Emerald Holding, Inc. Second Quarter 2025 August 4, 2025 Exhibit 99.2

Legal Disclaimer Forward-Looking Statements The information provided in this presentation is for general informational purposes only. This presentation contains certain forward-looking statements regarding Emerald Holding, Inc. and its subsidiaries (the “Company”), including, but not limited to, statements regarding the Company’s ability to return its business to pre-COVID levels; general economic conditions, or more specifically about the markets in which the Company operates, including growth of the Company’s various markets, and the Company’s expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance; the multiple avenues to return to organic growth; expectations regarding interest rates and economic conditions, among others; the Company’s guidance with respect to estimated revenues and Adjusted EBITDA; the Company’s ability or inability to obtain insurance coverage relating to event cancellations or interruptions; the Company’s ability to successfully identify and acquire acquisition targets; the Company’s expectations arising from the ongoing impact of natural disasters, or outbreaks of contagious disease or the potential for infection (including COVID-19) on its business; how the Company integrates and grows acquired businesses; how the Company expands its international operations; and the Company’s intention to continue to pay regular quarterly dividends. In particular, the declaration, timing and amount of any future dividends will be subject to the discretion and approval of the Company’s Board of Directors, and will depend on a number of factors. The forward-looking statements contained herein are based on management’s current expectations as well as estimates and assumptions prepared by management as of the date hereof, and although they are believed to be reasonable, they are inherently uncertain and not guaranteed. These statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of the Company’s control that may cause its business, industry, strategy, financing activities or actual results to differ materially. There can be no assurance that the projected results and forward-looking statements in this presentation will prove to be accurate. In addition, even if the Company’s results of operations, financial condition and liquidity, and events in the industry in which it operates, are consistent with the forward-looking statements contained in this presentation, they may not be predictive of results or developments in future periods. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Forward looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe, “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” or “would” or similar expressions and the negatives of those terms. For factors that could cause actual results to differ materially from the forward-looking statements in this presentation, please see the risks and uncertainties identified under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings, which are available on the Company’s Investor Relations website at investor.emeraldx.com and on the SEC’s EDGAR website at www.sec.gov. The Company disclaims any obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Past results are not indicative of future performance. Industry and Market Information To the extent this presentation includes information concerning the industry and the markets in which the Company operates, including general observations, expectations, market position, market opportunity and market size, such information is based on management's knowledge and experience in the markets in which the Company operates, including publicly available information from independent industry analysts and publications, which the Company believes to be reasonable, but which are inherently uncertain and imprecise. Accordingly, you are cautioned not to place undue reliance on such market and industry information. Non-GAAP Financial Information This presentation also includes certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and should not be considered as a substitute for or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles (“GAAP”). The non-GAAP measures included herein may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided herein for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Participants Hervé Sedky President and Chief Executive Officer David Doft Chief Financial Officer

Key Q2 2025 Takeaways Strategic portfolio refinement continues to yield results, fueling 22.7% year-over-year growth in Revenue and 59.5% year-over-year growth in Adjusted EBITDA Reported Organic Revenue of +0.4% year-over-year, reflecting a stable performance in a quarter impacted by event timing and mix The recent acquisitions of This is Beyond, Insurtech Insights and GRC World Forums would have driven approximately 5% year-over-year growth in Organic Revenues had they been part of Emerald’s portfolio in Q2 2024 Repurchased $6.9 million of its common stock at an average price of $4.24 per share in the second quarter Board of Director’s declared dividend for the quarter ending September 30, 2025, of $0.015 per share Reaffirms Full Year 2025 guidance of Revenue in the range of $450 to $460 million and Adjusted EBITDA in the range of $120 to $125 million

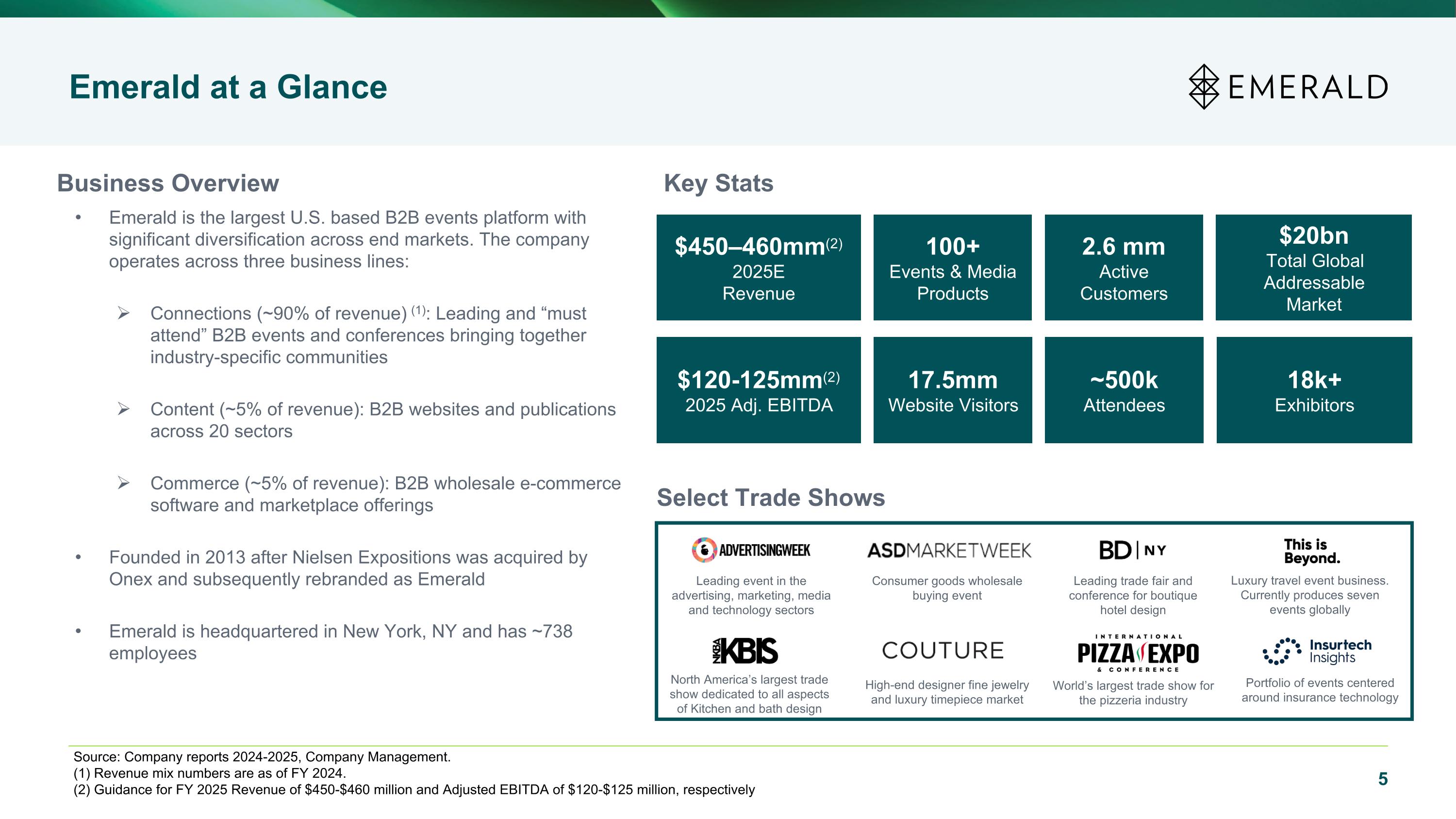

Emerald at a Glance Business Overview Emerald is the largest U.S. based B2B events platform with significant diversification across end markets. The company operates across three business lines: Connections (~90% of revenue) (1): Leading and “must attend” B2B events and conferences bringing together industry-specific communities Content (~5% of revenue): B2B websites and publications across 20 sectors Commerce (~5% of revenue): B2B wholesale e-commerce software and marketplace offerings Founded in 2013 after Nielsen Expositions was acquired by Onex and subsequently rebranded as Emerald Emerald is headquartered in New York, NY and has ~738 employees Key Stats 100+ Events & Media Products 2.6 mm Active Customers $20bn Total Global Addressable Market 18k+ Exhibitors ~500k Attendees 17.5mm Website Visitors Select Trade Shows Source: Company reports 2024-2025, Company Management. (1) Revenue mix numbers are as of FY 2024. (2) Guidance for FY 2025 Revenue of $450-$460 million and Adjusted EBITDA of $120-$125 million, respectively $450–460mm(2) 2025E Revenue $120-125mm(2) 2025 Adj. EBITDA Leading event in the advertising, marketing, media and technology sectors Consumer goods wholesale buying event North America’s largest trade show dedicated to all aspects of Kitchen and bath design Leading trade fair and conference for boutique hotel design High-end designer fine jewelry and luxury timepiece market World’s largest trade show for the pizzeria industry Luxury travel event business. Currently produces seven events globally Portfolio of events centered around insurance technology

Emerald’s Monetization Engine Provides Diverse And Highly Visible Revenue Generation Across Its Three Segments Collection of leading B2B trade shows and conferences that bring together industry-specific communities Revenue is generated from the production of trade shows and conference events, including booth space sales, registration fees and sponsorship fees B2B websites and publications that provide industry specific business news and information across multiple sectors Revenue primarily consists of advertising sales for industry publications and digital products SaaS software enables year-round B2B buying and selling which averages $1 billion per month of wholesale gross transaction volume Revenue consists of subscription revenue, implementation fees and professional services Connections (~90% of FY 2024 Revenue) Content Commerce

