Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Columbia Funds Series Trust II

|

| Entity Central Index Key |

0001352280

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| Columbia Quality Income Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Quality Income Fund

|

| Class Name |

Class A

|

| Trading Symbol |

AUGAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Quality Income Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 93 | 0.89 % |

|

| Expenses Paid, Amount |

$ 93

|

| Expense Ratio, Percent |

0.89%

|

| Factors Affecting Performance [Text Block] |

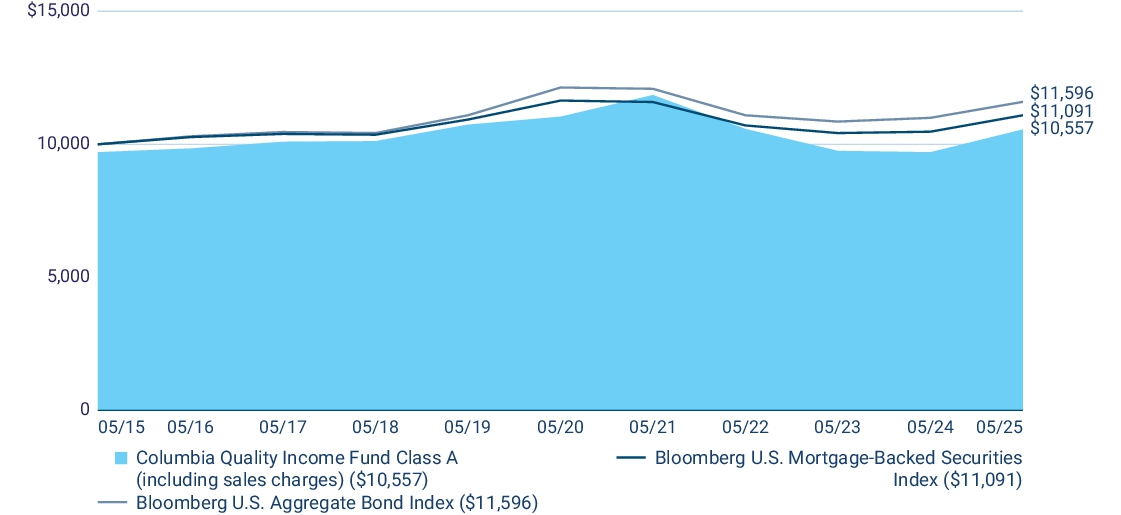

Management's Discussion of Fund Performance The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Interest rate positioning | The Fund’s positioning with respect to interest rates contributed most to relative and absolute outperformance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as short- and intermediate-term U.S. Treasury yields moved lower over the period. The Fund’s rate positioning also benefitted from a steepening yield curve over the period. Agency residential mortgage-backed securities | Performance for the Fund’s agency passthrough and collateralized mortgage obligation (CMO) holdings gained against a backdrop of falling interest rates and a steepening yield curve. Non-agency residential mortgage-backed securities | Non-agency residential mortgage-backed securities drove relative (the benchmark does not hold these securities) and absolute outperformance as housing fundamentals remained strong and borrower delinquencies remained low. Top Performance Detractors There were no material detractors to Fund performance during the period.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

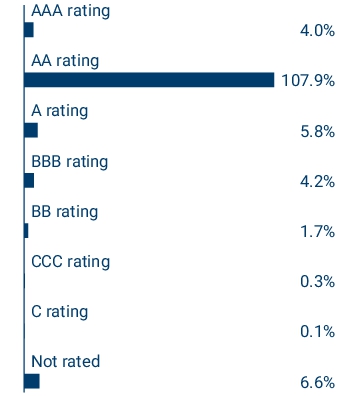

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class A (excluding sales charges) | 8.81 | (0.89 ) | 0.85 | | Class A (including sales charges) | 5.54 | (1.49 ) | 0.54 | | Bloomberg U.S. Mortgage-Backed Securities Index | 5.88 | (0.97 ) | 1.04 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 1,274,068,619

|

| Holdings Count | Holding |

339

|

| Advisory Fees Paid, Amount |

$ 6,652,421

|

| Investment Company, Portfolio Turnover |

330.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,274,068,619 | Total number of portfolio holdings | 339 | Management services fees

(represents 0.49% of Fund average net assets) | $ 6,652,421 | Portfolio turnover for the reporting period | 330% | Portfolio turnover for the reporting period excluding to be announced (TBA) securities | 17% |

|

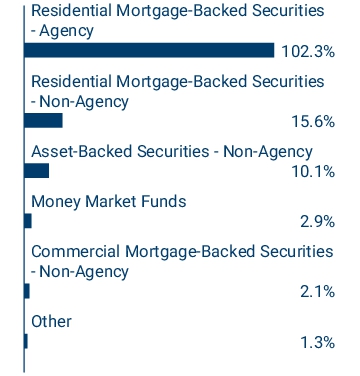

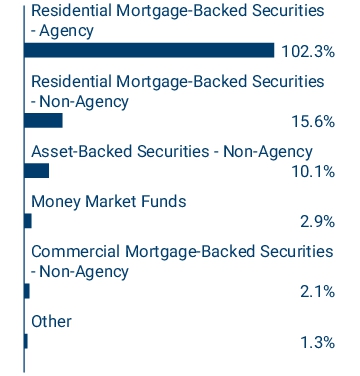

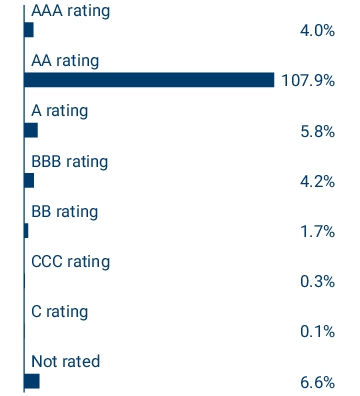

| Holdings [Text Block] |

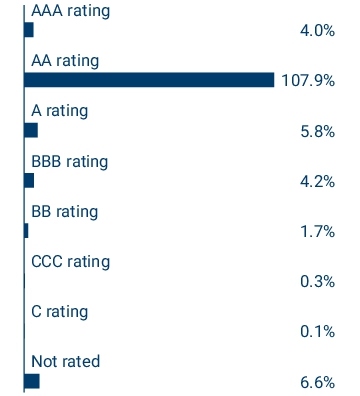

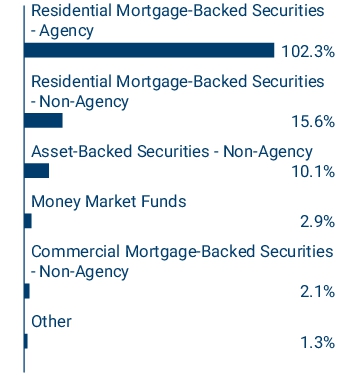

Graphical Representation of Fund Holdings The tables below show the investment m ak eup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

| Largest Holdings [Text Block] |

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

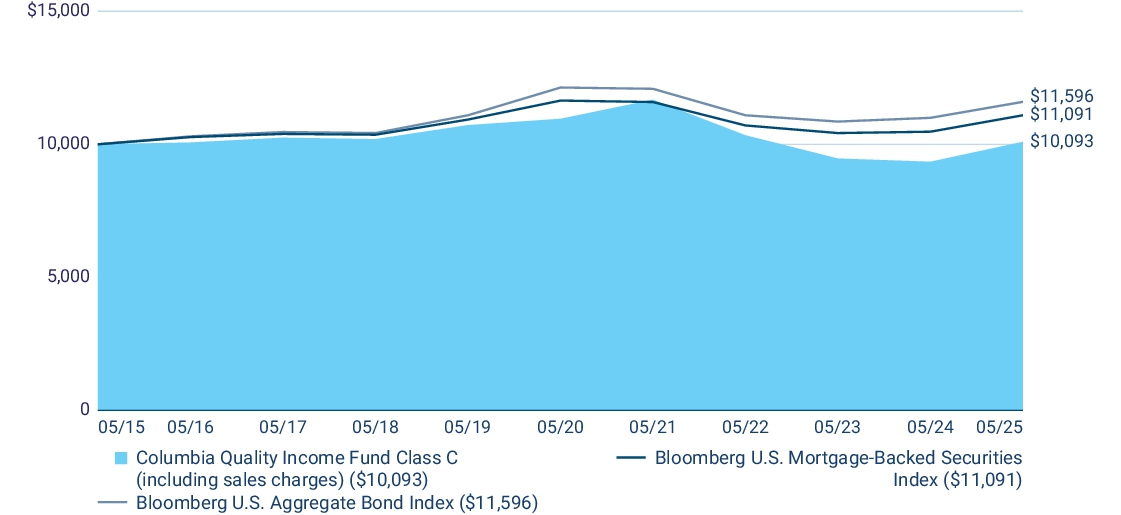

| Columbia Quality Income Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Quality Income Fund

|

| Class Name |

Class C

|

| Trading Symbol |

AUGCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Quality Income Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 170 | 1.64 % |

|

| Expenses Paid, Amount |

$ 170

|

| Expense Ratio, Percent |

1.64%

|

| Factors Affecting Performance [Text Block] |

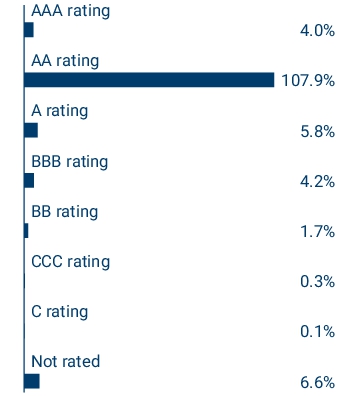

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Interest rate positioning | The Fund’s positioning with respect to interest rates contributed most to relative and absolute outperformance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as short- and intermediate-term U.S. Treasury yields moved lower over the period. The Fund’s rate positioning also benefitted from a steepening yield curve over the period. Agency residential mortgage-backed securities | Performance for the Fund’s agency passthrough and collateralized mortgage obligation (CMO) holdings gained against a backdrop of falling interest rates and a steepening yield curve. Non-agency residential mortgage-backed securities | Non-agency residential mortgage-backed securities drove relative (the benchmark does not hold these securities) and absolute outperformance as housing fundamentals remained strong and borrower delinquencies remained low. Top Performance Detractors There were no material detractors to Fund performance during the period.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | 7.99 | (1.63 ) | 0.09 | | Class C (including sales charges) | 6.99 | (1.63 ) | 0.09 | | Bloomberg U.S. Mortgage-Backed Securities Index | 5.88 | (0.97 ) | 1.04 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 1,274,068,619

|

| Holdings Count | Holding |

339

|

| Advisory Fees Paid, Amount |

$ 6,652,421

|

| Investment Company, Portfolio Turnover |

330.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,274,068,619 | Total number of portfolio holdings | 339 | Management services fees

(represents 0.49% of Fund average net assets) | $ 6,652,421 | Portfolio turnover for the reporting period | 330% | Portfolio turnover for the reporting period excluding to be announced (TBA) securities | 17% |

|

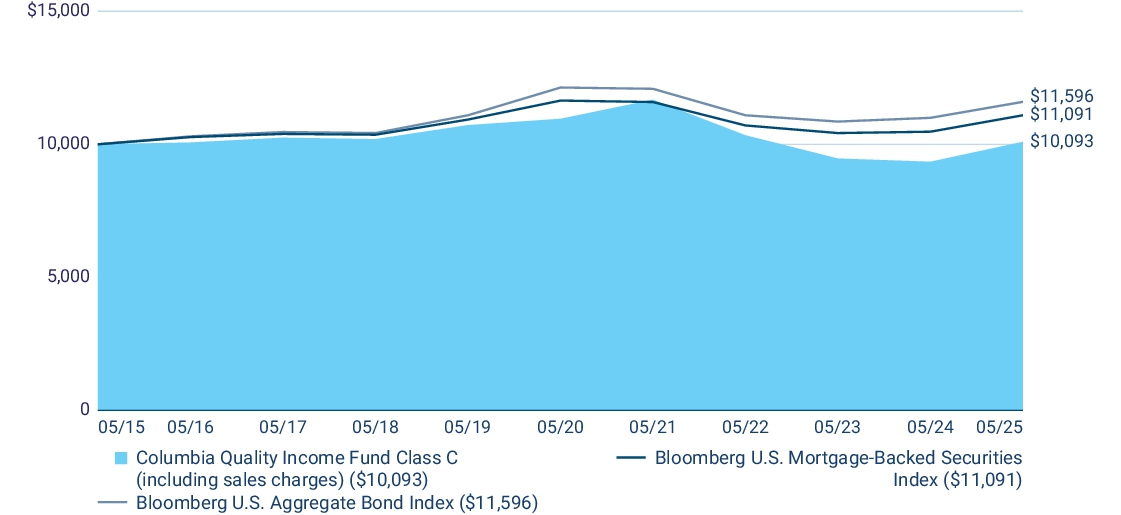

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

| Largest Holdings [Text Block] |

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

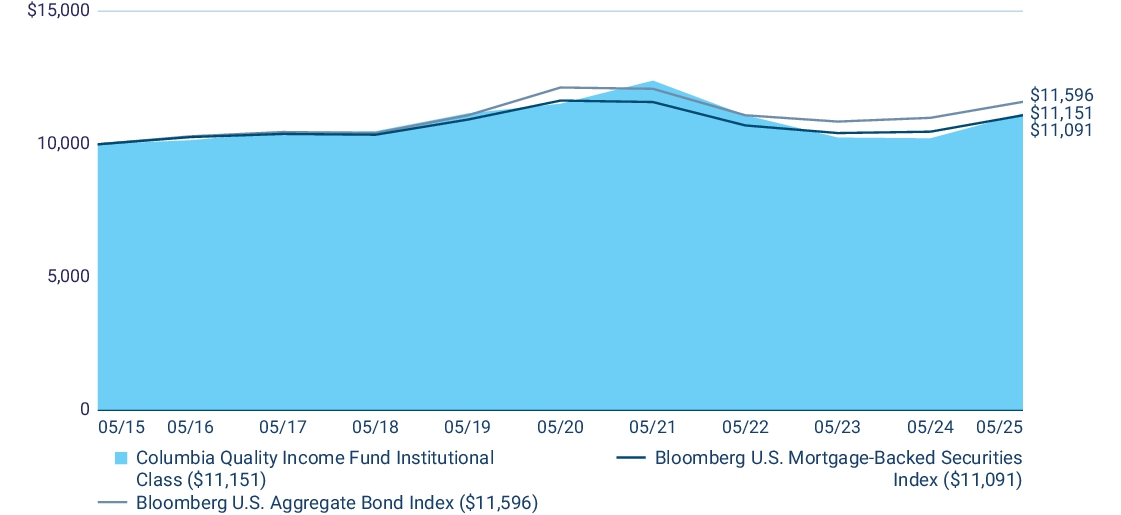

| Columbia Quality Income Fund - Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Quality Income Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

CUGZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Quality Income Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 67 | 0.64 % |

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

0.64%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Interest rate positioning | The Fund’s positioning with respect to interest rates contributed most to relative and absolute outperformance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as short- and intermediate-term U.S. Treasury yields moved lower over the period. The Fund’s rate positioning also benefitted from a steepening yield curve over the period. Agency residential mortgage-backed securities | Performance for the Fund’s agency passthrough and collateralized mortgage obligation (CMO) holdings gained against a backdrop of falling interest rates and a steepening yield curve. Non-agency residential mortgage-backed securities | Non-agency residential mortgage-backed securities drove relative (the benchmark does not hold these securities) and absolute outperformance as housing fundamentals remained strong and borrower delinquencies remained low. Top Performance Detractors There were no material detractors to Fund performance during the period.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

