Performance Management

|

Jul. 25, 2025 |

| T. Rowe Price Retirement 2005 Fund |

|

| Prospectus [Line Items] |

|

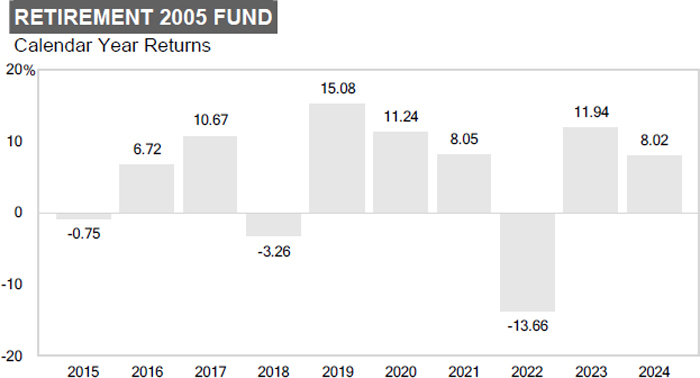

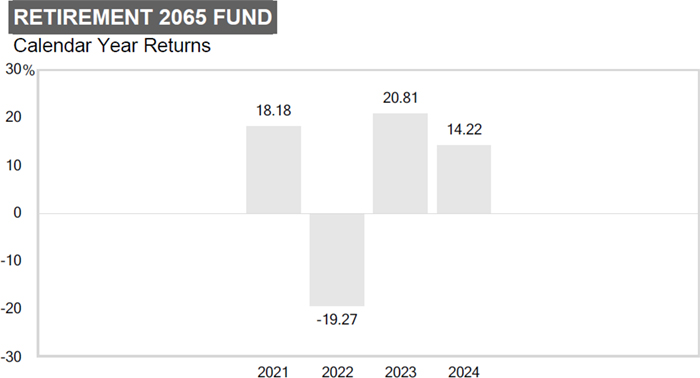

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

-0.75 |

| 2016 |

6.72 |

| 2017 |

10.67 |

| 2018 |

-3.26 |

| 2019 |

15.08 |

| 2020 |

11.24 |

| 2021 |

8.05 |

| 2022 |

-13.66 |

| 2023 |

11.94 |

| 2024 |

8.02 |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return |

|

| |

Best

Quarter |

6/30/20 |

11.24% |

|

Worst

Quarter |

3/31/20 |

-10.36% |

|

The

fund’s return for the six months ended 6/30/25 was 5.60%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

5.60%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

11.24%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(10.36%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods

ended December

31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA.

|

| Performance [Table] |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Annual Total Returns |

|

|

|

|

|

|

|

| |

|

|

Periods

ended |

|

| |

|

|

December

31, 2024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Since |

Inception |

|

| |

|

|

1

Year |

|

|

5

Years |

|

|

10

Years |

|

|

inception |

date |

|

| |

Investor

Class |

|

|

|

|

|

|

|

|

|

|

|

02/27/2004 |

|

|

| |

|

Returns

before taxes |

8.02 |

% |

|

4.65 |

% |

|

5.06 |

% |

|

—

|

% |

|

|

|

| |

|

Returns

after taxes on distributions |

6.64 |

|

|

2.51 |

|

|

3.29 |

|

|

—

|

|

|

|

|

| |

|

Returns

after taxes on distributions and sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

of

fund shares |

5.01 |

|

|

3.09 |

|

|

3.47 |

|

|

—

|

|

|

|

|

| |

I

Class |

|

|

|

|

|

|

|

|

|

|

|

11/13/2023 |

|

|

| |

|

Returns

before taxes |

8.22 |

|

|

—

|

|

|

—

|

|

|

13.55 |

|

|

|

|

| |

Advisor

Class |

|

|

|

|

|

|

|

|

|

|

|

05/31/2007 |

|

|

| |

|

Returns

before taxes |

7.84 |

|

|

4.40 |

|

|

4.80 |

|

|

—

|

|

|

|

|

| |

R

Class |

|

|

|

|

|

|

|

|

|

|

|

05/31/2007 |

|

|

| |

|

Returns

before taxes |

7.62 |

|

|

4.13 |

|

|

4.54 |

|

|

—

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Regulatory

Benchmark |

|

|

|

| |

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| |

|

1.25 |

|

|

-0.33 |

|

|

1.35 |

|

|

6.77 |

a |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Strategy

Benchmark(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

S&P Target Date Retirement Income Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

6.54 |

|

|

3.62 |

|

|

4.14 |

|

|

11.86 |

a |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated

performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

| T. Rowe Price Retirement 2010 Fund |

|

| Prospectus [Line Items] |

|

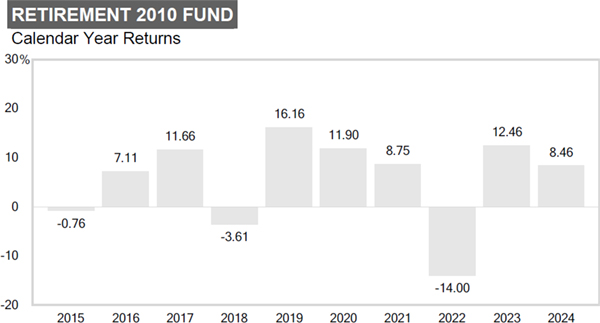

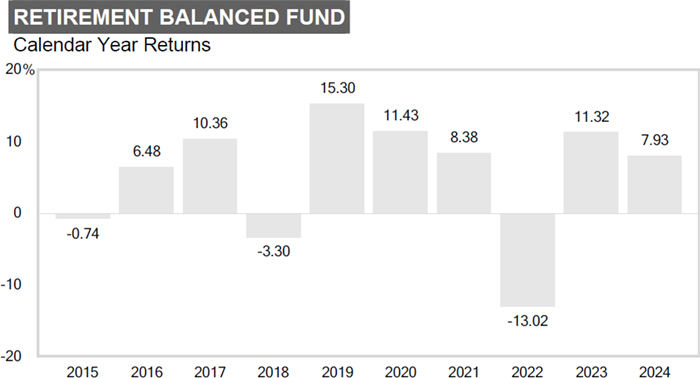

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least

one full calendar year. The fund’s performance information included in the table is compared with a regulatory required

