Shareholder Report

|

|

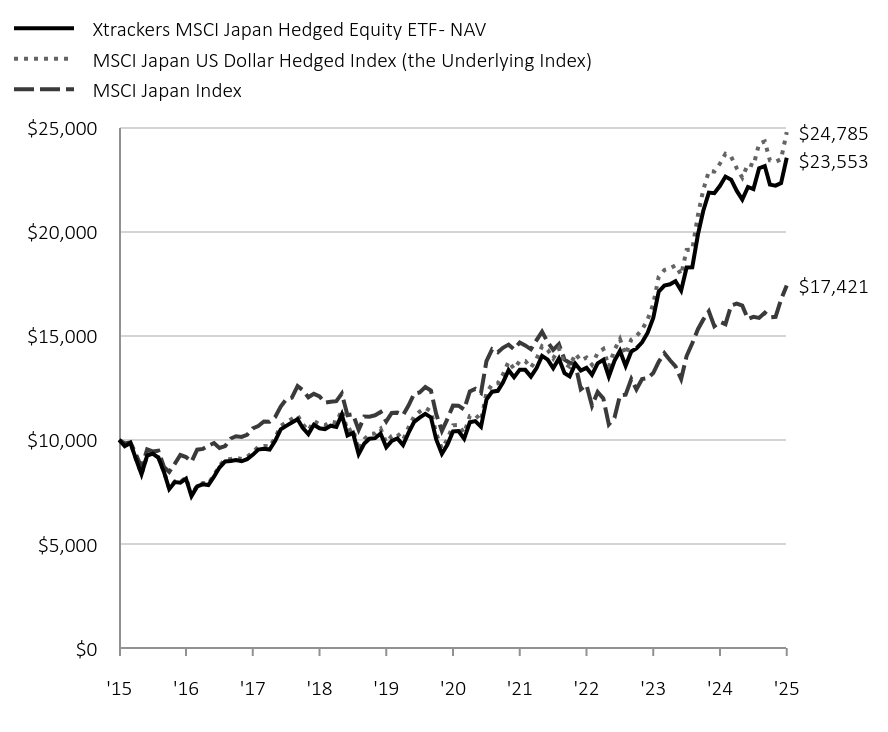

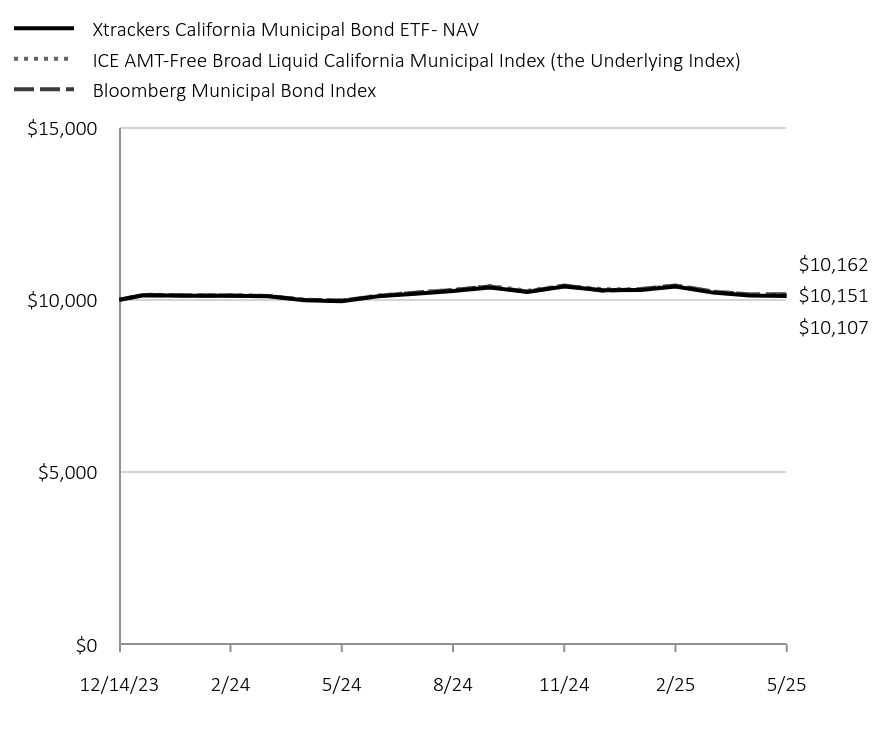

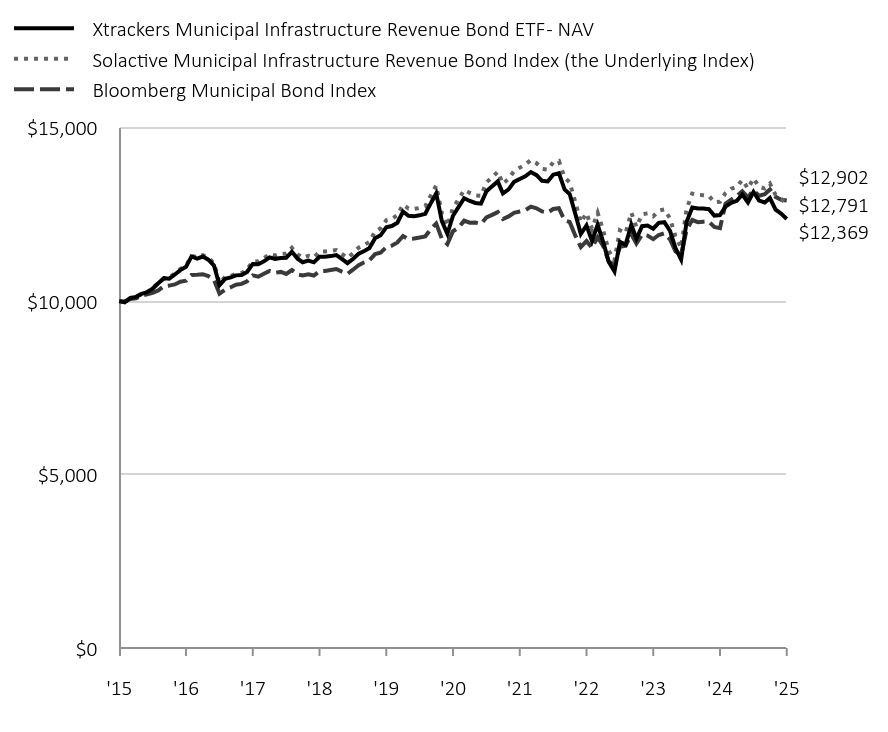

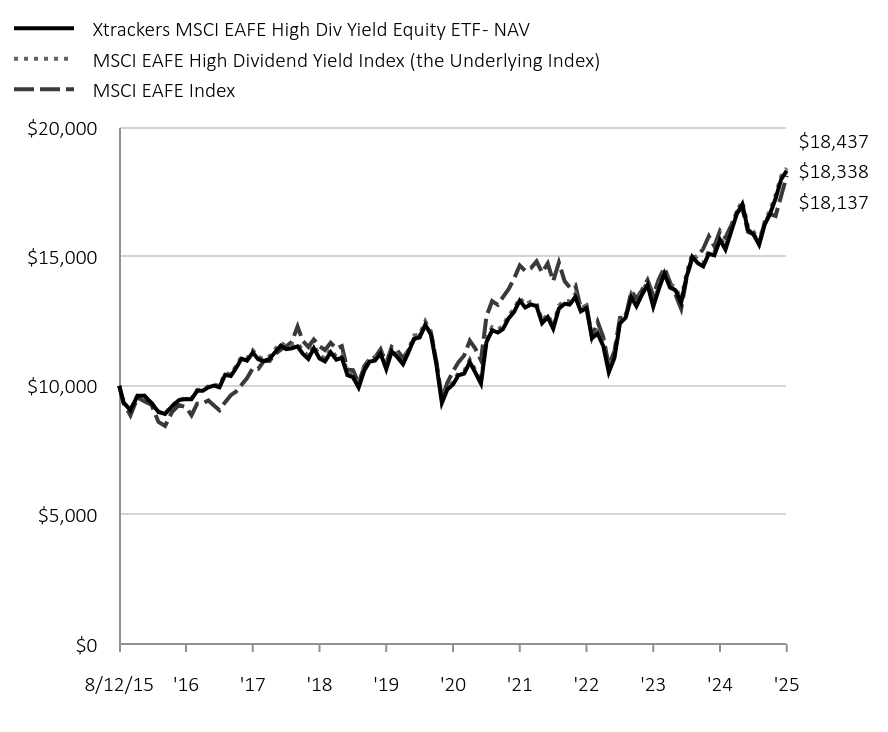

12 Months Ended |

Jun. 01, 2024 |

May 31, 2025

USD ($)

Holding

|

| Shareholder Report [Line Items] |

|

|

|

| Document Type |

|

|

N-CSR

|

| Amendment Flag |

|

|

false

|

| Registrant Name |

|

|

DBX ETF TRUST

|

| Entity Central Index Key |

|

|

0001503123

|

| Entity Investment Company Type |

|

|

N-1A

|

| Document Period End Date |

|

|

May 31, 2025

|

| C000250300 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers Artificial Intelligence and Big Data ETF

|

| Class Name |

|

|

Xtrackers Artificial Intelligence and Big Data ETF

|

| Trading Symbol |

|

|

XAIX

|

| Security Exchange Name |

|

|

NASDAQ

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Artificial Intelligence and Big Data ETF (the "Fund") for the period August 2, 2024 (commencement of operations) to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Artificial Intelligence and Big Data ETF (the "Fund") for the period August 2, 2024 (commencement of operations) to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the reporting period?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

XAIX |

$32Footnote Reference(a) |

0.35%Footnote Reference(b) | (a) Based on the period August 2, 2024 (commencement of operations) through May 31, 2025. Expenses would have been higher if the Fund had been in existence for the full reporting period. (b) Annualized. Gross expense ratio as of the latest prospectus: 0.35%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

| Footnote |

Description |

Footnote(a) |

Based on the period August 2, 2024 (commencement of operations) through May 31, 2025. Expenses would have been higher if the Fund had been in existence for the full reporting period. |

