| Silver Star Proxy Discussion July 31, 2025 Al Hartman For shareholder information only. Not legal, financial, or investment advice. Statements may include opinions or forward-looking information subject to change. |

| Today’s Objectives: ● Review mismanagement that resulted in destruction of 70% of company value and how value can be salvaged ● Discuss 3 specific areas in flagrant breaking of the law ● Explain Haddock’s stock award of 3 millions shares ● Introduce the new independent board members ● Provide an open forum to address your questions directly For shareholder information only. Not legal, financial, or investment advice. Statements may include opinions or forward-looking information subject to change. |

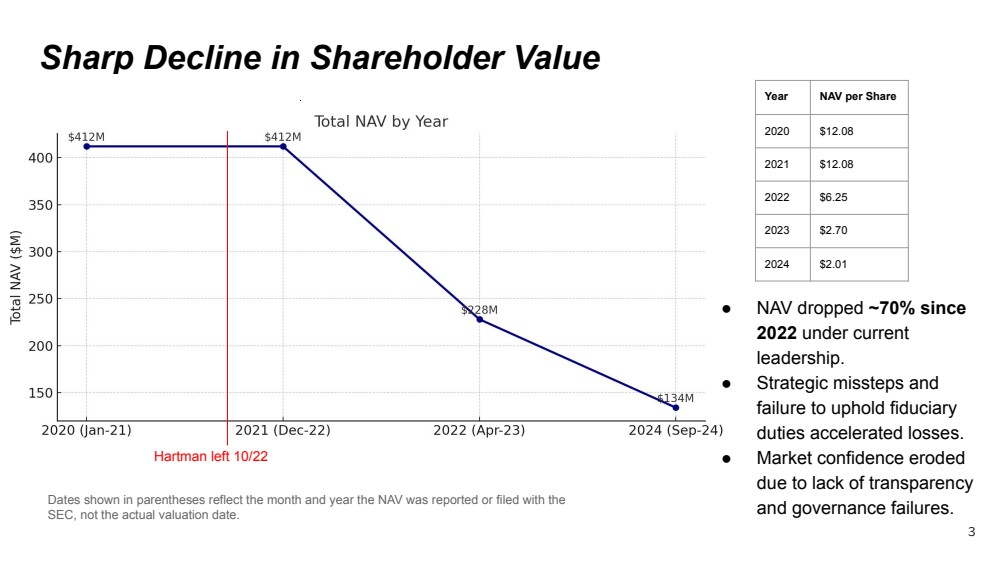

| Sharp Decline in Shareholder Value Dates shown in parentheses reflect the month and year the NAV was reported or filed with the SEC, not the actual valuation date. Hartman left 10/22 ● NAV dropped ~70% since 2022 under current leadership. ● Strategic missteps and failure to uphold fiduciary duties accelerated losses. ● Market confidence eroded due to lack of transparency and governance failures. Year NAV per Share 2020 $12.08 2021 $12.08 2022 $6.25 2023 $2.70 2024 $2.01 3 |

