| 1 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 1 MISSION & MASTER-PLAN Gerard Barron, Chairman & CEO August 2025 |

| 2 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that relate to future events, TMC the metals company Inc.’s (“TMC” or the “Company”) future operations and financial performance, and the Company’s plans, strategies and prospects. Forward-looking statements include, but are not limited to, expectations regarding permitting and production timelines under the Deep Seabed Hard Mineral Resources Act (DSHMRA), the development of a domestic U.S. supply chain, commercialization of the Metals-as-a-Service (MaaS) model, long-term resource utilization, and the Company’s partnerships, infrastructure investments, and regulatory approvals. These statements involve risks, uncertainties and assumptions and are based on the current estimates and assumptions of the management of the Company as of the date of this presentation and are subject to uncertainty and changes. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, among others, those set forth under the heading “Risk Factors” contained in TMC’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the Securities and Exchange Commission on March 27, 2025, as well as any updates to those risk factors filed from time to time in TMC’s subsequent periodic and current reports. All information in this presentation is as of the date of this presentation, and the Company undertakes no duty to update this information unless required by law. Forward looking statements. |

| The metals in our nodules were not made on Earth. The lightest metals—like lithium—formed minutes after the Big Bang. Heavier ones, like manganese, were forged in stars through nuclear fusion. But to make metals like cobalt, nickel, and copper, you need something more violent: a supernova. Only the energy of an exploding star can fuse atoms that heavy. These atoms drifted through space for billions of years before Earth existed. 3 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 3 25 Mn Manganese 54.938 28 Ni Nickel 58.693 27 Co Cobalt 58.933 29 Cu Copper 63.546 Cosmic origins of our metals. |

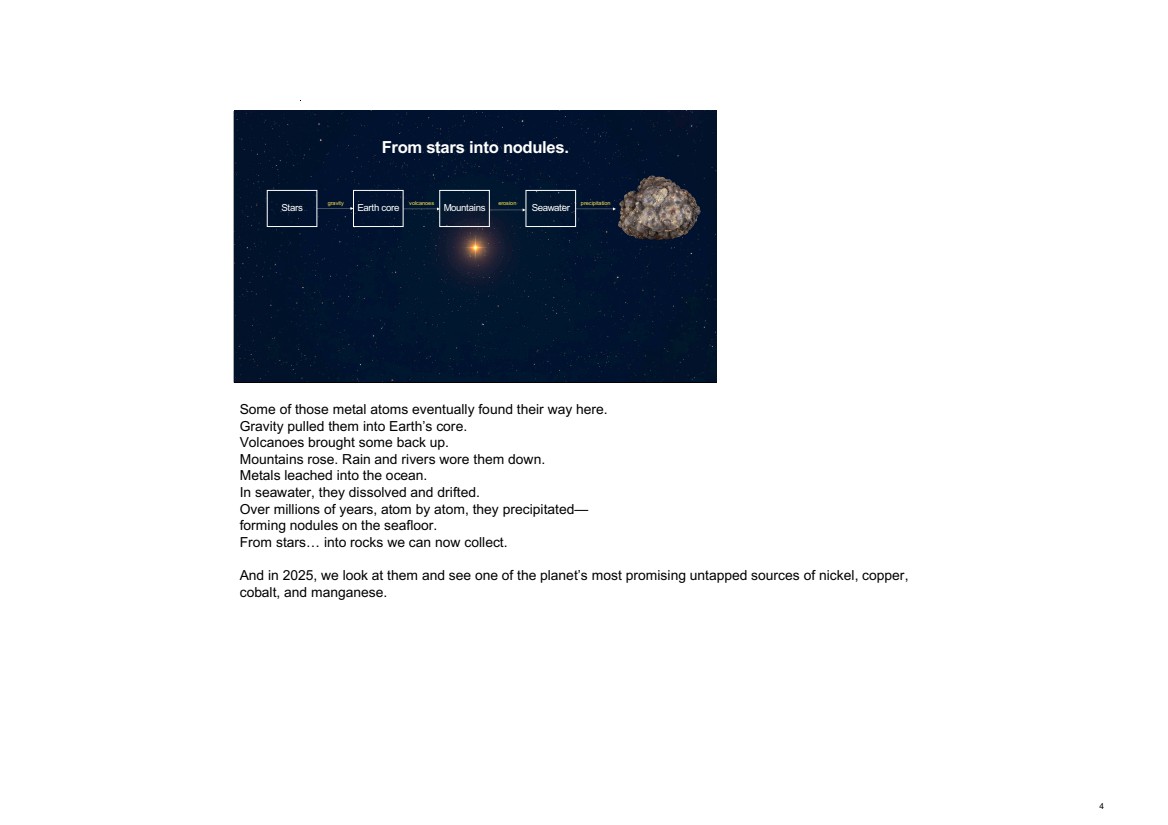

| Some of those metal atoms eventually found their way here. Gravity pulled them into Earth’s core. Volcanoes brought some back up. Mountains rose. Rain and rivers wore them down. Metals leached into the ocean. In seawater, they dissolved and drifted. Over millions of years, atom by atom, they precipitated— forming nodules on the seafloor. From stars… into rocks we can now collect. And in 2025, we look at them and see one of the planet’s most promising untapped sources of nickel, copper, cobalt, and manganese. 4 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 4 From stars into nodules. Stars Earth core Mountains Seawater gravity volcanoes erosion precipitation |

| This is where The Metals Company (TMC) enters this story. At TMC, our job is to recover these nodules, extract the metal, and put star-made metal to work in the technium. The technium is more than just technology—it’s the evolving system of tools, machines, infrastructure, and knowledge that shapes how we live. It’s not static. It’s built, changed and transformed. And it runs on our metals. By recovering and supplying these metals, we become the link between deep time and human ingenuity. 5 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 5 From nodules into technium. 25 Mn Manganese 54.938 28 Ni Nickel 58.693 27 Co Cobalt 58.933 29 Cu Copper 63.546 Technium …the sphere of visible technology and intangible organizations that form what we think of as modern culture. It is the most powerful force in our world today, and it is only just beginning. Kevin Kelly, What Technology Wants (2010) |

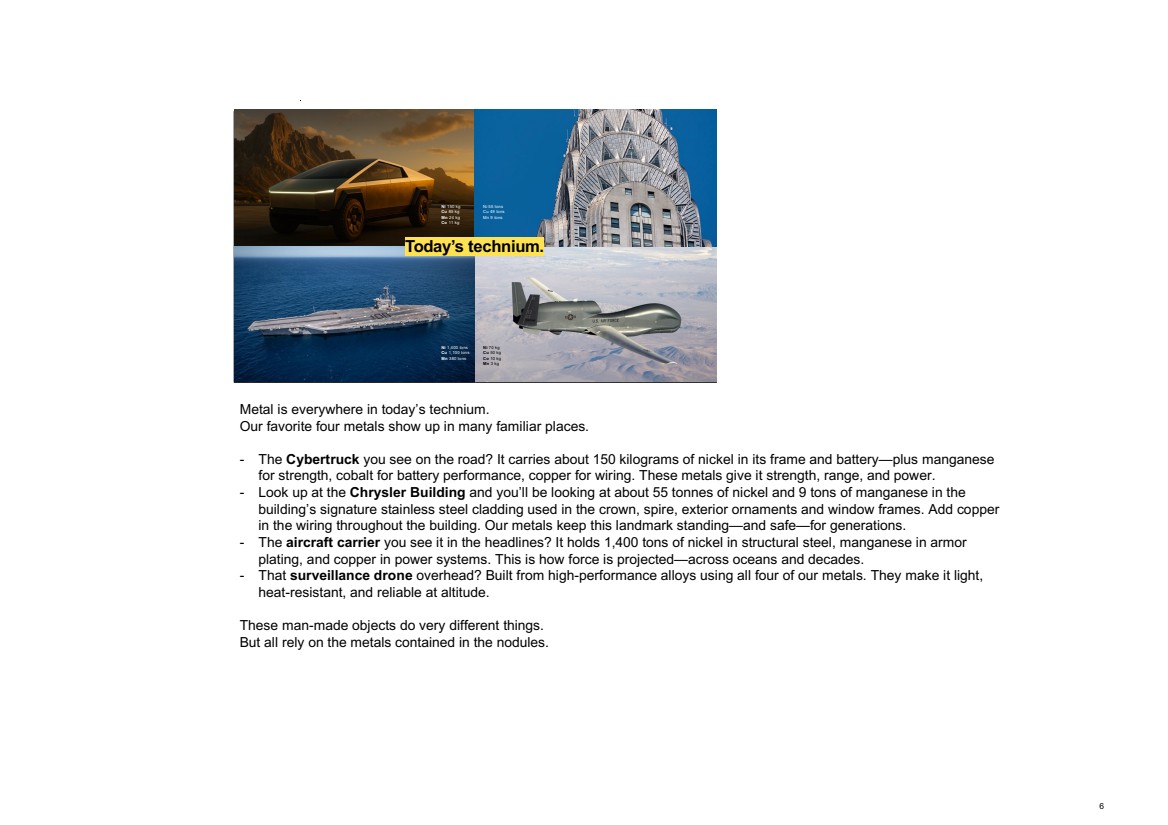

| Metal is everywhere in today’s technium. Our favorite four metals show up in many familiar places. - The Cybertruck you see on the road? It carries about 150 kilograms of nickel in its frame and battery—plus manganese for strength, cobalt for battery performance, copper for wiring. These metals give it strength, range, and power. - Look up at the Chrysler Building and you’ll be looking at about 55 tonnes of nickel and 9 tons of manganese in the building’s signature stainless steel cladding used in the crown, spire, exterior ornaments and window frames. Add copper in the wiring throughout the building. Our metals keep this landmark standing—and safe—for generations. - The aircraft carrier you see it in the headlines? It holds 1,400 tons of nickel in structural steel, manganese in armor plating, and copper in power systems. This is how force is projected—across oceans and decades. - That surveillance drone overhead? Built from high-performance alloys using all four of our metals. They make it light, heat-resistant, and reliable at altitude. These man-made objects do very different things. But all rely on the metals contained in the nodules. 6 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 6 Ni 150 kg Cu 85 kg Mn 24 kg Co 11 kg Ni 1,400 tons Cu 1,100 tons Mn 380 tons Ni 70 kg Cu 50 kg Co 10 kg Mn 3 kg Re-estimate with Grok Today’s technium. Ni 55 tons Cu 49 tons Mn 9 tons |

| We may not know exactly what tomorrow’s technium will look like. But we know it will demand more from the materials that shape it. - Tomorrow’s vehicles will be lighter, smarter, more electric. Built from stronger alloys and higher-performance batteries. Our metals could be in the frame, the drive unit, the energy core—and maybe even the software. - Intelligent robots will leave the lab and enter our industries, homes, and hospitals. Every actuator, circuit, and cooling system could rely on copper, nickel, cobalt, and manganese. These metals could make intelligence mobile. - Cities are changing, too. Adaptive buildings. Responsive infrastructure. Smarter grids. Future skylines could be built with the same four metals—in ways we’re only beginning to imagine. - Space colonization could become science fact. From launch vehicles to lunar and Martian infrastructure, space tech needs metals that can handle vacuum, heat, and vibration. Our metals could help. We may not know what tomorrow’s technium will look like. But we know what it could be made of. And we know where to find it. 7 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 7 Ni XXX kg Cu XX kg Mn XX kg Co XX kg Tomorrow’s technium. Ni XX kg Cu XX kg Mn XX kg Co XX kg Ni XXX kg Cu XX kg Mn XX kg Co XX kg Ni XXX kg Cu XX kg Mn XX kg Co XX kg |

| The beautiful thing about metal atoms is—they don’t wear out. They can be used, recovered, and reused. Again and again. That nickel inside your car could serve your great-grandchildren a hundred years from now. And theirs, a hundred years after that. Nature figured this out long ago. Nutrients cycle through living systems. We believe metals should do the same. That means treating base metals like we already treat precious metals—not as disposable, but as enduring. Because what’s truly precious isn’t the metal atom—it’s the cost of disturbing ecosystems and communities to get it. If we manage metal stocks carefully—once mined, forever useful—we can extend their value and limit the damage. Our technium won’t just grow blindly at people’s and nature’s expense. It would keep transforming through smart reuse and thoughtful extraction. 8 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 8 Our vision. Imagine this: A hundred years from now, our great-grandchildren using the same metal atoms inside today’s vehicles, factories, machines, and buildings. The same atoms, cycling through generations of tools and technologies. We envision a world where metals move through the technium like nutrients through a living system—used, recovered, reused again and again. Not for a decade. For millennia. |

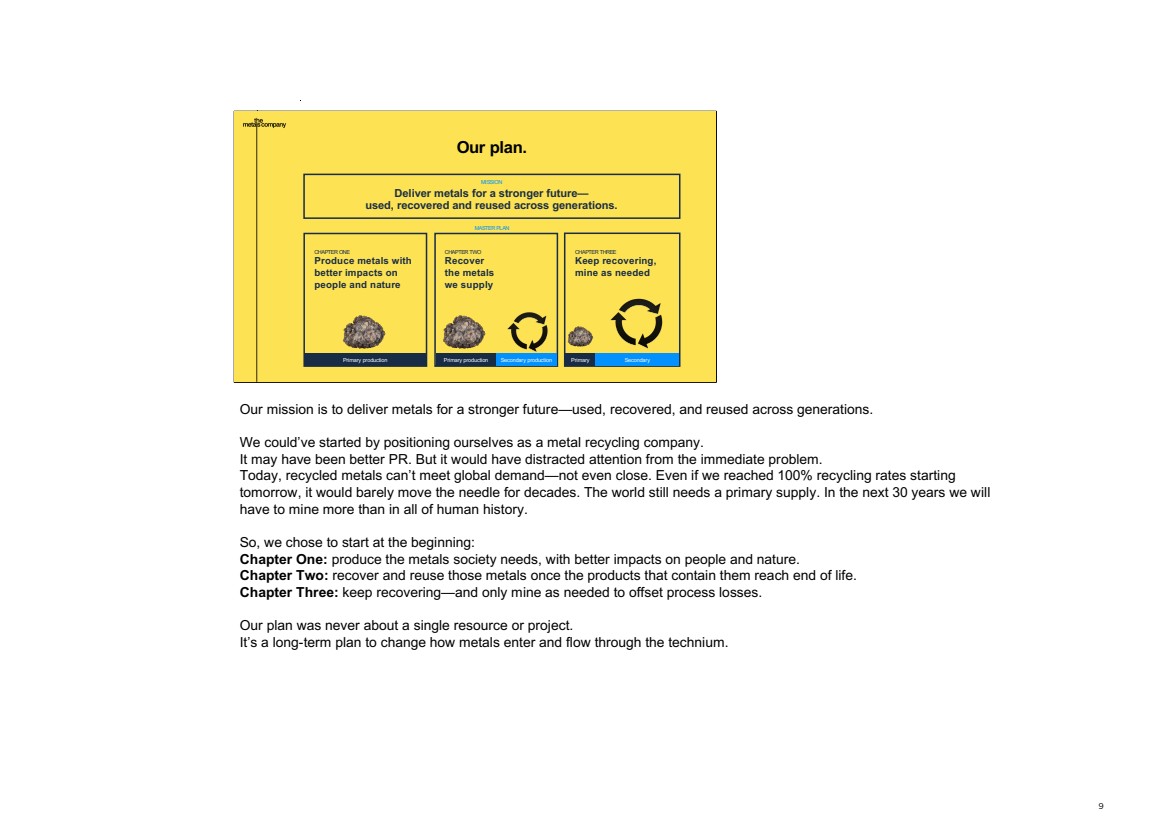

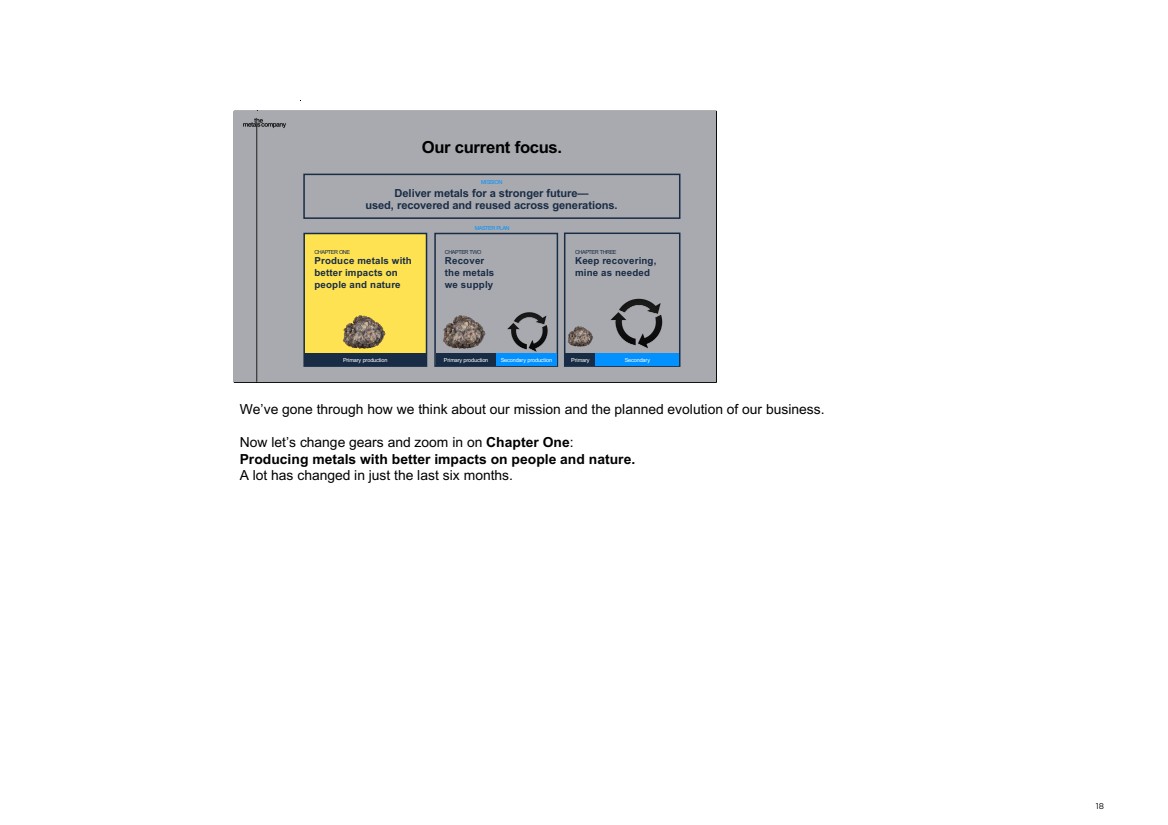

| Our mission is to deliver metals for a stronger future—used, recovered, and reused across generations. We could’ve started by positioning ourselves as a metal recycling company. It may have been better PR. But it would have distracted attention from the immediate problem. Today, recycled metals can’t meet global demand—not even close. Even if we reached 100% recycling rates starting tomorrow, it would barely move the needle for decades. The world still needs a primary supply. In the next 30 years we will have to mine more than in all of human history. So, we chose to start at the beginning: Chapter One: produce the metals society needs, with better impacts on people and nature. Chapter Two: recover and reuse those metals once the products that contain them reach end of life. Chapter Three: keep recovering—and only mine as needed to offset process losses. Our plan was never about a single resource or project. It’s a long-term plan to change how metals enter and flow through the technium. 9 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 9 CHAPTER ONE Produce metals with better impacts on people and nature CHAPTER TWO Recover the metals we supply CHAPTER THREE Keep recovering, mine as needed MISSION Deliver metals for a stronger future— used, recovered and reused across generations. MASTER PLAN Our plan. Primary production Primary production Secondary production Primary Secondary |

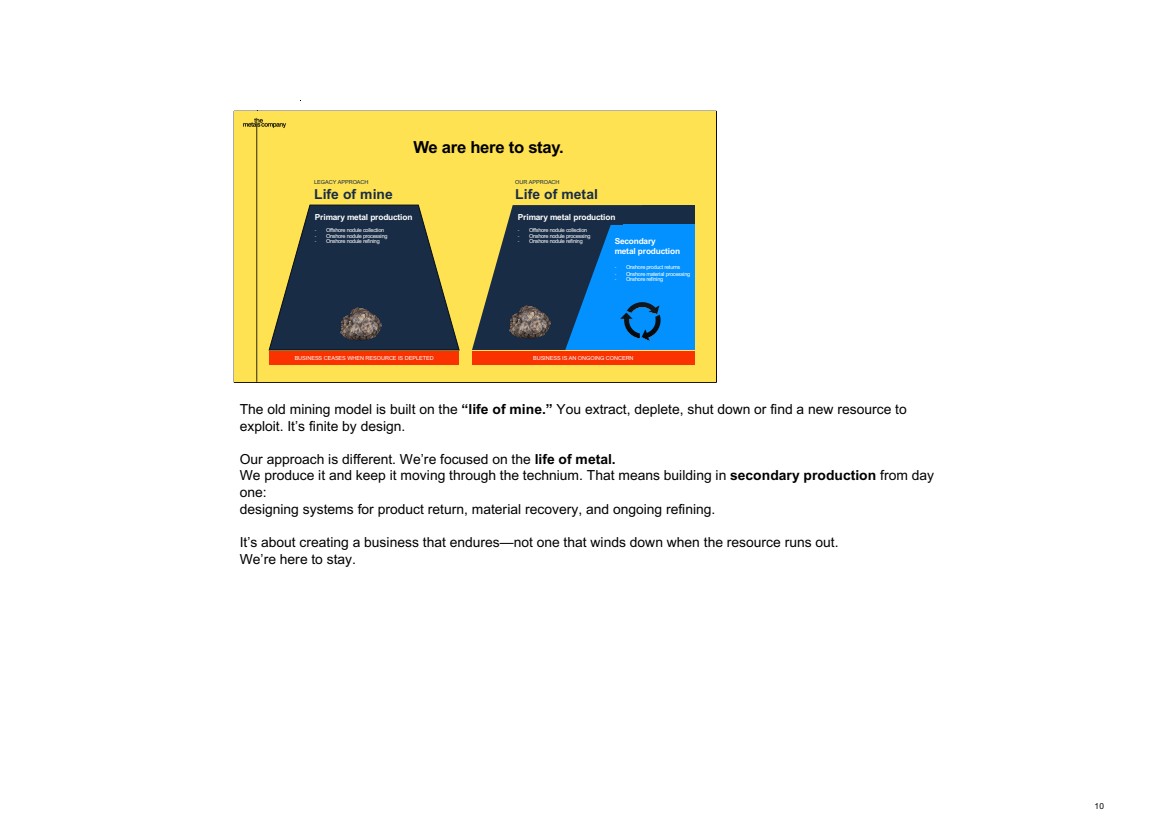

| The old mining model is built on the “life of mine.” You extract, deplete, shut down or find a new resource to exploit. It’s finite by design. Our approach is different. We’re focused on the life of metal. We produce it and keep it moving through the technium. That means building in secondary production from day one: designing systems for product return, material recovery, and ongoing refining. It’s about creating a business that endures—not one that winds down when the resource runs out. We’re here to stay. 10 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 10 We are here to stay. LEGACY APPROACH Life of mine OUR APPROACH Life of metal Primary metal production - Offshore nodule collection - Onshore nodule processing - Onshore nodule refining Secondary metal production - Onshore product returns - Onshore material processing - Onshore refining Primary metal production - Offshore nodule collection - Onshore nodule processing - Onshore nodule refining BUSINESS CEASES WHEN RESOURCE IS DEPLETED BUSINESS IS AN ONGOING CONCERN |

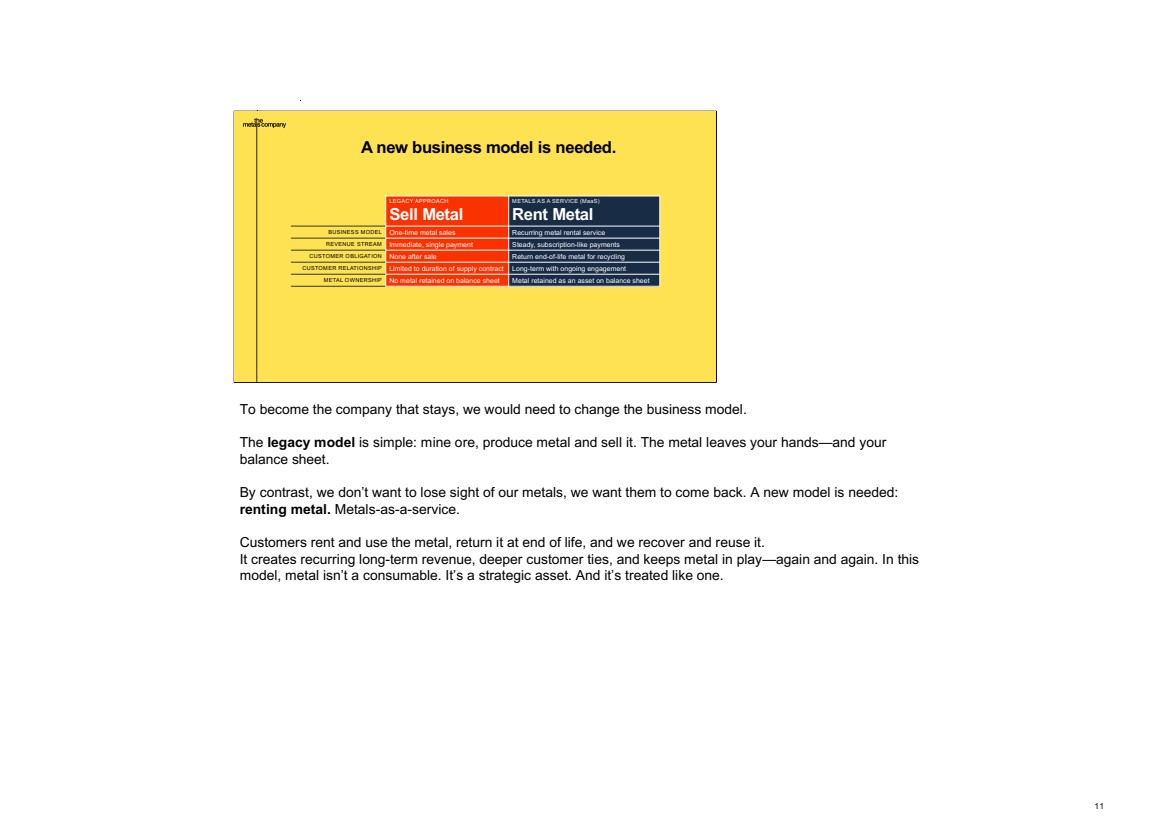

| To become the company that stays, we would need to change the business model. The legacy model is simple: mine ore, produce metal and sell it. The metal leaves your hands—and your balance sheet. By contrast, we don’t want to lose sight of our metals, we want them to come back. A new model is needed: renting metal. Metals-as-a-service. Customers rent and use the metal, return it at end of life, and we recover and reuse it. It creates recurring long-term revenue, deeper customer ties, and keeps metal in play—again and again. In this model, metal isn’t a consumable. It’s a strategic asset. And it’s treated like one. 11 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 11 A new business model is needed. LEGACY APPROACH Sell Metal METALS AS A SERVICE (MaaS) Rent Metal BUSINESS MODEL One-time metal sales Recurring metal rental service REVENUE STREAM Immediate, single payment Steady, subscription-like payments CUSTOMER OBLIGATION None after sale Return end-of-life metal for recycling CUSTOMER RELATIONSHIP Limited to duration of supply contract Long-term with ongoing engagement METAL OWNERSHIP No metal retained on balance sheet Metal retained as an asset on balance sheet |

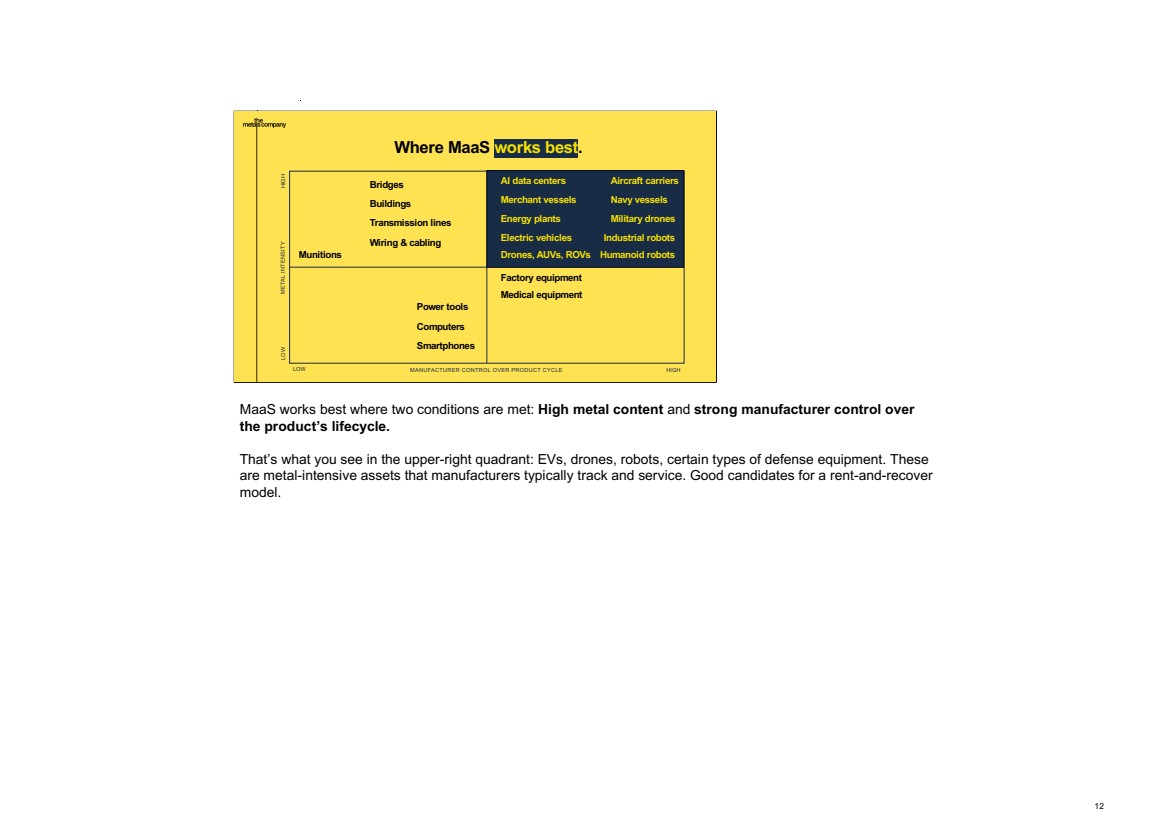

| MaaS works best where two conditions are met: High metal content and strong manufacturer control over the product’s lifecycle. That’s what you see in the upper-right quadrant: EVs, drones, robots, certain types of defense equipment. These are metal-intensive assets that manufacturers typically track and service. Good candidates for a rent-and-recover model. 12 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 12 Where MaaS works best. LOW MANUFACTURER CONTROL OVER PRODUCT CYCLE HIGH METAL INTENSITY LOW HIGH Smartphones Computers Bridges Buildings Electric vehicles AI data centers Drones, AUVs, ROVs Humanoid robots Aircraft carriers Transmission lines Wiring & cabling Military drones Merchant vessels Navy vessels Energy plants Industrial robots Medical equipment Power tools Munitions Factory equipment |