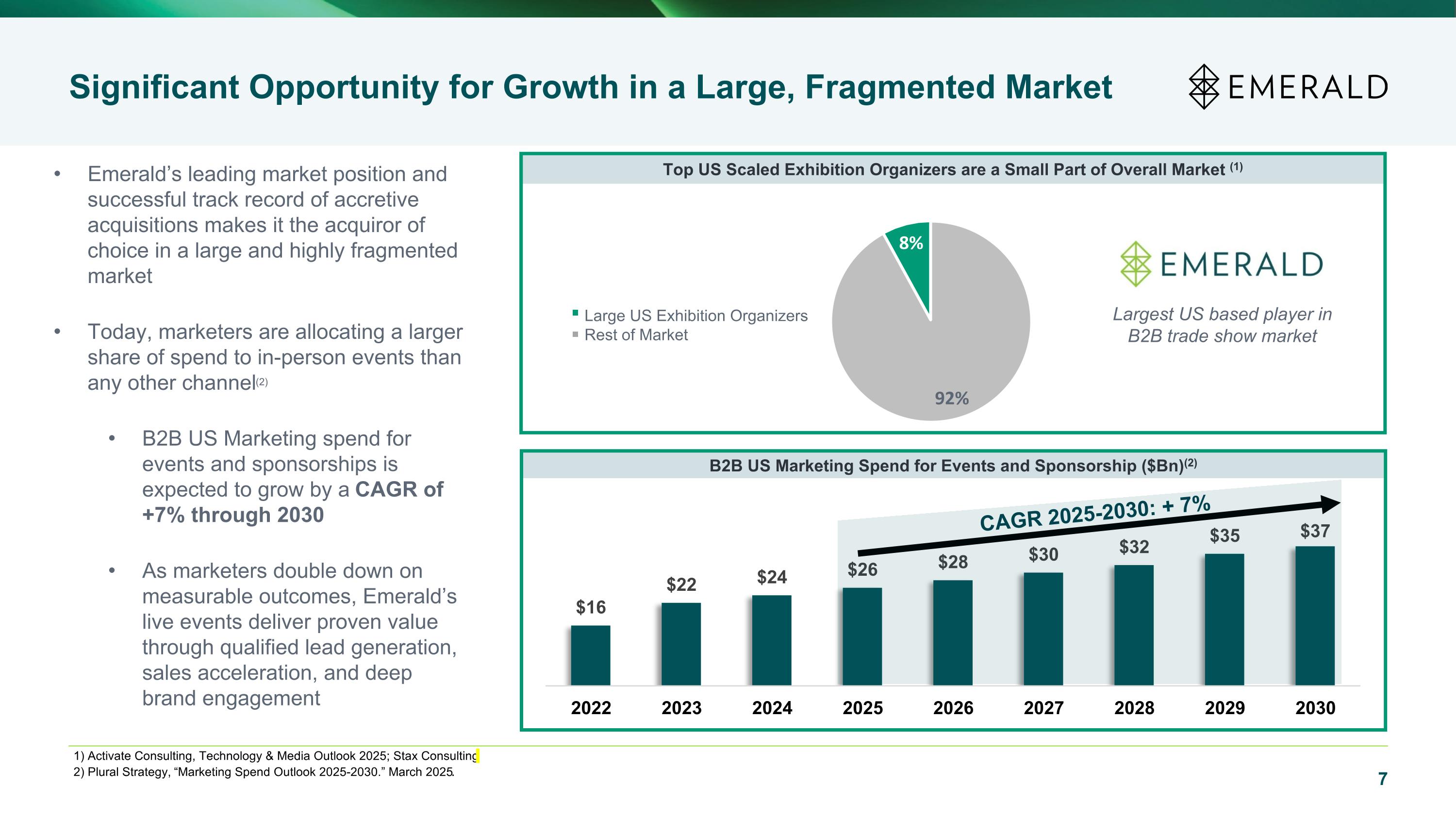

Top US Scaled Exhibition Organizers are a Small Part of Overall Market (1) B2B US Marketing Spend for Events and Sponsorship ($Bn)(2) Significant Opportunity for Growth in a Large, Fragmented Market Emerald’s leading market position and successful track record of accretive acquisitions makes it the acquiror of choice in a large and highly fragmented market Today, marketers are allocating a larger share of spend to in-person events than any other channel(2) B2B US Marketing spend for events and sponsorships is expected to grow by a CAGR of +7% through 2030 As marketers double down on measurable outcomes, Emerald’s live events deliver proven value through qualified lead generation, sales acceleration, and deep brand engagement 1) Activate Consulting, Technology & Media Outlook 2025; Stax Consulting 2) Plural Strategy, “Marketing Spend Outlook 2025-2030.” March 2025. Large US Exhibition Organizers Rest of Market Largest US based player in B2B trade show market // CAGR 2025-2030: + 7%

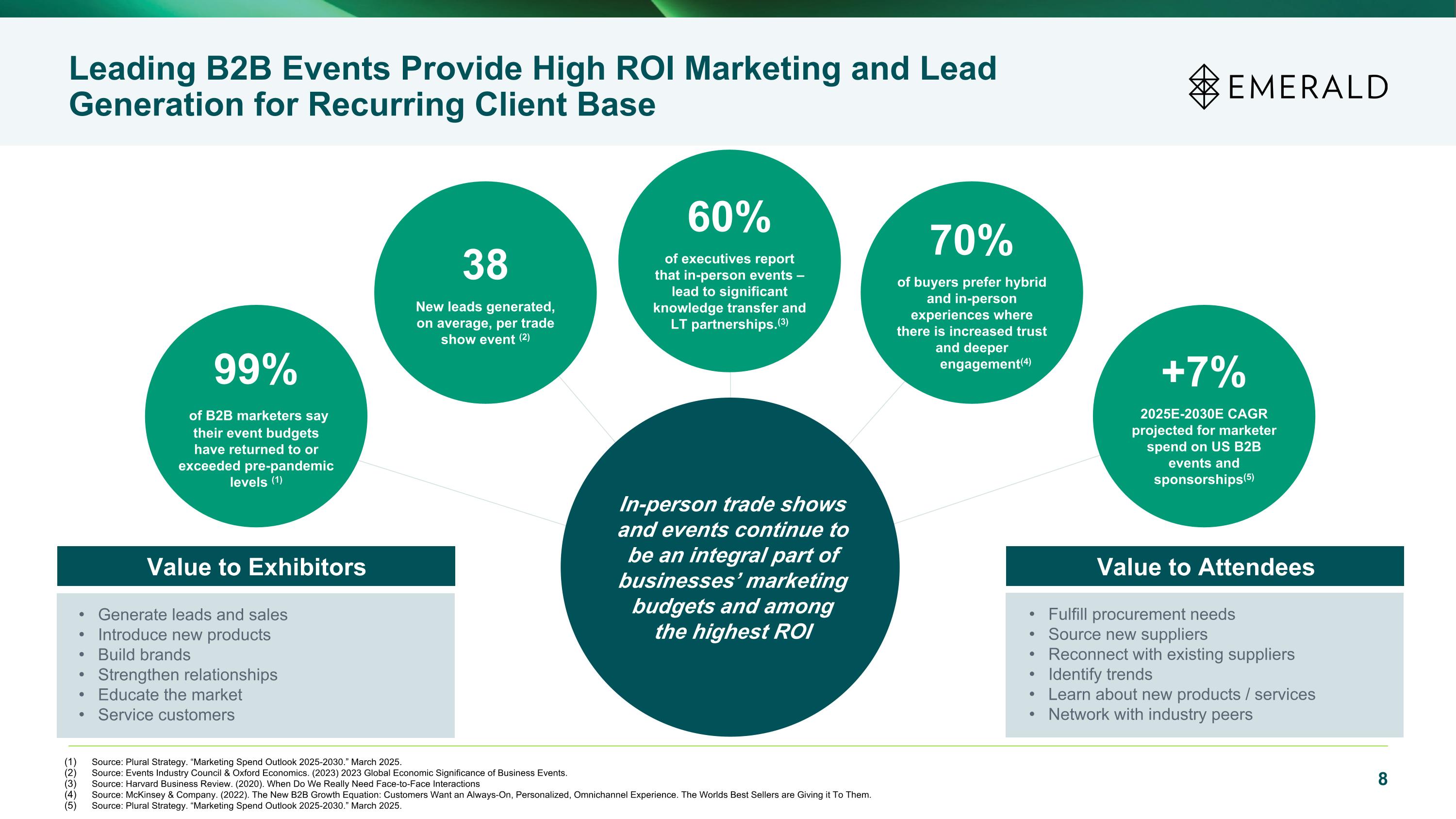

Leading B2B Events Provide High ROI Marketing and Lead Generation for Recurring Client Base Source: Plural Strategy. “Marketing Spend Outlook 2025-2030.” March 2025. Source: Events Industry Council & Oxford Economics. (2023) 2023 Global Economic Significance of Business Events. Source: Harvard Business Review. (2020). When Do We Really Need Face-to-Face Interactions Source: McKinsey & Company. (2022). The New B2B Growth Equation: Customers Want an Always-On, Personalized, Omnichannel Experience. The Worlds Best Sellers are Giving it To Them. Source: Plural Strategy. “Marketing Spend Outlook 2025-2030.” March 2025. In-person trade shows and events continue to be an integral part of businesses’ marketing budgets and among the highest ROI Generate leads and sales Introduce new products Build brands Strengthen relationships Educate the market Service customers Fulfill procurement needs Source new suppliers Reconnect with existing suppliers Identify trends Learn about new products / services Network with industry peers Value to Exhibitors Value to Attendees 99% of B2B marketers say their event budgets have returned to or exceeded pre-pandemic levels (1) 38 New leads generated, on average, per trade show event (2) 60% of executives report that in-person events – lead to significant knowledge transfer and LT partnerships.(3) 70% of buyers prefer hybrid and in-person experiences where there is increased trust and deeper engagement(4) +7% 2025E-2030E CAGR projected for marketer spend on US B2B events and sponsorships(5)

Technology, Advertising & Marketing Diversified and Growing Portfolio of Market-Leading Brands Well-balanced and diversified Emerald’s largest five shows represent 30% of FY 2024A revenues No single customer is more than 1% of revenue, and largest trade show is in single-digit % of revenue 90% of FY 2024A revenues from Live Events(1) 90%+ of trade show franchises hold market-leading positions within their respective industry verticals All Content publications complement our trade show portfolio Enterprise SaaS Commerce platform enables wholesale buying and selling Design & Construction Gift, Home & General Merchandise Action Sports Industrial Luxury Food (1) Includes revenue from Trade Shows and Other Events.

