Exhibit 99.1

Explanatory Statement

Carrier Global Corporation ("we" or "our" or the "Company") is filing the following Exhibit 99.1 to recast certain amounts previously reported in the Company's 2024 Annual Report on Form 10-K filed with the SEC on February 11, 2025 (the "2024 Form 10-K") to conform with revisions to our reportable segments made during the quarter ended March 31, 2025.

As a result of our portfolio transformation, we revised our reportable segments to better reflect our business strategy, align our management reporting and increase transparency for investors. Under the revised segment structure, we have three new regional HVAC operating segments. Combined with the Climate Solutions Transportation operating segment, the four operating segments also serve as our reportable segments. In connection with the revised structure, we changed the measure used to evaluate segment profitability from Operating profit to Segment operating profit. All prior period comparative information has been recast to reflect the revised segment structure.

PART I

ITEM 1. BUSINESS

General

Carrier Global Corporation ("we" or "our" or the "Company") is a global leader in intelligent climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to our customers. Our portfolio includes industry-leading brands such as Carrier, Viessmann, Toshiba, Automated Logic and Carrier Transicold that offer innovative heating, ventilating and air conditioning ("HVAC"), refrigeration and cold chain transportation solutions to help make the world safer and more comfortable. We also provide a broad array of related building services, including audit, design, installation, system integration, repair, maintenance and monitoring.

Through our performance-driven culture, we anticipate creating long-term shareowner value by investing strategically to strengthen our product position in homes, buildings and across the cold chain in order to drive profitable growth. We believe our business segments are well positioned to benefit from favorable secular trends, including the mega-trends of urbanization, population growth and demographic shifts, food security and safety, digitalization, global connectivity and energy efficiency. Coupled with our industry-leading brands and track record of innovation, we continue to provide market-leading solutions for our customers.

In addition, we continue to invest in product and technology innovation within our offerings as well as invest in new business models including Carrier Energy, our solution to reduce demands on power grids and energy infrastructure by better managing energy consumption and reducing end-customer energy costs. This new business model is also expected to provide a digital connection between the end-customers and Carrier, providing us with opportunities to offer services and aftermarket parts and components over the life of a product.

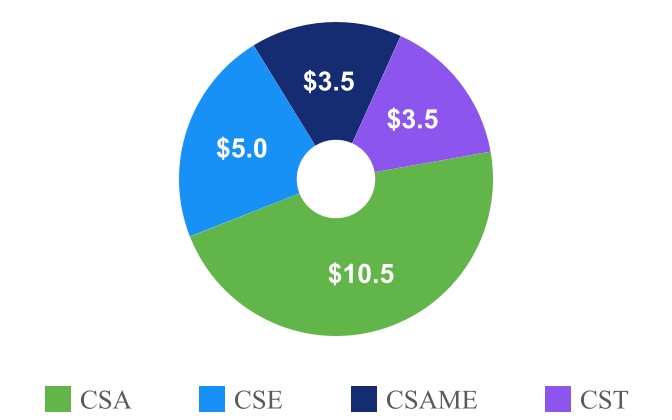

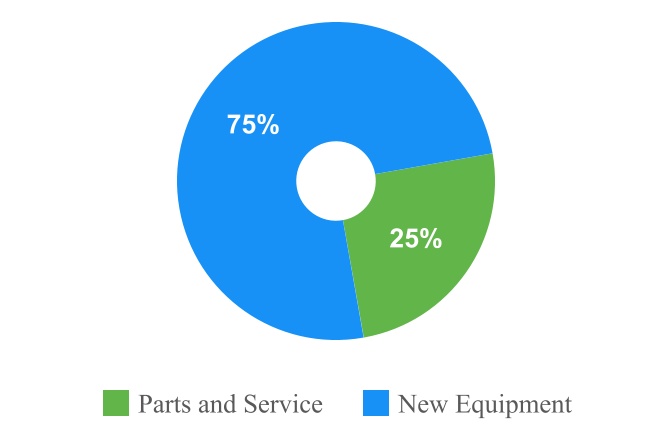

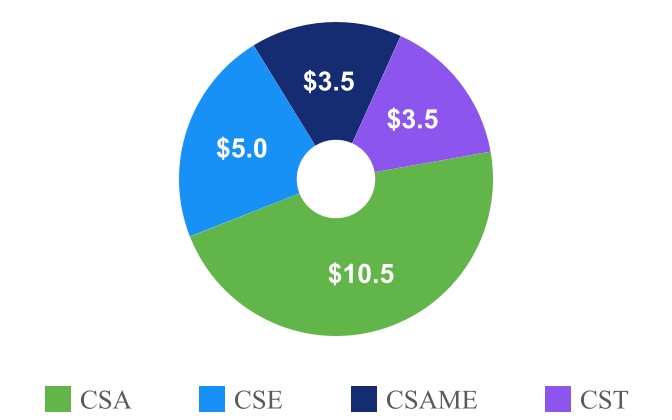

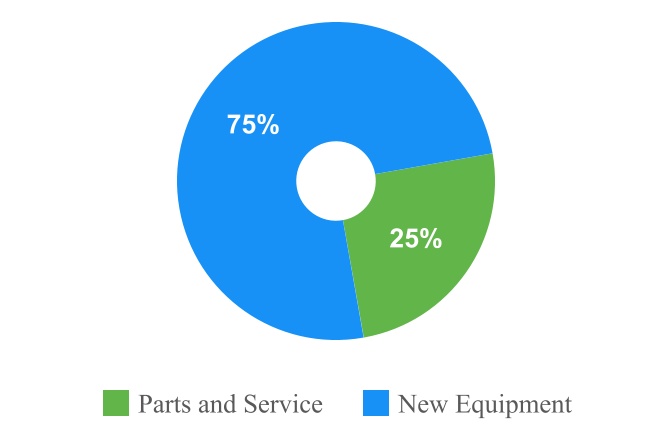

For the year ended December 31, 2024, our net sales were $22.5 billion and our operating profit was $2.6 billion. Our international operations, including U.S. export sales, represented approximately 50% of our net sales for 2024. During the same period, new equipment comprised 75% and parts and service comprised 25% of our net sales.

| | | | | | | | | | |

| Sales by Segment | | | | Sales by Type |

Separation from United Technologies Corporation

On April 3, 2020 (the "Distribution Date"), United Technologies Corporation, ("UTC"), since renamed RTX Corporation ("Raytheon Technologies Corporation" or "RTX") completed the spin-off of Carrier into an independent publicly traded company (the "Separation") through a pro rata distribution (the "Distribution") on a one-for-one basis of all of the outstanding shares of common stock of Carrier to UTC shareowners who held shares of UTC common stock as of the close of business on March 19, 2020, the record date of the Distribution. In addition, we entered into several agreements with UTC and Otis Worldwide Corporation ("Otis") that govern various aspects of the relationship among us, UTC and Otis following the Separation and Distribution. As of December 31, 2024, only certain portions of the Tax Matters Agreement ("TMA") remain in effect.

Business Segments

In May 2025, we announced changes to reportable segments to better reflect our business strategy, align our management reporting and increase transparency for investors. Under the revised segment structure, we globally manage our business operations through four segments: Climate Solutions Americas ("CSA"), Climate Solutions Europe ("CSE"), Climate Solutions Asia Pacific, Middle East & Africa ("CSAME") and Climate Solutions Transportation ("CST"). Each respective segment's major products, services and distribution methods are as follows:

The Climate Solutions Americas, Climate Solutions Europe and Climate Solutions Asia Pacific, Middle East & Africa segments provide products and controls, services and system solutions to meet the heating, cooling and ventilation needs of our customers while enhancing building performance, health and energy efficiency on a regional basis. Products and controls, services and systems include air conditioners, heat pumps, heating systems, home and building energy management systems, aftermarket components, repair and maintenance services and rentals as well as modernization and upgrades through the product lifecycle. We serve a wide range of customers, including in the residential, commercial, education, healthcare, technology, retail, hospitality, data center, and infrastructure markets, among others. Products and controls, services and systems are sold directly to building contractors and owners and indirectly through joint ventures, independent sales representatives, distributors, wholesalers, dealers and retail outlets. Our established brands include Carrier, Viessmann, Toshiba, Automated Logic, Bryant, CIAT, Day & Night, Heil, NORESCO and Riello which offer innovative solutions and a complete portfolio of products to our customers. These products and controls, services and systems, in addition to the markets they serve, provide future service opportunities including replacement components, preventative and on-demand contractual maintenance and repair, digital monitoring and modifications/upgrades.

