Shareholder Report

|

6 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

SMEAD FUNDS TRUST

|

| Entity Central Index Key |

0001614370

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000146930 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

SVFAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class A/SVFAX) |

$56 |

1.22% |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.22%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

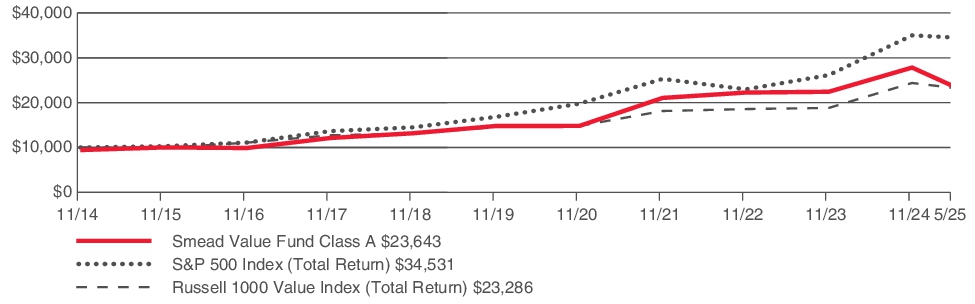

In the first half of fiscal year 2025, the Smead Value Fund (Class A/SVFAX) lost (15.01)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class A shares. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Class A/SVFAX) with sales charge |

(16.26)% |

12.51% |

8.55% |

| Smead Value Fund (Class A/SVFAX) |

(11.15)% |

13.85% |

9.20% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

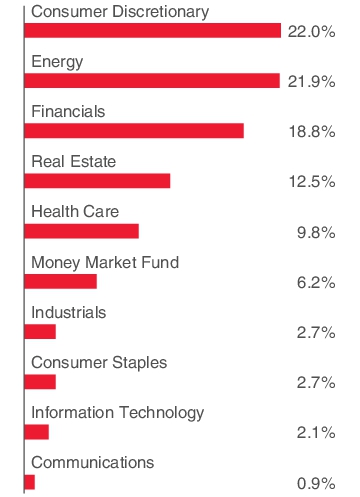

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146929 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

SVFCX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class C/SVFCX) |

$83 |

1.80% |

|

| Expenses Paid, Amount |

$ 83

|

| Expense Ratio, Percent |

1.80%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

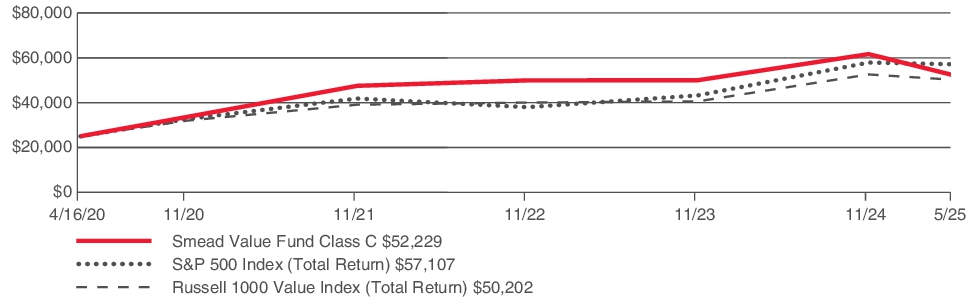

In the first half of fiscal year 2025, the Smead Value Fund (Class C/SVFCX) lost (15.27)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Class C shares since its inception on April 16, 2020. It assumes a $25,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $25,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

Since

Inception |

| Smead Value Fund (Class C/SVFCX) |

(11.70)% |

13.18% |

15.46% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

17.50% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

14.58% |

|

| Performance Inception Date |

Apr. 16, 2020

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

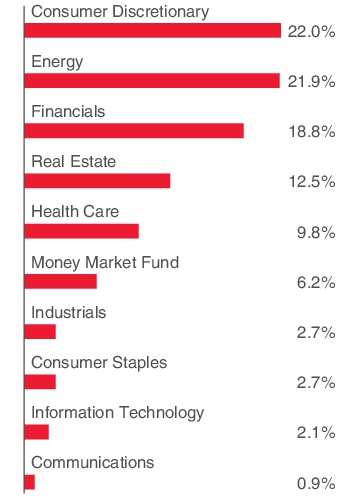

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146931 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class I1

|

| Trading Symbol |

SVFFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class I1/SVFFX) |

$44 |

0.95% |

|

| Expenses Paid, Amount |

$ 44

|

| Expense Ratio, Percent |

0.95%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In the first half of fiscal year 2025, the Smead Value Fund (Class I1/SVFFX) lost (14.90)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

