|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Regional Review

The performances of the regions are discussed below. The following discussion is based upon the Group’s internal reporting structure.

All references to volume share or value share movement in the following discussion are compared to FY 2024. See page 40 for a discussion on the use of these measures.

Our products as sold in the U.S., including Vuse, Velo, Grizzly, Kodiak, and Camel Snus, are subject to FDA regulation and no reduced-risk claims will be made as to these products without agency clearance.

United States (U.S.):

| – |

Reported revenue up 1.0%, being an increase of 3.7% at constant rates.

|

| – |

Velo category volume share up 6.8 ppts to 13.2%, with Velo Plus driving strong revenue growth in Modern Oral, up 372%.

|

| – |

Vuse maintained value share leadership in tracked channels - despite a 14.5% decline in revenue, being a decrease of 12.3% at constant rates of exchange, mainly driven by lower volume due to the continued

impact of illicit single-use vapour products.

|

| – |

Combustibles revenue up 1.1% (up 3.8% at constant rates) as price/mix more than offset a 7.6% decline in volume which benefited from a lower comparator. Volume share grew 10 bps with value share up 20 bps.

|

| – |

Smokeless now represents 19.5% of total revenue.

|

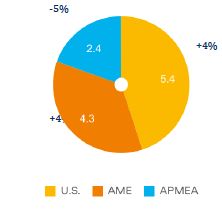

Volume/Revenue

Please see page 51 for a full reconciliation to constant currency metrics, including prior year data.

|

For six months to 30 June 2025

|

Volume

|

|

Revenue

|

|

Reported

|

|

Reported

|

| |

|

Current

|

Exchange

|

Constant

|

|

Unit

|

vs 2024

|

|

£m

|

vs 2024

|

£m

|

£m

|

vs 2024

|

|

New Categories

|

|

|

|

536

|

+1.3%

|

14

|

550

|

+3.9%

|

|

Vapour (units mn)

|

123

|

-13.8%

|

|

434

|

-14.5%

|

11

|

445

|

-12.3%

|

|

HP (sticks bn)

|

—

|

—%

|

|

—

|

—%

|

—

|

—

|

—%

|

|

Modern Oral (pouches bn)

|

1.1

|

+206%

|

|

102

|

+372%

|

3

|

105

|

+384%

|

|

Traditional Oral (stick eq bn)

|

2.5

|

-9.5%

|

|

521

|

-2.9%

|

14

|

535

|

-0.4%

|

|

Total Smokeless

|

|

|

|

1,057

|

-0.8%

|

28

|

1,085

|

+1.8%

|

|

Total Combustibles (bn sticks)

|

21

|

-7.6%

|

|

4,328

|

+1.1%

|

114

|

4,442

|

+3.8%

|

|

Other

|

|

|

|

47

|

+52.5%

|

1

|

48

|

+57.1%

|

|

Total

|

|

|

|

5,432

|

+1.0%

|

143

|

5,575

|

+3.7%

|

| |

|

|

|

|

|

|

|

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

See page 44 for a discussion on the preparation of the U.S. financial information, initially based on U.S. GAAP as the primary financial record and converted to IFRS for the purpose of consolidation

within the results of the Group.

Reported revenue increased 1.0%, despite a translational foreign exchange headwind, negatively impacting revenue by 2.7%.

| – |

On a constant currency basis, revenue increased 3.7%. This was driven by the performance in:

|

| – |

Combustibles, where revenue increased 3.8%, as price/mix (+11.4%) more than offset a 7.6% reduction in volume. While this was marginally lower than the industry volume decline of 8%, our volume was

negatively impacted in 2024 by the phasing of wholesaler inventory. Our volume share was up 10 bps and value share was up 20 bps following the actions taken in 2024 to improve performance;

|

| – |

Vapour, where the U.S. is the world's largest Vapour market. The Group maintained leadership in value share (of Vapour closed systems consumables in tracked channels) despite a decline in value share of 20

bps to 49.5%. Revenue was down 12.3%, as price/mix (+1.5%) was offset by a 13.8% decline in consumables volume mainly due to the continued impact of illicit single-use vapes which we estimate to be more than 50% of the total Vapour

market;

|

| – |

Modern Oral, where revenue increased by 384%, driven by higher volume (up 206%) following the successful national roll-out of Velo Plus, with Velo category volume share almost doubling, up 6.8 ppts to 13.2%1;

and

|

| – |

Traditional Oral, where revenue declined 0.4%, as price/mix (+9.1%) was more than offset by lower volume (down 9.5%) due to the continued cross-category use of Modern Oral.

|

| 1. |

Please refer to page 40.

|

Profit from operations and operating margin

Please see page 47 for a full reconciliation to constant currency metrics, including prior year data.

|

For six months to 30 June 2025

|

Reported

|

|

Adj.

|

Exchange

|

Adjusted

|

|

Current

|

|

|

|

Constant

|

|

£m

|

vs 2024

|

|

£m

|

£m

|

£m

|

vs 2024

|

|

Profit from Operations

|

2,255

|

+27.1%

|

|

808

|

87

|

3,150

|

+3.2%

|

|

Operating Margin

|

41.5%

|

+8.5 ppts

|

|

|

|

56.5%

|

-30 bps

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

Reported profit from operations increased by 27.1%, as both an impairment charge of £472 million in respect of Camel Snus (see page 25) and income (£132 million) related to Fox River recognised in 2024 did not

repeat. Accordingly, reported operating margin was up 8.5 ppts to 41.5%.

Excluding adjusting items (largely in respect of amortisation and impairment charges and income related to Fox River recognised in 2024) and a translational foreign exchange headwind of £87 million, our performance

was positively impacted by the growth in revenue (described above).

Adjusted profit from operations, at constant rates of exchange was up 3.2% to £3,150 million.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Regional Review

Continued

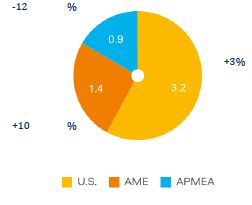

Americas and Europe (AME):

| – |

Reported revenue down 2.2%, up 3.5% at constant rates.

|

| – |

New Category revenue declined 0.8%, but up 1.3% at constant rates of exchange.

|

| – |

Resilient combustibles revenue performance - down 3.5% due to currency, being an increase of 2.8% at constant rates of exchange driven by price/mix.

|

| – |

Combustibles volume share down 30 bps and value share down 80 bps.

|

| – |

Multi-category region with smokeless now representing 19.9% of revenue.

|

Volume/Revenue

Please see page 51 for a full reconciliation to constant currency metrics, including prior year data.

