| SHAREHOLDER TRANSACTION EXPENSES | I Share | S Share | U Share | U-2 Share | D Share | ||||||

| Maximum sales load imposed on purchases(1) | None | 3.50 | % | None | 2.50 | % | None | ||||

| Maximum early repurchase fee(2) | 2.00 | % | 2.00 | % | 2.00 | % | 2.00 | % | 2.00 | % |

| (1) | Investors purchasing Class S Shares may be charged a sales load of up to 3.50% of the amount invested and investors purchasing Class U-2 Shares may be charged a sales load of up to 2.50% of the amount invested. The table assumes the maximum sales load is charged. The Distributor may, in its discretion, waive all or a portion of the sales load for certain investors. No upfront sales load will be paid with respect to Class D Shares, Class I Shares and Class U Shares, however, if you buy Class D Shares or Class U Shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine. Financial intermediaries will not charge such fees on Class I Shares. Your financial intermediary may impose additional charges when you purchase Shares. Please consult your financial intermediary for additional information. See “Plan of Distribution.” |

| (2) | A 2.00% early repurchase fee payable to the Fund will be charged with respect to the repurchase of a Shareholder’s Shares at any time prior to the day immediately preceding the one-year anniversary of the Shareholder’s purchase of the Shares (on a “first in-first out” basis). An early repurchase fee payable by a Shareholder may be waived by the Fund, in circumstances where the Board determines that doing so is in the best interests of the Fund and in a manner as will not discriminate unfairly against any Shareholder. The early repurchase fee will be retained by the Fund for the benefit of the remaining Shareholders. |

|

ANNUAL FUND EXPENSES |

|||||||||||

| Management Fee(3) | 1.60 | % | 1.60 | % | 1.60 | % | 1.60 | % | 1.60 | % | |

| Acquired Fund Fees and Expenses(4) | 0.06 | % | 0.06 | % | 0.06 | % | 0.06 | % | 0.06 | % | |

| Interest payments on borrowed funds(5) | 0.36 | % | 0.36 | % | 0.36 | % | 0.36 | % | 0.36 | % | |

| Other expenses(6) | |||||||||||

| Distribution and Servicing Fee(7) | None | 0.85 | % | 0.75 | % | 0.75 | % | 0.25 | % | ||

| Remaining other expenses | 1.20 | % | 1.20 | % | 1.20 | % | 1.20 | % | 1.20 | % | |

| Total annual fund expenses | 3.22 | % | 4.07 | % | 3.97 | % | 3.97 | % | 3.47 | % | |

| Less expense limitation and reimbursement(8)(9) | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | |

| Total net annual fund expenses | 3.22 | % | 4.07 | % | 3.97 | % | 3.97 | % | 3.47 | % |

| (3) | The “Management Fee” includes the Fund’s pro-rata portion of the Management Fee payable by the Master Fund. In light of the Advisers’ arrangements with the Master Fund and the fact that the Fund will seek to achieve its investment objective by investing substantially all of its assets in the Master Fund, the Advisers will not charge the Fund a fee for the investment management services provided to the Fund. For any assets of the Fund that are not invested in the Master Fund, the Feeder Fund Management Agreement provides that the Adviser will be entitled to a management fee that is calculated in the same manner as the Management Fee. |

| (4) | The acquired fund fees and expenses are the expenses indirectly incurred by the Fund as a result of the Master Fund’s investments in the underlying Infrastructure Funds. The AFFE are based on estimated amounts for the Fund’s current fiscal year. Some or all of the Infrastructure Funds in which the Fund intends to invest charge carried interests, incentive fees or allocations based on the Infrastructure Funds’ performance. The Infrastructure Funds in which the Fund intends to invest generally charge a management fee of 1.00% to 2.00% based on committed capital, and approximately 15% to 20% of net profits as a carried interest allocation. The AFFE disclosed above are based on historic returns of the Infrastructure Funds in which the Fund invests, which may change substantially over time, therefore, significantly affecting AFFE. The AFFE shown in the expense table above reflects operating expenses of Infrastructure Funds (e.g., management fees, administration fees and professional and other direct, fixed fees and expenses of Infrastructure Funds) and does not reflect any performance-based compensation or carried interest or allocations paid by the Infrastructure Funds that are calculated solely on the realization and/or distribution of gains, or on the sum of such gains and unrealized appreciation of assets distributed in-kind. As such, performance-based compensation or carried interest allocations for a particular period may be unrelated to the cost of investing in the Infrastructure Funds. The total annual expenses in this fee table are different from the ratio of expenses to average net assets given in the Financial Highlights, because the Financial Highlights do not include acquired fund fees and expenses. |

| (5) | These expenses represent estimated interest payments the Fund expects to incur in connection with its pro rata share of the Master Fund’s expected use of a credit facility during the current fiscal year. See “GCM Grosvenor and the GCM Grosvenor Infrastructure Platform—Leverage.” |

| (6) | The Other Expenses include, among other things, professional fees and other expenses that the Fund will bear, including initial and ongoing offering costs and fees and expenses of the transfer agent and custodian and includes amounts that the Fund (or the Master Fund, as applicable) reimburses to the Adviser for administrative services that the Adviser provides or arranges to be provided to the Fund (or the Master Fund, as applicable). Other Expenses are estimated for the current fiscal year and may vary. |

| (7) | The Fund charges a Distribution and Servicing Fee pursuant to a distribution and servicing plan adopted pursuant to Rule 12b-1 under the 1940 Act. Class S Shares, Class U Shares, Class U-2 Shares and Class D Shares will pay a Distribution and Servicing Fee that will accrue at an annual rate equal to 0.85%, 0.75%, 0.75% and 0.25%, respectively, of the Fund’s average daily net assets attributable to such Class of Shares and is payable on a quarterly basis. The Fund may use these fees, in respect of the relevant Class, to compensate the Fund’s Distributor and/or other qualified recipients for distribution-related expenses and providing ongoing services in respect of clients with whom they have distributed such Class of Shares. Class I Shares are not subject to the Distribution and Servicing Fee. See “Plan of Distribution.” |

| (8) | The Master Fund bears all expenses of the Fund, including the Fund’s organizational costs and ongoing operating and offering costs, including, among other things, legal, accounting, printing and other expenses. However, the Fund, and not the Master Fund, will be responsible for operating expenses associated solely with respect to a specific class of Shares. The Adviser has entered into an Expense Limitation and Reimbursement Agreement with the Fund with a term ending one-year from the initial closing date for subscriptions for Shares. The Adviser may extend the Limitation Period for a period of one year on an annual basis. Under the Expense Limitation and Reimbursement Agreement, the Adviser will, subject to possible reimbursement by the Fund as described below, waive fees and/or it or its affiliate will pay, absorb or reimburse expenses of the Fund (including the Fund’s share of the ordinary operating expenses of the Master Fund). The Expense Limitation and Reimbursement Agreement limits the amount of the aggregate Operating Expenses of each Class of Shares during the Limitation Period to an amount not to exceed 1.0% of the respective Class’s daily net assets on an annualized basis (the “Expense Cap”). “Specified Expenses” that are not covered by the Expense Limitation and Reimbursement Agreement include: (i) the Fund’s pro rata portion of the Master Fund’s fees and expenses not otherwise borne by the Adviser or its affiliates, including the Management Fee and those other fees and expenses disclosed herein under “Fund Expenses”; (ii) all fees and expenses of the investments in which the Fund invests (including the underlying fees of Infrastructure Funds, Infrastructure Assets and other investments); (iii) transactional costs, including legal costs and brokerage commissions, associated with the acquisition and disposition of Infrastructure Funds, Infrastructure Assets and other investments; (iv) interest payments incurred on borrowing by the Fund; (v) fees and expenses incurred in connection with a credit facility, if any, obtained by the Fund; (vi) distribution and/or shareholder servicing fees, as applicable; (vii) taxes; and (viii) extraordinary expenses resulting from events and transactions that are distinguished by their unusual nature and by the infrequency of their occurrence, including, without limitation, costs incurred in connection with any claim, litigation, arbitration, mediation, government investigation or similar proceeding, indemnification expenses, and expenses in connection with holding and/or soliciting proxies for all annual and other meetings of Shareholders. If the Fund’s aggregate Operating Expenses, exclusive of the Specified Expenses, in respect of any class of Shares for any month exceeds the Expense Cap applicable to that class of Shares, the Adviser will waive fees or pay or reimburse expenses of the Fund to the extent necessary to eliminate such excess. The Adviser or its affiliates may also directly pay expenses on behalf of the Fund and waive reimbursement under the Expense Limitation and Reimbursement Agreement. To the extent that the Adviser waives fees, reimburses expenses to the Fund or the Adviser or its affiliates pay expenses directly on behalf of the Fund, it is permitted to recoup from the Fund any such amounts for a period not to exceed three years from the month in which such fees and expenses were waived, reimbursed or paid, even if such recoupment occurs after the termination of the Limitation Period. However, the Adviser may only recoup the waived fees, reimbursed expenses or directly paid expenses in respect of the applicable class of Shares if the ordinary Operating Expenses have fallen to a level below the Expense Cap and the recouped amount does not raise the aggregate level of ordinary Operating Expenses in respect of a class of Shares in the month of recoupment to a level that exceeds any expense cap applicable at such time. The Adviser and the Board have approved the continuance of the Expense Limitation and Reimbursement Agreement through at least July 31, 2026. The Expense Limitation and Reimbursement Agreement may be terminated only by the Board on notice to the Adviser. |

| (9) | The expense cap applicable to the Master Fund’s Expense Limitation and Reimbursement Agreement with the Adviser is calculated separately from the Fund’s Expense Cap. As described in footnote 8 above, the expenses of the Master Fund are excluded from the Fund’s Expense Cap. The values in the table above reflect the impact of the Master Fund’s Expense Limitation and Reimbursement Agreement with the Adviser which limits the amount of the aggregate Operating Expenses of interests issued by the Master Fund during the Limitation Period to an amount not to exceed 1.0% of such interest’s daily net assets on an annualized basis. See “Fund Expenses” for additional information. |

Example:

The purpose of the table above and the example below is to assist prospective investors in understanding the various costs and expenses Shareholders will bear. The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assume that all distributions are reinvested at net asset value and that the percentage amounts listed under Annual Expenses remain the same (except that the examples incorporate the fee waiver and expense reimbursement arrangements from the Expense Limitation and Reimbursement Agreement for only the one-year example and the first year of the three-, five- and ten-year examples).

The following example illustrates the hypothetical expenses that you would pay on a $1,000 investment assuming annual expenses attributable to Shares remain unchanged and Shares earn a 5% annual return (the Example assumes the Fund’s Expense Limitation and Reimbursement Agreement will remain in effect for only one year):

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| Class I | $ | 32 | $ | 99 | $ | 168 | $ | 352 | ||||||||

| Class S | $ | 74 | $ | 154 | $ | 236 | $ | 447 | ||||||||

| Class U | $ | 40 | $ | 121 | $ | 204 | $ | 418 | ||||||||

| Class U-2 | $ | 64 | $ | 143 | $ | 224 | $ | 433 | ||||||||

| Class D | $ | 35 | $ | 107 | $ | 180 | $ | 375 | ||||||||

The example and the expenses in the table above should not be considered a representation of the Fund’s future expenses, and actual expenses may be greater or less than those shown. The example above exclude the early repurchase fee which would apply if Shares were repurchased within one year of their purchase. If an investor’s Shares are repurchased within one year of their purchase, the Shares would incur the 2.00% early repurchase fee. While the example assumes a 5.0% annual return, as required by the SEC, the Fund’s performance will vary and may result in a return greater or less than 5.0%. For a more complete description of the various fees and expenses borne directly and indirectly by the Fund, see “Fund Expenses” and “Advisory Arrangements.”

The purpose of the table above and the example below is to assist prospective investors in understanding the various costs and expenses Shareholders will bear. The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assume that all distributions are reinvested at net asset value and that the percentage amounts listed under Annual Expenses remain the same (except that the examples incorporate the fee waiver and expense reimbursement arrangements from the Expense Limitation and Reimbursement Agreement for only the one-year example and the first year of the three-, five- and ten-year examples).

INVESTMENT OBJECTIVE, OPPORTUNITIES AND STRATEGIES

Investment Objective

The Fund’s investment objective is to seek to provide current income and long-term capital appreciation.

The Fund pursues its investment objective by investing substantially all of its assets in the Master Fund. The Master Fund has the same investment objective and substantially the same investment policies as the Fund. This form of investment structure is commonly known as a “master-feeder fund” arrangement. The investment objectives of the Fund and of the Master Fund are not fundamental and may be changed without shareholder approval.

Investment Strategy

The Fund will seek to achieve its investment objective by generating attractive risk-adjusted returns and current income through a variety of direct and indirect investments in infrastructure and infrastructure-related assets or businesses (collectively, “Infrastructure Assets”) including but not limited to investment opportunities in the transportation, digital infrastructure, energy and energy transition, supply chain / logistics and infrastructure adjacent businesses (e.g. social infrastructure and infrastructure services businesses), including without limitation, the sectors contained in “Targeted Infrastructure Sectors” below. A “risk-adjusted return” measures an investment’s return after taking into account the degree of risk that was taken to achieve it.

The Fund expects that it will primarily obtain its exposure to Infrastructure Assets through directly acquired Originated Investments, Co-Investments, and Single-Asset Secondaries (each as defined below) and, to a lesser extent over time, investments in portfolios, funds or other investment vehicles that make or hold investments in multiple Infrastructure Assets (“Infrastructure Funds”), primarily through Multi-Asset Secondaries. Infrastructure Assets and Infrastructure Funds are collectively referred to throughout as “Infrastructure Investments”. Investments in Infrastructure Assets will generally be made in the Organisation for Economic Co-operation and Development (“OECD”) countries, principally in North America and Europe.

The Fund intends to invest a portion of its assets in liquid investments, including cash, cash equivalents, fixed income securities and other credit instruments, other short term investments, mutual funds and listed companies such as exchange-traded funds (“ETFs”) and master-limited partnerships (“MLPs”) (collectively, “Liquid Investments”).

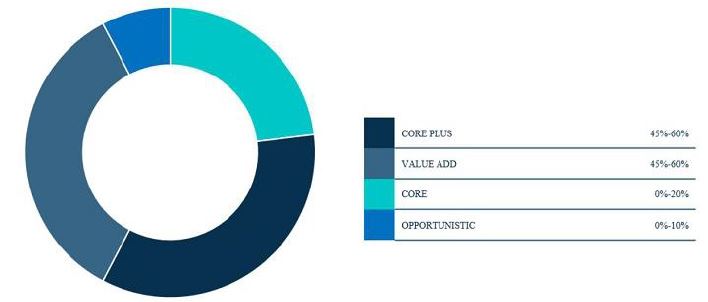

The Fund’s investments are expected to primarily be allocated amongst Infrastructure Assets that have core plus and value added risk profiles, and to a lesser extent, core risk profiles. Core risk profiles include operating businesses with predictable cash flows, driven by long term contracts or pricing set by regulatory bodies. Core risk profile assets typically demonstrate strong cash yield, given the predictable nature of their cash flows. Core-plus risk profiles offer characteristics similar to core assets, but the duration of the contractual or regulatory protection around their cash flows is typically shorter, which requires some assumptions around recontracting. The uncertainty associated with recontracting outcomes typically causes buyers to seek higher returns on these assets. Value added risk profiles are characterized by assets that exhibit traditional infrastructure characteristics such as high barriers to entry or provision of essential services, but typically also require the buyer to assume construction risk or growth in some other fashion (merger and acquisition, operational improvements or efficiencies, etc.). Given the execution risk associated with these opportunities, returns are underwritten to higher levels than core plus assets.

