|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$123

|

1.24%

|

|

Top Contributors

|

|

|

↑

|

Equitable Holdings, Inc., CNO Financial Group, Inc., Delta Air Lines, Inc.

|

|

Top Detractors

|

|

|

↓

|

JELD-WEN Holding, Inc., Olin Corporation, Dollar General Corporation

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

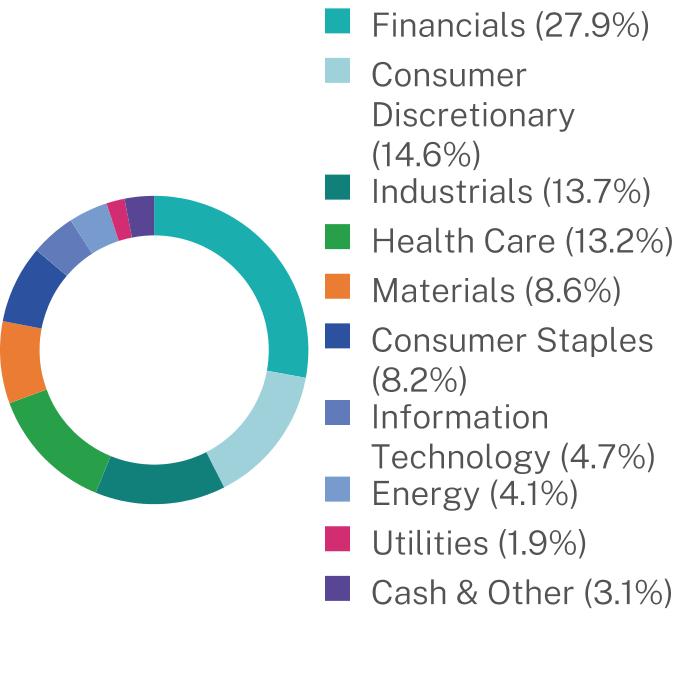

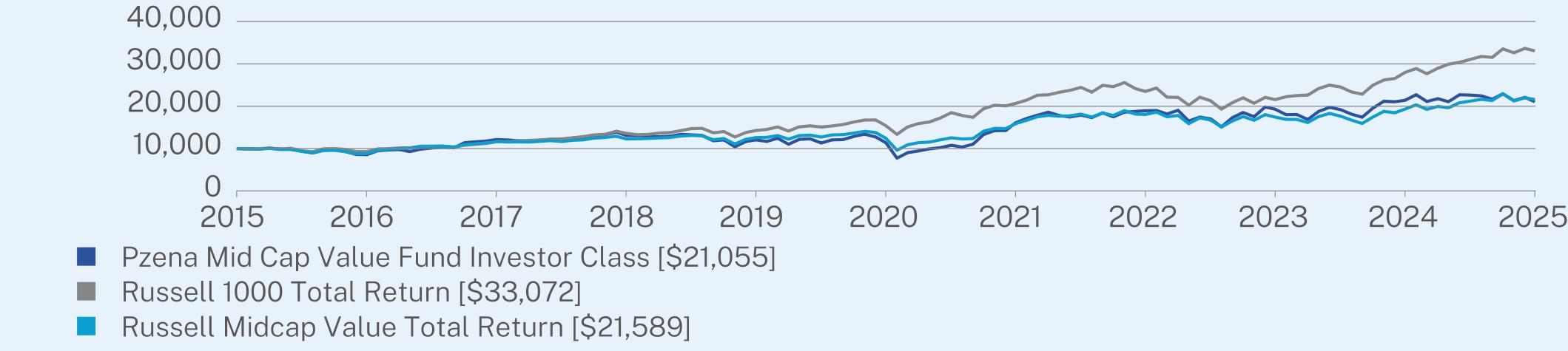

Pzena Mid Cap Value Fund - Investor Class

|

-1.69

|

13.09

|

7.73

|

|

Russell 1000 Total Return

|

18.11

|

16.54

|

12.71

|

|

Russell Midcap Value Total Return

|

11.67

|

11.68

|

8.00

|

|

Net Assets

|

$135,244,048

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$1,068,790

|

|

Portfolio Turnover

|

35%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Humana, Inc.

|

4.5%

|

|

Baxter International, Inc.

|

4.5%

|

|

Dollar General Corp.

|

3.8%

|

|

Charter Communications, Inc. - Class A

|

3.7%

|

|

Delta Air Lines, Inc.

|

3.4%

|

|

Capital One Financial Corp.

|

3.2%

|

|

Dow, Inc.

|

3.1%

|

|

CH Robinson Worldwide, Inc.

|

3.1%

|

|

Fresenius Medical Care AG & Co. KGaA

|

3.1%

|

|

Lear Corp.

|

3.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$89

|

0.90%

|

|

Top Contributors

|

|

|

↑

|

Equitable Holdings, Inc., CNO Financial Group, Inc., Delta Air Lines, Inc.

