|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$101

|

0.97%

|

|

Top contributors to performance:

|

|

|

↑

|

Opportunistic allocation to collateralized loan obligations

|

|

↑

|

Underweight the capital goods sector

|

|

↑

|

Issue selection within the information technology and consumer non-cyclical sectors

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight the banking sector

|

|

↓

|

Issue selection within the consumer cyclical sector

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

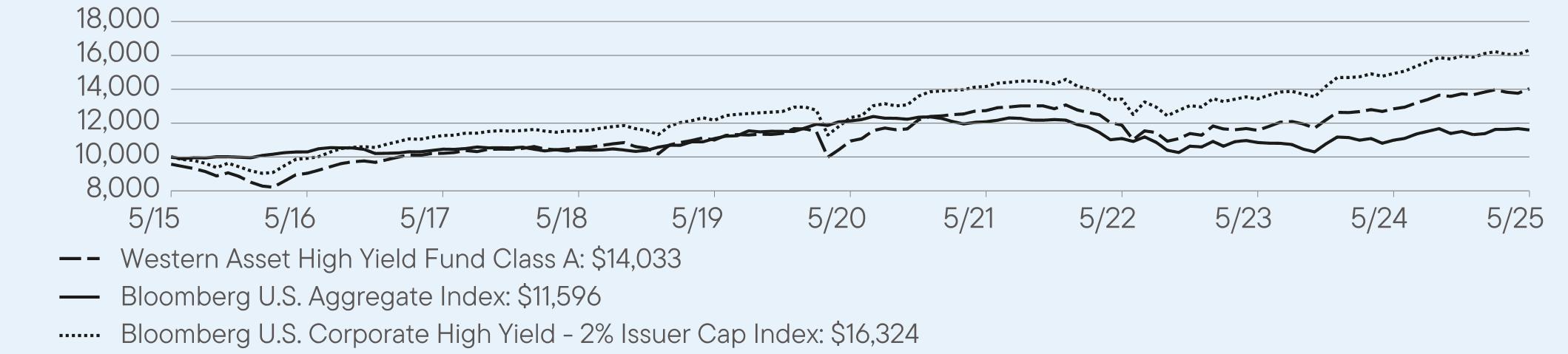

Class A

|

9.23

|

5.10

|

3.90

|

|

Class A (with sales charge)

|

5.06

|

4.19

|

3.45

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield - 2% Issuer Cap Index

|

9.32

|

5.77

|

5.02

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$221,959,458

|

|

Total Number of Portfolio Holdings*

|

386

|

|

Total Management Fee Paid

|

$1,165,019

|

|

Portfolio Turnover Rate

|

41%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$179

|

1.72%

|

|

Top contributors to performance:

|

|

|

↑

|

Opportunistic allocation to collateralized loan obligations

|

|

↑

|

Underweight the capital goods sector

|

|

↑

|

Issue selection within the information technology and consumer non-cyclical sectors

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight the banking sector

|

|

↓

|

Issue selection within the consumer cyclical sector

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

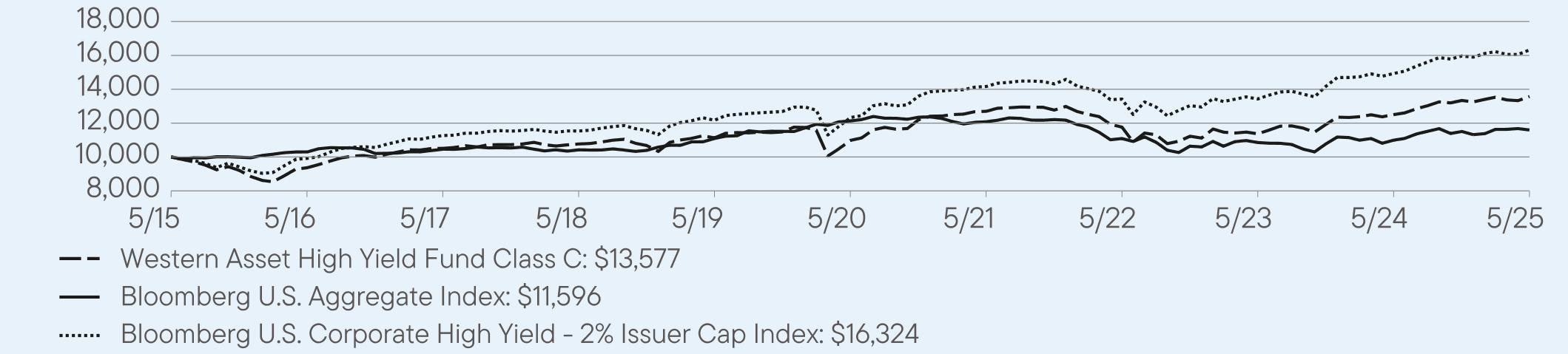

Class C

|

8.58

|

4.34

|

3.11

|

|

Class C (with sales charge)

|

7.58

|

4.34

|

3.11

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield - 2% Issuer Cap Index

|

9.32

|

5.77

|

5.02

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$221,959,458

|

|

Total Number of Portfolio Holdings*

|

386

|

|

Total Management Fee Paid

|

$1,165,019

|

|

Portfolio Turnover Rate

|

41%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

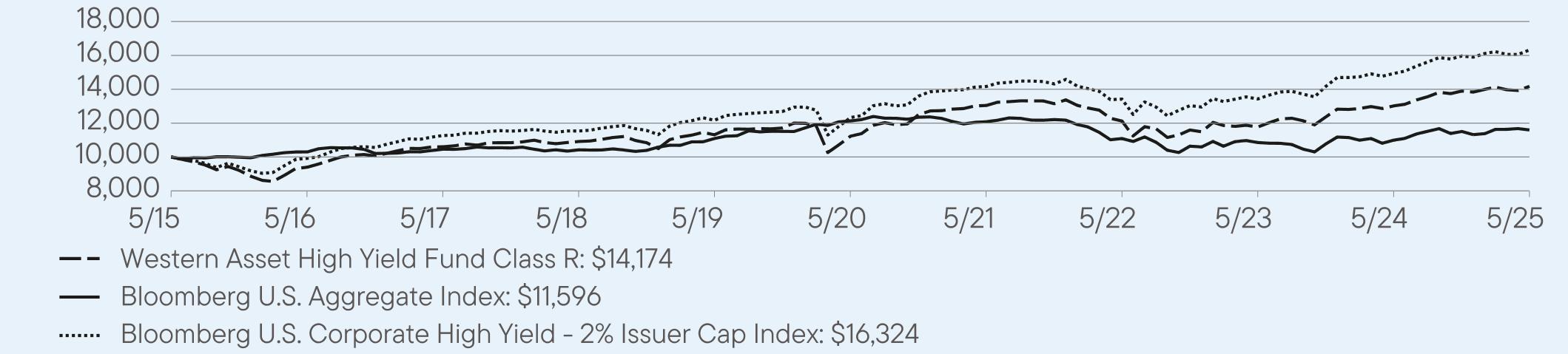

Class R

|

$136

|

1.30%

|

|

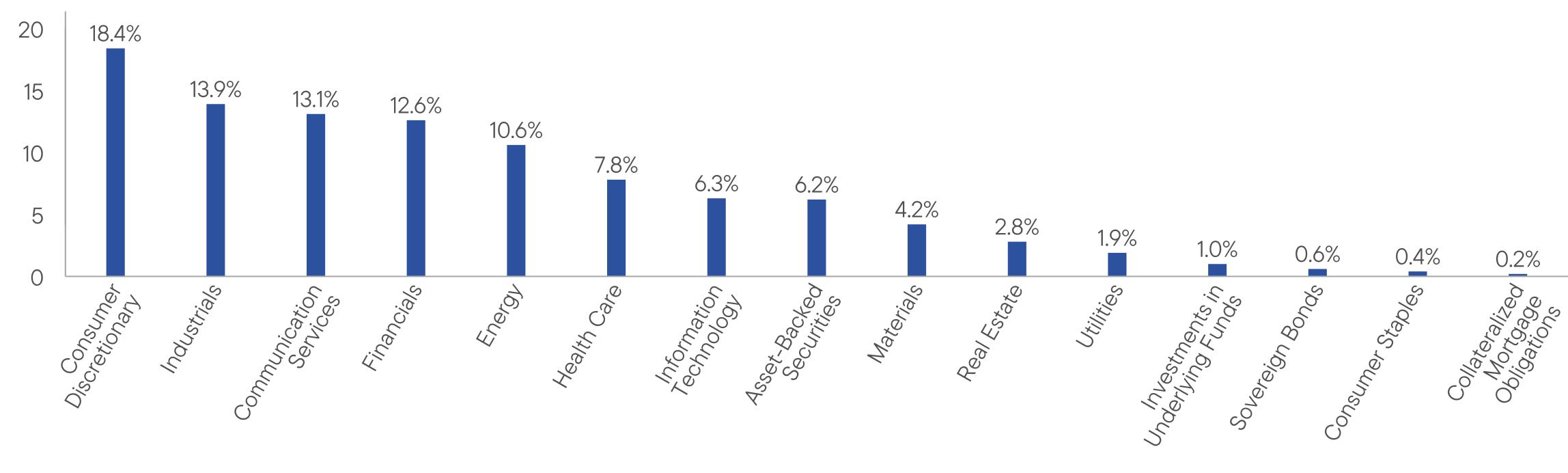

Top contributors to performance:

|

|

|

↑

|

Opportunistic allocation to collateralized loan obligations

|

|

↑

|

Underweight the capital goods sector

|

|

↑

|

Issue selection within the information technology and consumer non-cyclical sectors

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight the banking sector

|

|

↓

|

Issue selection within the consumer cyclical sector

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class R

|

8.87

|

4.77

|

3.55

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield - 2% Issuer Cap Index

|

9.32

|

5.77

|

5.02

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$221,959,458

|

|

Total Number of Portfolio Holdings*

|

386

|

|

Total Management Fee Paid

|

$1,165,019

|

|

Portfolio Turnover Rate

|

41%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

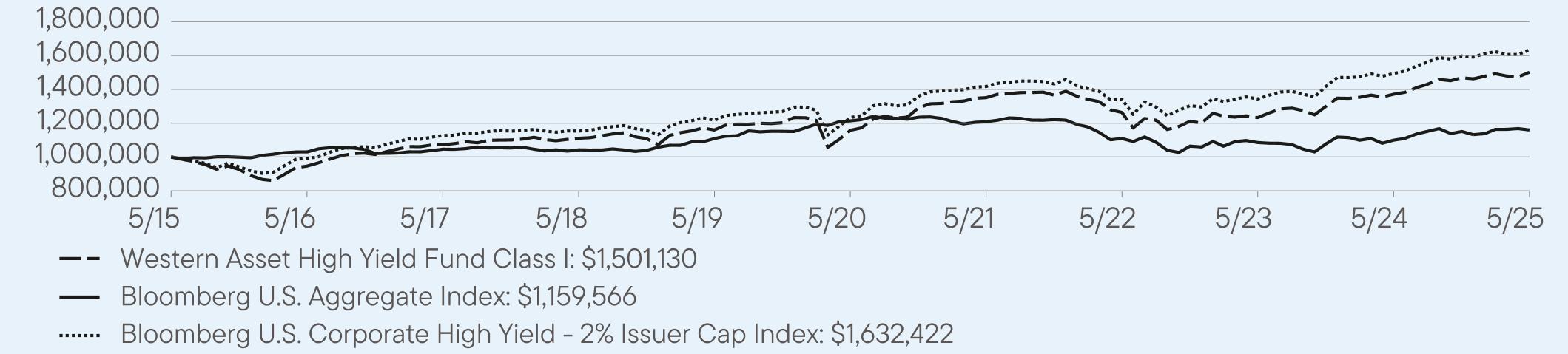

Class I

|

$79

|

0.75%

|

|

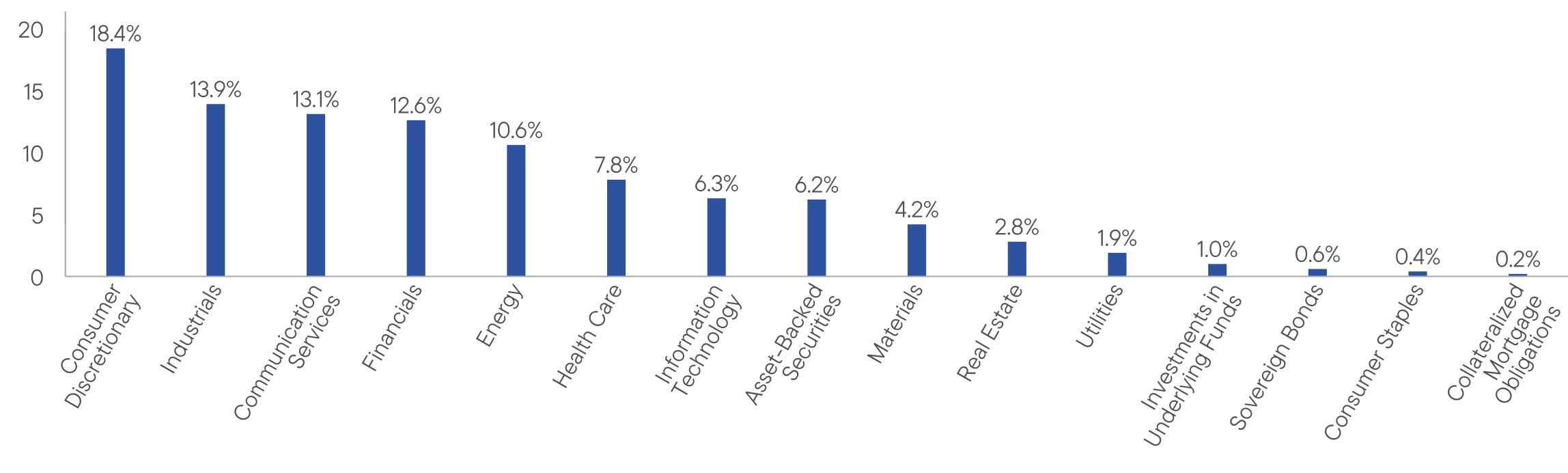

Top contributors to performance:

|

|

|

↑

|

Opportunistic allocation to collateralized loan obligations

|

|

↑

|

Underweight the capital goods sector

|

|

↑

|

Issue selection within the information technology and consumer non-cyclical sectors

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight the banking sector

|

|

↓

|

Issue selection within the consumer cyclical sector

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

9.47

|

5.33

|

4.15

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield - 2% Issuer Cap Index

|

9.32

|

5.77

|

5.02

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$221,959,458

|

|

Total Number of Portfolio Holdings*

|

386

|

|

Total Management Fee Paid

|

$1,165,019

|

|

Portfolio Turnover Rate

|

41%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class IS

|

$68

|

0.65%

|

|

Top contributors to performance:

|

|

|

↑

|

Opportunistic allocation to collateralized loan obligations

|

|

↑

|

Underweight the capital goods sector

|

|

↑

|

Issue selection within the information technology and consumer non-cyclical sectors

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight the banking sector

|

|

↓

|

Issue selection within the consumer cyclical sector

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

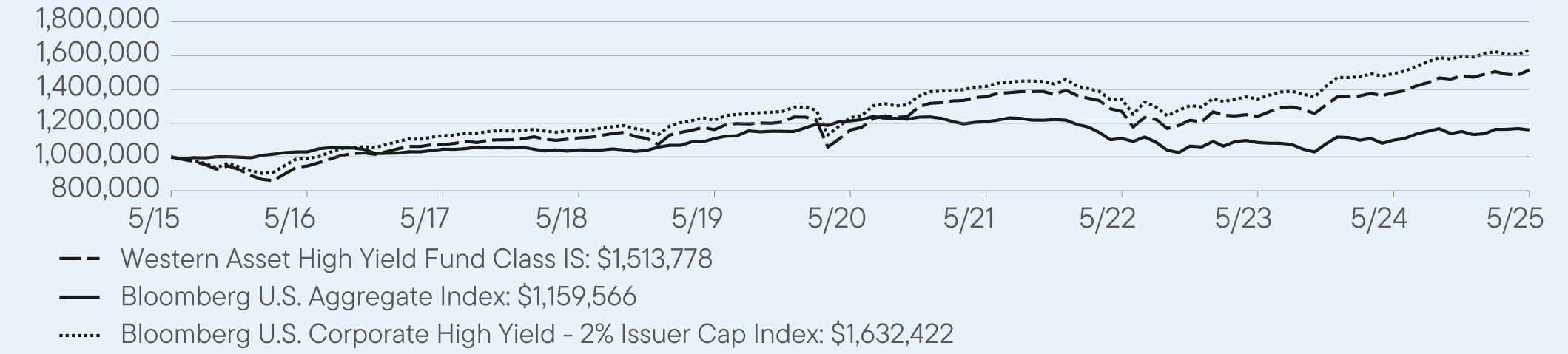

Class IS

|

9.71

|

5.47

|

4.23

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield - 2% Issuer Cap Index

|

9.32

|

5.77

|

5.02

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$221,959,458

|

|

Total Number of Portfolio Holdings*

|

386

|

|

Total Management Fee Paid

|

$1,165,019

|

|

Portfolio Turnover Rate

|

41%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|