Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Funds Series Trust II

|

|

| Entity Central Index Key |

0001352280

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| Columbia High Yield Bond Fund - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

INEAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Class A |

$ 101 |

0.97 % |

|

|

| Expenses Paid, Amount |

$ 101

|

|

| Expense Ratio, Percent |

0.97%

|

|

| Factors Affecting Performance [Text Block] |

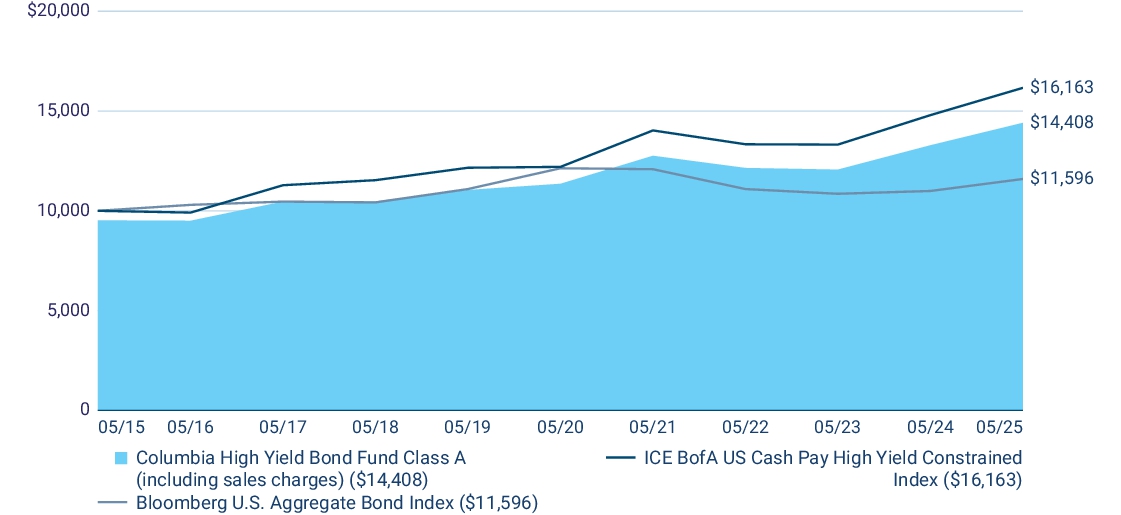

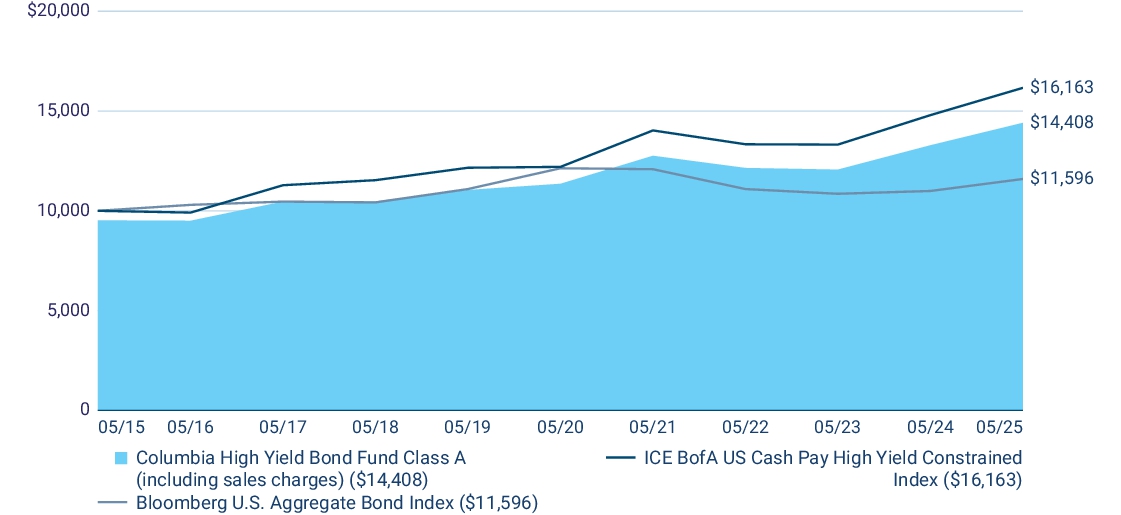

Management's Discussion of Fund Performance The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors

Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

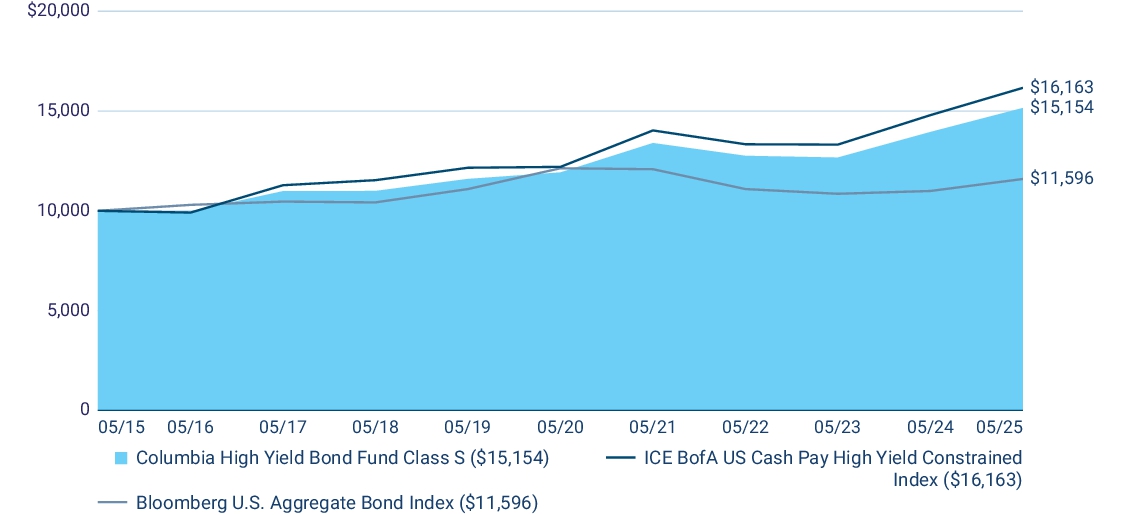

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Class A (excluding sales charges) |