The Climate Solutions Transportation segment provides climate and energy solutions for customers globally. Our products, services, systems and monitoring solutions offer reliable transport and preservation of food, medicine and other perishable cargo. Products include trucks, trailers, shipping containers and intermodal applications to meet customer needs for both ground transport and ocean freight, while services include maintenance, repair, and monitoring. Products and services are sold directly to transportation companies and indirectly through joint ventures, independent sales representatives, distributors, wholesalers and dealers. Products and services are sold under established brand names, including Carrier Transicold and Sensitech. We provide customers the flexibility to select solutions from a very broad range of technologies including fossil fuel applications and electric solutions to best adhere to their objectives and preferences as well as regulatory requirements. In addition, our focus on digitalization and innovation is expanding our offering of service and aftermarket solutions, including on-demand and subscription-based monitoring of customer cargo. Through the lifecycle of the product, we also offer modifications and upgrades to the current installed base, improving energy efficiency, noise or other customer requirements.

Portfolio Transformation

In 2023, we began the journey to further simplify our company and accelerate our business strategy. Our actions transformed our business portfolio in an effort to establish us as a pure-play, global leader in intelligent climate and energy solutions. We believe that our greater focus on breakthrough innovation, electrification, energy-efficient solutions, the use of environmentally friendly refrigerants and connected ecosystems will further strengthen our global leadership position in our end-markets and provide responsible solutions for our customers.

On April 25, 2023, we announced that we entered into a Share Purchase Agreement (the “Agreement”) to acquire the climate solutions business (the "VCS Business") of Viessmann Group GmbH & Co. KG (“Viessmann”), a privately-held company. The VCS Business develops intelligent, integrated and sustainable technologies, including heat pumps, boilers, photovoltaic systems, home battery storage and digital solutions, primarily for residential customers in Europe. The acquisition was completed on January 2, 2024, and reported primarily within our Climate Solutions Europe segment.

On June 2, 2024, we completed the sale of our Access Solutions business ("Access Solutions") to Honeywell International Inc. ("Honeywell") for cash proceeds of $5.0 billion. Access Solutions, historically reported in our Fire & Security segment, is a global supplier of physical security and digital access solutions supporting the hospitality, commercial, education and military markets. We recognized a net gain on the sale of $1.8 billion.

On July 1, 2024, we completed the sale of our Industrial Fire business ("Industrial Fire") for cash proceeds of $1.4 billion. Industrial Fire, historically reported in our Fire & Security segment, is a leading manufacturer of a full spectrum of fire detection and suppression solutions and services in critical high-hazard environments, including oil and gas, power generation, marine and offshore facilities, automotive, data centers and aircraft hangars. We recognized a net gain on the sale of $319 million.

On October 1, 2024, we completed the sale of our Commercial Refrigeration business ("CCR") for cash proceeds of $679 million. CCR, historically reported in our Climate Solutions Transportation segment, is a global supplier of turnkey solutions for commercial refrigeration systems and services, with a primary focus on serving food retail customers, cold storage facilities and warehouses. We recognized a net gain on the sale of $292 million. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

On December 2, 2024, we completed the sale of our Commercial and Residential Fire business ("CRF Business") for cash proceeds of $2.9 billion. The CRF Business, historically reported in our Fire & Security segment, is a leading manufacturer of fire detection and alarm solutions for both commercial and residential applications. We recognized a net gain on the sale of $1.4 billion. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

Business Strategy

Our vision is to be a global leader in intelligent climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to our customers. To achieve our vision, our core business strategy is to create innovative, differentiated products and solutions to provide a fully-integrated customer experience in order to be our customer’s preferred provider. We believe our strategy is supported by significant favorable secular trends, our industry-leading brands and track record of innovation. Our business strategy is built around the following pillars to drive long-term growth and deliver shareholder value:

Differentiated Products, Channels and Brands

Our strategy involves driving organic growth by further enhancing our proven track record of innovation, which is focused on designing smarter, more connected and more efficient sustainable systems and solutions. Our strategy also relies on our iconic, industry-leading brands and on strengthening our long-term relationships with channel partners and customers by offering solutions that anticipate customer needs with a focus on technologies related to energy efficiency, emissions, air quality, electrification, refrigerants with lower global warming potential and noise reduction.

Digitally-Enabled Lifecycle Solutions

We are focused on offering a comprehensive and differentiated suite of sustainable technologies and services. We expect that these solutions increase our total available market opportunity, enhance our predictive service and maintenance capabilities, strengthen our customer intimacy and increase aftermarket growth. Beginning with product design, our product offerings are moving towards digitally-enabled solutions that connect us to our customers throughout the product’s full lifecycle and help us grow our aftermarket sales. We plan to meet our customer’s needs by offering a wider-range of aftermarket products and services including replacement components, preventative and on-demand maintenance and repair, digital monitoring and modifications/upgrades. Our digitally-enabled lifecycle solutions include Abound, a cloud-based building platform that unlocks and unites building data to create healthy, sustainable and intelligent solutions for indoor spaces. It gathers data from disparate systems, sensors and sources; identifies opportunities to optimize performance; and works with healthy building solutions to improve occupant experiences. In addition, our Lynx digital platform, developed in collaboration with Amazon Web Services (“AWS”), allows customers to leverage data to enhance visibility, resiliency, agility and efficiency in the cold chain to reduce loss of cargo, lower operations costs and support real-time decisions.

Expand Portfolio with Energy Management Solutions

As power grids and transportation infrastructure shift from fossil fuels to renewables, we will continue to position ourselves as a leader in innovative solutions that reduce emissions and energy consumption and promote power grid stability. Our solutions range from residential home energy management to sustainable solutions for commercial and industrial buildings to optimized low noise and low gas emission transport solutions. With the addition of the VCS Business on January 2, 2024, we are well positioned to provide complete energy solutions globally. Our portfolio includes environmentally friendly refrigerants, high temperature heat pumps for use in industrial and commercial applications, natural refrigerant heat pumps for residential buildings and a connected ecosystem for homes including solar PV, batteries and a differentiated digital platform, all supported by extensive service and aftermarket offerings.

Strategic Capital Allocation

Our priorities for capital deployment include funding organic growth, acquisitions and capital returns to shareowners through a growing and sustainable dividend and share repurchases. We pursue potential acquisitions to complement existing products and services and to expand the range of technologies and solutions available to our customers. We leverage our global operations, the strength of our iconic, industry-leading brands and our success in creating valuable partnerships to focus on targeted expansion into new locations and channels where we believe that we can drive profitable growth. These drivers are supported by research and development activities with a focus on new product development and new technology innovation. In addition, Carrier Ventures, our global venture capital wholly-owned subsidiary, focuses on investments to accelerate the development of sustainable innovations and disruptive technologies to transform future building and cold chain management. It engages in strategic partnerships with high growth organizations as they invest in the development of technologies to innovate and commercialize the next generation of integrated offerings.

Other Matters Relating to Our Business as a Whole

Competitive Conditions

Each of our businesses is subject to significant competition from a number of companies throughout the world. Due to the nature of our products and services and the markets we serve, our competition can vary from regional or specialized companies to larger public or private companies.

The most significant competitive factors we face are technology differentiation, product performance, service, delivery schedule and price. Brand reputation, service to customers and quality are also important competitive factors for our products and services. While our competitive position varies among our products and services, we are a significant competitor with respect to each of our major product and service offerings. We believe that the loss of any individual contract or customer would not have a material adverse effect on our results.

Raw Materials and Supplies

We rely on suppliers and commodity markets to secure components and raw materials such as copper, aluminum and steel. In addition, we also use semi-conductors and other electronic components in the manufacture of our products. To maximize our buying effectiveness and leverage our scale, we have a central strategic sourcing group that consolidates purchases of certain materials and components across our business segments. We work closely with our suppliers to ensure availability of products and implement other cost savings initiatives. In addition, we continue to invest in our supply chain to improve its resilience with a focus on automation, dual sourcing of critical components and localized manufacturing when feasible.

Intellectual Property

We maintain a broad portfolio of patents, trademarks, copyrights, trade secrets, licenses and franchises related to our business to protect our research and development investments and to maintain our competitive advantages. We hold approximately 12,000 active patents and pending patent applications worldwide. From time to time, we take actions to protect our business by asserting our intellectual property rights against third-party infringement. We believe that we have taken reasonable measures to build and protect this portfolio of intellectual property rights, but we cannot be assured that these rights will not be challenged, found invalid or unenforceable.

Operating System

We plan to continue to foster operational, financial and commercial excellence to drive sales and earnings growth. With roots in our legacy manufacturing and business processes, the Carrier operating system — Carrier Excellence — is our continuous improvement framework that is expected to drive operational excellence across our businesses. Our Supplier Excellence program is intended to apply these same operating principles to our supply base and we continue to focus on strategic cost reductions through operational efficiency, digitalization, automation and supply chain productivity.

Joint Ventures and Strategic Relationships

Our joint ventures and strategic relationships are an important part of our business. We hold direct ownership interests in approximately 55 joint ventures, the financial results of which are accounted for by the equity method of accounting or the cost basis of accounting, of which 61% relates to Climate Solutions Americas and 34% relates to Climate Solutions Asia Pacific, Middle East & Africa. These relationships engage in distribution, manufacturing and product development activities and are integral to our business operations and growth strategy.

Seasonality

Demand for certain of our products and services is seasonal and can be impacted by weather conditions. For instance, sales and services of our HVAC products to residential customers have historically been higher in the second and third quarters of the calendar year, which represent the peak seasons for air conditioning-related sales in North America markets. A change in building and remodeling activity also can affect our financial performance. In addition, our financial performance may be influenced by the production and utilization of transport equipment, including truck production cycles in North America and Europe.

Compliance with the Regulation of our Business and Operations

We operate our businesses and sell our products all over the world. As a result, rapid changes in legislation, regulations and government policies affect our operations and business in the countries, regions and localities in which we operate and sell our products. International accords such as the Paris Agreement and the subsequent U.S. climate policies to meet its nationally determined contributions as well as local regulations in the U.S. reducing the use of fossil fuels in buildings all have the potential to impact our products and service offerings. Such changes, which can render our products and technologies non-compliant, involve refrigerants, noise levels, product and fire safety, hydrofluorocarbon emissions, fluorinated gases, hazardous substances and electric and electronic equipment waste. Increased fragmentation of regulatory requirements changes the manner in which we conduct our business and increases our costs because it necessitates the development of country or regional specific variants, monitoring of and compliance with those regulations and additional testing and certifications. In addition, our operations are subject to and affected by environmental regulations promulgated by federal, state and local authorities in the U.S. and by authorities with jurisdiction over our foreign operations. We have made, and will be required to continue to make, capital expenditures to design and upgrade our products to comply with or exceed environmental and other regulations and energy efficiency standards. However, we believe that the costs related to compliance requirements for environmental or other government regulations will not have a material adverse effect on our capital expenditures, financial results or competitive position.

Environmental Goals

As a global leader in intelligent climate and energy solutions, we are committed to making the world safer, sustainable and more comfortable. We have set ambitious sustainability goals to be reached by 2030, which include the following:

•Invest over $4 billion to develop intelligent climate and energy solutions that reduce environmental impacts,

•Avoid more than 1 gigaton of customer greenhouse gas emissions,

•Achieve carbon neutral operations,

•Reduce energy intensity by 10% across our operations,

•Develop water stewardship programs across our global operations, prioritizing water-scarce locations, and

•Promote sustainability and positively impact communities and our workforce through education, partnerships, programs and volunteering our time and talent.

Human Capital Management

At Carrier, we strive to connect our people to our purpose, our vision, our strategic priorities, our culture and each other, with the ultimate goal to engage our teams, drive success and create value for our customers and shareowners.

Culture and People

Our operating fundamentals - The Carrier Way, Leading People The Carrier Way, and Carrier Excellence – serve as a basis for how we operate our company and drive success, as One Team. The Carrier Way outlines our vision, values, and cultural behaviors. Leading People The Carrier Way sets expectations for people leaders and how we build the best teams. Carrier Excellence is our continuous improvement operating system, a mindset that focuses the organization on enhancing efficiency, and delivering high-quality outcomes across all facets of our business.

Our employees collaborate as one team across more than 50 countries. We develop and deploy best-in-class programs and practices, provide enriching career opportunities, listen to employee feedback and always challenge ourselves to do better. As of December 31, 2024, we had approximately 48,000 employees worldwide, of which 35% are located in the Americas, 34% are located in Europe and 31% are located in Asia Pacific, Middle East & Africa.

We are an employer of choice and we focus on our Build Best Teams cultural behavior priority through the deployment of our talent ecosystem that connects strategy, embeds talent in our culture and activates it through people programs, processes and leadership. One of our core values in The Carrier Way, inclusion, is fundamental to who we are and what we do. We aspire to have an inclusive culture where each and every employee can come to work, every day, feeling like they _belong, and can contribute to their fullest and greatest potential. We continuously evaluate, modify and enhance our recruitment and retention strategies as part of the overall management of our business.

Aligned to our fundamentals and talent ecosystem, we promote learning and development through technical and leadership programs, as well as tuition assistance to enhance our employees’ skills and abilities. Our offerings include an online platform, strategic partnerships and on-site technical training centers. We conduct annual leadership development reviews to identify future leaders and foster succession planning. We also renew our talent pipeline with internships and early career rotational programs. Through a strategic approach to human capital, we are creating an environment where employees thrive, belong, and contribute to a more sustainable and resilient world.

Employee Well-being, Health and Safety

Creating an environment where employees thrive includes prioritizing health, safety, and overall well-being. We are committed to maintaining world-class standards.

Our Environmental, Health and Safety program is focused on eliminating the risk of serious injuries, illness and fatalities to employees, contractors and customers during manufacturing, installation, servicing and other business activities. We apply rigorous standards to ensure that our operations and premises comply with national and local regulations and our incident reporting requirements. For 2024, our total recordable incident rate ("TRIR"), based upon the number of employee injuries per 200,000 hours worked, was 0.32 and our lost time incident rate ("LTIR") was 0.15.

Our global well-being programs support employees’ physical, mental and financial health, offering flexible benefits, mental health resources, hybrid-work and financial planning tools. Our total rewards philosophy is designed to align the compensation of our employees with individual and company performance and to provide the appropriate market-competitive incentives to attract, retain and motivate employees to achieve superior results.

We measure the Pulse of our workforce three times per year through company-wide employee surveys to help us understand how employees feel about working at Carrier and what we can do to improve their experience.

As of December 31, 2024, in the U.S., 90% of our approximately 4,000 production and maintenance employees were covered under six collective bargaining agreements with expiration dates ranging from 2025 to 2027. In Europe, approximately 16,200 employees are represented by a European Works Council and, at national and local levels, we inform and consult with 49 local works councils and with unions representing employees at approximately 40 sites. Relations with our labor unions and works councils are generally positive.

Corporate Information

Carrier was incorporated in Delaware in connection with the Separation on March 15, 2019. Our principal executive offices are located at 13995 Pasteur Boulevard, Palm Beach Gardens, Florida 33418, and our telephone number is (561) 365-2000. We maintain an Internet website at www.corporate.carrier.com.

ITEM 2. PROPERTIES

We operate approximately 900 sites, which comprise approximately 36 million square feet of productive space. Of these, our facilities and key manufacturing sites greater than 100,000 square feet comprise approximately 27 million square feet of productive space. Approximately 26%, 24%, 30% and 9% of these significant properties are associated with our Climate Solutions Americas, Climate Solutions Europe, Climate Solutions Asia Pacific, Middle East & Africa and Climate Solutions Transportation segments, respectively, with approximately 11% not associated with a particular segment. Approximately 35% of these significant properties are leased and the remainder are owned. Approximately 30% of these significant properties are located in the U.S.

Our fixed assets as of December 31, 2024, include manufacturing facilities and non-manufacturing facilities, such as warehouses and machinery and equipment, most of which is general purpose machinery and equipment that use special jigs, tools and fixtures and that, in many instances, have automatic control features and special adaptations. The facilities, warehouses, machinery and equipment in use as of December 31, 2024, are in good operating condition, are well-maintained and substantially all are in regular use.

PART II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

BUSINESS OVERVIEW

Business Summary

Carrier Global Corporation ("we" or "our") is a global leader in intelligent climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to our customers. Our portfolio includes industry-leading brands such as Carrier, Viessmann, Toshiba, Automated Logic and Carrier Transicold that offer innovative heating, ventilating and air conditioning ("HVAC"), refrigeration and cold chain transportation solutions to help make the world safer and more comfortable. We also provide a broad array of related building services, including audit, design, installation, system integration, repair, maintenance and monitoring. Our operations are classified into four segments: Climate Solutions Americas, Climate Solutions Europe, Climate Solutions Asia Pacific, Middle East & Africa and Climate Solutions Transportation.

Through our performance-driven culture, we anticipate creating long-term shareowner value by investing strategically to strengthen our product position in homes, buildings and across the cold chain in order to drive profitable growth. We believe our business segments are well positioned to benefit from favorable secular trends, including the mega-trends of urbanization, population growth and demographic shifts, food security and safety, digitalization, global connectivity and energy efficiency. Coupled with our industry-leading brands and track record of innovation, we continue to provide market-leading solutions for our customers.

Our worldwide operations are affected by global and regional industrial, economic and political factors, trade policies and trends. They are also affected by changes in the general level of economic activity, such as changes in business and consumer spending, construction and shipping activity as well as short-term economic factors such as currency fluctuations, commodity price volatility and supply disruptions. We continue to invest in our business, take pricing actions to mitigate supply chain and inflationary pressures, develop new products and services in order to remain competitive in our markets and use risk management strategies to mitigate various exposures.

We are actively monitoring recent trade policy and tariff announcements including the three executive orders issued by the President in February 2025 directing the United States to impose new tariffs on imports from Canada, Mexico and China and the subsequent announcement that the Administration intended to pause tariffs on Canada and Mexico for a month. We are currently evaluating the potential impact of the announced tariffs on our business and financial condition and actions we may take to mitigate the impact. In addition, we are currently monitoring the potential impact, if any, of actions taken by these countries in response to the announced tariffs. There can be no assurance that the future imposition of any tariffs, changes thereto or potential actions taken by countries in response to the tariffs will not have a material adverse effect upon our results of operations, financial condition or liquidity in any period or that any actions we take to mitigate the impact of the tariffs will be effective.

Significant Events

Acquisition of Viessmann Climate Solutions

On April 25, 2023, we announced that we entered into a Share Purchase Agreement (the “Agreement”) to acquire the climate solutions business (the "VCS Business") of Viessmann Group GmbH & Co. KG (“Viessmann”), a privately-held company. The VCS Business develops intelligent, integrated and sustainable technologies, including heat pumps, boilers, photovoltaic systems, home battery storage and digital solutions, primarily for residential customers in Europe. The acquisition was completed on January 2, 2024. As a result, the assets, liabilities and results of operations of the VCS Business are consolidated in the accompanying Consolidated Financial Statements as of the date of acquisition and reported predominantly within our Climate Solutions Europe segment.

Portfolio Transformation

On June 2, 2024, we completed the sale of our Access Solutions business ("Access Solutions") for cash proceeds of $5.0 billion. Access Solutions, historically reported in our Fire & Security segment, is a global supplier of physical security and digital access solutions supporting the hospitality, commercial, education and military markets. We recognized a net gain on the sale of $1.8 billion, which is included in Discontinued operations, net of tax on the accompanying Consolidated Statement of Operations during the year ended December 31, 2024.

On July 1, 2024, we completed the sale of our Industrial Fire business ("Industrial Fire") for cash proceeds of $1.4 billion. Industrial Fire, historically reported in our Fire & Security segment, is a leading manufacturer of a full spectrum of fire detection and suppression solutions and services in critical high-hazard environments, including oil and gas, power generation, marine and offshore facilities, automotive, data centers and aircraft hangars. We recognized a net gain on the sale of $319 million, which is included in Discontinued operations, net of tax on the accompanying Consolidated Statement of Operations during the year ended December 31, 2024.

On October 1, 2024, we completed the sale of our Commercial Refrigeration business ("CCR") for cash proceeds of $679 million. CCR, historically reported in our Climate Solutions Transportation segment, is a global supplier of turnkey solutions for commercial refrigeration systems and services, with a primary focus on serving food retail customers, cold storage facilities and warehouses. We recognized a gross gain on the sale of $318 million, which is included in Other income (expense), net on the accompanying Consolidated Statement of Operations during the year ended December 31, 2024. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

On December 2, 2024, we completed the sale of our Commercial and Residential Fire business ("CRF Business") for cash proceeds of $2.9 billion. The CRF Business, historically reported in our Fire & Security segment, is a leading manufacturer of fire detection and alarm solutions for both commercial and residential applications. We recognized a net gain on the sale of $1.4 billion, which is included in Discontinued operations, net of tax on the accompanying Consolidated Statement of Operations during the year ended December 31, 2024. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

Segment Reorganization

As a result of our portfolio transformation, we revised our reportable segments to better reflect our business strategy, align our management reporting and increase transparency for investors. Under the revised segment structure, we have three new regional HVAC operating segments. Combined with the existing Climate Solutions Transportation operating segment, the four operating segments also serve as our reportable segments. This model is designed to create a simplified, more focused and customer-centric organization across the globe. Each segment reports through separate management teams which regularly review their operating results with our Chief Operating Decision Maker (the "CODM") determined in accordance with applicable accounting guidance. In connection with the revised structure, the CODM changed the measure used to evaluate segment profitability from Operating profit to Segment operating profit. All prior period comparative information has been recast to reflect the revised segment structure.

Deconsolidation of Kidde-Fenwal, Inc.

On May 14, 2023, Kidde-Fenwal, Inc. ("KFI"), an indirect wholly-owned subsidiary of ours, filed a petition for voluntary reorganization under Chapter 11 of the United States Bankruptcy Code ("Chapter 11") in the United States Bankruptcy Court for the District of Delaware. KFI, an industrial fire detection and suppression business historically reported in our Fire & Security segment, filed a voluntary petition with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) seeking relief under chapter 11 of the Bankruptcy Code. As of the petition date, KFI was deconsolidated and its respective assets and liabilities were derecognized from our Consolidated Financial Statements.

Acquisition of Toshiba Carrier Corporation

On February 6, 2022, we entered into a binding agreement to acquire a majority ownership interest in Toshiba Carrier Corporation ("TCC"), a variable refrigerant flow ("VRF") and light commercial HVAC joint venture between Carrier and Toshiba Corporation. The acquisition was completed on August 1, 2022. As a result, the assets, liabilities and results of operations of TCC are consolidated in the accompanying Consolidated Financial Statements as of the date of acquisition and reported predominantly within our Climate Solutions Asia Pacific, Middle East & Africa segment. Upon closing, Toshiba Corporation retained a 5% ownership interest in TCC.

Sale of Chubb Fire & Security Business

On July 26, 2021, we entered into a stock purchase agreement to sell our Chubb Fire & Security business ("Chubb") to APi Group Corporation ("APi"). Chubb, which was reported within our Fire & Security segment, delivered essential fire safety and security solutions from design and installation to monitoring, service and maintenance across more than 17 countries around the globe. On January 3, 2022, we completed the sale of Chubb (the "Chubb Sale") for net proceeds of $2.9 billion and recognized a gain on the sale of $1.1 billion during the year ended December 31, 2022.

RESULTS OF OPERATIONS

This discussion summarizes the significant factors affecting our consolidated results of operations, financial condition and liquidity for the year ended December 31, 2024, compared with December 31, 2023, as well as the year ended December 31, 2023, compared with December 31, 2022. This discussion should be read in conjunction with Item 8, the Consolidated Financial Statements and the accompanying Notes to the Consolidated Financial Statements in this Annual Report.

Year Ended December 31, 2024 Compared with Year Ended December 31, 2023

The following represents our consolidated net sales and operating results:

| | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | 2024 | | 2023 | | Period Change | | % Change | |

| Net sales | $ | 22,486 | | | $ | 18,951 | | | $ | 3,535 | | | 19 | % | |

| Cost of products and services sold | (16,505) | | | (13,789) | | | (2,716) | | | 20 | % | |

| Gross margin | 5,981 | | | 5,162 | | | 819 | | | 16 | % | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses | (3,335) | | | (3,002) | | | (333) | | | 11 | % | |

| Operating profit | 2,646 | | | 2,160 | | | 486 | | | 23 | % | |

| | | | | | | | |

| | | | | | | | |

| Non-operating income (expense), net | (372) | | | (161) | | | (211) | | | 131 | % | |

| Earnings (loss) before income taxes | 2,274 | | | 1,999 | | | 275 | | | 14 | % | |

| Income tax expense | (1,062) | | | (521) | | | (541) | | | 104 | % | |

| Earnings (loss) from continuing operations | 1,212 | | | 1,478 | | | (266) | | | (18) | % | |

| Discontinued operations, net of income taxes | 4,496 | | | (38) | | | 4,534 | | | (11932) | % | |

| Net earnings (loss) | 5,708 | | | 1,440 | | | 4,268 | | | 296 | % | |

| Less: Non-controlling interest in subsidiaries' earnings from operations | 104 | | | 91 | | | 13 | | | 14 | % | |

| Net earnings (loss) attributable to common shareowners | $ | 5,604 | | | $ | 1,349 | | | $ | 4,255 | | | 315 | % | |

Net Sales

For the year ended December 31, 2024, Net sales was $22.5 billion, a 19% increase compared with the same period of 2023.

The components of the year-over-year change were as follows:

| | | | | | |

| 2024 | |

| Organic / Operational | 3 | % | |

| | |

| Acquisitions and divestitures, net | 16 | % | |

| | |

| Total % change | 19 | % | |

Organic sales for the year ended December 31, 2024, increased by 3% compared with the same period of 2023. The organic increase was primarily due to our Climate Solutions Americas segment as strong end-market demand continued to drive higher volumes. Results in our Climate Solutions Europe segment were flat. These results were partially offset by lower end-market demand in both Climate Solutions Asia Pacific, Middle East & Africa and Climate Solutions Transportation. Refer to "Segment Review" below for a discussion of Net sales by segment.

Gross Margin

For the year ended December 31, 2024, gross margin was $6.0 billion, a 16% increase compared with the same period of 2023. The components were as follows:

| | | | | | | | | | | |

| (In millions) | 2024 | | 2023 |

| Net sales | $ | 22,486 | | | $ | 18,951 | |

| Cost of products and services sold | (16,505) | | | (13,789) | |

| Gross margin | $ | 5,981 | | | $ | 5,162 | |

| Percentage of net sales | 26.6 | % | | 27.2 | % |

Gross margin increased by $819 million compared with the year ended December 31, 2023. The main driver of the increase related to ongoing customer demand, pricing improvements and our continued focus on productivity initiatives. Operating results associated with the VCS Business since the date of acquisition further benefited gross margin during the period. However, the results of the VCS Business included inventory step-up, backlog amortization and intangible asset amortization resulting from the recognition of acquired assets at fair value. These costs had a 260 basis point unfavorable impact on gross margin as a percentage of Net sales. As a result, gross margin as a percentage of Net sales decreased by 60 basis points compared with the same period of 2023.

Operating Expenses

For the year ended December 31, 2024, operating expenses, including Equity method investment net earnings, was $3.3 billion, a 11% increase compared with the same period of 2023. The components were as follows:

| | | | | | | | | | | | | |

| For the Year Ended December 31, | | |

| (In millions) | 2024 | | 2023 | | |

| Selling, general and administrative | $ | (3,197) | | | $ | (2,607) | | | |

| Research and development | (686) | | | (493) | | | |

| Equity method investment net earnings | 231 | | | 211 | | | |

| Other income (expense), net | 317 | | | (113) | | | |

| Operating expenses | $ | (3,335) | | | $ | (3,002) | | | |

| Percentage of net sales | 14.8 | % | | 15.8 | % | | |

| | | | | |

For the year ended December 31, 2024, Selling, general and administrative expenses were $3.2 billion, a 23% increase compared with the same period of 2023. The increase is primarily due to incremental expenses associated with the VCS Business since the date of acquisition. In addition, higher compensation and other employee-related costs further contributed to the increase. The current year also included $95 million of acquisition and divestiture-related costs compared with $123 million during the year ended December 31, 2023.

Research and development costs relate to new product development and new technology innovation. Due to the variable nature of program development schedules, year-over-year spending levels can fluctuate. In addition, we continue to invest to prepare for future energy efficiency and refrigerant regulation changes and in digital controls technologies.

Investments over which we do not exercise control, but have significant influence, are accounted for using the equity method of accounting. For the year ended December 31, 2024, Equity method investment net earnings were $231 million, a 9% increase compared with the same period of 2023. The increase was primarily driven by higher earnings in joint ventures across all regions. The increase was partially offset by a $23 million charge associated with the devaluation of U.S. Dollar denominated balances at an equity investment located in Egypt and reported in Climate Solutions Asia Pacific, Middle East & Africa. In addition, prior year results include a $16 million benefit recognized in connection with a favorable tax ruling at a minority owned joint venture.

Other income (expense), net primarily includes the impact of gains and losses related to the sale of businesses or interests in our equity method investments, foreign currency gains and losses on transactions that are denominated in a currency other than an entity's functional currency and hedging-related activities. During the year ended December 31, 2024, we completed the sale of CCR and recognized a gain on the sale of $318 million. In addition, we recognized a $46 million gain associated with our share of United Technologies Corporation's conclusion of certain income tax matters from their 2017 and 2018 tax audit with the Internal Revenue Service ("IRS"). In connection with the acquisition of the VCS Business, we recognized an $86 million loss on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price.

During the year ended December 31, 2023, we recognized a $96 million loss on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price of the VCS Business. In addition, the carrying value of our previously held equity investments in TCC were recognized at fair value at the date of acquisition. As a result, we recognized an $8 million non-cash loss associated with the increase in our ownership interest.

Non-Operating Income (Expense), net

For the year ended December 31, 2024, Non-operating income (expense), net was $372 million, a 131% increase compared with the same period of 2023. The components were as follows:

| | | | | | | | | | | | |

| For the Year Ended December 31, | |

| (In millions) | 2024 | | 2023 | |

| Non-service pension benefit (expense) | $ | (1) | | | $ | (1) | | |

| | | | |

| Interest expense | (580) | | | (306) | | |

| Interest income | 209 | | | 146 | | |

| Interest (expense) income, net | (371) | | | (160) | | |

| | | | |

| Non-operating income (expense), net | $ | (372) | | | $ | (161) | | |

| | | | |

Non-operating income (expense), net includes the results from activities other than normal business operations such as interest expense, interest income and the non-service components of pension and post-retirement obligations. Interest expense is affected by the amount of debt outstanding and the interest rates on that debt. For the year ended December 31, 2024, interest expense was $580 million, a 90% increase compared with the same period of 2023. During 2024, we redeemed $1.0 billion aggregate principal amount of USD-denominated 5.80% notes due in 2025 and redeemed €750 million aggregate principal amount of 4.375% Euro-denominated notes due 2025 with the proceeds from the issuance of €750 million aggregate principal amount of 3.625% Euro-denominated notes due 2037. In addition, we completed tender offers to repurchase approximately $1.1 billion aggregate principal which included $125 million of notes due 2034, $350 million of notes due 2054, and approximately $600 million of notes due 2050. Combined, we incurred make-whole premiums of $14 million in Interest expense, wrote off $17 million of unamortized deferred financing costs in Interest expense and recognized a net gain of $97 million in Interest income. During 2023, we entered into several financing arrangements in connection with the acquisition of the VCS Business and capitalized $105 million of deferred financing costs. As a result, we amortized $55 million of deferred financing costs in Interest expense, of which $47 million related to our senior unsecured bridge term loan facility (the "Bridge Loan").

Income Taxes

| | | | | | | | | | | | | | | | |

| | | 2024 | | 2023 | | |

| Effective tax rate | | 46.7 | % | | 26.1 | % | | |

The effective tax rate for the year ended December 31, 2024, was higher than the statutory U.S. federal income tax rate. The increase was primarily driven by a net tax charge of $650 million related to a re-organization of the VCS Business and a non-deductible loss of $86 million on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price of the VCS Business, partially offset by the lower effective tax rate on the $318 million gain on the sale of CCR and $44 million of foreign tax credits generated and utilized in the current year.

The effective tax rate for the year ended December 31, 2023, was higher than the statutory U.S. federal income tax rate. The increase was primarily driven by a net tax charge of $27 million relating to the re-organization and disentanglement of the CCR businesses in advance of the planned divestiture. In addition, the effective tax rate was impacted by the recognition of a deferred tax liability for withholding tax of $19 million on repatriated foreign earnings, non-deductible divestiture-related costs and a non-deductible loss of $96 million on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price of the VCS Business.

Adjusted Operating Profit

We report our financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). In addition, we supplement the reporting of our financial information determined under GAAP with certain non-GAAP financial information. Adjusted operating profit is a non-GAAP measure and defined as consolidated operating profit (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items of a nonoperational nature. This measure is useful to investors because it is how management assesses the operating performance of the business. A reconciliation of the amounts prepared in accordance with GAAP to the corresponding non-GAAP measure appears below and provides additional information as to the items and amounts that have been excluded from the adjusted measure.

| | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| (In millions) | | 2024 | | 2023 |

| Reconciliation to Adjusted operating profit | | | | |

| Operating profit | | $ | 2,646 | | | $ | 2,160 | |

| | | | |

| Restructuring costs | | 108 | | | 75 | |

| Amortization of acquired intangibles | | 689 | | | 143 | |

| Acquisition step-up amortization | | 282 | | | 41 | |

| Acquisition/divestiture-related costs | | 95 | | | 123 | |

| Viessmann-related hedges | | 86 | | | 96 | |

| CCR gain | | (318) | | | — | |

| Gain on liability adjustment | | (46) | | | — | |

| Bridge loan financing costs | | — | | | 3 | |

| TCC Acquisition-related gain | | — | | | 8 | |

| Adjusted operating profit | | $ | 3,542 | | | $ | 2,649 | |

Adjusted operating profit may not be comparable to similarly-titled measures used by other companies and should not be considered a substitute for Operating profit in accordance with GAAP. The non-GAAP information presented provides investors with additional useful information, but should not be considered in isolation or as a substitute for the related GAAP measure. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

Year Ended December 31, 2023 Compared with Year Ended December 31, 2022

The following represents our consolidated net sales and operating results:

| | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | 2023 | | 2022 | | Period Change | | % Change | |

| Net sales | $ | 18,951 | | | $ | 17,288 | | | $ | 1,663 | | | 10 | % | |

| Cost of products and services sold | (13,789) | | | (12,991) | | | (798) | | | 6 | % | |

| Gross margin | 5,162 | | | 4,297 | | | 865 | | | 20 | % | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses | (3,002) | | | (313) | | | (2,689) | | | 859 | % | |

| Operating profit | 2,160 | | | 3,984 | | | (1,824) | | | (46) | % | |

| | | | | | | | |

| | | | | | | | |

| Non-operating income (expense), net | (161) | | | (161) | | | — | | | — | % | |

| Earnings (loss) before income taxes | 1,999 | | | 3,823 | | | (1,824) | | | (48) | % | |

| Income tax expense | (521) | | | (616) | | | 95 | | | (15) | % | |

| Earnings (loss) from continuing operations | 1,478 | | | 3,207 | | | (1,729) | | | (54) | % | |

| Discontinued operations, net of income taxes | (38) | | | 377 | | | (415) | | | (110) | % | |

| Net earnings (loss) | 1,440 | | | 3,584 | | | (2,144) | | | (60) | % | |

| Less: Non-controlling interest in subsidiaries' earnings from operations | 91 | | | 50 | | | 41 | | | 82 | % | |

| Net earnings (loss) attributable to common shareowners | $ | 1,349 | | | $ | 3,534 | | | $ | (2,185) | | | (62) | % | |

Net Sales

For the year ended December 31, 2023, Net sales was $19.0 billion, a 10% increase compared with the same period of 2022. The components of the year-over-year change were as follows:

| | | | | |

| 2023 |

| Organic / Operational | 3 | % |

| |

| Acquisitions and divestitures, net | 7 | % |

| |

| Total % change | 10 | % |

Organic sales for the year ended December 31, 2023, increased by 3% compared with the same period of 2022. The organic increase was primarily due to our Climate Solutions Americas segment as strong end-market demand continued to drive higher volumes. In addition, higher volumes and pricing improvements benefited our Climate Solutions Asia Pacific, Middle East & Africa and Climate Solutions Europe segments. These results were partially offset by lower end-market demand in Climate Solutions Transportation. Refer to "Segment Review" below for a discussion of Net sales by segment.

On August 1, 2022, we acquired a majority ownership interest in TCC, a VRF and light commercial HVAC joint venture between Carrier and Toshiba Corporation. The results of TCC have been included in our Consolidated Financial Statements since the date of acquisition and reported predominantly within our Climate Solutions Asia Pacific, Middle East & Africa segment. The transaction added 6% to Net sales during the year ended December 31, 2023, and is included in Acquisitions and divestitures, net.

Gross Margin

For the year ended December 31, 2023, gross margin was $5.2 billion, a 20% increase compared with the same period of 2022. The components were as follows:

| | | | | | | | | | | |

| (In millions) | 2023 | | 2022 |

| Net sales | $ | 18,951 | | | $ | 17,288 | |

| Cost of products and services sold | (13,789) | | | (12,991) | |

| Gross margin | $ | 5,162 | | | $ | 4,297 | |

| Percentage of net sales | 27.2 | % | | 24.9 | % |

Gross margin increased by $865 million compared with the year ended December 31, 2022. A main driver of the increase related to ongoing customer demand, pricing improvements and our continued focus on productivity initiatives. In addition, operating results associated with TCC further benefited gross margin during the year. These amounts were partially offset by the higher cost of commodities and components used in our products and certain supply chain constraints. Although inflationary cost pressures have begun to moderate, they remain elevated and continue to impact the cost of products and services sold in each of our segments. Gross margin as a percentage of Net sales increased by 230 basis points compared with the same period of 2022.

Operating Expenses

For the year ended December 31, 2023, operating expenses, including Equity method investment net earnings, was $3.0 billion, an 859% increase compared with the same period of 2022. The components were as follows:

| | | | | | | | | | | | | |

| For the Year Ended December 31, | | |

| (In millions) | 2023 | | 2022 | | |

| Selling, general and administrative | $ | (2,607) | | | $ | (1,977) | | | |

| Research and development | (493) | | | (416) | | | |

| Equity method investment net earnings | 211 | | | 262 | | | |

| Other income (expense), net | (113) | | | 1,818 | | | |

| Operating expenses | $ | (3,002) | | | $ | (313) | | | |

| Percentage of net sales | 15.8 | % | | 1.8 | % | | |

| | | | | |

For the year ended December 31, 2023, Selling, general and administrative expenses were $2.6 billion, a 32% increase compared with the same period of 2022. The increase is primarily due to higher compensation, commissions and other employee-related costs during the current period. In addition, incremental selling, general and administrative expenses associated with TCC further contributed to the increase. The current year also included $123 million of acquisition and divestiture-related costs compared with $31 million during the year ended December 31, 2022.

