Second Quarter 2025 Financial Results Presentation / August 4, 2025

Forward-looking statements disclosure This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "may," "will," "expect," "plan," "anticipate" and similar expressions (as well as other words or expressions referencing future events, progress, timing or circumstances) are intended to identify forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding future operations, financial results and the financial condition of Syndax Pharmaceuticals, Inc. (“Syndax” or the “Company”), including financial position, strategy and plans, the progress, timing, clinical development and scope of clinical trials and the reporting of clinical data for Syndax’s product candidates, the progress of regulatory submissions and approvals and subsequent commercialization and the potential use of Syndax’s product candidates to treat various cancer indications and fibrotic diseases, and Syndax’s expectations for liquidity and future operations, are forward-looking statements. Many factors may cause differences between current expectations and actual results, including unexpected safety or efficacy data observed during preclinical studies or clinical trials, clinical site activation rates or clinical trial enrollment rates that are lower than expected; changes in expected or existing competition; the impact of macroeconomic conditions (the Russia-Ukraine war, inflation, among others) on Syndax’s business and that of the third parties on which Syndax depends, including delaying or otherwise disrupting Syndax’s clinical trials and preclinical studies, manufacturing and supply chain, or impairing employee productivity; failure of our collaborators to support or advance collaborations or product candidates and unexpected litigation or other disputes. Moreover, Syndax operates in a very competitive and rapidly changing environment. Other factors that may cause our actual results to differ from current expectations are discussed in Syndax’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” sections contained therein. New risks emerge from time to time. It is not possible for Syndax’s management to predict all risks, nor can Syndax assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied. Except as required by law, neither Syndax nor any other person assumes responsibility for the accuracy and completeness of the forward- looking statements. Syndax undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in Syndax’s expectations.

Two exceptional product launches, with sales significantly exceeding expectations 3 Two first- & best-in-class medicines addressing major unmet needs Syndax is positioned to continue its rapid growth in 2025 and beyond, with $10B+ market opportunity across R/R and frontline indications On the road to profitability and multi-billion-dollar franchises $5B+ TAM $5B+ TAM R/R, relapsed or refractory

Robust KMT2A patient identification & uptake Strong Revuforj growth in 2Q25 with multiple drivers for continued momentum Concentrated use in early lines of Tx for R/R KMT2A acute leukemia Building transplant rate & usage post-transplant Near-term opportunity in R/R mNPM1 AML $28.6 M Revuforj net revenue in 2Q25 (+43% q/q growth), with ~1/3 of KMT2A patients proceeding to stem cell transplant First- and best-in-class menin inhibitor Tx, treatment; q/q, quarter over quarter Drivers of continued momentum