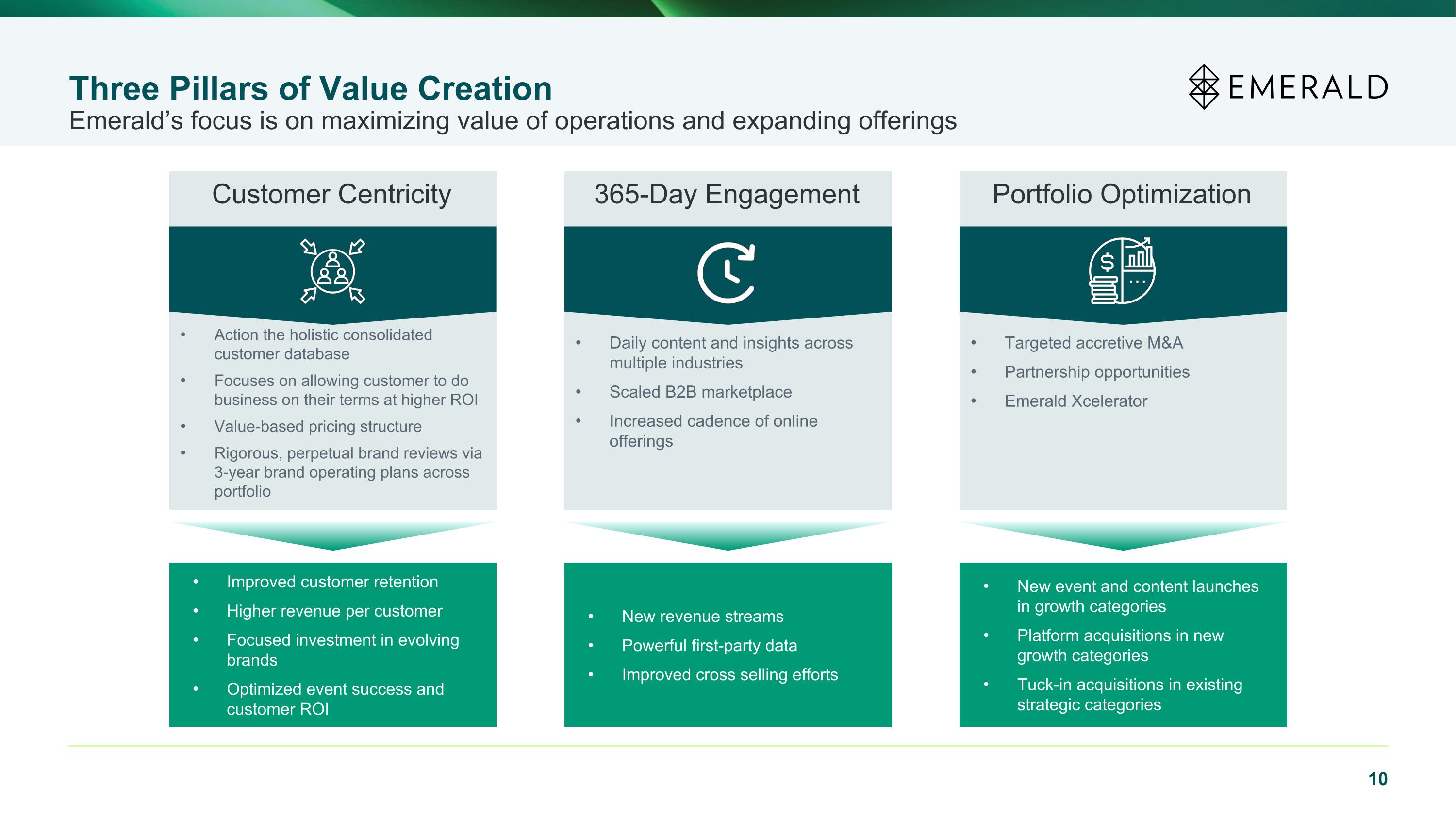

Three Pillars of Value Creation Emerald’s focus is on maximizing value of operations and expanding offerings Action the holistic consolidated customer database Focuses on allowing customer to do business on their terms at higher ROI Value-based pricing structure Rigorous, perpetual brand reviews via 3-year brand operating plans across portfolio Improved customer retention Higher revenue per customer Focused investment in evolving brands Optimized event success and customer ROI Customer Centricity Targeted accretive M&A Partnership opportunities Emerald Xcelerator New event and content launches in growth categories Platform acquisitions in new growth categories Tuck-in acquisitions in existing strategic categories Portfolio Optimization Daily content and insights across multiple industries Scaled B2B marketplace Increased cadence of online offerings New revenue streams Powerful first-party data Improved cross selling efforts 365-Day Engagement

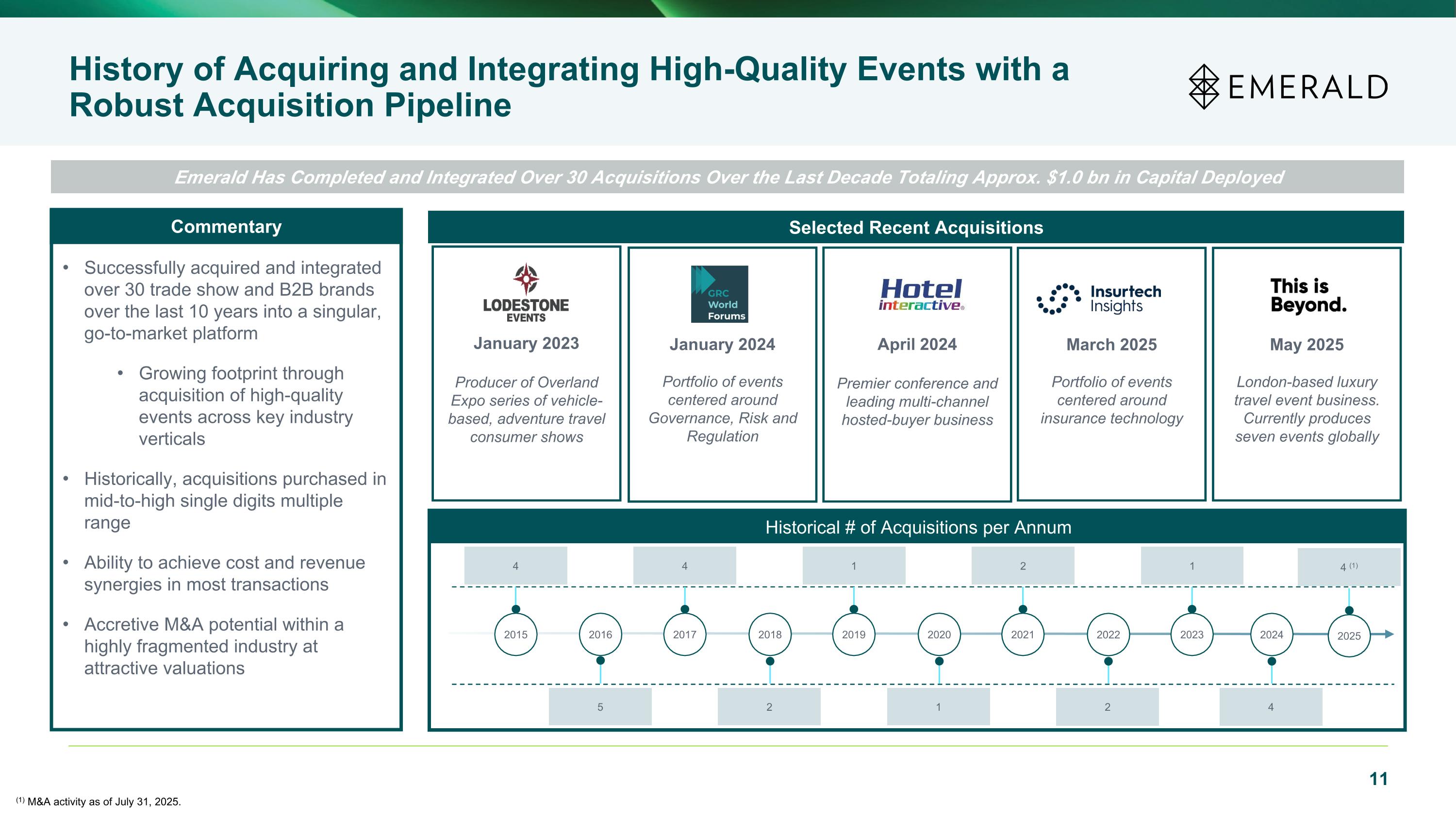

History of Acquiring and Integrating High-Quality Events with a Robust Acquisition Pipeline Selected Recent Acquisitions April 2024 Premier conference and leading multi-channel hosted-buyer business Successfully acquired and integrated over 30 trade show and B2B brands over the last 10 years into a singular, go-to-market platform Growing footprint through acquisition of high-quality events across key industry verticals Historically, acquisitions purchased in mid-to-high single digits multiple range Ability to achieve cost and revenue synergies in most transactions Accretive M&A potential within a highly fragmented industry at attractive valuations Commentary Emerald Has Completed and Integrated Over 30 Acquisitions Over the Last Decade Totaling Approx. $1.0 bn in Capital Deployed Historical # of Acquisitions per Annum 2015 4 2016 5 2018 2 2020 1 2021 2 2019 1 2017 4 2022 2 2023 1 2024 4 May 2025 London-based luxury travel event business. Currently produces seven events globally March 2025 Portfolio of events centered around insurance technology 2025 4 (1) (1) M&A activity as of July 31, 2025. January 2023 Producer of Overland Expo series of vehicle-based, adventure travel consumer shows January 2024 Portfolio of events centered around Governance, Risk and Regulation

