Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

HOLDINGS

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Columbia Funds Series Trust II

|

| Entity Central Index Key |

0001352280

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| Columbia Large Cap Value Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Large Cap Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

INDZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 100 | 0.96 % |

|

| Expenses Paid, Amount |

$ 100

|

| Expense Ratio, Percent |

0.96%

|

| Factors Affecting Performance [Text Block] |

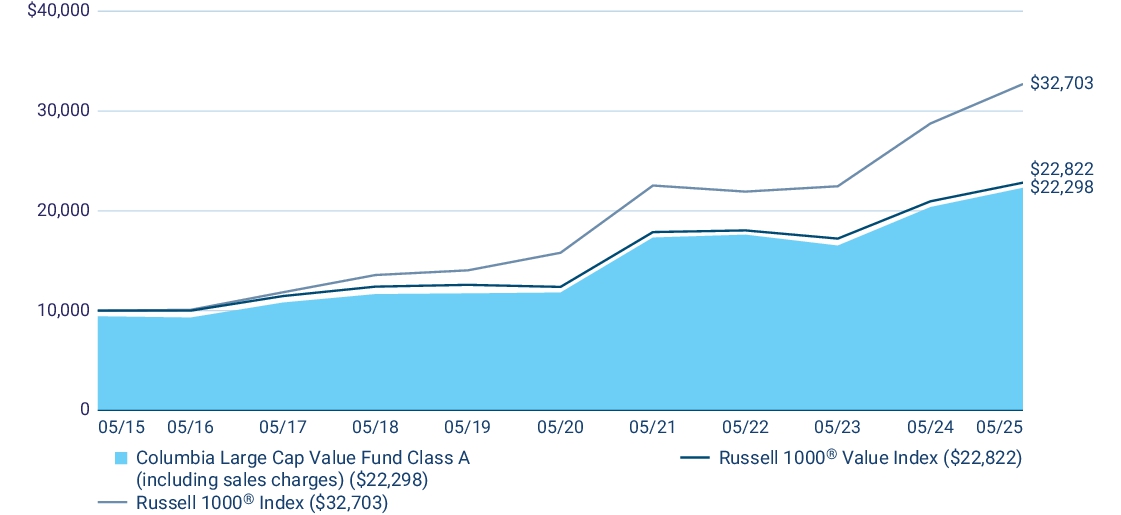

Management's Discussion of Fund Performance The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the consumer discretionary, financials and industrials sectors boosted the Fund’s results most relative to the benchmark during the annual period. Allocations | Larger weightings relative to the benchmark in the financials and industrials sectors and smaller relative weightings in the materials and energy sectors improved Fund results during the annual period. Individual holdings | A relative overweight position in JPMorgan Chase & Co., a multinational financial and investment banking company; a relative overweight position in Boston Scientific Corporation, a medical devices company; a relative overweight position in Goldman Sachs Group, Inc., a multinational financial and investment banking company; a relative overweight position in Oracle Corporation, a computer technology company that engages in the provision of products and services used for corporate applications; and a relative overweight position in Allstate Corp., an insurance company, were among the top contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the health care, consumer staples, information technology, energy, communication services, utilities, real estate and materials sectors hurt the Fund’s results during the annual period. Allocations | Larger weightings relative to the benchmark in the health care and information technology sectors and smaller relative weightings in the real estate, utilities, consumer staples and communication services sectors detracted from Fund performance during the period. Individual holdings | A relative overweight position in UnitedHealth Group, Inc., a health insurance and health care service company; a relative overweight position in Thermo Fisher Scientific, Inc., a life science tools and clinical research company; a relative overweight position in Merck & Co., Inc., a pharmaceutical company; a relative overweight position in ON Semiconductor Corp., a semiconductor company; and a relative overweight position in Target Corp., a retail corporation that operates a chain of general merchandise stores, were notable detractors from Fund performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

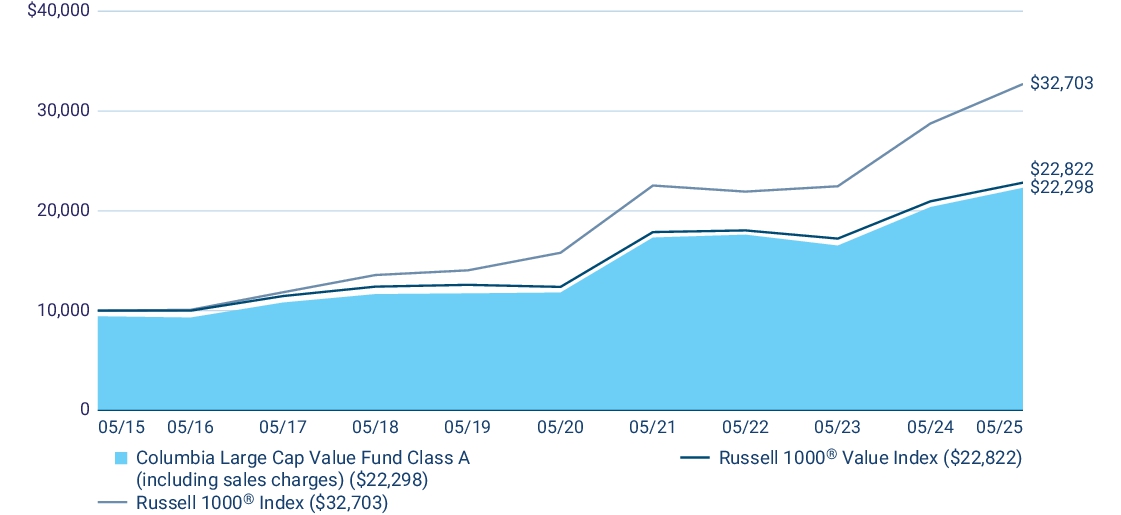

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class A (excluding sales charges) | 9.46 | 13.56 | 8.99 | | Class A (including sales charges) | 3.18 | 12.23 | 8.35 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 2,422,466,912

|

| Holdings Count | HOLDINGS |

67

|

| Advisory Fees Paid, Amount |

$ 15,376,718

|

| Investment Company, Portfolio Turnover |

27.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 2,422,466,912 | Total number of portfolio holdings | 67 | Management services fees

(represents 0.63% of Fund average net assets) | $ 15,376,718 | Portfolio turnover for the reporting period | 27% |

|

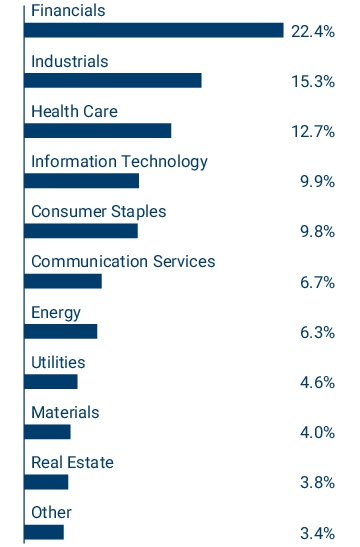

| Holdings [Text Block] |

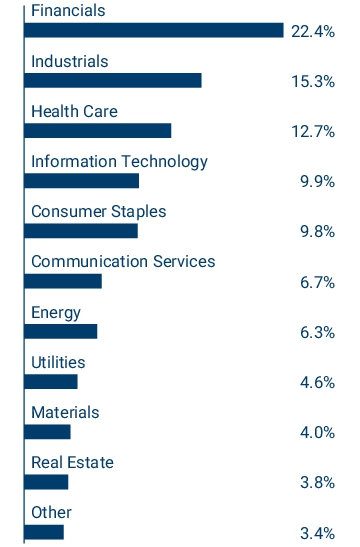

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Columbia Large Cap Value Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Large Cap Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

ADECX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 178 | 1.71 % |

|

| Expenses Paid, Amount |

$ 178

|

| Expense Ratio, Percent |

1.71%

|

| Factors Affecting Performance [Text Block] |

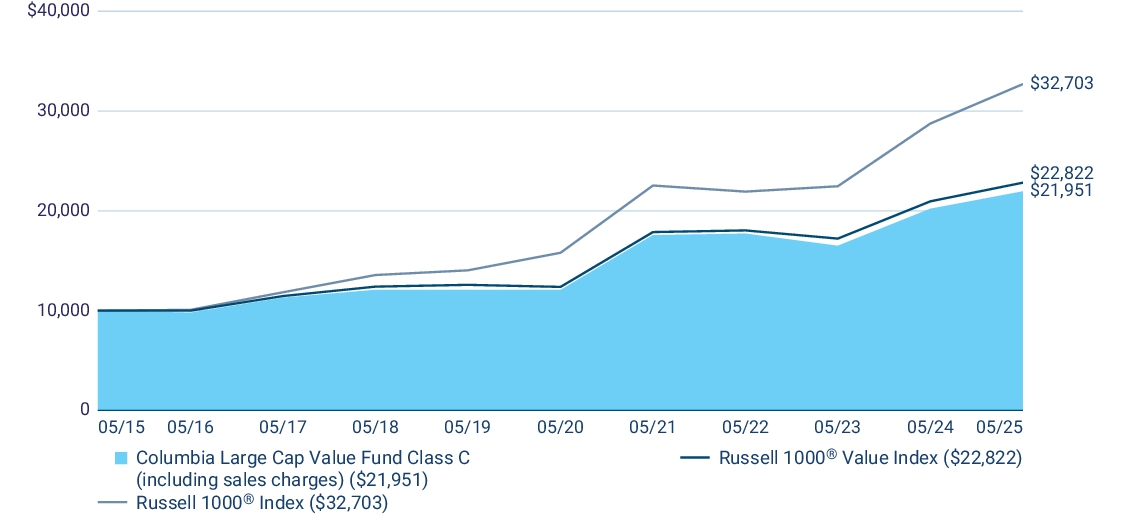

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the consumer discretionary, financials and industrials sectors boosted the Fund’s results most relative to the benchmark during the annual period. Allocations | Larger weightings relative to the benchmark in the financials and industrials sectors and smaller relative weightings in the materials and energy sectors improved Fund results during the annual period. Individual holdings | A relative overweight position in JPMorgan Chase & Co., a multinational financial and investment banking company; a relative overweight position in Boston Scientific Corporation, a medical devices company; a relative overweight position in Goldman Sachs Group, Inc., a multinational financial and investment banking company; a relative overweight position in Oracle Corporation, a computer technology company that engages in the provision of products and services used for corporate applications; and a relative overweight position in Allstate Corp., an insurance company, were among the top contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the health care, consumer staples, information technology, energy, communication services, utilities, real estate and materials sectors hurt the Fund’s results during the annual period. Allocations | Larger weightings relative to the benchmark in the health care and information technology sectors and smaller relative weightings in the real estate, utilities, consumer staples and communication services sectors detracted from Fund performance during the period. Individual holdings | A relative overweight position in UnitedHealth Group, Inc., a health insurance and health care service company; a relative overweight position in Thermo Fisher Scientific, Inc., a life science tools and clinical research company; a relative overweight position in Merck & Co., Inc., a pharmaceutical company; a relative overweight position in ON Semiconductor Corp., a semiconductor company; and a relative overweight position in Target Corp., a retail corporation that operates a chain of general merchandise stores, were notable detractors from Fund performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

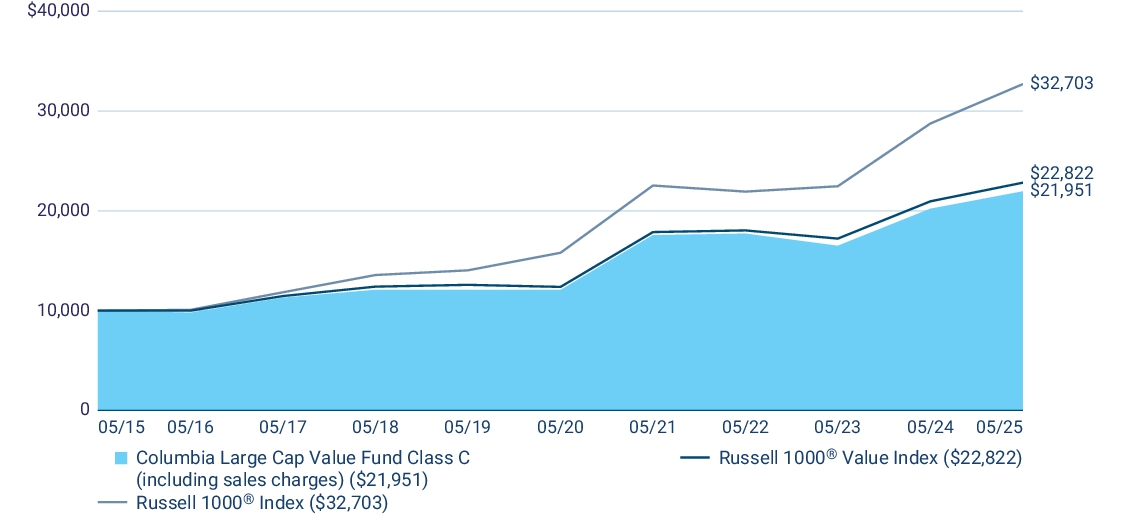

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | 8.61 | 12.71 | 8.18 | | Class C (including sales charges) | 7.61 | 12.71 | 8.18 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 2,422,466,912

|

| Holdings Count | HOLDINGS |

67

|

| Advisory Fees Paid, Amount |

$ 15,376,718

|

| Investment Company, Portfolio Turnover |

27.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 2,422,466,912 | Total number of portfolio holdings | 67 | Management services fees

(represents 0.63% of Fund average net assets) | $ 15,376,718 | Portfolio turnover for the reporting period | 27% |

|

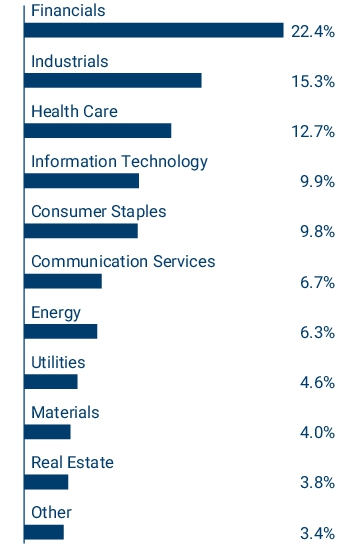

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Columbia Large Cap Value Fund - Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Large Cap Value Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

CDVZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 75 | 0.72 % |

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

0.72%

|

| Factors Affecting Performance [Text Block] |

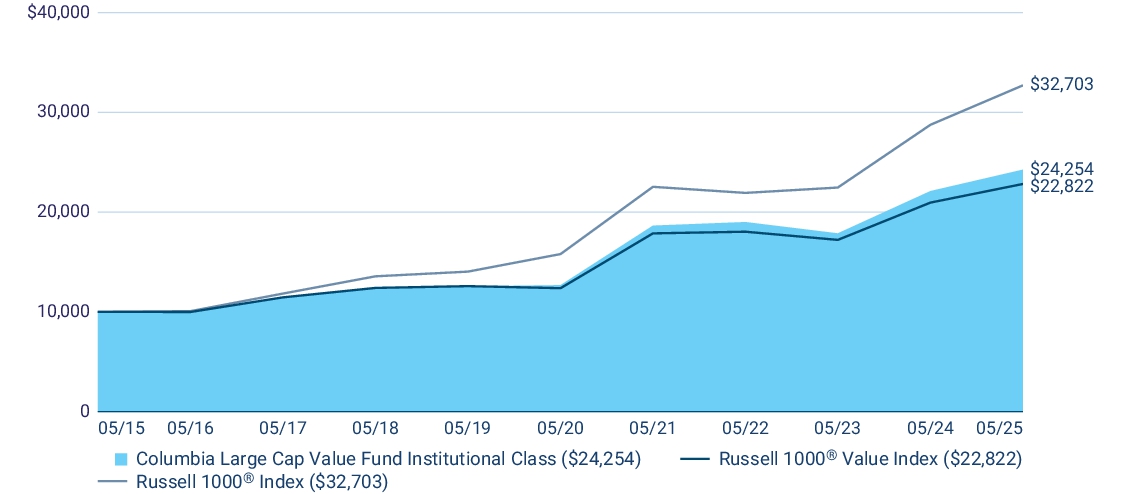

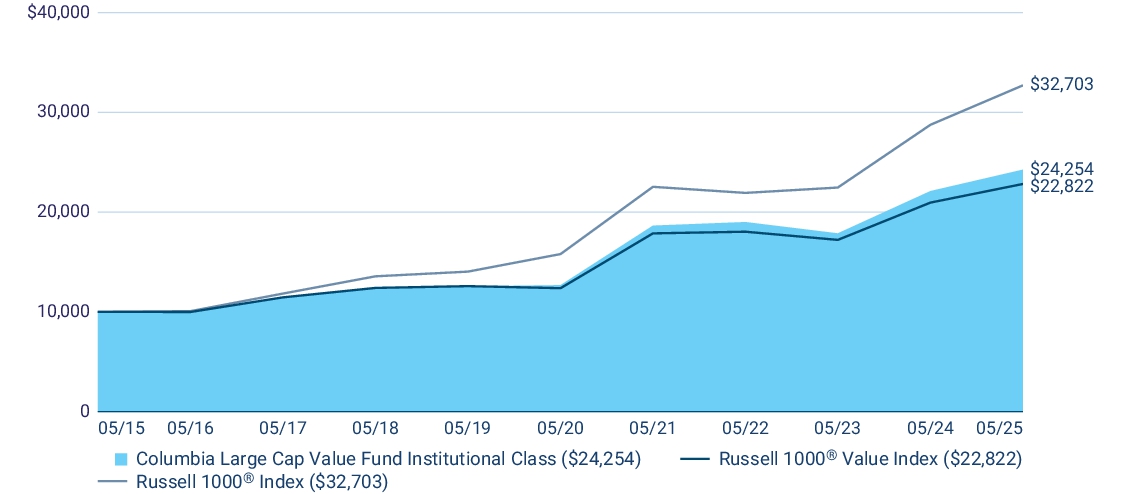

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the consumer discretionary, financials and industrials sectors boosted the Fund’s results most relative to the benchmark during the annual period. Allocations | Larger weightings relative to the benchmark in the financials and industrials sectors and smaller relative weightings in the materials and energy sectors improved Fund results during the annual period. Individual holdings | A relative overweight position in JPMorgan Chase & Co., a multinational financial and investment banking company; a relative overweight position in Boston Scientific Corporation, a medical devices company; a relative overweight position in Goldman Sachs Group, Inc., a multinational financial and investment banking company; a relative overweight position in Oracle Corporation, a computer technology company that engages in the provision of products and services used for corporate applications; and a relative overweight position in Allstate Corp., an insurance company, were among the top contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the health care, consumer staples, information technology, energy, communication services, utilities, real estate and materials sectors hurt the Fund’s results during the annual period. Allocations | Larger weightings relative to the benchmark in the health care and information technology sectors and smaller relative weightings in the real estate, utilities, consumer staples and communication services sectors detracted from Fund performance during the period. Individual holdings | A relative overweight position in UnitedHealth Group, Inc., a health insurance and health care service company; a relative overweight position in Thermo Fisher Scientific, Inc., a life science tools and clinical research company; a relative overweight position in Merck & Co., Inc., a pharmaceutical company; a relative overweight position in ON Semiconductor Corp., a semiconductor company; and a relative overweight position in Target Corp., a retail corporation that operates a chain of general merchandise stores, were notable detractors from Fund performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | 9.70 | 13.85 | 9.26 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 2,422,466,912

|

| Holdings Count | HOLDINGS |

67

|

| Advisory Fees Paid, Amount |

$ 15,376,718

|

| Investment Company, Portfolio Turnover |

27.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 2,422,466,912 | Total number of portfolio holdings | 67 | Management services fees

(represents 0.63% of Fund average net assets) | $ 15,376,718 | Portfolio turnover for the reporting period | 27% |

|

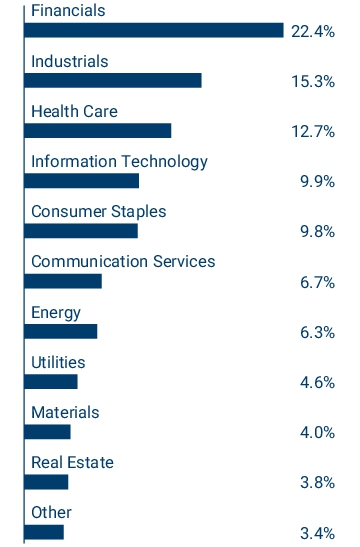

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Columbia Large Cap Value Fund - Institutional 2 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Large Cap Value Fund

