To the shareholders of Kaspi.kz:

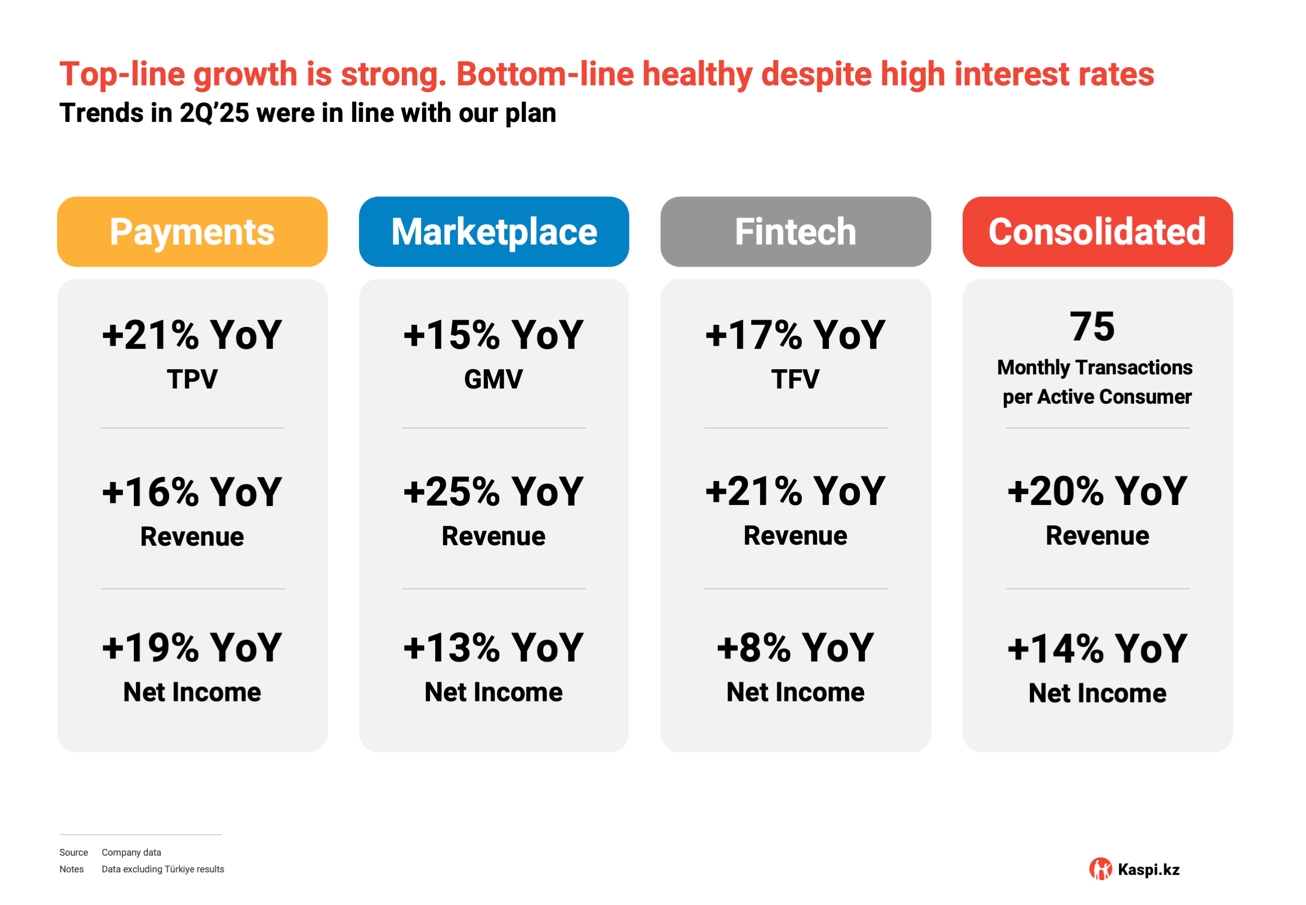

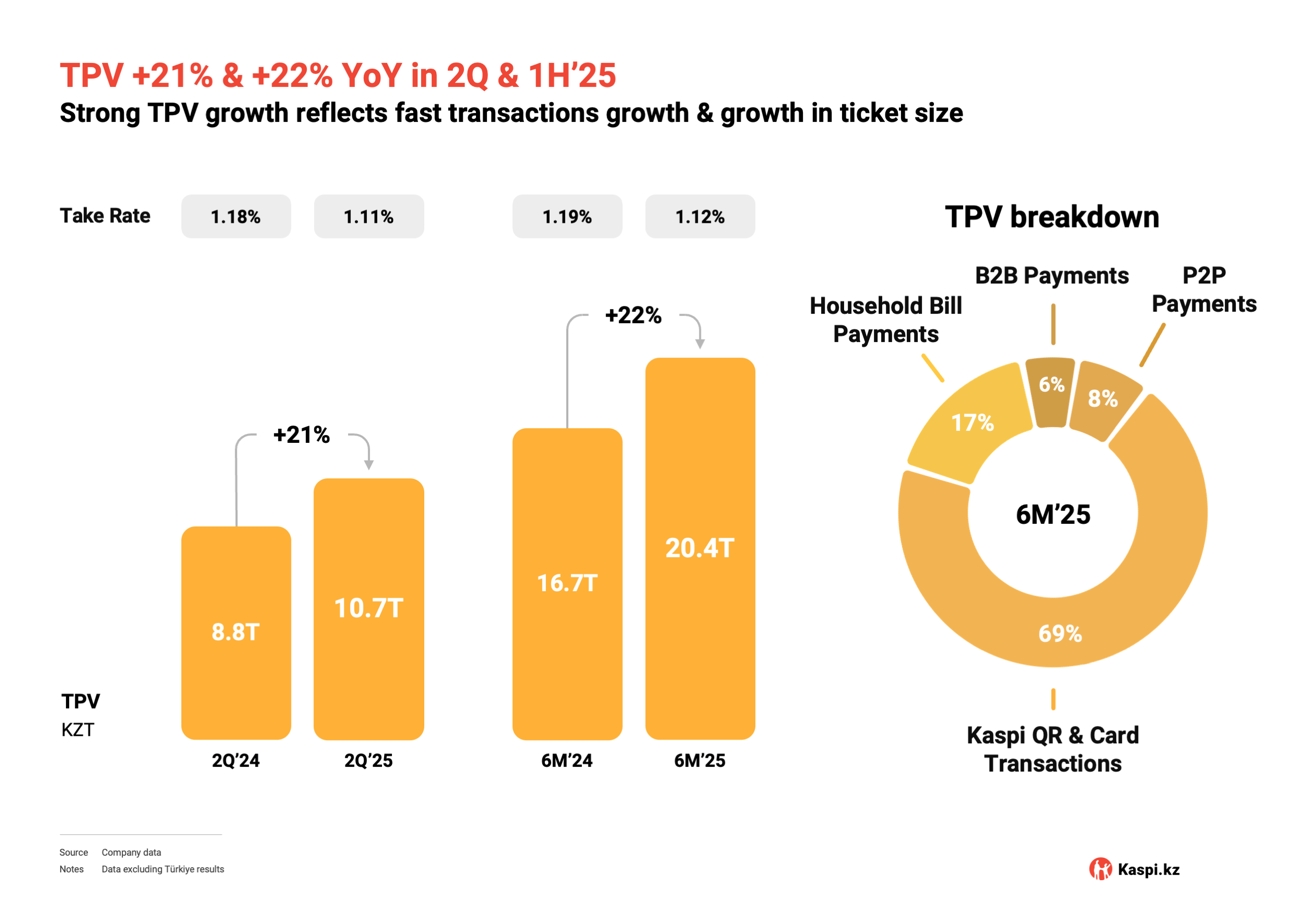

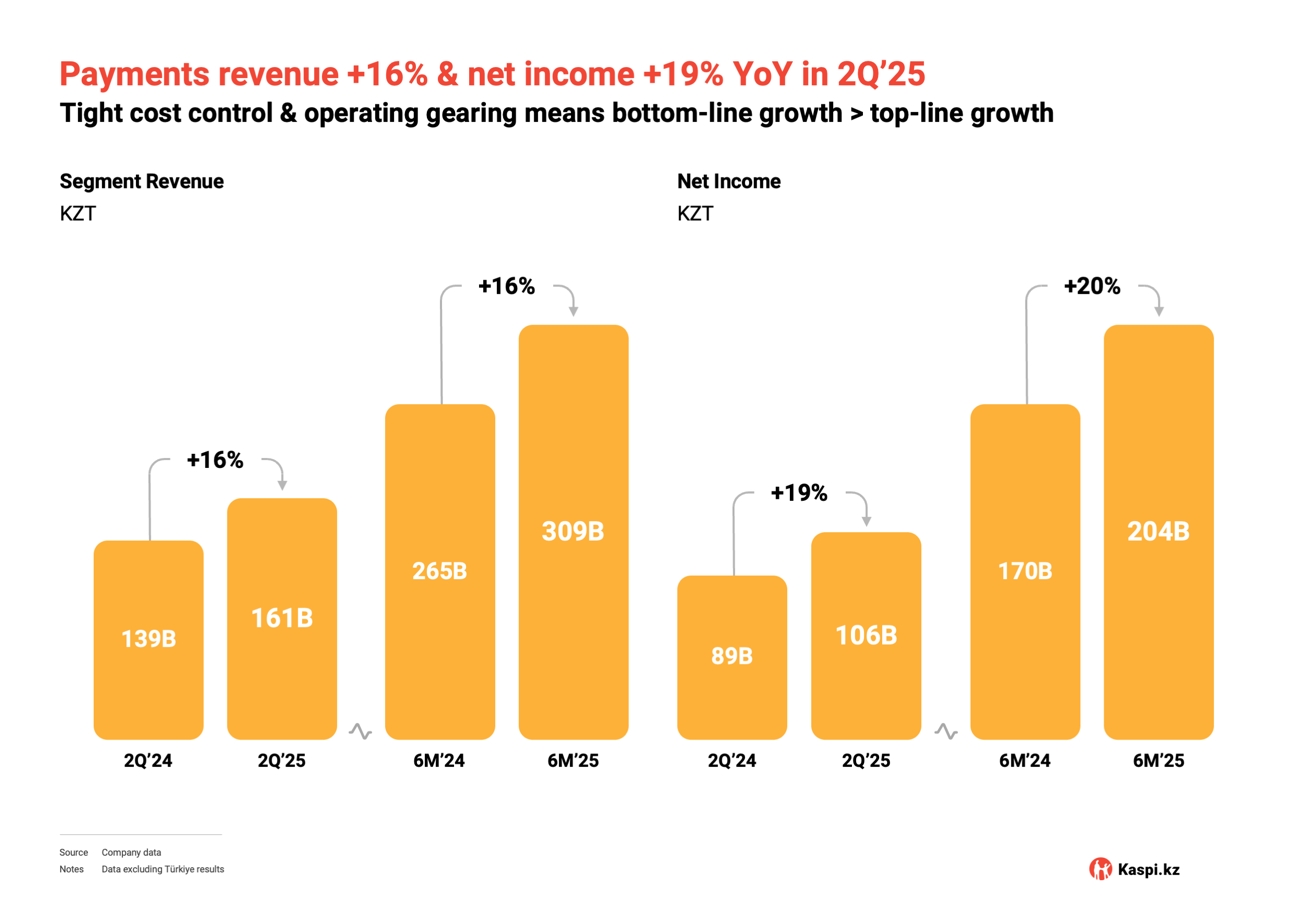

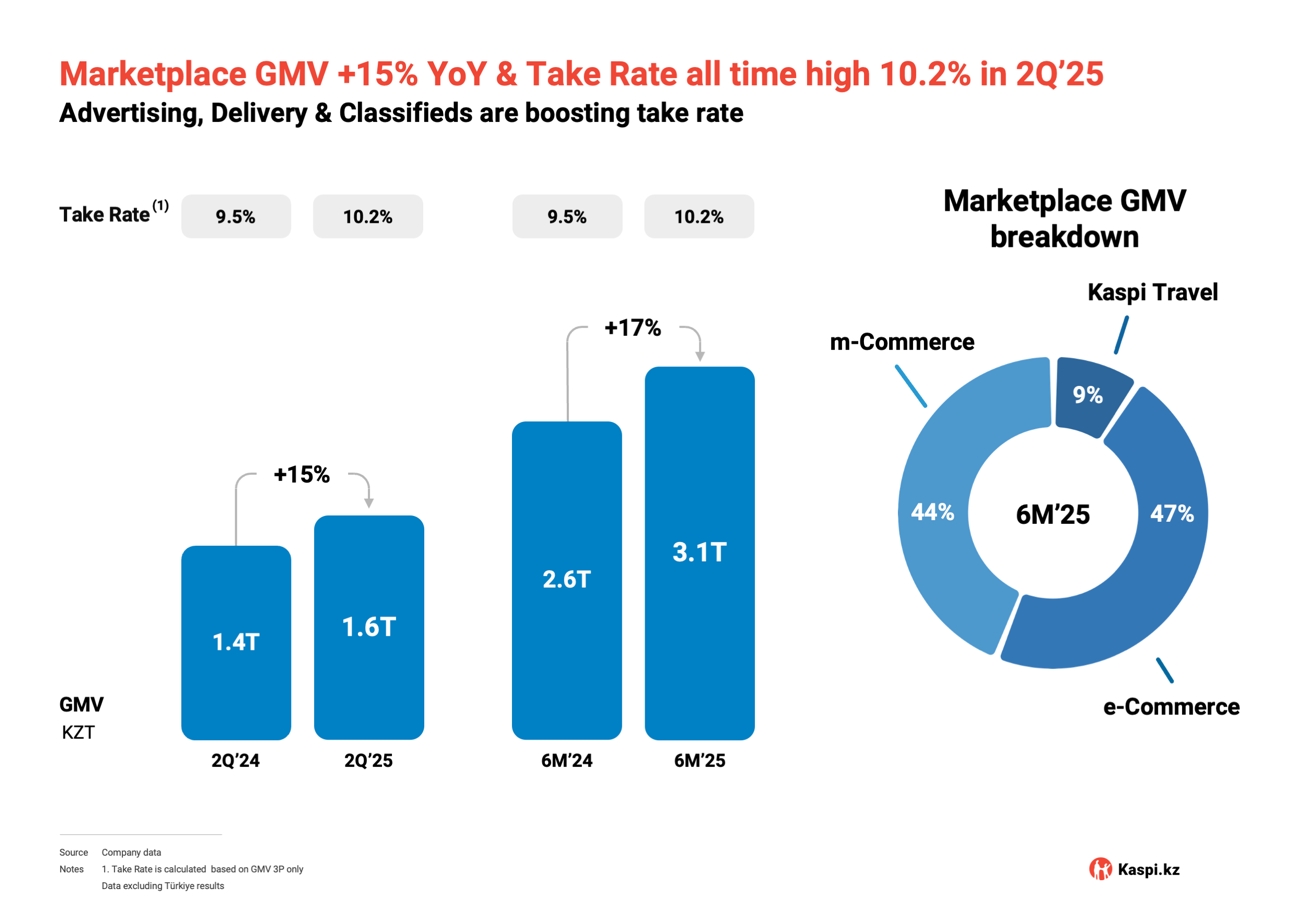

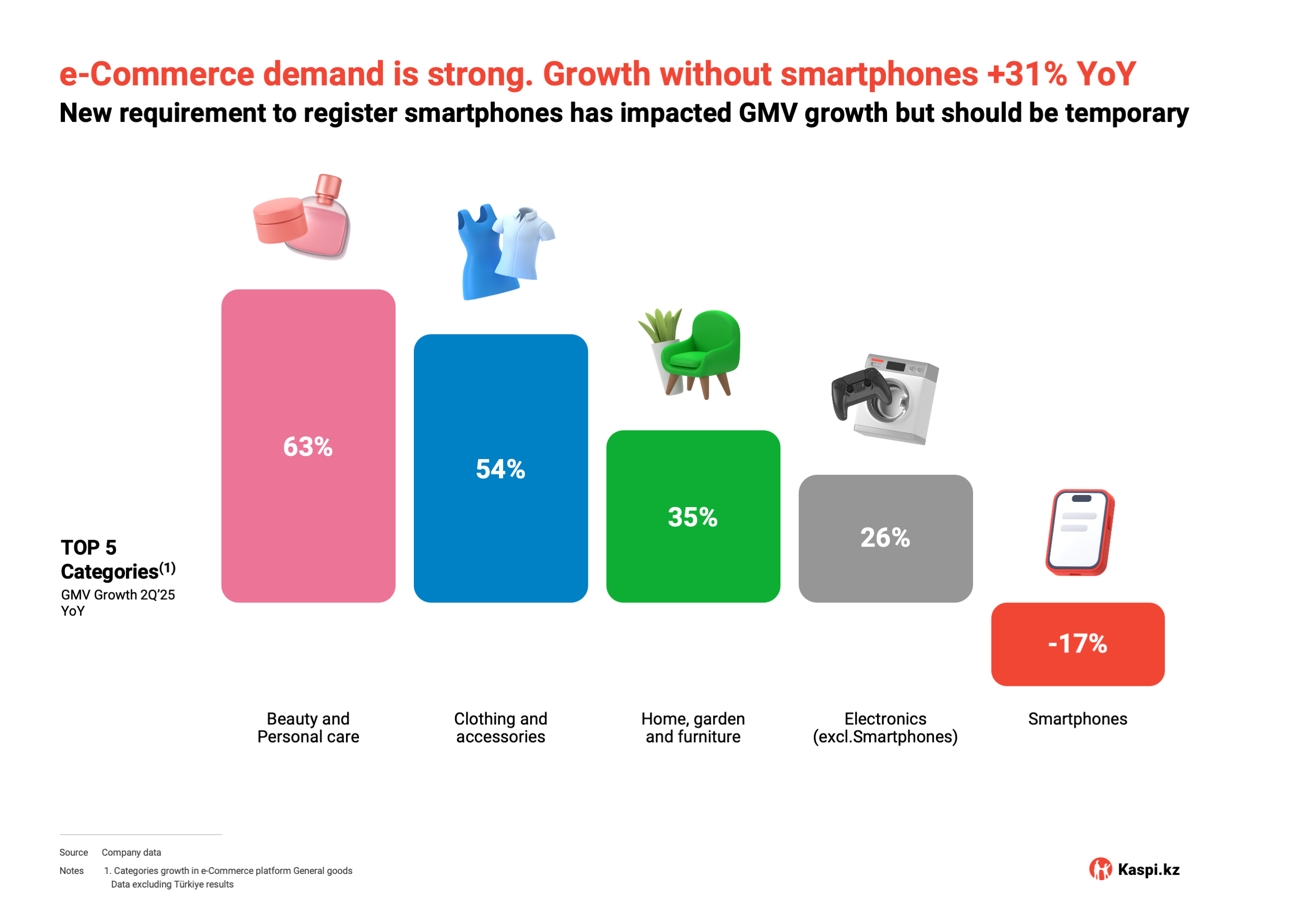