index that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or

more indexes that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| year |

returns |

| 2015 |

-0.76% |

| 2016 |

7.11% |

| 2017 |

11.66% |

| 2018 |

-3.61% |

| 2019 |

16.16% |

| 2020 |

11.90% |

| 2021 |

8.75% |

| 2022 |

-14.00% |

| 2023 |

12.46% |

| 2024 |

8.46% |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return

|

|

| |

Best

Quarter |

6/30/20 |

12.08% |

|

Worst

Quarter |

3/31/20 |

-11.37% |

|

The

fund’s return for the six months ended 6/30/25 was 5.74%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

5.74%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

12.08%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(11.37%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods ended December 31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least

one full calendar year. The fund’s performance information included in the table is compared with a regulatory required

index that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or

more indexes that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA.

|

| Performance [Table] |

| Average

Annual Total Returns |

|

|

|

|

|

|

|

|

|

Periods ended

December 31, 2024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Since |

Inception |

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

inception |

date |

|

| Investor

Class |

|

|

|

|

|

|

|

|

|

|

|

09/30/2002 |

|

| |

Returns before taxes |

8.46 |

% |

|

5.00 |

% |

|

5.43 |

% |

|

—

|

% |

|

|

|

| |

Returns after taxes on distributions |

7.04 |

|

|

2.63 |

|

|

3.42 |

|

|

—

|

|

|

|

|

| |

Returns after taxes on distributions

and sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

of fund shares |

5.33 |

|

|

3.37 |

|

|

3.75 |

|

|

—

|

|

|

|

|

| I Class |

|

|

|

|

|

|

|

|

|

|

|

11/13/2023 |

|

|

| |

Returns before

taxes |

8.71 |

|

|

—

|

|

|

—

|

|

|

14.17 |

|

|

|

|

| Advisor Class |

|

|

|

|

|

|

|

|

|

|

|

10/31/2003 |

|

|

| |

Returns before taxes |

8.26 |

|

|

4.75 |

|

|

5.16 |

|

|

—

|

|

|

|

|

| R Class |

|

|

|

|

|

|

|

|

|

|

|

10/31/2003 |

|

|

| |

Returns before taxes |

7.99 |

|

|

4.49 |

|

|

4.90 |

|

|

—

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Regulatory

Benchmark |

|

|

|

| Bloomberg

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| |

1.25 |

|

|

-0.33 |

|

|

1.35 |

|

|

6.77 |

a |

|

|

|

| Strategy Benchmark(s) |

|

|

|

| S&P

Target Date 2010 Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| |

6.74 |

|

|

4.17 |

|

|

4.66 |

|

|

12.06 |

a |

|

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated

performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

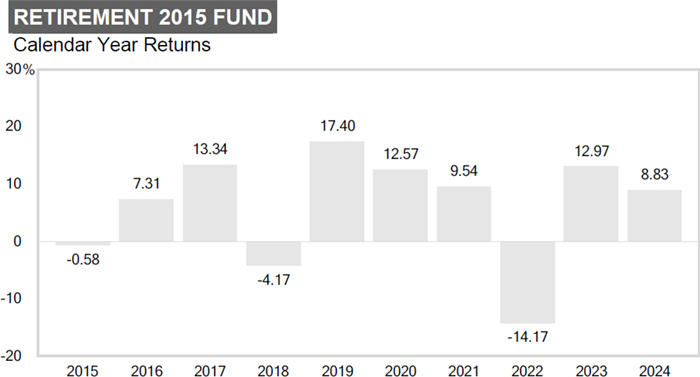

| T. Rowe Price Retirement 2015 Fund |

|

| Prospectus [Line Items] |

|

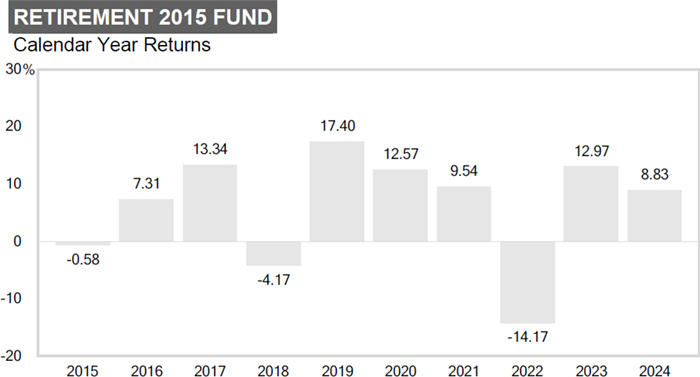

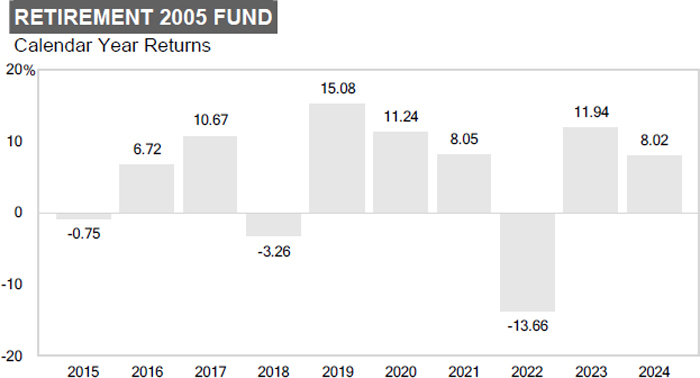

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calendar

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

-0.58% |

| 2016 |

7.31% |

| 2017 |

13.34% |

| 2018 |

-4.17% |

| 2019 |

17.40% |

| 2020 |

12.57% |

| 2021 |

9.54% |

| 2022 |

-14.17% |

| 2023 |

12.97% |

| 2024 |

8.83% |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return

|

|

|

Quarter

Ended |

Total

Return

|

|

| |

Best

Quarter |

6/30/20 |

13.00% |

|

Worst

Quarter |

3/31/20 |

-12.48% |

|

The

fund’s return for the six months ended 6/30/25 was 5.80%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

5.80%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

13.00%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(12.48%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods ended December 31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA.

|

| Performance [Table] |

| Average

Annual Total Returns |

|

|

|

|

|