8.46 |

4.88 |

4.23 |

| Class A (including sales charges) |

3.27 |

3.86 |

3.72 |

| ICE BofA US Cash Pay High Yield Constrained Index |

9.24 |

5.78 |

4.92 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets |

$ 1,355,498,411 |

Total number of portfolio holdings |

458 |

Management services fees

(represents 0.63% of Fund average net assets) |

$ 8,621,920 |

Portfolio turnover for the reporting period |

45% |

|

|

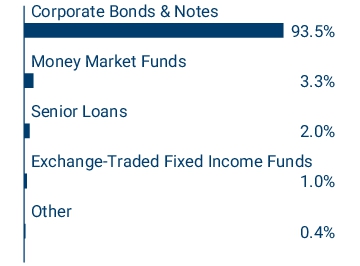

| Holdings [Text Block] |

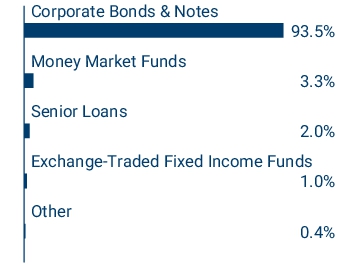

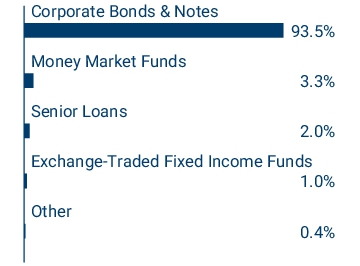

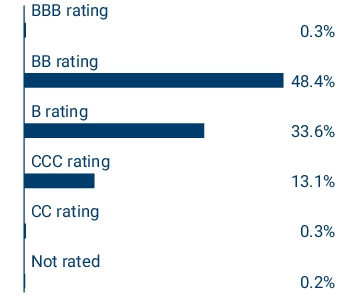

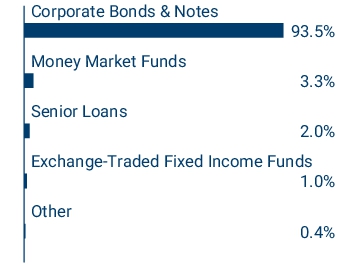

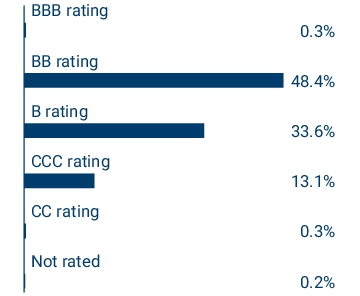

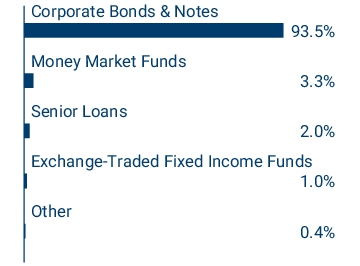

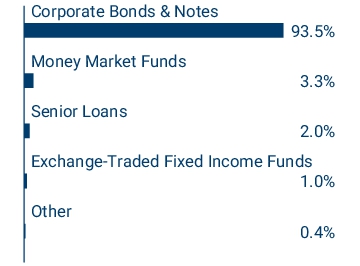

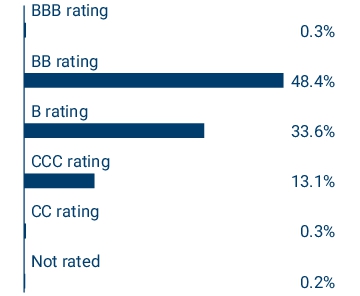

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

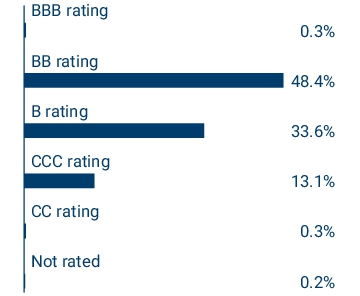

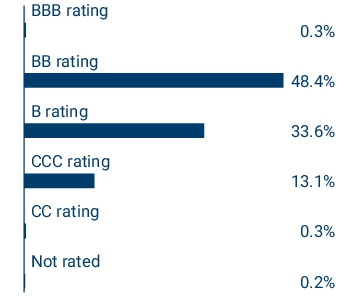

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Columbia High Yield Bond Fund -Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

APECX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 178 | 1.72 % |

|

|

| Expenses Paid, Amount |

$ 178

|

|

| Expense Ratio, Percent |

1.72%

|

|

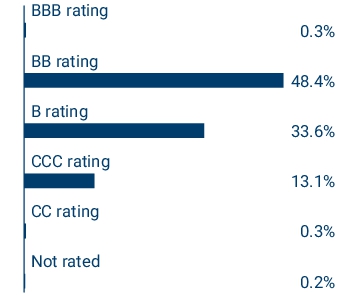

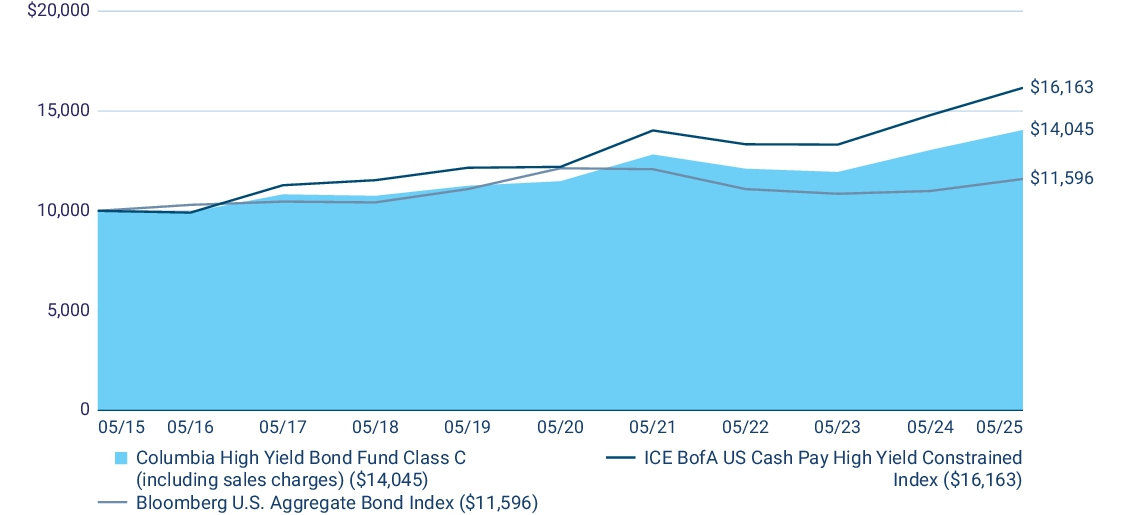

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | 7.67 | 4.12 | 3.45 | | Class C (including sales charges) | 6.67 | 4.12 | 3.45 | | ICE BofA US Cash Pay High Yield Constrained Index | 9.24 | 5.78 | 4.92 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 1,355,498,411 | Total number of portfolio holdings | 458 | Management services fees

(represents 0.63% of Fund average net assets) | $ 8,621,920 | Portfolio turnover for the reporting period | 45% |

