Exhibit 99.1

|

|

Press Release |

|

|

Brussels – 31 July 2025 - 7:00am CET |

Regulated information1 |

AB InBev Reports Second Quarter 2025 Results

Consistent execution of our strategy delivered an EBITDA increase of 6.5%, continued margin expansion and high-single digit Underlying EPS growth

“Beer is a passion point for consumers. The resilience of the beer category and the continued momentum of our megabrands delivered another quarter of profitable growth. EBITDA increased by 6.5% and the ongoing optimization of our business drove Underlying EPS growth of 8.7%. While the operating environment remains dynamic, the consistent execution of our strategy by our teams and partners drove a solid first half of the year and reinforces our confidence in delivering on our outlook for 2025.” – Michel Doukeris, CEO, AB InBev

| Revenue +3.0%

Revenue increased by 3.0% in 2Q25 with revenue per hl growth of 4.9% and by 2.3% in HY25 with revenue per hl growth of 4.3%.

Reported revenue decreased by 2.1% in 2Q25 to 15 004 million USD and by 4.2% in HY25 to 28 632 million USD, impacted by unfavorable currency translation.

5.6% increase in combined revenues of our megabrands, led by Corona, which grew by 7.7% outside of its home market in 2Q25.

33% increase in revenue of our no-alcohol beer portfolio in 2Q25.

63% increase in Gross Merchandise Value (GMV) from sales of third-party products through BEES Marketplace to reach 785 million USD in 2Q25.

Volumes -1.9%

Volumes declined by 1.9% in 2Q25, with beer volumes down by 2.2% and non-beer volumes up by 0.3%. Volumes declined by 2.0% in HY25, with beer volumes down by 2.3% and non-beer volumes flat. |

Normalized EBITDA +6.5%

Normalized EBITDA increased by 6.5% to 5 301 million USD in 2Q25, with a margin expansion of 116bps to 35.3%. Normalized EBITDA increased by 7.2% to 10 156 million USD in HY25, with a margin expansion of 166bps to 35.5%.

Underlying Profit 1 950 million USD

Underlying Profit was 1 950 million USD in 2Q25 compared to 1 811 million USD in 2Q24 and was 3 556 million USD in HY25 compared to 3 320 million USD in HY24. Reported profit attributable to equity holders of AB InBev was 1 676 million USD in 2Q25 compared to 1 472 million USD in 2Q24, negatively impacted by non-underlying items, and was 3 824 million in HY25 compared to 2 564 million in HY24, positively impacted by non-underlying items.

Underlying EPS 0.98 USD

Underlying EPS increased by 8.7% to 0.98 USD in 2Q25, compared to 0.90 USD in 2Q24, and increased by 8.0% to 1.79 USD in HY25, compared to 1.66 USD in HY24. On a constant currency basis, Underlying EPS increased by 17.4% in 2Q25 and by 18.7% in HY25. | |

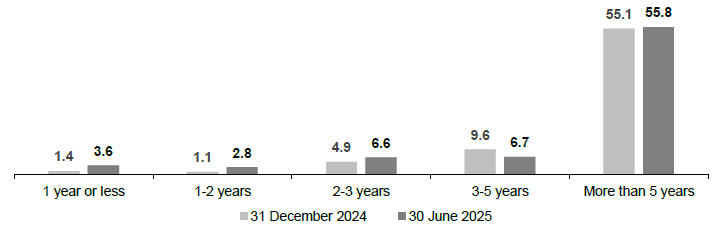

| Net Debt to EBITDA 3.27x

Net debt to normalized EBITDA ratio was 3.27x at 30 June 2025 compared to 3.42x at 30 June 2024 and 2.89x at 31 December 24. | ||

The 2025 Half Year Financial Report is available on our website at www.ab-inbev.com

1The enclosed information constitutes regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 16.

| ab-inbev.com |

Press release – 31 July 2025 – 1 |