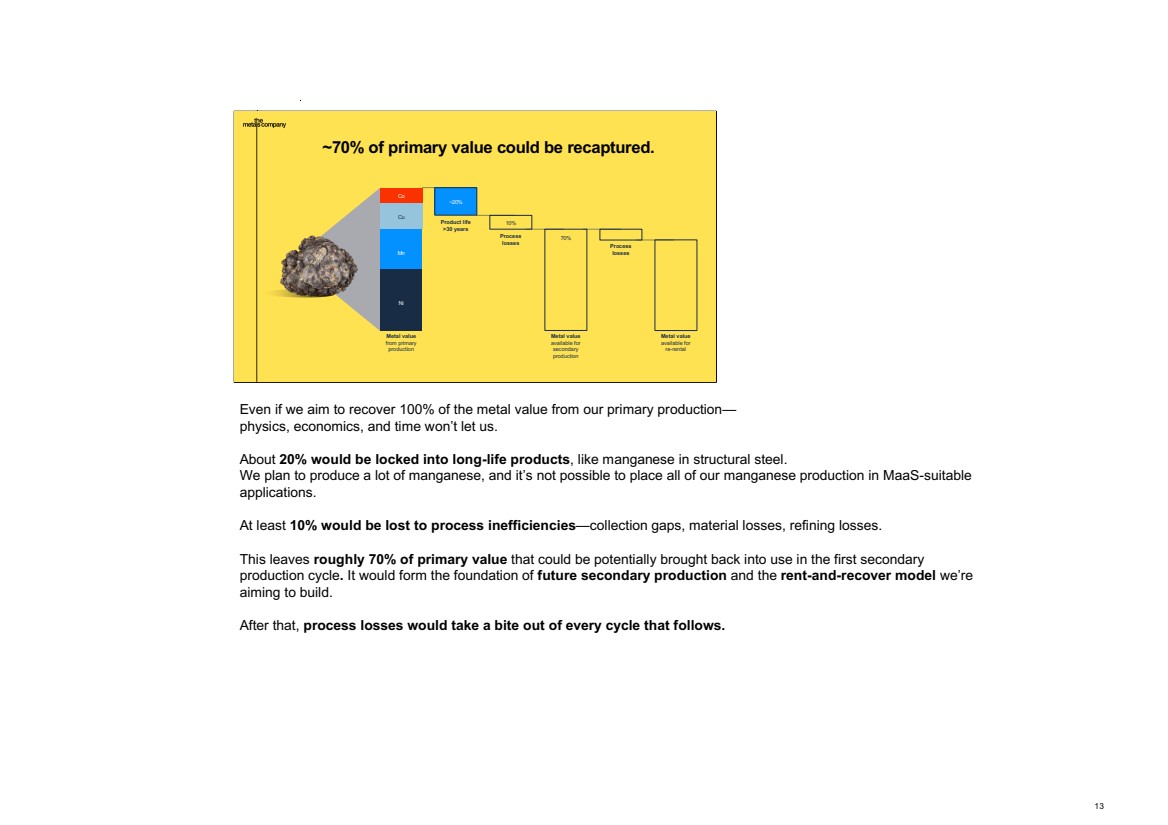

| Even if we aim to recover 100% of the metal value from our primary production— physics, economics, and time won’t let us. About 20% would be locked into long-life products, like manganese in structural steel. We plan to produce a lot of manganese, and it’s not possible to place all of our manganese production in MaaS-suitable applications. At least 10% would be lost to process inefficiencies—collection gaps, material losses, refining losses. This leaves roughly 70% of primary value that could be potentially brought back into use in the first secondary production cycle. It would form the foundation of future secondary production and the rent-and-recover model we’re aiming to build. After that, process losses would take a bite out of every cycle that follows. 13 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 13 ~70% of primary value could be recaptured. Product life >30 years Mn Co Cu Ni Metal value from primary production Metal value available for secondary production 10% Process losses 70% ~20% Assuming - all of Ni, Co & Cu goes into an EV - 93% of Mn mass goes into Mn silicate ($500/t of Mn contained) and 7% of Mn mass goes into battery grade Mn sulfate ($3,080-6,160/t of Mn contained) PFS: $595/dt Ni 268 Mn 167 (28%) Cu 101 Co 54 Modified: $718/dt Ni 268 Mn 155 (21%) – Mn silicate Mn 140 – Mn sulfate (x12 revenue vs Mn silicate) Cu 101 Co 54 Metal value available for re-rental Process losses |

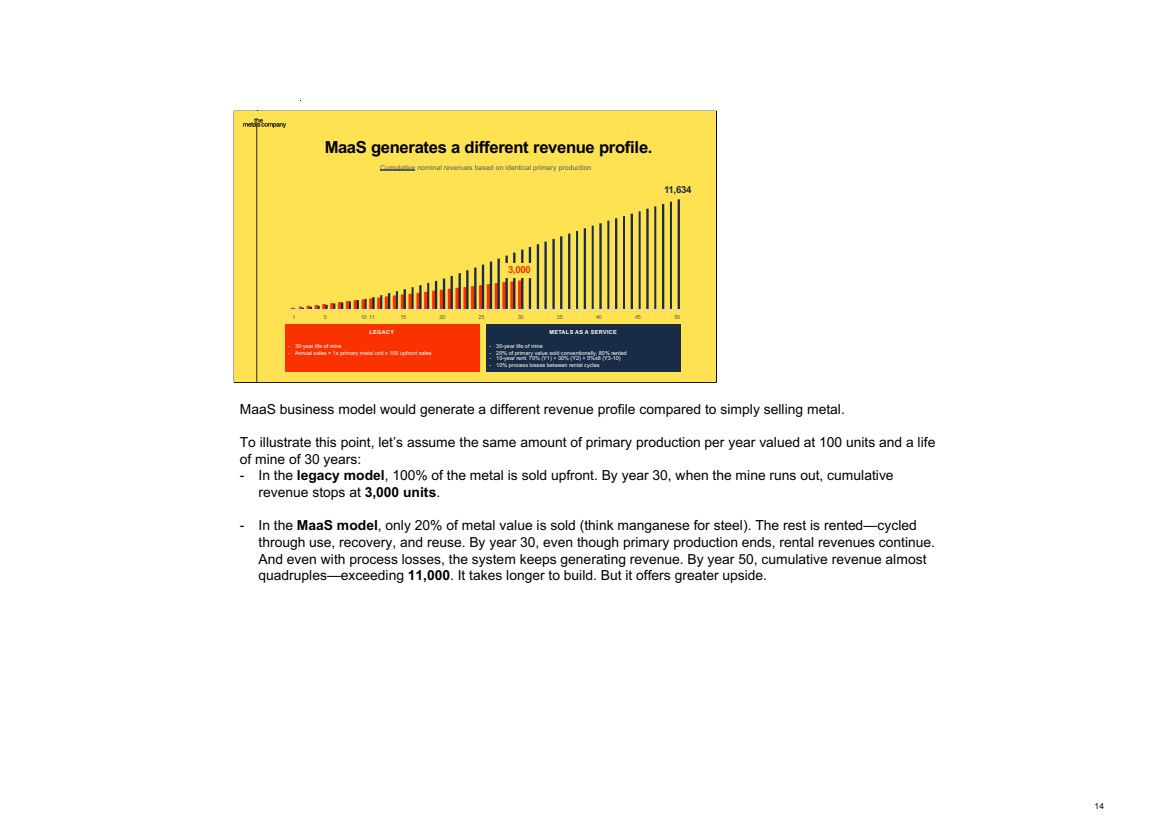

| MaaS business model would generate a different revenue profile compared to simply selling metal. To illustrate this point, let’s assume the same amount of primary production per year valued at 100 units and a life of mine of 30 years: - In the legacy model, 100% of the metal is sold upfront. By year 30, when the mine runs out, cumulative revenue stops at 3,000 units. - In the MaaS model, only 20% of metal value is sold (think manganese for steel). The rest is rented—cycled through use, recovery, and reuse. By year 30, even though primary production ends, rental revenues continue. And even with process losses, the system keeps generating revenue. By year 50, cumulative revenue almost quadruples—exceeding 11,000. It takes longer to build. But it offers greater upside. 14 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 14 MaaS generates a different revenue profile. 1 5 10 11 15 20 25 30 35 40 45 50 Cumulative nominal revenues based on identical primary production LEGACY - 30-year life of mine - Annual sales = 1x primary metal unit x 100 upfront sales METALS AS A SERVICE - 30-year life of mine - 20% of primary value sold conventionally, 80% rented - 10-year rent: 70% (Y1) + 30% (Y2) + 5%x8 (Y3-10) - 10% process losses between rental cycles 11,634 3,000 |

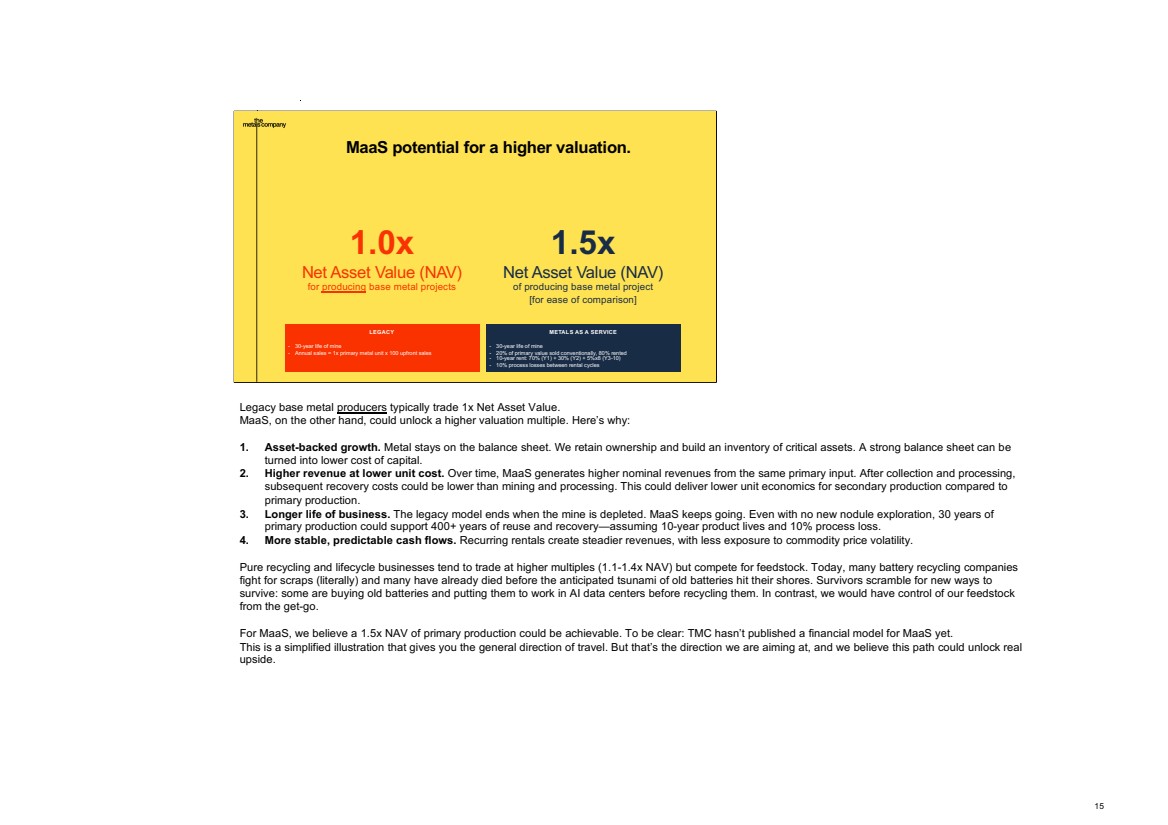

| Legacy base metal producers typically trade 1x Net Asset Value. MaaS, on the other hand, could unlock a higher valuation multiple. Here’s why: 1. Asset-backed growth. Metal stays on the balance sheet. We retain ownership and build an inventory of critical assets. A strong balance sheet can be turned into lower cost of capital. 2. Higher revenue at lower unit cost. Over time, MaaS generates higher nominal revenues from the same primary input. After collection and processing, subsequent recovery costs could be lower than mining and processing. This could deliver lower unit economics for secondary production compared to primary production. 3. Longer life of business. The legacy model ends when the mine is depleted. MaaS keeps going. Even with no new nodule exploration, 30 years of primary production could support 400+ years of reuse and recovery—assuming 10-year product lives and 10% process loss. 4. More stable, predictable cash flows. Recurring rentals create steadier revenues, with less exposure to commodity price volatility. Pure recycling and lifecycle businesses tend to trade at higher multiples (1.1-1.4x NAV) but compete for feedstock. Today, many battery recycling companies fight for scraps (literally) and many have already died before the anticipated tsunami of old batteries hit their shores. Survivors scramble for new ways to survive: some are buying old batteries and putting them to work in AI data centers before recycling them. In contrast, we would have control of our feedstock from the get-go. For MaaS, we believe a 1.5x NAV of primary production could be achievable. To be clear: TMC hasn’t published a financial model for MaaS yet. This is a simplified illustration that gives you the general direction of travel. But that’s the direction we are aiming at, and we believe this path could unlock real upside. 15 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 15 MaaS potential for a higher valuation. LEGACY - 30-year life of mine - Annual sales = 1x primary metal unit x 100 upfront sales METALS AS A SERVICE - 30-year life of mine - 20% of primary value sold conventionally, 80% rented - 10-year rent: 70% (Y1) + 30% (Y2) + 5%x8 (Y3-10) - 10% process losses between rental cycles 1.0x Net Asset Value (NAV) for producing base metal projects 1.5x Net Asset Value (NAV) of producing base metal project [for ease of comparison] The case for 1.5x NAV multiple for MaaS - The 50-year NPV(8%) is 1.85x higher than for Legacy (2,091 vs 1,126) - Additional CAPEX is likely marginal as the same refining facilities could be re-used – albeit production volumes would need an adjustment, pulling down the revenue - MaaS OPEX for primary production is the same but likely lower for secondary production as it is unlikely that the unit cost of collecting and disassembly of end-of-life products is higher than collecting, transporting and primary processing of nodules. - Multiple is applied to the NAV of primary production, not NAV of MaaS model > smaller base calls for higher multiple If we believed that (1) OPEX for primary production and for secondary production is equal and (2) cumulative MaaS revenue is lower to match the refining capacity of the primary production, we believe 1.5x for MaaS is justified. |

| MaaS model requires vertical integration. Our goal is to minimize the distance between us and the manufacturers of end-use products. Ideally, we take our nickel, cobalt, copper—and some manganese—all the way to precursor Cathode Active Materials, or pCAM. Many pCAM customers are themselves vertically integrating into CAM, batteries, and battery-powered products. They also tend to maintain control over their product life cycles—which is critical for return, recovery, and reuse. Most of our manganese by mass would end up in structural steel and remain locked away for decades. That value chain (highlighted in red) is not well-suited to MaaS, and we are not aiming to vertically integrate there. But we do see potential in higher-value manganese pathways—like converting our manganese silicate into manganese metal or manganese sulfate. These pathways offer both higher margins and the possibility of future reuse. Our refining facilities would need to be designed to maximize optionality—produce multiple product formats but also take in multiple feedstocks (including not only nodule-derived materials and black mass from the batteries we supplied but also other intermediates and black mass from end-of-life batteries we did not supply). This way we could capture additional metals into our MaaS model but also withstand any disruptions in nodule collection and processing or collection and return of end-of-life products made with our metals. Vertical integration will give us more control, more value capture, and the infrastructure we need to keep metals in circulation through many cycles. It’s the foundation of MaaS. 16 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 16 Vertical integration is the way. EXPLORATION Value chain NODULE COLLECTION & TRANSPORT INTERMEDIATE REFINING SILICO MANGANESE SMELTING MANGANESE SULFATE PRODUCTION PCAM PRODUCTION SPECIALTY ALLOYS STEEL PRODUCTION CAM / BATTERY / PRODUCT SPECIALTY PRODUCTS STEEL SCRAP RECYCLING END OF LIFE COLLECTION & DISASSEMBLY NODULE PROCESSING OFFSHORE ONSHORE |

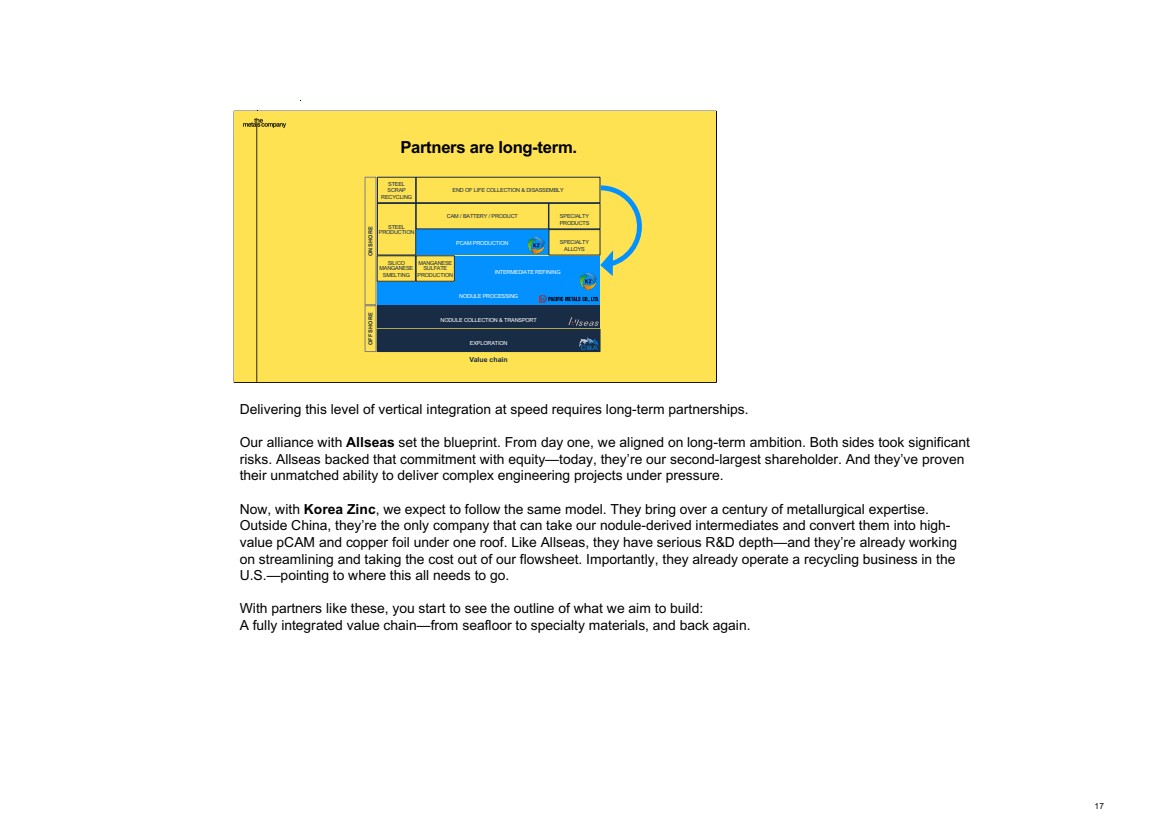

| Delivering this level of vertical integration at speed requires long-term partnerships. Our alliance with Allseas set the blueprint. From day one, we aligned on long-term ambition. Both sides took significant risks. Allseas backed that commitment with equity—today, they’re our second-largest shareholder. And they’ve proven their unmatched ability to deliver complex engineering projects under pressure. Now, with Korea Zinc, we expect to follow the same model. They bring over a century of metallurgical expertise. Outside China, they’re the only company that can take our nodule-derived intermediates and convert them into high-value pCAM and copper foil under one roof. Like Allseas, they have serious R&D depth—and they’re already working on streamlining and taking the cost out of our flowsheet. Importantly, they already operate a recycling business in the U.S.—pointing to where this all needs to go. With partners like these, you start to see the outline of what we aim to build: A fully integrated value chain—from seafloor to specialty materials, and back again. 17 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 17 Partners are long-term. EXPLORATION NODULE COLLECTION & TRANSPORT INTERMEDIATE REFINING SILICO MANGANESE SMELTING MANGANESE SULFATE PRODUCTION PCAM PRODUCTION SPECIALTY ALLOYS STEEL PRODUCTION CAM / BATTERY / PRODUCT SPECIALTY PRODUCTS STEEL SCRAP RECYCLING END OF LIFE COLLECTION & DISASSEMBLY NODULE PROCESSING Value chain OFFSHORE ONSHORE |

| We’ve gone through how we think about our mission and the planned evolution of our business. Now let’s change gears and zoom in on Chapter One: Producing metals with better impacts on people and nature. A lot has changed in just the last six months. 18 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 18 CHAPTER TWO Recover the metals we supply CHAPTER THREE Keep recovering, mine as needed MISSION Deliver metals for a stronger future— used, recovered and reused across generations. MASTER PLAN Our current focus. Primary production Primary production Secondary production Primary Secondary CHAPTER ONE Produce metals with better impacts on people and nature |

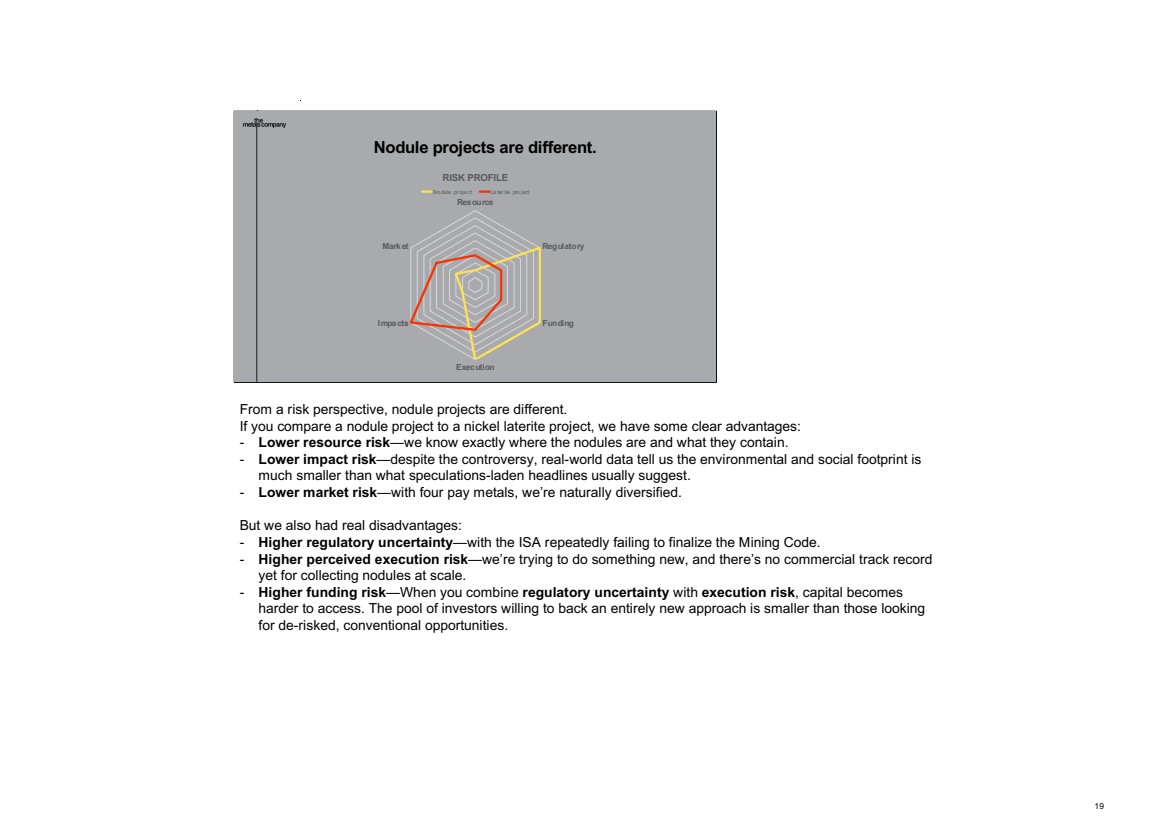

| From a risk perspective, nodule projects are different. If you compare a nodule project to a nickel laterite project, we have some clear advantages: - Lower resource risk—we know exactly where the nodules are and what they contain. - Lower impact risk—despite the controversy, real-world data tell us the environmental and social footprint is much smaller than what speculations-laden headlines usually suggest. - Lower market risk—with four pay metals, we’re naturally diversified. But we also had real disadvantages: - Higher regulatory uncertainty—with the ISA repeatedly failing to finalize the Mining Code. - Higher perceived execution risk—we’re trying to do something new, and there’s no commercial track record yet for collecting nodules at scale. - Higher funding risk—When you combine regulatory uncertainty with execution risk, capital becomes harder to access. The pool of investors willing to back an entirely new approach is smaller than those looking for de-risked, conventional opportunities. 19 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 19 Nodule projects are different. Resource Regulatory Funding Execution Impacts Market RISK PROFILE No dule pr oje ct La ter ite pro ject |

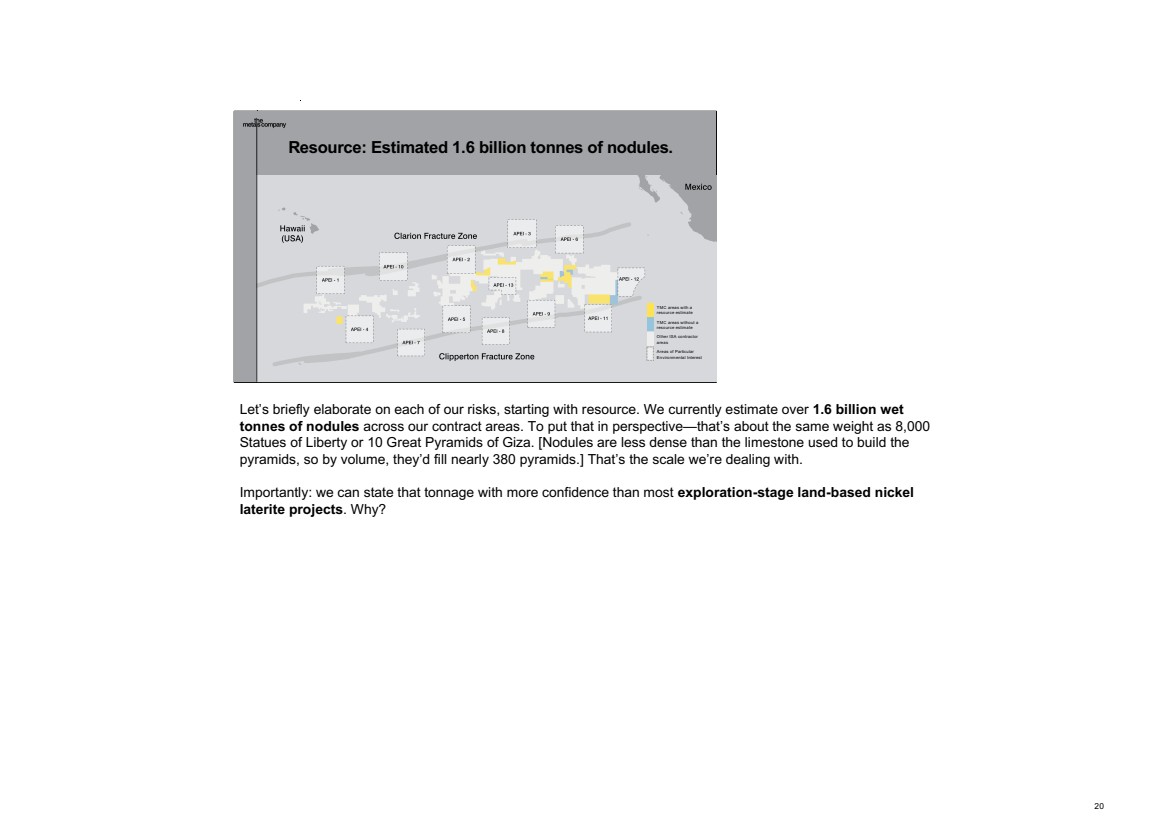

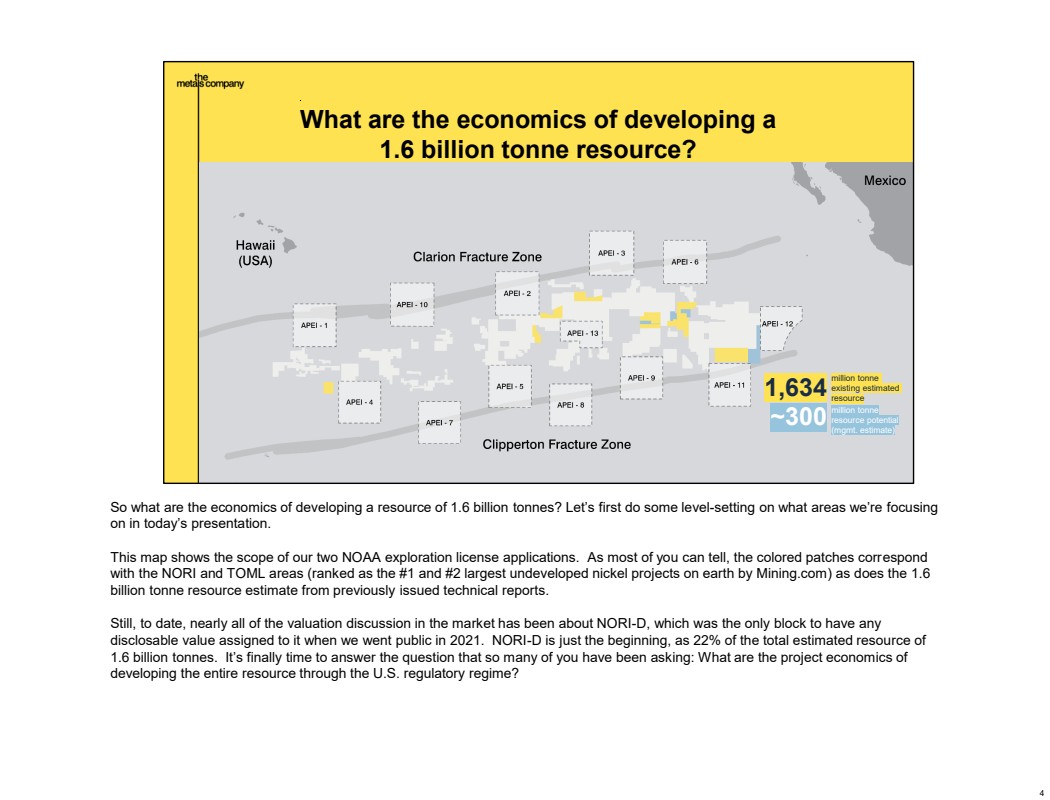

| Let’s briefly elaborate on each of our risks, starting with resource. We currently estimate over 1.6 billion wet tonnes of nodules across our contract areas. To put that in perspective—that’s about the same weight as 8,000 Statues of Liberty or 10 Great Pyramids of Giza. [Nodules are less dense than the limestone used to build the pyramids, so by volume, they’d fill nearly 380 pyramids.] That’s the scale we’re dealing with. Importantly: we can state that tonnage with more confidence than most exploration-stage land-based nickel laterite projects. Why? 20 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 20 Resource: Estimated 1.6 billion tonnes of nodules. * Exact savings depends on whether the ISA approves of the approach outlined in TOML Scoping Report Source: TMC analysis TMC areas with a resource estimate TMC areas without a resource estimate Other ISA contractor areas Areas of Particular Environmental Interest |

| Unlike most land-based mining ventures, we can see our resource. Over the past 15 years, we’ve assembled a large dataset. - We’ve mapped nearly 180,000 square kilometers of the seafloor in high-resolution. That’s roughly the size of Washington state. - We’ve also captured more than 5,000 square kilometers of detailed seafloor imagery—that’s about twice the size of Delaware. - We have collected 250 box cores and brought about 3,100 tonnes of nodules to the surface. That’s not theoretical modelling—it’s physical, visible, and verifiable. This is why we can speak with such confidence about the size and quality of our resource. 21 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 2121 We can see it. Source: SEC Regulation S-K (Subpart 1300) Compliant NORI Area D Clarion Clipperton Zone Mineral Resource Estimate, AMC, March 2021; DeepOcean NORI – D Bulk Sampling Report, 2020; NORI Test Mining Report, 2024. 178,591 km2 of high-res bathymetric survey 4,498 Line km of detailed seafloor imagery 415 box cores collected 3,100 tonnes of wet nodules collected and brought ashore |

| Polymetallic nodules pack four metals in a single rock. On land, producing this mix of metals typically requires at least three different mines. Because these nodules form over millions of years through metal precipitation from seawater, their composition is remarkably consistent. You could travel for many miles and still find almost identical metal grades. That level of homogeneity is unheard of in land-based deposits. 22 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 2222 29 Cu Copper 63.546 28 Ni Nickel 58.693 27 Co Cobalt 58.933 25 Mn Manganese 54.938 Four metals in one ore, low variability. |

