Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class A) | $ 74 | 1.53 % |

* | Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

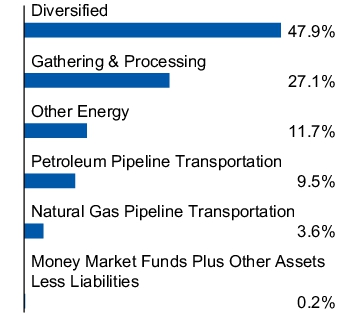

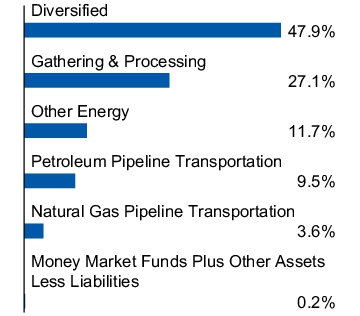

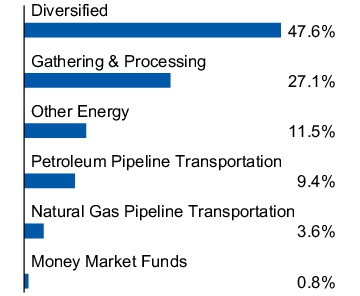

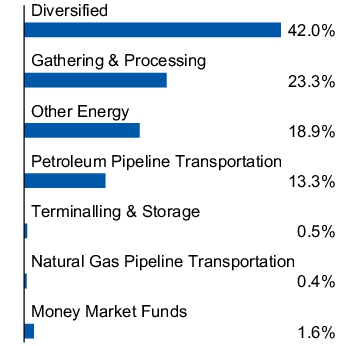

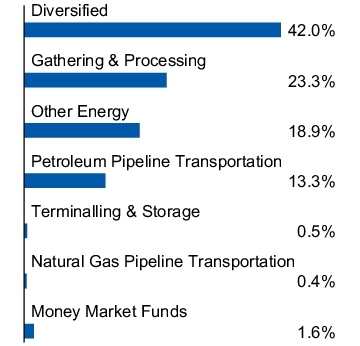

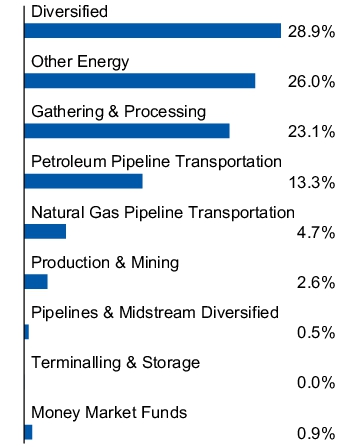

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money m arket fun d holdings, if any. |

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money m arket fun d holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class C) |

