|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$78

|

0.76%

|

|

Top contributors to performance:

|

|

|

↑

|

Duration positioning as yields fell

|

|

↑

|

Structured product positioning

|

|

↑

|

Investment-grade credit positioning

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. dollar-denominated emerging market positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

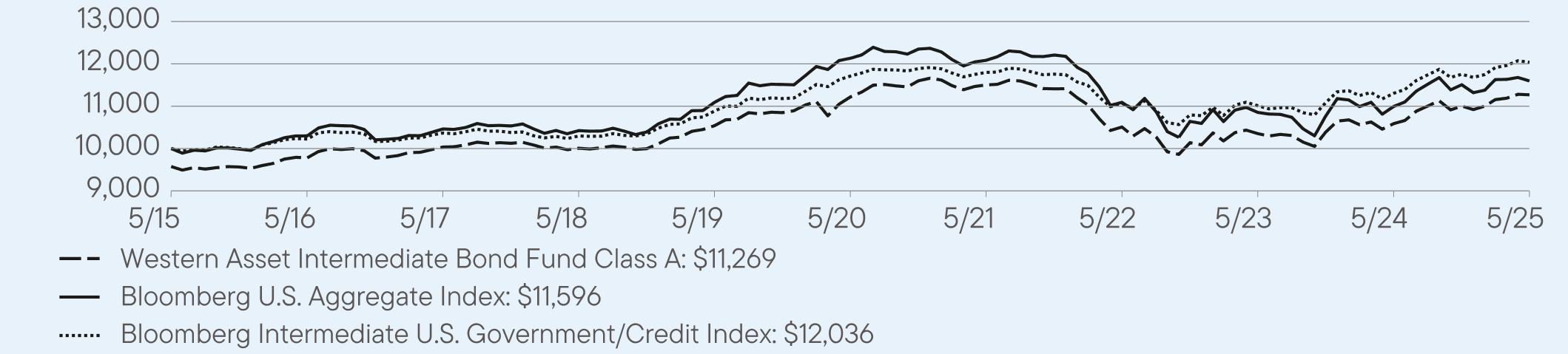

Class A

|

6.43

|

0.09

|

1.65

|

|

Class A (with sales charge)

|

2.44

|

-0.79

|

1.20

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg Intermediate U.S. Government/Credit Index