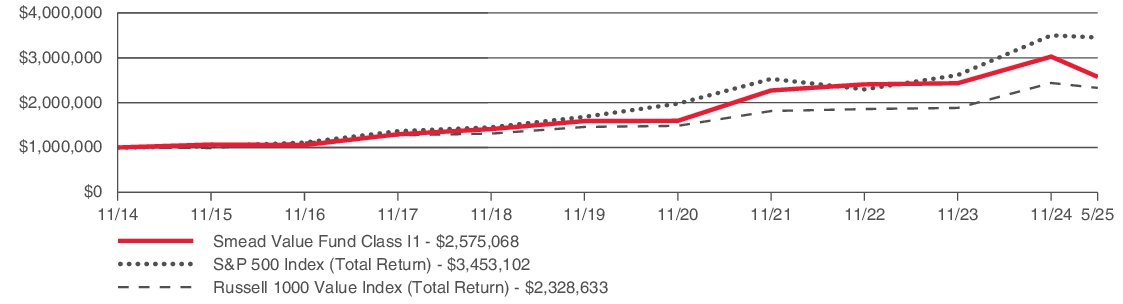

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class I1 shares. It assumes a $1,000,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $1,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Class I1/SVFFX) |

(10.92)% |

14.15% |

9.47% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

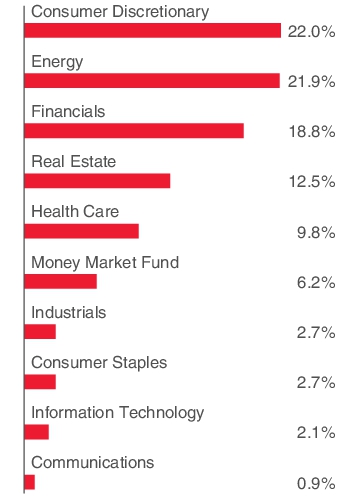

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146933 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class R1

|

| Trading Symbol |

SVFDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class R1/SVFDX) |

$73 |

1.59% |

|

| Expenses Paid, Amount |

$ 73

|

| Expense Ratio, Percent |

1.59%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In the first half of fiscal year 2025, the Smead Value Fund (Class R1/SVFDX) lost (15.17)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

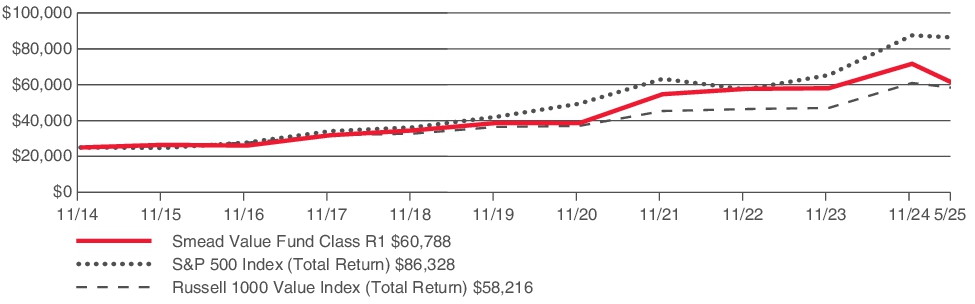

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class R1 shares. It assumes a $25,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $25,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Class R1/SVFDX) |

(11.57)% |

13.54% |

8.88% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

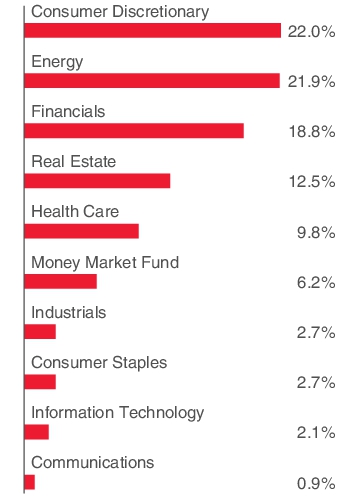

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146934 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class R2

|

| Trading Symbol |

SVFKX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class R2/SVFKX) |

$66 |

1.44% |

|

| Expenses Paid, Amount |

$ 66

|

| Expense Ratio, Percent |

1.44%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In the first half of fiscal year 2025, the Smead Value Fund (Class R2/SVFKX) lost (15.11)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