Footnote(b) |

Annualized. | |

| Expenses Paid, Amount |

[1] |

|

$ 32

|

| Expense Ratio, Percent |

[2] |

|

0.35%

|

| Factors Affecting Performance [Text Block] |

|

|

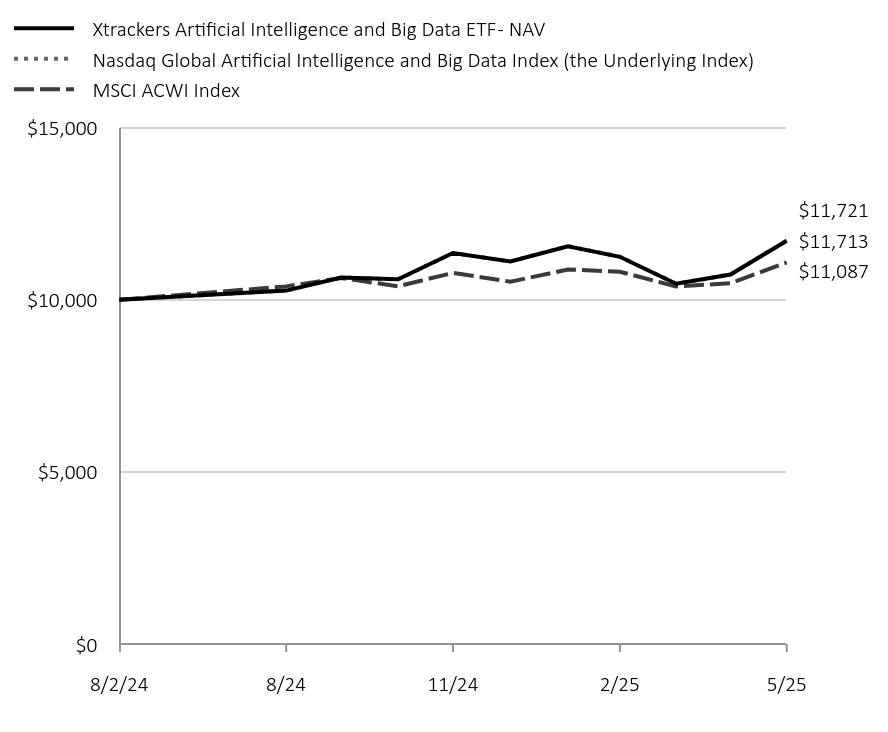

How did the fund perform last year and what affected its performance?The fund seeks investment results that correspond generally to the performance, before fees and expenses, of the Nasdaq Global Artificial Intelligence and Big Data Index (the Underlying Index). The Underlying Index is designed to track the performance of a selection of companies from global developed and emerging markets engaged in the following themes and sub-themes, each as defined by Nasdaq, Inc. (“Nasdaq” or “Index Provider”). The Fund returned 17.13% for the period ended May 31, 2025. The Fund's underlying index returned 17.21% and the Fund's broad-based index the MSCI ACWI Index returned 10.87% during the same period. All sectors contributed positively to performance during the period with the greatest contribution coming from Information Technology, Communication Services and Consumer Discretionary. From a geographical perspective, the United States, Germany and Japan were the major positive contributors, while Korea was the only that contributed negatively to performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers Artificial Intelligence and Big Data ETF - NAV |

Nasdaq Global Artificial Intelligence and Big Data Index (the Underlying Index) |

MSCI ACWI Index |

8/2/24 |

$10,000 |

$10,000 |

$10,000 |

8/31/24 |

$10,267 |

$10,268 |

$10,390 |

9/30/24 |

$10,645 |

$10,648 |

$10,632 |

10/31/24 |

$10,595 |

$10,594 |

$10,393 |

11/30/24 |

$11,359 |

$11,357 |

$10,782 |

12/31/24 |

$11,114 |

$11,113 |

$10,527 |

1/31/25 |

$11,557 |

$11,559 |

$10,880 |

2/28/25 |

$11,249 |

$11,252 |

$10,815 |

3/31/25 |

$10,467 |

$10,469 |

$10,387 |

4/30/25 |

$10,733 |

$10,735 |

$10,484 |

5/31/25 |

$11,713 |

$11,721 |

$11,087 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

Since Inception 8/2/24 |

Xtrackers Artificial Intelligence and Big Data ETF - NAV |

17.13% |

Nasdaq Global Artificial Intelligence and Big Data Index |

17.21% |

MSCI ACWI Index |

10.87% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 42,484,460

|

| Holdings Count | Holding |

|

|

94

|

| Advisory Fees Paid, Amount |

|

|

$ 69,255

|

| InvestmentCompanyPortfolioTurnover |

|

|

11.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

42,484,460 |

Number of Portfolio Holdings |

94 |

Portfolio Turnover Rate (%) |

11 |

Total Net Advisory Fees Paid ($) |

69,255 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Software |

38% |

Semiconductors & Semiconductor Equipment |

11% |

Technology Hardware, Storage & Peripherals |

9% |

Interactive Media & Services |

9% |

IT Services |

7% |

Diversified Telecommunication Services |

6% |

Banks |

6% |

Communications Equipment |

6% |

Broadline Retail |

4% |

Financial Services |

1% |

Other |

1% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

41.9% of Net Assets |

SAP SE |

4.9% |

Meta Platforms, Inc. |

4.6% |

Microsoft Corp. |

4.6% |

NVIDIA Corp. |

4.2% |

Bank of America Corp. |

4.2% |

Palantir Technologies, Inc. |

4.1% |

Oracle Corp. |

4.1% |

Amazon.com, Inc. |

3.9% |

Alphabet, Inc. |

3.8% |

Cisco Systems, Inc. |

3.5% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000242878 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers Cybersecurity Select Equity ETF

|

| Class Name |

|

|

Xtrackers Cybersecurity Select Equity ETF

|

| Trading Symbol |

|

|

PSWD

|

| Security Exchange Name |

|

|

NASDAQ

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Cybersecurity Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Cybersecurity Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

PSWD |

$22 |

0.20% | Gross expense ratio as of the latest prospectus: 0.20%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 22

|

| Expense Ratio, Percent |

|

|

0.20%

|

| Factors Affecting Performance [Text Block] |

|

|

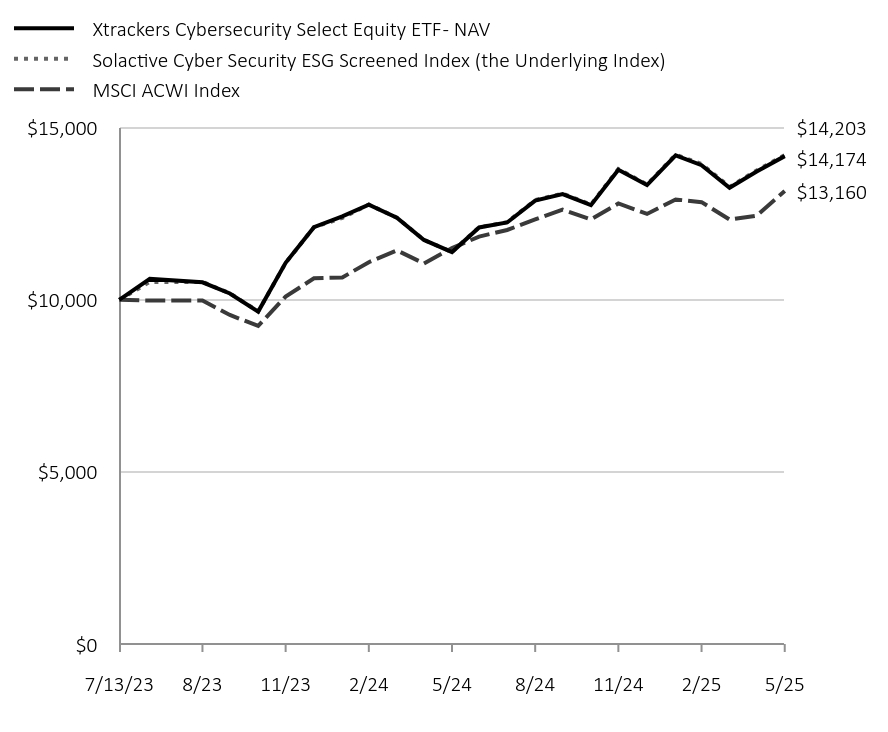

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the Solactive Cyber Security ESG Screened Index (the Underlying Index). The Underlying Index is comprised of companies that have business operations in the field of cybersecurity and that fulfill certain sustainability criteria. The Fund returned 24.47% for the period ended May 31, 2025. The Fund's underlying index returned 24.67% and the Fund's broad-based index the MSCI ACWI Index returned 13.65% during the same period. The majority of sectors contributed positively to performance during the period with the greatest contribution coming from Systems Software, IT Consulting & Other Services and Communication Equipment. Internet Services & Infrastructure and Research & Consulting Services were the only sectors that detracted from the performance. From a geographical perspective, the United States, Japan and Canada were the major positive contributors, while Australia, Turkey and Malaysia contributed negatively to performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers Cybersecurity Select Equity ETF - NAV |

Solactive Cyber Security ESG Screened Index (the Underlying Index) |

MSCI ACWI Index |

7/13/23 |

$10,000 |

$10,000 |

$10,000 |

7/31/23 |

$10,607 |

$10,520 |

$9,979 |

8/31/23 |

$10,507 |

$10,520 |

$9,979 |

9/30/23 |

$10,184 |

$10,188 |

$9,559 |

10/31/23 |

$9,657 |

$9,663 |

$9,241 |

11/30/23 |

$11,076 |

$11,071 |

$10,095 |

12/31/23 |

$12,109 |

$12,108 |

$10,624 |

1/31/24 |

$12,425 |

$12,378 |

$10,648 |

2/29/24 |

$12,766 |

$12,767 |

$11,093 |

3/31/24 |

$12,388 |

$12,388 |

$11,437 |

4/30/24 |

$11,739 |

$11,737 |

$11,056 |

5/31/24 |

$11,387 |

$11,392 |

$11,503 |

6/30/24 |

$12,102 |

$12,109 |

$11,837 |

7/31/24 |

$12,246 |

$12,255 |

$12,028 |

8/31/24 |

$12,881 |

$12,896 |

$12,334 |

9/30/24 |

$13,072 |

$13,087 |

$12,620 |

10/31/24 |

$12,748 |

$12,765 |

$12,337 |

11/30/24 |

$13,776 |

$13,800 |

$12,798 |

12/31/24 |

$13,334 |

$13,349 |

$12,495 |

1/31/25 |

$14,194 |

$14,216 |

$12,915 |

2/28/25 |

$13,910 |

$13,945 |

$12,837 |

3/31/25 |

$13,253 |

$13,280 |

$12,330 |

4/30/25 |

$13,727 |

$13,758 |

$12,445 |

5/31/25 |

$14,174 |

$14,203 |

$13,160 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

Since Inception 7/13/23 |

Xtrackers Cybersecurity Select Equity ETF - NAV |

24.47% |

20.29% |

Solactive Cyber Security ESG Screened Index |

24.67% |

20.43% |

MSCI ACWI Index |

13.65% |

15.66% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 7,815,324

|

| Holdings Count | Holding |

|

|

52

|

| Advisory Fees Paid, Amount |

|

|

$ 13,218

|

| InvestmentCompanyPortfolioTurnover |

|

|

49.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

7,815,324 |

Number of Portfolio Holdings |

52 |

Portfolio Turnover Rate (%) |

49 |

Total Net Advisory Fees Paid ($) |

13,218 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Systems Software |

57% |

Internet Services & Infrastructure |

23% |

IT Consulting & Other Services |

8% |

Application Software |

6% |

Communications Equipment |

2% |

Research & Consulting Services |

2% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

47.2% of Net Assets |

NEXTDC Ltd. |

5.6% |

Zscaler, Inc. |

5.5% |

Crowdstrike Holdings, Inc. |

5.0% |

Trend Micro, Inc. |

4.7% |

Varonis Systems, Inc. |

4.6% |

Palo Alto Networks, Inc. |

4.4% |

GDS Holdings Ltd. |

4.4% |

Qualys, Inc. |

4.4% |

CyberArk Software Ltd. |

4.4% |

Check Point Software Technologies Ltd. |

4.2% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000130526 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers International Real Estate ETF

|

| Class Name |

|

|

Xtrackers International Real Estate ETF

|

| Trading Symbol |

|

|

HAUZ

|

| Security Exchange Name |

|

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers International Real Estate ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers International Real Estate ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

