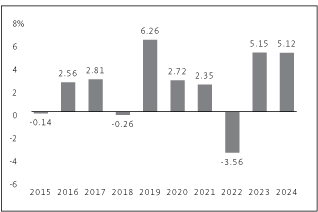

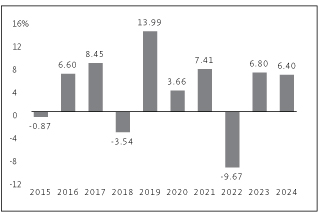

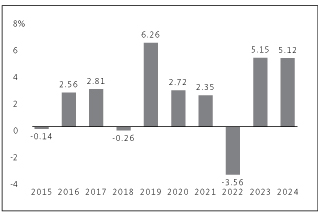

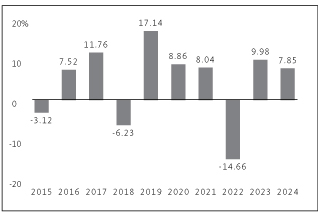

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 3.24% (12/31/2023) Worst Quarter: -2.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.43%. |

||||||

|

|

Best Quarter: 3.24% (12/31/2023) Worst Quarter: -2.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.43%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg 1-3 Month Treasury Bill Index (20%), the Russell 3000 Index (5%) and the MSCI ACWI ex-USA Index (5%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Defensive Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.12 |

% |

2.31 |

% |

2.26 |

% |

2.31 |

% |

|||||||||||

|

Return After Taxes on Distributions |

3.41 |

% |

1.03 |

% |

1.28 |

% |

1.38 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.06 |

% |

1.26 |

% |

1.34 |

% |

1.44 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

5.55 |

% |

2.61 |

% |

2.44 |

% |

2.79 |

% |

|||||||||||

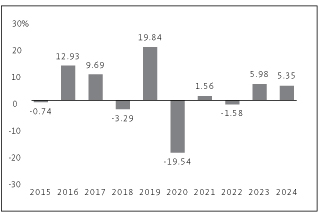

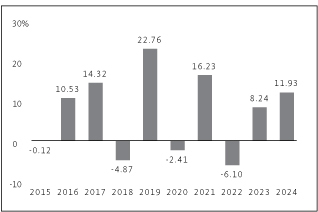

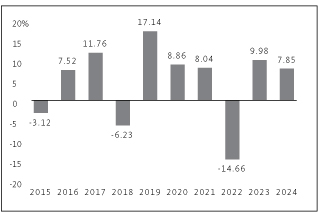

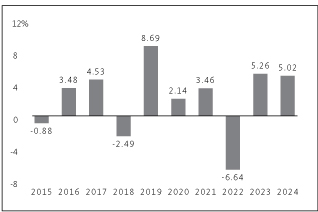

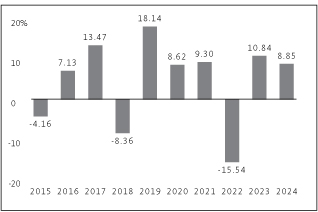

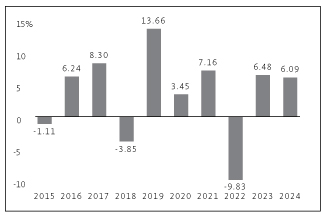

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 10.12% (3/31/2019) Worst Quarter: -22.83% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 2.21%. |

||||||

|

|

Best Quarter: 10.12% (3/31/2019) Worst Quarter: -22.83% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 2.21%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US 3-Month Treasury Bill Index (USD) (80%) and the ICE BofA US High Yield Constrained Index (USD) (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Defensive Strategy Allocation Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.35 |