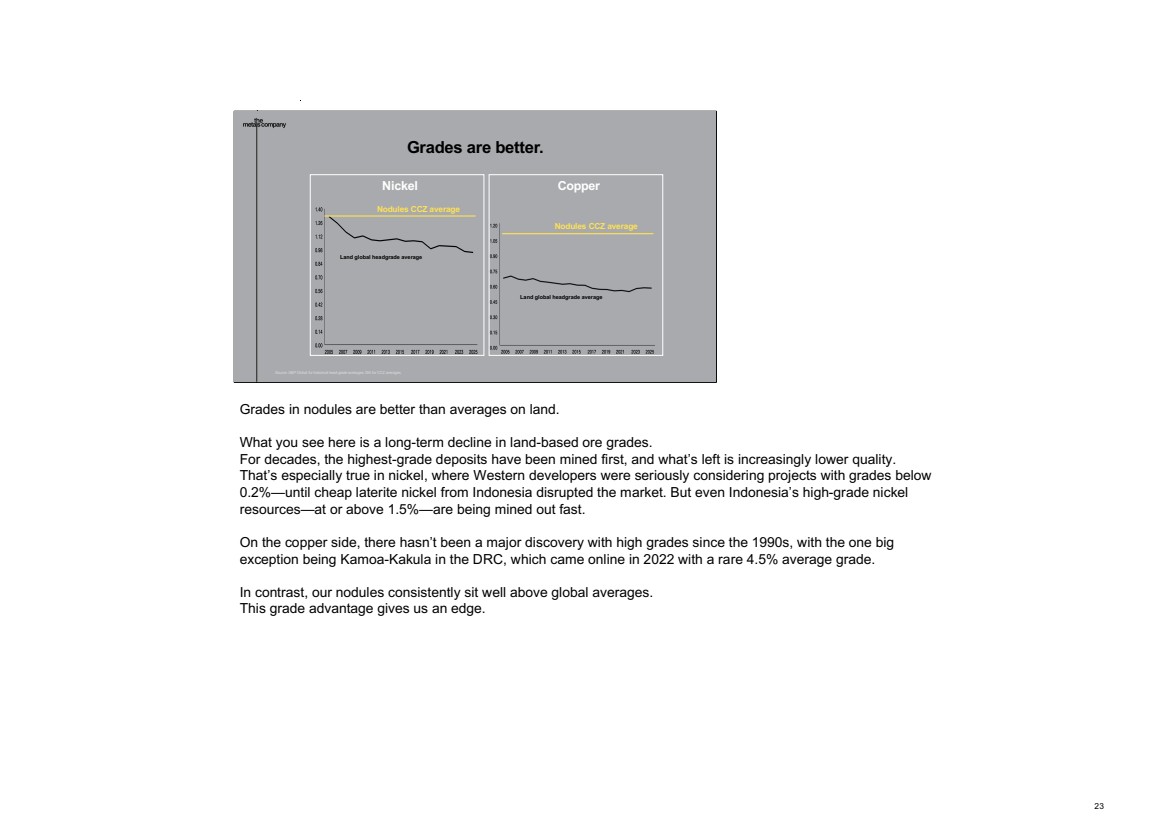

| Grades in nodules are better than averages on land. What you see here is a long-term decline in land-based ore grades. For decades, the highest-grade deposits have been mined first, and what’s left is increasingly lower quality. That’s especially true in nickel, where Western developers were seriously considering projects with grades below 0.2%—until cheap laterite nickel from Indonesia disrupted the market. But even Indonesia’s high-grade nickel resources—at or above 1.5%—are being mined out fast. On the copper side, there hasn’t been a major discovery with high grades since the 1990s, with the one big exception being Kamoa-Kakula in the DRC, which came online in 2022 with a rare 4.5% average grade. In contrast, our nodules consistently sit well above global averages. This grade advantage gives us an edge. 23 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 23 Nickel Copper Land global headgrade average Nodules CCZ average Land global headgrade average Nodules CCZ average Grades are better. Source: S&P Global for historical head-grade averages; ISA for CCZ averages. |

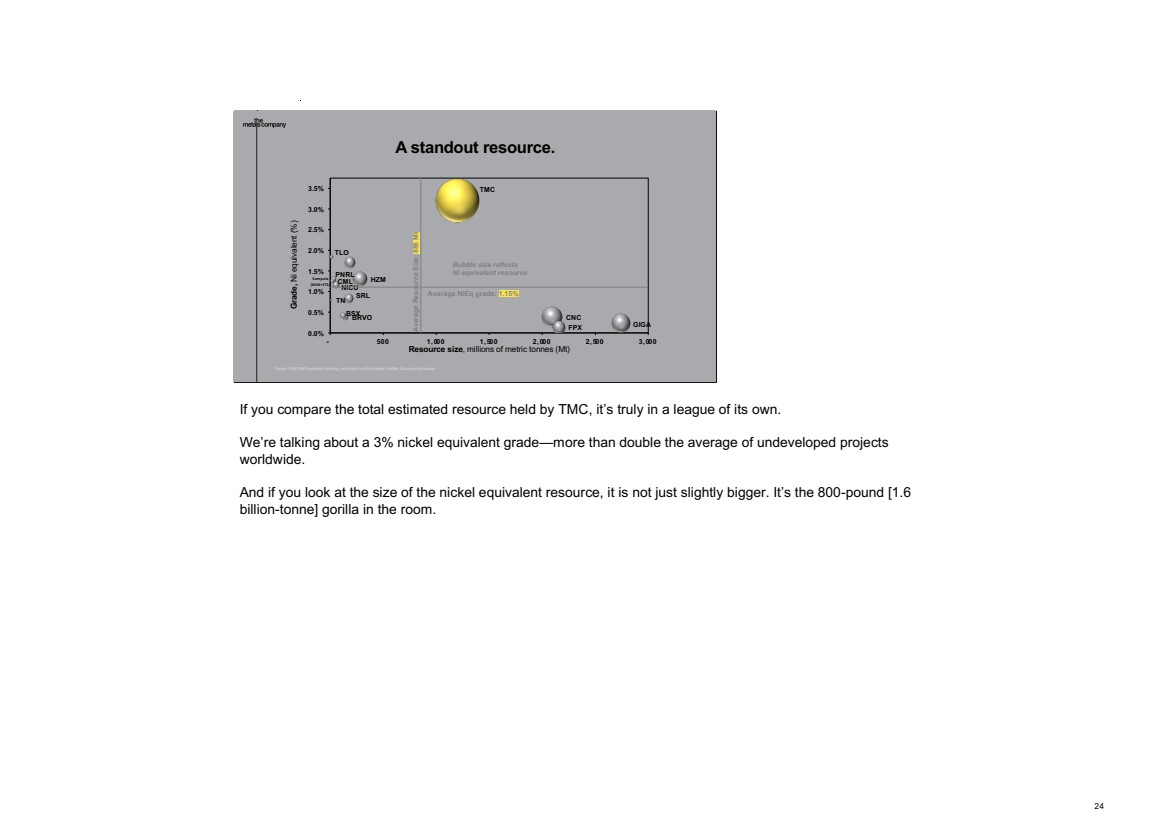

| If you compare the total estimated resource held by TMC, it’s truly in a league of its own. We’re talking about a 3% nickel equivalent grade—more than double the average of undeveloped projects worldwide. And if you look at the size of the nickel equivalent resource, it is not just slightly bigger. It’s the 800-pound [1.6 billion-tonne] gorilla in the room. 24 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 24 HZM TLO BRVO CNC PNRL SRL FPX NICU BSX GIGA TN CML 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% - 500 1,000 1,500 2,000 2,500 3,000 Grade, Ni equivalent (%) Resource size, millions of metric tonnes (Mt) Sampala (MJN+ETL) Average NiEq grade: 1.15% Average Resource Size: 886 Mt TMC Bubble size reflects Ni equivalent resource Source: Stifel GMP investment banking, using data from Bloomberg, FactSet, Company disclosures. A standout resource. |

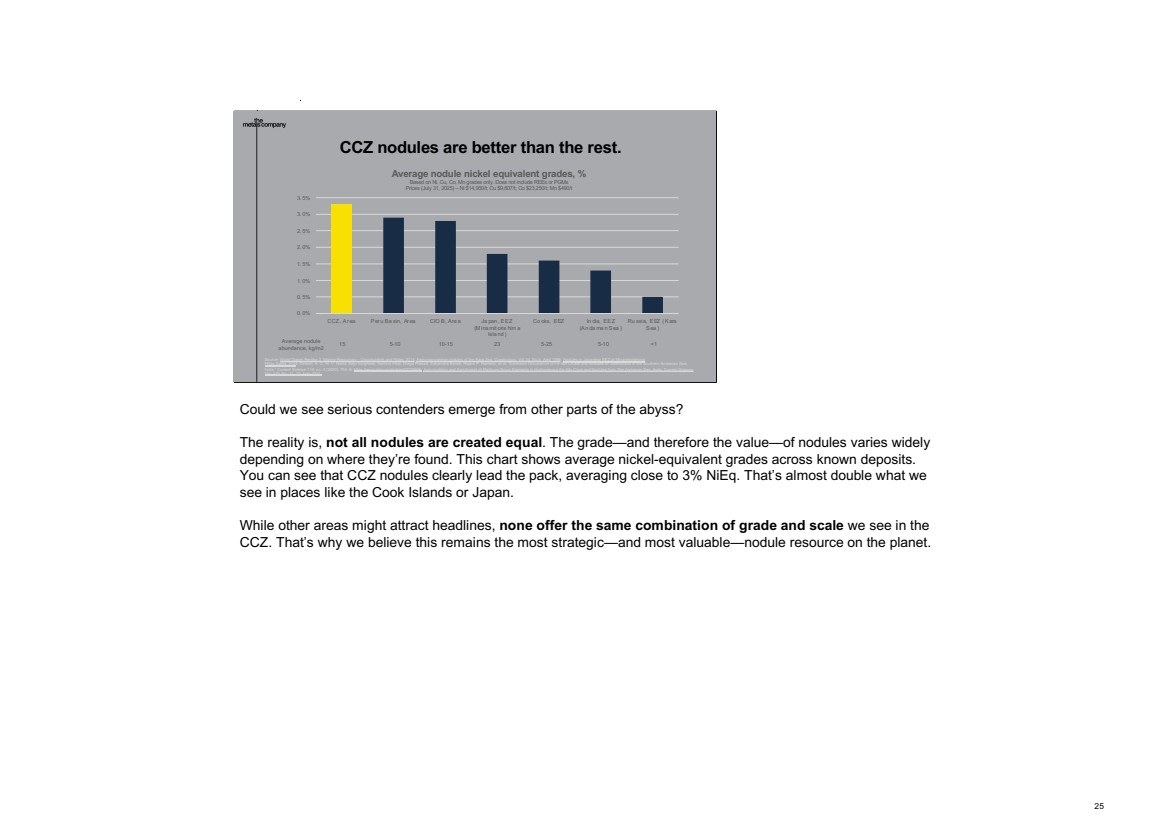

| Could we see serious contenders emerge from other parts of the abyss? The reality is, not all nodules are created equal. The grade—and therefore the value—of nodules varies widely depending on where they’re found. This chart shows average nickel-equivalent grades across known deposits. You can see that CCZ nodules clearly lead the pack, averaging close to 3% NiEq. That’s almost double what we see in places like the Cook Islands or Japan. While other areas might attract headlines, none offer the same combination of grade and scale we see in the CCZ. That’s why we believe this remains the most strategic—and most valuable—nodule resource on the planet. 25 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 25 CCZ nodules are better than the rest. Source: World Ocean Review 3, Marine Resources – Opportunities and Risks, 2014; Ferromanganese nodules of the Kara Sea, Oceanology, Vol 34, No.5, April 1995; Nodules in Japanese EEZ at Minamitorishima, Philip Gales, 2024; Dinesh, A. C., N. V. Nisha, Saju Varghese, Rachna Pillai, Durga Prasad, Satyendra Baraik, Rajani P. Ramesh, et al. “Extensive Occurrence of Fe–Mn Crusts and Nodules on Seamounts in the Southern Andaman Sea, India.” Current Science 119, no. 4 (2020): 704–8. https://www.jstor.org/stable/27229906; Accumulation and Enrichment of Platinum Group Elements in Hydrogenous Fe–Mn Crust and Nodules from The Andaman Sea, India, Current Science, Vol. 120, No. 11, 10 June 2021. 0. 0% 0. 5% 1. 0% 1. 5% 2. 0% 2. 5% 3. 0% 3. 5% CCZ , Ar ea Per u Ba sin, Ar ea CIO B, Are a Ja pan , EEZ (M ina mit oris him a Isla nd ) Co oks, EEZ In dia, EEZ (An da ma n Sea ) Ru ssia, EEZ ( Kara Sea ) Average nodule nickel equivalent grades, % Based on Ni, Cu, Co, Mn grades only. Does not include REEs or PGMs Prices (July 31, 2025) – Ni $14,950/t; Cu $9,607/t; Co $23,250/t; Mn $490/t 15 5-10 5-10 Average nodule abundance, kg/m2 10-15 23 5-25 <1 |

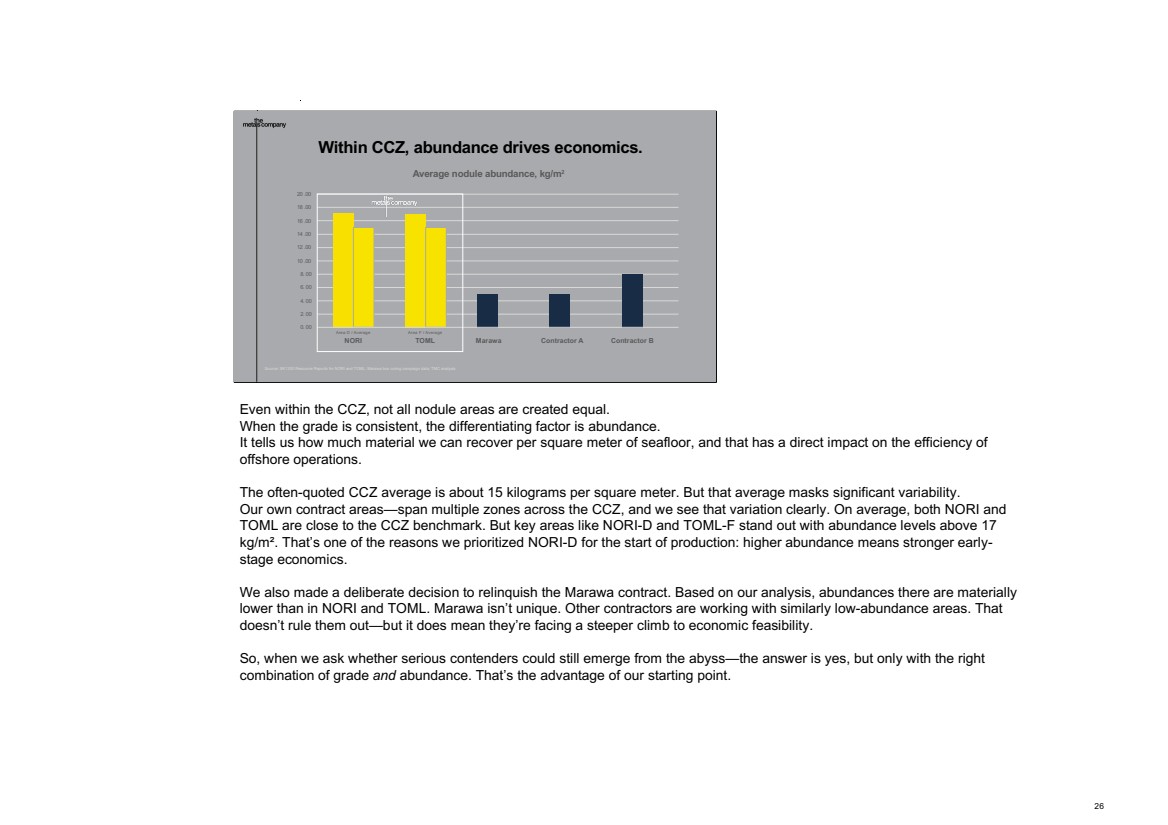

| Even within the CCZ, not all nodule areas are created equal. When the grade is consistent, the differentiating factor is abundance. It tells us how much material we can recover per square meter of seafloor, and that has a direct impact on the efficiency of offshore operations. The often-quoted CCZ average is about 15 kilograms per square meter. But that average masks significant variability. Our own contract areas—span multiple zones across the CCZ, and we see that variation clearly. On average, both NORI and TOML are close to the CCZ benchmark. But key areas like NORI-D and TOML-F stand out with abundance levels above 17 kg/m². That’s one of the reasons we prioritized NORI-D for the start of production: higher abundance means stronger early-stage economics. We also made a deliberate decision to relinquish the Marawa contract. Based on our analysis, abundances there are materially lower than in NORI and TOML. Marawa isn’t unique. Other contractors are working with similarly low-abundance areas. That doesn’t rule them out—but it does mean they’re facing a steeper climb to economic feasibility. So, when we ask whether serious contenders could still emerge from the abyss—the answer is yes, but only with the right combination of grade and abundance. That’s the advantage of our starting point. 26 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 26 Within CCZ, abundance drives economics. Source: SK1300 Resource Reports for NORI and TOML; Marawa box coring campaign data; TMC analysis 0. 00 2. 00 4. 00 6. 00 8. 00 10 .00 12 .00 14 .00 16 .00 18 .00 20 .00 NOR I-D T OM L- F M arawa Co nt ract or A Co nt ract or B Average nodule abundance, kg/m2 Area D / Average NORI Area F / Average TOML Marawa Contractor A Contractor B |

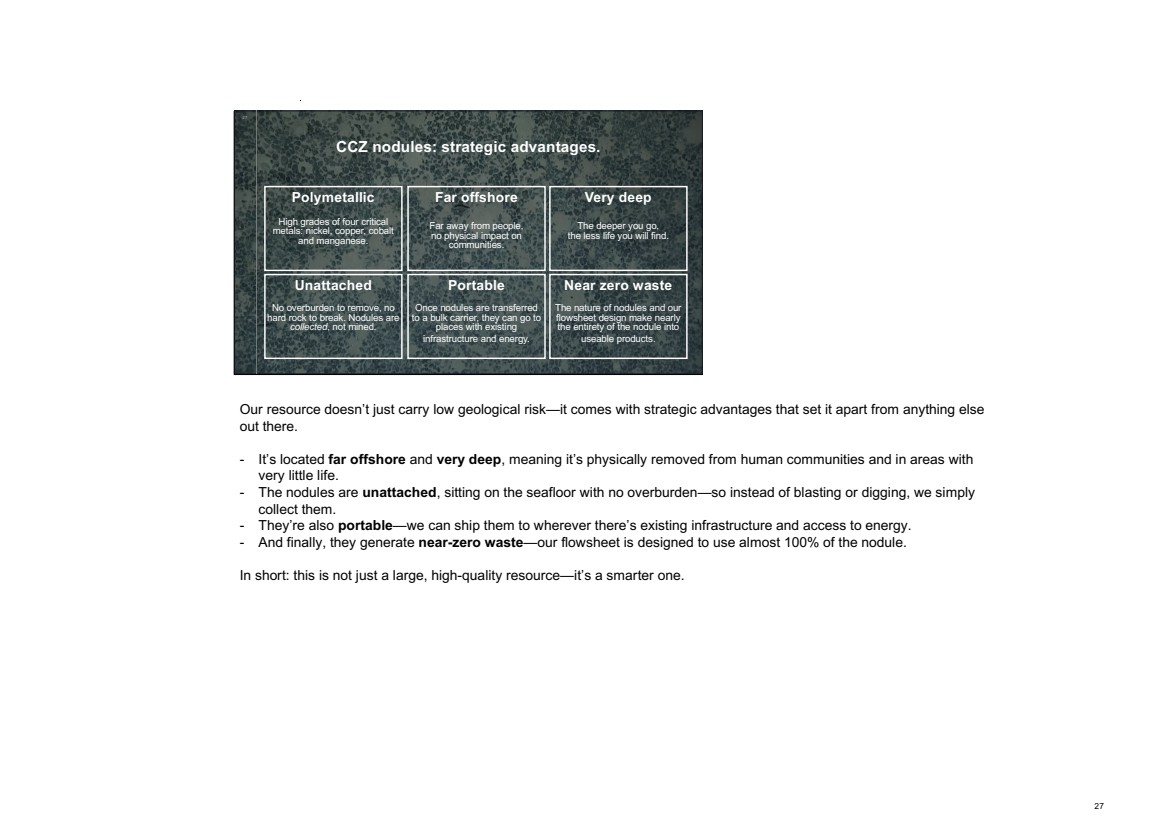

| Our resource doesn’t just carry low geological risk—it comes with strategic advantages that set it apart from anything else out there. - It’s located far offshore and very deep, meaning it’s physically removed from human communities and in areas with very little life. - The nodules are unattached, sitting on the seafloor with no overburden—so instead of blasting or digging, we simply collect them. - They’re also portable—we can ship them to wherever there’s existing infrastructure and access to energy. - And finally, they generate near-zero waste—our flowsheet is designed to use almost 100% of the nodule. In short: this is not just a large, high-quality resource—it’s a smarter one. 27 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 2727 Polymetallic High grades of four critical metals: nickel, copper, cobalt and manganese. Unattached No overburden to remove, no hard rock to break. Nodules are collected, not mined. Far offshore Far away from people, no physical impact on communities. Very deep The deeper you go, the less life you will find. Portable Once nodules are transferred to a bulk carrier, they can go to places with existing infrastructure and energy. Near zero waste The nature of nodules and our flowsheet design make nearly the entirety of the nodule into useable products. CCZ nodules: strategic advantages. |

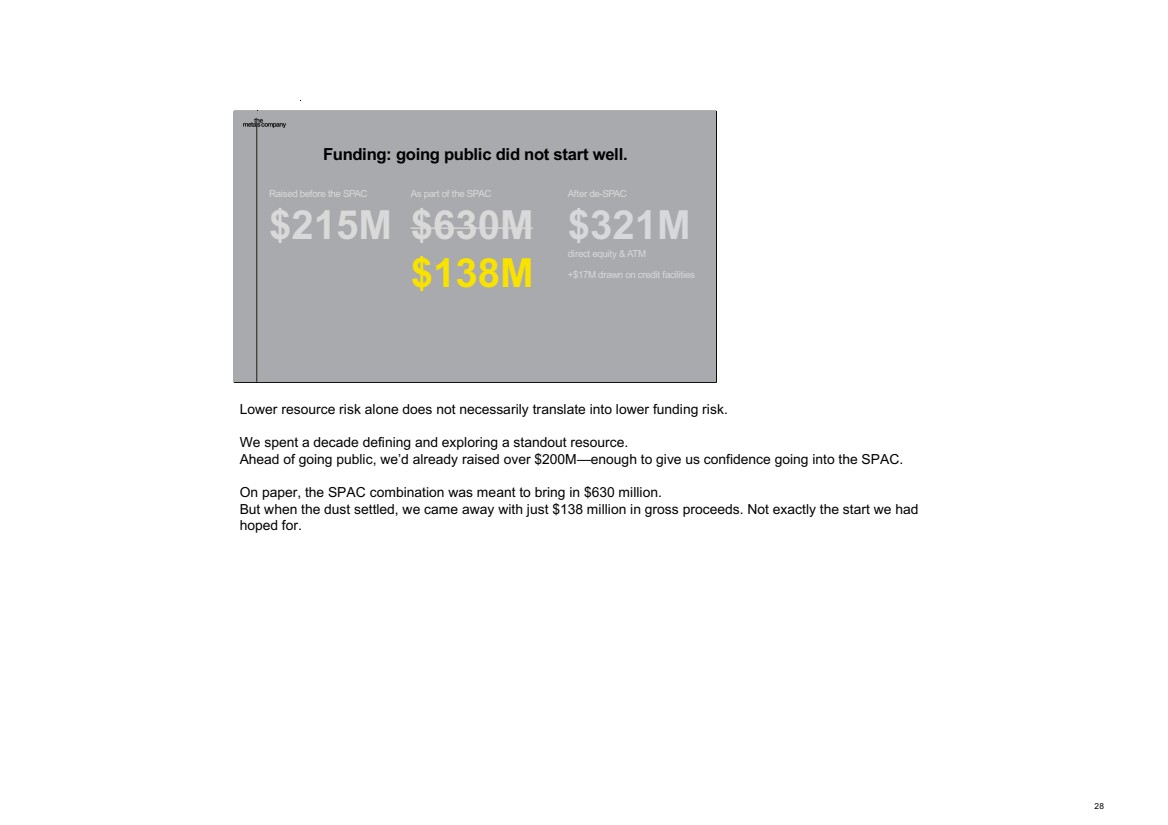

| Lower resource risk alone does not necessarily translate into lower funding risk. We spent a decade defining and exploring a standout resource. Ahead of going public, we’d already raised over $200M—enough to give us confidence going into the SPAC. On paper, the SPAC combination was meant to bring in $630 million. But when the dust settled, we came away with just $138 million in gross proceeds. Not exactly the start we had hoped for. 28 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 28 Funding: going public did not start well. Raised before the SPAC $215M As part of the SPAC $630M $138M After de-SPAC $321M direct equity & ATM +$17M drawn on credit facilities |

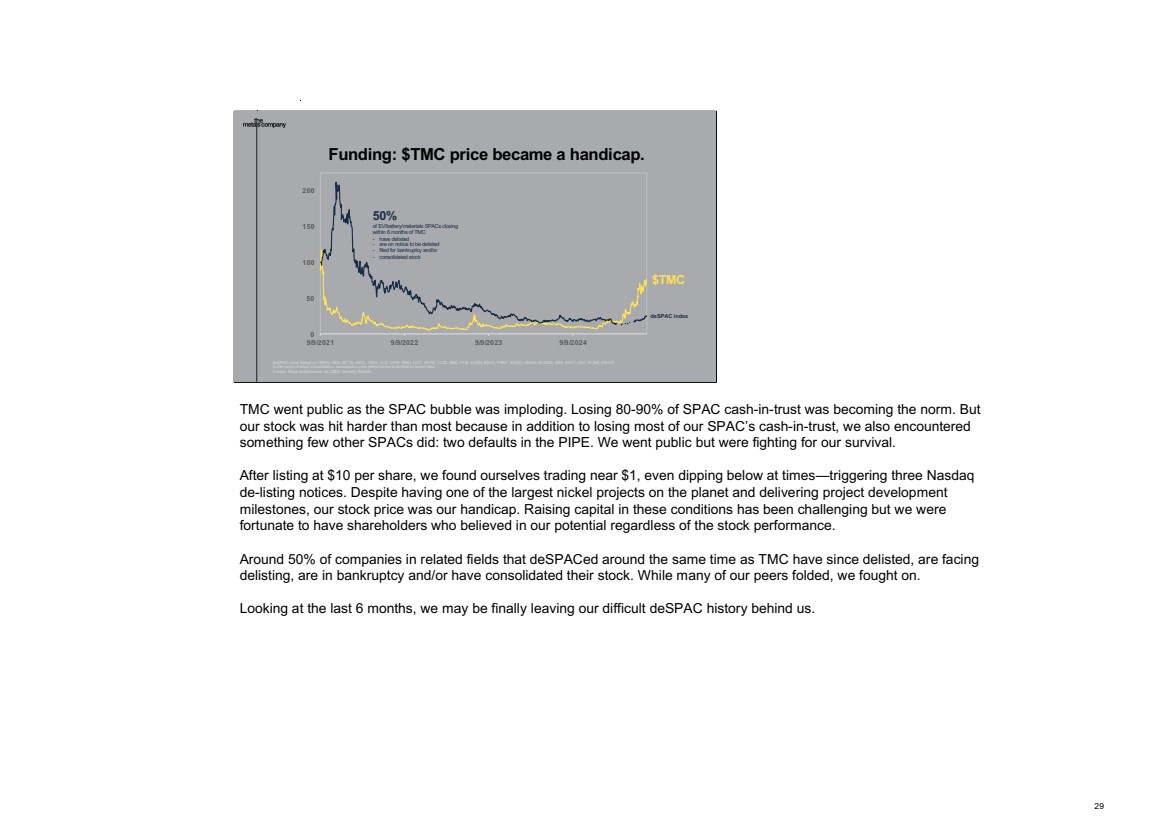

| TMC went public as the SPAC bubble was imploding. Losing 80-90% of SPAC cash-in-trust was becoming the norm. But our stock was hit harder than most because in addition to losing most of our SPAC’s cash-in-trust, we also encountered something few other SPACs did: two defaults in the PIPE. We went public but were fighting for our survival. After listing at $10 per share, we found ourselves trading near $1, even dipping below at times—triggering three Nasdaq de-listing notices. Despite having one of the largest nickel projects on the planet and delivering project development milestones, our stock price was our handicap. Raising capital in these conditions has been challenging but we were fortunate to have shareholders who believed in our potential regardless of the stock performance. Around 50% of companies in related fields that deSPACed around the same time as TMC have since delisted, are facing delisting, are in bankruptcy and/or have consolidated their stock. While many of our peers folded, we fought on. Looking at the last 6 months, we may be finally leaving our difficult deSPAC history behind us. 29 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 29 Funding: $TMC price became a handicap. deSPAC index $TMC deSPAC index based on NRGV, SES, NVTS, ASTL, GWH, VLN, CIFR, RNW, LICY, MVST, LCID, REE, FFIE, HYZN, ENVX, FREY, EVGO, ORGN, ELMSQ, INDI, ZEVY, LEV, STEM, ARVLF. In the event of stock consolidation, subsequent price performance is divided by share ratio. Source: Stock performance via LSEG, formerly Refinitiv. 0 50 100 150 200 9/9/2021 9/9/2022 9/9/2023 9/9/2024 50% of EV/battery/materials SPACs closing within 6 months of TMC - have delisted - are on notice to be delisted - filed for bankruptcy and/or - consolidated stock |