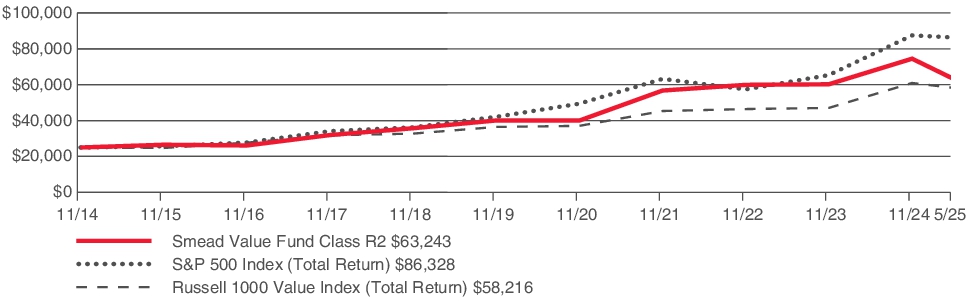

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class R2 shares. It assumes a $25,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $25,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Class R2/SVFKX) |

(11.45)% |

13.60% |

9.30% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

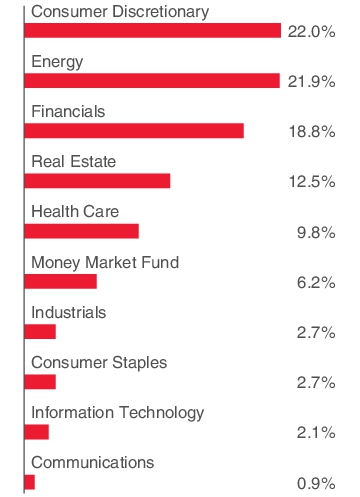

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146937 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

SVFYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Class Y/SVFYX) |

$37 |

0.80% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.80%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In the first half of fiscal year 2025, the Smead Value Fund (Class Y/SVFYX) lost (14.84)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

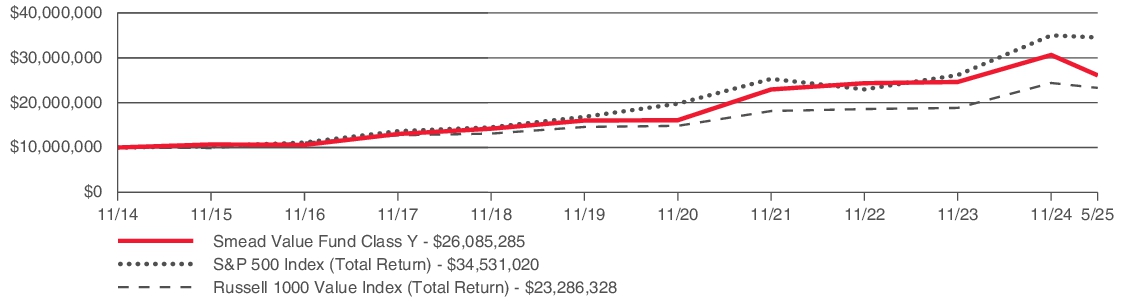

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class Y shares. It assumes a $10,000,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Class Y/SVFYX) |

(10.86)% |

14.26% |

9.60% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

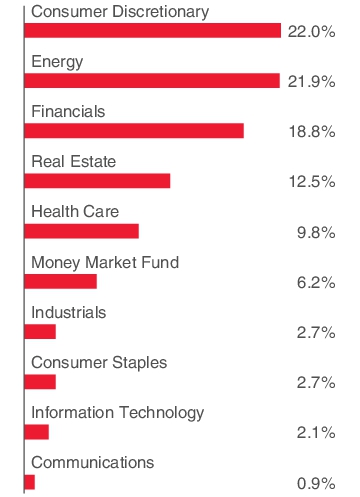

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000146928 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead Value Fund

|

| Class Name |

Investor Class

|

| Trading Symbol |

SMVLX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead Value Fund

(Investor Class/SMVLX) |

$56 |

1.22% |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.22%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In the first half of fiscal year 2025, the Smead Value Fund (Investor Class/SMVLX) lost (15.01)% versus a loss in the S&P 500 Index of (1.35)% and a loss in the Russell 1000 Value Index of (4.51)%.

TOP PERFORMANCE CONTRIBUTORS

Our biggest gainers in the fiscal period were eBay Inc. (EBAY), ULTA Beauty (ULTA), and Millrose Properties (MRP).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were Lennar Corp (LEN), D.R. Horton (DHI), and Macerich (MAC).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

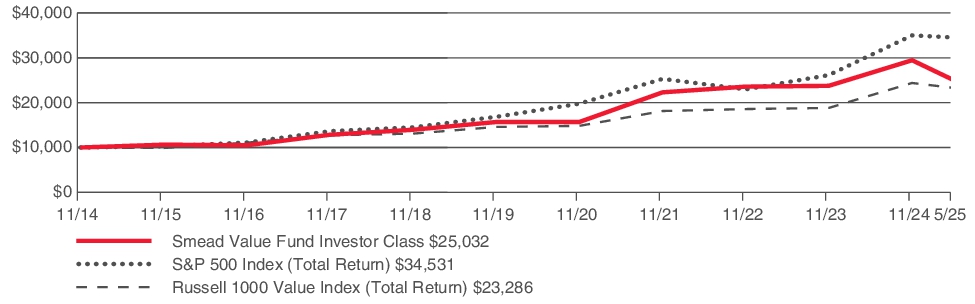

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Investor Class shares. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead Value Fund (Investor Class/SMVLX) |

(11.18)% |

13.84% |

9.17% |

| S&P 500® Index (Total Return) |

13.52% |

15.94% |

12.86% |

| Russell 1000® Value Index (Total Return) |

8.91% |

13.02% |

8.60% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 4,448,078,252

|

| Holdings Count | Holding |

31

|

| Investment Company Portfolio Turnover |

7.50%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$4,448,078,252 |

| Total number of portfolio holdings |

31 |

| Portfolio turnover rate |

7.50% |

|

| Holdings [Text Block] |

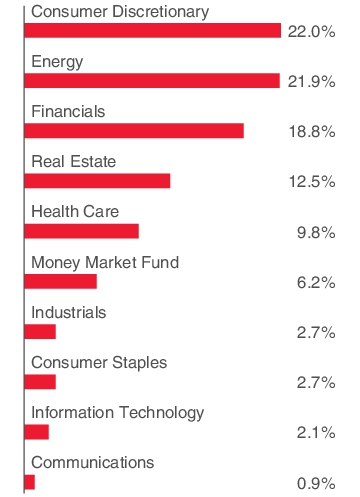

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

SECTOR ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Simon Property Group, Inc. – REIT |

6.7% |

| Amgen, Inc. |

5.3% |

| American Express Co. |

5.2% |

| Macerich Co. (The) – REIT |

5.2% |

| DR Horton, Inc. |

4.7% |

| Merck & Co., Inc. |

4.5% |

| Lennar Corp. – Class A |

4.4% |

| Cenovus Energy, Inc. |

4.3% |

| eBay, Inc. |

4.3% |

| NVR, Inc. |

4.1% |

|

| C000233728 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead International Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

SVXAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead International Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead International Value Fund

(Class A/SVXAX) |

$75 |

1.42% |

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

1.42%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The first half of fiscal year 2025 in the Smead International Value Fund (Class A/SVXAX) produced 12.69% for the shareholders compared to 14.21% for the MSCI EAFE NR Index and 11.81% for the MSCI ACWI ex-US NR Index.

TOP PERFORMANCE CONTRIBUTORS

Our best performers in the fiscal period were Bawag Group (BG AV), Unicredit SPA (UCG IM), and Bankinter (BKT SM).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were West Fraser Timer (WFG CN), Cenovus Energy (CVE CN), and Whitehaven Coal (WHC AU).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