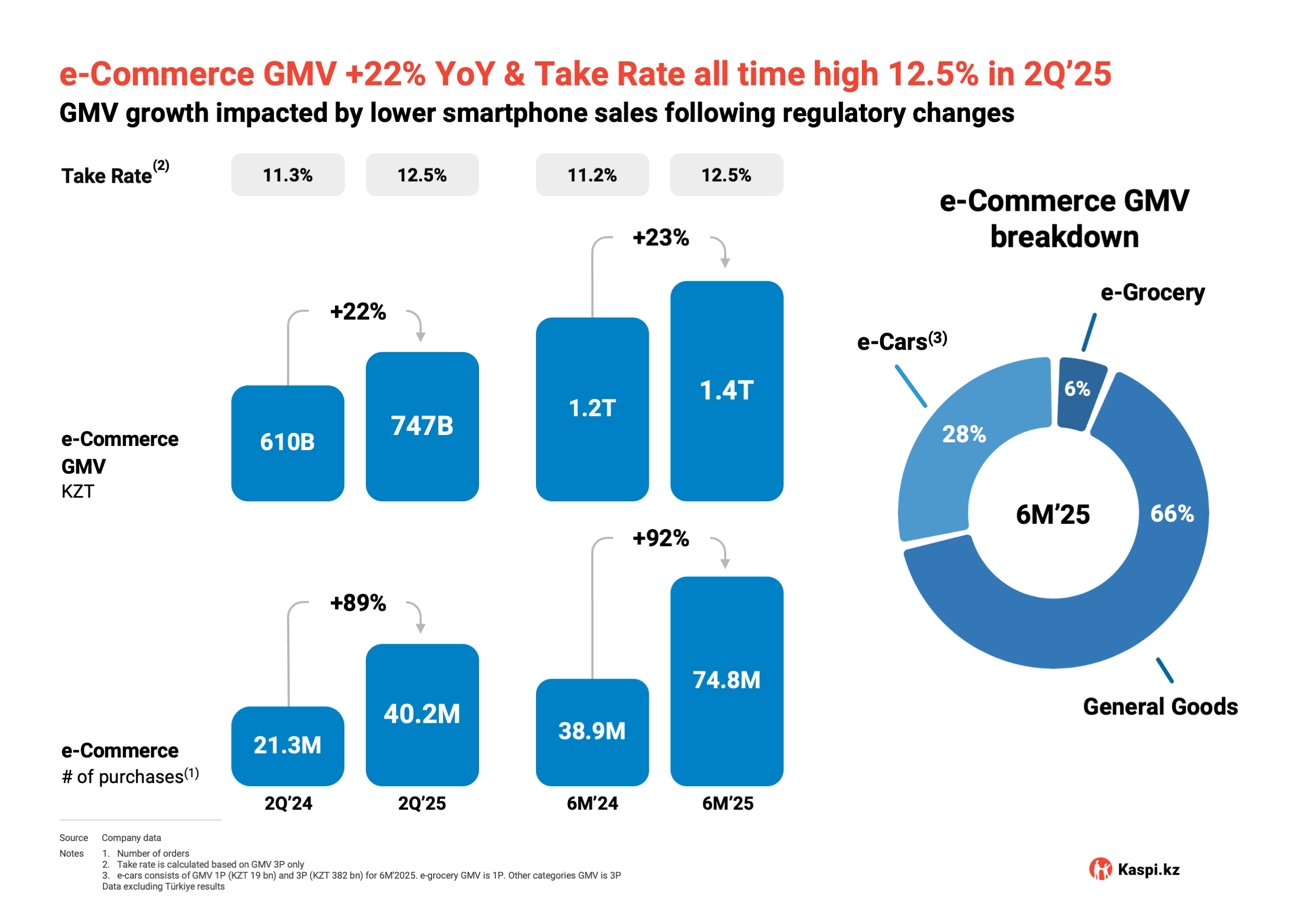

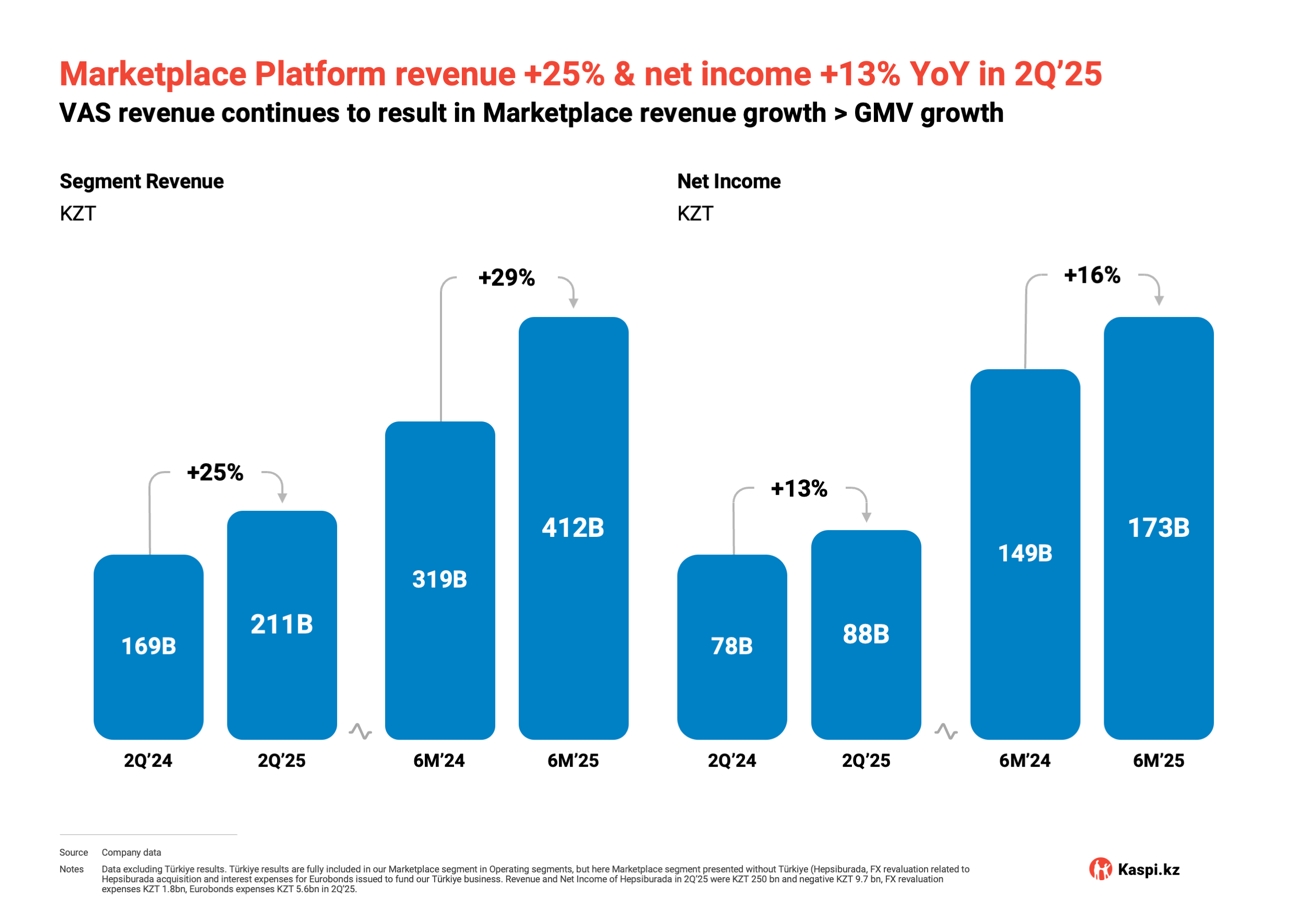

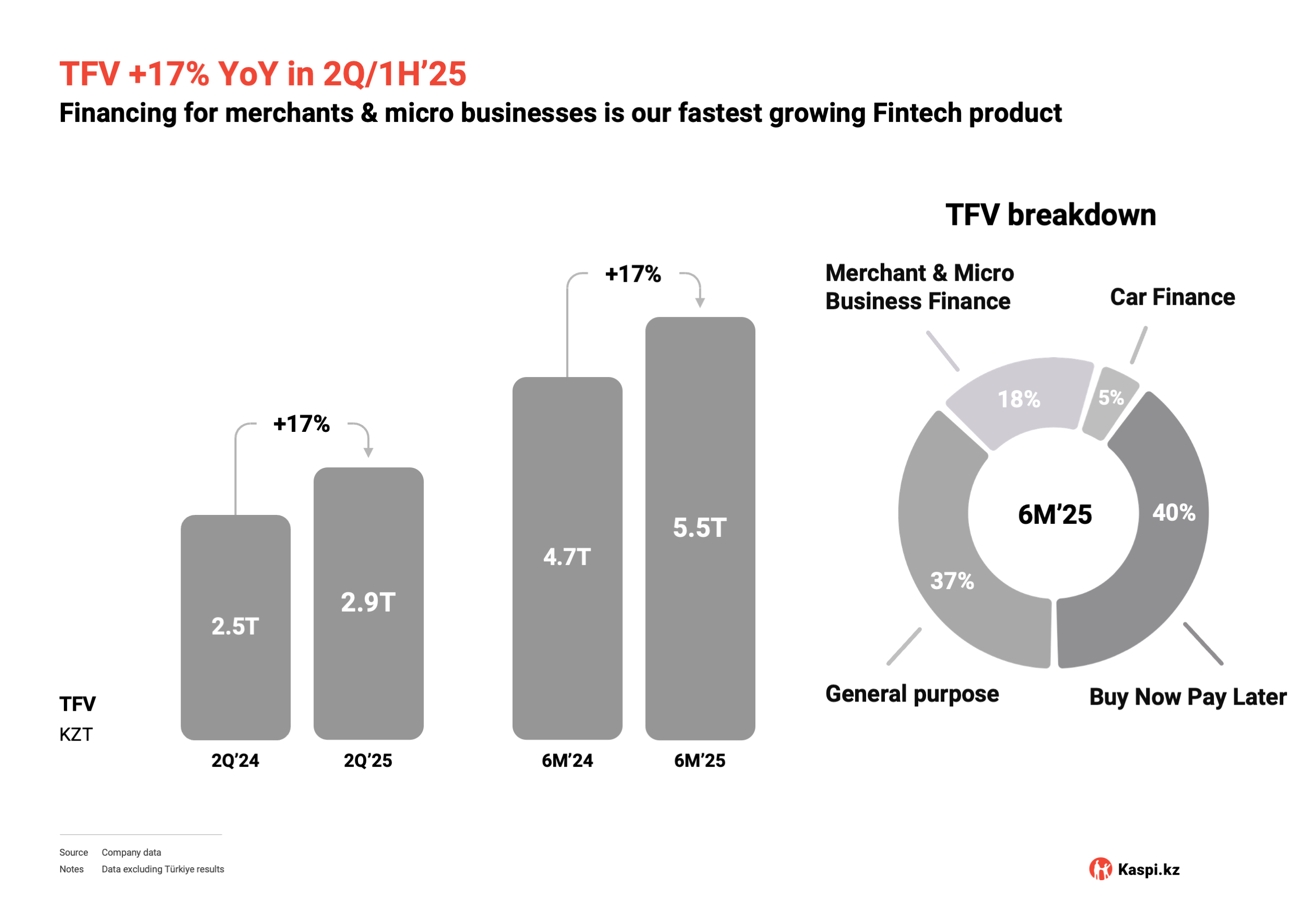

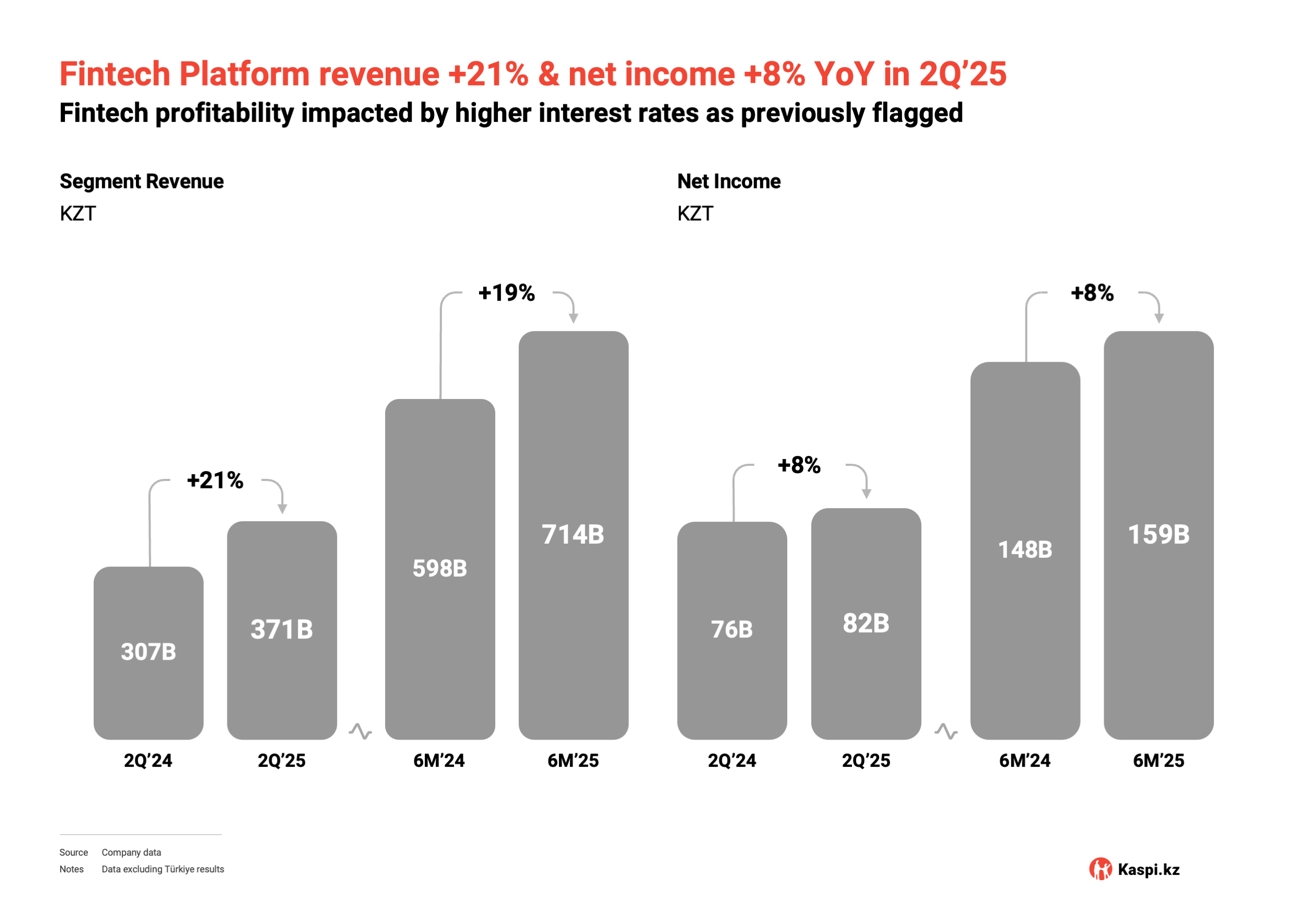

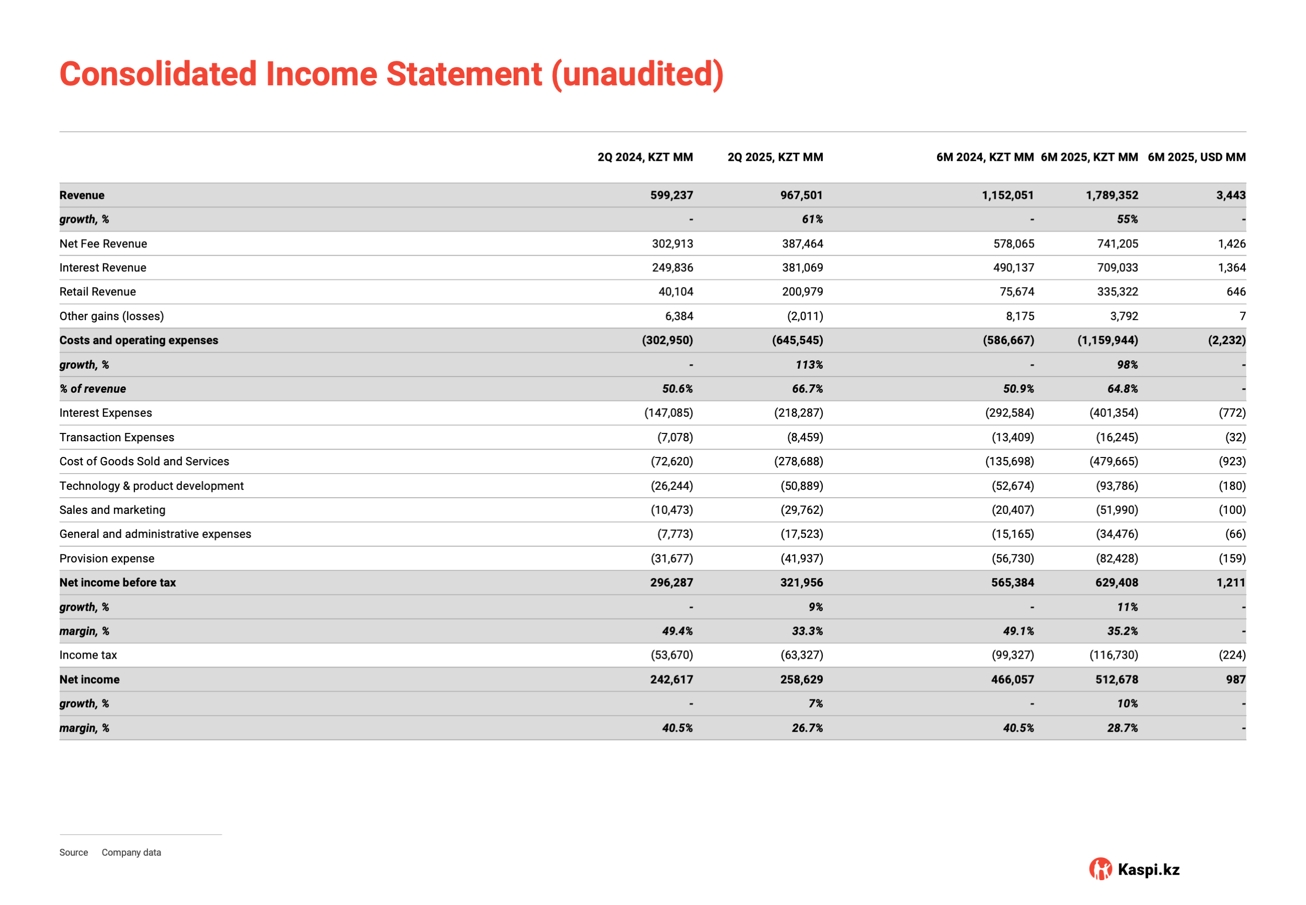

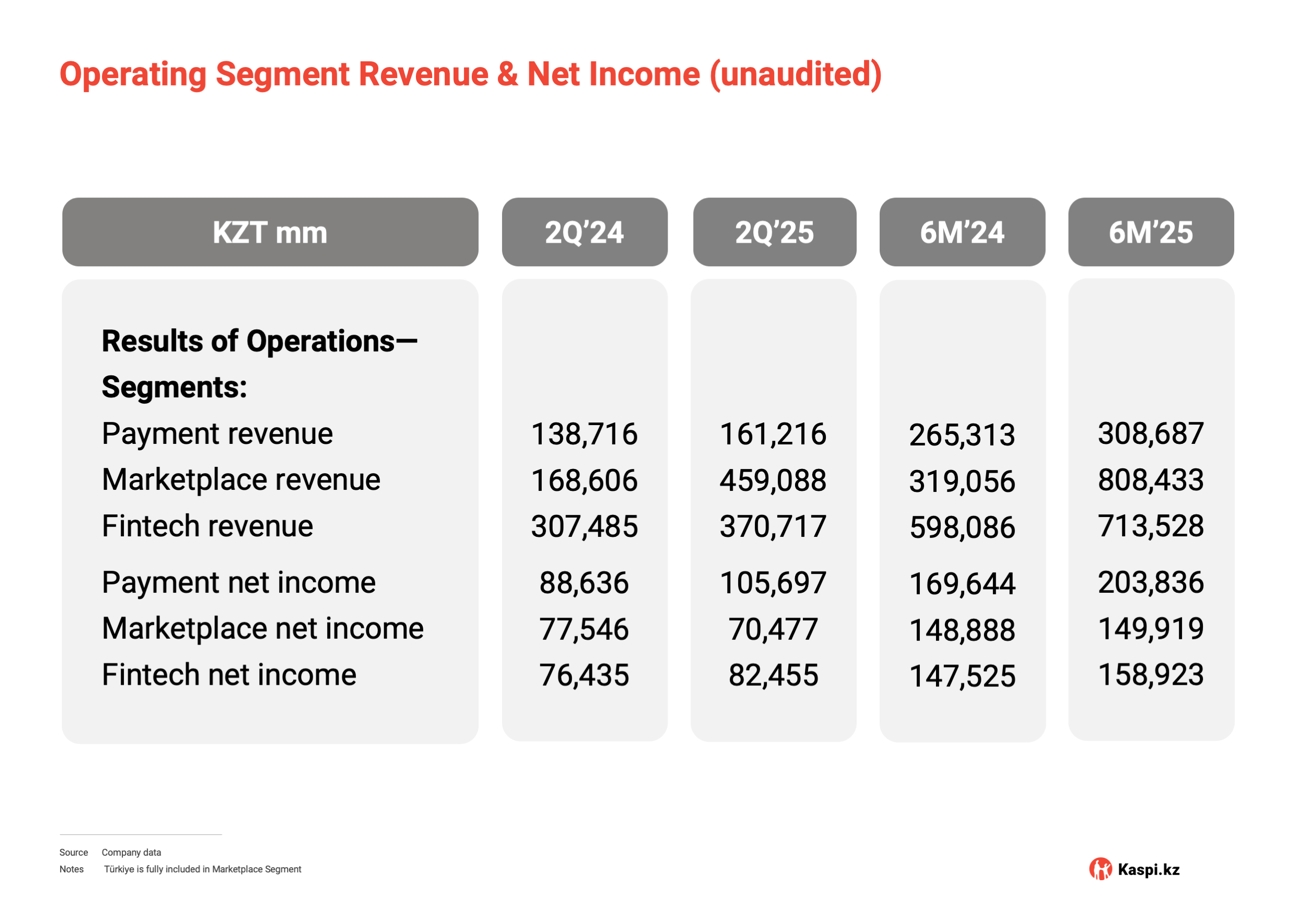

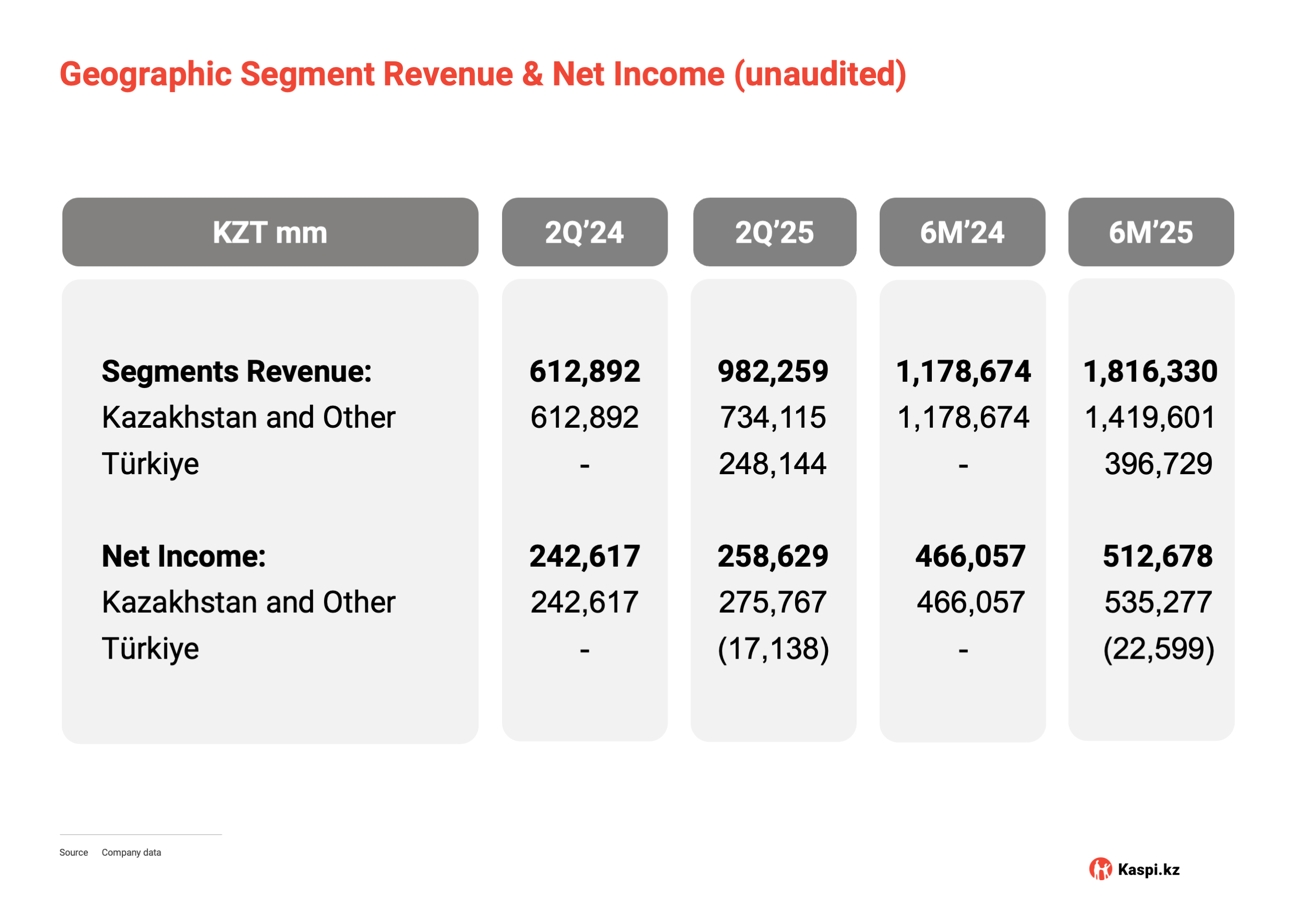

Our financial results in the second quarter of 2025, were as we expected them to be. Consumer and merchant engagement in Kazakhstan remains strong, with 75 transactions per active consumer. Robust transaction trends, in turn contributed to solid top-line growth, with revenue excluding Türkiye up 20% year-over-year in both the second quarter and first half of 2025.

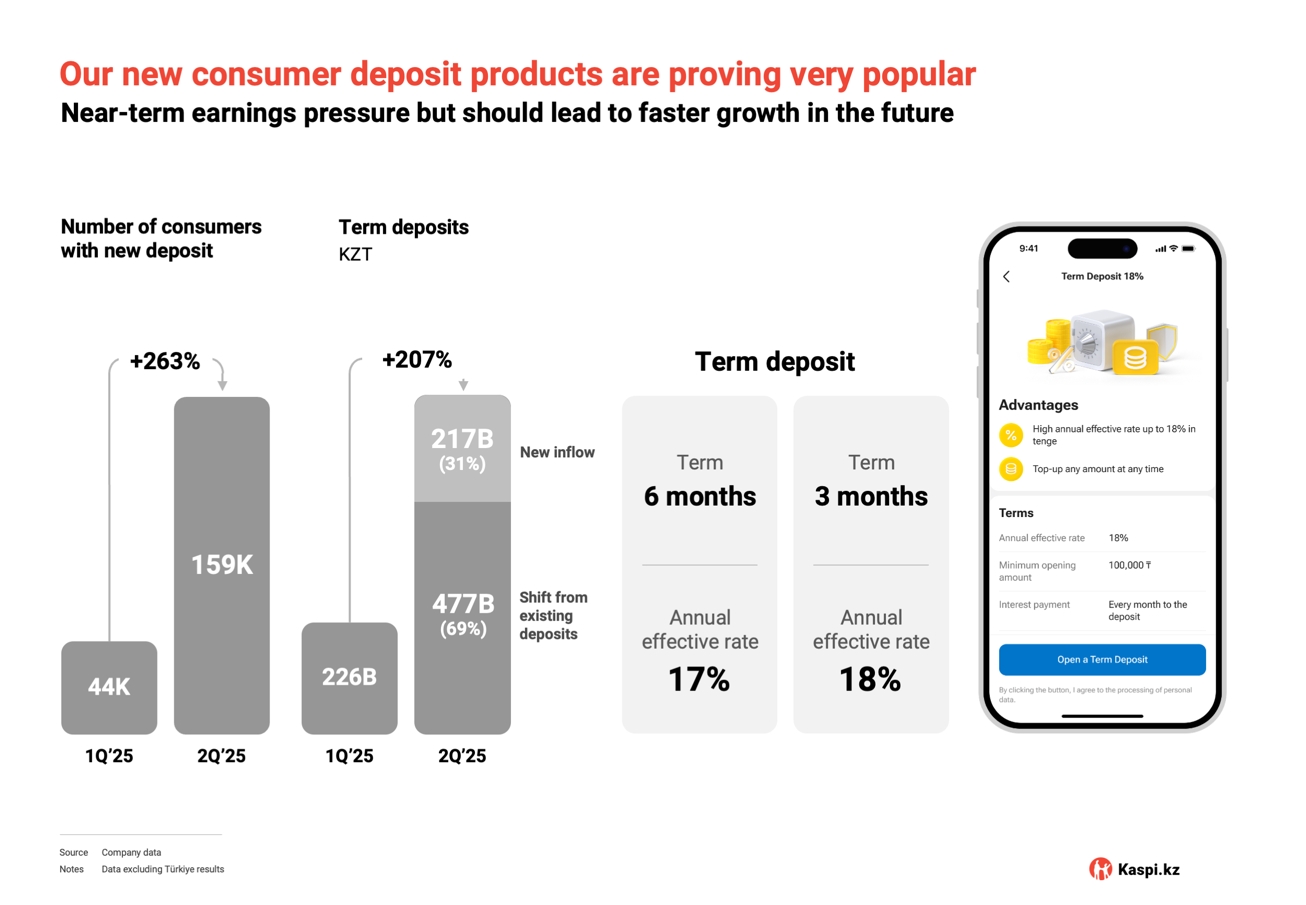

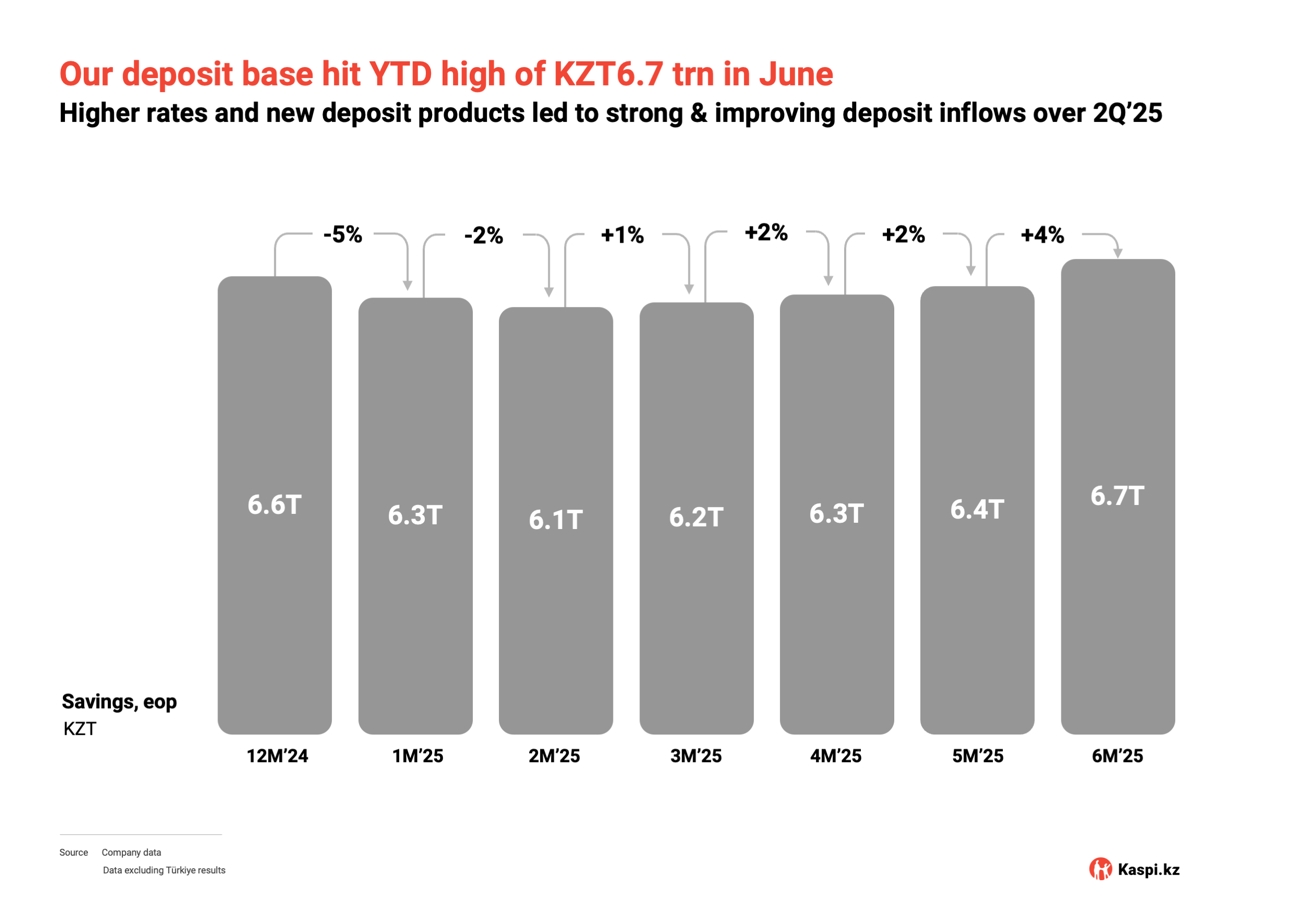

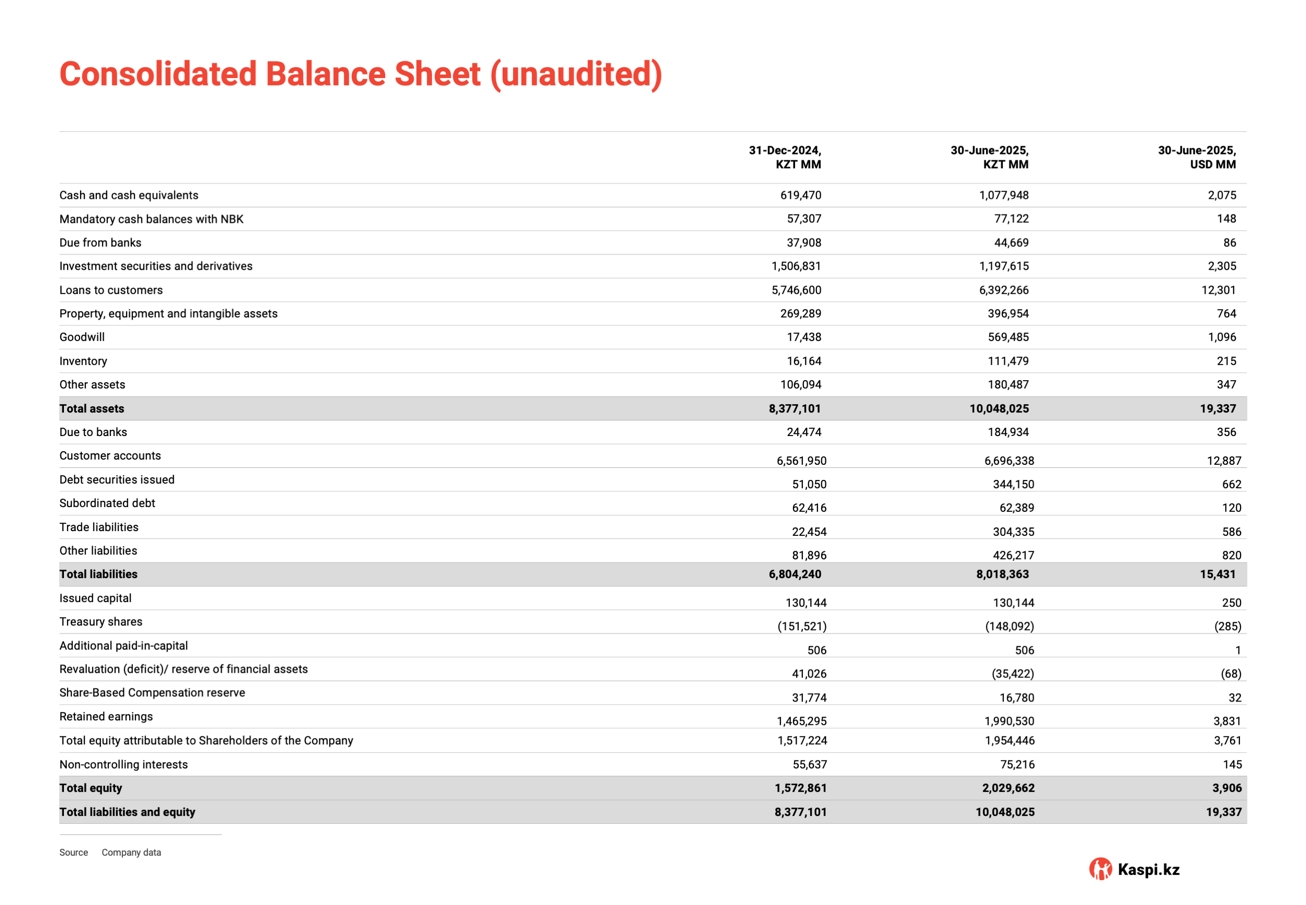

In April we raised our main deposit rate and our new higher rate, fixed term deposit products are proving popular. As we explained at the time of our first quarter results, this is putting pressure on our near-term earnings and is an important reason why bottom-line growth in Kazakhstan is below top-line growth. However, we are first and foremost a transaction-based business and we expect more deposits today will lead to more transactions and faster growth in the future.