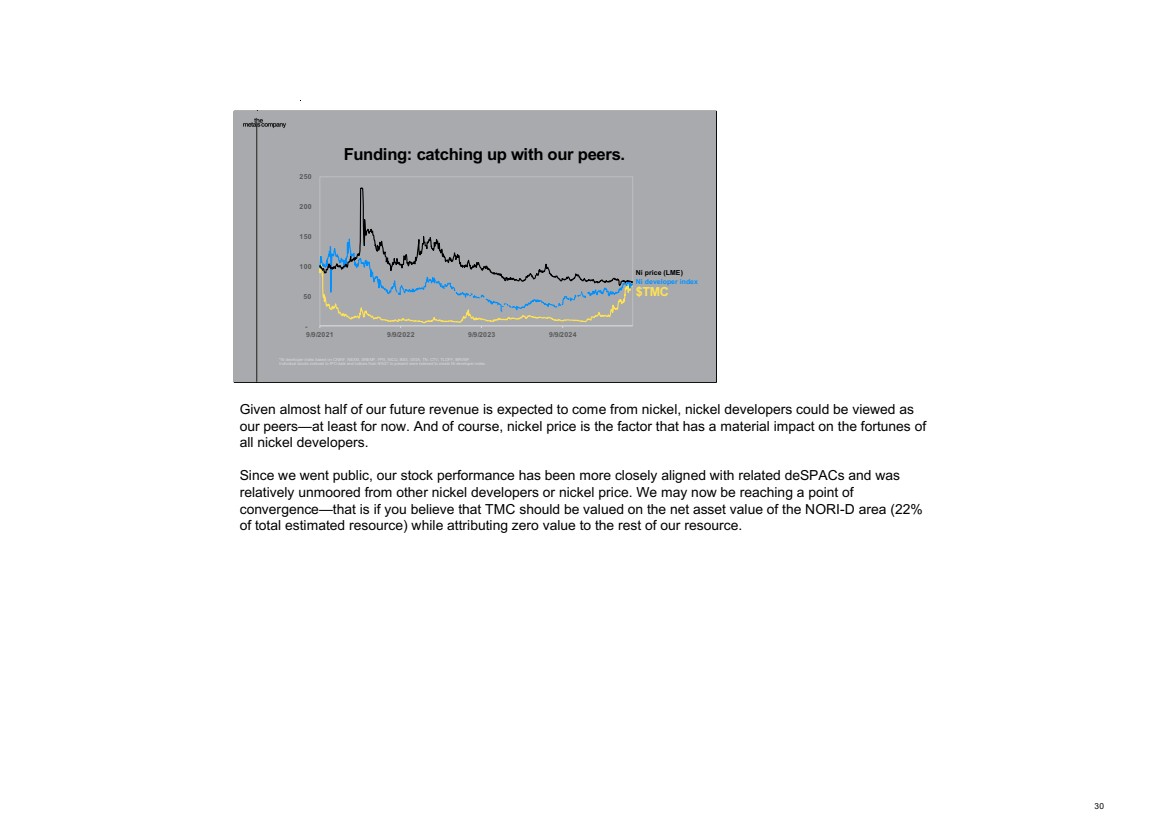

| Given almost half of our future revenue is expected to come from nickel, nickel developers could be viewed as our peers—at least for now. And of course, nickel price is the factor that has a material impact on the fortunes of all nickel developers. Since we went public, our stock performance has been more closely aligned with related deSPACs and was relatively unmoored from other nickel developers or nickel price. We may now be reaching a point of convergence—that is if you believe that TMC should be valued on the net asset value of the NORI-D area (22% of total estimated resource) while attributing zero value to the rest of our resource. 30 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 30 Funding: catching up with our peers. *Ni developer index based on CNIKF, NEXM, SREMF, FPX, NICU, BSX, GIGA, TN, CTV, TLOFF, BRVMF. Individual stocks indexed to IPO date and indices from 9/9/21 to present were indexed to create Ni-developer index. $TMC Ni developer index Ni price (LME) - 50 100 150 200 250 9/9/2021 9/9/2022 9/9/2023 9/9/2024 |

| Our ability to raise capital without unacceptable levels of dilution was limited. So, we focused on reducing how much capital we’d need to reach production. That meant doubling down on our capital-light strategy and leaning on our partners. Together with our partners, we’ve advanced the project offshore and onshore while keeping costs low. - We’ve successfully piloted our offshore system with Allseas. They continued advancing production system design to PFS level while looking after the Hidden Gem. - We secured a smelting partnership with PAMCO in Japan who were willing to run industrial nodule calcining and smelting campaigns, complete pre-feasibility and feasibility studies and pay for all of this work themselves. - We worked with top-tier institutions on the world’s most comprehensive environmental baseline and impact program for the deep sea. We were getting ready to lodge our application with the ISA by the end of June, including an EIS designed to meet the ISA requirements—both currently drafted and the ones we anticipated. We materially de-risked our execution against the odds. 31 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 31 Source: xxx Execution: materially de-risked against the odds. OFFSHORE ENVIRO RESEARCH ü Collaboration with leading institutions OFFSHORE ENVIRO IMPACTS ü Enviro baseline & impact monitoring PROJECT ECONOMICS ü PFS using partner production assets OFFSHORE TECHNOLOGY ü Successful pilot & pre-feasibility w/ Allseas ONSHORE PROCESSING ü Partnership w/ PAMCO (smelters) ONSHORE PROCESSING ü Pre-feasibility & industrial pilot in Japan |

| While we were adapting to market realities—fighting for equity value and making real progress on limited capital—regulatory uncertainty remained a major drag on our stock price. Despite years of constructive engagement, it became clear by mid-last year that the ISA is unlikely to deliver a Mining Code on a timeline that works for a commercial enterprise. The process wasn’t built for private sector urgency—it was shaped by and for state-backed players who can afford to wait...for decades. After 14 years of paddling upstream, we faced the reality: the ISA was unlikely to deliver. That was a serious disappointment. We needed a plan B. 32 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 32 Regulatory risk: ISA was a disappointment. |

| The ISA saga did have a silver lining: our enduring partnerships with Nauru and the Kingdom of Tonga. One part of the UNCLOS’ vision always resonated with us—ensuring developing nations benefit from the development of seabed resources in international waters. Our subsidiaries NORI and TOML have long operated in these Pacific island nations, delivering on-the-ground value through local programs. When it became clear that the ISA might not deliver, we realized we didn’t need to wait for permission to fulfil the intent of UNCLOS—we could live it ourselves. We are committed to these partnerships. Our presence—and our impact—on these islands will continue beyond our engagement with the ISA. 33 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 33 A silver lining? Our friendship with Nauru & Tonga. |

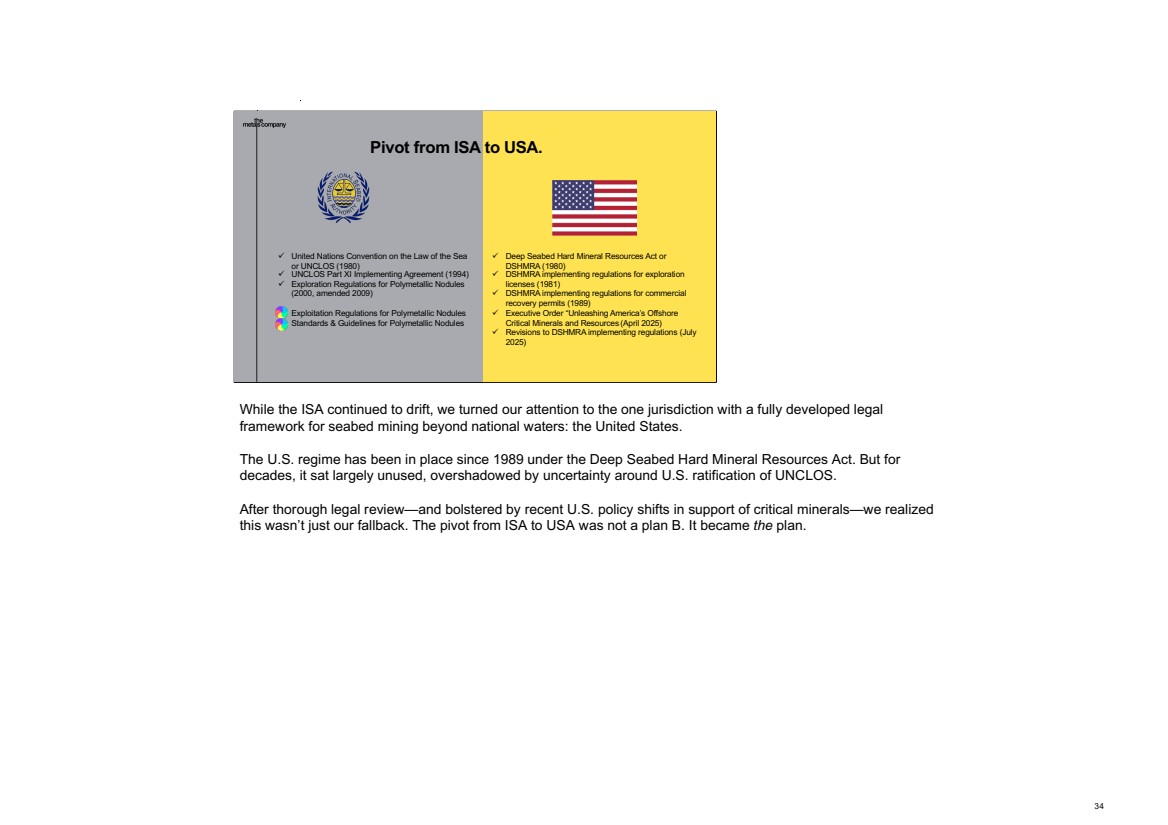

| While the ISA continued to drift, we turned our attention to the one jurisdiction with a fully developed legal framework for seabed mining beyond national waters: the United States. The U.S. regime has been in place since 1989 under the Deep Seabed Hard Mineral Resources Act. But for decades, it sat largely unused, overshadowed by uncertainty around U.S. ratification of UNCLOS. After thorough legal review—and bolstered by recent U.S. policy shifts in support of critical minerals—we realized this wasn’t just our fallback. The pivot from ISA to USA was not a plan B. It became the plan. 34 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 34 ü Deep Seabed Hard Mineral Resources Act or DSHMRA (1980) ü DSHMRA implementing regulations for exploration licenses (1981) ü DSHMRA implementing regulations for commercial recovery permits (1989) ü Executive Order “Unleashing America’s Offshore Critical Minerals and Resources (April 2025) ü Revisions to DSHMRA implementing regulations (July 2025) ü United Nations Convention on the Law of the Sea or UNCLOS (1980) ü UNCLOS Part XI Implementing Agreement (1994) ü Exploration Regulations for Polymetallic Nodules (2000, amended 2009) ü Exploitation Regulations for Polymetallic Nodules ü Standards & Guidelines for Polymetallic Nodules Pivot from ISA to USA. |

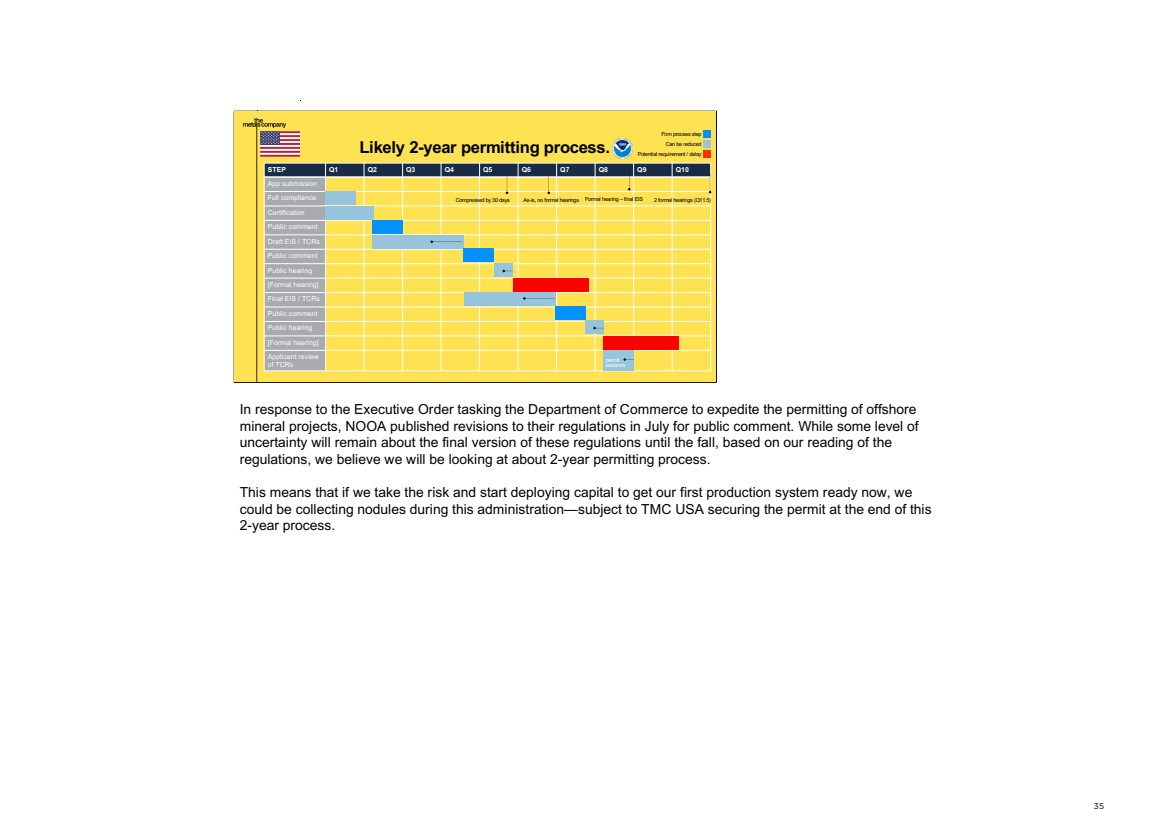

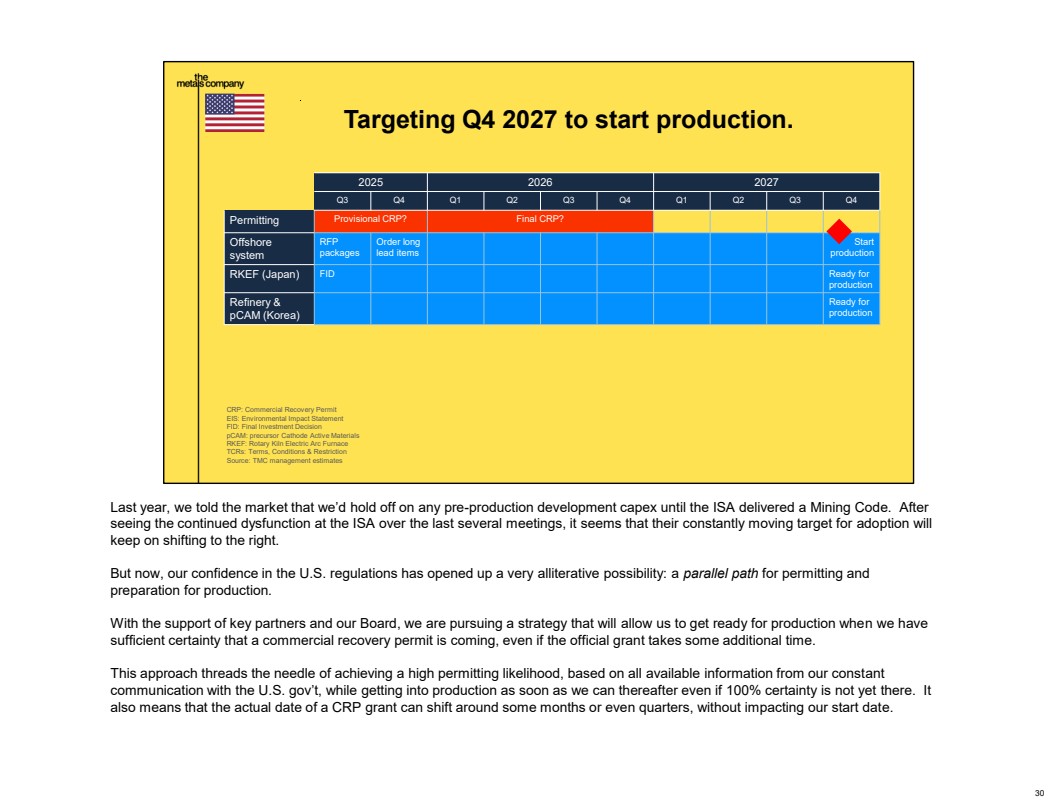

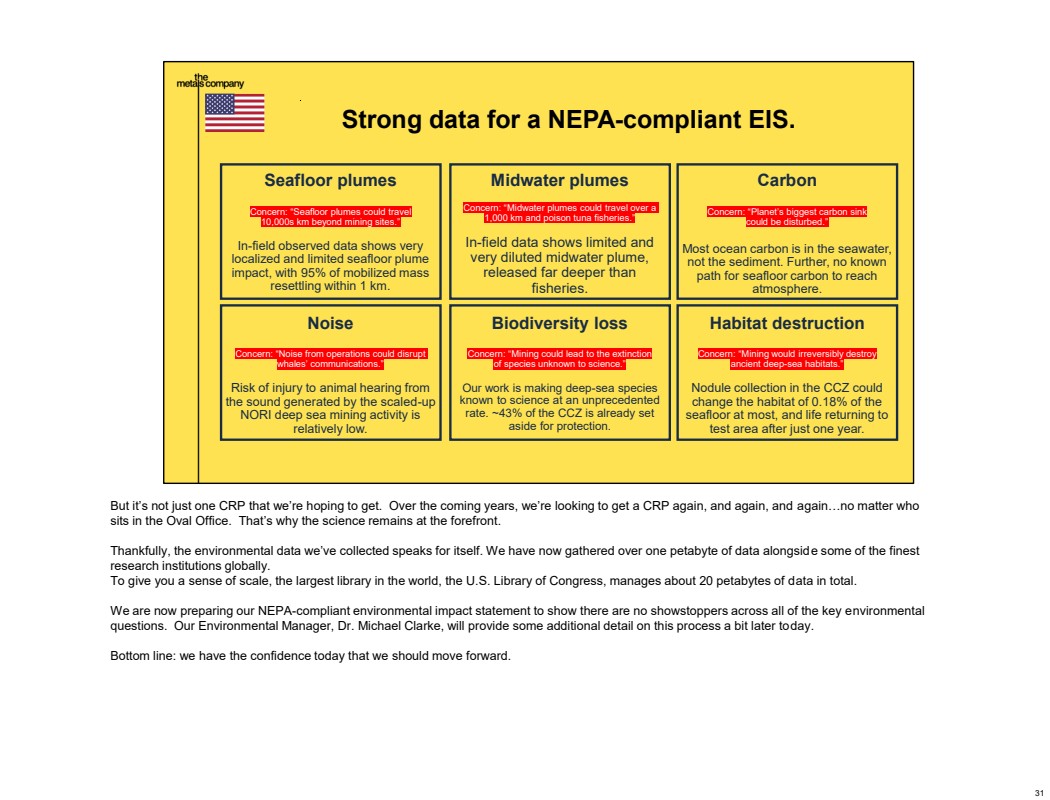

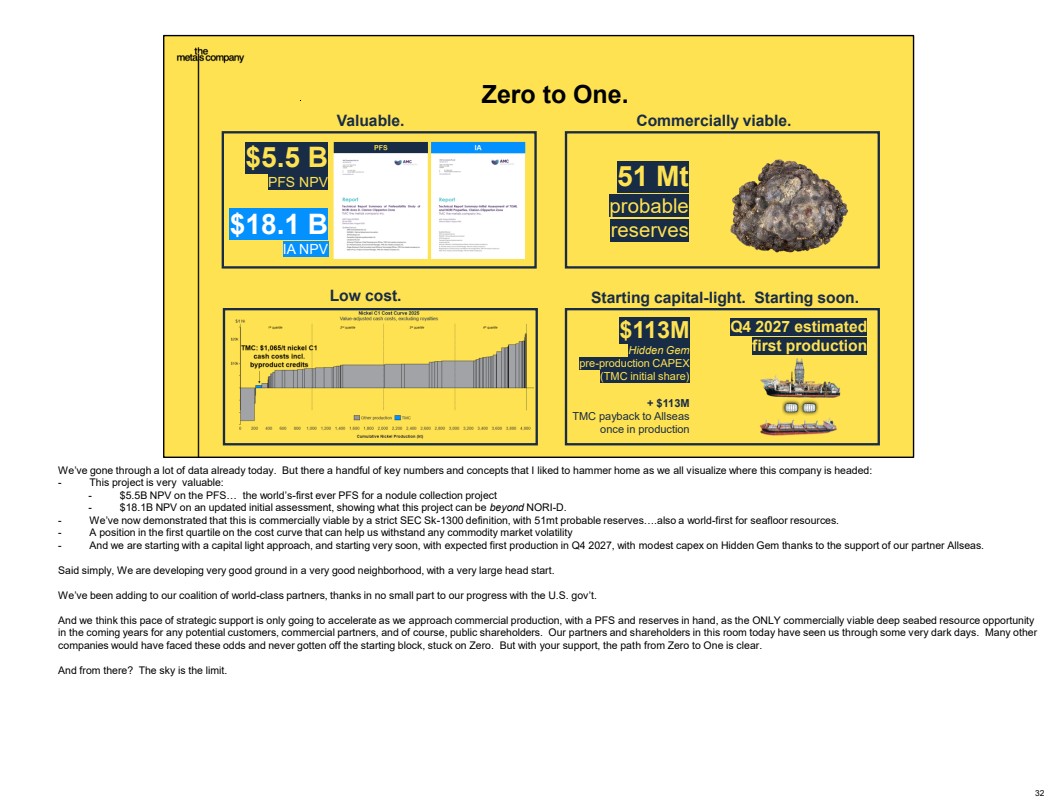

| In response to the Executive Order tasking the Department of Commerce to expedite the permitting of offshore mineral projects, NOOA published revisions to their regulations in July for public comment. While some level of uncertainty will remain about the final version of these regulations until the fall, based on our reading of the regulations, we believe we will be looking at about 2-year permitting process. This means that if we take the risk and start deploying capital to get our first production system ready now, we could be collecting nodules during this administration—subject to TMC USA securing the permit at the end of this 2-year process. 35 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 35 STEP Q1 Q2 Q3 Q4 Q5 Q6 Q7 Q8 Q9 Q10 App submission Full compliance Certification Public comment Draft EIS / TCRs Public comment Public hearing [Formal hearing] Final EIS / TCRs Public comment Public hearing [Formal hearing] Applicant review of TCRs permit issuance Firm process step Can be reduced Potential requirement / delay Compressed by 30 days As-is, no formal hearings Formal hearing – final EIS 2 formal hearings (Q11.5) Likely 2-year permitting process. |

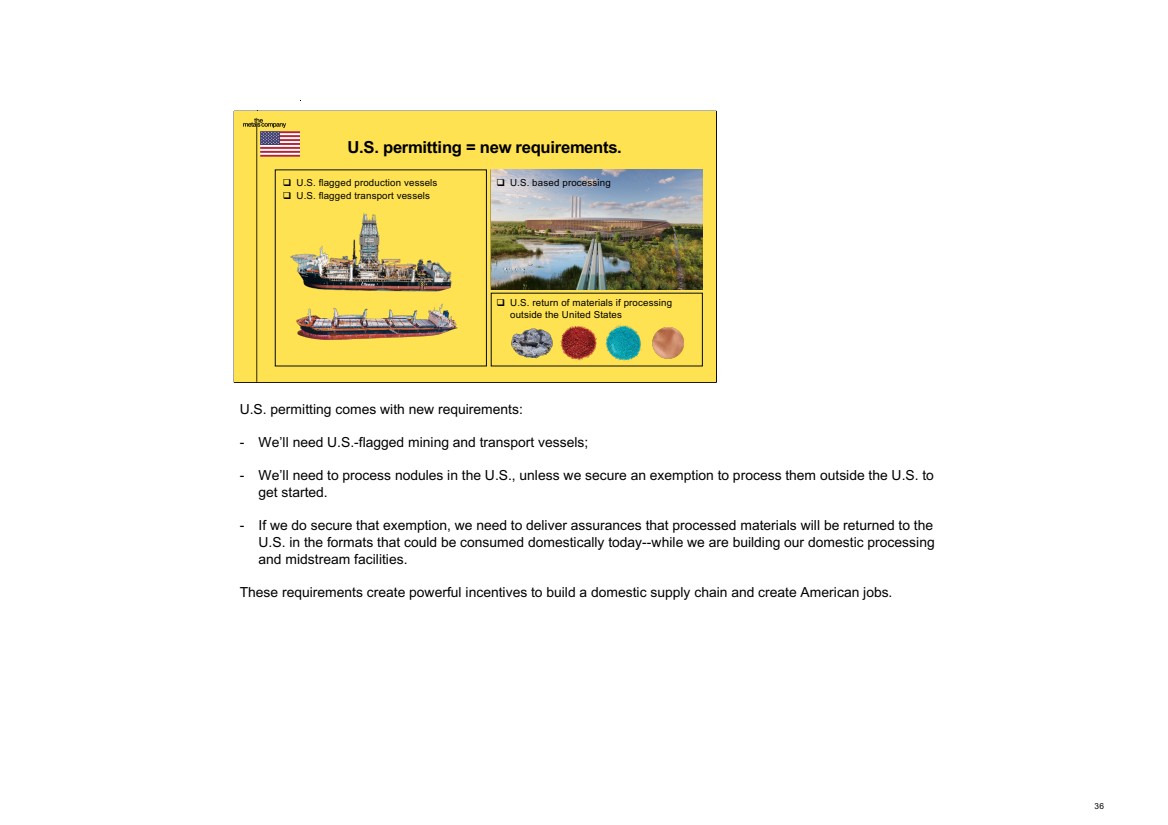

| U.S. permitting comes with new requirements: - We’ll need U.S.-flagged mining and transport vessels; - We’ll need to process nodules in the U.S., unless we secure an exemption to process them outside the U.S. to get started. - If we do secure that exemption, we need to deliver assurances that processed materials will be returned to the U.S. in the formats that could be consumed domestically today--while we are building our domestic processing and midstream facilities. These requirements create powerful incentives to build a domestic supply chain and create American jobs. 36 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 36 U.S. permitting = new requirements. q U.S. flagged production vessels q U.S. flagged transport vessels q U.S. return of materials if processing outside the United States q U.S. based processing |