|

|

Top Detractors

|

|

|

↓

|

JELD-WEN Holding, Inc., Olin Corporation, Dollar General Corporation

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

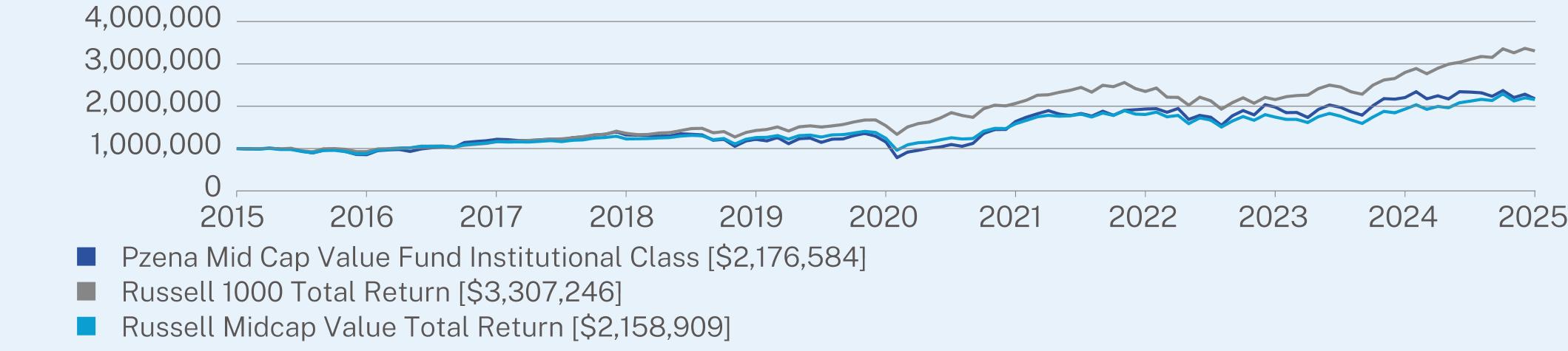

Pzena Mid Cap Value Fund - Institutional Class

|

-1.33

|

13.53

|

8.09

|

|

Russell 1000 Total Return

|

18.11

|

16.54

|

12.71

|

|

Russell Midcap Value Total Return

|

11.67

|

11.68

|

8.00

|

|

Net Assets

|

$135,244,048

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$1,068,790

|

|

Portfolio Turnover

|

35%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Humana, Inc.

|

4.5%

|

|

Baxter International, Inc.

|

4.5%

|

|

Dollar General Corp.

|

3.8%

|

|

Charter Communications, Inc. - Class A

|

3.7%

|

|

Delta Air Lines, Inc.

|

3.4%

|

|

Capital One Financial Corp.

|

3.2%

|

|

Dow, Inc.

|

3.1%

|

|

CH Robinson Worldwide, Inc.

|

3.1%

|

|

Fresenius Medical Care AG & Co. KGaA

|

3.1%

|

|

Lear Corp.

|

3.0%

|

|

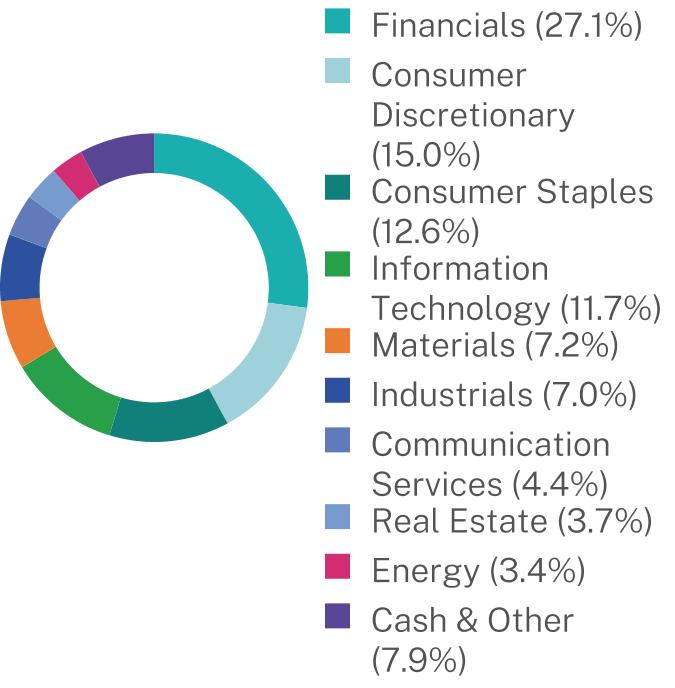

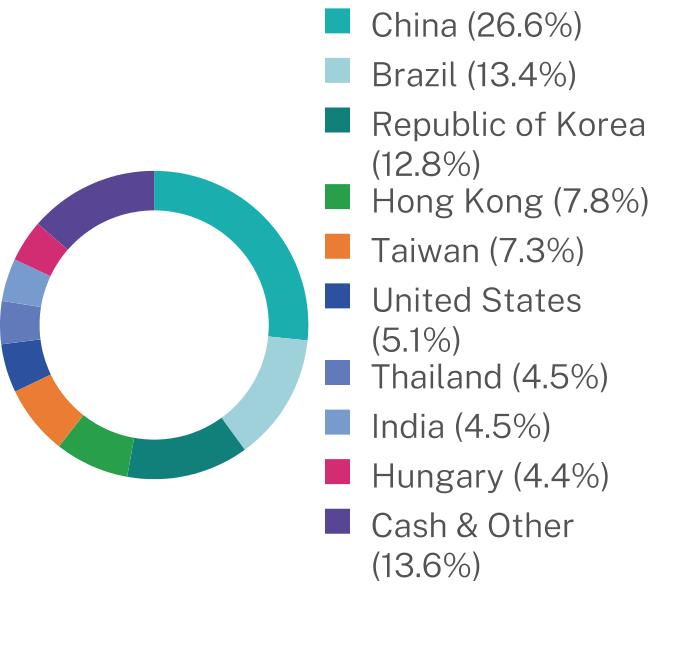

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$149

|

1.42%

|

|

Top Contributors

|

|

|

↑

|

Hon Hai Precision Industry Co., Ltd., Alibaba Group Holding Limited, Taiwan Semiconductor Manufacturing Co., Ltd.

|

|

Top Detractors

|

|

|

↓

|

Samsung Electronics Co., Ltd., PT Bank Rakyat Indonesia (Persero) Tbk Class B, Hankook Tire & Technology Co., Ltd.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