|

|

Periods ended

December 31, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

1

Year |

|

|

5

Years |

|

10

Years |

|

Since inception |

Inception

date |

| |

Investor

Class |

|

|

|

|

|

|

|

|

|

02/27/2004 |

| |

|

Returns

before taxes |

8.83 |

% |

|

5.41 |

% |

5.88 |

% |

—

|

% |

|

| |

|

Returns

after taxes on distributions |

7.48 |

|

|

3.11 |

|

3.83 |

|

—

|

|

|

| |

|

Returns

after taxes on distributions and sale of

fund shares |

5.58 |

|

|

3.71 |

|

4.11 |

|

—

|

|

|

| |

I

Class |

|

|

|

|

|

|

|

|

|

11/13/2023 |

| |

|

Returns

before taxes |

8.98 |

|

|

|

|

—

|

|

14.63 |

|

|

| |

Advisor

Class |

|

|

|

|

|

|

|

|

|

05/31/2007 |

| |

|

Returns

before taxes |

8.54 |

|

|

5.14 |

|

5.62 |

|

—

|

|

|

| |

R

Class |

|

|

|

|

|

|

|

|

|

05/31/2007 |

| |

|

Returns

before taxes |

8.32 |

|

|

4.88 |

|

5.35 |

|

—

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Regulatory

Benchmark |

|

| |

Bloomberg

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

| |

|

1.25 |

|

|

-0.33 |

|

1.35 |

|

6.77 |

a |

|

| |

Strategy Benchmark(s) |

|

|

|

|

|

|

|

|

|

|

| |

S&P Target Date 2015 Index (reflects no deduction for fees, expenses, or taxes) |

|

| |

|

7.25 |

|

|

4.56 |

|

5.11 |

|

12.77 |

a |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated

performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

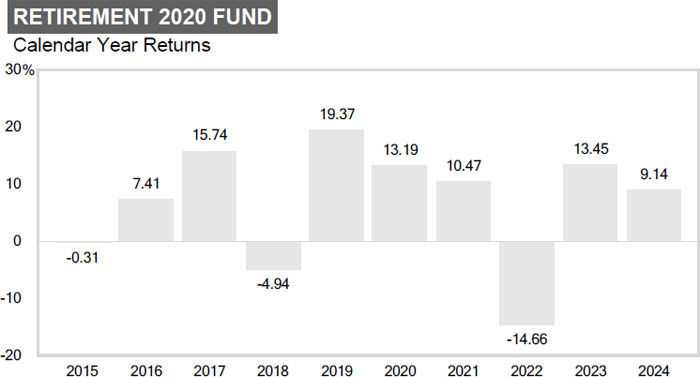

| T. Rowe Price Retirement 2020 Fund |

|

| Prospectus [Line Items] |

|

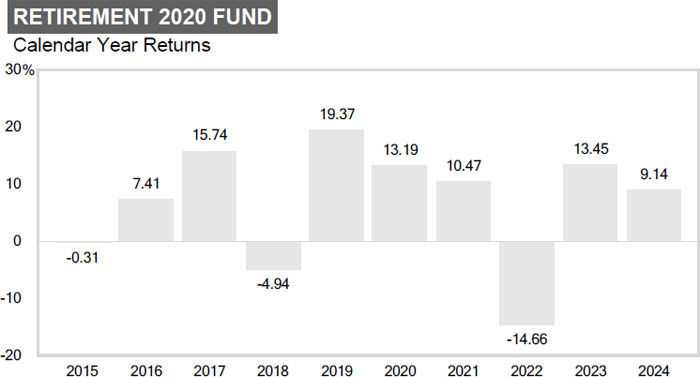

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The following performance information

provides some indication of the risks of investing in the fund. The fund’s performance information represents only past

performance (before and after taxes) and is not necessarily an indication of future results.

The following bar chart illustrates

how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns

during those years for the fund’s Investor Class. Returns for other

share classes vary since they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance information represents only past

performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The following performance information

provides some indication of the risks of investing in the fund.The following bar chart illustrates

how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns

during those years for the fund’s Investor Class. Returns for other

share classes vary since they have different expenses.The following table shows the

average annual total returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall securities

market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely aligns to the fund’s

investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calendar

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

-0.31% |

| 2016 |

7.41% |

| 2017 |

15.74% |

| 2018 |

-4.94% |

| 2019 |

19.37% |

| 2020 |

13.19% |

| 2021 |

10.47% |

| 2022 |

-14.66% |

| 2023 |

13.45% |

| 2024 |

9.14% |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return

|

|

| |

Best

Quarter |

6/30/20 |

14.51% |

|

Worst

Quarter |

3/31/20 |

-14.21% |

|

The fund’s

return for the six months ended 6/30/25 was 6.02%.

|

| Year to Date Return, Label [Optional Text] |

The fund’s

return for the six months ended

|

| Bar Chart, Year to Date Return |

6.02%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

14.51%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(14.21%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods ended December 31, 2024

|

| Performance Table Narrative |

The following table shows the

average annual total returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall securities

market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely aligns to the fund’s

investment strategy (Strategy Benchmark(s)).

