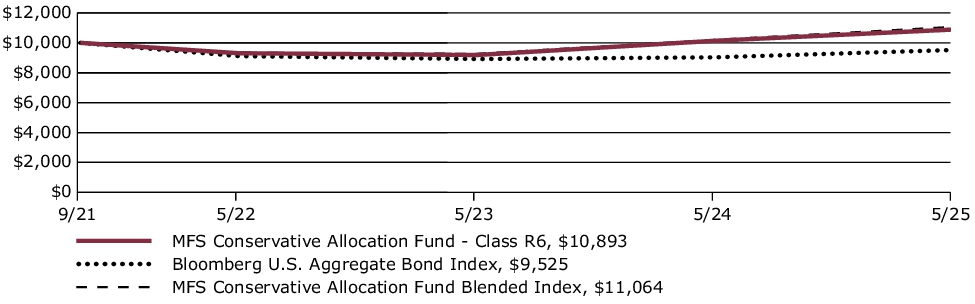

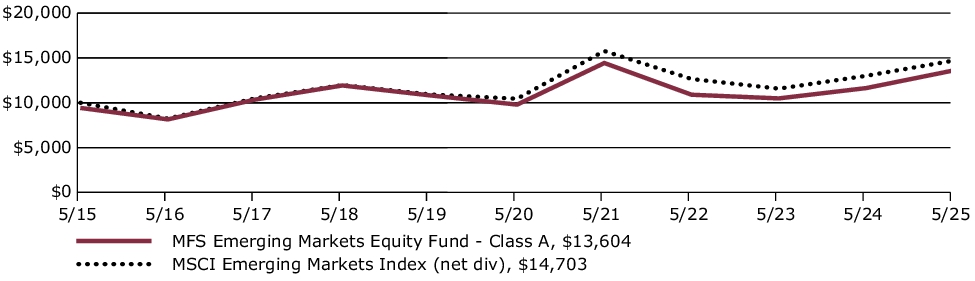

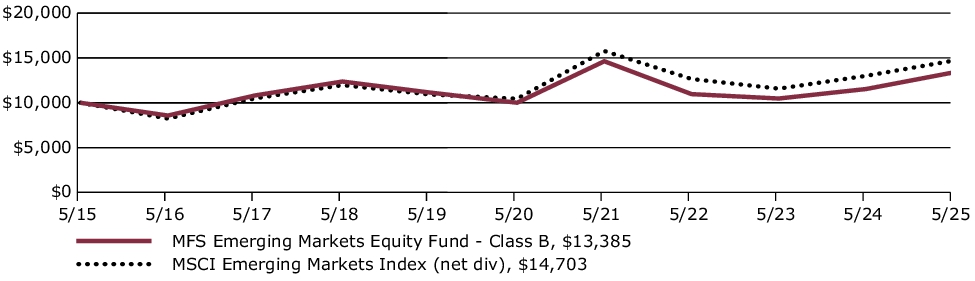

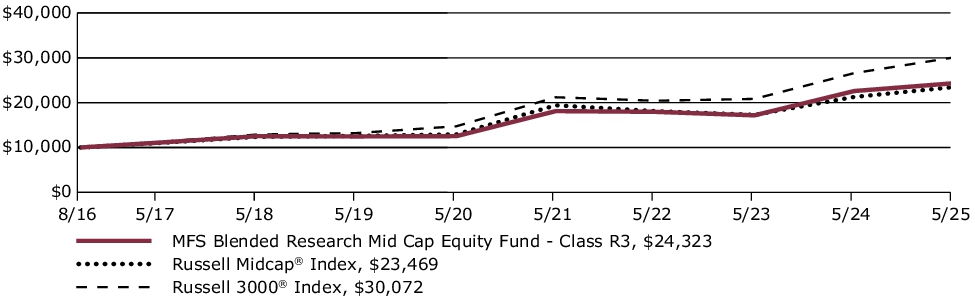

Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

MFS SERIES TRUST X

|

|

| Entity Central Index Key |

0000783740

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000006838 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MAAGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| A |

$40 |

0.38% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 40

|

[1] |

| Expense Ratio, Percent |

0.38%

|

[1] |

| Factors Affecting Performance [Text Block] |

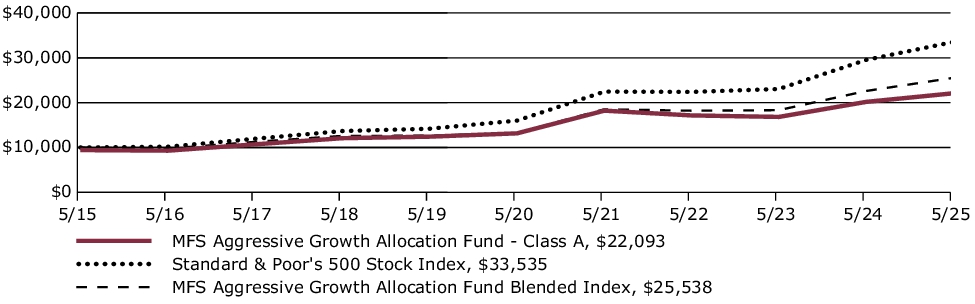

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class A shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.52%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

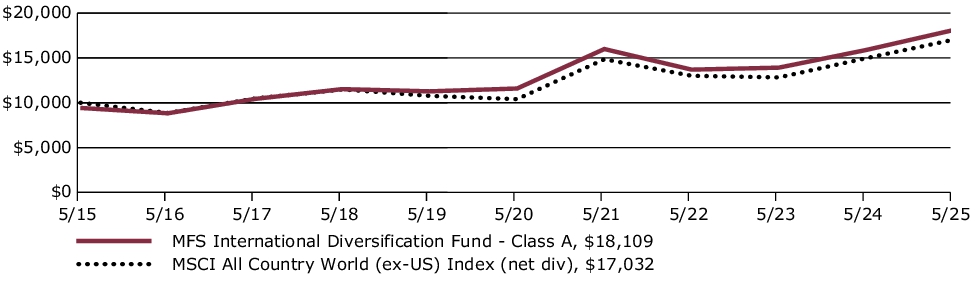

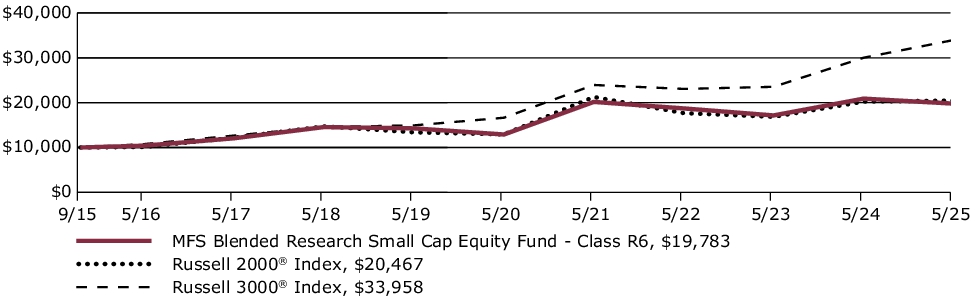

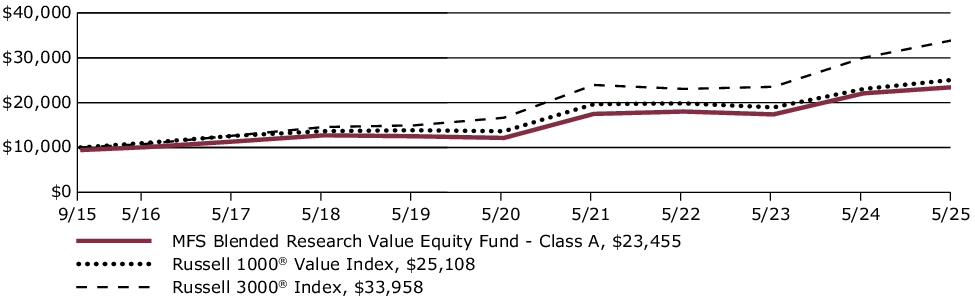

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class A over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests. This graph includes the deduction of the maximum applicable sales charge.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| A without sales charge |

9.52% |

10.92% |

8.89% |

| A with initial sales charge (5.75%) |

3.22% |

9.62% |

8.25% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/a for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[2] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

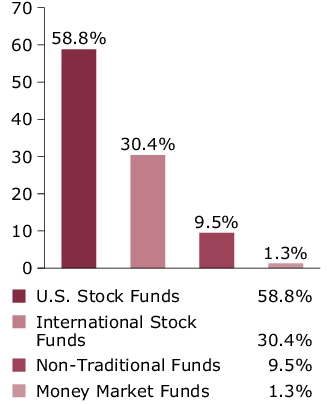

| Holdings [Text Block] |

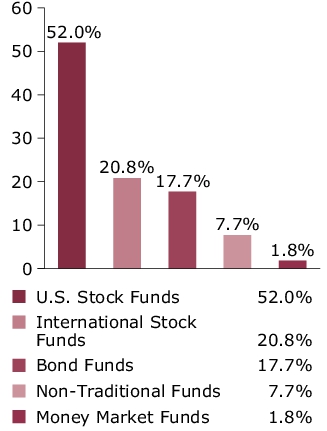

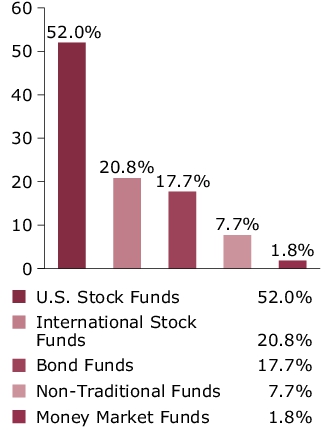

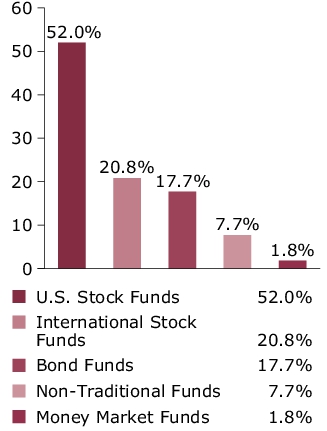

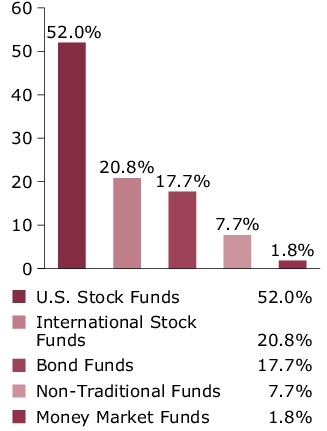

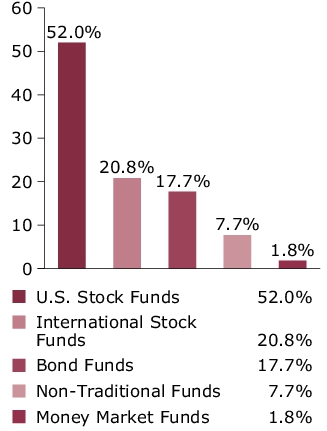

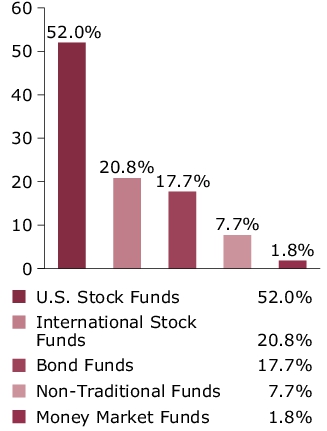

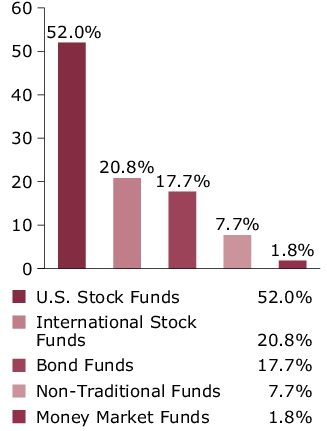

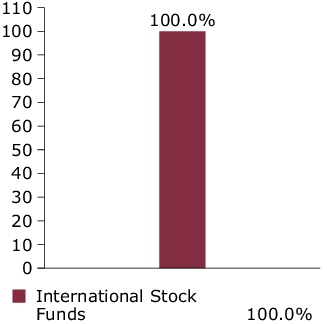

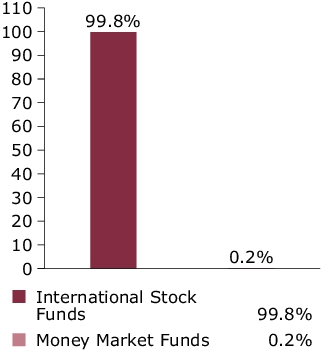

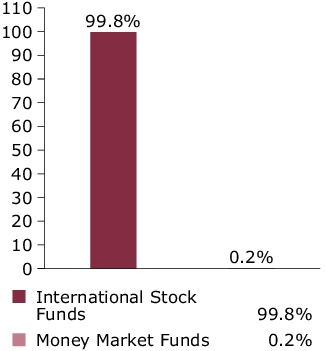

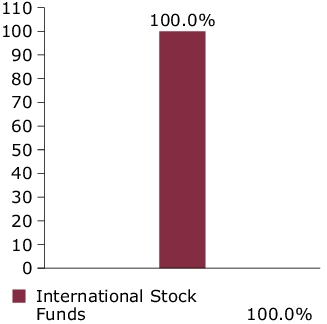

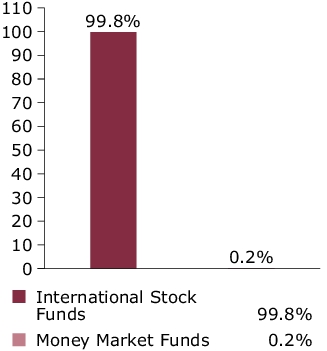

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006843 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class B

|

|

| Trading Symbol |

MBAGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| B |

$118 |

1.13% |

˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 118

|

[3] |

| Expense Ratio, Percent |

1.13%

|

[3] |

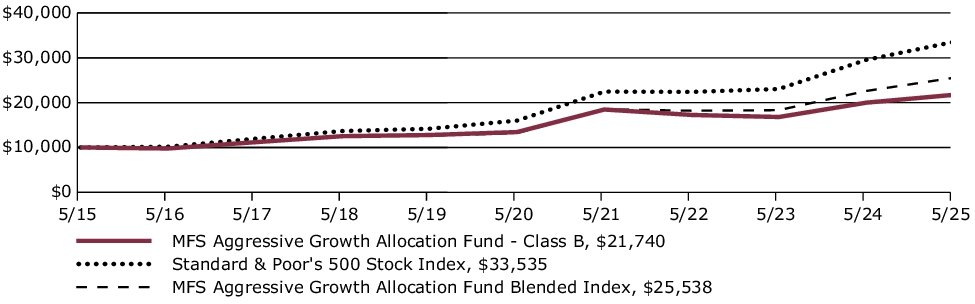

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class B shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 8.72%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

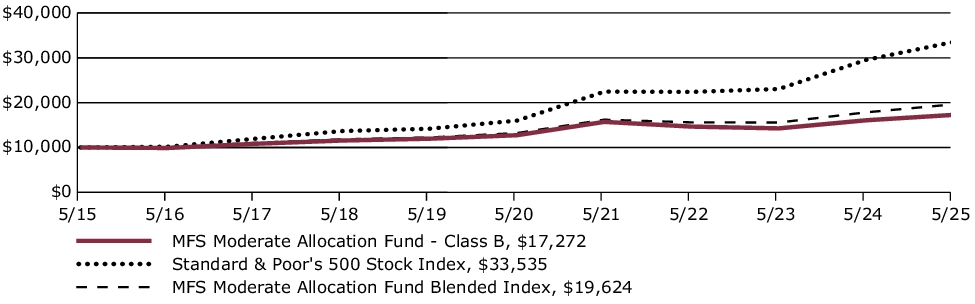

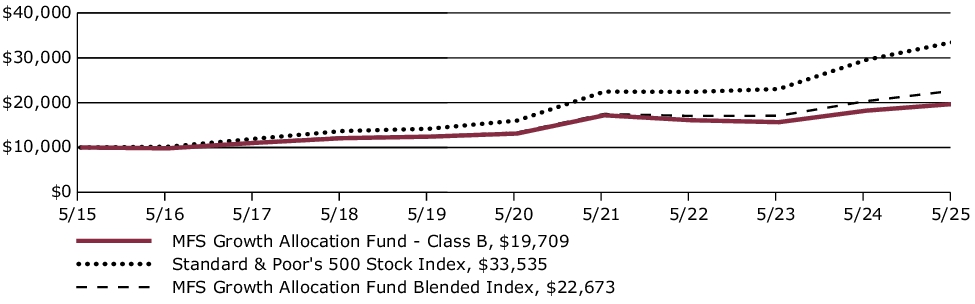

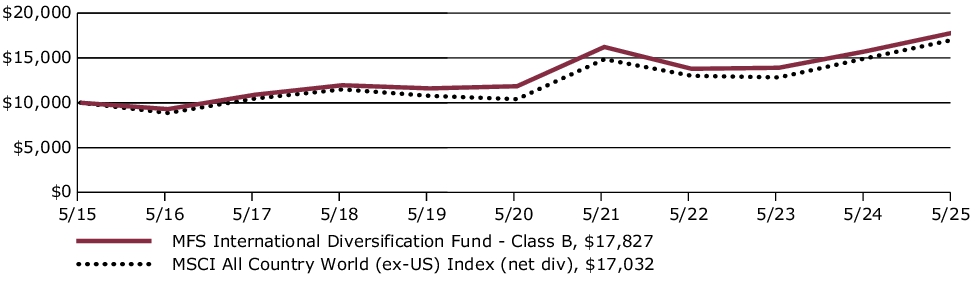

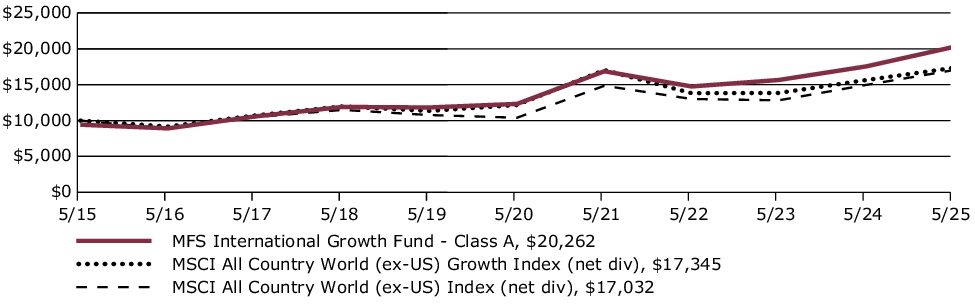

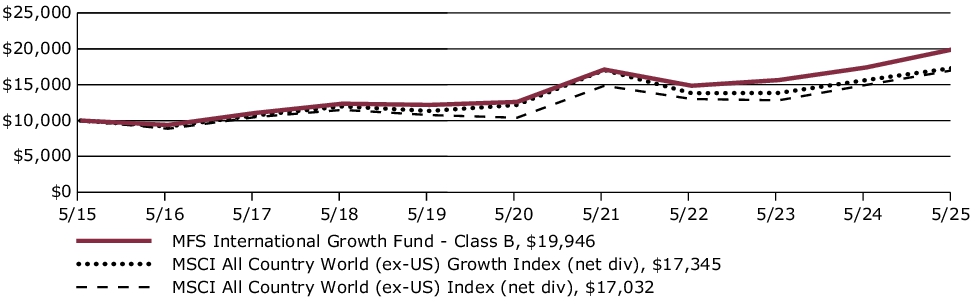

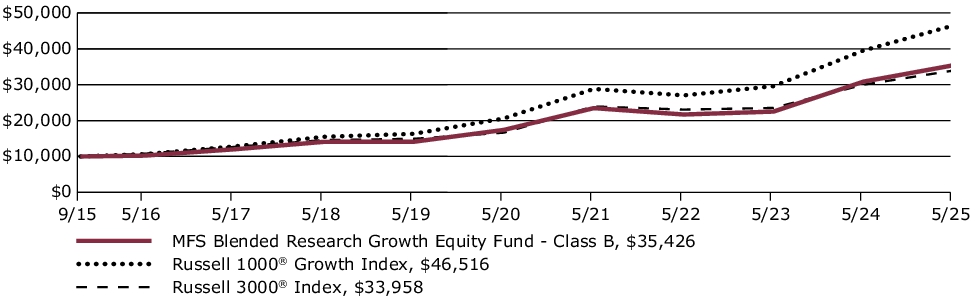

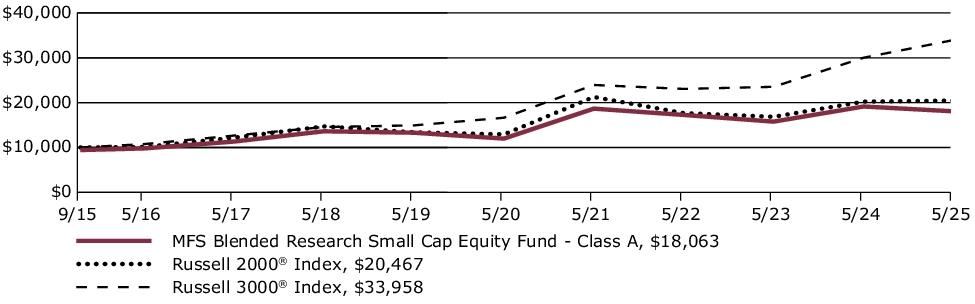

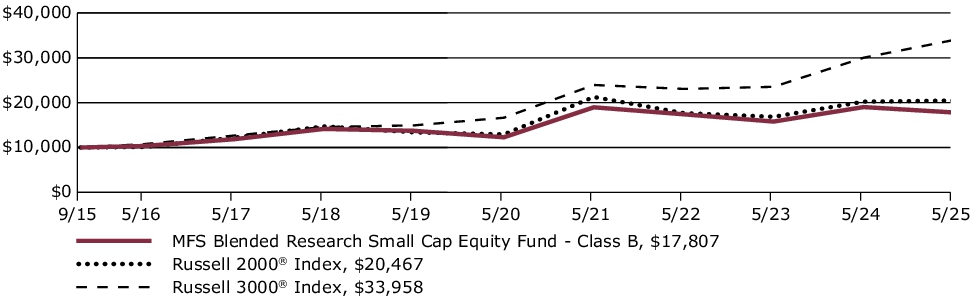

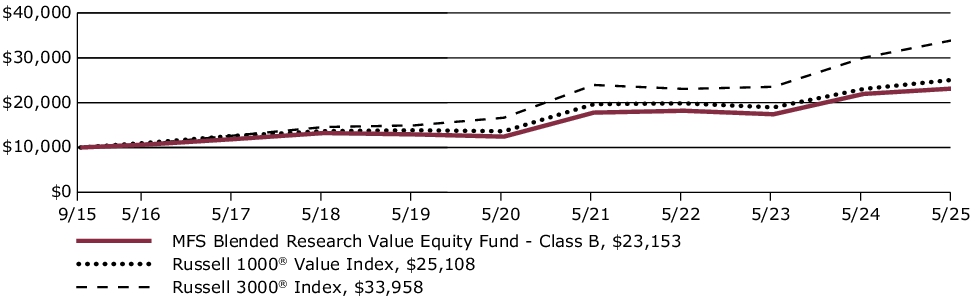

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class B over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| B without sales charge |

8.72% |

10.10% |

8.08% |

| B with CDSC (declining over six years from 4% to 0%)× |

4.72% |

9.82% |

8.08% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/b for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[4] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 |

# The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

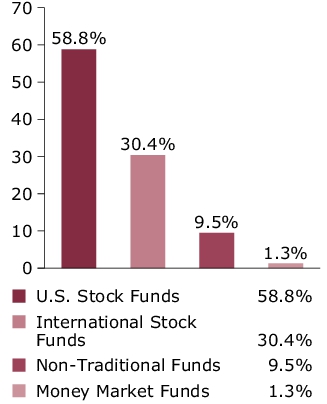

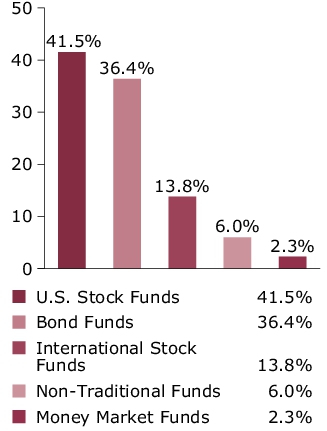

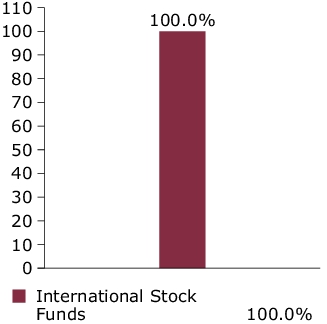

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25)

Portfolio allocation

Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006844 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

MCAGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| C |

$118 |

1.13% |

˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 118

|

[5] |

| Expense Ratio, Percent |

1.13%

|

[5] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class C shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 8.71%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

