Exhibit 99.1

Jiuzi Holdings, Inc.

Consolidated Balance Sheets

Unaudited

| April 30, | October 31, | |||||||

| 2025 | 2024 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Notes receivable | ||||||||

| Accounts receivable, net | ||||||||

| Due from related parties | ||||||||

| Advances to suppliers | ||||||||

| Prepaid taxes and taxes recoverable | ||||||||

| Other receivables and other current assets | ||||||||

| Total Current Assets | ||||||||

| Non-Current Assets | ||||||||

| Property, plant and equipment, net | ||||||||

| Total Non-Current Assets | ||||||||

| Total Assets | ||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accruals and other payables | ||||||||

| Accounts payable | ||||||||

| Due to related parties | ||||||||

| Taxes payable | ||||||||

| Contract liability | ||||||||

| Total Current Liabilities | ||||||||

| Total Liabilities | ||||||||

| Shareholders’ Equity | ||||||||

| Ordinary shares, $ | ||||||||

| Additional paid-in capital | ||||||||

| Statutory reserve | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Shareholders’ Equity | ||||||||

| Total Liabilities and Shareholders’ Equity | $ | $ | ||||||

See accompanying notes to financial statements.

Jiuzi Holdings, Inc.

Consolidated Statements of Loss and Comprehensive Loss

Unaudited

| Six Months Ended | Six Months Ended | |||||||

| April 30, 2025 | April 30, 2024 | |||||||

| Revenues, net | $ | $ | ||||||

| Revenues – related party, net | ||||||||

| Total revenues | ||||||||

| Cost of revenues | ||||||||

| Cost of revenues– related party | ||||||||

| Total cost of revenues | ||||||||

| Gross profit/(loss) | ( | ) | ||||||

| Selling and marketing expense | ||||||||

| General and administrative expenses | ||||||||

| Share-based compensation | ||||||||

| Allowance for credit loss on loans receivable | ||||||||

| Reversal of allowance for credit losses | ( | ) | ||||||

| Total operating expense | ||||||||

| Operating loss | ( | ) | ( | ) | ||||

| Non-operating income (expense): | ||||||||

| Other income, net | ||||||||

| Interest income | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| ( | ) | ( | ) | |||||

| Loss before income tax | ( | ) | ( | ) | ||||

| Income tax | ||||||||

| Gain from discontinued operations | ||||||||

| Net loss | ( | ) | ( | ) | ||||

| Less: Loss attributable to non-controlling interest | ( | ) | ||||||

| Net loss attributable to controlling interest | ( | ) | ( | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation (expense) income | ( | ) | ||||||

| Total comprehensive loss | ( | ) | ( | ) | ||||

| Loss per share | ||||||||

| Basic | ( | ) | ( | ) | ||||

| Diluted | ( | ) | ( | ) | ||||

| Weighted average number of ordinary shares outstanding | ||||||||

| Basic | ||||||||

| Diluted | ||||||||

See accompanying notes to financial statements.

2

Jiuzi Holdings, Inc.

Consolidated Statements of Changes in Shareholders’ Equity

Unaudited

| Common Stock | Additional | Accumulated other | Equity | Non- | ||||||||||||||||||||||||||||||||

| Number of | Paid-in | Statutory | Retained | Comprehensive | attributable | Controlling | Total | |||||||||||||||||||||||||||||

| Shares | Amount | Capital | Reserve | Earnings | Income | to Jiuzi | interest | Equity | ||||||||||||||||||||||||||||

| Balance at October 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Shares issued for cash proceeds, net | ||||||||||||||||||||||||||||||||||||

| Shares issued for compensation | ||||||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Non-Controlling Interest | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||||

| Disposition of discontinued operation | - | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at April 30, 2024 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Balance at October 31, 2024 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Disposition of discontinued operation | - | ( | ) | |||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at April 30, 2025 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

3

Jiuzi Holdings, Inc.