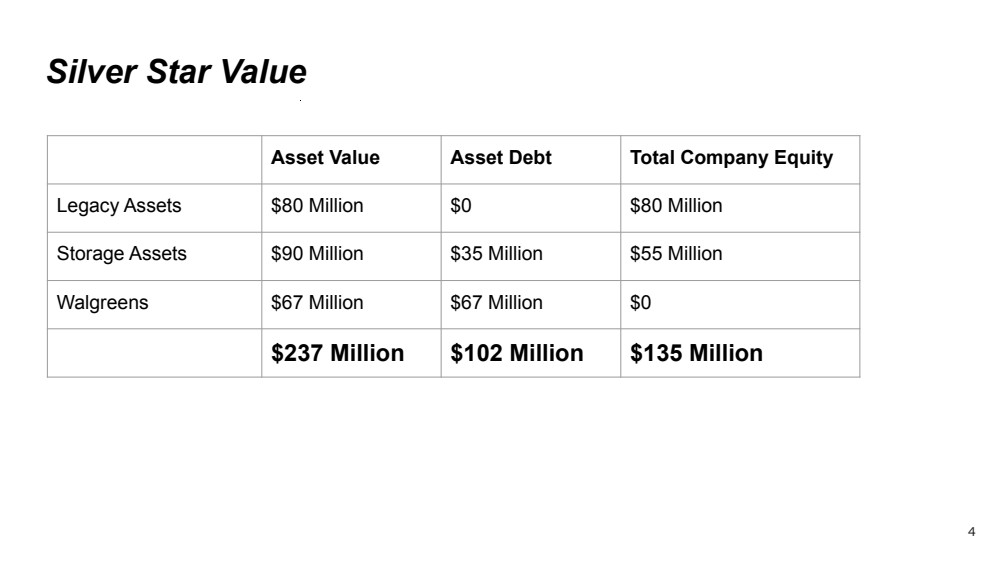

| Silver Star Value Asset Value Asset Debt Total Company Equity Legacy Assets $80 Million $0 $80 Million Storage Assets $90 Million $35 Million $55 Million Walgreens $67 Million $67 Million $0 $237 Million $102 Million $135 Million 4 |

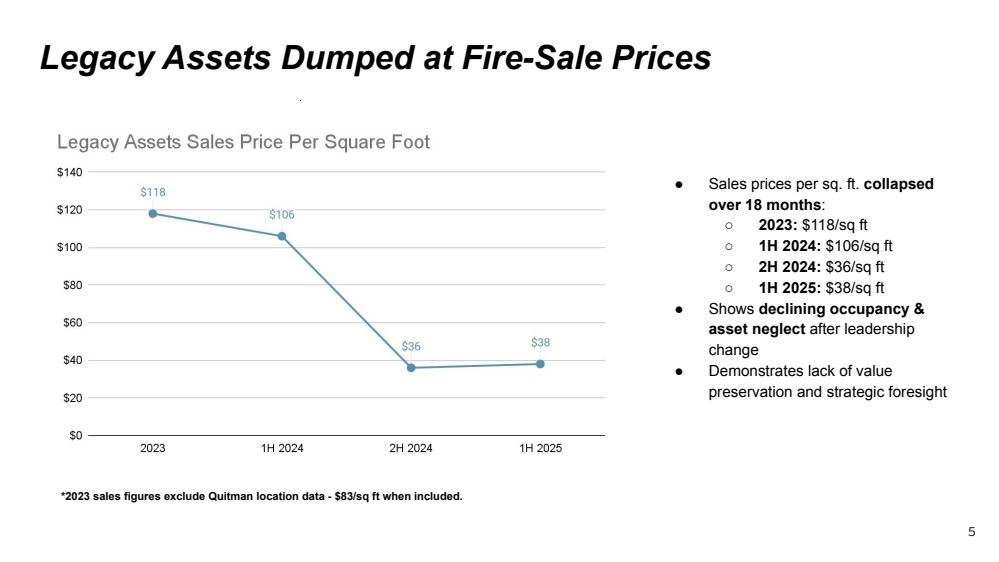

| Legacy Assets Dumped at Fire-Sale Prices ● Sales prices per sq. ft. collapsed over 18 months: ○ 2023: $118/sq ft ○ 1H 2024: $106/sq ft ○ 2H 2024: $36/sq ft ○ 1H 2025: $38/sq ft ● Shows declining occupancy & asset neglect after leadership change ● Demonstrates lack of value preservation and strategic foresight *2023 sales figures exclude Quitman location data - $83/sq ft when included. 5 |