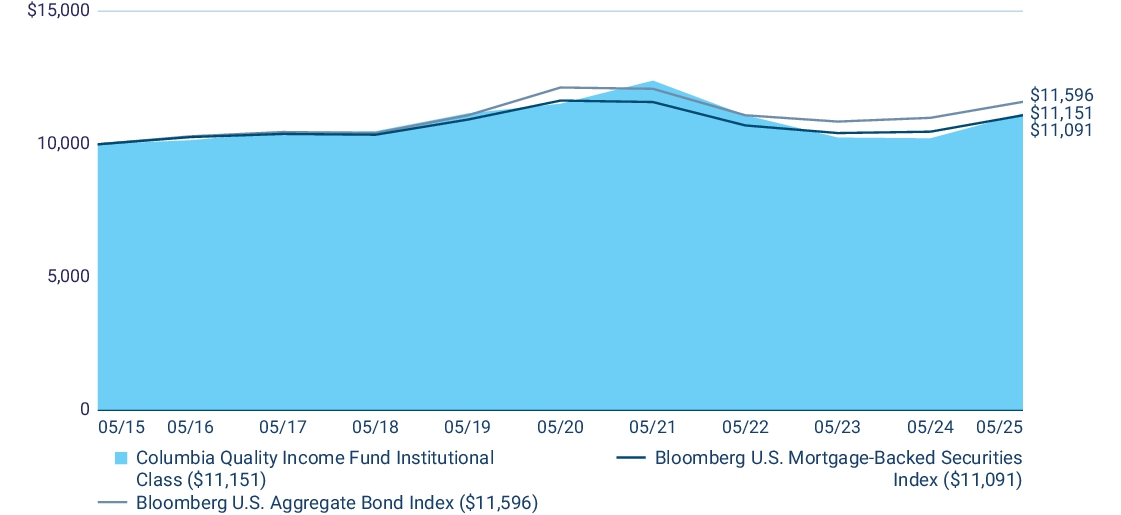

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | 9.08 | (0.65 ) | 1.10 | | Bloomberg U.S. Mortgage-Backed Securities Index | 5.88 | (0.97 ) | 1.04 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 1,274,068,619

|

| Holdings Count | Holding |

339

|

| Advisory Fees Paid, Amount |

$ 6,652,421

|

| Investment Company, Portfolio Turnover |

330.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,274,068,619 | Total number of portfolio holdings | 339 | Management services fees

(represents 0.49% of Fund average net assets) | $ 6,652,421 | Portfolio turnover for the reporting period | 330% | Portfolio turnover for the reporting period excluding to be announced (TBA) securities | 17% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

| Largest Holdings [Text Block] |

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% | 8.2 % | Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% | 7.9 % | Government National Mortgage Association TBA

06/20/2054 4.500% | 4.8 % | Government National Mortgage Association

05/20/2051 2.500% | 2.7 % | Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% | 2.7 % | Federal National Mortgage Association

08/01/2052 4.000% | 2.3 % | Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% | 1.9 % | Federal National Mortgage Association

11/01/2052 4.500% | 1.8 % | Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% | 1.8 % | Federal Home Loan Mortgage Corp.

08/01/2052 3.000% | 1.6 % |

|

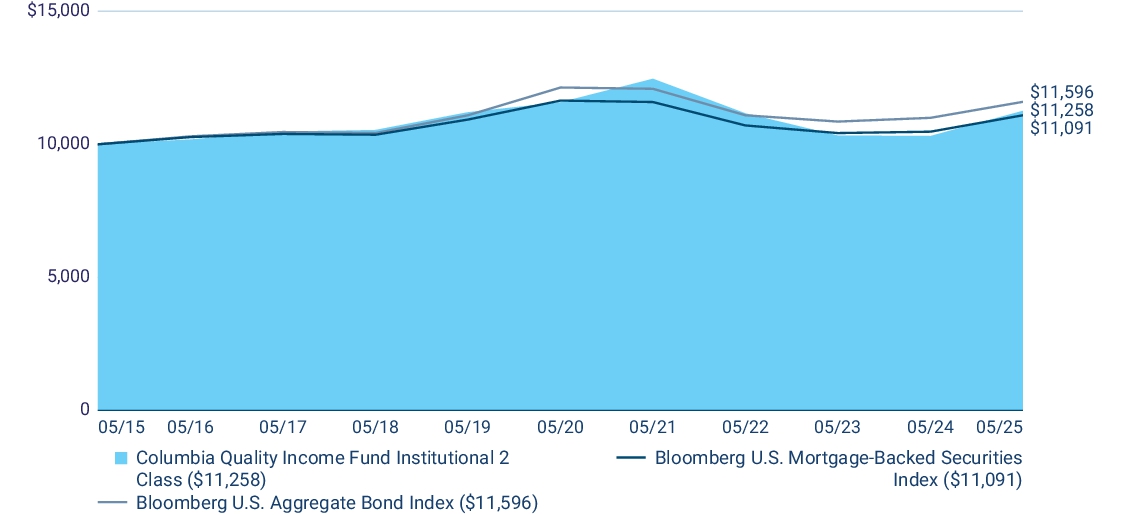

| Columbia Quality Income Fund - Institutional 2 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Quality Income Fund

|

| Class Name |

Institutional 2 Class

|

| Trading Symbol |

CGVRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Quality Income Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Institutional 2 Class |

$ 57 |

0.55 % |

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

0.55%

|

| Factors Affecting Performance [Text Block] |

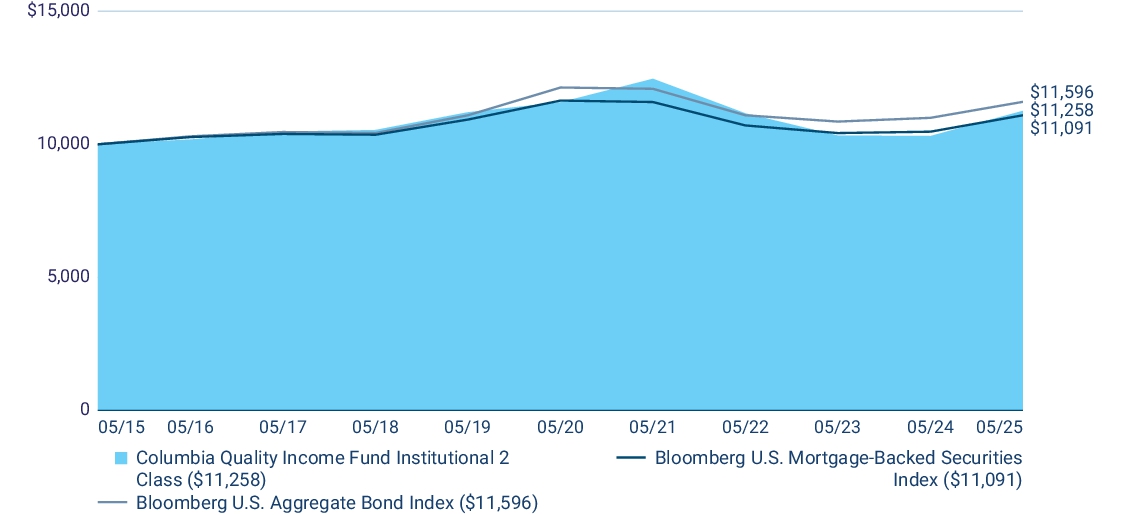

Management's Discussion of Fund Performance

The performance of Institutional 2 Class shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Interest rate positioning | The Fund’s positioning with respect to interest rates contributed most to relative and absolute outperformance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as short- and intermediate-term U.S. Treasury yields moved lower over the period. The Fund’s rate positioning also benefitted from a steepening yield curve over the period. Agency residential mortgage-backed securities | Performance for the Fund’s agency passthrough and collateralized mortgage obligation (CMO) holdings gained against a backdrop of falling interest rates and a steepening yield curve. Non-agency residential mortgage-backed securities | Non-agency residential mortgage-backed securities drove relative (the benchmark does not hold these securities) and absolute outperformance as housing fundamentals remained strong and borrower delinquencies remained low. Top Performance Detractors

There were no material detractors to Fund performance during the period.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Institutional 2 Class |

9.18 |

(0.56 ) |

1.19 |

| Bloomberg U.S. Mortgage-Backed Securities Index |

5.88 |

(0.97 ) |

1.04 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 1,274,068,619

|

| Holdings Count | Holding |

339

|

| Advisory Fees Paid, Amount |

$ 6,652,421

|

| Investment Company, Portfolio Turnover |

330.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 1,274,068,619 |

Total number of portfolio holdings |

339 |

Management services fees

(represents 0.49% of Fund average net assets) |

$ 6,652,421 |

Portfolio turnover for the reporting period |

330% |

Portfolio turnover for the reporting period excluding to be announced (TBA) securities |

17% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% |

8.2 % |

Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% |

7.9 % |

Government National Mortgage Association TBA

06/20/2054 4.500% |

4.8 % |

Government National Mortgage Association

05/20/2051 2.500% |

2.7 % |

Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% |

2.7 % |

Federal National Mortgage Association

08/01/2052 4.000% |

2.3 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% |

1.9 % |

Federal National Mortgage Association

11/01/2052 4.500% |

1.8 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% |

1.8 % |

Federal Home Loan Mortgage Corp.

08/01/2052 3.000% |

1.6 % |

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

| Largest Holdings [Text Block] |

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% |

8.2 % |

Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% |

7.9 % |

Government National Mortgage Association TBA

06/20/2054 4.500% |

4.8 % |

Government National Mortgage Association

05/20/2051 2.500% |

2.7 % |

Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% |

2.7 % |

Federal National Mortgage Association

08/01/2052 4.000% |

2.3 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% |

1.9 % |

Federal National Mortgage Association

11/01/2052 4.500% |

1.8 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% |

1.8 % |

Federal Home Loan Mortgage Corp.