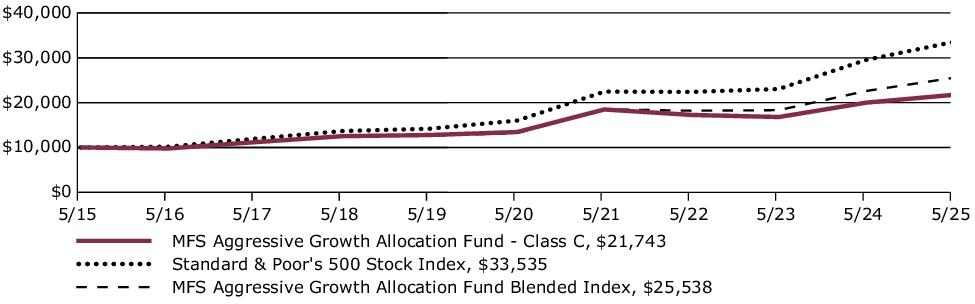

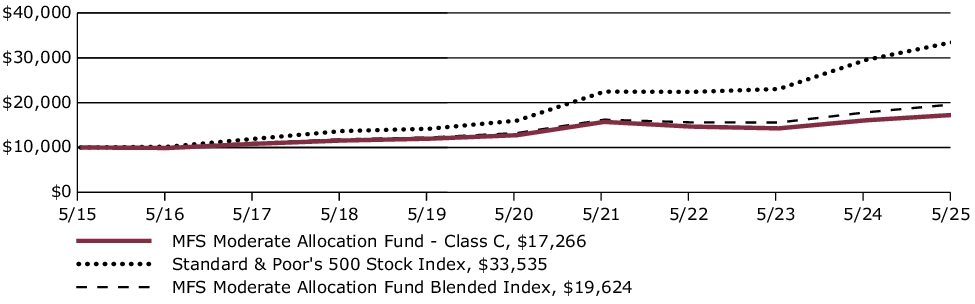

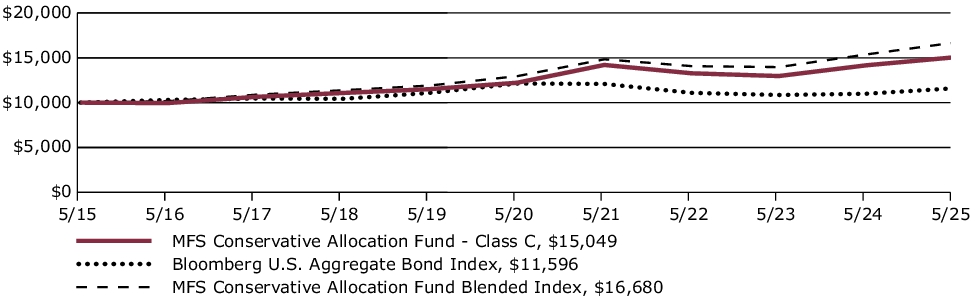

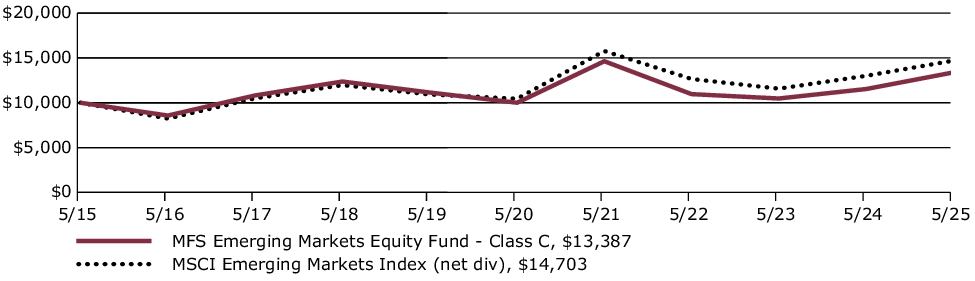

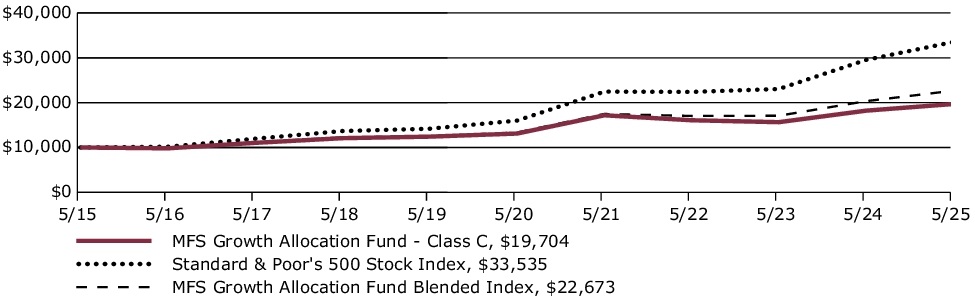

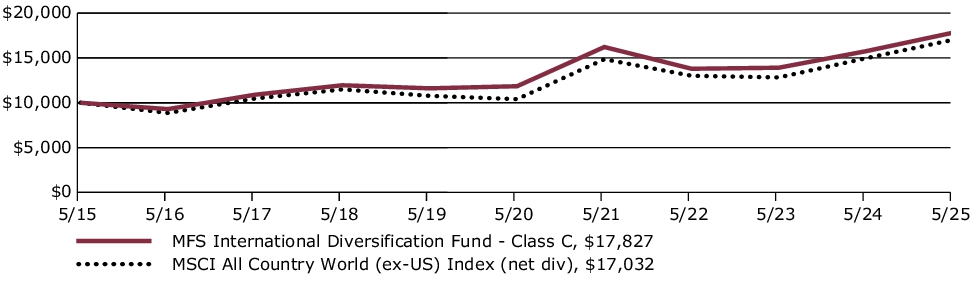

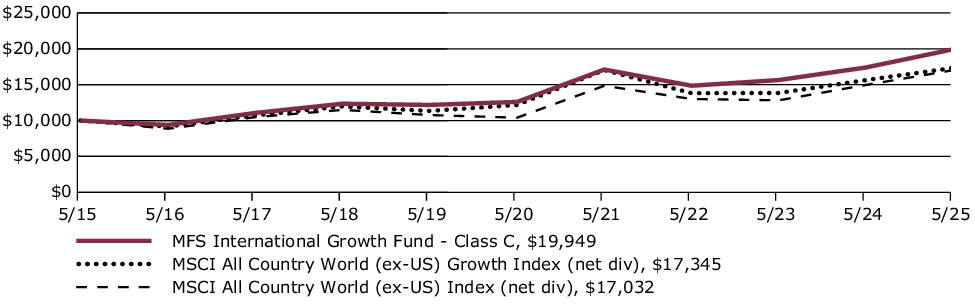

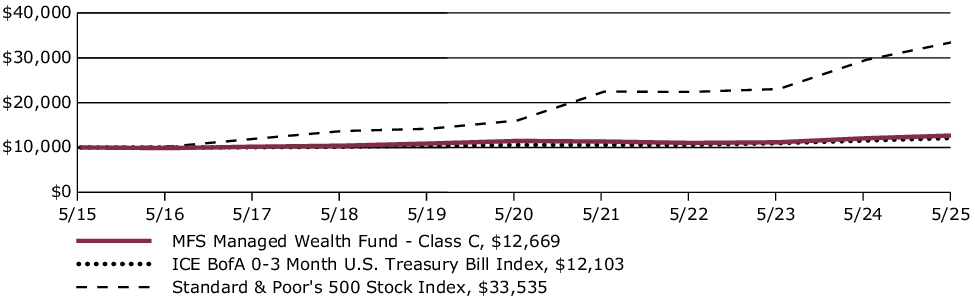

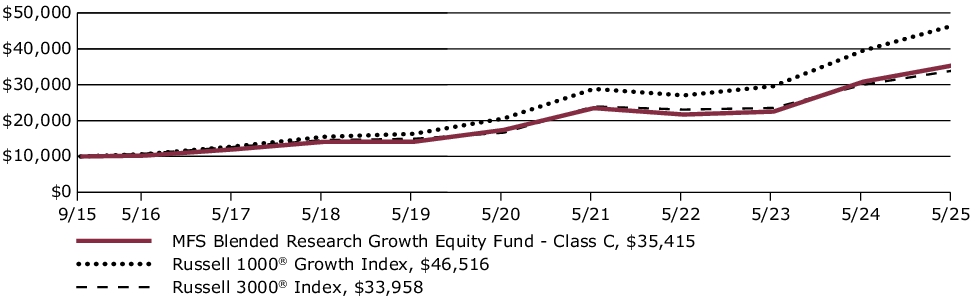

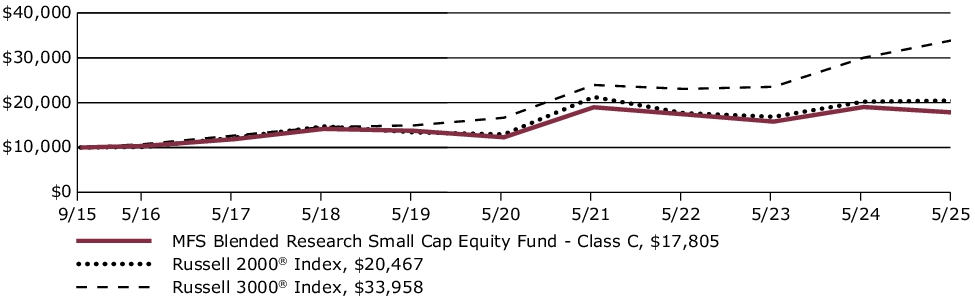

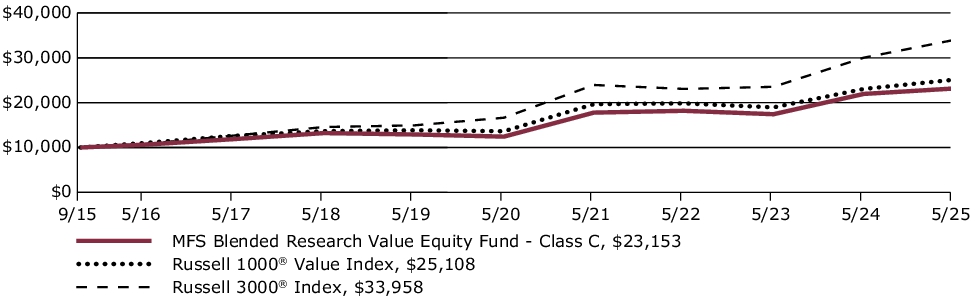

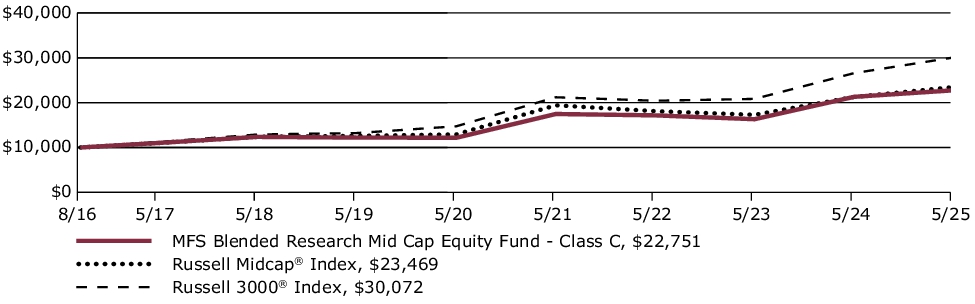

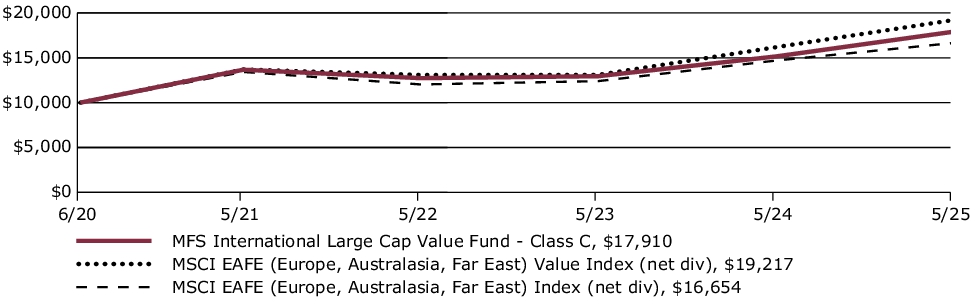

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class C over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| C without sales charge |

8.71% |

10.09% |

8.08% |

| C with CDSC (1% for 12 months)× |

7.71% |

10.09% |

8.08% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/c for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[6] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 |

# The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

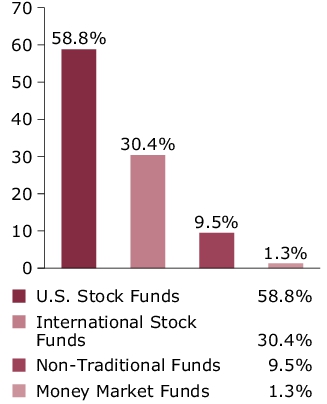

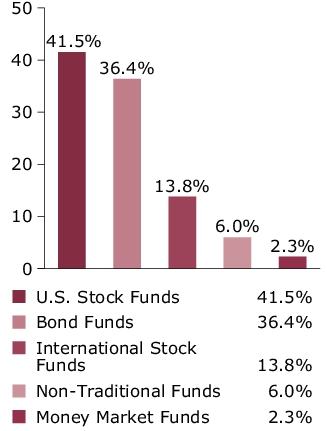

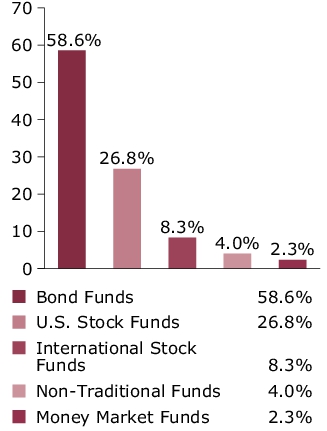

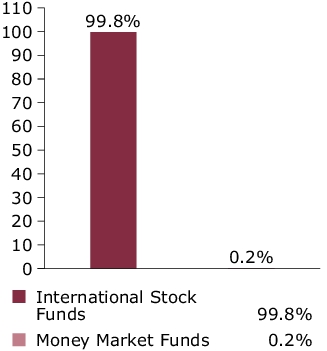

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25)

Portfolio allocation

Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006845 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

MIAGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| I |

$14 |

0.13% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 14

|

[7] |

| Expense Ratio, Percent |

0.13%

|

[7] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class I shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.80%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

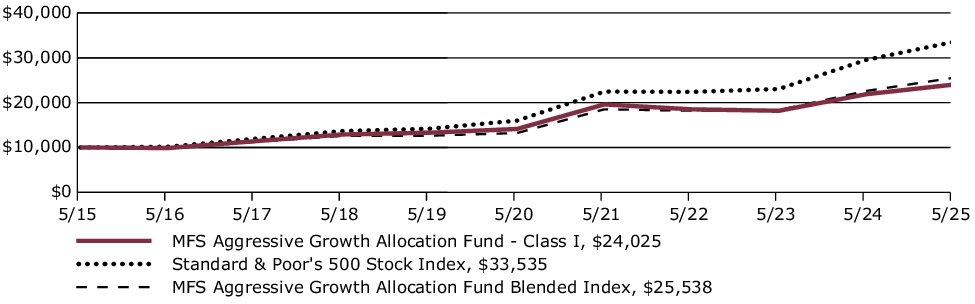

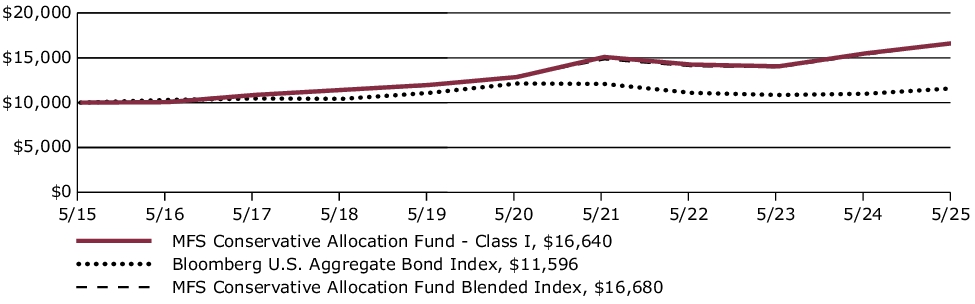

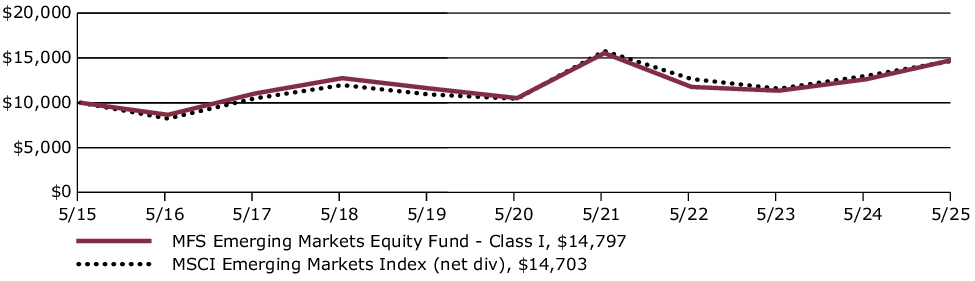

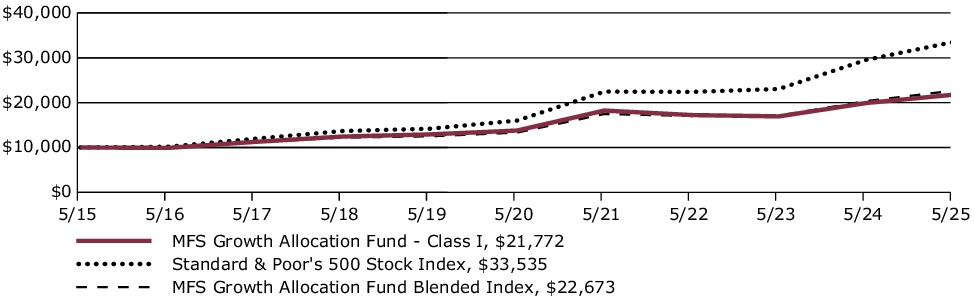

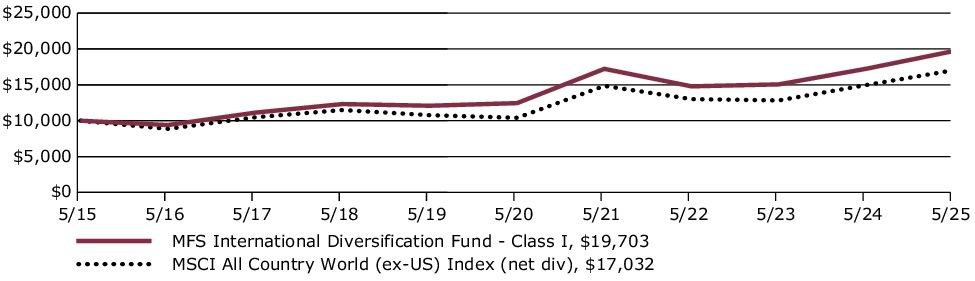

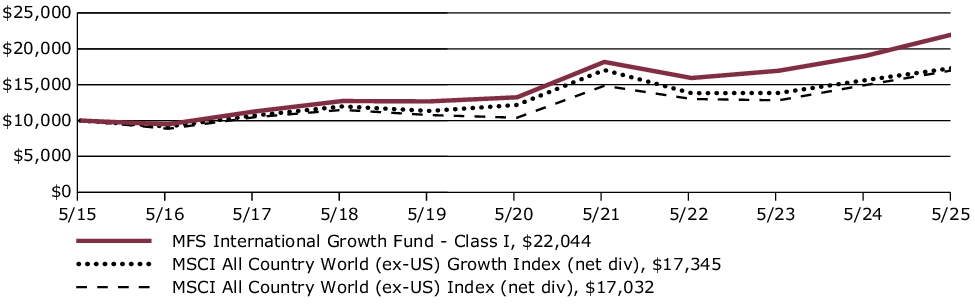

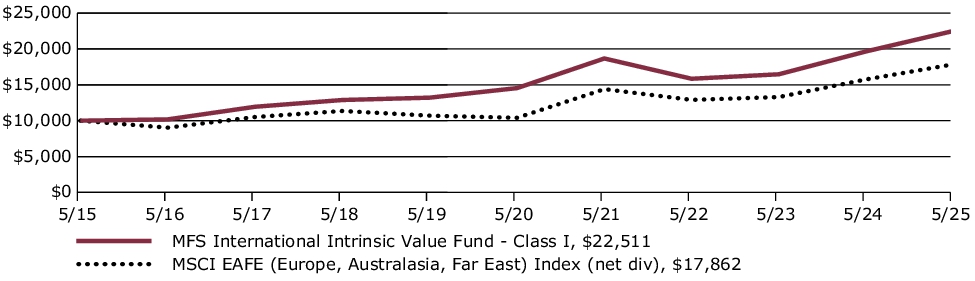

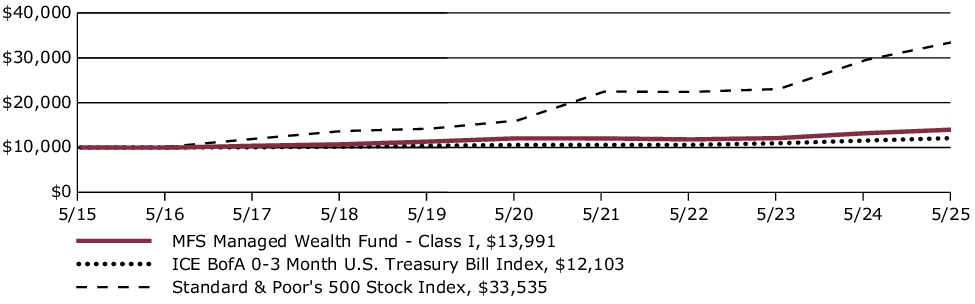

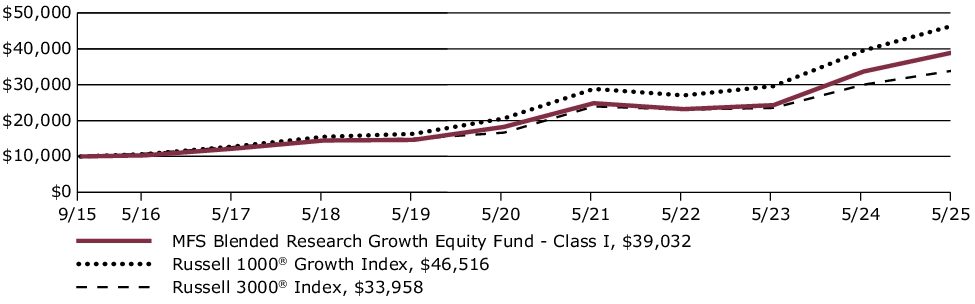

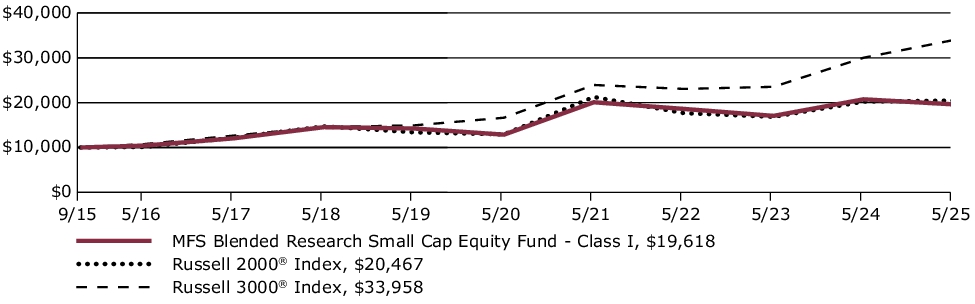

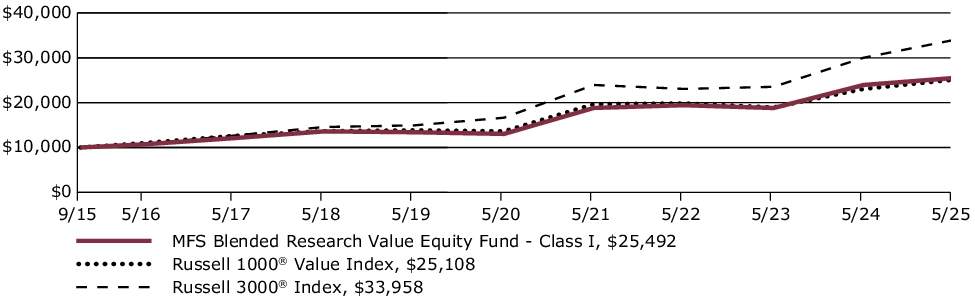

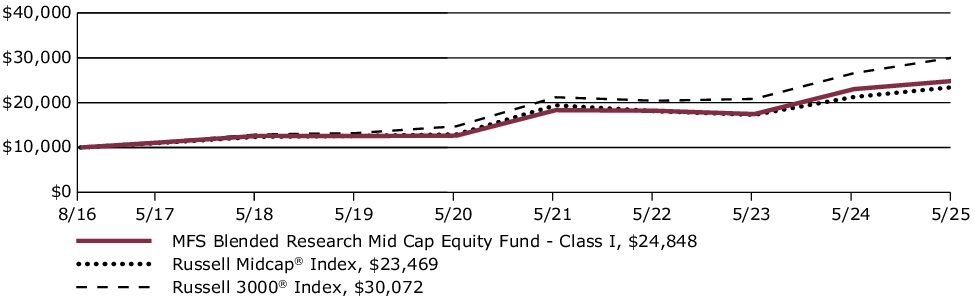

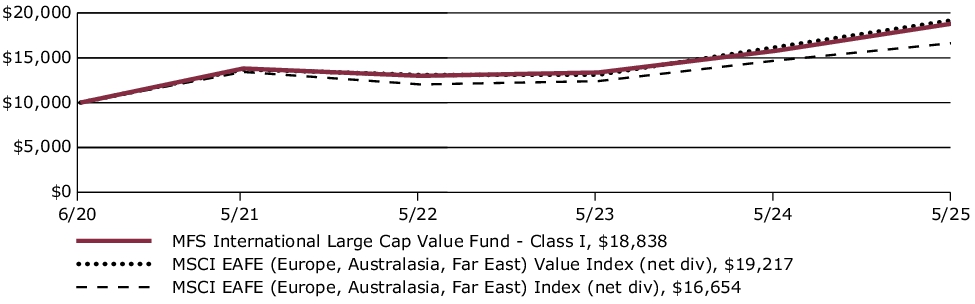

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class I over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| I without sales charge |

9.80% |

11.20% |

9.16% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/i for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[8] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

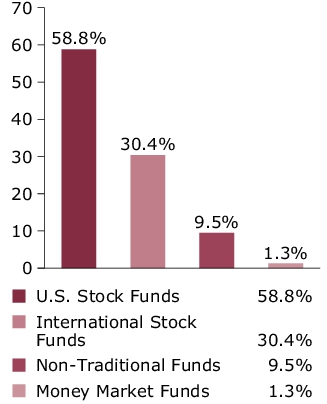

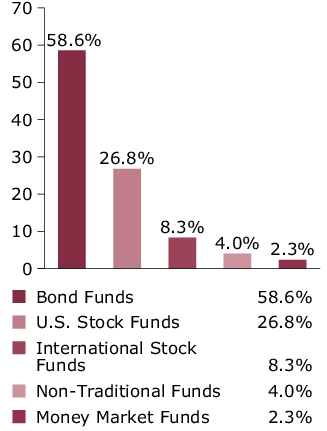

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006847 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class R1

|

|

| Trading Symbol |

MAAFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| R1 |

$118 |

1.13% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 118

|

[9] |

| Expense Ratio, Percent |

1.13%

|

[9] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class R1 shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 8.72%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