|

6.45

|

0.55

|

1.87

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

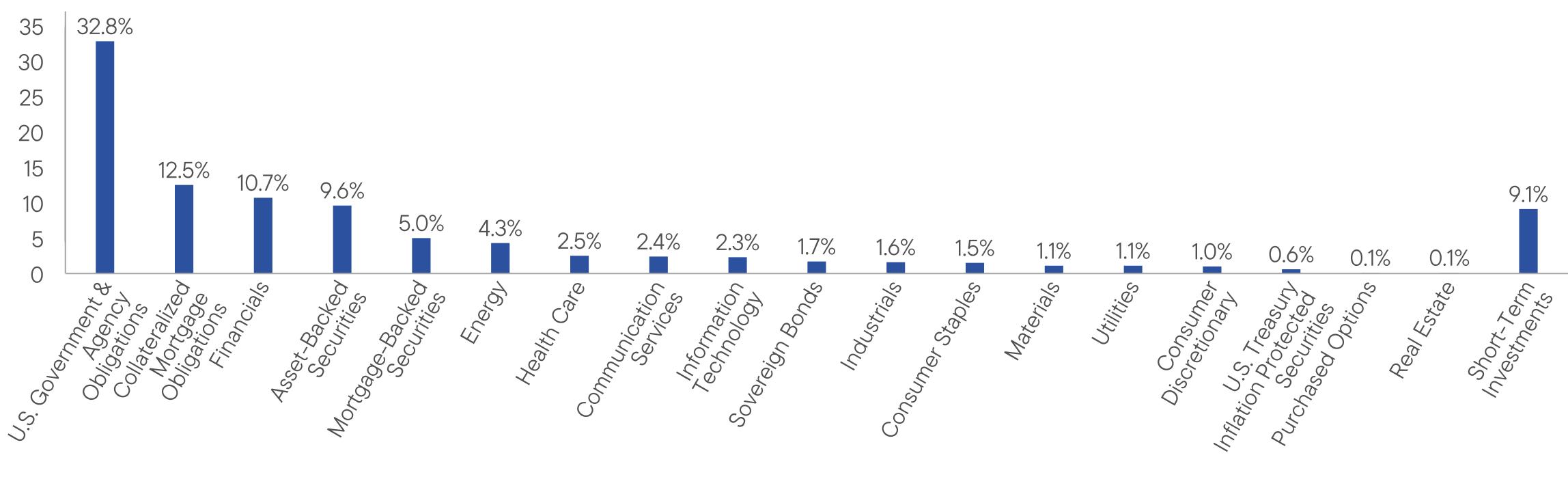

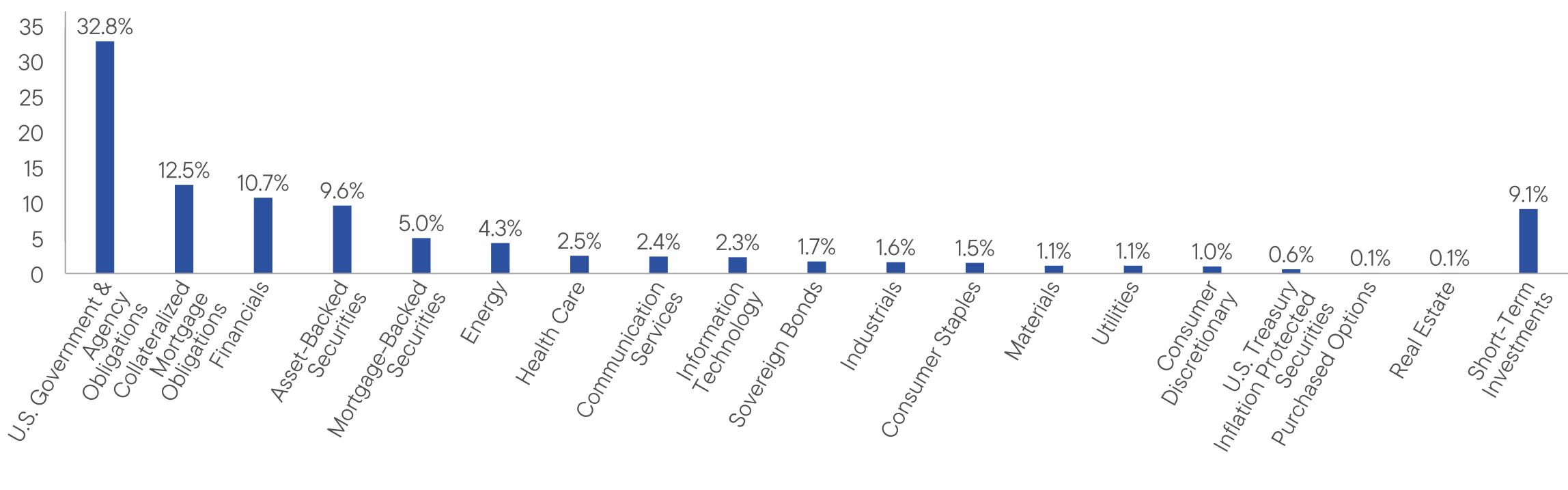

Total Net Assets

|

$194,075,576

|

|

Total Number of Portfolio Holdings*

|

493

|

|

Total Management Fee Paid

|

$1,365,316

|

|

Portfolio Turnover Rate

|

62%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$156

|

1.52%

|

|

Top contributors to performance:

|

|

|

↑

|

Duration positioning as yields fell

|

|

↑

|

Structured product positioning

|

|

↑

|

Investment-grade credit positioning

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. dollar-denominated emerging market positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

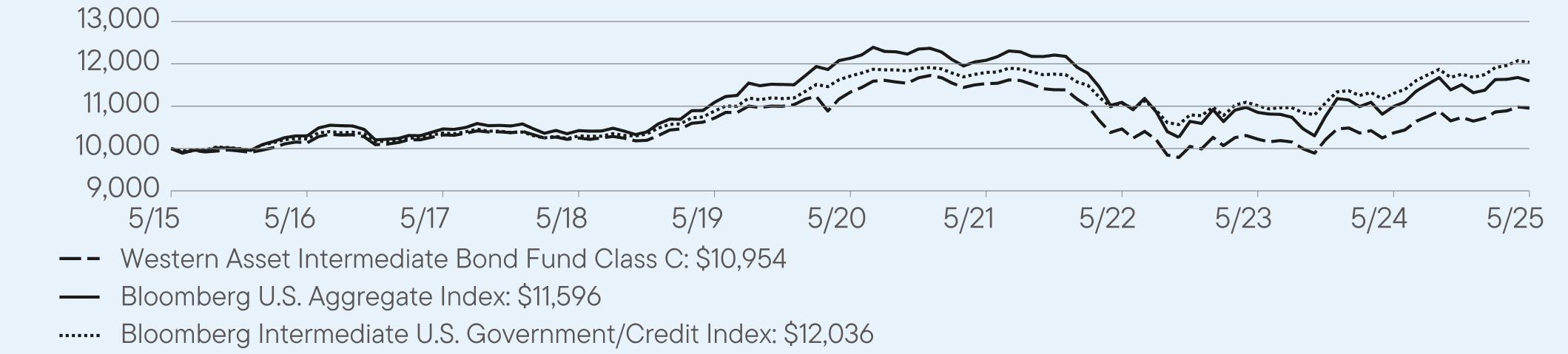

Class C

|

5.62

|

-0.68

|

0.92

|

|

Class C (with sales charge)

|

4.62

|

-0.68

|

0.92

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg Intermediate U.S. Government/Credit Index

|

6.45

|

0.55

|

1.87

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

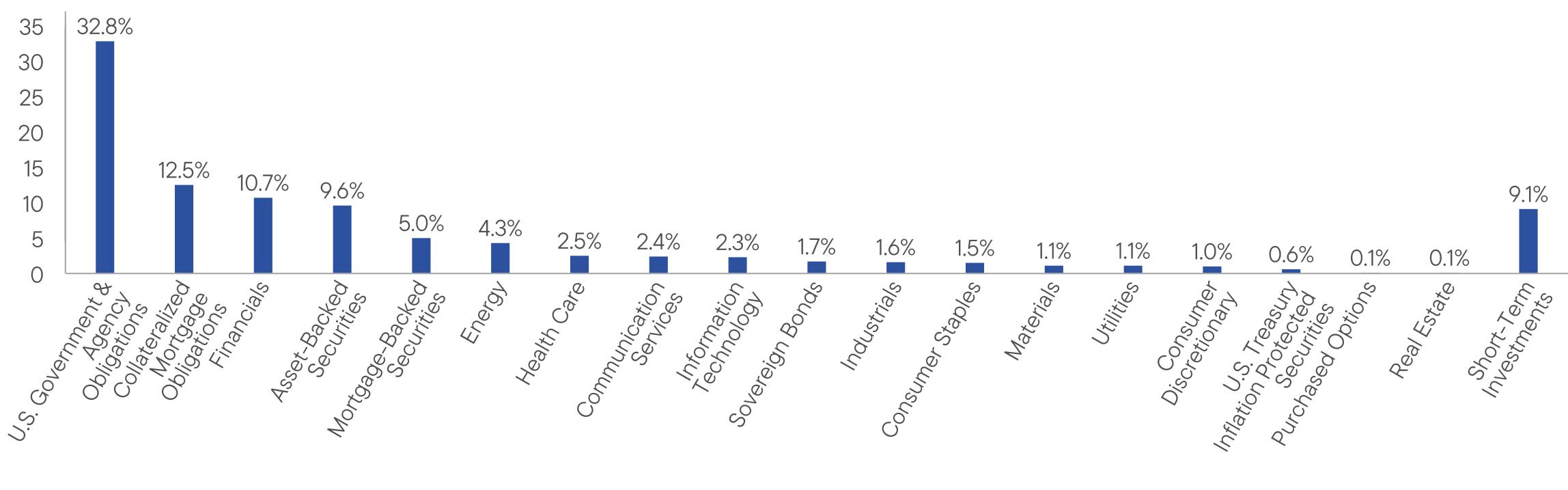

Total Net Assets

|

$194,075,576

|

|

Total Number of Portfolio Holdings*

|

493

|

|

Total Management Fee Paid

|

$1,365,316

|

|

Portfolio Turnover Rate

|

62%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R

|

$117

|

1.14%

|

|

Top contributors to performance:

|

|

|

↑

|

Duration positioning as yields fell

|

|

↑

|

Structured product positioning

|

|

↑

|

Investment-grade credit positioning

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. dollar-denominated emerging market positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

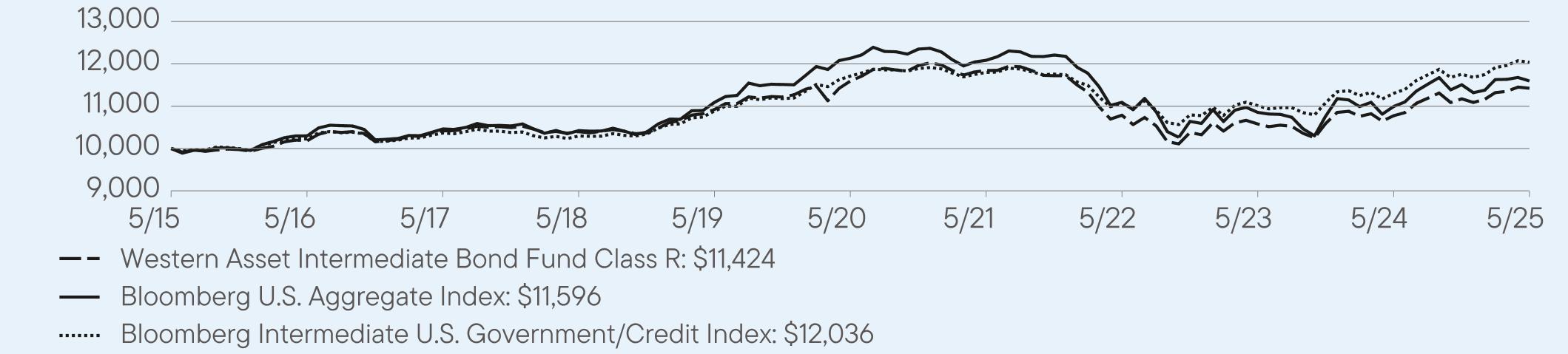

Class R

|

6.02

|

-0.30

|

1.34

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg Intermediate U.S. Government/Credit Index

|

6.45

|

0.55

|

1.87

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$194,075,576

|

|

Total Number of Portfolio Holdings*

|

493

|

|

Total Management Fee Paid

|

$1,365,316

|

|

Portfolio Turnover Rate

|

62%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$57

|

0.55%

|

|

Top contributors to performance:

|

|

|

↑

|

Duration positioning as yields fell

|

|

↑

|

Structured product positioning

|

|

↑

|

Investment-grade credit positioning

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. dollar-denominated emerging market positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

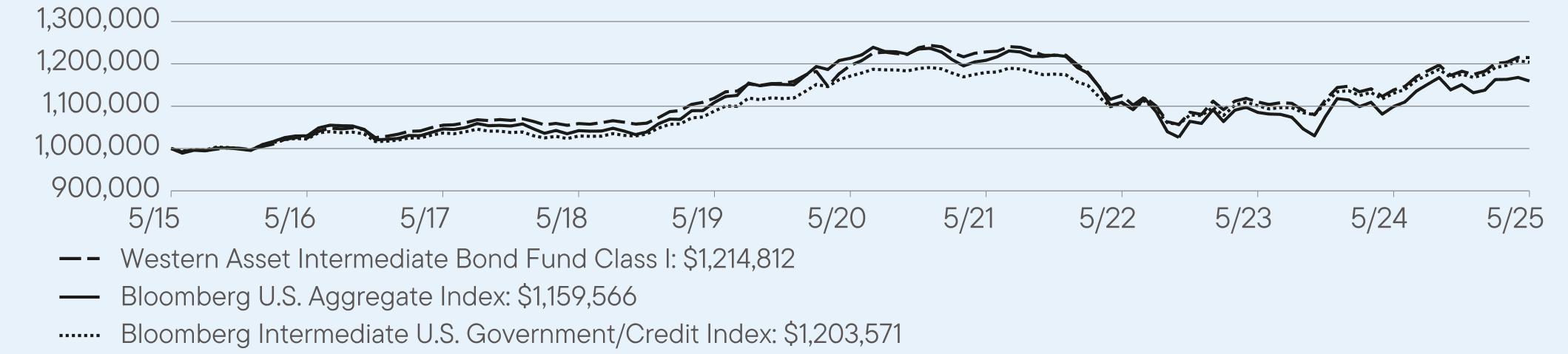

Class I

|

6.69

|

0.30

|

1.97

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg Intermediate U.S. Government/Credit Index

|

6.45

|

0.55

|

1.87

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

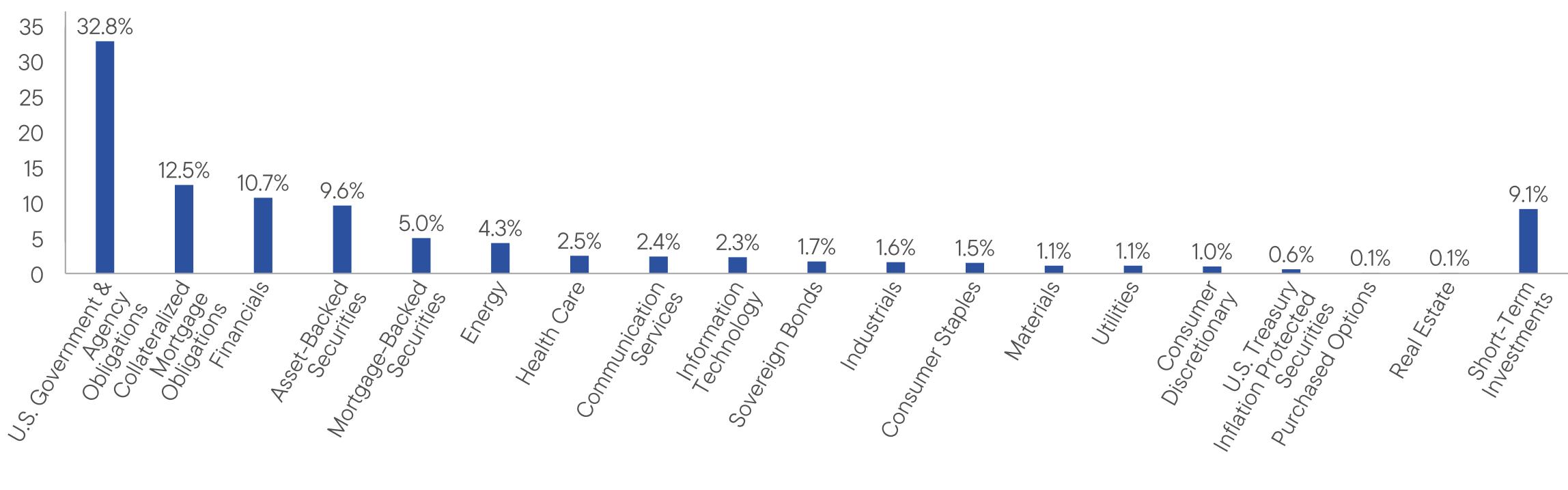

Total Net Assets

|

$194,075,576

|

|

Total Number of Portfolio Holdings*

|

493

|

|

Total Management Fee Paid

|

$1,365,316

|

|

Portfolio Turnover Rate

|

62%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class IS

|

$47

|

0.45%

|

|

Top contributors to performance:

|

|

|

↑

|

Duration positioning as yields fell

|

|

↑

|

Structured product positioning

|

|

↑

|

Investment-grade credit positioning

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. dollar-denominated emerging market positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

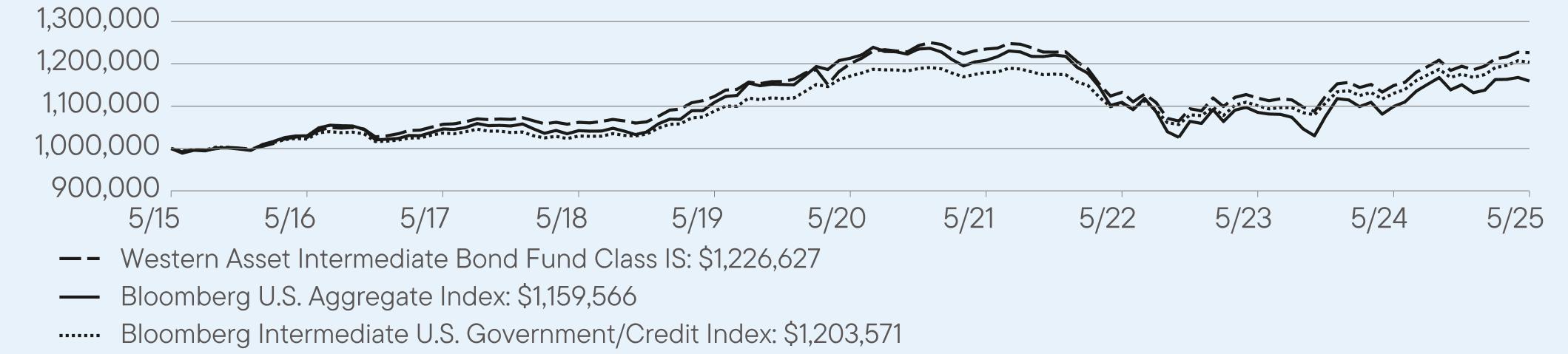

Class IS

|

6.75

|

0.43

|

2.06

|

|

Bloomberg U.S. Aggregate Index

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg Intermediate U.S. Government/Credit Index

|

6.45

|

0.55

|

1.87

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$194,075,576

|

|

Total Number of Portfolio Holdings*

|

493

|

|

Total Management Fee Paid

|

$1,365,316

|

|

Portfolio Turnover Rate

|

62%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|