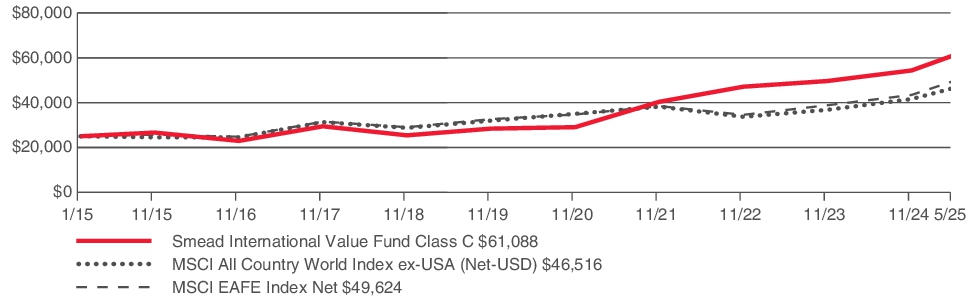

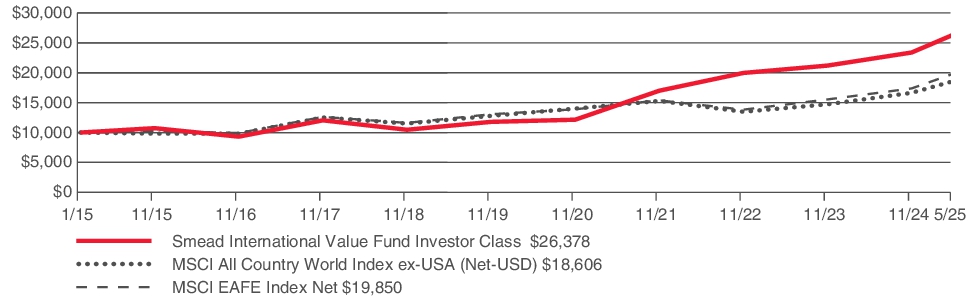

| Line Graph [Table Text Block] |

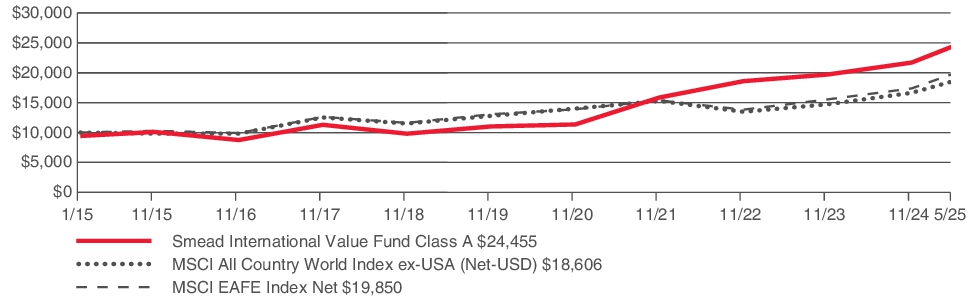

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Class A shares since its inception on January 12, 2015. It assumes a $10,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead International Value Fund (Class A/SVXAX) with sales charge |

(3.56)% |

22.71% |

8.06% |

| Smead International Value Fund (Class A/SVXAX) |

2.32% |

24.17% |

8.70% |

| MSCI All Country World Index ex-USA (Net-USD) |

13.75% |

10.37% |

5.47% |

| MSCI EAFE Index Net |

13.33% |

11.42% |

5.97% |

|

| Performance Inception Date |

Jan. 12, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 168,890,712

|

| Holdings Count | Holding |

28

|

| Investment Company Portfolio Turnover |

14.13%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$168,890,712 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