In addition, the table shows

hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated

using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown

are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated

using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown

are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

|

| Performance [Table] |

| |

|

|

|

|

| Average

Annual Total Returns |

|

|

|

|

|

|

|

Periods ended

December 31, 2024 |

|

| |

|

|

|

|

|

|

|

Since |

Inception |

|

| |

|

1

Year |

|

5

Years |

|

10

Years |

|

inception |

date |

|

| |

Investor Class |

|

|

|

|

|

|

|

|

09/30/2002 |

|

| |

Returns before

taxes |

9.14 |

% |

5.73 |

% |

6.39 |

% |

—

|

% |

|

|

| |

Returns after taxes

on distributions |

7.74 |

|

3.25 |

|

4.34 |

|

—

|

|

|

|

| |

Returns after taxes

on distributions and sale |

|

|

|

|

|

|

|

|

|

|

| |

of

fund shares |

5.84 |

|

3.97 |

|

4.57 |

|

—

|

|

|

|

| |

I Class |

|

|

|

|

|

|

|

|

11/13/2023 |

|

| |

Returns

before taxes |

9.29 |

|

—

|

|

—

|

|

15.03 |

|

|

|

| |

Advisor Class |

|

|

|

|

|

|

|

|

10/31/2003 |

|

| |

Returns before

taxes |

8.90 |

|

5.48 |

|

6.13 |

|

—

|

|

|

|

| |

R Class |

|

|

|

|

|

|

|

|

10/31/2003 |

|

| |

Returns before

taxes |

8.61 |

|

5.22 |

|

5.86 |

|

—

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Regulatory Benchmark |

|

|

| |

Bloomberg

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

1.25 |

|

-0.33 |

|

1.35 |

|

6.77 |

a |

|

|

| |

Strategy Benchmark(s) |

|

|

| |

S&P

Target Date 2020 Index (reflects no deduction for fees, expenses, or taxes) |

|

|

| |

|

8.09 |

|

4.88 |

|

5.52 |

|

13.86 |

a |

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated performance information

is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

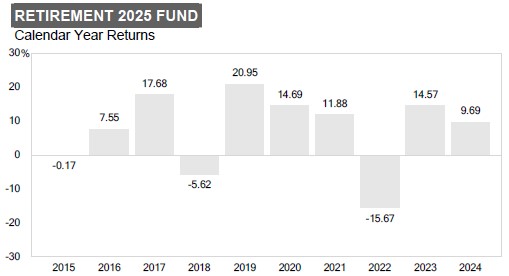

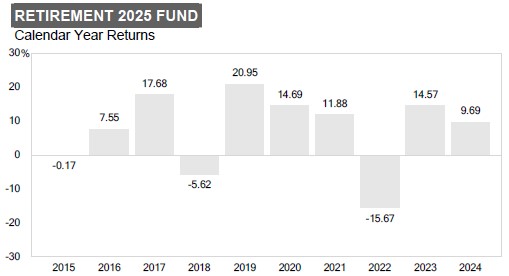

| T. Rowe Price Retirement 2025 Fund |

|

| Prospectus [Line Items] |

|

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

-0.17 |

| 2016 |

7.55 |

| 2017 |

17.68 |

| 2018 |

-5.62 |

| 2019 |

20.95 |

| 2020 |

14.69 |

| 2021 |

11.88 |

| 2022 |

-15.67 |

| 2023 |

14.57 |

| 2024 |

9.69 |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return

|

|

| |

Best

Quarter |

6/30/20 |

16.18% |

|

Worst

Quarter |

3/31/20 |

-15.86% |

|

The

fund’s return for the six months ended 6/30/25 was 6.22%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

6.22%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

16.18%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(15.86%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods

ended December

31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA.

