Pay vs Performance Disclosure

|

12 Months Ended |

|

|

|

Mar. 31, 2025

USD ($)

$ / shares

|

Mar. 31, 2024

USD ($)

$ / shares

|

Mar. 31, 2023

USD ($)

$ / shares

|

Mar. 28, 2024

$ / shares

|

Mar. 31, 2022

$ / shares

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

Pay Versus Performance We are required by SEC rules to disclose the following information regarding compensation paid to our Principal Executive Officer (the “PEO”) and our other NEOs (collectively, the “Non-PEO NEOs”). The amounts set forth below under the headings “Compensation Actually Paid to PEO” and “Average Compensation Actually Paid to Non-PEO NEOs” have been calculated in a manner prescribed by the SEC rules and do not necessarily align with how we or the Compensation Committee view the link between our performance and the pay of our NEOs. | | | | | | | | | | | | | | | | | | | | | | Fiscal 2024 | | | $163,293,744 | | | $120,292,276 | | | $54,974,046 | | | $43,159,484 | | | $204 | | | $104 | | | $(356.7) | | | $10.09 | Fiscal 2023 | | | $738,189 | | | $45,536,504 | | | $4,740,297 | | | $8,126,392 | | | $213 | | | $108 | | | $4,231.2 | | | $10.54 | Fiscal 2022 | | | $48,978,825 | | | $97,617,266 | | | $48,706,774 | | | $97,819,396 | | | $149 | | | $100 | | | $(1,115.5) | | | $7.38 | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)

| Matthew Gline, our Chief Executive Officer, was our PEO for each of the fiscal years presented. The individuals comprising the Non-PEO NEOs for each year presented are listed below. |

| | | | | | | Richard Pulik | | | Richard Pulik | | | Mayukh Sukhatme | Mayukh Sukhatme | | | Rakhi Kumar | | | Eric Venker | Eric Venker | | | | | | | Jennifer Humes | | | | | | | Rakhi Kumar | | | | | | | | | | | | | |

(2)

| The dollar amounts reported in these columns represent the amount of total compensation reported for our PEO and on average for our Non-PEO NEOs for each covered fiscal year in the “Total” column of the Summary Compensation Table. |

(3)

| The applicable Summary Compensation Table totals reported for the PEO and the average of the Non-PEO NEOs for each year were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “Compensation Actually Paid”: |

| | | | Summary Compensation Table Total | | | $163,293,744 | | | $54,974,046 | Adjustments

| | | | | | | - Grant date fair value of awards granted during the covered fiscal year | | | $157,577,851 | | | $36,452,356 | + Fair value as of the end of the covered fiscal year of all awards granted during the covered fiscal year that are outstanding and unvested at the end of the covered year | | | $121,690,235 | | | $27,878,123 | +/- Change in fair value as of the end of the covered fiscal year (from the end of the prior fiscal year) of any awards granted in any prior fiscal year that are outstanding and unvested as of the end of the covered fiscal year | | | $(6,888,326) | | | $(3,215,961) | +/- Change in fair value as of the vesting date (from the end of the prior fiscal year) of any awards granted in any prior fiscal year for which all applicable vesting conditions were satisfied at the end of or during the covered fiscal year | | | $(225,526) | | | $(24,369) | Compensation Actually Paid | | | $120,292,276 | | | $43,159,484 | | | | | | | |

The fair values set forth in the table above are computed in accordance with Topic 718 as of the end of Fiscal 2024, other than fair values of awards that vest in the covered year, which are valued as of the applicable vesting date. As of March 31, 2025, the Company began using a blend of its historical and implied volatility, rather than exclusively relying on historical volatility, to estimate the expected volatility assumption of various equity instruments issued by the Company. Due to changes in the Company’s capital position, the Company believes this methodology better reflects its expected future volatility. (4)