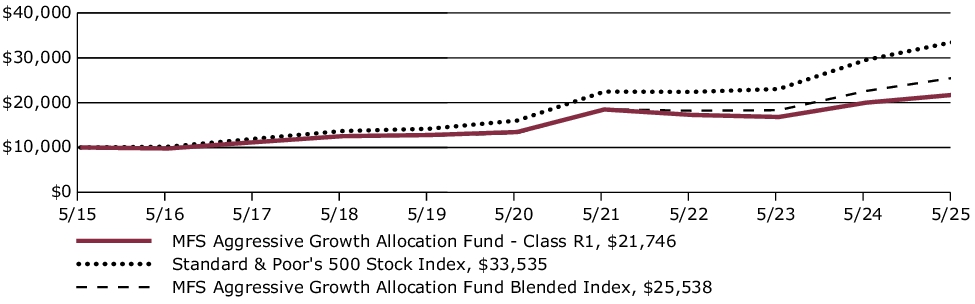

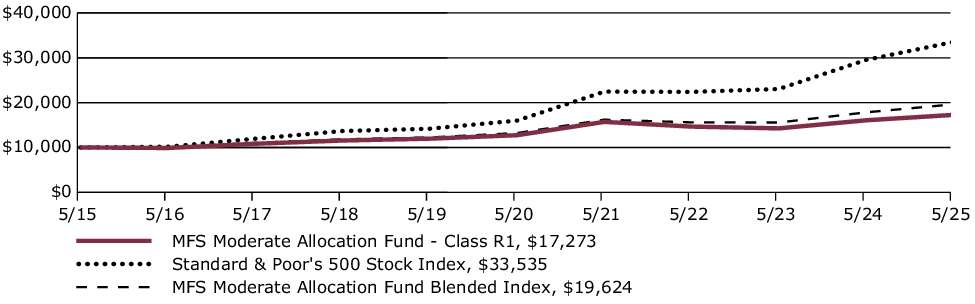

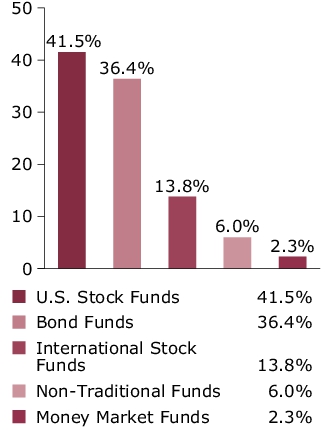

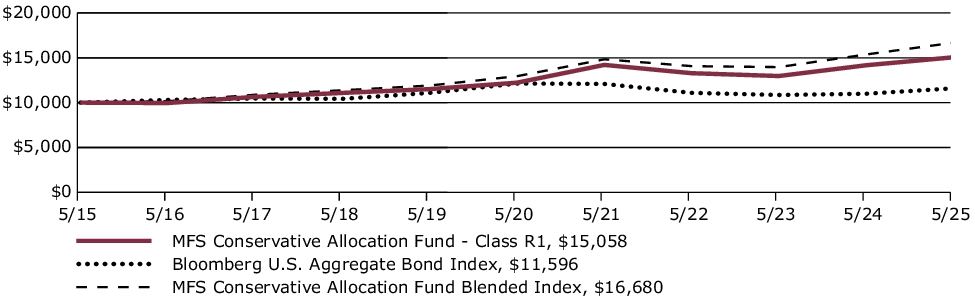

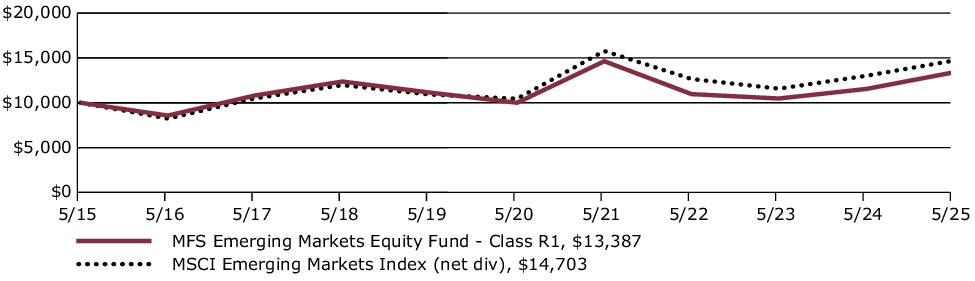

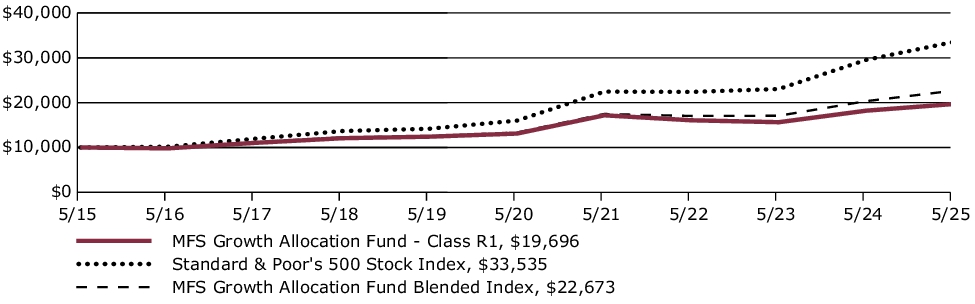

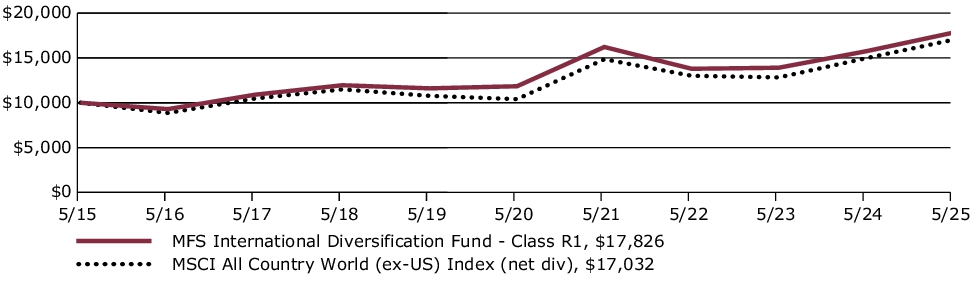

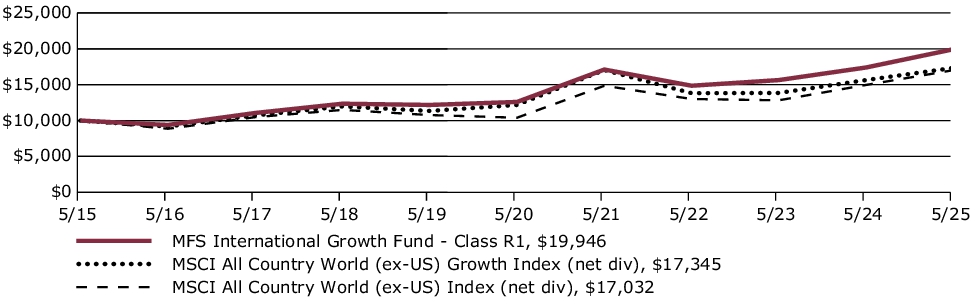

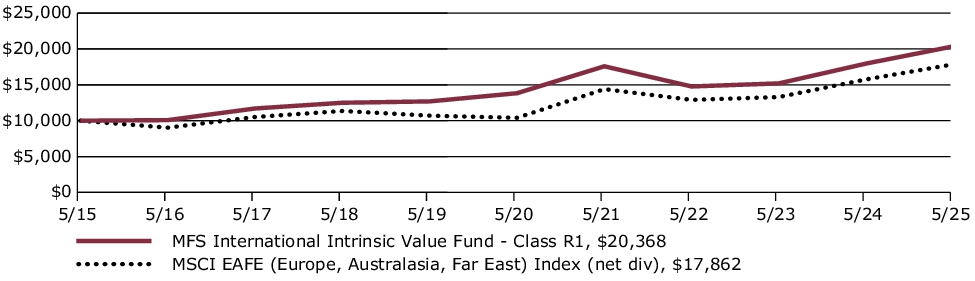

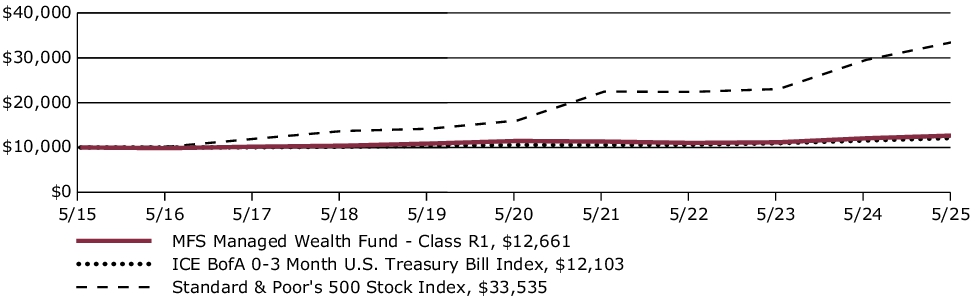

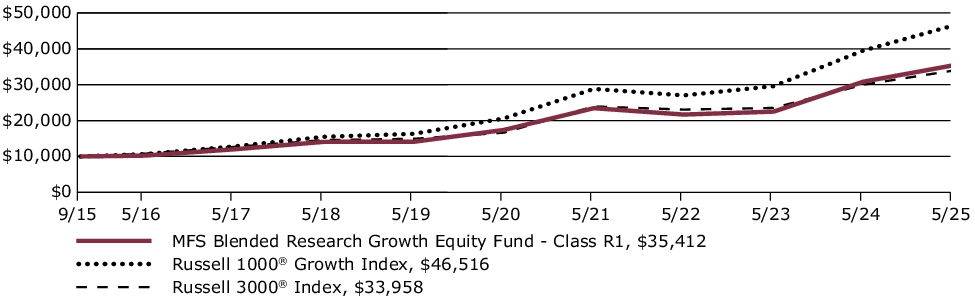

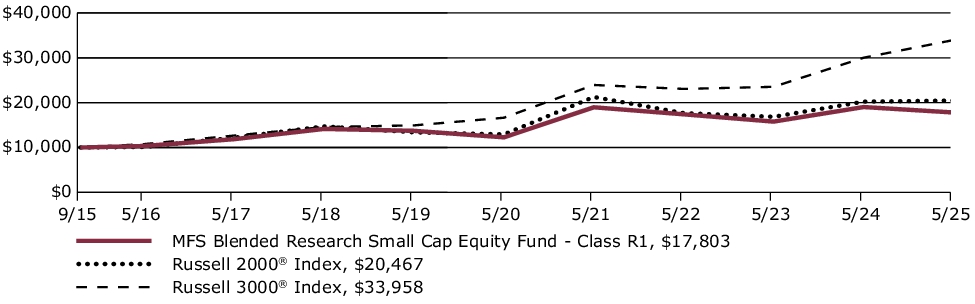

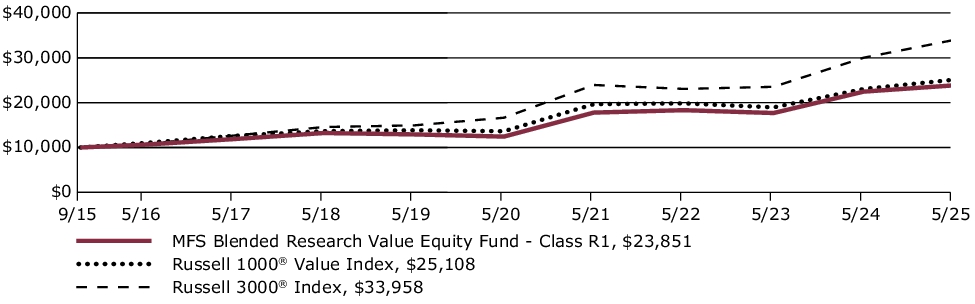

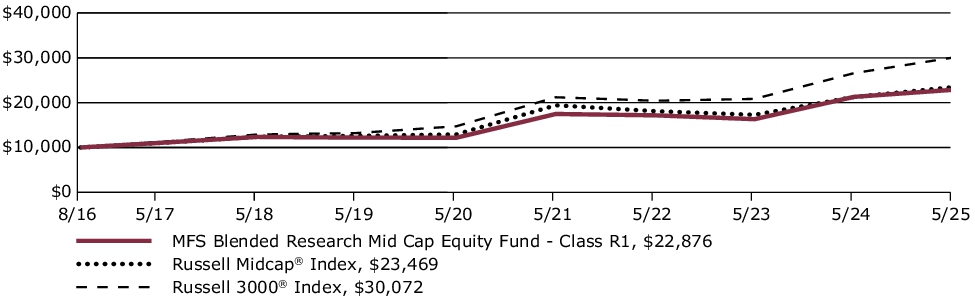

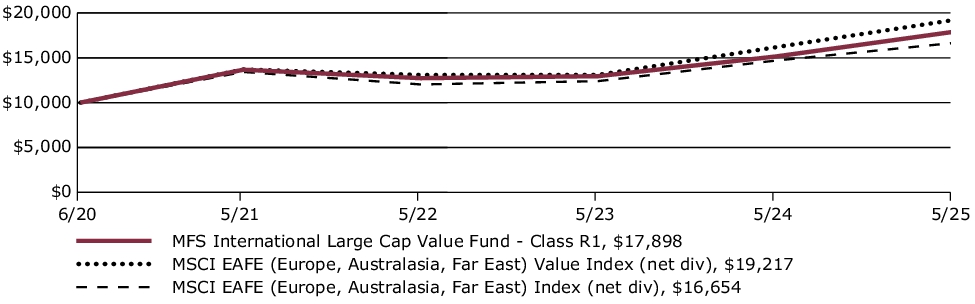

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R1 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R1 without sales charge |

8.72% |

10.09% |

8.08% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r1 for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[10] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

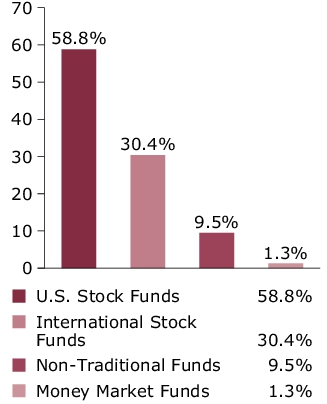

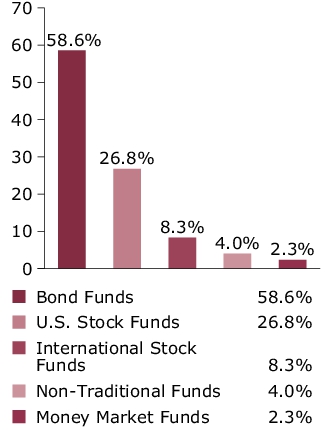

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006849 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class R2

|

|

| Trading Symbol |

MAWAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| R2 |

$66 |

0.63% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 66

|

[11] |

| Expense Ratio, Percent |

0.63%

|

[11] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class R2 shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.28%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

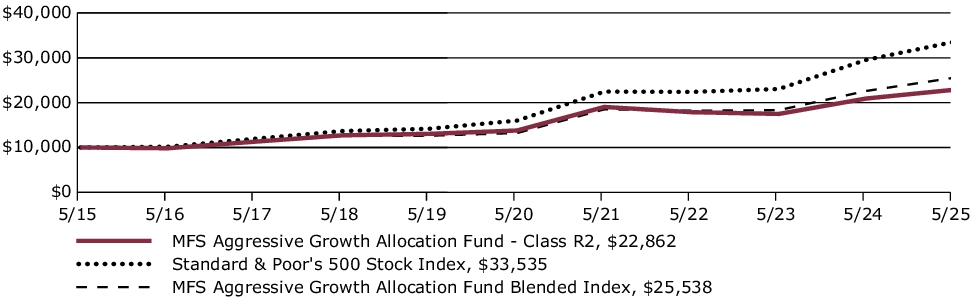

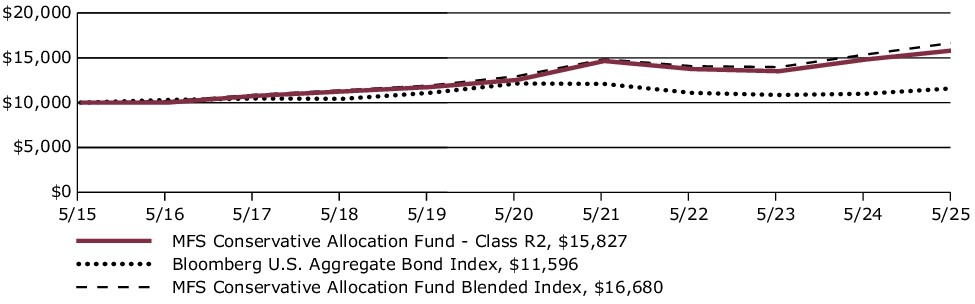

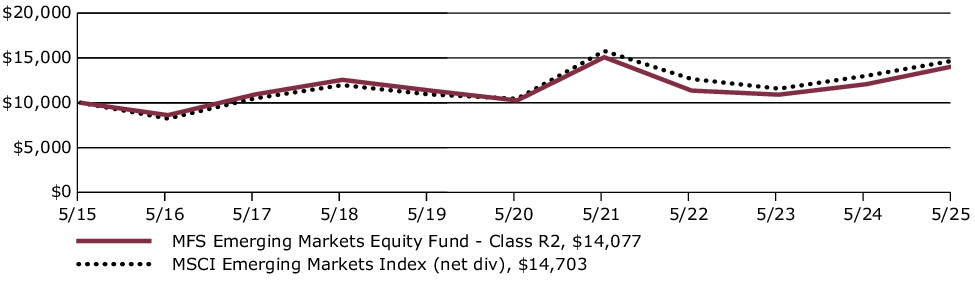

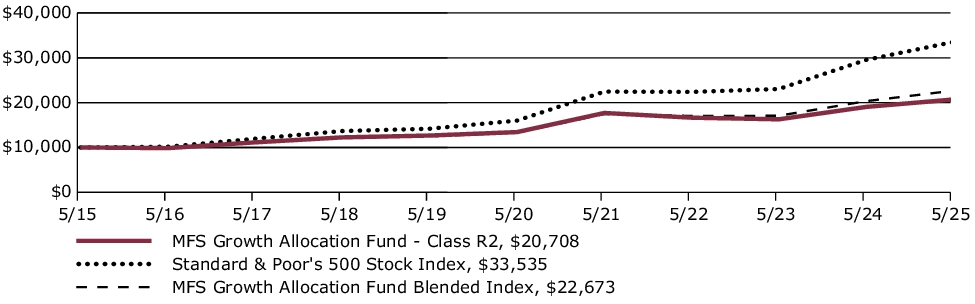

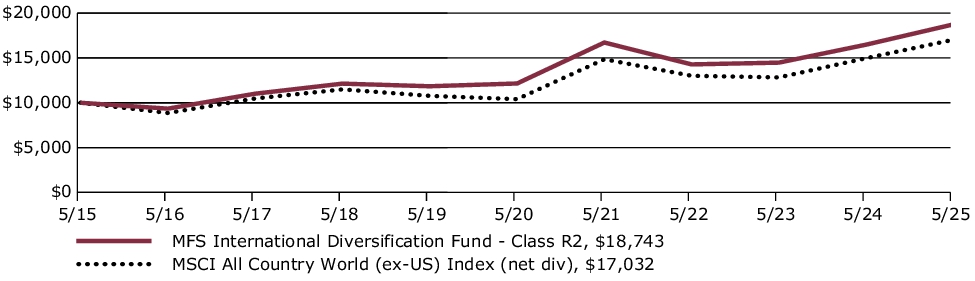

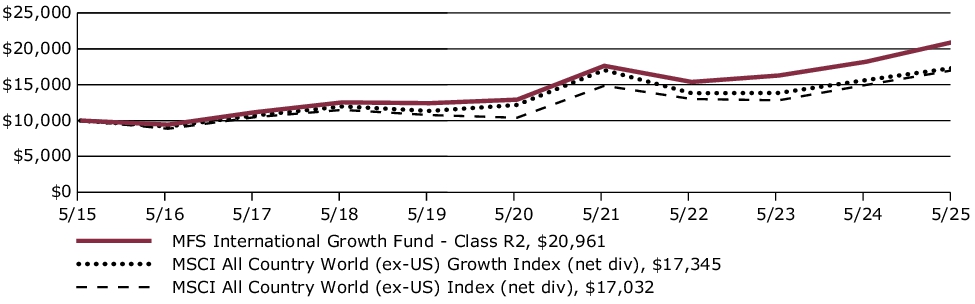

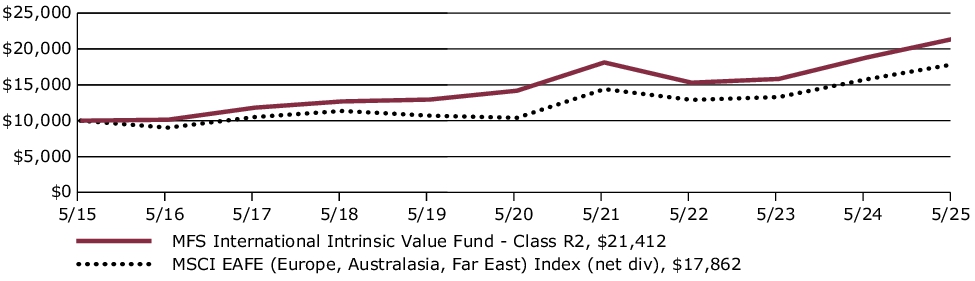

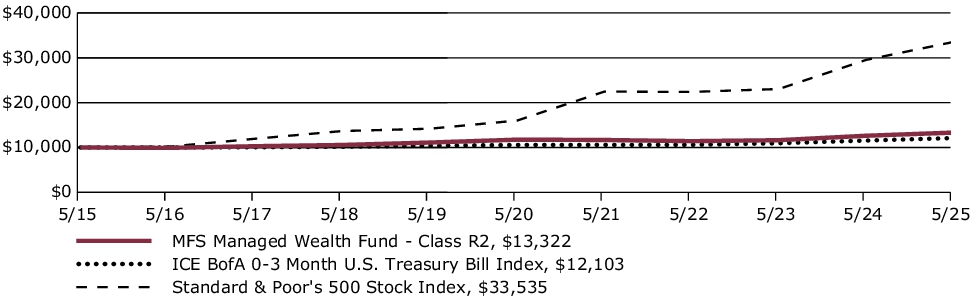

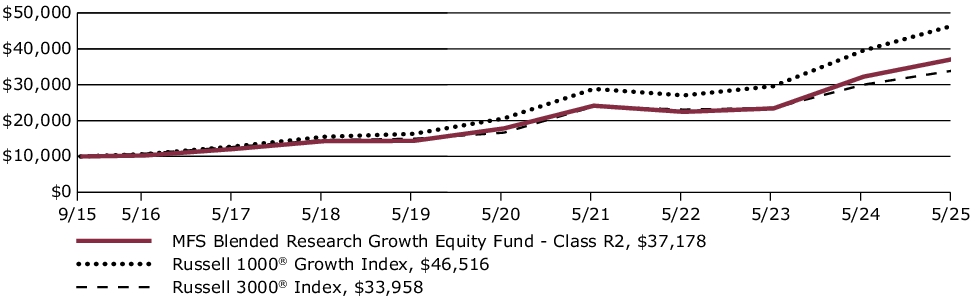

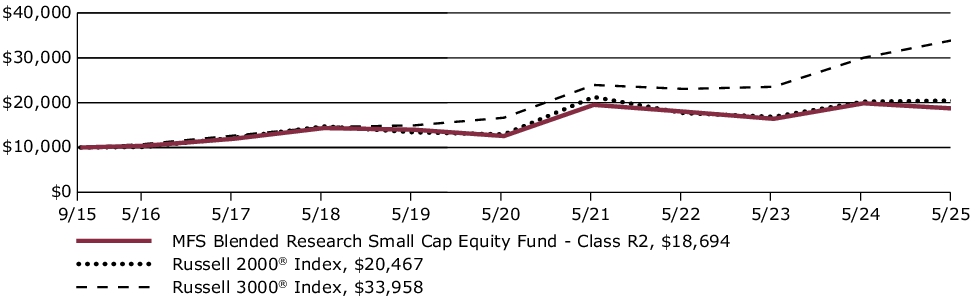

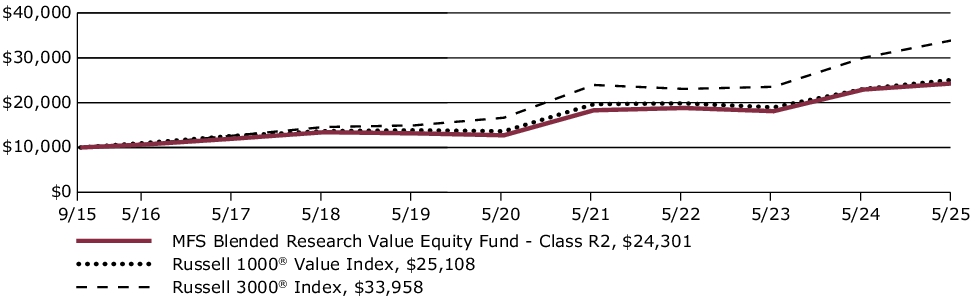

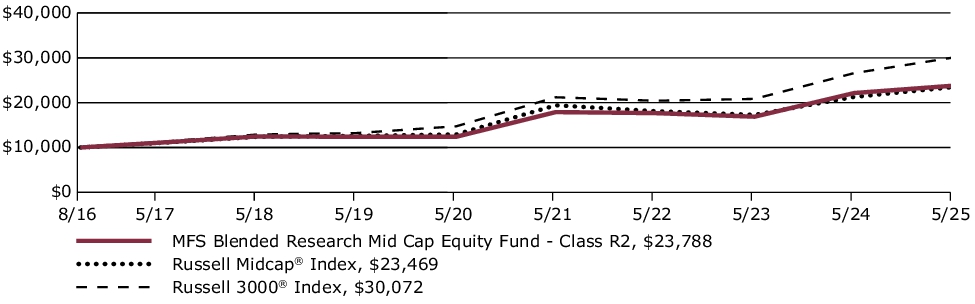

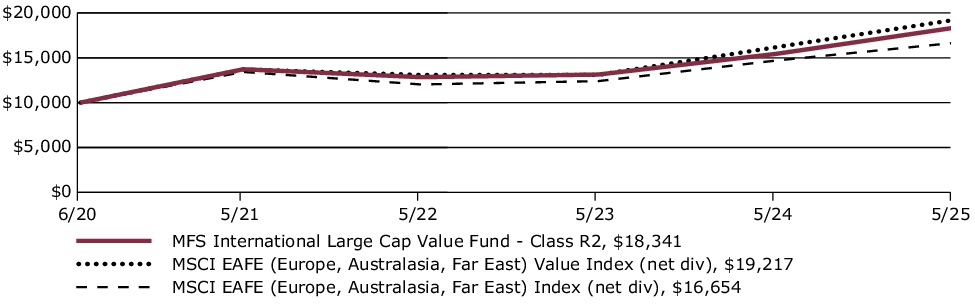

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R2 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R2 without sales charge |

9.28% |

10.64% |

8.62% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r2 for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[12] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

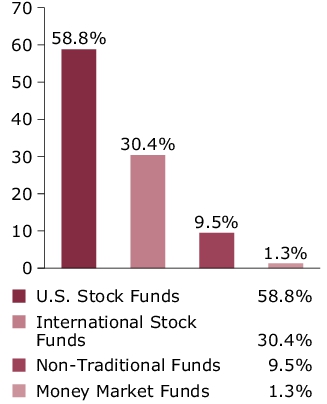

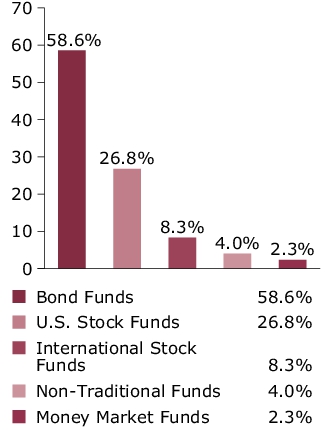

| Holdings [Text Block] |

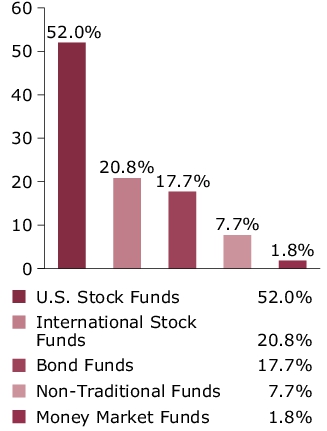

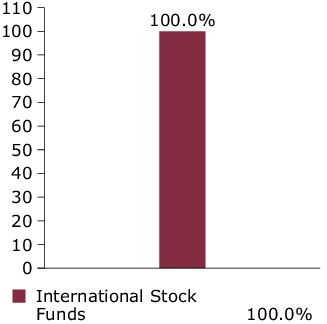

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006850 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class R3

|

|

| Trading Symbol |

MAAHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| R3 |

$40 |

0.38% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 40

|

[13] |

| Expense Ratio, Percent |

0.38%

|

[13] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class R3 shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.55%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

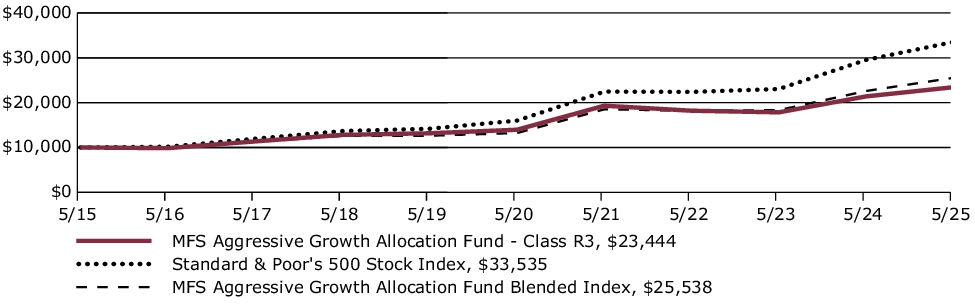

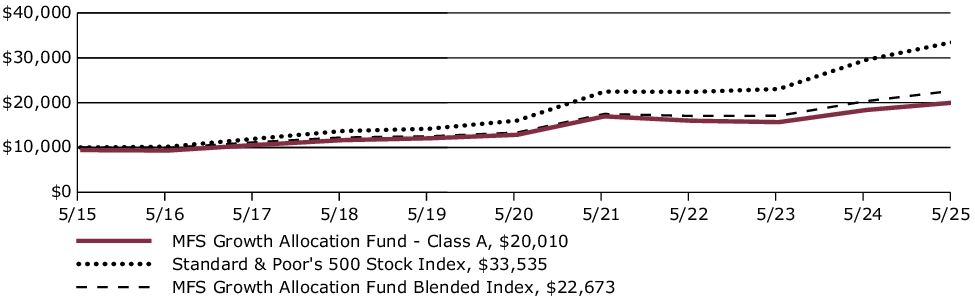

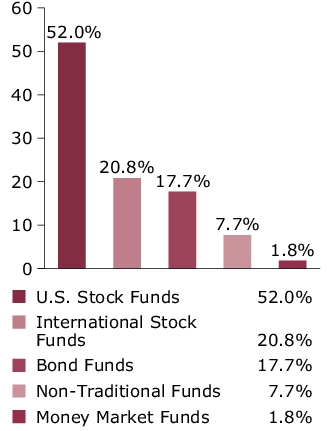

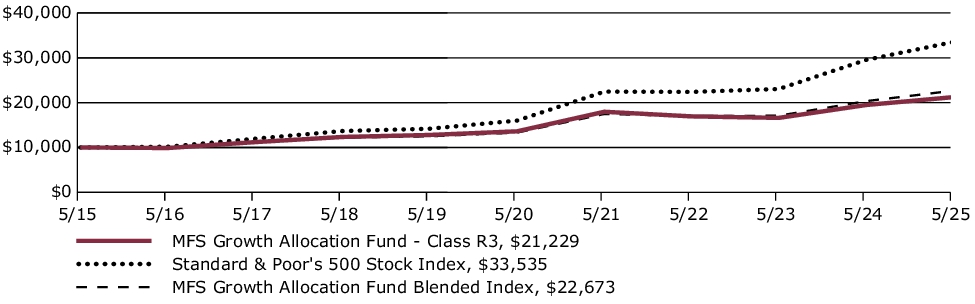

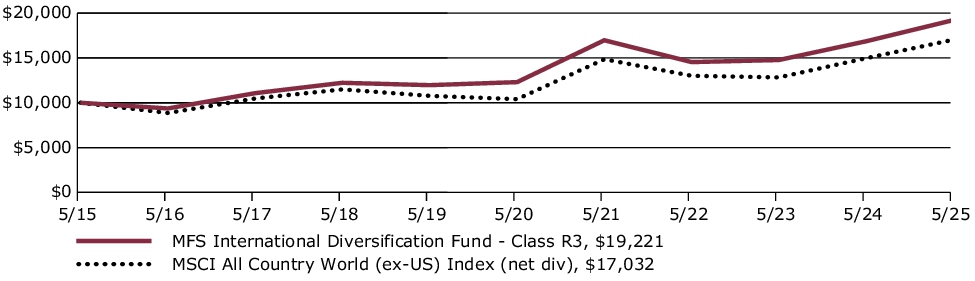

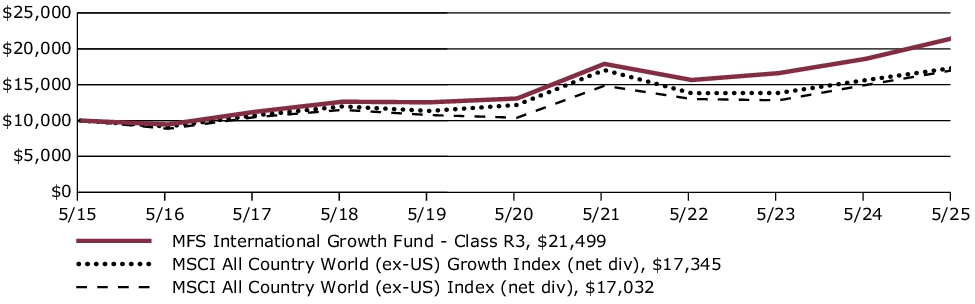

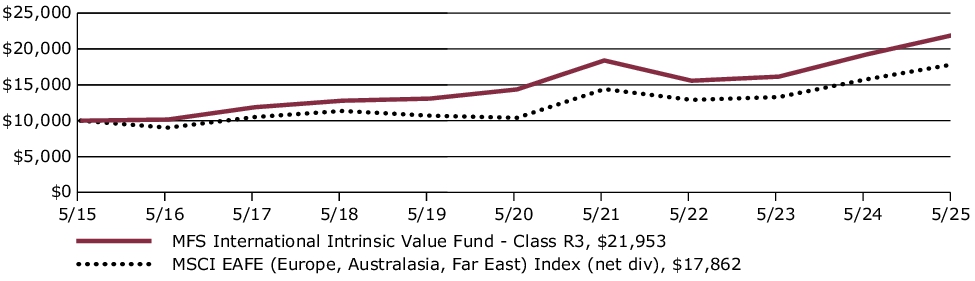

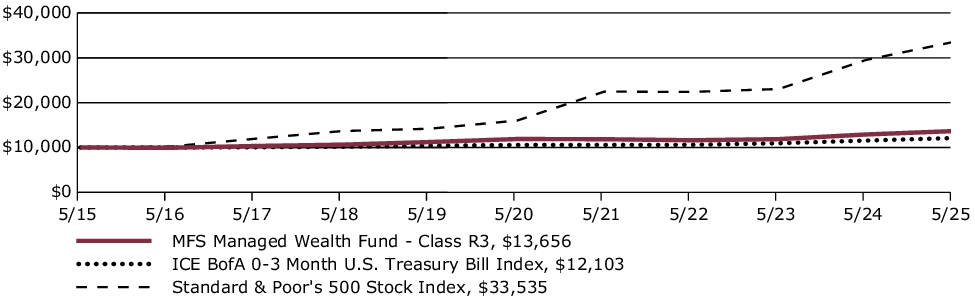

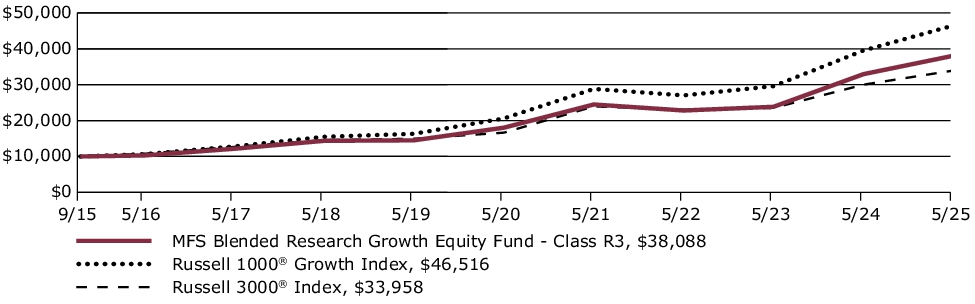

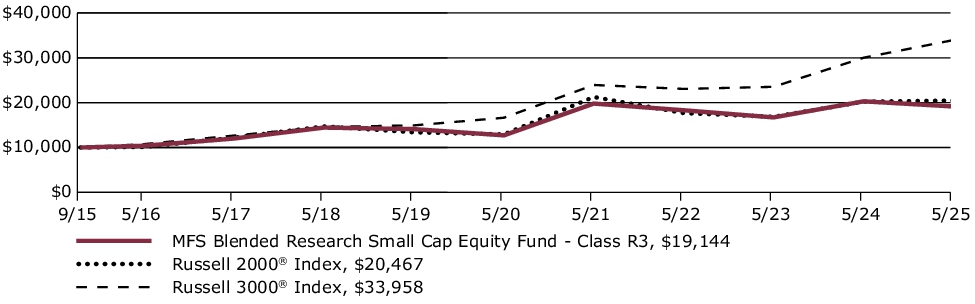

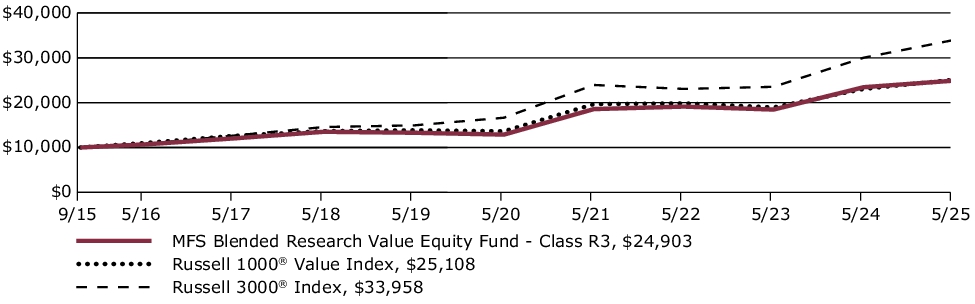

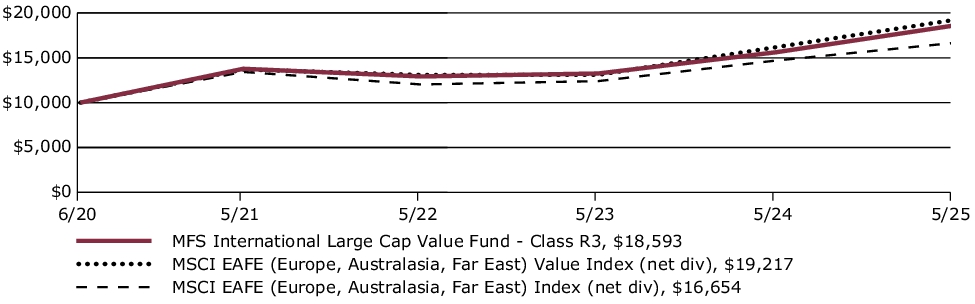

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R3 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R3 without sales charge |

9.55% |

10.92% |

8.89% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r3 for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[14] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

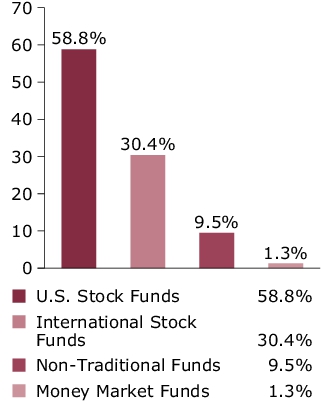

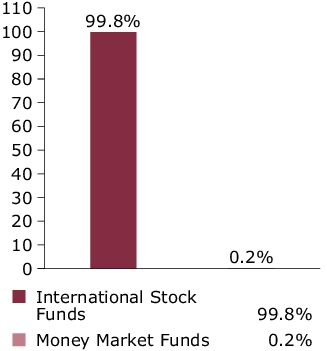

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006839 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class R4

|

|

| Trading Symbol |

MAALX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| R4 |

$14 |

0.13% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 14

|

[15] |

| Expense Ratio, Percent |

0.13%

|

[15] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class R4 shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.84%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

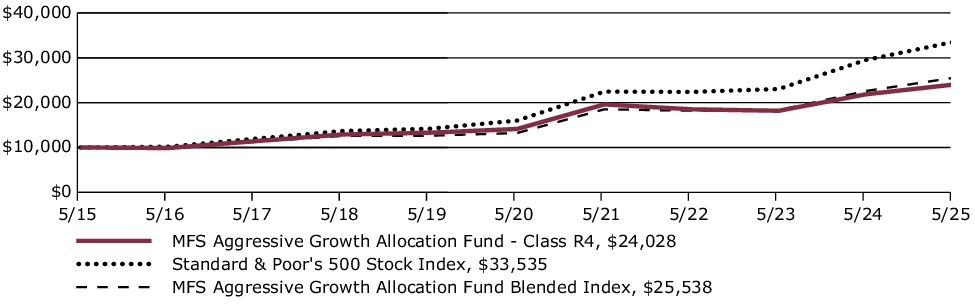

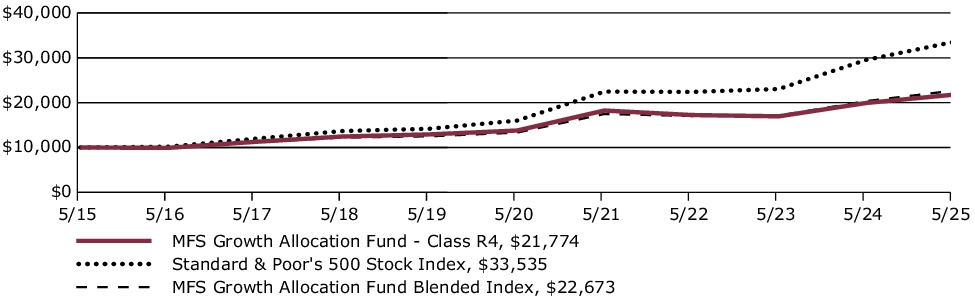

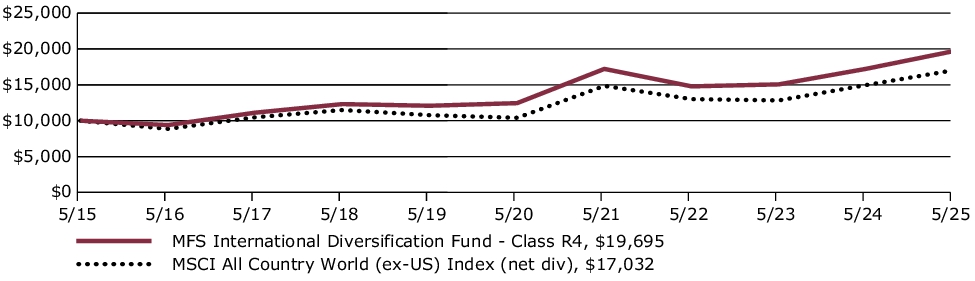

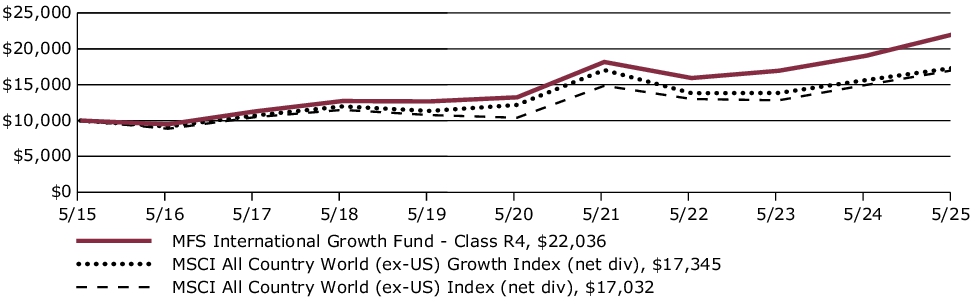

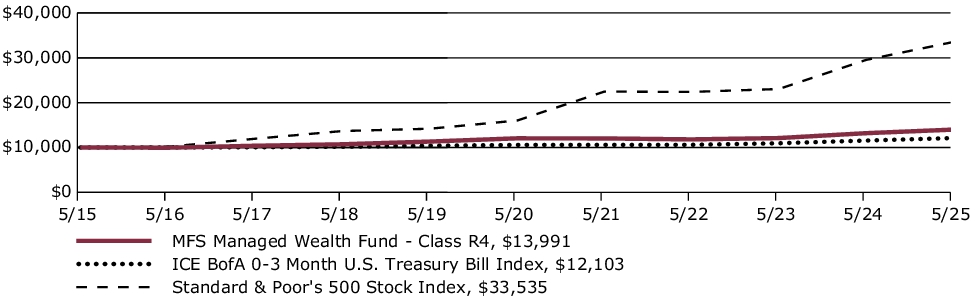

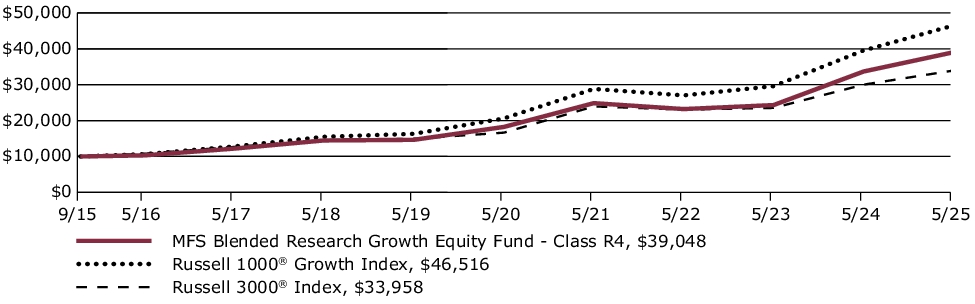

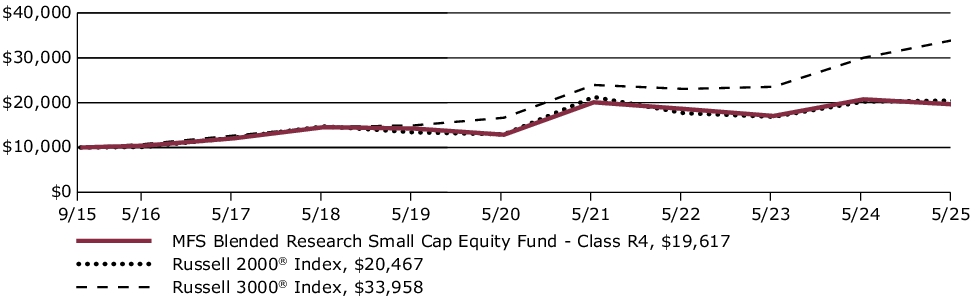

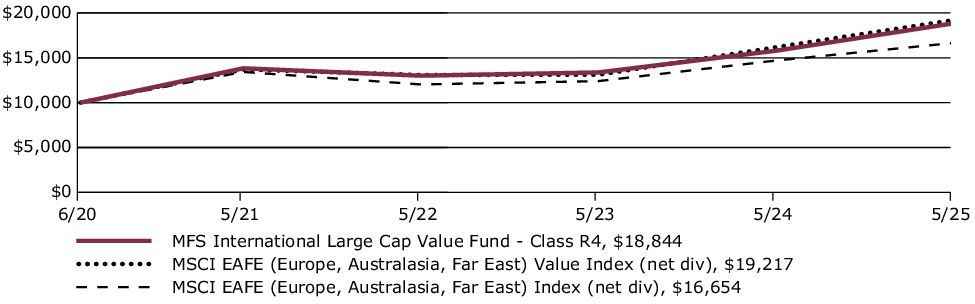

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R4 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R4 without sales charge |

9.84% |

11.20% |

9.16% |

| Comparative Benchmark(s) |

|

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

15.94% |

12.86% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

14.06% |

9.83% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r4 for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[16] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

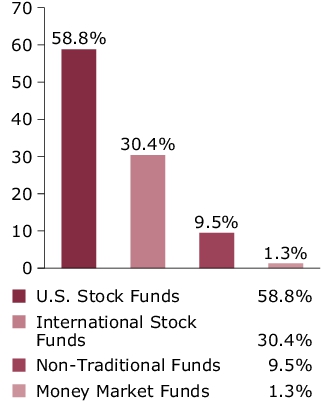

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000231058 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Aggressive Growth Allocation Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

AGGPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Aggressive Growth Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| R6 |

$5 |

0.05% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 5

|

[17] |

| Expense Ratio, Percent |

0.05%

|

[17] |

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended May 31, 2025, Class R6 shares of the MFS Aggressive Growth Allocation Fund (fund) provided a total return of 9.89%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Aggressive Growth Allocation Fund Blended Index (Blended Index), generated a return of 12.97%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

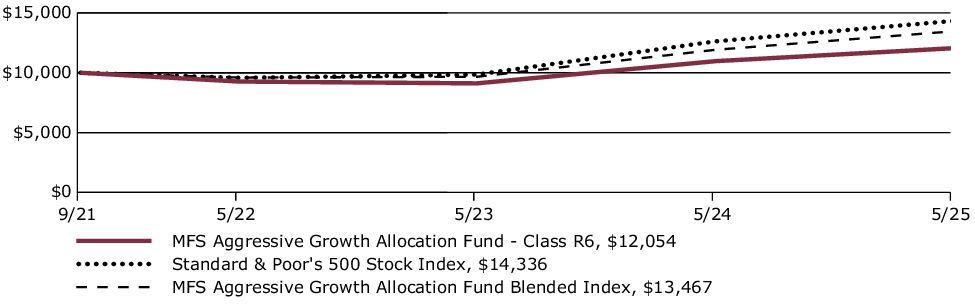

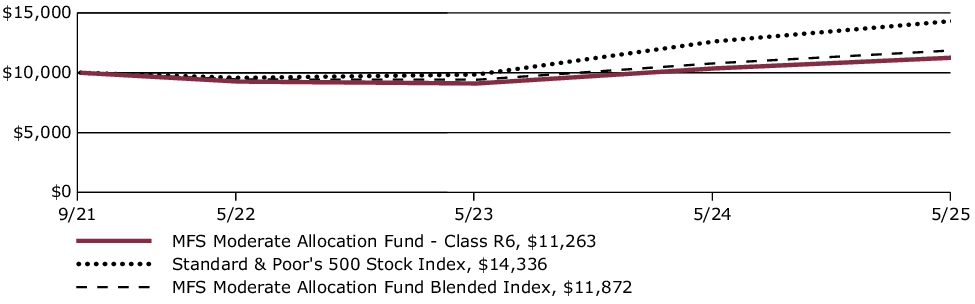

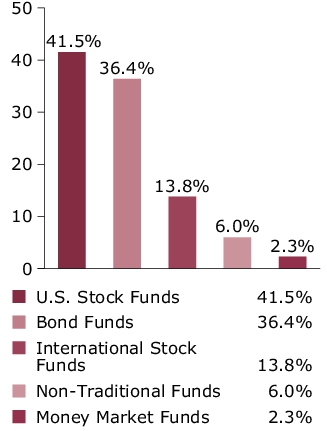

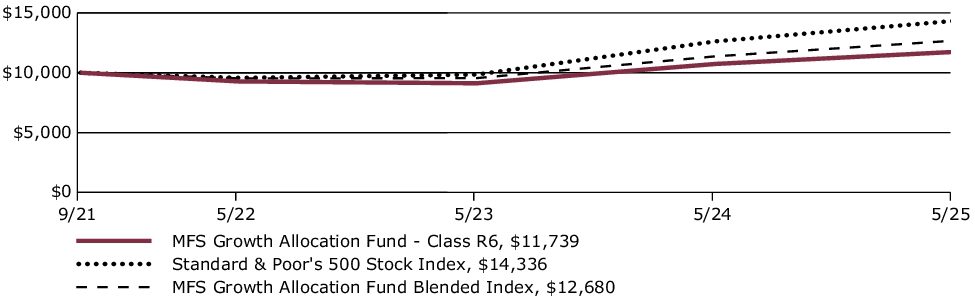

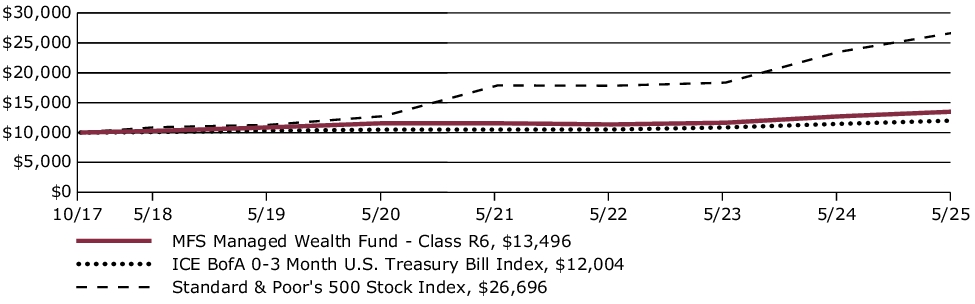

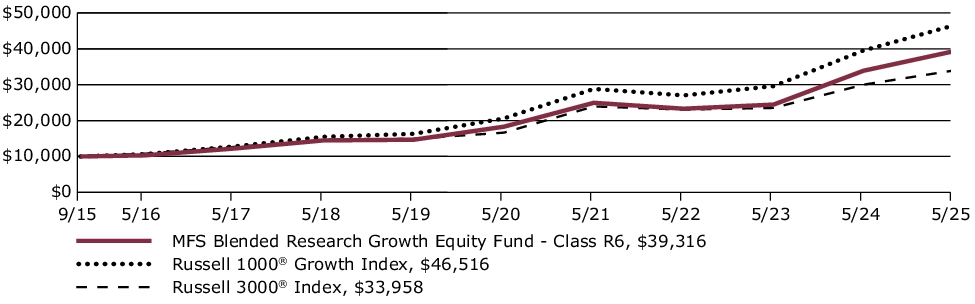

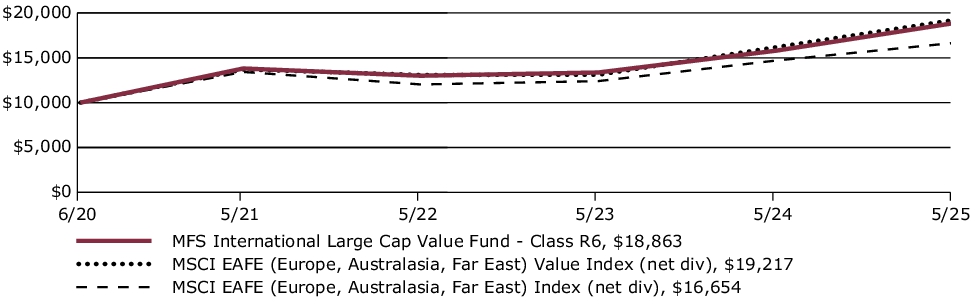

| Line Graph [Table Text Block] |

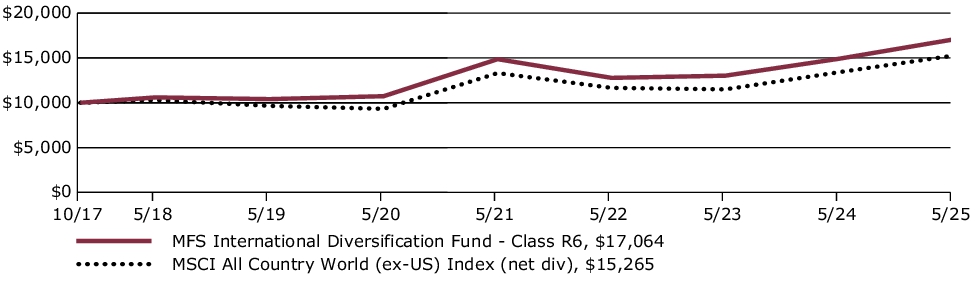

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment* This graph shows the performance of a hypothetical $10,000 investment in Class R6 over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests. *For the period from the commencement of the class's investment operations, September 30, 2021 through May 31, 2025.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 5/31/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests, over the same periods.