14.13% |

|

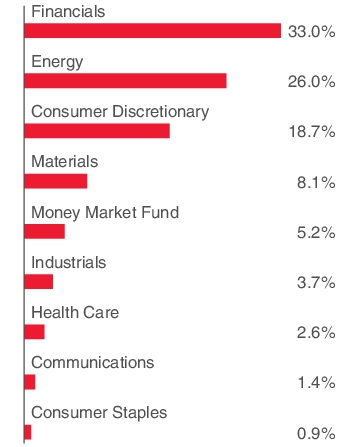

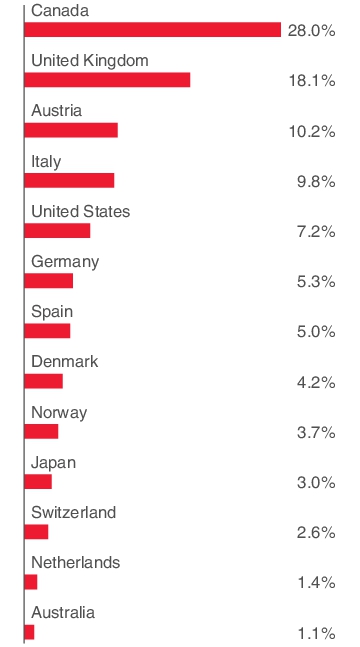

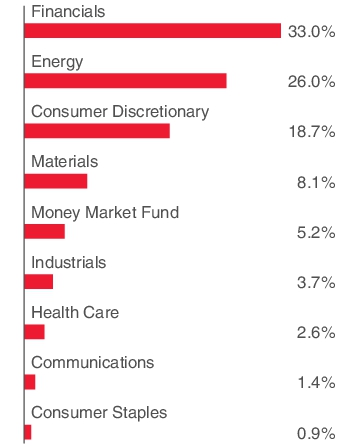

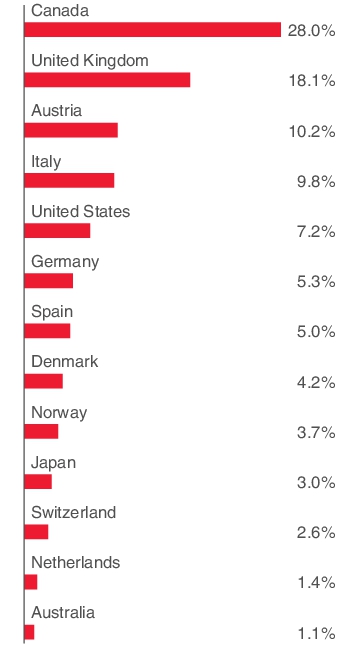

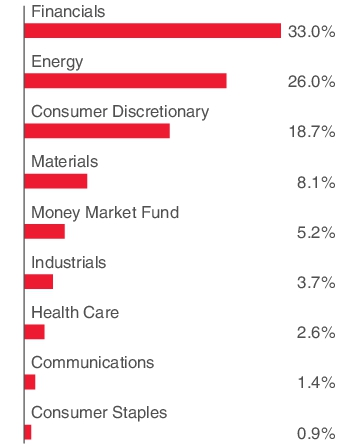

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

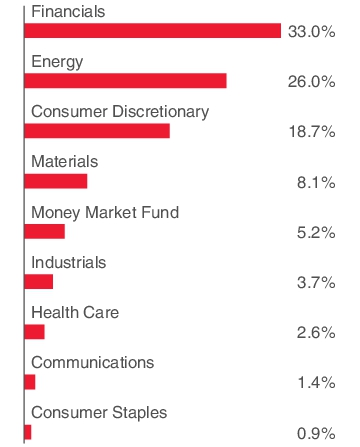

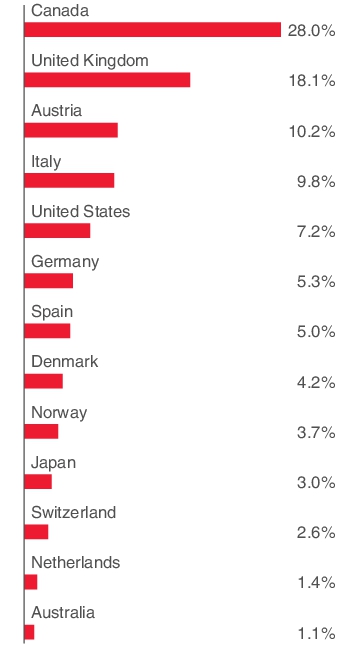

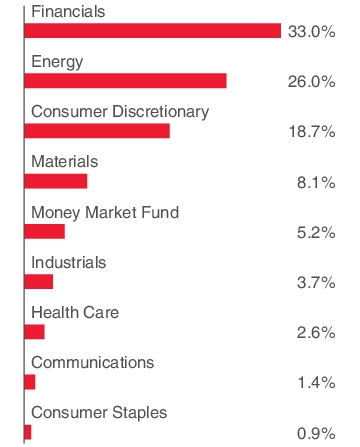

SECTOR ALLOCATION

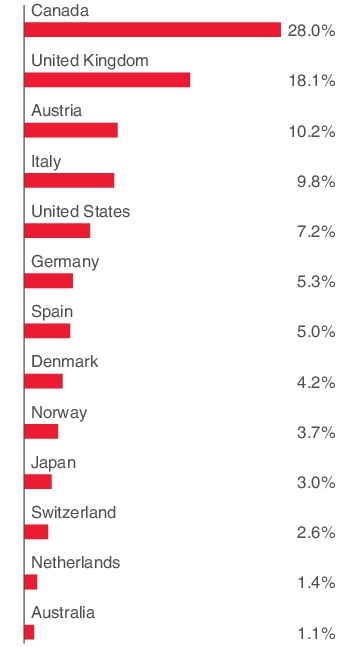

GEOGRAPHIC ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

|

| C000233724 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead International Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

SVXCX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead International Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead International Value Fund

(Class C/SVXCX) |

$106 |

2.00% |

|

| Expenses Paid, Amount |

$ 106

|

| Expense Ratio, Percent |

2.00%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The first half of fiscal year 2025 in the Smead International Value Fund (Class C/SVXCX) produced 12.38% for the shareholders compared to 14.21% for the MSCI EAFE NR Index and 11.81% for the MSCI ACWI ex-US NR Index.

