Shareholder Report

|

6 Months Ended |

|

May 31, 2025

USD ($)

$ / shares

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Putnam

Funds Trust

|

|

| Entity Central Index Key |

0001005942

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Intermediate-Term Municipal Income Fund

|

|

| Class Name |

Class

A

|

|

| Trading Symbol |

PIMEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Putnam

Intermediate-Term Municipal Income Fund for the period

December 1, 2024, to May

31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

A |

$43

|

0.87%

|

|

[1],[2] |

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.87%

|

|

| Material Change Date |

Jul. 18, 2025

|

|

| Net Assets |

$ 25,339,878

|

|

| Holdings Count | $ / shares |

74

|

[3] |

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of May 31, 2025)

|

|

|

Total

Net Assets |

$25,339,878

|

|

Total

Number of Portfolio Holdings*

|

74

|

|

Portfolio

Turnover Rate |

6%

|

|

[3] |

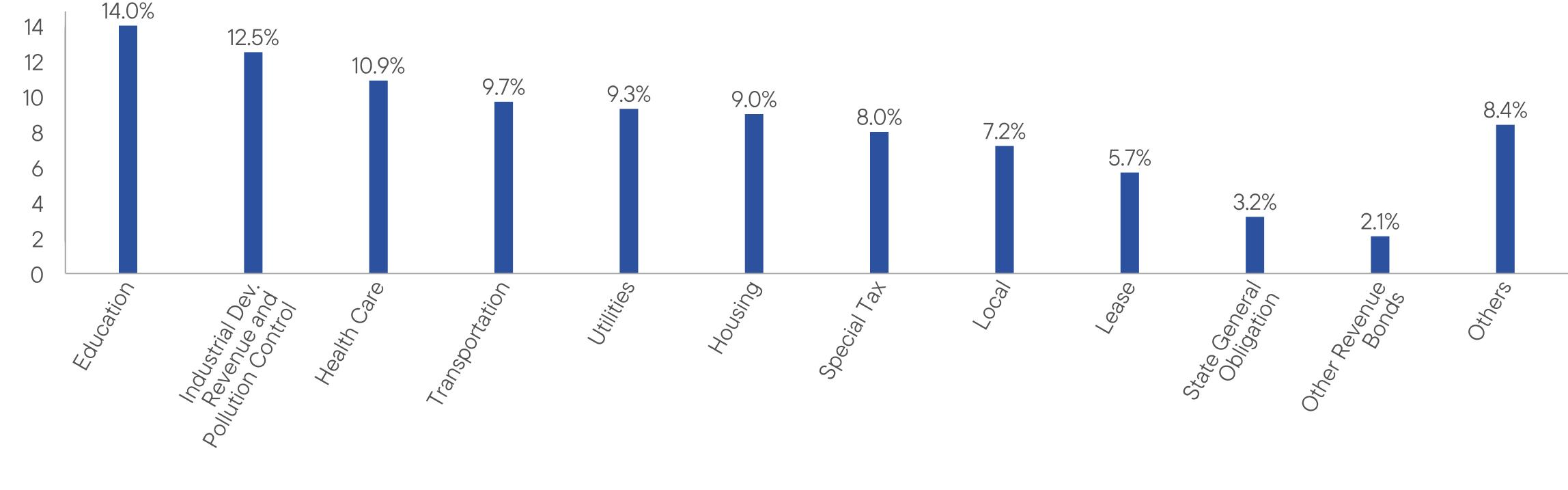

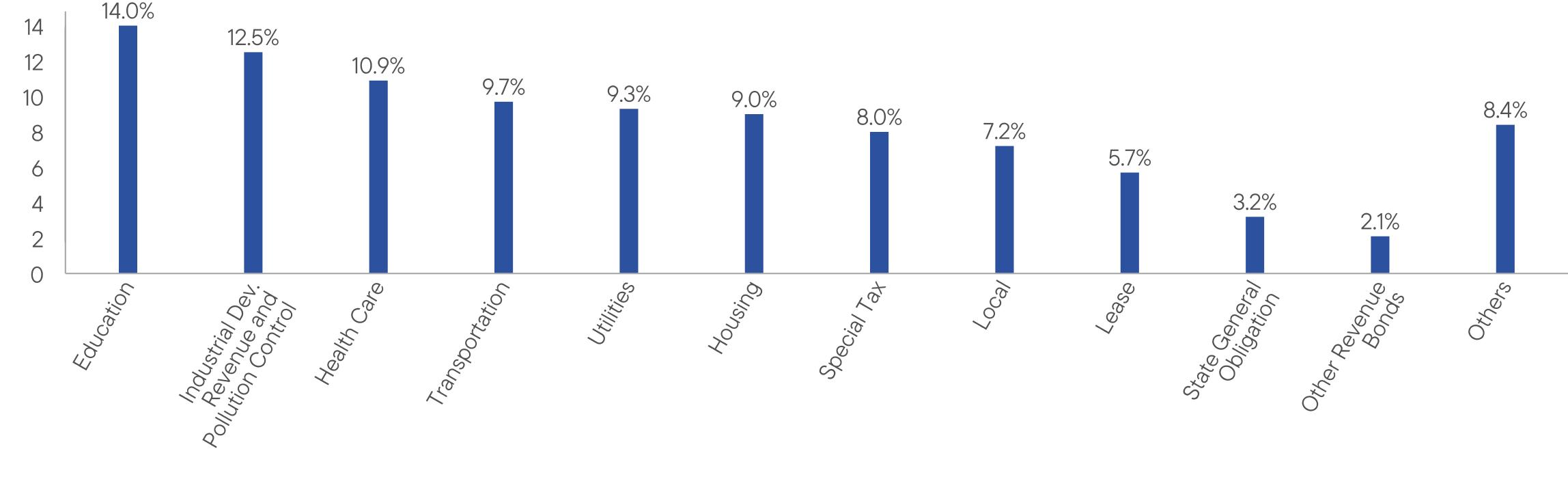

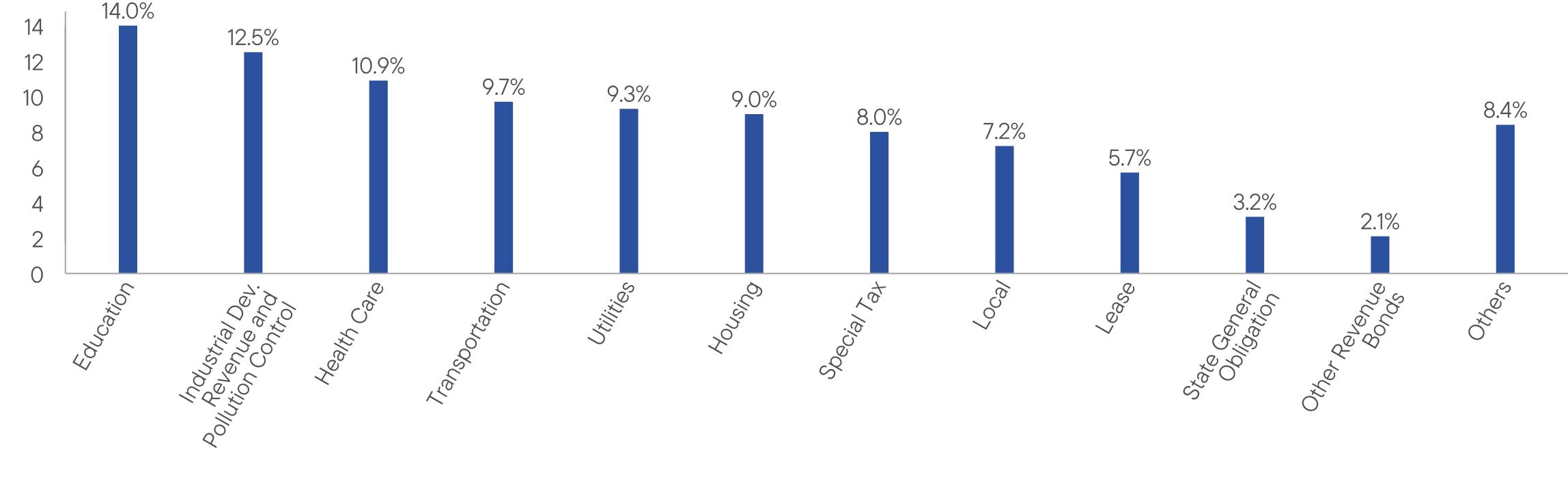

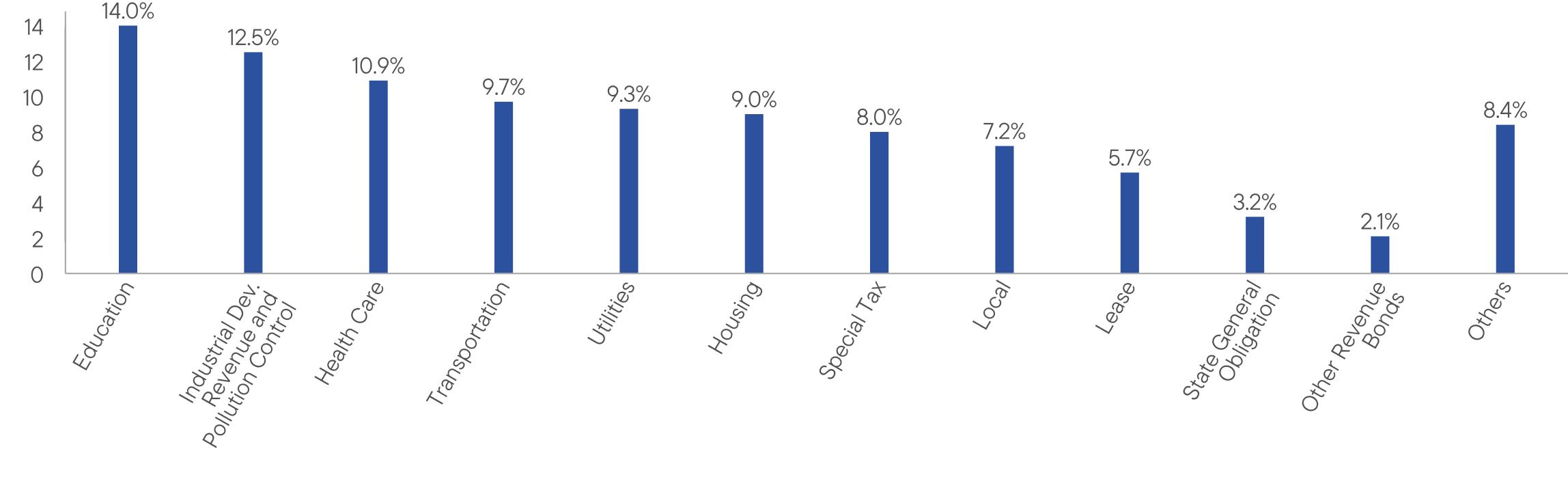

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

The liquidation of the Fund is

expected to occur on or about July

18, 2025, pursuant

to a plan of liquidation. For more complete information,

you may review the Fund’s current prospectus and any applicable supplements at

https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Intermediate-Term Municipal Income Fund

|

|

| Class Name |

Class

C

|

|

| Trading Symbol |

PIMFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Putnam

Intermediate-Term Municipal Income Fund for the period

December 1, 2024, to May

31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

C |

$80

|

1.62%

|

|

[4],[5] |

| Expenses Paid, Amount |

$ 80

|

|

| Expense Ratio, Percent |

1.62%

|

|

| Material Change Date |

Jul. 18, 2025

|

|

| Net Assets |

$ 25,339,878

|

|

| Holdings Count | $ / shares |

74

|

[6] |

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of May 31, 2025)

|

|

|

Total

Net Assets |

$25,339,878

|

|

Total

Number of Portfolio Holdings*

|

74

|

|

Portfolio

Turnover Rate |

6%

|

|

[6] |

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

The liquidation of the Fund is

expected to occur on or about July

18, 2025, pursuant

to a plan of liquidation. For more complete information,

you may review the Fund’s current prospectus and any applicable supplements at

https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Intermediate-Term Municipal Income Fund

|

|

| Class Name |

Class

R6

|

|

| Trading Symbol |

PIMRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Putnam

Intermediate-Term Municipal Income Fund for the period

December 1, 2024, to May

31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R6 |

$28

|

0.57%

|

|

[7],[8] |

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.57%

|

|

| Material Change Date |

Jul. 18, 2025

|

|

| Net Assets |

$ 25,339,878

|

|

| Holdings Count | $ / shares |

74

|

[9] |

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of May 31, 2025)

|

|

|

Total

