Exhibit 4.19

Strictly Confidential—Do Not Forward

This document is available only to investors who are outside the United States and purchasing the securities described in the attached offering memorandum in “offshore transactions” as defined in, and in reliance on, Regulation S under the Securities Act.

Important: You must read this disclaimer before continuing. This disclaimer applies to the attached offering memorandum. You are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the offering memorandum. In accessing the offering memorandum, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access.

Confirmation of your representation: In order to be eligible to view the offering memorandum or make an investment decision with respect to the securities described therein, investors must be persons outside the United States purchasing the securities described in the attached memorandum in “offshore transactions” as defined in, and in reliance on, Regulation S under the Securities Act. By accepting the e-mail and accessing the offering memorandum, you will be deemed to have represented to us that (1) you and any customers you represent are not located in the United States and that the e-mail address that you gave us and to which this e-mail has been delivered is not located in the United States, its territories or possessions or other areas subject to its jurisdiction and (2) you consent to the delivery of the offering memorandum and any amendments or supplements thereto by electronic transmission.

The offering memorandum has been made available to you in electronic form. Documents may be altered when transmitted electronically and consequently none of the Issuer, the Parent Guarantor, The Hongkong and Shanghai Banking Corporation Limited, Standard Chartered Bank, or any of their respective directors, employees, representatives, affiliates or agents accept any liability or responsibility whatsoever in respect of any discrepancies between the offering memorandum distributed to you electronically and the hard copy version. A hard copy version will be provided to you upon request.

Restrictions: The offering memorandum is being furnished in connection with an offering exempt from registration under the Securities Act solely for the purpose of enabling a prospective investor to consider the purchase of the securities described therein.

The securities have not been, and will not be, registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any applicable state or local securities laws. Nothing in this electronic transmission constitutes an offer of securities for sale in any jurisdiction where it is unlawful to do so.

Except with respect to eligible investors in jurisdictions where such offer is permitted by law, nothing in this electronic transmission constitutes an offer or an invitation to subscribe for or purchase any of the securities described herein, and access has been limited so that it shall not constitute a general advertisement or solicitation in the United States or elsewhere. If a jurisdiction requires that the offering be made by a licensed broker or dealer and any of the Joint Global Coordinators and Joint Bookrunners or any affiliate of any of the Joint Global Coordinators and Joint Bookrunners is a licensed broker or dealer in that jurisdiction, the offering shall be deemed to be made by that Joint Global Coordinator and Joint Bookrunner or affiliate on behalf of the Issuer in such jurisdiction.

You are reminded that you have accessed the offering memorandum on the basis that you are a person into whose possession it may be lawfully delivered in accordance with the laws of the jurisdiction in which you are located. If you have gained access to this electronic transmission contrary to the foregoing restrictions, you will be unable to purchase any of the securities described therein.

Actions that you may not take: You should not reply by e-mail to this communication, and you may not purchase any securities by doing so. Any reply e-mail communications, including those you generate by using the “Reply” function on your e-mail software, will be ignored or rejected.

You may not forward or deliver the offering memorandum, electronically or otherwise, to any other person or reproduce it in any manner whatsoever. Any forwarding, distribution or reproduction of the offering memorandum, in whole or in part, is unauthorized. Failure to comply with this directive may result in a violation of the Securities Act or the securities laws of other jurisdictions.

You are responsible for protecting against viruses and other destructive items. Your use of this e-mail is at your own risk and it is your responsibility to take precautions to ensure that it is free from viruses and other items of a destructive nature.

Confidential

Diamond II Limited

(INCORPORATED IN MAURITIUS WITH LIMITED LIABILITY)

U.S.$125,000,000

7.95% SENIOR SECURED NOTES DUE 2026

GUARANTEED BY RENEW ENERGY GLOBAL PLC

(to be consolidated and form a single series with the U.S.$400,000,000 7.95% Senior Secured Notes due 2026)

Diamond II Limited (the “Issuer”), a limited liability company incorporated in Mauritius, and a wholly owned subsidiary of ReNew Energy Global plc, a public limited company organized under the laws of England and Wales (“ReNew Global” or the “Parent Guarantor”), is offering U.S.$125,000,000 in aggregate principal amount of its 7.95% senior secured notes due 2026 (the “Notes”). The Notes shall constitute a further issuance of, and be fungible with and be consolidated and form a single series which rank pari passu with the US$400,000,000 7.95% Senior Secured Notes due 2024 issued by the Co-Issuers on April 28, 2023 (the “Original Notes”). The Notes have the same terms and conditions as the Original Notes in all respects except for issue date and issue price. Upon the issue of the Notes, the aggregate principal amount of outstanding Notes and Original Notes will be US$525,000,000. Interest on the Notes will be payable semi-annually in arrears on January 28 and July 28 of each year, commencing on January 28, 2025. The Notes will mature on July 28, 2026. The due and punctual payment of the principal of, premium, if any, and interest on, and all other amounts payable under the Notes will be fully and unconditionally guaranteed on a senior basis by the Parent Guarantor as per the terms of the Indenture (as defined herein) (the “Parent Guarantee”).

At any time prior to July 28, 2025, the Issuer may, on one or more occasions, redeem the Notes, in whole or in part, at a redemption price equal to 100.0% of the principal amount of the Notes redeemed, plus the Applicable Premium (as defined herein), as of, and accrued and unpaid interest, if any, to (but not including) the applicable redemption date. At any time prior to July 28, 2025, the Issuer may, on one or more occasions, redeem up to 40.0% of the aggregate principal amount of the Notes at a redemption price equal to 107.95% of the principal amount of the Notes redeemed, plus accrued and unpaid interest, if any, to (but not including) the applicable redemption date, with the equivalent of the net cash proceeds from one or more (x) Equity Offerings and/or (y) INVIT Offerings, subject to certain conditions. At any time on or after July 28, 2025, the Issuer may, on one or more occasions, redeem the Notes, in whole or in part, at the redemption prices set forth under “Description of the Notes—Optional Redemptions”, plus accrued and unpaid interest, if any, on the Notes redeemed, to (but not including), the applicable redemption date.

The Issuer shall have the right to redeem the Notes on the SOR Redemption Date (as defined herein) at a redemption price equal to 100.0% of the principal amount of the Notes redeemed, plus accrued and unpaid interest on such Notes to (but not including) the SOR Redemption Date, subject to certain conditions as more fully described under “Description of the Notes—Special Optional Redemption”. Upon any Rating Decline (as defined herein) as a result of the incurrence of any Senior Issuer Indebtedness (as defined herein), the Issuer shall, within forty-five (45) days of such Rating Decline, either (i) repay in full such Senior Issuer Indebtedness or (ii) redeem the Notes in full at a redemption price of 100.0% of their principal amount, plus accrued and unpaid interest to (but not including) the applicable date of redemption.

Not later than 30 days following a Change of Control Triggering Event (as defined herein), the Issuer will make an Offer to Purchase (as defined herein) all outstanding Notes at a purchase price equal to 101.0% of the principal amount thereof, plus accrued and unpaid interest, if any, to (but not including) the applicable Offer to Purchase Payment Date (as defined herein). Subject to certain conditions as more fully described under “Description of the Notes—Redemption for Taxation Reasons”, the Notes may be redeemed at the option of the Issuer, as a whole but not in part, at a redemption price equal to 100.0% of the principal amount thereof, plus accrued and unpaid interest, if any, to (but not including) the applicable redemption date, upon the occurrence of certain changes in applicable tax law.

The Notes will be general obligations of the Issuer, secured on a first priority basis by the applicable Collateral (as described herein) and will rank equally in right of payment with any existing and future obligations of the Issuer that are not subordinated in right of payment to the Notes. The Parent Guarantee will be a general obligation of the Parent Guarantor and will rank equally in right of payment with any existing and future obligations of the Parent Guarantor that are not subordinated in right of payment to the Parent Guarantee.

Investing in the Notes involves a high degree of risk. See “Risk Factors” starting on page 16.

Price: 101.0% plus accrued interest from, and including, July 28, 2024 to, but excluding August 14, 2024

The Notes and the Parent Guarantee have not been, and will not be, registered under the U.S. Securities Act of 1933 (the “Securities Act”) or the securities laws of any other jurisdiction. Accordingly, the Notes are being offered and sold outside the United States in “offshore transactions” as defined in, and in accordance with, Regulation S under the Securities Act (“Regulation S”).

Application will be made to the Singapore Exchange Securities Trading Limited (the “SGX-ST”) for the listing of and quotation for the Notes on the Official List of the SGX-ST. The SGX-ST assumes no responsibility for the correctness of any statements made, opinions expressed, or reports contained herein. Admission of the Notes to the Official List of the SGX-ST and quotation of the Notes on the SGX-ST is not to be taken as an indication of the merits of the Issuer, the Parent Guarantor, any of their subsidiaries, their associated companies or the Notes.

The Notes are expected to be rated Ba3 by Moody’s Investors Service, Inc. (“Moody’s”) and BB- by Fitch Ratings Inc. (“Fitch”). A rating is not a recommendation to buy, sell or hold the Notes and may be subject to suspension, reduction or withdrawal at any time. A suspension, reduction or withdrawal of the rating assigned to the Notes may adversely affect the market price of the Notes.

The Notes offered outside the United States in reliance on Regulation S will be evidenced by a Regulation S Global Note (as defined herein) deposited with a depositary for, and registered in the name of a nominee of, The Depository Trust Company (“DTC”) for its direct and indirect participants, including Euroclear Bank SA/NV (“Euroclear”), and Clearstream Banking S.A. (“Clearstream”). Delivery of the Notes is expected to be made through the facilities of DTC on or about August 14, 2024 (the “Closing Date”).

Joint Global Coordinators and Joint Bookrunners

|

|

HSBC |

Standard Chartered Bank |

The date of this offering memorandum is August 7, 2024.

NOTICE TO INVESTORS

This offering memorandum is not an offer to sell the Notes and is not soliciting an offer to buy the Notes in any jurisdiction in which the offer or sale is prohibited.

Neither the delivery of this offering memorandum nor any sale made under the terms described herein shall imply that the information herein is correct as of any date after the date hereof. The business, financial condition, results of operations and prospects of the Issuer and the Parent Guarantor may have changed since that date.

This offering memorandum has not and will not be registered or produced or made available as an offer document whether as a prospectus in respect of a public offer or an information memorandum or private placement offer letter or other offering material in respect of a private placement under the Companies Act or any other applicable Indian laws, with any regulatory or statutory body in India including but not limited to the Registrar of Companies, the Securities and Exchange Board of India (“SEBI”) or any Indian stock exchange. This offering memorandum or any other offering document or material relating to the Notes will not be circulated or distributed and have not been circulated or distributed, directly or indirectly, to any person or the public or any member of the public in India or otherwise generally distributed or circulated in India which would constitute an advertisement, invitation, offer, sale, invitation to offer or solicitation of an offer to subscribe for or purchase any securities to the public or to any person resident in India within the meaning of, the Indian Companies Act, 2013, as amended from time to time, and other applicable securities laws of India or in violation of any Indian laws. Any failure to comply with these restrictions may result in a violation of the applicable securities laws of India and other jurisdictions. This offering memorandum has not been and will not be reviewed or approved by any regulatory authority in India (including but not limited to SEBI, the International Financial Services Centres Authority and any registrar of companies) or Indian stock exchange, save and except for any information relating to the Notes which is mandatorily required to be disclosed or filed in India under any applicable Indian laws, including, but not limited to, the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015, as amended from time to time, and under the listing agreements with any Indian stock exchanges pursuant to the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended from time to time, or pursuant to the directives of any statutory, regulatory and adjudicatory body in India.

This offering is being made in reliance upon exemptions from registration under the Securities Act, for an offer and sale of securities which does not involve a public offering. If you purchase any of the Notes, you will be deemed to make certain acknowledgments, representations and agreements set forth under “Plan of Distribution — Investor Representation”. In making an investment decision, you must rely on your own examination of the Issuer and the terms of the offering, including the merits and risks involved. See “Risk Factors” for a discussion of certain factors to be considered in connection with an investment in the Notes. You may be required to bear the financial risks of this investment for an indefinite period of time.

This offering memorandum does not constitute a prospectus for the purposes of the Prospectus Rules of the United Kingdom’s Financial Conduct Authority (“FCA”) or section 85 of the United Kingdom’s Financial Services and Markets Act 2000 (as amended) (“FSMA”) and has not been, and will not be, approved by or filed with the FCA. This offering memorandum does not constitute an offer or any part of an offer to the public within the meaning of sections 85 and 102B of FSMA.

We prepared this offering memorandum solely for use in connection with this offering. In accepting this offering memorandum, you have agreed that this offering memorandum is confidential and that you will hold the information contained herein in confidence. We and the Joint Global Coordinators and Joint Bookrunners reserve the right to reject any offer to purchase any of the Notes for any reason, or to sell less than the principal amount of the Notes for which any prospective purchaser has subscribed. This offering memorandum is personal to each offeree and is not an offer to any other person or to the public generally to subscribe for the Notes. You represent that you are basing

your investment decision solely on this offering memorandum and your own examination of us and the terms of this offering. You cannot distribute this offering memorandum or the information contained in it, by electronic or other means, to any person other than your professional advisor without our prior written consent. You cannot make any photocopies of this offering memorandum.

By receiving this offering memorandum, and by purchasing the Notes, you acknowledge that (1) you have not relied on the Joint Global Coordinators and Joint Bookrunners or any person affiliated with the Joint Global Coordinators and Joint Bookrunners in connection with investigating the accuracy of such information or your investment decision, and (2) no person has been authorized to give information or to make any representation concerning us or the Notes other than as contained in this offering memorandum and information given by our duly authorized representatives in connection with your examination of us and the terms of this offering. You cannot rely on any such other information or representation.

None of the Joint Global Coordinators and Joint Bookrunners, the Trustee, the Collateral Agents, the Principal Paying Agent, the Registrar or the Transfer Agent makes any representation or warranty, express or implied, concerning the accuracy or completeness of the information in this offering memorandum, and nothing contained in this offering memorandum is, or shall be relied upon as, a promise or representation, from the Joint Global Coordinators and Joint Bookrunners, the Trustee, the Collateral Agents, the Principal Paying Agent, the Registrar or the Transfer Agent whether as to the past or the future. To the fullest extent permitted by law, none of the Joint Global Coordinators and Joint Bookrunners, the Trustee, the Collateral Agents, the Principal Paying Agent, the Registrar or the Transfer Agent accept any responsibility for the contents of this offering memorandum or for any statement made or purported to be made by the Joint Global Coordinators and Joint Bookrunners or on their behalf in connection with the Issuer, the Parent Guarantor or the issue and offering of the Notes. The Joint Global Coordinators and Joint Bookrunners, the Trustee, the Collateral Agents, the Principal Paying Agent, the Registrar and the Transfer Agent accordingly disclaim all and any liability whether arising in tort or contract or otherwise (save as referred to above) which they might otherwise have in respect of this offering memorandum or any such statement.

The contents of this offering memorandum do not constitute legal, business or tax advice, and neither we, the Joint Global Coordinators and Joint Bookrunners, the Trustee, the Collateral Agents, the Principal Paying Agent, the Registrar nor the Transfer Agent (or any of our or their respective directors, officers, employees, agents, representatives, affiliates or advisers) make any representation to any purchaser of the Notes regarding the legality of an investment in the Notes by such purchaser under any legal investment or similar laws or regulations. You should consult your own attorney, business advisor and tax advisor as to legal, business or tax advice related to a purchase of the Notes.

The Notes and the Parent Guarantee have not been and will not be registered under the Securities Act, the securities laws of any state of the United States or the securities laws of any other jurisdiction.

Neither the U.S. Securities and Exchange Commission (“U.S. SEC”) nor any state securities commission nor any other securities regulatory authority has approved or disapproved of these securities or determined if this offering memorandum is truthful or complete. Any representation to the contrary is a criminal offense.

In connection with this offering, the Joint Global Coordinators and Joint Bookrunners may engage in transactions that stabilize, maintain or otherwise affect the price of the Notes. Specifically, the Joint Global Coordinators and Joint Bookrunners may over-allot in connection with this offering, may bid for and purchase the Notes in the open market and may impose penalty bids. For a description of these activities, see “Plan of Distribution”.

PRIIPS REGULATION/PROHIBITION OF SALES TO EEA RETAIL INVESTORS

The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

PROHIBITION OF SALES TO UK RETAIL INVESTORS

The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (the “UK”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

IMPORTANT NOTICE TO PROSPECTIVE INVESTORS PURSUANT TO PARAGRAPH 21 OF THE HONG KONG SFC CODE OF CONDUCT

Prospective investors should be aware that certain intermediaries in the context of this offering of the Notes, including certain Joint Global Coordinators and Joint Bookrunners, are “capital market intermediaries” (“CMIs”) subject to Paragraph 21 of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission (the “SFC Code”). This notice to prospective investors is a summary of certain obligations the SFC Code imposes on such CMIs, which require the attention and cooperation of prospective investors.

Prospective investors important who are the directors, employees or major shareholders of the Issuer, the Parent Guarantor, a CMI or its group companies would be considered under the SFC Code as having an association (“Association”) with the Issuer or the Parent Guarantor, the CMI or the relevant group company. Prospective investors associated with the Issuer or the Parent Guarantor or any CMI (including its group companies) should specifically disclose this when placing an order for the Notes and should disclose, at the same time, if such orders may negatively impact the price discovery process in relation to this offering. Prospective investors who do not disclose their Associations are hereby deemed not to be so associated. Where prospective investors disclose their Associations but do not disclose that such order may negatively impact the price discovery process in relation to this offering, such order is hereby deemed not to negatively impact the price discovery process in relation to this offering.

Prospective investors should ensure, and by placing an order prospective investors are deemed to confirm, that orders paced are bona fide, are not inflated and do not constitute duplicated orders (i.e. two or more corresponding or identical orders placed via two or more CMIs). If a prospective investor is an asset manager arm affiliated with any Joint Global Coordinator and Joint Bookrunner, such prospective investor should indicate when placing an order if it is for a fund or portfolio where the Joint Global Coordinator and Joint Bookrunner or its group company has more than 50% interest, in which case it will be classified as a “proprietary order” and subject to appropriate handling by CMIs in accordance with the SFC Code and should disclose, at the same time, if such “proprietary order” may negatively impact the price discovery process in relation to this offering. Prospective investors who do not indicate this information when placing an order are hereby deemed to confirm that their order is not a “proprietary order”. If a prospective investor is otherwise affiliated with any Joint Global Coordinator and Joint Bookrunner, such that its order may be considered to be a “proprietary order” (pursuant to the SFC Code), such prospective investor should indicate to the relevant Join Bookrunner when placing such order. Prospective investors who do not indicate this information when placing an order are hereby deemed to confirm that their order is not a “proprietary order”. Where prospective investors disclose such information but do not disclose that such “proprietary order” may negatively impact the price discovery process in relation to this offering, such “proprietary order” is hereby deemed not to negatively impact the price discovery process in relation to this offering.

Prospective investors should be aware that certain information may be disclosed by CMIs (including private banks) which is personal and/or confidential in nature to the prospective investor. By placing an order, prospective investors are deemed to have understood and consented to the collection, disclosure, use and transfer of such information by the Joint Global Coordinators and Joint Bookrunners and/or any other third parties as may be required by the SFC Code, it being understood and agreed that such information shall only be used for the purpose of complying with the SFC Code, during the bookbuilding process for this offering. Failure to provide such information may result in that order being rejected.

NOTICE TO MAURITIAN INVESTORS

This offering memorandum has not been and will not be registered as a prospectus or a statement in lieu of a prospectus with the Financial Services Commission of Mauritius. This offering memorandum has not been and will not be approved by any regulatory authority in Mauritius, including, but not limited to, the Financial Services Commission, the Registrar of Companies or the Stock Exchange of Mauritius. This offering memorandum and the Notes are not and should not be construed as an advertisement, invitation, offer or sale of any securities to the public of any person resident in Mauritius.

The Notes may not be offered or sold, directly or indirectly, to the public in Mauritius. Neither this offering memorandum, nor any offering material or information contained herein relating to the offer of Notes, may be released or issued to the public in Mauritius or used in connection with any such offer. This offering memorandum does not constitute an offer to sell Notes to the public in Mauritius.

Noteholders are not protected by any statutory compensation arrangements in Mauritius in the event of the Issuer’s failure although the Notes are guaranteed by the Parent Guarantor and are secured pursuant to the Indenture, the Share Pledge and the Issuer Floating Charge.

The Mauritius Financial Services Commission is not responsible for the contents of this offering memorandum and shall not be liable to any action in damages suffered in connection with this offering memorandum.

PRESENTATION OF FINANCIAL AND OTHER DATA

Unless otherwise specified or the context otherwise requires:

•“fiscal year” refers to the fiscal year ended or ending on March 31 of the year indicated;

•the “Issuer” refers to Diamond II Limited;

•the “Parent Guarantor” refers to ReNew Energy Global plc;

•the “Company” refers to Diamon II Limited or ReNew Energy Global plc, as the context requires;

•the “Group” refers to ReNew Energy Global plc and its subsidiaries;

•the “ReNew India” refers to ReNew Power Private Limited and its subsidiaries; and

•“we”, “us” and “our” refers to the Group or the Issuer, as the context requires.

Financial Statements

The Group

This offering memorandum includes the Group’s audited consolidated financial statements as of March 31, 2023 and 2024 and for each of the three years in the period ended March 31, 2024 (the “Group’s Audited Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The Group’s audited consolidated financial statements as of March 31, 2023 and 2024 and for each of the three years in the period ended March 31, 2024 have been audited by S.R. Batliboi & Co. LLP (“S.R. Batliboi”), an independent registered public accounting firm, as set forth in their reports thereon, which are included in this offering memorandum.

Non-IFRS Financial Measures

This offering memorandum contains non-IFRS measures and ratios, including Adjusted EBITDA, cash flow to equity (“CFe”) and Net Debt which are not required by, or presented in accordance with, U.S. SEC requirements, IFRS or the accounting standards of any other jurisdiction.

The Group defined adjusted EBITDA as loss for the year plus (a) current and deferred tax, (b) finance costs and fair value changes on derivative instruments, (c) change in fair value of warrants (if recorded as expense) (d) depreciation and amortisation, (e) listing expenses, (f) share based payment and other expense related to listing less (g) share in loss of jointly controlled entities (h) finance income and fair value change in derivative instruments, (i) change in fair value of warrants (if recorded as income).

The Group defines CFe as Adjusted EBITDA plus non-cash expense and finance income and fair value change in derivative instruments, less interest expense paid, tax paid/(refund) and normalized loan repayments. Normalized loan repayments are repayment of scheduled payments as per the loan agreement. Ad hoc payments and refinancing are not included in normalized loan repayments. The definition also excludes changes in net working capital and investing activities.

Non-IFRS measures should not be considered in isolation and are not measures of the financial performance or liquidity of the Group under IFRS and should not be considered as an alternative to operating profit or loss for the period or any other performance measures derived in accordance with IFRS or as an alternative to cash flow from operating, investing or financing activities or any other measure of the Group’s liquidity derived in accordance with IFRS. The non-IFRS measures of the Group do not necessarily indicate whether cash flow will be sufficient or available for cash requirements and may not be indicative of the results of operations of the Group.

Non-IFRS financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS. Non-IFRS financial information may be different from similarly titled non-IFRS measures used by other companies. The principal limitation of these non-IFRS financial measures is that they exclude significant expenses and income that are required by IFRS to be recorded in our financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-IFRS financial measures.

Due to these limitations, none of the Group’s non-IFRS measures should be considered as measures of discretionary cash available to the Group to invest in the growth of their business or as measures of cash that will be available to them to meet their obligations. You should compensate for these limitations by relying primarily on the IFRS results of the Group and using these non-IFRS measures only to supplement your evaluation of their performance.

Rounding

Certain amounts in this offering memorandum have been rounded. Accordingly, amounts shown as totals may not be the arithmetic sum of the amounts that precede them.

Currency Translations

This offering memorandum contains translations of Indian rupee amounts to U.S. dollars solely for the convenience of the reader. Unless otherwise stated, all translations for March 31, 2024 numbers were made at the exchange rate of Rs.83.34 per U.S.$1.00, being the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York as of March 31, 2024. No representation is made that the Indian rupee amounts referred to in this offering memorandum have been, could have been or could be converted into U.S. dollars at that rate or any other rate.

Currency Presentation

Unless otherwise specified or the context otherwise requires, all references to “rupee(s),” “Rs.,” “Indian rupee(s)” and “INR” are to the lawful currency of India and all references to “$,” “U.S.$” and “U.S. dollar(s)” are to the lawful currency of the United States.

Other than as disclosed in this offering memorandum, there has been no material adverse change in the prospects of the Group since the date of the last published audited financial statements.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this offering memorandum concerning our industry and the regions in which we operate, including our general expectations and market position, market opportunity, market share and other management estimates, is based on information obtained from various independent publicly available sources and reports provided to us. We have not independently verified the accuracy or completeness of any third-party information. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon its management’s knowledge of the industry, have not been independently verified. While we believe that the market data, industry forecasts and similar information included in this offering memorandum are generally reliable, such information is inherently imprecise. Forecasts and other forward-looking information obtained from third parties are subject to the same qualifications and uncertainties as the other forward-looking statements in this offering memorandum. In addition, assumptions and estimates of our future performance and growth objectives and the future performance of our industry and the markets in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this offering memorandum.

CERTAIN DEFINITIONS

Unless otherwise specified or the context otherwise requires, in this offering memorandum:

•“APSPDCL” refers to Southern Power Distribution Company of Andhra Pradesh Limited;

•“AVVNL” refers to Ajmer Vidyut Vitran Nigam Limited;

•“BESCOM” refers to Bangalore Electricity Supply Company Limited;

•“Board” or “ReNew Global Board” or “Board of Directors” means the board of directors of Renew Global;

•“Business Combination” means the Merger, the Exchange and the other transactions contemplated by the Business Combination Agreement;

•“Business Combination Agreement” means the Business Combination Agreement, dated February 24, 2021 by and among RMG II, ReNew India, RMG II Representative, ReNew Global, the Merger Sub and the Major Shareholders;

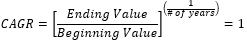

•“CAGR” refers to compound annual growth rate, which is:

•“CCD” refers to compulsorily convertible debenture;

•“CERC” refers to the Central Electricity Regulatory Commission of India;

•“Cognisa” means Cognisa Investment, a partnership firm, having its office at 1st Floor, Penkar House, Jaishuklal Mehta Road, Santacruz (West), Mumbai – 400 054;

•“Companies Act” refers to the Companies Act 2013 and/or the Companies Act 1956, as applicable;

•“Companies Act 1956” refers to the Companies Act, 1956 (without reference to the provisions thereof that have ceased to have effect upon the notification of the sections of the Companies Act 2013) along with the relevant rules, regulations, clarifications and modifications thereunder;

•“Companies Act 2013” refers to the Companies Act, 2013, as amended and to the extent effective, read with the rules, regulations, clarifications and modifications thereunder;

•“CPP Investments” means Canada Pension Plan Investment Board, a Canadian crown corporation organized and validly existing under the Canada Pension Plan Investment Board Act, 1997, c.40;

•“ECB Regulations” refers to Master Directions on External Commercial Borrowings, Trade Credits and Structured Obligations dated March 26, 2019, as amended, updated or replaced, from time to time, applicable provisions of the Master Direction on Reporting under Foreign Exchange Management Act, 1999 dated January 1, 2016, as amended, updated or replaced, from time to time, the Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder, as amended from time to time and the Foreign Exchange Management (Borrowing and Lending) Regulations, 2018, as amended from time to time and the circulars issued thereunder from time to time and any other directions, notifications and circulars issued in connection with the same, and other applicable Indian laws in connection herewith;

•“FICCI” refers to the Federation of Indian Chambers of Commerce and Industry;

•“Founder” refers to Mr Sumant Sinha;

•“Founder Investors” refers to, collectively, the Founder, Cognisa and Wisemore;

•“FPI” means foreign portfolio investor;

•“FVCI” means foreign venture capital investor;

•“GESCOM” refers to Gulbarga Electricity Supply Company Limited;

•“GoI” refers to the government of India;

•“Government” refers to state governments in India;

•“GPCL” refers to Gujarat Power Corporation Limited;

•“GSW” means GS Wyvern Holdings Limited, a company organized under the laws of Mauritius;

•“GUVNL” refers to Gujarat Urja Vikas Nigam Limited;

•“HESCOM” refers to Hubli Electricity Supply Company Limited;

•“IREDA” refers to the Indian Renewable Energy Development Agency Limited;

•“JDVVNL” refers to Jodhpur Vidyut Vitran Nigam Limited;

•“JVVNL” refers to Jaipur Vidyut Vitran Nigam Limited;

•“Merger” means the merger pursuant to the terms of the Business Combination Agreement whereby Merger Sub merged with and into RMG II, with RMG II continuing as the surviving entity;

•“Merger Sub” means ReNew Power Global Merger Sub, a Cayman Islands exempted company;

•“MESCOM” refers to Mangalore Electricity Supply Company Limited;

•“MPPMCL” refers to Madhya Pradesh Power Management Company Limited;

•“MSEDCL” refers to Maharashtra State Electricity Distribution Company Limited;

•“NVVN” refers to NTPC Vidyut Vyapar Nigam Ltd;

•“NTPC” refers to NTPC Limited;

•“PFC” refers to Power Finance Corporation Limited;

•“PGCIL” refers to Power Grid Corporation of India Limited;

•“Pipe Debt” refers to any form of senior secured indebtedness incurred by any person from the Issuer in compliance with applicable law, certain terms of which are set out in Appendix A;

•“PSU” refers to public sector undertaking;

•“PTC” refers to PTC India Limited;

•“RBI” refers to the Reserve Bank of India;

•“RG Pipe Debt” refers to the Pipe Debt incurred by any Restricted Group entity from the Issuer;

•“ReNew Global” refers to ReNew Energy Global plc and its subsidiaries unless the context otherwise requires;

•“ReNew Global Articles” means the articles of association of ReNew Global from time to time;

•“ReNew Global Shareholders Agreement” means the shareholders agreement dated August 23, 2021, by and among ReNew Global and each Shareholders Agreement Investor;

•“ReNew India” or “RPPL” refers to ReNew Power Private Limited and its subsidiaries unless the context otherwise requires;

•“ReNew India Ordinary Shares” means the equity shares in the issued, subscribed and paid-up share capital of ReNew India having a par value of Rs.10 each;

•“Restricted Group” means, collectively, RPPL and all of its subsidiaries (other than unrestricted subsidiaries).

•“RLDC” refers to Regional Load Despatch Centre;

•“RMG II” means RMG Acquisition Corporation II, a Cayman Islands exempted company;

•“RMG II Representative” means Mr Philip Kassin;

•“RMG Sponsor II” means RMG Sponsor II, LLC, which assigned its rights and novated its obligations under the ReNew Global Shareholders Agreement to MKC Investments, LLC and was liquidated on February 17, 2022;

•“RREC” refers to Rajasthan Renewable Energy Corporation Limited;

•“SEBI” refers to the Securities and Exchange Board of India;

•“SEBI FPI Regulations” refers to the Securities Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019 (formerly, the Securities Exchange Board of India (Foreign Portfolio Investors) Regulations, 2014), as amended from time to time;

•“SEBI FVCI Regulations” refers to the Securities and Exchange Board of India (Foreign Venture Capital Investor) Regulations, 2000 as amended from time to time;

•“SECI” Solar Energy Corporation of India;

•“SERC” refers to a State Electricity Regulatory Commission;

•“Shareholders Agreement Investors” means each of the Founder Investors, GSW, CPP Investments, Platinum Cactus, JERA and MKC Investments, LLC (as assignee of RMG Sponsor II);

•“SPV” mean special purpose vehicle;

•“TS SPDCL” refers to Telangana State Southern Power Distribution Company Limited;

•“TSNPDCL” refers to Telangana State Northern Power Distribution Company Limited; and

•“VRR” or “VRR Scheme” refers to the voluntary retention route under Circular No. 22 bearing reference number RBI/2021-22/156 titled “Voluntary Retention Route (VRR) for Foreign Portfolio Investors (FPIs) investment in debt” issued by the RBI on February 10, 2022, as amended, amended and restated, modified or replaced from time to time.

GLOSSARY OF TECHNICAL INDUSTRY TERMS

•“APPC” refers to average power purchase cost of electricity;

•“BOP” refers to balance of plant;

•“CER” refers to certified emission reduction;

•“COD” refers to commercial operation date;

•“CUF” refers to capacity utilization factor and “PLF” refers to plant load factor, both of which refer to a project’s actual generation output over the stated period of time as a percentage of its installed capacity;

•“EPC” refers to engineering, procurement and construction;

•“ERPA” refers to emission reduction purchase agreement;

•“FiT” refers to feed-in tariff;

•“GBI” refers to generation based incentives;

•“GW” refers to gigawatt;

•“GWh” refers to an hour during which one GW of electrical power has been continuously produced;

•“IPP” refers to independent power producer;

•“kV” refers to kilovolt;

•“kW” refers to kilowatt;

•“kWh” refers to an hour during which one kW of electrical power has been continuously produced;

•“MkWh” refers to an hour during which one million kW of electrical power has been continuously produced;

•“MW” refers to megawatt;

•“MWDC” refers to megawatt of direct current;

•“MWh” refers to an hour during which one MW of electrical power has been continuously produced;

•“OEM” refers to original equipment manufacturer;

•“O&M” refers to operation and maintenance;

•“PPA” refers to power purchase agreement;

•“PVSyst” refers to the software provided by PVSyst SA;

•“RE” refers to renewable energy;

•“REC” refers to renewable energy certificate;

•“RPO” refers to Renewable Purchase Obligation;

•“SaaS” refers to software as a service;

•“SVAGRIHA” refers to Griha Council’s small, versatile and affordable green rating for integrated habitat assessment;

•“tCO2e” refers to tons of carbon dioxide equivalent; and

•“UDAY” refers to Ujwal DISCOM Assurance Yojana.

FORWARD-LOOKING STATEMENTS

This offering memorandum contains both historical and forward-looking statements. Forward-looking statements may contain words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “goal,” “intend,” “plan,” “seek,” “will” and similar expressions. Similarly, statements that describe the strategies, objectives, plans or goals of the Group are also forward-looking statements. All forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those contemplated by the relevant statement.

Forward-looking statements appear throughout this offering memorandum and include statements regarding our intentions, beliefs or current expectations concerning, among other things, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance and the markets in which we operate. The forward-looking statements contained in this offering memorandum are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated.

The future events referred to in these forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Group, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on numerous assumptions regarding the present and future business strategies of and the environment in which the Group will operate and are not a guarantee of future performance. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We will not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Important factors that could cause the actual results, performance or achievements to differ materially from those in the forward-looking statements include the following:

•We face risks and uncertainties when developing our projects;

•If environmental conditions at our energy projects are unfavourable, our electricity production, and therefore our revenue from operations may be substantially below expectations;

•There are a limited number of purchasers of utility-scale quantities of electricity, which exposes us and our energy projects to risks;

•The majority of our revenue is exposed to fixed tariffs, changes in tariff regulation and structuring;

•Counterparties to our PPAs may not fulfil their obligations, which could result in a material adverse impact on our business, financial condition, results of operations and cashflows;

•Our PPAs may be terminated upon the occurrence of certain events;

•Our in-house EPC operations expose us to certain risks;

•Operation and maintenance of renewable energy projects involve significant risks that could result in unplanned outages, reduced output, interconnection or termination issues, or other adverse consequences;

•We are subject to credit and performance risk from third-party suppliers and contractors;

•Our business has grown rapidly since its inception, and it may not be able to sustain its rate of growth;

•Restrictions on solar equipment imports, and other factors affecting the price or availability of solar equipment, may increase our business costs;

•Delays in obtaining, or a failure to maintain, governmental approvals and permits required to construct and operate our projects may adversely affect such projects and our business;

•Implementing our growth strategy requires significant capital expenditure and will depend on our ability to maintain access to multiple funding sources on acceptable terms;

•The delay between making significant upfront investments in our wind, solar and hydro power projects and receiving revenue could materially and adversely affect our liquidity, business, results of operations and cash flows;

•If we cannot develop our projects and convert them into operational projects for any reason, our business will not grow and we may have significant write-offs and penalties;

•Our ability to deliver electricity to various counterparties requires the availability of and access to interconnection facilities and transmission systems, and we are exposed to the extent and reliability of the Indian power grid and its dispatch regime;

•Technical problems may reduce energy production below our expectations;

•The growth of our business depends on developing and securing rights to sites suitable for the development of projects;

•We do not own all the land on which we operate;

•We may face difficulties as we expand our operations into new areas of business or geographies within renewable/ green energy generation in which we have limited or no prior operating experience;

•We may not be successful in pursuing strategic partnerships, acquisitions and capital recycling, and future partnerships and acquisitions may subject us to additional risks and not bring us anticipated benefits;

•We face competition from conventional and other renewable energy producers;

•Our operations have inherent safety risks and hazards that require continuous oversight;

•We are required to comply with anti-corruption laws and regulations of the United States government, United Kingdom and India. The implementation of compliance procedures and related controls may be time consuming and expensive and possibly not effective, and our past non-compliance or our future failure to comply, if any, may subject us to civil or criminal penalties and other remedial measures;

•Material weaknesses in our internal controls over financial reporting could materially and adversely affect our financial condition and results of operations and our ability to operate our business;

•The loss of any of our senior management or key employees may adversely affect our ability to conduct business and implement our strategy;

•The order of the Supreme Court of India directing a conversion of existing overhead transmission lines into underground transmission lines in certain environmentally protected areas might adversely impact the business and operation of certain Group entities;

•We have substantial indebtedness and are subject to restrictive and other covenants under our debt financing arrangements;

•Impairment of our long-term assets may have an adverse impact on our results of operations and financial condition;

•We are involved in various tax and legal proceedings that may cause us to incur significant fees, costs and expenses and may result in unfavourable outcomes;

•If we incur an uninsured loss or a loss that significantly exceeds the limits of our insurance policies, the resulting costs may adversely affect our financial condition;

•Changes in technology may render our technologies obsolete or require us to make substantial capital investments;

•We may not be able to adequately protect our intellectual property rights, including the use of the “ReNew” name and the associated logo, which could harm our competitiveness;

•We have entered into a number of related party transactions and may continue to enter into related party transactions in the future;

•Our results of operations could be adversely affected by strikes, work stoppages or increased wage demands by our employees or any other kind of disputes with our employees;

•A substantial portion of our business and operations are located in India and we are subject to regulatory, economic, social and political uncertainties in India.

Additional factors that could cause the actual results, performance or achievements to differ materially include those discussed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” When relying on forward-looking statements, including projections, you should carefully consider the foregoing factors and other uncertainties and events, especially in light of the political, economic, social and legal environment in which the Group operates. Such forward-looking statements speak only as of the date on which they are made. Accordingly, the Issuer does not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. The Issuer does not make any representation, warranty or prediction that the results anticipated by such forward-looking statements will be achieved. Accordingly, you should not place undue reliance on any forward-looking statements to evaluate the future prospects of the Issuer.

LISTING OF THE NOTES

Application will be made to the Singapore Exchange Securities Trading Limited (the “SGX-ST”) for the listing of and quotation for the Notes on the Official List of the SGX-ST.

The Notes will be traded on the SGX-ST in a minimum board lot size of S$200,000 (or its equivalent in other currencies) for so long as the Notes are listed on the SGX-ST and the rules of the SGX-ST so require.

For so long as the Notes are listed on the SGX-ST and the rules of the SGX-ST so require, the Issuer shall appoint and maintain a paying agent in Singapore, where the Notes may be presented or surrendered for payment or redemption, in the event that the Global Certificates are exchanged for individual definitive certificates. In addition, in the event that the Global Certificates are exchanged for individual definitive certificates, an announcement of such exchange will be made by the Issuer through the SGX-ST and such announcement will include all material information with respect to the delivery of the individual definitive certificates, including details of the paying agent in Singapore.

TABLE OF CONTENTS

|

|

|

Page |

SUMMARY |

1 |

THE OFFERING |

10 |

RISK FACTORS |

17 |

USE OF PROCEEDS |

71 |

DEVELOPMENT IMPACT |

72 |

GREEN BOND FRAMEWORK OVERVIEW |

75 |

CAPITALIZATION |

77 |

SELECTED FINANCIAL AND OTHER DATA OF THE GROUP |

78 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF THE GROUP |

82 |

DESCRIPTION OF THE ISSUER |

112 |

DESCRIPTION OF CERTAIN RESTRICTED GROUP ENTITIES |

113 |

BUSINESS |

114 |

REGULATION |

150 |

DIRECTORS AND SENIOR MANAGEMENT |

171 |

PRINCIPAL SHAREHOLDERS |

197 |

RELATED PARTY TRANSACTIONS |

199 |

DESCRIPTION OF OTHER INDEBTEDNESS |

210 |

DESCRIPTION OF THE NOTES |

228 |

TAXATION |

298 |

INDIAN GOVERNMENT FILINGS AND APPROVALS |

301 |

PLAN OF DISTRIBUTION |

304 |

LEGAL MATTERS |

315 |

INDEPENDENT AUDITORS |

316 |

ENFORCEABILITY OF CIVIL LIABILITIES |

317 |

INDEX TO THE CONSOLIDATED FINANCIAL STATEMENTS |

F-1 |

APPENDIX A CERTAIN TERMS OF THE PIPE DEBT |

A-1 |

SUMMARY

This summary highlights certain information contained in this offering memorandum. It does not contain all the information you should consider before investing in the Notes. You should read this entire offering memorandum carefully, including “Risk Factors,” and the financial statements and related notes thereto set forth herein, before making an investment decision.

Overview

We are a leading decarbonization solutions company. Our clean energy portfolio of approximately 15.6 GWs on a gross basis as of May 31, 2024, is one of the largest globally. We are one of the largest utility-scale renewable energy solutions providers in India in terms of total commissioned capacity. We operate wind, solar and hydro energy projects in India and as of May 31, 2024, we had a total operational capacity of 9.52 GW, out of which 8.87 GW is commissioned and 650 MW is generating pre-commissioning revenue through sales in the merchant market, and an additional 6.1 GW of committed capacity. In addition to being one of the largest independent power producers in India, we provide end-to-end solutions in the areas of clean energy, value-added energy offerings through digitalization, storage, and carbon markets that increasingly are integral to addressing climate change. During the year ended March 31, 2024, we signed Memorandum of Understandings (“MoU”) with various financial institutions such as Power Finance Corporation Limited (“PFC”), REC Limited (“REC”), and Asian Development Bank (“ADB”) to the tune of approximately $13 bn to enable financing of renewable energy (“RE”) projects. We also signed an MoU with JERA Power RN BV (“JERA”) for evaluating investments in green hydrogen. In addition, during the year ended March 31, 2024, Gentari purchased a 49% equity stake in our 403 MW Peak Power project and we also signed an MoU with Gentari for a joint investment in renewable energy projects of up to 5 GW.

Our projects are based on proven wind, solar and storage technologies, typically covered under long-term PPAs with creditworthy offtakers including central government agencies, state electricity utilities and private industrial and commercial consumers in India. We are supported by high quality long-term global investors such as CPP Investments, Abu Dhabi Investment Authority (“ADIA”), JERA (a joint venture between TEPCO Fuel & Power, a wholly owned subsidiary of Tokyo Electric Power Company, and Chubu Electric Power Co., Inc.), South Asia Clean Energy Fund and public markets shareholders and we are led by an experienced management team under the leadership of our Founder, Chairman and Chief Executive Officer, Mr. Sumant Sinha, who has extensive experience across our operational and strategic focus areas.

Our strong track record of organic and inorganic growth is demonstrated by an increase in our operational capacity which has grown 4.8 times from the year ended March 31, 2017 to March 31, 2024. We are one of the largest independent power producers (in terms of total commissioned capacity) in the Indian renewable energy industry which has been achieved by delivering wind and solar energy projects, against the backdrop of Government of India’s policies to promote the growth of renewable energy in India. We have a robust financial position and demonstrated access to diversified pool of capital from Indian and international investors, lenders and other capital providers.

We are also a provider of intelligent energy solutions. We have an experienced in-house team focused on forecasting renewable energy demand and modelling energy distribution profiles. These solutions underpin grid infrastructure developed around renewable energy, minimize intra-day and seasonal demand variations and cost less than building new thermal power resources.

Recent Developments

The following developments have occurred since March 31, 2024.

Separation request of Executive Officer and Group President, India RE Business

The Board of ReNew Global has taken note of the separation request of Mr. Mayank Bansal as Executive Officer (Group President, India RE Business) of ReNew Global. The effective date of Mr. Bansal’s separation from the Company was April 30, 2024. Mr. Bansal’s decision to separate is not as a result of any dispute or disagreement with ReNew Global, its Board or management, or any matters relating to the operations, performance, policies, or practices of ReNew Global.

Upcoming release of the unaudited financial results for the three months ended June 30, 2024

ReNew Global expects to issue an earnings release announcing its unaudited financial results for the three months ended June 30, 2024, as well as certain other business updates in a current report on Form 6-K to be furnished to the SEC by no later than August 31, 2024.

Our Market Opportunity

Key drivers of growth in renewable energy in India include structural policy reforms in India’s power sector, overall growth in power demand, economically viable tariffs compared to other fuel sources, “must- run” status to renewable power plants (which means that renewable power that is generated must always be accepted by the grid), fixed price over long-term contracts allowing risk diversification and greater mix of central government offtakers (with better credit ratings) in recently awarded projects. India had approximately 190 GW of total renewable installed generating capacity (comprising of wind, solar and large hydro assets) as of March 31, 2024, and it has announced a target of 500 GW of clean energy by 2030. In addition, under the National Green Hydrogen Mission, one of the key mission outcomes projected by 2030 entails development of green hydrogen production capacity of at least 5 million metric tons (“MMT”) per annum and abatement of nearly 50 MMT of annual greenhouse gas emissions, which may require 125 GW of additional RE capacity.

We believe that through our disciplined bidding approach and vast project execution expertise, we are well positioned to tap this potential and grow our capacity through a combination of (i) our committed projects of 3.93 GW as on March 31, 2024 and 6.12 GW as on May 31, 2024; and (ii) uncontracted pipeline capacity of 5.8 GW, which will continue to be auctioned by central and state government agencies as part of the Government of India’s objective to achieve India’s renewable energy targets. Considering the importance of the corporate PPA market, ReNew has a separate department which exclusively looks at clean energy solutions for corporate customers. We pursue business with these customers through channel partners and also by responding to tenders.

Our Competitive Strengths

Market leadership in India’s high growth renewable energy sector

We are one of India’s largest utility-scale renewable energy solutions providers in terms of total commissioned capacity. During Fiscal 2023-24, bidding activities in India picked up considerably, driven by the Indian government’s 50 GW annual bids plan. ReNew dominated the utility segment bidding landscape by winning over 13% of the bids in Fiscal 2023-24. Our total operational capacity has grown at a CAGR of 25% from 2.0 GW in March 2017 to 9.52 GW in March 2024. We contributed 11% of new renewable generating capacity (comprised of wind and solar assets) added in India in Fiscal 2023-24. As of March 31, 2024, the total installed capacity in India, comprised of solar and wind assets, was 128 GW, and 18 GW increase over Fiscal 2022-23.

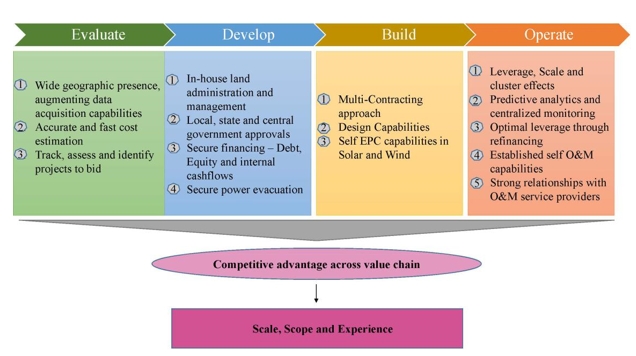

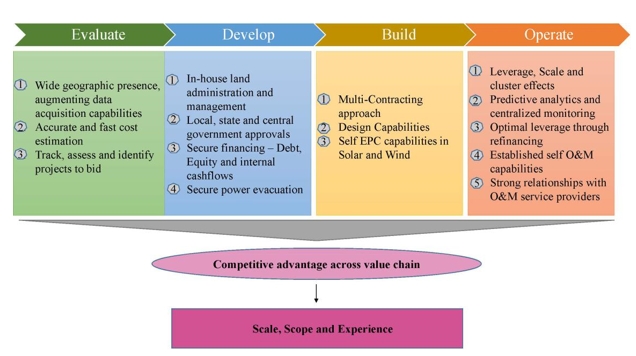

Presence across value chain through extensive in-house end-to-end project execution capabilities

We have a proven track record of developing, operating and maintaining projects at high standards. Our Board closely monitors project performance and actively guides our senior management in addressing operational issues. Our key competitive advantage is having in-house, project execution capabilities with a focus on execution and operational excellence. We believe that our range of wind and solar capabilities across project selection, resource assessment, project funding, land acquisition, project execution and project O&M positions us well for bidding for larger projects. For example,

•Access to reliable data: Our project development team has access to multiple sources of data, including data from 171 active met masts across 125 sites in nine states in India, performance data from our commissioned capacity, data from our OEM vendors, and other reliable public data from multiple agencies, which helps us efficiently bid for projects, navigate the development process of each project and also improve the reliability of our pipeline.

•Land acquisition and site selection: We have acquired through ownership or leasehold rights over 47,000 acres of land (for utility scale solar and utility scale wind energy projects) as of March 31, 2024, and are able to navigate through the complex land acquisition process in India. We are also in the process of engaging with state governments to acquire more land across various states in India.

•EPC capabilities: We are able to execute both our solar and wind projects in-house. As of March 31, 2024, of 4.3 GW of commissioned organic solar capacity, approximately 4.0 GW was developed in-house through self-EPC. We have an in-house design team with access to cutting-edge technology and strong long-term relationships with our suppliers. We employ large teams for wind and solar EPC, across project design and engineering, procurement and project execution.

•Evacuation: We have a team dedicated for managing power evacuation generated at our projects. They manage connectivity, evacuation infrastructure and coordinate with central and state transmission companies.

•Operation and maintenance: We have developed in-house O&M capabilities with a team of over 800 employees and manage almost 100% of our solar projects. In respect of our wind projects we manage approximately 1.6 GW of WTGs and another 1.8 GW of BoP in-house, which we believe provides us significant cost and operational benefits. In addition, our O&M team also manages more than 1 GWp of renewable energy assets for third party IPPs.

Building expertise in intelligent energy solutions and services

We believe that we are transforming renewable energy from real-time energy to dispatchable and controllable energy through digitization and use of storage solutions to support the economy-wide shift to a carbon-neutral electricity mix in India. Over the past four years, we have transitioned from a mainstream utility scale renewable energy company to an intelligent energy utility platform to solve digital integration of energy sources requirement.

Our ability to provide fixed power and on-demand schedulable peak power, enables us to solve for key issues that our offtakers face on scheduling and peak power, thereby giving us a competitive advantage.

We are working with global battery OEMs and system integrators to build a pipeline of utility-scale battery energy storage systems in India. The growth areas for this segment include battery pack assembly and building battery asset management capabilities. We actively look out for and partner with developers of renewable technology to remain competitive and enhance our capabilities. We have formed a 50:50 JV with Fluence to bring market-leading energy storage technology and global experience to Indian customers by localizing and integrating Fluence’s energy storage products and packages in India.

While our business is not directly exposed to seasonality on the demand side, weather conditions can have a significant effect on our power generation and construction activities. The profitability of our wind and solar energy projects is directly correlated to wind and solar conditions at our project sites. The generation profile of these projects therefore does not always correlate with power demand. ReNew is therefore aiming to provide more balanced renewable power supply. We are among the few renewable energy producers with wind, solar and hydro assets and have won three intelligent energy solution projects, Peak Power (322 MW wind and 81 MW solar), Round-The-Clock (901 MW wind and 400 MW solar) and SJVN Firm & Dispatchable Renewable Energy (“FDRE I”) (500 MW solar and 450 MW wind) as of May 31, 2024. Our competitive differentiators are our ability to handle multiple renewables technologies, forecast generation profiles to minimize deviations from demand and sell excess power economically to the market, notwithstanding fluctuation generation profiles.

Project portfolio diversification across resources, geography, offtakers and vendors

Our portfolio is well diversified between wind and solar energy projects across eight states in India. We also enjoy a diversified base of offtakers and vendors. This diversification mitigates the operational volatility due to seasonal weather conditions, reduces concentration risk and places us at an advantage in bidding and winning bids for projects. Our offtakers include central government agencies and public utilities including state electricity utilities, and private industrial and commercial consumers. We focus particularly on the credit profile of our offtakers. As of March 31, 2024, approximately 44% of our offtakers (in terms of total capacity) included central agencies such as Solar Energy Corporation of India Ltd., or “SECI”, National Thermal Power Corporation Limited, or “NTPC” and PTC India Limited, or “PTC”. In addition, approximately 16% of our total offtaker base comprised of corporate and industrial customers. We also work with a broad range of OEM suppliers for sourcing wind and solar equipment. We continue to build in-house O&M capabilities for wind energy projects, thereby reducing our dependence on third parties and managing our costs.

Predictive analytics and centralized monitoring

We closely monitor the performance of our wind and solar energy projects through our central and state monitoring centres, namely ReNew Diagnostics Centre and ReNew Command and Control Centres. Our dedicated team equipped with digital tools continuously tracks real-time data on energy generation at each site, promptly identifying any anomalies for immediate resolution. Moreover, our team analyses each project for potential issues, enabling us to enhance operational efficiency, monitor asset health, and optimize OEM maintenance processes. To support these efforts, our comprehensive ReD (ReNew Digital) Analytics Lab brings together cross-functional teams to develop advanced analytics solutions.

Strong and stable financial position with access to diverse sources of funding

We benefit from a strong financial position which we leverage prudently to support our growth. We have raised a mix of equity and debt to finance our projects. Our equity investors include a diversified pool of well-known international private equity, sovereign wealth and pension funds as well as renewables and infrastructure focused investors. We also have access to a range of project finance and debt instruments from multiple Indian and international investors. Our broad base of long-standing, equity investors include CPP Investments, ADIA, JERA, South Asia Clean Energy Fund and public markets shareholders. Since our incorporation in 2011, our equity investors have invested a total of $2.1 billion in the Group in various tranches, helping us retain an efficient capital structure with no mezzanine capital instruments. We have long-standing relationships with our project finance, corporate debt lenders and other capital providers including public and private commercial banks, non-banking financial companies, institutional investors, mutual funds and pension funds as well as specialized infrastructure lenders.

We routinely refinance our projects once they are operational. We have benefited from refinancing as it gives us the opportunity to create additional liquidity through top -up as well as release of existing cash, enhanced accrual of internal cash flows due to bullet repayment structures in bonds and easier restricted payment conditions. The additional liquidity can be utilized for various distributions, including to fund additional capital expenditure and optimize capital structure across the broader portfolio. We have had access to the on- shore bonds and non-convertible debentures market, allowing us to raise funds from institutional investors. We also deploy innovative structures to raise finance for our projects. From 2017 to March 2024, we have raised over $3.9 billion through overseas dollar green bonds. Our dollar bonds are currently rated BB- by Fitch and Ba3 by Moody’s, and we have a corporate rating of Ba2 by Moody’s.

Recurring and long-term cash flows supported by stable and long-term offtaker contracts

Our projects benefit from long-term PPAs, thereby enhancing the offtake security and long-term visibility of our cash flows. The term of our PPAs with central government agencies and state electricity distribution companies is generally 25 years from the commercial operation date of the project. The term of our PPAs with commercial and industrial customers, that constitute approximately 16% of our portfolio, ranges from 8 to 25 years. These PPAs provide for fixed tariff rates with limited escalation provisions, thus providing stream of visible, predictable and long-term cash flows.

Experienced professional management team.

We are led by a professional and extensively experienced management team, which has a deep understanding of managing renewable energy projects and a proven track record of performance. We draw on the knowledge of our Board, which brings us expertise in the areas of corporate governance, business strategy, and operational and financial capabilities, among others. Our shareholders and investors also have extensive experience of investing in the renewable energy industry, which we believe is key to a number of our growth strategies, including our measured approach to project selection, our expansion into solar energy projects and our development of internal capabilities across several operational areas.

Capital discipline

We target levered project equity IRRs of 16-20%. We are also focusing on raising capital through asset sales and minority stake sales, which have helped improve our returns by 20-25%. In the case of minority stake sale, we typically reduce our capital deployed to 5-10% of project cost (compared to 25% if we were to hold 100% equity in the project). For asset sale, we typically sell assets at approximately 2x book value. The capital released from such capital recycling may be deployed in greenfield bids and new growth opportunities. In April 2022, we finalized a partnership with Mitsui & Co., Ltd., a leading global general trading and investment firm to invest in the RTC renewable energy project being developed by us, with Mitsui taking a 49% stake in the project. In May 2023, we entered into a partnership with PETRONAS’ clean energy subsidiary Gentari, where Gentari purchased a 49% equity stake in our 403 MW Peak Power project. Under the partnership, we invested approximately Rs. 3,130 million (approximately $38 million) for our 51% stake in the project and through our affiliates, will provide EPC, O&M, and project management services for the project. In addition, during Fiscal 2023-24, we sold 400 MW of operating solar assets (100 MW to Technique Solaire and 300 MW to IndiGrid), wherein we realised cash inflow of approximately $104 million (including $8 million to be received against change in law claims) from the asset sales.

Our Strategies

Maintain market position as India’s leading clean energy solutions provider

Against the backdrop of supportive regulatory and industry trends in India’s renewable energy sector, we intend to continue to strengthen our market leading position (in terms of total commissioned capacity) in our core utility-scale wind and solar energy businesses, maintain our diversified portfolio between wind and solar energy projects and

focus on new geographical clusters to increase our economies of scale. We also aim to continue to be the leader in developing and deploying new technologies in the renewable energy sector. We intend to leverage our experience in executing large wind and solar energy projects to further win bids for firm power energy solutions, which places us in a unique position to provide our offtakers innovative energy solutions. We will also look at growth opportunities through corporate PPAs where overall capacity as well as average capacity per site has grown significantly. We believe that our capabilities in group captive and open access projects as well as our ability to deliver multiple solutions to corporate customers, including firm power solutions, will enable us to capture a greater share of this fast-growing market which we consider will be a key renewable energy business in the future.