The Fund expects to invest across a variety of investment types, Sponsor Managers (as defined below), investment stages, deal sizes and geographies. The Fund expects to make the majority of its investments in previously developed infrastructure or infrastructure-related assets or businesses that generate cash flows, but where investors may seek to increase revenue and/or reduce expenses by creating operating efficiencies, acquiring new equipment making modifications or repurposing of the asset (such investments, “Brownfield” stage investments). A small portion of the Fund’s investments may be made into new projects requiring development and construction that may not be cash flowing at the time of investment (such investments, “Greenfield” stage investments).

The Fund expects to primarily invest in equity or equity-like instruments issued by Infrastructure Assets, but may also invest in debt instruments issued by Infrastructure Assets. The Fund can invest in issuers of any size or market capitalization. The Fund may invest in debt securities of any credit quality, including lower-rated or non-rated debt securities which are commonly referred to as “junk” bonds.

Since the Fund seeks to achieve its investment objective by investing in Infrastructure Assets, the Fund has adopted a fundamental policy to concentrate in infrastructure industries. In addition, under normal circumstances, the Fund intends to invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity or debt securities issued by Infrastructure Investments. The Fund intends to count the value of any money market funds, cash, other cash equivalents or U.S. Treasury securities with remaining maturities of one year or less that cover unfunded commitments to invest equity in Infrastructure Funds or special purpose vehicles controlled by unaffiliated general partners that will acquire an Infrastructure Investment, in each case that the Fund reasonably expects to be called in the future, as qualifying Infrastructure Investments for purposes of its 80% policy. The Fund may invest in Infrastructure Assets directly or indirectly through investment vehicles, including but not limited to affiliated or unaffiliated mutual funds and ETFs. An Infrastructure Asset will directly or indirectly derive at least 50% of its revenues from, or devote at least 50% of its assets to, infrastructure or infrastructure-related assets or businesses. The Fund defines infrastructure as an asset or investment that primarily comprises physical facilities, buildings, equipment, systems, networks and/or services and their associated operations in sectors and industries including energy, power, communication, transportation, social (e.g., education, hospitals, judicial buildings, arenas, housing, recreation, etc.), supply chain and associated logistics, water, waste and the sectors contained under “Targeted Infrastructure Sectors” below. This policy may be changed by the Board, and with at least 60 days’ prior notice to Shareholders. Compliance with this policy is tested no less frequently than quarterly, and is also applied at the time of investment; later percentage changes caused by a change in the value of the Fund’s assets, including as a result of the issuance or repurchase of Shares, will not require the Fund to dispose of an investment, however, the Fund will make future investments to come back into compliance as soon as reasonably practicable in accordance with Rule 35d-1 under the 1940 Act. The Fund and the Advisers do not guarantee any level of return or risk on investments and there can be no assurance that the Fund’s investment objective will be achieved or that the Fund’s investment program will be successful. For additional information on the types of Infrastructure Assets the Fund will invest in, see “Investment Objective, Opportunities and Strategies—Types of Investments”.

The portfolio will be allocated strategically by the Sub-Adviser, an experienced infrastructure investor with a track record in infrastructure investments dating back to 2003. The Sub-Adviser’s portfolio construction approach is designed to maintain a relatively high level of exposure to Infrastructure Assets while still maintaining appropriate portfolio liquidity to manage Shareholder redemptions. The Sub-Adviser will seek to follow a deliberate approach to portfolio construction focused on generating current yield, maximizing risk-adjusted returns and targeting a variety of investments.

With respect to its own investment restrictions, the Fund will “look through” to the Master Fund’s investments.

Infrastructure Opportunity

A confluence of factors, including economic growth, technological development, population shifts, and urbanization, continue to stress public funding sources, creating a unique and growing opportunity for private investment in infrastructure worldwide. The Global Infrastructure Hub, a not-for-profit organization formed by the G20, estimates that the global infrastructure investment spend will be $94 trillion through 2040, or approximately $3.7 trillion per year to close the current spending gap. The recognition of this capital need, together with the belief that Infrastructure Assets present compelling opportunities for long-term risk-adjusted returns has significantly increased both total inflows of private capital into the sector, as well as the ways in which such capital may be deployed.

The Advisers believe that this infrastructure funding gap, because of its size, presents a continued, growing opportunity for private capital investment in Infrastructure Assets. In response to this growth, the infrastructure market has seen strong inflows of capital and a proliferation of strategies for investing in the sector, including return-based strategies (yield, total return, super core, core, core plus, value added and opportunistic), sector specific strategies (energy, upstream, transportation, telecommunication), capital structure strategies (equity, senior credit, mezzanine and distressed debt), geography-based strategies (North America, Europe, Asia, emerging markets and OECD), development strategies, Greenfield and Brownfield strategies (see “—Target Portfolio Attributes—Target Stage”) and impact strategies (zero carbon, renewables, environmental, social and governance-focused, socially conscious, labor friendly). The Sub-Adviser’s broad sourcing capabilities (as outlined in further detail below) will provide the Fund opportunities to invest across the various specialized strategies, targeting the strategies where the risk reward profile is most attractive at any point in time, and creating a varied experience across the infrastructure investment landscape. A “Sponsor Manager” is an independent investment manager that (i) leads a transaction investing directly into an Infrastructure Asset, typically through a pooled investment vehicle managed by the Sponsor Manager or (ii) manages an Infrastructure Fund.

Within the varied set of strategies that make up the infrastructure market, the Advisers generally expect Infrastructure Assets eligible for inclusion in the Fund’s portfolio to satisfy the following conditions:

| ● | Underpinned by physical assets within a system of public works of a country, state or region; |

| ● | Provides essential services to the communities which they serve (e.g., utilities, power generation assets, transportation networks, waste management); and |

| ● | High barriers to entry resulting from a comprehensive regulatory framework, high costs of new construction, geographic limitations, long dated contractual incumbency, and/or limited access/transmission. |

By satisfying these criteria, the Advisers anticipate that the underlying Infrastructure Assets and/or businesses are likely to experience less volatility, less correlation with economic cycles, longer term, more predictable cash flows, and less exposure to commodity price fluctuations.

In the face of the infrastructure market’s funding gap, strategy proliferation and growing opportunity set, the Advisers believe that the Sub-Adviser’s deep sector expertise, proprietary relationships and sourcing mechanics across strategies, and disciplined approach to investment due diligence present the Fund with a unique opportunity to deliver a set of attractive investments and the opportunity to earn compelling risk adjusted returns.

