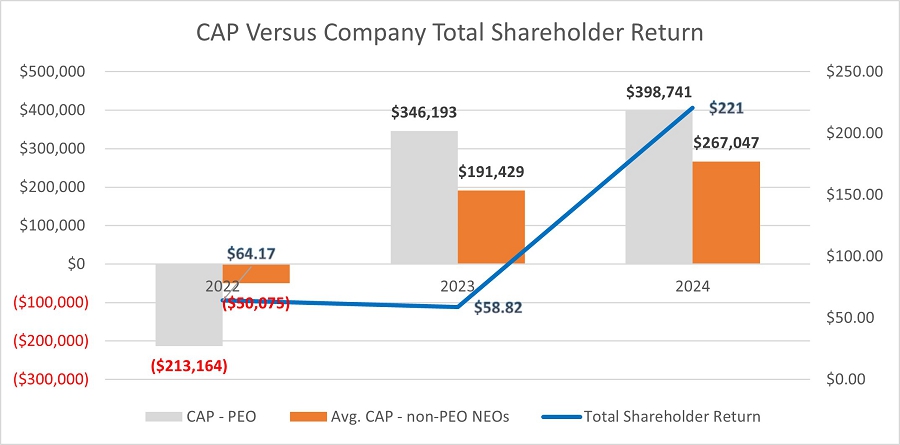

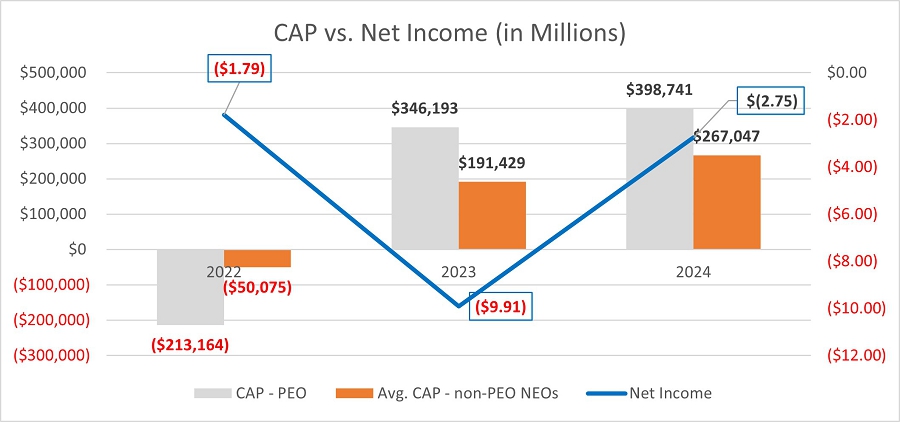

Year (a) | Summary Compensation Table Total for Principal Executive Officer (“PEO”) (1) (b) | Compensation Actually Paid to PEO (2) (c) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) (3) (d) | Average Compensation Actually Paid to Non-PEO NEOs (4) (e) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (5) (f) | Net Income (Loss) (millions) (6) (h) | ||||||||||||||||||

| 2024 | $ | 359,805 | $ | 469,786 | $ | 244,055 | $ | 297,495 | $ | 220.86 | $ | (2.75 | ) | |||||||||||

| 2023 | $ | 400,105 | $ | 346,193 | $ | 259,555 | $ | 191,429 | $ | 58.82 | $ | (9.91 | ) | |||||||||||

| 2022 | $ | 290,305 | $ | (213,164 | ) | $ | 167,305 | $ | (50,075 | ) | $ | 64.17 | $ | (1.79 | ) | |||||||||

| Year | Reported Summary Compensation Table Total for PEO ($) | Reported Value of Equity Awards (a) ($) | Equity Award Adjustments (b) ($) | Compensation Actually Paid to PEO ($) | ||||||||||||

| 2024 | $ | 359,805 | $ | (42,000 | ) | $ | 151,981 | $ | 469,786 | |||||||

| 2023 | $ | 400,105 | $ | (94,800 | ) | $ | 40,888 | $ | 346,193 | |||||||

| 2022 | $ | 290,305 | $ | $ | (503,469 | ) | $ | (213,164 | ) | |||||||

| (a) | The grant date fair value of equity awards represents the total of the amounts reported in the “Option Awards” columns in the Summary Compensation Table for the applicable year. |

| (b) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

The amounts deducted or added in calculating the equity award adjustments are as follows:

| Year | Year End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year ($) | Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years ($) | Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year ($) | Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) | Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year ($) | Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation ($) | Total Equity Award Adjustments ($) | |||||||||||||||||||||

| 2024 | $ | 71,045 | $ | $ | 74,100 | $ | 6,836 | $ | $ | $ | 151,981 | |||||||||||||||||

| 2023 | $ | $ | (21,430 | ) | $ | 61,600 | $ | 718 | $ | $ | $ | 40,888 | ||||||||||||||||

| 2022 | $ | $ | (363,860 | ) | $ | $ | (139,609 | ) | $ | $ | $ | (503,468 | ) | |||||||||||||||

| [1] | The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Madhu (President and CEO) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation - Summary Executive Compensation Table.” |

| [2] | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Madhu, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Madhu during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Madhu’s total compensation for each year to determine the compensation actually paid: |

| [3] | The grant date fair value of equity awards represents the total of the amounts reported in the “Option Awards” columns in the Summary Compensation Table for the applicable year. |

| [4] | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |