Exhibit 1A-6C

1 CNOTE-CUSTODIAL AGENT FEE AGREEMENT This CNoteCustodial Agent Fee Agreement ( "Agreement"), dated as of July 30, 2021, is made by and between CNote Group, Inc.. ("CNote"), organized under the laws of the State of Delaware, and The Northern Trust Company, a banking institution ("Custodial Agent") organized under the laws of the State of Illinois, under which CNote agrees to pay certain fees to Custodial Agent in connection with the Custodial Agent serving as Custodial Agent under and pursuant to various Tri-Party Settlement and Deposit Account Agreements (the "Tri-Party Agreements") by and among Custodial Agent, Sponsor and Customers, as those terms are defined in the Tri-Party Agreements. This Agreement sets forth the fees CNote shall pay to Custodial Agent in connection with Custodial Agent's participation in and performance of its functions under the Tri-Party Agreements, arrangements for distribution of fees associated with the Tri-Party Agreements and the Program (as defined in the Tri-Party Agreements), and the understanding between the parties with respect to Custodial Agent's role and participation in the Program. All capitalized terms not otherwise defined in this Agreement shall have the meanings assigned to them in the Tri-Party Agreements. CNote and Custodial Agent agree as follows: Section 1. Effective Date. The Effective Date for this Agreement shall be the date set forth above. Section 2. Fee. (a) CNote shall pay to Custodial Agent ("Custodial Agent Fee") the fee set forth on Schedule I to this Agreement. (b) CNote shall establish a deposit account at Custodial Agent (the "Fee Account") to be titled "CNote, acting as Fee Disbursement Agent." The Fee Account shall be deemed an account for the benefit of recipients of fees under the Tri-Party Agreements and related agreements in connection with the operation and management of the Program. All funds disbursed from the Fee Account shall be made solely upon the written instructions of CNote. (c) CNote shall pay the Custodial Agent Fee each calendar quarter as set forth on Schedule I by instructing Custodial Agent to withdraw its fee from the Fee Account within one Business Day after CNote delivers the calculation of the Custodial Agent Fee, which shall be determined by the 4th Business Day of each calendar quarter for the previous calendar quarter. Section 3. Representations and Warranties of Custodial Agent and CNote. (a) Custodial Agent makes the following representations and warranties to CNote now and at all times that this Agreement is in effect: (i) Custodial Agent is a state-chartered bank duly organized, validly existing and in good standing under the laws of the State of Illinois, the deposits of which are insured by the Federal Deposit Insurance Corporation, and which is a member of the Federal Reserve System. The execution, delivery and performance of this Agreement by Custodial Agent have been authorized and approved by all

2 requisite action on the part of Custodial Agent, and neither the execution nor the delivery of this Agreement nor the consummation of the transactions contemplated hereby nor the compliance with nor fulfillment of the terms and provisions of this Agreement, will (i) conflict with or result in a breach of terms, conditions or provisions of, or constitute a default under, the Articles of Association or Bylaws of Custodial Agent; (ii) materially conflict with or result in a material breach of the terms, conditions or provisions, or constitute a material default under, any material instrument, agreement, mortgage, judgment, order, award, decree or other restriction to which it is a party or by which it is bound; (iii) require, to the best of the knowledge of Custodial Agent, any affirmative approval, consent, authorization, or other order or action of any court, governmental authority or regulatory body or of any creditor of Custodial Agent; (iv) result, to the best of the knowledge of Custodial Agent, in the violation by Custodial Agent of any applicable law; or (v) violate or conflict with the terms of the Tri-Party Agreements or any of the agreements by and among the parties thereto with respect to the operation of the Program. (ii) This Agreement has been duly authorized, executed and delivered by Custodial Agent and constitutes a legal, valid and binding obligation of Custodial Agent, enforceable against Custodial Agent in accordance with its terms, except as may be limited by (i) bankruptcy laws and other similar laws affecting the rights of creditors generally, and (ii) principles of equity. Custodial Agent has full power and authority to do and perform all acts contemplated by this Agreement. (iii) Custodial Agent shall promptly notify CNote in writing upon becoming aware or when it reasonably should have become aware that any of the representations and warranties given by it is no longer true. (b) CNote makes the following representations and warranties to Custodial Agent now and at all times that this Agreement is in effect: (i) CNote is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. The execution, delivery and performance of this Agreement by CNote have been authorized and approved by all requisite action on the part of CNote, and neither the execution nor the delivery of this Agreement nor the consummation of the transactions contemplated hereby nor the compliance with nor fulfillment of the terms and provisions of this Agreement, will (i) conflict with or result in a breach of terms, conditions or provisions of, or constitute a default under, the Certificate of Formation and Operating Agreement of CNote; (ii) materially conflict with or result in a material breach of the terms, conditions or provisions, or constitute a material default under, any material instrument, agreement, mortgage, judgment, order, award, decree or other restriction to which it is a party or by which it is bound; (iii) require, to the best of the knowledge of CNote, any affirmative approval, consent, authorization, or other order or action of any court, governmental authority or regulatory body or of any creditor of CNote; (iv) result, to the best of the knowledge of CNote, in the violation by CNote of any applicable law; or (v) violate or conflict with the terms of the Tri-Party Agreements or any of the agreements by and among the parties thereto with respect to the operation of the Program. (ii) This Agreement has been duly authorized, executed and delivered by CNote and constitutes a legal, valid and binding obligation of CNote, enforceable against CNote in accordance with its terms, except as may be limited by (i) bankruptcy laws and other similar laws affecting the rights of creditors generally; and (ii) principles of equity. CNote has full power and authority to do and perform all acts contemplated by this Agreement.

3 (iii) CNote shall promptly notify Custodial Agent in writing upon becoming aware or when it reasonably should have become aware that any of the representations and warranties given by it is no longer true. Section 4. Participation in the Program. (a) CNote will allow funds to flow through the Settlement Account, and into and out of deposit accounts, only if: (i) Such funds originate from Customers that have executed a Tri-Party Agreement with Custodial Agent; and (ii) Such deposit accounts are at Program Institutions that have executed an Account Opening Agreement Addendum with Custodial Agent. (b) CNote acknowledges and agrees that: (i) Upon Custodial Agent's reasonable request, CNote will provide written evidence of its compliance with the requirements in subsection 4(a) above. (ii) Custodial Agent transfers funds from the Settlement Account only in conformance with instructions from CNote, and that Custodial Agent can reconcile the accuracy of funds transfers directly from or to the Settlement Account but has no ability to reconcile or assign funds that flow through the Settlement Account that neither originate from nor terminate at the Settlement Account, and Custodial Agent cannot reconcile or assign funds that flow between deposit accounts. Section 5. Termination. (a) Except as otherwise provided in this Section 5, this Agreement shall remain in effect so long as any of the Tri-Party Agreements remain in effect. At the termination of all Tri-Party Agreements, CNote shall follow the termination procedures set forth in such Tri-Party Agreements. (b) In the event (i) a representation or warranty made by either party pursuant to this Agreement proves to have been incorrect or inaccurate in any material respect, or (ii) an agreement undertaken by either party pursuant to this Agreement is not fulfilled (the "Breaching Party"), resulting in a material breach of such representation, warranty, or agreement, and such material breach continues for a period of fifteen (15) days following delivery of written notice by the non-breaching party to the Breaching Party regarding such breach, such other party may, by delivering a written termination notice to the Breaching Party, terminate this Agreement and the Tri-Party Agreements, and terminate the non-breaching party's involvement in the Program, effective on the forty-fifth (45th) day following the day on which such written termination notice is delivered; provided, however, that Custodial Agent in its sole discretion may immediately terminate the Tri-Party Agreements and Custodial Agent's involvement in the Program for any breach by CNote of Section 4 of this Agreement.

4 (c) In the event that Custodial Agent or CNote reasonably determines that the other party is or will be incapable of meeting its obligations under this Agreement, or that the other party presents unacceptable levels of reputational, compliance or other risk to the Program, the party making such determination may immediately terminate this Agreement by delivering a written termination notice specifying the basis for the determination to the other party. (d) This Agreement may be terminated by mutual agreement of the parties. (e) In the event that either party assigns this Agreement by operation of law in connection with a merger, acquisition or similar event affecting the assigning party (as provided for in Section 6(d) below), the non-assigning party may immediately terminate this Agreement by delivering a written termination notice to the assigning party. Section 6. Other Provisions. (a) Each party agrees that it and its agents will use any and all information it acquires from any other party pursuant to the terms of this Agreement only as contemplated hereby, will keep all of such information confidential, and will cause its agents, employees, subcontractors and representatives to keep all of such information confidential, provided however, nothing herein shall be construed to prevent any party from making any disclosure of information otherwise subject to the terms hereof (i) if requested or required by any applicable law; (ii) to any governmental agency or regulatory body having or claiming authority to regulate or oversee any aspect of its business or that of its affiliates; (iii) pursuant to subpoena; (iv) to the extent necessary or appropriate to enforce any remedy provided for in this Agreement; or (v) as is required of either party in the normal course of providing services under the Tri-Party Agreements and related agreements in connection with the operation and management of the Program. (b) All notices or other communications required or permitted hereunder shall be in writing and shall be deemed given if (i) delivered personally; (ii) sent by overnight courier service; or (iii) mailed by registered or certified mail (return receipt requested) when received or (iv) via email: (A) If to Custodial Agent: The Northern Trust Company, Attention: Head of Correspondent Trust Services, 50 S. LaSalle, Chicago, Illinois 60603; email: mks3@ntrs.com, Attention: Michael Sullivan (B) If to CNote: CNote Group, Inc., Attention: Yuliya Tarasava, 2323 Broadway, Oakland, CA 94612; email: operations@mycnote.com, Attention: Yuliya Tarasava The parties shall notify the other parties in writing of any change to its address or contact information. (c) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of Delaware, without giving effect to applicable principles of conflicts of laws. (d) This Agreement shall be binding upon and inure to the benefit of the parties hereto and the respective successors and permitted assigns of the parties hereto, provided, however, that except by operation of law in connection with a merger, acquisition or similar event affecting either party, neither of

5 the parties hereto may assign this Agreement without the prior written consent of the other, which consent shall not be unreasonably withheld. Except as provided above, any attempted assignment of this Agreement without such prior written consent shall be void. Neither this Agreement nor any provision hereof, nor any Schedule hereto or document executed or delivered herewith, shall create any right in favor of or impose any obligation upon any person or entity other than the parties hereto and their respective successors and permitted assigns. (e) This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become a binding agreement when one or more counterparts have been signed by each of the parties and delivered to the other party. (f) The making, execution and delivery of this Agreement by the parties has been induced by no representations, statements, warranties or agreements other than those herein expressed. This Agreement, together with the schedule and documents referred to herein, embodies the entire understanding of the parties and there are no other agreements or understandings, written or oral, in effect between parties relating to the subject matter hereof, except as specifically referenced herein. Neither this Agreement nor any of the terms hereof may be terminated, amended, supplemented or modified orally, but only by an instrument in writing signed by all parties. (g) No waiver or consent, express or implied, by any party to or of any breach or default by any party in the performance by such party of its obligations hereunder shall be deemed or construed to be a consent or waiver to or of any other breach or default in the performance by such party of the same or any other obligations of such party hereunder. Failure on the part of a party to complain of any act of any party or to declare any party in default, shall not constitute a waiver by such party of its rights hereunder. Section 7. Dispute Resolution. (a) Any controversy or claim between the parties hereto arising out of or relating to this agreement ("Claim") will be determined by binding arbitration. The parties agree and understand that there is no right to trial by jury and the arbitrator will have no authority to award consequential, special, punitive, indirect, or other form of damages not measured by the prevailing party's actual damages. (b) The arbitration will be conducted (i) in County of New Castle, Delaware; (ii) before one arbitrator designated by the parties, or if the parties cannot agree on the designation of an arbitrator within sixty days of a request by either party for binding arbitration, by the arbitration association (defined below); (iii) in accordance with the United States Arbitration Act (Title 9 of the United States Code), notwithstanding any choice of law provision in this agreement; and (iv) under the arbitration rules (defined below) in effect at the time of the filing of the demand for arbitration. The arbitrator's award will be final and in writing and will include a statement of the reasons for the award. Judgment upon the award may be entered in any court having jurisdiction. By agreeing to arbitration, the parties do not intend to limit their right to exercise self-help remedies, such as setoff or to obtain provisional or ancillary remedies from a court of competent jurisdiction to maintain the status quo or prevent irreparable harm before or during the arbitration proceeding. (c) The parties each waive the right to trial by jury to the extent permitted by applicable law.

