Exhibit 99.1

Semi-Annual Report

As of and for the six months ended June 30, 2025

TABLE OF CONTENTS

Cautionary Statements Concerning Forward Looking Statements

Statements contained in this Semi-Annual Report, particularly those regarding possible or assumed future performance, competitive strengths, costs, dividends, reserves, our growth, industry growth and other trends and projections and estimated company earnings are “forward-looking statements” that contain risks and uncertainties. In some cases, words such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms are used to identify forward-looking statements. These forward-looking statements reflect our current views with respect to future events and involve significant risks and uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, without limitation:

•our ability to launch new products successfully and to maintain vehicle shipment volumes;

•changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality;

•our ability to successfully manage the industry-wide transition from internal combustion engines to full electrification;

•our ability to offer innovative, attractive products, and to develop, manufacture and sell vehicles with advanced features, including enhanced electrification, connectivity and autonomous-driving characteristics;

•our ability to produce or procure electric batteries with competitive performance, cost and at required volumes;

•our ability to successfully launch new businesses and integrate acquisitions;

•a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in our vehicles;

•exchange rate fluctuations, interest rate changes, credit risk and other market risks;

•increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in our vehicles;

•changes in local economic and political conditions;

•changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in laws and regulations;

•the level of governmental economic incentives available to support the adoption of battery electric vehicles;

•the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions;

•various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits;

•material operating expenditures in relation to compliance with environmental, health and safety regulations;

•the level of competition in the automotive industry, which may increase due to consolidation and new entrants;

•our ability to attract and retain experienced management and employees;

•exposure to shortfalls in the funding of our defined benefit pension plans;

•our ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies;

•our ability to access funding to execute our business plan;

•our ability to realize anticipated benefits from joint venture arrangements;

•disruptions arising from political, social and economic instability;

•risks associated with our relationships with employees, dealers and suppliers;

•our ability to maintain effective internal controls over financial reporting;

•developments in labor and industrial relations and developments in applicable labor laws;

•earthquakes or other disasters; and

•other factors discussed elsewhere in this report.

Furthermore, in light of the inherent difficulty in forecasting future results, any estimates or forecasts of particular periods that are provided in this report are uncertain. We expressly disclaim and do not assume any liability in connection with any inaccuracies in any of the forward-looking statements in this report or in connection with any use by any third party of such forward-looking statements. Actual results could differ materially from those anticipated in such forward-looking statements. We do not undertake an obligation to update or revise publicly any forward-looking statements.

Additional factors which could cause actual results and developments to differ from those expressed or implied by the forward-looking statements are included in the section — Risks and uncertainties of this Semi-Annual Report.

CERTAIN DEFINED TERMS

In this Semi-Annual Report, unless otherwise specified, the terms “we”, “our”, “us”, the “Company” and “Stellantis” refer to Stellantis N.V., together with its consolidated subsidiaries, or any one or more of them, as the context may require.

References to “FCA” and “FCA N.V.” mean Fiat Chrysler Automobiles N.V. or Fiat Chrysler Automobiles N.V. together with its consolidated subsidiaries, or any one or more of them, as the context may require.

References to “PSA” and “Groupe PSA” mean Peugeot S.A. or Peugeot S.A. together with its consolidated subsidiaries, or any one or more of them, as the context may require.

References to the “merger” refer to the merger between PSA and FCA completed on January 16, 2021 and resulting in the creation of Stellantis.

All references in this Semi-Annual Report to “Euro” and “€” refer to the currency issued by the European Central Bank. Stellantis’ financial information is presented in Euro. All references to “U.S. Dollars”, “U.S. Dollar”, “USD” and “$” refer to the currency of the United States of America (“U.S.”). All figures shown are rounded to the nearest million. Certain totals in the tables included in this report may not add due to rounding.

The Semi-Annual Report is filed with the Dutch Authority for Financial Markets (Autoriteit Financiële Markten, the “AFM”) and is furnished to the U.S. Securities and Exchange Commission (“SEC”) on Form 6-K.

MANAGEMENT DISCUSSION AND ANALYSIS

Highlights

| | | | | | | | | | | | | | | | |

| | | | | |

| | Six months ended June 30, | | |

| (€ million, except shipments, which are in thousands of units, and per share amounts) | | 2025 | | 2024 | | |

Combined shipments(1) | | 2,690 | | | 2,931 | | | |

Consolidated shipments(2) | | 2,664 | | | 2,872 | | | |

| | | | | | |

Net revenues | | 74,261 | | | 85,017 | | | |

Net profit/(loss) | | (2,256) | | | 5,647 | | | |

| | | | | | |

| | | | | | |

Adjusted operating income (“AOI”)(3) | | 540 | | | 8,463 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Earnings/(loss) per share (“EPS”)(4) | | | | | | |

Basic (loss)/earnings per share (€) | | (0.78) | | | 1.87 | | | |

Diluted (loss)/earnings per share (€) | | (0.78) | | | 1.86 | | | |

Adjusted diluted earnings/(loss) per share (€)(5) | | 0.18 | | | 2.36 | | | |

| | | | | | |

Ordinary dividends, per share (€) | | 0.68 | | | 1.55 | | | |

| | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | Six months ended June 30, | | |

| (€ million) | | 2025 | | 2024 | | |

Net cash from/(used in) operating activities(6) | | € | (2,287) | | | € | 3,970 | | | |

| | | | | | |

| | | | | | |

Industrial free cash flows(7) | | (3,005) | | | (392) | | | |

| | | | | | | | | | | | | | | | |

| (€ million) | | | | At June 30, 2025 | | At December 31, 2024 |

| Available liquidity | | | | € | 49,736 | | | € | 51,780 | |

| Of which: Industrial Available liquidity | | | | 47,228 | | | 49,481 | |

Industrial net financial position(7) | | | | 8,992 | | | 15,128 | |

________________________________________________________________________________________________________________________________________________

(1) Combined shipments include shipments from Stellantis' consolidated subsidiaries and unconsolidated joint ventures

(2) Consolidated shipments only include shipments from Stellantis' consolidated subsidiaries

(3) Refer to sections — Non-GAAP Financial Measures, Company results and Results by segment in this Semi-Annual Report for further discussion

(4) Refer to Note 22, Earnings/(loss) per share, in the Semi-Annual Condensed Consolidated Financial Statements included in this Semi-Annual Report

(5) Refer to sections — Non-GAAP Financial Measures and Company Results in this Semi-Annual Report for further discussion

(6) Refer to Note 1, Basis of preparation, in the Semi-Annual Condensed Consolidated Financial Statements included in this Semi-Annual Report

(7) Refer to sections — Non-GAAP Financial Measures and Liquidity and capital resources in this Semi-Annual Report for further discussion

Non-GAAP financial measures

We monitor our operations through the use of several non-generally accepted accounting principles (“non-GAAP”) financial measures: Adjusted operating income, Adjusted operating income margin, Industrial free cash flows and Industrial net financial position. We believe that these non-GAAP financial measures provide useful and relevant information regarding our operating results and enhance the overall ability to assess our financial performance and financial position. They provide us with comparable measures which facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions. We also present the non-GAAP measure, Adjusted diluted EPS which is not used to monitor our operations but which we believe provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. These and similar measures are widely used in the industry in which we operate, however, these financial measures may not be comparable to other similarly titled measures of other companies and are not intended to be substitutes for measures of financial performance as prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), as well as IFRS as adopted by the European Union.

Adjusted operating income/(loss): Adjusted operating income/(loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company's ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit).

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company's ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to:

•Impacts from strategic decisions to rationalize Stellantis’ core operations;

•Facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand; and

•Convergence and integration costs directly related to significant acquisitions or mergers.

Adjusted operating income/(loss) is used for internal reporting to assess performance and as part of the Company's forecasting, budgeting and decision making processes as it provides additional transparency to the Company's core operations. We believe this non-GAAP measure is useful because it excludes items that we do not believe are indicative of the Company’s ongoing operating performance and allows management to view operating trends, perform analytical comparisons and benchmark performance between periods and among our segments. We also believe that Adjusted operating income/(loss) is useful for analysts and investors to understand how management assesses the Company’s ongoing operating performance on a consistent basis. In addition, Adjusted operating income/(loss) is one of the metrics used in the determination of the annual performance bonus for eligible employees, including members of the senior management.

Refer to the sections “Company results” and “Results by segment” below for further discussion and for a reconciliation of this non-GAAP measure to Net profit/(loss), which is the most directly comparable measure included in our Semi-Annual Condensed Consolidated Income Statement. Adjusted operating income/(loss) should not be considered as a substitute for Net profit/(loss), cash flow or other methods of analyzing our results as reported under IFRS.

Adjusted operating income/(loss) margin: is calculated as Adjusted operating income/(loss) divided by Net revenues.

Adjusted diluted earnings per share: is calculated by adjusting Diluted earnings per share for the post-tax impact per share of the same items excluded from Adjusted operating income as well as tax expense/(benefit) items that are considered rare or infrequent, or whose nature would distort the presentation of the ongoing tax charge of the Company. We believe this non-GAAP measure is useful because it also excludes items that we do not believe are indicative of the Company’s ongoing operating performance and provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. Refer to the section “Company results” below for a reconciliation of this non-GAAP measure to Diluted earnings per share from operations, which is the most directly comparable measure included in our Semi-Annual Condensed Consolidated Financial Statements. Adjusted diluted EPS should not be considered as a substitute for Basic earnings per share, Diluted earnings per share from operations or other methods of analyzing our quality of earnings as reported under IFRS.

Industrial free cash flows: is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities and (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition, Industrial free cash flows is one of the metrics used in the determination of the annual performance bonus for eligible employees, including members of the senior management. We believe that this measure is useful for investors to facilitate their review and evaluation of the cash generation of our industrial operations, net of investing needs.

Refer to “Liquidity and capital resources” — “Industrial free cash flows” for further information and the reconciliation of this non-GAAP measure to Cash flows from operating activities, which is the most directly comparable measure included in our Semi-Annual Condensed Consolidated Statement of Cash Flows. Industrial free cash flows should not be considered as a substitute for Net profit/(loss), cash flow or other methods of analyzing our results as reported under IFRS.

Industrial net financial position is calculated as: Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents; (ii) financial securities that are considered liquid; (iii) current financial receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale. We believe it is useful for investors to report the Industrial net financial position to assist in comparability with the industrial operations of our peers. Refer to “Liquidity and capital resources” — “Industrial net financial position” for further information.

Company results

The following is a discussion of the Company's results of operations for the six months ended June 30, 2025 compared to the six months ended June 30, 2024.

| | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | |

| (€ million) | | 2025 | | 2024 | | |

| Net revenues | | € | 74,261 | | | € | 85,017 | | | |

| Cost of revenues | | 68,267 | | | 69,818 | | | |

| Selling, general and other costs | | 4,174 | | | 4,564 | | | |

| Research and development costs | | 3,371 | | | 2,819 | | | |

| Gains/(losses) on disposal of investments | | (204) | | | (46) | | | |

| Restructuring costs | | 522 | | | 1,212 | | | |

| Share of the profit/(loss) of equity method investees | | (433) | | | 81 | | | |

| Operating income/(loss) | | (2,710) | | | 6,639 | | | |

| Net financial expenses/(income) | | 160 | | | (350) | | | |

| Profit/(loss) before taxes | | (2,870) | | | 6,989 | | | |

| Tax expense/(benefit) | | (614) | | | 1,342 | | | |

| | | | | | |

| | | | | | |

| Net profit/(loss) | | € | (2,256) | | | € | 5,647 | | | |

| | | | | | |

| Net profit/(loss) attributable to: | | | | | | |

Owners of the parent | | € | (2,240) | | | € | 5,624 | | | |

Non-controlling interests | | € | (16) | | | € | 23 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Net revenues | | € | 74,261 | | | € | 85,017 | | | (12.7) | % | | | | | | |

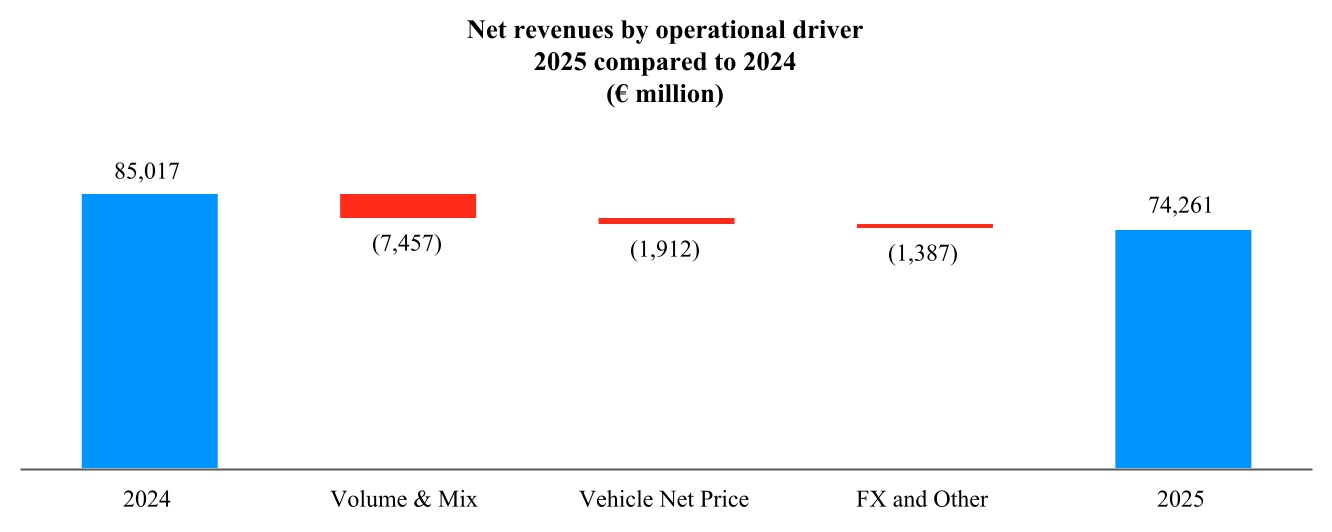

The following charts present Company’s Net revenues walk by operational driver for 2025 compared to the corresponding period in 2024:

See — Results by segment below for a discussion of Net revenues for each of our six reportable segments (North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati).

Cost of revenues | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Cost of revenues | | € | 68,267 | | | € | 69,818 | | | (2.2) | % | | | | | | |

Cost of revenues as % of Net revenues | | 91.9 | % | | 82.1 | % | | | | | | |

The decrease in Cost of revenues during the six months ended June 30, 2025 compared to the corresponding period in 2024, was primarily related to: (i) lower shipment volumes in North America and Enlarged Europe partially offset by (ii) costs related to the expansion of the Takata airbags recall campaign in Enlarged Europe; (iii) platform impairments, program cancellations and supplier claims, and (iv) impairment and other costs related to the discontinuation of the hydrogen fuel cell technology development program in Enlarged Europe. Refer to Note 8, Property, plant and equipment and to Note 7, Other intangible assets within the Semi-Annual Condensed Consolidated Financial Statements included elsewhere in this report for additional information.

Selling, general and other costs

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Selling, general and other costs | | € | 4,174 | | | € | 4,564 | | | (8.5) | % | | | | | | |

Selling, general and other costs as % of Net revenues | | 5.6 | % | | 5.4 | % | | | | | | |

The decrease in Selling, general and other costs during the six months ended June 30, 2025 compared to the corresponding period in 2024, was primarily related to the recognition of indirect tax credits in South America and the gain on disposal from the sale of the Luton plant in the UK.

Research and development costs

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Research and development expenditures expensed | | € | 1,411 | | | € | 1,542 | | | (8.5) | % | | | | | | |

Amortization of capitalized development expenditures | | 1,088 | | | 1,076 | | | 1.1 | % | | | | | | |

Impairment and write-off of capitalized development expenditures | | 872 | | | 201 | | | 333.8 | % | | | | | | |

Total Research and development costs | | € | 3,371 | | | € | 2,819 | | | 19.6 | % | | | | | | |

| | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | |

| | 2025 | | 2024 | | |

Research and development expenditures expensed as % of Net revenues | | 1.9 | % | | 1.8 | % | | |

Amortization of capitalized development expenditures as % of Net revenues | | 1.5 | % | | 1.3 | % | | |

Impairment and write-off of capitalized development expenditures as % of Net revenues | | 1.2 | % | | 0.2 | % | | |

Total Research and development cost as % of Net revenues | | 4.5 | % | | 3.3 | % | | |

Research and development expenditures expensed during the six months ended June 30, 2025 decreased by 8.5 percent as compared to the corresponding period in 2024 was primarily driven by cost optimization initiatives.

Amortization of capitalized development expenditures during the six months ended June 30, 2025 were substantially unchanged as compared to the corresponding period in 2024.

Impairments of capitalized development expenditures recognized in the six months ended June 30, 2025 were attributable to: (i) impairment of platforms used for Maserati and Alfa Romeo vehicles, (ii) impairments as a result of program cancellations, and (iii) impairments as a result of the Company’s decision to discontinue its hydrogen fuel cell technology program.

Total Research and development expenditures during the six months ended June 30, 2025 and 2024 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Capitalized development expenditures excl.borrowing costs(1) | | € | 1,705 | | | € | 2,078 | | | (17.9) | % | | | | |

Research and development expenditures expensed | | 1,411 | | | 1,542 | | | (8.5) | % | | | | |

Total Research and development expenditures | | € | 3,116 | | | € | 3,620 | | | (13.9) | % | | | | |

| | | | | | | | | | |

Capitalized development expenditures as % of Total Research and development expenditures | | 54.7 | % | | 57.4 | % | | | | | | |

Total Research and development expenditures as % of Net revenues | | 4.2 | % | | 4.3 | % | | | | | | |

________________________________________________________________________________________________________________________________________________

(1) Additions to capitalized development expenditures of €1,822 million and €2,175 million adjusted to remove capitalized borrowing costs of €117 million and €97 million for the six months ended June 30, 2025 and 2024, respectively, in accordance with IAS 23 - Borrowing costs (Revised)

Total Research and development expenditures during the six months ended June 30, 2025 has decreased compared to the corresponding period in 2024. Research and development expenditures expensed decreased by 8.5 percent as mentioned above, and Capitalized development expenditures (excluding borrowing costs) were 17.9 percent lower for the six months ended June 30, 2025 compared to the corresponding period in 2024, as the prior period reflected significant investments in a new product wave including investments in key products on the STLA Medium platform (including Peugeot 3008/5008 and Opel Grandland), STLA Large platform and Smart Car platform (including Citroën C3, Opel Frontera).