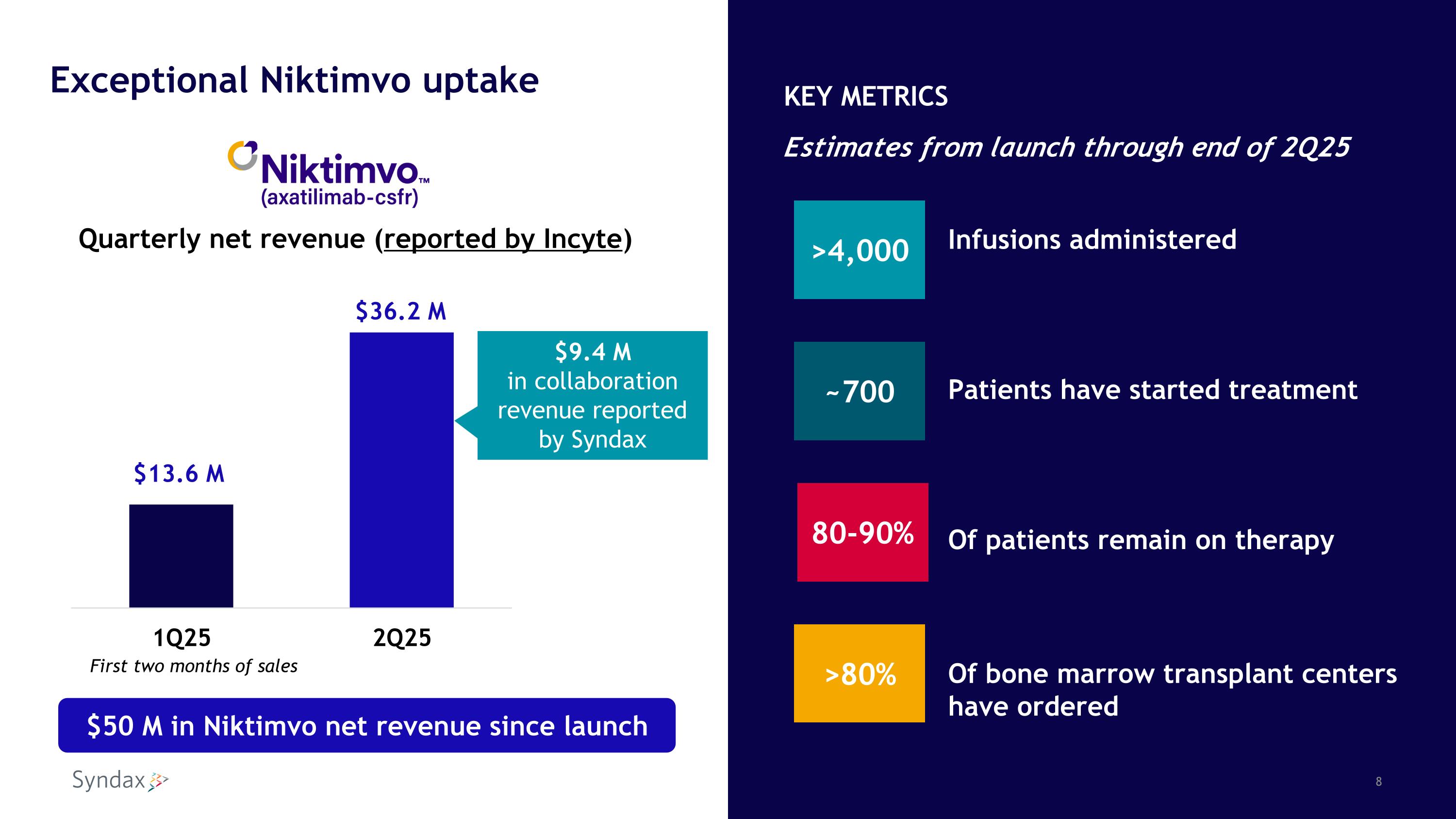

Exceptional Niktimvo results underscore the importance of this novel medicine to patients and Syndax First- and best-in-class anti-CSF-1R antibody $36.2 M Niktimvo net revenue reported by Incyte in 2Q25, the first full quarter of sales Substantial growth compared to $13.6 M net revenue in first 2 months of Q1 launch Profitable to Syndax in first full quarter ($9.4 M to Syndax in collaboration revenue) Proportion of net revenue retained by Syndax expected to materially grow over time

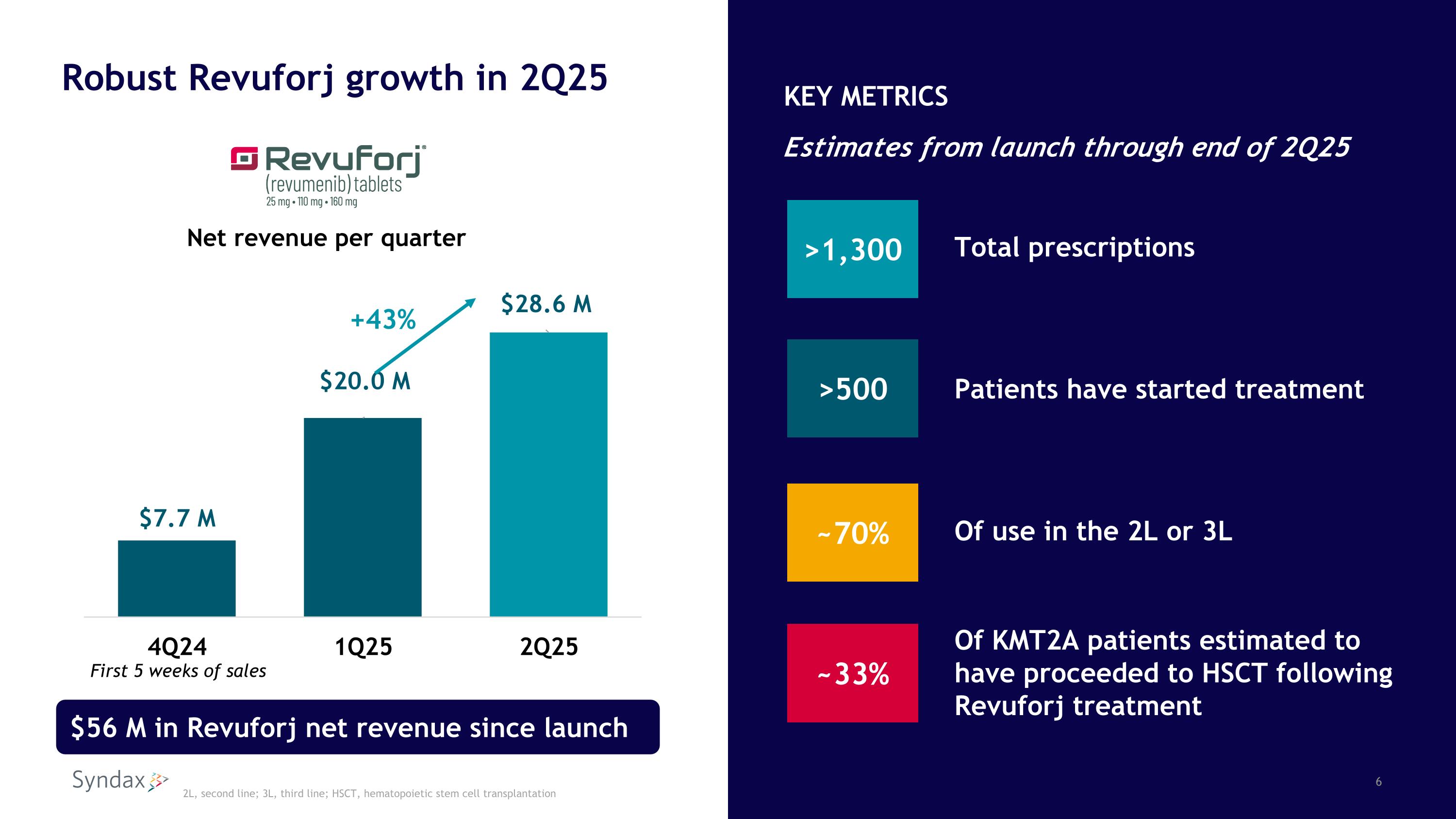

Net revenue per quarter First 5 weeks of sales +43% $56 M in Revuforj net revenue since launch >1,300 Total prescriptions Patients have started treatment Of use in the 2L or 3L Of KMT2A patients estimated to have proceeded to HSCT following Revuforj treatment >500 ~70% KEY METRICS Estimates from launch through end of 2Q25 ~33% Robust Revuforj growth in 2Q25 2L, second line; 3L, third line; HSCT, hematopoietic stem cell transplantation

