| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower Introduction Pacic Coast Oil Trust is a statutory trust formed in January 2012 under the Delaware Statutory Trust Act pursuant to a Trust Agreement among Pacic Coast Energy Company ("PCEC") as trustor and The Bank of New York Mellon Trust Company, N.A. ("BNY") as Trustee The Trust was created to acquire and hold net prots and royalty interests in certain oil and natural gas properties located in California for the benet of the Trust unitholders On 8 May 2012, the Trust and PCEC entered into a Conveyance of Net Prots Interests and Overriding Royalty Interest ("Conveyance Agreement"), pursuant to which PCEC conveyed to the Trust the Conveyed Interests The Conveyance Agreement can be found here; the Trust Agreement here Between 2012 and 2018, the Trust averaged $30M per year in distributions. In the 12 months through June 2019 (the last time the Trust reported nancials), distributions were $13M. In 2019 PCEC came under new management. That management introduced new accounting for Asset Retirement Obligations ("ARO"), stopped reporting nancials, and ceased all distributions to the Trust. The following pages describe the disputes that followed, including a Unitholder class action in which a TRO was granted but which was ultimately dismissed for lack of standing N e x t p a g e 8/3/25, 10:31 AM Intro | Pacific Coast https://www.savepcot.com 1/1 |

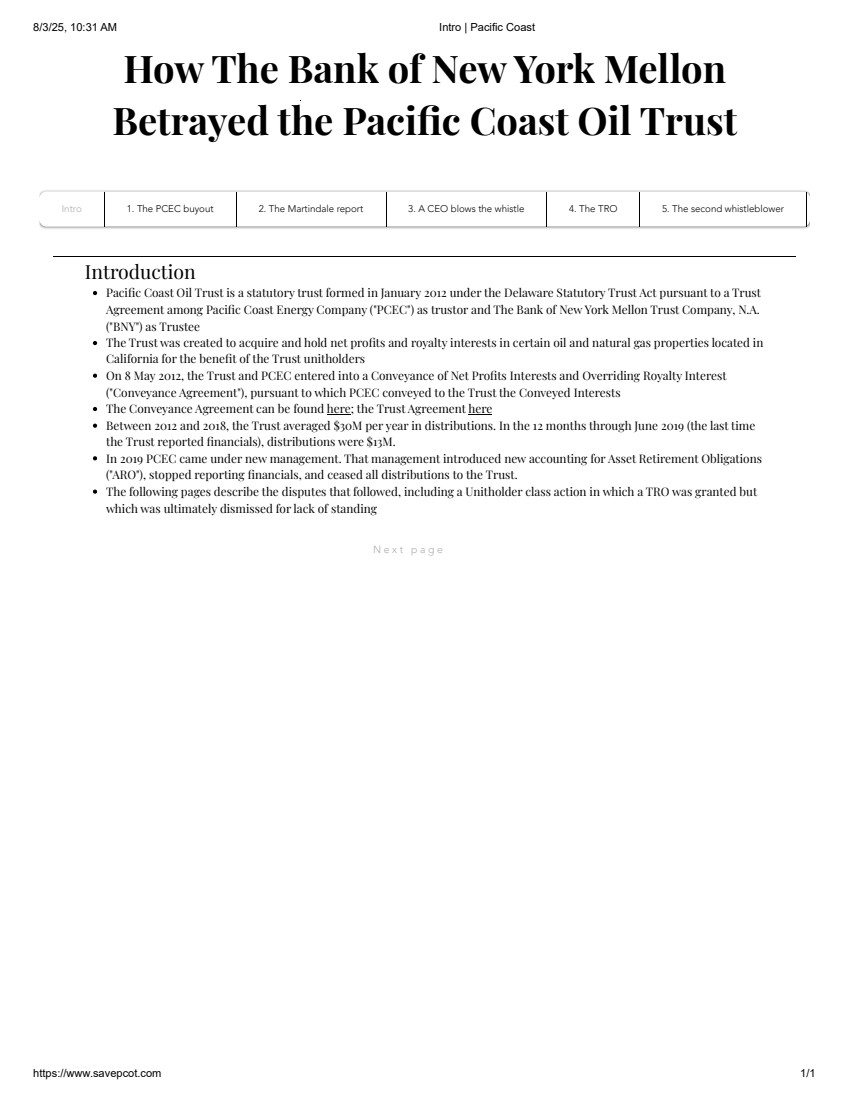

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 1. The PCEC buyout On 16 May 2019, the general partner of Pacic Coast Energy Company ("PCEC", the Trust's operator) entered into a merger agreement that would see PCEC come under new management. On 4 October 2019 PricewaterhouseCoopers ("PwC") resigned as the Trust's auditor, telling Bank of New York Mellon ("BNY", the Trustee) that they were "unwilling to be associated with the Trust's nancial statements in the future" and that this unwillingness stemmed from PCEC's change in ownership. On 13 November 2019, BNY noted to Unitholders that one of PCEC's new owners might have been an executive ocer of ERG Intermediate Holdings, LLC, which had previously gone bankrupt. BNY did not say why a previous bankruptcy was relevant, but it is noteworthy that in the ERG bankruptcy, debtors alleged that the named executive had engaged in "massive transfers of corporate assets" and "mismanagement and self-dealing". Also on 13 November 2019, BNY disclosed that PCEC's new management intended to begin deducting "estimated future plugging and abandonment costs from the amounts otherwise payable to the Trust". This announcement was signicant, because for seven years following the Trust's 2012 IPO, PCEC had not deducted such cost estimates from distributions to the Trust. Indeed, the Trust's nal IPO prospectus, to which BNY was a party, represented to Unitholders that so-called Asset Retirement Obligations ("ARO") would not be deducted from distributions. In the table above, showing historical PCEC nancials, note the two costs recorded for 2011: $29.901M for "Development costs" and $5.321M for "Asset retirement costs--development". In the table below, showing pro forma distributions to the Trust, note that the identical $29.901M appears but that the $5.321M is absent. In other words, the ARO was to stay with PCEC. 8/3/25, 10:31 AM 1. The PCEC buyout | Pacific Coast https://www.savepcot.com/1-the-pcec-acquisition 1/2 |

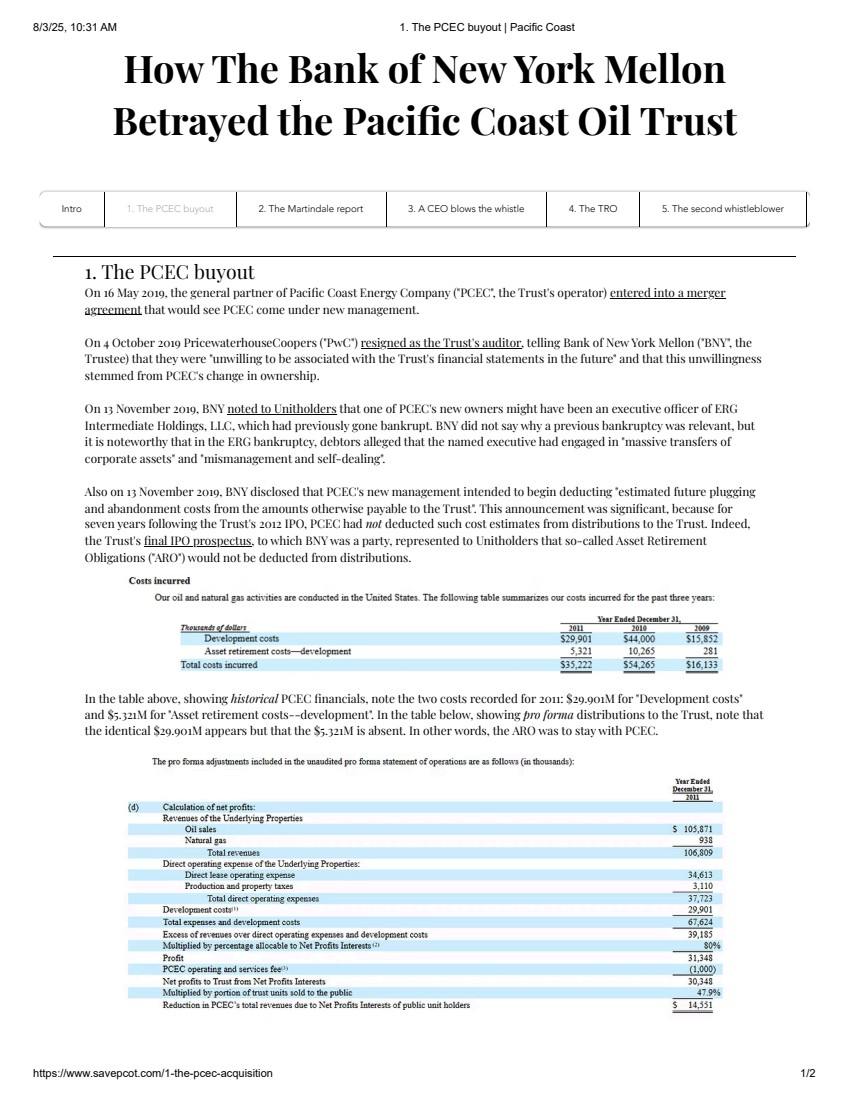

| Consistent with the absence of any ARO amount in the pro forma distribution table, the pro forma balance sheet also showed the ARO remaining with PCEC: In its 13 November 2019 Form 8-K to Unitholders, BNY disclosed that PCEC's initial estimate of ARO deductions was $56.7M. The next day, Trust Units fell 77% in trading on the New York Stock Exchange. BNY has never explained why, if the Conveyance Agreement allows deductions for ARO, the IPO prospectus showed no ARO deductions from pro forma distributions to the Trust. N e x t p a g e 8/3/25, 10:31 AM 1. The PCEC buyout | Pacific Coast https://www.savepcot.com/1-the-pcec-acquisition 2/2 |

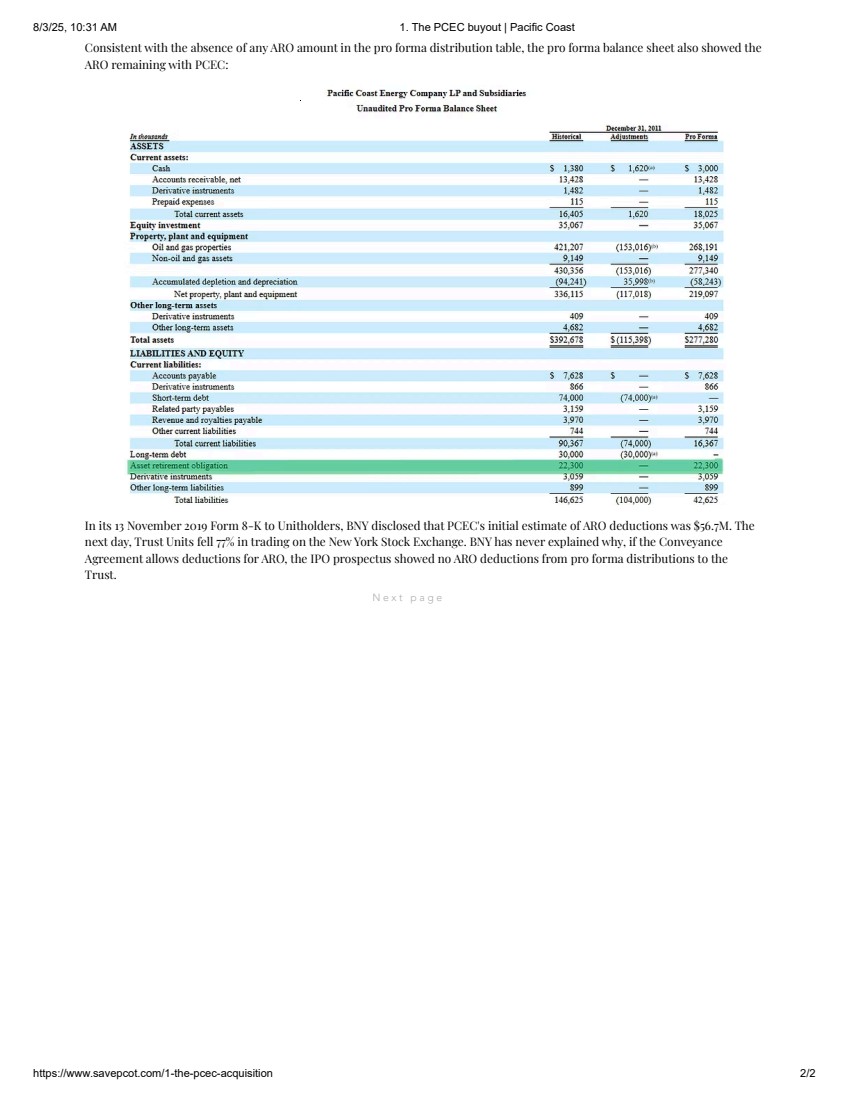

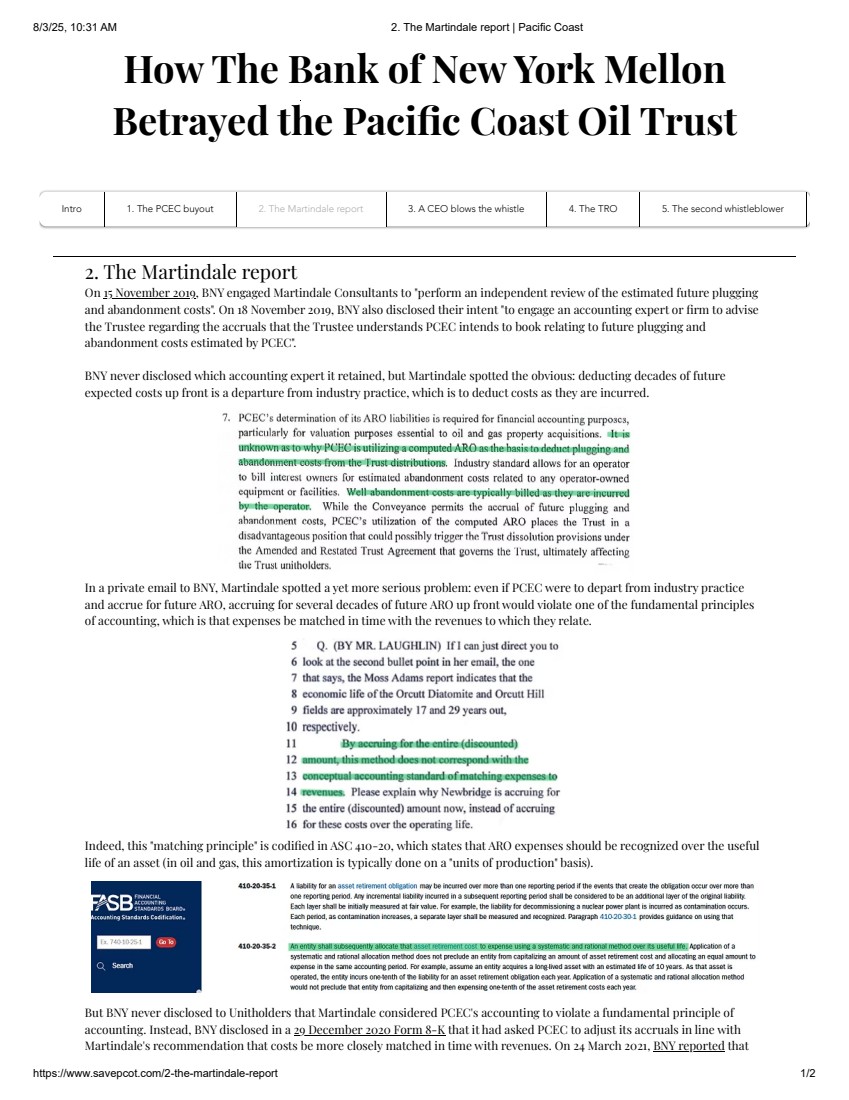

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 2. The Martindale report On 15 November 2019, BNY engaged Martindale Consultants to "perform an independent review of the estimated future plugging and abandonment costs". On 18 November 2019, BNY also disclosed their intent "to engage an accounting expert or rm to advise the Trustee regarding the accruals that the Trustee understands PCEC intends to book relating to future plugging and abandonment costs estimated by PCEC". BNY never disclosed which accounting expert it retained, but Martindale spotted the obvious: deducting decades of future expected costs up front is a departure from industry practice, which is to deduct costs as they are incurred. In a private email to BNY, Martindale spotted a yet more serious problem: even if PCEC were to depart from industry practice and accrue for future ARO, accruing for several decades of future ARO up front would violate one of the fundamental principles of accounting, which is that expenses be matched in time with the revenues to which they relate. Indeed, this "matching principle" is codied in ASC 410-20, which states that ARO expenses should be recognized over the useful life of an asset (in oil and gas, this amortization is typically done on a "units of production" basis). But BNY never disclosed to Unitholders that Martindale considered PCEC's accounting to violate a fundamental principle of accounting. Instead, BNY disclosed in a 29 December 2020 Form 8-K that it had asked PCEC to adjust its accruals in line with Martindale's recommendation that costs be more closely matched in time with revenues. On 24 March 2021, BNY reported that 8/3/25, 10:31 AM 2. The Martindale report | Pacific Coast https://www.savepcot.com/2-the-martindale-report 1/2 |

| PCEC had refused its requests and that BNY "has determined not to take further action at this time". As recently as the 23 December 2024 Form 8-K, BNY still says that it "has determined not to take further action at this time". N e x t p a g e 8/3/25, 10:31 AM 2. The Martindale report | Pacific Coast https://www.savepcot.com/2-the-martindale-report 2/2 |

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 3. A CEO blows the whistle On 8 July 2020, a putative class action was brought by a Evergreen Capital against BNY and PCEC alleging the existence of a scheme by PCEC to use improper accounting to starve the Trust of distributions. On 22 January 2022, Evergreen led a second amended complaint, which included testimony from PCEC's recently-ousted CEO, who had fallen out with his former colleagues. The ex-CEO alleged that his colleagues had indeed orchestrated a scheme to expropriate Trust assets using improper ARO accounting: 8/3/25, 10:37 AM 3. A CEO blows the whistle | Pacific Coast https://www.savepcot.com/3-a-ceo-blows-the-whistle 1/2 |

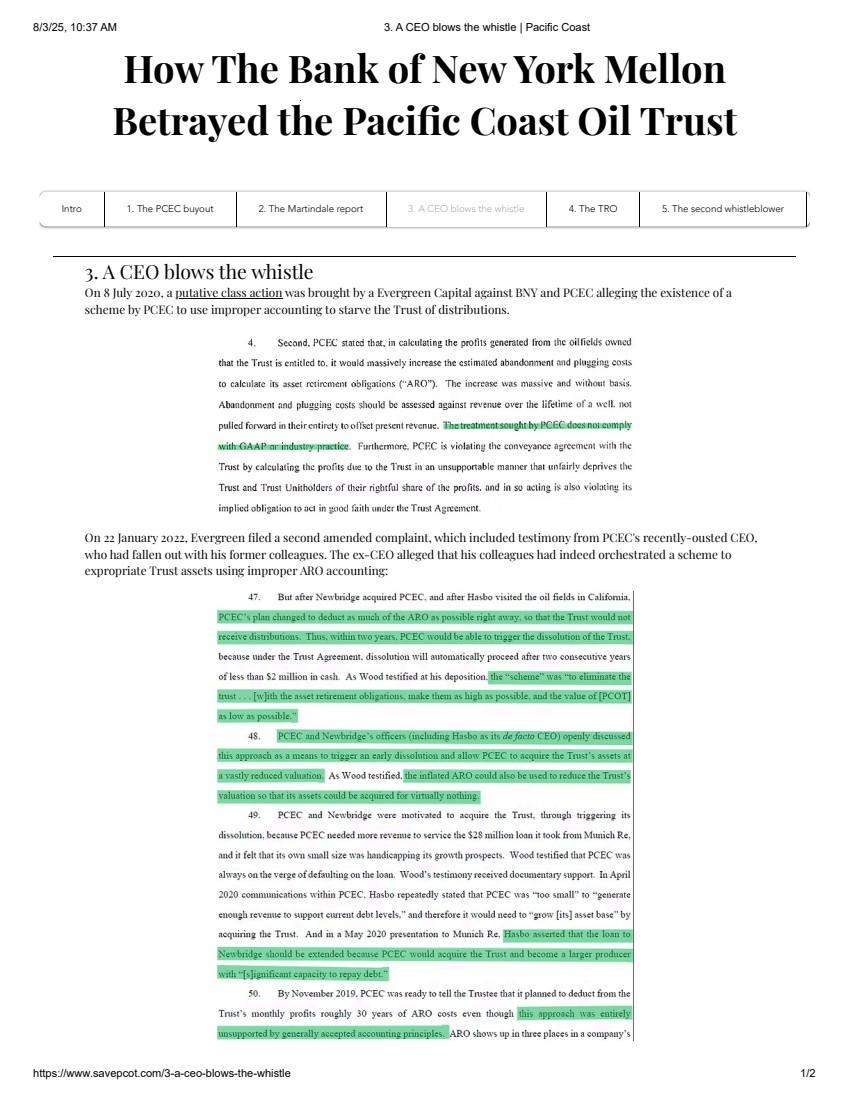

| Discovery in the Evergreen class action produced what the former CEO alleged was a "second set of books" used by PCEC to show its lenders an estimate of ARO expense that was lower than the estimates represented in the Trust's SEC lings. Indeed, the document produced appears to show that PCEC budgeted for only $2-$3M per year of ARO expense, far below the level that would necessitate stopping all distributions to the Trust (the Trust had earned $13M in the 12 months through June 2019). Also produced in discovery was an email from a buyer oering to pay $6M for a property (West Pico) that PCEC alleged was worth less than the ARO associated with it. According to PCEC's ex-CEO, PCEC rebued oers (including from the ex-CEO himself) because they wanted to retain the liabilities associated with West Pico long enough to force the Trust into dissolution: N e x t p a g e 8/3/25, 10:37 AM 3. A CEO blows the whistle | Pacific Coast https://www.savepcot.com/3-a-ceo-blows-the-whistle 2/2 |

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 4. The TRO In the Evergreen class action, the ex-CEO's testimony about the existence of a scheme was supplemented by plainti's depositions of PCEC's two expert witnesses. The class action alleged that both experts admitted under deposition that PCEC's ARO accounting was not in keeping with generally accepted accounting principles: In her dicta at a 1 Dec 2021 preliminary injunction hearing, the Honorable Judge Kuhl also took issue with PCEC's accounting: Later in the same hearing: 8/3/25, 10:32 AM 4. The TRO | Pacific Coast https://www.savepcot.com/4-the-california-tro 1/2 |

| On 16 December 2021, Judge Kuhl granted plaintis a Temporary Restraining Order ("TRO") enjoining dissolution of the Trust. Her order recapitulated the accounting arguments advanced by Evergreen: More important than the judge's endorsement of plainti's accounting arguments was the pleading standard that Evergreen had to meet in order to be granted the TRO: Judge Kuhl had to nd that the moving party was likely to prevail on the merits. And she did: BNY was thus aware, as early as December 2021, that a court considered the Trust likely to win in a suit against PCEC. But when the Evergreen class action was eventually dismissed because it was ruled that only BNY has standing to sue PCEC, BNY declined to bring suit. N e x t p a g e 8/3/25, 10:32 AM 4. The TRO | Pacific Coast https://www.savepcot.com/4-the-california-tro 2/2 |

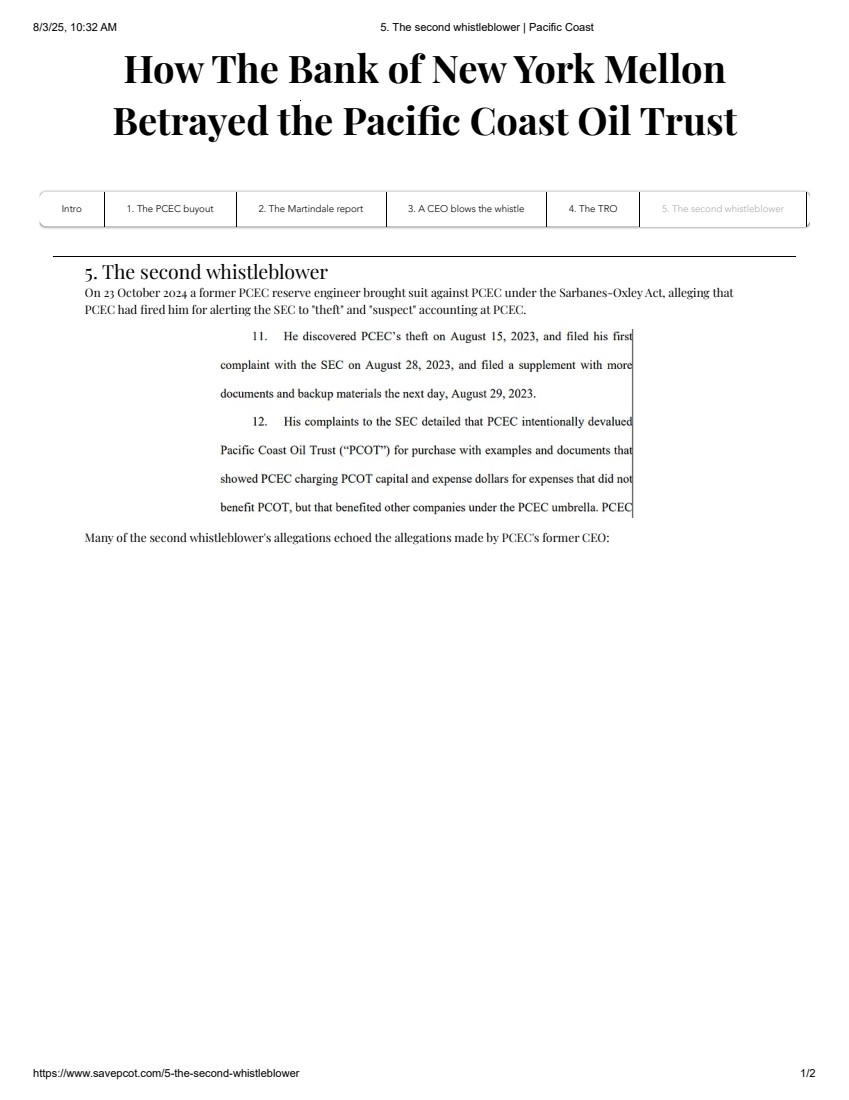

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 5. The second whistleblower On 23 October 2024 a former PCEC reserve engineer brought suit against PCEC under the Sarbanes-Oxley Act, alleging that PCEC had red him for alerting the SEC to "theft" and "suspect" accounting at PCEC. Many of the second whistleblower's allegations echoed the allegations made by PCEC's former CEO: 8/3/25, 10:32 AM 5. The second whistleblower | Pacific Coast https://www.savepcot.com/5-the-second-whistleblower 1/2 |