TOP PERFORMANCE CONTRIBUTORS

Our best performers in the fiscal period were Bawag Group (BG AV), Unicredit SPA (UCG IM), and Bankinter (BKT SM).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were West Fraser Timer (WFG CN), Cenovus Energy (CVE CN), and Whitehaven Coal (WHC AU).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Class C shares since its inception on January 12, 2015. It assumes a $25,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $25,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead International Value Fund (Class C/SVXCX) |

1.72% |

23.48% |

8.08% |

| MSCI All Country World Index ex-USA (Net-USD) |

13.75% |

10.37% |

5.47% |

| MSCI EAFE Index Net |

13.33% |

11.42% |

5.97% |

|

| Performance Inception Date |

Jan. 12, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 168,890,712

|

| Holdings Count | Holding |

28

|

| Investment Company Portfolio Turnover |

14.13%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$168,890,712 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

14.13% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

SECTOR ALLOCATION

GEOGRAPHIC ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

|

| C000233723 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead International Value Fund

|

| Class Name |

Class I1

|

| Trading Symbol |

SVXFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead International Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead International Value Fund

(Class I1/SVXFX) |

$61 |

1.15% |

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.15%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The first half of fiscal year 2025 in the Smead International Value Fund (Class I1/SVXFX) produced 12.85% for the shareholders compared to 14.21% for the MSCI EAFE NR Index and 11.81% for the MSCI ACWI ex-US NR Index.

TOP PERFORMANCE CONTRIBUTORS

Our best performers in the fiscal period were Bawag Group (BG AV), Unicredit SPA (UCG IM), and Bankinter (BKT SM).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were West Fraser Timer (WFG CN), Cenovus Energy (CVE CN), and Whitehaven Coal (WHC AU).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

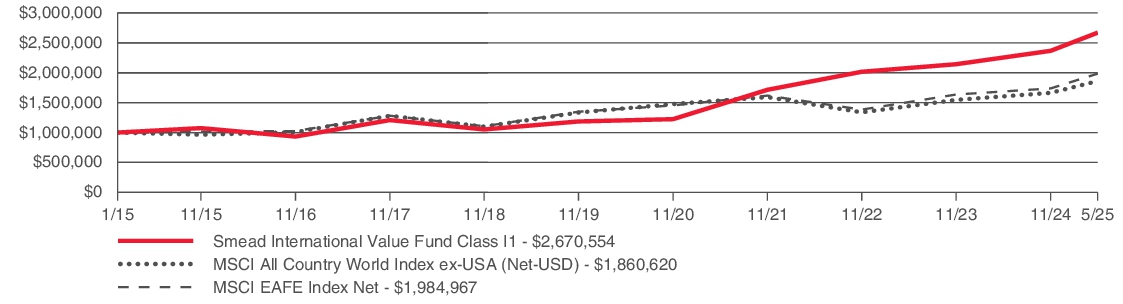

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Class I1 shares since its inception on January 12, 2015. It assumes a $1,000,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $1,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead International Value Fund (Class I1/SVXFX) |

2.59% |

24.51% |

9.01% |

| MSCI All Country World Index ex-USA (Net-USD) |

13.75% |

10.37% |

5.47% |

| MSCI EAFE Index Net |

13.33% |

11.42% |

5.97% |

|

| Performance Inception Date |

Jan. 12, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 168,890,712

|

| Holdings Count | Holding |

28

|

| Investment Company Portfolio Turnover |

14.13%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$168,890,712 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

14.13% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

SECTOR ALLOCATION

GEOGRAPHIC ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

|

| C000233727 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead International Value Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

SVXYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead International Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead International Value Fund

(Class Y/SVXYX) |

$53 |

1.00% |

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

1.00%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The first half of fiscal year 2025 in the Smead International Value Fund (Class Y/SVXYX) produced 12.95% for the shareholders compared to 14.21% for the MSCI EAFE NR Index and 11.81% for the MSCI ACWI ex-US NR Index.

TOP PERFORMANCE CONTRIBUTORS

Our best performers in the fiscal period were Bawag Group (BG AV), Unicredit SPA (UCG IM), and Bankinter (BKT SM).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were West Fraser Timer (WFG CN), Cenovus Energy (CVE CN), and Whitehaven Coal (WHC AU).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

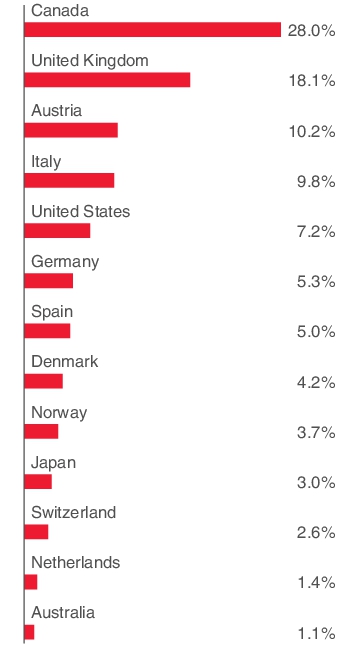

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Class Y shares since its inception on January 12, 2015. It assumes a $10,000,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead International Value Fund (Class Y/SVXYX) |