Targeted Infrastructure Sectors

The infrastructure market has a robust and varied opportunity set today, driven by the factors outlined above. The Fund expects to invest principally across the following infrastructure sectors, where the Sub-Adviser’s team and broad network of relationships have deep asset-level knowledge and where strong secular trends drive a robust investment opportunity set. Within these broad sectors of the infrastructure space, the Sub-Adviser intends to employ a “sector agnostic” approach that allows it to assess each opportunity on a relative basis, selecting those that offer the most compelling risk and return profile at the relevant time.

| Sector | Risk/Return Profile | Opportunity Drivers |

| Transportation | ||

| Airports | Lower risk, core plus, valued added returns | Continuing need for modernization and growth, shortage of publicly available capital |

| Toll Roads / Bridges / Tunnels | Low to moderate risk, core returns | Modernization of outdated infrastructure, technological advances allowing for “managed lanes” and other similar solutions |

| Public Transport | Varied risk profile | Partnering opportunities with municipalities, including financing opportunities |

| Sector | Risk/Return Profile | Opportunity Drivers |

| Rail, Ferries | Risk profile may vary, core plus and value added returns | Disparate ownership, capital expenditure needs, shifting approach to cargo opportunities |

| Parking (on and off-street) | Varied risk return profiles, related to geographic location of assets | Partnering opportunities with municipalities and universities, optimization opportunities related to technology |

| Digital Infrastructure | ||

| Cell Towers | Moderate risk, core plus and value added returns | Critical backbone of enhanced data usage and 5G rollout |

| Transmission Networks | Moderate risk, opportunistic returns | Development opportunities, driven by increased data usage and long term contracts |

| Data Centers | Moderate risk, value added and opportunistic return profiles | Development opportunities underpinned by long term contracts, growing global need |

| Fiberoptics | Moderate risk, core plus returns | Aging existing infrastructure and increased usage create strong development and upgrade needs |

| Energy and Energy Transition | ||

| Electric transmission line | Generally lower risk unless construction required | Existing assets typically contracted for long term, new build opportunities where population centers are shifting and demand is growing |

| Electric/gas utilities | Lower risk, regulated rates of return | Opportunistic divestments and Co-Investments |

| Conventional power generation | Risk profile may vary, core plus and value added returns | Repowering opportunities, Greenfield opportunities, re-contracting opportunities |

| Renewable power generation | Moderate risk, core and core plus return profiles | Regulatory landscape, technological advancement, environmentally focused and impact-driven capital |

| Storage facilities | Opportunistic, subject to contract profiles | Shift to renewable energy creates a growing need for storage capacity; technology is still being developed |

| Supple Chain / Logistics | ||

| Warehouse / Cold Storage | Moderate risk, core and core plus return profiles | Growth of movement of agricultural and other refrigerated product, evolution of public platforms and further consolidation of a growing space |

| Ports | Moderate risk, core and core plus return profiles | Gross domestic product (“GDP”) linkage, capex requirements related to ship size and automation, operational efficiencies |

| Sector | Risk/Return Profile | Opportunity Drivers |

| Land Side Shipping | Core plus to value add risk profile and return opportunity | Continuing shift to ecommerce, greater movement of goods, near shoring opportunities |

| Fleet Management / Parking | Core plus to value add risk profile and return opportunity | Shift to electric fleets, need for consolidated and efficient parking/charging; continued progress in fleet management and technology driven efficiencies |

| Infrastructure Adjacencies | ||

| Services (“asset- lite” infra) | Higher risk, value add returns | Critical need for services to support existing infrastructure, but without underlying assets; opportunities to service renewable installations and other similar concepts |

| Infra Tech (“smart” infra, batteries, EV) | Higher risk, value add returns | Early stage technologies vying for scale and market share; barriers to entry still lower and opportunities to build dominant platforms |

| Real Estate / Social infra (housing, education, medical, recreation, waste management) | Moderate risk, core and core plus return profiles | Construction may create opportunity for higher returns, but projects typically supported by municipalities or universities with a critical need |

Targeted Risk-Reward Profiles

The infrastructure industry generally characterizes investments as core, core plus, value added and opportunistic based the risk profile for a given investment, as further described below. The Sub-Adviser expects to primarily target investments that the market would consider exhibiting core plus and value added risk profiles, and to a lesser extent, core risk profiles. Opportunistic risk profile investments are not expected to be a meaningful portion of the portfolio.

|

Profile |

Typical Attributes |

|

| Core |

● Low-risk businesses or assets with little operating risk ● Availability-based revenues from long-term contracts with highly creditworthy counterparties ● Strong cash yield, viewed as an investment alternative to debt ● Can have limited potential for outsized returns due to limited risk profile ● Typically fixed concessions (public-private partnerships) or perpetual assets (regulated utilities) |

|

| Core Plus |

● Downside protection from contracted cash flows ● Ability to enhance returns through asset optimization, new contracts, growth projects ● Generally has attractive cash yield, though typically lower than core ● Potentially greater exposure to volumetric risk, recontracting risk |

|

| Value Added |

● Assets or businesses with strong barriers to entry, though returns are driven much more by growth ● Contracted cash flows may have meaningful volumetric exposure ● May also have some exposure to uncontracted or merchant revenues |

|

| Opportunistic |

● Investments take on private equity-like risks, more reliant on management execution, realizing growth ● Meaningful exposure to uncontracted or merchant revenues |

Notwithstanding this general industry view, the Sub-Adviser believes that every asset and opportunity needs to be evaluated on its own merits, and as such, looks at the specific risk and return attributes of a given Infrastructure Asset in order to uncover asymmetries. The Sub-Adviser seeks to identify investments with these asymmetries—i.e., an investment opportunity that has a core/core-plus risk profile but believe can achieve a value added return profile—and seeks to construct a portfolio that achieves the targeted returns profile while minimizing the underlying risk profile.

Types of Investments

The Fund expects the majority of its portfolio will be comprised of directly acquired investments in Infrastructure Assets, which are implemented through Co-Investment, Single-Asset Secondary and Originated Investment structures that typically involve a single underlying asset or investment and, to a lesser extent, portfolio-level acquisitions of Infrastructure Assets through Multi-Asset Secondaries. Infrastructure Assets are generally long-lived physical assets that are valued for their tangible physical qualities in addition to their revenue generation and/or capital appreciation potential. Defining characteristics of Infrastructure Assets include: long useful lives, high barriers to entry, monopolistic market positioning, stable usage, inelastic demand, stable cash flows, and low long-term exposure to commodity prices. Relative to investments in Multi-Asset Secondaries, investments in directly acquired Infrastructure Assets typically involve a more detailed level of due diligence review on the single asset, afford the Fund greater ability to control portfolio construction and can offer a more fee efficient investment implementation (particularly for Co-Investments and Originated Investments).

Directly Acquired Investments

“Originated Investments” are investments that are directly originated by the Sub-Adviser’s infrastructure platform (the “GCM Grosvenor Infrastructure Platform”) and held via a direct interest. These Originated Investments may include a variety of investment structures, investment entry points and investment opportunities, including control investments, minority positions, joint ventures, co-bidding arrangements, preferred equity / debt investments, warehousing arrangements, or investments alongside other Sponsor Manager firms and their Infrastructure Funds. The Fund expects to take advantage of what it believes are the best opportunities within these various investment options to achieve what it believes are the best risk adjusted return. Originated Investments have the benefit of not bearing an additional layer of fees and expenses generally associated with investing in an Infrastructure Fund (although the Fund may still bear transactional expenses). Originated Investments and Co-Investments can be very similar and often differ based on the original sourcing, level of control, specific investment form, certain rights afforded to other Sponsor Manager(s), control of exit and related factors.