Net Assets |

$25,339,878

|

|

Total

Number of Portfolio Holdings*

|

74

|

|

Portfolio

Turnover Rate |

6%

|

|

[9] |

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

The liquidation of the Fund is

expected to occur on or about July

18, 2025, pursuant

to a plan of liquidation. For more complete information,

you may review the Fund’s current prospectus and any applicable supplements at

https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class Y |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Intermediate-Term Municipal Income Fund

|

|

| Class Name |

Class

Y

|

|

| Trading Symbol |

PIMYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Putnam

Intermediate-Term Municipal Income Fund for the period

December 1, 2024, to May

31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

Y |

$31

|

0.62%

|

|

[10],[11] |

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.62%

|

|

| Material Change Date |

Jul. 18, 2025

|

|

| Net Assets |

$ 25,339,878

|

|

| Holdings Count | $ / shares |

74

|

[12] |

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of May 31, 2025)

|

|

|

Total

Net Assets |

$25,339,878

|

|

Total

Number of Portfolio Holdings*

|

74

|

|

Portfolio

Turnover Rate |

6%

|

|

[12] |

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

The liquidation of the Fund is

expected to occur on or about July

18, 2025, pursuant

to a plan of liquidation. For more complete information,

you may review the Fund’s current prospectus and any applicable supplements at

https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

|

|