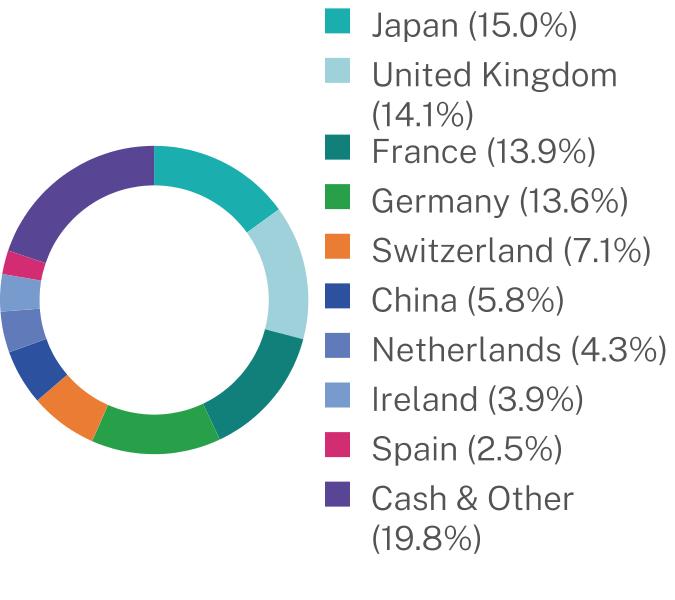

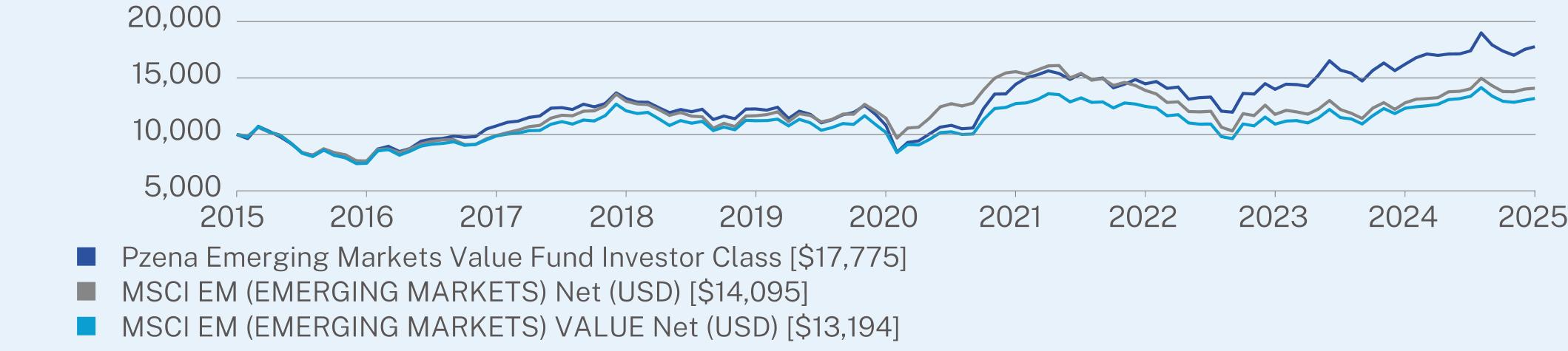

Pzena Emerging Markets Value Fund - Investor Class

|

9.57

|

10.47

|

5.92

|

|

MSCI EM (EMERGING MARKETS) Net (USD)

|

10.07

|

4.26

|

3.49

|

|

MSCI EM (EMERGING MARKETS) VALUE Net (USD)

|

7.05

|

5.33

|

2.81

|

|

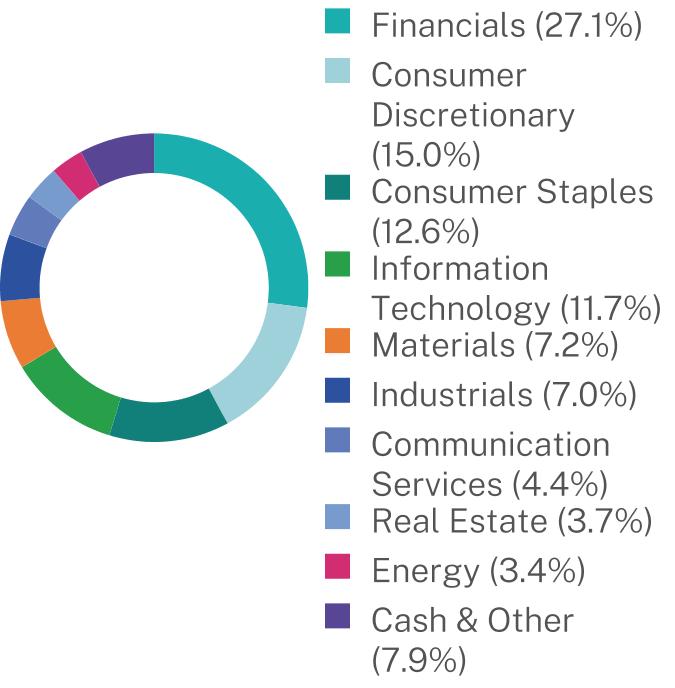

Net Assets

|

$2,137,973,654

|

|

Number of Holdings

|

65

|

|

Net Advisory Fee

|

$18,965,253

|

|

Portfolio Turnover

|

22%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Samsung Electronics Co., Ltd.

|

3.8%

|

|

China Overseas Land & Investment, Ltd.

|

3.7%

|

|

Alibaba Group Holding, Ltd.

|

3.6%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

3.5%

|

|

Weichai Power Co., Ltd.

|

2.9%

|

|

Ambev S.A.

|

2.7%

|

|

WH Group, Ltd.

|

2.6%

|

|

Cognizant Technology Solutions Corp.

|

2.6%

|

|

First American Government Obligations Fund - Class X

|

2.5%

|

|

China Merchants Bank Co., Ltd.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

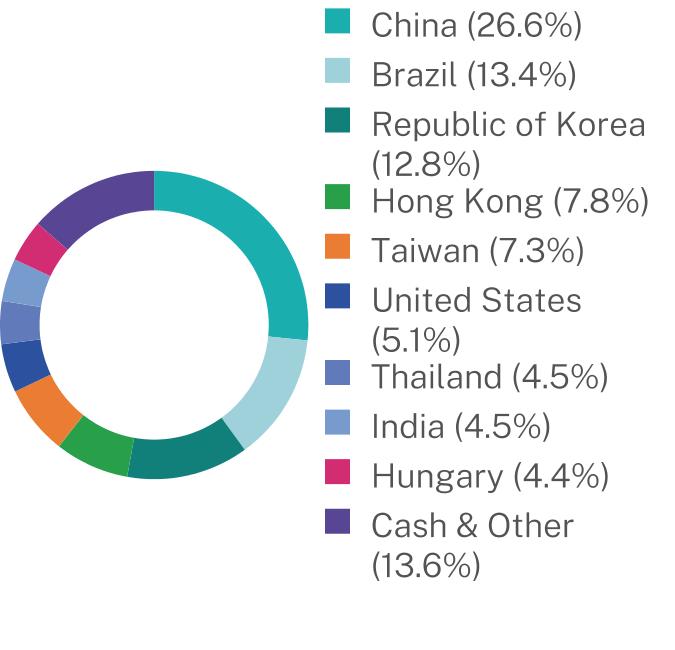

Institutional Class

|

$113

|

1.08%

|

|

Top Contributors

|

|

|

↑

|

Hon Hai Precision Industry Co., Ltd., Alibaba Group Holding Limited, Taiwan Semiconductor Manufacturing Co., Ltd.

|

|

Top Detractors

|

|

|

↓

|

Samsung Electronics Co., Ltd., PT Bank Rakyat Indonesia (Persero) Tbk Class B, Hankook Tire & Technology Co., Ltd.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

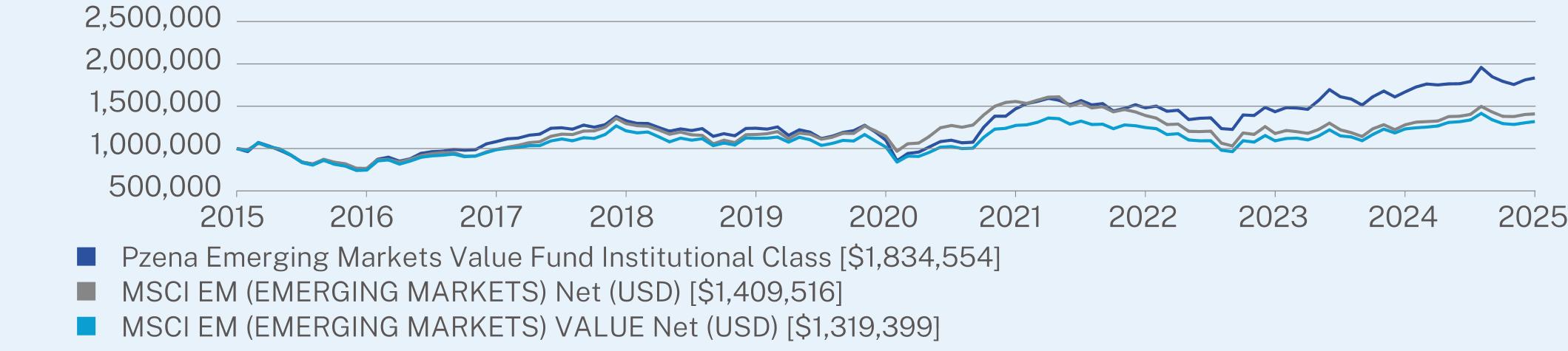

Pzena Emerging Markets Value Fund - Institutional Class

|

9.92

|

10.82

|

6.26

|

|

MSCI EM (EMERGING MARKETS) Net (USD)

|

10.07

|

4.26

|

3.49

|

|

MSCI EM (EMERGING MARKETS) VALUE Net (USD)

|

7.05

|

5.33

|

2.81

|

|

Net Assets

|

$2,137,973,654

|

|

Number of Holdings

|

65

|

|

Net Advisory Fee

|

$18,965,253

|

|

Portfolio Turnover

|

22%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Samsung Electronics Co., Ltd.

|

3.8%

|

|

China Overseas Land & Investment, Ltd.

|

3.7%

|

|

Alibaba Group Holding, Ltd.

|

3.6%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

3.5%

|

|

Weichai Power Co., Ltd.

|

2.9%

|

|

Ambev S.A.

|

2.7%

|

|

WH Group, Ltd.

|

2.6%

|

|

Cognizant Technology Solutions Corp.

|

2.6%

|

|

First American Government Obligations Fund - Class X

|

2.5%

|

|

China Merchants Bank Co., Ltd.

|

2.3%

|

|

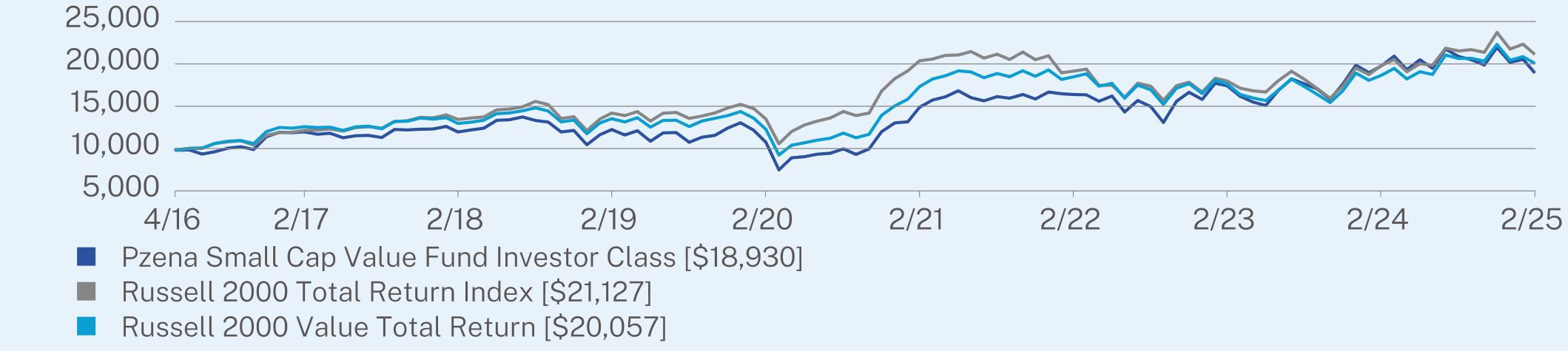

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$128

|

1.31%

|

|

Top Contributors

|

|

|

↑

|

CNO Financial Group, Inc., Columbia Banking System, Inc., Old National Bancorp

|

|

Top Detractors

|

|

|

↓

|

JELD-WEN Holding, Inc., Adient plc, Olin Corporation

|

|

|

1 Year

|

5 Year

|

Since Inception

(04/27/2016) |

|

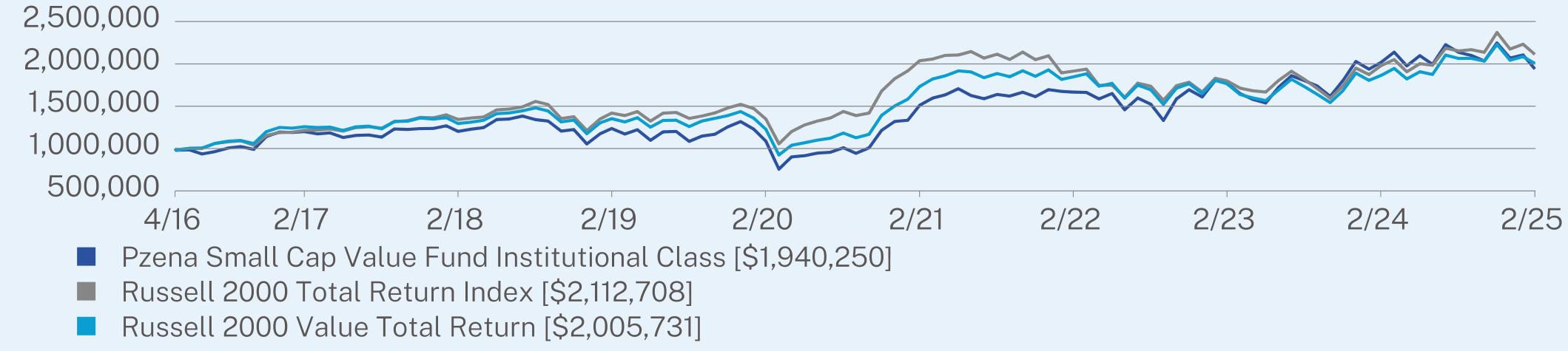

Pzena Small Cap Value Fund - Investor Class

|

-4.15

|

11.98

|

7.48

|

|

Russell 2000 Total Return Index

|

6.69

|

9.39

|

8.83

|

|

Russell 2000 Value Total Return

|

7.58

|

10.32

|

8.19

|

|

Net Assets

|

$60,826,198

|

|

Number of Holdings

|

49

|

|

Net Advisory Fee

|

$314,713

|

|

Portfolio Turnover

|

30%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

First American Government Obligations Fund - Class X

|

3.9%

|

|

CNO Financial Group, Inc.

|

3.6%

|

|

Korn Ferry

|

3.1%

|

|

Spectrum Brands Holdings, Inc.

|

3.0%

|

|

Advance Auto Parts, Inc.

|

2.9%

|

|

Adient PLC

|

2.9%

|

|

Old National Bancorp of Indiana

|

2.9%

|

|

Douglas Dynamics, Inc.

|

2.8%

|

|

MRC Global, Inc.

|

2.8%

|

|

Associated Banc-Corp.

|

2.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$98

|

1.00%

|

|

Top Contributors

|

|

|

↑

|

CNO Financial Group, Inc., Columbia Banking System, Inc., Old National Bancorp

|

|

Top Detractors

|

|

|

↓

|

JELD-WEN Holding, Inc., Adient plc, Olin Corporation

|

|

|

1 Year

|

5 Year

|

Since Inception

(04/27/2016) |

|

Pzena Small Cap Value Fund - Institutional Class

|

-3.90

|

12.27

|

7.79

|

|

Russell 2000 Total Return Index

|

6.69

|

9.39

|

8.83

|

|

Russell 2000 Value Total Return

|

7.58

|

10.32

|

8.19

|

|

Net Assets

|

$60,826,198

|

|

Number of Holdings

|

49

|

|

Net Advisory Fee

|

$314,713

|

|

Portfolio Turnover

|

30%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

First American Government Obligations Fund - Class X

|

3.9%

|

|

CNO Financial Group, Inc.

|

3.6%

|

|

Korn Ferry

|

3.1%

|

|

Spectrum Brands Holdings, Inc.

|

3.0%

|

|

Advance Auto Parts, Inc.

|

2.9%

|

|

Adient PLC

|

2.9%

|

|

Old National Bancorp of Indiana

|

2.9%

|

|

Douglas Dynamics, Inc.

|

2.8%

|

|

MRC Global, Inc.

|

2.8%

|

|

Associated Banc-Corp.