Consolidated Statements of Changes in Shareholders’ Equity

Unaudited

| Six Months Ended | Six Months Ended | |||||||

| April 30, | April 30, | |||||||

| 2025 | 2024 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Net income from discontinued operation | ||||||||

| Net loss from continuing operation | ( | ) | ( | ) | ||||

| Depreciation and amortization | ||||||||

| Reversal of allowance for credit loss | ( | ) | ||||||

| Amortization of operating lease ROU assets | ||||||||

| Impairment loss Other Assets | ||||||||

| Loss from disposal of assets | ||||||||

| Stock-based compensation | ||||||||

| Changes in assets and liabilities | ||||||||

| Increase in accounts receivable | ( | ) | ||||||

| Increase in accounts receivable – related party | ( | ) | ||||||

| Decrease in inventories | ||||||||

| Decrease in prepaid expenses | ||||||||

| (Increase)/decrease in advances to suppliers | ( | ) | ||||||

| (Increase)/decrease in notes receivable- customers sales | ( | ) | ||||||

| Increase in notes receivable-related party customers sales | ( | ) | ||||||

| Increase in due from related parties | ( | ) | ( | ) | ||||

| (Increase)/Decrease in other receivables | ( | ) | ||||||

| Increase in other assets | ( | ) | ||||||

| (Decrease)/increase in accrued and other liabilities | ( | ) | ||||||

| Increase/(decrease) in account payable | ( | ) | ||||||

| Increase in accounts payable – related party | ||||||||

| Increase in taxes payable | ||||||||

| Decrease in contract liability | ( | ) | ( | ) | ||||

| Decrease in contract liability – related party | ( | ) | ||||||

| Increase in operating lease liabilities | ||||||||

| Net cash operating activities of continued operations | ( | ) | ( | ) | ||||

| Net cash operating activities of discontinued operations | ) | |||||||

| Cash Used in Operating Activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities | ||||||||

| Acquisition of investment | ( | ) | ||||||

| Purchase of fixed assets | ( | ) | ||||||

| Net cash used in investing activities of continued operations | ( | ) | ( | ) | ||||

| Net cash used in investing activities of discontinued operations | ( | ) | ||||||

| Cash Used in Investing Activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from owner’s injection of capital | ||||||||

| Proceeds (repayment) to related party payable | ( | ) | ||||||

| Net cash from financing activities of continued operations | ||||||||

| Net cash from financing activities of discontinued operations | ||||||||

| Cash Provided by Financing Activities | ||||||||

| Net decrease of cash and cash equivalents | ( | ) | ( | ) | ||||

| Effect of foreign currency translation on cash and cash equivalents | ||||||||

| Cash, cash equivalents, and restricted cash – beginning of period | ||||||||

| Less: cash and cash equivalents attributable to discontinued operations | ||||||||

| Cash, cash equivalents, and restricted cash – end of period | $ | $ | ||||||

| Reconciliation of Cash, Cash Equivalents & Restricted Cash to Statements of Cash Flows | ||||||||

| Cash and cash equivalents | ||||||||

| Restricted cash | ||||||||

| Total cash, cash equivalents, and restricted cash | $ | |||||||

See accompanying notes to financial statements.

4

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 1 – ORGANIZATION AND BASIS OF PRESENTATION

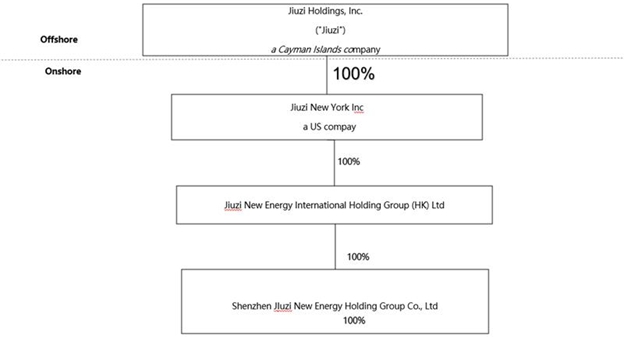

Jiuzi Holdings, Inc. (“Company” or “Jiuzi Holdings”) was incorporated in the Cayman Islands on October 10, 2019. It is a holding company with no operations. The Company sells new energy batteries, electronic power equipment and auxiliaries through its wholly owned subsidiaries located in the People’s Republic of China (“PRC” or “China”).

Jiuzi New York Inc. (“Jiuzi New York”), a New York corporation established on April 3, 2023. is a wholly owned subsidiary of Jiuzi Holdings. It is mainly involved in corporate investment consulting.

Jiuzi New Energy International Holding Group (HK) Limited (“Jiuzi HK”) was organized under the laws of the Hong Kong Special Administrative Region of the PRC on May 23, 2023 and it was a wholly owned subsidiary of. Jiuzi New York that is mainly involved in corporate investment consulting.

Shenzhen Jiuzi New Energy Holding Group Co., Ltd. (“Shenzhen Jiuzi”) was incorporated on August 1, 2023 under the laws of the People’s Republic of China. It was a wholly owned subsidiary of New Energy Holding HK and is mainly involved in the sales of batteries, electronic power equipment and auxiliaries.

5

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Below is Jiuzi Holdings’ organizational chart:

6

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”).

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its subsidiary. Significant inter-company transactions have been eliminated in consolidation.

Going Concern and Management’s Plan

The accompanying consolidated

financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization

of assets and the discharge of liabilities in the normal course of business for the foreseeable future. As of April 30, 2025, the Company

had an accumulated deficit of $

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to reflect the possible future effect on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the outcome of these uncertainties. The Company commits its core competencies in the renewable energy sector with driving innovation. The Company enters into trade business with a focus on sales of new energy batteries including design, commissioned processing, transportation and packaging, sales of electrical equipment, mobile phone accessories and other products. In future, the Company will focus on sales and production of electric two wheelers, three wheelers and slow-speeding cars in Southeast Asia. Management believes that the actions presently being taken to obtain additional funding and implement its strategic plan provides the opportunity for the Company to continue as a going concern.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions.

7

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Functional and presentation currency

The functional currency of the Company is which is Chinese Yuan (“RMB”), the currency of the primary economic environment in which the Company operates.

Transactions in currencies other than the entity’s functional currency are recorded at the rates of exchange prevailing on the date of the transaction. At the end of each reporting period, monetary items denominated in foreign currencies are translated at the rates prevailing at the end of the reporting periods. Exchange differences arising on the settlement of monetary items and on translation of monetary items at period-end are included in income statement of the period.

For the purpose of presenting these financial statements, the Company’s assets and liabilities are expressed in US$ at the exchange rate on the balance sheet date, stockholder’s equity accounts are translated at historical rates, and income and expense items are translated at the weighted average exchange rate during the period. The resulting translation adjustments are reported under accumulated other comprehensive income in the stockholder’s equity section of the balance sheets.

Exchange rate used for the translation as follows:

US$ to RMB

| Period End | Average | |||||||

| April 30, 2025 | ||||||||

| October 31, 2024 | ||||||||

| April 30, 2024 | ||||||||

Fair Values of Financial Instruments

The Company adopted ASC 820 “Fair Value Measurements,” which defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. Current assets and current liabilities qualified as financial instruments and management believes their carrying amounts are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and if applicable, their current interest rate is equivalent to interest rates currently available. The three levels are defined as follow:

| ● | Level 1 — inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 — inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| ● | Level 3 — inputs to the valuation methodology are unobservable and significant to the fair value. |

As of the balance sheet date, the estimated fair values of the financial instruments approximated their fair values due to the short-term nature of these instruments. Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates the hierarchy disclosures each year.

8

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Related parties

The Company adopted ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Cash and Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Note receivable

As of April 30, 2025, the Company held a bank

acceptance of $

Accounts Receivable, net

Accounts receivable is recorded at the net value less estimates for expected credit losses. Management regularly reviews outstanding accounts and provides an allowance for doubtful accounts. When collection of the original invoice amounts is no longer probable, the Company will either partially or fully write-off the balance against the allowance for doubtful accounts.

Other receivable and other current assets

Other receivables primarily include prepayment to suppliers, advances to employees, and others. Management regularly reviews the aging of receivables and changes in payment trends and records allowances when management believes collection of amounts due are at risk. Accounts considered uncollectable are written off against allowances after exhaustive efforts at collection are made.

Accounts Payables

Accounts payable primarily represent obligations to suppliers for goods and services received but not yet paid. Payment terms are generally within 90 days.

Revenue Recognition

The Company adopted ASC Topic 606 using the modified retrospective adoption method. Based on the requirements of ASC Topic 606, revenue is recognized when control of the promised goods or services is transferred to the customers in an amount that reflects the consideration the Company expects to be entitled to receive in exchange for those goods or services. Revenue is recognized when the following 5-step revenue recognition criteria are met:

| 1) | Identify the contract with a customer |

| 2) | Identify the performance obligations in the contract |

| 3) | Determine the transaction price |

| 4) | Allocate the transaction price |

| 5) | Recognize revenue when or as the entity satisfies a performance obligation |

Revenue from product sales is recognized at the point in time control of the products is transferred, generally upon customer receipt based upon the contract terms. Shipping and handling activities are considered to be fulfillment activities rather than promised services and are not, therefore, considered to be separate performance obligations. The Company’s sales terms provide no right of return outside of a standard quality policy and has not experienced any sales returns. Payment terms for product sales are generally set at 30 to 90 days after the consideration becomes due and payable.