08/01/2052 3.000% |

1.6 % |

|

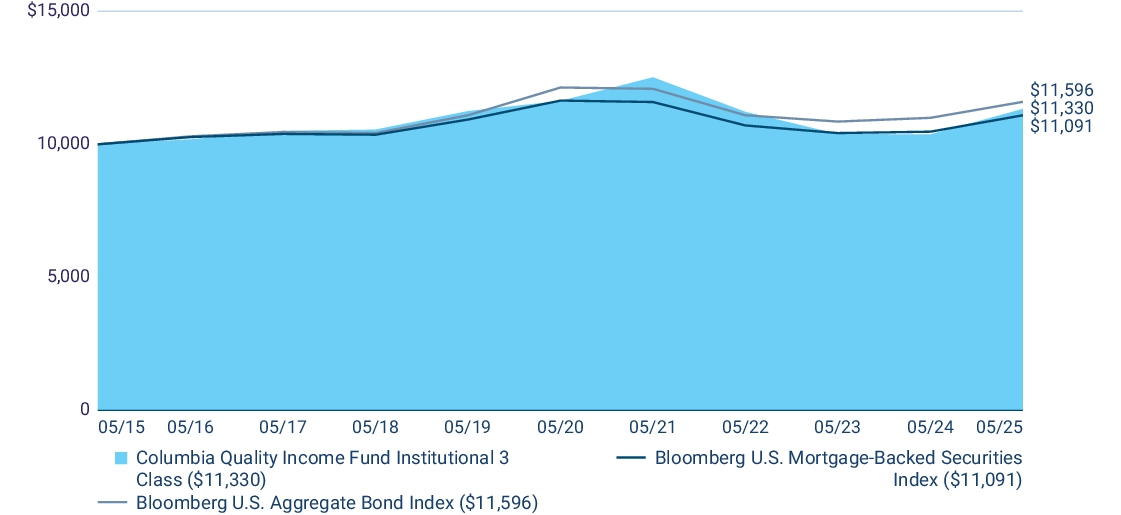

| Columbia Quality Income Fund - Institutional 3 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Quality Income Fund

|

| Class Name |

Institutional 3 Class

|

| Trading Symbol |

CUGYX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Quality Income Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Institutional 3 Class |

$ 52 |

0.50 % |

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

0.50%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Interest rate positioning | The Fund’s positioning with respect to interest rates contributed most to relative and absolute outperformance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as short- and intermediate-term U.S. Treasury yields moved lower over the period. The Fund’s rate positioning also benefitted from a steepening yield curve over the period. Agency residential mortgage-backed securities | Performance for the Fund’s agency passthrough and collateralized mortgage obligation (CMO) holdings gained against a backdrop of falling interest rates and a steepening yield curve. Non-agency residential mortgage-backed securities | Non-agency residential mortgage-backed securities drove relative (the benchmark does not hold these securities) and absolute outperformance as housing fundamentals remained strong and borrower delinquencies remained low. Top Performance Detractors

There were no material detractors to Fund performance during the period.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

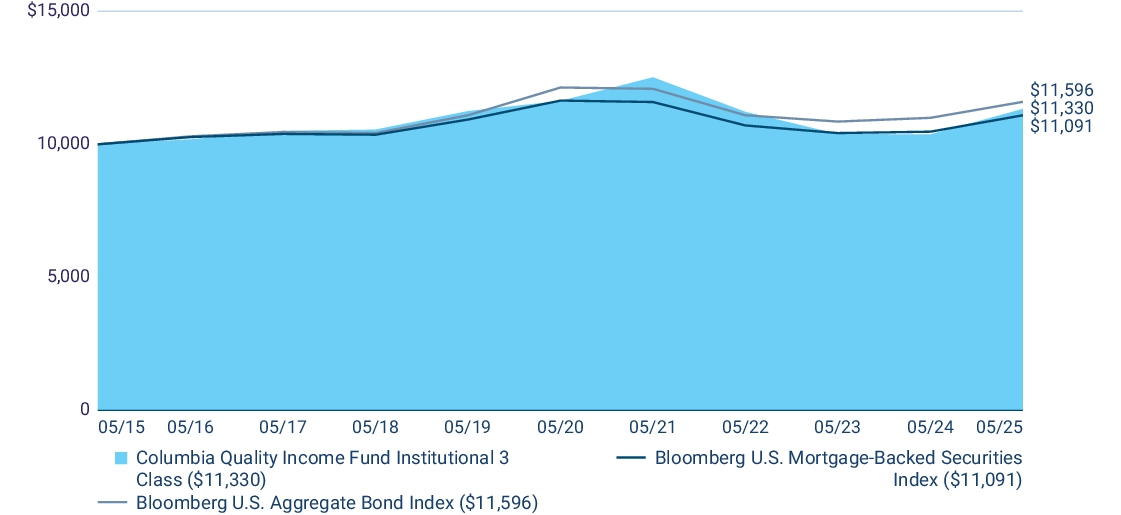

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Institutional 3 Class |

9.25 |

(0.52 ) |

1.26 |

| Bloomberg U.S. Mortgage-Backed Securities Index |

5.88 |

(0.97 ) |

1.04 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 1,274,068,619

|

| Holdings Count | Holding |

339

|

| Advisory Fees Paid, Amount |

$ 6,652,421

|

| Investment Company, Portfolio Turnover |

330.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 1,274,068,619 |

Total number of portfolio holdings |

339 |

Management services fees

(represents 0.49% of Fund average net assets) |

$ 6,652,421 |

Portfolio turnover for the reporting period |

330% |

Portfolio turnover for the reporting period excluding to be announced (TBA) securities |

17% |

|

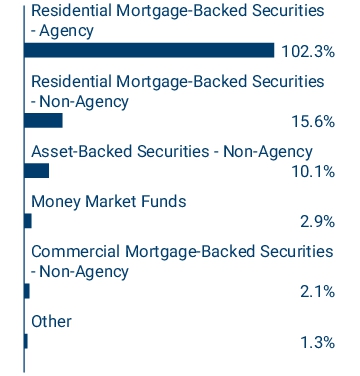

| Holdings [Text Block] |

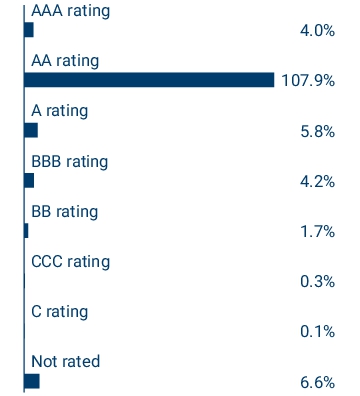

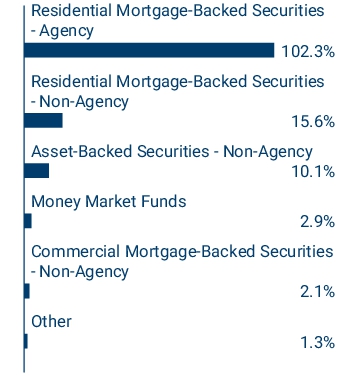

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% |

8.2 % |

Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% |

7.9 % |

Government National Mortgage Association TBA

06/20/2054 4.500% |

4.8 % |

Government National Mortgage Association

05/20/2051 2.500% |

2.7 % |

Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% |

2.7 % |

Federal National Mortgage Association

08/01/2052 4.000% |

2.3 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% |

1.9 % |

Federal National Mortgage Association

11/01/2052 4.500% |

1.8 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% |

1.8 % |

Federal Home Loan Mortgage Corp.

08/01/2052 3.000% |

1.6 % |

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

| Largest Holdings [Text Block] |

Uniform Mortgage-Backed Security TBA

06/13/2054 4.500% |

8.2 % |

Uniform Mortgage-Backed Security TBA

06/12/2055 3.500% |

7.9 % |

Government National Mortgage Association TBA

06/20/2054 4.500% |

4.8 % |

Government National Mortgage Association

05/20/2051 2.500% |

2.7 % |

Uniform Mortgage-Backed Security TBA

06/18/2040 3.000% |

2.7 % |

Federal National Mortgage Association

08/01/2052 4.000% |

2.3 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 3.000% |

1.9 % |

Federal National Mortgage Association

11/01/2052 4.500% |

1.8 % |

Uniform Mortgage-Backed Security TBA

06/13/2054 2.000% |

1.8 % |

Federal Home Loan Mortgage Corp.

08/01/2052 3.000% |

1.6 % |

|