HAUZ |

$11 |

0.10% | Gross expense ratio as of the latest prospectus: 0.10%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 11

|

| Expense Ratio, Percent |

|

|

0.10%

|

| Factors Affecting Performance [Text Block] |

|

|

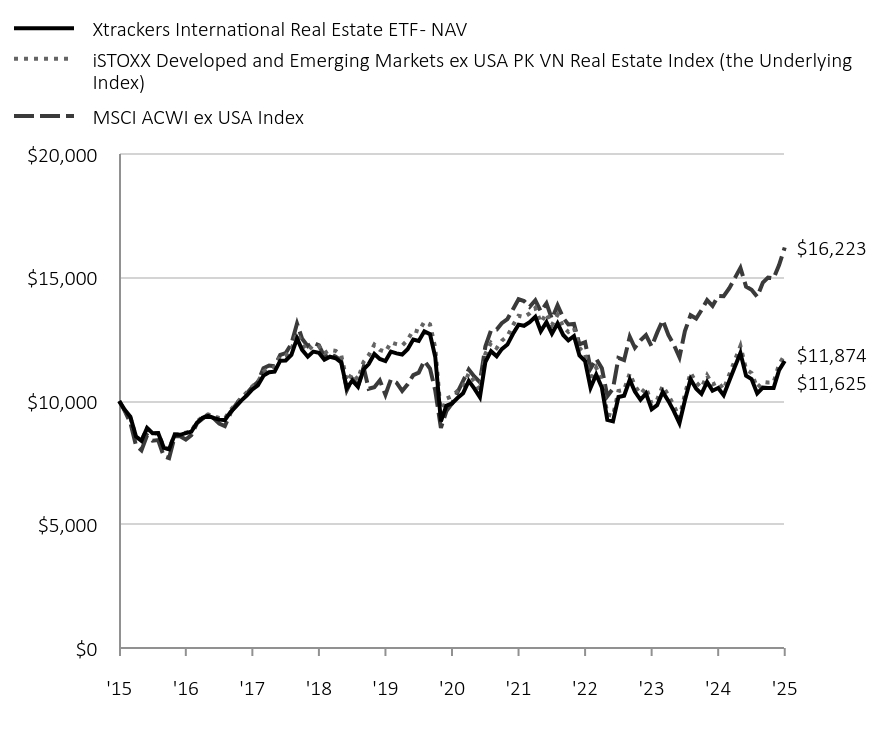

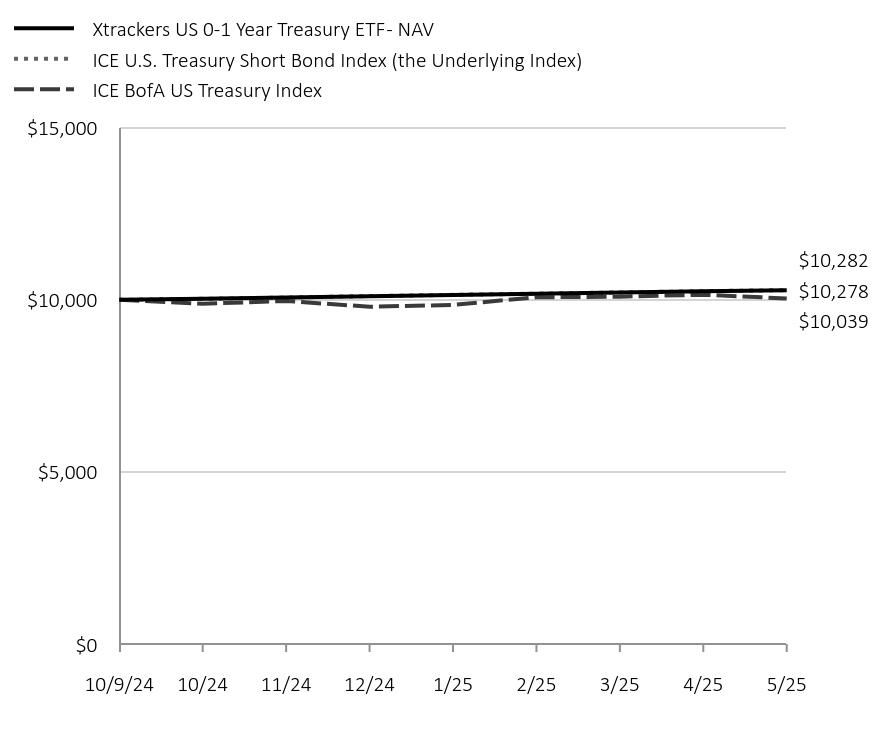

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index (the Underlying Index). The Underlying Index is a free-float capitalization weighted index that provides exposure to publicly traded real estate securities in countries outside the United States, excluding Pakistan and Vietnam. The Fund returned 10.39% for the period ended May 31, 2025. The Fund's underlying index returned 10.16% and the Fund's broad-based index the MSCI ACWI ex USA Index returned 13.75% during the same period. The majority of sectors contributed positively to performance during the period with the greatest contribution coming from Real Estate Operating Companies, Retail REITs and Diversified Real Estate Activities. The Real Estate Development, Industrial REITs and Self-Storage REITs sectors detracted from the performance. From a geographical perspective, the majority of countries contributed positively to performance during the period with the greatest contribution coming from Japan, Australia and Switzerland while Thailand, Taiwan and Philippines contributed negatively to performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers International Real Estate ETF - NAV |

iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index (the Underlying Index) |