Restructuring costs

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Restructuring costs | | € | 522 | | | € | 1,212 | | | (56.9) | % | | | | |

Restructuring costs decreased during the six months ended June 30, 2025 compared to the same period in 2024, primarily due to a lower level of workforce reduction activities in the Enlarged Europe region.

Share of the profit/(loss) of equity method investees

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Share of the profit/(loss) of equity method investees | | € | (433) | | | € | 81 | | | (634.6) | % | | | | |

For the six months ended June 30, 2025, the Company recorded a Share of loss of equity method investees compared to a Share of profit of equity method investees in the same period in 2024. This variance was primarily attributable to charges of €404 million recognized following the Company’s decision to discontinue its hydrogen fuel cell technology program, including the full impairment of its 33.3 percent interest in the Symbio joint venture, amounting to €179 million, the impairment of loans granted to Symbio for €162 million and provisions for risk of €63 million. For further details, refer to Note 7, Other intangible assets, within the Semi-Annual Condensed Consolidated Financial Statements included elsewhere in this report for additional information.

Net financial expenses/(income)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Net financial expenses/(income) | | € | 160 | | | € | (350) | | | (145.7) | % | | | | |

For the six months ended June 30, 2025, the Company recorded Net financial expenses of €160 million, compared to Net financial income of €350 million in the same period of 2024. The variance is primarily driven by lower interest income from liquidity investments, reflecting both reduced liquidity levels and a decline in short-term market rates, and expenses recognized during the period upon termination of commodity derivative contracts. Refer to Note 10, Financial assets, within the Semi-Annual Condensed Consolidated Financial Statements for additional information.

Tax expense/(benefit)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

| Tax expense/(benefit) | | € | (614) | | | € | 1,342 | | | (145.8) | % | | | | |

Effective tax rate | | 21.4 | % | | 19.2 | % | | | | | | |

The effective tax rate of 21.4 percent for the six months ended June 30, 2025, is higher compared to the effective tax rate of 19.2 percent for the six months ended June 30, 2024. The increase in effective tax rate is primarily related to an increased proportion of earnings in higher tax rate jurisdictions driven by decreased results in North America and in Enlarged Europe. The current period loss before tax resulted in a corresponding overall tax benefit for the six months ended June 30, 2025, driven primarily by decreased results in North America and Enlarged Europe.

The Company’s ability to realize the full value of its deferred tax assets is dependent upon the generation of future taxable income. Based on the losses generated for the six months ended June 30, 2025, we are closely monitoring the realizability of our recognized deferred tax assets. If actual future taxable income differs from current estimates, the Company may be required to de-recognize deferred tax assets, which could materially impact future results.

Net profit/(loss)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Net profit/(loss) | | € | (2,256) | | | € | 5,647 | | | (140.0) | % | | | | |

For the six months ended June 30, 2025, the Company recorded a Net loss of €2,256 million compared to a Net profit of €5,647 million in the same period of 2024. The variance was primarily driven by: (i) lower operating performance in North America and Enlarged Europe; (ii) charges recognized as a result of program cancellations and corresponding supplier claims, (iii) charges recognized as a result of the Company’s decision to discontinue its hydrogen fuel cell technology program, and (iv) impairment of platforms used for Maserati and Alfa Romeo vehicles.

Adjusted operating income | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | |

| (€ million) | | 2025 | | 2024 | | 2025 vs. 2024 | | | | | | |

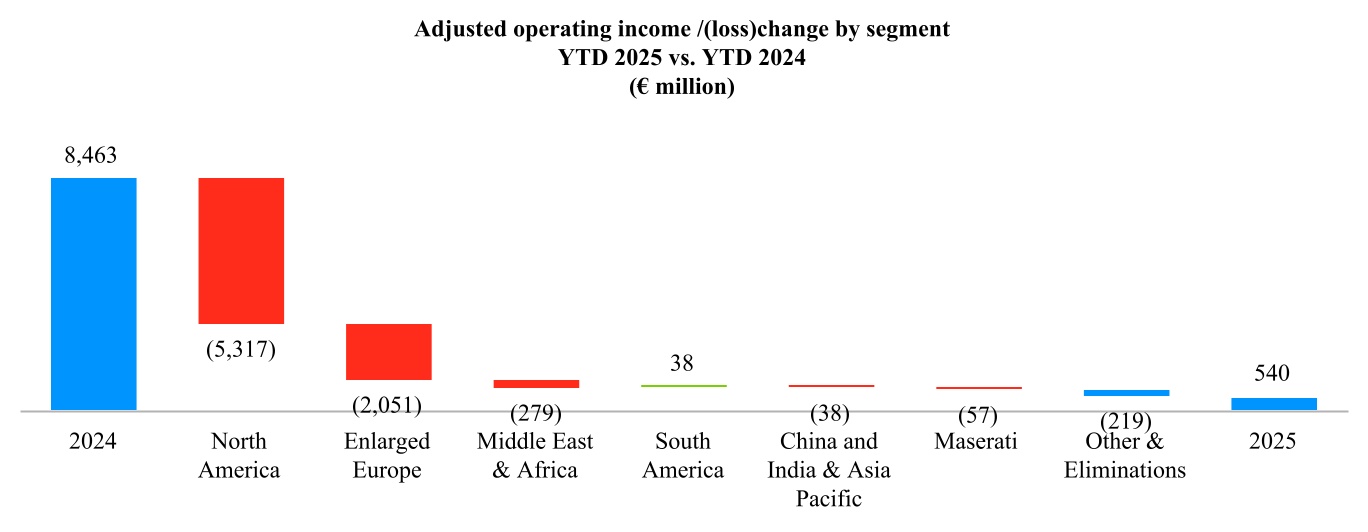

Adjusted operating income | | € | 540 | | | € | 8,463 | | | (93.6) | % | | | | | | |

Adjusted operating income margin (%) | | 0.7 | % | | 10.0 | % | | -930 bps | | | | | | |

The following chart presents the change in Adjusted operating income/(loss) by segment for the six months ended June 30, 2025 compared to the corresponding period in 2024.

Refer to — Results by segment below for a discussion of Adjusted operating income/(loss) for each of our six reportable segments (North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati).

The following table is the reconciliation of Net profit/(loss), which is the most directly comparable measure included in the Semi-Annual Condensed Consolidated Income Statement, to Adjusted operating income: | | | | | | | | | | | |

| (€ million) | | | Six Months Ended June 30, 2025 |

Net profit/(loss) | | € | (2,256) | |

Tax expense/(benefit) | | (614) | |

Net financial expenses/(income) | | 160 | |

Operating income/(loss) | | € | (2,710) | |

Adjustments: | | |

| Restructuring and other costs, net of reversals | | € | 522 | |

| Takata airbags recall campaign | | 239 | |

| Impairments and supplier claims | | |

| Platform impairments | | 578 | |

| Program cancellations and supplier claims | | 789 | |

| Fuel cell program discontinuation | | 733 | |

CAFE(1) penalty rate | | 269 | |

Stellantis Türkiye(2) disposal | | 246 | |

| Other | | (126) | |

Total Adjustments | | 3,250 | |

Adjusted operating income | | € | 540 | |

_______________________________________________________________________________________________________________________________________________________________________ (1) Corporate Average Fuel Economy (“CAFE”)

(2) Stellantis Otomotiv Pazarlama A.S. (“Stellantis Türkiye”)

| | | | | | | | | | | |

| (€ million) | | | Six Months Ended June 30, 2024 |

Net profit/(loss) | | € | 5,647 | |

Tax expense/(benefit) | | 1,342 | |

Net financial expenses/(income) | | (350) | |

Operating income/(loss) | | € | 6,639 | |

Adjustments: | | |

| Restructuring and other costs, net of reversals | | € | 1,212 | |

| | |

| | |

Impairment expense and supplier obligations, net of reversals | | 388 | |

| | |

Takata airbags recall campaign, net of recoveries | | 79 | |

| | |

| Other | | 145 | |

Total Adjustments | | 1,824 | |

Adjusted operating income | | € | 8,463 | |

During the six months ended June 30, 2025, Adjusted operating income excluded the following items, primarily related to:

•€522 million of restructuring and other costs, primarily related to workforce reductions, mainly in Enlarged Europe, partially offset by a €41 million reduction in estimated North America restructuring costs;

•€239 million of Takata airbags recall campaign, related to stop-drive campaign on certain vehicles in Enlarged Europe announced in June 2025;

•€578 million of platform impairments. Due to reduced volumes, platforms used for Maserati and Alfa Romeo vehicles were impaired and recognized in Maserati for €552 million and in Enlarged Europe for €26 million;