|

For six months to 30 June 2025

|

Volume

|

|

Revenue

|

|

Reported

|

|

Reported

|

| |

|

Current

|

Exchange

|

Constant

|

|

Unit

|

vs 2024

|

|

£m

|

vs 2024

|

£m

|

£m

|

vs 2024

|

|

New Categories

|

|

|

|

832

|

-0.8%

|

17

|

849

|

+1.3%

|

|

Vapour (units mn)

|

112

|

-7.3%

|

|

267

|

-11.4%

|

7

|

274

|

-9.1%

|

|

HP (sticks bn)

|

3.9

|

-8.3%

|

|

218

|

-7.4%

|

5

|

223

|

-4.8%

|

|

Modern Oral (pouches bn)

|

3.3

|

+24.9%

|

|

347

|

+14.7%

|

5

|

352

|

+16.5%

|

|

Traditional Oral (stick eq bn)

|

0.3

|

-16.8%

|

|

21

|

+11.4%

|

(1)

|

20

|

+10.1%

|

|

Total Smokeless

|

|

|

|

853

|

-0.6%

|

16

|

869

|

+1.5%

|

|

Total Combustibles (bn sticks)

|

115

|

-4.0%

|

|

3,216

|

-3.5%

|

211

|

3,427

|

+2.8%

|

|

Other

|

|

|

|

212

|

+15.2%

|

22

|

234

|

+26.4%

|

|

Total

|

|

|

|

4,281

|

-2.2%

|

249

|

4,530

|

+3.5%

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

Reported revenue was down 2.2% due to a translational foreign exchange headwind of 5.7%.

On a constant currency basis, which we believe reflects the operational performance, revenue increased by 3.5% to £4,530 million, driven by:

| – |

Higher revenue from combustibles (up 2.8%), largely driven by higher volume and pricing in both Brazil and Türkiye. These factors combined with robust pricing in Romania and Poland to more than offset a

reduction in revenue in Canada; and

|

| – |

Modern Oral, where we are category leaders, with volume up 24.9%. Revenue grew 16.5%, while volume share of the Modern Oral category was down 30 bps.

The volume and revenue growth reflects the strength of our portfolio in both established oral markets across Scandinavia and markets that are more recent adopters of Modern Oral, such as the UK,

Austria and Switzerland.

|

These more than offset:

| – |

Lower revenue from Vapour (down 9.1%), largely driven by lower revenue in Canada (due to the continued lack of enforcement against illegal flavoured vapour products) and evolving market dynamics (in the UK

and France). Our value share leadership was up 30 bps with gains in Europe partly offset by value share loss in Canada; and

|

| – |

HP (down 4.8%), as higher revenue in Poland and Portugal was more than offset by declines in the Czech Republic, Germany and Romania partly due to the prioritisation of resource allocation ahead of the wider

roll-out of glo Hilo.

|

Profit from operations and operating margin

Please see page 47 for a full

reconciliation to constant currency and as adjusted for Canada metrics, including prior year data.

|

For six months to 30 June 2025

|

Reported

|

|

Adj.

|

Exchange

|

Adjusted

|

|

Adjusted for Canada1

|

|

Current

|

|

|

|

Constant

|

|

Constant

|

|

£m

|

vs 2024

|

|

£m

|

£m

|

£m

|

vs 2024

|

|

vs 2024

|

|

Profit from Operations

|

1,969

|

+33.6%

|

|

-495

|

76

|

1,550

|

+4.3%

|

|

+10.4%

|

|

Operating Margin

|

46.0%

|

+12.3 ppts

|

|

|

|

34.2%

|

+20 bps

|

|

+1.9 ppts

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

| 1. |

Adjusted for Canada excludes the performance of the Canadian business (excluding New Categories)

|

Reported profit from operations increased by 33.6% mainly due to a net credit of £575 million as the provision recognised in relation to the Canadian litigation settlement was updated following a change to the

forecasted Canadian combustibles industry performance impacting the present value of the future liability described on page 13. H1 2025 was also impacted by a translational foreign exchange headwind.

| – |

Excluding the impact of foreign exchange, adjusting items and also adjusting for the performance of Canada, adjusted profit from operations was up 10.4% to £1,386 million, driven by an improved financial

performance in:

|

| – |

Brazil, due to combustibles with higher volume and pricing;

|

| – |

Romania, due to pricing in combustibles;

|

| – |

Türkiye, due to the revenue performance in combustibles; and

|

| – |

An improved financial performance across our New Categories, notably in Modern Oral (driven by Sweden, the UK, Switzerland and Norway), and a reduction in losses in HP (in Germany, Switzerland and Poland)

driven by resource allocation.

|

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Regional Review

Continued

Asia-Pacific, Middle East and Africa (APMEA):

| – |

Reported revenue declined 8.9%, being a decrease of 4.8% at constant rates.

|

| – |

New Category revenue up 0.4%, or 2.5% at constant rates of exchange, driven by HP in Japan.

|

| – |

Headwinds to volume and financial performance due to regulatory and fiscal challenges in Australia and Bangladesh.

|

| – |

Combustibles value share down 20 bps with volume share down 10 bps..

|

| – |

Smokeless now represents 12.0% of total revenue.

|

Volume/Revenue

Please see page 51 for a full reconciliation to constant currency metrics, including prior year data.

|

For six months to 30 June 2025

|

Volume

|

|

Revenue

|

|

Reported

|

|

Reported

|

| |

|

Current

|

Exchange

|

Constant

|

|

Unit

|

vs 2024

|

|

£m

|

vs 2024

|

£m

|

£m

|

vs 2024

|

|

New Categories

|

|

|

|

283

|

+0.4%

|

7

|

290

|

+2.5%

|

|

Vapour (units mn)

|

18

|

-33.4%

|

|

36

|

-40.5%

|

1

|

37

|

-38.4%

|

|

HP (sticks bn)

|

6.2

|

+8.7%

|

|

226

|

+10.1%

|

5

|

231

|

+12.3%

|

|

Modern Oral (pouches bn)

|

0.6

|

+15.1%

|

|

21

|

+29.7%

|

1

|

22

|

+32.7%

|

|

Traditional Oral (stick eq bn)

|

—

|

—%

|

|

—

|

—%

|

—

|

—

|

—%

|

|

Total Smokeless

|

|

|

|

283

|

+0.4%

|

7

|

290

|

+2.5%

|

|

Total Combustibles (bn sticks)

|

98

|

-14.1%

|

|

1,971

|

-12.0%

|

93

|

2,064

|

-7.9%

|

|

Other

|

|

|

|

102

|

+63.1%

|

6

|

108

|

+73.0%

|

|

Total

|

|

|

|

2,356

|

-8.9%

|

106

|

2,462

|

-4.8%

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

Reported revenue declined 8.9% largely due to the regulatory and fiscal challenges in Australia and Bangladesh, which more than offset higher revenue in the remainder of the region, notably in Pakistan, Nigeria and

Indonesia. Translational foreign exchange was a further headwind of 4.1%.

On a constant currency basis, which we believe reflects the operational performance, revenue was down 4.8%.

However, New Categories increased by 2.5% at constant rates, driven by:

| – |

HP, largely driven by Japan and Kazakhstan; and

|

| – |

Modern Oral, fuelled by robust growth from Global Travel Retail and a performance that further demonstrates Modern Oral's potential in Emerging Markets.

|

This was offset by lower revenue in Vapour, as volume declined 33.4%, leading to a 40.5% reduction in revenue (being down 38.4% at constant rates), largely driven by the Group exiting the category in a number of

markets (including Malaysia, Japan and Saudi Arabia) and a change in competitive dynamics in other markets (such as South Africa and New Zealand).

Profit from operations and operating margin

Please see page 47 for a full reconciliation to constant currency metrics, including prior year data.

|

For six months to 30 June 2025

|

Reported

|

|

Adj.

|

Exchange

|

Adjusted

|

|

Current

|

|

|

|

Constant

|

|

£m

|

vs 2024

|

|

£m

|

£m

|

£m

|

vs 2024

|

|

Profit from Operations

|

845

|

-16.3%

|

|

12

|

42

|

899

|

-12.3%

|

|

Operating Margin

|

35.9%

|

-3.2 ppts

|

|

|

|

36.5%

|

-3.1 ppts

|

Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and,

where applicable, its segments.

Profit from operations was 16.3% lower, including a translational foreign exchange headwind of 4.0%.

Excluding adjusting items and translational foreign exchange, adjusted profit from operations at constant rates was down 12.3% to £899 million driven by:

| – |

Australia due to continued increases in the illicit segment which we estimate now accounts for more than 50% of the combustibles industry volume, with the duty paid combustibles industry volume down more

than 30% in 2025; and

|

| – |

Bangladesh, driven by the increase in excise and minimum price in January 2025, necessitating an increase in consumer prices by 20-30%, which has resulted in a reduction in the duty paid combustibles

industry volume by an estimated 27%.

|

However, these were partly offset by an increase in Pakistan (led by the growth of Modern Oral and pricing in combustibles), Nigeria (driven by higher combustibles volume and improved combustibles pricing) and

Indonesia where combustibles volume was up.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Category Performance Review

Vapour

| – |

Continued value share* leadership (in tracked channels) despite flat performance.

|

| – |

Vapour revenue down 15.3% or 13.0% (at constant rates), with volume down 12.9%, impacted by illicit products in the U.S. and Canada and evolving market dynamics (in the UK and France).

|

| – |

In Europe, Vapour value share up 30 bps, with industry rechargeable closed systems back in growth.

|

| – |

Vuse Ultra, our new premium product, continues to be rolled out in H2 2025, with expected acceleration in vapour revenue.

|

Group Vapour performance was negatively impacted by:

| – |

The U.S., the world's largest Vapour market, where Group volume was down 13.8% mainly due to the continued proliferation of illicit single-use vapes and inventory movements. Accordingly, revenue was down

14.5% (or 12.3% on a constant currency basis). The Group maintained leadership in value share (of Vapour closed systems consumables in tracked channels) despite a decline in value share of 20 bps to 49.5%.

|

| – |

AME, where revenue declined 11.4% (or 9.1% on a constant currency basis), largely driven by lower revenue in Canada (due to the continued lack of enforcement against illegal flavoured vapour products) and

evolving market dynamics (in the UK and France). Our value share leadership was up 30 bps with gains in Europe partly offset by value share loss in Canada; and

|

| – |

APMEA, where volume declined 33.4%, leading to a 40.5% reduction in revenue (being down 38.4% at constant rates), largely driven by the Group exiting the category in a number of markets (including Malaysia,

Japan and Saudi Arabia) and a change in competitive dynamics in other markets (such as South Africa and New Zealand).

|

Our new premium innovation, Vuse Ultra, offers consumers a highly differentiated, connected and customisable experience. We are encouraged by the early performance in Canada and will continue the roll-out in a

targeted way through H2 2025.

| * |

Based on Vuse estimated value share in measured retail for Vapour (i.e., value share of rechargeable closed systems consumables and disposables sales in retail) in the Top global markets**.

|

| ** |

Top Vapour markets are defined as the Top markets by industry revenue, being the U.S., Canada, the UK, France, Germany, Poland and Spain. These Top markets account for c.80% of total industry

vapour revenue (rechargeable closed systems consumables and disposables in tracked channels) in 2024.

|

Heated Products (HP)

| – |

Revenue up 0.8%, or 3.1% at constant rates, driven by Quality Growth focus in largest profit pools.

|

| – |

Volume share ***, down 70 bps, impacted by competitive pressure in Japan and phase-out of legacy super-slims.

|

| – |

AME volume share down 10 bps with growth in Poland and the Czech Republic, stable share in Italy more than offset by Germany and Romania.

|

| – |

Momentum building with successful pilot of glo Hilo ahead of phased roll-out in key markets in H2 2025, with expected acceleration in revenue.

|

In APMEA, volume was up 8.7%, with revenue up 10.1%, or 12.3% at constant rates, largely driven by Japan and Kazakhstan.

In AME, volume was down 8.3%, with revenue down 7.4% (being a decline of 4.8% at constant rates), as higher revenue in Poland and Portugal was more than offset by declines in the Czech Republic, Germany and Romania

partly due to the prioritisation of resource allocation ahead of the wider roll-out of glo Hilo.

Our new premium connected device, glo Hilo, offers superior heating technology and an integrated display combined with a new consumables range, Virto and tobacco-free Rivo. We will continue the roll-out through H2

2025 in a targeted way focused on the largest profit pools.

| *** |

Volume share is based upon the Top HP markets which are defined as the Top markets by industry revenue. Top markets are Japan, South Korea, Italy, Germany, Greece, Poland, Romania, the Czech

Republic, Spain and Portugal. These Top markets account for c.80% of total industry HP revenue in 2024.

|

Modern Oral

| – |

Revenue up 38.1%, or 40.6% at constant rates, with volume growth of 42.2%.

|

| – |

Growth in volume share* up 3.3 ppts in Total Oral and up 4.4 ppts in Modern Oral.

|

| – |

AME volume share leadership maintained, with strong financial performances in Scandinavia and the UK.

|

| – |

Triple-digit volume and revenue growth in the U.S. following the national roll-out of Velo Plus.

|

In AME, we are category leaders, with volume up 24.9%. Revenue grew 14.7% (or 16.5% at constant rates) while volume share of the Modern Oral category was down 30 bps.

The volume and revenue growth reflects the strength of our portfolio in both established oral markets across Scandinavia and markets that are more recent adopters of Modern Oral, such as the UK, Austria and

Switzerland.

In the U.S., revenue increased by 372% (or 384% at constant rates), driven by higher volume (up 206%) following the successful national roll-out of Velo Plus, with Velo category volume share almost doubling, up 6.8

ppts to 13.2%.

In APMEA, our volume grew 15.1% and our revenue grew 29.7% (or 32.7% at constant rates), fuelled by robust growth from Global Travel Retail and a performance that further demonstrates Modern Oral's potential in

Emerging Markets.

| * |

Volume share is based uoon the Top Oral and Modern Oral markets which are defined as the Top markets by industry revenue, being the U.S., Sweden, Denmark, Norway, Switzerland, UK and Poland,

accounting for c.90% of total industry Modern Oral revenue in 2024.

|

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Category Performance Review

Continued

Combustibles

| – |

Volume and value share down 10 bps*, growth in the U.S. more than offset by AME and APMEA.

|

| – |

Excluding currency, positive revenue and category contribution growth driven by the U.S. and AME.

|

| – |

Return to growth in the U.S., with revenue up 1.1% (or 3.8% at constant rates) as price/mix more than offset volume decline.

|

| – |

Resilient AME performance with revenue down 3.5%, or up 2.8% at constant rates, driven by Brazil, Türkiye and Romania.

|

| – |

APMEA revenue declined 12.0%, or 7.9% at constant rates, impacted by Australia and Bangladesh with volume down 14.1%.

|

Group cigarette volume was down 8.7% to 229 billion sticks as volume growth in Brazil and Türkiye was more than offset by lower volume in a number of markets, mainly driven by Bangladesh, the U.S. and Poland and

market exits (including Mali).

Revenue from combustibles declined 3.5% to £9,515 million. Our performance was negatively impacted by a translational foreign exchange headwind, with revenue up 0.8% at constant rates as continued robust price/mix

of 9.6% was partly offset by the lower volume (down 8.8%).

Excluding the impact of translational foreign exchange:

| – |

In the U.S., revenue increased 3.8%, as price/mix (+11.4%) more than offset a 7.6% reduction in volume. While this was marginally lower than the industry volume decline of 8.3%, our volume was negatively

impacted in 2024 by the phasing of wholesaler inventory. Our volume share was up 10 bps and value share was up 20 bps following the actions taken in 2024 to improve performance;

|

| – |

In AME, higher revenue (up 2.8%) was largely driven by higher volume and pricing in both Brazil and Türkiye. These factors combined with robust pricing in Romania and Poland to more than offset a reduction

in revenue in Canada; and

|

| – |

In APMEA, revenue declined 7.9% due to fiscal and regulatory headwinds in Australia and Bangladesh, which more than offset higher revenue in the remainder of the region, notably in Pakistan, Nigeria and

Indonesia.

|

| * |

Volume and value share are based upon the Top cigarette markets which are defined as the Top cigarette markets by industry revenue, being the U.S., Japan, Brazil, Germany, Pakistan, Mexico

and Romania, accounting for c.60% of total industry cigarettes revenue in 2024.

|

Traditional Oral

Group volume declined 10.4% to 2.8 billion stick equivalents. Total revenue was £542 million, down 2.4% but flat at constant rates.

In the U.S., which accounts for 96% of the Group's revenue from the category, revenue declined 0.4% at constant rates, as price/mix (+9.1%) was more than offset by lower volume (down 9.5%) due to the continued

cross-category use of Modern Oral.

Value share in Traditional Oral decreased 40 bps, with volume share down 20 bps.

Beyond Nicotine

Btomorrow Ventures has completed 29 investments since its launch in 2020 and continues to invest in innovative, consumer-led brands, new science and technologies.

The Group has continued its exploration in the Wellbeing and Stimulation category with Ryde: functional shots now selling in the U.S. on Amazon and in Texas retailers in addition to Australia and Canada.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other Financial Information

Cash flow

We continue to make good progress on de-leveraging our balance sheet, driven by continued strong cash generation.

Cash flow is typically weighted to the second half of the year.

Our active capital allocation framework considers the continued investment in our transformation, the macro-environment, and potential future litigation and regulatory outcomes.

We understand the importance of cash returns to shareholders, and remain committed to our progressive dividend based upon 65% of long-term sustainable earnings.

Subsequent to recognising the dilutive effect of share issuances under the Company's Employee Share Option Scheme, which reduced BAT's shareholding from 25.45% (31 December 2024) to 25.43%, in May 2025, we monetised

a further portion of our ITC stake (further lowering our holding from 25.43% to 22.93% at 30 June 2025), realising £1.1 billion and enabling an increase in our sustainable share buy-back for 2025 from £0.9 billion to £1.1 billion.

| |

For six months to 30 June

|

|

2025

|

2024

|

Change

|

|

£m

|

£m

|

%

|

|

Net cash generated from operating activities

|

2,309

|

3,165

|

-27.0%

|

| |

|

|

|

| |

As at 30 June

|

|

2025

|

2024

|

Change

|

|

£m

|

£m

|

%

|

|

Borrowings (including lease liabilities)

|

35,208

|

40,158

|

-12.3%

|

In the Group’s cash flow statement, prepared in accordance with IFRS and presented on page 22, net cash generated from operating activities declined by 27.0% to £2,309 million. This was largely due to the previously

announced:

| – |

deferral of £700 million (US$895 million) of tax payments in the U.S. from 2024 to 2025, partly offset by a deferral in 2025 from the first half of the year to the second half (£209 million /

US$271 million); and

|

| – |

payment related to the Franked Investment Income Group Litigation Order (FII GLO) of £368 million. The Group will make a further payment in H2 2025 of £111 million, followed by payments of £222 million in

2026 and £43 million in 2027 (see page 36).

|

These were partly offset by payments in the first half of 2024 in respect of the DOJ and OFAC (£267 million) that did not repeat.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other Financial Information

Continued

Borrowings and net debt

Borrowings (which includes lease liabilities) were £35,208 million at 30 June 2025, a decrease of 12.3% compared to £40,158 million at 30 June 2024 (31 December 2024 : £36,950 million).

The Group remains confident of its ability to access the debt capital markets successfully and reviews its options on a continuing basis.

The Group’s average centrally managed debt maturity was 10.0 years at 30 June 2025 (30 June 2024: 9.2 years; 31 December 2024: 9.5 years), and the highest proportion of centrally managed debt maturing in a single

rolling 12-month period was 15.3% (30 June 2024: 15.6%; 31 December 2024: 14.8%).

The Group defines net debt as borrowings (including related derivatives and lease liabilities), less cash and cash equivalents (including restricted cash) and current investments held at fair value. Closing net debt

was £30,342 million at 30 June 2025 (30 June 2024: £33,658 million; 31 December 2024: £31,253 million).

A reconciliation of borrowings to net debt is provided below.

| |

As at 30 June

|

|

As at 31 December

|

|

2025

|

2024

|

Change

|

|

2024

|

|

£m

|

£m

|

%

|

|

£m

|

|

Borrowings (including lease liabilities)

|

(35,208)

|

(40,158)

|

-12.3%

|

|

(36,950)

|

|

Derivatives in respect of net debt

|

(27)

|

(130)

|

-79.2%

|

|

(113)

|

|

Cash and cash equivalents

|

4,404

|

5,934

|

-25.8%

|

|

5,297

|

|

Current investments held at fair value

|

489

|

696

|

-29.7%

|

|

513

|

|

Net debt

|

(30,342)

|

(33,658)

|

-9.9%

|

|

(31,253)

|

|

Maturity profile of net debt:

|

|

|

|

|

|

|

Net debt due within one year

|

1,573

|

(686)

|

n/m

|

|

1,545

|

|

Net debt due beyond one year

|

(31,915)

|

(32,972)

|

-3.2%

|

|

(32,798)

|

|

Net debt

|

(30,342)

|

(33,658)

|

-9.9%

|

|

(31,253)

|

n/m not meaningful

Impacting the carrying value of net debt are:

| – |

Cash payments related to share schemes and investing activities of £47 million (30 June 2024: £103 million);

|

| – |

£1,052 million (30 June 2024: £1,577 million) net proceeds from the partial monetisation of our investment in ITC;

|

| – |

The purchase of £450 million (30 June 2024: £366 million) of own shares under the Group’s 2025 share buy-back programme;

|

| – |

Other non-cash movements of £120 million (30 June 2024: £619 million) with the prior year impacted by the repurchase of series of bonds in May 2024 as part of the Group's debt liability management exercise;

and

|

| – |

Foreign exchange impacts related to the revaluation of foreign currency denominated net debt balances being a net tailwind of £1,611 million (30 June 2024: £269 million headwind).

|

Investments held at fair value through profit and loss above include restricted amounts of £427 million (31 December 2024: £437 million) due to investments held by subsidiaries in CCAA protection, as well as

£17 million (31 December 2024: £60 million) subject to potential exchange control restrictions.

Cash and cash equivalents include restricted amounts of £2,047 million (31 December 2024: £2,072 million) due to subsidiaries in CCAA protection, as well as £255 million (31 December 2024: £339 million) principally

due to exchange control restrictions.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other Financial Information

Continued

Foreign currencies

The principal exchange rates used to convert the results of the Group’s foreign operations to pounds sterling for the purposes of inclusion and consolidation within the Group’s financial statements are indicated in

the table below. Where the Group has provided results “at constant rates of exchange” this refers to the translation of the results from the foreign operations at rates of exchange prevailing in the prior period – thereby eliminating the

potentially distorting impact of the movement in foreign exchange on the reported results.

The principal exchange rates used were as follows:

| |

Average for the period ended

|

|

As at

|

|

30 June

|

|

31 December

|

|

30 June

|

|

31 December

|

|

2025

|

2024

|

|

2024

|

|

2025

|

2024

|

|

2024

|

|

Australian dollar

|

2.045

|

1.922

|

|

1.937

|

|

2.091

|

1.893

|

|

2.023

|

|

Bangladeshi taka

|

158.273

|

141.684

|

|

147.803

|

|

168.176

|

149.132

|

|

149.662

|

|

Brazilian real

|

7.468

|

6.431

|

|

6.893

|

|

7.479

|

7.021

|

|

7.737

|

|

Canadian dollar

|

1.828

|

1.718

|

|

1.751

|

|

1.870

|

1.730

|

|

1.801

|

|

Chilean peso

|

1,238.902

|

1,190.267

|

|

1,206.394

|

|

1,279.119

|

1,193.216

|

|

1,245.543

|

|

Euro

|

1.187

|

1.170

|

|

1.181

|

|

1.167

|

1.179

|

|

1.209

|

|

Indian rupee

|

111.763

|

105.275

|

|

106.952

|

|

117.521

|

105.410

|

|

107.223

|

|

Japanese yen

|

192.489

|

192.515

|

|

193.583

|

|

197.940

|

203.343

|

|

196.827

|

|

Romanian leu

|

5.939

|

5.821

|

|

5.877

|

|

5.929

|

5.870

|

|

6.018

|

|

South African rand

|

23.859

|

23.692

|

|

23.423

|

|

24.353

|

23.082

|

|

23.633

|

|

Swiss franc

|

1.118

|

1.125

|

|

1.125

|

|

1.091

|

1.136

|

|

1.135

|

|

US dollar

|

1.298

|

1.265

|

|

1.278

|

|

1.370

|

1.264

|

|

1.252

|

Other Information

Risks and uncertainties

The Board carried out a robust assessment of the Principal Risks and uncertainties facing the Group for the period, including those that would threaten its business model, future performance, solvency, liquidity and

viability. The Board also maintained close oversight of the Group’s response to critical external uncertainties, recognising current macro-economic and geopolitical challenges.

All Group risks are reviewed biannually by the Audit Committee and annually by the Board. During the period, the risk related to "Litigation" was renamed "Litigation and external investigations" and the risk related

to "Circular economy" was renamed "Circularity", reflecting the nature of the risk. There were no changes to the underlying risks.

Sustainability is core to the Group’s long-term business strategy and sustainability risk factors are embedded across the Group’s risks in accordance with the Group's Risk Management Framework.

The Principal Risks facing the Group are summarised under the headings of:

| – |

Competition from illicit trade;

|

| – |

Tobacco, New Categories and other regulation interrupts the growth strategy;

|

| – |

Supply chain disruption;

|

| – |

Litigation and external investigations;

|

| – |

Significant increases or structural changes in tobacco, nicotine and New Categories related taxes;

|

| – |

Inability to develop, commercialise and deliver the New Categories strategy;

|

| – |

Disputed taxes, interest and penalties;

|

| – |

Injury, illness or death in the workplace;

|

| – |

Solvency and liquidity;

|

| – |

Foreign exchange rate exposures;

|

A summary of all the risk factors (including the Principal Risks) which are monitored by the Board through the Group’s risk register are set out on pages 414 to 435 of the Group’s Annual Report and Accounts and Form

20-F for the year ended 31 December 2024. All the Group’s risks should be read in the context of the forward-looking statements on page 44 of this Half-Year Report.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other Information

Continued

Update on Quebec class action, CCAA and the Proposed Plans in Canada

As previously announced, on 17 October 2024, the court-appointed Mediator’s and Monitor’s plan of compromise and arrangement was filed in the Ontario Superior Court of Justice. Substantially similar proposed plans

were also filed for Rothmans, Benson & Hedges Inc. (RBH, a subsidiary of Philip Morris International Inc.) and JTI-Macdonald Corp. (JTIM, a subsidiary of Japan Tobacco International) (collectively, the Proposed Plans).