9

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Inventory

Inventories, which are primarily comprised of finished goods for sale, are stated at the lower of cost or net realizable value, using the first-in first-out method. The Company evaluates the need for reserves associated with obsolete, slow-moving and non-salable inventory by reviewing net realizable values on a periodic basis. Only defective products can be returned to our suppliers.

Contract Liabilities

Contract liabilities are mainly advance from customers.

Income Taxes

Income taxes are provided in accordance with ASC No. 740, Accounting for Income Taxes. A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carry-forwards. Deferred tax expense (benefit) results from the net change during the years of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion of all of the deferred tax assets will be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

A tax benefit from an uncertain tax position may be recognized only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities. The determination is based on the technical merits of the position and presumes that the relevant taxing authority that has full knowledge of all relevant information will examine each uncertain tax position. Although the Company believes the estimates are reasonable, no assurance can be given that the final outcome of these matters will not be different than what is reflected in the historical income tax provisions and accruals.

Earnings (loss) per share

Basic income (loss) per share is computed by dividing net income (loss) attributable to the holders of ordinary shares by the weighted average number of ordinary shares outstanding during the year. Diluted income (loss) per share is calculated by dividing net income (loss) attributable to the holders of ordinary shares as adjusted for the effect of dilutive ordinary share equivalents, if any, by the weighted average number of ordinary shares and dilutive ordinary share equivalents outstanding during the period. However, ordinary share equivalents are not included in the denominator of the diluted earnings per share calculation when inclusion of such shares would be anti-dilutive, such as in a period in which a net loss is recorded.

10

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Property and Equipment & Depreciation

Property and equipment are stated at historical

cost net of accumulated depreciation. Repairs and maintenance are expensed as incurred.

| Equipment | ||

| Furniture and fixtures | ||

| Motor vehicles |

Impairment of Long-lived assets

The Company accounts for impairment of property and equipment and amortizable intangible assets in accordance with ASC 360, “Accounting for Impairment of Long-Lived Assets and Long-Lived Assets to be Disposed Of”, which requires the Company to evaluate a long-lived asset for recoverability when there is event or circumstance that indicate the carrying value of the asset may not be recoverable. An impairment loss is recognized when the carrying amount of a long-lived asset or asset group is not recoverable (when carrying amount exceeds the gross, undiscounted cash flows from use and disposition) and is measured as the excess of the carrying amount over the asset’s (or asset group’s) fair value.

New Accounting Pronouncements

Impact of Recently Issued Accounting Pronouncements

Segment Reporting (Topic 280). In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280)- Improvements to Reportable Segment Disclosures. ASU No. 2023-07 requires an enhanced disclosure of significant segment expenses that are regularly provided to the CODM and included within each reported measure of segment profit or loss, on an annual and interim basis.

The guidance is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Adoption of this guidance should be applied retrospectively to all prior periods presented. The Company’s adoption of this standard did not have a material impact on its consolidated financial statements.

Other accounting standards that the Company adopted beginning November 1, 2024 did not have a significant impact on the Company’s consolidated financial statements.

11

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

Impact of Recently Issued Accounting Pronouncements Not Yet Effective

Income Taxes (Topic 740). In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740)-Improvements to Income Tax Disclosures. ASU No. 2023-09 requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as additional information on income taxes paid. The guidance is effective for annual periods beginning after December 15, 2024 on a prospective basis. Early adoption is permitted. The Company does not expect to adopt ASU No. 2023-09 early and is currently evaluating the impact of adopting this standard on its consolidated financial statements.

Income Statement (Topic 220) in November 2024, the FASB issued ASU No. 2024-03, Income Statement (Topic 220) Reporting Comprehensive Income-expense Disaggregation Disclosures (Subtopic 220-40). ASU No. 2024-03 requires publicly-traded business entities to disclose specified information about the components of certain costs and expenses that are currently disclosed in the financial statements. The guidance is effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. The Company does not expect to adopt ASU No. 2024-03 early and is currently evaluating the impact of adopting this standard on its consolidated financial statements.

Besides the above, the Company’s management does not believe that any recently issued, but not yet effective, accounting standards, if currently adopted would have a material effect on the consolidated financial statements.