|

2.7%

|

|

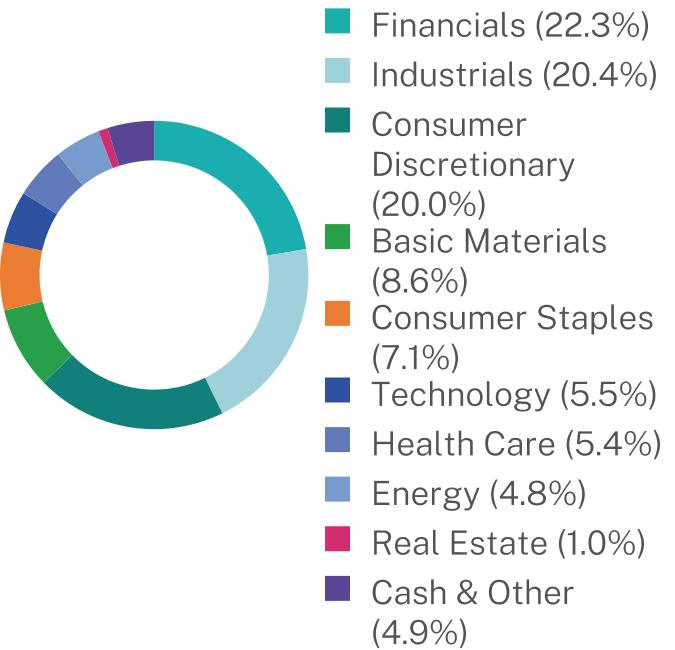

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$150

|

1.44%

|

|

Top Contributors

|

|

|

↑

|

BPER Banca S.p.A., Unicaja Banco S.A., Yue Yuen Industrial (Holdings) Limited

|

|

Top Detractors

|

|

|

↓

|

ams-OSRAM AG, Nexity SA, Umicore SA

|

|

|

1 Year

|

5 Year

|

Since Inception

(07/02/2018) |

|

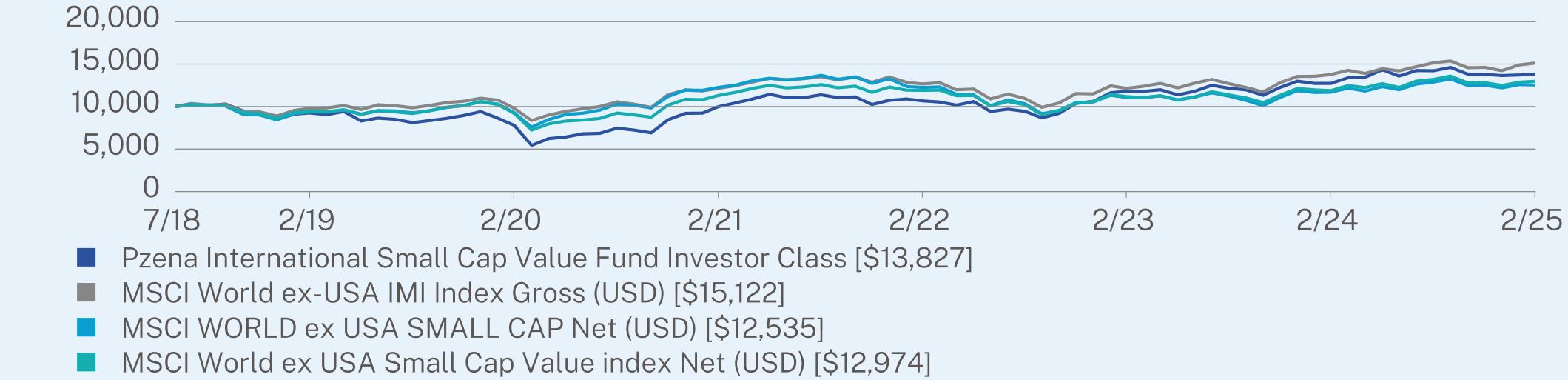

Pzena International Small Cap Value Fund - Investor Class

|

8.66

|

12.17

|

4.99

|

|

MSCI World ex-USA IMI Index Gross (USD)

|

9.74

|

9.08

|

6.41

|

|

MSCI WORLD ex USA SMALL CAP Net (USD)

|

7.13

|

6.20

|

3.45

|

|

MSCI World ex USA Small Cap Value index Net (USD)

|

9.27

|

7.11

|

3.99

|

|

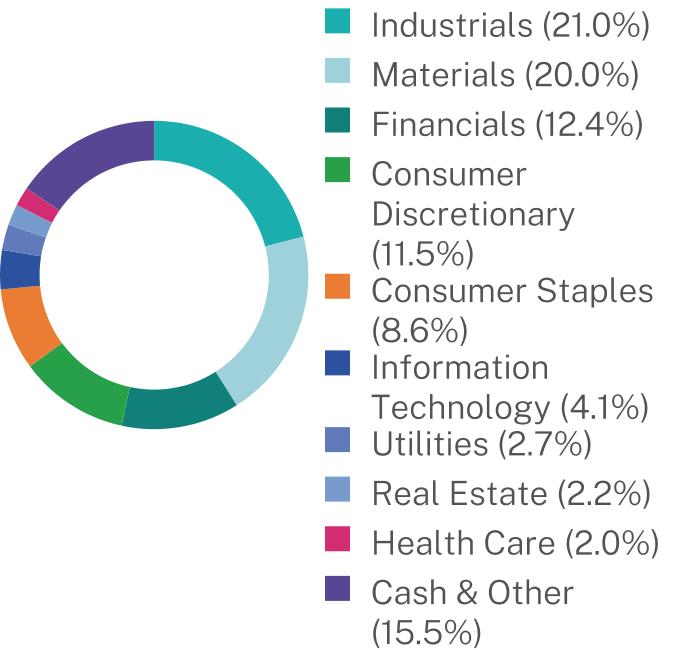

Net Assets

|

$64,146,738

|

|

Number of Holdings

|

47

|

|

Net Advisory Fee

|

$94,100

|

|

Portfolio Turnover

|

39%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

First American Government Obligations Fund - Class X

|

25.0%

|

|

Origin Enterprises PLC

|

3.5%

|

|

Senior PLC

|

3.4%

|

|

Signify N.V.

|

3.0%

|

|

Pennon Group PLC

|

2.7%

|

|

C&C Group PLC

|

2.6%

|

|

Sabre Insurance Group PLC

|

2.6%

|

|

Elders Ltd.

|

2.5%

|

|

Nexity SA

|

2.2%

|

|

Anima Holding S.p.A.

|

2.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$121

|

1.16%

|

|

Top Contributors

|

|

|

↑

|

BPER Banca S.p.A., Unicaja Banco S.A., Yue Yuen Industrial (Holdings) Limited

|

|

Top Detractors

|

|

|

↓

|

ams-OSRAM AG, Nexity SA, Umicore SA

|

|

|

1 Year

|

5 Year

|

Since Inception

(07/02/2018) |

|

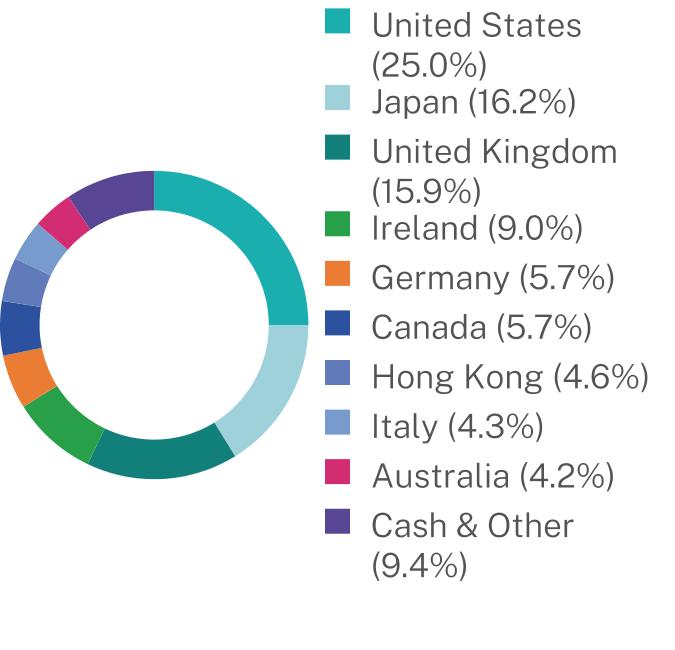

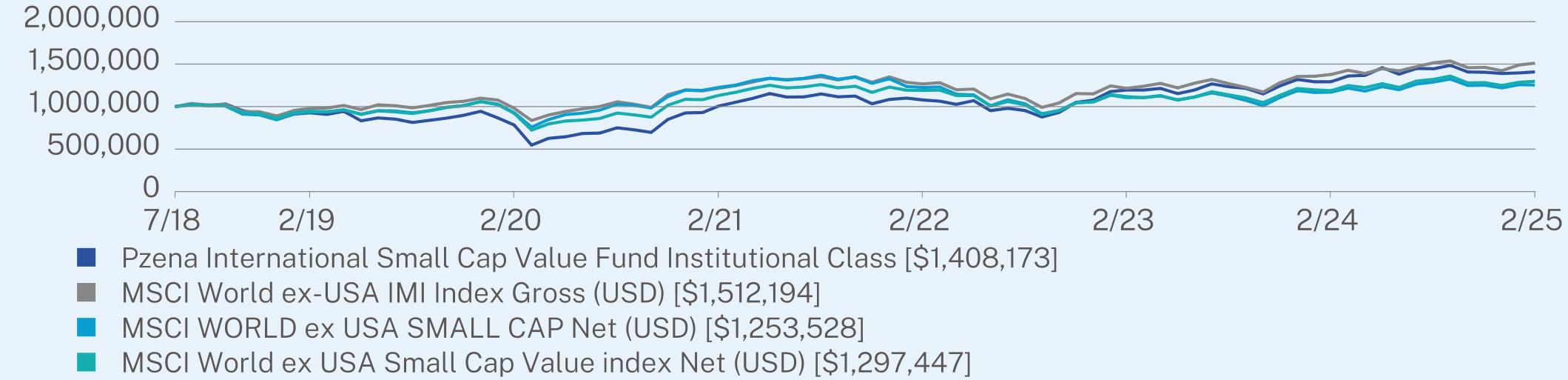

Pzena International Small Cap Value Fund - Institutional Class

|

8.99

|

12.46

|

5.27

|

|

MSCI World ex-USA IMI Index Gross (USD)

|

9.74

|

9.08

|

6.41

|

|

MSCI WORLD ex USA SMALL CAP Net (USD)

|

7.13

|

6.20

|

3.45

|

|

MSCI World ex USA Small Cap Value index Net (USD)

|

9.27

|

7.11

|

3.99

|

|

Net Assets

|

$64,146,738

|

|

Number of Holdings

|

47

|

|

Net Advisory Fee

|

$94,100

|

|

Portfolio Turnover

|

39%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

First American Government Obligations Fund - Class X

|

25.0%

|

|

Origin Enterprises PLC

|

3.5%

|

|

Senior PLC

|

3.4%

|

|

Signify N.V.

|

3.0%

|

|

Pennon Group PLC

|

2.7%

|

|

C&C Group PLC

|

2.6%

|

|

Sabre Insurance Group PLC

|

2.6%

|

|

Elders Ltd.

|

2.5%

|

|

Nexity SA

|

2.2%

|

|

Anima Holding S.p.A.

|

2.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$108

|

0.99%

|

|

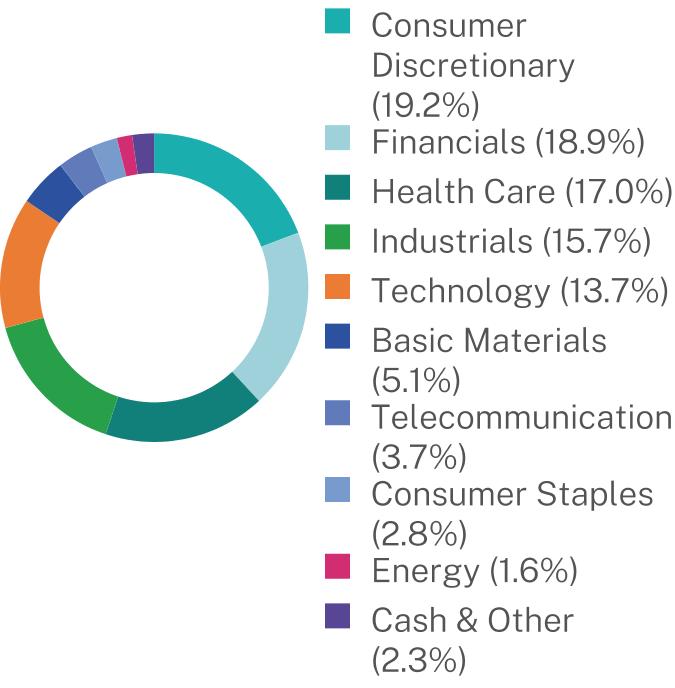

Top Contributors

|

|

|

↑

|

Hon Hai Precision Industry Co., Ltd. Sponsored GDR RegS, Alibaba Group Holding Limited, CaixaBank SA