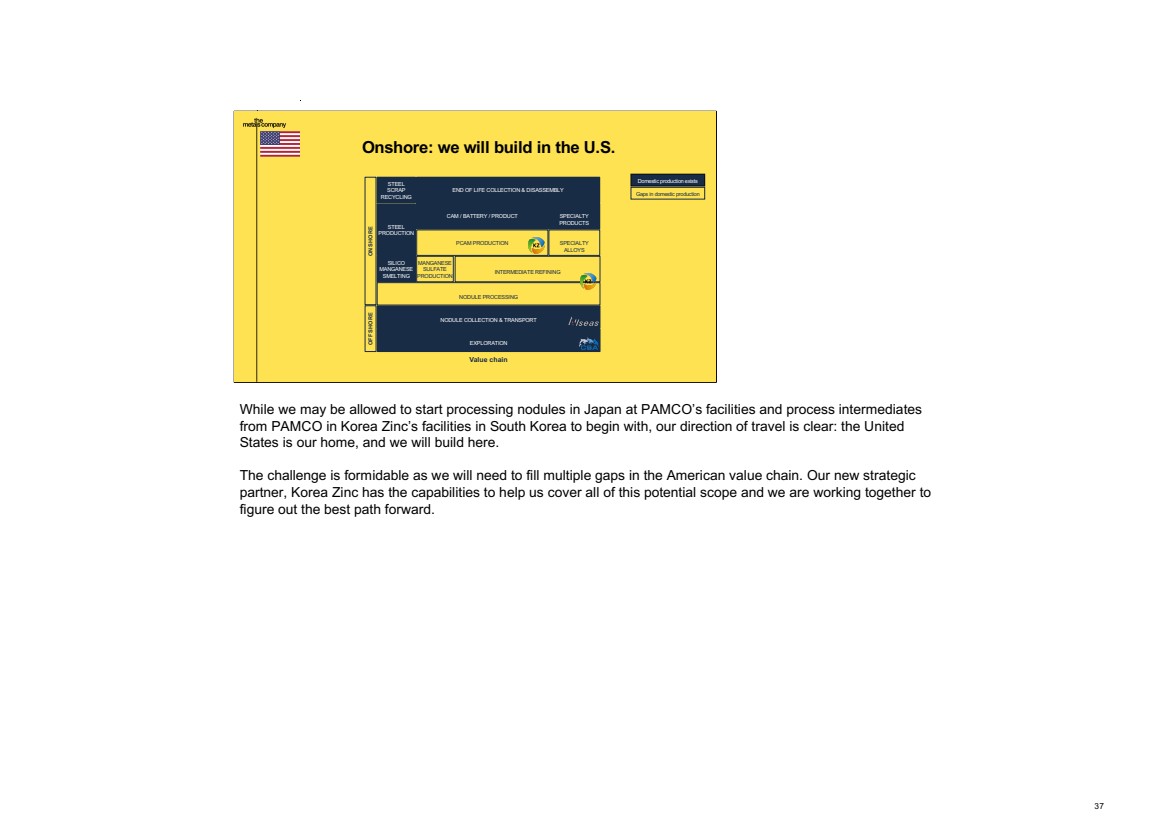

| While we may be allowed to start processing nodules in Japan at PAMCO’s facilities and process intermediates from PAMCO in Korea Zinc’s facilities in South Korea to begin with, our direction of travel is clear: the United States is our home, and we will build here. The challenge is formidable as we will need to fill multiple gaps in the American value chain. Our new strategic partner, Korea Zinc has the capabilities to help us cover all of this potential scope and we are working together to figure out the best path forward. 37 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 37 Onshore: we will build in the U.S. EXPLORATION NODULE COLLECTION & TRANSPORT INTERMEDIATE REFINING SILICO MANGANESE SMELTING MANGANESE SULFATE PRODUCTION PCAM PRODUCTION SPECIALTY ALLOYS STEEL PRODUCTION CAM / BATTERY / PRODUCT SPECIALTY PRODUCTS STEEL SCRAP RECYCLING END OF LIFE COLLECTION & DISASSEMBLY NODULE PROCESSING Value chain OFFSHORE ONSHORE Domestic production exists Gaps in domestic production |

| It’s time to build in America again. Most people forget that America was once a dominant force in global mining. From the late 19th century through the mid-20th, America led global production of copper, manganese, nickel, and cobalt. This was driven by vast domestic demand, strategic exports, and rich deposits across states like Arizona, Minnesota, Michigan, and Idaho. In 1900, the U.S. produced nearly 40% of the world’s copper. Arizona’s Morenci mine was one of the largest in the world. Minnesota’s Mesabi Range supplied the manganese essential to steelmaking. Nickel came from Michigan’s Upper Peninsula, with output supporting alloys in aviation and manufacturing. Idaho was producing cobalt long before it became a battery metal, fueling toolmaking and early aerospace. Major industrial players like Phelps Dodge and Inco ran massive operations, employing thousands and supplying materials that built both American infrastructure and global industries—everything from Japanese shipyards to European factories. This domestic production underpinned iconic achievements: the Golden Gate Bridge, Empire State Building, early Boeing aircraft, and warships like the USS Missouri. It also powered industries like Ford and GM, Bethlehem Steel, and the electrification of American cities. From 1896 to 1970, the U.S. had a positive trade balance in base metals—no small feat. In 1950 alone, it exported $800 million (adjusted) in copper and $150 million in manganese, far exceeding imports. Government incentives and strategic stockpiles ensured security of supply. But by the 1970s, the edge began to slip. Environmental regulations like the Clean Air Act, rising costs, and global competition—from places like Chile and Canada—chipped away at America’s mining dominance. By 1980, domestic production of key metals had fallen sharply. The legacy, however, reminds us: the U.S. knows how to lead in mining. It’s done it before. And it can do it again. 38 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 38 America used to be a global mining powerhouse. Kennecott Copper Corporation: Bingham Canyon Mine, Utah (1957) Utah State Archives Hanna Nickel Smelting Company: Nickel Mountain, Oregon (1961) University of Oregon Libraries |

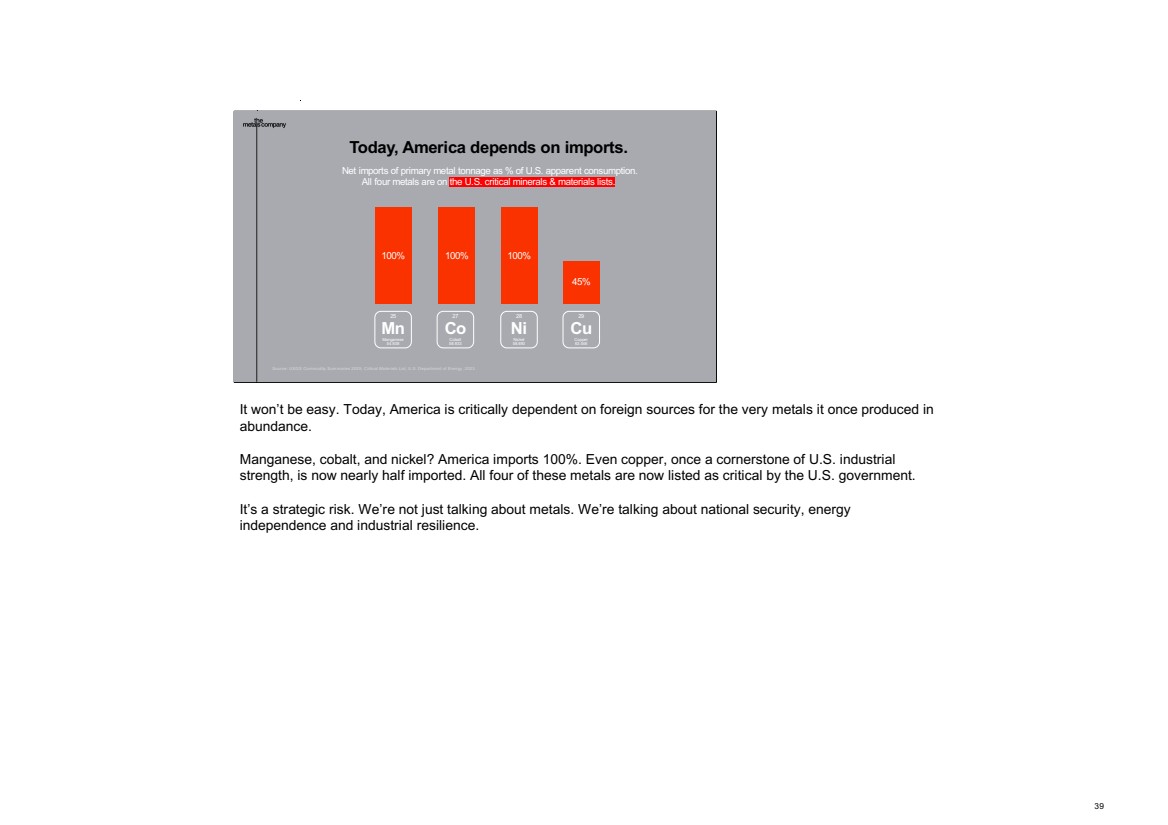

| It won’t be easy. Today, America is critically dependent on foreign sources for the very metals it once produced in abundance. Manganese, cobalt, and nickel? America imports 100%. Even copper, once a cornerstone of U.S. industrial strength, is now nearly half imported. All four of these metals are now listed as critical by the U.S. government. It’s a strategic risk. We’re not just talking about metals. We’re talking about national security, energy independence and industrial resilience. 39 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 39 Today, America depends on imports. Source: USGS Commodity Summaries 2025; Critical Materials List, U.S. Department of Energy, 2023 Net imports of primary metal tonnage as % of U.S. apparent consumption. All four metals are on the U.S. critical minerals & materials lists. 100% 25 Mn Manganese 54.938 27 Co Cobalt 58.933 100% 28 Ni Nickel 58.693 100% 29 Cu Copper 63.546 45% |

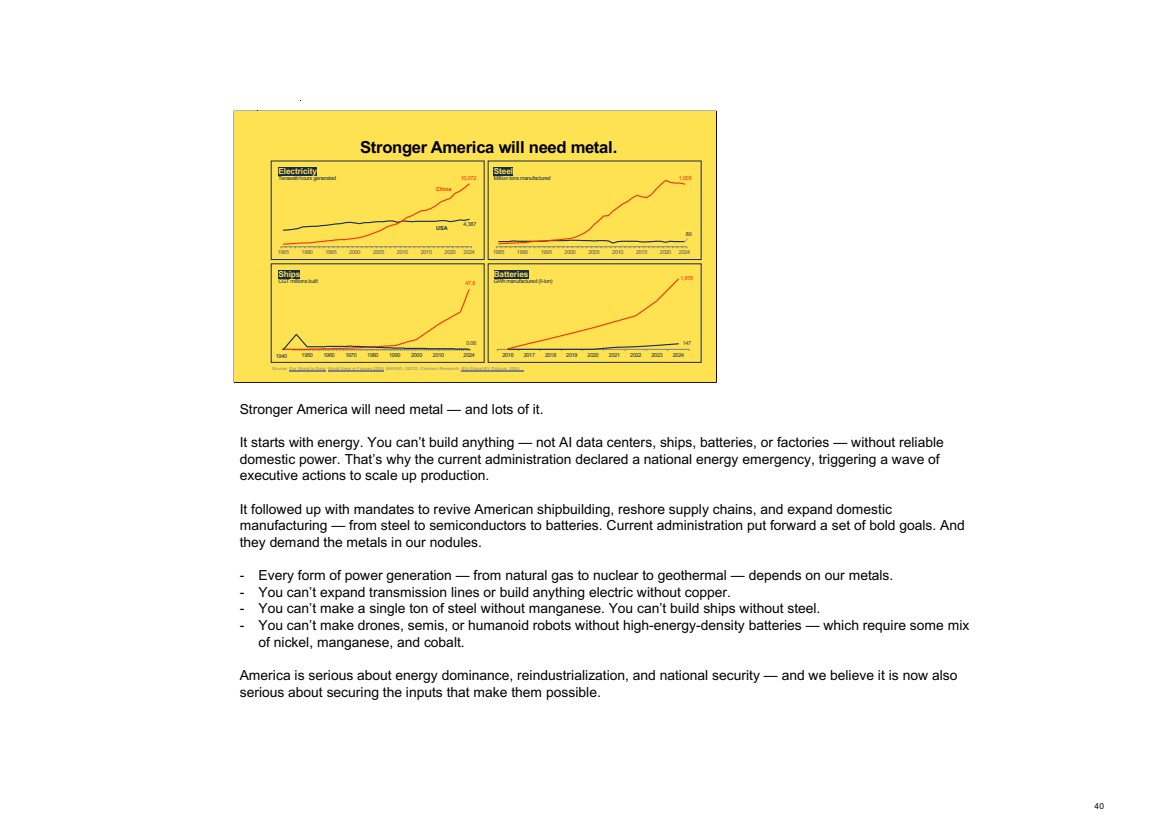

| Stronger America will need metal — and lots of it. It starts with energy. You can’t build anything — not AI data centers, ships, batteries, or factories — without reliable domestic power. That’s why the current administration declared a national energy emergency, triggering a wave of executive actions to scale up production. It followed up with mandates to revive American shipbuilding, reshore supply chains, and expand domestic manufacturing — from steel to semiconductors to batteries. Current administration put forward a set of bold goals. And they demand the metals in our nodules. - Every form of power generation — from natural gas to nuclear to geothermal — depends on our metals. - You can’t expand transmission lines or build anything electric without copper. - You can’t make a single ton of steel without manganese. You can’t build ships without steel. - You can’t make drones, semis, or humanoid robots without high-energy-density batteries — which require some mix of nickel, manganese, and cobalt. America is serious about energy dominance, reindustrialization, and national security — and we believe it is now also serious about securing the inputs that make them possible. 40 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 40 Stronger America will need metal. Source: Our World in Data; World Steel in Figures 2025; MARAD, OECD, Clarkson Research; IEA Global EV Outlook, 2024 4,387 10,072 1985 1990 1995 2000 2005 2010 2015 2020 2024 80 1,005 1985 1990 1995 2000 2005 2010 2015 2020 2024 Electricity Terawatt-hours generated Steel Million tons manufactured Ships CGT millions built 47.8 0.06 Year 1940 1950 1960 1970 1980 1990 2000 2010 2024 147 1,878 1940 2016 2017 2018 2019 2020 2021 2022 2023 2024 China USA Batteries GWh manufactured (li-ion) |

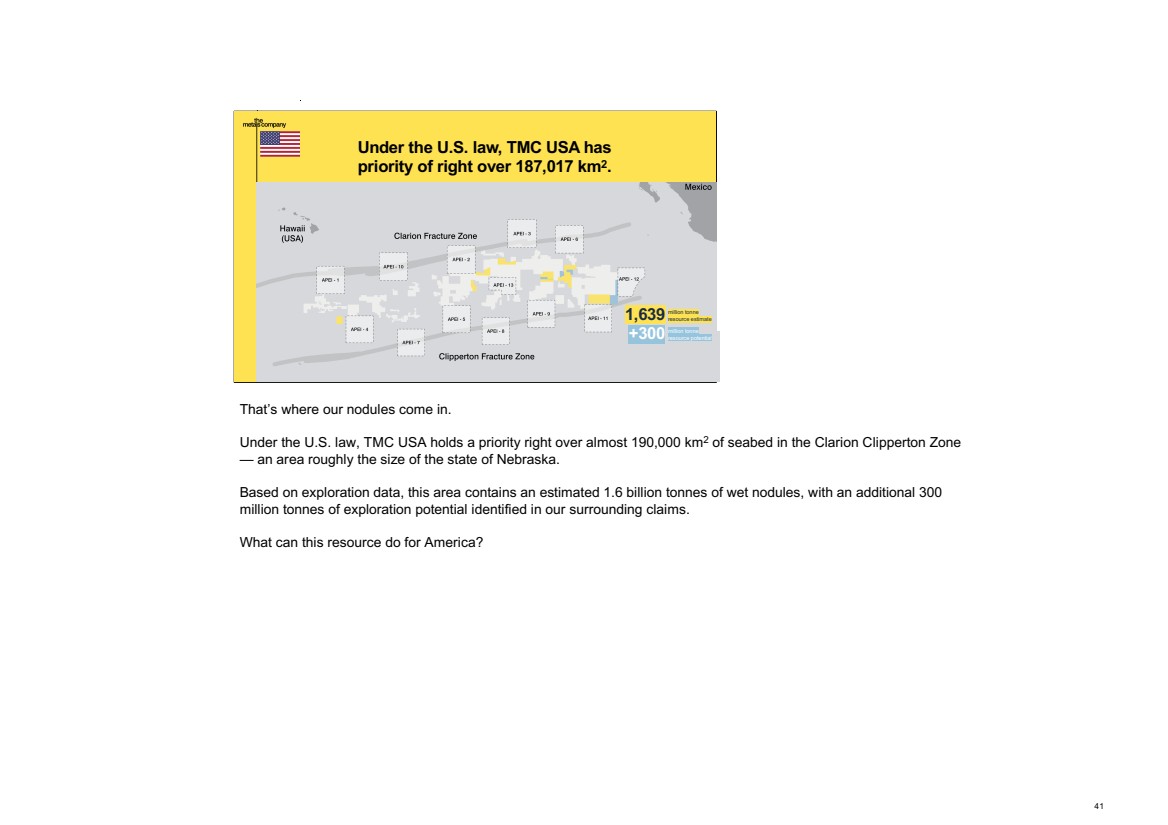

| That’s where our nodules come in. Under the U.S. law, TMC USA holds a priority right over almost 190,000 km2 of seabed in the Clarion Clipperton Zone — an area roughly the size of the state of Nebraska. Based on exploration data, this area contains an estimated 1.6 billion tonnes of wet nodules, with an additional 300 million tonnes of exploration potential identified in our surrounding claims. What can this resource do for America? 41 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 41 Under the U.S. law, TMC USA has priority of right over 187,017 km2. 1,639 +300 million tonne resource estimate million tonne resource potential |

| A resource this size can deliver a multi-generational supply. Just one billion tons of nodules would be nothing short of transformational. Based on today’s levels of American consumption, it could supply: - Three centuries of manganese - Two centuries of cobalt - Almost a century of nickel and - 5 years of copper. And that’s only primary production. When you factor in future recycling loops, the utility of this metal base stretches into many centuries. But let’s be clear: We’re not trying to sustain today’s level of demand — we’re aiming to reindustrialize. America is gearing up for rapid growth in energy, manufacturing, and defense. That means consumption of these metals will surge. And that’s exactly why the scale and grade of our nodules matter so much. They aren’t just enough to meet current needs — they are what make scaling possible. It’s the foundation for a generational industrial revival. 42 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 42 We can deliver: Multi-generational supply for America. 330 years Source: USGS Commodity Summaries 2025; TMC analysis 95 years 210years 5 years 25 Mn Manganese 54.938 27 Co Cobalt 58.933 28 Ni Nickel 58.693 29 Cu Copper 63.546 Approximate number of years of current U.S. consumption that could be supplied by a billion tons of nodules. Primary production only—secondary production extends these timelines by hundreds of years. |

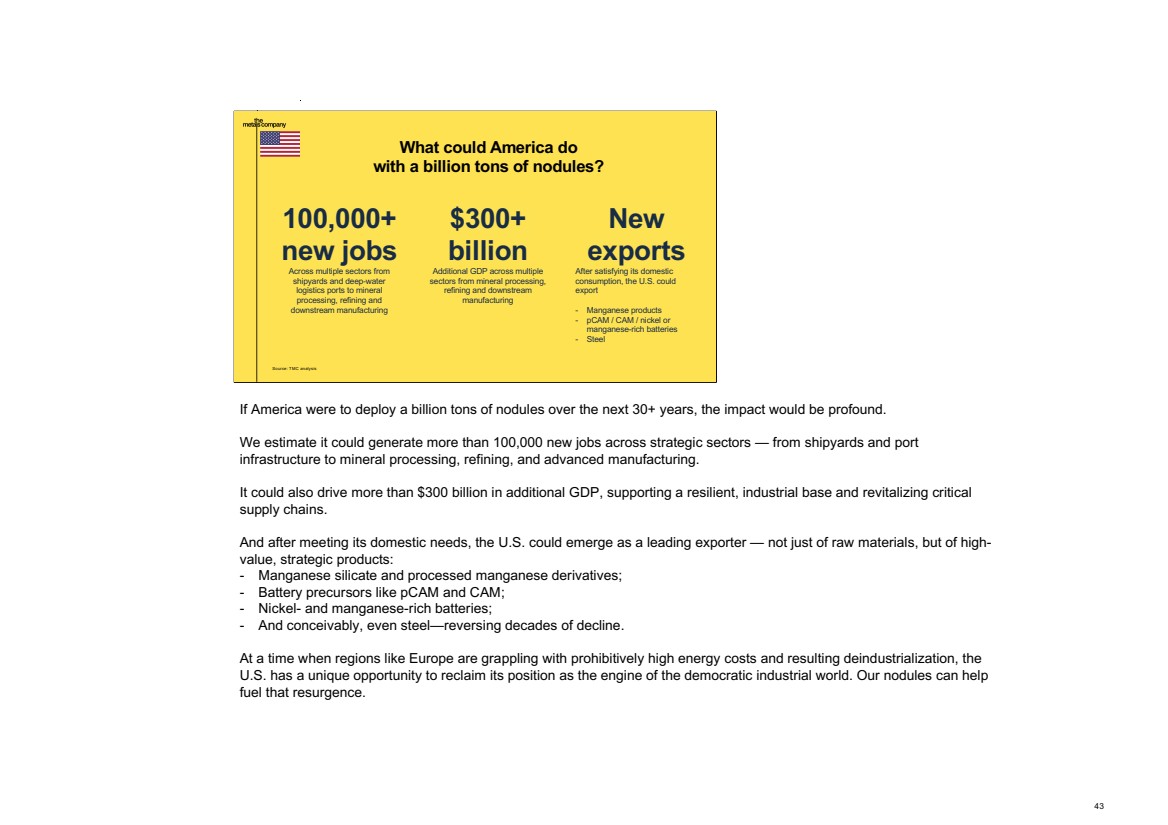

| If America were to deploy a billion tons of nodules over the next 30+ years, the impact would be profound. We estimate it could generate more than 100,000 new jobs across strategic sectors — from shipyards and port infrastructure to mineral processing, refining, and advanced manufacturing. It could also drive more than $300 billion in additional GDP, supporting a resilient, industrial base and revitalizing critical supply chains. And after meeting its domestic needs, the U.S. could emerge as a leading exporter — not just of raw materials, but of high-value, strategic products: - Manganese silicate and processed manganese derivatives; - Battery precursors like pCAM and CAM; - Nickel- and manganese-rich batteries; - And conceivably, even steel—reversing decades of decline. At a time when regions like Europe are grappling with prohibitively high energy costs and resulting deindustrialization, the U.S. has a unique opportunity to reclaim its position as the engine of the democratic industrial world. Our nodules can help fuel that resurgence. 43 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 43 100,000+ new jobs Across multiple sectors from shipyards and deep-water logistics ports to mineral processing, refining and downstream manufacturing New exports After satisfying its domestic consumption, the U.S. could export - Manganese products - pCAM / CAM / nickel or manganese-rich batteries - Steel $300+ billion Additional GDP across multiple sectors from mineral processing, refining and downstream manufacturing Source: TMC analysis What could America do with a billion tons of nodules? |

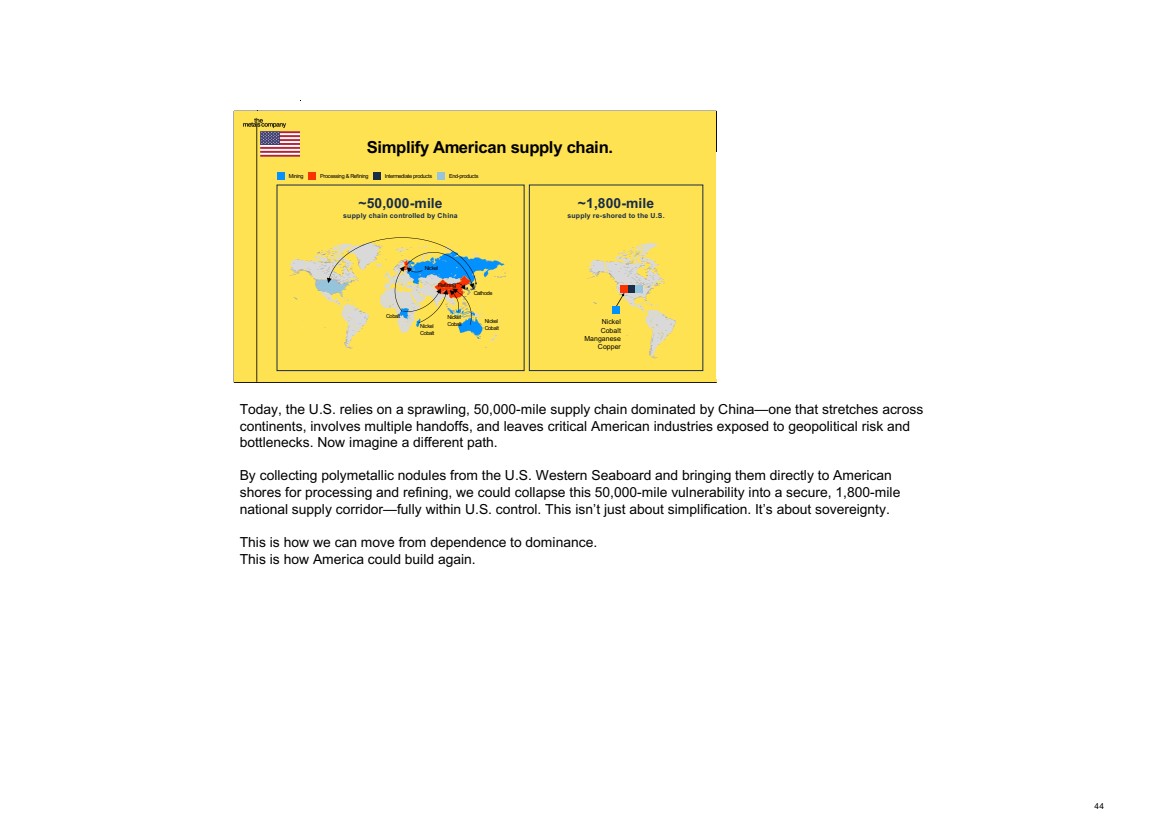

| Today, the U.S. relies on a sprawling, 50,000-mile supply chain dominated by China—one that stretches across continents, involves multiple handoffs, and leaves critical American industries exposed to geopolitical risk and bottlenecks. Now imagine a different path. By collecting polymetallic nodules from the U.S. Western Seaboard and bringing them directly to American shores for processing and refining, we could collapse this 50,000-mile vulnerability into a secure, 1,800-mile national supply corridor—fully within U.S. control. This isn’t just about simplification. It’s about sovereignty. This is how we can move from dependence to dominance. This is how America could build again. 44 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 44 ~50,000-mile supply chain controlled by China Mining Processing & Refining Intermediate products End-products Nickel Cobalt Cobalt Nickel Cobalt Nickel Cobalt Nickel Cathode Refining ~1,800-mile supply re-shored to the U.S. Nickel Cobalt Manganese Copper Simplify American supply chain. |

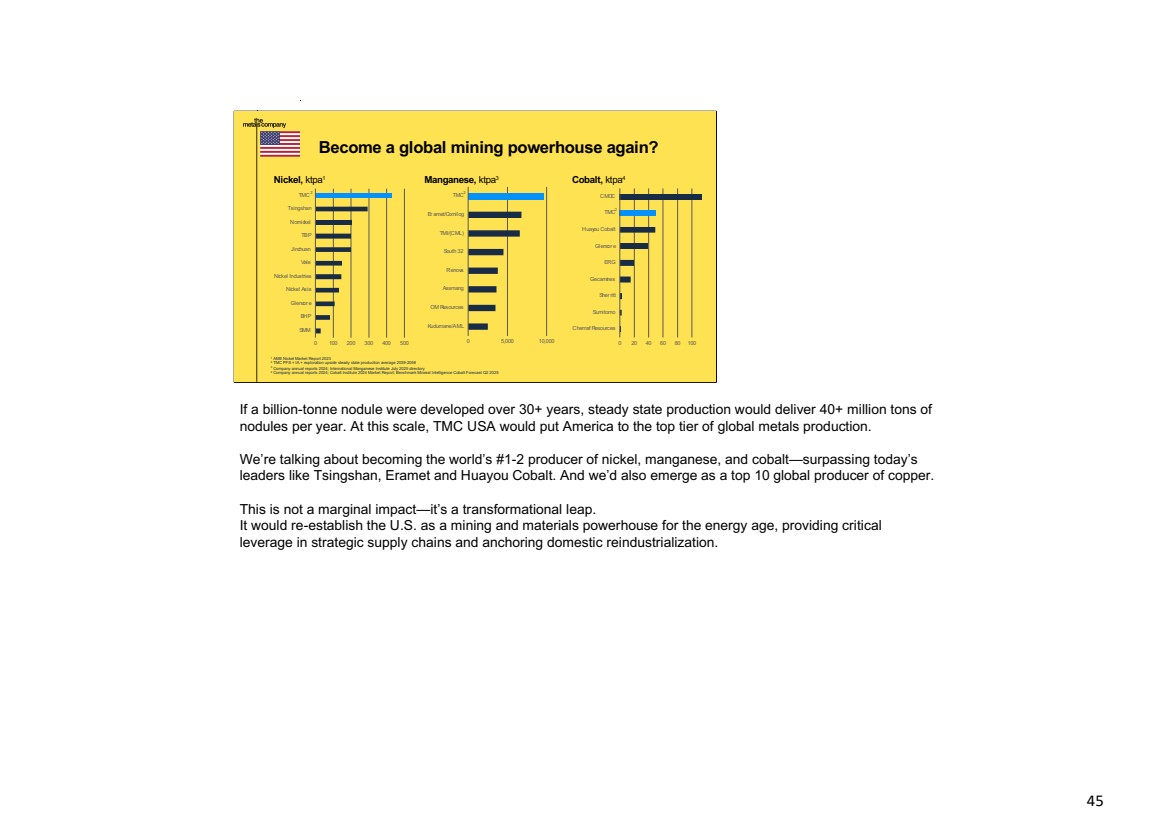

| If a billion-tonne nodule were developed over 30+ years, steady state production would deliver 40+ million tons of nodules per year. At this scale, TMC USA would put America to the top tier of global metals production. We’re talking about becoming the world’s #1-2 producer of nickel, manganese, and cobalt—surpassing today’s leaders like Tsingshan, Eramet and Huayou Cobalt. And we’d also emerge as a top 10 global producer of copper. This is not a marginal impact—it’s a transformational leap. It would re-establish the U.S. as a mining and materials powerhouse for the energy age, providing critical leverage in strategic supply chains and anchoring domestic reindustrialization. 45 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 45 Nickel, ktpa1 2 Manganese, ktpa3 Become a global mining powerhouse again? 0 100 200 300 400 500 SMM BHP Glencor e Nickel Asia Nickel Industries Vale Jinchuan TBP Nornickel Tsingshan TMC 0 5,000 10,000 Kudumane/AML OM Resources Assmang Renova South 32 TMI/(CML) Er amet/Comilog TMC2 Cobalt, ktpa4 0 20 40 60 80 100 Chemaf Resources Sumitomo Sher ritt Gecamines ERG Glencor e Huayou Cobalt TMC CMOC 2 ------------------------------------------------------------------------------------ Mn: Eramet – 6,800 kt Mn https://www.eramet.com/en/news/eramet-confirms-its-resilience-and-successfully-delivers-on-its-strategic-roadmap/ South32 – 4,500kt Mn slide 18 in https://www.listcorp.com/asx/s32/south32- limited/news/2024-full-year-financial-results-3076162.html TMI/ConsMin – 6,600 kt Mn IMnI July 2025 Mn directory Assmang – 3,600kt https://www.assmang.co.za/assmang-manganese-ore/ OM Holdings – 3,500kt https://www.listcorp.com/asx/omh/om-holdings-limited/news/2024-annual-report-3181159.html Renova – 3,800kt IMnI July 2025 Mn directory Kudumane – 2,500 kt IMnI July 2025 Mn directory 1 AME Nickel Market Report 2023 2 TMC PFS + IA + exploration upside steady state production average 2039-2058 3 Company annual reports 2024; International Manganese Institute July 2025 directory 4 Company annual reports 2024; Cobalt Institute 2024 Market Report; Benchmark Mineral Intelligence Cobalt Forecast Q2 2025 |