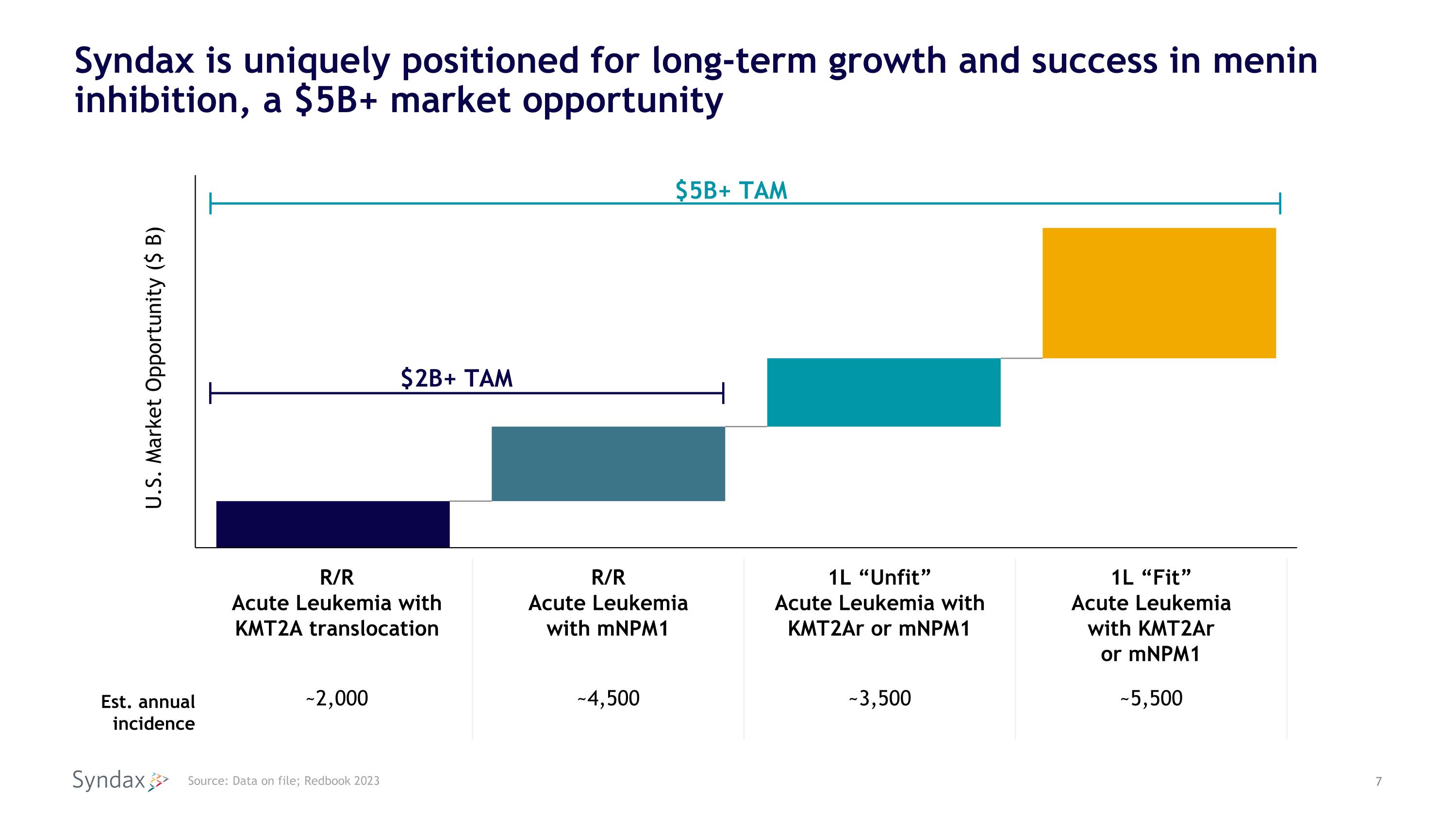

Syndax is uniquely positioned for long-term growth and success in menin inhibition, a $5B+ market opportunity Source: Data on file; Redbook 2023 U.S. Market Opportunity ($ B) $5B+ TAM $2B+ TAM R/R Acute Leukemia with KMT2A translocation R/R Acute Leukemia with mNPM1 1L “Unfit” Acute Leukemia with KMT2Ar or mNPM1 1L “Fit” Acute Leukemia with KMT2Ar or mNPM1 Est. annual incidence ~2,000 ~4,500 ~3,500 ~5,500

Quarterly net revenue (reported by Incyte) $9.4 M in collaboration revenue reported by Syndax $50 M in Niktimvo net revenue since launch First two months of sales Exceptional Niktimvo uptake >4,000 ~700 >80% Infusions administered Patients have started treatment Of patients remain on therapy Of bone marrow transplant centers have ordered 80-90% KEY METRICS Estimates from launch through end of 2Q25

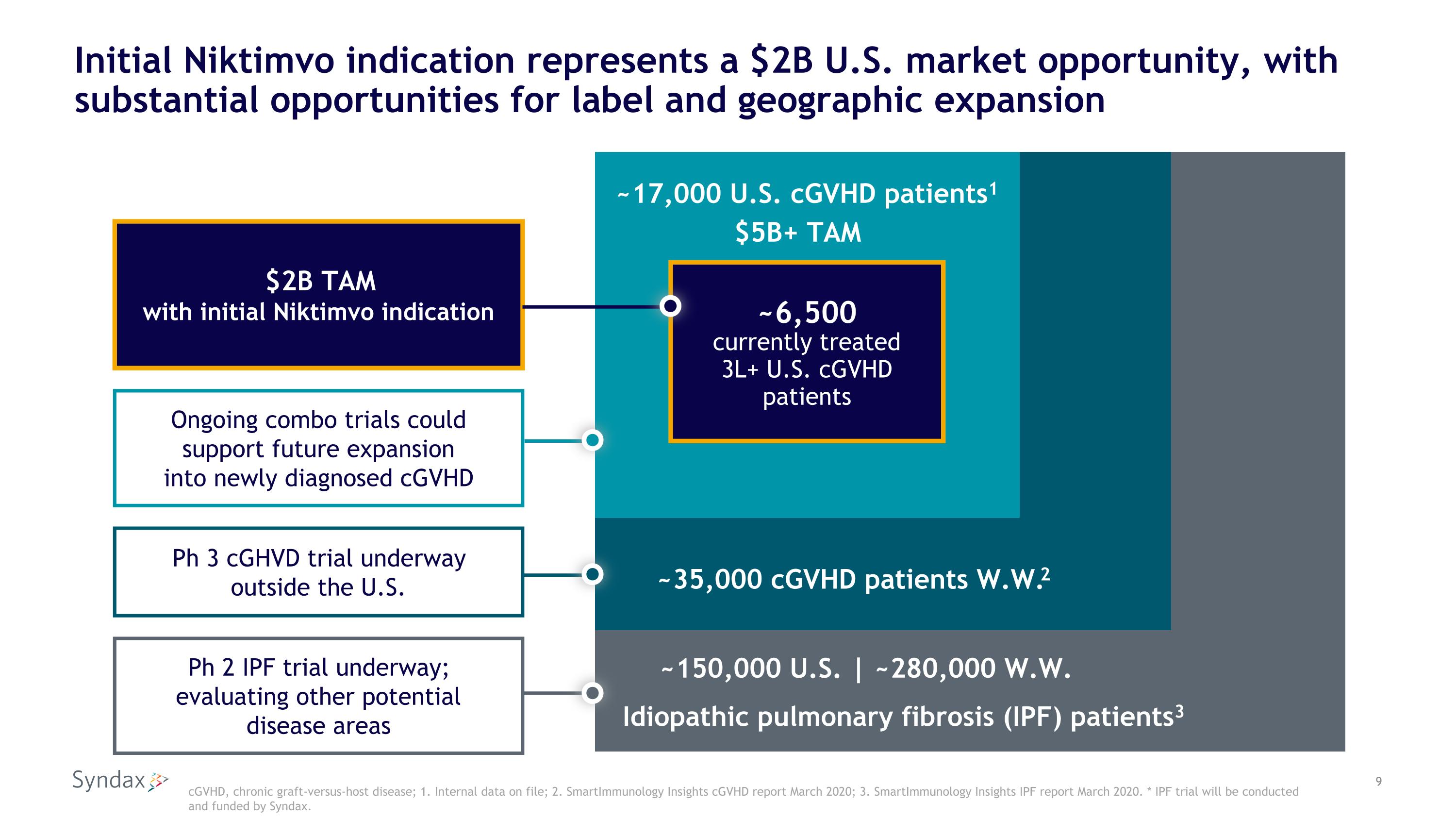

Initial Niktimvo indication represents a $2B U.S. market opportunity, with substantial opportunities for label and geographic expansion cGVHD, chronic graft-versus-host disease; 1. Internal data on file; 2. SmartImmunology Insights cGVHD report March 2020; 3. SmartImmunology Insights IPF report March 2020. * IPF trial will be conducted and funded by Syndax. ~17,000 U.S. cGVHD patients1 ~6,500 currently treated 3L+ U.S. cGVHD patients ~35,000 cGVHD patients W.W.2 Idiopathic pulmonary fibrosis (IPF) patients3 ~150,000 U.S. | ~280,000 W.W. $2B TAM with initial Niktimvo indication Ongoing combo trials could support future expansion into newly diagnosed cGVHD Ph 2 IPF trial underway; evaluating other potential disease areas Ph 3 cGHVD trial underway outside the U.S. $5B+ TAM

Recent presentations/publications solidify revumenib’s leading profile AUGMENT-101 data presented at EHA highlight robust activity across R/R mNPM1, KMT2Ar, and NUP98r acute leukemia Ph 2 R/R mNPM1 AML data: 26% (20/77) CR+CRh, 48% (37/77) ORR, and 23-month mOS observed among responders in a subgroup analysis Ph 1 R/R NUP98r AML data: 60% (3/5) ORR Pivotal R/R mNPM1 AML data published in Blood BEAT AML data presented at EHA and published in JCO support combinability of revumenib with ven/aza in 1L setting and potential for high rates of CR and MRD negativity First real-world revumenib evidence anticipated before year end ORR, overall response rate; CR, complete remission; CRh, complete remission with partial hematologic recovery; mOS, median overall survival; MRD, measurable residual disease; 1L, frontline

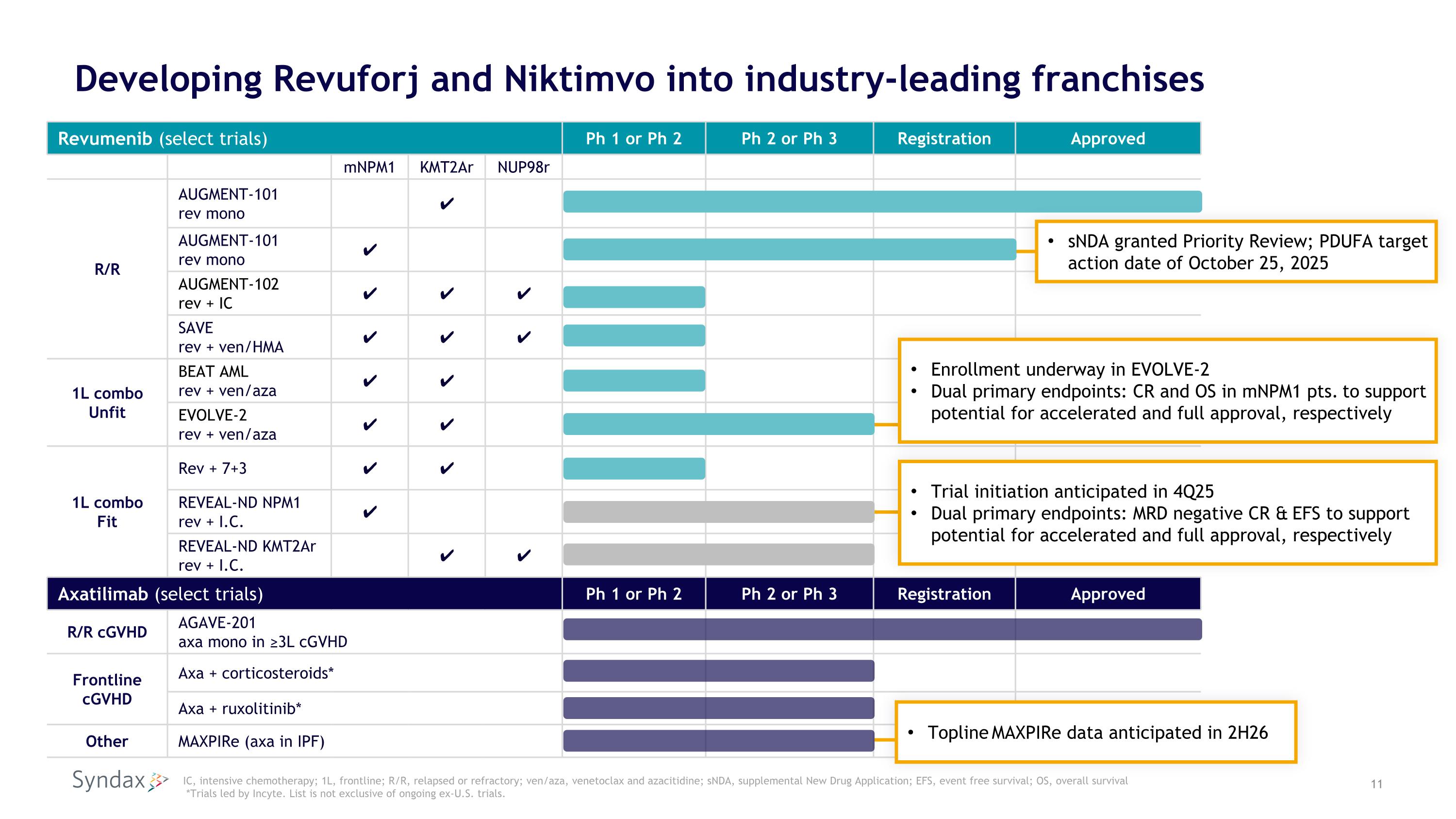

Developing Revuforj and Niktimvo into industry-leading franchises Revumenib (select trials) Ph 1 or Ph 2 Ph 2 or Ph 3 Registration Approved mNPM1 KMT2Ar NUP98r R/R AUGMENT-101 rev mono ✔ AUGMENT-101 rev mono ✔ AUGMENT-102 