Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

HOLDING

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Funds Series Trust II

|

|

| Entity Central Index Key |

0001352280

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| Columbia Select Large Cap Value Fund - Class A [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SLVAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 83 | 0.80 % |

|

|

| Expenses Paid, Amount |

$ 83

|

|

| Expense Ratio, Percent |

0.80%

|

|

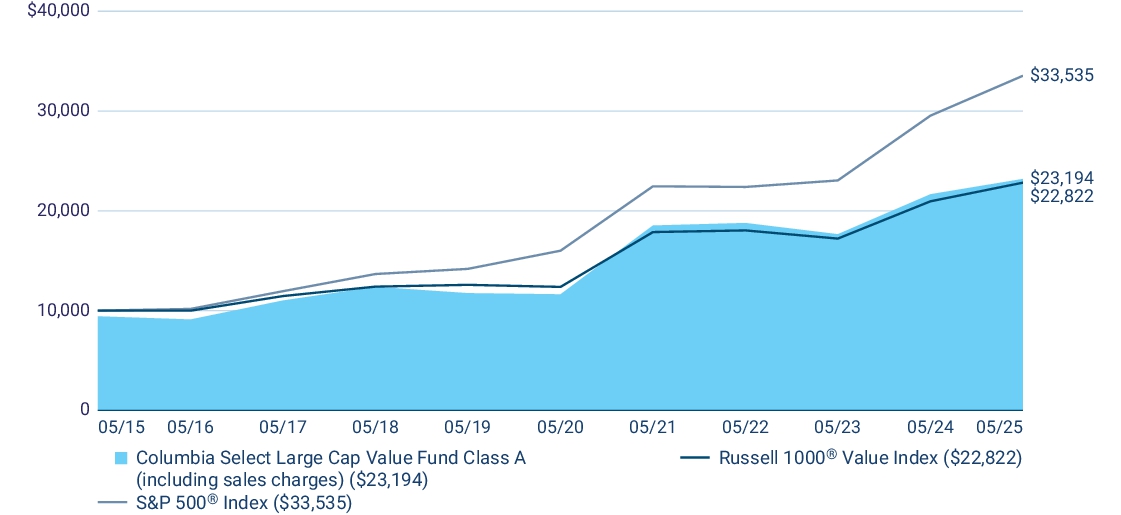

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

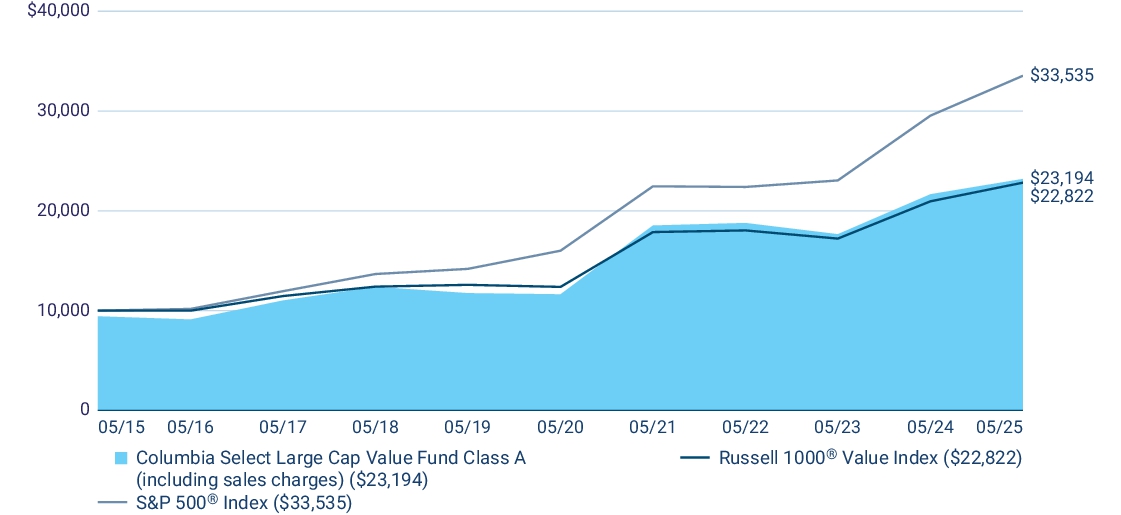

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class A (excluding sales charges) | 7.08 | 14.80 | 9.42 | | Class A (including sales charges) | 0.92 | 13.45 | 8.78 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

