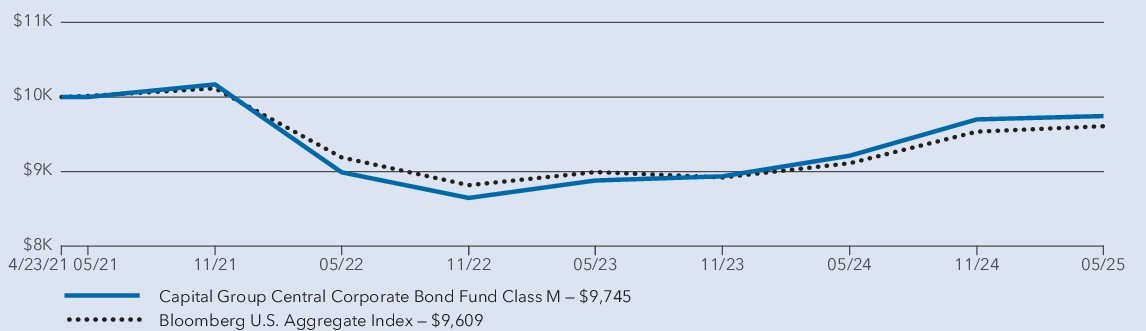

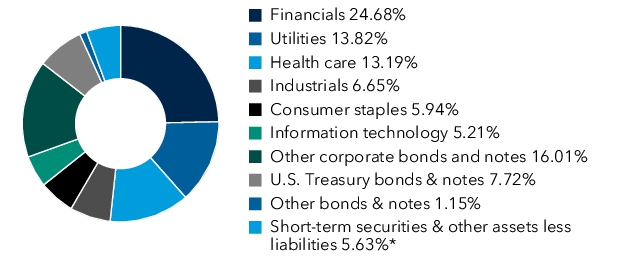

Management's discussion of fund performance The fund’s Class M shares gained 5.77% for the year ended May 31, 2025. That result compares with a 5.46% gain for the Bloomberg U.S. Aggregate Index. What factors influenced results During the fund’s fiscal year, the Bloomberg U.S. Corporate Investment Grade Index outpaced both the Bloomberg U.S. Aggregate Bond Index and Bloomberg U.S. Treasury Index. The U.S. Federal Reserve reduced rates three times in 2024 as inflation eased. U.S. Treasury yields rose following the first rate cut in September, but fluctuated in early 2025 amid concerns over slower economic growth and higher perceived credit risk. Although corporate bond valuations deflated as corporate credit spreads widened, they remain attractive due to solid fundamentals and substantial yield advantage over Treasuries. Within the fund, each of the major sectors contributed positively to overall returns, with the fund’s holdings in consumer noncyclical and electric utilities debt being particularly additive relative to the benchmark. Duration and curve positioning had little impact. Holding a smaller portion of investments than the index in consumer cyclical, technology and banking sectors had a relative negative impact on returns. Likewise, exposure to derivatives used to hedge credit and more efficiently execute interest rate positioning negatively impacted returns.

|