“Co-Investments” are investments made directly or indirectly into an Infrastructure Asset in partnership with a third-party Sponsor Manager. A Co-Investment is typically structured either as an investment directly into an Infrastructure Asset through a separate issuer organized as a special purpose vehicle (“SPV”) controlled by the Sponsor Manager. A “Sponsor Manager” is an independent investment manager that (i) leads a transaction investing directly into an Infrastructure Asset, typically through a pooled investment vehicle managed by the Sponsor Manager or (ii) manages an Infrastructure Fund. The Sponsor Manager may also offer third parties, such as GCM Grosvenor, the opportunity to co-invest alongside the Sponsor Manager in the transaction in order to raise the total necessary capital. Investing in Infrastructure Assets through Co-Investments can be a more fee-efficient way to invest than through Infrastructure Funds. While a Co-Investment opportunity is typically the same investment the Sponsor Manager makes for its Infrastructure Fund, co-investors typically will bear no additional layer of fees and expenses or a significantly reduced layer of fees and expenses compared to investing in an Infrastructure Asset through an Infrastructure Fund (although the Fund may still bear transactional expenses). As a result, a Co-Investment can provide exposure to the same underlying investment as an Infrastructure Fund managed by a Sponsor Manager, but in a more fee efficient implementation. Additionally, a portfolio of Co-Investments can include investments alongside a set of industry leading Sponsor Managers and Infrastructure Funds, as opposed to investing in a single Sponsor Manager’s Infrastructure Fund that creates concentration risk around that specific Sponsor Manager’s platform, strategy and other key attributes. The Fund will seek to invest in Co-Investments alongside a varied set of high-quality Sponsor Managers that the Advisers believe have an attractive risk / reward opportunity.

“Single-Asset Secondaries” are investments acquiring an interest in a fund vehicle or SPV that holds a single business or asset (or a group of affiliated businesses or assets) that is known prior to the investment. These investments can be made in a seasoned investment in an Infrastructure Asset or in a new investment vehicle set up specifically to acquire the identified asset. Due to the single asset nature of a Single-Asset Secondary, a greater level of information is typically available and a deeper level of due diligence can be performed compared to an Infrastructure Fund, similar to the diligence performed on other Infrastructure Assets implemented through Co-Investments or Originated Investments. Typically, a Single-Asset Secondary is executed at a discount to the investment’s current NAV in order to compensate the purchaser for providing the seller with liquidity and to compensate for and/or offset the additional layer of fees typically associated with an investment in an Infrastructure Fund. A Single-Asset Secondary acquired at a discount to its NAV may result in an unrealized gain the next time the Fund calculates its NAV. The Fund will seek to acquire Single-Asset Secondaries with attractive risk / reward profiles identified through the same rigorous sourcing and diligence process as those undertaken for Co-Investments and Originated Investments.

Portfolio Acquired Investments

The Fund may also invest in Infrastructure Assets through the acquisition of an existing portfolio of Infrastructure Assets via Multi-Asset Secondaries. Multi-Asset Secondaries are expected to be a smaller portion of the Fund’s Infrastructure Assets than Infrastructure Assets.

“Multi-Asset Secondaries” are investments acquiring an interest in multiple Infrastructure Assets, typically in the form of an interest in an Infrastructure Fund. In a Multi-Asset Secondary, the underlying Infrastructure Fund has typically been at least partially deployed into a set of multiple investments in Infrastructure Assets that are known prior to the Fund acquiring the interest in the Multi-Asset Secondary. The investment may also include a related unfunded commitment to an Infrastructure Fund. Similar to Single-Asset Secondaries, Multi-Asset Secondaries are typically executed at a discount to the portfolio’s current NAV in order to compensate the purchaser for providing the seller with liquidity and to compensate for and/or offset the additional layer of fees typically associated with an investment in an Infrastructure Fund. A Multi-Asset Secondary acquired at a discount to its NAV may result in an unrealized gain the next time the Fund calculates its NAV. Due to the fact that there are multiple investments included in a Multi-Asset Secondary, typically less information is provided by the selling party or the Sponsor Manager on the individual underlying assets, though the Sub-Adviser will still underwrite each Infrastructure Asset in the Multi-Asset Secondary based on the information provided by the Sponsor Manager. The Fund will seek to invest in Multi-Asset Secondaries where it has such an informational advantage or other reason to believe that the investment has an attractive risk/reward profile.

Multi-Asset Secondaries may include both traditional LP-led investments and investments through GP-led processes. LP-led Multi-Asset Secondaries include investments in existing portfolios of interests in Infrastructure Assets, with a focus on mature, largely funded positions. GP-led Multi-Asset Secondaries include secondary opportunities presented from general partner-led recapitalizations, asset sell downs, and platform combinations. These can include multiple assets currently owned by the Sponsor Manager or multi-asset fund continuation vehicles.

Target Portfolio Attributes

The Fund intends to pursue a varied pool of Infrastructure Investments that the Advisers believe represent an attractive risk / reward profile, take advantage of industry trends and seek to mitigate risk. The Sub-Adviser will seek to follow a deliberate approach to portfolio construction focused on generating current yield, maximizing risk-adjusted returns and targeting a variety of investments. As described above in Infrastructure Opportunity, the Sub-Adviser seeks to invest across a number of target sectors and intends to focus on core, core plus and value added risk profiles, while seeking asymmetric return profiles that target to exceed associated risk profiles. In sourcing portfolio investments, the Sub-Adviser expects to consider other important factors, such as limiting investments in Infrastructure Investments where the underlying asset(s) are unknown (i.e., blind pools), and managing the Fund’s exposure to any one investment structure, geography, and investment stage in an attempt to create a varied portfolio across individual investments and Sponsor Managers all as generally outlined below:

Target Investment Structure

As noted above, the Fund expects to primarily invest in equity or equity-like instruments issued by Infrastructure Assets. The Fund expects that these investments will primarily be made through private capital transactions. Under normal circumstances, with respect to the Fund’s investments in Infrastructure Assets, the Fund primarily expects, to be either an influential minority shareholder or controlling shareholder or to make such investments alongside Sponsor Managers and teams that are known well to the Sub-Adviser and that enjoy similar rights. The Fund expects that its investments in Multi-Asset Secondaries will primarily be made where the Sub-Adviser believes the portfolio of Infrastructure Assets or Sponsor Manager has a relative advantage compared to other investment funds or managers, such as differentiated investment strategy, strong record of performance, opportunistic pricing, relative value of the investment opportunity, unique access or relationships or other distinguishing factors.

As noted above, the Fund may also invest in debt instruments issued by Infrastructure Assets. The Fund expects that its investments in debt instruments will not exceed 20% of its total assets under normal conditions, though the Fund may exceed this limit to make investments that are underwritten by the investment team as equity investments but are structured in part as debt investments due to structuring, regulatory, tax, or similar factors unrelated to the underlying investment thesis. The Fund can invest in issuers of any size or market capitalization. The Fund may invest in debt securities at any part of a capital structure, including senior and mezzanine debt, and of any credit quality, including lower-rated or non-rated debt securities which are commonly referred to as “junk” bonds. The Sub-Adviser intends to source debt investments for the Fund where it believes the risk, return and yield profile of these investments can be accretive to the Fund’s overall portfolio construction, and where the capital structure provides added protection against adverse outcomes. The Fund may also invest in preferred equity, including structured investments.

Notwithstanding the foregoing, the actual percentage of the Fund’s portfolio that is invested in each investment type may from time to time be outside the levels provided above due to factors such as a large inflow of capital over a short period of time, the Advisers’ assessment of the relative attractiveness of opportunities, or an increase in anticipated cash requirements or repurchase requests. Certain investments, such as preferred equity investments, could be characterized as either equity or debt depending on the terms and characteristics of such investments.

The Fund may make investments directly or indirectly through one or more wholly owned subsidiaries (each, a “Subsidiary” and collectively, the “Subsidiaries”). The Fund may form a Subsidiary in order to pursue its investment objective and strategies in a potentially tax-efficient manner or for the purpose of facilitating its use of permitted borrowings, such as through a credit facility, or to act as a tax blocker to facilitate compliance with the RIC gross income test in relation to the income earned in respect of certain Infrastructure Assets. Certain Subsidiaries may not be consolidated for income tax purposes and may incur income tax expense as a result of their ownership of Infrastructure Assets. If the Fund uses one or more Subsidiaries to make investments, they will bear their respective organizational and operating fees, costs, expenses and liabilities and, as a result, the Fund will indirectly bear these fees, costs, expenses and liabilities. As the Subsidiaries are wholly owned, they have the same investment strategies as the Fund. The Fund and its Subsidiaries will be subject to the same investment restrictions and limitations on a consolidated basis. In addition, the Subsidiaries are consolidated subsidiaries of the Fund and the Fund complies with the provisions of the 1940 Act governing capital structure and leverage on an aggregate basis with the Subsidiaries. The Advisers comply with the provisions of the 1940 Act relating to investment advisory contracts as an investment adviser to the Fund and to each of the Subsidiaries under Section 2(a)(20) of the 1940 Act. The Subsidiaries comply with the provisions relating to affiliated transactions and custody of the 1940 Act. The Bank of New York Mellon serves as the custodian to the Subsidiaries and the Fund. The Fund does not intend to create or acquire primary control of any entity which engages in investment activities in securities or other assets other than entities wholly owned or majority-owned by the Fund.

Target Sourcing

The Sub-Adviser expects its broad industry relationships to allow the Fund to source a variety of opportunities to invest in Infrastructure Assets that come from difference sources. Such relationships may also include sourcing investments from a variety of infrastructure industry Sponsor Managers. The Advisers believe this creates a competitive advantage relative to an investment portfolio that is all sourced from a single Sponsor Manager or single investment team.

The Advisers expect that sourcing from a broad range of different industry relations, including multiple Sponsor Managers can improve portfolio construction while still providing investment exposure to industry leading investments and investment teams. It also avoids risks relating to key elements of an individual Sponsor Manager’s investment strategy or platform. This is particularly important with the proliferation of specific strategies for investing in the infrastructure landscape, where a single Sponsor Manager or single Infrastructure Asset may be targeting specific return-based strategies, sector specific strategies, capital structure strategies, geography-based strategies or strategies focused on specific investment stages. The Advisers believe that sourcing a portfolio of investments that differ among these key attributes is an important element of portfolio construction. Notwithstanding the above, the Fund may partner with the same Sponsor Manager across multiple different investments where the Advisers deem appropriate and based on the available investment opportunity set at any point in time.

Target Geographies

The Fund expects the focus of its investment activity to be in North America and Europe, with a smaller portion of its capital reserved to access assets and businesses in other geographies (principally focused in countries with developed economies—i.e., OECD) on an opportunistic basis.

The Advisers expect that this geographic approach will provide opportunities to access transactions where the Sub-Adviser has a keen understanding of the regulatory environment, the rule of law and the markets which these assets and businesses serve. In addition, the Fund expects that this focus will allow for better management by the Sub-Adviser of currency risk and to ensure that strong investments deliver strong financial results. From time to time, if the Sub-Adviser believes that an opportunity outside of these core markets may be prudent, it expects to typically seek a local partner that exhibits the same understanding of the underlying local legal and economic framework that the Sub-Adviser possesses in its core markets.

Target Stage

The Fund expects to make the majority of its investments in previously developed infrastructure assets that generate cash flows, but where investors may seek to increase revenue and/or reduce expenses by creating operating efficiencies, acquiring new equipment making modifications or repurposing of the asset (such investments “Brownfield” stage investments). A small portion of the Fund’s investments may be made into new projects requiring development and construction that may not be cash flowing at the time of investment (such investments “Greenfield” stage investments).

From time to time, the Sub-Adviser expects to electively evaluate later stage (e.g., post-permitting, pre-construction) Greenfield opportunities where the Sub-Adviser believes that risks are under control and the assets, once completed, are likely to represent core infrastructure. In these cases, the Sub-Adviser intends to take particular care to ensure that its underwriting contemplates an appropriate risk and return profile for the stage of development and lack of operating history that the Sub-Adviser is underwriting.

TYPES OF INVESTMENTS AND RELATED RISKS

Investors should carefully consider the risk factors described below, before deciding on whether to make an investment in the Fund. The risks set out below are not the only risks the Fund faces. Additional risks and uncertainties not currently known to the Fund or that the Fund currently deems to be immaterial also may materially adversely affect the Fund’s business, financial condition and/or operating results. If any of the following events occur, the Fund’s business, financial condition and results of operations could be materially adversely affected. In such case, the NAV of the Shares could decline, and investors may lose all or part of their investment. Furthermore, the impact of a particular risk on an Infrastructure Investment, including those managed by a Sponsor Manager, will impact the Master Fund and, in turn, have a corresponding impact on the Fund.

Principal Risks Related to Infrastructure Investments

Infrastructure Risk. Investment in Infrastructure Assets involves many significant, relatively unusual and acute risks. Project revenues can be affected by a number of factors including economic and market conditions, political events, competition, regulation and the financial position and business strategy of customers. Unanticipated changes in the availability or price of inputs necessary for the operation of Infrastructure Assets may adversely affect the overall profitability of the investment or related project. Events outside the control of a company, such as political action, governmental regulation, demographic changes, economic growth, increasing fuel prices, government macroeconomic policies, toll rates, social stability, competition from untolled or other forms of transportation, natural disasters, changes in weather, changes in demand for products or services, bankruptcy or financial difficulty of a major customer and acts of war or terrorism, could significantly reduce the revenues generated or significantly increase the expense of constructing, operating, maintaining or restoring infrastructure facilities. In turn, this may impair a company’s ability to repay its debt, make distributions to its owners or even result in termination of an applicable concession or other agreement. As a general matter, the operation and maintenance of Infrastructure Assets or businesses involve various risks and is subject to substantial regulation, many of which may not be under the control of the owner/operator, including labor issues, failure of technology to perform as anticipated, structural failures and accidents and the need to comply with the directives of government authorities. Although companies may maintain insurance to protect against certain risks, where available on reasonable commercial terms (such as business interruption insurance that is intended to offset loss of revenues during an operational interruption), such insurance is subject to customary deductibles and coverage limits and may not be sufficient to recoup all of a company’s losses. Furthermore, once Infrastructure Assets become operational, they may face competition from other Infrastructure Assets in the vicinity of the assets they operate, the presence of which depends in part on governmental plans and policies.

Specific infrastructure investment risks include:

| ● | risks associated with due diligence; |

| ● | risks associated with construction; |

| ● | commodity price risks; |

| ● | risks associated with public demand and usage; |

| ● | risks associated with strategic assets; |

| ● | risks associated with privatizations; |

| ● | risks associated with the energy sector; |

| ● | risks associated with the utility industry; |

| ● | project-specific risks; |

| ● | risks related to infrastructure operations; |

| ● | risks associated with asset-level management; |

| ● | risks associated with concession agreements; |

| ● | competition in the infrastructure investment space; |

| ● | statutory and regulatory risks associated with infrastructure projects; |

| ● | risks associated with environmental regulations; |

| ● | inflation and interest rate risks; and |

| ● | risks associated with documentation. |

Due Diligence Risk. The Fund or Infrastructure Funds may make investments where market and financial information is limited. Formal business plans, financial projections and market analyses may not be available. Public information on such potential Infrastructure Assets may be difficult to obtain or verify. In addition, the Fund may find it cost-prohibitive to obtain certain information which would be easily obtainable in more developed countries. While the Fund will endeavor to conduct rigorous due diligence on each company in which it invests, no assurance can be given that it will obtain the information or assurances that an investor in a more sophisticated economy would generally expect to obtain before committing to an investment.