|

| Performance [Table] |

| |

|

|

|

|

|

|

|

|

|

|

|

| Average

Annual Total Returns |

|

|

|

|

|

| |

|

Periods

ended |

|

| |

|

December

31, 2024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Inception |

|

| |

|

|

|

|

|

|

|

Since |

|

date |

|

| |

Investor

Class |

1

Year |

|

5

Years |

|

10

Years |

|

inception |

|

02/27/2004 |

|

| |

|

Returns

before taxes |

9.69 |

% |

6.34 |

% |

6.97 |

% |

—

|

% |

|

|

| |

|

Returns

after taxes on distributions |

8.37 |

|

4.25 |

|

5.21 |

|

—

|

|

|

|

| |

|

Returns

after taxes on distributions and sale of fund shares |

6.19 |

|

4.54 |

|

5.13 |

|

—

|

|

|

|

| |

I

Class |

|

|

|

|

|

|

|

|

11/13/2023 |

|

| |

|

Returns

before taxes |

9.91 |

|

—

|

|

—

|

|

16.06 |

|

|

|

| |

Advisor

Class |

|

|

|

|

|

|

|

|

05/31/2007 |

|

| |

|

Returns

before taxes |

9.44 |

|

6.07 |

|

6.70 |

|

—

|

|

|

|

| |

R

Class |

|

|

|

|

|

|

|

|

05/31/2007 |

|

| |

|

Returns

before taxes |

9.19 |

|

5.81 |

|

6.44 |

|

—

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Regulatory

Benchmark |

|

|

| |

Russell

3000® Index (reflects no deduction for fees, expenses, or taxes) |

|

|

| |

|

23.81 |

|

13.86 |

|

12.55 |

|

30.97 |

a |

|

|

| |

Strategy

Benchmark(s) |

|

|

| |

S&P

Target Date 2025 Index (reflects no deduction for fees, expenses, or taxes) |

|

|

| |

|

8.44 |

|

5.55 |

|

6.14 |

|

14.41 |

a |

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated

performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

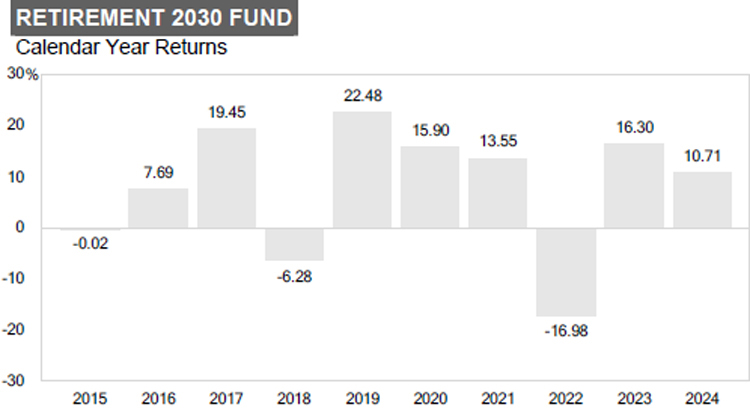

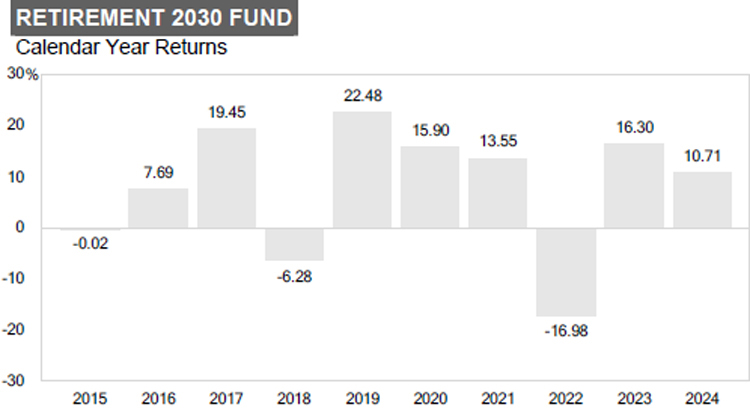

| T. Rowe Price Retirement 2030 Fund |

|

| Prospectus [Line Items] |

|

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst

calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have

different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst

calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have

different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

-0.02 |

| 2016 |

7.69 |

| 2017 |

19.45 |

| 2018 |

-6.28 |

| 2019 |

22.48 |

| 2020 |

15.90 |

| 2021 |

13.55 |

| 2022 |

-16.98 |

| 2023 |

16.30 |

| 2024 |

10.71 |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return |

|

| |

Best

Quarter |

6/30/20 |

17.47% |

|

Worst

Quarter |

3/31/20 |

-17.34% |

|

The

fund’s return for the six months ended 6/30/25 was 6.75%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

6.75%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

17.47%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(17.34%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods

ended December

31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements,

such as a 401(k) account or an IRA.

|

| Performance [Table] |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Annual Total Returns |

|

|

|

|

|

|

|

| |

|

|

Periods

ended |

|

| |

|

|

December

31, 2024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Inception |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Since |

date |

|

|

| |

Investor

Class |

1

Year |

|

|

5

Years |

|

|

10

Years |

|

|

inception |

09/30/2002 |

|

|

| |

|

Returns

before taxes |

10.71 |

% |

|

7.06 |

% |

|

7.58 |

% |

|

—

|

% |

|

|

|

| |

|

Returns

after taxes on distributions |

9.66 |

|

|

5.16 |

|

|

5.87 |

|

|

—

|

|

|

|

|

| |

|

Returns

after taxes on distributions and sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

of

fund shares |

6.76 |

|

|

5.19 |

|

|

5.67 |

|

|

—

|

|

|

|

|

| |

I

Class |

|

|

|

|

|

|

|

|

|

|

|

11/13/2023 |

|

|

| |

|

Returns

before taxes |

10.92 |

|

|

—

|

|

|

—

|

|

|

17.56 |

|

|

|

|

| |

Advisor

Class |

|

|

|

|

|

|

|

|

|

|

|

10/31/2003 |

|

|

| |

|

Returns

before taxes |

10.46 |

|

|

6.79 |

|

|

7.31 |

|

|

—

|

|

|

|

|

| |

R

Class |

|

|

|

|

|

|

|

|

|

|

|

10/31/2003 |

|

|

| |

|

Returns

before taxes |

10.19 |

|

|

6.53 |

|

|

7.05 |

|

|

—

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Regulatory

Benchmark |

|

|

|

| |

Russell

3000® Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| |

|

23.81 |

|

|

13.86 |

|

|

12.55 |

|

|

30.97 |

a |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Strategy

Benchmark(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

S&P

Target Date 2030 Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

9.90 |

|

|

6.46 |

|

|

6.87 |

|

|

16.41 |

a |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated

performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

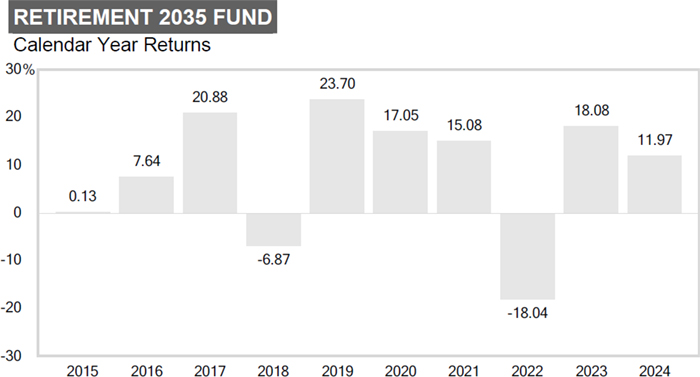

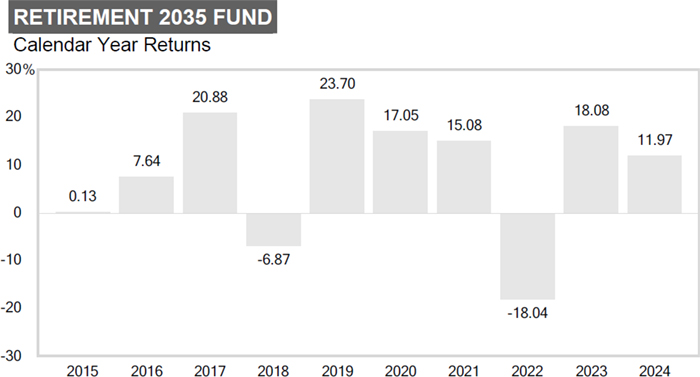

| T. Rowe Price Retirement 2035 Fund |

|

| Prospectus [Line Items] |

|

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The following performance information provides some indication

of the risks of investing in the fund. The fund’s performance information represents only past performance (before and after

taxes) and is not necessarily an indication of future results.

The following bar chart illustrates how much returns can differ

from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years

for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance information represents only past performance (before and after

taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The following performance information provides some indication

of the risks of investing in the fund.The following bar chart illustrates how much returns can differ

from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years

for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.The following table shows the average annual total

returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall

securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely

aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

0.13 |

| 2016 |

7.64 |

| 2017 |

20.88 |

| 2018 |

-6.87 |

| 2019 |

23.70 |

| 2020 |

17.05 |

| 2021 |

15.08 |

| 2022 |

-18.04 |

| 2023 |

18.08 |

| 2024 |

11.97 |

|

| Bar Chart Closing [Text Block] |

|

|

Quarter Ended |

Total Return |

|

|

Quarter Ended |

Total Return |

|

|

Best Quarter |

6/30/20 |

18.65% |

|

Worst Quarter |

3/31/20 |

-18.55% |

|

The fund’s

return for the six months ended 6/30/25 was 7.40%.

|

| Year to Date Return, Label [Optional Text] |

The fund’s

return for the six months ended

|

| Bar Chart, Year to Date Return |

7.40%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best Quarter

|

| Highest Quarterly Return |

18.65%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst Quarter

|

| Lowest Quarterly Return |

(18.55%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods

ended December

31, 2024

|

| Performance Table Narrative |

The following table shows the average annual total

returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall

securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely

aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In addition, the table shows hypothetical after-tax returns

to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend

on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who

hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA. After-tax returns are shown only

for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not relevant to investors who

hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

|

| Performance [Table] |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Annual Total Returns |

|

|

|

|

|

|

|

|

|

Periods

ended |

|

|

|

|

December

31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since |

Inception |

|

|

|

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

inception |

date |

|

|

Investor Class |

|

|

|

|

|

|

|

|

|

|

|

02/27/2004 |

|

|

|

Returns before taxes |

11.97 |

% |

|

7.86 |

% |

|

8.16 |

% |

|

—

|

% |

|

|

|

|

Returns after taxes on distributions |

11.26 |

|

|

6.37 |

|

|

6.67 |

|

|

—

|

|

|

|

|

|

Returns after

taxes on distributions and sale of fund shares |

7.43 |

|

|

5.90 |

|

|

6.21 |

|

|

—

|

|

|

|

|

I Class |

|

|

|

|

|

|

|

|

|

|

|

11/13/2023 |

|

|

|

Returns before

taxes |

12.15 |

|

|

—

|

|

|

—

|

|

|

19.24 |

|

|

|

|

Advisor Class |

|

|

|

|

|

|

|

|

|

|

|

05/31/2007 |

|

|

|

Returns before taxes |

11.67 |

|

|

7.59 |

|

|

7.89 |

|

|

—

|

|

|

|

|

R Class |

|

|

|

|

|

|

|

|

|

|

|

05/31/2007 |

|

|

|

Returns before taxes |

11.34 |

|

|

7.31 |

|

|

7.62 |

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Regulatory Benchmark |

|

|

|

Russell

3000® Index (reflects no deduction for fees,

expenses, or taxes) |

|

|

|

|

23.81 |

|

|

13.86 |

|

|

12.55 |

|

|

30.97 |

a |

|

|

|

Strategy Benchmark(s) |

|

|

|

S&P

Target Date 2035 Index (reflects no deduction for fees, expenses, or taxes) |

|

|

| |

|

|

11.38 |

|

|

7.44 |

|

|

7.60 |

|

|

18.33 |

a |

|

|

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns are shown only

for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees,

expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated performance information is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

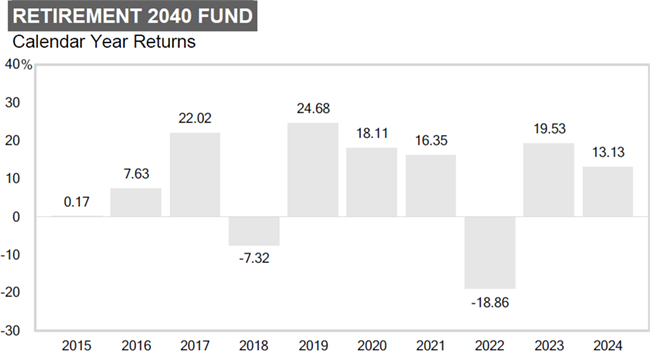

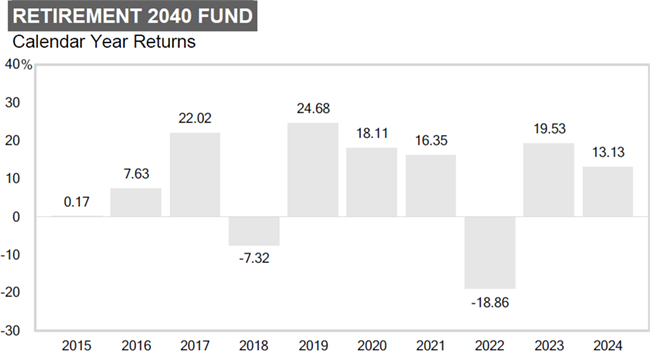

| T. Rowe Price Retirement 2040 Fund |

|

| Prospectus [Line Items] |

|

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

The following performance information

provides some indication of the risks of investing in the fund. The fund’s performance information represents only past

performance (before and after taxes) and is not necessarily an indication of future results.

The following bar chart illustrates

how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns

during those years for the fund’s Investor Class. Returns for other

share classes vary since they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance information represents only past

performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The following performance information

provides some indication of the risks of investing in the fund.The following bar chart illustrates

how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns

during those years for the fund’s Investor Class. Returns for other

share classes vary since they have different expenses.The following table shows the

average annual total returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall securities

market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely aligns to the fund’s

investment strategy (Strategy Benchmark(s)).

|

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

0.17 |

| 2016 |

7.63 |

| 2017 |

22.02 |

| 2018 |

-7.32 |

| 2019 |

24.68 |

| 2020 |

18.11 |

| 2021 |

16.35 |

| 2022 |

-18.86 |

| 2023 |

19.53 |

| 2024 |

13.13 |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return |

|

| |

Best Quarter |

6/30/20 |

19.50% |

|

Worst Quarter |

3/31/20 |

-19.48% |

|

The fund’s

return for the six months ended 6/30/25 was 7.92%.

|

| Year to Date Return, Label [Optional Text] |

The fund’s

return for the six months ended

|

| Bar Chart, Year to Date Return |

7.92%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best Quarter

|

| Highest Quarterly Return |

19.50%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst Quarter

|

| Lowest Quarterly Return |

(19.48%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average

Annual Total Returns Periods ended December 31, 2024

|

| Performance Table Narrative |

The following table shows the

average annual total returns for each class of the fund that has been in operation for at least one full calendar year. The fund’s

performance information included in the table is compared with a regulatory required index that represents an overall securities

market (Regulatory Benchmark). In addition, the table may also include one or more indexes that more closely aligns to the fund’s

investment strategy (Strategy Benchmark(s)).

In addition, the table shows hypothetical

after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using

the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not

relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA. After-tax

returns are shown only for the Investor Class and will differ for other share classes.

|

| Performance Table Uses Highest Federal Rate |

After-tax returns are calculated using

the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

After-tax returns shown are not

relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

|

| Performance [Table] |

Average

Annual Total Returns

| |

|

|

|

|

|

| |

Periods ended |

| |

December 31, 2024 |

| |

|

| |

|

|

|

Since |

Inception |

| |

1 Year |

5 Years |

10 Years |

inception |

date |

| Investor Class |

|

|

|

|

|

09/30/2002 |

| Returns before taxes |

13.13 |

% |

8.56 |

% |

8.65 |

% |

— |

% |

|

| Returns after taxes on distributions |

12.51 |

|

7.05 |

|

7.11 |

|

— |

|

|

| Returns after taxes on distributions and sale of fund shares |

8.17 |

|

6.50 |

|

6.63 |

|

— |

|

|

| I Class |

|

|

|

|

|

|

|

|

11/13/2023 |

| Returns before taxes |

13.38 |

|

— |

|

— |

|

20.72 |

|

|

| Advisor Class |

|

|

|

|

|

|

|

|

10/31/2003 |

| Returns before taxes |

12.84 |

|

8.29 |

|

8.38 |

|

— |

|

|

| R Class |

|

|

|

|

|

|

|

|

10/31/2003 |

| Returns before taxes |

12.58 |

|

8.02 |

|

8.11 |

|

— |

|

|

| Regulatory Benchmark |

|

|

|

|

|

|

|

|

|

| Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

| |

23.81 |

|

13.86 |

|

12.55 |

|

30.97 |

a |

|

| Strategy Benchmark(s) |

|

|

|

|

|

|

|

|

|

| S&P Target Date 2040 Index (reflects no deduction for fees, expenses, or taxes) |

| |

12.87 |

|

8.27 |

|

8.19 |

|

20.18 |

a |

|

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax

returns are shown only for the Investor Class and will differ for other share classes.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

(reflects no deduction for fees, expenses, or taxes)

|

| Performance Table Closing [Text Block] |

Updated performance information

is available through troweprice.com.

