Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

$ / shares

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Putnam Funds Trust

|

|

| Entity Central Index Key |

0001005942

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam Dynamic Asset Allocation Equity Fund

|

|

| Class Name |

Class A

|

|

| No Trading Symbol |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Putnam Dynamic Asset Allocation Equity Fund for the period June 1, 2024, to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) 225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-internalusefunds-documents

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$71

|

0.66%

|

|

[1] |

| Expenses Paid, Amount |

$ 71

|

|

| Expense Ratio, Percent |

0.66%

|

|

| Factors Affecting Performance [Text Block] |

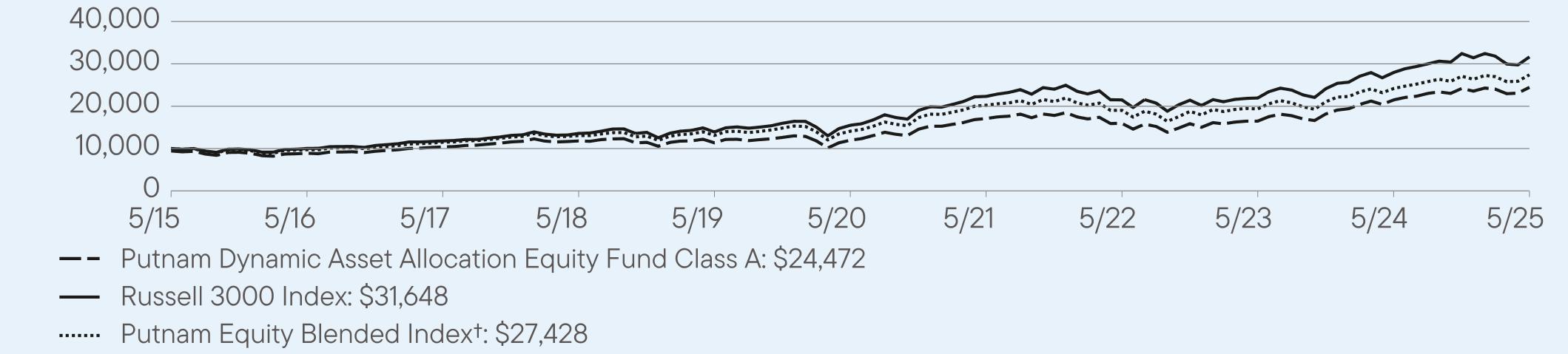

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? For the twelve months ended May 31, 2025, Class A shares of Putnam Dynamic Asset Allocation Equity Fund returned 13.84%. The Fund compares its performance to the Russell 3000 Index and the Putnam Equity Blended Index†, which returned 13.12% and 13.39%, respectively, for the same period. PERFORMANCE HIGHLIGHTS

|

|

|

Top contributors to performance:

|

|

↑

|

Selection effects within the Quantitative U.S. Large Cap Strategy sleeve were beneficial for benchmark-relative performance.

|

|

↑

|

Selection effects within the Quantitative International Equity Strategy sleeve were beneficial for benchmark-relative performance.

|

|

↑

|

Selection effects within the Fundamental Emerging Markets Equity Strategy sleeve were beneficial for benchmark-relative performance.

|

|

|

|

Top detractors to performance:

|

|

↓

|

Selection effects within the Fundamental Large-Cap Growth Equity Strategy sleeve detracted from performance.

|

|

↓

|

Allocation decisions within the Fundamental Large-Cap Growth Equity Strategy sleeve detracted from performance.

|

|

↓

|

Selection effects within the Quantitative U.S. Small-Cap Equity Strategy sleeve detracted from performance.

|

Use of Derivatives impacting performance: Futures were used to manage the Fund’s exposure to market (systematic) risk, which detracted from performance. Forward currency contracts were used to hedge foreign exchange risk, which resulted in a slightly positive impact on performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended May 31, 2025

|

|

|

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A

|

13.84

|

15.36

|

10.01

|

|

Class A (with sales charge)

|

7.30

|

14.00

|

9.36

|

|

Russell 3000 Index

|

13.12

|

15.34

|

12.21

|

|

Putnam Equity Blended Index†

|

13.39

|

14.22

|

10.62

|

|

[2] |

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Jun. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance, please call Franklin Templeton at (800) 225-1581. Important data provider notices and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 26,982,820

|

|

| Holdings Count | $ / shares |

566

|

[3] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

74.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

|

|

|

Total Net Assets

|

$26,982,820

|

|

Total Number of Portfolio Holdings*

|

566

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

74%

|

|

[3] |

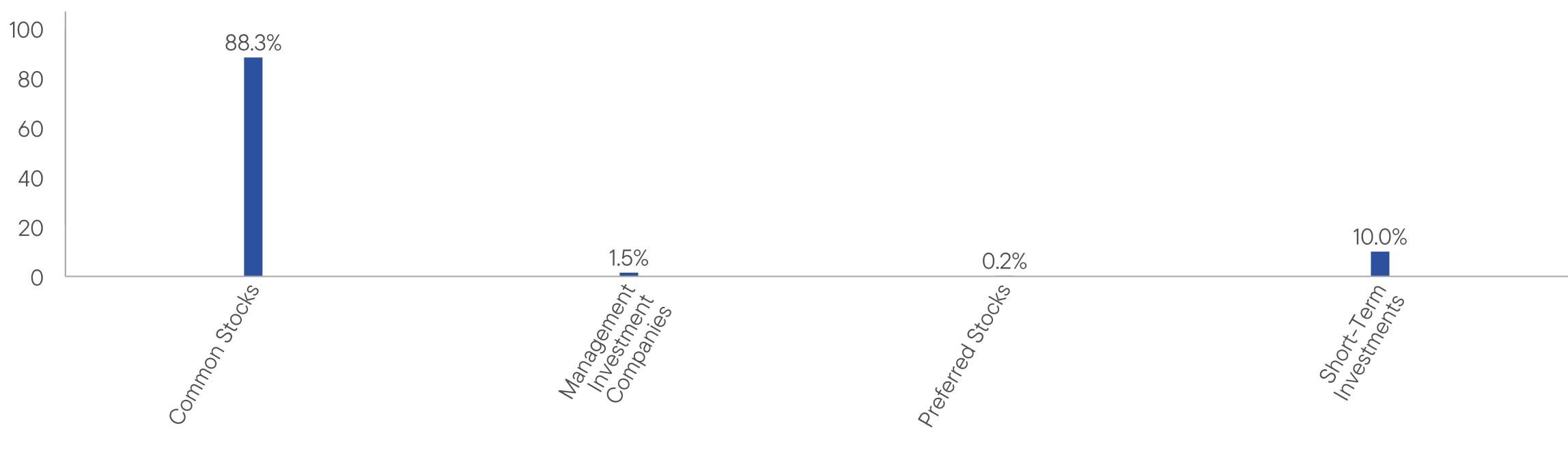

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW HAS THE FUND CHANGED? On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisors, Putnam Investments Limited (“PIL”), and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes. Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new subadvisory agreement. Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date. Effective March 31, 2025, the portfolio managers for the Fund are Brett Goldstein, Adrian Chan, Jacqueline Kenney and Thomas A. Nelson. This is a summary of certain changes to the Fund since June 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by October 1, 2025, at https://www.franklintempleton.com/regulatory-internalusefunds-documents.

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-internalusefunds-documents.

|

|

| Class P |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam Dynamic Asset Allocation Equity Fund

|

|

| Class Name |

Class P

|

|

| No Trading Symbol |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Putnam Dynamic Asset Allocation Equity Fund for the period June 1, 2024, to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) 225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-internalusefunds-documents

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class P

|

$63

|

0.59%

|

|

[4] |

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

0.59%

|

|

| Factors Affecting Performance [Text Block] |

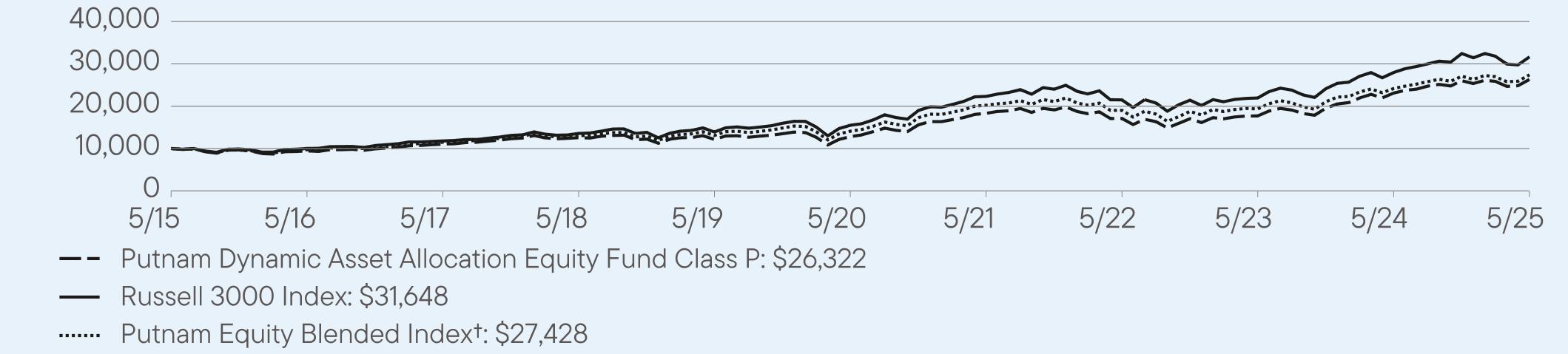

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? For the twelve months ended May 31, 2025, Class P shares of Putnam Dynamic Asset Allocation Equity Fund returned 13.90%. The Fund compares its performance to the Russell 3000 Index and the Putnam Equity Blended Index†, which returned 13.12% and 13.39%, respectively, for the same period. PERFORMANCE HIGHLIGHTS

|

|

|

Top contributors to performance:

|

|

↑

|

Selection effects within the Quantitative U.S. Large Cap Strategy sleeve were beneficial for benchmark-relative performance.

