser may assign this Purchase Agreement without Seller’s prior written consent (but upon prior written notice to Seller and Seller’s attorney) to an entity in which Purchaser or any of its affiliates control the day-to-day operations of such entity, or which controls, is controlled by, or which is under common control with Purchaser. Purchaser may also direct Seller to deliver the Deed and other closing deliverables to Purchaser’s designee, by giving Seller written notice thereof at or prior to the Closing.

SECTION 19

TAX DEFERRED EXCHANGE

19.1 Seller may desire to exchange, for other property of like kind and qualifying use within the meaning of Section 1031 of the Code and the Regulations promulgated thereunder, fee title in the Premises. Seller expressly reserves the right to assign its rights, but not its obligations, hereunder to a Qualified Intermediary as provided in IRC Reg. 1.1031(k)-1(g)(4) on or before the Closing Date. Purchaser shall cooperate with Seller and the Qualified Intermediary to complete any such exchange.

19.2 Purchaser may desire to exchange, for other property of like kind and qualifying use within the meaning of Section 1031 of the Code and the Regulations promulgated thereunder, fee title in the Premises. Purchaser expressly reserves the right to assign its rights, but not its obligations, hereunder to a Qualified Intermediary as provided in IRC Reg. 1.1031(k)-1(g)(4) on or before the Closing Date. Seller shall cooperate with Purchaser and the Qualified Intermediary to complete any such exchange.

SECTION 20

TAX REDUCTION PROCEEDING

20.1 Purchaser acknowledges that proceedings are pending to correct or reduce the assessed valuation of the Premises for a number of tax years. Such proceedings shall, at Seller’s election, be continued by Seller between the Effective Date and the Closing Date, and Purchaser agrees to pay a share of the fees and disbursements in the event that a reduction is obtained which shall be in proportion to the share of the benefit to Purchaser from the Closing Date to the date of determination of the proceeding. Any reduction or refund received by or benefiting Purchaser which is applicable to tax years prior to Closing shall be promptly paid by Purchaser to Seller. This provision shall survive the Closing.

SECTION 21

INFRASTRUCTURE AND SHARED COSTS

21.1 Purchaser shall construct an on-site sewerage treatment plant (“STP”) on the Premises substantially in accordance with those certain plans annexed hereto and made a part hereof as EXHIBIT “D”. Seller shall have the modify the STP Plans as required by the Suffolk County Department of Health Services provided that same does not result in the diminution of sewage capacity. Seller shall be responsible for Seller’s share of the cost to construct the STP based on the flow allocated to Seller on the chart of sanitary flow to be delivered by Seller to Purchaser during the Investigation Period and incorporated into this Purchase Agreement at or prior to the Investigation Period Notice Date as EXHIBIT “E” (the “Flow Chart”). At Closing, Seller’s share of the cost to construct the STP, up to a maximum of $2,500,000.00, shall be escrowed out of the Purchase Price to be released to Purchaser during construction pursuant to an escrow agreement to be agreed to by the parties. The STP shall be completed and approved by all governmental and quasi-governmental authorities having jurisdiction over the Premises including, without limitation, the Town of Smithtown, the Suffolk County Department of Health, and the Suffolk County Department of Public Works. The STP shall service all portions of the Overall Property, with such service being in accordance with the Flow Chart. At Closing, Seller, [******] and Purchaser shall enter into a formal connection agreement with standard terms including, but not limited to, fees to be paid for the operations and maintenance of the STP on a pro-rata basis based on each parcel’s flow and a hook up fee equal to based on each user’s pro-rata share of the initial cost of construction of the STP; [******] The STP Agreement shall include a provision which provides that any unused or unassigned flow shall be assigned to Purchaser.

21.2 [******]

21.3 The subdivision of the Overall Property will necessarily require the construction and subsequent maintenance of certain common facilities, including but not limited to: interior roadways/walkways/curbing/sidewalks, drainage facilities, lighting, landscaping, retaining walls, water supply system and utilities (collectively, “Common Facilities”) and off-site improvements (collectively, “Offsite Improvements”), including, without limitation, installation of traffic light, addition of turning lane, and improvement of intersection of Route 25A and Stony Brook Road and the intersection of Mill Pond Road and Route 25A as detailed on EXHIBIT “H” annexed hereto and made a part hereof. Purchaser shall, at Purchaser’s sole cost and expense, construct those certain Common Facilities which are located on the Premises, any Offsite Improvements which are required under the Subdivision Approvals (including, without limitation, SEQRA) for the development of the Project, and any other Common Facilities and Offsite Improvements which Purchaser agrees to construct during the Investigation Period; provided, however, that in the event Purchaser does not agree, in writing, to construct all Common Facilities and Offsite Improvements prior to the Investigation Period Notice Date, then in such event, Seller shall have the right to terminate this Purchase Agreement, in which event the Initial Deposit shall be returned to Purchaser and the parties shall have no further rights or obligations under this Purchase Agreement except as otherwise expressly set forth in this Agreement. The maintenance and repair of the Common Facilities and Offsite Improvements shall be governed by a Property Owner’s Association Declaration of Covenants, Restrictions, Easements, and Charges (“POA Declaration”) in substantially the same form annexed hereto and made a part hereof as EXHIBIT “I”. Seller shall record the POA Declaration at or prior to the Closing. Purchaser and Seller shall each be responsible to pay its proportionate share (based on acreage) of the cost of the maintenance, repair, and/or replacement of the Common Facilities in accordance with the terms, covenants, and conditions of the POA Declaration.

21.4 The provisions of this Section 21 shall survive the Closing.

SECTION 22

ESCROW OF DEPOSIT

22.1 Escrow Agent shall hold the proceeds of the checks delivered to Escrow Agent for the Deposit, in escrow, in one or more interest-bearing account(s) maintained at one or more financial institutions selected by Escrow Agent.

22.2 Except as otherwise expressly set forth in this Agreement, the Deposit shall be held by Escrow Agent until the Closing or sooner termination of this Agreement and Escrow Agent shall pay over the interest or income earned thereon, if any, to the party entitled to the Deposit. The party receiving such interest or income shall pay any income taxes due thereon. If for any reason the Closing does not occur pursuant to the provisions of this Agreement and either party makes a written demand upon Escrow Agent, in the manner required for notices, for payment of the Deposit, then Escrow Agent shall give written notice, in accordance with the provisions of Section 13.1 to the other party of such demand. If Escrow Agent does not receive a written objection from the other party to the proposed payment of the Deposit pursuant to the aforesaid demand within ten (10) days after the delivery of such notice by Escrow Agent, Escrow Agent is hereby authorized to make such payment in accordance with the aforesaid demand. If Escrow Agent receives written objection from the other party to the proposed payment of the Deposit pursuant to the aforesaid demand within such ten (10) day period or if for any other reason Escrow Agent in good faith shall elect not to make such payment, Escrow Agent shall continue to hold the Deposit until otherwise directed by written instructions from Seller and Purchaser or a final judgment of a court of competent jurisdiction. Escrow Agent, however, shall have the right at any time to deposit the Deposit with the clerk of any court of competent jurisdiction in the State of New York, and Escrow Agent shall give written notice of such deposit to Seller and Purchaser, and upon such deposit being made, Escrow Agent shall be discharged from all obligations and responsibilities hereunder. Notwithstanding the foregoing, Seller shall have no right to object to the release of the Initial Deposit to Purchaser in the event Purchaser terminates this Purchase Agreement in accordance with Section 3.1C of this Purchase Agreement, in which event Escrow Agent shall release the Initial Deposit to Purchaser within three (3) business days following Escrow Agent’s receipt of Purchaser’s cancellation notice thereunder. The parties acknowledge that Escrow Agent is acting solely as a stakeholder at their request and for their convenience, that Escrow Agent may act upon any writing believed by it in good faith to be genuine and to be signed and presented by the proper person, and Escrow Agent shall not be deemed to be the agent of either of the parties, and that Escrow Agent shall not be liable to either of the parties for any act or omission on its part unless taken or suffered in bad faith, or in willful disregard of this Purchase Agreement or involving gross negligence. Seller and Purchaser hereby jointly and severally indemnify and shall jointly and severally protect, save, defend, and hold Escrow Agent harmless from and against all costs, claims, liabilities, damages, and expenses, including, without limitation, reasonable attorneys’ fees, incurred in connection with the performance of Escrow Agent’s duties hereunder, except with respect to actions or omissions taken or suffered by Escrow Agent in bad faith, in willful disregard of this Purchase Agreement, or involving gross negligence. If the Deposit shall not earn any interest, or no interest be paid thereon by reason of the withdrawal of the proceeds, or part thereof, under the provisions of this Agreement or before interest shall be earned or credited, or during any period of reasonable delay in opening an account, Escrow Agent shall not be liable by reason thereof. Notwithstanding anything contained herein to the contrary, Escrow Agent may represent Seller as Seller’s counsel in any action, suit, or other proceeding between Seller and Purchaser or in which Seller and Purchaser may be involved. Escrow Agent shall have no duties or responsibilities except as set forth herein. Escrow Agent shall not be bound by any modification of the Agreement unless the same is in writing and signed by Purchaser and Seller and, if Escrow Agent’s duties hereunder are affected, Escrow Agent. The provisions relating to the indemnification of Escrow Agent shall survive the Closing or, if the Closing does not occur for any reason, shall survive the termination of this Purchase Agreement.

22.3 [******], Escrow Agent shall, automatically but upon notice to Purchaser, release the sum of One Hundred Thousand and No/100 ($100,000.00) Dollars from the Deposit to Seller, which amount shall be deemed non-refundable, unless this Purchase Agreement is terminated due to Seller’s default hereunder.

22.4 Commencing as of that certain date which is one (1) month following the date upon which the [******] Approval is granted, and on the first day of each month thereafter, Escrow Agent shall, automatically but upon notice to Purchaser, release the sum of Ten Thousand and No/100 ($10,000.00) Dollars to Seller, which amounts shall, upon release, be deemed non-refundable, unless this Purchase Agreement is terminated due to Seller’s default hereunder.

SECTION 23

MISCELLANEOUS

23.1 The Section headings are inserted for convenience of reference only and in no way define, describe or limit the scope or intent of this Purchase Agreement or any of the provisions hereof.