MSCI ACWI ex USA Index |

'15 |

$10,000 |

$10,000 |

$10,000 |

'15 |

$9,648 |

$9,614 |

$9,607 |

'15 |

$9,372 |

$9,324 |

$9,125 |

'15 |

$8,565 |

$8,558 |

$8,198 |

'15 |

$8,389 |

$8,397 |

$8,009 |

'15 |

$8,915 |

$8,899 |

$8,614 |

'15 |

$8,702 |

$8,682 |

$8,398 |

'15 |

$8,706 |

$8,707 |

$8,423 |

'16 |

$8,112 |

$8,132 |

$7,763 |

'16 |

$8,050 |

$8,061 |

$7,693 |

'16 |

$8,644 |

$8,659 |

$8,582 |

'16 |

$8,636 |

$8,657 |

$8,576 |

'16 |

$8,702 |

$8,724 |

$8,443 |

'16 |

$8,758 |

$8,774 |

$8,622 |

'16 |

$9,124 |

$9,169 |

$9,102 |

'16 |

$9,325 |

$9,365 |

$9,291 |

'16 |

$9,400 |

$9,464 |

$9,457 |

'16 |

$9,317 |

$9,383 |

$9,300 |

'16 |

$9,250 |

$9,319 |

$9,093 |

'16 |

$9,231 |

$9,298 |

$8,991 |

'17 |

$9,554 |

$9,641 |

$9,513 |

'17 |

$9,766 |

$9,871 |

$9,841 |

'17 |

$10,022 |

$10,138 |

$10,144 |

'17 |

$10,226 |

$10,347 |

$10,303 |

'17 |

$10,472 |

$10,598 |

$10,578 |

'17 |

$10,642 |

$10,784 |

$10,773 |

'17 |

$11,033 |

$11,194 |

$11,330 |

'17 |

$11,168 |

$11,339 |

$11,445 |

'17 |

$11,194 |

$11,371 |

$11,412 |

'17 |

$11,638 |

$11,834 |

$11,875 |

'17 |

$11,644 |

$11,846 |

$11,948 |

'17 |

$11,868 |

$12,092 |

$12,317 |

'18 |

$12,538 |

$12,764 |

$13,144 |

'18 |

$12,075 |

$12,314 |

$12,523 |

'18 |

$11,800 |

$12,036 |

$12,228 |

'18 |

$12,005 |

$12,267 |

$12,367 |

'18 |

$11,959 |

$12,219 |

$12,265 |

'18 |

$11,674 |

$11,939 |

$11,804 |

'18 |

$11,798 |

$12,072 |

$11,931 |

'18 |

$11,737 |

$12,037 |

$11,798 |

'18 |

$11,571 |

$11,870 |

$11,635 |

'18 |

$10,524 |

$10,803 |

$10,441 |

'18 |

$10,829 |

$11,119 |

$10,907 |

'18 |

$10,589 |

$10,871 |

$10,602 |

'19 |

$11,281 |

$11,592 |

$11,374 |

'19 |

$11,502 |

$11,857 |

$10,500 |

'19 |

$11,911 |

$12,287 |

$10,562 |

'19 |

$11,710 |

$12,078 |

$10,841 |

'19 |

$11,625 |

$11,995 |

$10,260 |

'19 |

$12,008 |

$12,383 |

$10,877 |

'19 |

$11,935 |

$12,307 |

$10,746 |

'19 |

$11,887 |

$12,251 |

$10,414 |

'19 |

$12,101 |

$12,473 |

$10,682 |

'19 |

$12,492 |

$12,876 |

$11,054 |

'19 |

$12,434 |

$12,816 |

$11,152 |

'19 |

$12,826 |

$13,217 |

$11,635 |

'20 |

$12,716 |

$13,108 |

$11,322 |

'20 |

$11,790 |

$12,152 |

$10,427 |

'20 |

$9,185 |

$9,461 |

$8,918 |

'20 |

$9,814 |

$10,106 |

$9,593 |

'20 |

$9,906 |

$10,198 |

$9,907 |

'20 |

$10,128 |

$10,416 |

$10,355 |

'20 |

$10,323 |

$10,616 |

$10,817 |

'20 |

$10,820 |

$11,127 |

$11,280 |

'20 |

$10,514 |

$10,814 |

$11,002 |

'20 |

$10,158 |

$10,447 |

$10,766 |

'20 |

$11,586 |

$11,919 |

$12,214 |

'20 |

$12,024 |

$12,365 |

$12,874 |

'21 |

$11,816 |

$12,151 |

$12,902 |

'21 |

$12,104 |

$12,445 |

$13,158 |

'21 |

$12,291 |

$12,633 |

$13,324 |

'21 |

$12,717 |

$13,068 |

$13,716 |

'21 |

$13,098 |

$13,459 |

$14,130 |

'21 |

$13,051 |

$13,405 |

$14,054 |

'21 |

$13,196 |

$13,553 |

$13,822 |

'21 |

$13,420 |

$13,777 |

$14,085 |

'21 |

$12,832 |

$13,183 |

$13,634 |

'21 |

$13,200 |

$13,557 |

$13,959 |

'21 |

$12,733 |

$13,081 |

$13,331 |

'21 |

$13,148 |

$13,498 |

$13,881 |

'22 |

$12,679 |

$13,015 |

$13,370 |

'22 |

$12,462 |

$12,802 |

$13,105 |

'22 |

$12,635 |

$12,968 |

$13,126 |

'22 |

$11,851 |

$12,159 |

$12,302 |

'22 |

$11,622 |

$11,916 |

$12,390 |

'22 |

$10,540 |

$10,806 |

$11,324 |

'22 |

$11,077 |

$11,357 |

$11,712 |

'22 |

$10,550 |

$10,818 |

$11,335 |

'22 |

$9,240 |

$9,464 |

$10,203 |

'22 |

$9,179 |

$9,399 |

$10,507 |

'22 |

$10,169 |

$10,412 |

$11,748 |

'22 |

$10,219 |

$10,458 |

$11,660 |

'23 |

$10,867 |

$11,121 |

$12,606 |

'23 |

$10,384 |

$10,625 |

$12,163 |

'23 |

$10,053 |

$10,288 |

$12,461 |

'23 |

$10,311 |

$10,553 |

$12,677 |

'23 |

$9,669 |

$9,893 |

$12,216 |

'23 |

$9,835 |

$10,060 |

$12,764 |

'23 |

$10,375 |

$10,615 |

$13,283 |

'23 |

$10,009 |

$10,239 |

$12,683 |

'23 |

$9,597 |

$9,821 |

$12,283 |

'23 |

$9,107 |

$9,320 |

$11,776 |

'23 |

$10,038 |

$10,277 |

$12,836 |

'23 |

$10,891 |

$11,152 |

$13,481 |

'24 |

$10,499 |

$10,753 |

$13,347 |

'24 |

$10,297 |

$10,547 |

$13,685 |

'24 |

$10,781 |

$11,043 |

$14,092 |

'24 |

$10,422 |

$10,675 |

$13,859 |

'24 |

$10,531 |

$10,778 |

$14,262 |

'24 |

$10,241 |

$10,475 |

$14,248 |

'24 |

$10,827 |

$11,078 |

$14,578 |

'24 |

$11,399 |

$11,663 |

$14,993 |

'24 |

$11,952 |

$12,235 |

$15,397 |

'24 |

$11,027 |

$11,281 |

$14,641 |

'24 |

$10,893 |

$11,141 |

$14,509 |

'24 |

$10,314 |

$10,541 |

$14,227 |

'25 |

$10,545 |

$10,775 |

$14,800 |

'25 |

$10,529 |

$10,751 |

$15,006 |

'25 |

$10,533 |

$10,759 |

$14,971 |

'25 |

$11,254 |

$11,495 |

$15,512 |

'25 |

$11,625 |

$11,874 |

$16,223 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

5-Year |

10-Year |

Xtrackers International Real Estate ETF - NAV |

10.39% |

3.25% |

1.52% |

iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index |

10.16% |

3.09% |

1.73% |

MSCI ACWI ex USA Index |

13.75% |

10.37% |

5.47% | |

| Material Change Date |

|

Jun. 01, 2024

|

|

| AssetsNet |

|

|

$ 824,687,814

|

| Holdings Count | Holding |

|

|

387

|

| Advisory Fees Paid, Amount |

|

|

$ 737,455

|

| InvestmentCompanyPortfolioTurnover |

|

|

8.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

824,687,814 |

Number of Portfolio Holdings |

387 |

Portfolio Turnover Rate (%) |

8 |

Total Net Advisory Fees Paid ($) |

737,455 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Real Estate Operations/Development |

33% |

Diversified |

14% |

Real Estate Management/Services |

13% |

Warehouse/Industry |

12% |

Shopping Centers |

10% |

Office Property |

5% |

Apartments |

4% |

Regional Malls |

2% |

Health Care |

2% |

E-Commerce/Services |

1% |

Other |

0% | Geographical Diversification

Country |

% of Net Assets |

Japan |

22% |

Australia |

13% |

Hong Kong |

10% |

United Kingdom |

8% |

Canada |

6% |

Singapore |

6% |

Sweden |

4% |

Germany |

4% |

France |

4% |

Switzerland |

3% |

Israel |

2% |

Other |

17% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

22.6% of Net Assets |

Goodman Group (Australia) |

4.9% |

Mitsui Fudosan Co. Ltd. (Japan) |

3.0% |

Mitsubishi Estate Co. Ltd. (Japan) |

2.6% |

Vonovia SE (Germany) |

2.6% |

Sumitomo Realty & Development Co. Ltd. (Japan) |

2.1% |

Sun Hung Kai Properties Ltd. (Hong Kong) |

1.8% |

Link (Hong Kong) |

1.6% |

Scentre Group (Australia) |

1.4% |

Segro PLC (United Kingdom) |

1.3% |

Swiss Prime Site AG (Switzerland) |

1.3% | |

| Material Fund Change [Text Block] |

|

|

This is a summary of certain changes of the Fund since June 1, 2024. For more information, review the Fund's current prospectus at dws.com/etfreports, or by calling (844) 851-4255. Effective August 13, 2024, the Fund’s unitary advisory fee was reduced from 0.12% to 0.10%. At the same time, the Board terminated the contractual expense limitation that capped the fund’s operating expenses at the same level because of the redundancy. |

| Material Fund Change Expenses [Text Block] |

|

|

Effective August 13, 2024, the Fund’s unitary advisory fee was reduced from 0.12% to 0.10%. At the same time, the Board terminated the contractual expense limitation that capped the fund’s operating expenses at the same level because of the redundancy.

|

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000242879 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers Semiconductor Select Equity ETF

|

| Class Name |

|

|

Xtrackers Semiconductor Select Equity ETF

|

| Trading Symbol |

|

|

CHPS

|

| Security Exchange Name |

|

|

NASDAQ

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Semiconductor Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Semiconductor Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

CHPS |

$14 |

0.15% | Gross expense ratio as of the latest prospectus: 0.15%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 14

|

| Expense Ratio, Percent |

|

|

0.15%

|

| Factors Affecting Performance [Text Block] |

|

|

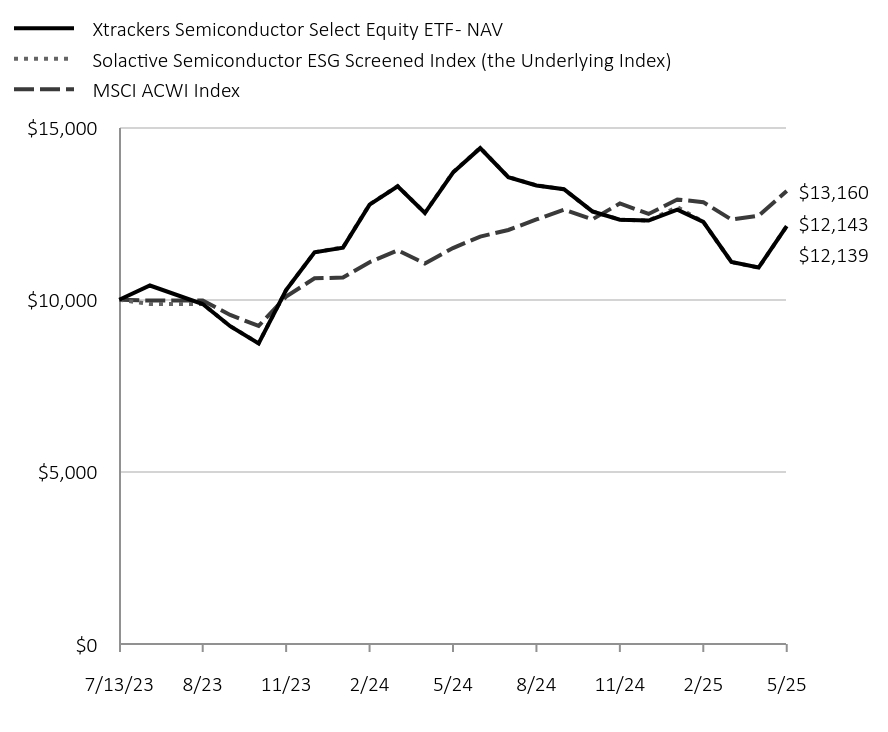

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the Solactive Semiconductor ESG Screened Index (the Underlying Index). The Underlying Index is comprised of companies that have business operations in the semiconductor industry and that fulfill certain sustainability criteria. The Fund returned -11.35% for the period ended May 31, 2025. The Fund's underlying index returned -11.43% and the Fund's broad-based index the MSCI ACWI Index returned 13.65% during the same period. The Electronic Components was the only sector that contributed positively to performance during the period. The Semiconductor Materials & Equipment, Semiconductors and Industrial Machinery & Supplies & Components sectors detracted from the performance. From a geographical perspective, Taiwan, Korea and Israel were the major positive contributors while the United States, Japan and Netherlands contributed negatively to performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers Semiconductor Select Equity ETF - NAV |

Solactive Semiconductor ESG Screened Index (the Underlying Index) |

MSCI ACWI Index |

7/13/23 |

$10,000 |

$10,000 |

$10,000 |

7/31/23 |

$10,415 |

$9,880 |

$9,979 |

8/31/23 |

$9,876 |

$9,880 |

$9,979 |

9/30/23 |

$9,232 |

$9,234 |

$9,559 |

10/31/23 |

$8,733 |

$8,736 |

$9,241 |

11/30/23 |

$10,280 |

$10,284 |

$10,095 |

12/31/23 |

$11,379 |

$11,383 |

$10,624 |

1/31/24 |

$11,515 |

$11,520 |

$10,648 |

2/29/24 |

$12,764 |

$12,770 |

$11,093 |

3/31/24 |

$13,296 |

$13,302 |

$11,437 |

4/30/24 |

$12,521 |

$12,527 |

$11,056 |

5/31/24 |

$13,698 |

$13,705 |

$11,503 |

6/30/24 |

$14,406 |

$14,413 |

$11,837 |

7/31/24 |

$13,560 |

$13,566 |

$12,028 |

8/31/24 |

$13,323 |

$13,326 |

$12,334 |

9/30/24 |

$13,211 |

$13,210 |

$12,620 |

10/31/24 |

$12,570 |

$12,568 |

$12,337 |

11/30/24 |

$12,328 |

$12,330 |

$12,798 |

12/31/24 |

$12,301 |

$12,301 |

$12,495 |

1/31/25 |

$12,617 |

$12,691 |

$12,915 |

2/28/25 |

$12,265 |

$12,266 |

$12,837 |

3/31/25 |

$11,099 |

$11,095 |

$12,330 |

4/30/25 |

$10,938 |

$10,933 |

$12,445 |

5/31/25 |

$12,143 |

$12,139 |

$13,160 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

Since Inception 7/13/23 |

Xtrackers Semiconductor Select Equity ETF - NAV |

-11.35% |

10.83% |

Solactive Semiconductor ESG Screened Index |

-11.43% |

10.81% |

MSCI ACWI Index |

13.65% |

15.66% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 6,975,779

|

| Holdings Count | Holding |

|

|

54

|

| Advisory Fees Paid, Amount |

|

|

$ 10,872

|

| InvestmentCompanyPortfolioTurnover |

|

|

19.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

6,975,779 |

Number of Portfolio Holdings |

54 |

Portfolio Turnover Rate (%) |

19 |

Total Net Advisory Fees Paid ($) |

10,872 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Semiconductors |

69% |

Semiconductor Materials & Equipment |

29% |

Electronic Components |

1% |

Industrial Machinery & Supplies |

1% |

Electronic Manufacturing Services |

1% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

45.3% of Net Assets |

Taiwan Semiconductor Manufacturing Co. Ltd. |

5.2% |

Broadcom, Inc. |

5.0% |

ASML Holding NV |

4.6% |

Micron Technology, Inc. |

4.6% |

NVIDIA Corp. |

4.5% |

SK Hynix, Inc. |

4.4% |

Advanced Micro Devices, Inc. |

4.4% |

Lam Research Corp. |

4.3% |

Analog Devices, Inc. |

4.2% |

Texas Instruments, Inc. |

4.1% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000242880 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers US Green Infrastructure Select Equity ETF

|

| Class Name |

|

|

Xtrackers US Green Infrastructure Select Equity ETF

|

| Trading Symbol |

|

|

UPGR

|

| Security Exchange Name |

|

|

NASDAQ

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers US Green Infrastructure Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers US Green Infrastructure Select Equity ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

UPGR |

$32 |

0.35% | Gross expense ratio as of the latest prospectus: 0.35%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 32

|

| Expense Ratio, Percent |

|

|

0.35%

|

| Factors Affecting Performance [Text Block] |

|

|

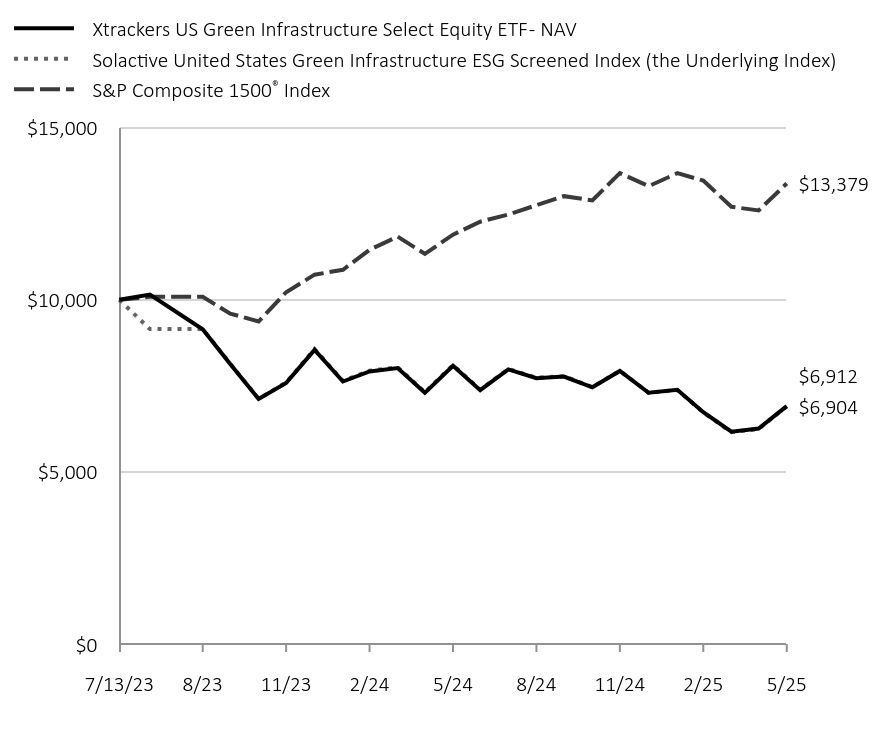

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the Solactive United States Green Infrastructure ESG Screened Index (the Underlying Index). The Underlying Index is comprised of companies that have business exposure in the production, generation, or distribution of green energy or are engaged in the establishment of a sustainable infrastructure to enable the use of renewable energy and that fulfill certain sustainability criteria. The Fund returned -14.51% for the period ended May 31, 2025. The Fund's underlying index returned -14.82% and the Fund's broad-based index the S&P Composite 1500® Index returned 12.49% during the same period. Consumer Discretionary and Materials were the only sectors that contributed positively to performance. The Industrials, Utilities and Energy sectors detracted from the performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers US Green Infrastructure Select Equity ETF - NAV |

Solactive United States Green Infrastructure ESG Screened Index (the Underlying Index) |

S&P Composite 1500® Index |

7/13/23 |

$10,000 |

$10,000 |

$10,000 |

7/31/23 |

$10,154 |

$9,148 |

$10,085 |

8/31/23 |

$9,142 |

$9,148 |

$10,085 |

9/30/23 |

$8,138 |

$8,145 |

$9,599 |

10/31/23 |

$7,117 |

$7,125 |

$9,370 |

11/30/23 |

$7,581 |

$7,595 |

$10,221 |

12/31/23 |

$8,546 |

$8,566 |

$10,730 |

1/31/24 |

$7,626 |

$7,643 |

$10,873 |

2/29/24 |

$7,917 |

$7,939 |

$11,452 |

3/31/24 |

$8,017 |

$8,039 |

$11,836 |

4/30/24 |

$7,297 |

$7,313 |

$11,335 |

5/31/24 |

$8,085 |

$8,104 |

$11,893 |

6/30/24 |

$7,374 |

$7,389 |

$12,269 |

7/31/24 |

$7,978 |

$7,990 |

$12,477 |

8/31/24 |

$7,721 |

$7,736 |

$12,749 |

9/30/24 |

$7,770 |

$7,781 |

$13,011 |

10/31/24 |

$7,457 |

$7,463 |

$12,888 |

11/30/24 |

$7,934 |

$7,939 |

$13,682 |

12/31/24 |

$7,299 |

$7,297 |

$13,300 |

1/31/25 |

$7,386 |

$7,378 |

$13,678 |

2/28/25 |

$6,736 |

$6,727 |

$13,462 |

3/31/25 |

$6,169 |

$6,157 |

$12,703 |

4/30/25 |

$6,258 |

$6,246 |

$12,595 |

5/31/25 |

$6,912 |

$6,904 |

$13,379 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

Since Inception 7/13/23 |

Xtrackers US Green Infrastructure Select Equity ETF - NAV |

-14.51% |

-17.77% |

Solactive United States Green Infrastructure ESG Screened Index |

-14.82% |

-17.82% |

S&P Composite 1500® Index |

12.49% |

16.67% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 3,829,011

|

| Holdings Count | Holding |

|

|

46

|

| Advisory Fees Paid, Amount |

|

|

$ 14,201

|

| InvestmentCompanyPortfolioTurnover |

|

|

60.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

3,829,011 |

Number of Portfolio Holdings |

46 |

Portfolio Turnover Rate (%) |

60 |

Total Net Advisory Fees Paid ($) |

14,201 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Industrials |

63% |

Materials |

14% |

Consumer Discretionary |

12% |

Information Technology |

5% |

Utilities |

4% |

Energy |

2% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

30.0% of Net Assets |

Microvast Holdings, Inc. |

4.2% |

EVgo, Inc. |

3.2% |

PureCycle Technologies, Inc. |

3.1% |

Array Technologies, Inc. |

3.0% |

NEXTracker, Inc. |

3.0% |

GE Vernova, Inc. |

3.0% |

Shoals Technologies Group, Inc. |

2.7% |

Tesla, Inc. |

2.7% |

Rivian Automotive, Inc. |

2.6% |

First Solar, Inc. |

2.5% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000245888 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers US National Critical Technologies ETF

|

| Class Name |

|

|

Xtrackers US National Critical Technologies ETF

|

| Trading Symbol |

|

|

CRTC

|

| Security Exchange Name |

|

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers US National Critical Technologies ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers US National Critical Technologies ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

CRTC |

$37 |

0.35% | Gross expense ratio as of the latest prospectus: 0.35%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 37

|

| Expense Ratio, Percent |

|

|

0.35%

|

| Factors Affecting Performance [Text Block] |

|

|

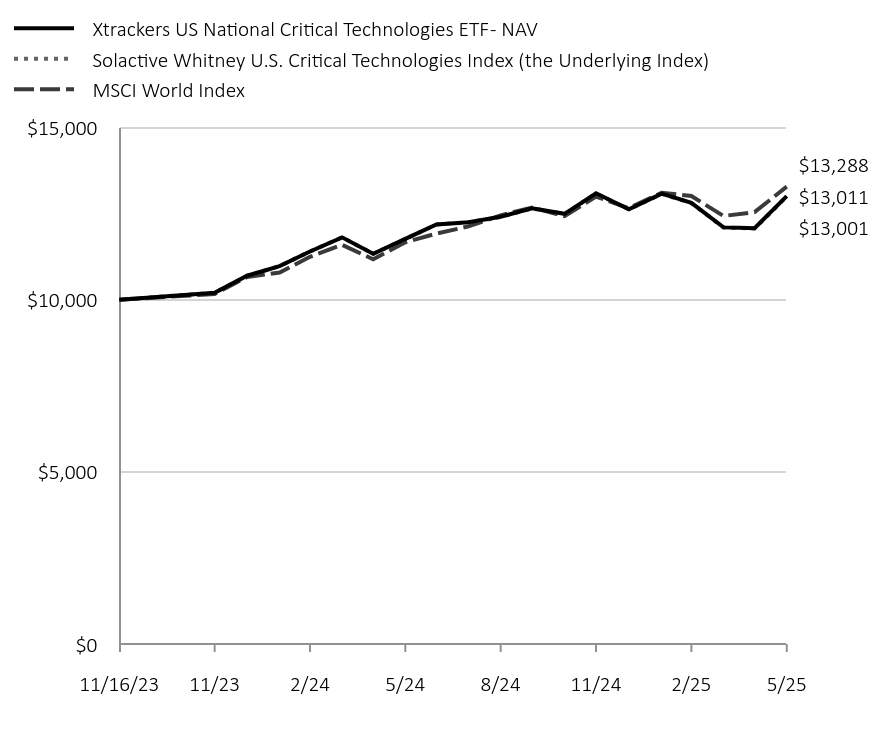

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the Solactive Whitney U.S. Critical Technologies Index (the Underlying Index). The Underlying Index is a market-capitalization weighted index, subject to caps on the weighting of individual companies, that is designed to track companies that support critical emerging technologies across the U.S. and its allies by selecting companies from a defined investment universe that satisfy key criteria related to their association with critical technology sectors and their geopolitical risk rating. The Fund returned 10.54% for the period ended May 31, 2025. The Fund's underlying index returned 10.48% and the Fund's broad-based index the MSCI World Index returned 13.72% during the same period. The majority of sectors contributed positively to performance during the period with the greatest contribution coming from Information Technology, Industrials and Consumer Discretionary. The Energy, Materials and Real Estate sectors detracted from the performance. From a geographical perspective, the United States, the United Kingdom and Canada were the major positive contributors, while Denmark, Australia and France contributed negatively to performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers US National Critical Technologies ETF - NAV |