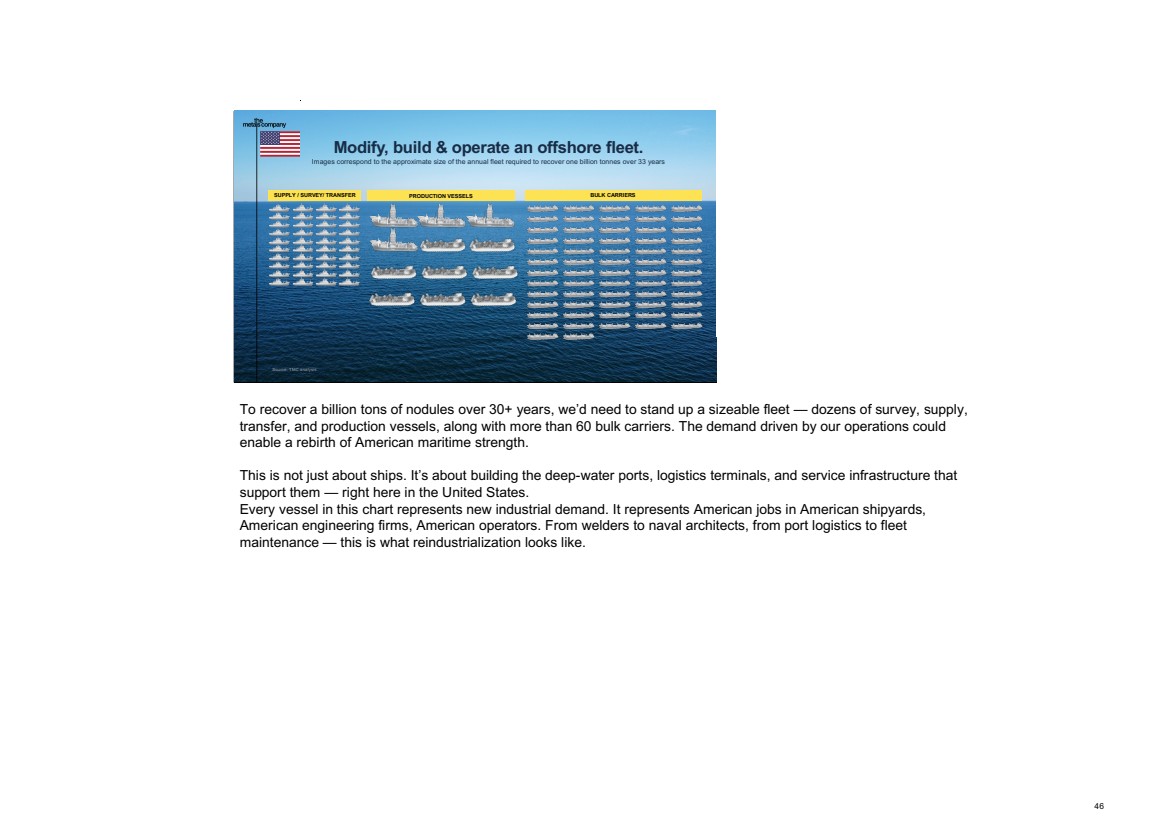

| To recover a billion tons of nodules over 30+ years, we’d need to stand up a sizeable fleet — dozens of survey, supply, transfer, and production vessels, along with more than 60 bulk carriers. The demand driven by our operations could enable a rebirth of American maritime strength. This is not just about ships. It’s about building the deep-water ports, logistics terminals, and service infrastructure that support them — right here in the United States. Every vessel in this chart represents new industrial demand. It represents American jobs in American shipyards, American engineering firms, American operators. From welders to naval architects, from port logistics to fleet maintenance — this is what reindustrialization looks like. 46 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 46 Modify, build & operate an offshore fleet. Images correspond to the approximate size of the annual fleet required to recover one billion tonnes over 33 years SUPPLY / SURVEY/ TRANSFER PRODUCTION VESSELS BULK CARRIERS Source: TMC analysis ------------------------------------------------------- Assuming 43 Mtpa for PFS+IA+EU during steady period 2039-2058 - 12 production vessels - 14 transfer vessels - 38 supply & survey vessels - 62 bulk carriers |

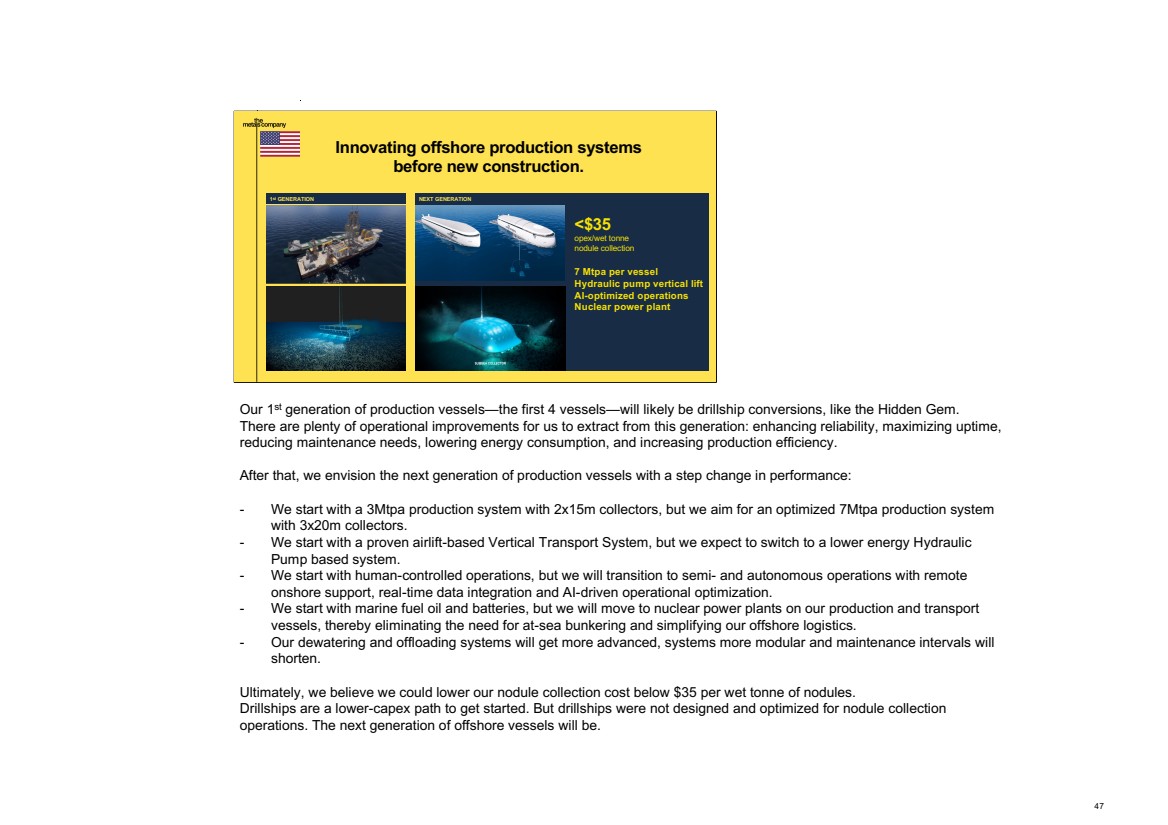

| Our 1st generation of production vessels—the first 4 vessels—will likely be drillship conversions, like the Hidden Gem. There are plenty of operational improvements for us to extract from this generation: enhancing reliability, maximizing uptime, reducing maintenance needs, lowering energy consumption, and increasing production efficiency. After that, we envision the next generation of production vessels with a step change in performance: - We start with a 3Mtpa production system with 2x15m collectors, but we aim for an optimized 7Mtpa production system with 3x20m collectors. - We start with a proven airlift-based Vertical Transport System, but we expect to switch to a lower energy Hydraulic Pump based system. - We start with human-controlled operations, but we will transition to semi- and autonomous operations with remote onshore support, real-time data integration and AI-driven operational optimization. - We start with marine fuel oil and batteries, but we will move to nuclear power plants on our production and transport vessels, thereby eliminating the need for at-sea bunkering and simplifying our offshore logistics. - Our dewatering and offloading systems will get more advanced, systems more modular and maintenance intervals will shorten. Ultimately, we believe we could lower our nodule collection cost below $35 per wet tonne of nodules. Drillships are a lower-capex path to get started. But drillships were not designed and optimized for nodule collection operations. The next generation of offshore vessels will be. 47 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 47 Innovating offshore production systems before new construction. <$35 opex/wet tonne nodule collection 7 Mtpa per vessel Hydraulic pump vertical lift AI-optimized operations Nuclear power plant 1st GENERATION NEXT GENERATION |

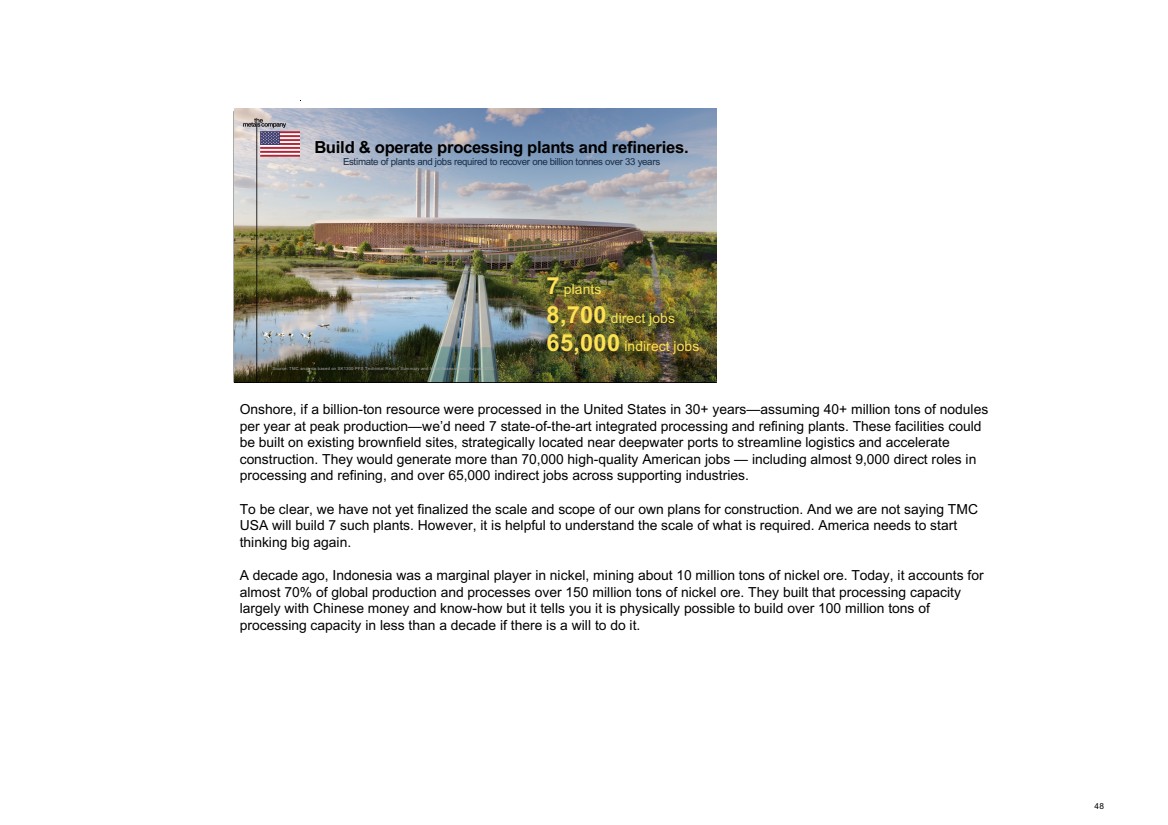

| Onshore, if a billion-ton resource were processed in the United States in 30+ years—assuming 40+ million tons of nodules per year at peak production—we’d need 7 state-of-the-art integrated processing and refining plants. These facilities could be built on existing brownfield sites, strategically located near deepwater ports to streamline logistics and accelerate construction. They would generate more than 70,000 high-quality American jobs — including almost 9,000 direct roles in processing and refining, and over 65,000 indirect jobs across supporting industries. To be clear, we have not yet finalized the scale and scope of our own plans for construction. And we are not saying TMC USA will build 7 such plants. However, it is helpful to understand the scale of what is required. America needs to start thinking big again. A decade ago, Indonesia was a marginal player in nickel, mining about 10 million tons of nickel ore. Today, it accounts for almost 70% of global production and processes over 150 million tons of nickel ore. They built that processing capacity largely with Chinese money and know-how but it tells you it is physically possible to build over 100 million tons of processing capacity in less than a decade if there is a will to do it. 48 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 48 Build & operate processing plants and refineries. Estimate of plants and jobs required to recover one billion tonnes over 33 years 7 plants 8,700 direct jobs 65,000 indirect jobs Source: TMC analysis based on SK1300 PFS Technical Report Summary and Initial Assessment, August 2025 |

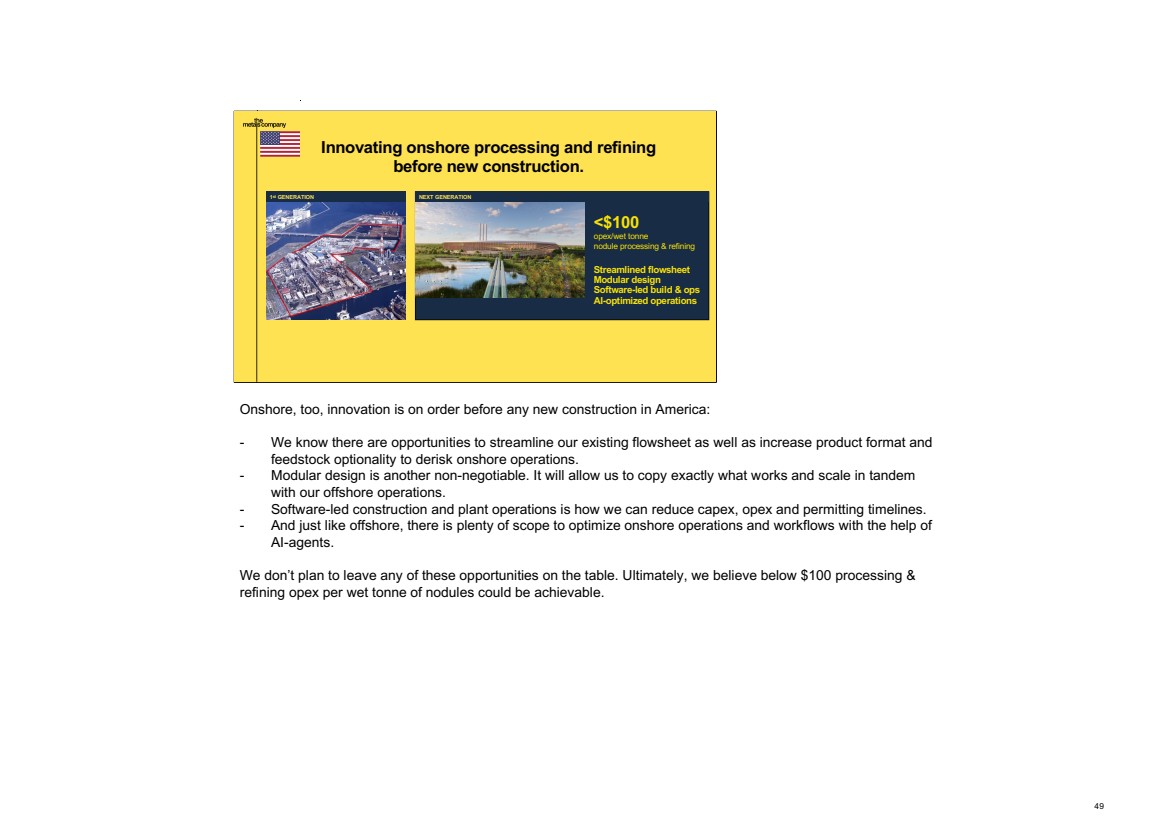

| Onshore, too, innovation is on order before any new construction in America: - We know there are opportunities to streamline our existing flowsheet as well as increase product format and feedstock optionality to derisk onshore operations. - Modular design is another non-negotiable. It will allow us to copy exactly what works and scale in tandem with our offshore operations. - Software-led construction and plant operations is how we can reduce capex, opex and permitting timelines. - And just like offshore, there is plenty of scope to optimize onshore operations and workflows with the help of AI-agents. We don’t plan to leave any of these opportunities on the table. Ultimately, we believe below $100 processing & refining opex per wet tonne of nodules could be achievable. 49 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 49 <$100 opex/wet tonne nodule processing & refining Streamlined flowsheet Modular design Software-led build & ops AI-optimized operations 1st GENERATION NEXT GENERATION Innovating onshore processing and refining before new construction. |

| Several years ago, as a private company, we worked with the naval and industrial designers at BIG to conceptualize what the next generation of operations could look like. Here is a video that may no longer capture all of the details of our current thinking, but it certainly captures our direction of travel. 50 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 50 Video: https://vimeo.com/1106731880/1907565031?share=copy |

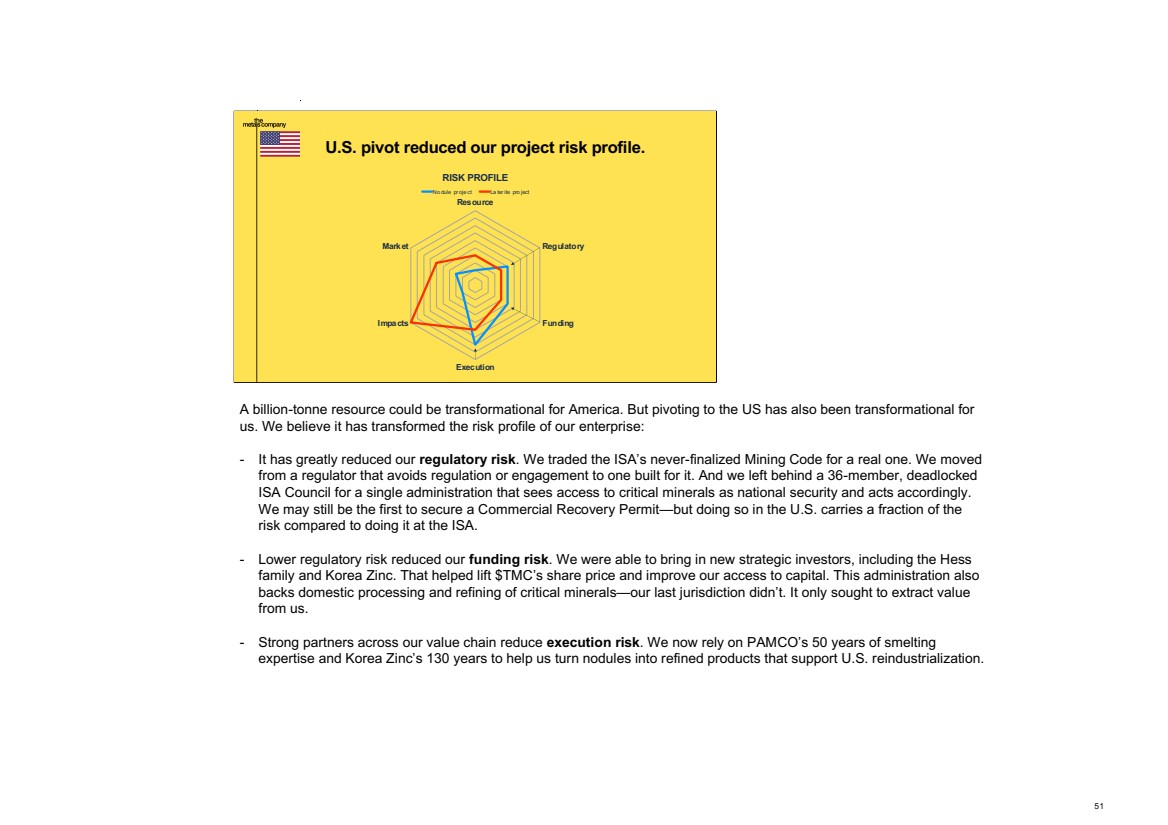

| A billion-tonne resource could be transformational for America. But pivoting to the US has also been transformational for us. We believe it has transformed the risk profile of our enterprise: - It has greatly reduced our regulatory risk. We traded the ISA’s never-finalized Mining Code for a real one. We moved from a regulator that avoids regulation or engagement to one built for it. And we left behind a 36-member, deadlocked ISA Council for a single administration that sees access to critical minerals as national security and acts accordingly. We may still be the first to secure a Commercial Recovery Permit—but doing so in the U.S. carries a fraction of the risk compared to doing it at the ISA. - Lower regulatory risk reduced our funding risk. We were able to bring in new strategic investors, including the Hess family and Korea Zinc. That helped lift $TMC’s share price and improve our access to capital. This administration also backs domestic processing and refining of critical minerals—our last jurisdiction didn’t. It only sought to extract value from us. - Strong partners across our value chain reduce execution risk. We now rely on PAMCO’s 50 years of smelting expertise and Korea Zinc’s 130 years to help us turn nodules into refined products that support U.S. reindustrialization. 51 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 51 U.S. pivot reduced our project risk profile. Resource Regulatory Funding Execution Impacts Market RISK PROFILE No dule pr oje ct La ter ite pro ject |