% |

-2.13 |

% |

2.50 |

% |

5.18 |

% |

|||||||||||

|

Return After Taxes on Distributions |

3.26 |

% |

-3.49 |

% |

0.68 |

% |

3.43 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.14 |

% |

-2.18 |

% |

1.30 |

% |

3.49 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

5.84 |

% |

2.85 |

% |

2.47 |

% |

2.69 |

% |

|||||||||||

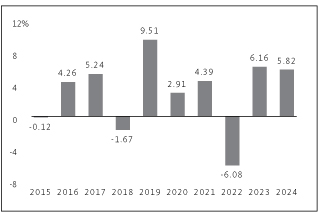

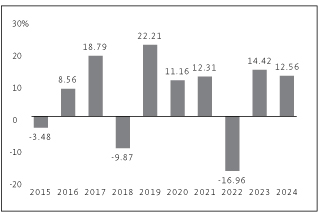

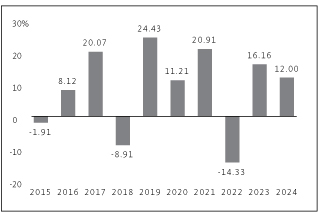

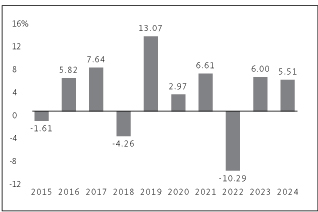

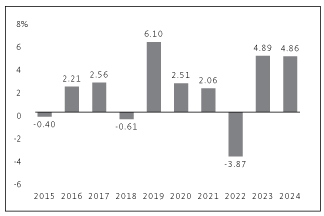

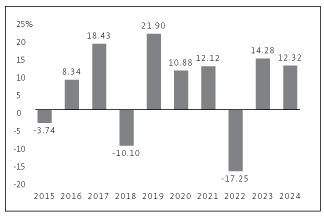

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 4.98% (6/30/2020) Worst Quarter: -6.54% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.76%. |

||||||

|

|

Best Quarter: 4.98% (6/30/2020) Worst Quarter: -6.54% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.76%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg U.S. Aggregate Bond Index (10%), the Russell 3000 Index (10%) and the MSCI ACWI ex-USA Index (10%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Conservative Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.82 |

% |

2.54 |

% |

2.95 |

% |

3.21 |

% |

|||||||||||

|

Return After Taxes on Distributions |

4.20 |

% |

1.18 |

% |

1.81 |

% |

2.10 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.51 |

% |

1.45 |

% |

1.84 |

% |

2.08 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

6.04 |

% |

3.06 |

% |

3.15 |

% |

3.70 |

% |

|||||||||||

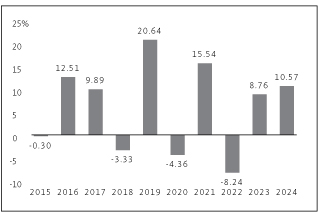

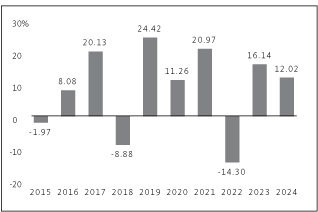

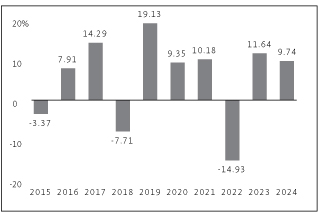

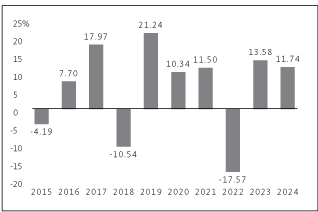

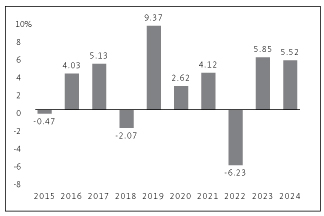

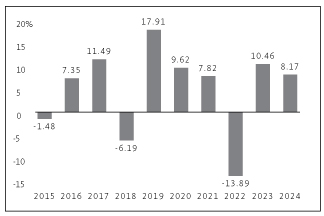

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 10.54% (3/31/2019) Worst Quarter: -20.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.91%. |

||||||

|

|

Best Quarter: 10.54% (3/31/2019) Worst Quarter: -20.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.91%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US 3-Month Treasury Bill Index (USD) (20%), the ICE BofA US High Yield Constrained Index (USD) (30%) and the S&P 500 Index (50%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Conservative Strategy Allocation Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