|

|

↑

|

Selection effects within the Quantitative International Equity Strategy sleeve were beneficial for benchmark-relative performance.

|

|

↑

|

Selection effects within the Fundamental Emerging Markets Equity Strategy sleeve were beneficial for benchmark-relative performance.

|

|

|

|

Top detractors to performance:

|

|

↓

|

Selection effects within the Fundamental Large-Cap Growth Equity Strategy sleeve detracted from performance.

|

|

↓

|

Allocation decisions within the Fundamental Large-Cap Growth Equity Strategy sleeve detracted from performance.

|

|

↓

|

Selection effects within the Quantitative U.S. Small-Cap Equity Strategy sleeve detracted from performance.

|

Use of Derivatives impacting performance: Futures were used to manage the Fund’s exposure to market (systematic) risk, which detracted from performance. Forward currency contracts were used to hedge foreign exchange risk, which resulted in a slightly positive impact on performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended May 31, 2025

|

|

|

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class P

|

13.90

|

15.48

|

10.16

|

|

Russell 3000 Index

|

13.12

|

15.34

|

12.21

|

|

Putnam Equity Blended Index†

|

13.39

|

14.22

|

10.62

|

|

[5] |

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Jun. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance, please call Franklin Templeton at (800) 225-1581. Important data provider notices and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 26,982,820

|

|

| Holdings Count | $ / shares |

566

|

[6] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

74.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of May 31, 2025)

|

|

|

Total Net Assets

|

$26,982,820

|

|

Total Number of Portfolio Holdings*

|

566

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

74%

|

|

[6] |

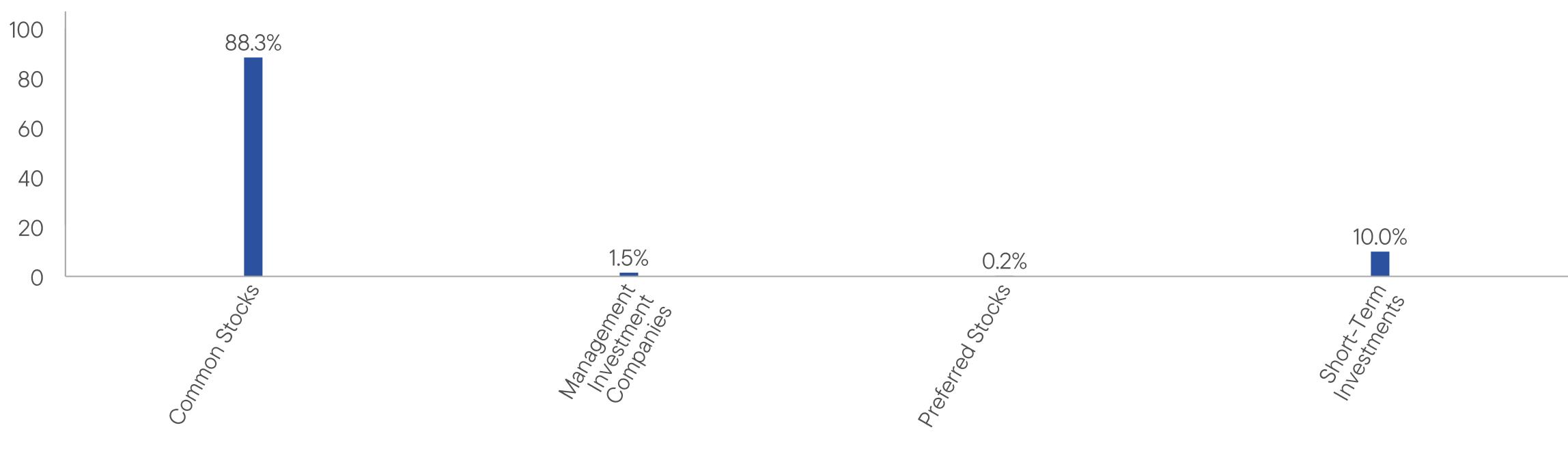

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

HOW HAS THE FUND CHANGED? On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisors, Putnam Investments Limited (“PIL”), and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes. Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new subadvisory agreement. Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date. Effective March 31, 2025, the portfolio managers for the Fund are Brett Goldstein, Adrian Chan, Jacqueline Kenney and Thomas A. Nelson. This is a summary of certain changes to the Fund since June 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by October 1, 2025, at https://www.franklintempleton.com/regulatory-internalusefunds-documents.

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-internalusefunds-documents.

|

|

|

|