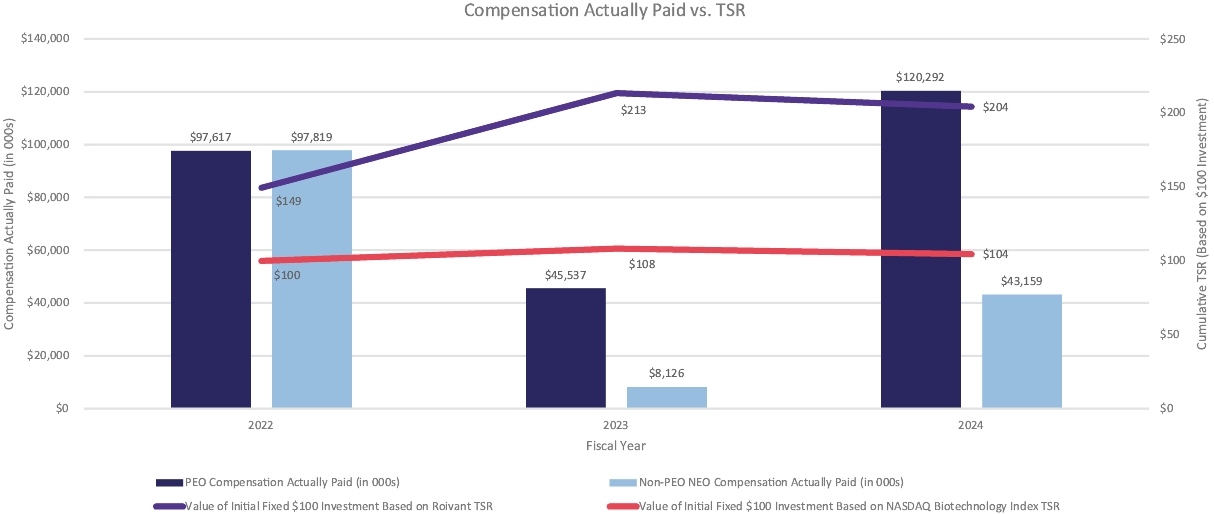

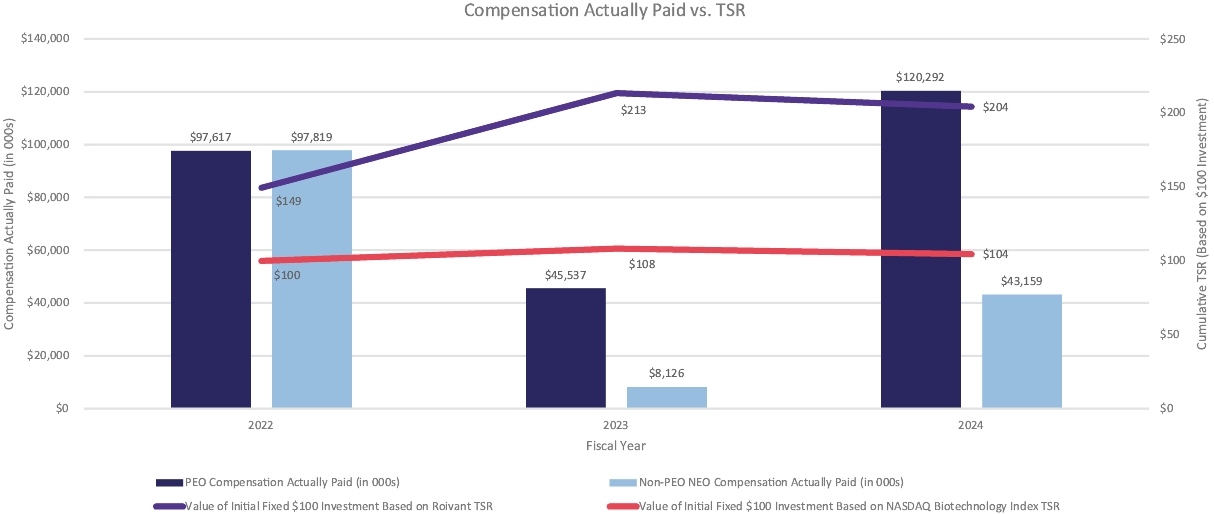

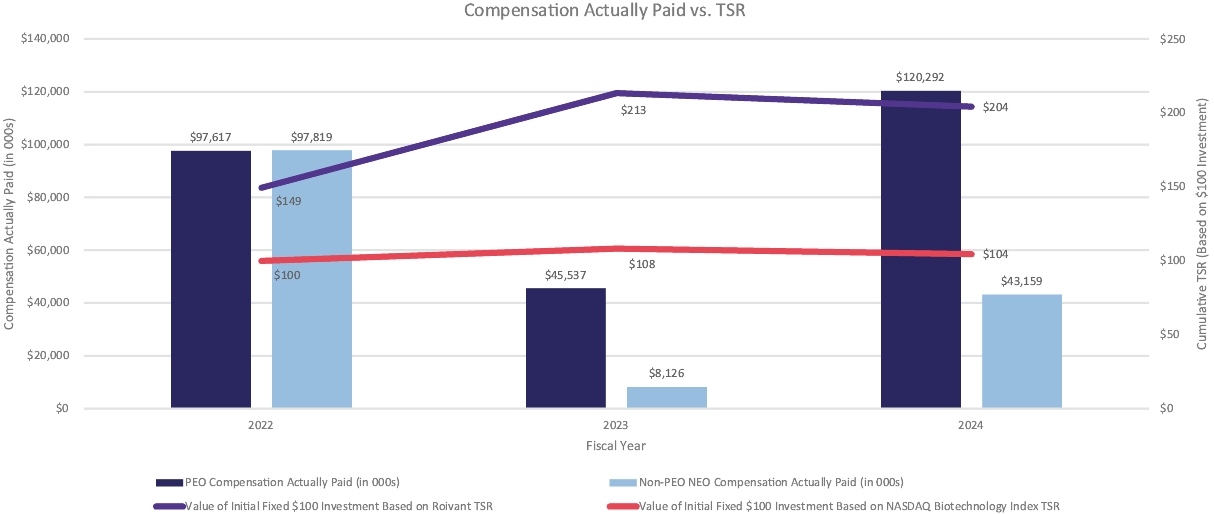

| Roivant TSR assumes $100 was invested at market close on March 31, 2022 and is calculated by dividing (i) the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between our share price at market close at the end of the measurement period (March 31, 2025 for Fiscal 2024; March 28, 2024 for Fiscal 2023; and March 31, 2023 for Fiscal 2022) and our share price at market close at the beginning of the measurement period (March 31, 2022) by (ii) our share price at market close at the beginning of the measurement period (March 31, 2022). On March 31, 2025, March 28, 2024 and March 31, 2023 and 2022, the per share closing prices for our common shares were $10.09, $10.54, $7.38 and $4.94, respectively. No dividends were paid for any periods presented. |

(5)

| The Peer Group TSR set forth in this table utilizes the NASDAQ Biotechnology Index, which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2025. The comparison assumes $100 was invested for the period from March 31, 2022 to March 31, 2025. |

(6)