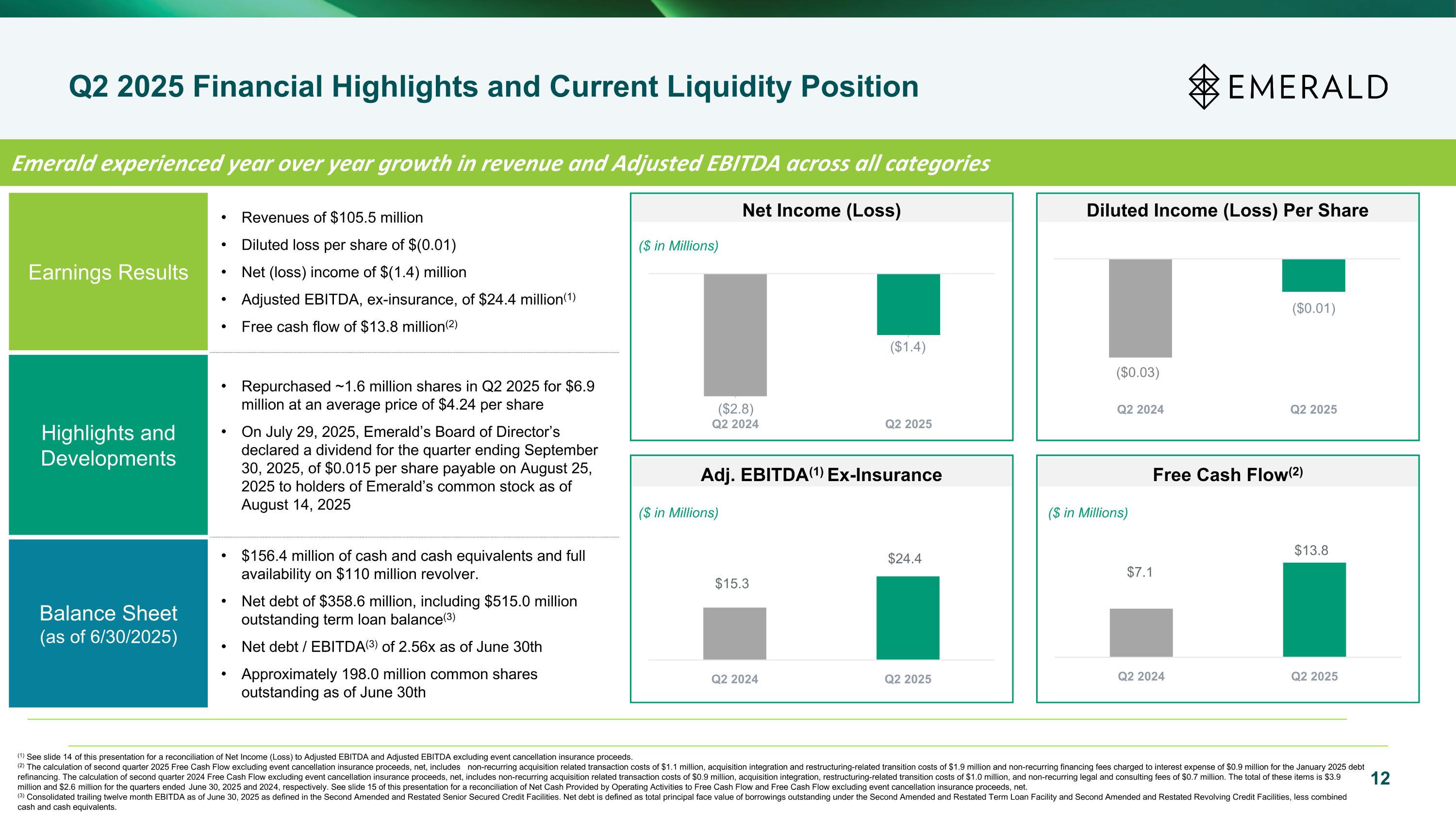

12 Adj. EBITDA(1) Ex-Insurance Free Cash Flow(2) Net Income (Loss) Diluted Income (Loss) Per Share ($ in Millions) ($ in Millions) (1) See slide 14 of this presentation for a reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA excluding event cancellation insurance proceeds. (2) The calculation of second quarter 2025 Free Cash Flow excluding event cancellation insurance proceeds, net, includes non-recurring acquisition related transaction costs of $1.1 million, acquisition integration and restructuring-related transition costs of $1.9 million and non-recurring financing fees charged to interest expense of $0.9 million for the January 2025 debt refinancing. The calculation of second quarter 2024 Free Cash Flow excluding event cancellation insurance proceeds, net, includes non-recurring acquisition related transaction costs of $0.9 million, acquisition integration, restructuring-related transition costs of $1.0 million, and non-recurring legal and consulting fees of $0.7 million. The total of these items is $3.9 million and $2.6 million for the quarters ended June 30, 2025 and 2024, respectively. See slide 15 of this presentation for a reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow and Free Cash Flow excluding event cancellation insurance proceeds, net. (3) Consolidated trailing twelve month EBITDA as of June 30, 2025 as defined in the Second Amended and Restated Senior Secured Credit Facilities. Net debt is defined as total principal face value of borrowings outstanding under the Second Amended and Restated Term Loan Facility and Second Amended and Restated Revolving Credit Facilities, less combined cash and cash equivalents. Earnings Results Revenues of $105.5 million Diluted loss per share of $(0.01) Net (loss) income of $(1.4) million Adjusted EBITDA, ex-insurance, of $24.4 million(1) Free cash flow of $13.8 million(2) Highlights and Developments Repurchased ~1.6 million shares in Q2 2025 for $6.9 million at an average price of $4.24 per share On July 29, 2025, Emerald’s Board of Director’s declared a dividend for the quarter ending September 30, 2025, of $0.015 per share payable on August 25, 2025 to holders of Emerald’s common stock as of August 14, 2025 Balance Sheet (as of 6/30/2025) $156.4 million of cash and cash equivalents and full availability on $110 million revolver. Net debt of $358.6 million, including $515.0 million outstanding term loan balance(3) Net debt / EBITDA(3) of 2.56x as of June 30th Approximately 198.0 million common shares outstanding as of June 30th Emerald experienced year over year growth in revenue and Adjusted EBITDA across all categories ($ in Millions) ($0.03) Q2 2025 Financial Highlights and Current Liquidity Position

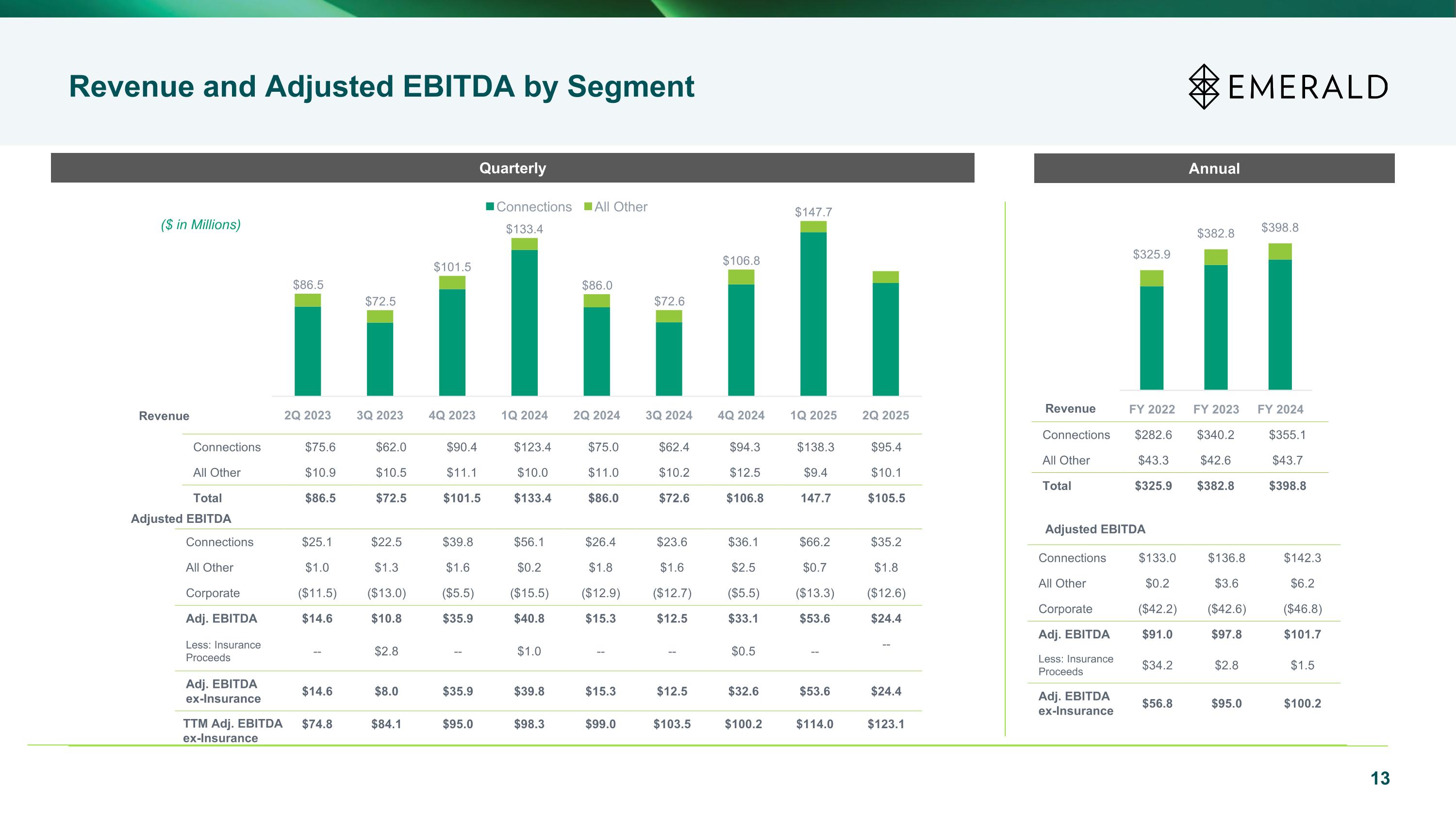

13 ($ in Millions) Revenue and Adjusted EBITDA by Segment Quarterly Connections $75.6 $62.0 $90.4 $123.4 $75.0 $62.4 $94.3 $138.3 $95.4 All Other $10.9 $10.5 $11.1 $10.0 $11.0 $10.2 $12.5 $9.4 $10.1 Total $86.5 $72.5 $101.5 $133.4 $86.0 $72.6 $106.8 147.7 $105.5 Connections $282.6 $340.2 $355.1 All Other $43.3 $42.6 $43.7 Total $325.9 $382.8 $398.8 Annual Connections $25.1 $22.5 $39.8 $56.1 $26.4 $23.6 $36.1 $66.2 $35.2 All Other $1.0 $1.3 $1.6 $0.2 $1.8 $1.6 $2.5 $0.7 $1.8 Corporate ($11.5) ($13.0) ($5.5) ($15.5) ($12.9) ($12.7) ($5.5) ($13.3) ($12.6) Adj. EBITDA $14.6 $10.8 $35.9 $40.8 $15.3 $12.5 $33.1 $53.6 $24.4 Less: Insurance Proceeds -- $2.8 -- $1.0 -- -- $0.5 -- -- Adj. EBITDA ex-Insurance $14.6 $8.0 $35.9 $39.8 $15.3 $12.5 $32.6 $53.6 $24.4 $74.8 $84.1 $95.0 $98.3 $99.0 $103.5 $100.2 $114.0 $123.1 Revenue Adjusted EBITDA Connections $133.0 $136.8 $142.3 All Other $0.2 $3.6 $6.2 Corporate ($42.2) ($42.6) ($46.8) Adj. EBITDA $91.0 $97.8 $101.7 Less: Insurance Proceeds $34.2 $2.8 $1.5 Adj. EBITDA ex-Insurance $56.8 $95.0 $100.2 Adjusted EBITDA Revenue TTM Adj. EBITDA ex-Insurance