|

|

Top Detractors

|

|

|

↓

|

Magna International Inc., Randstad NV, Galaxy Entertainment Group Limited

|

|

|

1 Year

|

Since Inception

(06/28/2021) |

|

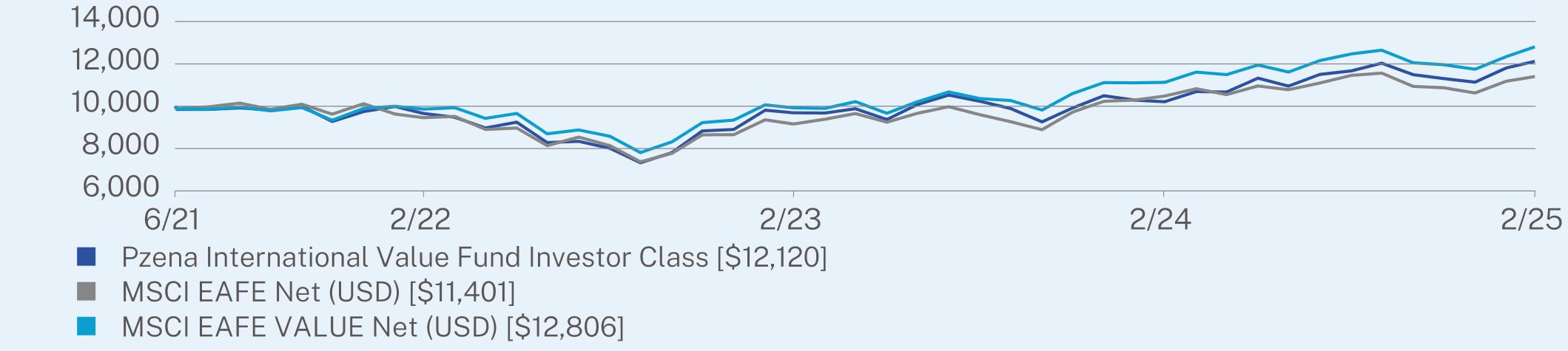

Pzena International Value Fund - Investor Class

|

18.67

|

5.38

|

|

MSCI EAFE Net (USD)

|

8.77

|

3.64

|

|

MSCI EAFE VALUE Net (USD)

|

15.09

|

6.97

|

|

Net Assets

|

$98,499,998

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$358,480

|

|

Portfolio Turnover

|

21%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Daimler Truck Holding AG

|

3.2%

|

|

Roche Holding AG

|

2.8%

|

|

Sanofi

|

2.8%

|

|

Alibaba Group Holding, Ltd.

|

2.7%

|

|

BASF SE

|

2.7%

|

|

Reckitt Benckiser Group PLC

|

2.6%

|

|

Teleperformance SE

|

2.6%

|

|

HSBC Holdings PLC

|

2.5%

|

|

CaixaBank S.A.

|

2.5%

|

|

Bank of Ireland Group PLC

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$81

|

0.74%

|

|

Top Contributors

|

|

|

↑

|

Hon Hai Precision Industry Co., Ltd. Sponsored GDR RegS, Alibaba Group Holding Limited, CaixaBank SA

|

|

Top Detractors

|

|

|

↓

|

Magna International Inc., Randstad NV, Galaxy Entertainment Group Limited

|

|

|

1 Year

|

Since Inception

(06/28/2021) |

|

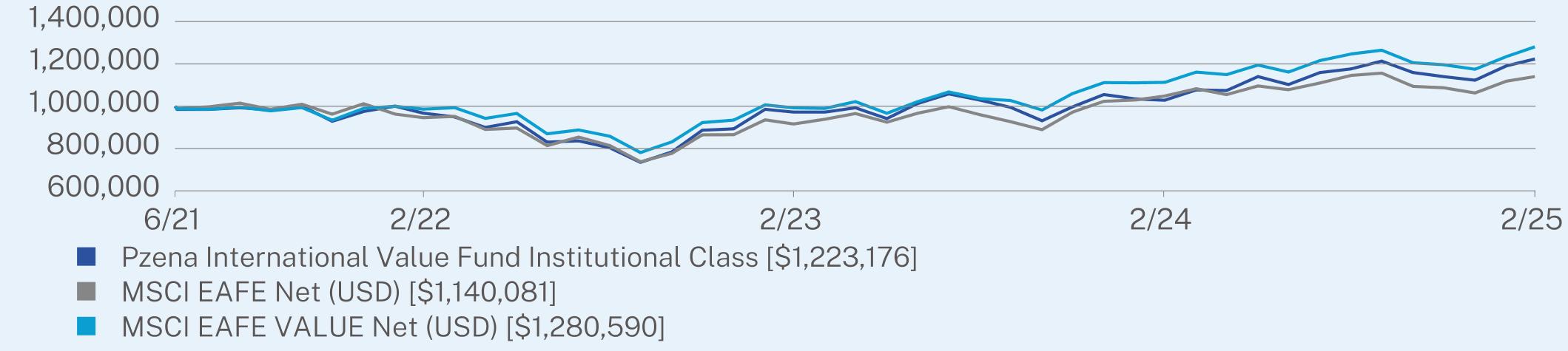

Pzena International Value Fund - Institutional Class

|

18.97

|

5.64

|

|

MSCI EAFE Net (USD)

|

8.77

|

3.64

|

|

MSCI EAFE VALUE Net (USD)

|

15.09

|

6.97

|

|

Net Assets

|

$98,499,998

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$358,480

|

|

Portfolio Turnover

|

21%

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Daimler Truck Holding AG

|

3.2%

|

|

Roche Holding AG

|

2.8%

|

|

Sanofi

|

2.8%

|

|

Alibaba Group Holding, Ltd.

|

2.7%

|

|

BASF SE

|

2.7%

|

|

Reckitt Benckiser Group PLC

|

2.6%

|

|

Teleperformance SE

|

2.6%

|

|

HSBC Holdings PLC

|

2.5%

|

|

CaixaBank S.A.

|

2.5%

|

|

Bank of Ireland Group PLC

|

2.3%

|