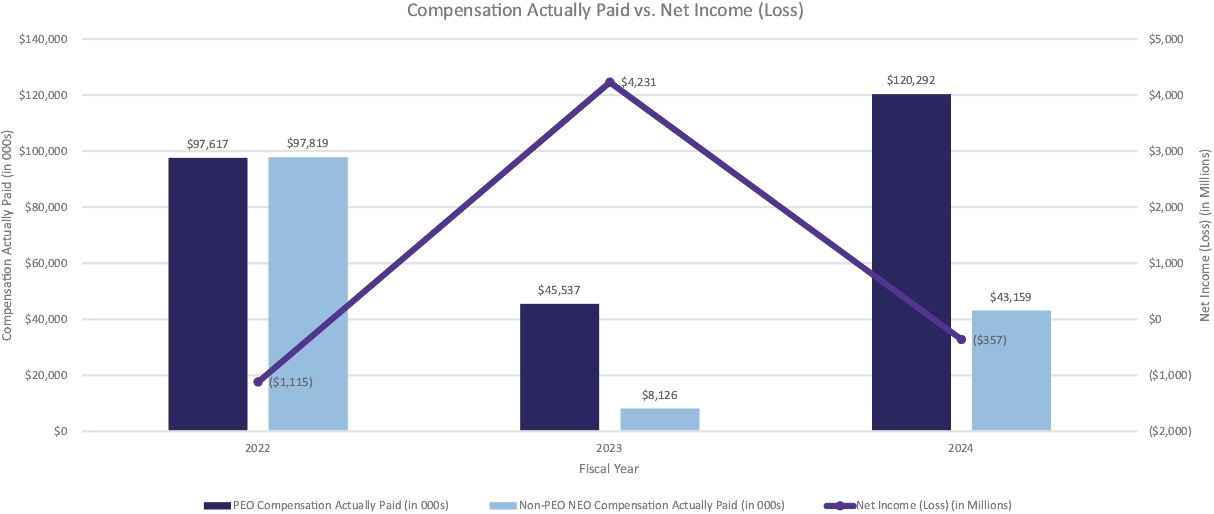

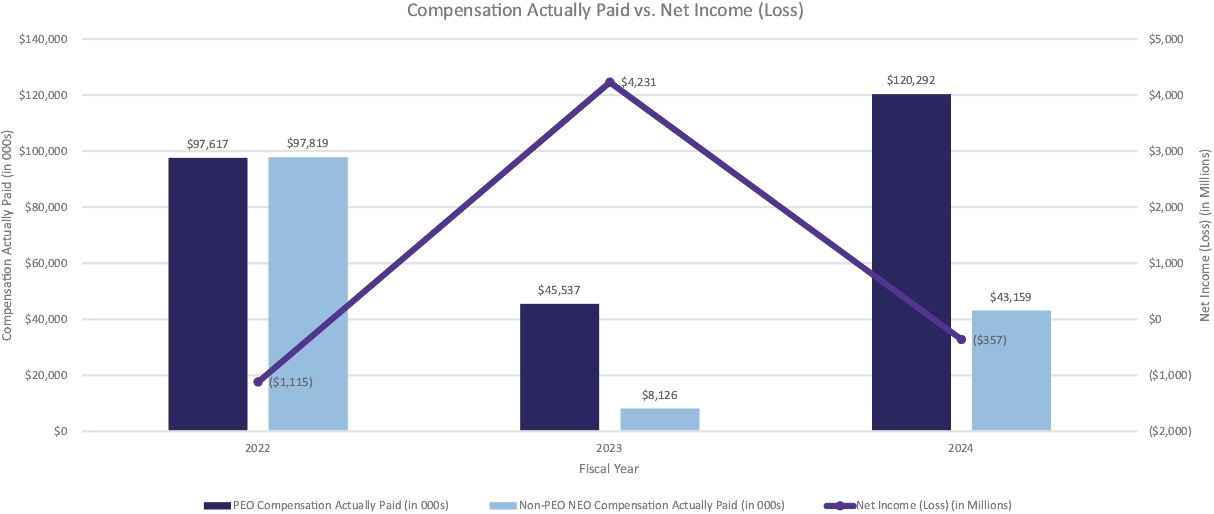

| Reflects “Net income (loss)” in the Company’s Consolidated Statements of Operations included in the Company’s Annual Reports on Form 10-K for each of Fiscal 2024, Fiscal 2023 and Fiscal 2022. |

(7)

