| 1 ECOLAB Second Quarter 2025 Supplemental |

| Cautionary statement Forward-Looking Information This communication contains forward looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding macroeconomic conditions and our financial and business performance and prospects, including sales, earnings, special (gains) and charges, raw material costs, margins, pricing, currency translation, productivity, investments and new business. These statements are based on the current expectations of management. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. In particular, the ultimate results of any restructuring initiative depend on a number of factors, including the development of final plans, the impact of local regulatory requirements regarding employee terminations, the time necessary to develop and implement the restructuring initiatives and the level of success achieved through such actions in improving competitiveness, efficiency and effectiveness. Additional risks and uncertainties are set forth under Item 1A of our most recent Form 10-K, and our other public filings with the Securities and Exchange Commission (“SEC”), and include the impact of economic factors such as the worldwide economy, interest rates, foreign currency risk, reduced sales and earnings in our international operations resulting from the weakening of local currencies versus the U.S. dollar, demand uncertainty, supply chain challenges and inflation; the vitality of the markets we serve; exposure to global economic, political and legal risks related to our international operations, including international trade policies, geopolitical instability and the escalation of armed conflicts; our ability to successfully execute organizational change and management transitions; information technology infrastructure failures or breaches in data security; difficulty in procuring raw materials or fluctuations in raw material costs; our increasing reliance on artificial intelligence technologies in our products, services and operations; the occurrence of severe public health outbreaks not limited to COVID-19; our ability to acquire complementary businesses and to effectively integrate such businesses; our ability to execute key business initiatives; our ability to successfully compete with respect to value, innovation and customer support; the costs and effect of complying with laws and regulations; the occurrence of litigation or claims, including class action lawsuits; and other uncertainties or risks reported from time to time in our reports to the SEC. In light of these risks, uncertainties and factors, the forward-looking events discussed in this communication may not occur. We caution that undue reliance should not be placed on forward-looking statements, which speak only as of the date made. Ecolab does not undertake, and expressly disclaims, any duty to update any forward-looking statement, except as required by law. Non-GAAP Financial Information This communication includes Company information that does not conform to generally accepted accounting principles (GAAP). Management believes that a presentation of this information is meaningful to investors because it provides insight with respect to ongoing operating results of the Company and allows investors to better evaluate the financial results of the Company. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consistent with similar measures provided by other companies. Reconciliations of our non-GAAP measures included within this presentation are included in the “Non-GAAP Financial Measures” section of this presentation. |

| Expect to deliver continued 12-15% EPS growth 3 Solid organic sales growth Strong organic OI margin expansion, confident in delivering a 20% margin by 2027 Reported diluted EPS $1.84; adjusted diluted EPS $1.89, +13% Continue to expect 12-15% EPS growth in 2025 and beyond ▪ Reported sales +1%, including a 2% unfavorable impact from the sale of the global surgical solutions business ▪ Organic sales +3%. Institutional & Specialty and Water segments delivered continued solid growth. Ecolab’s growth engines, which include Life Sciences, Pest Elimination, Global High-Tech and Ecolab Digital, collectively grew double-digits. ▪ Reported OI +8%, Organic OI +14% ▪ Reported OI margin 17.6%. Organic OI margin 18.3%, +170 bps as value pricing and improved productivity more than offset growth-oriented investments in the business. ▪ As expected, Ecolab delivered another strong quarter of double-digit EPS growth ▪ Performance was driven by value pricing, volume growth, and productivity improvements ▪ 2025: Continue to expect full year 2025 adjusted diluted earnings per share in the $7.42 to $7.62 range, +12% to 15% versus last year. Ecolab expects to overcome the unpredictable operating environment through strong new business wins, value and surcharge pricing, and improved productivity. ▪ 3Q 2025: Expect third quarter 2025 adjusted diluted earnings per share in the $2.02 to $2.12 range, +10% to 16% |

| 2Q overview ▪ Solid performance with reported sales +1% and organic sales +3% o Volume +1%, driven by good new business and breakthrough innovation o Pricing +2%, supported by ongoing customer value delivery ▪ Organic growth led by Institutional & Specialty, Pest Elimination, and Life Sciences o Water +2%, accelerating food & beverage sales and continued double-digit growth in Global High-Tech offsetting soft end-market trends in Paper and Basic Industries o Institutional & Specialty remained strong at +4%, reflecting continued mid-single digit growth in hospitality and modestly lower sales to hospitals o Pest Elimination accelerated to +6%, fueled by the One Ecolab growth strategy o Life Sciences +4%, with robust growth in bioprocessing and pharma sales more than offsetting softer industrial purification sales ▪ Reported diluted EPS $1.84 ▪ Adjusted diluted EPS $1.89, +13% o Strong performance was fueled by value pricing, volume growth, and productivity improvements Sales EPS 4 |

| Expect strong 3Q and 2025 performance 3Q 2025 ▪ Ecolab expects third quarter 2025 adjusted diluted earnings per share in the $2.02 to $2.12 range, rising 10% to 16% compared with adjusted diluted earnings per share of $1.83 a year ago. ▪ Secular growth trends in water, hygiene, infection prevention, and digital technologies continue to fuel resilient, long-term demand for Ecolab’s innovative technologies and services. Strong momentum in Ecolab’s growth engines, which include Life Sciences, Pest Elimination, Global High-Tech and Ecolab Digital, is expected to continue. ▪ In the near-term, the global operating environment remains unpredictable, characterized by constantly evolving end-market demand and impacts from geopolitics and evolving international trade policy. Importantly, with these current macroeconomic assumptions, Ecolab’s expectations for 2025 earnings remain unchanged. The company has made proactive and strategically consistent adjustments to its delivery path, overcoming the unpredictable operating environment. Ecolab expects to outperform its end markets by converting strong new business wins, which leverage the company’s One Ecolab growth strategy and its record innovation pipeline. The company is also well prepared to manage through the dynamic international trade environment given the strength of Ecolab’s world class supply chain, its ‘local for local’ production model, and its recently implemented trade surcharge. ▪ Ecolab continues to expect full year 2025 adjusted diluted earnings per share in the $7.42 to $7.62 range, rising 12% to 15% compared with adjusted diluted earnings per share of $6.65 in 2024. 5 |