Solactive Whitney U.S. Critical Technologies Index (the Underlying Index) |

MSCI World Index |

11/16/23 |

$10,000 |

$10,000 |

$10,000 |

11/30/23 |

$10,207 |

$10,205 |

$10,170 |

12/31/23 |

$10,699 |

$10,699 |

$10,661 |

1/31/24 |

$10,979 |

$10,978 |

$10,794 |

2/29/24 |

$11,402 |

$11,402 |

$11,249 |

3/31/24 |

$11,814 |

$11,816 |

$11,597 |

4/30/24 |

$11,334 |

$11,335 |

$11,177 |

5/31/24 |

$11,770 |

$11,768 |

$11,672 |

6/30/24 |

$12,188 |

$12,187 |

$11,923 |

7/31/24 |

$12,254 |

$12,252 |

$12,133 |

8/31/24 |

$12,412 |

$12,408 |

$12,454 |

9/30/24 |

$12,657 |

$12,653 |

$12,682 |

10/31/24 |

$12,498 |

$12,494 |

$12,431 |

11/30/24 |

$13,096 |

$13,090 |

$13,001 |

12/31/24 |

$12,632 |

$12,626 |

$12,662 |

1/31/25 |

$13,082 |

$13,076 |

$13,109 |

2/28/25 |

$12,815 |

$12,808 |

$13,015 |

3/31/25 |

$12,106 |

$12,100 |

$12,435 |

4/30/25 |

$12,078 |

$12,071 |

$12,546 |

5/31/25 |

$13,011 |

$13,001 |

$13,288 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

Since Inception 11/16/23 |

Xtrackers US National Critical Technologies ETF - NAV |

10.54% |

18.60% |

Solactive Whitney U.S. Critical Technologies Index |

10.48% |

18.55% |

MSCI World Index |

13.72% |

20.24% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 112,124,556

|

| Holdings Count | Holding |

|

|

225

|

| Advisory Fees Paid, Amount |

|

|

$ 242,221

|

| InvestmentCompanyPortfolioTurnover |

|

|

29.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

112,124,556 |

Number of Portfolio Holdings |

225 |

Portfolio Turnover Rate (%) |

29 |

Total Net Advisory Fees Paid ($) |

242,221 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Information Technology |

35% |

Health Care |

17% |

Communication Services |

16% |

Industrials |

13% |

Consumer Discretionary |

6% |

Utilities |

5% |

Energy |

5% |

Materials |

2% |

Financials |

1% |

Real Estate |

0% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

35.8% of Net Assets |

NVIDIA Corp. |

5.9% |

Meta Platforms, Inc. |

5.7% |

Microsoft Corp. |

5.5% |

Amazon.com, Inc. |

5.2% |

Alphabet, Inc. |

4.9% |

Exxon Mobil Corp. |

2.4% |

AbbVie, Inc. |

1.8% |

Palantir Technologies, Inc. |

1.5% |

Oracle Corp. |

1.5% |

Cisco Systems, Inc. |

1.4% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000125568 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers Harvest CSI 300 China A‑Shares ETF

|

| Class Name |

|

|

Xtrackers Harvest CSI 300 China A‑Shares ETF

|

| Trading Symbol |

|

|

ASHR

|

| Security Exchange Name |

|

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Harvest CSI 300 China A-Shares ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Harvest CSI 300 China A-Shares ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

ASHR |

$68 |

0.65% | Gross expense ratio as of the latest prospectus: 0.65%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 68

|

| Expense Ratio, Percent |

|

|

0.65%

|

| Factors Affecting Performance [Text Block] |

|

|

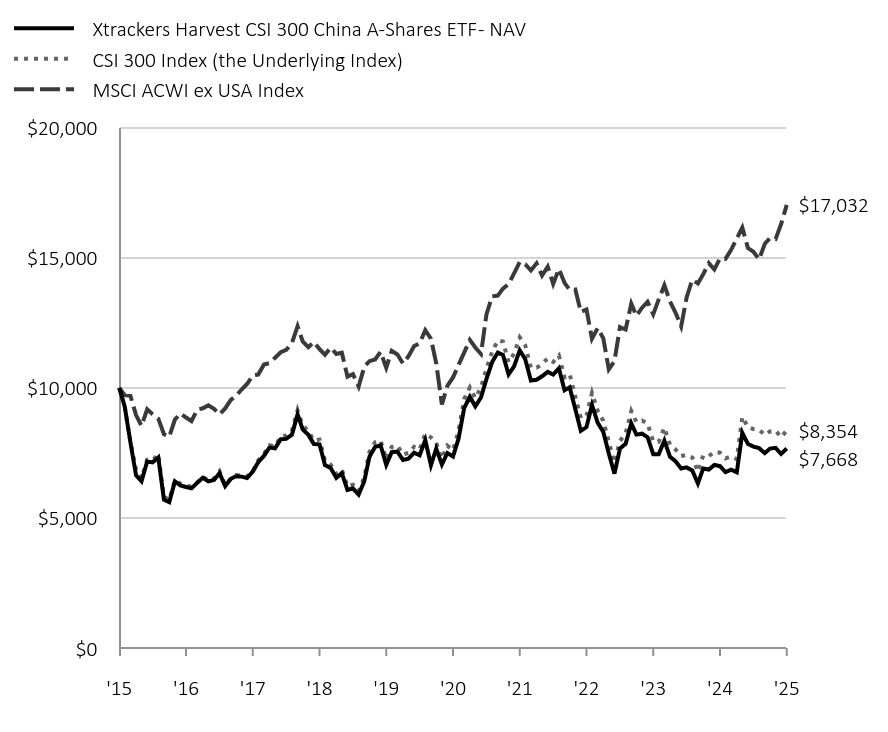

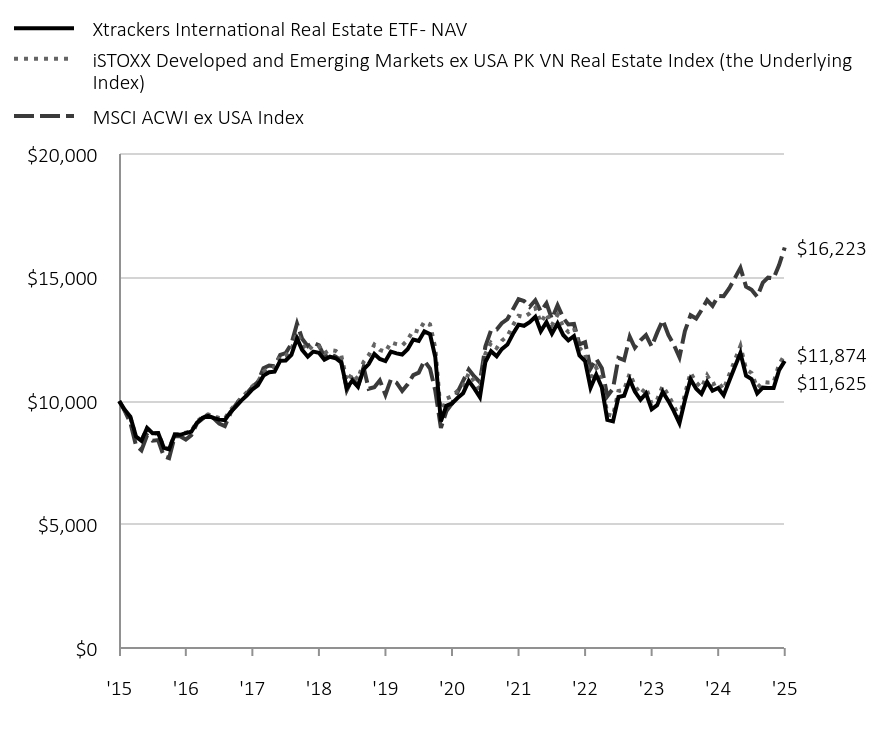

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the CSI 300 Index (the Underlying Index). The Underlying Index is designed to reflect the price fluctuation and performance of the China A-Share market and is composed of the 300 largest and most liquid stocks in the China A-Share market. The Fund returned 9.72% for the period ended May 31, 2025. The Fund's underlying index returned 11.30% and the Fund's broad-based index the MSCI ACWI ex USA Index returned 13.75% during the same period. The majority of sectors contributed positively to performance during the period with the greatest contribution coming from Financials, Consumer Discretionary and Industrials. The Consumer Staples, Materials and Energy sectors detracted from performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers Harvest CSI 300 China A-Shares ETF - NAV |