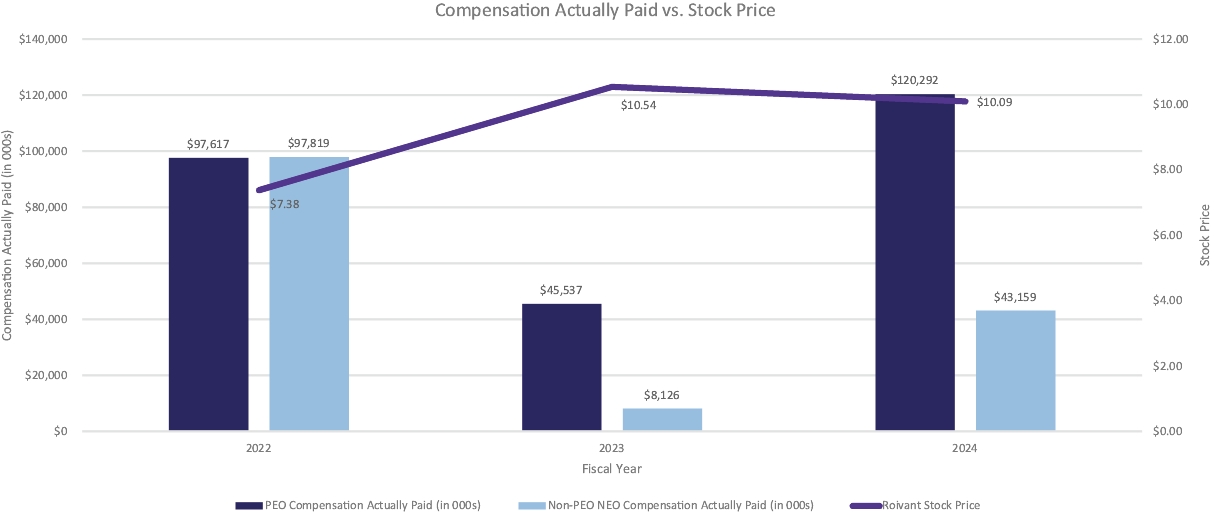

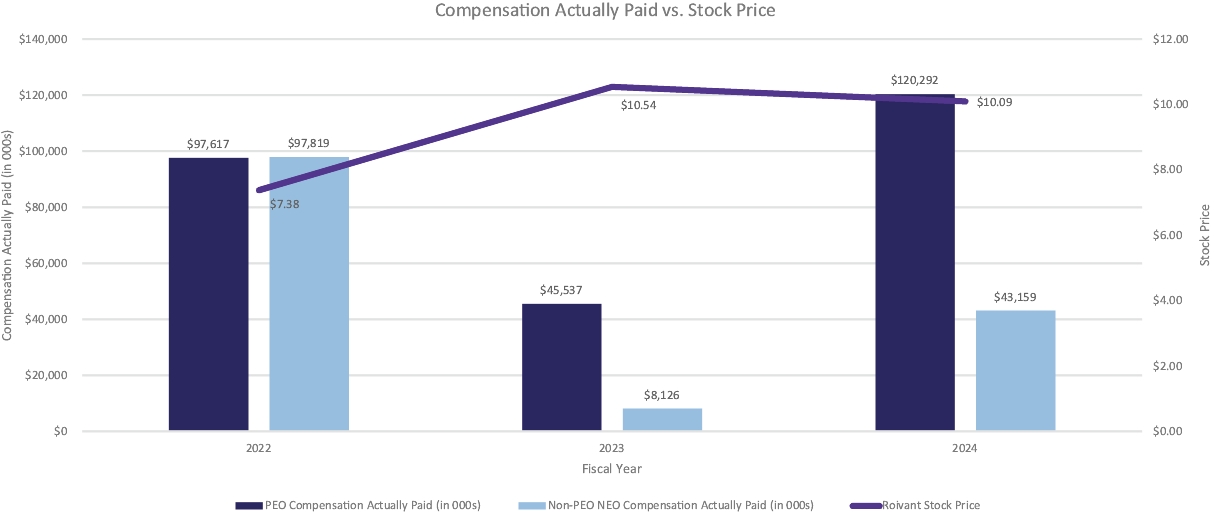

| Reflects the per share closing price for our common shares on each of March 31, 2025, March 28, 2024 and March 31, 2023. |