|

|

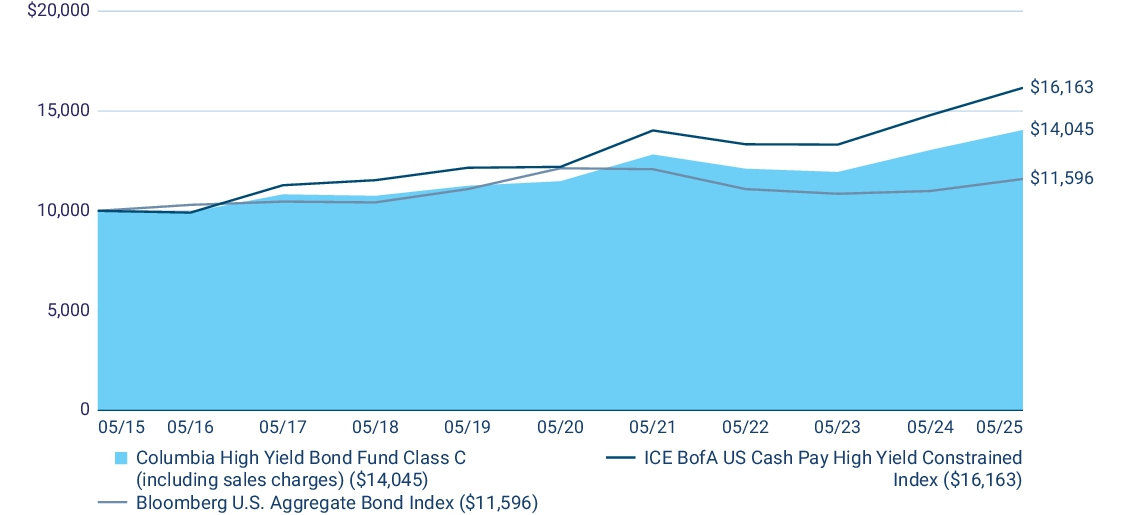

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Deriva tives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions , not statements of f act , and are subject to change, including daily. | Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions , not statements of fact , and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

| Columbia High Yield Bond Fund - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

CHYZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 75 | 0.72 % |

|

|

| Expenses Paid, Amount |

$ 75

|

|

| Expense Ratio, Percent |

0.72%

|

|

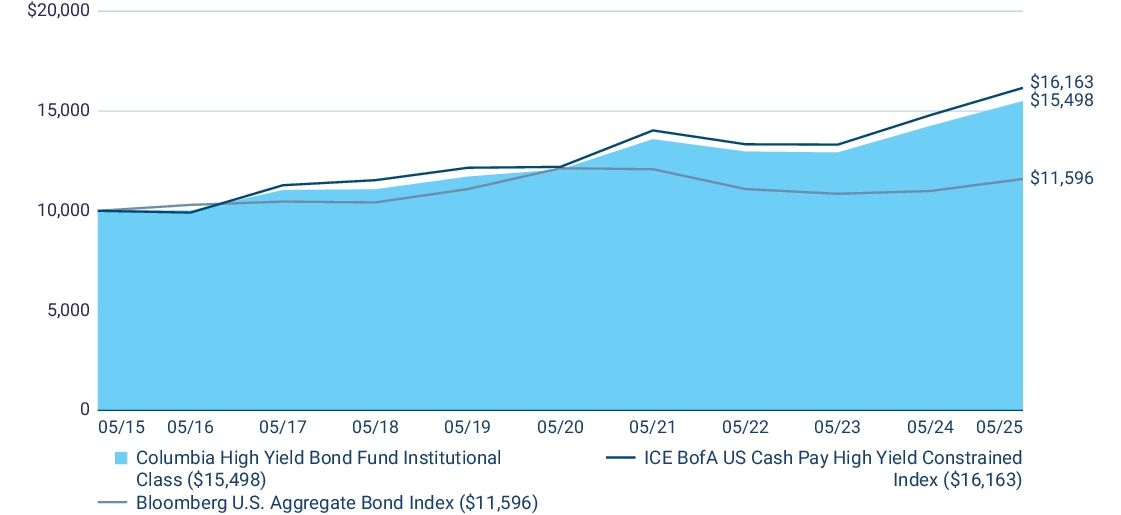

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

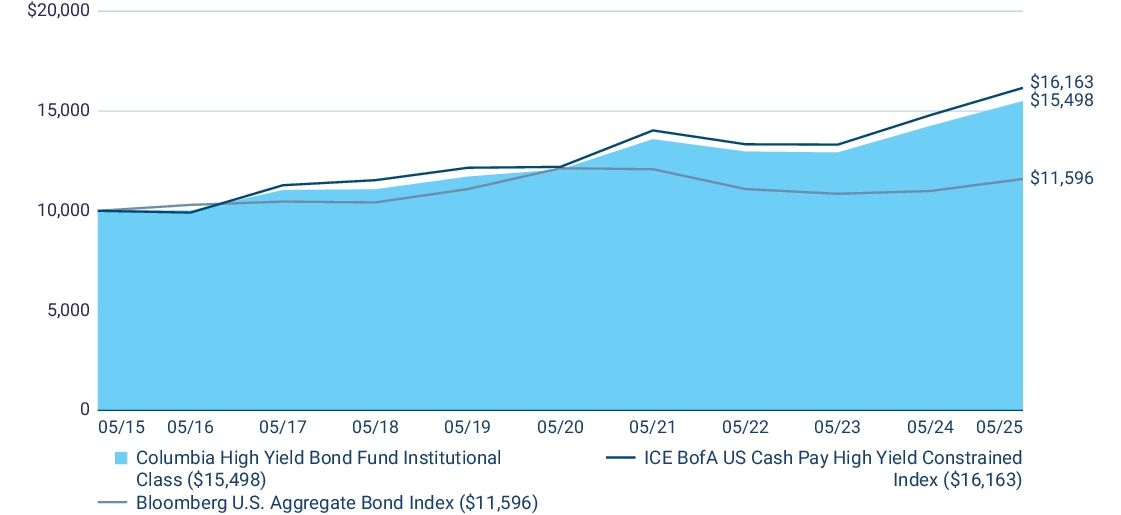

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | 8.73 | 5.12 | 4.48 | | ICE BofA US Cash Pay High Yield Constrained Index | 9.24 | 5.78 | 4.92 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 1,355,498,411 | Total number of portfolio holdings | 458 | Management services fees