Research and development costs relate to new product development and new technology innovation. Due to the variable nature of program development schedules, year-over-year spending levels can fluctuate. In addition, we continue to invest to prepare for future energy efficiency and refrigerant regulation changes and in digital controls technologies.

Investments over which we do not exercise control, but have significant influence, are accounted for using the equity method of accounting. For the year ended December 31, 2023, Equity method investment net earnings were $211 million, a 19% decrease compared with the same period of 2022. The decrease was primarily driven by the increase in our ownership interest in TCC on August 1, 2022. As a result, TCC is no longer accounted for under the equity method of accounting since the date of acquisition. The decrease was partially offset by a $16 million benefit recognized in connection with a favorable tax ruling at a minority owned joint venture. During the year ended December 31, 2022, pre-acquisition equity earnings of TCC totaled $87 million which included a $27 million gain on the sale of two minority owned subsidiaries.

Other income (expense), net primarily includes the impact of gains and losses related to the sale of businesses or interests in our equity method investments, foreign currency gains and losses on transactions that are denominated in a currency other than an entity's functional currency and hedging-related activities. During the year ended December 31, 2023, we recognized a $96 million loss on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price of the VCS Business.

In connection with the TCC acquisition, the carrying value of our previously held TCC equity investments were recognized at fair value at the date of acquisition. As a result, we recognized a $705 million non-cash gain associated with the increase in our ownership interest during the year ended December 31, 2022. In addition, we completed the Chubb Sale and recognized a net gain on the sale of $1.1 billion. Results for the year ended December 31, 2022 also included a $22 million charge resulting from a litigation matter within our Climate Solutions Asia Pacific, Middle East & Africa segment.

Non-Operating Income (Expense), net

For the year ended December 31, 2023, Non-operating income (expense), net was $161 million, flat compared with the same period of 2022. The components were as follows:

| | | | | | | | | | | | | |

| For the Year Ended December 31, | | |

| (In millions) | 2023 | | 2022 | | |

| Non-service pension benefit (expense) | $ | (1) | | | $ | (4) | | | |

| | | | | |

| Interest expense | (306) | | | (238) | | | |

| Interest income | 146 | | | 81 | | | |

| Interest (expense) income, net | (160) | | | (157) | | | |

| | | | | |

| Non-operating income (expense), net | $ | (161) | | | $ | (161) | | | |

| | | | | |

Non-operating income (expense), net includes the results from activities other than normal business operations such as interest expense, interest income and the non-service components of pension and post-retirement obligations. Interest expense is affected by the amount of debt outstanding and the interest rates on that debt. For the year ended December 31, 2023, interest expense was $306 million, a 29% increase compared with the same period of 2022. In connection with the proposed acquisition of the VCS Business, we entered into several financing arrangements and capitalized $105 million of deferred financing costs during 2023. As a result, we amortized $55 million of deferred financing costs in Interest expense, of which $47 million related to our senior unsecured bridge term loan facility (the "Bridge Loan"). During the year ended December 31, 2022, we completed tender offers to repurchase approximately $1.15 billion aggregate principal of our 2.242% Notes due 2025 and 2.493% Notes due 2027. Upon settlement, we wrote off $5 million of unamortized deferred financing costs in Interest expense and recognized a net gain of $33 million in Interest income.

Income Taxes

| | | | | | | | | | | | | | | | |

| | | 2023 | | 2022 | | |

| Effective tax rate | | 26.1 | % | | 16.1 | % | | |

The effective tax rate for the year ended December 31, 2023, was higher than our statutory U.S. federal income tax rate. The increase was primarily driven by a net tax charge of $27 million relating to the re-organization and disentanglement of the CCR businesses in advance of the planned divestiture. In addition, the effective tax rate was impacted by the recognition of a deferred tax liability for withholding tax of $19 million on repatriated foreign earnings, non-deductible divestiture-related costs and a non-deductible loss of $96 million on the mark-to-market valuation of our window forward contracts associated with the expected cash outflows of the Euro-denominated purchase price of the VCS Business.

The effective tax rate for the year ended December 31, 2022, was lower than our statutory U.S. federal income tax rate. The decrease was driven by a lower effective tax rate on the $705 million non-cash gain resulting from the recognition of our previously held TCC equity investments at fair value upon acquisition of TCC, a lower effective tax rate on the $1.1 billion Chubb gain and $45 million of foreign tax credits generated and utilized in 2022.

Adjusted Operating Profit

We report our financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). In addition, we supplement the reporting of our financial information determined under GAAP with certain non-GAAP financial information. Adjusted operating profit is a non-GAAP measure and defined as consolidated operating profit (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items of a nonoperational nature. This measure is useful to investors because it is how management assesses the operating performance of the business. A reconciliation of the amounts prepared in accordance with GAAP to the corresponding non-GAAP measure appears below and provides additional information as to the items and amounts that have been excluded from the adjusted measure.

| | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| (In millions) | | 2023 | | 2022 |

| Reconciliation to Adjusted operating profit | | | | |

| Operating profit | | $ | 2,160 | | | $ | 3,984 | |

| | | | |

| Restructuring costs | | 75 | | | 20 | |

| Amortization of acquired intangibles | | 143 | | | 46 | |

| Acquisition step-up amortization | | 41 | | | 51 | |

| Acquisition/divestiture-related costs | | 123 | | | 31 | |

| Viessmann-related hedges | | 96 | | | — | |

| Bridge loan financing costs | | 3 | | | — | |

| TCC Acquisition-related gain | | 8 | | | (705) | |

| Chubb gain | | — | | | (1,105) | |

| Russia/Ukraine asset impairment | | — | | | 3 | |

| Charge resulting from legal matter | | — | | | 22 | |

| Adjusted operating profit | | $ | 2,649 | | | $ | 2,347 | |

Adjusted operating profit may not be comparable to similarly-titled measures used by other companies and should not be considered a substitute for Operating profit in accordance with GAAP. The non-GAAP information presented provides investors with additional useful information, but should not be considered in isolation or as a substitute for the related GAAP measure. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

Segment Review

We have four operating segments:

•Climate Solutions Americas provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in North and South America while enhancing building performance, health, energy efficiency and sustainability.

•Climate Solutions Europe provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Europe while enhancing building performance, health, energy efficiency and sustainability.

•Climate Solutions Asia Pacific, Middle East & Africa provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Asia Pacific, the Middle East and Africa while enhancing building performance, health, energy efficiency and sustainability.

•Climate Solutions Transportation includes global transport refrigeration and monitoring products, services and digital solutions for trucks, trailers, shipping containers, intermodal and rail.

Segment operating profit is the measure of profit and loss that our CODM uses to evaluate the financial performance of the business and as the basis for resource allocation, performance reviews and compensation. It represents operating profit (a GAAP measure) adjusted to exclude restructuring costs, amortization of acquired intangible assets and other significant items of a nonoperational nature.