|

| Class Name |

Institutional 2 Class

|

| Trading Symbol |

RSEDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 72 | 0.69 % |

|

| Expenses Paid, Amount |

$ 72

|

| Expense Ratio, Percent |

0.69%

|

| Factors Affecting Performance [Text Block] |

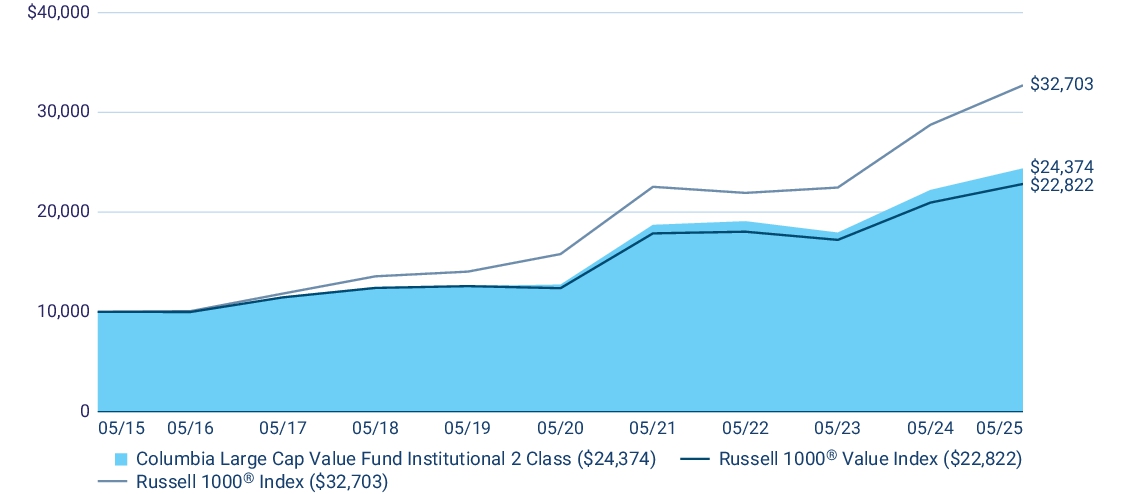

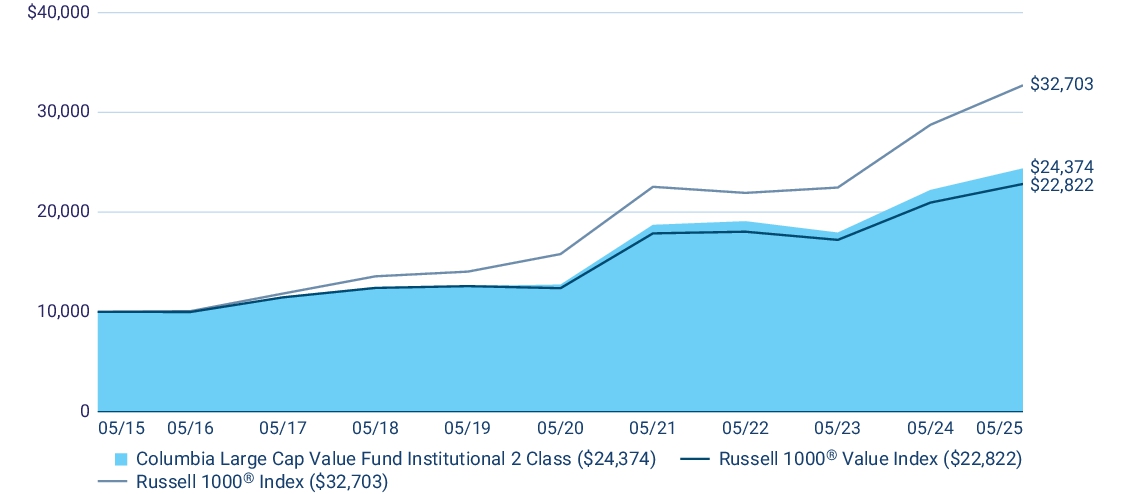

Management's Discussion of Fund Performance The performance of Institutional 2 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the consumer discretionary, financials and industrials sectors boosted the Fund’s results most relative to the benchmark during the annual period. Allocations | Larger weightings relative to the benchmark in the financials and industrials sectors and smaller relative weightings in the materials and energy sectors improved Fund results during the annual period. Individual holdings | A relative overweight position in JPMorgan Chase & Co., a multinational financial and investment banking company; a relative overweight position in Boston Scientific Corporation, a medical devices company; a relative overweight position in Goldman Sachs Group, Inc., a multinational financial and investment banking company; a relative overweight position in Oracle Corporation, a computer technology company that engages in the provision of products and services used for corporate applications; and a relative overweight position in Allstate Corp., an insurance company, were among the top contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the health care, consumer staples, information technology, energy, communication services, utilities, real estate and materials sectors hurt the Fund’s results during the annual period. Allocations | Larger weightings relative to the benchmark in the health care and information technology sectors and smaller relative weightings in the real estate, utilities, consumer staples and communication services sectors detracted from Fund performance during the period. Individual holdings | A relative overweight position in UnitedHealth Group, Inc., a health insurance and health care service company; a relative overweight position in Thermo Fisher Scientific, Inc., a life science tools and clinical research company; a relative overweight position in Merck & Co., Inc., a pharmaceutical company; a relative overweight position in ON Semiconductor Corp., a semiconductor company; and a relative overweight position in Target Corp., a retail corporation that operates a chain of general merchandise stores, were notable detractors from Fund performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 2 Class | 9.71 | 13.86 | 9.32 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 2,422,466,912

|

| Holdings Count | HOLDINGS |

67

|

| Advisory Fees Paid, Amount |

$ 15,376,718

|

| Investment Company, Portfolio Turnover |

27.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 2,422,466,912 | Total number of portfolio holdings | 67 | Management services fees

(represents 0.63% of Fund average net assets) | $ 15,376,718 | Portfolio turnover for the reporting period | 27% |

|

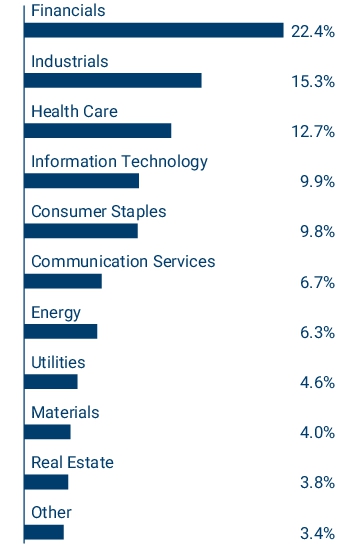

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Columbia Large Cap Value Fund - Institutional 3 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Large Cap Value Fund

|

| Class Name |

Institutional 3 Class

|

| Trading Symbol |

CDEYX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Large Cap Value Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 68 | 0.65 % |