Under the Proposed Plans, ITCAN, RBH and JTIM (the Companies) would pay an aggregate settlement amount of CAD$32.5 billion (approximately £17.4 billion). This amount would be funded by:

– an upfront payment equal to all the Companies’ cash and cash equivalents on hand (including investments held at fair value) plus certain court deposits (subject to an aggregate industry withholding of CAD$750

million (approximately £401 million)) plus 85% of any cash tax refunds that may be received by the Companies on account of the upfront payments; and

– annual payments based on a percentage (initially 85%, reducing over time) of each of the Companies’ net income after taxes, based on amounts generated from all sources, excluding New Categories, until the

aggregate settlement amount is paid.

On 31 October 2024, the court granted certain orders pursuant to which the Proposed Plans were accepted for filing. On 12 December 2024, the Proposed Plans were approved by the requisite majorities of the creditors.

On 6 March 2025, the Court sanctioned an amended version of the Proposed Plans (hereinafter referred to as the Approved Plans), wherein the aggregate industry withholding of CAD$750 million was allocated to RBH. In this sanction order, the

Court has also extended the stays of litigation up to the implementation date of the Approved Plans.

The Approved Plans resolve all Canadian tobacco litigation and provide a full and comprehensive release to ITCAN, BAT p.l.c. and all related companies for all past, present and future tobacco claims in Canada.

In line with IFRS 10 Consolidated Financial Statements, ITCAN is consolidated in the Group’s results.

Under IAS 37 Provisions, Contingent Liabilities and Contingent Assets, when there is an expected future economic outflow, arising from a past event, the value of which can

be reasonably estimated, a provision should be recognised. A provision of £6.2 billion was recognised in 2024.

It is expected that approximately £2.6 billion will be paid in the second half of 2025 in relation to the upfront payment.

In the six months to 30 June 2025, the Group's estimated share of the undiscounted future liability has not materially changed. However, the Group has recognised a net credit of £575 million as the provision

recognised in relation to the Canadian litigation settlement was updated in line with the latest forecast of the Canadian combustibles industry performance, impacting the present value of the future liability described on page 26. The update

was, in particular, in respect of pricing and volume decline assumptions, The net credit has been treated as an adjusting item.

At 30 June 2025, restricted cash in ITCAN was £2,047 million and restricted investments held at fair value were £427 million, with goodwill recognised on the balance of the Group at £2,148 million.

Please refer to “Contingent Liabilities and Financial Commitments” below (page 34) and the Group’s Annual Report and Accounts and Form 20-F for the year ended 31 December 2024 (note 12 Intangible Assets and note 31

Contingent Liabilities and Financial Commitments) for a full discussion of the case and the assessment of goodwill.

There has been no trigger to further reassess goodwill for impairment at 30 June 2025.

Adjusted performance:

As the Chief Operating Decision Maker, the Management Board (from 1 January 2025) assesses the performance of the Group by reviewing adjusted profit from operations as adjusted for Canada using the prior year

translational exchange rate (constant rate) to evaluate segment performance and allocate resources to the overall business on a regional basis.

This new measure, being adjusted profit from operations as adjusted for Canada, at constant rates, recognises a charge calculated in line with the Approved Plans – based on a percentage of Imperial Tobacco Canada

Limited's and Imperial Tobacco Company Limited's (together ITCAN) adjusted profit from operations from all sources in Canada, excluding New Categories. This charge will continue until the aggregate settlement amount is paid. This is reflected

in the adjusted performance of the Group and is referred to as “as adjusted for Canada”. This approach presents the economic delivery from the AME region in a manner comparable to that of the other regions in the Group.

Due to the uncertain nature of the timing of the implementation of the settlement on the Group’s 2025 results, for the purposes of 2025 versus 2024 this charge is 100% of the adjusted profit from operations from all

sources in Canada, excluding New Categories.

From 2026 (assuming the Approved Plans as sanctioned by the Court on 6 March 2025 have been implemented in 2025), this charge will (following the underlying terms of the Approved Plans) be 85% of the adjusted profit

from operations earned in Canada from all sources, excluding New Categories, reducing in future periods in line with the Approved Plans.

Also from 1 January 2025, the Group has recognised an adjusting charge in net finance costs in respect of interest earned on the restricted cash held in Canada that will be paid as part of the upfront settlement

payment. This is adjusted out from the current year and comparator performance, as the interest income is not representative of the ongoing business.

Update on investigations and other proceedings

The Group investigates, and becomes aware of governmental authorities’ investigations into, allegations of misconduct, including alleged breaches of sanctions and allegations of corruption at Group companies. Some

of these allegations are currently being investigated. The Group cooperates with the authorities, where appropriate.

In addition, the Group is, and may in the future be, subject to investigations or legal proceedings in relation to, among other things, its marketing, promotion or distribution activities in respect of its

products. As such, the Group or Group companies, could be subject to liability and costs associated with any damages, fines, or penalties brought in connection with these allegations.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other Information

Continued

Operational and process review

To further support our transformation and underpin investment initiatives to drive long-term sustainable profit and cash flow growth, we have started a structured time-bound programme to review processes and ways of

working which will generate efficiencies and facilitate faster, more agile and effective decision making.

This programme includes a comprehensive review of our overhead optimisation opportunities, route to market and digitalisation, in order to deliver more effective, data-driven digital ways of working.

It is expected to generate annualised cost efficiencies and cash flow which will be re-invested to support further sustainable growth initiatives.

We expect associated one-off costs of £500 million, which as a one-off time bound programme and, to aid comparison of performance, c.£350 million will be treated as adjusting items having commenced in H1 2025 and

which are expected to complete in 2027.

Changes to the Main Board and Management Board

As previously disclosed, the following Board changes have taken place:

| – |

Karen Guerra joined the Remuneration Committee and stepped down from the Audit Committee with effect from 10 February 2025;

|

|

–

|

Uta Kemmerich-Keil joined the Board as an independent Non-Executive Director and member of the Audit and Nominations Committees with effect from 17 February 2025;

and

|

|

–

|

Murray S. Kessler stepped down from the Board with effect from 17 February 2025 and did not stand for re-election at the Annual General Meeting in April 2025.

|

As announced on 14 July 2025, the following Management Board changes will take place:

| – |

Michael Dijanosic, Regional Director, Asia Pacific, Middle East and Africa (APMEA) will step down from his role and from the Management Board on 31 December 2025; and

|

| – |

Pascale Meulemeester will be appointed as Regional Director Designate (APMEA), with effect from 1 September 2025 and then as Regional Director, APMEA, and a member of the Management Board with effect from 1

January 2026.

|

Going concern

A description of the Group’s business activities, its financial position, cash flows, liquidity position, facilities and borrowings position, together with the factors likely to affect its future development,

performance and position, as well as risks associated with the business, are set out in the Strategic Report and in the Notes on the Accounts, all of which are included in the Group's Annual Report and Accounts and Form 20-F for the year

ended 31 December 2024, and available on the Group's website, www.bat.com.