CSI 300 Index (the Underlying Index) |

MSCI ACWI ex USA Index |

'15 |

$10,000 |

$10,000 |

$10,000 |

'15 |

$9,275 |

$9,268 |

$9,721 |

'15 |

$7,911 |

$7,952 |

$9,694 |

'15 |

$6,635 |

$6,831 |

$8,953 |

'15 |

$6,407 |

$6,526 |

$8,538 |

'15 |

$7,170 |

$7,236 |

$9,174 |

'15 |

$7,136 |

$7,222 |

$8,984 |

'15 |

$7,324 |

$7,443 |

$8,815 |

'16 |

$5,699 |

$5,804 |

$8,215 |

'16 |

$5,606 |

$5,695 |

$8,121 |

'16 |

$6,403 |

$6,450 |

$8,782 |

'16 |

$6,250 |

$6,317 |

$9,013 |

'16 |

$6,190 |

$6,253 |

$8,861 |

'16 |

$6,135 |

$6,203 |

$8,725 |

'16 |

$6,349 |

$6,351 |

$9,157 |

'16 |

$6,542 |

$6,580 |

$9,215 |

'16 |

$6,406 |

$6,447 |

$9,328 |

'16 |

$6,461 |

$6,514 |

$9,194 |

'16 |

$6,716 |

$6,792 |

$8,982 |

'16 |

$6,221 |

$6,269 |

$9,211 |

'17 |

$6,504 |

$6,509 |

$9,538 |

'17 |

$6,601 |

$6,647 |

$9,690 |

'17 |

$6,588 |

$6,632 |

$9,935 |

'17 |

$6,536 |

$6,597 |

$10,148 |

'17 |

$6,786 |

$6,785 |

$10,477 |

'17 |

$7,142 |

$7,213 |

$10,510 |

'17 |

$7,384 |

$7,462 |

$10,897 |

'17 |

$7,709 |

$7,792 |

$10,954 |

'17 |

$7,674 |

$7,744 |

$11,158 |

'17 |

$8,027 |

$8,138 |

$11,368 |

'17 |

$8,038 |

$8,162 |

$11,460 |

'17 |

$8,199 |

$8,335 |

$11,716 |

'18 |

$8,981 |

$9,140 |

$12,369 |

'18 |

$8,400 |

$8,561 |

$11,785 |

'18 |

$8,193 |

$8,338 |

$11,560 |

'18 |

$7,839 |

$7,977 |

$11,762 |

'18 |

$7,829 |

$8,013 |

$11,490 |

'18 |

$7,032 |

$7,204 |

$11,275 |

'18 |

$6,918 |

$7,051 |

$11,544 |

'18 |

$6,539 |

$6,693 |

$11,303 |

'18 |

$6,719 |

$6,854 |

$11,354 |

'18 |

$6,072 |

$6,213 |

$10,431 |

'18 |

$6,137 |

$6,273 |

$10,529 |

'18 |

$5,899 |

$6,032 |

$10,052 |

'19 |

$6,413 |

$6,559 |

$10,812 |

'19 |

$7,352 |

$7,537 |

$11,024 |

'19 |

$7,728 |

$7,910 |

$11,089 |

'19 |

$7,793 |

$7,976 |

$11,382 |

'19 |

$7,043 |

$7,247 |

$10,771 |

'19 |

$7,526 |

$7,731 |

$11,420 |

'19 |

$7,549 |

$7,779 |

$11,282 |

'19 |

$7,227 |

$7,434 |

$10,933 |

'19 |

$7,278 |

$7,499 |

$11,215 |

'19 |

$7,509 |

$7,733 |

$11,606 |

'19 |

$7,411 |

$7,627 |

$11,708 |

'19 |

$7,997 |

$8,234 |

$12,215 |

'20 |

$7,024 |

$8,094 |

$11,887 |

'20 |

$7,664 |

$7,881 |

$10,947 |

'20 |

$7,049 |

$7,283 |

$9,362 |

'20 |

$7,495 |

$7,779 |

$10,072 |

'20 |

$7,362 |

$7,600 |

$10,401 |

'20 |

$8,037 |

$8,332 |

$10,872 |

'20 |

$9,217 |

$9,565 |

$11,356 |

'20 |

$9,656 |

$10,016 |

$11,842 |

'20 |

$9,289 |

$9,606 |

$11,551 |

'20 |

$9,628 |

$10,010 |

$11,303 |

'20 |

$10,344 |

$10,739 |

$12,823 |

'20 |

$10,991 |

$11,384 |

$13,516 |

'21 |

$11,356 |

$11,825 |

$13,546 |

'21 |

$11,263 |

$11,782 |

$13,814 |

'21 |

$10,519 |

$10,988 |

$13,989 |

'21 |

$10,827 |

$11,317 |

$14,400 |

'21 |

$11,444 |

$11,941 |

$14,835 |

'21 |

$11,100 |

$11,635 |

$14,755 |

'21 |

$10,282 |

$10,765 |

$14,511 |

'21 |

$10,310 |

$10,776 |

$14,787 |

'21 |

$10,444 |

$10,910 |

$14,314 |

'21 |

$10,613 |

$11,142 |

$14,655 |

'21 |

$10,511 |

$10,999 |

$13,996 |

'21 |

$10,752 |

$11,243 |

$14,574 |

'22 |

$9,911 |

$10,407 |

$14,037 |

'22 |

$10,022 |

$10,530 |

$13,759 |

'22 |

$9,178 |

$9,657 |

$13,781 |

'22 |

$8,346 |

$8,835 |

$12,916 |

'22 |

$8,492 |

$8,934 |

$13,008 |

'22 |

$9,341 |

$9,804 |

$11,889 |

'22 |

$8,666 |

$9,118 |

$12,296 |

'22 |

$8,300 |

$8,732 |

$11,901 |

'22 |

$7,478 |

$7,923 |

$10,712 |

'22 |

$6,702 |

$7,121 |

$11,032 |

'22 |

$7,669 |

$7,964 |

$12,334 |

'22 |

$7,851 |

$8,242 |

$12,242 |

'23 |

$8,633 |

$9,111 |

$13,235 |

'23 |

$8,202 |

$8,684 |

$12,770 |

'23 |

$8,239 |

$8,739 |

$13,082 |

'23 |

$8,102 |

$8,628 |

$13,309 |

'23 |

$7,449 |

$7,936 |

$12,826 |

'23 |

$7,451 |

$7,928 |

$13,401 |

'23 |

$7,974 |

$8,469 |

$13,946 |

'23 |

$7,345 |

$7,802 |

$13,316 |

'23 |

$7,179 |

$7,634 |

$12,895 |

'23 |

$6,901 |

$7,382 |

$12,363 |

'23 |

$6,942 |

$7,421 |

$13,476 |

'23 |

$6,825 |

$7,326 |

$14,153 |

'24 |

$6,325 |

$6,778 |

$14,013 |

'24 |

$6,903 |

$7,400 |

$14,367 |

'24 |

$6,861 |

$7,376 |

$14,795 |

'24 |

$7,039 |

$7,541 |

$14,551 |

'24 |

$6,989 |

$7,506 |

$14,973 |

'24 |

$6,760 |

$7,288 |

$14,959 |

'24 |

$6,858 |

$7,363 |

$15,305 |

'24 |

$6,753 |

$7,258 |

$15,741 |

'24 |

$8,269 |

$8,886 |

$16,165 |

'24 |

$7,842 |

$8,488 |

$15,372 |

'24 |

$7,739 |

$8,418 |

$15,233 |

'24 |

$7,682 |

$8,389 |

$14,937 |

'25 |

$7,489 |

$8,191 |

$15,538 |

'25 |

$7,664 |

$8,324 |

$15,754 |

'25 |

$7,692 |

$8,362 |

$15,718 |

'25 |

$7,458 |

$8,102 |

$16,286 |

'25 |

$7,668 |

$8,354 |

$17,032 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

5-Year |

10-Year |

Xtrackers Harvest CSI 300 China A-Shares ETF - NAV |

9.72% |

0.82% |

-2.62% |

CSI 300 Index |

11.30% |

1.91% |

-1.78% |

MSCI ACWI ex USA Index |

13.75% |

10.37% |

5.47% | Average Annual Total Returns Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. To obtain the most recent month-end performance data visit etf.dws.com/en-us/etf-products or call (844) 851-4255. |

| AssetsNet |

|

|

$ 2,014,675,761

|

| Holdings Count | Holding |

|

|

285

|

| Advisory Fees Paid, Amount |

|

|

$ 14,257,775

|

| InvestmentCompanyPortfolioTurnover |

|

|

143.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Net Assets ($) |

2,014,675,761 |

Number of Portfolio Holdings |

285 |

Portfolio Turnover Rate (%) |

143 |

Total Net Advisory Fees Paid ($) |

14,257,775 | |

| Holdings [Text Block] |

|

|

Sector |

% of Net Assets |

Financials |

26% |

Industrials |

16% |

Information Technology |

16% |

Consumer Staples |

11% |

Consumer Discretionary |

9% |

Materials |

8% |

Health Care |

6% |

Utilities |

4% |

Energy |

2% |

Real Estate |

1% |

Communication Services |

1% | |

| Largest Holdings [Text Block] |

|

|

Ten Largest Equity Holdings

Holdings |

23.4% of Net Assets |

Kweichow Moutai Co. Ltd. |

4.7% |

Contemporary Amperex Technology Co. Ltd. |

3.3% |

Ping An Insurance Group Co. of China Ltd. |

2.9% |

China Merchants Bank Co. Ltd. |

2.7% |

Midea Group Co. Ltd. |

1.9% |

China Yangtze Power Co. Ltd. |

1.9% |

Industrial Bank Co. Ltd. |

1.6% |

BYD Co. Ltd. |

1.6% |

Zijin Mining Group Co. Ltd. |

1.5% |

East Money Information Co. Ltd. |

1.3% | |

| Updated Prospectus Phone Number |

|

|

(844) 851-4255

|

| Updated Prospectus Web Address |

|

|

dws.com/en-us/resources/proxy-voting

|

| C000138395 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Xtrackers Harvest CSI 500 China A‑Shares Small Cap ETF

|

| Class Name |

|

|

Xtrackers Harvest CSI 500 China A‑Shares Small Cap ETF

|

| Trading Symbol |

|

|

ASHS

|

| Security Exchange Name |

|

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (the "Fund") for the period June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

This annual shareholder report contains important information about the Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (the "Fund") for the period June 1, 2024 to May 31, 2025. You can find additional information about the Fund at dws.com/etfreports. You can also request this information by contacting us at (844) 851‐4255.

|

| Additional Information Phone Number |

|

|

(844) 851‐4255

|

| Additional Information Website |

|

|

dws.com/etfreports

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last year?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

ASHS |

$68 |

0.65% | Gross expense ratio as of the latest prospectus: 0.65%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. |

| Expenses Paid, Amount |

|

|

$ 68

|

| Expense Ratio, Percent |

|

|

0.65%

|

| Factors Affecting Performance [Text Block] |

|

|

How did the fund perform last year and what affected its performance?The Fund seeks investment results that correspond generally to the performance, before fees and expenses, of the CSI 500 Index (the Underlying Index). The Underlying Index is designed to reflect the price fluctuation and performance of small-cap companies in the China A-Share market and is composed of the 500 smallest and most liquid stocks in the China A-Share market. The Fund returned 8.21% for the period ended May 31, 2025. The Fund's underlying index returned 9.48% and the Fund's broad-based index the MSCI ACWI ex USA Index returned 13.75% during the same period. The majority of sectors contributed positively to performance during the period with the greatest contribution coming from Information Technology, Consumer Discretionary and Communication Services. The Energy, Materials and Utilities sectors detracted from performance. |