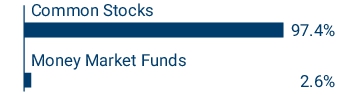

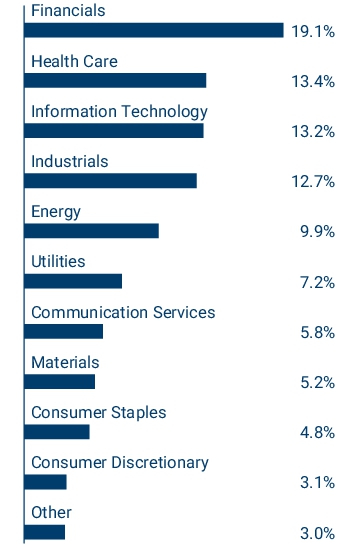

| Holdings [Text Block] |

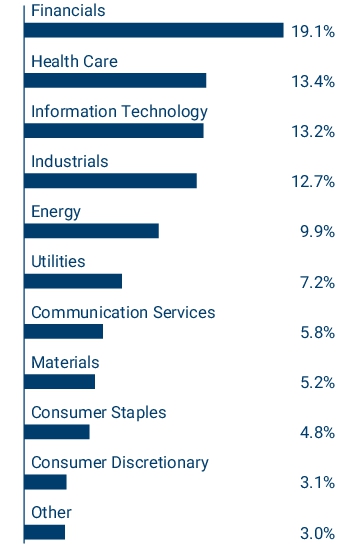

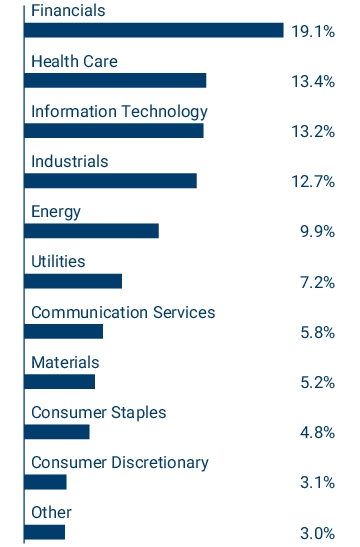

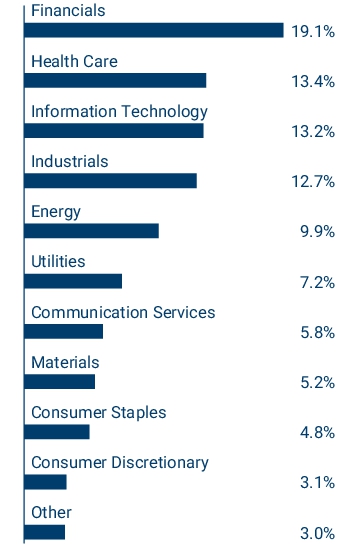

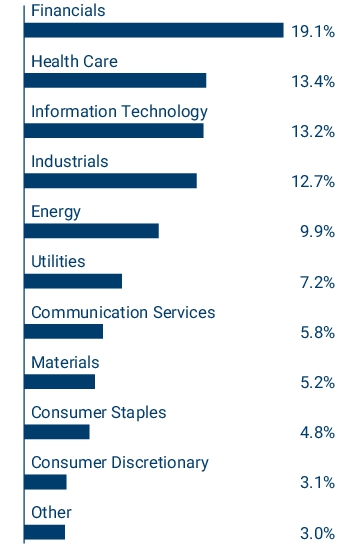

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fu nd represented as a percentag e of Fund n e t assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Class C [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

SVLCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 159 | 1.55 % |

|

|

| Expenses Paid, Amount |

$ 159

|

|

| Expense Ratio, Percent |

1.55%

|

|

| Factors Affecting Performance [Text Block] |

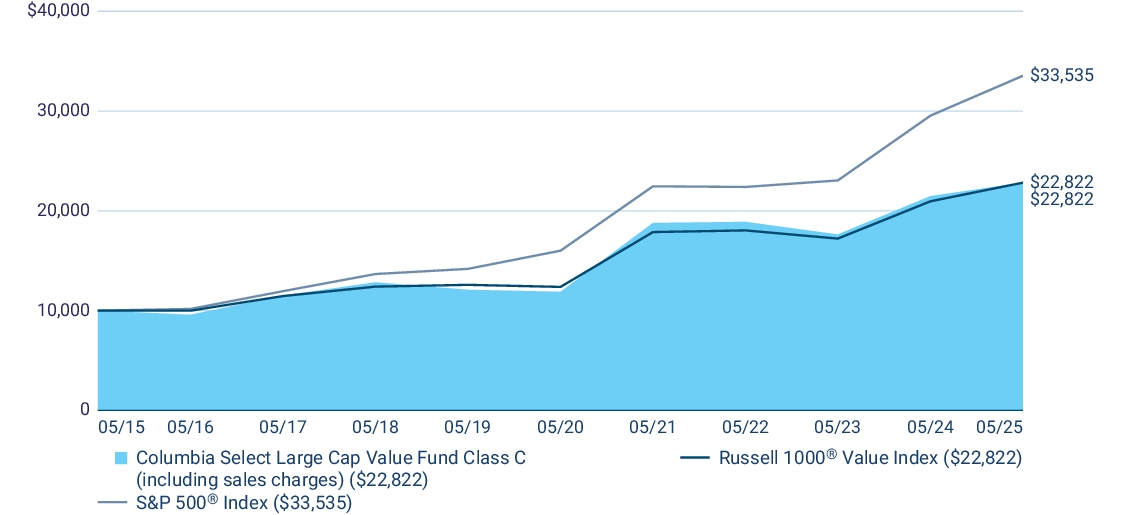

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

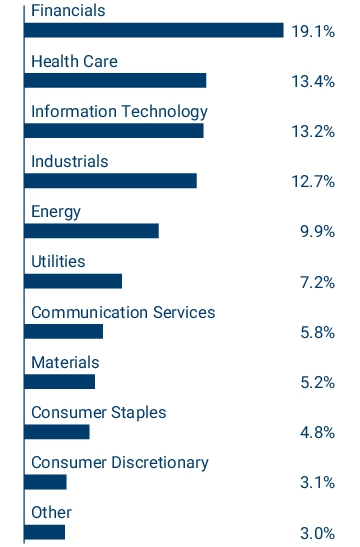

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | 6.28 | 13.94 | 8.60 | | Class C (including sales charges) | 5.28 | 13.94 | 8.60 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

CSVZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 57 | 0.55 % |

|

|

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

0.55%

|

|

| Factors Affecting Performance [Text Block] |

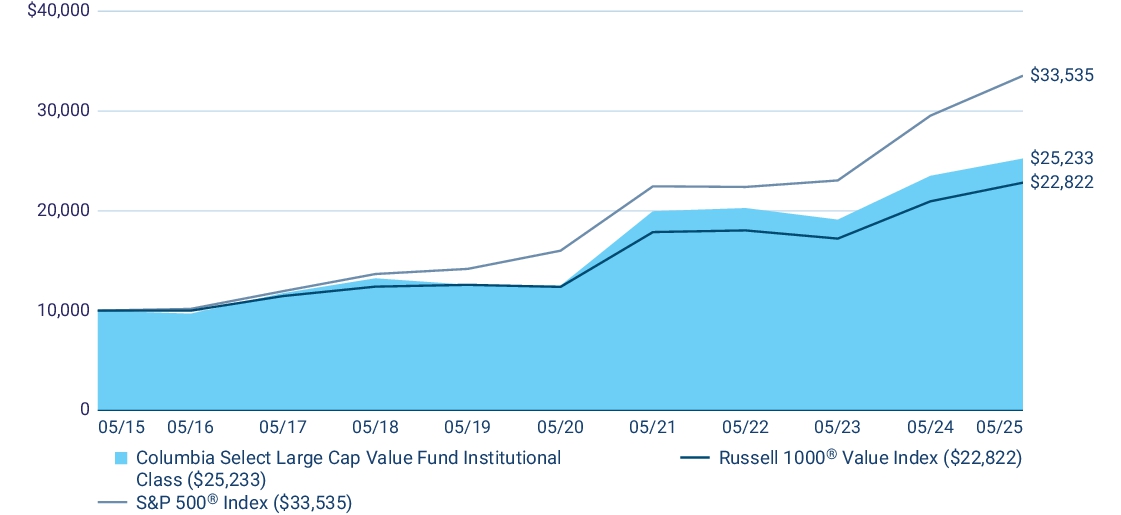

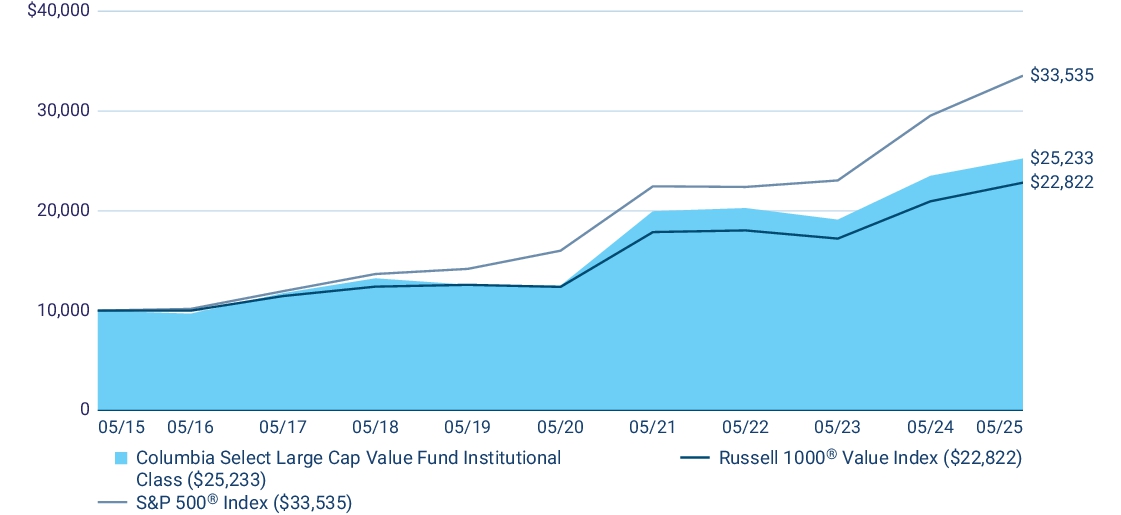

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | 7.36 | 15.09 | 9.70 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup o f the Fund r epr esented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Institutional 2 Class [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

SLVIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 48 | 0.46 % |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.46%