This Half-Year Report provides updated information regarding the business activities, including cash flow, for the six months to 30 June 2025 and of the financial position and liquidity position at 30 June 2025.

The Group has, at the date of this announcement, sufficient existing financing available for its estimated requirements for at least 12 months from the date of approval of this condensed consolidated financial

information. This, together with the ability to generate cash from trading activities, the performance of the Group’s Strategic Portfolio, its leading market positions in a number of countries and its broad geographical spread, as well as

numerous contracts with established customers and suppliers across different geographical areas and industries, provides the Directors with the confidence that the Group is well placed to manage its business risks successfully through the

ongoing uncertainty, the current macro-economic financial conditions and the general outlook in the global economy.

After reviewing the Group’s forecast financial performance and financing arrangements, the Directors consider that the Group has adequate resources to continue operating for at least 12 months from the date of

approval of this condensed consolidated financial information and that it is therefore appropriate to continue to adopt the going concern basis in preparing this Half-Year Report.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

This page is intentionally left blank

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Contents

| |

Page

|

|

Financial Statements:

|

|

|

Group Income Statement

|

17

|

|

Group Statement of Comprehensive Income

|

18

|

|

Group Statement of Changes in Equity

|

19

|

|

Group Balance Sheet

|

21

|

|

Group Cash Flow Statement

|

22

|

|

Notes to the Unaudited Interim Financial Statements

|

23

|

|

Other Information

|

40

|

|

Data Lake and Reconciliations

|

47

|

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Interim Financial Statements (unaudited)

Group Income Statement

| |

Six months ended

30 June

|

|

2025

|

2024

|

|

£m

|

£m

|

|

Revenue1

|

12,069

|

12,340

|

|

Raw materials and consumables used

|

(2,166)

|

(2,304)

|

|

Changes in inventories of finished goods and work in progress

|

185

|

140

|

|

Employee benefit costs

|

(1,463)

|

(1,375)

|

|

Depreciation, amortisation and impairment costs

|

(1,192)

|

(1,620)

|

|

Other operating income

|

54

|

223

|

|

Loss on reclassification from amortised cost to fair value

|

(5)

|

(4)

|

|

Other operating expenses

|

(2,413)

|

(3,142)

|

|

Profit from operations

|

5,069

|

4,258

|

|

Net finance costs

|

(969)

|

(305)

|

|

Share of post-tax results of associates and joint ventures

|

1,474

|

1,647

|

|

Profit before taxation

|

5,574

|

5,600

|

|

Taxation on ordinary activities

|

(1,009)

|

(1,041)

|

|

Profit for the period

|

4,565

|

4,559

|

|

Attributable to:

|

|

|

|

Owners of the parent

|

4,512

|

4,492

|

|

Non-controlling interests

|

53

|

67

|

| |

4,565

|

4,559

|

|

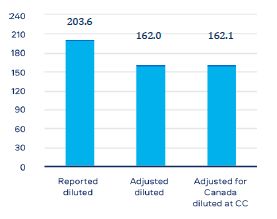

Earnings per share

|

|

|

|

Basic

|

204.6p

|

201.1p

|

|

Diluted

|

203.6p

|

200.3p

|

All of the activities during both years are in respect of continuing operations.

The accompanying notes on pages 23 to 39 form an integral

part of this condensed consolidated financial information.

| 1. |

Revenue is net of duty, excise and other taxes of £15,515 million and £16,509 million for the six months ended 30 June 2025 and 30 June 2024, respectively.

|

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Interim Financial Statements (unaudited)

Continued

Group Statement of Comprehensive Income

| |

Six months ended

30 June

|

|

2025

|

2024

|

|

£m

|

£m

|

|

Profit for the period (page 17)

|

4,565

|

4,559

|

|

Other comprehensive income

|

|

|

|

Items that may be reclassified subsequently to profit or loss:

|

(4,255)

|

(19)

|

|

Foreign currency translation and hedges of net investments in foreign operations

|

|

|

|

– differences on exchange from translation of foreign operations

|

(4,360)

|

(123)

|

|

– net investment hedges - net fair value gains/(losses) on derivatives

|

221

|

(7)

|

|

– net investment hedges - differences on exchange on borrowings

|

(13)

|

8

|

|

Cash flow hedges

|

|

|

|

– net fair value (losses)/gains

|

(45)

|

51

|

|

– reclassified and reported in profit for the period

|

23

|

17

|

|

– tax on net fair value (losses)/gains in respect of cash flow hedges

|

7

|

(23)

|

|

Associates

|

|

|

|

– share of OCI, net of tax

|

(135)

|

15

|

|

– differences on exchange reclassified to profit or loss

|

47

|

43

|

|

Items that will not be reclassified subsequently to profit or loss:

|

(6)

|

50

|

|

Retirement benefit schemes

|

|

|

|

– net actuarial (losses)/gains

|

(37)

|

21

|

|

– movements in surplus restrictions

|

(39)

|

(24)

|

|

– tax on actuarial (losses)/gains and movements in surplus restrictions

|

5

|

1

|

|

Investments held at fair value

|

|

|

|

– net fair value gains

|

70

|

—

|

|

Associates – share of OCI, net of tax

|

(5)

|

52

|

|

Total other comprehensive (expense)/income for the period, net of tax

|

(4,261)

|

31

|

|

Total comprehensive income for the period, net of tax

|

304

|

4,590

|

| |

|

|

|

Attributable to:

|

|

|

|

Owners of the parent

|

279

|

4,526

|

|

Non-controlling interests

|

25

|

64

|

| |

304

|

4,590

|

The accompanying notes on pages 23 to 39 form an integral

part of this condensed consolidated financial information.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Interim Financial Statements (unaudited)