$ 111 |

2.28 % |

* |

Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

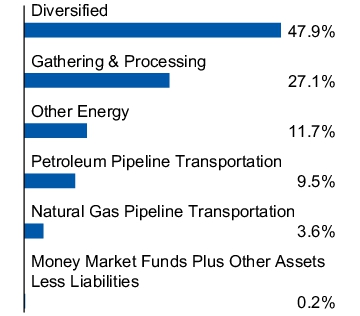

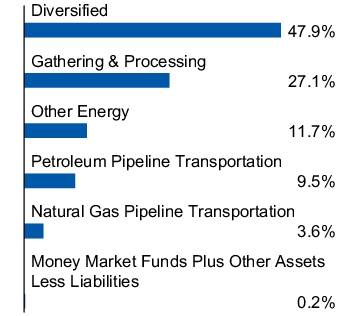

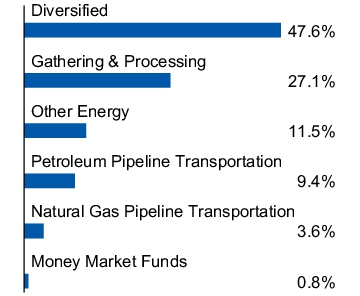

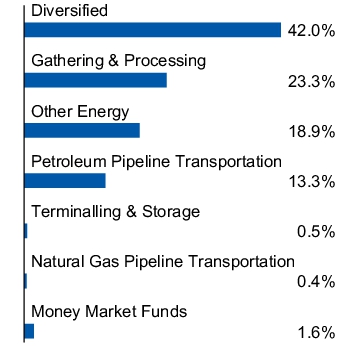

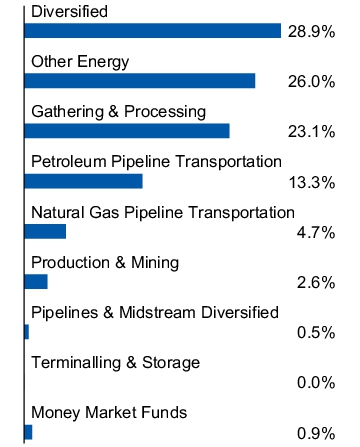

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

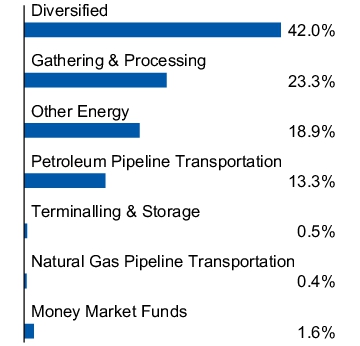

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class R) |

$ 86 |

1.78 % |

* |

Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

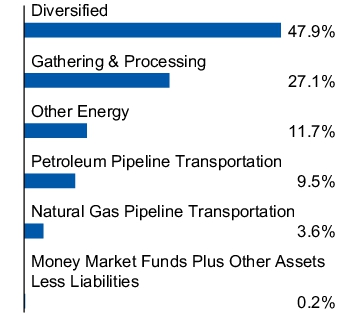

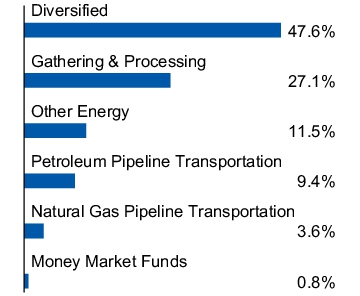

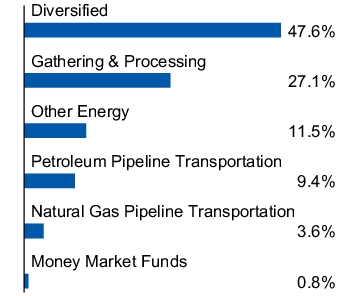

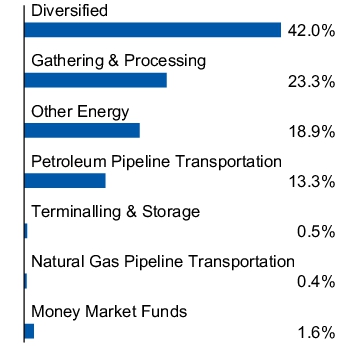

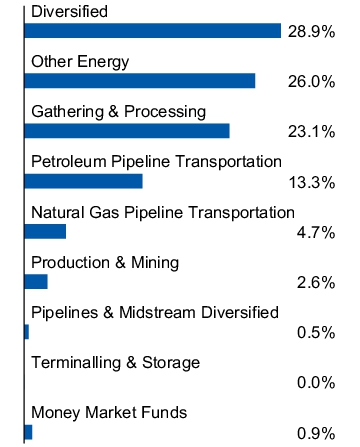

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class Y) |

$ 62 |

1.28 % |

* |

Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

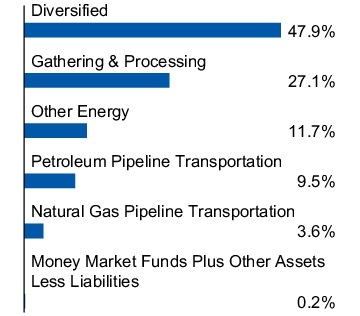

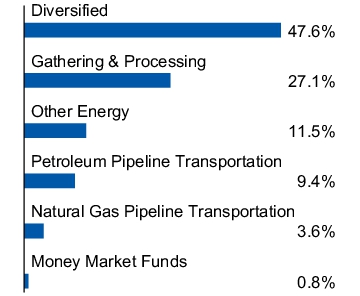

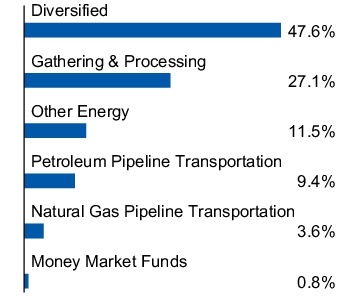

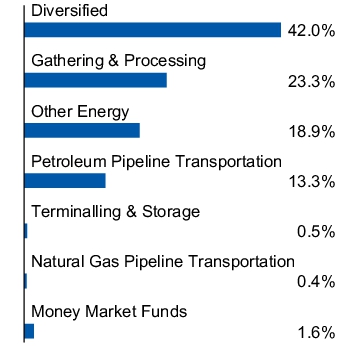

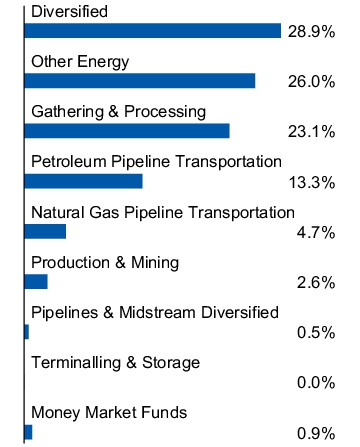

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class R5) |

$ 58 |

1.20 % |

* |

Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Fund (Class R6) |

$ 58 |

1.20 % |

* |

Annualized. |

| Fund net assets | $ 1,086,476,955 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 39 % |