Year Ended December 31, 2024 Compared with Year Ended December 31, 2023

Summary performance for each of our segments is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | Segment operating profit | | Segment operating profit margin |

| (In millions) | 2024 | | 2023 | | | | | | 2024 | | 2023 | | | | | | 2024 | | 2023 | | | | |

| Climate Solutions Americas | $ | 10,527 | | | $ | 9,615 | | | | | | | $ | 2,323 | | | $ | 1,831 | | | | | | | 22.1 | % | | 19.0 | % | | | | |

| Climate Solutions Europe | 4,984 | | | 1,937 | | | | | | | 469 | | | 177 | | | | | | | 9.4 | % | | 9.1 | % | | | | |

| Climate Solutions Asia Pacific, Middle East & Africa | 3,500 | | | 3,581 | | | | | | | 466 | | | 361 | | | | | | | 13.3 | % | | 10.1 | % | | | | |

| Climate Solutions Transportation | 3,475 | | | 3,818 | | | | | | | 485 | | | 494 | | | | | | | 14.0 | % | | 12.9 | % | | | | |

| Total segment | $ | 22,486 | | | $ | 18,951 | | | | | | | $ | 3,743 | | | $ | 2,863 | | | | | | | 16.6 | % | | 15.1 | % | | | | |

A reconciliation of Segment operating profit to Adjusted operating profit is as follows:

| | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| (In millions) | | 2024 | | 2023 |

| Segment operating profit | | $ | 3,743 | | | $ | 2,863 | |

| Corporate and other | | (201) | | | (214) | |

| Adjusted operating profit | | $ | 3,542 | | | $ | 2,649 | |

Climate Solutions Americas

For the year ended December 31, 2024, Net sales were $10.5 billion, a 9% increase compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Net sales |

| Organic / Operational | 8 | % |

| |

| Acquisitions and divestitures, net | 1 | % |

| |

| Total % change | 9 | % |

The organic increase in Net sales of 8% was driven by continued strong results in the segment. Growth in our residential business (up 10%) was primarily driven by strong end-market demand and pricing improvements compared to prior year. In addition, ongoing customer demand in our commercial business (up 11%) and pricing improvements in our light commercial business (up 3%) further benefited segment results.

For the year ended December 31, 2024, Segment operating profit was $2.3 billion, a 27% increase compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Segment operating profit |

| Organic / Operational | 26 | % |

| Foreign currency translation | 1 | % |

| |

| |

| Total % change | 27 | % |

The operational profit increase of 26% was primarily attributable to ongoing customer demand in certain end-markets compared with the prior year. In addition, favorable productivity initiatives and pricing improvements further benefited segment results. These benefits were partially offset by increased research and development expenditures as well as lower earnings from equity method investments.

Climate Solutions Europe

For the year ended December 31, 2024, Net sales were $5.0 billion, a 157% increase compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Net sales |

| Organic / Operational | — | % |

| Foreign currency translation | 1 | % |

| Acquisitions and divestitures, net | 156 | % |

| |

| Total % change | 157 | % |

Organic Net sales were flat as a result of mixed results across the segment compared with the prior year. Results in our commercial business (up 13%) benefited from ongoing end-market demand and pricing improvements. This growth was offset by results in our residential and light commercial business (down 16%) due to lower volumes across the region as economic conditions, inflationary cost pressures and regulatory uncertainty impacted end-market demand.

On January 2, 2024, we acquired the VCS Business, a leading manufacturer of high efficiency heating and renewable energy systems in Europe. The results of the VCS Business have been included in our Consolidated Financial Statements since the date of acquisition and primarily recorded in the Climate Solutions Europe segment. The transaction added 154% to Net sales for the year ended December 31, 2024, and is included in Acquisitions and divestitures, net.

For the year ended December 31, 2024, Segment operating profit was $469 million, a 165% increase compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Segment operating profit |

| Organic / Operational | 2 | % |

| |

| Acquisitions and divestitures, net | 163 | % |

| |

| Total % change | 165 | % |

The segment operational profit increase of 2% was primarily attributable to favorable productivity initiatives and pricing improvements. In addition, results further benefited from increased demand in certain end-markets but were offset by reduced demand in other end-markets.

Results from the VCS Business acquisition added 157% to Segment operating profit for the year ended December 31, 2024, and is included in Acquisitions and divestitures, net.

Climate Solutions Asia Pacific, Middle East & Africa

For the year ended December 31, 2024, Net sales were $3.5 billion, a 2% decrease compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Net sales |

| Organic / Operational | (3) | % |

| Foreign currency translation | (2) | % |

| Acquisitions and divestitures, net | 3 | % |

| |

| Total % change | (2) | % |

The organic decrease in Net sales of 3% was driven by volume reductions within certain end-markets compared with the prior year. Results in China decreased (down 10%) as both commercial and residential end-markets experienced economic challenges impacting demand. These results were partially offset by improved end-market demand in the remaining region.

For the year ended December 31, 2024, Segment operating profit was $466 million, a 29% increase compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Segment operating profit |

| Organic / Operational | 22 | % |

| Foreign currency translation | (1) | % |

| Acquisitions and divestitures, net | 8 | % |

| |

| Total % change | 29 | % |

The segment operational profit increase of 22% was primarily attributable to favorable productivity initiatives and pricing improvements across the region. In addition, the segment benefited from higher earnings from equity method investments compared with the prior year. These benefits were partially offset by volume reductions in certain end-markets.

Climate Solutions Transportation

For the year ended December 31, 2024, Net sales were $3.5 billion, a 9% decrease compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Net sales |

| Organic / Operational | (1) | % |

| |

| Acquisitions and divestitures, net | (8) | % |

| |

| Total % change | (9) | % |

The organic decrease in Net sales of 1% was primarily driven by volume reductions within certain end-markets compared with the prior year. Transport results decreased (down 8%) compared to the prior year primarily due to lower end-market demand in North America. The reduction was partially offset by higher volumes in Asia and Europe. Results in the Container business (up 24%) was primarily driven by strong end-market demand and improved pricing.

On October 1, 2024, we divested CCR, a global supplier of turnkey solutions for commercial refrigeration systems and services. The results of CCR are excluded from our Consolidated Financial Statements subsequent to the divestiture date. The transaction reduced Net Sales by 8% for the year ended December 31, 2024, and is included in Acquisitions and divestitures, net.

For the year ended December 31, 2024, Segment operating profit was $485 million, a 2% decrease compared with the same period of 2023. The components of the year-over-year change were as follows:

| | | | | |

| Segment operating profit |

| Organic / Operational | 3 | % |

| Foreign currency translation | (1) | % |

| Acquisitions and divestitures, net | (4) | % |

| |

| Total % change | (2) | % |

The segment increase in operational profit of 3% was primarily driven by favorable productivity initiatives and price improvements compared with the prior year. In addition, volume growth in certain end-markets further benefited the segment. These amounts were partially offset by volume reductions in certain other end-markets. Amounts reported in Other represent $10 million of divestiture-related costs associated with the sale of CCR. In addition, the prior year includes a $24 million gain on the sale of a business within the Transport business.

Year Ended December 31, 2023 Compared with Year Ended December 31, 2022

Summary performance for each of our segments is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net sales | | | | Segment operating profit | | | | Segment operating profit margin |

| (In millions) | | | 2023 | | 2022 | | | | | | 2023 | | 2022 | | | | | | 2023 | | 2022 | | |

| Climate Solutions Americas | | | $ | 9,615 | | | $ | 9,153 | | | | | | | $ | 1,831 | | | $ | 1,557 | | | | | | | 19.0 | % | | 17.0 | % | | |

| Climate Solutions Europe | | | 1,937 | | | 1,631 | | | | | | | 177 | | | 96 | | | | | | | 9.1 | % | | 5.9 | % | | |

| Climate Solutions Asia Pacific, Middle East & Africa | | | 3,581 | | | 2,621 | | | | | | | 361 | | | 297 | | | | | | | 10.1 | % | | 11.3 | % | | |

| Climate Solutions Transportation | | | 3,818 | | | 3,883 | | | | | | | 494 | | | 523 | | | | | | | 12.9 | % | | 13.5 | % | | |

| Total segment | | | $ | 18,951 | | | $ | 17,288 | | | | | | | $ | 2,863 | | | $ | 2,473 | | | | | | | 15.1 | % | | 14.3 | % | | |

A reconciliation of Segment operating profit to Adjusted operating profit is as follows:

| | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| (In millions) | | 2023 | | 2022 |

| Segment operating profit | | $ | 2,863 | | | $ | 2,473 | |

| Corporate and other | | (214) | | | (126) | |

| Adjusted operating profit | | $ | 2,649 | | | $ | 2,347 | |

Climate Solutions Americas