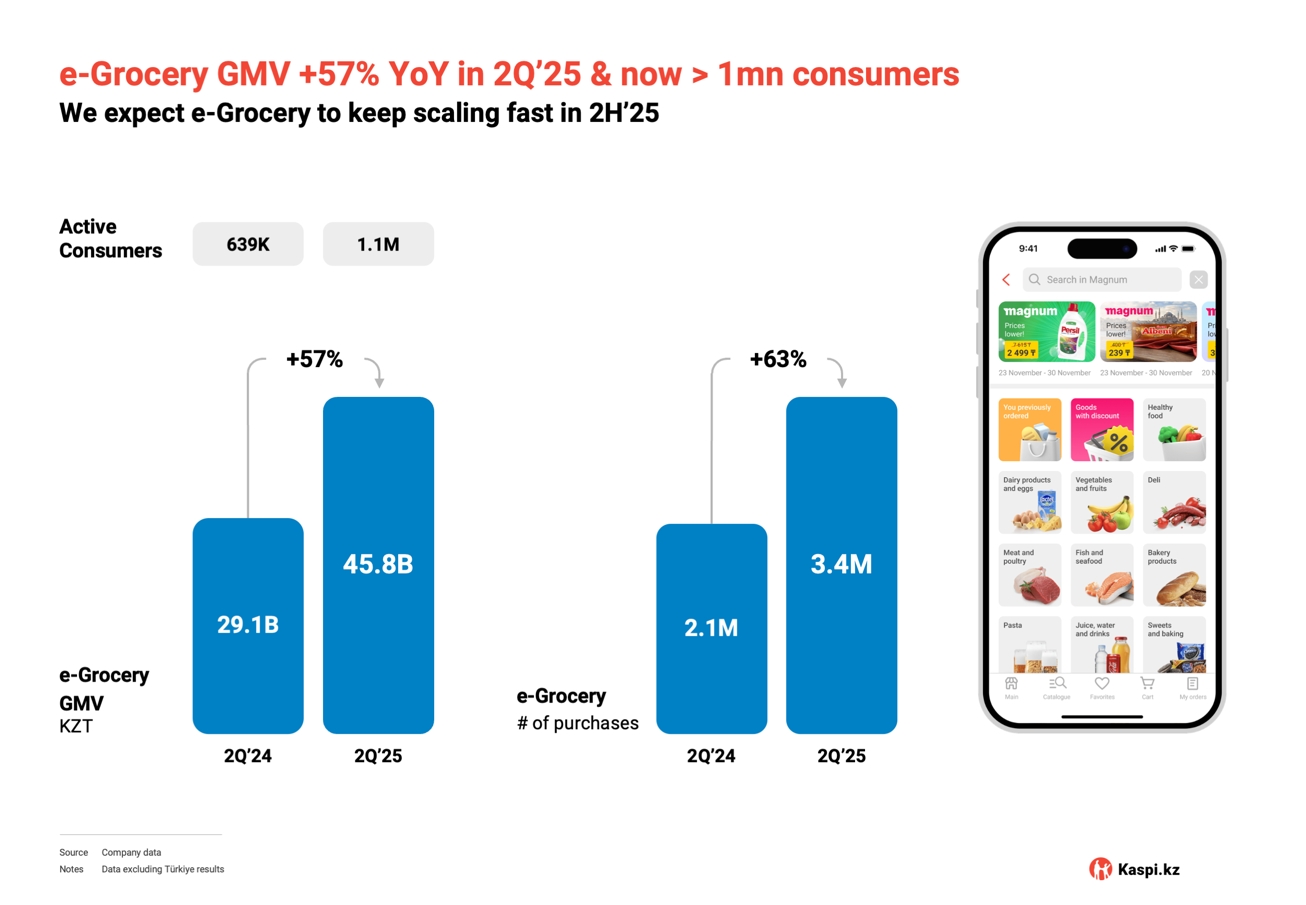

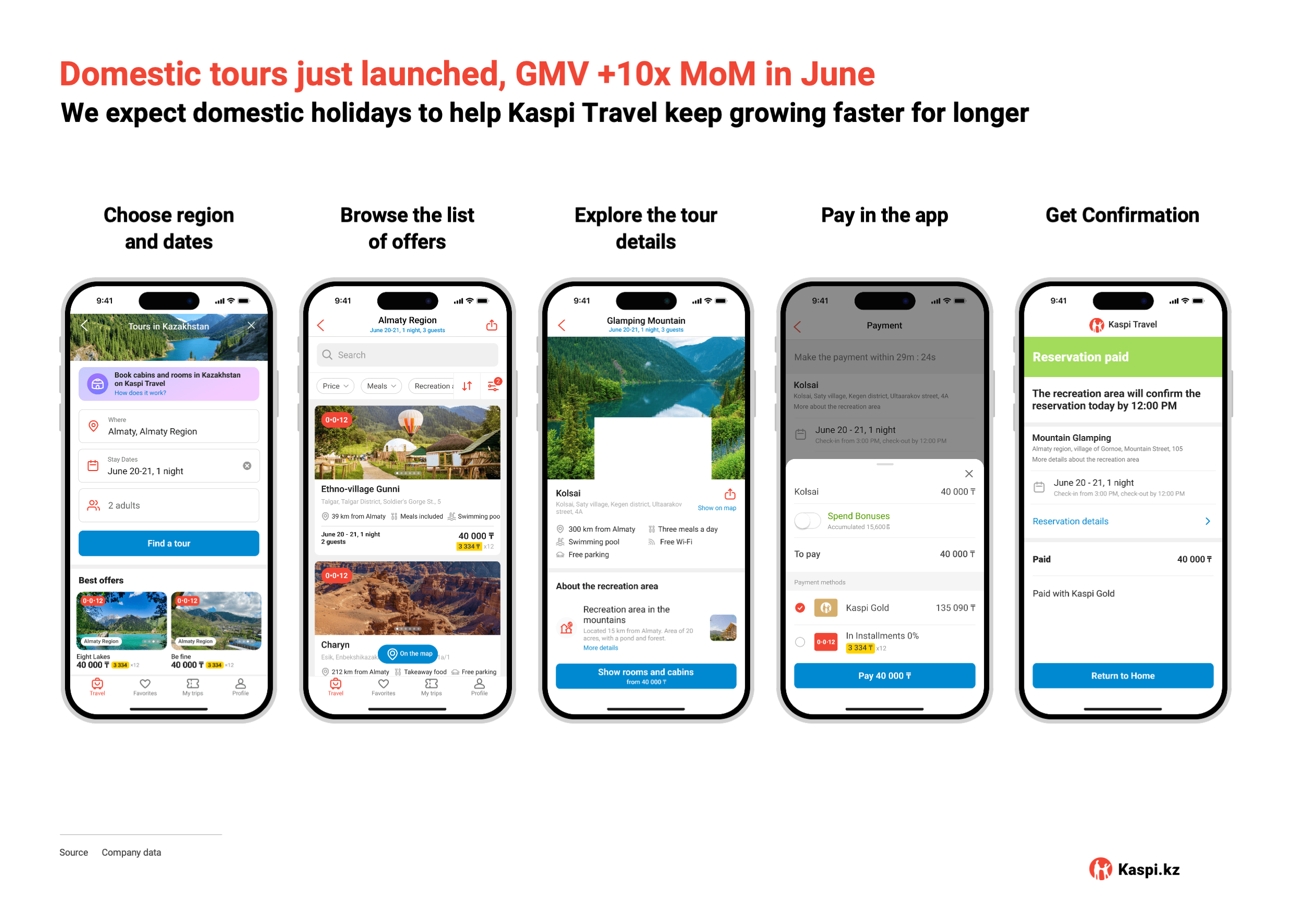

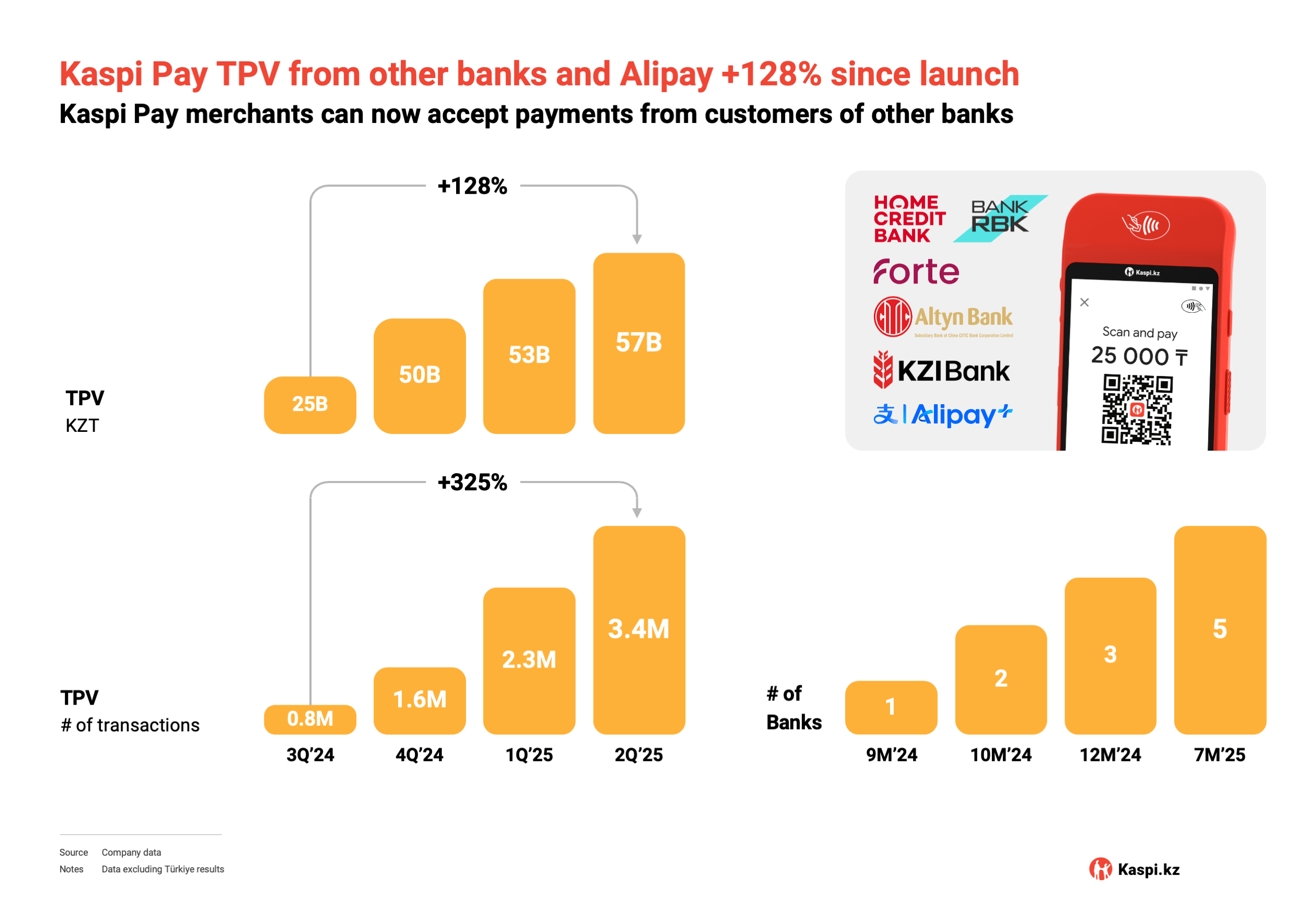

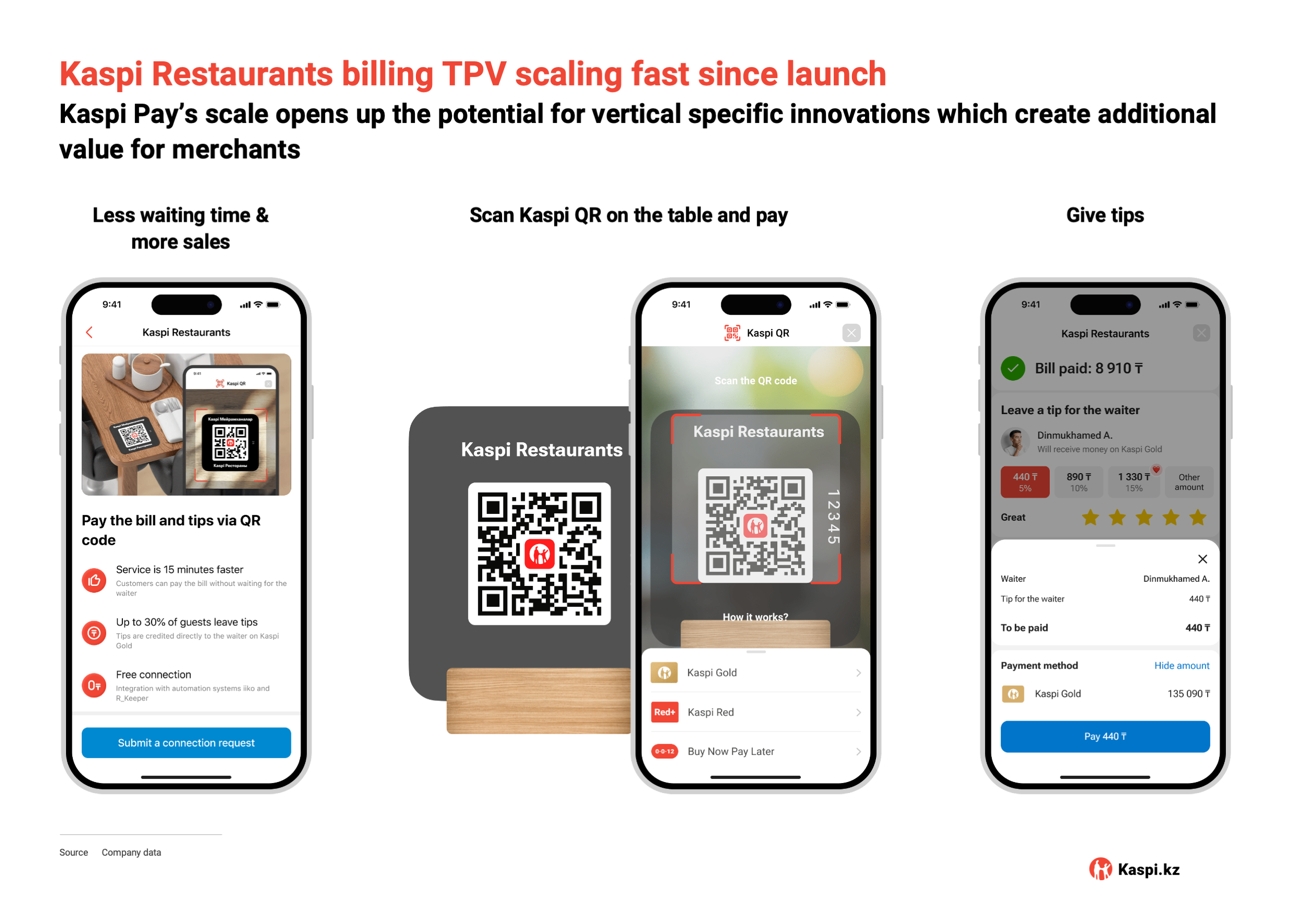

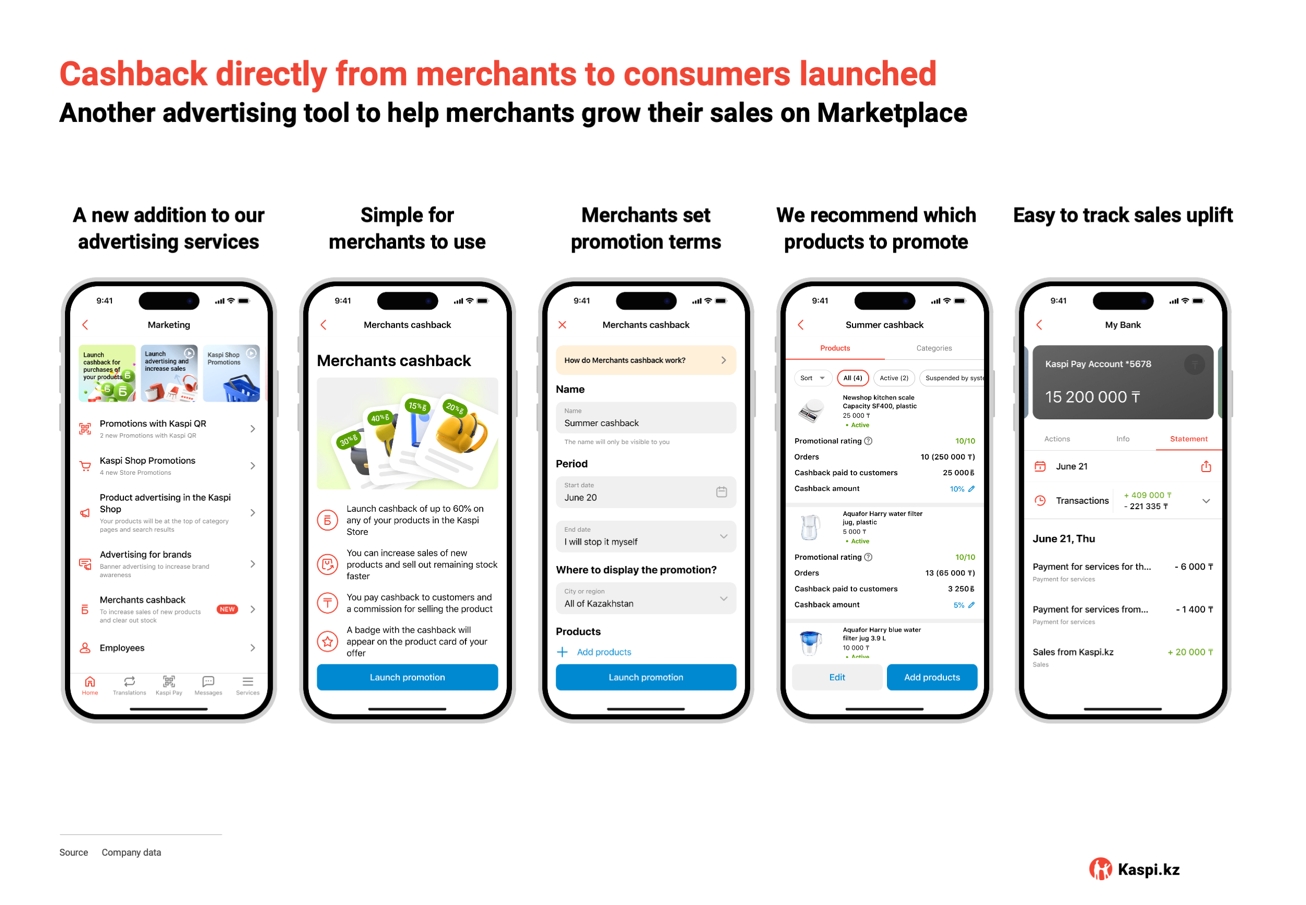

We also keep adding new Super App services. In the last few months, e-Grocery has expanded into 2 new cities, making 5 so far. Kaspi Travel has just launched holidays within Kazakhstan, new advertising tools for merchants have been rolled out and we have connected Kaspi Pay QR to several local banks, as well as integrated with AliPay+. These are just a few examples, with the point being that as a long as we keep innovating in our home market, there’s no reason why we can’t keep delivering profitable growth. If interest rates come down, our bottom-line can benefit even more.