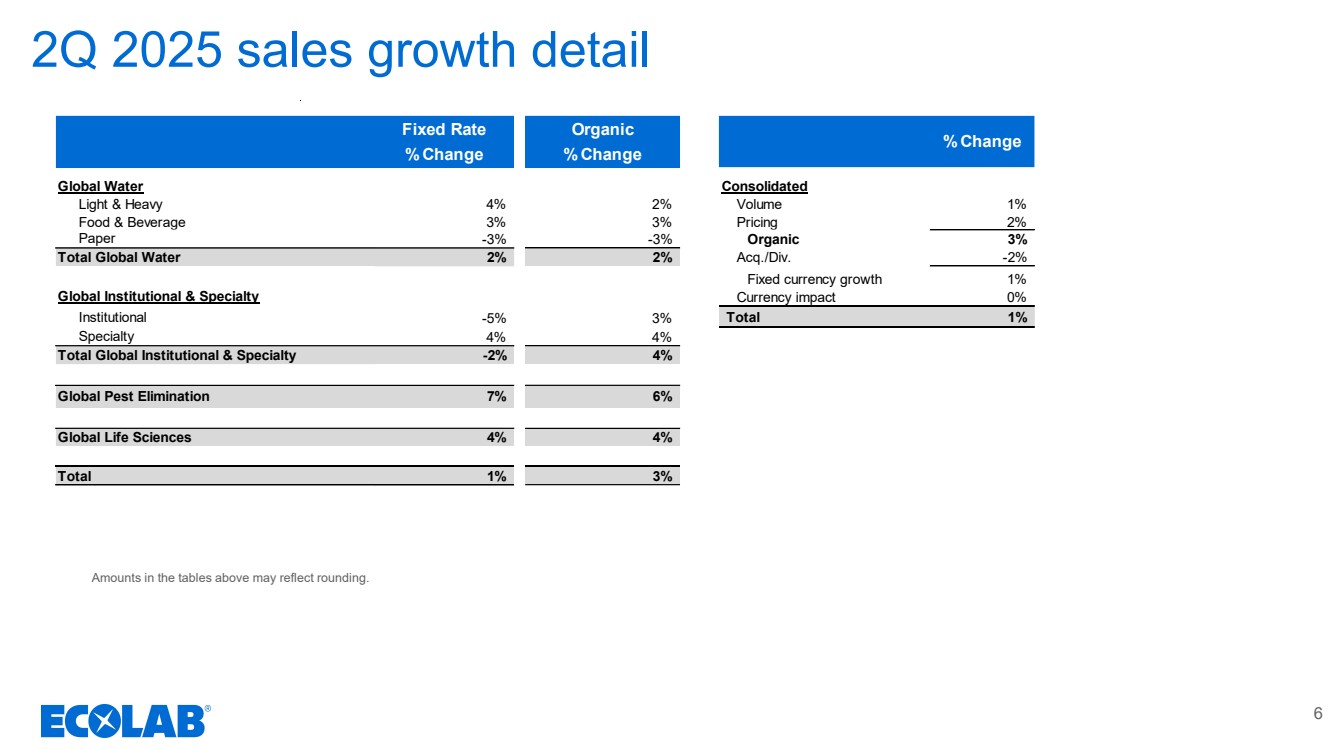

| 2Q 2025 sales growth detail 6 Amounts in the tables above may reflect rounding. Fixed Rate Organic % Change % Change Global Water Consolidated Light & Heavy 4% 2% Volume 1% Food & Beverage 3% 3% Pricing 2% Paper -3% -3% Organic 3% Total Global Water 2% 2% Acq./Div. -2% Fixed currency growth 1% Global Institutional & Specialty Currency impact 0% Institutional -5% 3% Total 1% Specialty 4% 4% Total Global Institutional & Specialty -2% 4% Global Pest Elimination 7% 6% Global Life Sciences 4% 4% Total 1% 3% % Change |

| 7 Sales +2% Light & Heavy All sales figures are organic unless otherwise noted Global Water Segment Q3: Expect solid sales growth as continued double-digit growth in Global High-Tech more than offsets softer demand across Basic Industries. ▪ Modest growth in light and heavy reflected continued double-digit growth in Global High-Tech and solid Manufacturing sales growth, which more than offset continued soft end-market demand in Basic Industries and Mining. o Manufacturing: Solid growth driven by continued good momentum in food & beverage, leveraging the One Ecolab enterprise selling strategy. o Basic industries: Sales modestly declined as further new business wins were more than offset by continued soft end market demand in primary metals and chemicals. o Global High-Tech: Continued strong double-digit sales growth driven by attractive share gains from our innovative cooling technologies for data centers and circular water programs for microelectronics. o Downstream: Slightly higher sales reflected continued good growth in North America, offset by softer sales in international regions. ▪ The impact of increasing water demand, which is being amplified by the rapid build out of artificial intelligence infrastructure, continues to be a critical issue for our customers, and one that Ecolab is uniquely positioned to help them solve. Our innovative circular water solutions, digital technologies, and service expertise help our customers improve their performance, significantly reduce water consumption, and meet their sustainability objectives. |

| 8 Sales -3% Paper All sales figures are organic unless otherwise noted Global Water Segment Sales +3% Food & Beverage Q3: Anticipate continued solid sales growth driven by value pricing and improved new business wins. ▪ Organic sales growth accelerated driven by value pricing and new business wins. Growth was led by good gains in beverage & brewing, dairy, and food. ▪ Regionally, sales growth improved in North America, Latin America, and IMEA, while sales grew modestly in Asia Pacific and Europe. ▪ We continue to benefit from our One Ecolab enterprise selling approach to customers. Our innovative solutions combine industry-leading cleaning, sanitizing and water treatment capabilities to deliver significant customer value through improved food safety, lower operating costs and water usage optimization. Q3: Expect modestly lower sales as new business wins are offset by continued soft customer production rates. ▪ As expected, sales were modestly lower as continued good new business wins were offset by soft customer production rates. ▪ Solid growth in tissue and towel was offset by softer demand in packaging. ▪ While soft customer production rates continue to present challenging market dynamics, our strong new business wins are largely mitigating these unfavorable market impacts. Good share gains continue to be driven by new innovation and our global service expertise, which help our customers improve their performance, optimize their costs, and reduce their water consumption. |

| 9 Sales +3% Institutional Sales +4% Specialty All sales figures are organic unless otherwise noted Global Institutional & Specialty Segment Q3: We expect continued strong growth in hospitality, partially offset by modestly lower sales to hospitals. ▪ Beginning in 2025, Ecolab’s healthcare business is being reported within the Institutional division. As expected, mid-single digit growth in sales to hospitality customers was partially offset by modestly lower sales to hospitals. o Hospitality: Strong growth continues to be driven by value pricing and attractive new business wins from our One Ecolab growth strategy. These strong gains continue to outperform end-market trends as customers leverage our innovative products and service expertise that help improve performance, optimize labor, and reduce total costs. o Hospitals: Modestly lower organic sales reflected continued non-strategic, low-margin business exits, which were partially offset by good value pricing. Our new business efforts are focused on attractive long-term growth opportunities in the infection prevention and instrument reprocessing areas to drive profitable long-term growth. ▪ We remain focused on capitalizing on our attractive long-term growth opportunities, maximizing service effectiveness, and leveraging investments in digital technology to deliver enhanced customer value and improved productivity, and attractive new business wins for Ecolab. Q3: Expect continued solid sales growth as continued strong underlying growth is partially offset by non-strategic, low-margin business exits. ▪ As expected, Specialty delivered strong underlying sales growth, which was partially offset by a 3% unfavorable impact from previously disclosed non- strategic, low-margin business exits. Strong underlying performance continued to outperform market trends. o Quick Service: Sales growth improved, reflecting strong new business and our ongoing product and program innovation that delivers leading food safety outcomes, labor optimization and lower total operating costs. Demand across the quick service industry for our labor optimization technologies continues to be strong, which we are uniquely positioned to capture. o Food Retail: Sales growth accelerated, reflecting good new business wins and new product innovation. As a trusted global partner for retailers, we continue to expand our competitive differentiation by helping our customers protect their brand, improve their customer experience, and optimize their operational performance. |

| 10 Sales +6% Pest Elimination All sales figures are organic unless otherwise noted Global Pest Elimination Segment ▪ Organic sales growth improved, led by good gains in food & beverage, restaurants, and healthcare, and improved growth in food retail. ▪ To fuel continued strong long-term growth and market share gains, our focus is on rapidly accelerating the rollout of our digital pest intelligence program to provide customers with enhanced service and value. This leading digital offering, along with our high service levels, are expanding the total value delivered to customers, extending our competitive advantages, and enhancing our long-term growth opportunities. Q3: Expect continued good growth, benefiting from new customer wins as we leverage our investments in pest intelligence. |

| 11 Sales +4% Life Sciences All sales figures are organic unless otherwise noted Global Life Sciences Segment ▪ Solid sales growth reflected continued good new business wins that leverage our innovation, investments in new capabilities, and progressively improving industry trends. ▪ Double-digit growth in bioprocessing and pharmaceutical & personal care more than offset softer industrial water purification sales, which was constrained by production limitations. ▪ The long-term growth opportunities for the Life Sciences industry are very attractive. We continue to invest and innovate to further expand our global capabilities and technical expertise across contamination control and purification technologies including bioprocessing to capitalize on this high-growth, high-margin opportunity. Q3: Expect continued solid growth driven by good business momentum and progressively improving industry trends. |

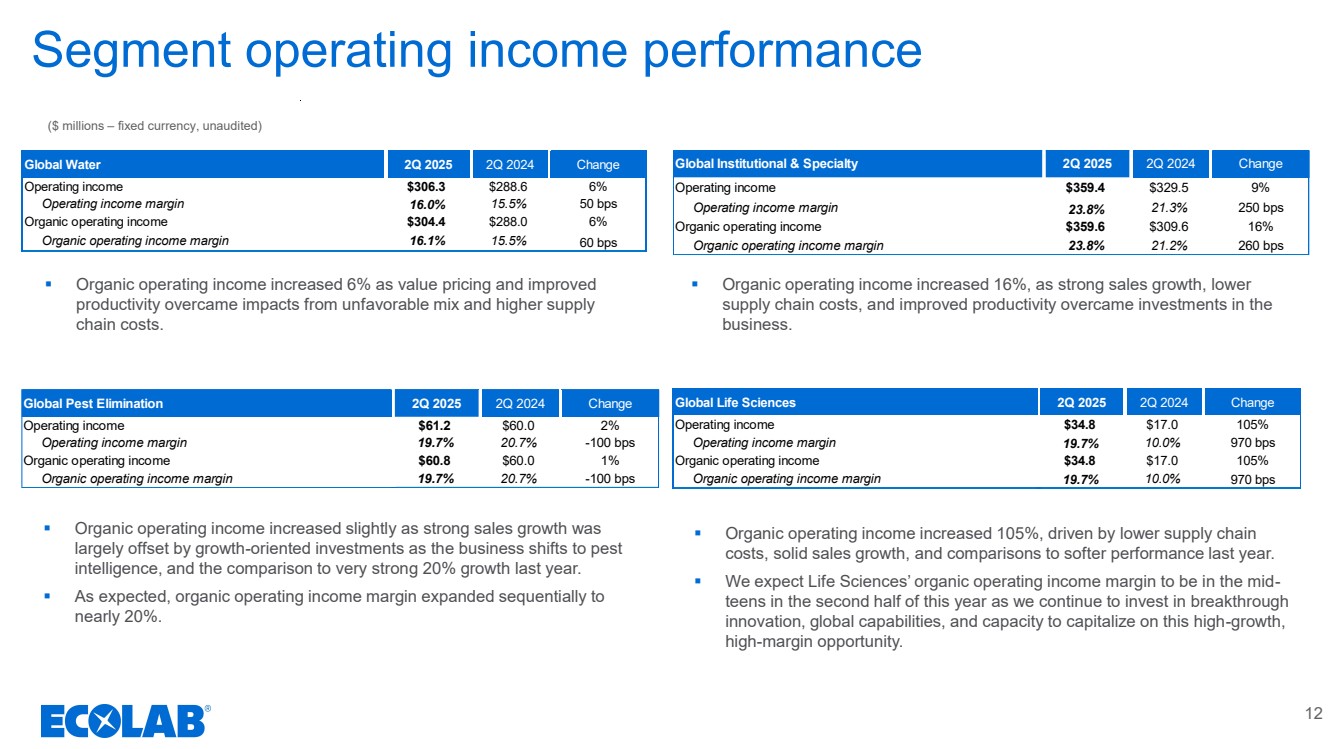

| Segment operating income performance ▪ Organic operating income increased 6% as value pricing and improved productivity overcame impacts from unfavorable mix and higher supply chain costs. ▪ Organic operating income increased slightly as strong sales growth was largely offset by growth-oriented investments as the business shifts to pest intelligence, and the comparison to very strong 20% growth last year. ▪ As expected, organic operating income margin expanded sequentially to nearly 20%. ($ millions – fixed currency, unaudited) 12 Global Water 2Q 2025 2Q 2024 Change Operating income $306.3 $288.6 6% Operating income margin 16.0% 15.5% 50 bps Organic operating income $304.4 $288.0 6% Organic operating income margin 16.1% 15.5% 60 bps Global Institutional & Specialty 2Q 2025 2Q 2024 Change Operating income $359.4 $329.5 9% Operating income margin 23.8% 21.3% 250 bps Organic operating income $359.6 $309.6 16% Organic operating income margin 23.8% 21.2% 260 bps Global Life Sciences 2Q 2025 2Q 2024 Change Operating income $34.8 $17.0 105% Operating income margin 19.7% 10.0% 970 bps Organic operating income $34.8 $17.0 105% Organic operating income margin 19.7% 10.0% 970 bps Global Pest Elimination 2Q 2025 2Q 2024 Change Operating income $61.2 $60.0 2% Operating income margin 19.7% 20.7% -100 bps Organic operating income $60.8 $60.0 1% Organic operating income margin 19.7% 20.7% -100 bps ▪ Organic operating income increased 105%, driven by lower supply chain costs, solid sales growth, and comparisons to softer performance last year. ▪ We expect Life Sciences’ organic operating income margin to be in the mid-teens in the second half of this year as we continue to invest in breakthrough innovation, global capabilities, and capacity to capitalize on this high-growth, high-margin opportunity. ▪ Organic operating income increased 16%, as strong sales growth, lower supply chain costs, and improved productivity overcame investments in the business. |