Construction Risk. In connection with any new development project (i.e., a “Greenfield” project), expansion of a facility or acquisition of a facility in late-stage development, a company may face construction risks typical for infrastructure businesses, including: (i) labor disputes, shortages of material and skilled labor or work stoppages, (ii) slower than projected construction progress and the unavailability or late delivery of necessary equipment, (iii) less than optimal coordination with public utilities in the relocation of their facilities, (iv) adverse weather conditions and unexpected construction conditions, (v) accidents or the breakdown or failure of construction equipment or processes, and (vi) catastrophic events such as explosions, fires and terrorist activities and other similar events beyond the Fund’s control. These risks could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent completion of construction activities once undertaken, any of which could have an adverse effect on the Fund and on the amount of funds available for distribution to the Fund. Construction costs may exceed estimates for various reasons, including inaccurate engineering and planning, labor and building material costs in excess of expectations and unanticipated problems with project startup. Such unexpected increases may result in increased debt service costs and funds being insufficient to complete construction, which in turn may result in the inability of project owners to meet the higher interest and principal repayments arising from the additional debt required. Delays in project completion can result in an increase in total project construction costs through higher capitalized interest charges and additional labor and material expenses and, consequently, an increase in debt service costs. Delays may also affect the scheduled flow of project revenues necessary to cover the scheduled operations phase debt service costs, operations and maintenance expenses and damage payments for late delivery. In addition, risks inherent in construction work may give rise to claims or demands against a company from time to time. Moreover, market conditions may change during the course of construction that make such development less attractive than at the time it was commenced.

Commodity Risk. Investments may be subject to commodity price risk, including, without limitation, the price of electricity and the price of fuel. The operation and cash flows of the Fund’s investments may depend, in some cases to a significant extent, upon prevailing market prices for energy commodities. Historically, the markets for oil, gas, coal and power have been volatile. This volatility is likely to continue in the future. Market prices of these energy commodities may fluctuate materially depending on a variety of factors beyond the control of the Fund, including, without limitation, weather conditions, foreign and domestic supply and demand, force majeure events, changes in law, governmental regulations, price and availability of alternative fuels and energy sources, international political conditions, actions of the Organization of Petroleum Exporting Countries (and other oil- and natural gas-producing nations) and overall economic conditions.

Public Demand and Usage Risk. The Fund may make investments that derive substantially all of their revenues from tolls, tariffs or other usage-related fees. Users of the applicable service may react negatively to any adjustments to the applicable rates, or public pressure may cause a government or agency to challenge such rates. In addition, adverse public opinion, or lobbying efforts by specific interest groups, could result in government pressure to reduce rates or to forego planned rate increases. It cannot be guaranteed that government entities with which a portfolio company has concession agreements will not try to exempt certain users from tolls, tariffs or other fees or negotiate lower rates. If public pressure or government action forces a portfolio company to restrict its rate increases or reduce their rates, and it is unable to secure adequate compensation to restore the economic balance of the relevant concession agreement, the Fund’s business, financial condition and results of operations could be adversely affected. Even though the Fund will target assets that are anticipated to be subject to lower demand, usage, and patronage risk, the Fund may not be able to eliminate these risks. To the extent that the Advisers assumptions regarding the demand, usage, and patronage of assets prove incorrect, the Fund’s financial returns could be adversely affected. Some portfolio companies may be subject to seasonal variations. Accordingly, the Fund’s operating results for any particular investment in any particular quarter may not be indicative of the results that can be expected for such investment throughout the entire year.

Strategic Asset Risk. Certain investments may be in public infrastructure that constitute significant strategic value to public or governmental bodies. Strategic assets are assets that have a national or regional profile, and may have monopolistic characteristics. The nature of these assets could generate additional risks not common in other industry sectors. Given their national or regional profile and/or their irreplaceable nature, strategic assets may constitute a higher risk target for terrorist acts or political actions. Any terrorist attacks that occur at or near infrastructure facilities would likely cause significant harm to employees, assets and, potentially, the surrounding community. Insurers may offer a limited amount of or no insurance coverage for liability to persons other than employees or passengers for claims resulting from acts of terrorism, war or similar events. A terrorist attack may result in liability far in excess of available insurance coverage. A terrorist attack on an Infrastructure Asset may also have adverse consequences for all assets of that type, including assets in which the Fund invests. For example, as a result of a terrorist attack in the vicinity of an Infrastructure Asset, the Infrastructure Asset may be forced to increase preventative security measures or expand its insurance coverage, adversely affecting the profitability of an investment in that asset. Similarly, a terrorist attack could cause reduced patronage, usage and demand for an entire class of Infrastructure Investments in the region of the terrorist attack, which could adversely affect the profitability of the Fund’s investments. Given the essential nature of the services provided by Infrastructure Assets, there is also a higher probability that the services provided by such assets will be in constant demand. Should an owner of such assets fail to make such services available, users of such services may incur significant damage and may, due to the characteristics of the strategic assets, be unable to replace the supply or mitigate any such damage, thereby heightening any potential loss from third-party claims.

Privatization Risk. The Fund may invest in state-owned enterprises that have been or will be transferred from government to private ownership. There can be no assurance that any privatizations will be undertaken or, if undertaken, that such plans will be successfully completed or even completed at all. There can also be no assurance that, if a privatization is undertaken on a private placement basis, the Fund will have the opportunity to participate in the investing consortium. Investors should also be aware that changes in governments or economic factors could result in a change in a country’s policies on privatization. Should these policies change in the future, it is possible that governments may determine to return infrastructure projects to public ownership. The level of compensation that would be provided to the owners of the private companies concerned cannot be accurately predicted but could be substantially less than the amount invested in such companies.

Energy Sector Risk. The operations of energy companies are subject to many risks inherent in the transporting, processing, storing, distributing, mining or marketing of natural gas, natural gas liquids, crude oil, coal, refined petroleum products or other hydrocarbons, or in the exploring, managing or producing of such commodities, including, without limitation: damage to pipelines, storage tanks or related equipment and surrounding properties caused by hurricanes, tornadoes, floods, fires and other natural disasters or by acts of terrorism; inadvertent damage from construction and farm equipment; leaks of natural gas, natural gas liquids, crude oil, refined petroleum products or other hydrocarbons; and fires and explosions. These risks could result in substantial losses due to personal injury or loss of life, severe damage to and destruction of property and equipment and pollution or other environmental damage, and may result in the curtailment or suspension of their related operations, any and all of which could result in lower than expected returns to the Fund.

Utility Industry Risk. The Fund may make certain investments in and relating to the utility asset class. In many regions, including the U.S., the electric utility industry is experiencing increasing competitive pressures, primarily in wholesale markets, as a result of consumer demands, technological advances, greater availability of natural gas and other factors. In response, for example, FERC has proposed regulatory changes to increase access to the nationwide transmission grid by utility and non-utility purchasers and sellers of electricity; similar actions are being taken or contemplated by regulators in other countries. A number of countries, including the U.S., are considering or implementing methods to introduce, promote and retain competition. To the extent competitive pressures increase and the pricing and sale of electricity assume more characteristics of a commodity business, the economics of independent power generation projects into which the Fund may invest may come under increasing pressure. Deregulation is fueling the current trend toward consolidation among domestic utilities, but also the disaggregation of many vertically integrated utilities into separate generation, transmission and distribution businesses. As a result, additional significant competitors could become active in the independent power industry.

Project Risk. The successful development of new or expansion infrastructure projects entails a variety of risks (some of which may be unforeseeable at the time a project is commenced) and may require or result in the involvement of a broad and diverse group of stakeholders who will either directly influence or potentially be capable of influencing the nature and outcome of the project. Such factors may include: political or local opposition, receipt of regulatory approvals or permits, site or land procurement, environmentally related issues, construction risks and delays (such as late delivery of necessary equipment), labor disputes (such as work stoppages), counterparty non-performance, project feasibility assessment and dealings with and reliance on third-party consultants. When making a portfolio investment value may be ascribed to infrastructure projects (new or expansion) that do not achieve successful implementation, potentially resulting in a lower than expected internal rate of return over the life of the investment. In addition, there are significant capital expenditures associated with the development and operating costs of Infrastructure Assets generally.

