June 4, 2025

Naveen Chopra

[___]

Re: Offer of Employment

Dear Naveen:

I am pleased to offer you a position with Roblox Corporation, a Delaware corporation (the "Company"), as Chief Financial Officer, reporting to the Chief Executive Officer. If you decide to join us, your start date will be a mutually acceptable date no later than September 15, 2025 (“Employment Start Date”), and you will receive an annual base salary of $735,000 which will be paid semi-monthly in accordance with the Company's normal payroll procedures. As an employee, you will also be eligible to receive certain employee benefits including those explained in Exhibit A. You should note that, subject to the below, the Company may modify job titles, duties, salaries and benefits from time to time as it deems necessary.

Initially, your principal place of employment will be located in [___] until August 30, 2026, during which it is estimated that you will spend approximately 50% of your working time in the Company’s headquarters in San Mateo, California. It is a condition to your continued employment that you will relocate your principal place of employment to the Company’s headquarters in San Mateo, California no later than August 31, 2026 (the “Relocation Requirement”). Any failure to satisfy the Relocation Requirement and any resulting termination of your employment with the Company shall be considered a termination for Cause. The Company will, in accordance with applicable Company policies and guidelines, reimburse you for reasonable and necessary expenses incurred in connection with your performance of services on behalf of the Company during your employment with the Company, including, without limitation, travel to and from the Company’s headquarters. Any business flights longer than two hours may be booked in business class and shall be reimbursable. Prior to your full-time relocation to the Company’s headquarters in San Mateo, California, the Company will reimburse you for temporary housing in California up to $15,000 per month through August 31, 2026, which sum shall be grossed up if necessary to ensure that it is tax neutral to you.

You will receive Relocation Assistance in accordance with the Roblox Executive Domestic Policy (except as provided otherwise in this letter) with a maximum limit of $900,000 for your reasonable and documented relocation expenses through the Company’s approved vendor, Cartus, as well as travel expenses for you and your spouse for one trip to the Bay Area to secure housing. Covered relocation charges will include any transfer taxes required to be

paid by you in connection with the sale of your home in [___]. Such relocation expenses shall be reimbursable by the Company so long as such relocation expenses have been incurred by Executive prior to August 31, 2028. Cartus will provide to you and the Company an itemized invoice for Relocation Assistance. For each month of completed service, 1/12 of this invoiced total will be deemed earned. You must notify the Company in writing (email is acceptable for such notice) once you have actually relocated. If you voluntarily terminate your employment with the Company for any reason (for purposes of this sentence, a termination as a result of Good Reason shall not be deemed to be a voluntary termination) before the first anniversary of your Employment Start Date, you shall repay to the Company any unearned portion of the invoiced total, which shall be net of any taxes accrued and paid as a result of receipt of such unearned Relocation Allowance. You shall make this repayment in full within 15 days of notification of termination of employment. You agree to enter into an agreement upon your termination to authorize the Company to immediately offset against and reduce any amounts otherwise due or will be due post termination to you for any amounts owing to the Company in repaying the invoiced total to the fullest extent allowed by law.

As soon as practicable following your Employment Start Date you will be granted Restricted Stock Units (“RSUs”) with a value of $28,000,000 (the “New Hire Grant”). The number of shares of the Company's Class A Common Stock covered by the New Hire Grant will be determined by dividing $28,000,000 by the 20 trading day average closing price of the Company’s Class A Common Stock on the NYSE as of the last trading day of the calendar month immediately prior to the calendar month that includes your employment start date. When determining the number of RSUs subject to your New Hire Grant, any partial RSUs will be rounded down to the nearest whole RSU. All vesting of your New Hire Grant is subject to your continued service with the Company through each applicable vesting date, except as may be modified by this letter, your Severance Agreement (as defined below), or any other agreement between you and the Company. Your New Hire Grant vesting schedule will provide that on the first Quarterly Vesting Date that is on or after the three month anniversary of your employment start date, a number of RSUs equal to the number of RSUs subject to the award multiplied by a fraction with a numerator equal to the number of completed months between your employment start date and the first Quarterly Vesting Date and a denominator equal to 36, rounded down to the nearest whole share will vest. Thereafter, approximately 1/12th of the RSUs granted will vest on each of the next 11 Quarterly Vesting Dates. Notwithstanding the language in Section 3(a)(iii) of the Severance Agreement, and subject to Sections 5 and 6 of the Severance Agreement, including your satisfaction of the Release Requirement described therein, if your employment is terminated by the Company without Cause, or if you terminate your employment for Good Reason, and in each such case termination occurs during the first eighteen (18) months of your employment with the Company, your RSUs subject to the New Hire Grant that otherwise would have vested had you remained employed by the Company through the 18-month anniversary of the date of your termination shall vest. For purposes of clarity, in the event of a qualifying termination

and with respect to your New Hire Grant only, you will be eligible to receive either (but not both) the equity acceleration benefits described in Section 3(a)(iii) of the Severance Agreement or the equity acceleration benefits provided for in this paragraph, whichever of the two results in the greater number of accelerated RSUs subject to the New Hire Grant.

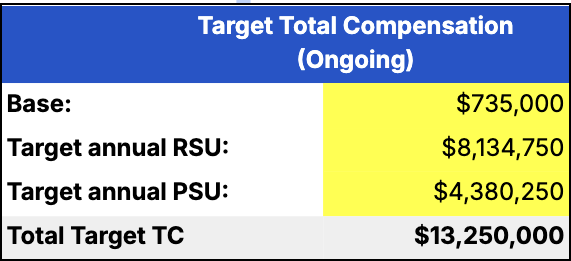

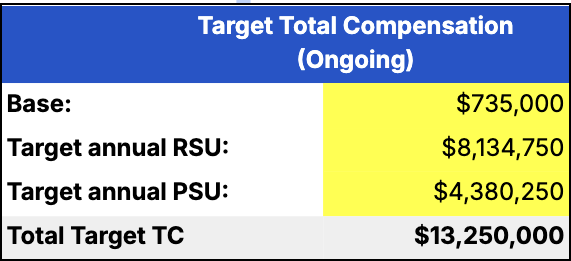

You shall be eligible to receive additional equity awards commensurate with your position, as the Company’s Board of Directors or its Leadership Development and Compensation Committee determines in its discretion and in accordance with Company practices from time to time. The current target total compensation for the position of the Company’s Chief Financial Officer is $13.25M per year, as shown in the table below. This amount was used to derive the terms of this offer, and the size of initial grants. The Company sets executive compensation yearly, typically on the 1st of March and it is anticipated that you would be eligible for RSU and PSU equity awards at the same time as the Company’s other executive officers.

The Company's standard Quarterly Vesting Dates are February 20, May 20, August 20 and November 20. Your RSU grant shall be subject to the terms and conditions of the Company's Equity Incentive Plan and RSU Agreement, including vesting requirements. Any performance-based RSU grant shall be subject to the terms and conditions of the Company's Equity Incentive Plan and applicable form of agreement, including vesting requirements. No right to any stock is earned or accrued until such time that vesting occurs, nor does the grant confer any right to continued vesting or employment.

Additionally, you will receive a cash signing bonus of $3,000,000 (“Signing Bonus”), which will vest over three years. All vesting of your Signing Bonus is subject to your continued service with the Company through each applicable vesting date, except as set forth below. The first installment of your Signing Bonus will be paid on the first Quarterly Vesting Date that is on or after the three month anniversary of your employment start date. On such first Quarterly Vesting Date you will receive a cash payment of $3,000,000 multiplied by a fraction, the numerator of which will be the number of completed months between your employment start date and the first Quarterly Vesting Date and the denominator of which will be 36. Thereafter, 1/11th of $3,000,000 less the amount of the Signing Bonus paid on the first Quarterly Vesting Date will vest on each of the next 11 Quarterly Vesting Dates. All payments of the Signing

Bonus will be subject to appropriate payroll deductions. Subject to Sections 5 and 6 of the Severance Agreement, including your satisfaction of the Release Requirement described therein, if your employment is terminated by the Company without Cause or you terminate your employment for Good Reason or your termination is as a result of your death or Disability, and such termination occurs during your first year of employment with the Company, you will receive any unpaid portion of the Signing Bonus that you would have received had you remained employed by the Company through the 18-month anniversary of the date of your termination (the “Signing Bonus Benefit”).

You will also receive a second cash signing bonus of $3,000,000 (the “Lump Signing Bonus”), payable with your first paycheck, subject to appropriate payroll deductions. For each month of completed service, 1/36 of the Lump Signing Bonus will be deemed earned. Subject to Sections 5 and 6 of the Severance Agreement, including your satisfaction of the Release Requirement described therein, if your employment is terminated by the Company without Cause or you resign for Good Reason or by reason of your death or Disability, any portion of the Lump Signing Bonus that would have been earned had you remained employed by the Company through the 18-month anniversary of the date of your termination, shall be fully earned (the “Lump Signing Bonus Benefit”).

If you voluntarily terminate your employment with the Company for any reason (for purposes of this sentence, a termination as a result of Good Reason shall not be deemed to be a voluntary termination) before the third anniversary of your first work day with the Company, you shall repay to the Company any unearned portion of the Lump Signing Bonus; and if your employment is terminated by the Company for Cause before the third anniversary of your first work day with the Company, you shall repay to the Company any unearned portion of the Lump Signing Bonus net of associated taxes incurred and actually paid. You shall make any applicable repayment in full within 15 days of notification of termination of employment. You agree to enter into an agreement upon your termination to authorize the Company to immediately offset against and reduce any amounts otherwise due or will be due post termination to you for any amounts owing to the Company in repaying the unearned total to the fullest extent allowed by law.

For purposes of this letter, “Cause” shall be defined as set forth in the Severance Agreement.

For purposes of this letter, “Good Reason” shall be defined as set forth in the Severance Agreement.

For purpose of this letter, “Disability” shall be defined as set forth in the Severance Agreement.

In connection with your employment, you will be eligible to enter into the Change in Control Severance Agreement attached hereto as Exhibit B (the “Severance Agreement”). The Severance Agreement specifies the severance payments and benefits you may become entitled to receive in connection with certain qualifying terminations of your employment with

the Company. In order to be eligible to receive any benefits under the Severance Agreement, you must sign and deliver the Severance Agreement to the Company.

The Company is excited about your joining and looks forward to a beneficial and productive relationship. Nevertheless, you should be aware that your employment with the Company is for no specified period and constitutes at-will employment. As a result, you are free to resign at any time, for any reason or for no reason. Similarly, the Company is free to conclude its employment relationship with you at any time, with or without cause, and with or without notice. We request that, in the event of resignation, you give the Company at least two-weeks’ notice.

The Company reserves the right to conduct background investigations and/or reference checks on all of its potential employees. Your job offer, therefore, is contingent upon a clearance of such a background investigation and/or reference check, if any. The Company understands that you will not resign your current employment until it notifies you of such clearance.

For purposes of federal immigration law, you will be required to provide to the Company documentary evidence of your identity and eligibility for employment in the United States. Such documentation must be provided to us within three business days of your date of hire, or our employment relationship with you may be terminated.

We also ask that, if you have not already done so, you disclose to the Company any and all agreements relating to your prior employment that may affect your eligibility to be employed by the Company or limit the manner in which you may be employed. It is the Company's understanding that any such agreements will not prevent you from performing the duties of your position and you represent that such is the case. Moreover, you agree that, during the term of your employment with the Company, you will not engage in any other employment, occupation, consulting or other business activity directly related to the business in which the Company is now involved or becomes involved during the term of your employment, nor will you engage in any other activities that conflict with your obligations to the Company. Similarly, you agree not to bring any third party confidential information to the Company, including that of your former employer, and that in performing your duties for the Company you will not in any way utilize any such information. Your service, if any, on any company board will be consistent with any Company policy that may apply. The Company agrees and acknowledges that your service as a director on the board of Macy’s, Inc. is consistent with Company policies.

You have disclosed to the Company your Paramount Global contract end date and any non- competition covenants that apply to you resulting from your employment with Paramount Global. So long as you do not act in a manner inconsistent with any Company instructions with respect to such non-competition covenants, to the fullest extent permitted by law the

Company shall indemnify you for all fees (including without limitation reasonable attorneys’ fees), costs, expenses, settlements, awards, judgments, clawbacks and/or forfeitures with respect to and/or arising out of any threatened and/or actual claims by Paramount Global. Such indemnification shall include timely advancement of any attorneys’ and other fees incurred by you. These indemnification obligations shall not apply to the breach or purported breach of any non-solicit provisions that may apply to you or your use or disclosure of any confidential or proprietary information belonging to any former employer or other person or entity with respect to which you owe an obligation of confidentiality under any agreement or otherwise.

As a Company employee, you will be expected to abide by the Company's rules and standards. Specifically, you will be required to sign an acknowledgment that you have read and that you understand the Company's Code of Business Conduct and Ethics and Insider Trading Policy, both of which will be available to you after your start date.

