Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Columbia Funds Series Trust II

|

| Entity Central Index Key |

0001352280

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| Multi-Manager Value Strategies Fund - Institutional Class [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Multi-Manager Value Strategies Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

CZMVX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Multi-Manager Value Strategies Fund (the Fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 71 | 0.69 % |

|

| Expenses Paid, Amount |

$ 71

|

| Expense Ratio, Percent |

0.69%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selection in the health care and information technology sectors boosted the Fund’s relative results most during the annual period. Allocations | An underweight to the health care sector and an overweight to the information technology sector positively impacted relative performance. Individual holdings | Positions in Broadcom, Inc., a global semiconductor and infrastructure software solutions company, and Abbott Laboratories, a developer and manufacturer of health care products, and an underweight to Thermo Fisher Scientific, Inc., a health care life sciences tools and services provider, were among the top contributors to Fund relative performance. Top Performance Detractors Stock selection I Selection in the consumer staples, energy, industrials and materials sectors detracted from the Fund’s relative results during the annual period. Allocations | Overweights to the energy and consumer discretionary sectors, an underweight to the utilities sector and the Fund’s cash holdings detracted from relative performance. Individual holdings | Overweights to ConocoPhillips Co., an oil and gas exploration and production company, and Diamondback Energy, Inc., a developer of unconventional onshore oil and natural gas reserves, and not holding Phillip Morris International, a multi-national tobacco company with a growing percentage of smoke-free product sales, were among the top detractors. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

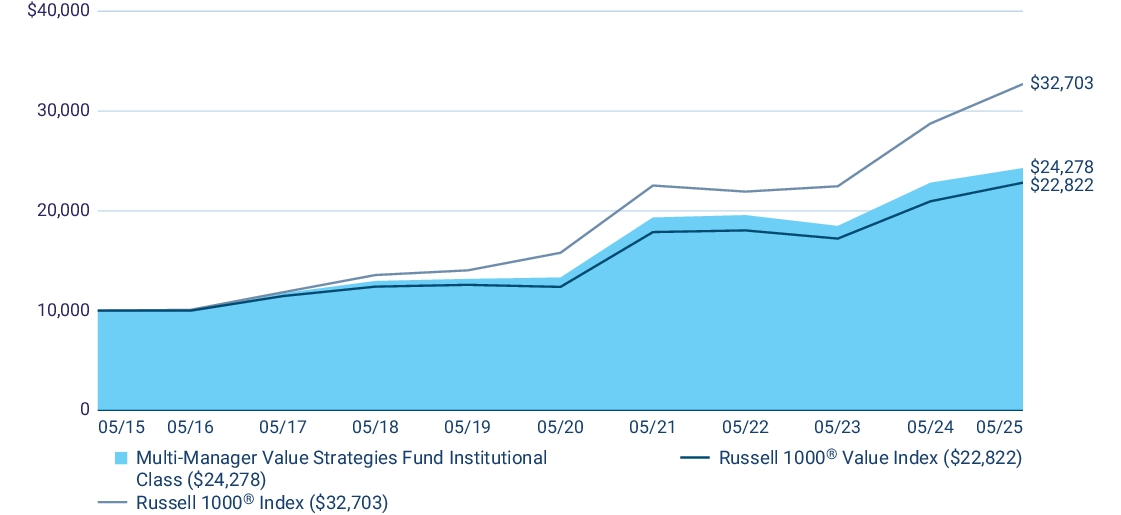

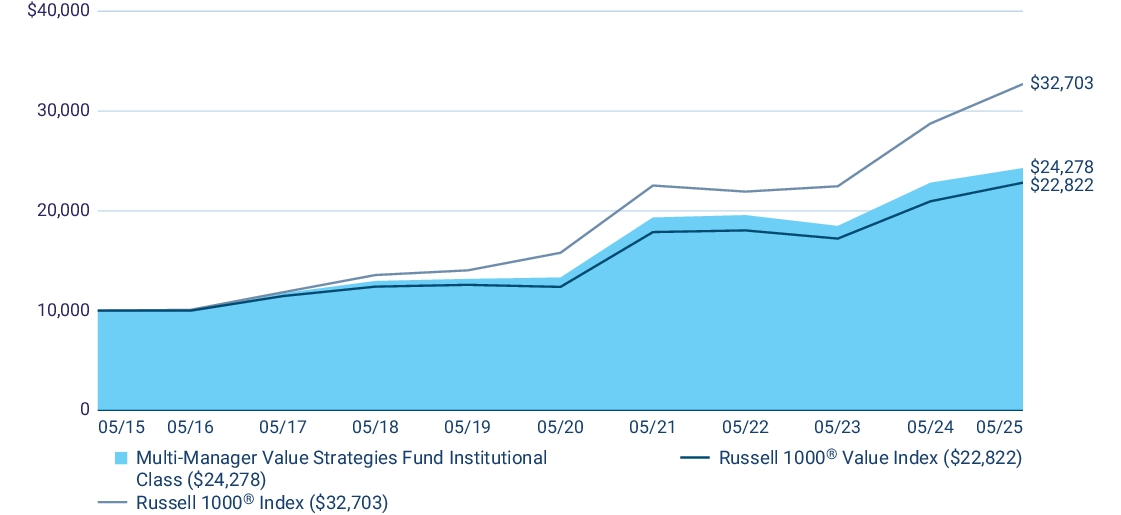

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class (a),(b) | 6.41 | 12.76 | 9.28 | | Russell 1000® Value Index | 8.91 | 13.02 | 8.60 | | Russell 1000® Index | 13.73 | 15.66 | 12.58 |