10.57 |

% |

4.05 |

% |

5.77 |

% |

7.15 |

% |

|||||||||||

|

Return After Taxes on Distributions |

7.72 |

% |

1.86 |

% |

3.31 |

% |

5.19 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

6.84 |

% |

2.29 |

% |

3.66 |

% |

5.09 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

15.82 |

% |

9.15 |

% |

8.56 |

% |

7.82 |

% |

|||||||||||

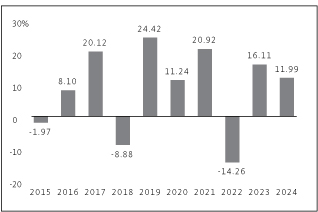

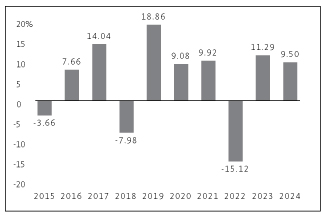

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 7.10% (6/30/2020) Worst Quarter: -10.05% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.29%. |

||||||

|

|

Best Quarter: 7.10% (6/30/2020) Worst Quarter: -10.05% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.29%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (35%), the Bloomberg U.S. Aggregate Bond Index (30%), the Russell 3000 Index (20%) and the MSCI ACWI ex-USA Index (15%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Moderate Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

6.40 |

% |

2.70 |

% |

3.71 |

% |

4.34 |

% |

|||||||||||

|

Return After Taxes on Distributions |

5.01 |

% |

1.10 |

% |

2.38 |

% |

3.07 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.88 |

% |

1.54 |

% |

2.39 |

% |

2.98 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

7.33 |

% |

4.07 |

% |

4.40 |

% |

4.99 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 11.20% (6/30/2020) Worst Quarter: -22.05% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.01%. |

||||||

|

|

Best Quarter: 11.20% (6/30/2020) Worst Quarter: -22.05% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.01%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US 3-Month Treasury Bill Index (USD) (15%), the ICE BofA US High Yield Constrained Index (USD) (20%), the S&P 500 Index (60%) and the MSCI EAFE Index (5%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Moderate Strategy Allocation Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

11.93 |

% |

5.23 |

% |

6.64 |

% |

7.37 |

% |

|||||||||||

|

Return After Taxes on Distributions |

8.29 |

% |

2.55 |

% |

4.34 |

% |

5.75 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

8.50 |

% |

3.42 |

% |

4.66 |

% |

5.61 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

17.43 |

% |

10.30 |

% |

9.53 |

% |

8.43 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 15.83% (6/30/2020) Worst Quarter: -19.73% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.58%. |

||||||

|

|

Best Quarter: 15.83% (6/30/2020) Worst Quarter: -19.73% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.58%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Russell 3000 Index (50%), the MSCI ACWI ex-USA Index (30%) and the Bloomberg U.S. Aggregate Bond Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Aggressive Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

12.56 |

% |

5.95 |

% |

6.23 |

% |

6.24 |

% |

|||||||||||

|

Return After Taxes on Distributions |

11.89 |

% |

3.87 |

% |

4.70 |

% |

4.97 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

7.50 |

% |

4.07 |

% |

4.49 |

% |

4.70 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

13.53 |

% |

8.21 |

% |

8.12 |

% |

7.95 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 18.35% (6/30/2020) Worst Quarter: -22.88% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.16%. |

||||||

|

|

Best Quarter: 18.35% (6/30/2020) Worst Quarter: -22.88% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.16%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US High Yield Constrained Index (USD) (5%), the S&P 500 Index (80%) and the MSCI EAFE Index (15%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

Tax-Managed Aggressive Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

12.02 |

% |

8.46 |

% |

8.03 |

% |

7.69 |

% |

|||||||||||

|

Return After Taxes on Distributions |

10.60 |

% |

6.85 |

% |

6.90 |

% |

6.85 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

7.90 |

% |

6.33 |

% |

6.24 |

% |

6.26 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

20.81 |

% |

12.55 |

% |

11.54 |

% |

9.81 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 11.01% (6/30/2020) Worst Quarter: -13.12% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.51%. |

||||||

|

|

Best Quarter: 11.01% (6/30/2020) Worst Quarter: -13.12% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.51%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (50%), the Russell 3000 Index (30%) and the MSCI ACWI ex-USA Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Core Market Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

7.85 |

% |

3.55 |

% |

4.29 |

% |

4.87 |

% |

|||||||||||

|

Return After Taxes on Distributions |

6.69 |

% |

1.55 |

% |

2.58 |

% |

3.35 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

4.72 |

% |

2.13 |

% |

2.77 |

% |

3.34 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

8.58 |

% |

4.99 |

% |

5.59 |

% |

6.22 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 18.33% (6/30/2020) Worst Quarter: -22.91% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.12%. |

||||||

|

|

Best Quarter: 18.33% (6/30/2020) Worst Quarter: -22.91% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.12%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US High Yield Constrained Index (USD) (10%), the S&P 500 Index (75%) and the MSCI EAFE Index (15%) because the Adviser believes the Blended Benchmark better reflects the Fund's investment strategy. The foregoing indexes, when considered together, may provide investors with a useful comparison of the Fund's overall performance.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

Core Market Strategy Allocation Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

12.00 |

% |

8.43 |

% |

8.02 |

% |

7.29 |

% |

|||||||||||

|

Return After Taxes on Distributions |

8.99 |

% |

6.18 |

% |

6.47 |

% |

6.21 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

9.02 |

% |

6.28 |

% |

6.18 |

% |

5.85 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

19.96 |

% |

12.04 |

% |

11.15 |

% |

9.63 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 12.89% (6/30/2020) Worst Quarter: -15.97% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.63%. |

||||||

|

|

Best Quarter: 12.89% (6/30/2020) Worst Quarter: -15.97% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.63%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (40%), the Russell 3000 Index (35%) and the MSCI ACWI ex-USA Index (25%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Market Growth Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

9.74 |

% |

4.66 |

% |

5.11 |

% |

5.35 |

% |

|||||||||||

|

Return After Taxes on Distributions |

8.24 |

% |

2.57 |

% |

3.55 |

% |

3.98 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

6.19 |

% |

3.01 |

% |

3.51 |

% |

3.84 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

9.92 |

% |

5.92 |

% |

6.32 |

% |

6.75 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 18.33% (6/30/2020) Worst Quarter: -22.92% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.16%. |

||||||

|

|

Best Quarter: 18.33% (6/30/2020) Worst Quarter: -22.92% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.16%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the ICE BofA US High Yield Constrained Index (USD) (10%), the S&P 500 Index (75%) and the MSCI EAFE Index (15%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

Market Growth Strategy Allocation Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

11.99 |

% |

8.44 |

% |

8.03 |

% |

7.49 |

% |

|||||||||||

|

Return After Taxes on Distributions |

10.07 |

% |

6.63 |

% |

6.84 |

% |

6.60 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

8.23 |

% |

6.31 |

% |

6.25 |

% |

6.07 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

19.96 |

% |

12.04 |

% |

11.15 |

% |

9.63 |

% |

|||||||||||

As of July 31, 2025, the Class D Shares of the Fund had not commenced operations. The bar chart and the performance table below provide some indication of the risks of investing in the Class D Shares of the Fund by showing changes in the Fund's Class F Shares performance from year to year for the past ten calendar years and by showing how the Fund's Class F Shares average annual returns for 1, 5 and 10 years, and since the Fund's Class F Shares inception, compared with those of a broad measure of market performance. Since Class D Shares are invested in the same portfolio of securities, returns for Class D Shares will be substantially similar to those of Class F Shares, shown here, and will differ only to the extent that Class D Shares have higher expenses. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 3.24% 12/31/2023 Worst Quarter: -2.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.43%. |

||||||

|

|

Best Quarter: 3.24% 12/31/2023 Worst Quarter: -2.70% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.43%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg 1-3 Month Treasury Bill Index (20%), the Russell 3000 Index (5%) and the MSCI ACWI ex-USA Index (5%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Defensive Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.12 |

% |

2.31 |

% |

2.26 |

% |

2.31 |

% |

|||||||||||

|

Return After Taxes on Distributions |

3.41 |

% |

1.03 |

% |

1.28 |

% |

1.38 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.06 |

% |

1.26 |

% |

1.34 |

% |

1.44 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

5.55 |

% |

2.61 |

% |

2.44 |

% |

2.79 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 4.88% (6/30/2020) Worst Quarter: -6.72% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.36%. |

||||||

|

|

Best Quarter: 4.88% (6/30/2020) Worst Quarter: -6.72% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.36%. |

||||||

This table compares the Fund's average annual total returns to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg U.S. Aggregate Bond Index (10%), the Russell 3000 Index (10%) and the MSCI ACWI ex-USA Index (10%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Conservative Strategy Fund* |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.02 |

% |

1.75 |

% |

2.17 |

% |

2.22 |

% |

|||||||||||

|

Return After Taxes on Distributions |

3.72 |

% |

0.70 |

% |

1.34 |

% |

1.31 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.03 |

% |

0.97 |

% |

1.36 |

% |

1.38 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

6.04 |

% |

3.06 |

% |

3.15 |

% |

3.70 |

% |

|||||||||||

* The Fund's Class D Shares commenced operations on March 25, 2011. For periods prior to March 25, 2011, the performance of the Fund's Class F Shares, adjusted for the higher total annual fund operating expenses of the Class D Shares has been used. Returns for Class D Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class D Shares have higher total annual fund operating expenses than Class F Shares.

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 6.89% (6/30/2020) Worst Quarter: -10.14% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 5.98%. |

||||||

|

|

Best Quarter: 6.89% (6/30/2020) Worst Quarter: -10.14% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 5.98%. |

||||||

This table compares the Fund's average annual total returns to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (35%), the Bloomberg U.S. Aggregate Bond Index (30%), the Russell 3000 Index (20%) and the MSCI ACWI ex-USA Index (15%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Moderate Strategy Fund* |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.51 |

% |

1.95 |

% |

2.94 |

% |

3.36 |

% |

|||||||||||

|

Return After Taxes on Distributions |

4.50 |

% |

0.66 |

% |

1.91 |

% |

2.28 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.33 |

% |

1.10 |

% |

1.92 |

% |

2.24 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

7.33 |

% |

4.07 |

% |

4.40 |

% |

4.99 |

% |

|||||||||||

* The Fund's Class D Shares commenced operations on March 25, 2011. For periods prior to March 25, 2011, the performance of the Fund's Class F Shares, adjusted for the higher total annual fund operating expenses of the Class D Shares has been used. Returns for Class D Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class D Shares have higher total annual fund operating expenses than Class F Shares.

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 15.59% (6/30/2020) Worst Quarter: -19.83% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.19%. |

||||||

|

|

Best Quarter: 15.59% (6/30/2020) Worst Quarter: -19.83% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.19%. |

||||||

This table compares the Fund's average annual total returns to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Russell 3000 Index (50%), the MSCI ACWI ex-USA Index (30%) and the Bloomberg U.S. Aggregate Bond Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Aggressive Strategy Fund* |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

11.74 |

% |

5.18 |

% |

5.44 |

% |

5.25 |

% |

|||||||||||

|

Return After Taxes on Distributions |

11.33 |

% |

3.28 |

% |

4.12 |

% |

4.06 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

6.99 |

% |

3.55 |

% |

3.94 |

% |

3.86 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

13.53 |

% |

8.21 |

% |

8.12 |

% |

7.95 |

% |

|||||||||||

* The Fund's Class D Shares commenced operations on March 25, 2011. For periods prior to March 25, 2011, the performance of the Fund's Class F Shares, adjusted for the higher total annual fund operating expenses of the Class D Shares has been used. Returns for Class D Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class D Shares have higher total annual fund operating expenses than Class F Shares.