| Line Graph [Table Text Block] |

|

|

|

Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF - NAV |

CSI 500 Index (the Underlying Index) |

MSCI ACWI ex USA Index |

'15 |

$10,000 |

$10,000 |

$10,000 |

'15 |

$8,884 |

$8,944 |

$9,721 |

'15 |

$7,351 |

$7,762 |

$9,694 |

'15 |

$5,856 |

$6,436 |

$8,953 |

'15 |

$5,495 |

$6,011 |

$8,538 |

'15 |

$6,643 |

$6,987 |

$9,174 |

'15 |

$6,854 |

$7,227 |

$8,984 |

'15 |

$6,951 |

$7,321 |

$8,815 |

'16 |

$4,882 |

$5,190 |

$8,215 |

'16 |

$4,805 |

$5,100 |

$8,121 |

'16 |

$5,729 |

$5,942 |

$8,782 |

'16 |

$5,554 |

$5,767 |

$9,013 |

'16 |

$5,463 |

$5,648 |

$8,861 |

'16 |

$5,574 |

$5,782 |

$8,725 |

'16 |

$5,665 |

$5,856 |

$9,157 |

'16 |

$5,822 |

$6,050 |

$9,215 |

'16 |

$5,732 |

$5,959 |

$9,328 |

'16 |

$5,752 |

$5,986 |

$9,194 |

'16 |

$5,757 |

$6,008 |

$8,982 |

'16 |

$5,401 |

$5,648 |

$9,211 |

'17 |

$5,479 |

$5,682 |

$9,538 |

'17 |

$5,661 |

$5,901 |

$9,690 |

'17 |

$5,603 |

$5,836 |

$9,935 |

'17 |

$5,414 |

$5,661 |

$10,148 |

'17 |

$5,191 |

$5,374 |

$10,477 |

'17 |

$5,468 |

$5,722 |

$10,510 |

'17 |

$5,665 |

$5,924 |

$10,897 |

'17 |

$5,930 |

$6,205 |

$10,954 |

'17 |

$5,994 |

$6,266 |

$11,158 |

'17 |

$5,968 |

$6,263 |

$11,368 |

'17 |

$5,696 |

$5,998 |

$11,460 |

'17 |

$5,770 |

$6,077 |

$11,716 |

'18 |

$5,903 |

$6,219 |

$12,369 |

'18 |

$5,700 |

$6,024 |

$11,785 |

'18 |

$5,759 |

$6,074 |

$11,560 |

'18 |

$5,543 |

$5,851 |

$11,762 |

'18 |

$5,384 |

$5,703 |

$11,490 |

'18 |

$4,706 |

$5,019 |

$11,275 |

'18 |

$4,572 |

$4,854 |

$11,544 |

'18 |

$4,221 |

$4,505 |

$11,303 |

'18 |

$4,200 |

$4,457 |

$11,354 |

'18 |

$3,687 |

$3,920 |

$10,431 |

'18 |

$3,808 |

$4,030 |

$10,529 |

'18 |

$3,676 |

$3,889 |

$10,052 |

'19 |

$3,768 |

$3,985 |

$10,812 |

'19 |

$4,532 |

$4,806 |

$11,024 |

'19 |

$4,984 |

$5,276 |

$11,089 |

'19 |

$4,760 |

$5,038 |

$11,382 |

'19 |

$4,292 |

$4,566 |

$10,771 |

'19 |

$4,366 |

$4,653 |

$11,420 |

'19 |

$4,310 |

$4,604 |

$11,282 |

'19 |

$4,144 |

$4,420 |

$10,933 |

'19 |

$4,200 |

$4,487 |

$11,215 |

'19 |

$4,233 |

$4,520 |

$11,606 |

'19 |

$4,222 |

$4,505 |

$11,708 |

'19 |

$4,589 |

$4,891 |

$12,215 |

'20 |

$4,209 |

$5,022 |

$11,887 |

'20 |

$4,731 |

$5,038 |

$10,947 |

'20 |

$4,303 |

$4,602 |

$9,362 |

'20 |

$4,579 |

$4,918 |

$10,072 |

'20 |

$4,593 |

$4,907 |

$10,401 |

'20 |

$5,044 |

$5,406 |

$10,872 |

'20 |

$5,734 |

$6,153 |

$11,356 |

'20 |

$5,929 |

$6,359 |

$11,842 |

'20 |

$5,558 |

$5,943 |

$11,551 |

'20 |

$5,554 |

$5,971 |

$11,303 |

'20 |

$5,839 |

$6,269 |

$12,823 |

'20 |

$5,947 |

$6,371 |

$13,516 |

'21 |

$5,976 |

$6,423 |

$13,546 |

'21 |

$5,955 |

$6,436 |

$13,814 |

'21 |

$5,778 |

$6,236 |

$13,989 |

'21 |

$6,076 |

$6,560 |

$14,400 |

'21 |

$6,369 |

$6,861 |

$14,835 |

'21 |

$6,413 |

$6,952 |

$14,755 |

'21 |

$6,396 |

$6,929 |

$14,511 |

'21 |

$6,854 |

$7,432 |

$14,787 |

'21 |

$6,717 |

$7,275 |

$14,314 |

'21 |

$6,673 |

$7,276 |

$14,655 |

'21 |

$6,919 |

$7,539 |

$13,996 |

'21 |

$7,015 |

$7,649 |

$14,574 |

'22 |

$6,267 |

$6,853 |

$14,037 |

'22 |

$6,576 |

$7,193 |

$13,759 |

'22 |

$6,029 |

$6,606 |

$13,781 |

'22 |

$5,134 |

$5,654 |

$12,916 |

'22 |

$5,485 |

$6,020 |

$13,008 |

'22 |

$5,901 |

$6,453 |

$11,889 |

'22 |

$5,727 |

$6,277 |

$12,296 |

'22 |

$5,481 |

$6,003 |

$11,901 |

'22 |

$4,916 |

$5,418 |

$10,712 |

'22 |

$4,847 |

$5,364 |

$11,032 |

'22 |

$5,360 |

$5,791 |

$12,334 |

'22 |

$5,203 |

$5,675 |

$12,242 |

'23 |

$5,712 |

$6,265 |

$13,235 |

'23 |

$5,610 |

$6,165 |

$12,770 |

'23 |

$5,654 |

$6,216 |

$13,082 |

'23 |

$5,526 |

$6,073 |

$13,309 |

'23 |

$5,226 |

$5,756 |

$12,826 |

'23 |

$5,100 |

$5,624 |

$13,401 |

'23 |

$5,285 |

$5,809 |

$13,946 |

'23 |

$4,892 |

$5,373 |

$13,316 |

'23 |

$4,837 |

$5,318 |

$12,895 |

'23 |

$4,669 |

$5,157 |

$12,363 |

'23 |

$4,813 |

$5,313 |

$13,476 |

'23 |

$4,723 |

$5,228 |

$14,153 |

'24 |

$4,054 |

$4,466 |

$14,013 |

'24 |

$4,601 |

$5,075 |

$14,367 |

'24 |

$4,459 |

$4,935 |

$14,795 |

'24 |

$4,650 |

$5,131 |

$14,551 |

'24 |

$4,545 |

$5,030 |

$14,973 |

'24 |

$4,244 |

$4,700 |

$14,959 |

'24 |

$4,247 |

$4,690 |

$15,305 |

'24 |

$4,113 |

$4,541 |

$15,741 |

'24 |

$5,142 |

$5,688 |

$16,165 |

'24 |

$5,156 |

$5,761 |

$15,372 |

'24 |

$5,030 |

$5,626 |

$15,233 |

'24 |

$4,862 |

$5,457 |

$14,937 |

'25 |

$4,763 |

$5,353 |

$15,538 |

'25 |

$5,020 |

$5,597 |

$15,754 |

'25 |

$5,037 |

$5,625 |

$15,718 |

'25 |

$4,837 |

$5,396 |

$16,286 |

'25 |

$4,918 |

$5,507 |

$17,032 |

|

| Average Annual Return [Table Text Block] |

|

|

Fund/Index |

1-Year |

5-Year |

10-Year |

Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF - NAV |

8.21% |

1.38% |

-6.85% |

CSI 500 Index |

9.48% |

2.34% |

-5.79% |

MSCI ACWI ex USA Index |

13.75% |

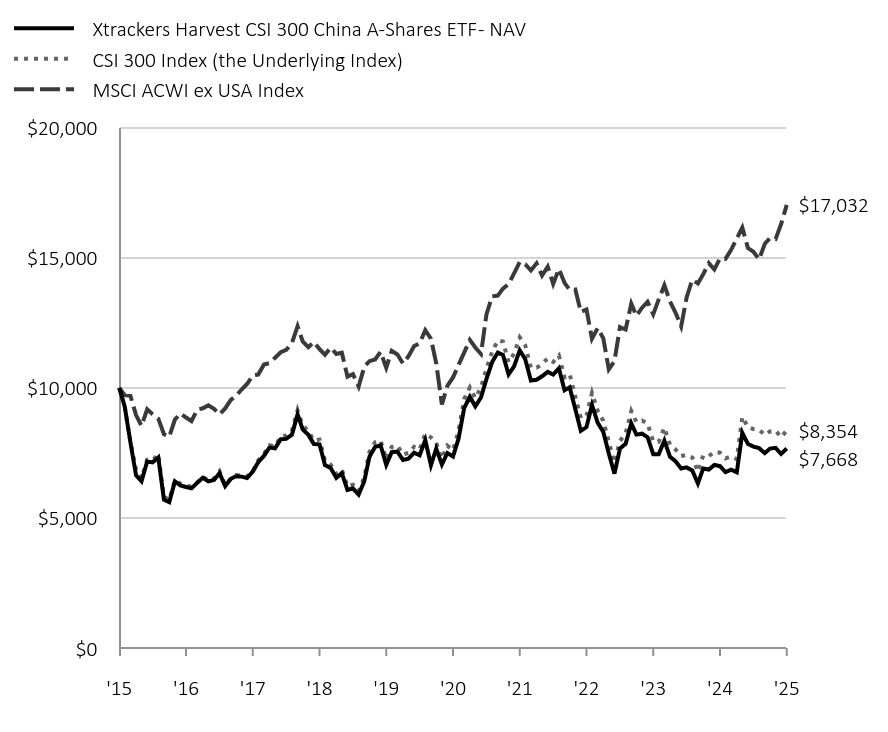

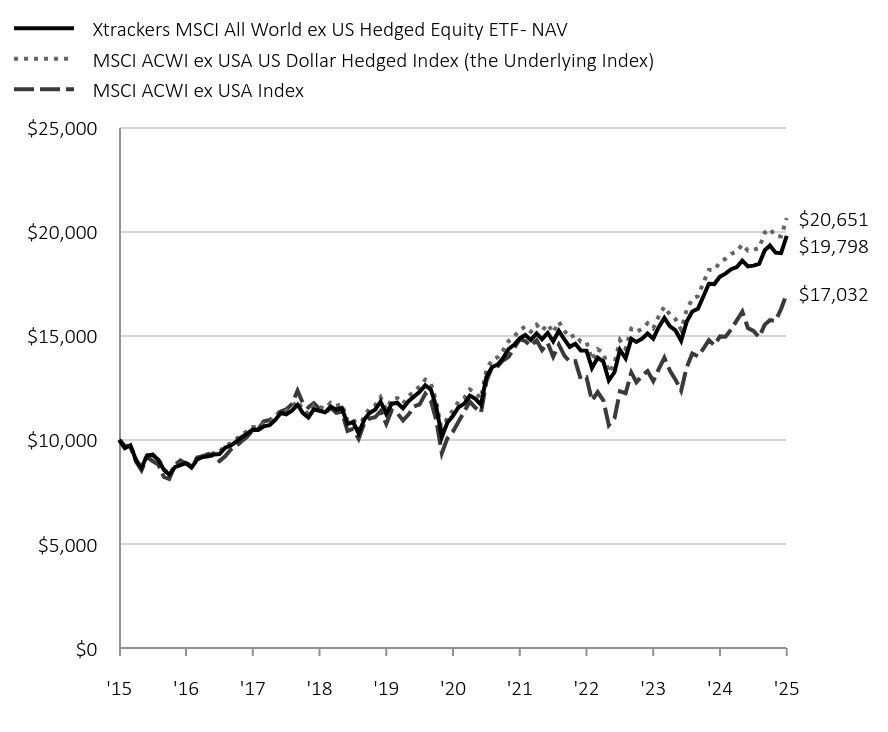

10.37% |