rev + IC ✔ ✔ ✔ SAVE rev + ven/HMA ✔ ✔ ✔ 1L combo Unfit BEAT AML rev + ven/aza ✔ ✔ EVOLVE-2 rev + ven/aza ✔ ✔ 1L combo Fit Rev + 7+3 ✔ ✔ REVEAL-ND NPM1 rev + I.C. ✔ REVEAL-ND KMT2Ar rev + I.C. ✔ ✔ Axatilimab (select trials) Ph 1 or Ph 2 Ph 2 or Ph 3 Registration Approved R/R cGVHD AGAVE-201 axa mono in ≥3L cGVHD Frontline cGVHD Axa + corticosteroids* Axa + ruxolitinib* Other MAXPIRe (axa in IPF) sNDA granted Priority Review; PDUFA target action date of October 25, 2025 IC, intensive chemotherapy; 1L, frontline; R/R, relapsed or refractory; ven/aza, venetoclax and azacitidine; sNDA, supplemental New Drug Application; EFS, event free survival; OS, overall survival *Trials led by Incyte. List is not exclusive of ongoing ex-U.S. trials. Trial initiation anticipated in 4Q25 Dual primary endpoints: MRD negative CR & EFS to support potential for accelerated and full approval, respectively Topline MAXPIRe data anticipated in 2H26 Enrollment underway in EVOLVE-2 Dual primary endpoints: CR and OS in mNPM1 pts. to support potential for accelerated and full approval, respectively

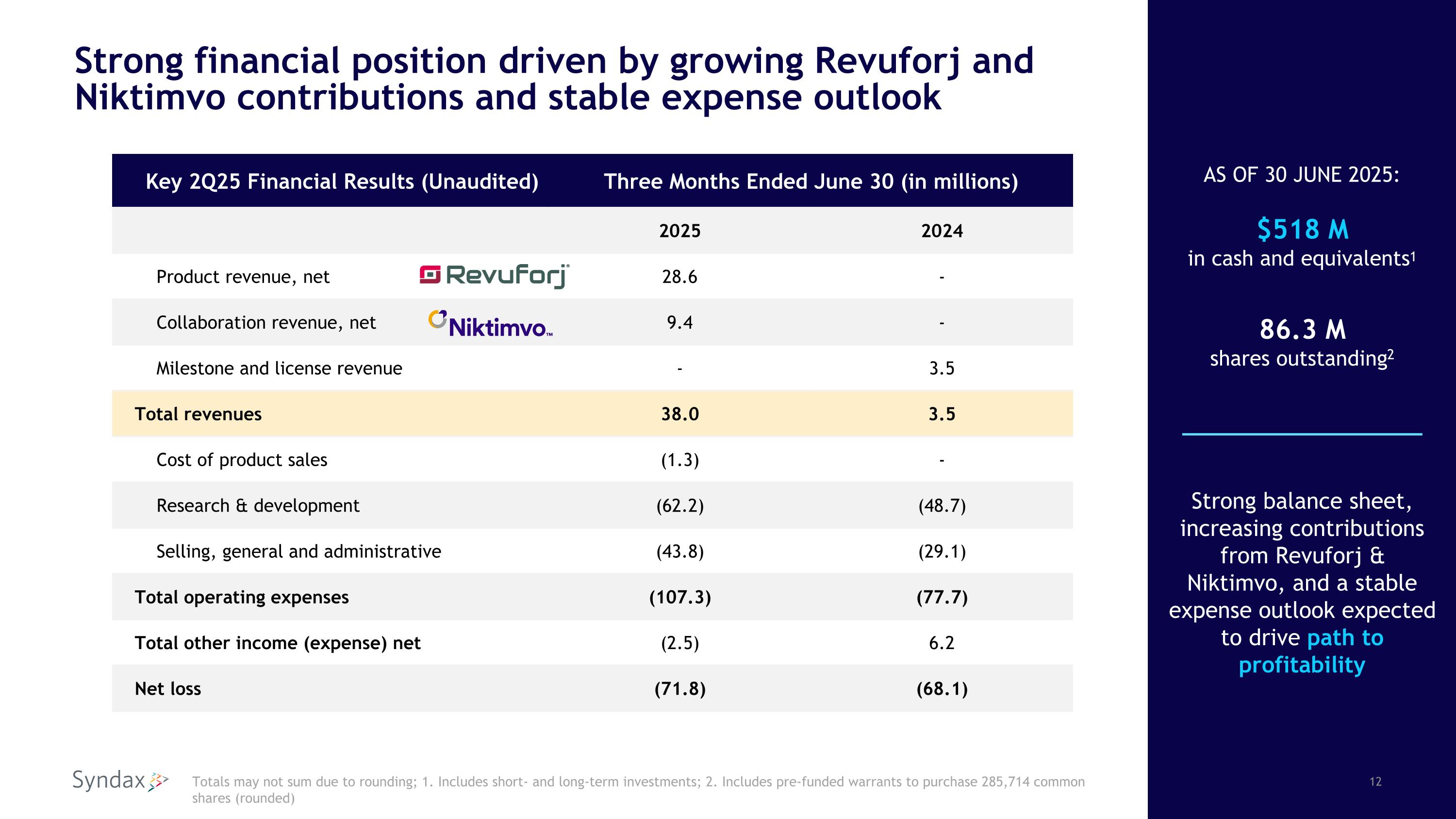

Strong financial position driven by growing Revuforj and Niktimvo contributions and stable expense outlook Key 2Q25 Financial Results (Unaudited) Three Months Ended June 30 (in millions) 2025 2024 Product revenue, net 28.6 - Collaboration revenue, net 9.4 - Milestone and license revenue - 3.5 Total revenues 38.0 3.5 Cost of product sales (1.3) - Research & development (62.2) (48.7) Selling, general and administrative (43.8) (29.1) Total operating expenses (107.3) (77.7) Total other income (expense) net (2.5) 6.2 Net loss (71.8) (68.1) Totals may not sum due to rounding; 1. Includes short- and long-term investments; 2. Includes pre-funded warrants to purchase 285,714 common shares (rounded) Strong balance sheet, increasing contributions from Revuforj & Niktimvo, and a stable expense outlook expected to drive path to profitability AS OF 30 JUNE 2025: $518 M in cash and equivalents1 86.3 M shares outstanding2

13 Two first- and best-in-class medicines addressing major unmet need Syndax is positioned to continue its rapid growth in 2025 and beyond, with $10B+ market opportunity across R/R and frontline indications Two exceptional product launches, with sales significantly exceeding expectations On the road to profitability and multi-billion-dollar franchises $5B+ TAM $5B+ TAM

Lilah, diagnosed with R/R AML FUELED BY A PASSION FOR PATIENTS