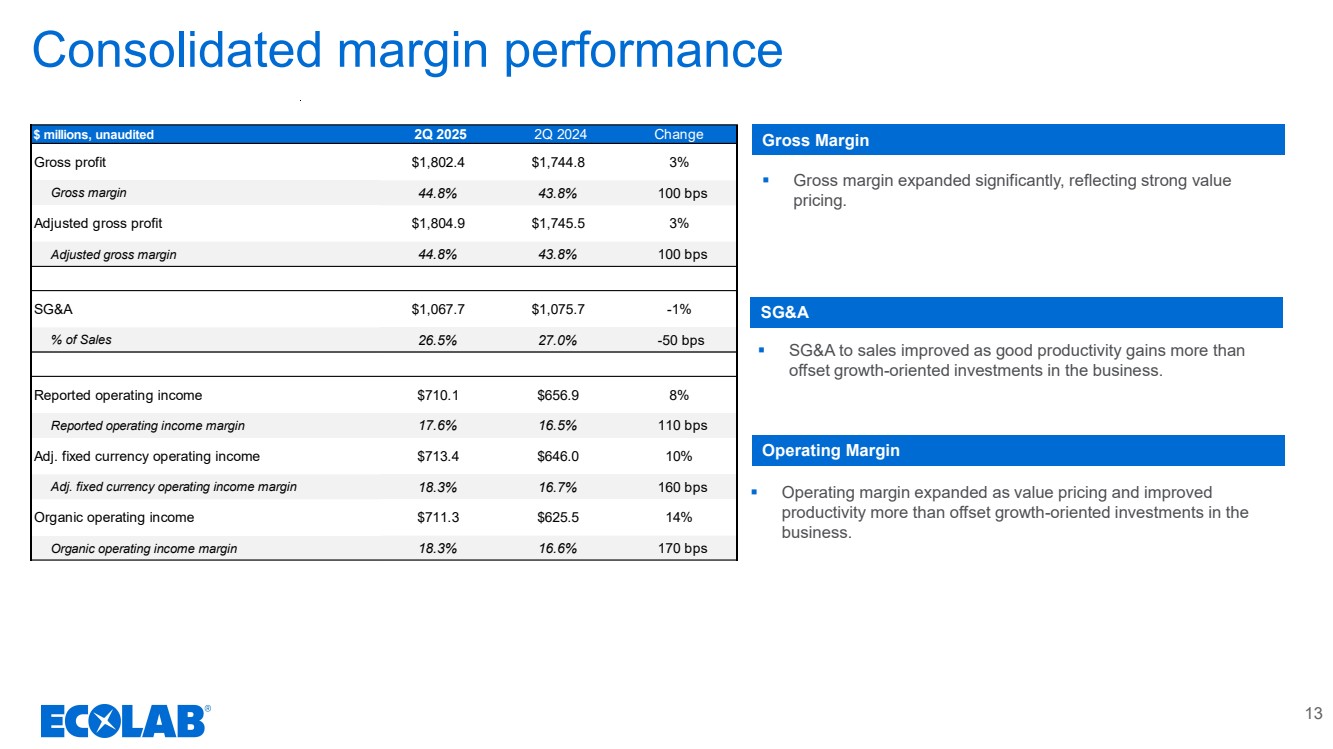

| Consolidated margin performance ▪ Gross margin expanded significantly, reflecting strong value pricing. ▪ SG&A to sales improved as good productivity gains more than offset growth-oriented investments in the business. ▪ Operating margin expanded as value pricing and improved productivity more than offset growth-oriented investments in the business. Gross Margin SG&A Operating Margin 13 $ millions, unaudited 2Q 2025 2Q 2024 Change Gross profit $1,802.4 $1,744.8 3% Gross margin 44.8% 43.8% 100 bps Adjusted gross profit $1,804.9 $1,745.5 3% Adjusted gross margin 44.8% 43.8% 100 bps SG&A $1,067.7 $1,075.7 -1% % of Sales 26.5% 27.0% -50 bps Reported operating income $710.1 $656.9 8% Reported operating income margin 17.6% 16.5% 110 bps Adj. fixed currency operating income $713.4 $646.0 10% Adj. fixed currency operating income margin 18.3% 16.7% 160 bps Organic operating income $711.3 $625.5 14% Organic operating income margin 18.3% 16.6% 170 bps |