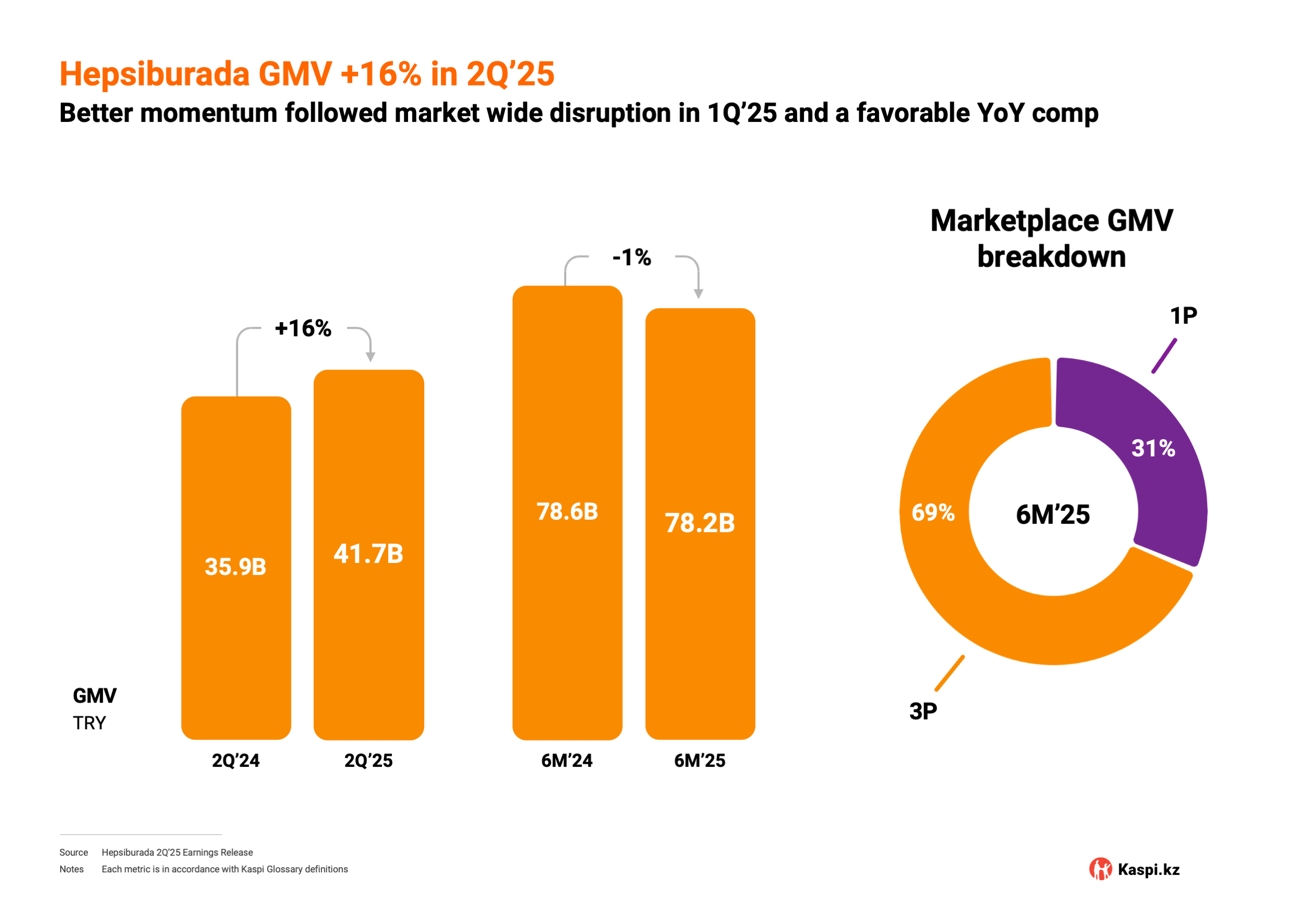

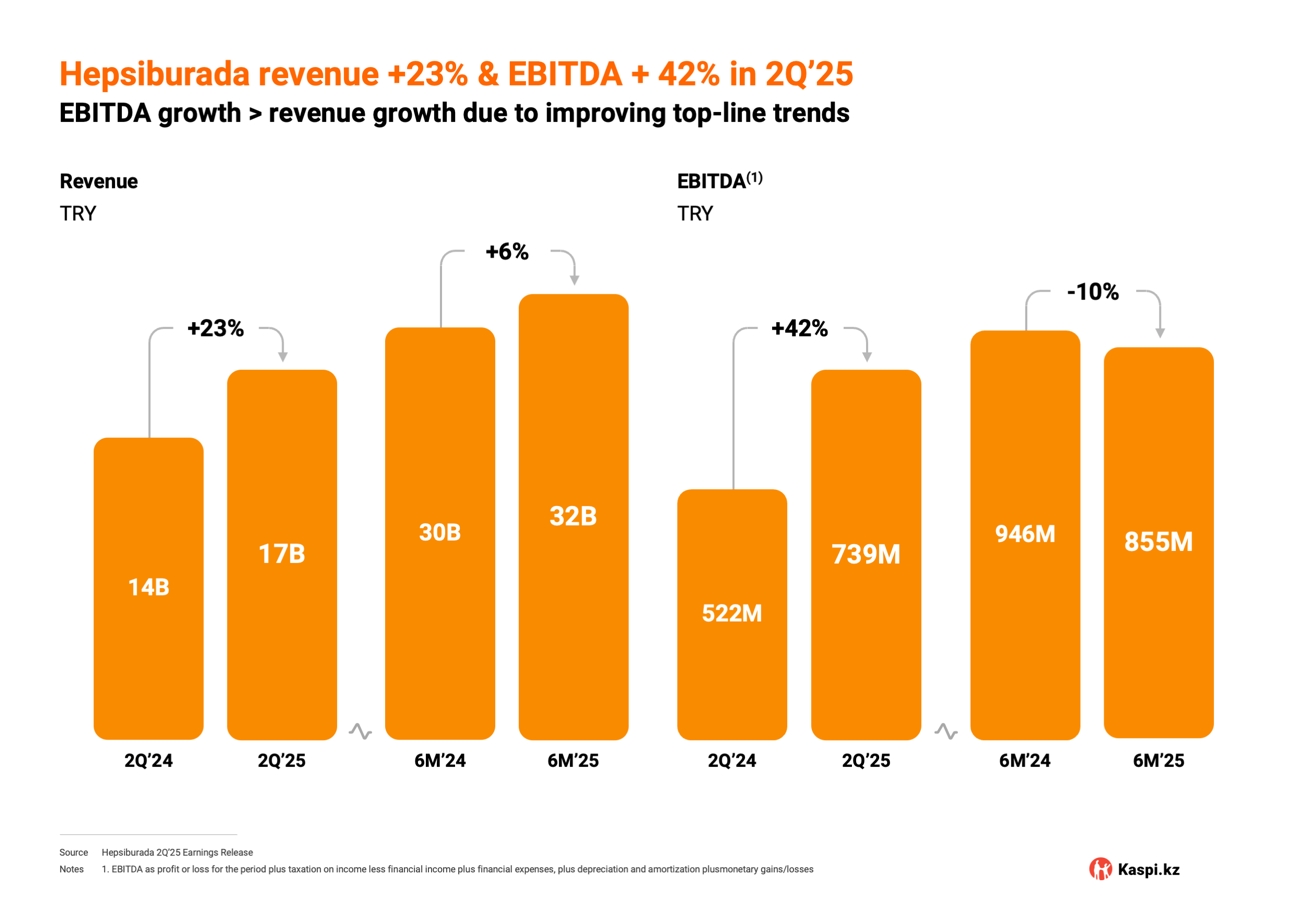

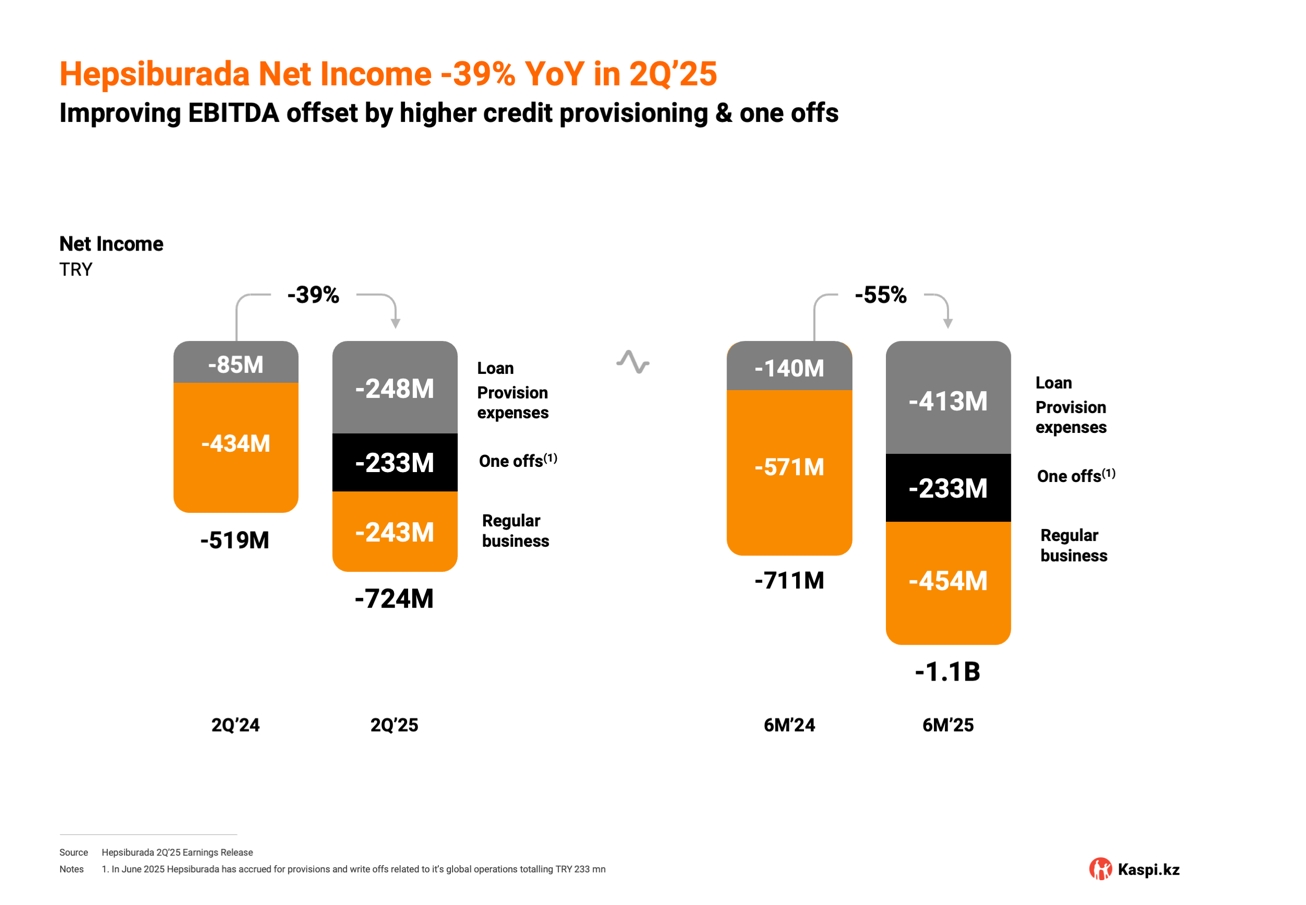

The second quarter marked our first full quarter owning Hepsiburada. The teams in Türkiye are currently focussed on multiple business improvements, encompassing areas including delivery, fintech solutions and the mobile app experience to name a few. By re-engineering Hepsiburada’s processes our goal is to bring the customer experience up to Kaspi.kz’s levels as quickly as possible.

At the same time, we’re working to secure the regulatory approvals to acquire Rabobank A.Ş. Our aim for this year remains to put the foundations of our long-term international growth strategy firmly in place. There is a lot of work to be done, and targeted investments will be required but we’re happy with the progress that has been made in a short period and as results start to come through, we will share them with you.

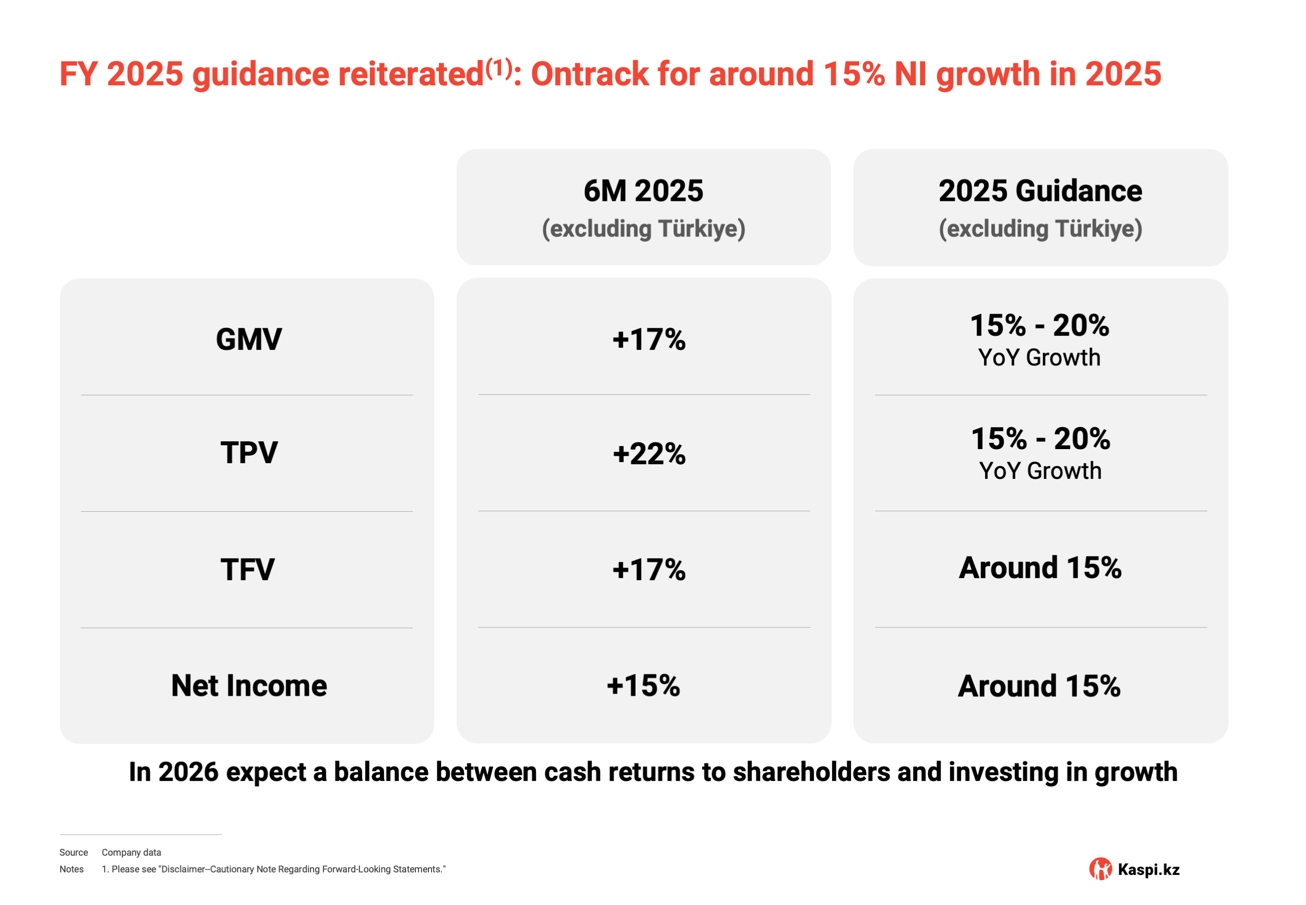

The third quarter of the year has started well, and I’m pleased to reiterate our 2025 guidance of around 15% net income growth year-over-year, excluding Türkiye. As we look into 2026, we believe Kaspi.kz can achieve a healthy balance between investing to create a bigger business and returning excess capital to our shareholders.

As always, I would like to thank every Kaspi.kz and Hepsiburada employee for their dedication to our consumers, merchants and partners. To our long-term shareholders, thank you for your ongoing trust and support.

Mikheil Lomtadze

Kaspi.kz CEO and co-founder