To the extent that the Fund invests in companies providing services or products (such as, for example, exploratory drilling rigs and support services) to participants in the natural resources exploration, development, extraction and transportation industries (such as, for example, oil, natural gas or minerals), the failure of such industry participants successfully to locate, develop, extract or transport such resources could materially impact the demand for the services or products of such companies, adversely affecting their performance and the Fund’s or such Infrastructure Investment’s investment therein.

Operational and Technical Risks and Force Majeure; Government Interventions Risk. The operations of infrastructure projects are exposed to unplanned interruptions caused by significant catastrophic and force majeure events, such as war, acts of God, pandemics, cyclones, earthquake, landslide, flood, explosion, fire, terrorist attack, social unrest, major plant breakdown, pipeline or electricity line rupture or other disaster. Operational disruption, as well as supply disruption, could adversely affect the cash flows available from these assets. In addition, the cost of repairing or replacing damaged assets could be considerable. Repeated or prolonged interruption may result in permanent loss of customers, substantial litigation or penalties for regulatory or contractual non-compliance. Moreover, any loss from such events may not be recoverable under relevant insurance policies. Business interruption insurance is not always available, or economical, to protect the business from these risks. Industrial action involving employees or third parties may disrupt the operations of infrastructure projects. Infrastructure projects are exposed to the risk of accidents that may give rise to personal injury, loss of life, damage to property, disruption to service and economic loss. In some cases, project agreements can be terminated if the force majeure event is so catastrophic as to render it incapable of remedy within a reasonable, pre-agreed time period.

The Fund’s investments may be affected by force majeure events (i.e., events beyond the control of the party claiming that the event has occurred, including, without limitation, acts of God, fire, flood, earthquakes, war, terrorism, labor strikes and pandemics or other public health crises – see “Risks Relating to Current Events—Market Disruption and Geopolitical Risk” below for more information). Some force majeure events may adversely affect the ability of a party (including a portfolio company or a counterparty to the Fund) to perform its obligations until such force majeure event is remedied. In addition, the cost to a portfolio company of repairing or replacing damaged assets resulting from such force majeure event could be considerable. There can be no assurance that each portfolio company will be fully insured against all risks inherent to their businesses. If a significant accident or event occurs that it is not fully insured, it could adversely affect the operations and financial condition of such portfolio company, and hence, the Fund. Additionally, a major governmental intervention into industry, including the nationalization of an industry, the assertion of control over one or more companies or its assets, changes in the regulatory landscape or the imposition of significant travel or other restrictions, could result in a loss to the Fund, including if its investment in such portfolio company is canceled, unwound or acquired (which could be without any compensation or what the Fund considers to be adequate compensation).

Asset-Level Management Risk. The management of the business or operations of a portfolio company or may be contracted to a third-party management company unaffiliated with the Fund. Although it would be possible to replace any such operator, the failure of such an operator adequately to perform its duties or to act in ways that are in the company’s best interest, or the breach by an operator of applicable agreements or laws, rules, and regulations, could have an adverse effect on the company’s financial condition or results of operations.

A third-party management company may suffer a business failure, become bankrupt, or engage in activities that compete with a portfolio company. These and other risks, including the deterioration of the business relationship between the Fund and the third-party management company, could have an adverse effect on a portfolio company.

Should a third-party management company fail to perform its functions satisfactorily, it may be necessary to find a replacement operator, which may require the approval of a government or agency that has granted a concession with respect to the relevant company. It may not be possible to replace an operator in such circumstances, or do so on a timely basis, or on terms that are favorable to the Fund.

Contract Risk. An infrastructure investment’s operations may rely on government licenses, concessions, leases, or contracts that are generally very complex and may result in a dispute over interpretation or enforceability. Even though most permits and licenses are obtained prior to the commencement of full project operations, many of these licenses and permits have to be maintained over the project’s life. If a portfolio company fails to comply with these regulations or contractual obligations, it could be subject to monetary penalties or may lose its right to operate the affected asset, or both. Where a portfolio company holds a concession or lease from a government body, such arrangements are subject to special risks as a result of the nature of the counterparty. The lease or concession may contain clauses more favorable to the government counterparty than a typical commercial contract. In addition, there is the risk that the relevant government body will exercise sovereign rights and take actions contrary to the rights of a portfolio company or under the relevant agreement. Certain investments may require the use of public ways or may operate under easements. Governments may retain the right to restrict the use of such public ways or easements or require a company to remove, modify, replace or relocate facilities relating to Infrastructure Assets at its own expense. If a government exercises these rights, a portfolio company could incur significant costs and its ability to provide service to its customers could be disrupted, which could adversely impact the performance of such investment.

Competitive Marketplace Risk. Once Infrastructure Assets become operational, they will face competition from other infrastructure and infrastructure-related assets and/or businesses in the vicinity of the assets they operate, the presence of which depends in part on government plans and policies. For example, an increase in the number and convenience of alternative routes and competition from other modes of transportation could reduce traffic on toll roads operated by an investment of the Fund thus materially and adversely affecting the Fund’s performance. Such competition may materially and adversely affect the Fund’s business, financial conditions and results of operations.

Regulatory Risk. The Fund’s investment projects may be subject to statutory and regulatory requirements, including those imposed by zoning, environmental, safety, labor and other regulatory or political authorities. For example, investment acquisitions and dispositions by the Fund may be subject to Federal Energy Regulatory Commission approval under the U.S. Federal Power Act, as amended. In addition, the adoption of new laws or regulations, or changes in the interpretation of existing laws or regulations, could have a material adverse effect on the investments of the Fund and thus on the Fund’s ability to meet their investment objectives. Such changes could necessitate the creation of new business models and the restructuring of investments to satisfy regulatory requirements, which may be costly and/or time consuming. Statutory and regulatory requirements also may require the Fund to obtain certain permits or approvals from government entities. In the U.S., certain acquisitions may be subject to approval by the Committee on Foreign Investment in the U.S. There can be no assurance that a portfolio company or Underlying Investment will be able to (i) obtain all required regulatory approvals that it does not yet have or that it may require in the future, (ii) obtain any necessary modifications to existing regulatory approvals, or (iii) maintain required regulatory approvals. Delay in obtaining or failure to obtain and maintain in full force and effect any regulatory approvals, or amendments thereto, or delay or failure to satisfy any regulatory conditions or other applicable requirements could prevent operation of a facility or sales to third parties or could result in additional costs to a portfolio company.

In addition, Infrastructure Assets may be subject to rate regulation by government agencies because of their unique position as the sole or predominant providers of services that are often essential to the community. As a result, a portfolio company may be subject to unfavorable price regulation by government agencies. For example, infrastructure companies engaged in businesses with monopolistic characteristics, such as electricity distribution, could face caps placed by regulators on allowable returns. Often these price determinations are final with limited or no right of appeal. Given the public interest aspect of the services that Infrastructure Assets provide, political oversight of the sector is likely to remain pervasive and unpredictable and governments may attempt to take actions which negatively affect operations, revenue, profitability or contractual relationships of certain investments, including through expropriation. Finally, certain projects may depend upon the use of public ways or may operate under easements. Under the terms of agreements governing the use of public ways or easements, government authorities may retain the right to restrict the use of such public ways or easements or to require a company to remove, modify, replace or relocate their facilities at such company’s expense. If a government authority exercises these rights, such a company could incur significant costs and its ability to provide service to its customers could be disrupted, which could adversely impact the performance of the relevant investment.