(represents 0.63% of Fund average net assets) | $ 8,621,920 | Portfolio turnover for the reporting period | 45% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivati ves are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating age ncy, that rat ing is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. | Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating age ncy, that rat ing is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

| Columbia High Yield Bond Fund - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

RSHRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Institutional 2 Class |

$ 68 |

0.65 % |

|

|

| Expenses Paid, Amount |

$ 68

|

|

| Expense Ratio, Percent |

0.65%

|

|

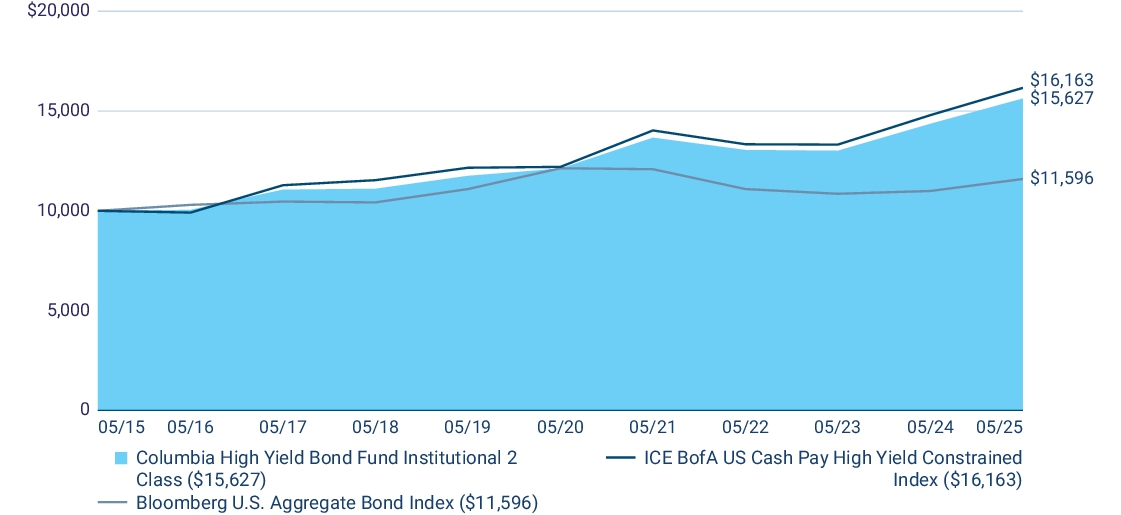

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional 2 Class shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors

Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

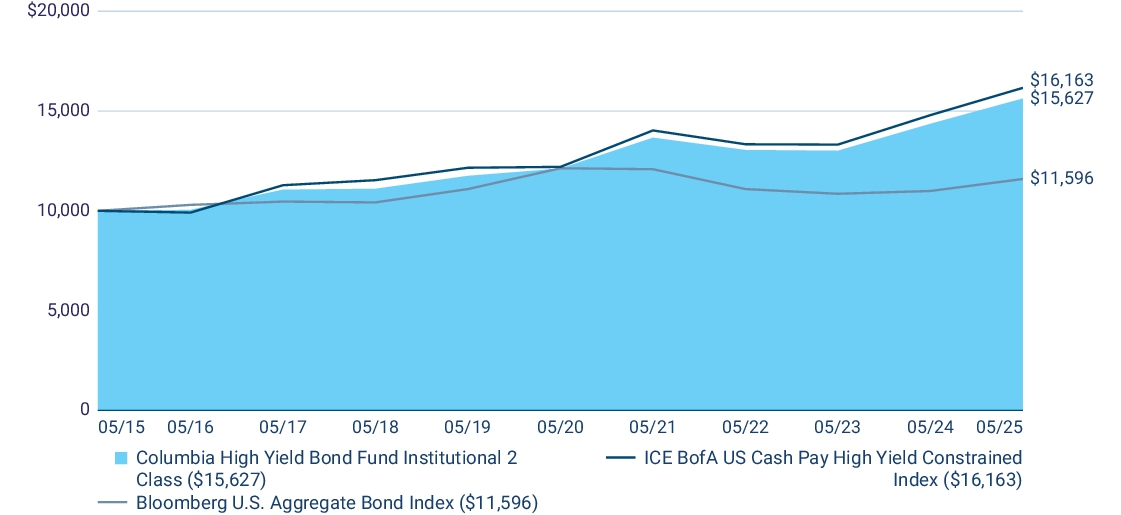

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Institutional 2 Class |

8.82 |

5.22 |

4.57 |

| ICE BofA US Cash Pay High Yield Constrained Index |

9.24 |

5.78 |

4.92 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets |

$ 1,355,498,411 |

Total number of portfolio holdings |

458 |

Management services fees

(represents 0.63% of Fund average net assets) |

$ 8,621,920 |

Portfolio turnover for the reporting period |

45% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivati ves are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Columbia High Yield Bond Fund - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CHYYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Institutional 3 Class |