6 (d) To the extent permitted by applicable law, no party hereto may pursue any Claim in arbitration as a class action, private attorney general action or other representative action, nor may any such claim be pursued on any party's behalf in any litigation in any court. (e) If an arbitration or judicial proceeding is commenced in connection with any Claim, the prevailing party shall be entitled to reasonable attorneys' fees, costs and necessary expenditures incurred in connection with such arbitration or judicial proceeding, as determined by the arbitrator or judge. (f) For purposes of this section, (i) the term "arbitration association" shall mean (A) JAMS or its successor; or (B) if an arbitrator associated with JAMS is not located in the metropolitan area where the Settlement Account is being administered by Custodial Agent, American Arbitration Association ("AAA"); and (ii) the term "arbitration rules" shall mean (A) if the arbitrator has been designated by the parties or by JAMS, the JAMS' Comprehensive Arbitration Rules and Procedures (unless the parties agree to use JAMS' Streamlined Rules); or (B) if the arbitrator has been designated by AAA, the Commercial Arbitration Rules of the AAA. (g) The provisions of this section shall survive the termination, amendment or expiration of this agreement. [Signature Page Follows]

7 IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first set forth above. THE NORTHERN TRUST COMPANY By: Name: Title: CNOTE GROUP, INC. By: Name: Title:

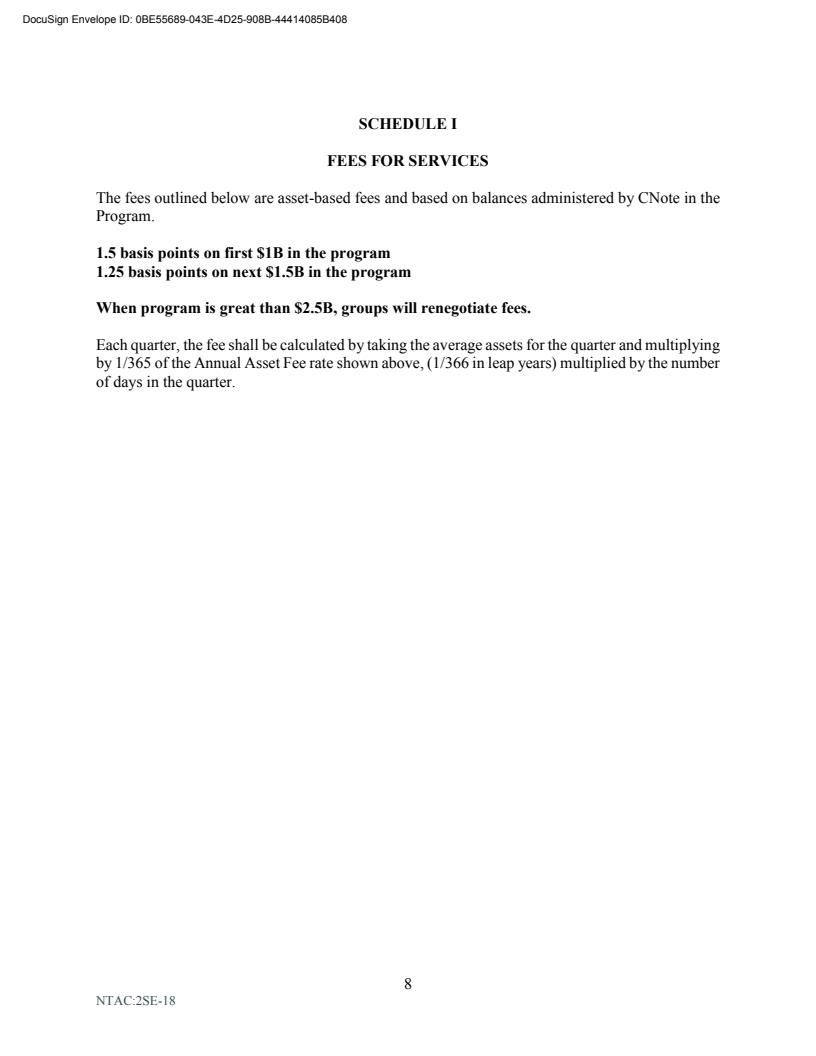

NTAC:2SE-18 8 SCHEDULE I FEES FOR SERVICES The fees outlined below are asset-based fees and based on balances administered by CNote in the Program. 1.5 basis points on first $1B in the program 1.25 basis points on next $1.5B in the program When program is great than $2.5B, groups will renegotiate fees. Each quarter, the fee shall be calculated by taking the average assets for the quarter and multiplying by 1/365 of the Annual Asset Fee rate shown above, (1/366 in leap years) multiplied by the number of days in the quarter.

A Fee Schedule or Proposal for Asset Services and Related Solutions: CNOTE GROUP, INC Effective Date: July 1, 2024 **CONFIDENTIAL** **CONFIDENTIAL** **CONFIDENTIAL** **CONFIDENTIAL**

1 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE CONTACT DETAILS DongYi Carvell Vice President | Sr. Relationship Manager | Correspondent Trust Services ? Asset Servicing Tel 312.630.1896 Email dc135@ntrs.com The Northern Trust Company 50 South LaSalle Street Chicago, IL 60603 For more information on Northern Trust: www.northerntrust.com Different services described in this fee summary may be provided by separate agreements Different services described in this fee summary may be provided by separate agreements Different services described in this fee summary may be provided by separate agreements Different services described in this fee summary may be provided by separate agreements

2 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE Table of Contents Correspondent Trust Services (CTS) ............................................................................................... 3 Other Fees and Expenses ............................................................................................................... 4

3 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE CORRESPONDENT TRUST SERVICES (CTS) Global Custody - Account Maintenance Flat Annual Custody Fee $150,000

4 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE OTHER FEES AND EXPENSES Additional charges may be applied for the following services: ? Services or special procedures required in respect of any directly held property or venture capital/private equity portfolios will be evaluated and priced on a case-by-case business, according to the level of work involved. ? Services associated with special events the client, its investment managers, or other service providers initiate, to the extent those events are not specifically described by the fees detailed in the Transition Related Fee Schedule. ? Customized services including, but not limited to, reporting for non-custodied assets, developing custom downloads, custom programming, special accounting or project work for any client or third-party organization, class action filing services with prior custodial records, client specific data requirements. ? Custom work or ad projects or consulting needs $250/hour ? Services to support in-house managed accounts - These are services for clients that manage investments internally, it goes beyond just safekeeping/custody of the assets, one example includes hiring Northern Trust (NT) for "back office" support ? Custom Cash Fund Services, which could include cash consolidation (sweep), fund accounting, investor reporting and a portfolio management fee. - This service is for clients that decide they want NT to create a custom vehicle fund specifically for them (they would be the only holder) and where trading daily would become a manual process. ? Supporting/facilitating on-site visits by your auditors. Where additional charges are applicable, the indicative fees will be disclosed prior to providing the service. CLASS ACTIONS A Northern Trust custody account that receives proceeds from securities class actions in US dollars will be assessed a charge of 3% of the proceeds up to $2,500 per distribution (per account) with a minimum charge of $25. Proceeds in other currencies are subject to higher charges ? 3% of the proceeds up to approximately $2,500 per distribution (per account) with a minimum charge of approximately $25. These charges, which may change over time in response to market conditions or processing complexity, will be deducted from the class action proceeds in the same currency as the proceeds are paid. We will notify you in advance if there will be any change to these charges. All charges are reported in your statement of account. If payments for a Northern Trust closed custody account are sent to another bank via wire or check, an additional $50 processing charge will be deducted from US dollar payments and a processing charge of approximately $50 will be deducted for other currencies. NEGATIVE INTEREST RATES If you maintain deposits with Northern Trust in markets for which prevailing money market rates fall to a level at or below zero, Northern Trust may, in its discretion, charge a fee on such balances. The amount of the fee, which may vary by market and circumstance and may change over time, will be the spread in excess of the prevailing over night or central bank rate in an affected market and will not exceed 100 basis points. In order to determine the interest rates, you are receiving, you can review your report from Institutional Investor Passport® (IIP) entitled: "Positions/Accrued Income/Interest Rates", where all such rates are disclosed. RELATIONSHIP PRICING Northern Trust offers relationship pricing to clients who wish to avail themselves of it. There are circumstances where it is possible that the use of relationship pricing could give rise to client conflict of interest or prohibited transaction concerns

5 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE under ERISA. Clients considering the use of relationship pricing are advised to consult with their ERISA counsel to assure that any such concerns are appropriately addressed. OVERDRAFT DISCLOSURE Northern Trust generally covers overdrafts as a service to its institutional trust and custody clients in order to assist in the timely processing of transactions. It is Northern Trust's policy to discourage the incidence of overdrafts and to prohibit their excessive use. Northern Trust promptly notifies clients or their investment managers of all overdrafts that occur in client accounts, and the associated fees are reflected in client cash statements. Northern Trust monitors accounts for any pattern or practice or routine overdraft use and takes active steps to address any perceived abuse of overdraft privileges. Thus, this service is an accommodation granted entirely at the discretion of Northern Trust and can be discontinued at any time. Northern Trust's charge for U.S. dollar overdrafts is the Northern Trust Prime Rate of interest. Northern Trust intends to assess overdraft fees on all overdrawn accounts, including separately managed and commingled funds managed by Northern Trust and its affiliates, except in cases where it is determined that Northern Trust or its affiliate was at fault in causing the overdraft. Unless otherwise agreed, overdraft charges will be determined on a daily basis and assessed monthly against client accounts. For non-U.S. dollar overdrafts, Northern Trust assesses overdraft recovery charges based upon prevailing local market rates. PASS-THROUGH EXPENSES Expenses to be passed through to clients include, but are not limited to: ? Commissions and placement or surrender fees. ? Execution attributable to settlement and associated activities in specific markets, including but not limited to market opening charges, stamp duty, securities re-registration fees, ADR/GDR agent pass through charges (including tax relief assistance), transfer agent pass through charges, proxy voting physical representation/ad hoc expenses, Legal entity identified registration charges, Deposit/Withdrawal at Custodian (DWAC) charges (Such charges will be passed through to the account where applicable.) ? Out of pocket expenses, including but not limited to vendor charges, fees for external legal and tax advice, and legal document processing fees. ? Other security-relates charges passed through by depositories. Note: All charges and expenses that are passed through to clients are dictated by markets or other third parties and are subject to change without notice. MATERIAL CHANGES AND TERMS The fees quoted above are offered contingent upon the information provided and assume that actual experience will not be materially different from projected activity and/or assumptions. "Material" changes, for the purposes of this provision, will be changes in excess of 10% from the assumptions used. In addition, Northern Trust reserves the right to modify any client fee schedule should there be a meaningful change in the account structure or services provided. In such event, a revised fee schedule will be discussed with the client and implemented upon client approval. BILLING / INVOICING Market value-based fees are based on prior period values, prorated for the current invoice period. For example, the 1Q invoice will use 4Q closing market values. Fees are due upon receipt of invoice.

6 Confidentiality Notice: Please consider this document including all detailed fee and pricing information as confidential. This information is intended solely for the recipient noted herein and not for any broad distribution. FEE SCHEDULE Transaction based fees are charged a period in arrears. For example, transactions from 4Q will be charged on the 1Q invoice. All fees are subject to direct debit. Fee Invoices will automatically be charged to account(s) designated by you.