|

|

| Factors Affecting Performance [Text Block] |

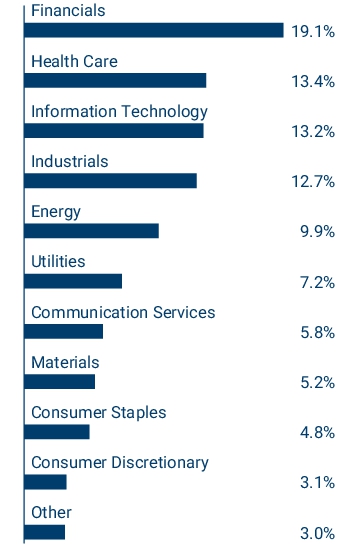

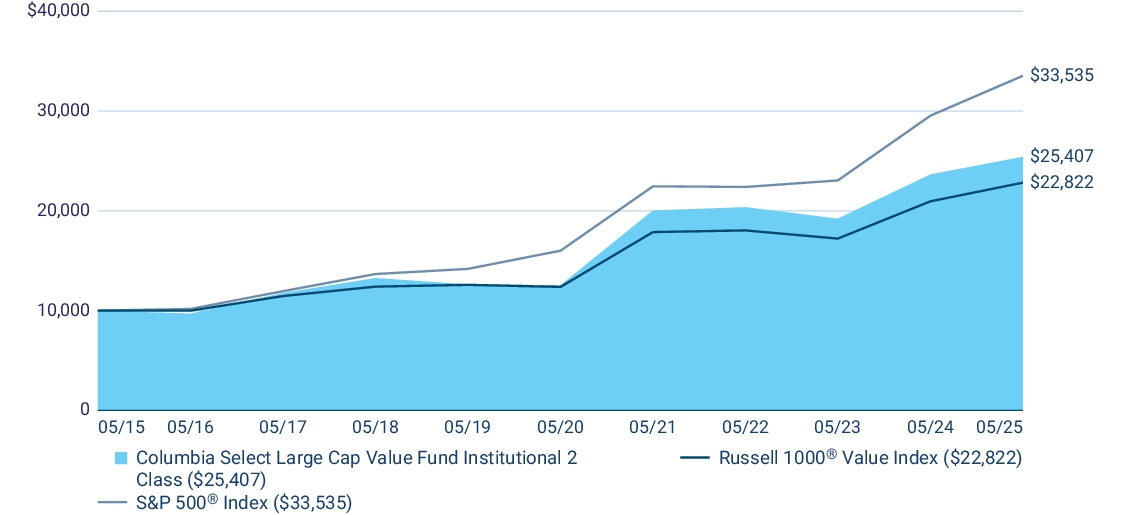

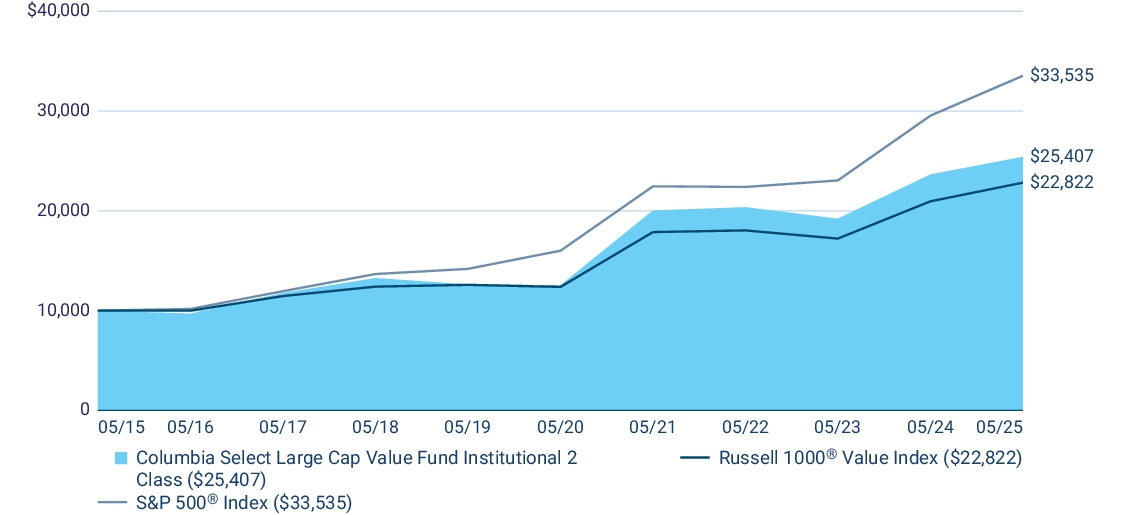

Management's Discussion of Fund Performance The performance of Institutional 2 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 2 Class | 7.47 | 15.17 | 9.77 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of t he Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Institutional 3 Class [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CSRYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 43 | 0.42 % |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.42%

|

|

| Factors Affecting Performance [Text Block] |

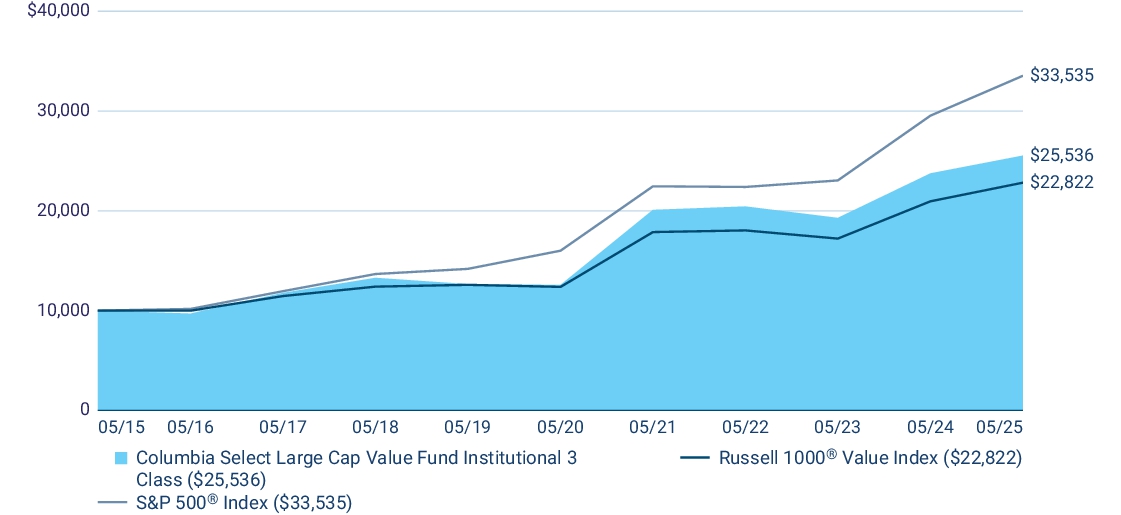

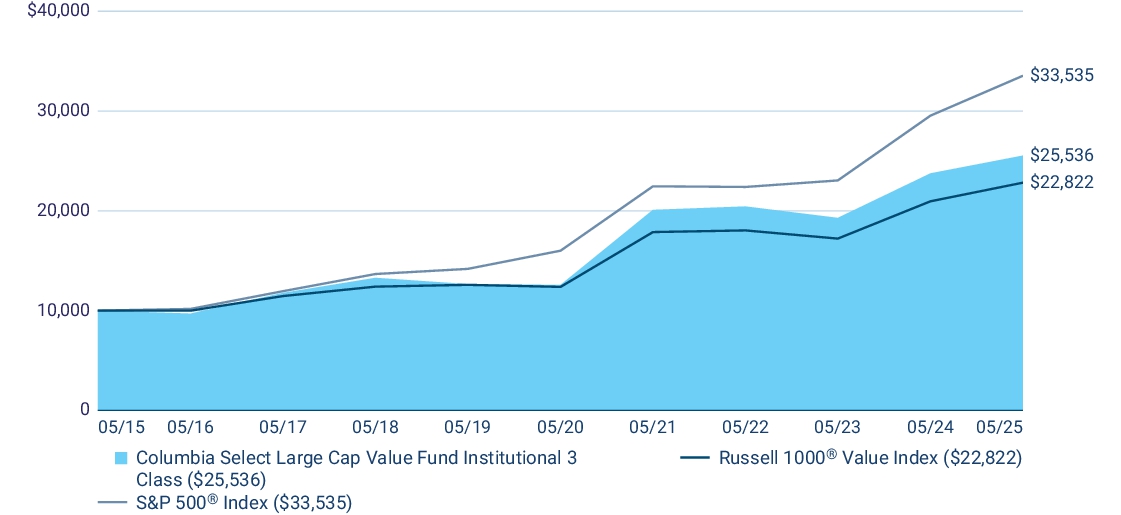

Management's Discussion of Fund Performance The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 3 Class | 7.50 | 15.22 | 9.83 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Class R [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Class R

|

|

| Trading Symbol |

SLVRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class R | $ 108 | 1.05 % |

|

|

| Expenses Paid, Amount |

$ 108

|

|

| Expense Ratio, Percent |

1.05%

|

|

| Factors Affecting Performance [Text Block] |

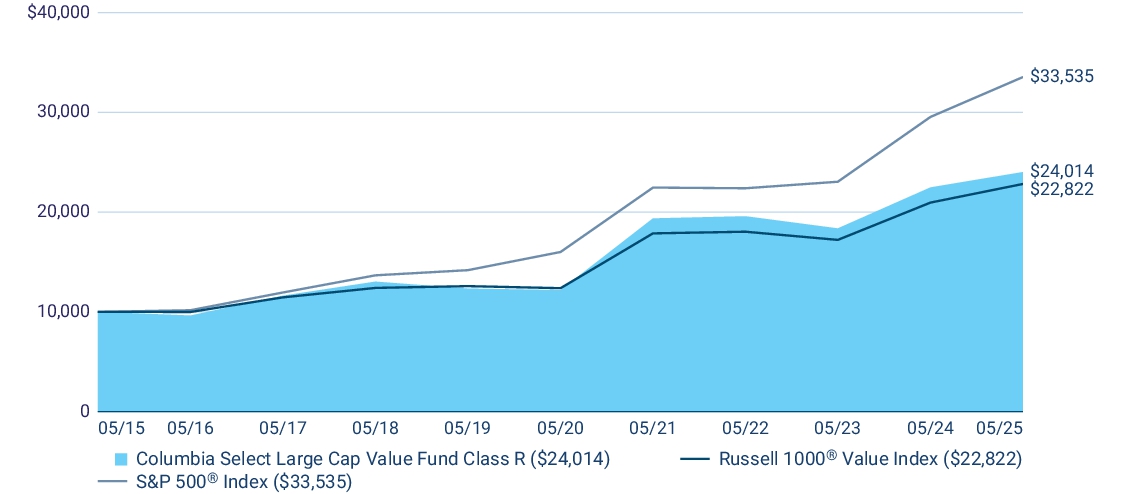

Management's Discussion of Fund Performance The performance of Class R shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

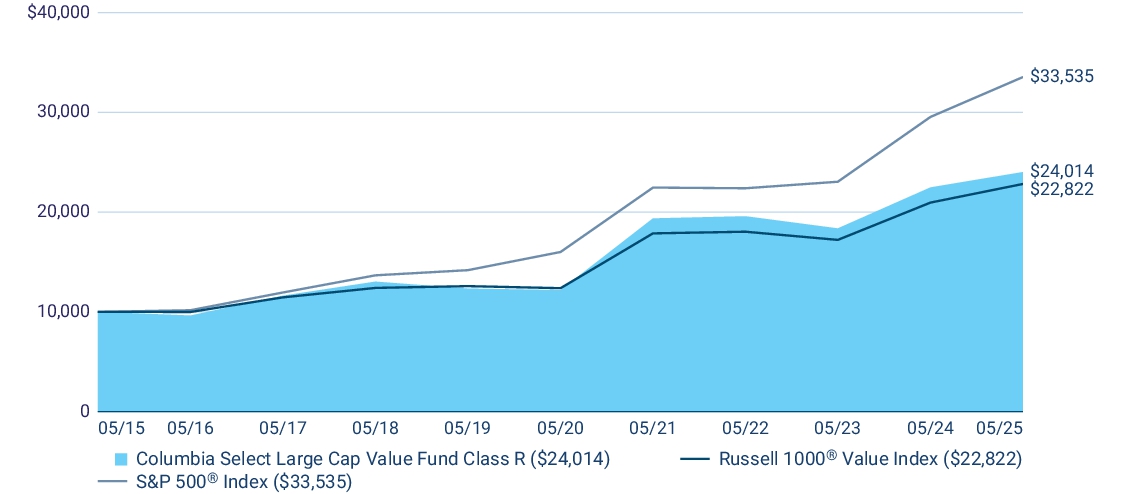

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class R | 6.84 | 14.53 | 9.16 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Represen ta tion of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Columbia Select Large Cap Value Fund - Class S [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Select Large Cap Value Fund

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

CSVGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Select Large Cap Value Fund (the Fund) for the period of October 2, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 36(a) | 0.55 % (b) |

| (a) | Based on operations from October 2, 2024 (commencement of operations) through the stated period end. Had the class been open for the entire reporting period, expenses shown in the table above would have been higher. | | (b) | Annualized. |

|

|

| Expenses Paid, Amount |

$ 36

|

[1] |

| Expense Ratio, Percent |

0.55%

|

[2] |

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class S shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the energy, health care and consumer staples sectors boosted the Fund’s relative results most during the annual period. Allocations | A smaller allocation to the health care sector and larger allocations to the communication services and utilities sectors buoyed the Fund’s relative results during the annual period. Individual holdings | Positions in Philip Morris International, Inc., a tobacco and nicotine products company; Tenet Healthcare Corp., a hospital operator and healthcare services company; Williams Companies, Inc., a natural gas pipeline operator; UnitedHealth Group, a health insurance and healthcare services company; and Corning, Inc., a technology company specializing in glass, ceramics and related materials, were among the top relative contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the utilities, information technology and communication services sectors hurt the Fund’s relative results during the annual period. Allocations | A larger weighting to the energy sector and smaller weightings to the financials and consumer staples sectors detracted from relative results. Individual holdings | Fund positions in AES Corp., an independent power provider; Freeport-McMoRan, Inc., a copper mining company; Qualcomm, Inc., a semiconductor company that provides chips and software for mobile phones and other devices; Applied Materials, Inc., a semiconductor fabrication equipment supplier; and Humana, Inc., a health insurance company, were among the top relative detractors during the period. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

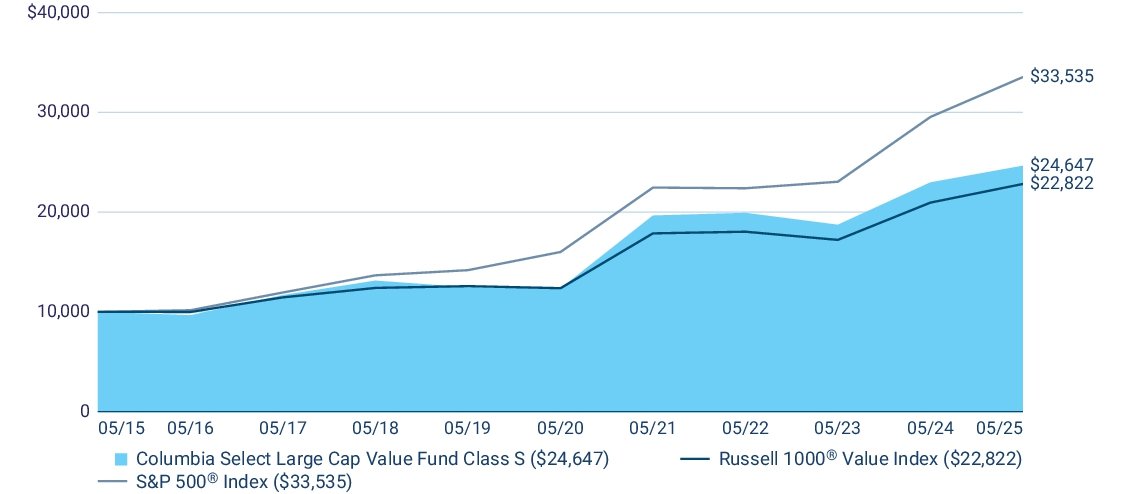

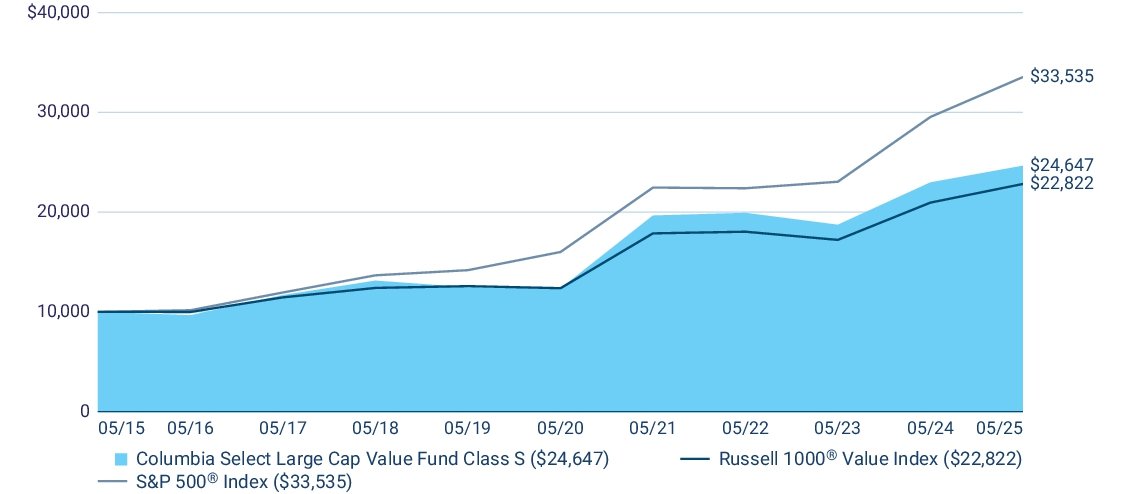

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class S (a) | 7.27 | 14.84 | 9.44 | | Russell 1000 ® Value Index | 8.91 | 13.02 | 8.60 | | S&P 500 ® Index | 13.52 | 15.94 | 12.86 |

(a) | The returns shown for periods prior to October 2, 2024 (including Since Fund Inception returns, if shown) include the returns of Class A. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information. |

|

|

| Performance Inception Date |

Oct. 02, 2024

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Prior Market Index Comparison [Text Block] |

The returns shown for periods prior to October 2, 2024 (including Since Fund Inception returns, if shown) include the returns of Class A. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 2,345,660,346

|

|

| Holdings Count | HOLDING |

38

|

|

| Advisory Fees Paid, Amount |

$ 16,008,828

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,345,660,346 | Total number of portfolio holdings | 38 | Management services fees

(represents 0.67% of Fund average net assets) | $ 16,008,828 | Portfolio turnover for the reporting period | 28% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund repr esent ed as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

| Largest Holdings [Text Block] |

| Verizon Communications, Inc. | 3.8 % | | Corning, Inc. | 3.7 % | | Boeing Co. (The) | 3.4 % | | Applied Materials, Inc. | 3.4 % | | Freeport-McMoRan, Inc. | 3.4 % | | Tenet Healthcare Corp. | 3.4 % | | PG&E Corp. | 3.1 % | | Lowe's Companies, Inc. | 3.1 % | | EPAM Systems, Inc. | 3.1 % | | Citigroup, Inc. | 3.1 % |

|

|

|

|