$ 62 |

0.60 % |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

0.60%

|

|

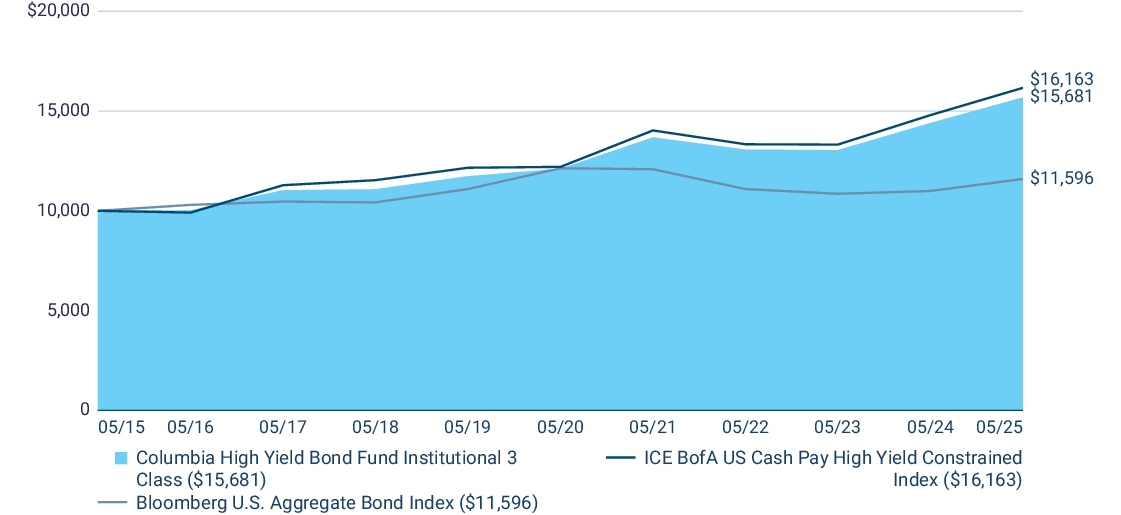

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors

Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

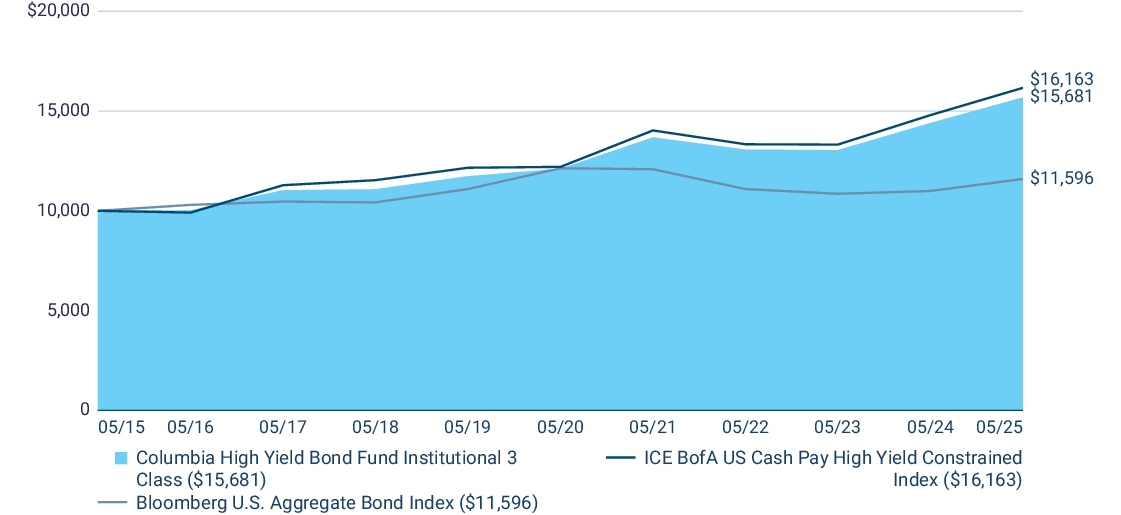

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Institutional 3 Class |

8.87 |

5.31 |

4.60 |

| ICE BofA US Cash Pay High Yield Constrained Index |

9.24 |

5.78 |

4.92 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets |

$ 1,355,498,411 |

Total number of portfolio holdings |

458 |

Management services fees

(represents 0.63% of Fund average net assets) |

$ 8,621,920 |

Portfolio turnover for the reporting period |

45% |

|

|

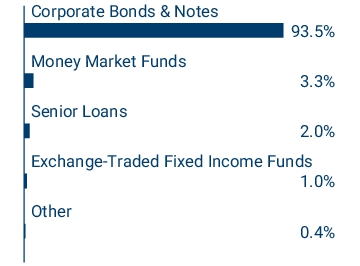

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Deriva tive s are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Columbia High Yield Bond Fund - Class R |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Class R

|

|

| Trading Symbol |

CHBRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Class R |

$ 127 |

1.22 % |

|

|

| Expenses Paid, Amount |

$ 127

|

|

| Expense Ratio, Percent |

1.22%

|

|

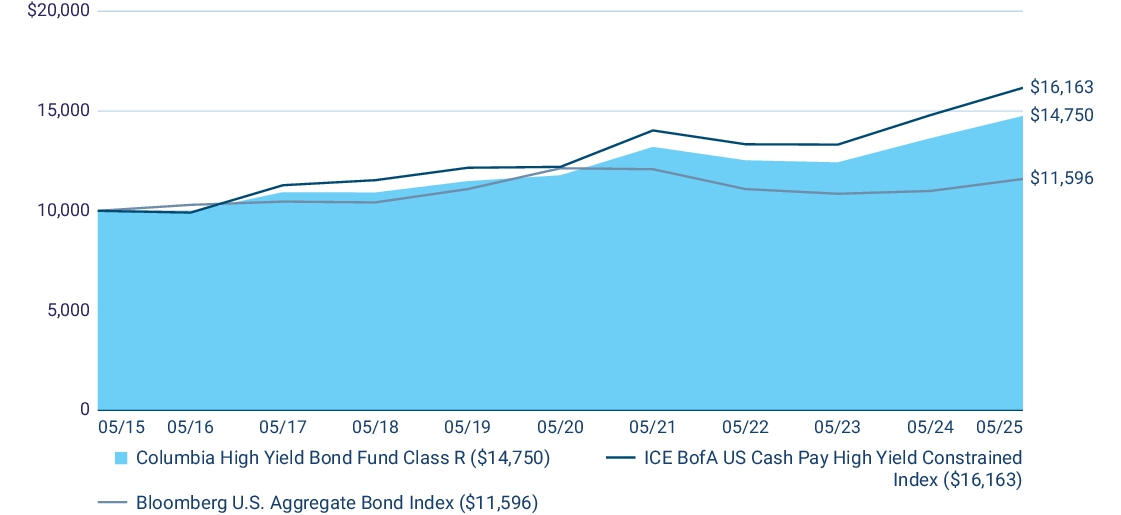

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class R shares for the period presented is shown in the Average Annual Total Returns t able. Top Performance Contributors

Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors

Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

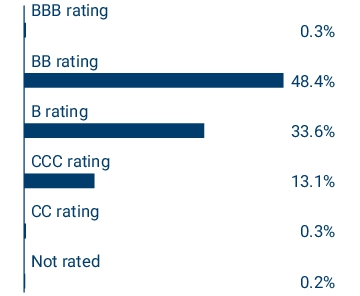

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Class R |

8.18 |

4.60 |

3.96 |

| ICE BofA US Cash Pay High Yield Constrained Index |

9.24 |

5.78 |

4.92 |

| Bloomberg U.S. Aggregate Bond Index |

5.46 |

(0.90 ) |

1.49 |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets |

$ 1,355,498,411 |

Total number of portfolio holdings |

458 |

Management services fees

(represents 0.63% of Fund average net assets) |

$ 8,621,920 |

Portfolio turnover for the reporting period |

45% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the average of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF |

1.0 % |

Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% |

0.7 % |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% |

0.6 % |

HUB International, Ltd.

06/15/2030 7.250% |

0.6 % |

DISH Network Corp.

11/15/2027 11.750% |

0.6 % |

CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% |

0.6 % |

Cloud Software Group, Inc.

09/30/2029 9.000% |

0.6 % |

Altice France SA

07/15/2029 5.125% |

0.6 % |

BroadStreet Partners, Inc.