| Share Class |

1-yr |

Life* |

| R6 without sales charge |

9.89% |

5.22% |

| Comparative Benchmark(s) |

|

|

| Standard & Poor's 500 Stock Index ∆ |

13.52% |

10.31% |

| MFS Aggressive Growth Allocation Fund Blended Index ∆ |

12.97% |

8.44% |

|

* |

For the period from the commencement of the class's investment operations, September 30, 2021 through May 31, 2025. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| Performance Inception Date |

Sep. 30, 2021

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r6 for more recent performance information.

|

|

| Net Assets |

$ 2,860,668,362

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

[18] |

| Investment Company Portfolio Turnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 5/31/25

| Net Assets ($): |

2,860,668,362 |

|

Total Management Fee ($)#: |

0 |

| Total Number of Holdings: |

16 |

|

Portfolio Turnover Rate (%): |

5 | # The fund itself does not pay a management fee but the underlying funds in which the fund invests do pay management fees to MFS.

|

|

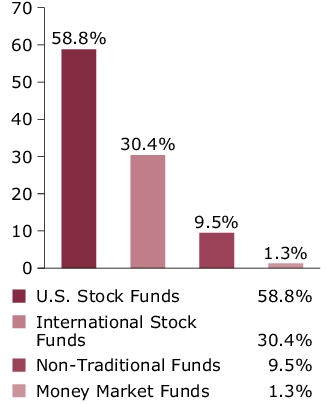

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 5/31/25) Portfolio allocation Portfolio holdings

| MFS Growth Fund |

11.7% |

| MFS Value Fund |

11.6% |

| MFS Research Fund |

10.4% |

| MFS Mid Cap Growth Fund |

10.2% |

| MFS Mid Cap Value Fund |

9.9% |

| MFS Research International Fund |

8.1% |

| MFS International Large Cap Value Fund |

5.2% |

| MFS International Intrinsic Value Fund |

5.1% |

| MFS International Growth Fund |

5.0% |

| MFS Global Real Estate Fund |

5.0% |

| MFS Commodity Strategy Fund |

4.5% |

| MFS International New Discovery Fund |

4.0% |

| MFS Emerging Markets Equity Fund |

3.0% |

| MFS New Discovery Fund |

2.5% |

| MFS New Discovery Value Fund |

2.5% |

| MFS Institutional Money Market Portfolio |

1.3% |

|

|

| C000006851 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Moderate Allocation Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MAMAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Moderate Allocation Fund for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment ~ |

Costs paid as a percentage of a $10,000 investment ~ |

| A |

$35 |

0.34% | ˜ Expenses are direct expenses and do not include underlying fund fees and expenses.

|

|

| Expenses Paid, Amount |

$ 35

|

[19] |

| Expense Ratio, Percent |

0.34%

|

[19] |

| Factors Affecting Performance [Text Block] |

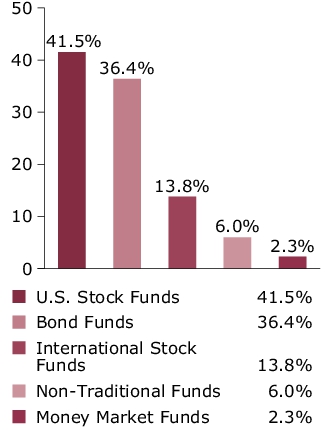

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

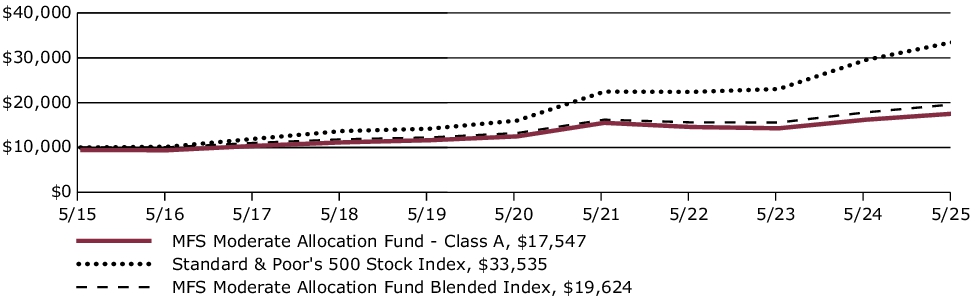

For the twelve months ended May 31, 2025, Class A shares of the MFS Moderate Allocation Fund (fund) provided a total return of 8.30%, at net asset value. This compares with a return of 13.52% for the fund’s benchmark, the Standard & Poor's 500 Stock Index. The fund's other benchmark, the MFS Moderate Allocation Fund Blended Index (Blended Index), generated a return of 10.00%. The Blended Index reflects the blended returns of broad asset class indices, with percentage allocations to each index designed to resemble the long term strategic allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Fund Performance.

-

Global equity markets reached record levels during the period but fell back from those highs amid international trade friction in the early months of the second Trump term. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of very high tariffs on most US trading partners. A temporary truce was reached separately with China, though tensions remain high. President Trump faces legal challenges to some of his tariff authority but has other mechanisms at his disposal if the challenges are successful. Sectoral tariffs remain in place.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. However, the pace of disinflation slowed toward the end of the period, particularly in the US, while tariffs made for a more difficult policymaking environment.

-

In fixed income markets, global yields declined during the first quarter of the reporting period, then fluctuated within a narrow band for the remainder of the period as volatility persisted. Credit spreads declined throughout the reporting period, and remain near historical lows, despite a brief period of widening as tariff concerns took hold. US bond market volatility, as measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended the period near session lows after increasing around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

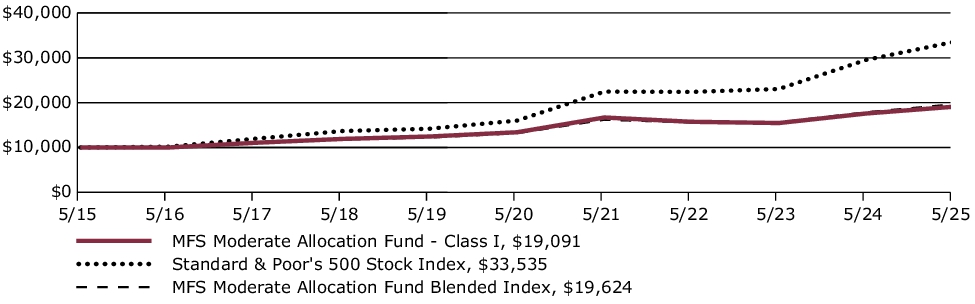

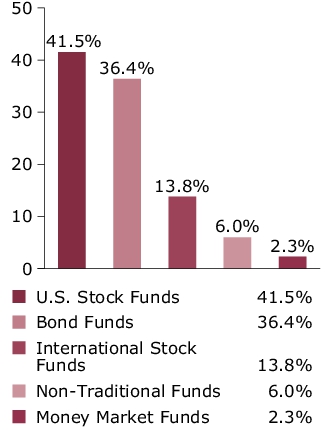

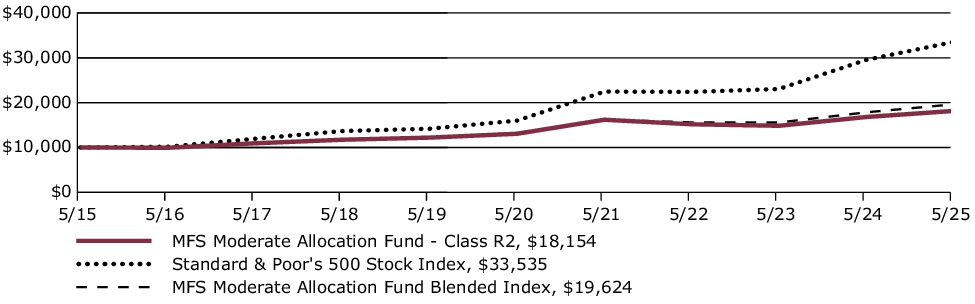

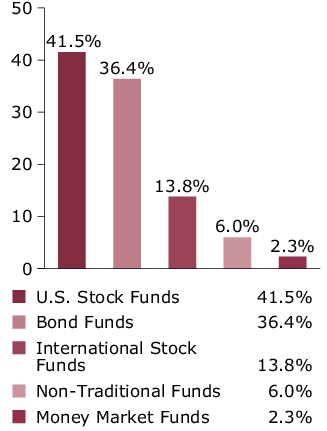

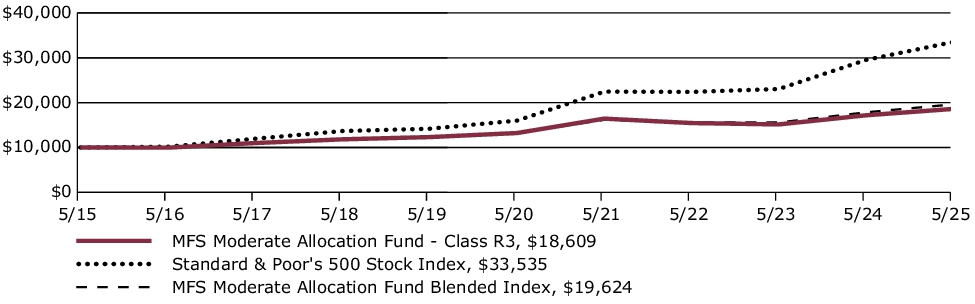

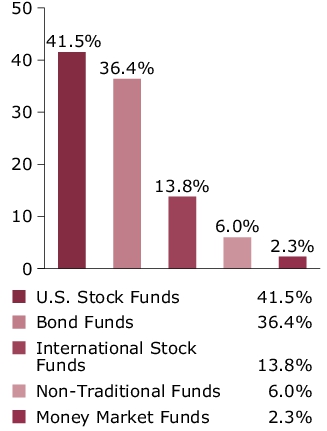

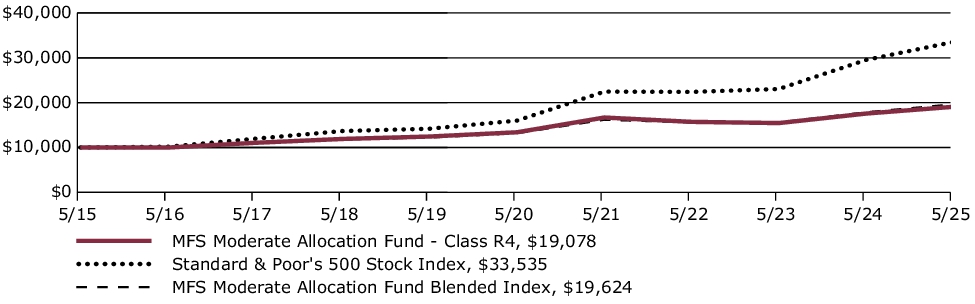

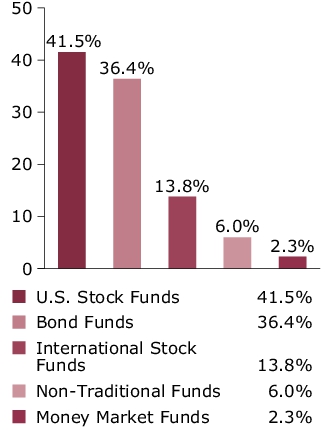

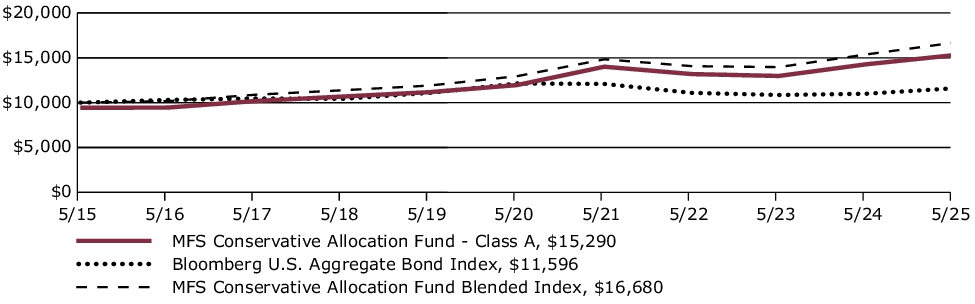

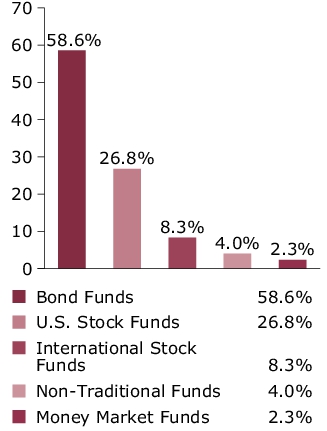

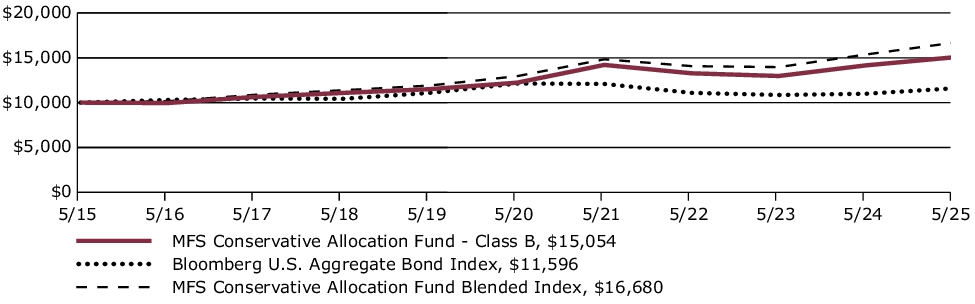

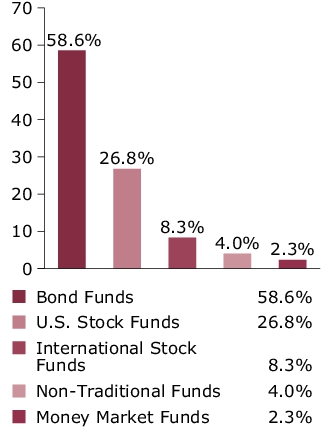

| Line Graph [Table Text Block] |

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class A over a ten year period or since inception, if shorter, in comparison to (i) a broad measure of market performance and (ii) an additional index that MFS believes more closely reflects the market segments in which the fund invests. This graph includes the deduction of the maximum applicable sales charge.

|

|

| Average Annual Return [Table Text Block] |