As of July 31, 2025, the Class D Shares of the Fund had not commenced operations. The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's Class F Shares performance from year to year for the past ten calendar years and by showing how the Fund's Class F Shares average annual returns for 1, 5 and 10 years, and since the Fund's Class F Shares inception, compared with those of a broad measure of market performance. Since Class D Shares are invested in the same portfolio of securities, returns for Class D Shares will be substantially similar to those of Class F Shares, shown here, and will differ only to the extent that Class D Shares have higher expenses. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 11.01% (6/30/2020) Worst Quarter: -13.12% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.51%. |

||||||

|

|

Best Quarter: 11.01% (6/30/2020) Worst Quarter: -13.12% (3/31/2020) The Fund's Class F total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.51%. |

||||||

This table compares the Fund's average annual total returns for Class F Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (50%), the Russell 3000 Index (30%) and the MSCI ACWI ex-USA Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Core Market Strategy Fund — Class F |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

7.85 |

% |

3.55 |

% |

4.29 |

% |

4.87 |

% |

|||||||||||

|

Return After Taxes on Distributions |

6.69 |

% |

1.55 |

% |

2.58 |

% |

3.35 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

4.72 |

% |

2.13 |

% |

2.77 |

% |

3.34 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

8.58 |

% |

4.99 |

% |

5.59 |

% |

6.22 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 12.62% (6/30/2020) Worst Quarter: -16.04% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.30%. |

||||||

|

|

Best Quarter: 12.62% (6/30/2020) Worst Quarter: -16.04% (3/31/2020) The Fund's Class D total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.30%. |

||||||

This table compares the Fund's average annual total returns to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (40%), the Russell 3000 Index (35%) and the MSCI ACWI ex-USA Index (25%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Market Growth Strategy Fund* |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

8.85 |

% |

3.88 |

% |

4.32 |

% |

4.36 |

% |

|||||||||||

|

Return After Taxes on Distributions |

7.74 |

% |

2.08 |

% |

3.04 |

% |

3.15 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

5.64 |

% |

2.54 |

% |

3.01 |

% |

3.07 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

9.92 |

% |

5.92 |

% |

6.32 |

% |

6.75 |

% |

|||||||||||

* The Fund's Class D Shares commenced operations on March 25, 2011. For periods prior to March 25, 2011, the performance of the Fund's Class F Shares, adjusted for the higher total annual fund operating expenses of the Class D Shares has been used. Returns for Class D Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class D Shares have higher total annual fund operating expenses than Class F Shares.

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 3.17% (12/31/2023) Worst Quarter: -2.85% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.33%. |

||||||

|

|

Best Quarter: 3.17% (12/31/2023) Worst Quarter: -2.85% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 3.33%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg 1-3 Month Treasury Bill Index (20%), the Russell 3000 Index (5%) and the MSCI ACWI ex-USA Index (5%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Defensive Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

4.86 |

% |

2.04 |

% |

1.99 |

% |

2.07 |

% |

|||||||||||

|

Return After Taxes on Distributions |

3.21 |

% |

0.84 |

% |

1.10 |

% |

1.19 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

2.91 |

% |

1.10 |

% |

1.17 |

% |

1.27 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

5.55 |

% |

2.61 |

% |

2.44 |

% |

2.79 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 4.91% (6/30/2020) Worst Quarter: -6.59% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.68%. |

||||||

|

|

Best Quarter: 4.91% (6/30/2020) Worst Quarter: -6.59% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 4.68%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (70%), the Bloomberg U.S. Aggregate Bond Index (10%), the Russell 3000 Index (10%) and the MSCI ACWI ex-USA Index (10%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Conservative Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

5.52 |

% |

2.27 |

% |

2.69 |

% |

3.04 |

% |

|||||||||||

|

Return After Taxes on Distributions |

4.04 |

% |

1.05 |

% |

1.68 |

% |

2.04 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.33 |

% |

1.30 |

% |

1.70 |

% |

2.00 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

6.04 |

% |

3.06 |

% |

3.15 |

% |

3.70 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 6.99% (6/30/2020) Worst Quarter: -10.00% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.17%. |

||||||

|

|

Best Quarter: 6.99% (6/30/2020) Worst Quarter: -10.00% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 6.17%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg 1-3 Year Government/Credit Index (35%), the Bloomberg U.S. Aggregate Bond Index (30%), the Russell 3000 Index (20%) and the MSCI ACWI ex-USA Index (15%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Moderate Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

6.09 |

% |

2.46 |

% |

3.45 |

% |

4.20 |

% |

|||||||||||

|

Return After Taxes on Distributions |

4.86 |

% |

1.00 |

% |

2.26 |

% |

3.05 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.69 |

% |

1.41 |

% |

2.25 |

% |

2.92 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

7.33 |

% |

4.07 |

% |

4.40 |

% |

4.99 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 15.81% (6/30/2020) Worst Quarter: -19.77% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.43%. |

||||||

|

|

Best Quarter: 15.81% (6/30/2020) Worst Quarter: -19.77% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 10.43%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Russell 3000 Index (50%), the MSCI ACWI ex-USA Index (30%) and the Bloomberg U.S. Aggregate Bond Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Aggressive Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

12.32 |

% |

5.72 |

% |

5.98 |

% |

5.94 |

% |

|||||||||||

|

Return After Taxes on Distributions |

11.73 |

% |

3.66 |

% |

4.49 |

% |

4.71 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

7.35 |

% |

3.91 |

% |

4.31 |

% |

4.46 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

13.53 |

% |

8.21 |

% |

8.12 |

% |

7.95 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 11.33% (6/30/2020) Worst Quarter: -13.06% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.57%. |

||||||

|

|

Best Quarter: 11.33% (6/30/2020) Worst Quarter: -13.06% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 7.57%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (50%), the Russell 3000 Index (30%) and the MSCI ACWI ex-USA Index (20%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Core Market Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

8.17 |

% |

3.99 |

% |

4.72 |

% |

5.17 |

% |

|||||||||||

|

Return After Taxes on Distributions |

7.20 |

% |

2.27 |

% |

3.31 |

% |

3.83 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

4.90 |

% |

2.56 |

% |

3.24 |

% |

3.67 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index Return (reflects no deduction for fees, expenses or taxes) |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.08 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

8.58 |

% |

4.99 |

% |

5.59 |

% |

6.22 |

% |

|||||||||||

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 12.74% (6/30/2020) Worst Quarter: -15.99% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.49%. |

||||||

|

|

Best Quarter: 12.74% (6/30/2020) Worst Quarter: -15.99% (3/31/2020) The Fund's Class I total return (pre-tax) from January 1, 2025 to June 30, 2025 was 8.49%. |

||||||

This table compares the Fund's average annual total returns for Class I Shares to those of an appropriate broad-based index and an additional index with characteristics relevant to the Fund's investment strategy. The additional index is the Fund's Blended Benchmark index, which consists of the Bloomberg U.S. Aggregate Bond Index (40%), the Russell 3000 Index (35%) and the MSCI ACWI ex-USA Index (25%).

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Market Growth Strategy Fund — Class I |

1 Year |

5 Years |

10 Years |

Since Inception (11/17/2003) |

|||||||||||||||

|

Return Before Taxes |

9.50 |

% |

4.40 |

% |

4.84 |

% |

5.08 |

% |

|||||||||||

|

Return After Taxes on Distributions |

8.07 |

% |

2.37 |

% |

3.36 |

% |

3.78 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

6.05 |

% |

2.84 |

% |

3.34 |

% |

3.65 |

% |

|||||||||||

|

S&P 500 Index Return (reflects no deduction for fees, expenses or taxes) |

25.02 |

% |

14.53 |

% |

13.10 |

% |

10.65 |

% |

|||||||||||

|

Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

9.92 |

% |

5.92 |

% |

6.32 |

% |

6.75 |

% |

|||||||||||