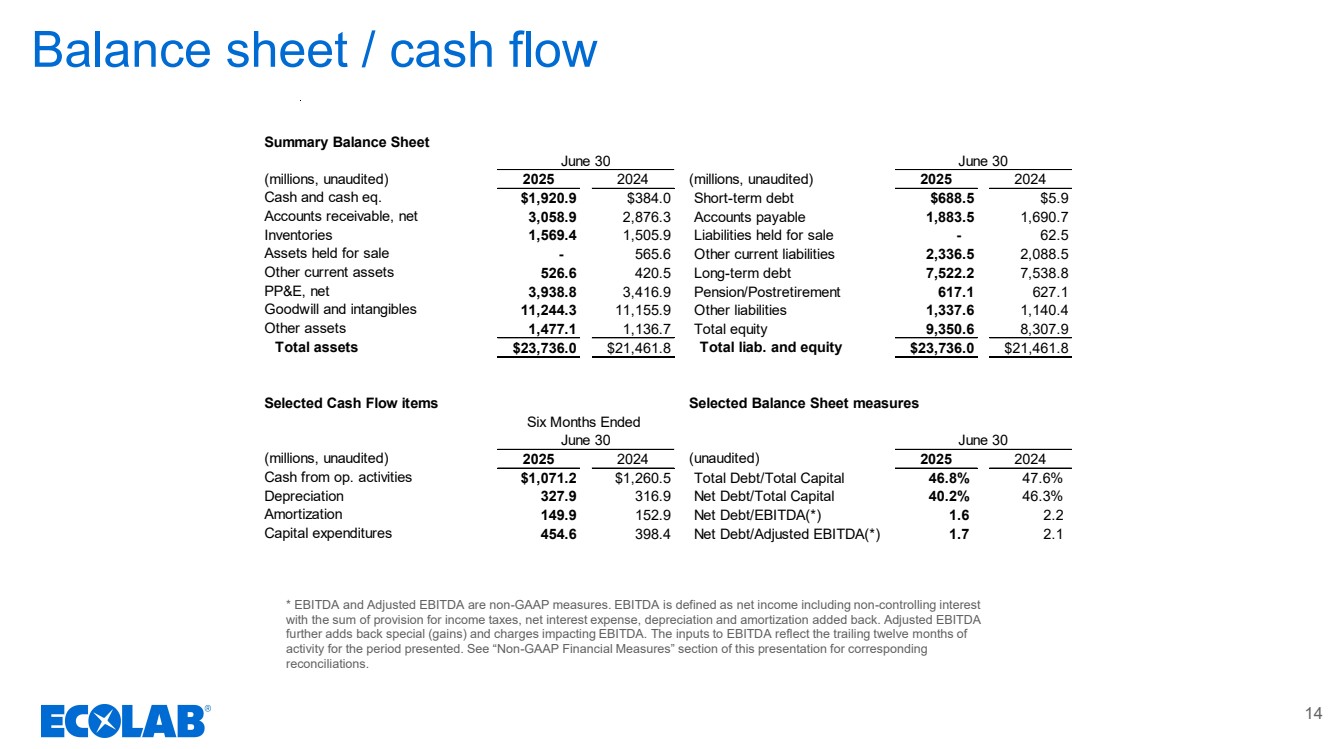

| Balance sheet / cash flow * EBITDA and Adjusted EBITDA are non-GAAP measures. EBITDA is defined as net income including non-controlling interest with the sum of provision for income taxes, net interest expense, depreciation and amortization added back. Adjusted EBITDA further adds back special (gains) and charges impacting EBITDA. The inputs to EBITDA reflect the trailing twelve months of activity for the period presented. See “Non-GAAP Financial Measures” section of this presentation for corresponding reconciliations. 14 Summary Balance Sheet (millions, unaudited) 2025 2024 (millions, unaudited) 2025 2024 Cash and cash eq. $1,920.9 $384.0 Short-term debt $688.5 $5.9 Accounts receivable, net 3,058.9 2,876.3 Accounts payable 1,883.5 1,690.7 Inventories 1,569.4 1,505.9 Liabilities held for sale - 62.5 Assets held for sale - 565.6 Other current liabilities 2,336.5 2,088.5 Other current assets 526.6 420.5 Long-term debt 7,522.2 7,538.8 PP&E, net 3,938.8 3,416.9 Pension/Postretirement 617.1 627.1 Goodwill and intangibles 11,244.3 11,155.9 Other liabilities 1,337.6 1,140.4 Other assets 1,477.1 1,136.7 Total equity 9,350.6 8,307.9 Total assets $23,736.0 $21,461.8 Total liab. and equity $23,736.0 $21,461.8 Selected Cash Flow items (millions, unaudited) 2025 2024 (unaudited) 2025 2024 Cash from op. activities $1,071.2 $1,260.5 Total Debt/Total Capital 46.8% 47.6% Depreciation 327.9 316.9 Net Debt/Total Capital 40.2% 46.3% Amortization 149.9 152.9 Net Debt/EBITDA(*) 1.6 2.2 Capital expenditures 454.6 398.4 Net Debt/Adjusted EBITDA(*) 1.7 2.1 June 30 June 30 Six Months Ended Selected Balance Sheet measures June 30 June 30 |

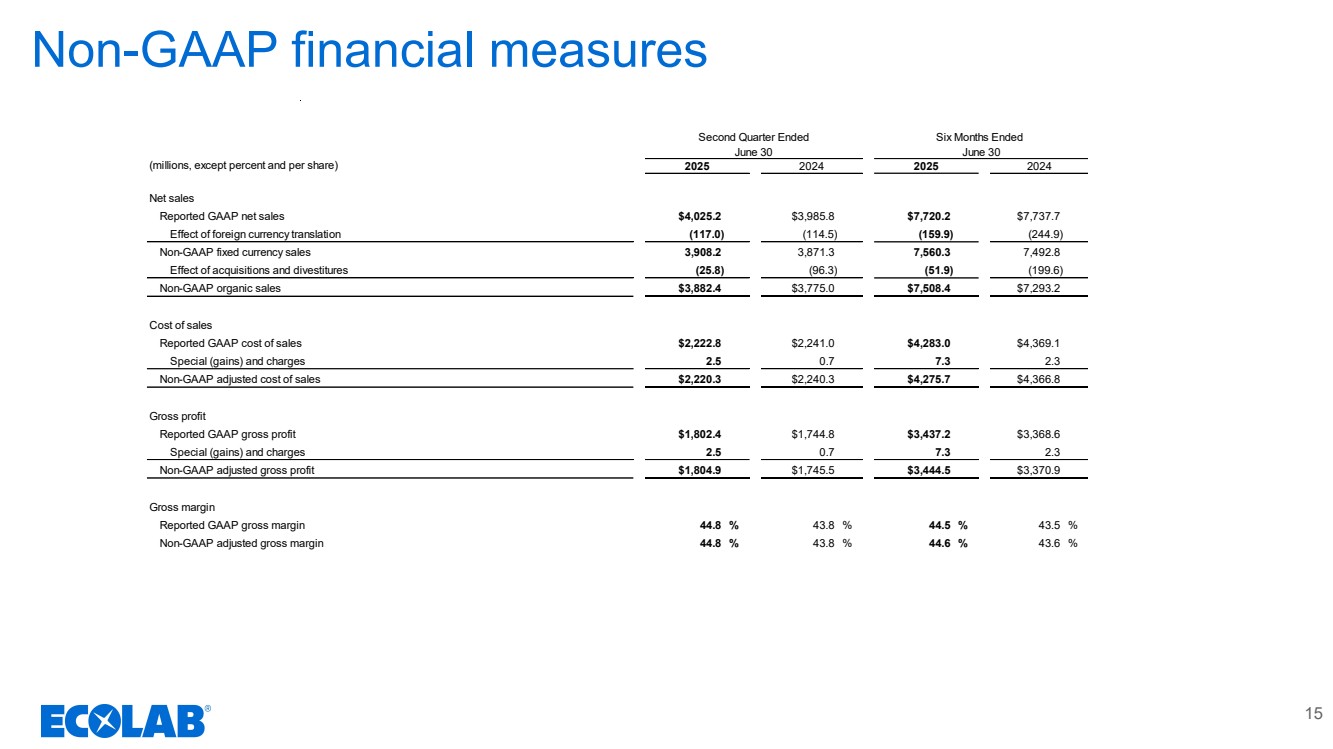

| Non-GAAP financial measures 15 (millions, except percent and per share) Net sales Reported GAAP net sales $4,025.2 $3,985.8 $7,720.2 $7,737.7 Effect of foreign currency translation (117.0) (114.5) (159.9) (244.9) Non-GAAP fixed currency sales 3,908.2 3,871.3 7,560.3 7,492.8 Effect of acquisitions and divestitures (25.8) (96.3) (51.9) (199.6) Non-GAAP organic sales $3,882.4 $3,775.0 $7,508.4 $7,293.2 Cost of sales Reported GAAP cost of sales $2,222.8 $2,241.0 $4,283.0 $4,369.1 Special (gains) and charges 2.5 0.7 7.3 2.3 Non-GAAP adjusted cost of sales $2,220.3 $2,240.3 $4,275.7 $4,366.8 Gross profit Reported GAAP gross profit $1,802.4 $1,744.8 $3,437.2 $3,368.6 Special (gains) and charges 2.5 0.7 7.3 2.3 Non-GAAP adjusted gross profit $1,804.9 $1,745.5 $3,444.5 $3,370.9 Gross margin Reported GAAP gross margin 44.8 % 43.8 % 44.5 % 43.5 % Non-GAAP adjusted gross margin 44.8 % 43.8 % 44.6 % 43.6 % Second Quarter Ended Six Months Ended June 30 June 30 2025 2024 2025 2024 |