|

|

|

|

|

| Company Selected Measure Name |

Share price

|

|

|

|

|

| Named Executive Officers, Footnote |

(1)

| Matthew Gline, our Chief Executive Officer, was our PEO for each of the fiscal years presented. The individuals comprising the Non-PEO NEOs for each year presented are listed below. |

| | | | | | | Richard Pulik | | | Richard Pulik | | | Mayukh Sukhatme | Mayukh Sukhatme | | | Rakhi Kumar | | | Eric Venker | Eric Venker | | | | | | | Jennifer Humes | | | | | | | Rakhi Kumar | | | | | | | | | | | | | |

|

|

|

|

|

| Peer Group Issuers, Footnote |

(5)

| The Peer Group TSR set forth in this table utilizes the NASDAQ Biotechnology Index, which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2025. The comparison assumes $100 was invested for the period from March 31, 2022 to March 31, 2025. |

|

|

|

|

|

| PEO Total Compensation Amount |

$ 163,293,744

|

$ 738,189

|

$ 48,978,825

|

|

|

| PEO Actually Paid Compensation Amount |

$ 120,292,276

|

45,536,504

|

97,617,266

|

|

|

| Adjustment To PEO Compensation, Footnote |

(3)

| The applicable Summary Compensation Table totals reported for the PEO and the average of the Non-PEO NEOs for each year were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “Compensation Actually Paid”: |

| | | | Summary Compensation Table Total | | | $163,293,744 | | | $54,974,046 | Adjustments

| | | | | | | - Grant date fair value of awards granted during the covered fiscal year | | | $157,577,851 | | | $36,452,356 | + Fair value as of the end of the covered fiscal year of all awards granted during the covered fiscal year that are outstanding and unvested at the end of the covered year | | | $121,690,235 | | | $27,878,123 | +/- Change in fair value as of the end of the covered fiscal year (from the end of the prior fiscal year) of any awards granted in any prior fiscal year that are outstanding and unvested as of the end of the covered fiscal year | | | $(6,888,326) | | | $(3,215,961) | +/- Change in fair value as of the vesting date (from the end of the prior fiscal year) of any awards granted in any prior fiscal year for which all applicable vesting conditions were satisfied at the end of or during the covered fiscal year | | | $(225,526) | | | $(24,369) | Compensation Actually Paid | | | $120,292,276 | | | $43,159,484 | | | | | | | |

The fair values set forth in the table above are computed in accordance with Topic 718 as of the end of Fiscal 2024, other than fair values of awards that vest in the covered year, which are valued as of the applicable vesting date. As of March 31, 2025, the Company began using a blend of its historical and implied volatility, rather than exclusively relying on historical volatility, to estimate the expected volatility assumption of various equity instruments issued by the Company. Due to changes in the Company’s capital position, the Company believes this methodology better reflects its expected future volatility.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 54,974,046

|

4,740,297

|

48,706,774

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 43,159,484

|

8,126,392

|

97,819,396

|

|

|

| Adjustment to Non-PEO NEO Compensation Footnote |

(3)

| The applicable Summary Compensation Table totals reported for the PEO and the average of the Non-PEO NEOs for each year were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “Compensation Actually Paid”: |

| | | | Summary Compensation Table Total | | | $163,293,744 | | | $54,974,046 | Adjustments