04/15/2029 5.875% |

0.6 % |

ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% |

0.6 % |

|

|

| Columbia High Yield Bond Fund - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia High Yield Bond Fund

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

CHYEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia High Yield Bond Fund (the Fund) for the period of October 2, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 48(a) | 0.72 % (b) |

| (a) | Based on operations from October 2, 2024 (commencement of operations) through the stated period end. Had the class been open for the entire reporting period, expenses shown in the table above would have been higher. | | (b) | Annualized. |

|

|

| Expenses Paid, Amount |

$ 48

|

[1] |

| Expense Ratio, Percent |

0.72%

|

[2] |

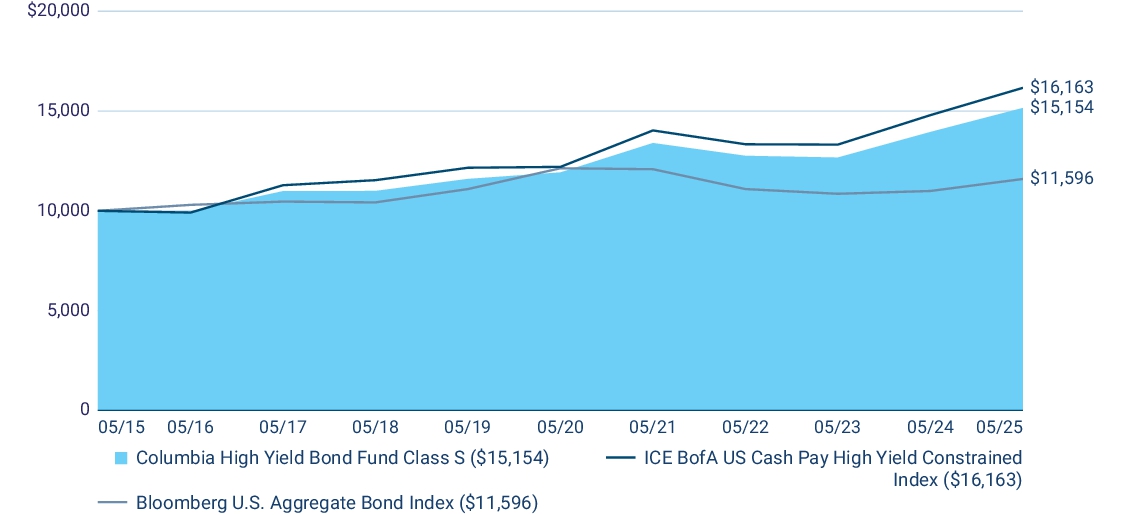

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class S shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Industry allocation | The Fund’s largest contributor to relative returns during the period was from its allocation to the building materials industry. Additional contribution during the period came from an allocation to department stores. Security selection | Security selection in the support–services sector, with an allocation to a roofing supply business, contributed to relative performance. Additional security selection was most positive in the gas–distribution sector with an allocation to a natural gas-distribution company. Credit allocation | Allocations to BB and B rated debt, as well as small allocations to investment-grade debt was most additive to Fund performance. Top Performance Detractors Industry allocation I Despite the overall relative positive performance of the Fund, negative returns came from the portfolio’s allocation to the electric generation industry. Portfolio underweights to both the media content and telecom–satellite industries also weighed on the Fund’s relative results. Security selection | Security selection in the telecom–wireline integrated industry detracted most, with an allocation to an internet service provider. Additional negative performance for the Fund came from the Real Estate Investment Trust industry, with allocations to an IT and storage company. Credit allocation | Allocations to CCC and below rated debt, as well as cash allocations, detracted from the Fund’s relative performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class S (a) | 8.63 | 4.91 | 4.24 | | ICE BofA US Cash Pay High Yield Constrained Index | 9.24 | 5.78 | 4.92 | | Bloomberg U.S. Aggregate Bond Index | 5.46 | (0.90 ) | 1.49 |

(a) | The returns shown for periods prior to October 2, 2024 (including Since Fund Inception returns, if shown) include the returns of Class A. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information. |

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

|

| Net Assets |

$ 1,355,498,411

|

|

| Holdings Count | Holding |

458

|

|

| Advisory Fees Paid, Amount |

$ 8,621,920

|

|

| Investment Company, Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 1,355,498,411 | Total number of portfolio holdings | 458 | Management services fees

(represents 0.63% of Fund average net assets) | $ 8,621,920 | Portfolio turnover for the reporting period | 45% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the ave rage of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. | Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the average rating of Moody’s Ratings, S&P and Fitch. When ratings are available from only two rating agencies, the ave rage of the two ratings is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

| Columbia US High Yield ETF | 1.0 % | Alliant Holdings Intermediate LLC/Co-Issuer

10/15/2027 6.750% | 0.7 % | American Airlines, Inc./AAdvantage Loyalty IP Ltd.

04/20/2029 5.750% | 0.6 % | HUB International, Ltd.

06/15/2030 7.250% | 0.6 % | DISH Network Corp.

11/15/2027 11.750% | 0.6 % | CCO Holdings LLC/Capital Corp.

03/01/2030 4.750% | 0.6 % | Cloud Software Group, Inc.

09/30/2029 9.000% | 0.6 % | Altice France SA

07/15/2029 5.125% | 0.6 % | BroadStreet Partners, Inc.

04/15/2029 5.875% | 0.6 % | ZoomInfo Technologies LLC/Finance Corp.

02/01/2029 3.875% | 0.6 % |

|

|

|

|