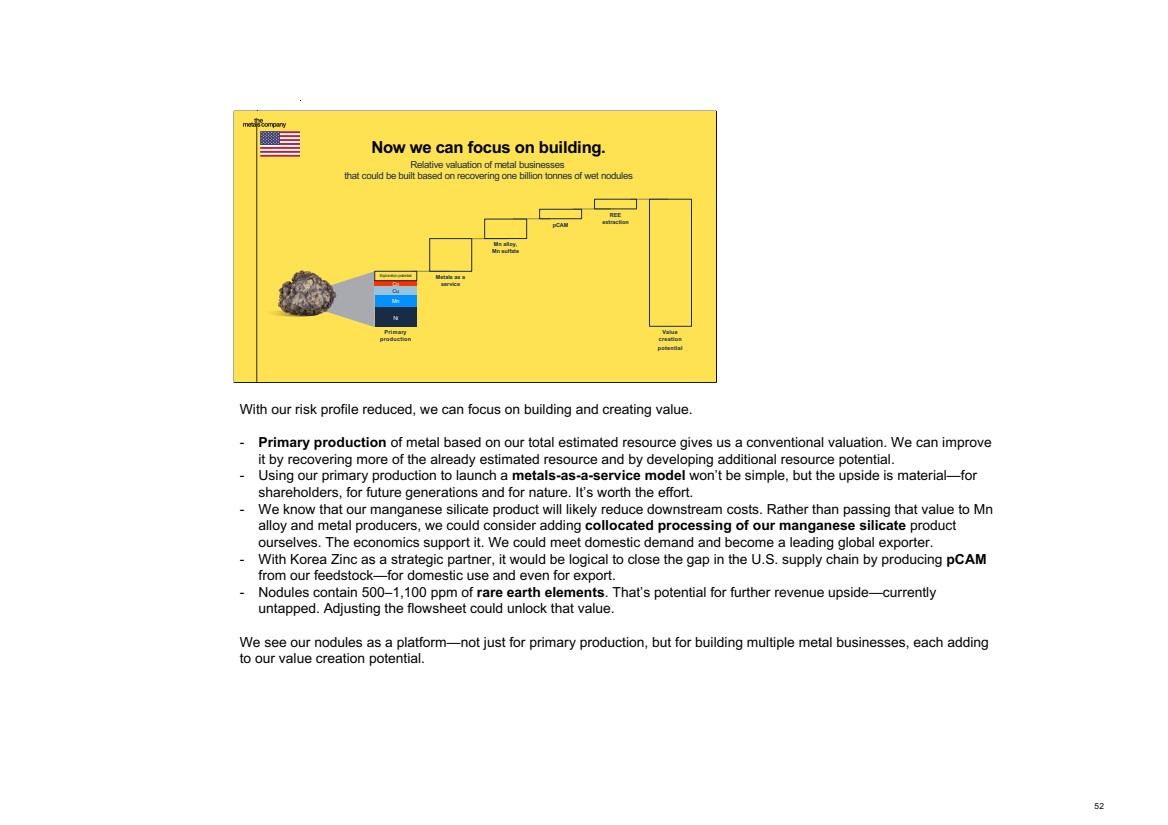

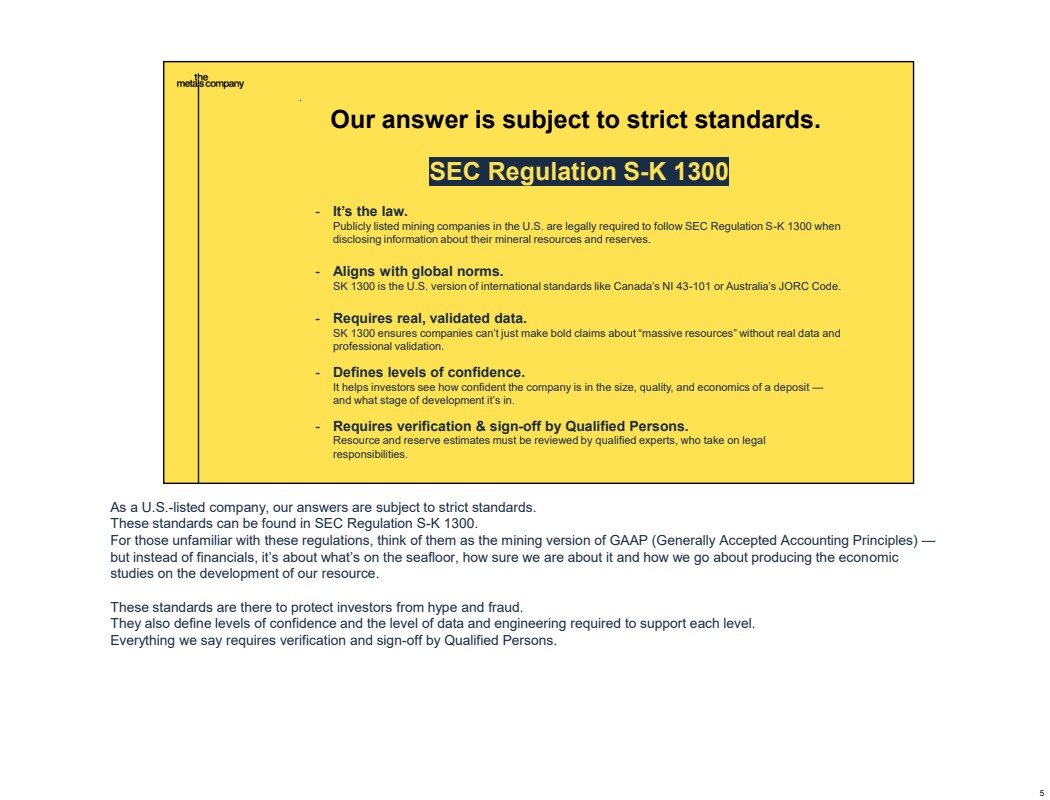

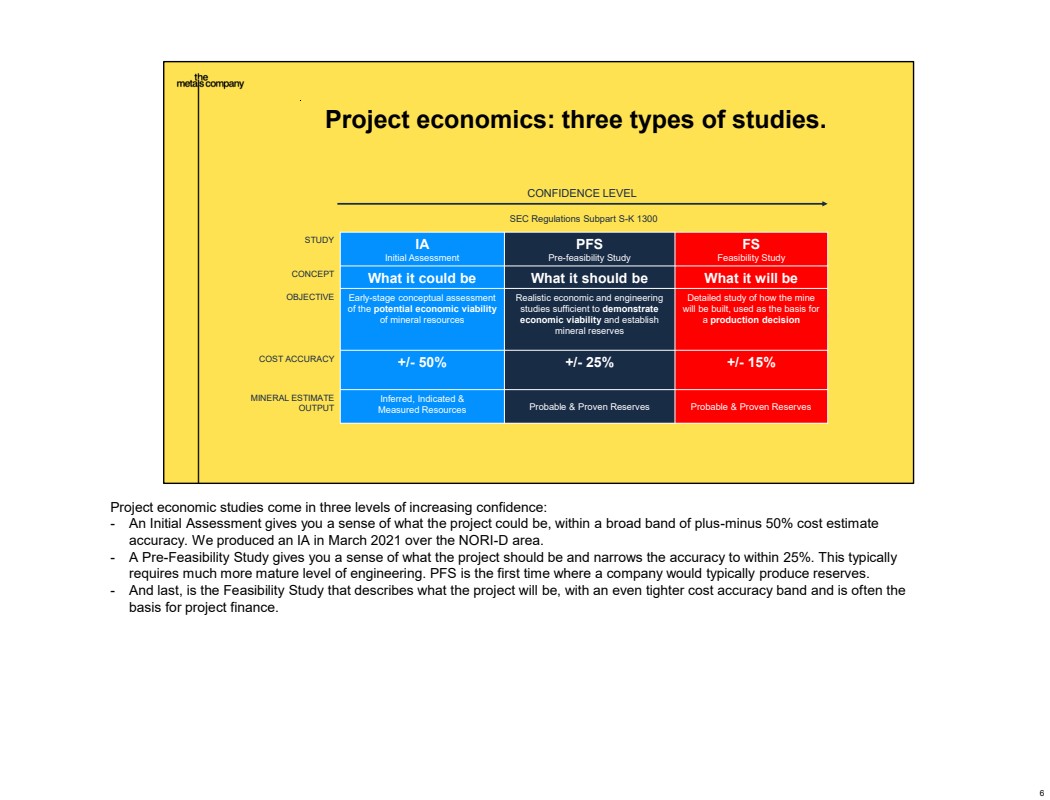

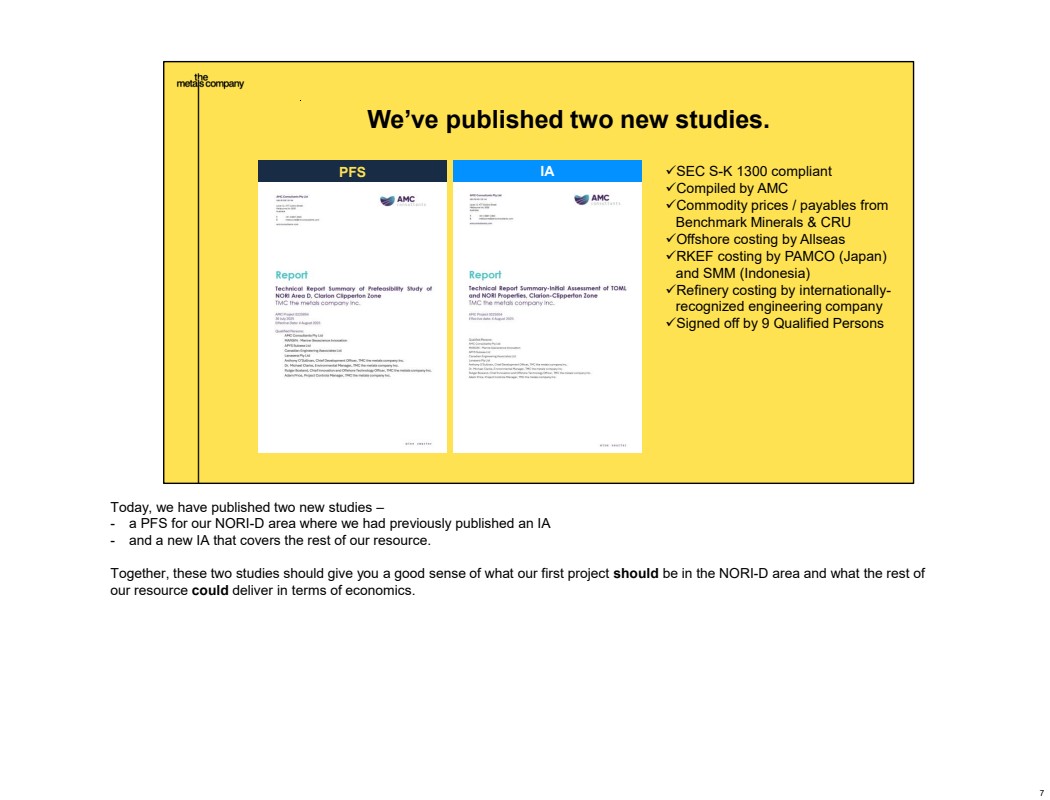

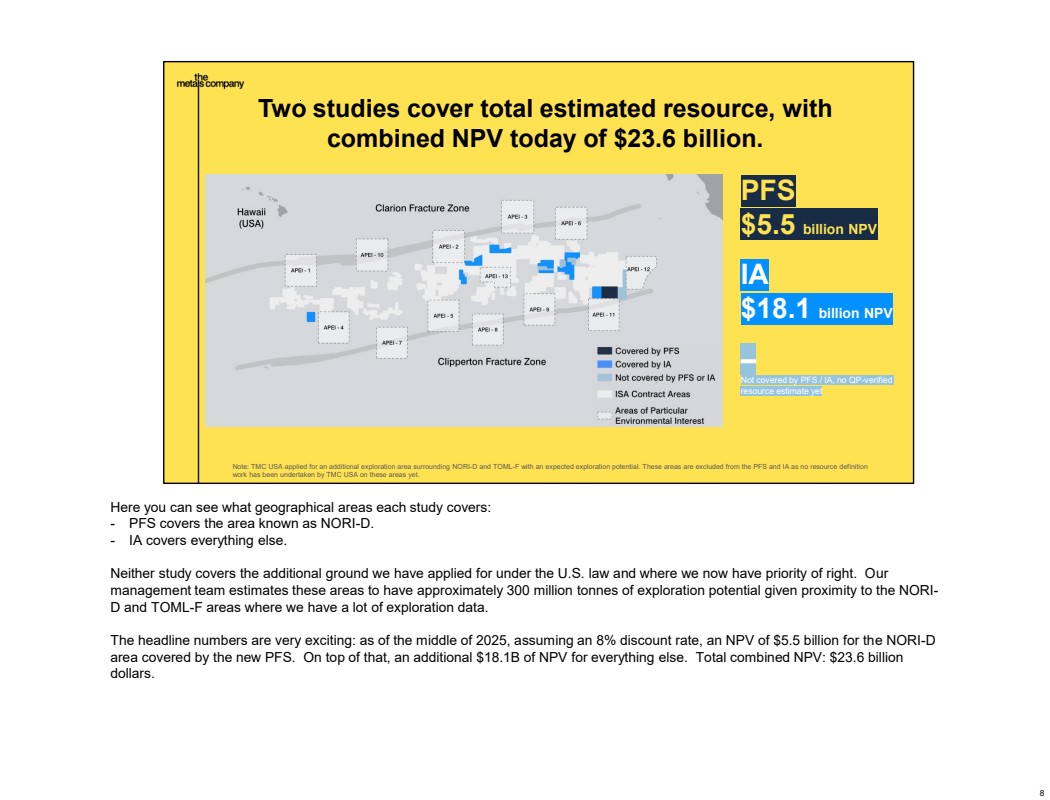

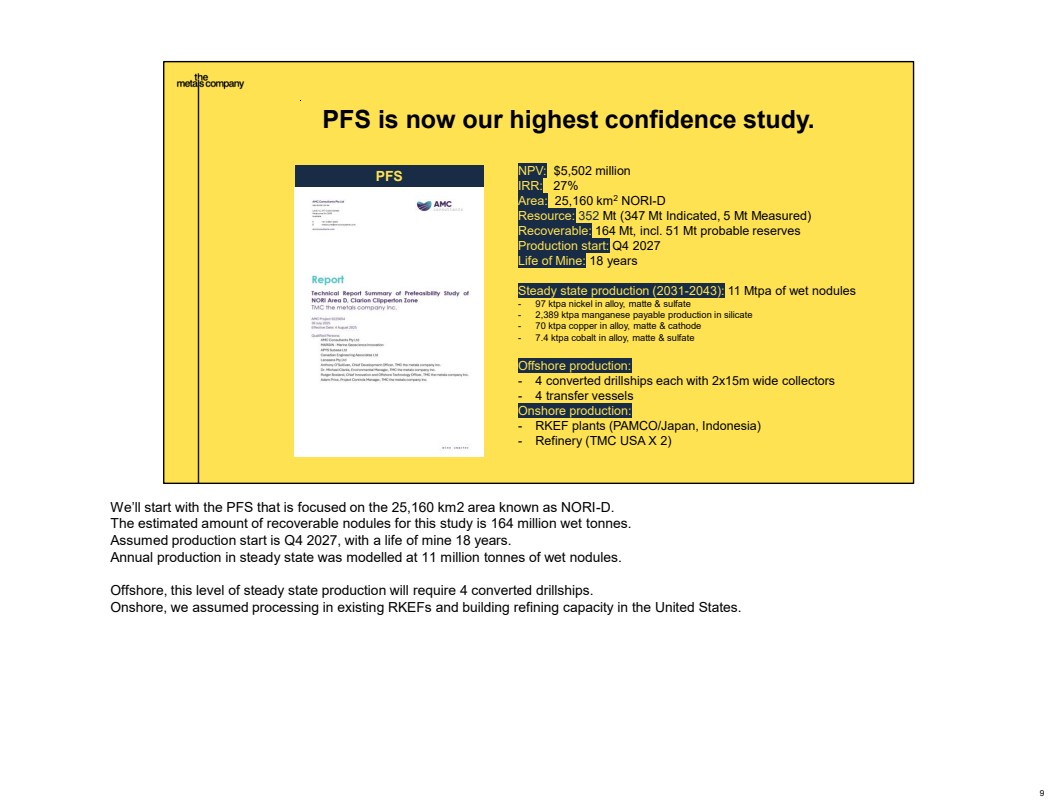

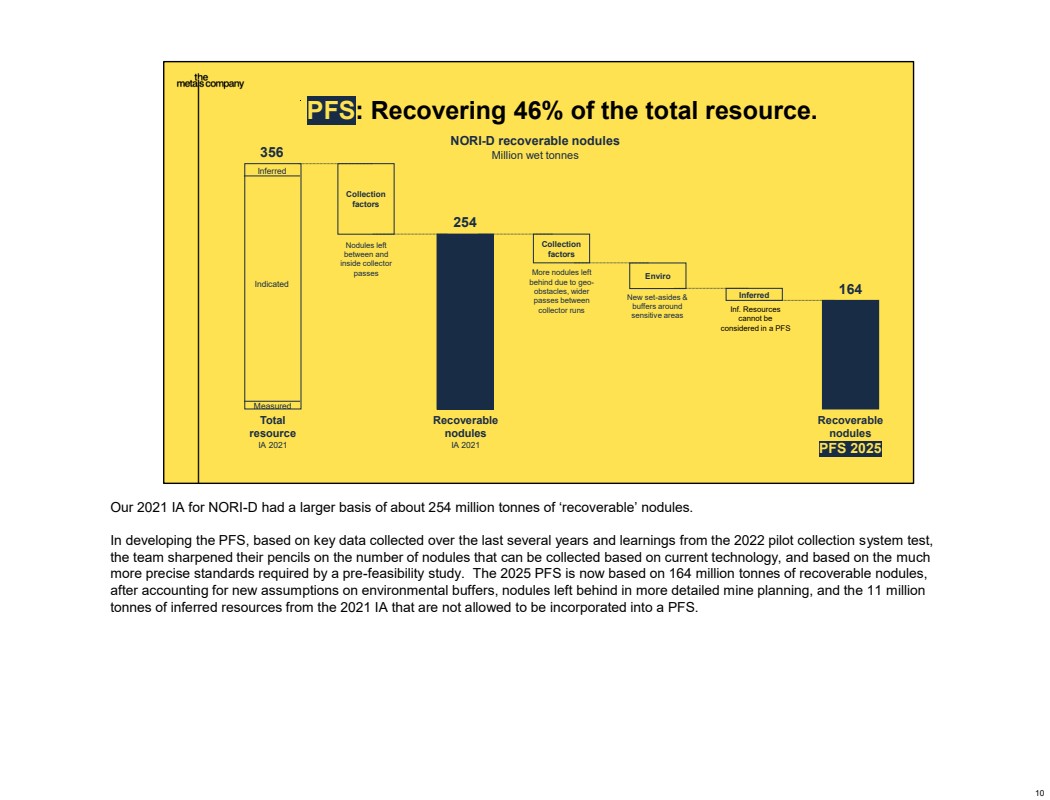

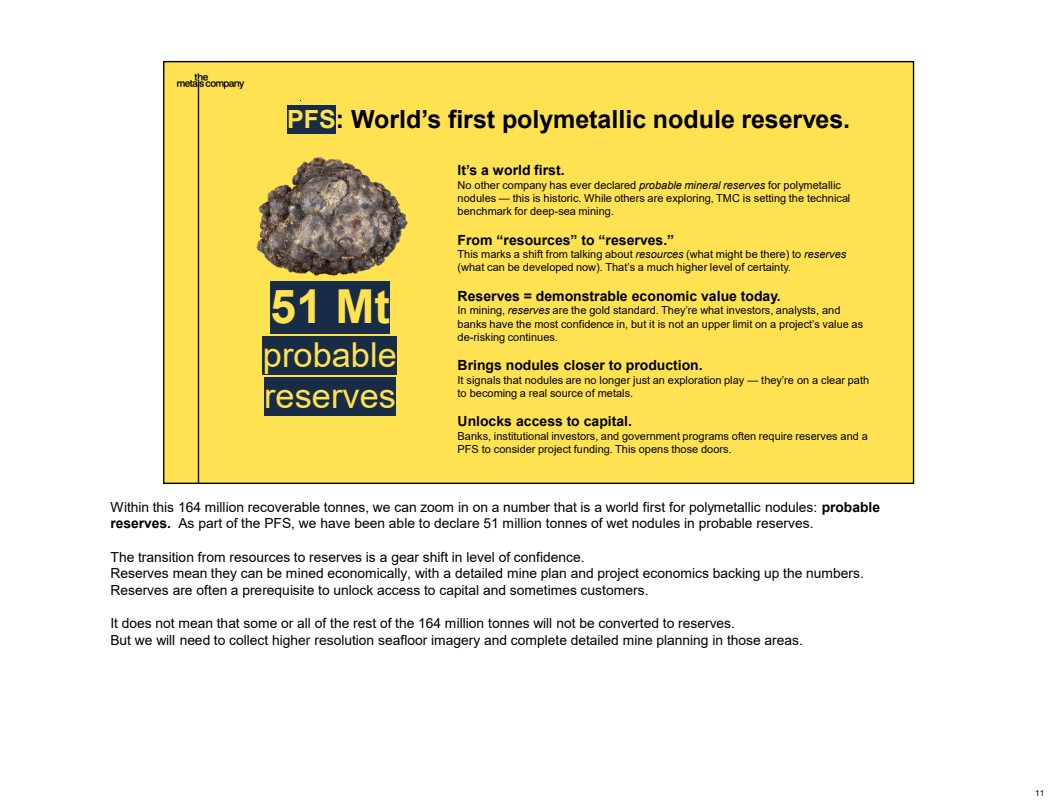

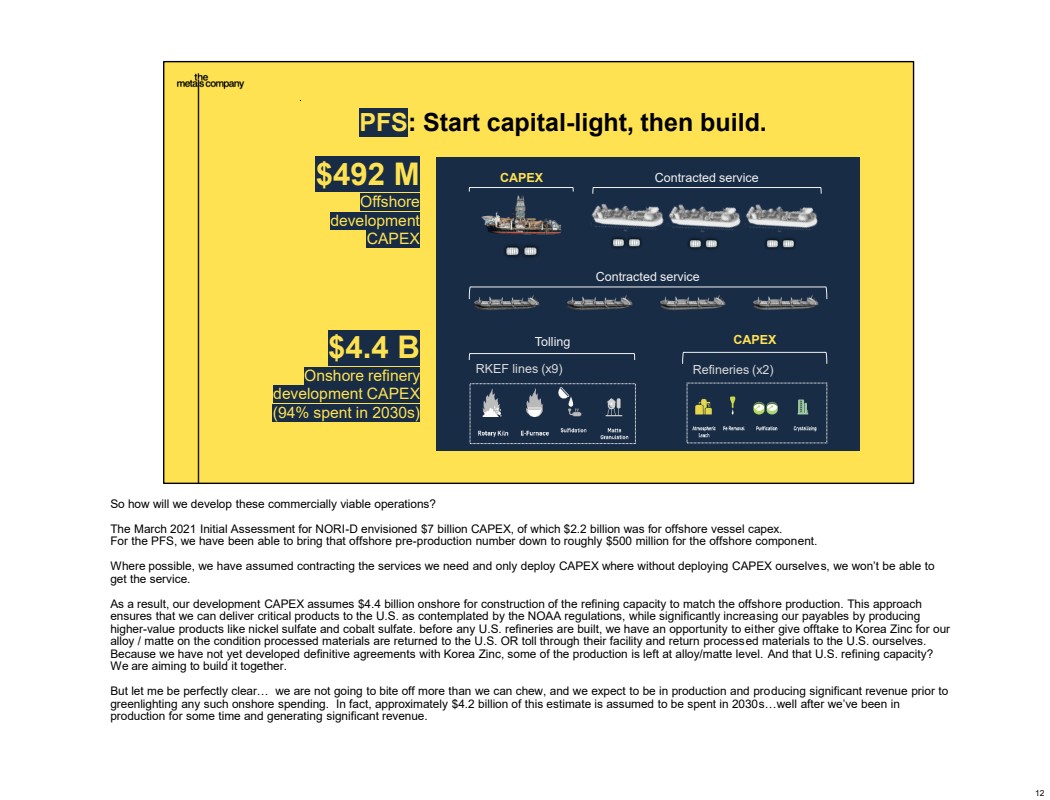

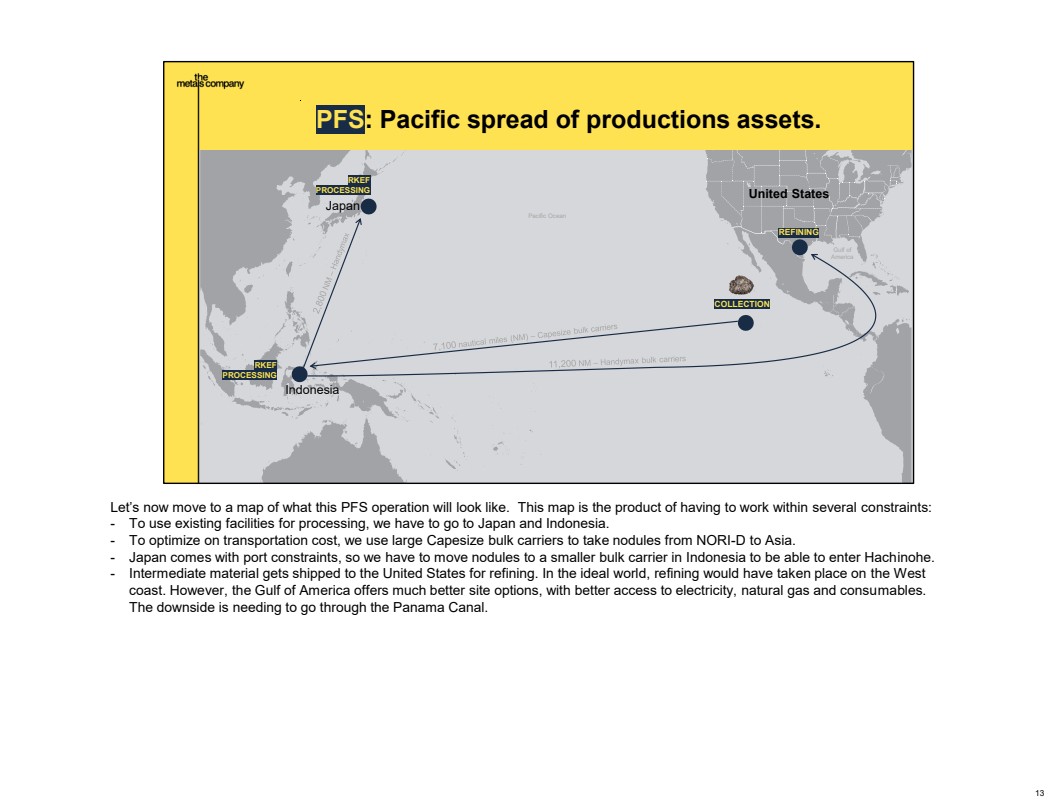

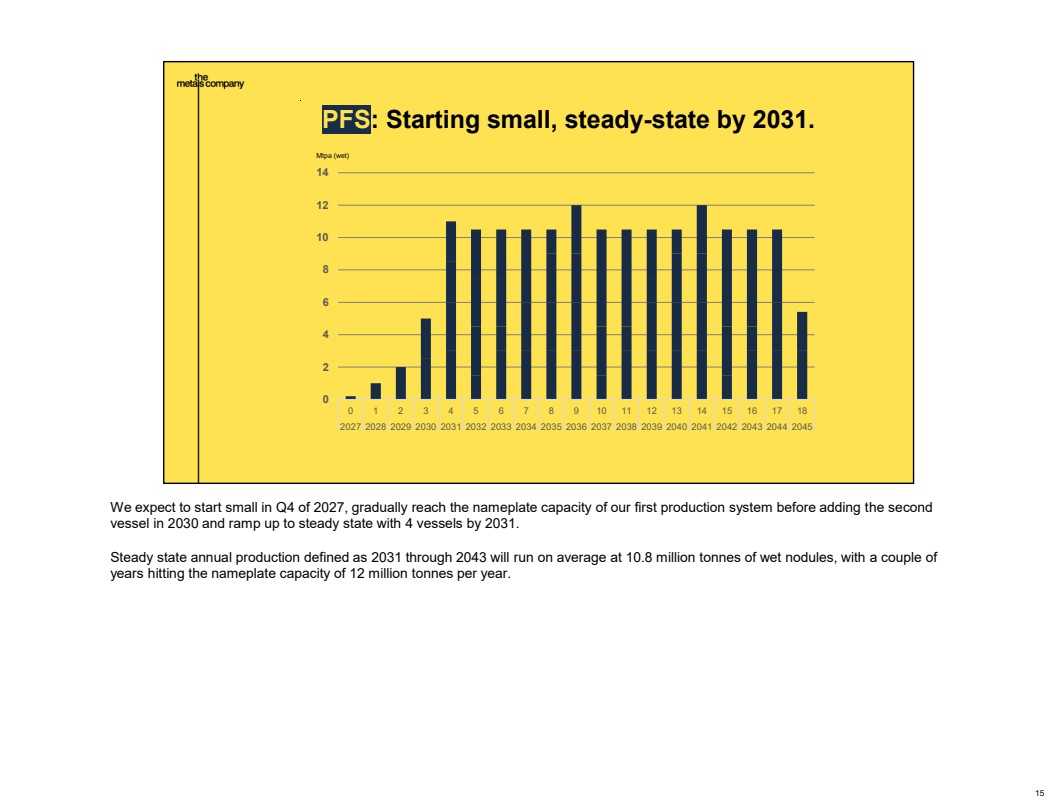

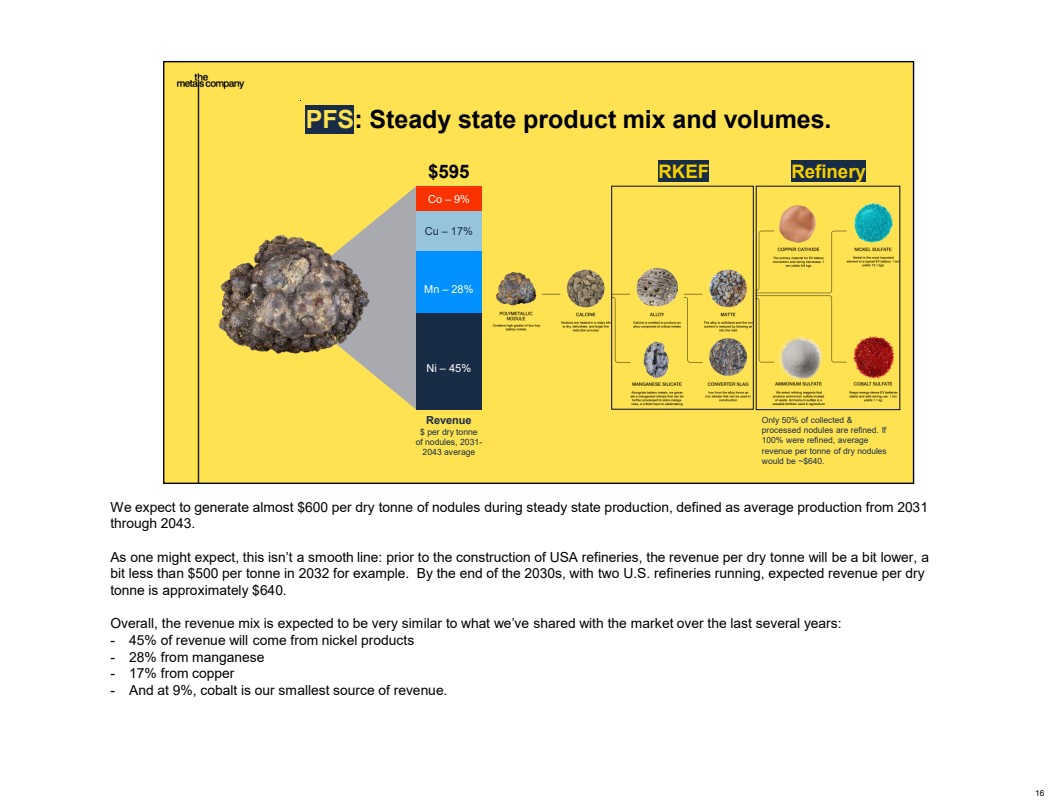

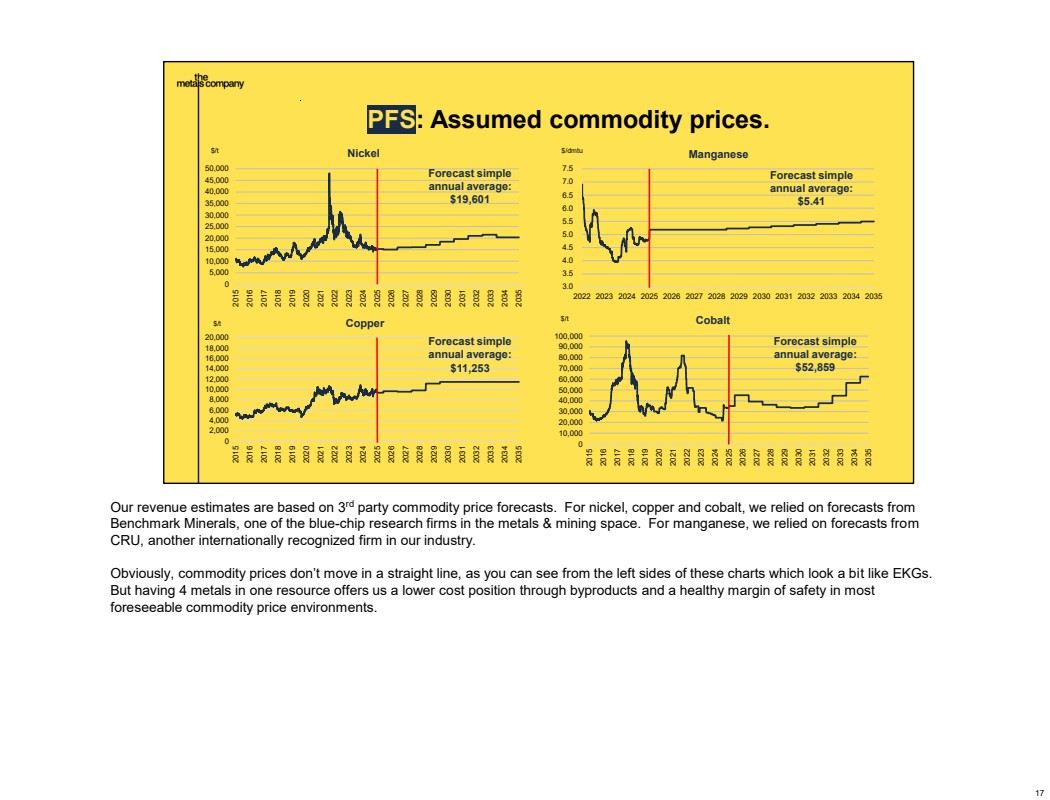

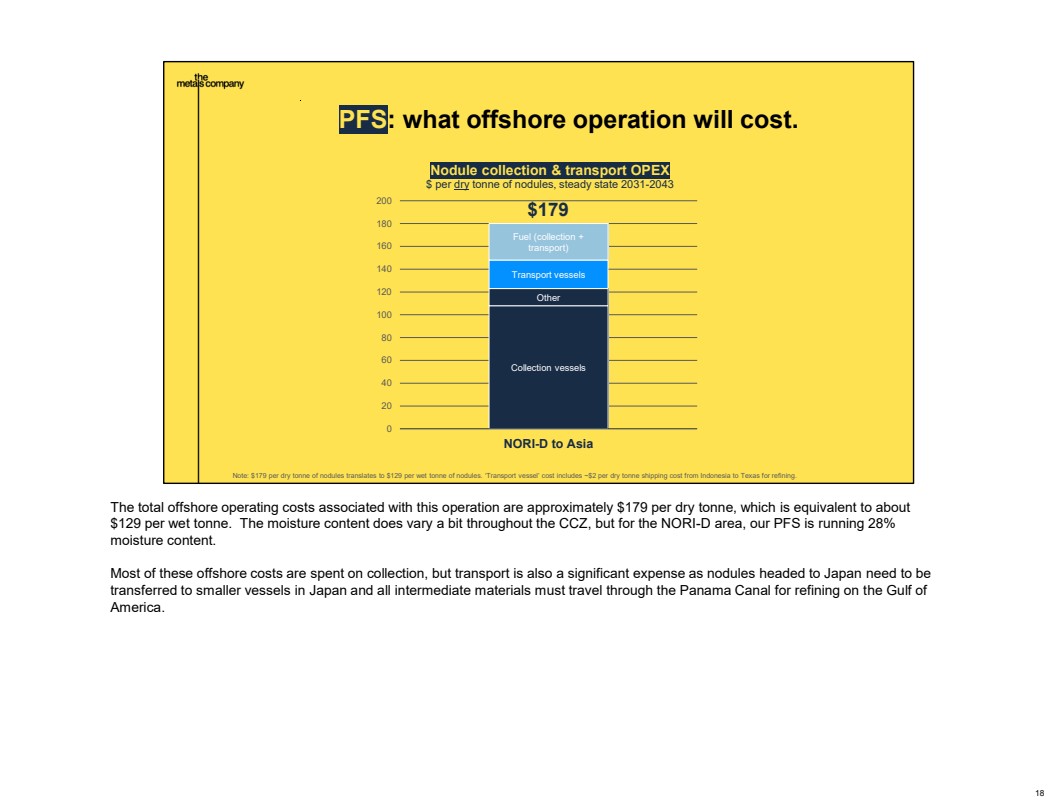

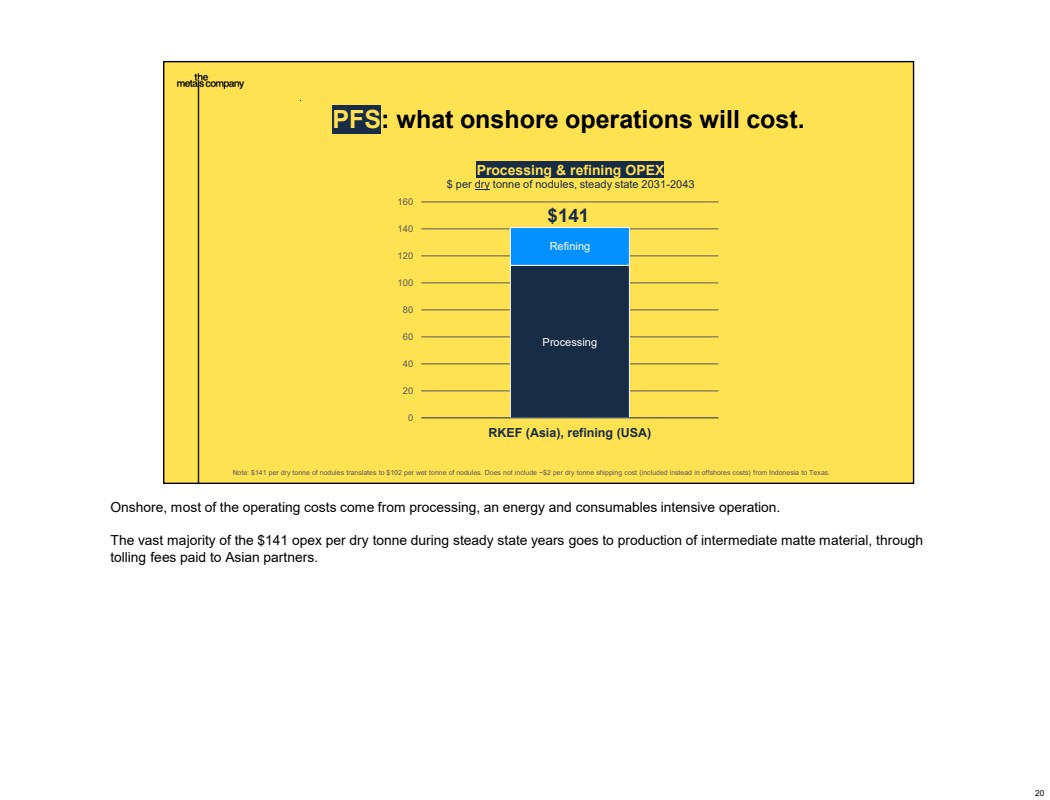

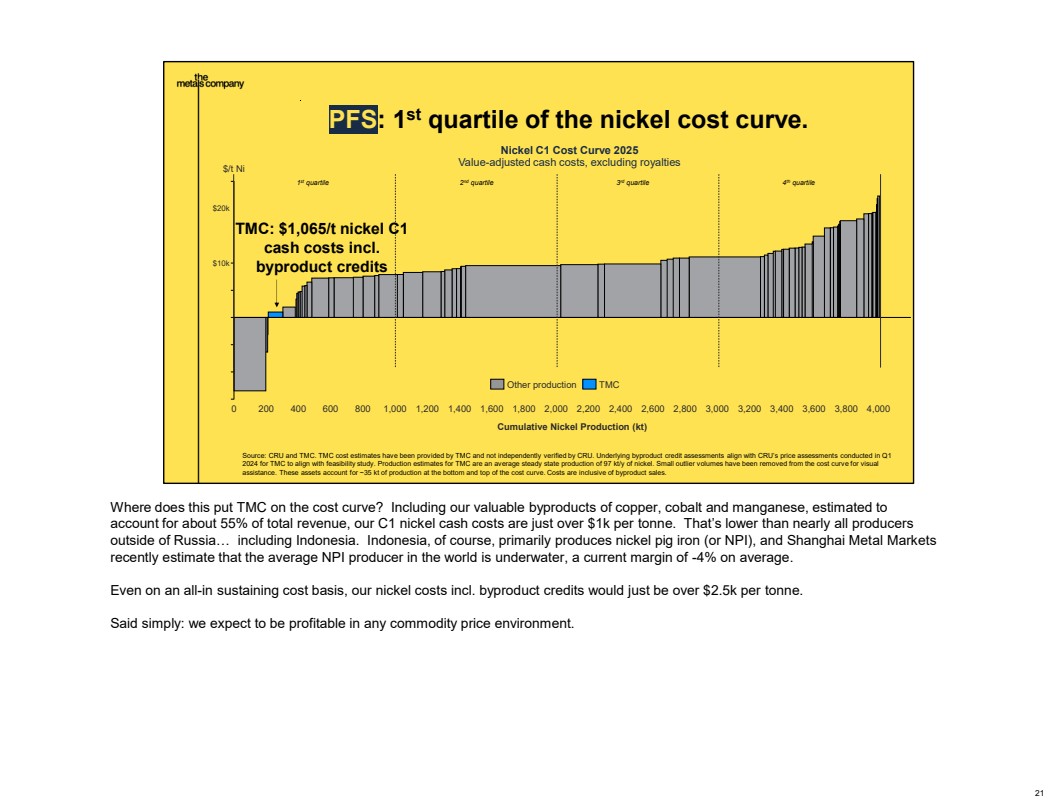

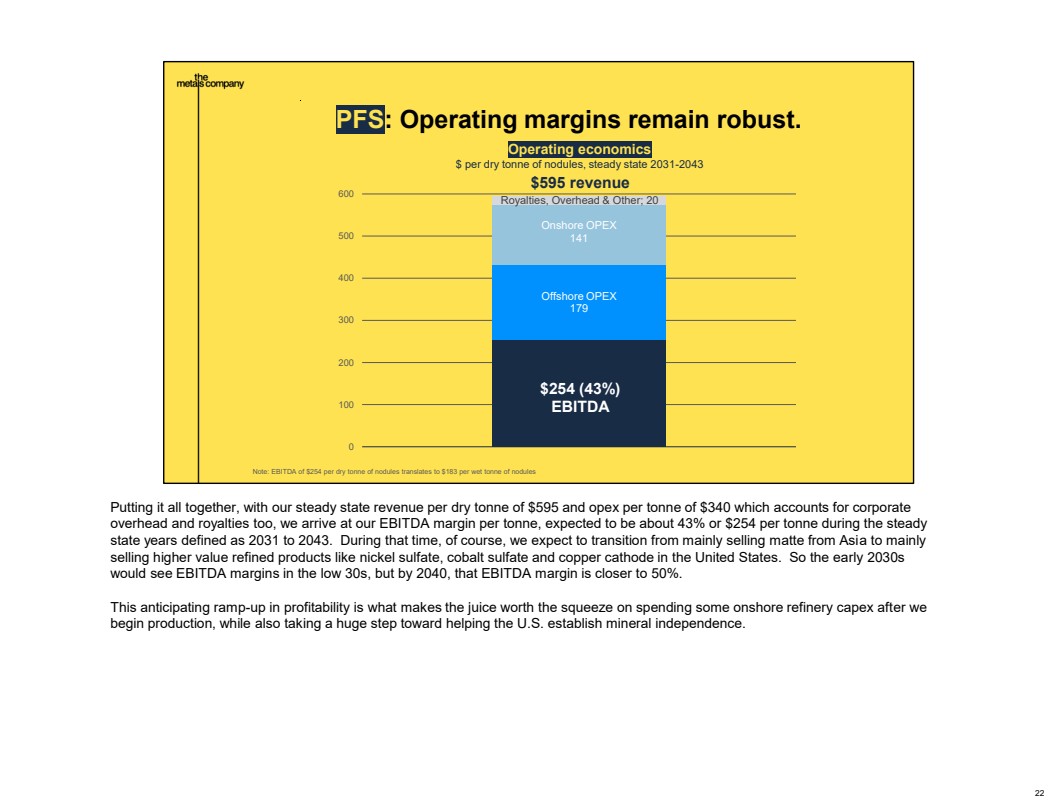

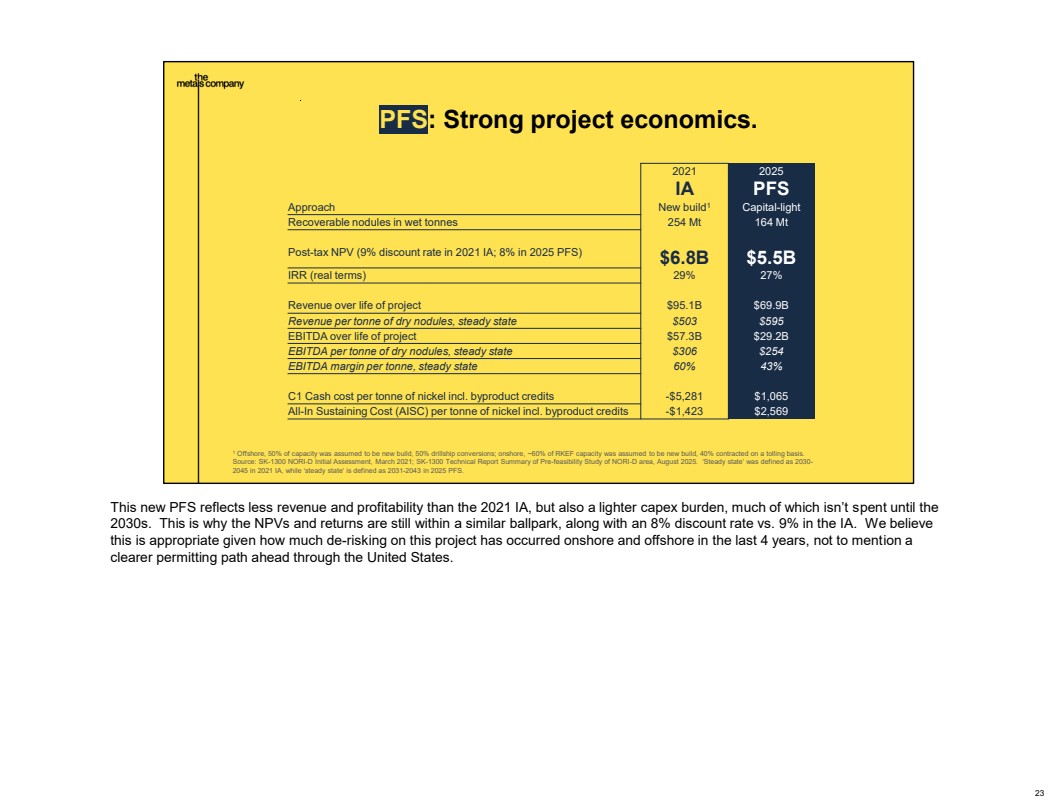

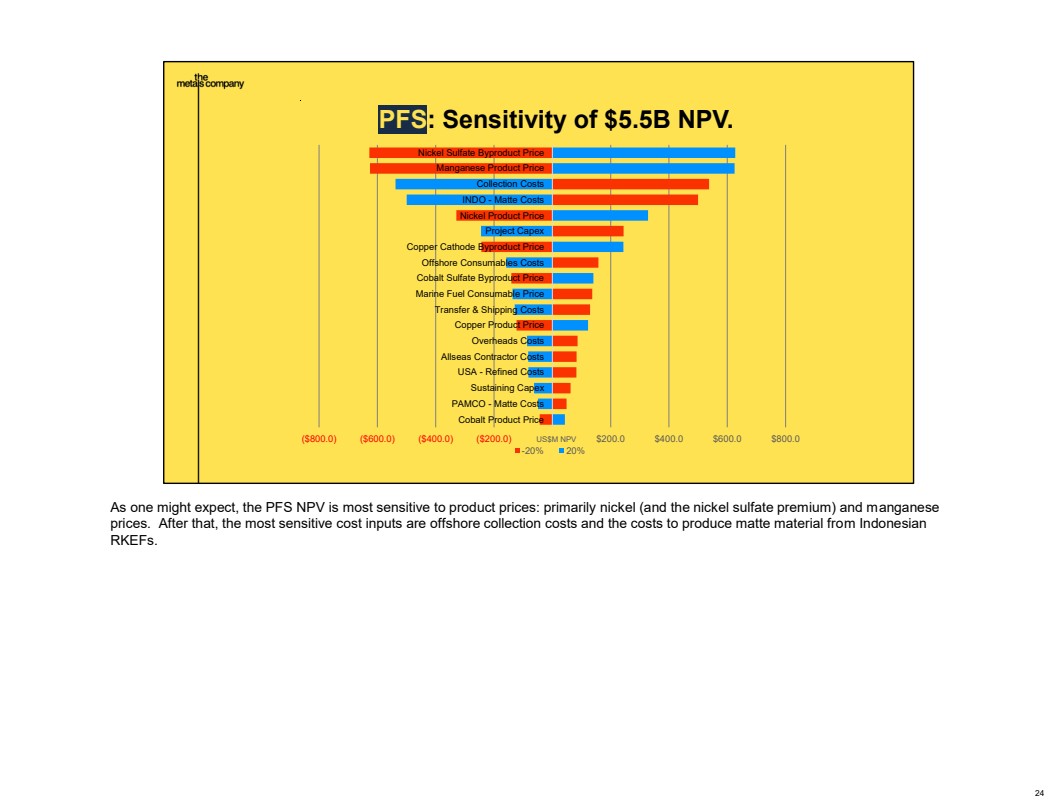

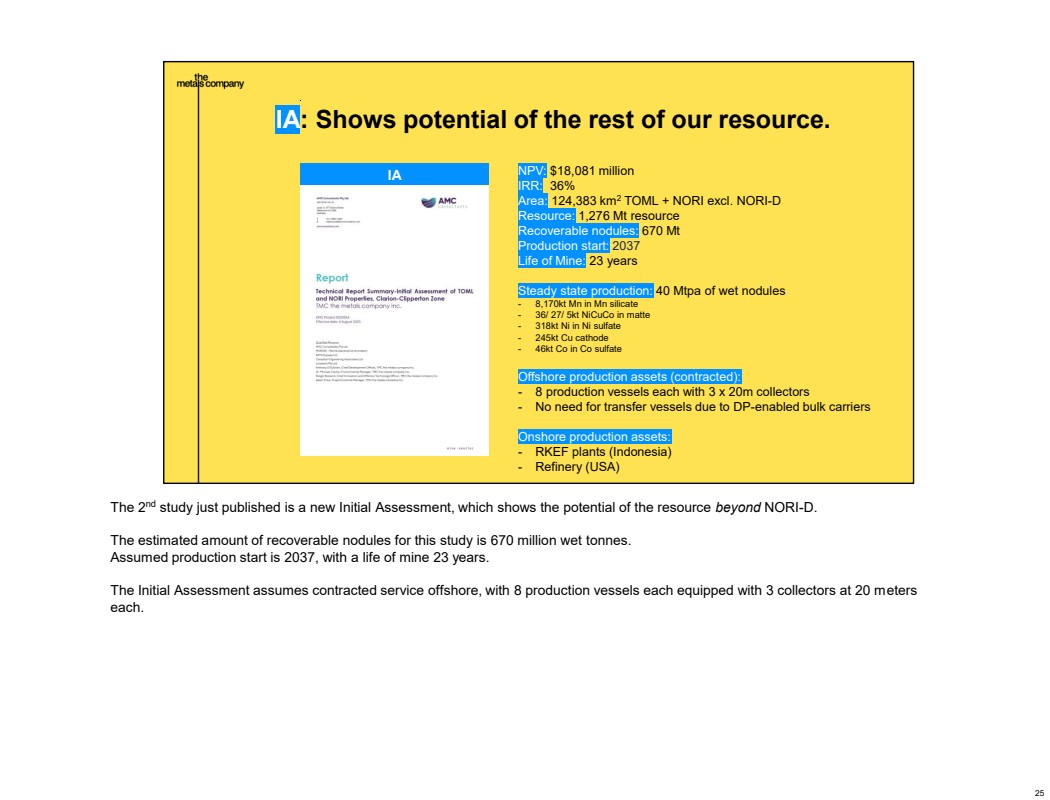

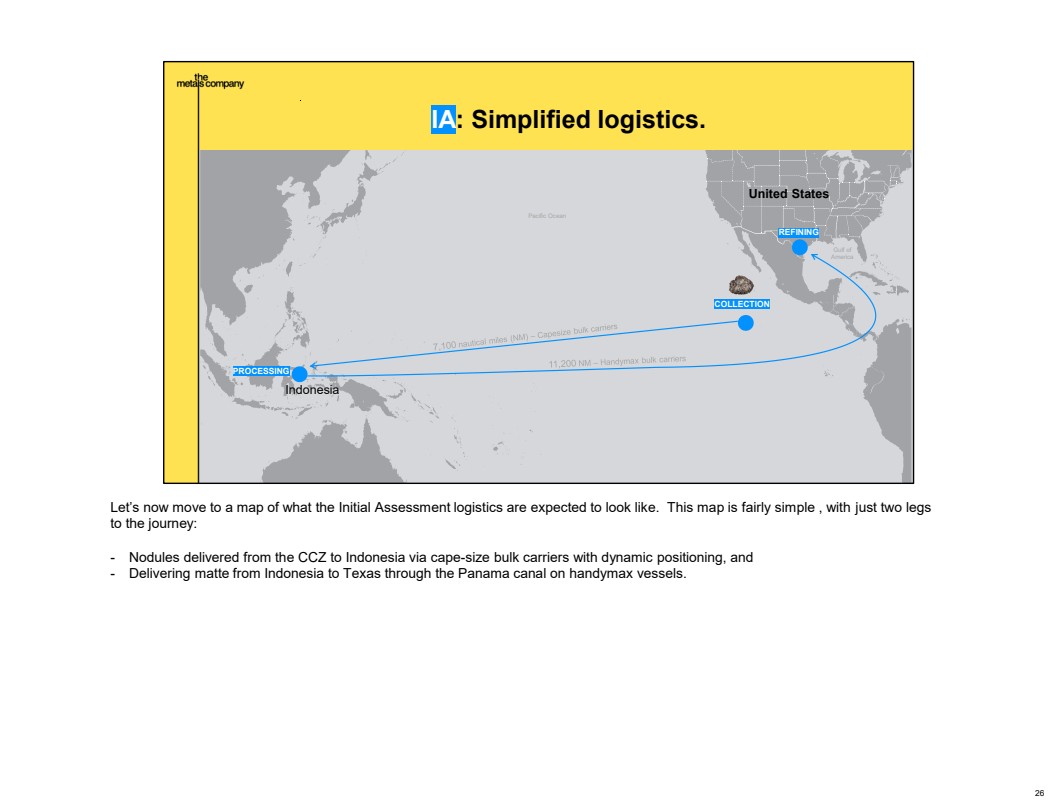

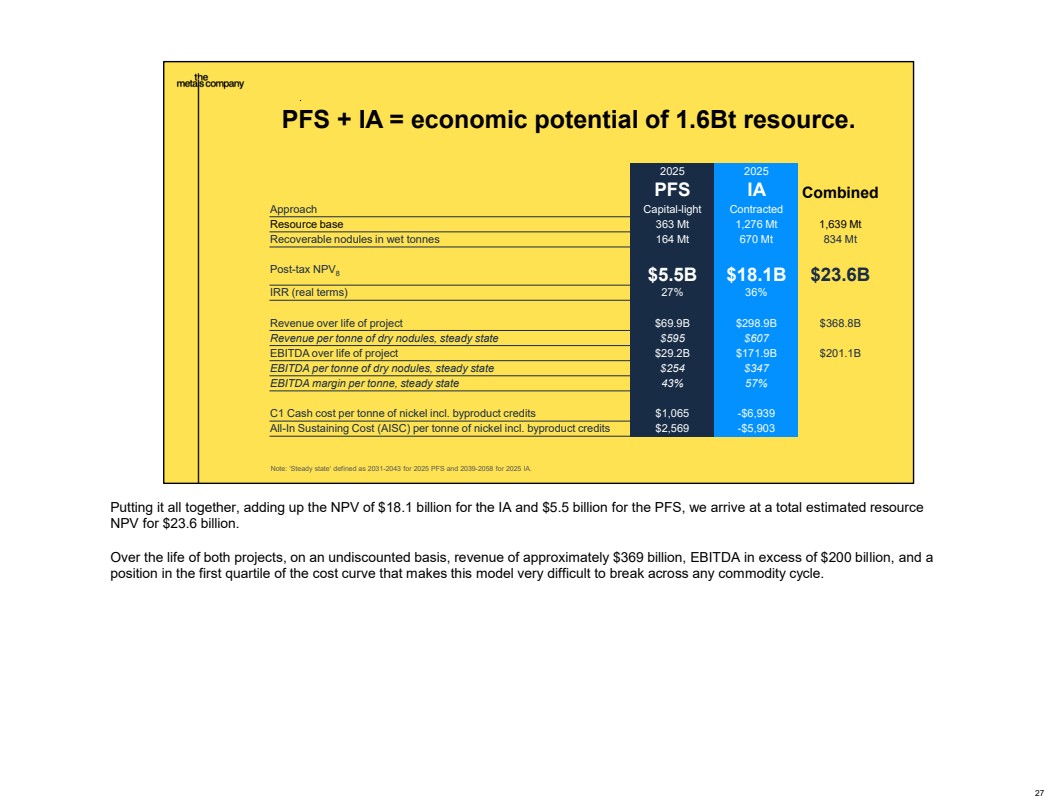

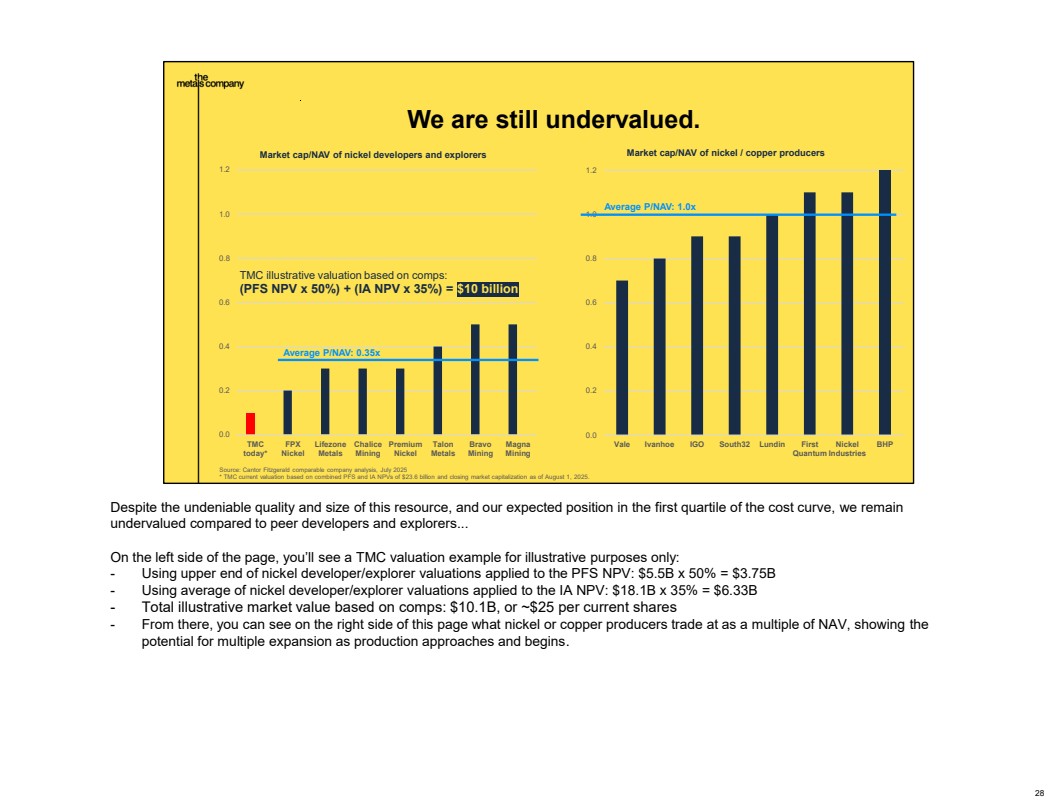

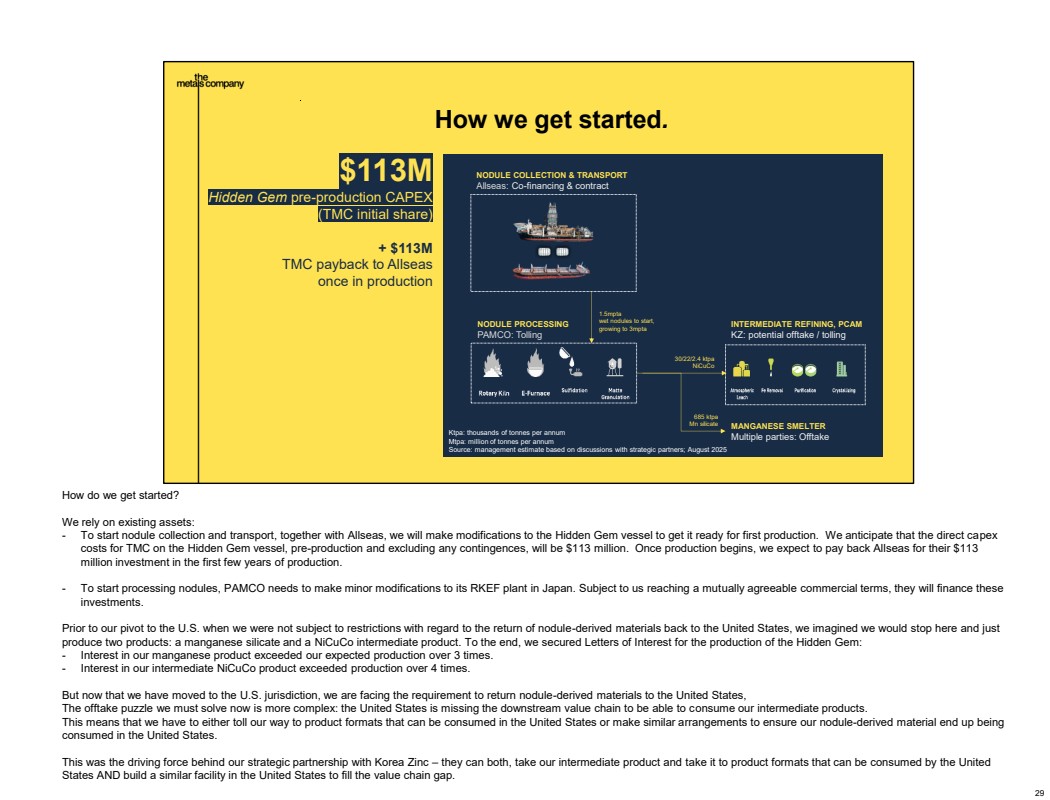

| With our risk profile reduced, we can focus on building and creating value. - Primary production of metal based on our total estimated resource gives us a conventional valuation. We can improve it by recovering more of the already estimated resource and by developing additional resource potential. - Using our primary production to launch a metals-as-a-service model won’t be simple, but the upside is material—for shareholders, for future generations and for nature. It’s worth the effort. - We know that our manganese silicate product will likely reduce downstream costs. Rather than passing that value to Mn alloy and metal producers, we could consider adding collocated processing of our manganese silicate product ourselves. The economics support it. We could meet domestic demand and become a leading global exporter. - With Korea Zinc as a strategic partner, it would be logical to close the gap in the U.S. supply chain by producing pCAM from our feedstock—for domestic use and even for export. - Nodules contain 500–1,100 ppm of rare earth elements. That’s potential for further revenue upside—currently untapped. Adjusting the flowsheet could unlock that value. We see our nodules as a platform—not just for primary production, but for building multiple metal businesses, each adding to our value creation potential. 52 25 45 70 0 145 255 253 226 83 169 170 174 249 50 0 115 175 210 Master Headline | Arial 25, Bold Headline | Arial 21, Bold BLUE SUBHEAD | Arial 12, all caps Subhead | Arial 16, Bold Body Copy | Arial 14 For Bullets, use - 52 Now we can focus on building. Relative valuation of metal businesses that could be built based on recovering one billion tonnes of wet nodules - 8.5M EVs x 80kWh = 680 GWh capacity - 70% x 680 GWh = 476 GWh uses nickel & manganese chemistries - 0.65 kg of pCAM (NMC) per KWh x 476 GWh = 309,400 tons of pCAM - $11,000 per ton of pCAM (conservative prices) x 309,400 tons of pCAM = $3.4B revenue - TMC USA/KZ would have 50% market share or $1.7B revenue - 12% EBITDA margin (CNGR at ~10-13%, Huayou at ~12-19%) - Annual EBITDA 12% x $1.7B revenue = $204 million - 10x EBITDA multiple (CATL at 11.6x and sector averages around 7-12x) - 10 x $204= $2B valuation - Potential for higher valuation because the OPEX of refinery+pCAM is almost the same as for pure refinery, so significant EBITDA synergies! Export potential - Assuming EVs are 30% of annual 90M car sales or 27M EVs - 50kWh average battery capacity (smaller in Europe, China) - 18.5M EVs (ex America) x 50kWh = 925 GWh capacity - 40% uses Ni & Mn chemistries x 925 GWh = 370GWh - 0.65 kg of pCAM (NMC) per KWh x 370 GWh = 240,500 tons of pCAM - $11,000 per ton of pCAM (conservative prices) x 240,500 tons of pCAM = $2.6B revenue - TMC USA/KZ would have 50% market share or $1.3B revenue - 12% EBITDA x $1.3B revenue x 10x EBITDA multiple = $1.6B valuation - Co: 19 ktpa Export - Ni: 121.9 ktpa - Mn: 14.3 ktpa - Co: 15.2 ktpa