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

(% of net assets)

(% of net assets)

| Energy Transfer L.P. | 13.73 % |

| MPLX L.P. | 13.54 % |

| Western Midstream Partners L.P. | 11.92 % |

| Targa Resources Corp. | 9.55 % |

| Enterprise Products Partners L.P. | 8.59 % |

| Plains All American Pipeline L.P. | 5.62 % |

| Williams Cos., Inc. (The) | 5.47 % |

| Hess Midstream L.P. | 4.98 % |

| Sunoco L.P. | 4.44 % |

| ONEOK, Inc. | 4.15 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class A) |

$ 173 |

3.62 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

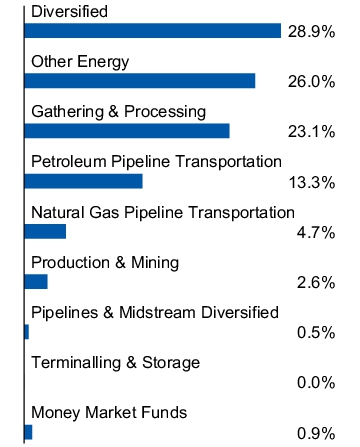

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class C) |

$ 209 |

4.37 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

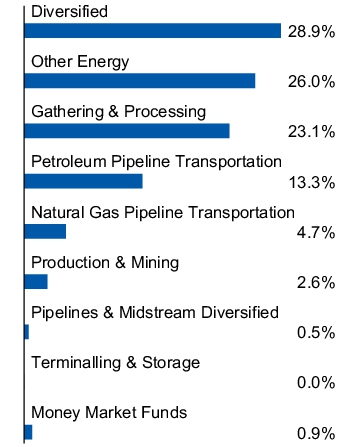

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class R) |

$ 185 |

3.87 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class Y) |

$ 161 |

3.37 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class R5) |

$ 160 |

3.35 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Alpha Plus Fund (Class R6) |

$ 158 |

3.30 % |

* |

Annualized. |

| Fund net assets | $ 305,604,739 |

| Total number of portfolio holdings | 22 |

| Portfolio turnover rate | 13 % |

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| Energy Transfer L.P. | 20.07 % |

| MPLX L.P. | 19.69 % |

| Western Midstream Partners L.P. | 17.38 % |

| Targa Resources Corp. | 14.02 % |

| Enterprise Products Partners L.P. | 12.55 % |

| Plains All American Pipeline L.P. | 8.23 % |

| Williams Cos., Inc. (The) | 8.00 % |

| Hess Midstream L.P. | 7.32 % |

| Sunoco L.P. | 6.48 % |

| ONEOK, Inc. | 5.98 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class A) |

$ 66 |

1.35 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class C) |

$ 103 |

2.10 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class R) |

$ 79 |

1.60 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class Y) |

$ 54 |

1.10 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class R5) |

$ 51 |

1.03 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Income Fund (Class R6) |

$ 51 |

1.03 % |

* |

Annualized. |

| Fund net assets | $ 3,901,650,336 |

| Total number of portfolio holdings | 27 |

| Portfolio turnover rate | 4 % |

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 15.34 % |

| Energy Transfer L.P. | 14.79 % |

| Western Midstream Partners L.P. | 14.54 % |

| Enterprise Products Partners L.P. | 14.44 % |

| Antero Midstream Corp. | 9.07 % |

| Plains All American Pipeline L.P. | 8.60 % |

| Sunoco L.P. | 8.10 % |

| USA Compression Partners L.P. | 5.91 % |

| Genesis Energy L.P. | 3.79 % |

| ONEOK, Inc. | 2.92 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class A) |

$ 55 |

1.11 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class C) |

$ 92 |

1.87 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class R) |

$ 67 |

1.36 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class Y) |

$ 43 |

0.86 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class R5) |

$ 39 |

0.78 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment* |

| Invesco SteelPath MLP Select 40 Fund (Class R6) |

$ 39 |

0.78 % † |

* |

Annualized. |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| Fund net assets | $ 2,063,199,803 |

| Total number of portfolio holdings | 46 |

| Portfolio turnover rate | 9 % |

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

(% of total investments)

(% of net assets)

| MPLX L.P. | 7.96 % |

| Energy Transfer L.P. | 7.88 % |

| Western Midstream Partners L.P. | 7.41 % |

| Genesis Energy L.P. | 5.49 % |

| Antero Midstream Corp. | 5.43 % |

| Archrock, Inc. | 5.37 % |

| Enterprise Products Partners L.P. | 5.30 % |

| Williams Cos., Inc. (The) | 5.28 % |

| Kinder Morgan, Inc. | 5.17 % |

| Targa Resources Corp. | 5.16 % |

| * Excluding money market fund holdings, if any. |

| [1] | Annualized. |

| [2] | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |