|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class J

|

$85

|

0.82%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

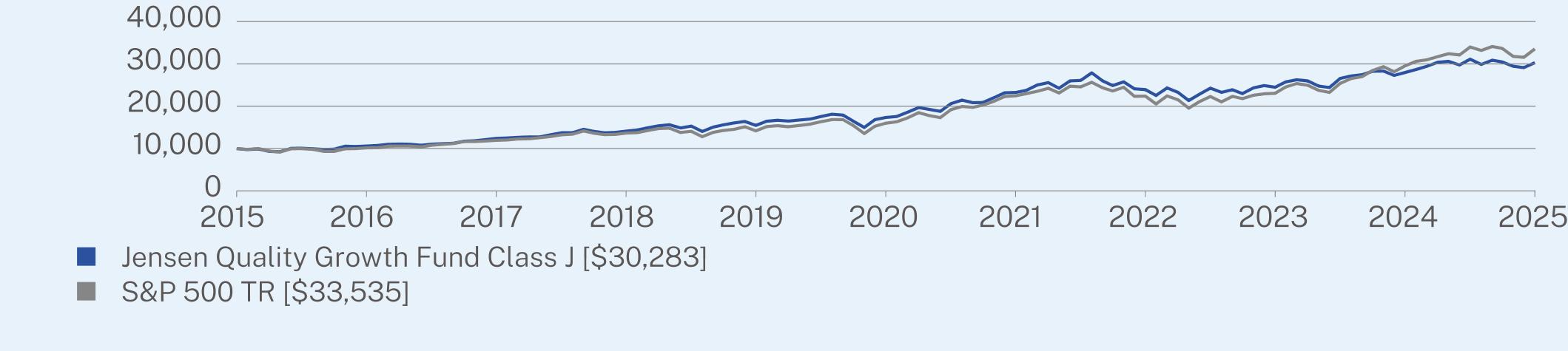

Class J (without sales charge)

|

8.25

|

11.78

|

11.72

|

|

S&P 500 Total Return Index

|

13.52

|

15.94

|

12.86

|

|

Net Assets

|

$6,090,880,950

|

|

Number of Holdings

|

28

|

|

Net Advisory Fee

|

$40,071,513

|

|

Portfolio Turnover

|

15%

|

|

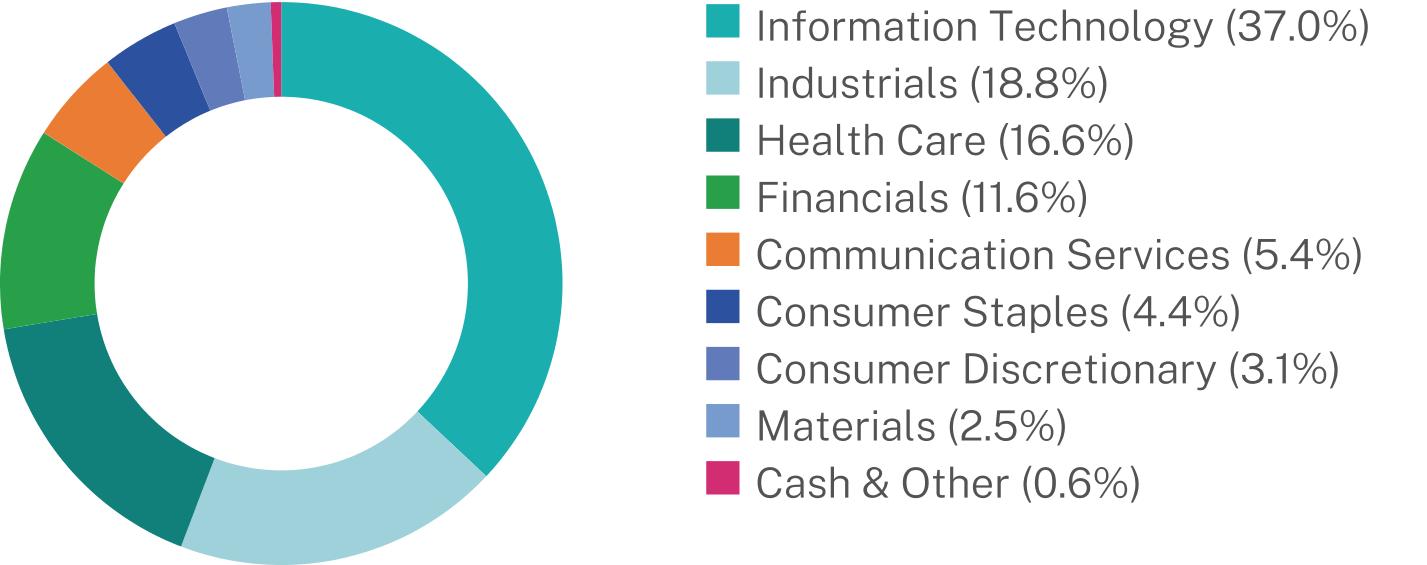

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

8.2%

|

|

Marsh & McLennan Cos., Inc.

|

6.9%

|

|

Intuit, Inc.

|

6.6%

|

|

Stryker Corp.

|

6.5%

|

|

Apple, Inc.

|

5.6%

|

|

Alphabet, Inc.

|

5.4%

|

|

Accenture PLC

|

5.2%

|

|

Mastercard, Inc.

|

4.7%

|

|

KLA Corp.

|

4.1%

|

|

Broadridge Financial Solutions, Inc.

|

3.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$63

|

0.60%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

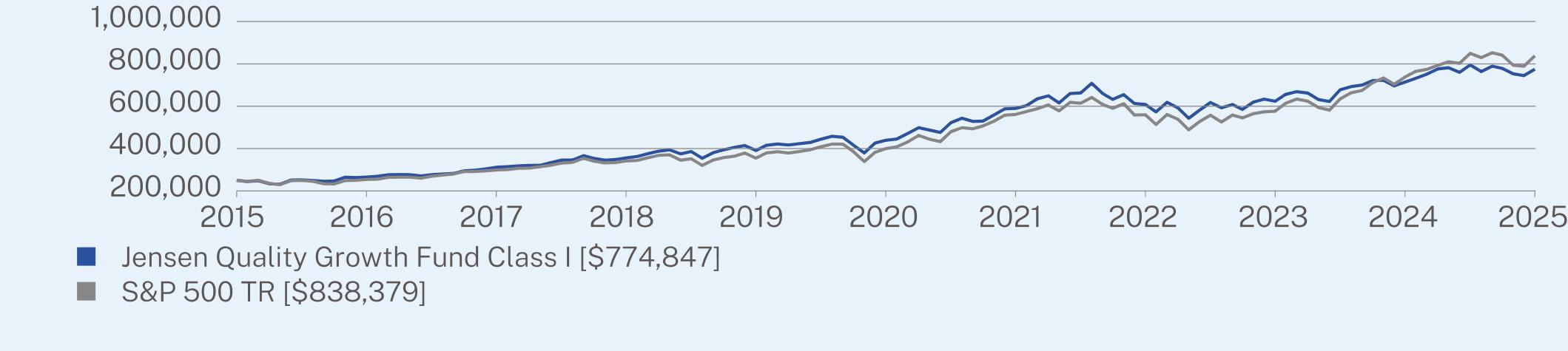

Class I (without sales charge)

|

8.49

|

12.02

|

11.98

|

|

S&P 500 Total Return Index

|

13.52

|

15.94

|

12.86

|

|

Net Assets

|

$6,090,880,950

|

|

Number of Holdings

|

28

|

|

Net Advisory Fee

|

$40,071,513

|

|

Portfolio Turnover

|

15%

|

|

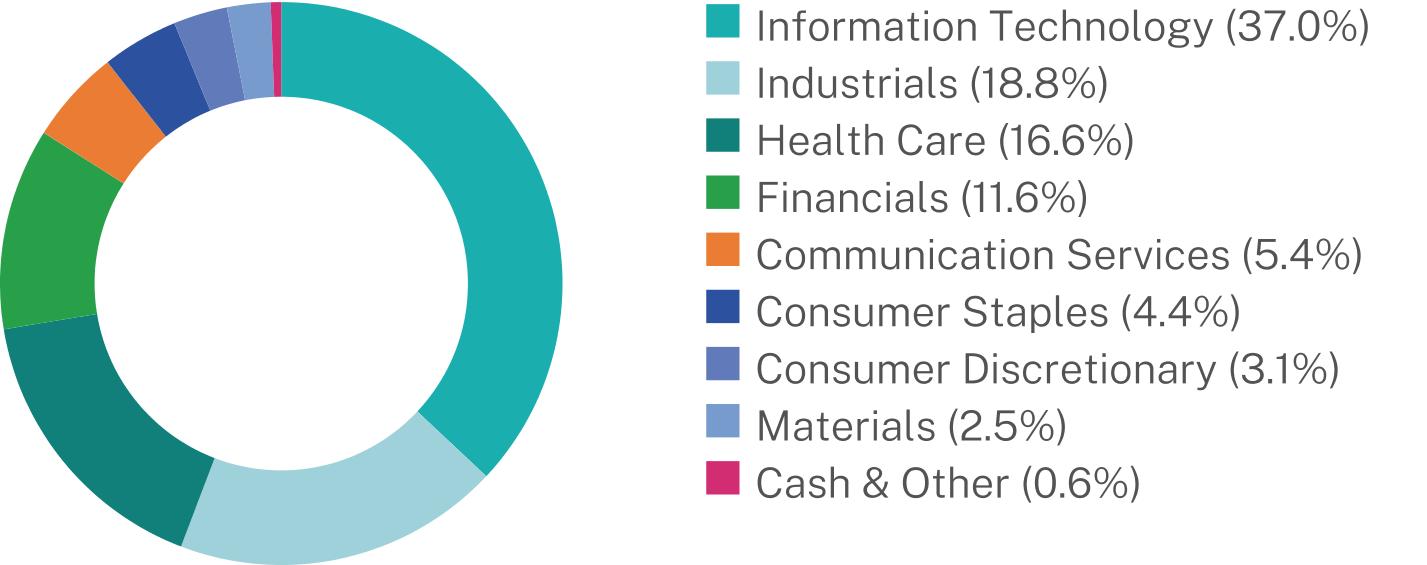

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

8.2%

|

|

Marsh & McLennan Cos., Inc.

|

6.9%

|

|

Intuit, Inc.

|

6.6%

|

|

Stryker Corp.

|

6.5%

|

|

Apple, Inc.

|

5.6%

|

|

Alphabet, Inc.

|

5.4%

|

|

Accenture PLC

|

5.2%

|

|

Mastercard, Inc.

|

4.7%

|

|

KLA Corp.

|

4.1%

|

|

Broadridge Financial Solutions, Inc.

|

3.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

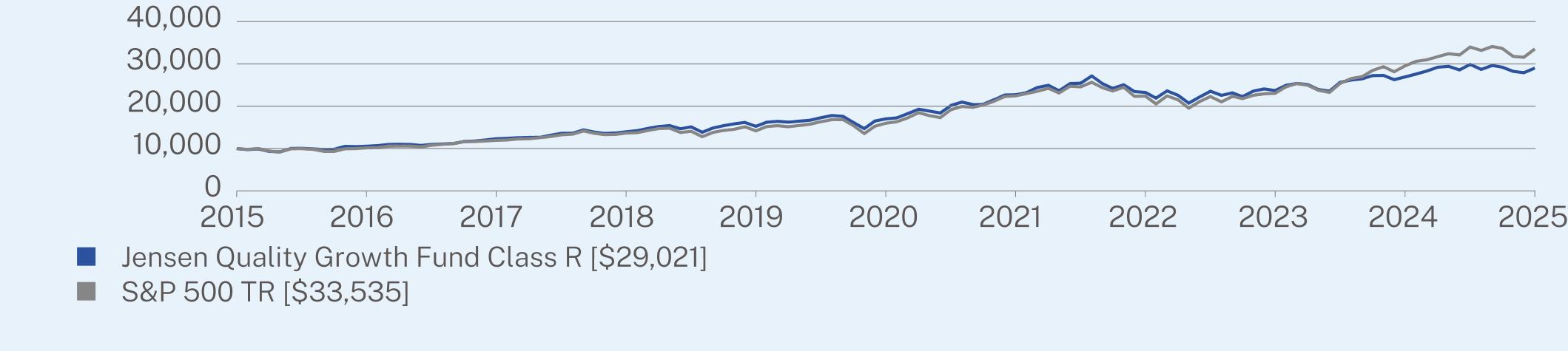

Class R

|

$142

|

1.37%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class R (without sales charge)

|

7.63

|

11.22

|

11.23

|

|

S&P 500 Total Return Index

|

13.52

|

15.94

|

12.86

|

|

Net Assets

|

$6,090,880,950

|

|

Number of Holdings

|

28

|

|

Net Advisory Fee

|

$40,071,513

|

|

Portfolio Turnover

|

15%

|

|

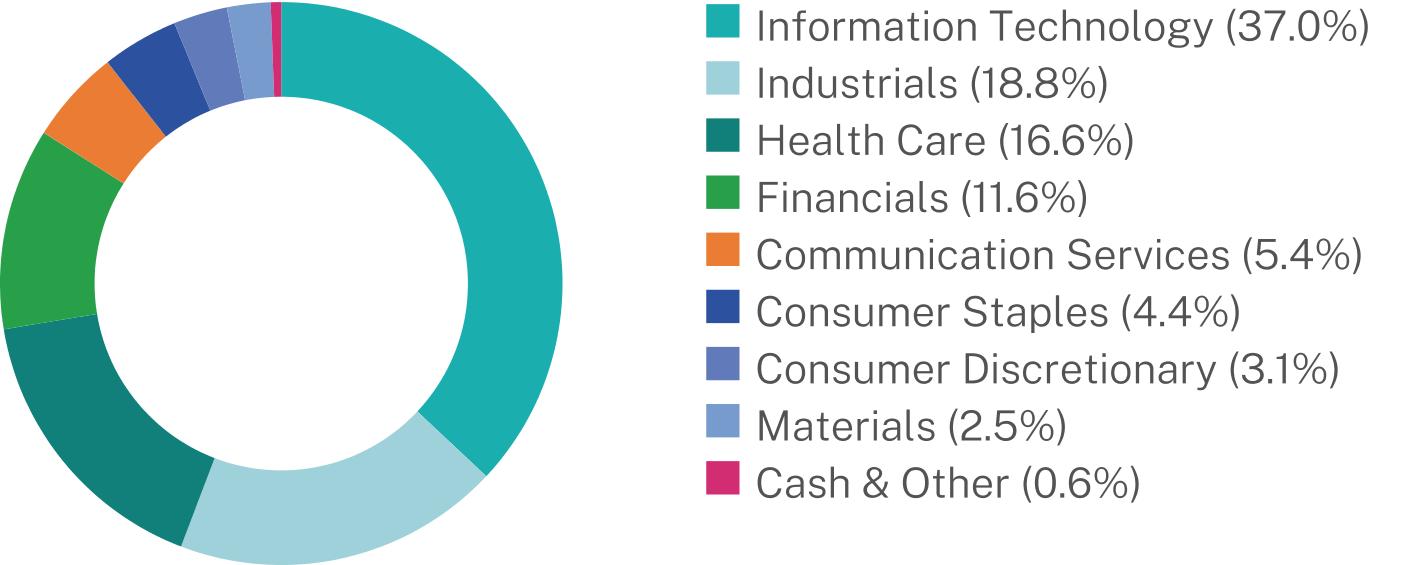

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

8.2%

|

|

Marsh & McLennan Cos., Inc.

|

6.9%

|

|

Intuit, Inc.

|

6.6%

|

|

Stryker Corp.

|

6.5%

|

|

Apple, Inc.

|

5.6%

|

|

Alphabet, Inc.

|

5.4%

|

|

Accenture PLC

|

5.2%

|

|

Mastercard, Inc.

|

4.7%

|

|

KLA Corp.

|

4.1%

|

|

Broadridge Financial Solutions, Inc.

|

3.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

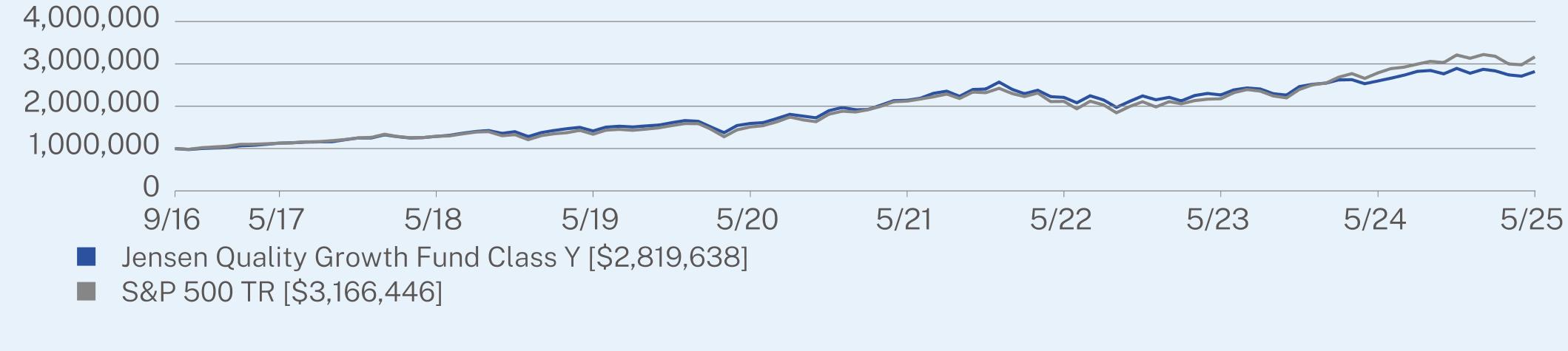

Class Y

|

$56

|

0.54%

|

|

|

1 Year

|

5 Year

|

Since Inception

(09/30/2016) |

|

Class Y (without sales charge)

|

8.54

|

12.10

|

12.71

|

|

S&P 500 Total Return Index

|

13.52

|

15.94

|

14.23

|

|

Net Assets

|

$6,090,880,950

|

|

Number of Holdings

|

28

|

|

Net Advisory Fee

|

$40,071,513

|

|

Portfolio Turnover

|

15%

|

|

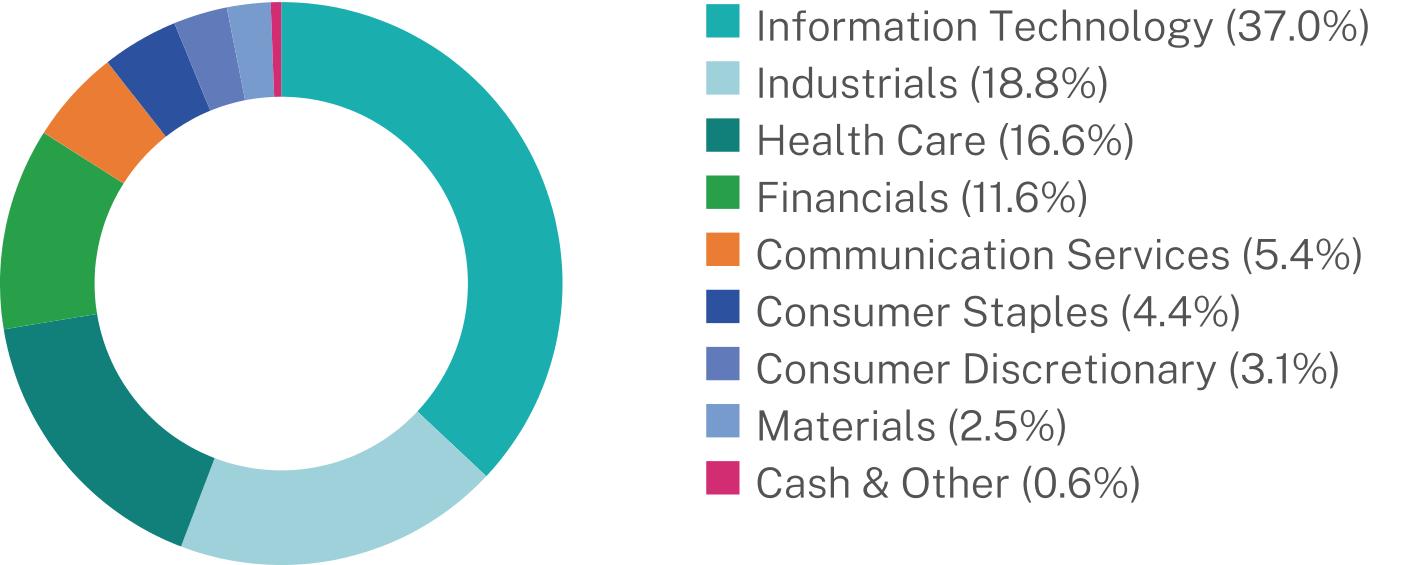

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

8.2%

|

|

Marsh & McLennan Cos., Inc.

|

6.9%

|

|

Intuit, Inc.

|

6.6%

|

|

Stryker Corp.

|

6.5%

|

|

Apple, Inc.

|

5.6%

|

|

Alphabet, Inc.

|

5.4%

|

|

Accenture PLC

|

5.2%

|

|

Mastercard, Inc.

|

4.7%

|

|

KLA Corp.

|

4.1%

|

|

Broadridge Financial Solutions, Inc.

|

3.9%

|

| [1] |

|