Mn alloy $0.5B USA $1.9B export $2.4B total +2.4 +9 +11.4 Domestic USA market - 370,000t of SiMn imported by USA in 2024 (240ktpa Mn at 65%) - TMC USA replaces 100% of imports - $1,200 per ton of SiMn x $370ktpa = $444 M - 12% EBITDA margin ( Eramet at 12%, Ferroglobe 16%, OM Holdings 12%) - 12% x $444M revenue = $53M - 9x EBITDA multiple (Eramet 10x, OM Holdings 4.3x, Indian Metals & Ferro Alloys at 7.7x). Picked higher end of the range due to (1) pre-reduced feedstock + (2) cost reductions due to co-location - 9x $53M EBITDA = $477M Export potential - The global market for silico-manganese alloy is 9 Mtpa (14 Mtpa at 65-68% Mn contents, 2023) - At 40Mtpa of wet nodules, we will have 8.6 Mtpa of Mn units – enough to do almost all of it - If we took 10% of that market or 900ktpa of contained Mn, we would increase this bucket by 3.75x or $0.5Bx3.75=$1.9B - Mn: 240,000 tpa Mn sulfate $0.12B (USA) $5.4B (export) $5.52B total +0.6 +25 +26 Domestic USA market - TMC USA produces 100% of Mn sulfate that goes into its own pCAM production (see above) - 100% of pCAM produced is NMC811; more Mn sulfate would be required for other chemistries like LMCR - $730 / t of battery-grade Mn sulfate or $2,246 per tonne of contained manganese, based on a manganese content of 32.5% in the compound - $2,246 x 17,850 tpa of Mn = $40M revenue - 50% EBITDA margin (Firebird Metals projects 47-48%, Giyani Metals 54%) - 50% EBITDA x $40M revenue = $20M EBITDA - 6x EBITDA multiple (Canadian Manganese modeled at 5.9-6.3x EBITDA; diversified chemicals 10-12x) - 6x $20M = $120M valuation Export potential - Global demand for battery-grade Mn sulfate is expected to reach 1.6 million metric tons on a contained Mn basis by 2035 (Giyani Metals) - If we took 50% of that market or 800ktpa of contained Mn, we would increase this bucket by 45x or $0.12x45=$5.4B - Mn: 17.9ktpa (pCAM USA) - Mn: 800ktpa (export) REE $3.5B +17 - 500-1,100 ppms of REEs in dry tonnes of CCZ nodules - $21.4-50 /dry ton of nodules; the value is driven primarily by neodymium, dysprosium, terbium, and praseodymium, while light REEs like lanthanum and cerium contribute minimally due to their low prices - 80% recovery rate - 40 Mtpa x 0.72% moisture x 80% recovery rate x $50 per dry ton = $1.15 billion - 50% EBITDA margin (Lynas Rare Earths 28.5% in FY2024 and down from 51% in FY2023 and 65% in FY2022 due to lower prices; MP Materials: historical averages 20-40% when profitable; Rainbow Rare Earths: Projected 75% for future operations, Margins are higher in high-price environments (up to 60-65%) but can turn negative during downturns, with industry averages aligning closer to specialty chemicals (20-40%). - 20x EBITDA valuation multiple (REE processing businesses range from 10x to 20x for growth-oriented firms, though current multiples can be higher due to volatility and low EBITDA in recent years. Industry benchmarks from metals/mining are 8.7x (positive EBITDA firms) to 11.3x (all firms), while specialty chemicals average 13.3x to 14.5x. For specific companies: Lynas Rare Earths: Current 83-154x (elevated due to compressed EBITDA); historical average ~51x; MP Materials: Current 68x; historical 21-84x, with targets around 19x for future projections. Multiples are influenced by strategic importance (e.g., supply chain security) and can reach 20-30x in optimistic scenarios, but 10-15x is more typical for stable operations) - $1.15B revenue x 50% EBITDA margin x 20 EBITDA multiple = $11.5B - Global market for REEs is $4-7B, although the market is expected to grow 9-13%...highest prediction is $37B by 2033 (IMARC Group) - If we took 50% of this market, we could add $3.5B short-term which would translate into a more reasonable 10% share by 2033 based on the most aggressive market forecast of $37B TOTAL $56.7B 240 Mn Co Cu Ni Primary production Metals as a service Value creation potential Exploration potential REE extraction Mn alloy, Mn sulfate pCAM |