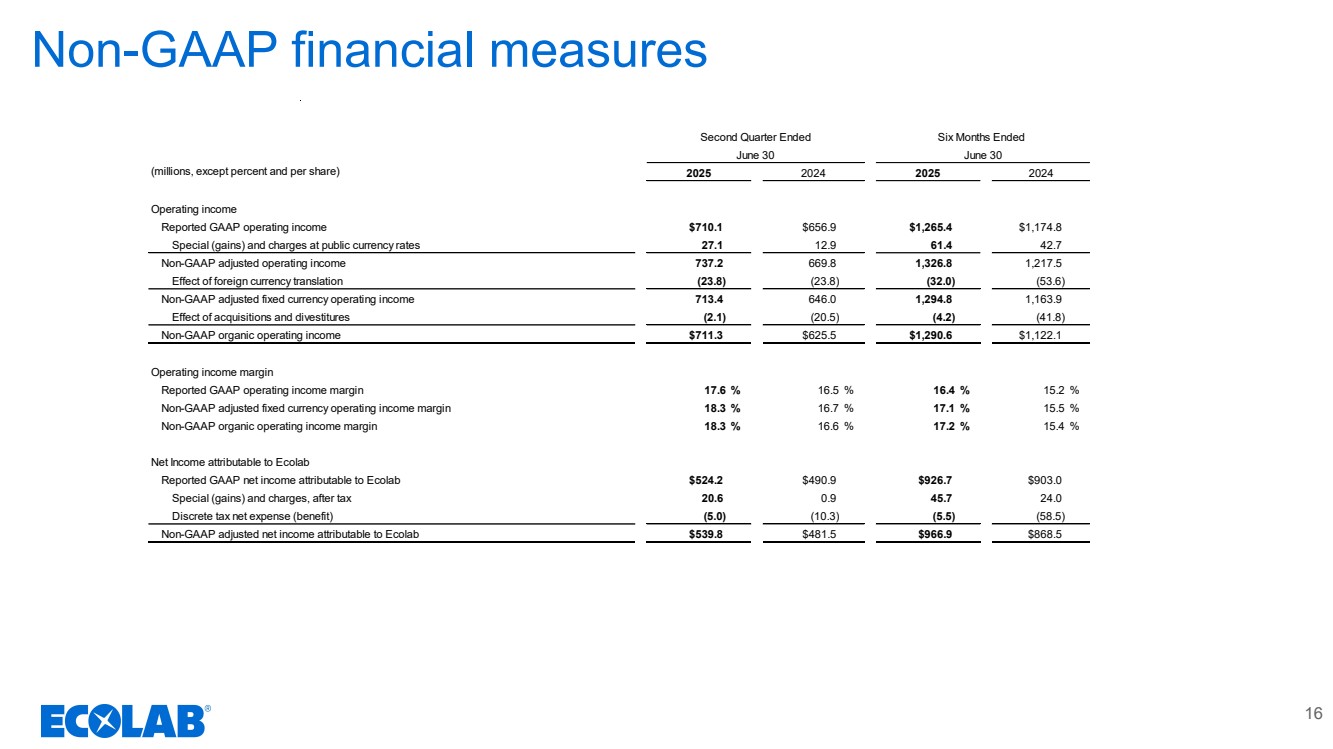

| Non-GAAP financial measures 16 (millions, except percent and per share) Operating income Reported GAAP operating income $710.1 $656.9 $1,265.4 $1,174.8 Special (gains) and charges at public currency rates 27.1 12.9 61.4 42.7 Non-GAAP adjusted operating income 737.2 669.8 1,326.8 1,217.5 Effect of foreign currency translation (23.8) (23.8) (32.0) (53.6) Non-GAAP adjusted fixed currency operating income 713.4 646.0 1,294.8 1,163.9 Effect of acquisitions and divestitures (2.1) (20.5) (4.2) (41.8) Non-GAAP organic operating income $711.3 $625.5 $1,290.6 $1,122.1 Operating income margin Reported GAAP operating income margin 17.6 % 16.5 % 16.4 % 15.2 % Non-GAAP adjusted fixed currency operating income margin 18.3 % 16.7 % 17.1 % 15.5 % Non-GAAP organic operating income margin 18.3 % 16.6 % 17.2 % 15.4 % Net Income attributable to Ecolab Reported GAAP net income attributable to Ecolab $524.2 $490.9 $926.7 $903.0 Special (gains) and charges, after tax 20.6 0.9 45.7 24.0 Discrete tax net expense (benefit) (5.0) (10.3) (5.5) (58.5) Non-GAAP adjusted net income attributable to Ecolab $539.8 $481.5 $966.9 $868.5 2025 2024 Second Quarter Ended Six Months Ended June 30 June 30 2025 2024 |

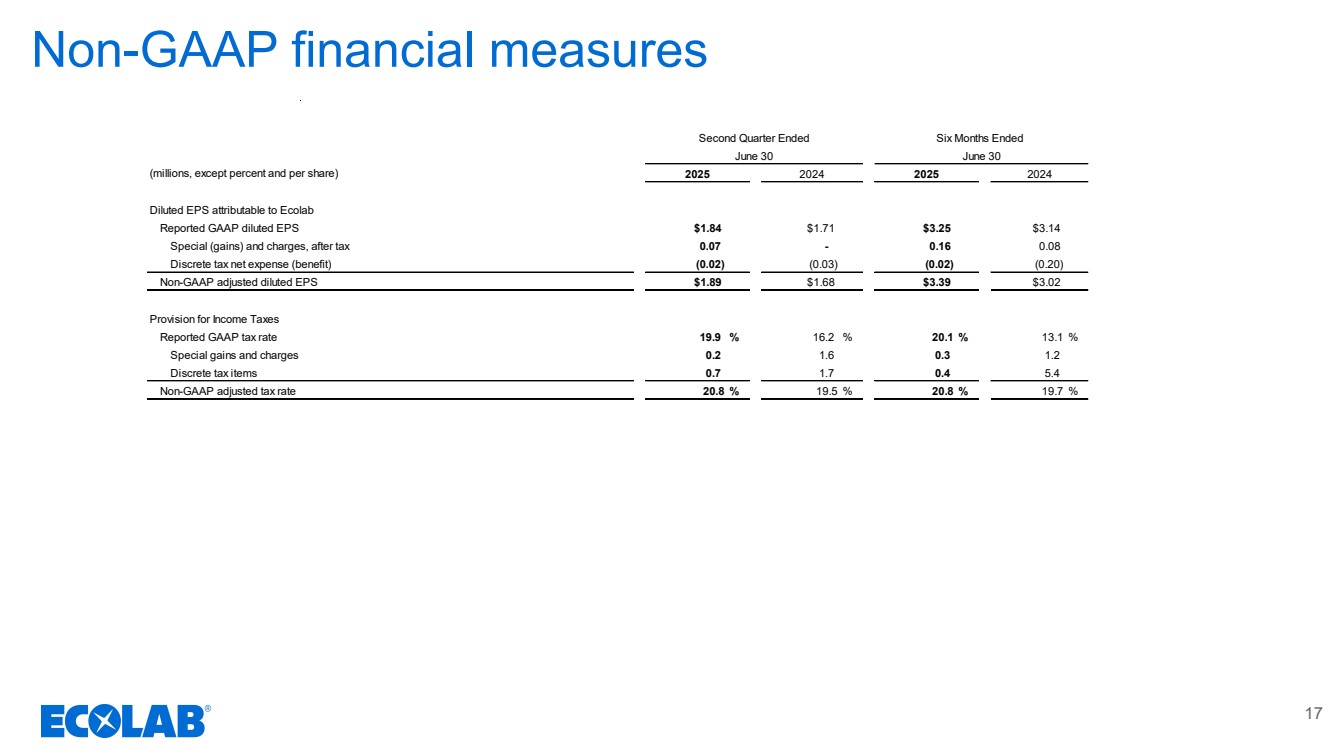

| Non-GAAP financial measures 17 (millions, except percent and per share) Diluted EPS attributable to Ecolab Reported GAAP diluted EPS $1.84 $1.71 $3.25 $3.14 Special (gains) and charges, after tax 0.07 - 0.16 0.08 Discrete tax net expense (benefit) (0.02) (0.03) (0.02) (0.20) Non-GAAP adjusted diluted EPS $1.89 $1.68 $3.39 $3.02 Provision for Income Taxes Reported GAAP tax rate 19.9 % 16.2 % 20.1 % 13.1 % Special gains and charges 0.2 1.6 0.3 1.2 Discrete tax items 0.7 1.7 0.4 5.4 Non-GAAP adjusted tax rate 20.8 % 19.5 % 20.8 % 19.7 % 2025 2024 Second Quarter Ended Six Months Ended June 30 June 30 2025 2024 |

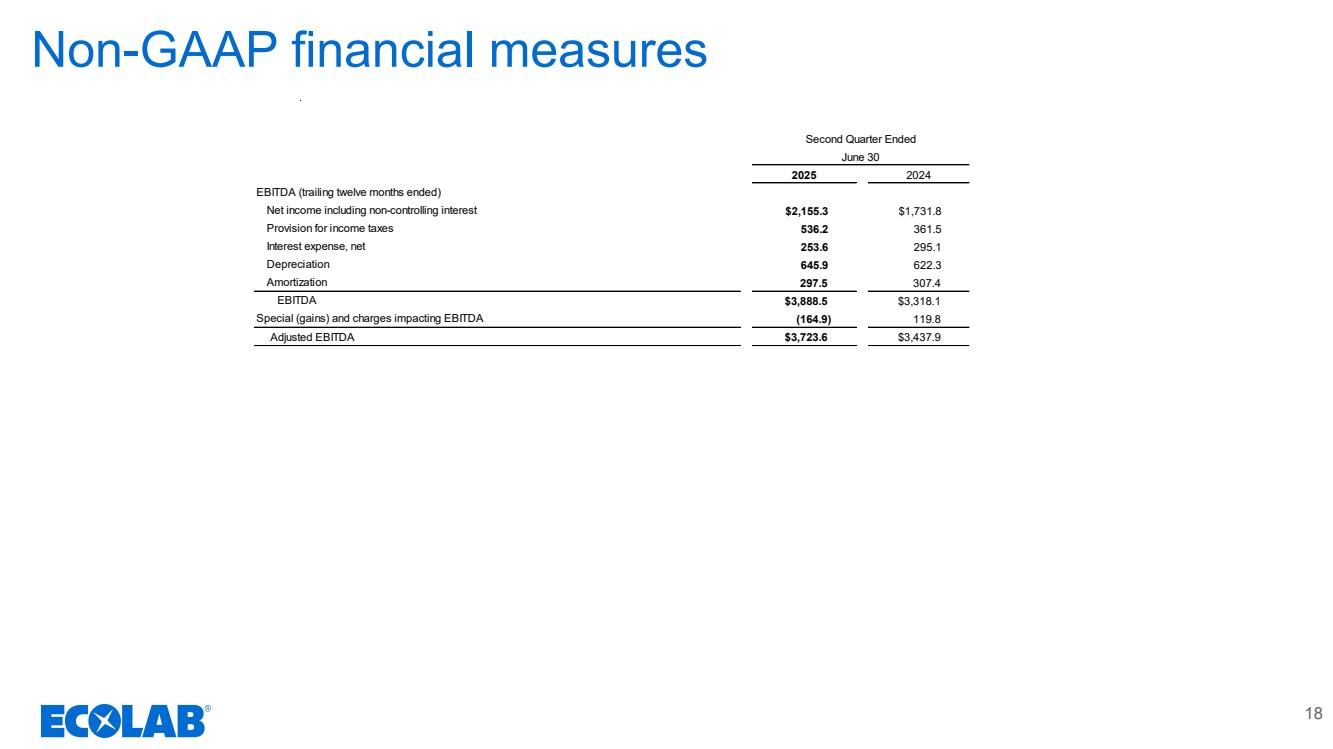

| Non-GAAP financial measures 18 EBITDA (trailing twelve months ended) Net income including non-controlling interest $2,155.3 $1,731.8 Provision for income taxes 536.2 361.5 Interest expense, net 253.6 295.1 Depreciation 645.9 622.3 Amortization 297.5 307.4 EBITDA $3,888.5 $3,318.1 Special (gains) and charges impacting EBITDA (164.9) 119.8 Adjusted EBITDA $3,723.6 $3,437.9 Second Quarter Ended June 30 2025 2024 |