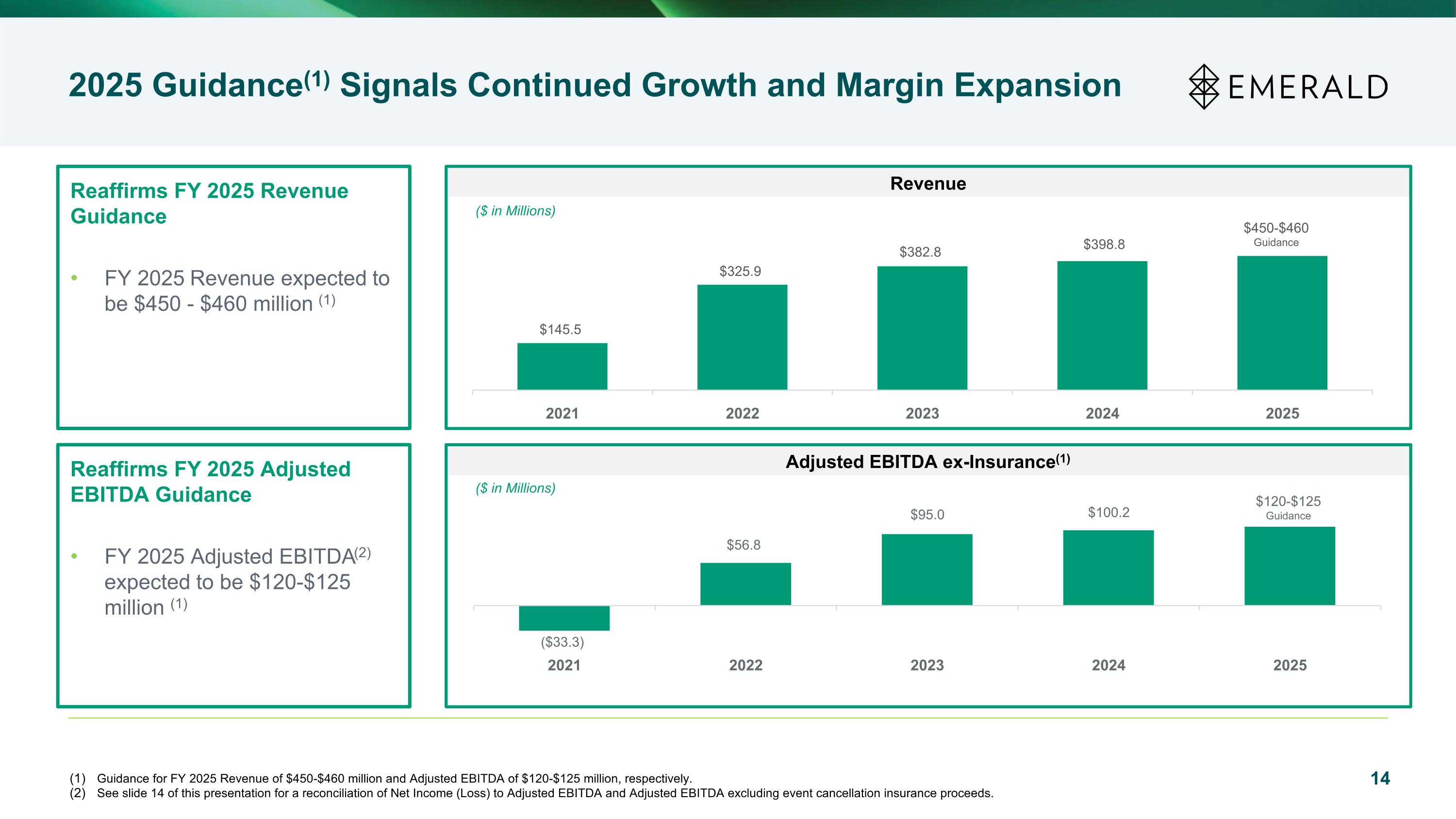

14 2025 Guidance(1) Signals Continued Growth and Margin Expansion Revenue ($ in Millions) Adjusted EBITDA ex-Insurance(1) ($ in Millions) Reaffirms FY 2025 Revenue Guidance FY 2025 Revenue expected to be $450 - $460 million (1) Guidance for FY 2025 Revenue of $450-$460 million and Adjusted EBITDA of $120-$125 million, respectively. See slide 14 of this presentation for a reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA excluding event cancellation insurance proceeds. Reaffirms FY 2025 Adjusted EBITDA Guidance FY 2025 Adjusted EBITDA(2) expected to be $120-$125 million (1)

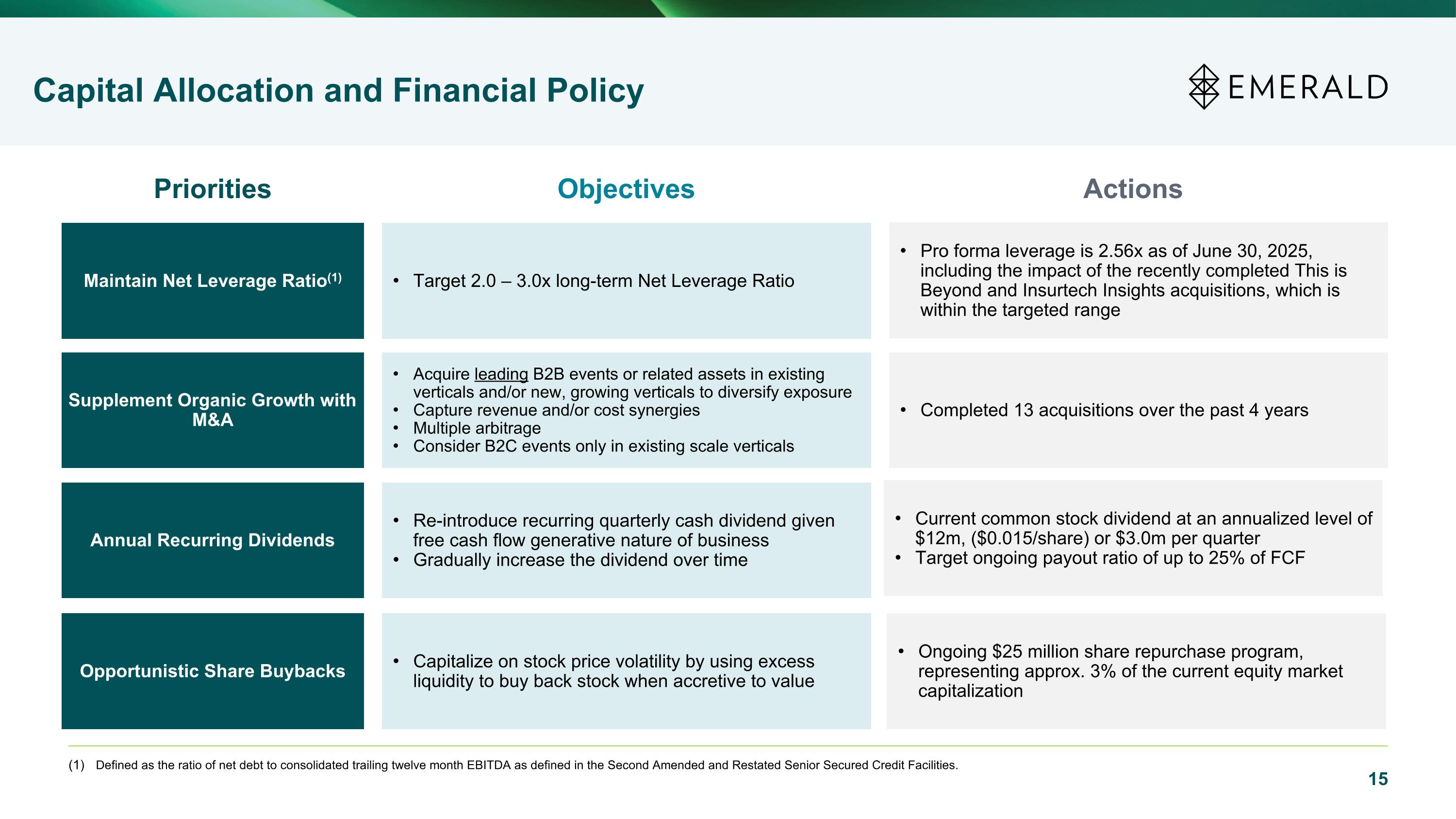

Defined as the ratio of net debt to consolidated trailing twelve month EBITDA as defined in the Second Amended and Restated Senior Secured Credit Facilities. Annual Recurring Dividends Re-introduce recurring quarterly cash dividend given free cash flow generative nature of business Gradually increase the dividend over time Current common stock dividend at an annualized level of $12m, ($0.015/share) or $3.0m per quarter Target ongoing payout ratio of up to 25% of FCF Maintain Net Leverage Ratio(1) Target 2.0 – 3.0x long-term Net Leverage Ratio Pro forma leverage is 2.56x as of June 30, 2025, including the impact of the recently completed This is Beyond and Insurtech Insights acquisitions, which is within the targeted range Opportunistic Share Buybacks Capitalize on stock price volatility by using excess liquidity to buy back stock when accretive to value Ongoing $25 million share repurchase program, representing approx. 3% of the current equity market capitalization Priorities Objectives Actions Capital Allocation and Financial Policy Supplement Organic Growth with M&A Acquire leading B2B events or related assets in existing verticals and/or new, growing verticals to diversify exposure Capture revenue and/or cost synergies Multiple arbitrage Consider B2C events only in existing scale verticals Completed 13 acquisitions over the past 4 years

Appendix

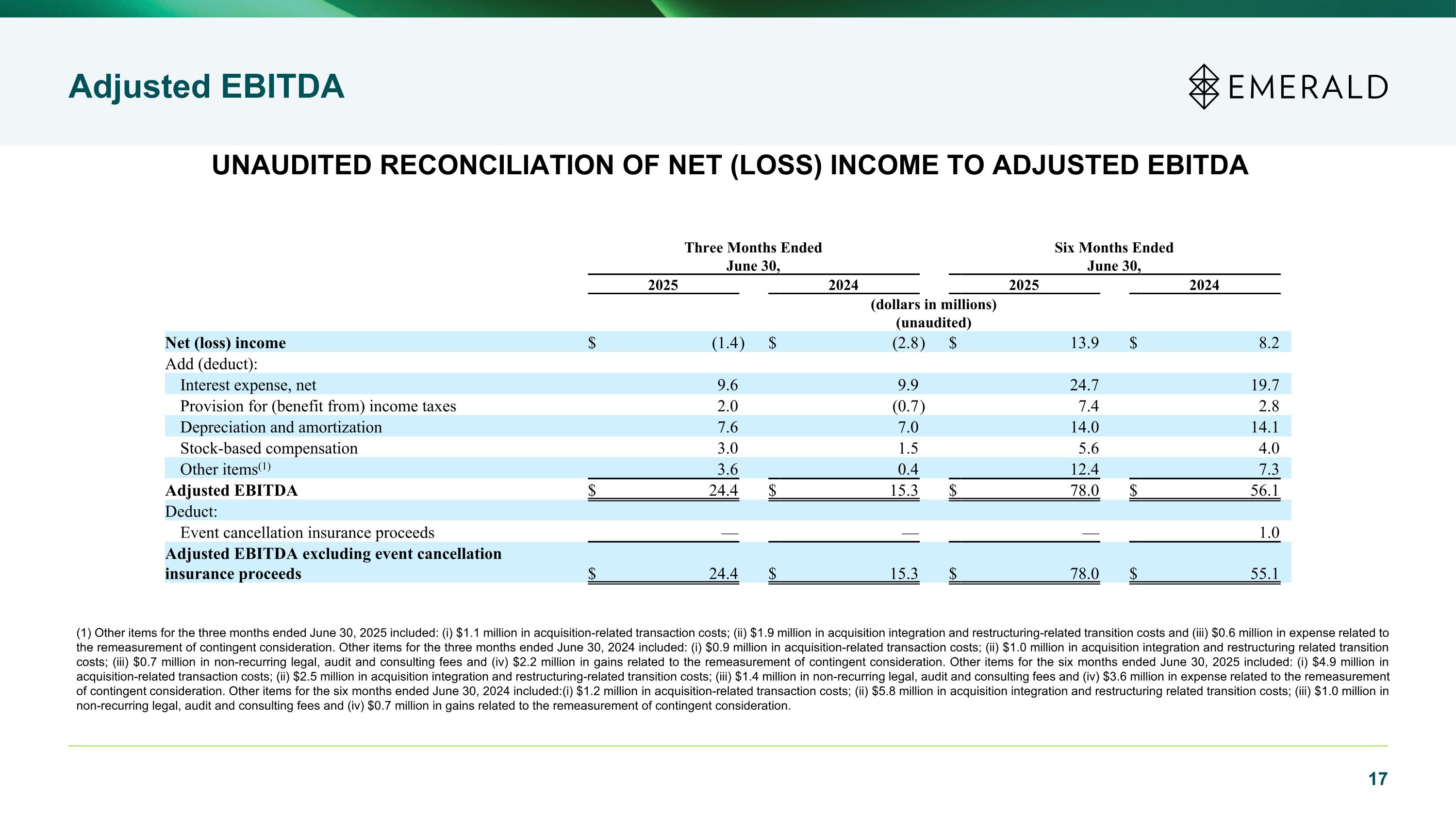

Adjusted EBITDA UNAUDITED RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA (1) Other items for the three months ended June 30, 2025 included: (i) $1.1 million in acquisition-related transaction costs; (ii) $1.9 million in acquisition integration and restructuring-related transition costs and (iii) $0.6 million in expense related to the remeasurement of contingent consideration. Other items for the three months ended June 30, 2024 included: (i) $0.9 million in acquisition-related transaction costs; (ii) $1.0 million in acquisition integration and restructuring related transition costs; (iii) $0.7 million in non-recurring legal, audit and consulting fees and (iv) $2.2 million in gains related to the remeasurement of contingent consideration. Other items for the six months ended June 30, 2025 included: (i) $4.9 million in acquisition-related transaction costs; (ii) $2.5 million in acquisition integration and restructuring-related transition costs; (iii) $1.4 million in non-recurring legal, audit and consulting fees and (iv) $3.6 million in expense related to the remeasurement of contingent consideration. Other items for the six months ended June 30, 2024 included:(i) $1.2 million in acquisition-related transaction costs; (ii) $5.8 million in acquisition integration and restructuring related transition costs; (iii) $1.0 million in non-recurring legal, audit and consulting fees and (iv) $0.7 million in gains related to the remeasurement of contingent consideration. Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 (dollars in millions) (unaudited) Net (loss) income $ (1.4 ) $ (2.8 ) $ 13.9 $ 8.2 Add (deduct): Interest expense, net 9.6 9.9 24.7 19.7 Provision for (benefit from) income taxes 2.0 (0.7 ) 7.4 2.8 Depreciation and amortization 7.6 7.0 14.0 14.1 Stock-based compensation 3.0 1.5 5.6 4.0 Other items(1) 3.6 0.4 12.4 7.3 Adjusted EBITDA $ 24.4 $ 15.3 $ 78.0 $ 56.1 Deduct: Event cancellation insurance proceeds — — — 1.0 Adjusted EBITDA excluding event cancellation insurance proceeds $ 24.4 $ 15.3 $ 78.0 $ 55.1

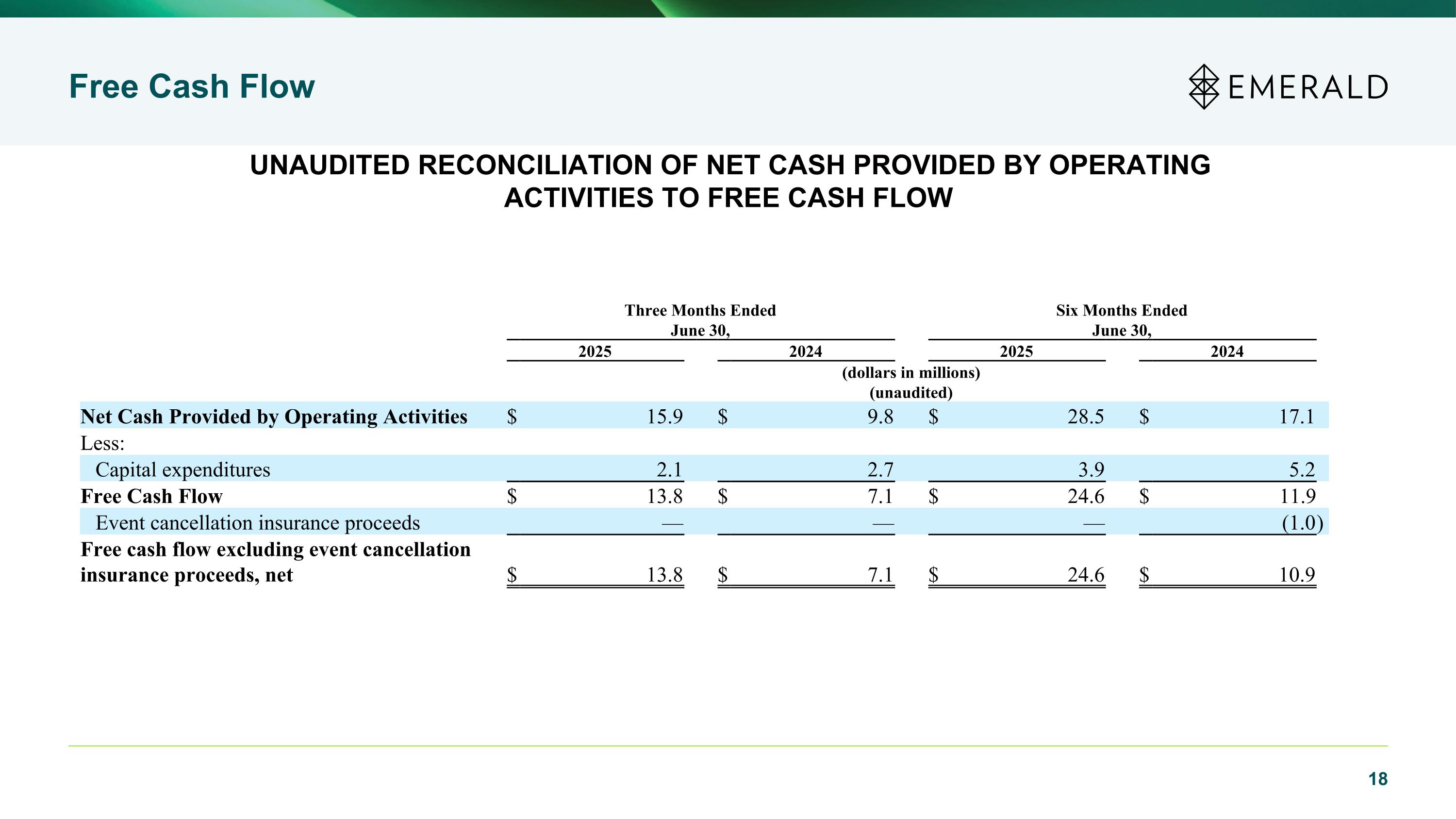

Free Cash Flow UNAUDITED RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 (dollars in millions) (unaudited) Net Cash Provided by Operating Activities $ 15.9 $ 9.8 $ 28.5 $ 17.1 Less: Capital expenditures 2.1 2.7 3.9 5.2 Free Cash Flow $ 13.8 $ 7.1 $ 24.6 $ 11.9 Event cancellation insurance proceeds — — — (1.0 ) Free cash flow excluding event cancellation insurance proceeds, net $ 13.8 $ 7.1 $ 24.6 $ 10.9

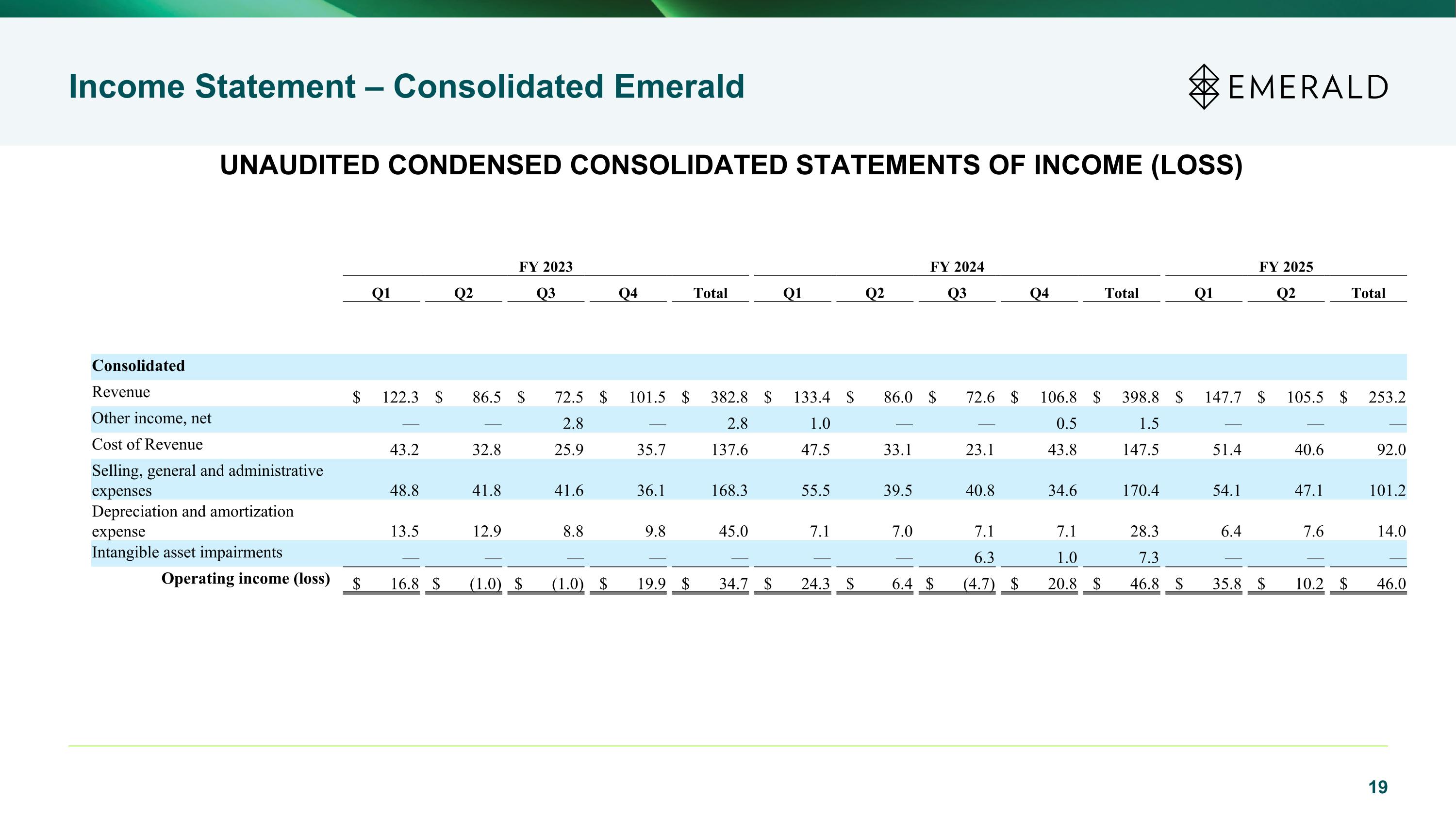

Income Statement – Consolidated Emerald UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) FY 2023 FY 2024 FY 2025 Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 Total Consolidated Revenue $ 122.3 $ 86.5 $ 72.5 $ 101.5 $ 382.8 $ 133.4 $ 86.0 $ 72.6 $ 106.8 $ 398.8 $ 147.7 $ 105.5 $ 253.2 Other income, net — — 2.8 — 2.8 1.0 — — 0.5 1.5 — — — Cost of Revenue 43.2 32.8 25.9 35.7 137.6 47.5 33.1 23.1 43.8 147.5 51.4 40.6 92.0 Selling, general and administrative expenses 48.8 41.8 41.6 36.1 168.3 55.5 39.5 40.8 34.6 170.4 54.1 47.1 101.2 Depreciation and amortization expense 13.5 12.9 8.8 9.8 45.0 7.1 7.0 7.1 7.1 28.3 6.4 7.6 14.0 Intangible asset impairments — — — — — — — 6.3 1.0 7.3 — — — Operating income (loss) $ 16.8 $ (1.0) $ (1.0) $ 19.9 $ 34.7 $ 24.3 $ 6.4 $ (4.7) $ 20.8 $ 46.8 $ 35.8 $ 10.2 $ 46.0

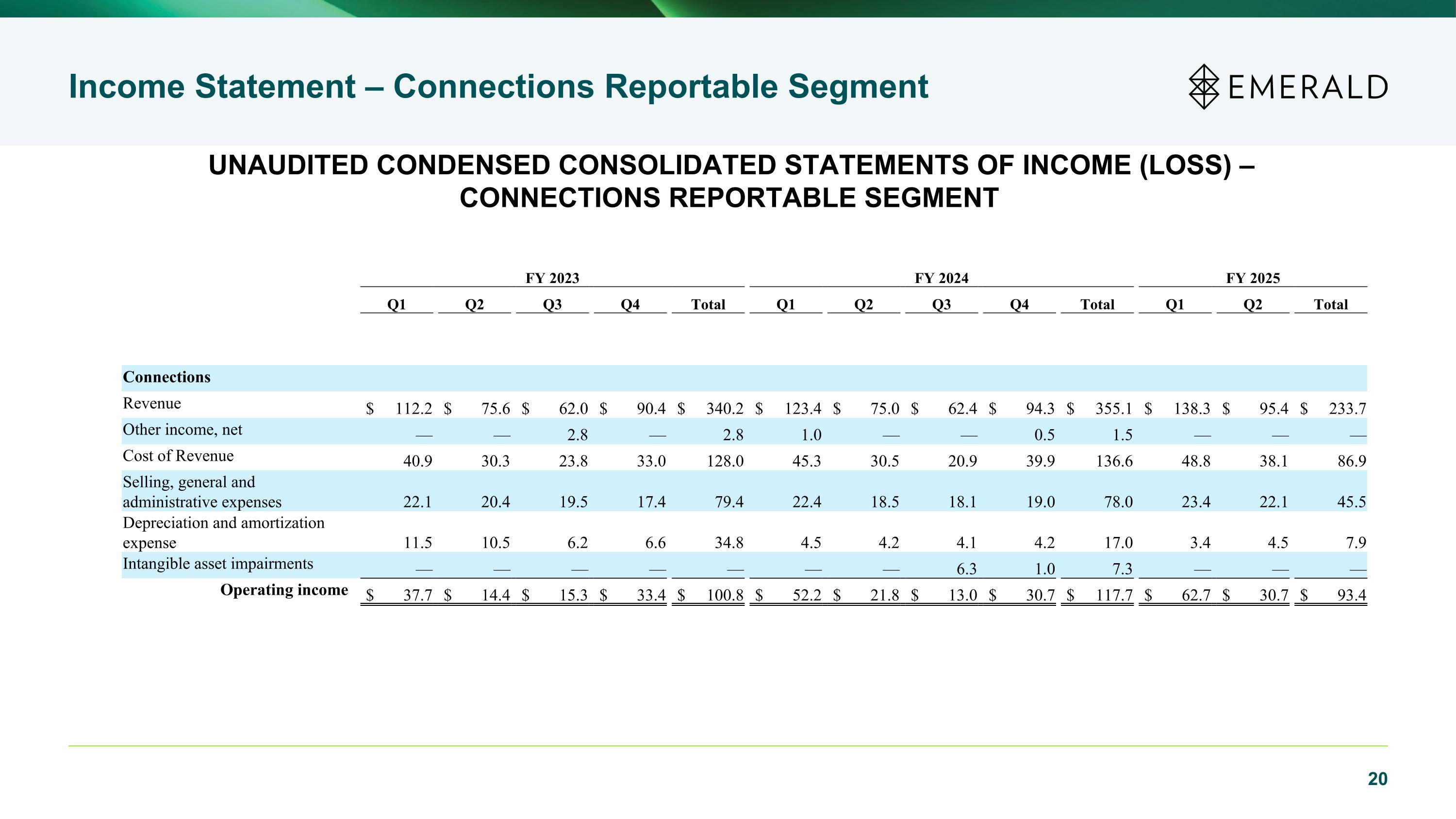

Income Statement – Connections Reportable Segment UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) – CONNECTIONS REPORTABLE SEGMENT FY 2023 FY 2024 FY 2025 Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 Total Connections Revenue $ 112.2 $ 75.6 $ 62.0 $ 90.4 $ 340.2 $ 123.4 $ 75.0 $ 62.4 $ 94.3 $ 355.1 $ 138.3 $ 95.4 $ 233.7 Other income, net — — 2.8 — 2.8 1.0 — — 0.5 1.5 — — — Cost of Revenue 40.9 30.3 23.8 33.0 128.0 45.3 30.5 20.9 39.9 136.6 48.8 38.1 86.9 Selling, general and administrative expenses 22.1 20.4 19.5 17.4 79.4 22.4 18.5 18.1 19.0 78.0 23.4 22.1 45.5 Depreciation and amortization expense 11.5 10.5 6.2 6.6 34.8 4.5 4.2 4.1 4.2 17.0 3.4 4.5 7.9 Intangible asset impairments — — — — — — — 6.3 1.0 7.3 — — — Operating income $ 37.7 $ 14.4 $ 15.3 $ 33.4 $ 100.8 $ 52.2 $ 21.8 $ 13.0 $ 30.7 $ 117.7 $ 62.7 $ 30.7 $ 93.4

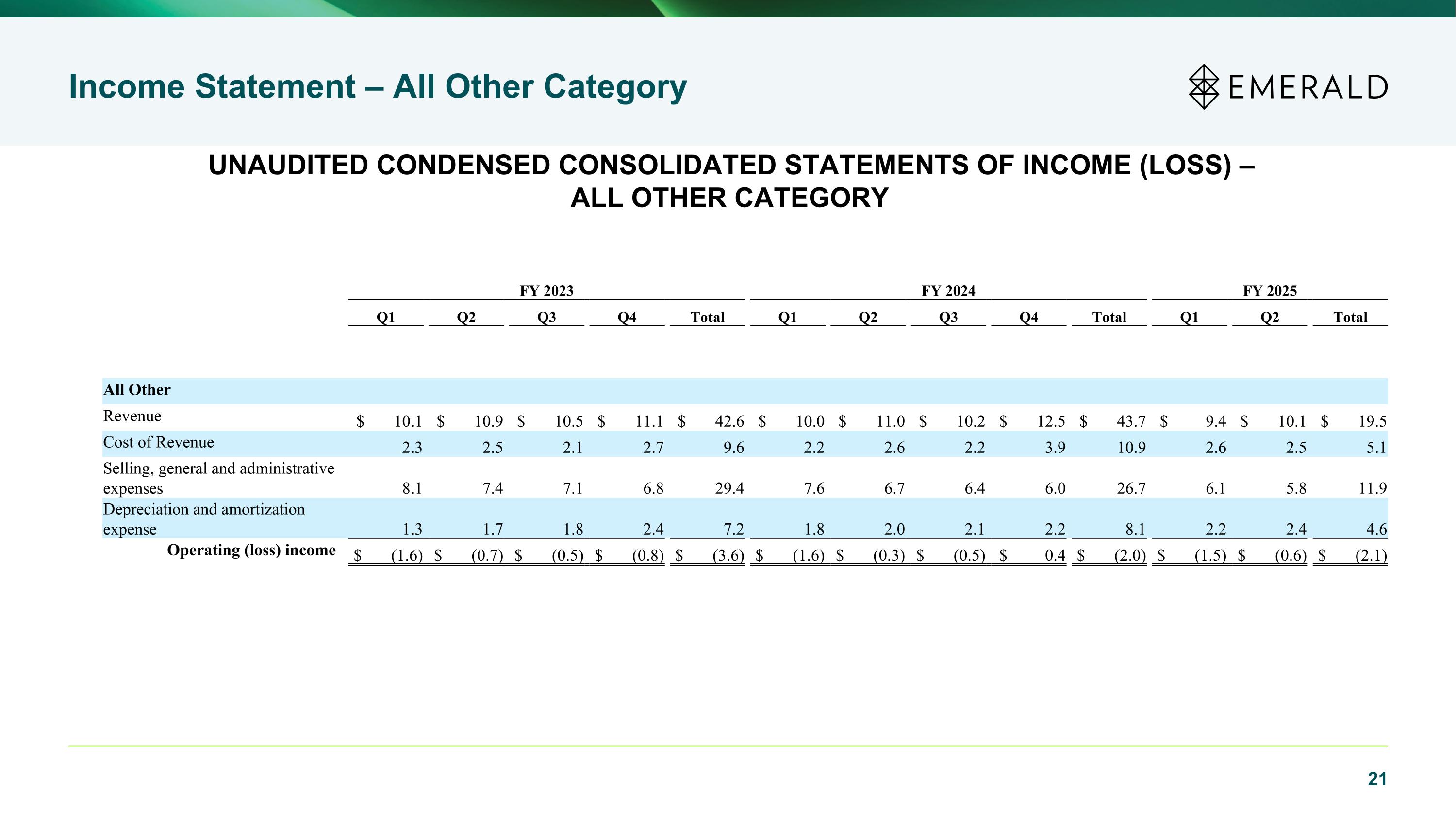

Income Statement – All Other Category UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) – ALL OTHER CATEGORY FY 2023 FY 2024 FY 2025 Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 Total All Other Revenue $ 10.1 $ 10.9 $ 10.5 $ 11.1 $ 42.6 $ 10.0 $ 11.0 $ 10.2 $ 12.5 $ 43.7 $ 9.4 $ 10.1 $ 19.5 Cost of Revenue 2.3 2.5 2.1 2.7 9.6 2.2 2.6 2.2 3.9 10.9 2.6 2.5 5.1 Selling, general and administrative expenses 8.1 7.4 7.1 6.8 29.4 7.6 6.7 6.4 6.0 26.7 6.1 5.8 11.9 Depreciation and amortization expense 1.3 1.7 1.8 2.4 7.2 1.8 2.0 2.1 2.2 8.1 2.2 2.4 4.6 Operating (loss) income $ (1.6) $ (0.7) $ (0.5) $ (0.8) $ (3.6) $ (1.6) $ (0.3) $ (0.5) $ 0.4 $ (2.0) $ (1.5) $ (0.6) $ (2.1)

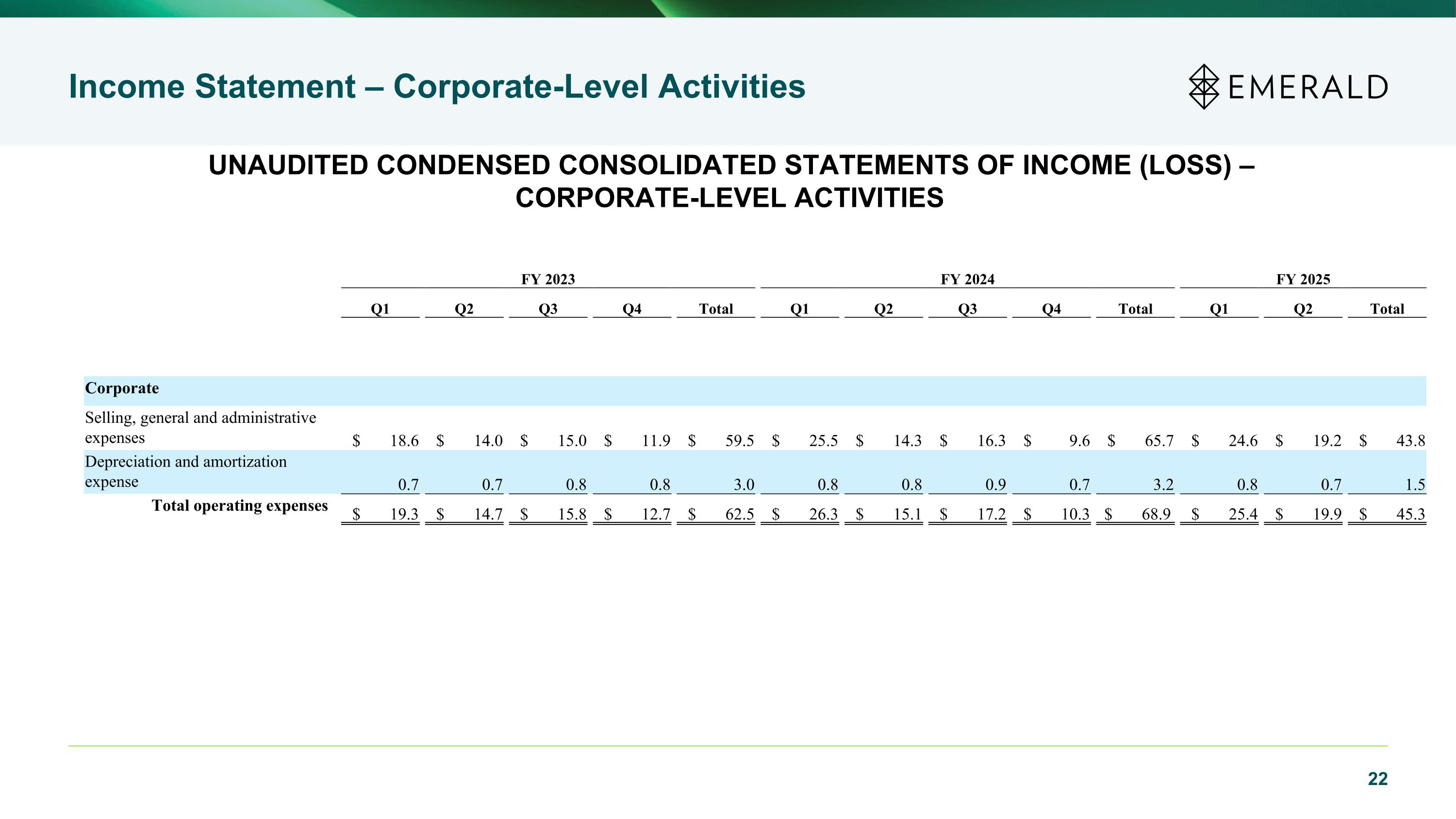

Income Statement – Corporate-Level Activities UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) – CORPORATE-LEVEL ACTIVITIES FY 2023 FY 2024 FY 2025 Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 Total Corporate Selling, general and administrative expenses $ 18.6 $ 14.0 $ 15.0 $ 11.9 $ 59.5 $ 25.5 $ 14.3 $ 16.3 $ 9.6 $ 65.7 $ 24.6 $ 19.2 $ 43.8 Depreciation and amortization expense 0.7 0.7 0.8 0.8 3.0 0.8 0.8 0.9 0.7 3.2 0.8 0.7 1.5 Total operating expenses $ 19.3 $ 14.7 $ 15.8 $ 12.7 $ 62.5 $ 26.3 $ 15.1 $ 17.2 $ 10.3 $ 68.9 $ 25.4 $ 19.9 $ 45.3