2.75% |

24.70% |

9.15% |

| MSCI All Country World Index ex-USA (Net-USD) |

13.75% |

10.37% |

5.47% |

| MSCI EAFE Index Net |

13.33% |

11.42% |

5.97% |

|

| Performance Inception Date |

Jan. 12, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 168,890,712

|

| Holdings Count | Holding |

28

|

| Investment Company Portfolio Turnover |

14.13%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$168,890,712 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

14.13% |

|

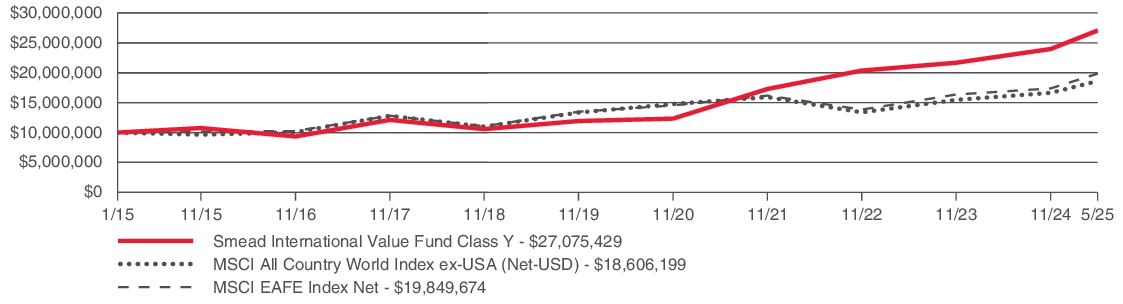

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

SECTOR ALLOCATION

GEOGRAPHIC ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

|

| C000233726 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Smead International Value Fund

|

| Class Name |

Investor Class

|

| Trading Symbol |

SVXLX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Smead International Value Fund (“Fund”) for the period of December 1, 2024, to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at smeadcap.com/smead-funds/forms/. You can also request this information by contacting us at 877-807-4122.

|

| Additional Information Phone Number |

877-807-4122

|

| Additional Information Website |

smeadcap.com/smead-funds/forms/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Smead International Value Fund

(Investor Class/SVXLX) |

$66 |

1.25% |

|

| Expenses Paid, Amount |

$ 66

|

| Expense Ratio, Percent |

1.25%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The first half of fiscal year 2025 in the Smead International Value Fund (Investor Class/SVXLX) produced 12.80% for the shareholders compared to 14.21% for the MSCI EAFE NR Index and 11.81% for the MSCI ACWI ex-US NR Index.

TOP PERFORMANCE CONTRIBUTORS

Our best performers in the fiscal period were Bawag Group (BG AV), Unicredit SPA (UCG IM), and Bankinter (BKT SM).

TOP PERFORMANCE DETRACTORS

The top detractors for the fiscal period were West Fraser Timer (WFG CN), Cenovus Energy (CVE CN), and Whitehaven Coal (WHC AU).

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the completed fiscal years of the Investor Class shares since its inception on January 12, 2015. It assumes a $10,000 initial investment at inception in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN AS OF MAY 31, 2025 |

1 Year |

5 Year |

10 Year |

| Smead International Value Fund (Investor Class/SVXLX) |

2.50% |

24.38% |

8.88% |

| MSCI All Country World Index ex-USA (Net-USD) |

13.75% |

10.37% |

5.47% |

| MSCI EAFE Index Net |

13.33% |

11.42% |

5.97% |

|

| Performance Inception Date |

Jan. 12, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit smeadcap.com/smead-funds/forms/ for the most recent performance information.

|

| Net Assets |

$ 168,890,712

|

| Holdings Count | Holding |

28

|

| Investment Company Portfolio Turnover |

14.13%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

The following table outlines key Fund statistics that you should pay attention to.

| Fund Net Assets |

$168,890,712 |

| Total number of portfolio holdings |

28 |

| Portfolio turnover rate |

14.13% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of May 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

SECTOR ALLOCATION

GEOGRAPHIC ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| BAWAG Group AG |

10.2% |

| Strathcona Resources Ltd. |

7.1% |

| MEG Energy Corp. |

6.9% |

| UniCredit SpA |

6.2% |

| Cenovus Energy, Inc. |

5.5% |

| Bankinter SA |

5.0% |

| Barclays PLC |

4.5% |

| Pandora AS |

4.2% |

| Glencore PLC |

4.0% |

| Frontline PLC |

3.7% |

|