|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$67

|

0.65%

|

|

Top contributors to performance:

|

|

|

↑

|

An overweight to investment-grade credit

|

|

↑

|

An overweight to asset-backed securities

|

|

↑

|

Long duration position

|

|

Top detractors from performance:

|

|

|

↓

|

Yield curve positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

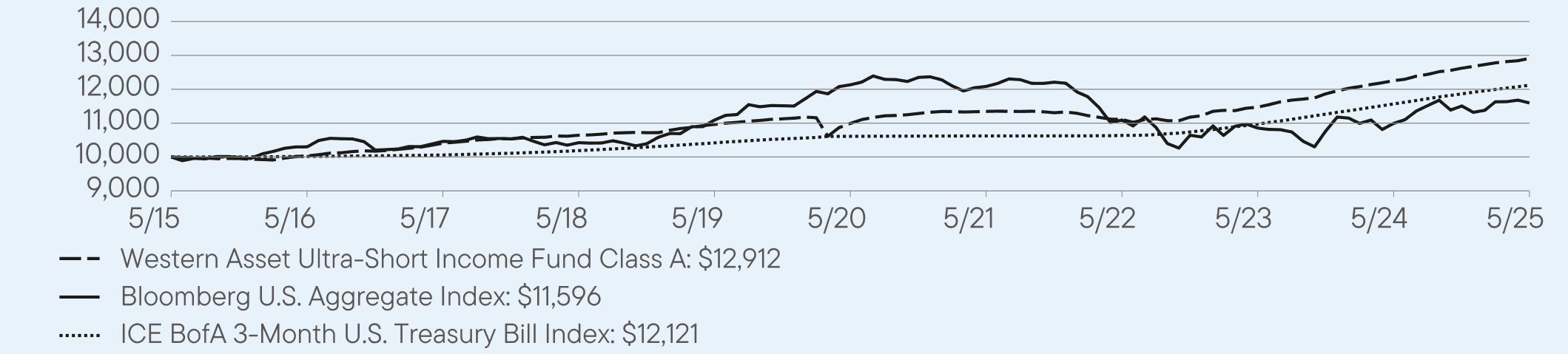

Class A

|

5.35

|

3.27

|

2.59

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

ICE BofA 3-Month U.S. Treasury Bill Index

|

4.76

|

2.70

|

1.94

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

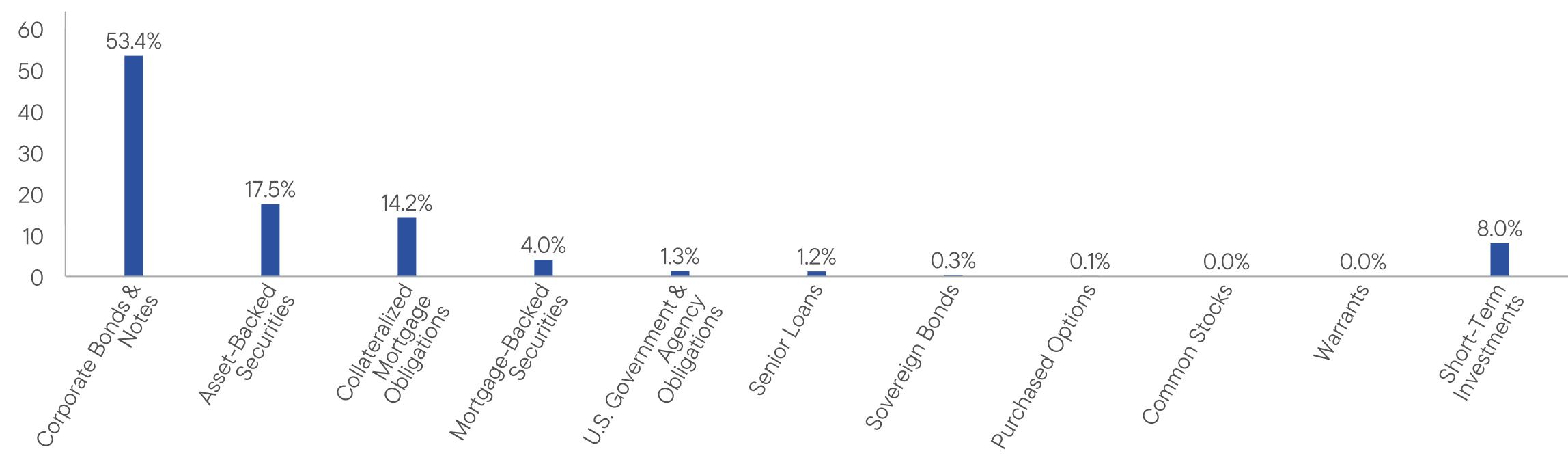

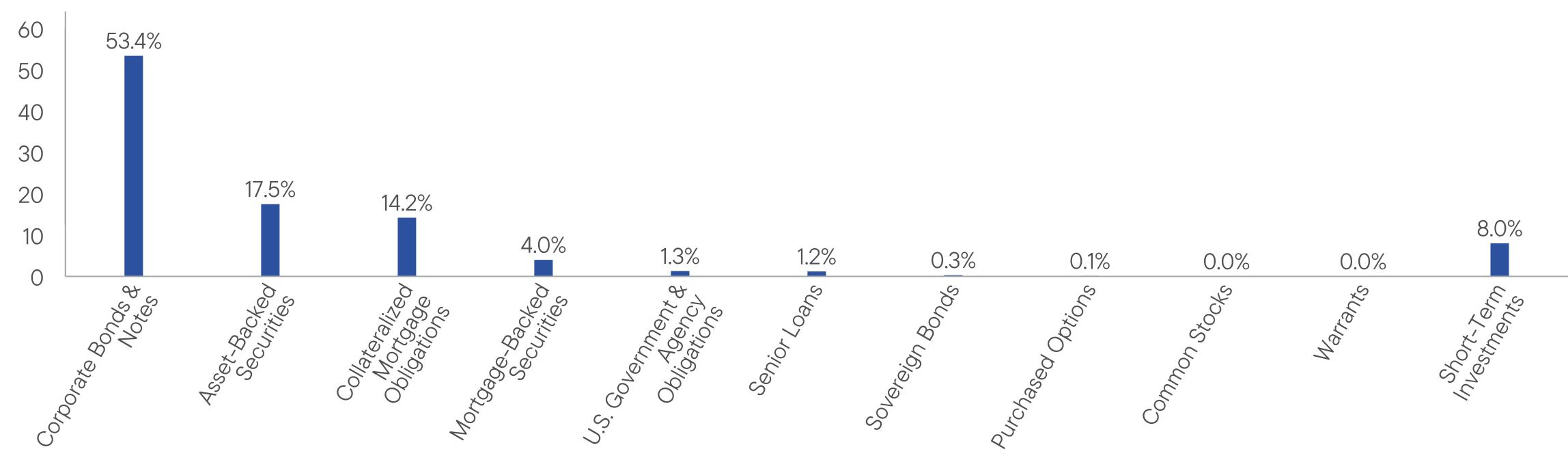

Total Net Assets

|

$410,936,039

|

|

Total Number of Portfolio Holdings*

|

448

|

|

Total Management Fee Paid

|

$961,612

|

|

Portfolio Turnover Rate

|

35%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$144

|

1.41%

|

|

Top contributors to performance:

|

|

|

↑

|

An overweight to investment-grade credit

|

|

↑

|

An overweight to asset-backed securities

|

|

↑

|

Long duration position

|

|

Top detractors from performance:

|

|

|

↓

|

Yield curve positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

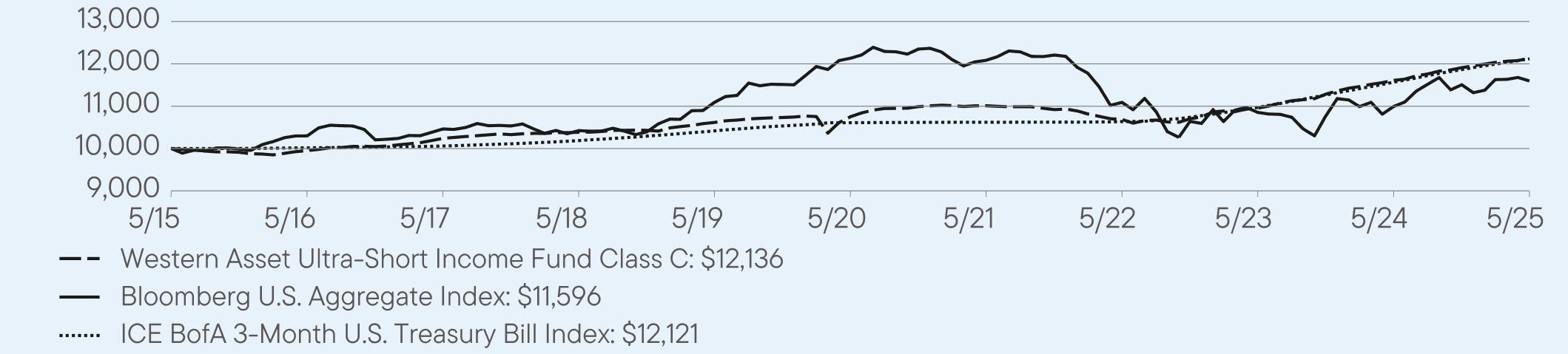

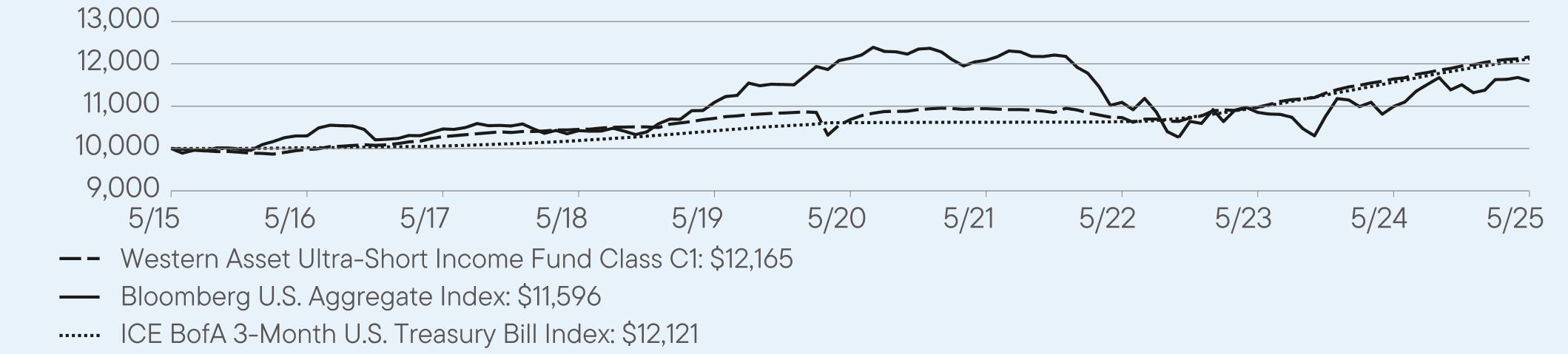

Class C

|

4.52

|

2.45

|

1.96

|

|

Class C (with sales charge)

|

3.52

|

2.45

|

1.96

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

ICE BofA 3-Month U.S. Treasury Bill Index

|

4.76

|

2.70

|

1.94

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

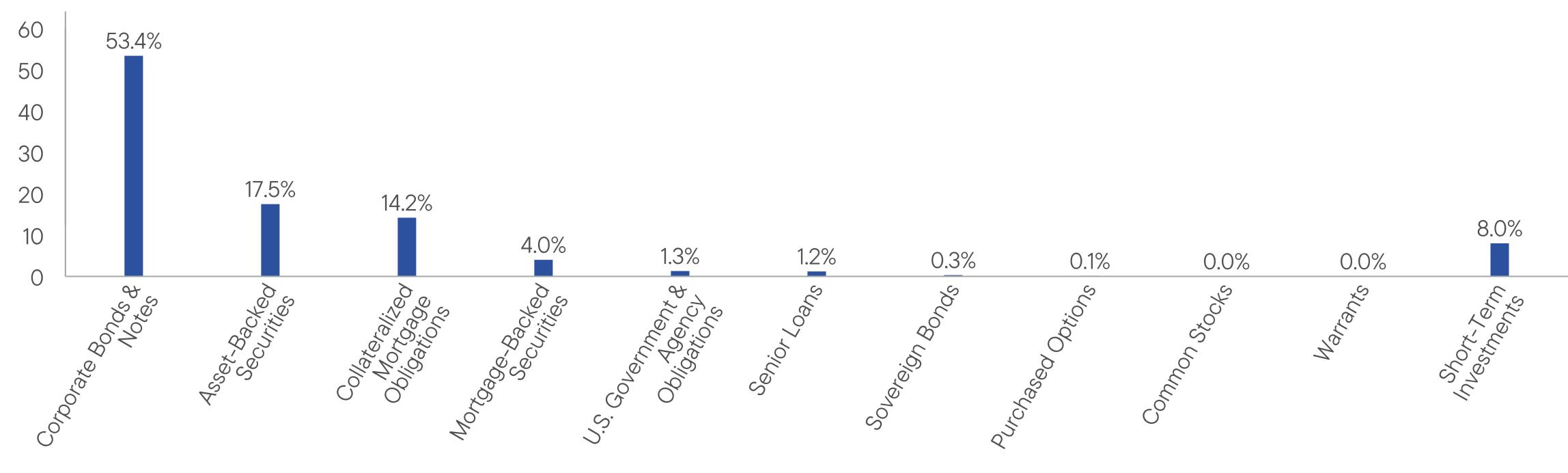

Total Net Assets

|

$410,936,039

|

|

Total Number of Portfolio Holdings*

|

448

|

|

Total Management Fee Paid

|

$961,612

|

|

Portfolio Turnover Rate

|

35%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1

|

$141

|

1.38%

|

|

Top contributors to performance:

|

|

|

↑

|

An overweight to investment-grade credit

|

|

↑

|

An overweight to asset-backed securities

|

|

↑

|

Long duration position

|

|

Top detractors from performance:

|

|

|

↓

|

Yield curve positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C1

|

4.47

|

2.63

|

1.98

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

ICE BofA 3-Month U.S. Treasury Bill Index

|

4.76

|

2.70

|

1.94

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$410,936,039

|

|

Total Number of Portfolio Holdings*

|

448

|

|

Total Management Fee Paid

|

$961,612

|

|

Portfolio Turnover Rate

|

35%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$39

|

0.38%

|

|

Top contributors to performance:

|

|

|

↑

|

An overweight to investment-grade credit

|

|

↑

|

An overweight to asset-backed securities

|

|

↑

|

Long duration position

|

|

Top detractors from performance:

|

|

|

↓

|

Yield curve positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

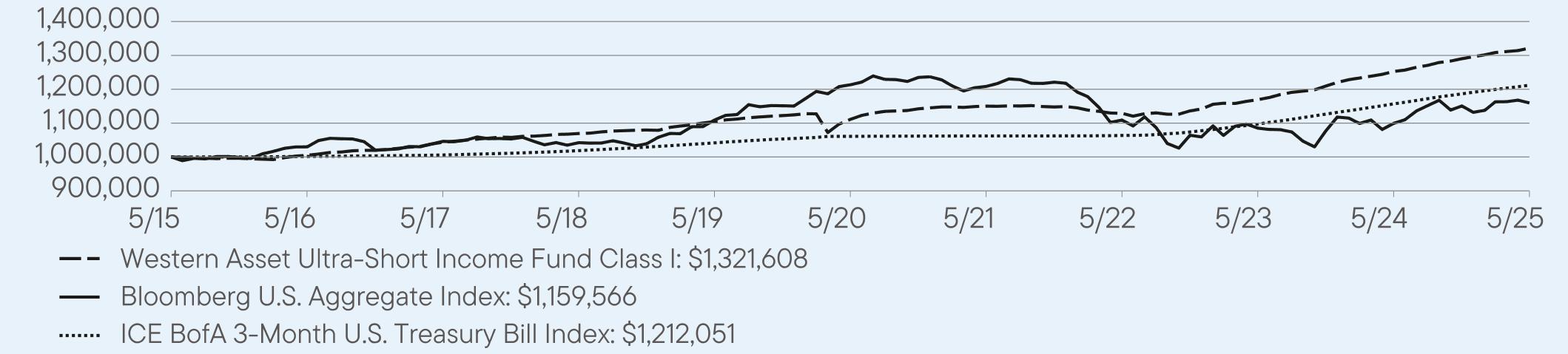

Class I

|

5.52

|

3.53

|

2.83

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

ICE BofA 3-Month U.S. Treasury Bill Index

|

4.76

|

2.70

|

1.94

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

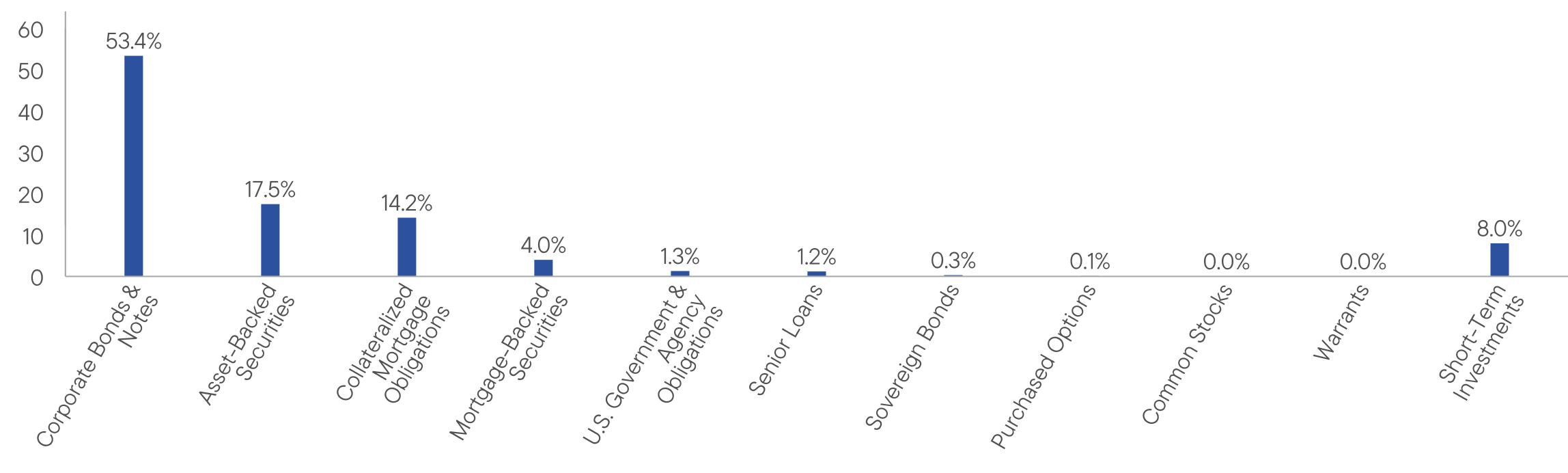

Total Net Assets

|

$410,936,039

|

|

Total Number of Portfolio Holdings*

|

448

|

|

Total Management Fee Paid

|

$961,612

|

|

Portfolio Turnover Rate

|

35%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class IS

|

$36

|

0.35%

|

|

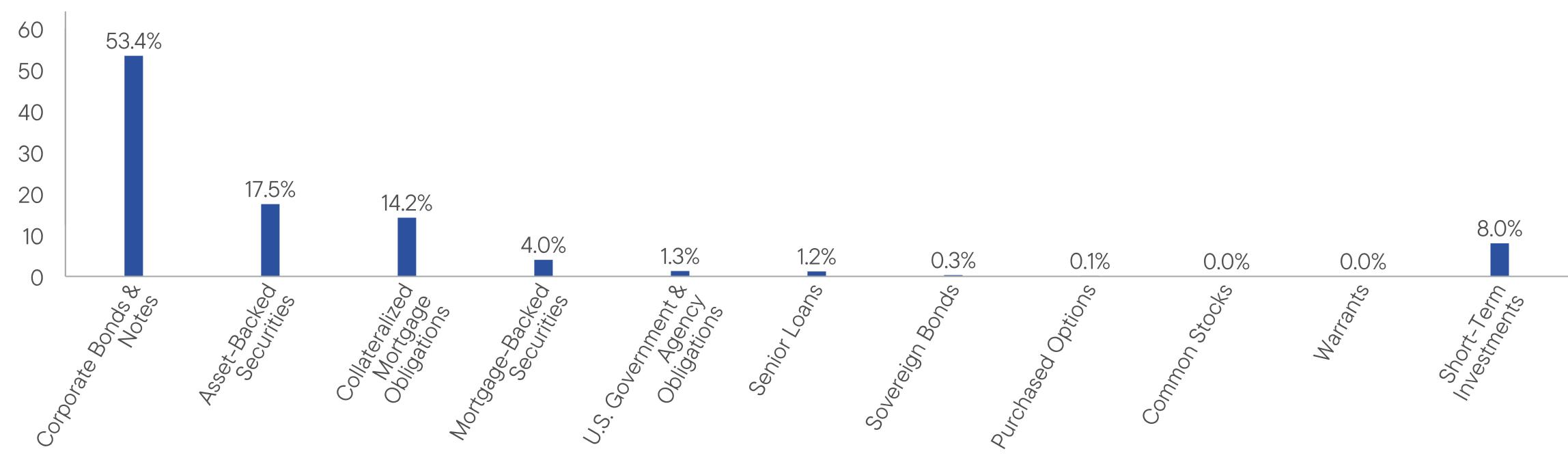

Top contributors to performance:

|

|

|

↑

|

An overweight to investment-grade credit

|

|

↑

|

An overweight to asset-backed securities

|

|

↑

|

Long duration position

|

|

Top detractors from performance:

|

|

|

↓

|

Yield curve positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

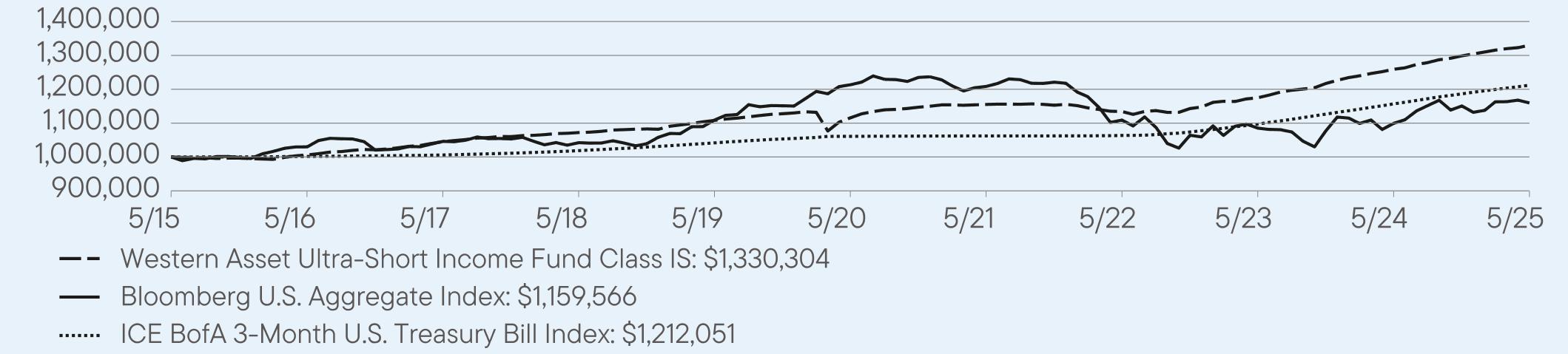

Class IS

|

5.66

|

3.58

|

2.89

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

ICE BofA 3-Month U.S. Treasury Bill Index

|

4.76

|

2.70

|

1.94

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$410,936,039

|

|

Total Number of Portfolio Holdings*

|

448

|

|

Total Management Fee Paid

|

$961,612

|

|

Portfolio Turnover Rate

|

35%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|