(a) | The returns shown for periods prior to January 3, 2017 (including Since Fund Inception returns, if shown) include the returns of Class A. Class A shares were offered prior to the Fund's Institutional Class shares but have since been merged into the Fund’s Institutional Class shares. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information. | (b) | The Fund’s performance prior to May 27, 2025, reflects returns achieved by one or more different subadviser(s) that managed the Fund according to different principal investment strategies. If the Fund’s current subadvisers and strategies had been in place for the prior periods, results shown may have been different. |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Previous Investment Adviser [Text Block] |

The Fund’s performance prior to May 27, 2025, reflects returns achieved by one or more different subadviser(s) that managed the Fund according to different principal investment strategies. If the Fund’s current subadvisers and strategies had been in place for the prior periods, results shown may have been different.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 4,982,358,659

|

| Holdings Count | Holdings |

352

|

| Advisory Fees Paid, Amount |

$ 29,904,546

|

| Investment Company, Portfolio Turnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 4,982,358,659 | Total number of portfolio holdings | 352 | Management services fees

(represents 0.59% of Fund average net assets) | $ 29,904,546 | Portfolio turnover for the reporting period | 49% |

|

| Holdings [Text Block] |

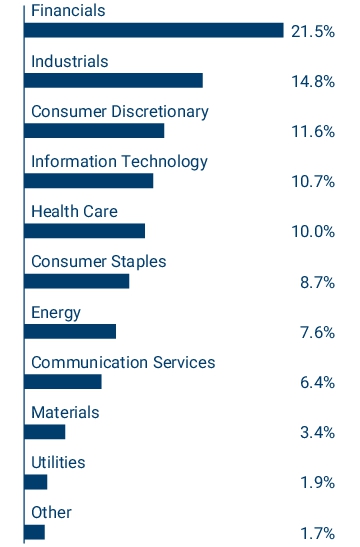

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. JPMorgan Chase & Co.

| 2.6% | | Abbott Laboratories | 2.0 % | | American International Group, Inc. | 2.0 % | | Exxon Mobil Corp. | 1.8 % | | ConocoPhillips Co. | 1.7% | | Union Pacific Corp. | 1.7 % | | Amazon.com, Inc. | 1.6 % | | Berkshire Hathaway, Inc., Class B | 1.6 % | | Bank of America Corp. | 1.5% | | Texas Instruments, Inc. | 1.5 % |

|

| Largest Holdings [Text Block] |

JPMorgan Chase & Co.

| 2.6% | | Abbott Laboratories | 2.0 % | | American International Group, Inc. | 2.0 % | | Exxon Mobil Corp. | 1.8 % | | ConocoPhillips Co. | 1.7% | | Union Pacific Corp. | 1.7 % | | Amazon.com, Inc. | 1.6 % | | Berkshire Hathaway, Inc., Class B | 1.6 % | | Bank of America Corp. | 1.5% | | Texas Instruments, Inc. | 1.5 % |

|

| Material Fund Change [Text Block] |

Certain Fund Changes This is a summary of certain changes to the Fund during the reporting period. For more complete information, you may review the Fund’s prospectus, which is available at columbiathreadneedleus.com/resources/literature or upon request at 1-800-345-6611 . Effective May 27, 2025 (the Effective Date), Dimensional Fund Advisors, LP (DFA) no longer serves as a subadviser to the Fund and American Century Investment Management, Inc. (American Century) assumed day-to-day management of a portion of the Fund’s portfolio. Accordingly, as of the Effective Date, the Fund’s principal investment strategies are revised to replace DFA's investment strategy and process with that of American Century.

|

| Material Fund Change Strategies [Text Block] |

Accordingly, as of the Effective Date, the Fund’s principal investment strategies are revised to replace DFA's investment strategy and process with that of American Century.

|

| Material Fund Change Adviser [Text Block] |

Effective May 27, 2025 (the Effective Date), Dimensional Fund Advisors, LP (DFA) no longer serves as a subadviser to the Fund and American Century Investment Management, Inc. (American Century) assumed day-to-day management of a portion of the Fund’s portfolio.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund during the reporting period. For more complete information, you may review the Fund’s prospectus, which is available at columbiathreadneedleus.com/resources/literature or upon request at 1-800-345-6611 .

|

| Updated Prospectus Phone Number |

1-800-345-6611

|

| Updated Prospectus Web Address |

columbiathreadneedleus.com/resources/literature

|