Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Virtus Opportunities Trust

|

| Entity Central Index Key |

0001005020

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000234173 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Emerging Markets Bond Fund

|

| Class Name |

Class A

|

| Trading Symbol |

VSHAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Bond Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred from the beginning of the reporting period through the date of issuance of this report.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Bond Fund

Class A / VSHAX |

$126 |

1.22% |

|

| Expenses Paid, Amount |

$ 126

|

| Expense Ratio, Percent |

1.22%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Country exposures and issue selection contributed to performance relative to the J.P. Morgan CEMBI Broad Diversified Index for the 12 months ended May 31, 2025. Exposures in Europe, the Middle East, and Africa contributed most to relative performance. In other regions, an underweight exposure and issue selection in Hong Kong, as well as issue selection in Indonesia, Mexico, and Brazil, enhanced performance. Some of the positive performance attribution was offset by issue selection decisions in Colombia and Argentina. In terms of industry attribution, an overweight exposure and issue selection in wireless contributed positively, as did an underweight exposure and issue selection in metals/mining/steel and financial/leasing. Underweight exposures in higher-rated credits and overweight exposures in lower-quality credits contributed to relative performance during the period.

| FACTOR |

IMPACT |

SUMMARY |

Indonesia

|

Positive

|

Issue selection, particularly in Cikarang Listrindo, contributed to Fund performance relative to the J.P. Morgan CEMBI Broad Diversified Index.

|

Mexico

|

Positive

|

Issue selection, particularly in Aeromexico, contributed to relative performance.

|

Colombia

|

Negative

|

Issue selection, particularly in Gran Tierra, detracted from relative performance.

|

| Argentina |

Negative |

Issue selection, particularly in Albanesi, detracted from relative performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

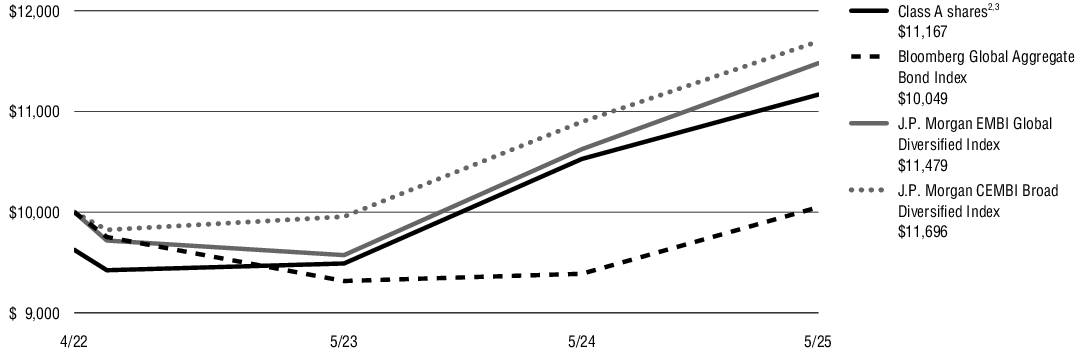

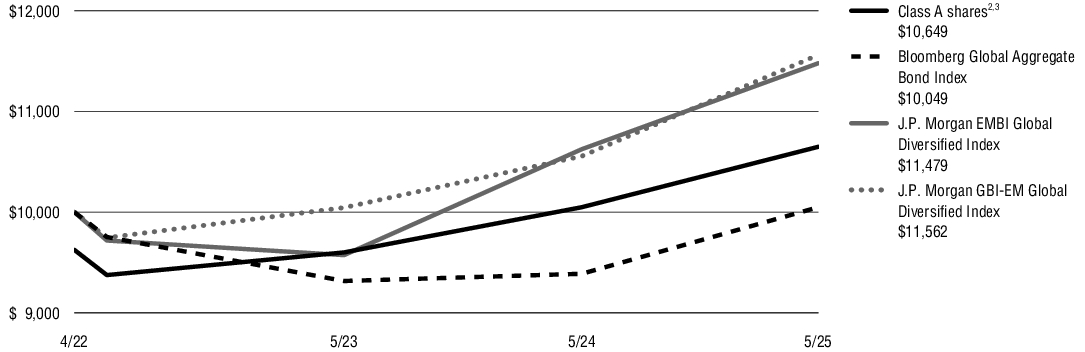

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in appropriate broad-based securities market and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions. The broad-based securities market index for the Fund changed from the J.P. Morgan EMBI Global Diversified Index to the Bloomberg Global Aggregate Bond Index, which is a broader representation of global fixed income markets. GROWTH OF $10,000 (2)“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge.(3)“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid.

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

Since Inception |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class A/VSHAX) at NAV(1) |

6.07% |

4.85% |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class A/VSHAX) at POP(2),(3) |

2.09% |

3.58% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

0.15% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

4.50% |

| J.P. Morgan CEMBI Broad Diversified Index |

7.33% |

5.12% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) |

“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) |

“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

|

| Performance Inception Date |

Apr. 11, 2022

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Material Change Date |

Jan. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 6,926,000

|

| Holdings Count | Holding |

164

|

| Advisory Fees Paid, Amount |

|

| Investment Company Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$6,926 |

| Total number of portfolio holdings |

164 |

| Total advisory fee paid (‘000s) |

$- |

| Portfolio turnover rate as of the end of the reporting period |

56% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Corporate Bonds and Notes |

|

100% |

| Financial & Lease |

19% |

|

| Electric |

16% |

|

| Exploration & Production |

14% |

|

| Wireless |

7% |

|

| Metals, Mining & Steel |

6% |

|

| Gaming |

5% |

|

| Chemicals |

5% |

|

| Services Other |

4% |

|

| Retail Food & Drug |

3% |

|

| Midstream |

3% |

|

| All other Corporate Bonds and Notes |

18% |

|

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective January 1, 2025, the new expense limitation of 1.20% went into effect for Class A shares.

|

| Material Fund Change Expenses [Text Block] |

Effective January 1, 2025, the new expense limitation of 1.20% went into effect for Class A shares.

|

| C000234172 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Emerging Markets Bond Fund

|

| Class Name |

Class I

|

| Trading Symbol |

SHCDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Bond Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred from the beginning of the reporting period through the date of issuance of this report.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Bond Fund

Class I / SHCDX |

$101 |

0.98% |

|

| Expenses Paid, Amount |

$ 101

|

| Expense Ratio, Percent |

0.98%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Country exposures and issue selection contributed to performance relative to the J.P. Morgan CEMBI Broad Diversified Index for the 12 months ended May 31, 2025. Exposures in Europe, the Middle East, and Africa contributed most to relative performance. In other regions, an underweight exposure and issue selection in Hong Kong, as well as issue selection in Indonesia, Mexico, and Brazil, enhanced performance. Some of the positive performance attribution was offset by issue selection decisions in Colombia and Argentina. In terms of industry attribution, an overweight exposure and issue selection in wireless contributed positively, as did an underweight exposure and issue selection in metals/mining/steel and financial/leasing. Underweight exposures in higher-rated credits and overweight exposures in lower-quality credits contributed to relative performance during the period.

| FACTOR |

IMPACT |

SUMMARY |

Indonesia

|

Positive

|

Issue selection, particularly in Cikarang Listrindo, contributed to Fund performance relative to the J.P. Morgan CEMBI Broad Diversified Index.

|

Mexico

|

Positive

|

Issue selection, particularly in Aeromexico, contributed to relative performance.

|

Colombia

|

Negative

|

Issue selection, particularly in Gran Tierra, detracted from relative performance.

|

| Argentina |

Negative |

Issue selection, particularly in Albanesi, detracted from relative performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

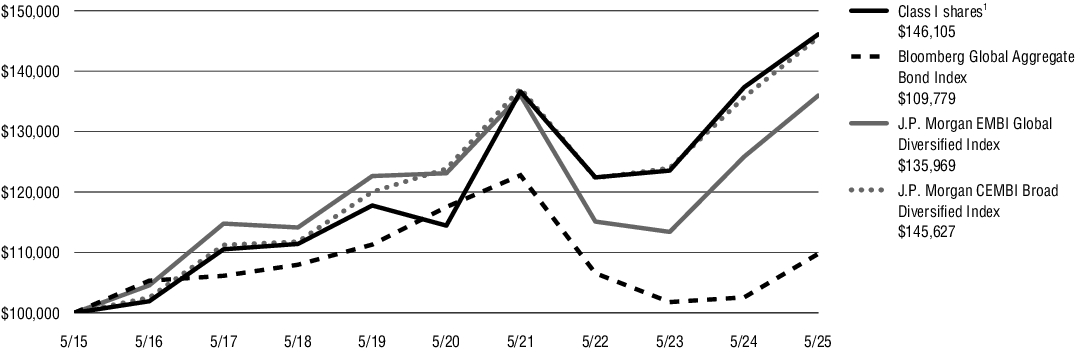

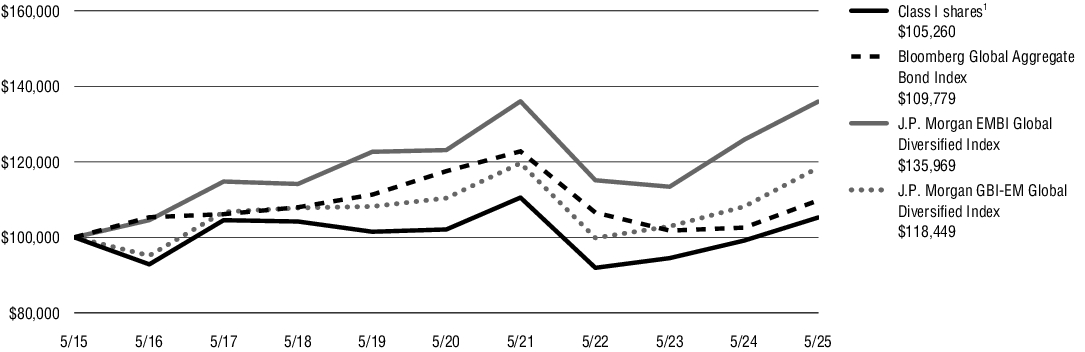

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in appropriate broad-based securities market and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions. The broad-based securities market index for the Fund changed from the J.P. Morgan EMBI Global Diversified Index to the Bloomberg Global Aggregate Bond Index, which is a broader representation of global fixed income markets. GROWTH OF $100,000

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

5 Years |

10 Years |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class I/SHCDX) at NAV(1) |

6.38% |

5.01% |

3.86% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

(1.35)% |

0.94% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

2.01% |

3.12% |

| J.P. Morgan CEMBI Broad Diversified Index |

7.33% |

3.29% |

3.83% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Material Change Date |

Jan. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 6,926,000

|

| Holdings Count | Holding |

164

|

| Advisory Fees Paid, Amount |

|

| Investment Company Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$6,926 |

| Total number of portfolio holdings |

164 |

| Total advisory fee paid (‘000s) |

$- |

| Portfolio turnover rate as of the end of the reporting period |

56% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Corporate Bonds and Notes |

|

100% |

| Financial & Lease |

19% |

|

| Electric |

16% |

|

| Exploration & Production |

14% |

|

| Wireless |

7% |

|

| Metals, Mining & Steel |

6% |

|

| Gaming |

5% |

|

| Chemicals |

5% |

|

| Services Other |

4% |

|

| Retail Food & Drug |

3% |

|

| Midstream |

3% |

|

| All other Corporate Bonds and Notes |

18% |

|

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective January 1, 2025, the new expense limitation of 0.95% went into effect for Class I shares.

|

| Material Fund Change Expenses [Text Block] |

Effective January 1, 2025, the new expense limitation of 0.95% went into effect for Class I shares.

|

| C000234177 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Emerging Markets Debt Income Fund

|

| Class Name |

Class A

|

| Trading Symbol |

VSHCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Debt Income Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Debt Income Fund

Class A / VSHCX |

$104 |

1.00% |

|

| Expenses Paid, Amount |

$ 104

|

| Expense Ratio, Percent |

1.00%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Country selection decisions contributed positively to performance relative to the J.P. Morgan EMBI Global Diversified Index for the 12 months ended May 31, 2025. Out-of-benchmark exposures to hard currency corporate debt also enhanced performance. Hard currency is generally issued by developed countries, globally traded, and seen as politically and economically stable. Some of the positive performance attribution was offset by exposure to local currency debt. Attribution from U.S. Treasuries was negative during the period. In terms of regional performance, Europe, the Middle East, and Africa – particularly an overweight and issue selection in Ghana – were considerable contributors to relative performance. In Latin America, an overweight to Ecuador was the largest contributor to performance. Underweights in several countries, including China and Indonesia, as well as issue selection in Sri Lanka, also contributed. Issue selection in Romania and Colombia detracted from performance.

| FACTOR |

IMPACT |

SUMMARY |

Mexico

|

Positive

|

An overweight exposure and issue selection in Mexico enhanced performance relative to the J.P. Morgan EMBI Global Diversified Index for the period.

|

Ecuador

|

Positive

|

An overweight exposure in Ecuador enhanced relative returns. The country outperformed when President Noboa was reelected in a second-round vote in April.

|

Romania

|

Negative

|

Issue selection detracted from the Fund’s relative performance.

|

| Colombia |

Negative |

Issue selection detracted from Fund performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

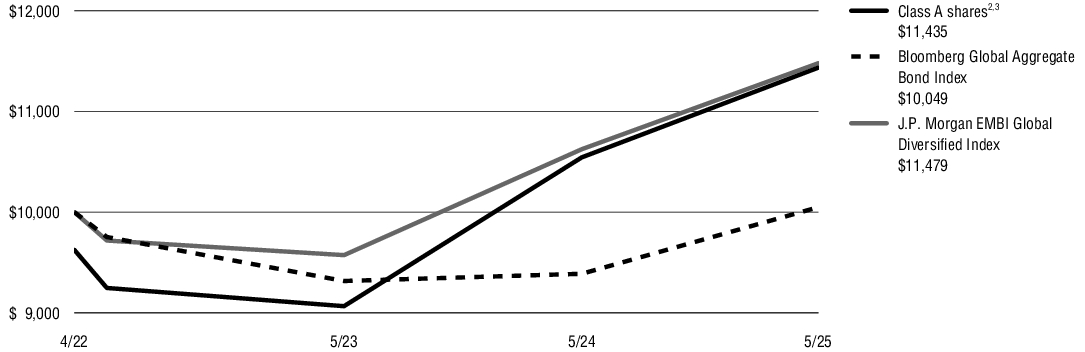

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions. GROWTH OF $10,000 (2)“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge.(3)“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid.

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

Since Inception |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class A/VSHCX) at NAV(1) |

8.45% |

5.65% |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class A/VSHCX) at POP(2),(3) |

4.38% |

4.37% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

0.15% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

4.50% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) |

“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) |

“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

|

| Performance Inception Date |

Apr. 11, 2022

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 258,131,000

|

| Holdings Count | Holding |

286

|

| Advisory Fees Paid, Amount |

$ 1,060,000

|

| Investment Company Portfolio Turnover |

143.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$258,131 |

| Total number of portfolio holdings |

286 |

| Total advisory fee paid (‘000s) |

$1,060 |

| Portfolio turnover rate as of the end of the reporting period |

143% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Foreign Government Securities |

|

71% |

| Corporate Bonds and Notes |

|

24% |

| Exploration & Production |

12% |

|

| Electric |

4% |

|

| Metals, Mining & Steel |

2% |

|

| Financial & Lease |

2% |

|

| All other Corporate Bonds and Notes |

4% |

|

| Affiliated Mutual Funds |

|

4% |

| Credit Linked Notes |

|

1% |

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|

| C000234176 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Emerging Markets Debt Income Fund

|

| Class Name |

Class I

|

| Trading Symbol |

SHMDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Debt Income Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Debt Income Fund

Class I / SHMDX |

$75 |

0.72% |

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

0.72%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Country selection decisions contributed positively to performance relative to the J.P. Morgan EMBI Global Diversified Index for the 12 months ended May 31, 2025. Out-of-benchmark exposures to hard currency corporate debt also enhanced performance. Hard currency is generally issued by developed countries, globally traded, and seen as politically and economically stable. Some of the positive performance attribution was offset by exposure to local currency debt. Attribution from U.S. Treasuries was negative during the period. In terms of regional performance, Europe, the Middle East, and Africa – particularly an overweight and issue selection in Ghana – were considerable contributors to relative performance. In Latin America, an overweight to Ecuador was the largest contributor to performance. Underweights in several countries, including China and Indonesia, as well as issue selection in Sri Lanka, also contributed. Issue selection in Romania and Colombia detracted from performance.

| FACTOR |

IMPACT |

SUMMARY |

Mexico

|

Positive

|

An overweight exposure and issue selection in Mexico enhanced performance relative to the J.P. Morgan EMBI Global Diversified Index for the period.

|

Ecuador

|

Positive

|

An overweight exposure in Ecuador enhanced relative returns. The country outperformed when President Noboa was reelected in a second-round vote in April.

|

Romania

|

Negative

|

Issue selection detracted from the Fund’s relative performance.

|

| Colombia |

Negative |

Issue selection detracted from Fund performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

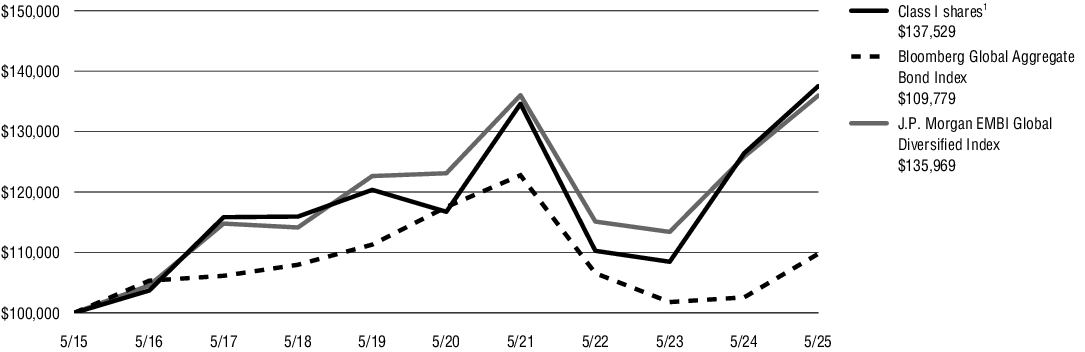

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions. GROWTH OF $100,000

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

5 Years |

10 Years |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class I/SHMDX) at NAV(1) |

8.78% |

3.33% |

3.24% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

(1.35)% |

0.94% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

2.01% |

3.12% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 258,131,000

|

| Holdings Count | Holding |

286

|

| Advisory Fees Paid, Amount |

$ 1,060,000

|

| Investment Company Portfolio Turnover |

143.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$258,131 |

| Total number of portfolio holdings |

286 |

| Total advisory fee paid (‘000s) |

$1,060 |

| Portfolio turnover rate as of the end of the reporting period |

143% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Foreign Government Securities |

|

71% |

| Corporate Bonds and Notes |

|

24% |

| Exploration & Production |

12% |

|

| Electric |

4% |

|

| Metals, Mining & Steel |

2% |

|

| Financial & Lease |

2% |

|

| All other Corporate Bonds and Notes |

4% |

|

| Affiliated Mutual Funds |

|

4% |

| Credit Linked Notes |

|

1% |

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|

| C000234181 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Local Markets Fund

|

| Class Name |

Class A

|

| Trading Symbol |

VSHEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Local Markets Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Local Markets Fund

Class A / VSHEX |

$129 |

1.25% |

|

| Expenses Paid, Amount |

$ 129

|

| Expense Ratio, Percent |

1.25%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Foreign exchange (FX) exposure (a measurement of currency risk) and duration positioning (a measurement of adjusting the portfolio’s sensitivity to changes in interest rates), as well as security selection and taxes, detracted from performance relative to the Fund’s style-specific benchmark ("Benchmark") for the 12 months ended May 31, 2025. Within FX, overweights in the Hungarian forint and Malaysian ringgit, as well as underweights in the Chinese yuan and Colombian peso, enhanced performance. The Fund also benefited from its cash/hard currency FX exposure. Hard currency is generally issued by developed countries, globally traded, and seen as politically and economically stable. Overweight exposures in the Brazilian real and Mexican peso detracted from performance. Within duration positioning, we continued to emphasize countries with attractive after-inflation yields that we believe have sufficient space to further ease policy interest rates. Overweights in Mexico and South Africa were the biggest contributors, while overweights to Brazil and Colombia underperformed. Among the Fund’s underweight positions, Turkey was the notable outperformer, while Thailand underperformed. The markdown of the Fund’s Russian ruble cash position detracted from performance.

| FACTOR |

IMPACT |

SUMMARY |

South Africa

|

Positive

|

The Fund benefited from an overweight duration position relative to the Benchmark during a period of central bank policy rate cuts in South Africa.

|

Colombia

|

Positive

|

Issue selection contributed, but some of the positive attribution was offset by the Fund’s overweight duration position in Colombia.

|

Brazil

|

Negative

|

The Fund’s overweight duration position relative to the Benchmark in Brazil detracted from performance, although some of the negative attribution was offset by positive attribution from security selection and taxes.

|

| Russia |

Negative |

The Fund marked down its Russian ruble cash position, which had been frozen due to the war in Ukraine, to zero. This was consistent with the industry standard practice, but detracted from relative performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in appropriate broad-based securities market and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions. The broad-based securities market index for the Fund changed from the J.P. Morgan EMBI Global Diversified Index to the Bloomberg Global Aggregate Bond Index, which is a broader representation of global fixed income markets. GROWTH OF $10,000 (2)“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge.(3)“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid.

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

Since Inception |

| Virtus Stone Harbor Local Markets Fund (Class A/VSHEX) at NAV(1) |

5.96% |

3.27% |

| Virtus Stone Harbor Local Markets Fund (Class A/VSHEX) at POP(2),(3) |

1.99% |

2.02% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

0.15% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

4.50% |

| J.P. Morgan GBI-EM Global Diversified Index |

9.53% |

4.74% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) |

“POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) |

“CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

|

| Performance Inception Date |

Apr. 11, 2022

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 18,489,000

|

| Holdings Count | Holding |

63

|

| Advisory Fees Paid, Amount |

|

| Investment Company Portfolio Turnover |

78.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$18,489 |

| Total number of portfolio holdings |

63 |

| Total advisory fee paid (‘000s) |

$- |

| Portfolio turnover rate as of the end of the reporting period |

78% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Foreign Government Securities |

|

97% |

| Corporate Bonds and Notes |

|

2% |

| Financial & Lease |

2% |

|

| Short-Term Investment |

|

1 |

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|

| C000234180 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Virtus Stone Harbor Local Markets Fund

|

| Class Name |

Class I

|

| Trading Symbol |

SHLMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Virtus Stone Harbor Local Markets Fund (“Fund”) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

|

| Additional Information Phone Number |

1‑800‑243‑1574

|

| Additional Information Website |

https://www.virtus.com/investor-resources/mutual-fund-documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Local Markets Fund

Class I / SHLMX |

$103 |

1.00% |

|

| Expenses Paid, Amount |

$ 103

|

| Expense Ratio, Percent |

1.00%

|

| Factors Affecting Performance [Text Block] |

What factors impacted Fund performance over the reporting period? Foreign exchange (FX) exposure (a measurement of currency risk) and duration positioning (a measurement of adjusting the portfolio’s sensitivity to changes in interest rates), as well as security selection and taxes, detracted from performance relative to the Fund’s style-specific benchmark ("Benchmark") for the 12 months ended May 31, 2025. Within FX, overweights in the Hungarian forint and Malaysian ringgit, as well as underweights in the Chinese yuan and Colombian peso, enhanced performance. The Fund also benefited from its cash/hard currency FX exposure. Hard currency is generally issued by developed countries, globally traded, and seen as politically and economically stable. Overweight exposures in the Brazilian real and Mexican peso detracted from performance. Within duration positioning, we continued to emphasize countries with attractive after-inflation yields that we believe have sufficient space to further ease policy interest rates. Overweights in Mexico and South Africa were the biggest contributors, while overweights to Brazil and Colombia underperformed. Among the Fund’s underweight positions, Turkey was the notable outperformer, while Thailand underperformed. The markdown of the Fund’s Russian ruble cash position detracted from performance.

| FACTOR |

IMPACT |

SUMMARY |

South Africa

|

Positive

|

The Fund benefited from an overweight duration position relative to the Benchmark during a period of central bank policy rate cuts in South Africa.

|

Colombia

|

Positive

|

Issue selection contributed, but some of the positive attribution was offset by the Fund’s overweight duration position in Colombia.

|

Brazil

|

Negative

|

The Fund’s overweight duration position relative to the Benchmark in Brazil detracted from performance, although some of the negative attribution was offset by positive attribution from security selection and taxes.

|

| Russia |

Negative |

The Fund marked down its Russian ruble cash position, which had been frozen due to the war in Ukraine, to zero. This was consistent with the industry standard practice, but detracted from relative performance. | The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in appropriate broad-based securities market and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions. The broad-based securities market index for the Fund changed from the J.P. Morgan EMBI Global Diversified Index to the Bloomberg Global Aggregate Bond Index, which is a broader representation of global fixed income markets. GROWTH OF $100,000

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/25 |

1 Year |

5 Years |

10 Years |

| Virtus Stone Harbor Local Markets Fund (Class I/SHLMX) at NAV(1) |

6.30% |

0.62% |

0.51% |

| Bloomberg Global Aggregate Bond Index |

7.03% |

(1.35)% |

0.94% |

| J.P. Morgan EMBI Global Diversified Index |

8.04% |

2.01% |

3.12% |

| J.P. Morgan GBI-EM Global Diversified Index |

9.53% |

1.42% |

1.71% |

| (1) |

“NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

|

| No Deduction of Taxes [Text Block] |

The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

|

| Updated Performance Information Location [Text Block] |

Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end.

|

| Net Assets |

$ 18,489,000

|

| Holdings Count | Holding |

63

|

| Advisory Fees Paid, Amount |

|

| Investment Company Portfolio Turnover |

78.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

| Fund net assets (‘000s) |

$18,489 |

| Total number of portfolio holdings |

63 |

| Total advisory fee paid (‘000s) |

$- |

| Portfolio turnover rate as of the end of the reporting period |

78% |

|

| Holdings [Text Block] |

Asset Allocation(1)

| Foreign Government Securities |

|

97% |

| Corporate Bonds and Notes |

|

2% |

| Financial & Lease |

2% |

|

| Short-Term Investment |

|

1 |

| Total |

|

100% |

| (1) |

Percentage of total investments as of May 31, 2025. |

|