Continued

Group Statement of Changes in Equity

|

At 30 June 2025

|

Attributable to owners of the parent

|

|

|

|

|

Share

capital

|

Share premium, capital redemption and merger reserves

|

Other

reserves

|

Retained

earnings

|

Total attributable

to owners

of parent

|

Perpetual hybrid bonds

|

Non-controlling interests

|

Total equity

|

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

|

Balance at 1 January 2025

|

585

|

26,665

|

(902)

|

21,610

|

47,958

|

1,685

|

352

|

49,995

|

|

Total comprehensive (expense)/income for the period comprising: (page 18)

|

—

|

—

|

(4,160)

|

4,439

|

279

|

—

|

25

|

304

|

|

Profit for the period (page 17)

|

—

|

—

|

—

|

4,512

|

4,512

|

—

|

53

|

4,565

|

|

Other comprehensive expense for the period (page 18)

|

—

|

—

|

(4,160)

|

(73)

|

(4,233)

|

—

|

(28)

|

(4,261)

|

|

Other changes in equity

|

|

|

|

|

|

|

|

|

|

Cash flow hedges reclassified and reported in total assets

|

—

|

—

|

5

|

—

|

5

|

—

|

—

|

5

|

|

Employee share options

|

|

|

|

|

|

|

|

|

|

–value of employee services

|

—

|

—

|

—

|

35

|

35

|

—

|

—

|

35

|

|

–proceeds from new shares issued

|

—

|

1

|

—

|

—

|

1

|

—

|

—

|

1

|

|

–treasury shares used for share option schemes

|

—

|

1

|

—

|

(1)

|

—

|

—

|

—

|

—

|

|

Dividends and other appropriations

|

|

|

|

|

|

|

|

|

|

–ordinary shares

|

—

|

—

|

—

|

(2,609)

|

(2,609)

|

—

|

—

|

(2,609)

|

|

–to non-controlling interests

|

—

|

—

|

—

|

—

|

—

|

—

|

(74)

|

(74)

|

|

Purchase of own shares

|

|

|

|

|

|

|

|

|

|

–held in employee share ownership trusts

|

—

|

—

|

—

|

(61)

|

(61)

|

—

|

—

|

(61)

|

|

–share buy-back programme and cancelled shares

|

(4)

|

4

|

—

|

(450)

|

(450)

|

—

|

—

|

(450)

|

|

Other movements

|

—

|

—

|

—

|

31

|

31

|

—

|

—

|

31

|

|

Balance at 30 June 2025

|

581

|

26,671

|

(5,057)

|

22,994

|

45,189

|

1,685

|

303

|

47,177

|

|

At 30 June 2024

|

Attributable to owners of the parent

|

|

|

|

|

Share

capital

|

Share premium, capital redemption and merger reserves

|

Other

reserves

|

Retained

earnings

|

Total attributable

to owners

of parent

|

Perpetual hybrid bonds

|

Non-controlling interests

|

Total equity

|

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

£m

|

|

Balance at 1 January 2024

|

614

|

26,630

|

(894)

|

24,531

|

50,881

|

1,685

|

368

|

52,934

|

|

Total comprehensive income for the period comprising: (page 18)

|

—

|

—

|

36

|

4,490

|

4,526

|

—

|

64

|

4,590

|

|

Profit for the period (page 17)

|

—

|

—

|

—

|

4,492

|

4,492

|

—

|

67

|

4,559

|

|

Other comprehensive income/(expense) for the period (page 18)

|

—

|

—

|

36

|

(2)

|

34

|

—

|

(3)

|

31

|

|

Other changes in equity

|

|

|

|

|

|

|

|

|

|

Cash flow hedges reclassified and reported in total assets

|

—

|

—

|

11

|

—

|

11

|

—

|

—

|

11

|

|

Employee share options

|

|

|

|

|

|

|

|

|

|

–value of employee services

|

—

|

—

|

—

|

30

|

30

|

—

|

—

|

30

|

|

–proceeds from new shares issued

|

—

|

4

|

—

|

—

|

4

|

—

|

—

|

4

|

|

Dividends and other appropriations

|

|

|

|

|

|

|

|

|

|

–ordinary shares

|

—

|

—

|

—

|

(2,603)

|

(2,603)

|

—

|

—

|

(2,603)

|

|

–to non-controlling interests

|

—

|

—

|

—

|

—

|

—

|

—

|

(74)

|

(74)

|

|

Purchase of own shares

|

|

|

|

|

|

|

|

|

|

–held in employee share ownership trusts

|

—

|

—

|

—

|

(93)

|

(93)

|

—

|

—

|

(93)

|

|

–share buy-back programme and cancelled shares, including treasury shares

|

(25)

|

25

|

—

|

(366)

|

(366)

|

—

|

—

|

(366)

|

|

Other movements

|

—

|

—

|

—

|

36

|

36

|

—

|

—

|

36

|

|

Balance at 30 June 2024

|

589

|

26,659

|

(847)

|

26,025

|

52,426

|

1,685

|

358

|

54,469

|

The accompanying notes on pages 23 to 39 form an integral

part of this condensed consolidated financial information.

|

BAT Interim Announcement 2025

|

Summary

|

|

Performance Review

|

|

Financial Statements

|

|

Other Information

|

|

Data Lake and Reconciliations

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Interim Financial Statements (unaudited)

Continued

Group Balance Sheet

| |

As at 30 June

|

|

As at 31 December

|

|

2025

|

2024

|

|

2024

|

|

£m

|

£m

|

|

£m

|

|

Assets

|

|

|

|

|

|

Intangible assets

|

86,223

|

94,700

|

|

94,276

|

|

Property, plant and equipment

|

4,159

|

4,427

|

|

4,379

|

|

Investments in associates and joint ventures

|

1,533

|

1,937

|

|

1,902

|

|

Retirement benefit assets

|

841

|

940

|

|

937

|

|

Deferred tax assets

|

2,434

|

953

|

|

2,573

|

|

Trade and other receivables

|

283

|

318

|

|

282

|

|

Investments held at fair value

|

737

|

122

|

|

146

|

|

Derivative financial instruments

|

141

|

100

|

|

110

|

|

Total non-current assets

|

96,351

|

103,497

|

|

104,605

|

|

Inventories

|

5,088

|

5,334

|

|

4,616

|

|

Income tax receivable

|

108

|

100

|

|

67

|

|

Trade and other receivables

|

3,475

|

3,637

|

|

3,604

|

|

Investments held at fair value

|

489

|

696

|

|

513

|

|

Derivative financial instruments

|

302

|

159

|

|

186

|

|

Cash and cash equivalents

|

4,404

|

5,934

|

|

5,297

|

| |

13,866

|

15,860

|

|

14,283

|

|

Assets classified as held-for-sale

|

9

|

12

|

|

11

|

|

Total current assets

|

13,875

|

15,872

|

|

14,294

|

|

Total assets

|

110,226

|

119,369

|

|

118,899

|

|

Equity – capital and reserves

|

|

|

|

|

|

Share capital

|

581

|

589

|

|

585

|

|

Share premium, capital redemption and merger reserves

|

26,671

|

26,659

|

|

26,665

|

|

Other reserves

|

(5,057)

|

(847)

|

|

(902)

|

|

Retained earnings

|

22,994

|

26,025

|

|

21,610

|

|

Owners of the parent

|

45,189

|

52,426

|

|

47,958

|

|

Perpetual hybrid bonds

|

1,685

|

1,685

|

|

1,685

|

|

Non-controlling interests

|

303

|

358

|

|

352

|

|

Total equity

|

47,177

|

54,469

|

|

49,995

|

|

Liabilities