•€789 million of program cancellations and supplier claims, primarily related to programs cancelled as a result of strategic reviews and corresponding supplier claims;

•€733 million related to the Company decision to discontinue its hydrogen fuel cell strategy. As a result, the following items have been impaired: (i) investment in Symbio (€179 million), (ii) loans granted to Symbio (€162 million), (iii) capitalized development expenditures and property, plant and equipment related to fuel cells (€329 million), and (iv) in addition, provisions for risks were recognized (€63 million);

•€269 million of CAFE penalty rate. As a result of the elimination of CAFE fines with the enactment of the One Big Beautiful Bill Act (“OBBB”), the Company recognized a net expense of €97 million, comprised of net €172 million of CAFE credits recognized as a reduction of Cost of revenues, which remains included in Adjusted operating income as these amounts reduced prior year CAFE fines, and a net expense of €269 million, which is excluded from AOI and comprised of (i) elimination of the CAFE provision of €844 million, (ii) impairment of the regulatory credit assets of €609 million, and (iii) onerous contracts related to contractual purchase commitments for CAFE credits of €504 million;

•€246 million related to the sale of Stellantis Türkiye to the Company’s joint venture, Tofas-Turk Otomobil Fabrikasi A.S. (“Tofas”), for which the Company recognized an estimated loss on disposal of €246 million, driven primarily by the recycling of the cumulative translation reserve from Equity to the Consolidated Income Statement upon disposal; and

•€(126) million of Other, primarily related to (i) adjustments to costs previously recognized to support the workforce during the transformation of certain plants in North America, (ii) gains on sales of real estate in Enlarged Europe, and (iii) a gain from dilution related to the investment in Archer Aviation.

During the six months ended June 30, 2024, Adjusted operating income excluded adjustments primarily related to:

•€1,212 million of restructuring and other costs, primarily related to workforce reductions;

•€388 million of impairments, primarily related to certain platform assets in Maserati and Enlarged Europe, net of reversal; and

•€145 million of Other, primarily related to costs to support the workforce during the transformation of a plant in North America.

Diluted and Adjusted diluted EPS

| | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) |

| (€ per share) | | 2025 | | 2024 | | 2025 vs. 2024 |

| Diluted EPS | | € | (0.78) | | € | 1.86 | | (141.9) | % |

| Adjusted diluted EPS | | € | 0.18 | | € | 2.36 | | (92.4) | % |

For the six months ended June 30, 2025, as a result of the loss attributable to owners of the parent, the theoretical effect that would arise if the share-based payment plans were exercised was not taken into consideration in the calculation of diluted earnings per share as this would have had an anti-dilutive effect.

The following table summarizes the reconciliation of Diluted (loss)/earnings per share to Adjusted diluted earnings per share:

| | | | | | | | | | | | | | |

| | Six months ended June 30, |

| (€ million except otherwise noted) | | 2025 | | 2024 |

| Net (loss)/profit attributable to owners of the parent | | (2,240) | | | 5,624 | |

| Weighted average number of shares outstanding (000) | | 2,882,611 | | | 3,002,791 | |

Number of shares deployable for share-based compensation (000)(1) | | — | | | 21,659 | |

| Weighted average number of shares outstanding for diluted earnings per share (000) | | 2,882,611 | | | 3,024,450 | |

| Diluted (loss)/earnings per share (A) (€/share) | | (0.78) | | | 1.86 | |

| | | | |

| Adjustments, per above | | 3,250 | | | 1,824 | |

Tax impact on adjustments(2) | | (470) | | | (316) | |

| | | | |

| Total adjustments, net of taxes | | 2,780 | | | 1,508 | |

Number of shares deployable for share-based compensation (000)(1) | | 17,162 | | | — | |

| Adjusted dilutive impact per share | | 0.00 | | | — | |

| Impact of adjustments above, net of taxes, on Diluted earnings per share (B) (€/share) | | 0.96 | | | 0.50 | |

| Adjusted Diluted earnings per share (€/share) (A+B) | | 0.18 | | | 2.36 | |

______________________________________________________________________________________________________________________________

(1) For the six-month period ended June 30, 2025, the Company reported a loss attributable to the owners of the parent. Consequently, the potential dilutive impact of share-based payment plans was excluded from the calculation of diluted earnings/(loss) per share, as their inclusion would have been anti-dilutive. However, for the purpose of calculating Adjusted diluted earnings per share, the adjusted net result reflects a profit. Therefore, the potential dilutive effect of share-based payment plans has been included in this calculation, as their impact is dilutive under these circumstances

(2) Tax impact on adjustments is calculated based on the expected local country tax implications for each adjustment

Results by segment

The following are the results by segment for the six months ended June 30, 2025 and 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net revenues | | | | Adjusted operating income/(loss) | | | | Consolidated Shipments | | |

| | Six months ended June 30, |

| (€ million, except shipments which are in thousands of units) | | 2025 | | 2024 | | | | 2025 | | | | 2024 | | | | 2025 | | 2024 | | |

| North America | | € | 28,198 | | | € | 38,353 | | | | | € | (951) | | | | | € | 4,366 | | | | | 647 | | | 838 | | | |

Enlarged Europe | | 29,241 | | | 29,969 | | | | | 9 | | | | | 2,060 | | | | | 1,289 | | | 1,387 | | | |

| Middle East & Africa | | 4,944 | | | 5,005 | | | | | 768 | | | | | 1,047 | | | | | 225 | | | 214 | | | |

South America | | 7,769 | | | 7,367 | | | | | 1,188 | | | | | 1,150 | | | | | 471 | | | 394 | | | |

China and India & Asia Pacific | | 923 | | | 1,072 | | | | | 19 | | | | | 57 | | | | | 28 | | | 32 | | | |

| Maserati | | 369 | | | 631 | | | | | (139) | | | | | (82) | | | | | 4.2 | | | 6.5 | | | |

| Other activities | | 3,109 | | | 2,908 | | | | | (60) | | | | | (59) | | | | | — | | | — | | | |

Unallocated items & eliminations(1) | | (292) | | | (288) | | | | | (294) | | | | | (76) | | | | | — | | | — | | | |

| Total | | € | 74,261 | | | € | 85,017 | | | | | € | 540 | | | | | € | 8,463 | | | | | 2,664 | | | 2,872 | | | |

________________________________________________________________________________________________________________________________________________(1) Primarily includes intercompany transactions which are eliminated on consolidation

The following are the market shares by segment for the six months ended June 30, 2025 and 2024:

| | | | | | | | | | | | | | |

| | Market share(1) |

| | Six months ended June 30, |

| | 2025 | | 2024 |

North America | | 7.0 | % | | 8.2 | % |

Enlarged Europe | | 16.1 | % | | 17.6 | % |

| Middle East & Africa | | 11.9 | % | | 13.2 | % |

South America | | 23.5 | % | | 22.7 | % |

| India & Asia Pacific | | 0.4 | % | | 0.5 | % |

| China | | 0.2 | % | | 0.2 | % |

Maserati | | 1.5 | % | | 1.8 | % |

________________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information. Represents passenger cars (“PC”) and light commercial vehicles (“LCV”), except as noted

•Enlarged Europe excludes Russia and Belarus; From 2025, includes Israel and Palestine (prior periods have not been restated);

•Middle East & Africa exclude Iran, Sudan and Syria; From 2025, excludes Israel and Palestine (prior periods have not been restated);

•South America excludes Cuba

•India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups), Australia, New Zealand and South East Asia)

•China represents PC only and includes licensed sales from Dongfeng Peugeot Citroën Automobiles (“DPCA”)

•Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from S&P Global data, Maserati competitive segment and internal information

Figures may not add due to rounding. Prior period figures have been updated to reflect current information provided by third-party industry sources

Refer to Note 23, Segment reporting in the Semi-Annual Condensed Consolidated Financial Statements for additional information on the Company’s reportable segments.

The following is a discussion of Net revenues, Shipments and Adjusted operating income/(loss) for each of our six reportable segments for the six months ended June 30, 2025 as compared to the six months ended June 30, 2024.

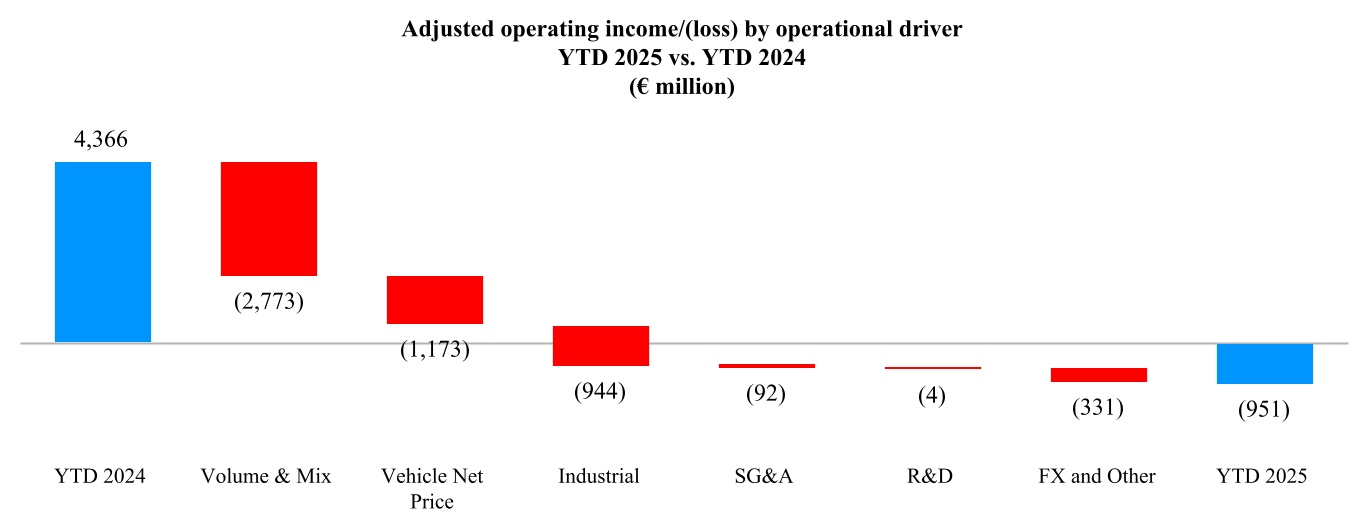

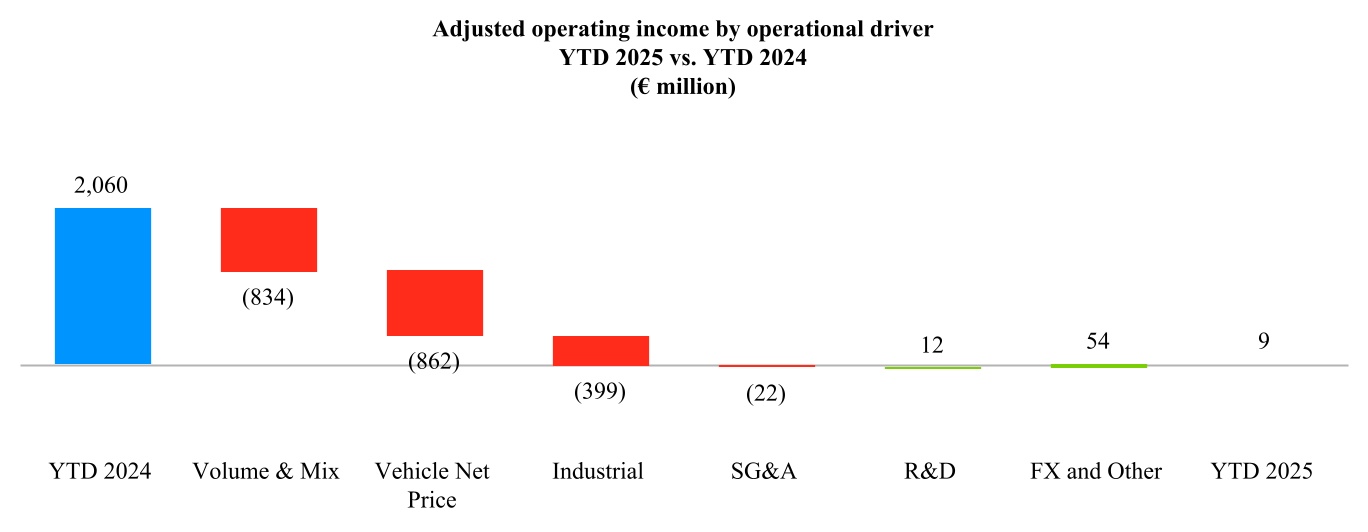

•Volume & Mix: Reflects changes in new car volumes (consolidated shipments), driven by industry volume, market share and dealer stocks, and mix evolutions such as channel, product line and trim mix. It also reflects the impact of some non-pricing items;

•Vehicle Net Price: Reflects changes in prices, net of discounts and other sales incentive programs;

•Industrial: Reflects manufacturing and purchasing cost changes associated with content, technology and enhancement of vehicle features, as well as industrial, logistics and purchasing efficiencies and inefficiencies. The impact of fixed manufacturing costs absorption related to the change in production output is included here. Cost changes to purchasing of raw materials, warranty, compliance costs, as well as depreciation related to property, plant and equipment are also included here. This also encompasses costs of tariffs;

•SG&A: Primarily includes costs for advertising and promotional activities, purchased services, information technology costs and other costs not directly related to the development and manufacturing of Stellantis products;

•R&D: Includes research and development costs, as well as amortization of capitalized development expenditures; and

•FX and Other: includes other items not mentioned above, such as used cars, parts & services, sales to partners, royalties, as well as foreign currency exchange translation, transaction and hedging.

North America

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Consolidated shipments (thousands of units) | | 647 | | | 838 | | | (22.8) | % | | | | | | |

Net revenues (€ million) | | € | 28,198 | | | € | 38,353 | | | (26.5) | % | | | | | | |

Adjusted operating income/(loss)(€ million) | | € | (951) | | | € | 4,366 | | | (121.8) | % | | | | | | |

Adjusted operating income margin (%) | | (3.4) | % | | 11.4 | % | | -1,480 bps | | | | | | |

The Company's market share(1) in North America of 7.0 percent for the six months ended June 30, 2025 reflected a decrease of 120 bps from 8.2 percent in the same period in 2024. The U.S. market share(1) of 7.3 percent reflected a decrease of 110 bps from 8.4 percent in the same period in 2024.

Shipments

North America shipments decreased in the six months ended June 30, 2025 compared to the corresponding period in 2024 and was mainly due to reduced production of imported vehicles most impacted by tariffs, lower fleet channel sales and production gaps resulting from discontinued models.

Net revenues

The decrease in North America Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was primarily due to production gaps resulting from discontinued models, as well as reduced production of certain products most impacted by tariffs.

Adjusted operating income/(loss)

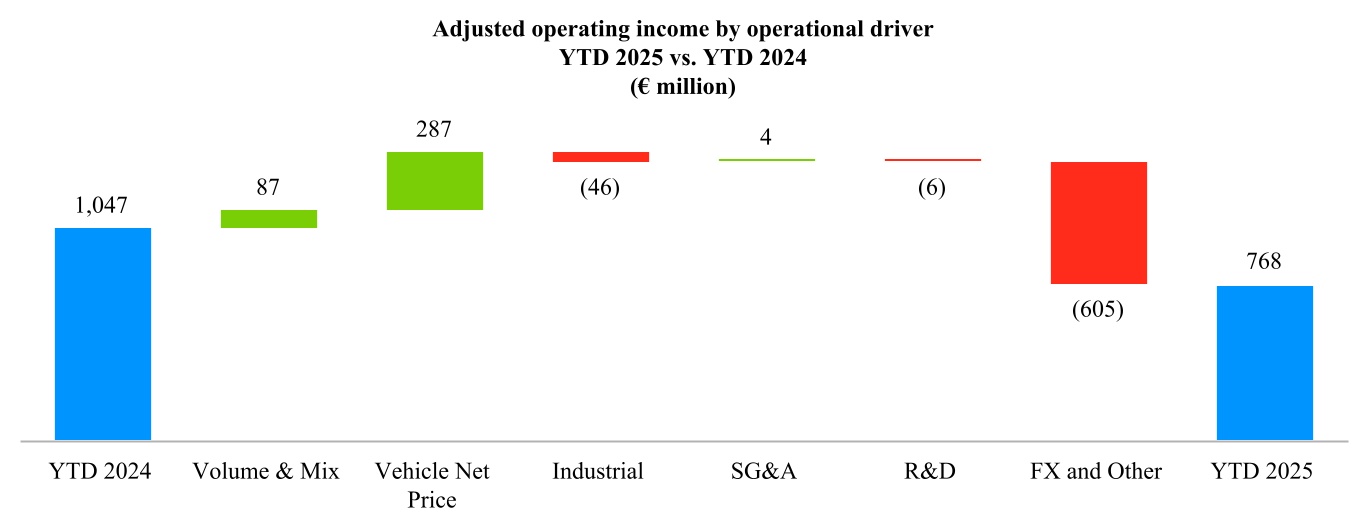

The following chart reflects the change in North America Adjusted operating income/(loss) by operational driver for the six months ended June 30, 2025 compared to the same period in 2024.

The decrease in North America Adjusted operating income/(loss) in the six months ended June 30, 2025 compared to the same period in 2024 was due to significant unfavorable impacts from volume and mix, increased sales incentives, as well as unfavorable variable cost absorption and warranty costs.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

Enlarged Europe

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Consolidated shipments (thousands of units) | | 1,289 | | | 1,387 | | | (7.1) | % | | | | | | |

Net revenues (€ million) | | € | 29,241 | | | € | 29,969 | | | (2.4) | % | | | | | | |

Adjusted operating income (€ million) | | € | 9 | | | € | 2,060 | | | (99.6) | % | | | | | | |

Adjusted operating income margin (%) | | — | % | | 6.9 | % | | -690 bps | | | | | | |

The Company's market share(1) in the EU30 for the six months ended June 30, 2025, decreased 120 bps to 17.0 percent from 18.2 percent in the same period in 2024.

Shipments

Shipments in Enlarged Europe decreased in the six months ended June 30, 2025 compared to the corresponding period in 2024, mainly driven by slower ramp of recently launched B-segment vehicles, partially offset by higher volumes of Fiat 600, Peugeot 3008 and 5008, as well as Jeep Avenger.

Net revenues

The decrease in Enlarged Europe Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was mainly due to decreased volumes and higher incentive levels, partially offset by positive impacts from vehicle mix.

_____________________________________________________________________________________________________________________________________________

(1) EU30 = EU27 (excluding Malta) and including Iceland, Norway, Switzerland and UK. Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

Adjusted operating income

The following chart reflects the change in Enlarged Europe Adjusted operating income by operational driver for the six months ended June 30, 2025 compared to the same period in 2024.

The decrease in Enlarged Europe Adjusted operating income in the six months ended June 30, 2025 compared to the same period in 2024 was primarily due to higher sales incentives, lower volumes and unfavorable mix, partially offset by reduced sales of vehicles with a buyback commitment.

Middle East & Africa

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Combined shipments (thousands of units) | | 251 | | | 273 | | | (8.1) | % | | | | | | |

Consolidated shipments (thousands of units) | | 225 | | | 214 | | | 5.1 | % | | | | | | |

Net revenues (€ million) | | € | 4,944 | | | € | 5,005 | | | (1.2) | % | | | | | | |

Adjusted operating income (€ million) | | € | 768 | | | € | 1,047 | | | (26.6) | % | | | | | | |

Adjusted operating income margin (%) | | 15.5 | % | | 20.9 | % | | -540 bps | | | | | | |

The Company's market share(1) in the Middle East & Africa for the six months ended June 30, 2025, decreased 130 bps to 11.9 percent from 13.2 percent in the same period in 2024.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

Shipments

The increase in consolidated shipments in Middle East & Africa in the six months ended June 30, 2025 compared to the corresponding period in 2024 was mainly due to increased shipments of Citroën Berlingo, Peugeot Partner, Opel/Vauxhall Combo and Fiat Doblo Cargo, partially offset by continued impacts from regional importation restrictions.

Net revenues

The decrease in Middle East & Africa Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was primarily due to unfavorable foreign exchange translation effects, mainly from Turkish Lira, largely offset by increases in volumes and favorable mix, as well as increases in net pricing.

Adjusted operating income

The following chart reflects the change in Middle East & Africa Adjusted operating income by operational driver for the six months ended June 30, 2025 compared to the same period in 2024.

The decrease in Middle East & Africa Adjusted operating income in the six months ended June 30, 2025 compared to the same period in 2024 was mainly due to unfavorable foreign exchange transaction and translation effects primarily related to the Turkish Lira, partially offset by positive pricing actions.

South America

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Consolidated shipments (thousands of units) | | 471 | | | 394 | | | 19.5 | % | | | | | | |

Net revenues (€ million) | | € | 7,769 | | | € | 7,367 | | | 5.5 | % | | | | | | |

Adjusted operating income (€ million) | | € | 1,188 | | | € | 1,150 | | | 3.3 | % | | | | | | |

Adjusted operating income margin (%) | | 15.3 | % | | 15.6 | % | | -30 bps | | | | | | |

The Company's market share(1) in South America for the six months ended June 30, 2025 increased 80 bps to 23.5 percent from 22.7 percent in the same period in 2024. The Company's market share in Brazil and Argentina for the six months ended June 30, 2025 increased 80 bps to 30.1 percent from 29.3 percent and increased 180 bps to 32.7 percent from 30.9 percent, respectively, compared to the corresponding period in 2024.

Shipments

Shipments in South America increased in the six months ended June 30, 2025 compared to the corresponding period in 2024, driven primarily by increased volumes in Argentina, as well as the increased shipments of the Fiat Strada, Fastback and Argo.

Net revenues

The increase in South America Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was due to increased volumes, mainly driven by Argentina, largely offset by foreign exchange impacts from Brazilian Real and Argentine Peso.

Adjusted operating income

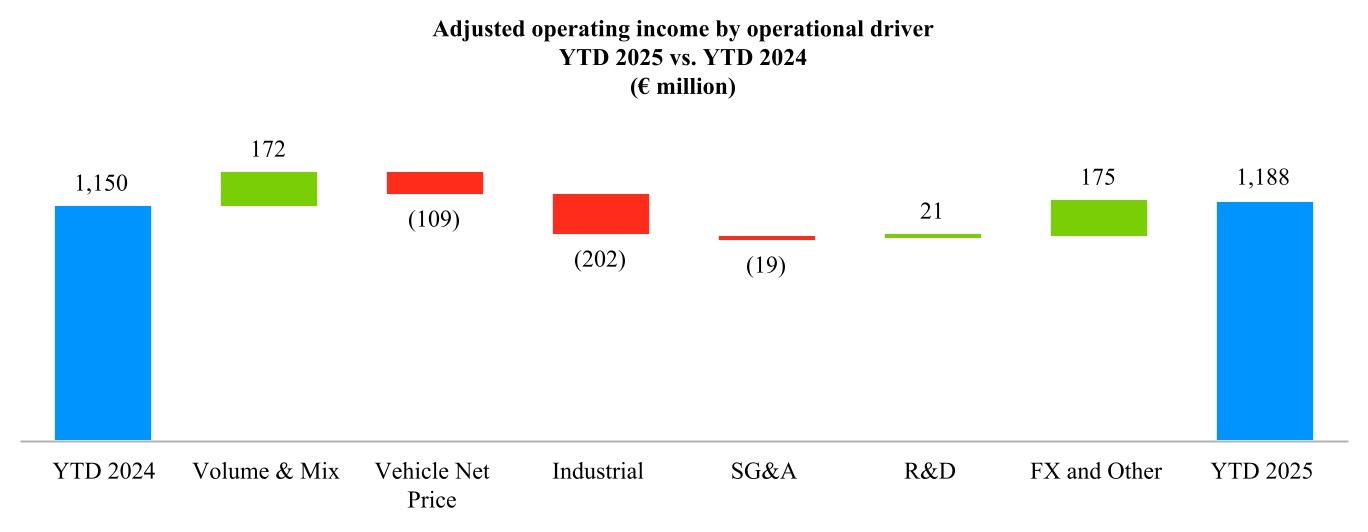

The following chart reflects the change in South America Adjusted operating income by operational driver for the six months ended June 30, 2025 compared to the same period in 2024.

The increase in South America Adjusted operating income in the six months ended June 30, 2025 compared to the same period in 2024 was primarily due to increased volumes in Argentina and a benefit from recognition of Brazilian indirect tax credits, partially offset by unfavorable foreign exchange effects.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

China and India & Asia Pacific | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Combined shipments (thousands of units) | | 28 | | | 32 | | | (12.5) | % | | | | | | |

Consolidated shipments (thousands of units) | | 28 | | | 32 | | | (12.5) | % | | | | | | |

Net revenues (€ million) | | € | 923 | | | € | 1,072 | | | (13.9) | % | | | | | | |

Adjusted operating income (€ million) | | € | 19 | | | € | 57 | | | (66.7) | % | | | | | | |

Adjusted operating income margin (%) | | 2.1 | % | | 5.3 | % | | -320 bps | | | | | | |

In China, we distribute imported vehicles primarily for the Jeep brand through an asset-light approach. Dongfeng Peugeot and Dongfeng Citroën brands in China are locally manufactured through DPCA under various license agreements. Dongfeng Peugeot Citroën Automobile Sales Co markets the DPCA vehicles in China.

We also produce the Jeep Compass and Jeep Meridian in India through our joint operation Fiat India Automobiles Private Limited (“FIAPL”) and we recognize our related interest in the joint operation on a line-by-line basis.

Shipments distributed by our consolidated subsidiaries, which include vehicles produced by FIAPL, are reported in both consolidated and combined shipments.

Shipments

The decrease in China and India & Asia Pacific consolidated shipments in the six months ended June 30, 2025 compared to the corresponding period in 2024 was mainly driven by lower shipments.

Net revenues

The decrease in China and India & Asia Pacific Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was mainly due to lower volumes.

Adjusted operating income

The decrease in China and India & Asia Pacific Adjusted operating income in the six months ended June 30, 2025 compared to the same period in 2024 was mainly driven by decline in shipments, continued pricing pressures, and foreign exchange impacts, partially offset by increased share of profit of equity method investees, driven by improved results from Zhejiang Leapmotor Technology Co., Ltd.

Maserati

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, | | Increase/(Decrease) | | | | |

| | 2025 | | 2024 | | 2025 vs. 2024 | | | | |

Consolidated shipments (thousands of units) | | 4.2 | | | 6.5 | | | (35.4) | % | | | | | | |

Net revenues (€ million) | | € | 369 | | | € | 631 | | | (41.5) | % | | | | | | |

Adjusted operating income/(loss) (€ million) | | € | (139) | | | € | (82) | | | 69.5 | % | | | | | | |

Adjusted operating income/(loss) margin (%) | | (37.7) | % | | (13.0) | % | | -2,470 bps | | | | | | |

Shipments

The decrease in Maserati shipments in the six months ended June 30, 2025 compared to the corresponding period in 2024 was mostly due to lower shipments across all markets.

Net revenues

The decrease in Maserati Net revenues in the six months ended June 30, 2025 compared to the corresponding period in 2024 was primarily due to lower volumes.

Adjusted operating income/(loss)

The decrease in Maserati Adjusted operating income/(loss) in the six months ended June 30, 2025 compared to the same period in 2024 was mainly due to decreased volume and mix impacts, as well as de-stocking and repositioning efforts in North America and China.

Liquidity and capital resources

Available liquidity

The following table summarizes our total Available liquidity:

| | | | | | | | | | | | | | |

(€ million) | | At June 30, 2025 | | At December 31, 2024 |

Cash, cash equivalents and financial securities(1) | | € | 32,836 | | € | 38,568 |

Undrawn committed credit lines | | 16,895 | | 12,915 |

Cash, cash equivalents and financial securities - included within Assets held for sale | | 5 | | 297 |

Total Available liquidity(2) | | € | 49,736 | | | € | 51,780 | |

| of which: Available liquidity of the Industrial Activities | | € | 47,228 | | | € | 49,481 | |

________________________________________________________________________________________________________________________________________________(1) Financial securities are comprised of short term or marketable securities which represent temporary investments but do not satisfy all the requirements to be classified as cash equivalents as they may be subject to risk of change in value (even if they are short-term in nature or marketable)

(2) The majority of our liquidity is available to our treasury operations in Europe and U.S.; however, liquidity is also available to certain subsidiaries which operate in other countries. Cash held in such countries may be subject to restrictions on transfer depending on the foreign jurisdictions in which these subsidiaries operate. Based on our review of such transfer restrictions in the countries in which we operate and maintain material cash balances, (and in particular in Argentina, in which we have €444 million cash and securities at June 30, 2025 (€680 million at December 31, 2024), and in Algeria, in which we have €373 million (€276 million at December 31, 2024)), we do not believe such transfer restrictions had an adverse impact on the Company’s ability to meet its liquidity requirements at the dates presented above. Cash and cash equivalents also include €511 million at June 30, 2025 (€451 million at December 31, 2024) held in bank deposits which are restricted to the operations related to securitization programs and warehouses credit facilities of Stellantis Financial Services U.S. (“SFS U.S.”)

Available liquidity of the industrial activities at June 30, 2025, decreased by €2.3 billion from December 31, 2024, primarily due to the €3.0 billion negative free cash flow of the period, a €2.0 billion dividend payment and a €1.3 billion negative effect due to foreign exchange translation. This was partially offset by funding actions, that include a new €4.0 billion committed credit line and €3.6 billion of bond issuances.

Our Available liquidity is subject to intra-month and seasonal fluctuations resulting from business and collection-payment cycles as well as to changes in foreign exchange conversion rates. Moreover, we tend to operate with negative working capital as we generally receive payment for vehicles within a few days of shipment, whereas there is a lag between the time when parts and materials are received from suppliers and when we pay for such parts and materials; therefore, in periods in which our vehicle shipments decline materially we will suffer a significant negative impact on cash flow and liquidity as we continue to pay suppliers for components purchased in a high volume environment during a period in which we receive lower proceeds from vehicle shipments. Plant shutdowns, whether associated with model year changeovers, or other factors such as temporary supplier interruptions or government-imposed restrictions, can have a significant negative impact on our revenues and working capital as we continue to pay suppliers while we do not receive proceeds from vehicle sales. Refer to the section — Cash flows below for additional information regarding the change in cash and cash equivalents.

Our liquidity is principally denominated in Euro and U.S. Dollar, with the remainder being distributed in various countries and denominated in the relevant local currencies. Out of the total cash, cash equivalents and financial securities available at June 30, 2025, €18.1 billion, or 55.1 percent (€21.4 billion, or 55 percent at December 31, 2024), were denominated in Euro and €8.6 billion, or 26.3 percent (€10.8 billion, or 28 percent at December 31, 2024), were denominated in U.S. Dollar.

At June 30, 2025, undrawn committed credit lines of €16.9 billion include the syndicated revolving credit facility (“RCF”) of €12.0 billion, originally signed in July 2021, amended and extended in July 2024 and further extended in June 2025, with a group of 29 relationship banks. The RCF is available for general corporate purposes and is structured in two tranches: €6.0 billion, with a 3-year tenor, and €6.0 billion, with a 5-year tenor, with each tranche benefiting from two further extension options, each of one year exercisable on the first and second anniversary of the amendment signing date. The first extension option was activated in June 2025, extending the maturities to July 2028 and July 2030, respectively, for the two tranches. The amount utilized under these credit lines was nil on June 30, 2025.

In January 2025, the Company entered a new committed credit line of €4.0 billion with a pool of relationship banks. The facility line is available for general corporate purposes, including without limitation the refinancing of existing indebtedness of the Company. The line expires in January 2026 and has two extension options, at the Company’s discretion, of six months each. The amount utilized under this credit line was nil on June 30, 2025.

In March 2024, a RCF committed credit line of $1 billion (€0.9 billion) was signed by SFS U.S. A first contractual extension option to extend the maturity by one year was activated in March 2025. As a result, the maturity of the line has been extended to March 2028 and, at June 30, 2025, it was one-third utilized at $330 million (€282 million).

Capital Market and Bank Debt

The Company issued five bonds during the period ended June 30, 2025:

(i) In March 2025, a USD bond with principal amount of $1,000 million with an interest rate of 6.45 percent and which matures in March 2035;

(ii) In March 2025, a USD bond with principal amount of $750 million with an interest rate of 5.75 percent and which matures in March 2030;

(iii) In March 2025, a USD bond with principal amount of $500 million with an interest rate of 5.35 percent and which matures in March 2028;

(iv) In June 2025, a EUR bond with principal amount of €700 million with an interest rate of 3.875 percent and which matures in June 2031; and

(v) In June 2025, a EUR bond with principal amount of €800 million with an interest rate of 4.625 percent and which matures in June 2035.

In March 2025, the Company repaid, at maturity, a €650 million note issued by PSA in 2018.

Borrowings from banks

In March 2025, the Company repaid, at maturity, a €300 million European Investment Bank loan.

Warehouse credit facilities

In June 2023, the First Investors Auto Receivables Corporation warehouse, with a capacity of $300 million, was extended to mature in June 2025 and in June 2025, was extended again to September 2025.

Asset-backed securities (“ABS”) term notes

In January 2025, SFS U.S., through SFS Auto Receivables Securitization Trust 2025-1, issued six classes of ABS Term Notes totaling $0.9 billion (€0.8 billion) in aggregate. The notes issued in each class bear a fixed rate. The ABS Term Notes are secured by a pool of prime retail loans.

In May 2025, SFS U.S., through Stellantis Financial Underwritten Enhanced Lease Trust 2025-A, issued six classes of ABS Term Notes totaling $1.5 billion (€1.3 billion) in aggregate. The notes issued in each class bear a fixed rate. The ABS Term Notes are secured by a pool of prime lease receivables.

In June 2025, SFS U.S., through SFS Auto Receivables Securitization Trust 2025-2, issued six classes of ABS Term Notes totaling $0.9 billion (€0.8 billion) in aggregate. The notes issued in each class bear a fixed rate. The ABS Term Notes are secured by a pool of prime retail loans.

Ratings

In March 2025, S&P revised Stellantis’ issuer credit rating and senior unsecured debt rating from “BBB+” to “BBB” and changed the outlook from negative to stable.

In May 2025, Moody’s revised Stellantis’ long-term issuer rating and senior unsecured debt rating from “Baa1” to “Baa2” and changed the outlook from negative to stable.

Cash flows

The following table summarizes the cash flows from operating, investing and financing activities for the six months ended June 30, 2025 and 2024. Refer to the Semi-Annual Condensed Consolidated Statement of Cash Flows for the six months ended June 30, 2025 and 2024 included in this Semi-Annual Report for additional information.

| | | | | | | | | | | | | | |

| | Six months ended June 30, |

(€ million) | | 2025 | | 2024 |

Net cash from/(used in) operating activities(1) | | € | (2,287) | | | € | 3,970 | |

| | | | |

Net cash from/(used in) investing activities(1) | | (2,146) | | | (6,926) | |

| | | | |

Net cash from/(used in) financing activities(1) | | 1,937 | | | (4,913) | |

| | | | |

| | | | |

Effects of changes in exchange rates | | (1,236) | | | 425 | |

| (Increase)/decrease in cash and cash equivalents included in asset held for sale | | 292 | | | 100 | |

| | | | |

| | | | |

| Increase/(decrease) in cash and cash equivalents | | (3,440) | | | (7,344) | |

| Net cash and cash equivalents at beginning of period | | 34,100 | | | 43,669 | |

| NET CASH AND CASH EQUIVALENTS AT END OF PERIOD | | € | 30,660 | | | € | 36,325 | |

________________________________________________________________________________________________________________________________________________

(1) Effective June 2025, the company adjusted certain classification items in the presentation of its Condensed Consolidated Statement of Cash Flows. Refer to Note 1, Basis of preparation, within the Semi-Annual Condensed Consolidated Financial Statements for additional information. Comparative figures for June 2024 have been reclassified accordingly.

Operating activities

For the six months ended June 30, 2025, cash flows used in operating activities was the result of Loss before taxes of €2,870 million primarily adjusted by (1) add back €3,582 million for depreciation and amortization expense, (2) add back €2,155 million for other non-cash items, which was mainly attributable to impairments of Other intangible assets and Property, plant and equipment recognized in North America, Maserati and Enlarged Europe, (2) an increase in receivables from financing activities of €1,738 million, which was mainly attributable to financial services activity in North America, (3) the absorption of €2,824 million for the increase in carrying amount of leased vehicles related to financial services activity in North America, (4) an €833 million net decrease in provisions, primarily due to a decrease in sales incentives, and (5) for the negative effect of the increase in working capital of €653 million, which includes (i) an increase of €2,145 million in inventories driven by higher new vehicles stock and manufacturing inventories, (ii) an increase of €1,094 million in trade receivables mainly reflecting the increased activity in June 2025 compared to December 2024, and (iii) a negative impact of €165 million in other changes, partially offset by (iv) an increase of €2,751 million in trade payables primarily reflecting higher production levels in June 2025 as compared to December 2024.

For the six months ended June 30, 2024, cash flows from operating activities was the result of Net profit before taxes of €6,989 million primarily adjusted by (1) add back €3,598 million for depreciation and amortization expense, (2) a €97 million net increase in provisions, primarily due to an increase in restructuring provisions partially offset by decreases in sales incentives and warranty and recall campaigns, (3) the absorption for the increase in carrying amount of leased vehicles of €1,717 million primarily attributable to the growth in SFS U.S., (4) an increase in receivables from financing activities of €1,739 million, which was mainly attributable to increased retail and dealers financing of SFS U.S., and (5) for the negative effect of the increase in working capital of €2,152 million, which includes (i) an increase of €900 million in inventories the largest contributor to which was the Middle East & Africa segment, which experienced increased inventory levels as a result of temporary local regulatory matters, (ii) an increase of €497 million in trade receivables mainly reflecting seasonality, and (iii) a decrease of €1,109 million in trade payables primarily reflecting decreases in production in the last months of the period as compared to the prior year.

Investing activities

For the six months ended June 30, 2025, cash used in investing activities was primarily the result of (1) €4,447 million of investment in property, plant and equipment and intangible assets, including €1,705 million of capitalized development expenditures, (2) €711 million decrease in payables related to investments in property, plant and equipment and intangible assets, (3) €247 million investment for acquisitions of consolidated subsidiaries and equity method and other investments which is primarily due to €89 million of capital injections to joint ventures and associates, and €158 million in acquisitions of consolidated subsidiaries and equity method investments associates, that were partially offset by (4) the decrease in securities of €2,444 million mainly due to decrease in investments held by treasury companies and (5) €389 million net proceeds from disposals of shares in consolidated companies and of investments in non-consolidated companies.

For the six months ended June 30, 2024, cash used in investing activities was primarily the result of (1) €5,703 million of investment in property, plant and equipment and intangible assets, including €2,078 million of capitalized development expenditures, partly offset by €233 million increase in payables related to investments in property, plant and equipment and intangible assets, (2) €1,316 million investment for acquisitions of consolidated subsidiaries and equity method and other investments which is primarily due to €970 million of capital injections to joint ventures and associates, and €328 million in acquisitions of subsidiaries mainly relating to the acquisition of control of Punch Powertrain E-Transmission N.V., Comercial Automotiva and Groupe 2L Logistics, and (3) the increase in securities of €175 million mainly related to investments which are not classified as cash equivalent, that were partially offset by (4) €233 million net proceeds from disposals of shares in consolidated companies and of investments in non-consolidated companies.

Financing activities

For the six months ended June 30, 2025, cash used in financing activities resulted primarily from (1) the net increase in long-term debt of €6,301 million, including (i) the issuance of bonds for €3,566 million, (ii) the proceeds from the issuance of ABS Term Notes for €3,825 million and (iii) new other long-term debt of €1,427 million, (iv) the repayment of bonds for €650 million, (v) the repayment of ABS Term Notes for € 1,226 million, and (vi) the repayment of other long-term debt of €641 million, (2) the net decrease of €2,402 million in short-term debt and other financial liabilities, and (3) the payment of dividends of €1,962 million.

For the six months ended June 30, 2024, cash used in financing activities resulted primarily from (1) the payment of dividends of €4,653 million, (2) share buybacks of €1,998 million, partially offset by (3) the net increase in long-term debt of €1,069 million, including (i) the issuance of bonds for €1,250 million, (ii) the proceeds from the issuance of ABS Term Notes for €3,277 million and (iii) new other long-term debt of €504 million, partially offset by (iv) the repayment of bonds for €1,950 million, (v) the repayment of ABS Term Notes for €1,286 million, and (vi) other long-term debt of €726 million, and by (4) a net increase of €659 million in short-term debt and other financial liabilities.

Industrial free cash flows

The following table provides a reconciliation of Cash flows from operating activities, the most directly comparable measure included in our Semi-Annual Condensed Consolidated Statement of Cash Flows, to Industrial free cash flows for the six months ended June 30, 2025 and 2024:

| | | | | | | | | | | | | | |

| | Six months ended June 30, |

| (€ million) | | 2025 | | 2024 |

| | | | |

| | | | |

Cash flows from/(used in) operating activities(1) | | (2,287) | | | 3,970 | |

Less: Financial services, net of inter-segment eliminations(1) | | (4,397) | | | (2,384) | |

Less: Capital Expenditures and capitalized research and development expenditures and change in amounts payable on property, plant and equipment and intangible assets for industrial activities | | 5,136 | | | 5,438 | |

| Add: Proceeds from disposal of assets and other changes in investing activities | | 473 | | | 163 | |

| | | | |

| Less: Contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments | | 480 | | | 1,495 | |

| | | | |

| Add: Defined benefit pension contributions, net of tax | | 28 | | | 24 | |

| Industrial free cash flows | | € | (3,005) | | | € | (392) | |

| | | | |

| | | | |

________________________________________________________________________________________________________________________________________________

(1) Effective H1 2025, two types of cash flows were reclassified to cash flows from operating activities: (i) the net change in receivables related to financial services activities have been reclassified from investing activities as these are part of our principal revenue-generating activities and (ii) certain financial receivables related to factoring transactions from financing activities. Refer to Note 1, Basis of preparation, within the Semi-Annual Condensed Consolidated Financial Statements for additional information. Comparative figures for June 2024 have been reclassified accordingly

Industrial free cash flow amounted to a net cash absorption of €3,005 million for the six months ended June 30, 2025, a decrease of €2,613 million, compared to the Industrial free cash flow net absorption of €392 million for the six months ended June 30, 2024. The main contributors to the decrease in free cash flow were (1) a decrease of €4,244 million in cash flows from industrial operating activities, as a result of (i) a €9,859 million decrease in Profit before taxes from industrial activities, partially offset by (ii) a lower absorption of cash in working capital of industrial activities of €2,628 million, (2) a decrease in capital expenditures and capitalized research and development expenditures and change in amounts payable on property, plant and equipment and intangible assets for industrial activities of €302 million, and (3) a decrease in contributions of equity to joint ventures and minor acquisitions for €1,015 million.

Industrial net financial position

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At June 30, 2025 | | At December 31, 2024 | | |

| (€ million) | | Stellantis | | Industrial activities | | Financial services | | Stellantis | | Industrial activities | | Financial services | | |

| Third parties debt (Principal) | | € | (40,217) | | | € | (25,195) | | | € | (15,022) | | | € | (36,609) | | | € | (23,499) | | | € | (13,110) | | | |

Capital market(1) | | (22,674) | | | (20,957) | | | (1,717) | | | (20,003) | | | (18,542) | | | (1,461) | | | |

Bank debt | | (2,657) | | | (1,486) | | | (1,171) | | | (3,562) | | | (1,902) | | | (1,660) | | | |

Other debt(2) | | (12,556) | | | (435) | | | (12,121) | | | (10,488) | | | (515) | | | (9,973) | | | |

Lease liabilities | | (2,330) | | | (2,317) | | | (13) | | | (2,556) | | | (2,540) | | | (16) | | | |

Accrued interest and other adjustments(3) | | (582) | | | (505) | | | (77) | | | (618) | | | (572) | | | (46) | | | |

| Debt with third parties (excluding held for sale) | | (40,799) | | | (25,700) | | | (15,099) | | | (37,227) | | | (24,071) | | | (13,156) | | | |

| Debt classified as held for sale | | (135) | | | — | | | (135) | | | (128) | | | (60) | | | (68) | | | |

| Debt with third parties including held for sale | | (40,934) | | | (25,700) | | | (15,234) | | | (37,355) | | | (24,131) | | | (13,224) | | | |

Intercompany, net(4) | | — | | | 2,211 | | | (2,211) | | | — | | | 1,570 | | | (1,570) | | | |