| | | | | | | - Grant date fair value of awards granted during the covered fiscal year | | | $157,577,851 | | | $36,452,356 | + Fair value as of the end of the covered fiscal year of all awards granted during the covered fiscal year that are outstanding and unvested at the end of the covered year | | | $121,690,235 | | | $27,878,123 | +/- Change in fair value as of the end of the covered fiscal year (from the end of the prior fiscal year) of any awards granted in any prior fiscal year that are outstanding and unvested as of the end of the covered fiscal year | | | $(6,888,326) | | | $(3,215,961) | +/- Change in fair value as of the vesting date (from the end of the prior fiscal year) of any awards granted in any prior fiscal year for which all applicable vesting conditions were satisfied at the end of or during the covered fiscal year | | | $(225,526) | | | $(24,369) | Compensation Actually Paid | | | $120,292,276 | | | $43,159,484 | | | | | | | |

The fair values set forth in the table above are computed in accordance with Topic 718 as of the end of Fiscal 2024, other than fair values of awards that vest in the covered year, which are valued as of the applicable vesting date. As of March 31, 2025, the Company began using a blend of its historical and implied volatility, rather than exclusively relying on historical volatility, to estimate the expected volatility assumption of various equity instruments issued by the Company. Due to changes in the Company’s capital position, the Company believes this methodology better reflects its expected future volatility.

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Total Shareholder Return (“TSR”) The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, Roivant TSR over the three most recently completed fiscal years and the NASDAQ Biotechnology Index TSR (our Peer Group TSR) over the same period.

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income (Loss) The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs and our Net Income (Loss) during the three most recently completed fiscal years.

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Share Price The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs and the closing price of our common shares are reported by Nasdaq as of the last business day of each of Fiscal 2024, Fiscal 2023 and Fiscal 2022.

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Total Shareholder Return (“TSR”) The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, Roivant TSR over the three most recently completed fiscal years and the NASDAQ Biotechnology Index TSR (our Peer Group TSR) over the same period.

|

|

|

|

|

| Tabular List, Table |

For Fiscal 2024, we did not use any financial performance measure to link “Compensation Actually Paid to PEO” or “Average Compensation Actually Paid to Non-PEO NEOs” to the Company’s performance, other than the Company’s share price, which was used as a performance vesting condition for the PSU awards granted to certain of our NEOs during Fiscal 2024, as described in more detail on page 0 above. Specifically, certain share price hurdles are used as performance vesting conditions for these PSU awards. The Compensation Committee believes this metric is the most reflective of our value. For further information regarding our performance-based approach to executive compensation and how the Compensation Committee aligns executive compensation with the Company’s performance, see “—Compensation Discussion and Analysis” above. | | | | | | | | | | Performance Measure | | | | | | | Share price | | | | | | | | | | |

Other than our share price, the Company does not use any other financial performance measures to link executive compensation actually paid to Company performance and, as permitted by the SEC rules, is not required to disclose any other measure as its most important financial performance measures. We utilize operational goals and objectives in our annual cash bonus program to link pay-with-performance. For details on such goals, see page 29 above. |

|

|

|

|

| Total Shareholder Return Amount |

$ 204

|

213

|

149

|

|

|

| Peer Group Total Shareholder Return Amount |

$ 104

|

$ 108,000

|

$ 100,000

|

|

|

| Company Selected Measure Amount | $ / shares |

10.09

|

10.54

|

7.38

|

|

|

| PEO Name |

Matthew Gline

|

Matthew Gline

|

Matthew Gline

|

|

|

| Net Income (Loss), Including Portion Attributable to Noncontrolling Interest |

$ (356,700,000)

|

$ 4,231,200,000

|

$ (1,115,500,000)

|

|

|

| Share Price | $ / shares |

$ 10.09

|

|

$ 7.38

|

$ 10.54

|

$ 4.94

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Share price

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (157,577,851)

|

|

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

121,690,235

|

|

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(6,888,326)

|

|

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(225,526)

|

|

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(36,452,356)

|

|

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

27,878,123

|

|

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,215,961)

|

|

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (24,369)

|

|

|

|

|