This letter shall be governed by the laws of the State of California without regard to its conflicts of law rules that may result in the application of the laws of any jurisdiction other than California.

As a condition of your employment, you are also required to sign and comply with an At-Will Employment, Confidential Information, Invention Assignment and Arbitration Agreement which requires, among other provisions, the assignment of patent rights to any invention made during your employment at the Company, and non-disclosure of Company proprietary information. In the event of any dispute or claim relating to or arising out of our employment relationship, you and the Company agree that (i) any and all disputes between you and the Company shall be fully and finally resolved by binding arbitration, (ii) you are waiving any and all rights to a jury trial but all court remedies will be available in arbitration, (iii) all disputes shall be resolved by a neutral arbitrator who shall issue a written opinion, (iv) the arbitration shall provide for adequate discovery, and (v) the Company shall pay all but the first $125 of the arbitration fees. Please note that we must receive your signed At-Will Employment, Confidential Information, Invention Assignment and Arbitration Agreement before your first day of employment.

Except as provided herein, you will not be required to mitigate the amount of any payment contemplated by this letter, nor will any payment be reduced by any earnings that you may receive from any other source.

The Company intends that all payments and benefits provided under this letter or otherwise are exempt from, or comply with, the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and any guidance promulgated under Section 409A of the Code (collectively, “Section 409A”) so that none of the payments or benefits will be subject to the additional tax imposed under Section 409A, and any ambiguities in this letter

will be interpreted in accordance with this intent. No payment or benefits to be paid to you, if any such payments or benefits, under this letter or otherwise, when considered together with any other severance payments or separation benefits that are considered deferred compensation under Section 409A (together, the “Deferred Payments”) will be paid or otherwise provided until you have a “separation from service” within the meaning of Section 409A. If, at the time of your termination of employment, you are a “specified employee” within the meaning of Section 409A, then the payment of the Deferred Payments will be delayed to the extent necessary to avoid the imposition of the additional tax imposed under Section 409A, which generally means that you will receive payment on the first payroll date that occurs on or after the date that is six months and one day following your termination of employment. The Company reserves the right to amend this letter as it considers necessary or advisable, in its sole discretion and without your consent or the consent of any other individual, to comply with any provision required to avoid the imposition of the additional tax imposed under Section 409A or to otherwise avoid income recognition under Section 409A prior to the actual payment of any benefits or imposition of any additional tax. Each payment, installment, and benefit payable under this letter is intended to constitute a separate payment for purposes of U.S. Treasury Regulation Section 1.409A-2(b)(2). In no event will the Company or any of its subsidiaries reimburse, indemnify, or hold harmless you for any taxes, penalties and interest that may be imposed, or other costs that may be incurred, as a result of Section 409A.

To accept the Company's offer, please sign and date this letter in the space provided below. If you accept our offer, your employment will commence at a date to be mutually agreed upon by the Parties in writing. This letter, along with any agreements relating to proprietary rights between you and the Company, set forth the terms of your employment with the Company and supersede any prior representations or agreements including, but not limited to, any representations made during your recruitment, interviews or pre-employment negotiations, whether written or oral. This letter, including, but not limited to its at-will employment provision, may not be modified or amended except by a written agreement signed by the Company and you. This offer of employment will terminate if it is not accepted, signed and returned by June 5, 2025, or if your employment has not commenced by September 15th, 2025; provided, however, that if after you resign your current employment and thereafter the Company withdraws its offer of employment, and such withdrawal of this offer of employment does not result from the Company’s discovery of any facts or acts that would be disqualifying for you to serve as the Chief Financial Officer of a public company, specifically: (i) your conviction of or a plea of guilty or no contest to any felony; (ii) your arrest or indictment for a crime involving allegations of possession or distribution of sexual content involving a minor; or (iii) your arrest or indictment for a crime involving financial fraud or dishonesty, then subject to Sections 5 and 6 of the Severance Agreement, including your satisfaction of the Release Requirement described therein, you shall receive a payment of $14,000,000, subject to appropriate deductions.

We look forward to your favorable reply and to working with you at Roblox Corporation.

Sincerely,

| | |

| /s/ David Baszucki |

David Baszucki, Founder, President and CEO |

Agreed to and accepted:

| | | | | |

| Signature: | /s/ Naveen Chopra |

| | | | | |

| Printed Name: | Naveen Chopra |

Enclosures:

At-Will Employment, Confidential Information, Invention Assignment and Arbitration Agreement Exhibit A