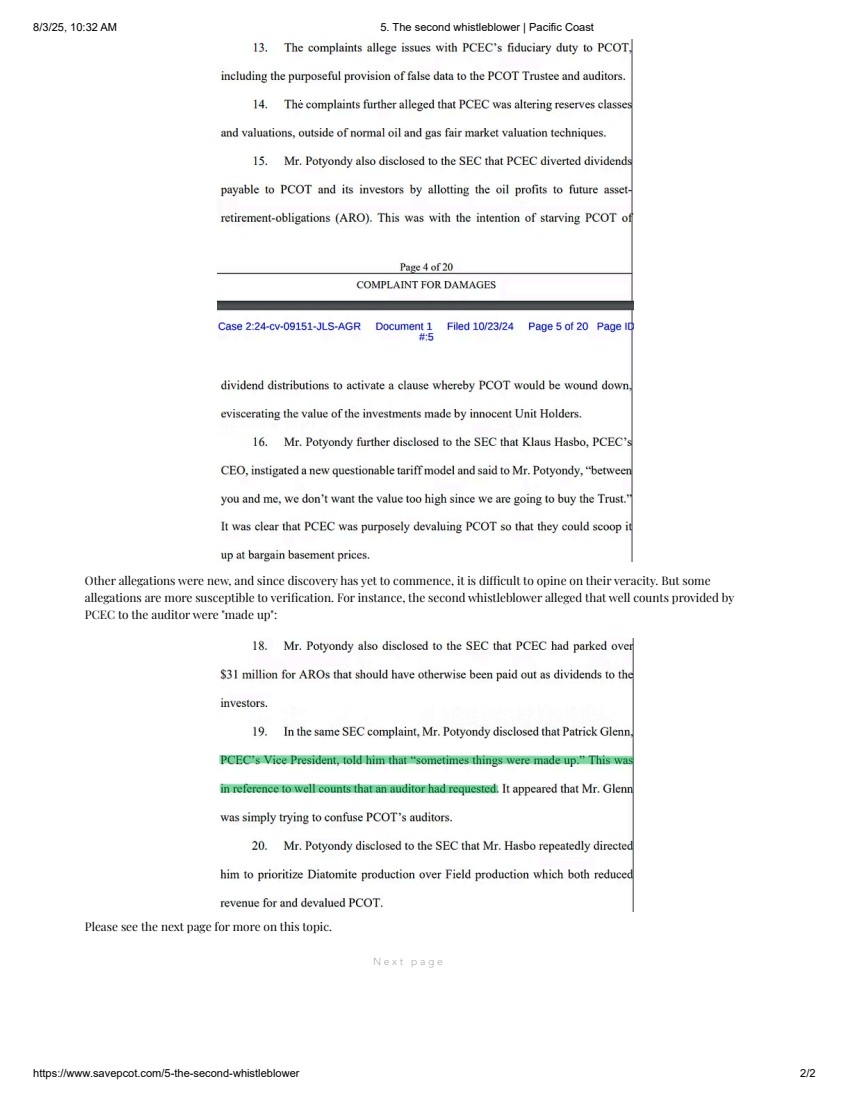

| Other allegations were new, and since discovery has yet to commence, it is dicult to opine on their veracity. But some allegations are more susceptible to verication. For instance, the second whistleblower alleged that well counts provided by PCEC to the auditor were "made up": Please see the next page for more on this topic. N e x t p a g e 8/3/25, 10:32 AM 5. The second whistleblower | Pacific Coast https://www.savepcot.com/5-the-second-whistleblower 2/2 |

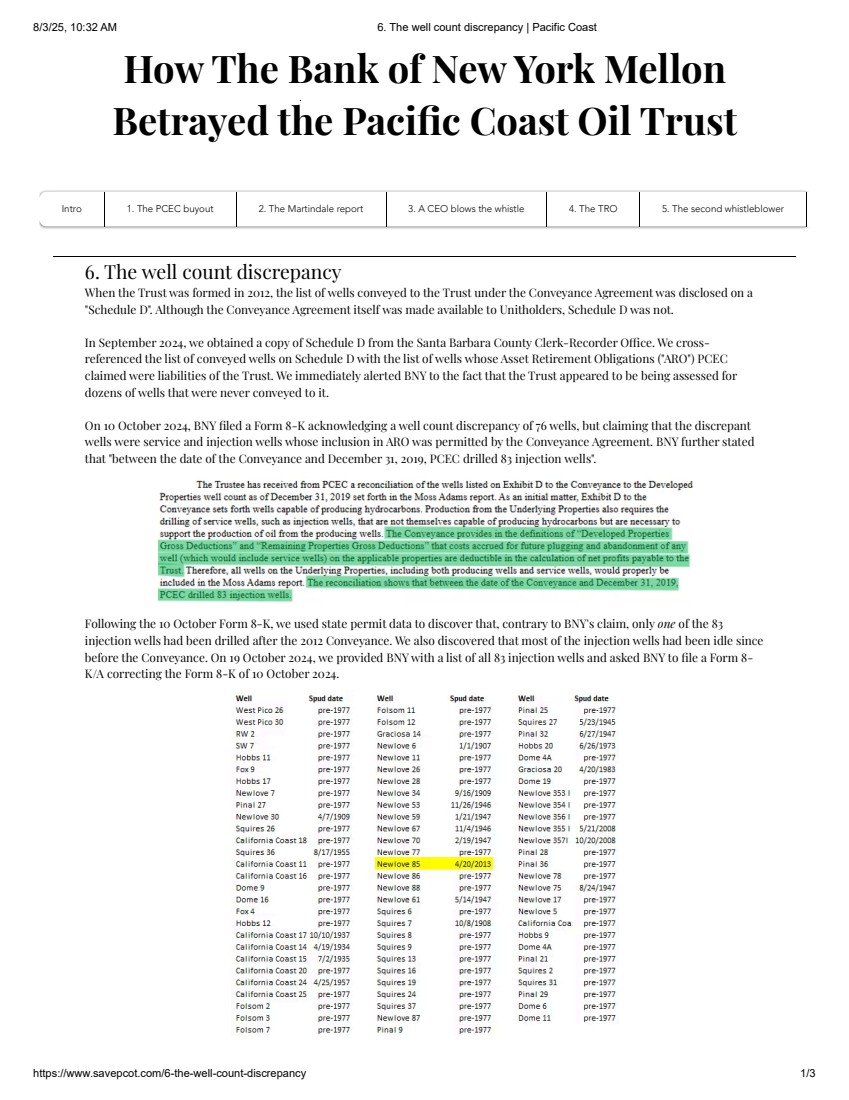

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 6. The well count discrepancy When the Trust was formed in 2012, the list of wells conveyed to the Trust under the Conveyance Agreement was disclosed on a "Schedule D". Although the Conveyance Agreement itself was made available to Unitholders, Schedule D was not. In September 2024, we obtained a copy of Schedule D from the Santa Barbara County Clerk-Recorder Oce. We cross-referenced the list of conveyed wells on Schedule D with the list of wells whose Asset Retirement Obligations ("ARO") PCEC claimed were liabilities of the Trust. We immediately alerted BNY to the fact that the Trust appeared to be being assessed for dozens of wells that were never conveyed to it. On 10 October 2024, BNY led a Form 8-K acknowledging a well count discrepancy of 76 wells, but claiming that the discrepant wells were service and injection wells whose inclusion in ARO was permitted by the Conveyance Agreement. BNY further stated that "between the date of the Conveyance and December 31, 2019, PCEC drilled 83 injection wells". Following the 10 October Form 8-K, we used state permit data to discover that, contrary to BNY's claim, only one of the 83 injection wells had been drilled after the 2012 Conveyance. We also discovered that most of the injection wells had been idle since before the Conveyance. On 19 October 2024, we provided BNY with a list of all 83 injection wells and asked BNY to le a Form 8- K/A correcting the Form 8-K of 10 October 2024. 8/3/25, 10:32 AM 6. The well count discrepancy | Pacific Coast https://www.savepcot.com/6-the-well-count-discrepancy 1/3 |

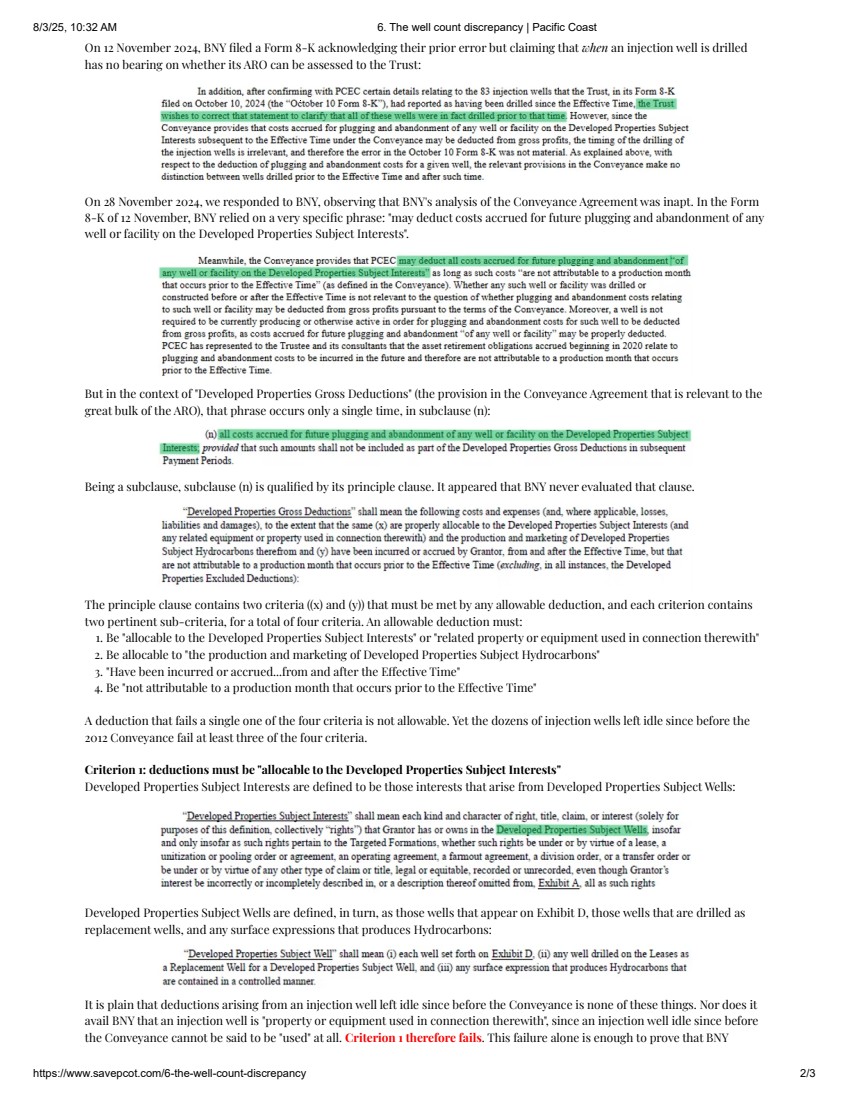

| On 12 November 2024, BNY led a Form 8-K acknowledging their prior error but claiming that when an injection well is drilled has no bearing on whether its ARO can be assessed to the Trust: On 28 November 2024, we responded to BNY, observing that BNY's analysis of the Conveyance Agreement was inapt. In the Form 8-K of 12 November, BNY relied on a very specic phrase: "may deduct costs accrued for future plugging and abandonment of any well or facility on the Developed Properties Subject Interests". But in the context of "Developed Properties Gross Deductions" (the provision in the Conveyance Agreement that is relevant to the great bulk of the ARO), that phrase occurs only a single time, in subclause (n): Being a subclause, subclause (n) is qualied by its principle clause. It appeared that BNY never evaluated that clause. The principle clause contains two criteria ((x) and (y)) that must be met by any allowable deduction, and each criterion contains two pertinent sub-criteria, for a total of four criteria. An allowable deduction must: 1. Be "allocable to the Developed Properties Subject Interests" or "related property or equipment used in connection therewith" 2. Be allocable to "the production and marketing of Developed Properties Subject Hydrocarbons" 3. "Have been incurred or accrued...from and after the Eective Time" 4. Be "not attributable to a production month that occurs prior to the Eective Time" A deduction that fails a single one of the four criteria is not allowable. Yet the dozens of injection wells left idle since before the 2012 Conveyance fail at least three of the four criteria. Criterion 1: deductions must be "allocable to the Developed Properties Subject Interests" Developed Properties Subject Interests are dened to be those interests that arise from Developed Properties Subject Wells: Developed Properties Subject Wells are dened, in turn, as those wells that appear on Exhibit D, those wells that are drilled as replacement wells, and any surface expressions that produces Hydrocarbons: It is plain that deductions arising from an injection well left idle since before the Conveyance is none of these things. Nor does it avail BNY that an injection well is "property or equipment used in connection therewith", since an injection well idle since before the Conveyance cannot be said to be "used" at all. Criterion 1 therefore fails. This failure alone is enough to prove that BNY 8/3/25, 10:32 AM 6. The well count discrepancy | Pacific Coast https://www.savepcot.com/6-the-well-count-discrepancy 2/3 |

| allowed dozens of pre-Conveyance defunct wells to be improperly included in the ARO. Still, for completeness, we can show that these "dead soldier" wells also fail at least two of the other three criteria for allowable deductions. Criterion 2: deductions must be allocable to "the production and marketing of Developed Properties Subject Hydrocarbons" Developed Properties Subject Hydrocarbons are those produced "from and after the Eective Time: An injection well defunct since before the Conveyance cannot generate deductions allocable to production that occurs after the Conveyance. Thus, Criterion 2 also fails. Criterion 3: deductions must "have been incurred or accrued...from and after the Eective Time" It is arguable that this criterion could be met by an injection well left idle since before the Conveyance. Criterion 4: deductions must not be "attributable to a production month that occurs prior to the Eective Time" An injection well defunct since before the Conveyance cannot generate deductions attributable to a production month that occurs after the Conveyance. Thus, Criterion 4 also fails. Despite defunct injection wells plainly failing the test for allowable deductions, BNY continues to endorse such deductions in its monthly Forms 8-K. As of 2 August 2025, BNY has refused to correct their false and materially misleading Form 8-K of 12 November 2024. N e x t p a g e 8/3/25, 10:32 AM 6. The well count discrepancy | Pacific Coast https://www.savepcot.com/6-the-well-count-discrepancy 3/3 |

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 7. The failure to prorate BNY's error in allowing deductions for defunct wells is merely the most extreme violation of a general principle: that the Trust only enjoy the fruits of production that occurs after the Conveyance and, equally, that the Trust only pay for liabilities attributable to such production. The phrases "from and after the Eective Time" and "not attributable to a production month that occurs prior to the Eective Time" litter the Conveyance Agreement. Indeed, without such a principle, much of the Conveyance Agreement would be a nullity: there would be no need to enumerate Subject Wells on Schedule D and no need to speak of pre- and post-Conveyance limitations at all. Any well or facility on the subject leases could be dumped on the Trust by the operator causing it to produce a single drop of oil and thereby satisfying the criteria of Developed Properties Gross Deductions. But the Conveyance Agreement was not written to allow such absurdities. The "from and after" and "attributable to a production month" language makes it clear that a well that produced, say, 90,000 barrels before the Conveyance and 10,000 barrels after the Conveyance and was then plugged and abandoned at a cost of $100,000 would only give rise to $10,000 of ARO deductions against distributions to the Trust. This principle has been ignored by BNY, which fact suggests that in addition to the ARO containing dozens of defunct injection wells that were never liabilities of the Trust, the ARO for producing and recently-abandoned wells is also improperly inated by the inclusion of liabilities that are properly attributable to pre-Conveyance production months. N e x t p a g e 8/3/25, 10:32 AM 7. The failure to prorate | Pacific Coast https://www.savepcot.com/7-the-failure-to-prorate 1/1 |

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 8. PKF resigns On 11 July 2025, ve years and four months after being appointed to serve as the Trust's auditor, Pannell Kerr Forster of Texas, P.C. ("PKF") resigned without having completed a single audit. According to BNY, PKF resigned because they could not verify "the well count used to develop the ARO estimate contained in the Trust's Registration on Form S-1". PKF's resignation came ve months after we rst documented the well count discrepancies on this website, ten months after we alerted BNY to the well count discrepancies, three years after we rst publicly alerted BNY to the ARO discrepancies in the Form S-1 and a former CEO alleged the existence of a scheme to saddle the Trust with improper ARO, and six years after PwC said that they were "unwilling to be associated with the Trust's nancial statements". On 31 July 2025, BNY announced that it "has taken all actions reasonably available to it" in connection with the ARO calculations and that it has "determined not to take further action at this time". N e x t p a g e 8/3/25, 10:32 AM 8. PKF resigns | Pacific Coast https://www.savepcot.com/copy-of-7-the-failure-to-prorate 1/1 |

| How The Bank of New York Mellon Betrayed the Pacic Coast Oil Trust Intro 1. The PCEC buyout 2. The Martindale report 3. A CEO blows the whistle 4. The TRO 5. The second whistleblower 9. Questions for BNY 1. BNY has represented that the pro forma disclosures in the IPO prospectus were consistent with ARO being deductible from distributions to the Trust. Why then do pages 11 and F-10 of the nal IPO prospectus show pro forma 2011 distributions unburdened by any ARO deduction? 2. If the disclosures in the IPO prospectus were incorrect, what claims does the Trust have under Sections 11 and 12(a)(2) of the 1933 Securities Act? 3. The Trust Agreement obligates BNY to provide Unitholders with audited nancials within 120 days of year end. Six years have elapsed with no audit. At what point does the Trust have a claim for nonperformance? 4. BNY quotes subclause (n) of Developed Properties Gross Deductions to justify the deduction from Trust distributions of ARO relating to injection wells that have been defunct since before the Conveyance. How does BNY reconcile this stance with the fact that subclause (n)'s principle clause specically disallows such deductions? 5. How much has BNY charged the Trust to date for all actions related to the Special Meeting, to the delayed audit, to the several whistleblowers, to the California and Delaware actions, to the various arbitral actions, and to any other work or consulting related to the PCEC accounting disputes? 6. How much has the Trust reimbursed to PCEC to date for such actions? 7. On what basis did BNY conclude that deductions for ARO need not be prorated by the proportion of production that occurred after the Conveyance? 8. Where is the approximately $50M that has been withheld from Unitholders to date for disputed ARO? Is it in escrow? 9. What allegations were in the Scott Wood deposition that Unitholders have not been made aware of? 8/3/25, 10:32 AM 9. Questions for BNY | Pacific Coast https://www.savepcot.com/8-questions-for-bny 1/1 |