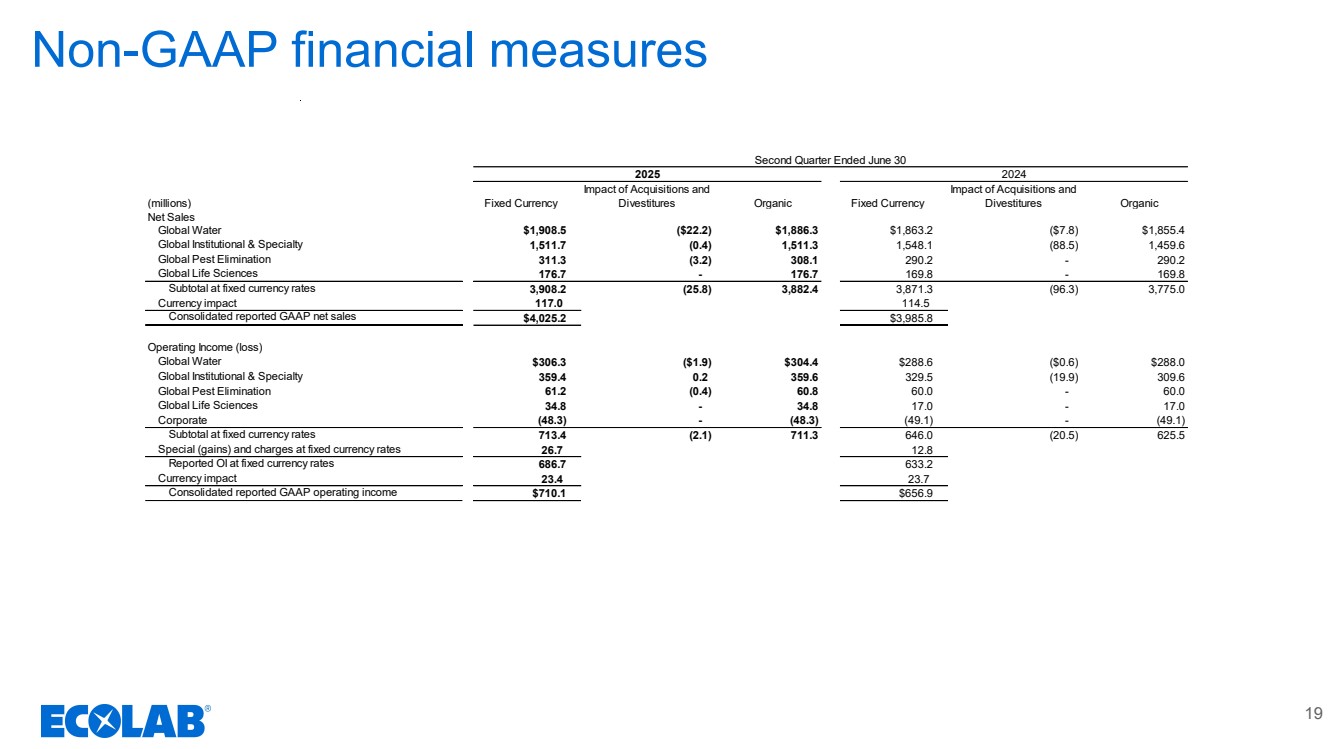

| Non-GAAP financial measures 19 (millions) Fixed Currency Impact of Acquisitions and Divestitures Organic Fixed Currency Impact of Acquisitions and Divestitures Organic Net Sales Global Water $1,908.5 ($22.2) $1,886.3 $1,863.2 ($7.8) $1,855.4 Global Institutional & Specialty 1,511.7 (0.4) 1,511.3 1,548.1 (88.5) 1,459.6 Global Pest Elimination 311.3 (3.2) 308.1 290.2 - 290.2 Global Life Sciences 176.7 - 176.7 169.8 - 169.8 Subtotal at fixed currency rates 3,908.2 (25.8) 3,882.4 3,871.3 (96.3) 3,775.0 Currency impact 117.0 114.5 Consolidated reported GAAP net sales $4,025.2 $3,985.8 Operating Income (loss) Global Water $306.3 ($1.9) $304.4 $288.6 ($0.6) $288.0 Global Institutional & Specialty 359.4 0.2 359.6 329.5 (19.9) 309.6 Global Pest Elimination 61.2 (0.4) 60.8 60.0 - 60.0 Global Life Sciences 34.8 - 34.8 17.0 - 17.0 Corporate (48.3) - (48.3) (49.1) - (49.1) Subtotal at fixed currency rates 713.4 (2.1) 711.3 646.0 (20.5) 625.5 Special (gains) and charges at fixed currency rates 26.7 12.8 Reported OI at fixed currency rates 686.7 633.2 Currency impact 23.4 23.7 Consolidated reported GAAP operating income $710.1 $656.9 2025 2024 Second Quarter Ended June 30 |

| 20 Non-GAAP Financial Information: This communication and certain of the accompanying tables include financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S. (“GAAP”). These non-GAAP financial measures include: • fixed currency sales • organic sales • adjusted cost of sales • adjusted gross profit • adjusted gross margin • fixed currency operating income • adjusted operating income • adjusted fixed currency operating income • adjusted fixed currency operating income margin • organic operating income • organic operating income margin • adjusted tax rate • adjusted net income attributable to Ecolab • adjusted diluted earnings per share • EBITDA • Adjusted EBITDA We provide these measures as additional information regarding our operating results. We use these non-GAAP measures internally to evaluate our performance and in making financial and operational decisions, including with respect to incentive compensation. We believe that our presentation of these measures provides investors with greater transparency with respect to our results of operations and that these measures are useful for period-to-period comparison of results. Non-GAAP financial information |

| 21 Non-GAAP Financial Information (Continued): Our non-GAAP financial measures for adjusted cost of sales, adjusted gross margin, adjusted gross profit and adjusted operating income exclude the impact of special (gains) and charges and our non-GAAP financial measures for adjusted tax rate, adjusted net income attributable to Ecolab and adjusted diluted earnings per share further exclude the impact of discrete tax items. We include items within special (gains) and charges and discrete tax items that we believe can significantly affect the period-over-period assessment of operating results and not necessarily reflect costs and/or income associated with historical trends and future results. After tax special (gains) and charges are derived by applying the applicable local jurisdictional tax rate to the corresponding pre-tax special (gains) and charges. EBITDA is defined as net income including non-controlling interest with the sum of provision for income taxes, net interest expense, depreciation and amortization added back. Adjusted EBITDA further adds back special (gains) and charges impacting EBITDA. EBITDA and adjusted EBITDA are used in our net debt to EBITDA and net debt to adjusted EBITDA ratios, which we view as important indicators of the operational and financial health of our organization. We evaluate the performance of our international operations based on fixed currency rates of foreign exchange, which eliminate the translation impact of exchange rate fluctuations on our international results. Fixed currency amounts included in this release are based on translation into U.S. dollars at the fixed foreign currency exchange rates established by management at the beginning of 2024. We also provide our segment results based on public currency rates for informational purposes. Our reportable segments do not include the impact of intangible asset amortization from the Nalco and Purolite transactions or the impact of special (gains) and charges as these are not allocated to the Company’s reportable segments. Our non-GAAP financial measures for organic sales, organic operating income and organic operating income margin are at fixed currency and exclude the impact of special (gains) and charges, the results of our acquired businesses from the first twelve months post acquisition and the results of divested businesses from the twelve months prior to divestiture. Further, due to the sale of the global surgical solutions business on August 1, 2024, we have excluded the results of the business for the six-month period ended June 30, 2024, from these organic measures for to remain comparable to the corresponding periods in 2025. In addition, as part of the separation of ChampionX in 2020, we continue to provide certain products to ChampionX, which are recorded in product and equipment sales in the Global Water segment along with the related cost of sales. These transactions are removed from the consolidated results as part of the calculation of the impact of acquisitions and divestitures. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and may be different from non-GAAP measures used by other companies. Investors should not rely on any single financial measure when evaluating our business. We recommend that investors view these measures in conjunction with the GAAP measures included in this news release. Reconciliations of our non-GAAP measures are included in the following “Non-GAAP Financial Measures” tables of this communication. We do not provide reconciliations for non-GAAP estimates on a forward-looking basis (including those contained in this news release) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of various items that have not yet occurred, are out of our control and/or cannot be reasonably predicted, and that would impact reported earnings per share and the reported tax rate, the most directly comparable forward-looking GAAP financial measures to adjusted earnings per share and the adjusted tax rate. For the same reasons, we are unable to address the probable significance of the unavailable information. Non-GAAP financial information (cont.) |