NOTE 3 – ACCOUNTS RECEIVABLES, NET

Accounts receivables, net is comprised of the following:

| April 30, 2025 | October 31, 2024 | |||||||

| Accounts receivables | $ | $ | ||||||

| Less: Allowance for credit losses | ( | ) | ( | ) | ||||

| Total, net | $ | $ | ||||||

The following is a summary of the activity in the allowance for credit losses:

| April 30, 2025 | October 31, 2024 | |||||||

| Balance at beginning of year | ||||||||

| Allowance | ||||||||

| Effect of translation adjustment | ( | ) | ||||||

| Balance at end | ||||||||

Bad debt

expense (recoveries) was and $

12

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 4 – OTHER RECEIVABLES AND OTHER CURRENT ASSETS

Other receivables and other current assets comprised of the following:

| April 30, | October 31, | |||||||

| 2025 | 2024 | |||||||

| Other receivables | $ | |||||||

| Prepaid expense | ||||||||

| Allowance for credit losses | ( | ) | ( | ) | ||||

| Total | $ | |||||||

As of April 30, 2025, the balance of prepaid expense

was $

On December 16, 2023, Shenzhen Jiuzi entered into an agreement with

a third party, Beijing YanErYouXin Technonogy Co., Ltd.(“YanErYouXin”). Shenzhen Jiuzi provided a prepayment in full

to YanErYouXin in the amount of RMB

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT, NET

Property and equipment, net comprised of the following:

| April 30, | October 31, | |||||||

| 2025 | 2024 | |||||||

| At Cost: | ||||||||

| Furniture and fixtures | ||||||||

| Less: Accumulated depreciation | ||||||||

| Total, net | ||||||||

Depreciation

expenses was $

13

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 6 – RELATED PARTY TRANSACTIONS

Due from related parties comprised of the following:

| April 30, | October 31, | |||||||||

| Nature | 2025 | 2024 | ||||||||

| Shuibo Zhang | ||||||||||

| Total | ||||||||||

Due to related parties comprised of the following:

| April 30, | October 31, | |||||||||

| Nature | 2025 | 2024 | ||||||||

| Shuibo Zhang | ||||||||||

| Tao Li | ||||||||||

| Total | ||||||||||

NOTE 7 – TAXES PAYABLE

Taxes payable comprised of the following:

| April 30, | October 31, | |||||||

| 2025 | 2024 | |||||||

| Value-added tax, net | ||||||||

| Other taxes | ( | ) | ( | ) | ||||

14

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 8 – SHAREHOLDERS’ EQUITY

As of April

30, 2025, the Company had

Reverse Stock Split

On July

7, 2023, our Board of Directors declared a reverse share split at a ratio of

During

the six months ended April 30, 2025, the Company issued: (i)

On March

18, 2025, the Company’s shareholders approved a stock split pursuant to which each issued and unissued share of the Company will

be subdivided into

Private Placement

On October

17, 2024, the Company entered into a securities purchase agreement with certain investors pursuant to which

the Company agreed to sell an aggregate of

NOTE 9 – INCOME TAX

The Company

is subject to profits tax rate at

15

Jiuzi Holdings, Inc.

Notes To Unaudited Condensed Consolidated Financial Statements

NOTE 10 – COMMITMENTS AND CONTINGENCIES

Capital commitment

As of April 30, 2025, the Company had capital commitments.

NOTE 11 – CONCENTRATIONS, RISKS AND UNCERTAINTIES

Credit risk

Cash deposits with banks are held in financial institutions in China, which deposits are not insured. Accordingly, the Company has a concentration of credit risk related to the uninsured part of its bank deposits. The Company has not experienced any losses in such accounts and believes it is not exposed to significant credit risk.

Concentration

The Company has a concentration risk related to suppliers and customers. The inability of the Company to maintain existing relationships with suppliers or to establish new relationships with customers in the future may have a negative impact on the Company’s ability to obtain goods sold to customers in a price advantageous and timely manner. If the Company is unable to obtain ample supply of goods from existing suppliers or alternative sources of supply, the Company may be unable to satisfy the orders from its customers, which may have a material adverse impact on revenue.

The concentration of sales revenues generated by third-party customers was the following:

| Six Months Ended | ||||||||||||||||

| April 30, 2025 | April 30, 2024 | |||||||||||||||

| Customer A | % | % | ||||||||||||||

| Total | % | % | ||||||||||||||

NOTE 12 – SUBSEQUENT EVENTS

The Company evaluated subsequent events and transactions that occurred after the balance sheet date up to the date that the financial statements were issued. Based upon this review, the Company did not identify any subsequent events that would have required adjustment or disclosure in the financial statements.

16