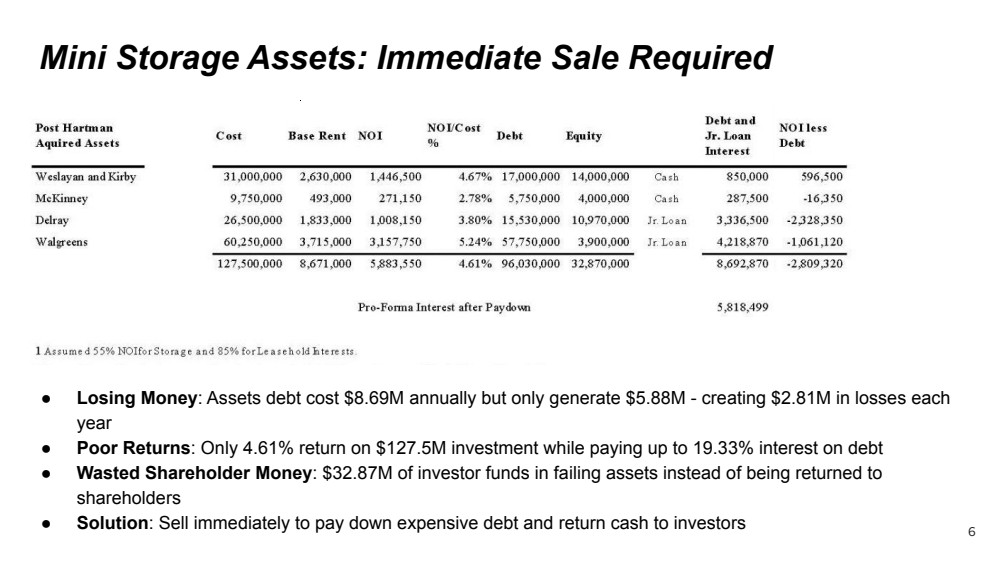

| Mini Storage Assets: Immediate Sale Required ● Losing Money: Assets debt cost $8.69M annually but only generate $5.88M - creating $2.81M in losses each year ● Poor Returns: Only 4.61% return on $127.5M investment while paying up to 19.33% interest on debt ● Wasted Shareholder Money: $32.87M of investor funds in failing assets instead of being returned to shareholders ● Solution: Sell immediately to pay down expensive debt and return cash to investors 6 |

| Legal Violations Three Flagrant Ways SSP Broke the Law ● Soliciting Proxy Votes with no Financial Audit ○ Violation of SEC Regulations ● Lying about Consent Solicitation to SEC ○ It did not include the Revocations ○ 51% votes - 30% revocations = 21% net votes received ● Books and Records Requests ○ They broke the law by not providing: i. Shareholder Lists ii. Financial Statements iii. Property Occupancy iv. Property Sale Prices 7 |

| How Haddock’s Stock Increased by 2M Shares ● Executed a 3:1 “flip-in” maneuver that tripled his shareholding ● Turned 1M shares into 3M ● High salaries taken as per SEC Filing dated on May 29, 2025 ● Timing aligned with sharp declines in shareholder value ● Breaking fiduciary responsibilities and creating conflict for themselves 8 |

| Proposed Independent Board Nominees Brent Longnecker – Governance & Compliance Expert ● National authority on board strategy, risk & accountability ● Advised 2,500+ public & private boards ● Brings independence, transparency & shareholder-first focus Benjamin Thomas – Entrepreneur & Real Estate Operator ● 40+ acquisitions & $350M+ in successful exits ● Hands-on operator with strong asset repositioning expertise ● Focused on cash flow, disciplined investment & value restoration Allen R. Hartman – Founder & Former CEO of Hartman Properties/Silver Star ● Built & led Hartman Properties/Silver Star for 30+ years, raising $500M+ in equity ● Major shareholder, deeply aligned with investors ● Committed to maximizing asset value and returning shareholder capital 9 |

| Your Questions & Feedback ● All questions are welcome ● Our commitment: clear, direct answers ● Together, we can restore accountability and value For shareholder information only. Not legal, financial, or investment advice. Statements may include opinions or forward-looking information subject to change. |