|

| Expenses Paid, Amount |

$ 68

|

| Expense Ratio, Percent |

0.65%

|

| Factors Affecting Performance [Text Block] |

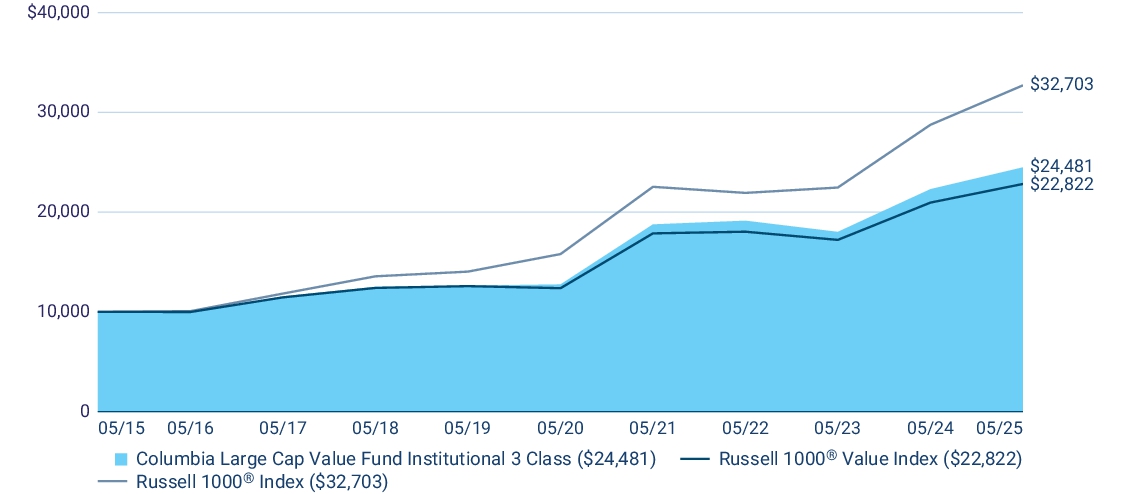

Management's Discussion of Fund Performance The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the consumer discretionary, financials and industrials sectors boosted the Fund’s results most relative to the benchmark during the annual period. Allocations | Larger weightings relative to the benchmark in the financials and industrials sectors and smaller relative weightings in the materials and energy sectors improved Fund results during the annual period. Individual holdings | A relative overweight position in JPMorgan Chase & Co., a multinational financial and investment banking company; a relative overweight position in Boston Scientific Corporation, a medical devices company; a relative overweight position in Goldman Sachs Group, Inc., a multinational financial and investment banking company; a relative overweight position in Oracle Corporation, a computer technology company that engages in the provision of products and services used for corporate applications; and a relative overweight position in Allstate Corp., an insurance company, were among the top contributors to Fund performance. Top Performance Detractors Stock selection I Selections in the health care, consumer staples, information technology, energy, communication services, utilities, real estate and materials sectors hurt the Fund’s results during the annual period. Allocations | Larger weightings relative to the benchmark in the health care and information technology sectors and smaller relative weightings in the real estate, utilities, consumer staples and communication services sectors detracted from Fund performance during the period. Individual holdings | A relative overweight position in UnitedHealth Group, Inc., a health insurance and health care service company; a relative overweight position in Thermo Fisher Scientific, Inc., a life science tools and clinical research company; a relative overweight position in Merck & Co., Inc., a pharmaceutical company; a relative overweight position in ON Semiconductor Corp., a semiconductor company; and a relative overweight position in Target Corp., a retail corporation that operates a chain of general merchandise stores, were notable detractors from Fund performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

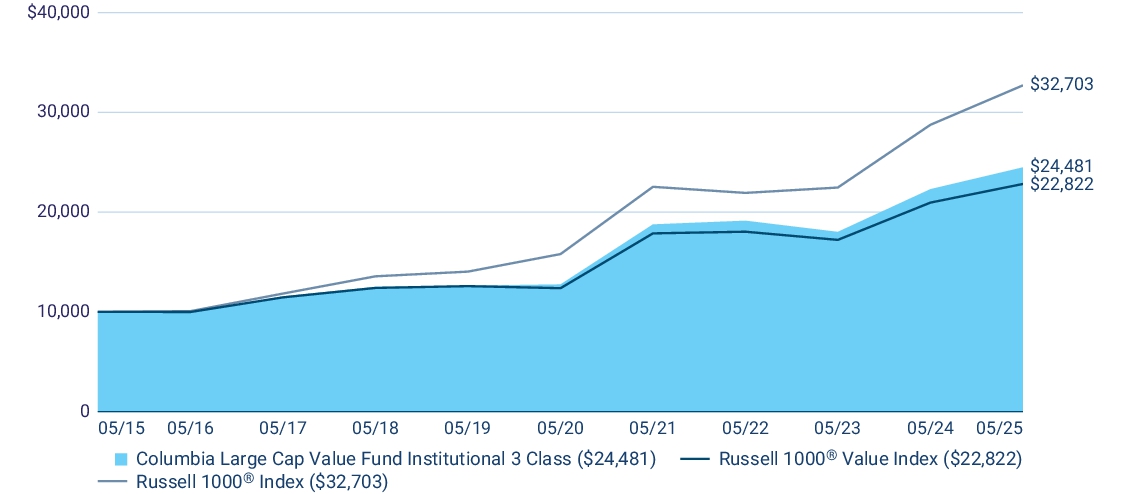

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 3 Class | 9.78 | 13.93 | 9.37 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 2,422,466,912

|

| Holdings Count | HOLDINGS |

67

|

| Advisory Fees Paid, Amount |

$ 15,376,718

|

| Investment Company, Portfolio Turnover |

27.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 2,422,466,912 | Total number of portfolio holdings | 67 | Management services fees

(represents 0.63% of Fund average net assets) | $ 15,376,718 | Portfolio turnover for the reporting period | 27% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 4.1 % | | Berkshire Hathaway, Inc., Class B | 3.4 % | | Walmart, Inc. | 3.0 % | | Exxon Mobil Corp. | 2.8 % | | Philip Morris International, Inc. | 2.7 % | | Procter & Gamble Co. (The) | 2.3 % | | Linde PLC | 2.2 % | | Citigroup, Inc. | 2.1 % | | Boeing Co. (The) | 2.0 % | | Walt Disney Co. (The) | 1.9 % |

|