|

| Performance Availability Website Address [Text] |

troweprice.com

|

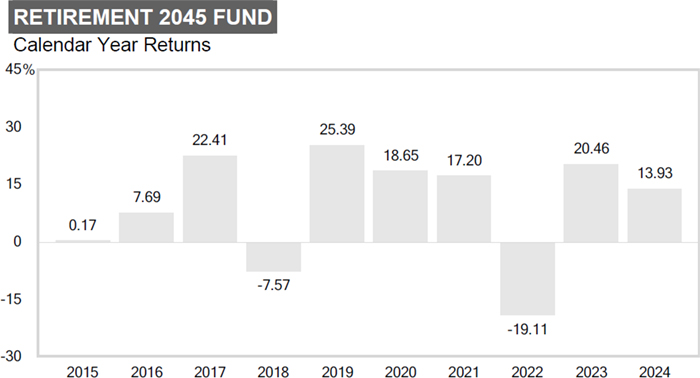

| T. Rowe Price Retirement 2045 Fund |

|

| Prospectus [Line Items] |

|

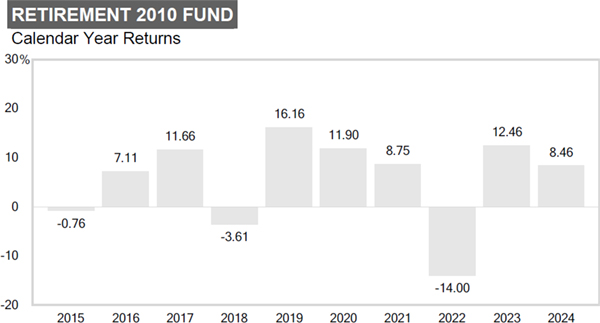

| Bar Chart and Performance Table [Heading] |

Performance

|

| Performance Narrative [Text Block] |

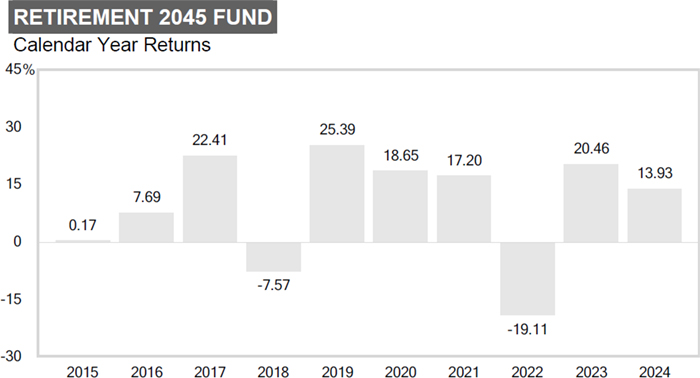

The

following performance information provides some indication of the risks of investing in the fund. The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s performance

information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

| Performance Information Illustrates Variability of Returns [Text] |

The

following performance information provides some indication of the risks of investing in the fund.The

following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and

worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since

they have different expenses.The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

|

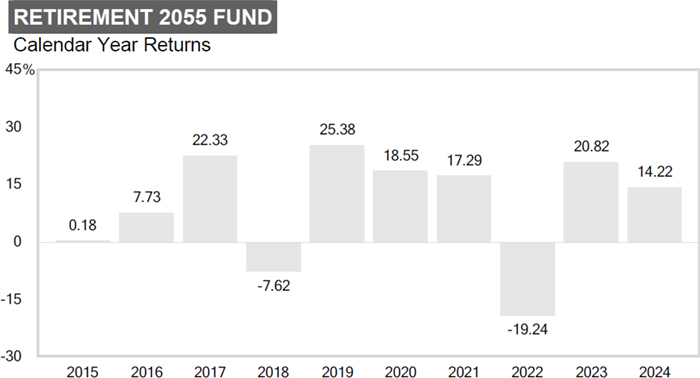

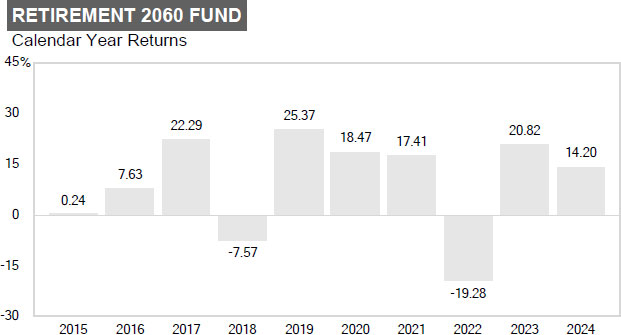

| Bar Chart [Heading] |

Calender

Year Returns

|

| Bar Chart [Table] |

| |

|

| 2015 |

0.17 |

| 2016 |

7.69 |

| 2017 |

22.41 |

| 2018 |

-7.57 |

| 2019 |

25.39 |

| 2020 |

18.65 |

| 2021 |

17.20 |

| 2022 |

-19.11 |

| 2023 |

20.46 |

| 2024 |

13.93 |

|

| Bar Chart Closing [Text Block] |

| |

|

Quarter

Ended |

Total

Return |

|

|

Quarter

Ended |

Total

Return |

|

| |

Best

Quarter |

6/30/20 |

20.19% |

|

Worst

Quarter |

3/31/20 |

-20.30% |

|

The

fund’s return for the six months ended 6/30/25 was 8.31%.

|

| Year to Date Return, Label [Optional Text] |

The

fund’s return for the six months ended

|

| Bar Chart, Year to Date Return |

8.31%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter

|

| Highest Quarterly Return |

20.19%

|

| Highest Quarterly Return, Date |

Jun. 30, 2020

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter

|

| Lowest Quarterly Return |

(20.30%)

|

| Lowest Quarterly Return, Date |

Mar. 31, 2020

|

| Performance Table Heading |

Average Annual Total Returns Periods

ended December

31, 2024

|

| Performance Table Narrative |

The

following table shows the average annual total returns for each class of the fund that has been in operation for at least one

full calendar year. The fund’s performance information included in the table is compared with a regulatory required index

that represents an overall securities market (Regulatory Benchmark). In addition, the table may also include one or more indexes

that more closely aligns to the fund’s investment strategy (Strategy Benchmark(s)).

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.